EXECUTIVE SUMMARY

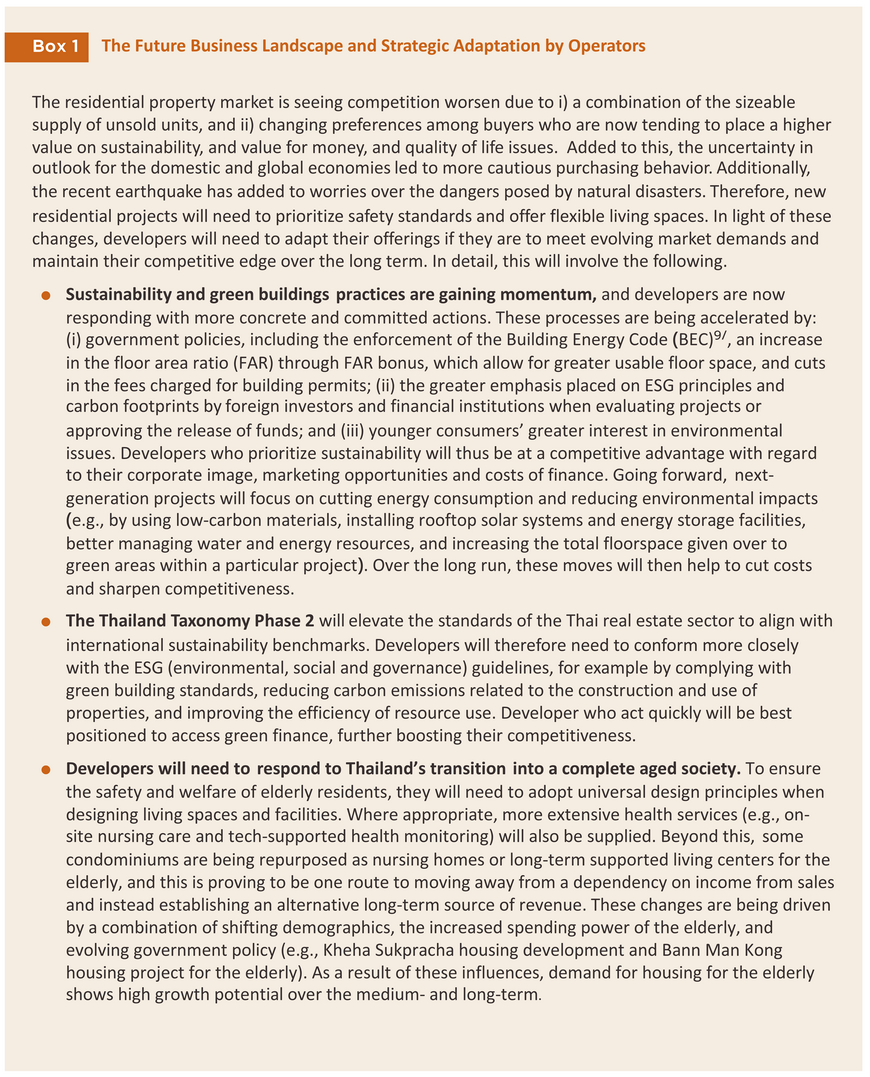

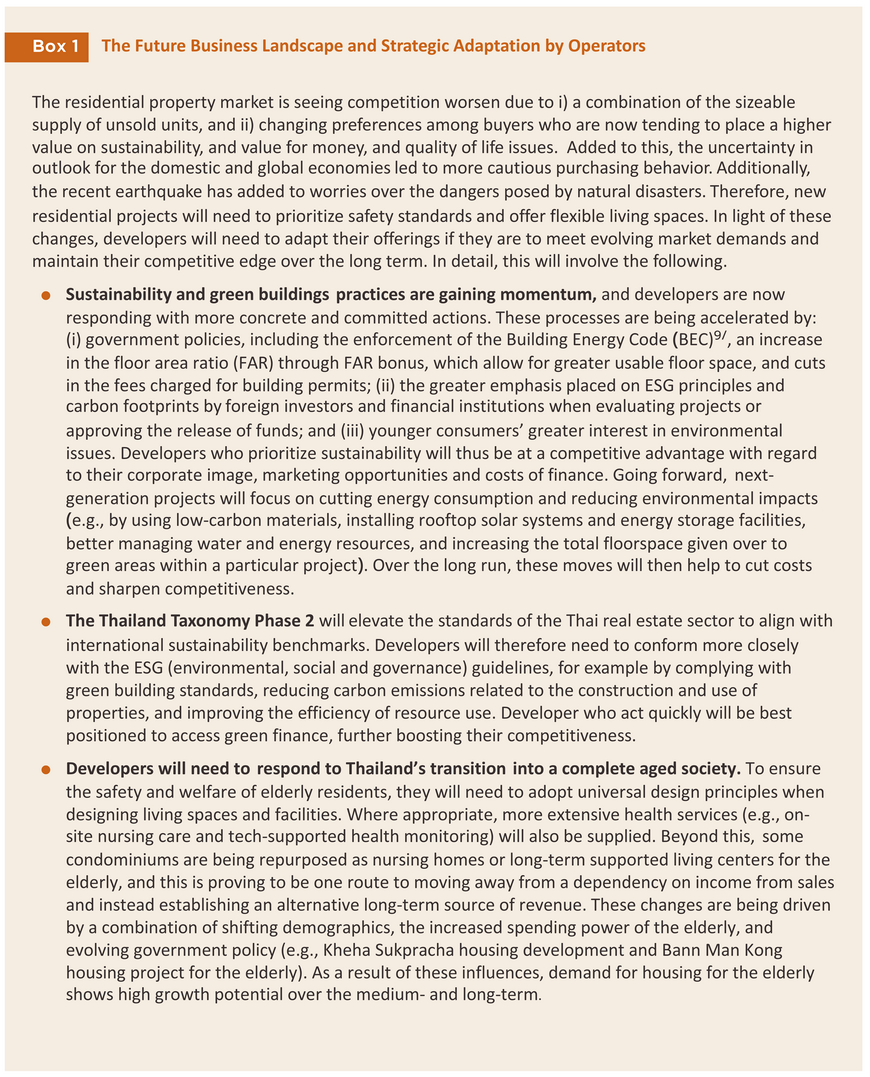

Through 2025, the market for residential property in the Bangkok Metropolitan Region (BMR) has been under great pressure due to softening domestic and international consumer purchasing power arising from the uncertainty generated by the global trade war. Meanwhile, some consumer groups in Thailand still have prolonged high levels of household debt; buyers therefore exercise much greater care before making purchases. At the same time, credit quality has declined, and future incomes have become less certain, so consumers have tended to postpone home-buying decisions and instead wait to see how current conditions play out. As a result, home sales have slid compared to a year earlier, while developers are tending to hold back on work on new projects and instead focus their efforts on selling off old stock. Through 2026-2027, the frail domestic economy and ongoing weakness in consumer spending will remain the major challenges to the housing market. This, however, will be at least partly offset by the stimulus effects resulting from progress on government mega-projects and growth in the tourism sector. Demand from overseas buyers working or living long-term in Thailand will add to demand at the middle and upper end of the market.

Krungsri Research view

The outlook for the housing market in 2025–2027 can be summarized as follows:

-

Low-rise housing developers (in BMR): Large developers will likely see their turnover remain flat or possibly edge up slightly because of stronger activity at the top end of the market. These companies will also benefit from their lower cost of financing, their access to funding generated from capital markets, their greater strategic flexibility, their capacity to forge new business partnerships, and their ability to differentiate themselves from the competition through the adoption of ESG principles, thereby aligning their corporate vision more closely with long-term changes in the market. By contrast, SME players will see their market share come under increasing pressure as competition intensifies. At the same time, the price of construction materials and the cost of finance are both rising, and so companies that have not had productive business partnerships or that are not embedded within wider commercial networks will find it more difficult to carve out a space within the market. Some smaller companies will thus face liquidity issues and problems accessing working capital, and they may be at risk of liquidity problems.

-

High-rise housing developers (in BMR): Large developers typically benefit from their access to capital and their well-developed project management skills. These players generally focus on developments in downtown locations or along new metro lines. However, with uncertainty over both the Thai and global economies currently high, confidence among domestic and international buyers is weak. Players will thus need to spend more heavily on marketing, but with competition worsening, profits will slip. SME developers generally concentrate on low-rise developments in more suburban areas. In these locations, buyers generally prefer town- or detached houses. Turnover will thus soften, and it will likely be some time before recovery. Moreover, the recent earthquake has shaken consumer confidence in the safety of high-rise buildings, potentially adding further to costs and eroding profitability.

Overview

The real estate sector has a big role in driving the Thai economy. A large amount of capital circulates within the economy and supports employment and income. The sector also has a large influence on the direction of related businesses such as construction, construction materials, electrical appliances, furniture and home decorations, and finance. When combined with other related sectors and industries in its value chain, the extended real estate sector contributed around 10%1/ of Thailand’s GDP in 2022.

The real estate sector generally consists of three principal segments: residential, commercial, and industrial property. In Thailand, residential sector is the largest with two-thirds of the total market value of the Thai real estate market (source: World Bank). The residential property market is driven primarily by domestic buyers as Thai law allow foreigners to purchase and hold ownership rights only in condominiums, with a maximum of 49% of the total saleable area in any project. It is also possible for non-Thais to own detached- and townhouses but the regulations governing this are very restrictive.

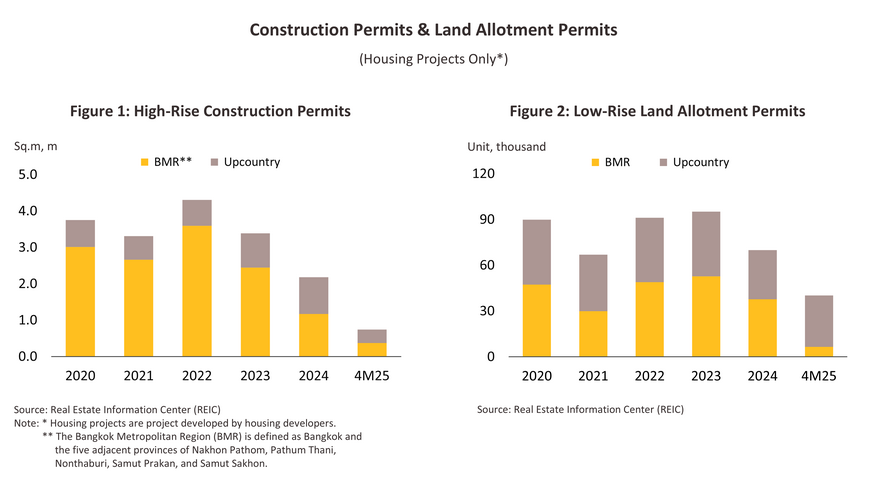

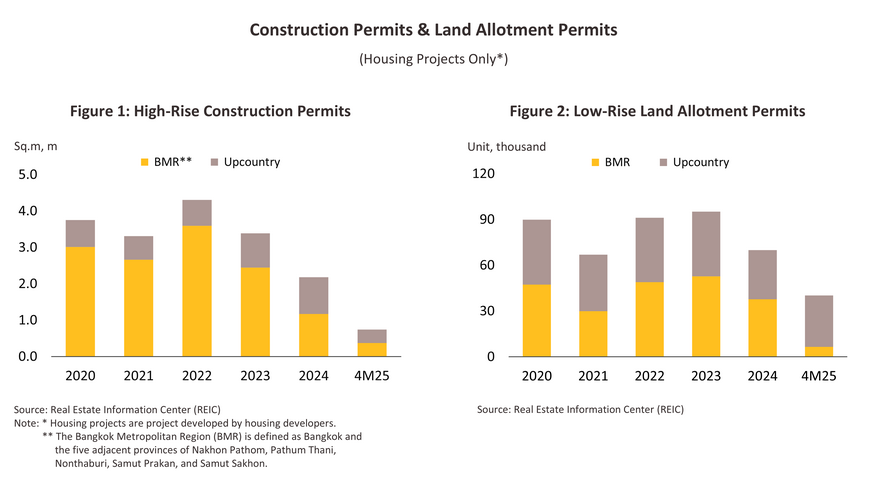

In the past, the housing market in the BMR has typically been stronger than for housing in the regions. This is reflected in building permit applications, which were overwhelmingly submitted for projects in the BMR. The average share of applications for high-rise and low-rise housing projects in the BMR versus the regions stood at 74:26 and 52:48, respectively (Figure 1 and Figure 2). This dominance can be attributed to the BMR’s role as a center of employment, education and major business hubs, which has then supported high rates of urbanization. The region also faces diverse housing demand, including both buying and rental markets, with buyers including both Thais and foreigners. As a result, major developers to keep a much stronger focus on the property market in the BMR over other regional markets.

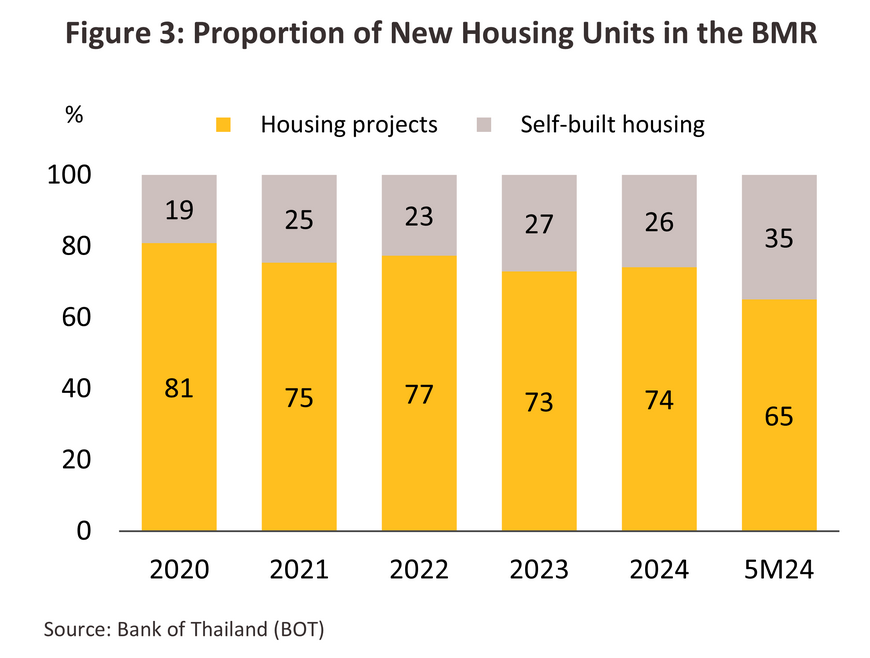

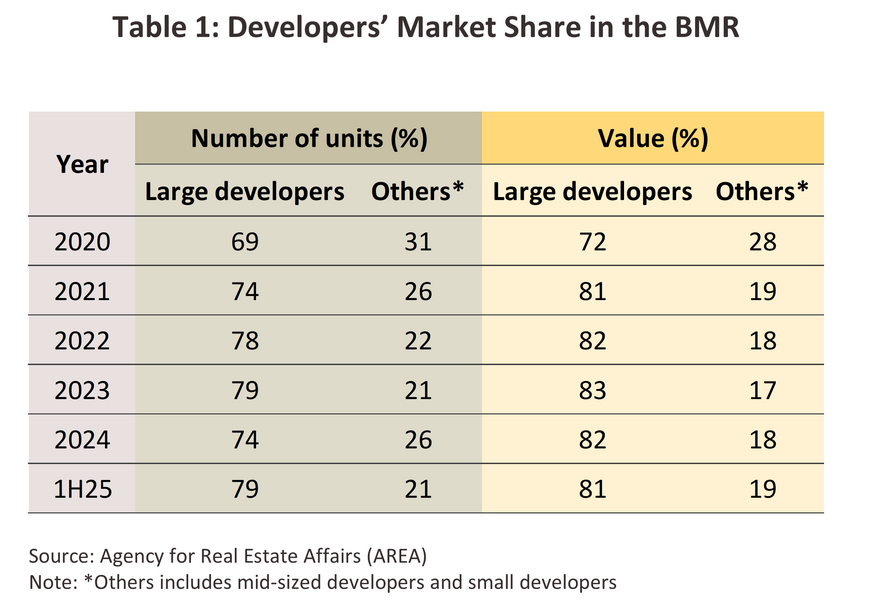

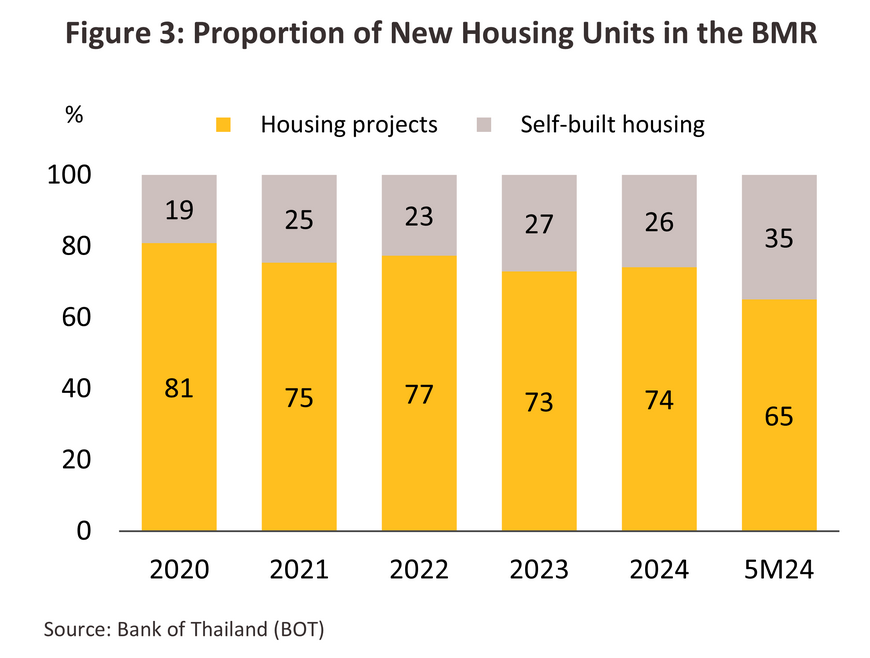

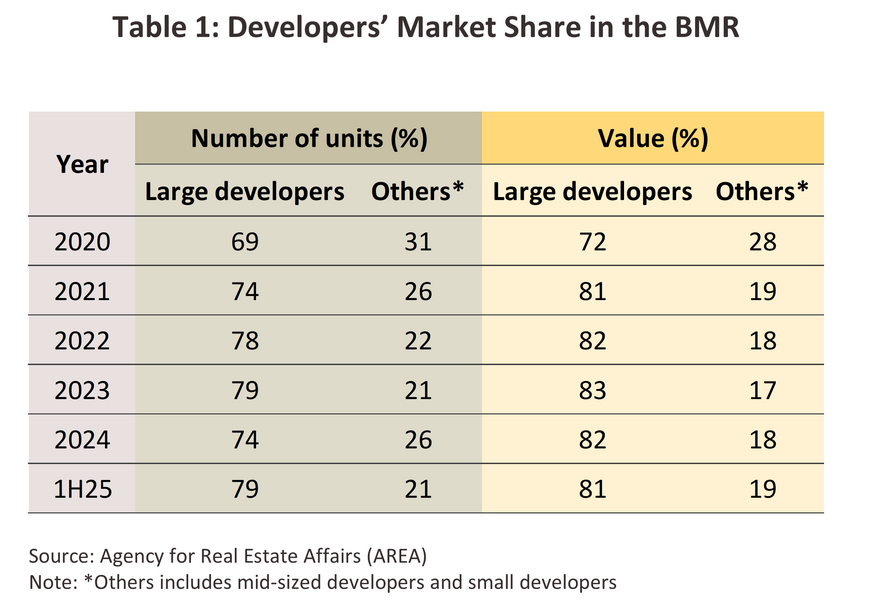

The housing market is split between self-built housing and housing projects (Figure 3). Currently, over 70% of new housing units in the BMR are in projects developed by housing developers, with annual market value of around THB 450-500 bn. Large developers (those listed on the SET) and their subsidiaries control 70-80% of the market by volume and value (Table 1). Because large companies are able to manage costs more effectively than their smaller peers; for example, they are in a position to buy larger land bank that would reduce project development cost. They can also undertake several projects simultaneously and thus achieve economies of scale. Beyond this, they benefit from stronger branding and marketing networks.

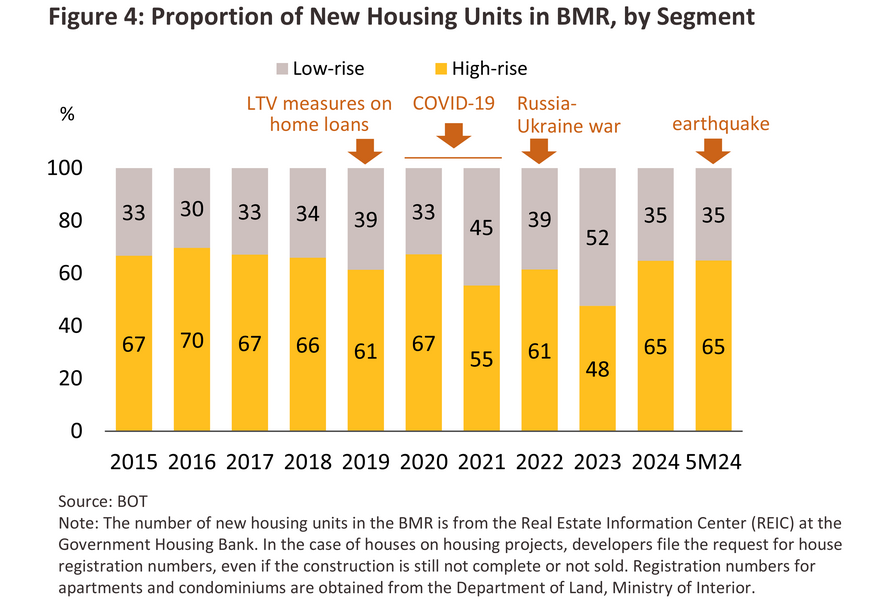

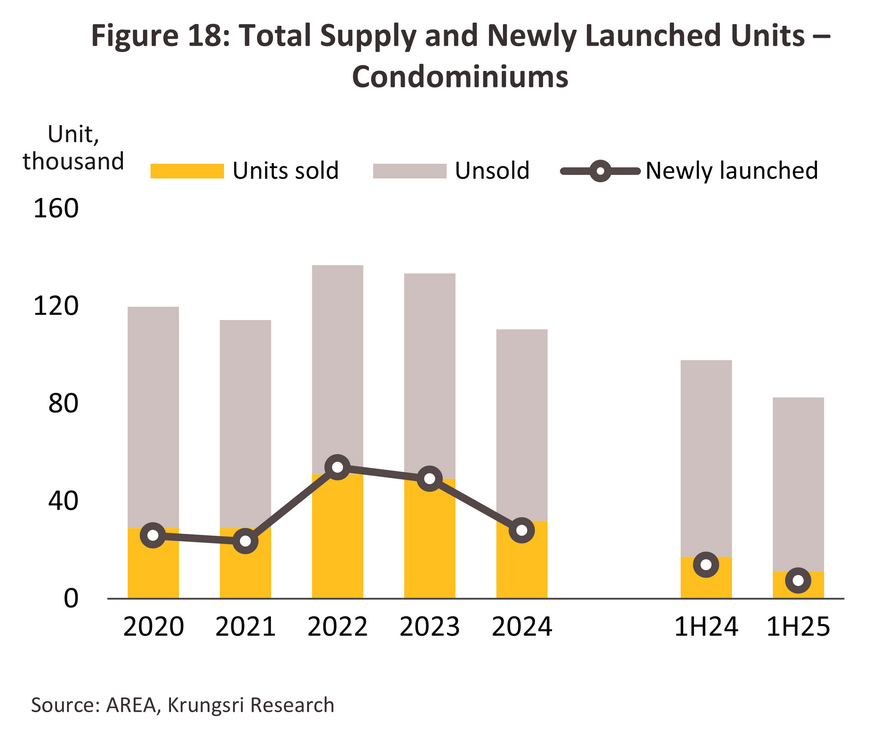

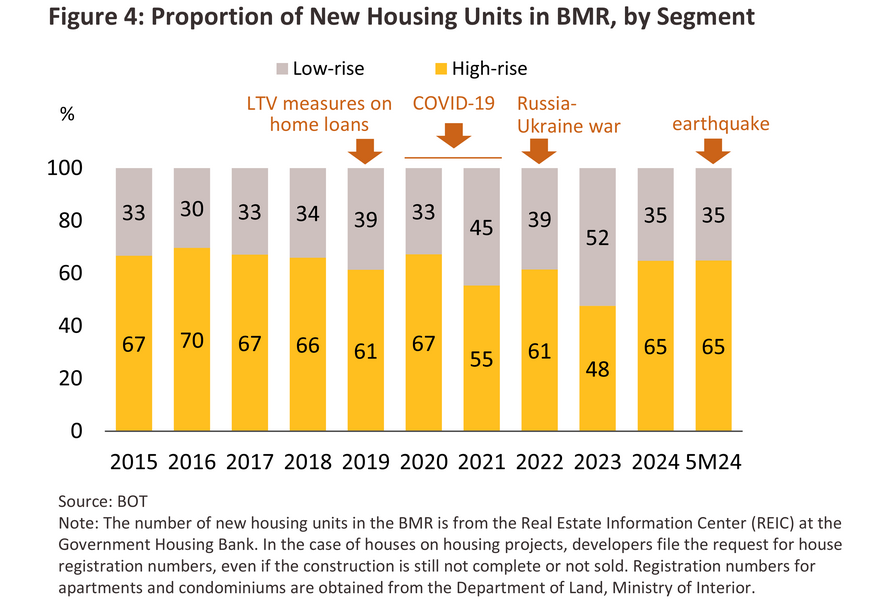

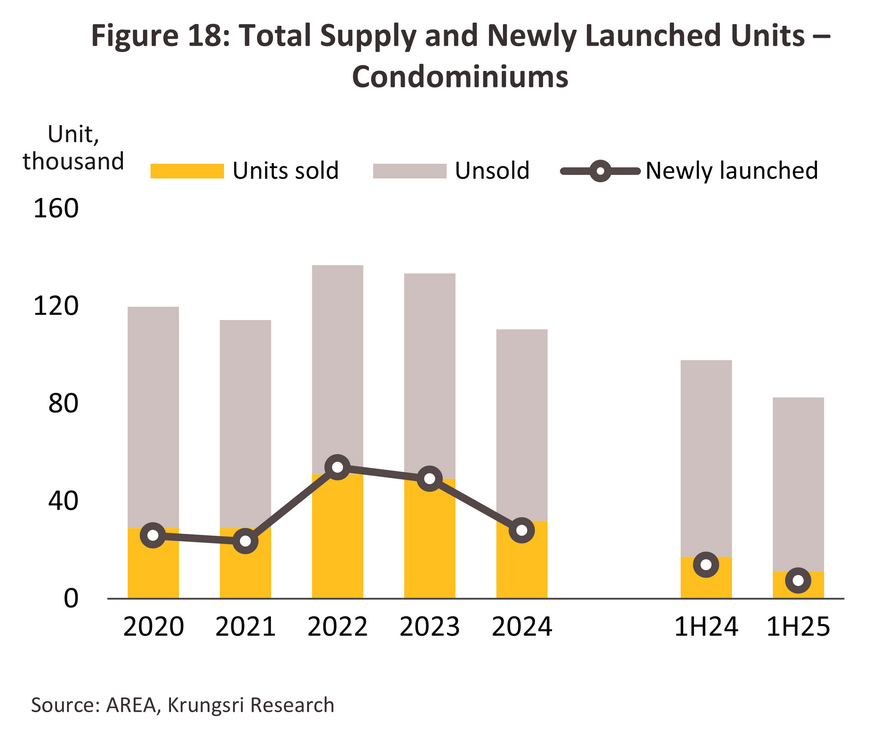

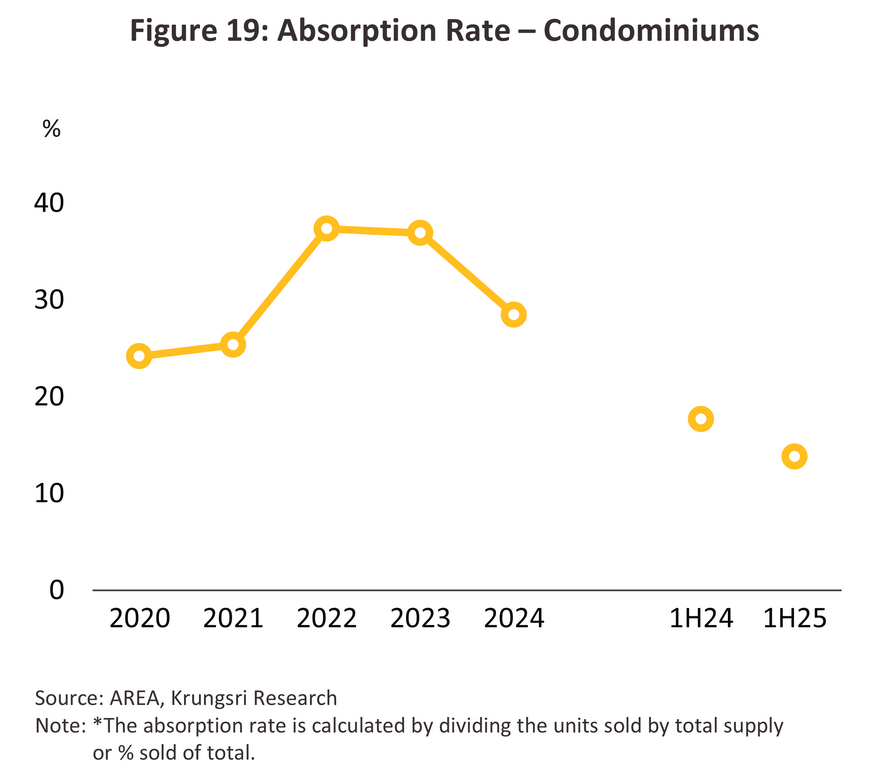

Over the past decade (2015-2024), high-rise projects (i.e., condominiums) have represented a larger share of new projects in the BMR than low-rise segment. (i.e., detached- and townhouses), with an average of 60-70% of all newly registered housing units2/ (Figure 4). This is because high-potential land in the BMR is in short supply and prices have continually tracked upwards. The previous reason combining with the expansion of the BMR’s metro system (the MRT and the BTS) which has made high-rise developments along these routes increasingly attractive to both developers and buyers. Nevertheless, the severe impact of the Covid-19 pandemic in 2021 and 2022, prompted a shift in consumer behavior, and the need for greater useable space to accommodate the shift to working from home has helped to lift demand for low-rise developments. These trends were accelerated by the closing of the country and the drop off in tourist arrivals, which further encouraged developers to begin postponing the launch of new condominium projects and instead to focus their efforts on low-rise properties targeting high-income consumer. As such, more low-rise units than condominiums were completed and registered in 2023, the first time the market had tilted in this direction.

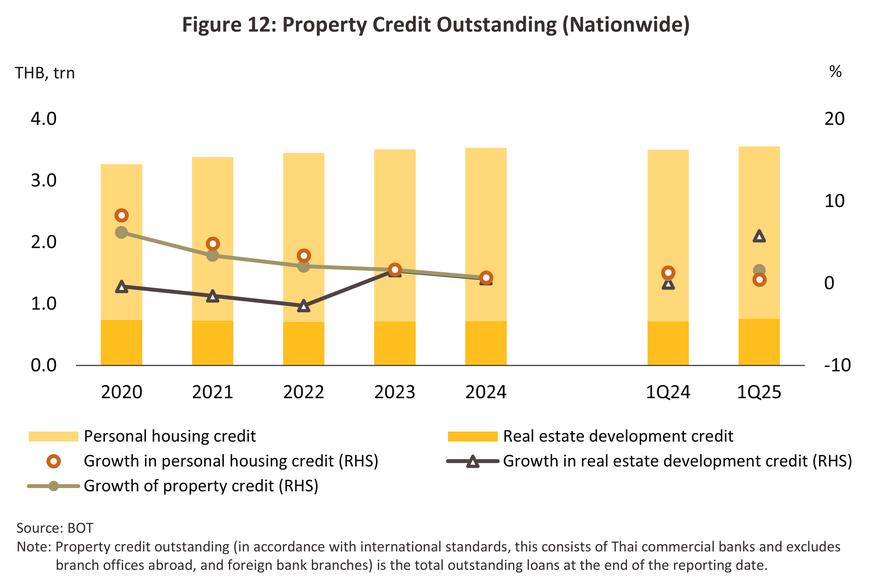

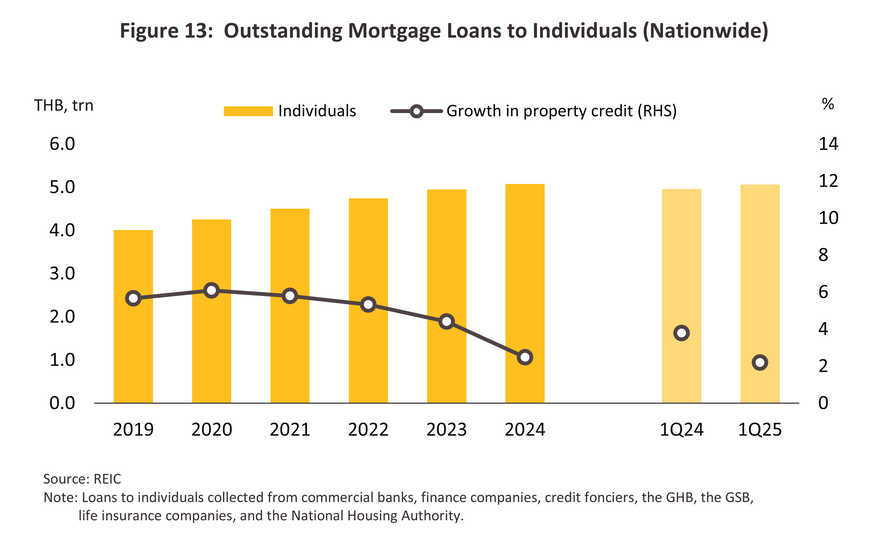

Situation

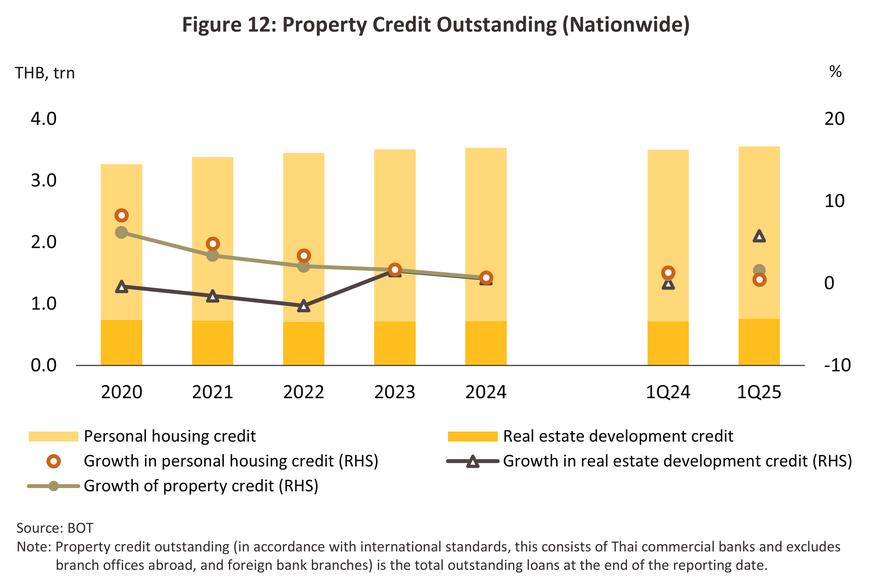

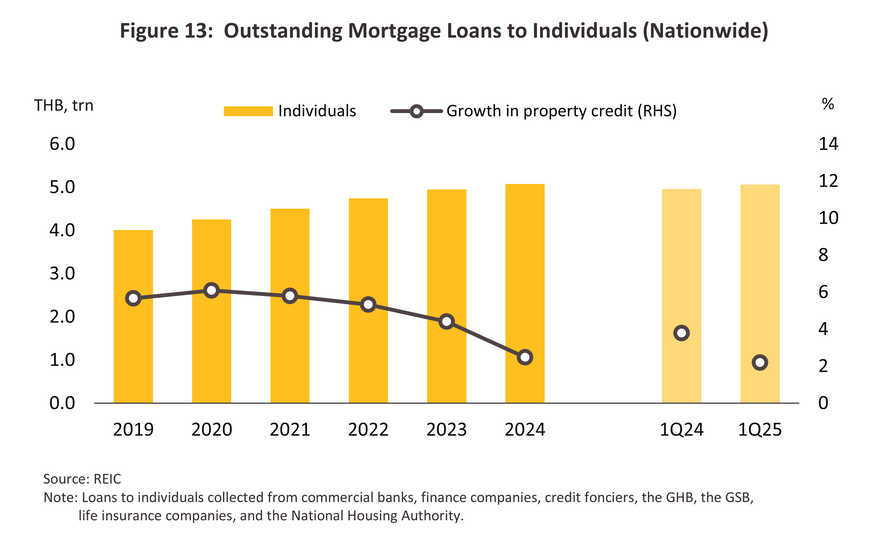

In 2024, the housing market was troubled by low levels of economic growth (2.7% from its 2023 level), while the high cost of living and the impacts of this on expansion in spending power, elevated household debt (88.4% of GDP) that then ate into consumer purchasing power in some demographics, and interest rates that hit a 10-year high of 2.5%. Faced with these headwinds, consumers, though especially those in low- and middle-income groups, became much more cautious about their spending. Some postponed purchases of real estate due to the long-term financial commitment while others saw a decline in credit quality, with mortgage rejection rates climbing to 50-60% for purchases of properties valued at THB 3 million or less (source: Bank of Thailand). In response to these challenging conditions, the government rolled out a series of stimulus measures, including reducing transfer and mortgage registration fees to 0.01% of the property’s value (from 2% and 1% respectively) from properties valued at not more than THB 3 million to THB 7 million (9 April, 2024 to 31 December, 2024), along with a tax deduction scheme for those building their own homes (9 April, 2024 to 31December, 2025), and relaxing the LTV rules to allow buyers to take out home loans to a maximum of 110% of the property’s value3/ . The market also benefited from October’s cut in policy rates, the first such reduction in more than 4 years. On the supply side, sluggish demand encouraged developers to rapidly adjust their business strategies to mitigate risk and adapt to intensifying competition such as launching projects aligned actual purchasing power, tightening cost control and lowering stock risks by reducing the number of units in each development, being more flexible over designing new products and stipulating sales conditions, and offering the sales promotions and discounts. Some developers chose to delay the launch of new projects and instead prioritized on clearing unsold stock. Details of the housing market through 2024 are given below

-

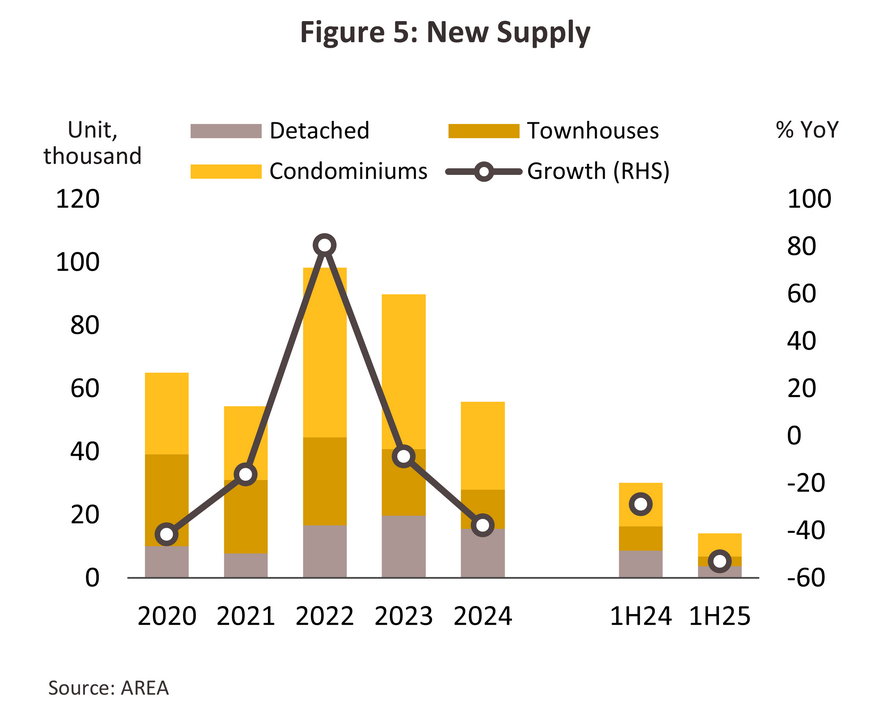

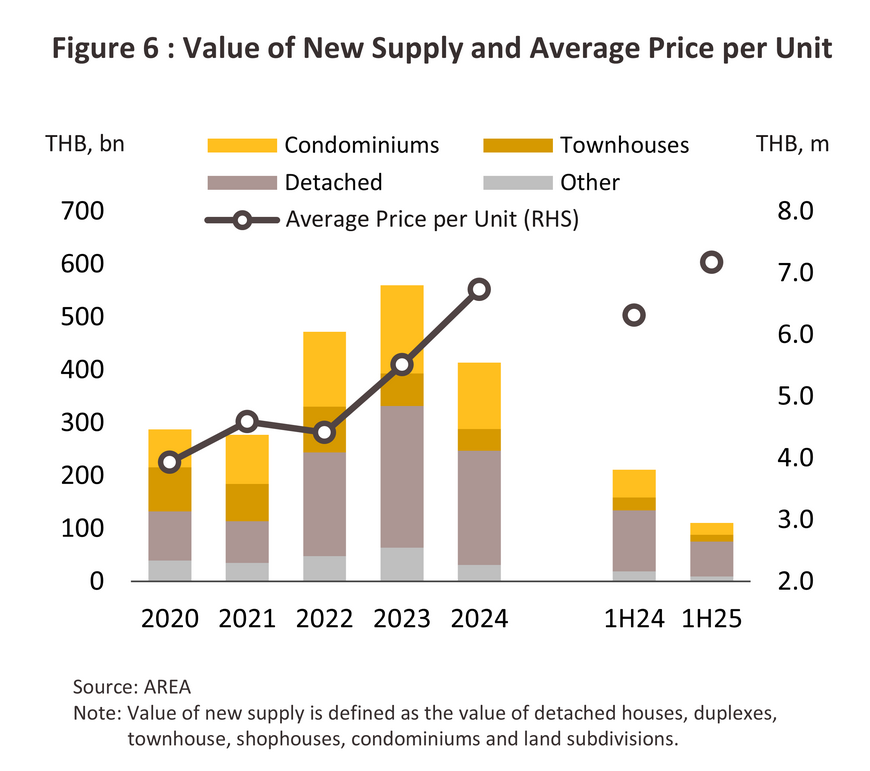

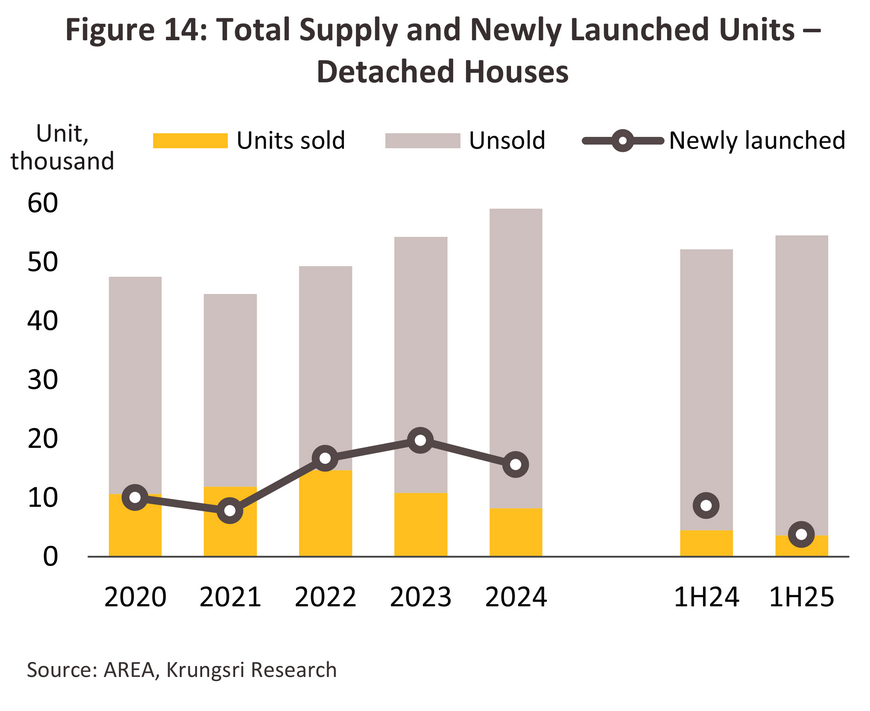

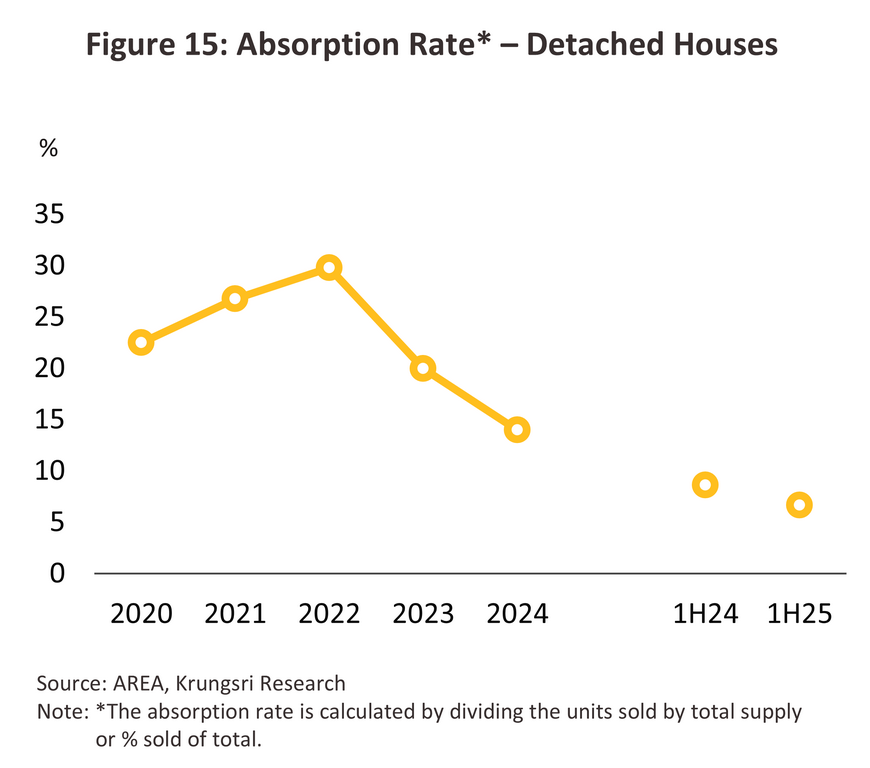

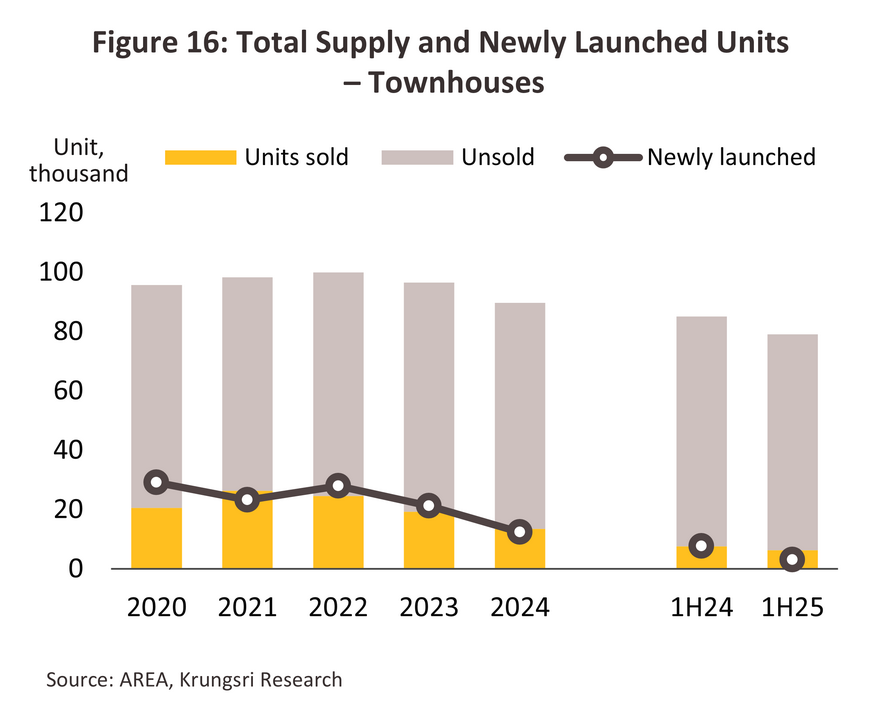

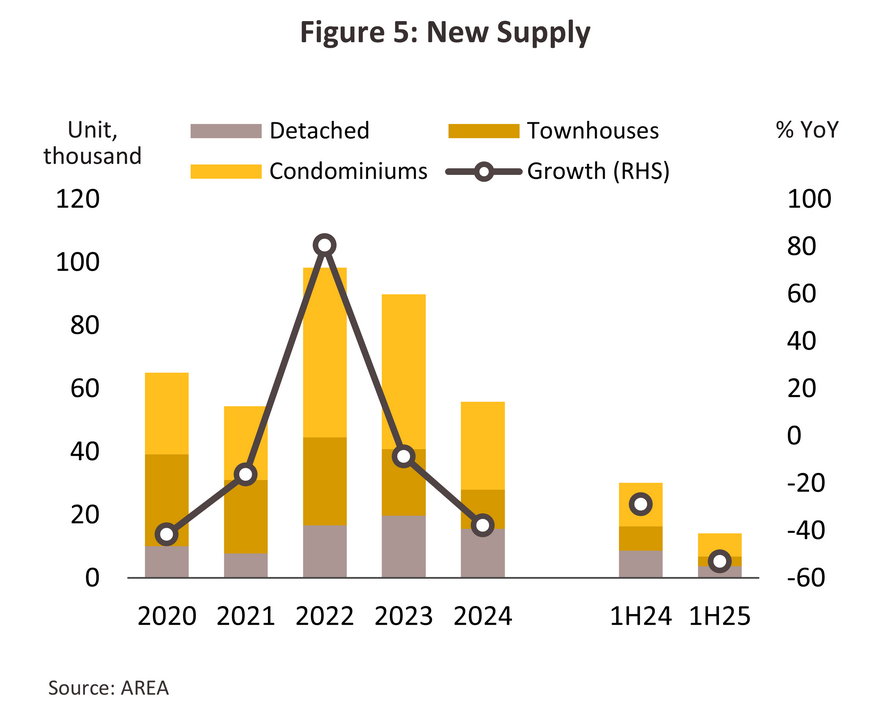

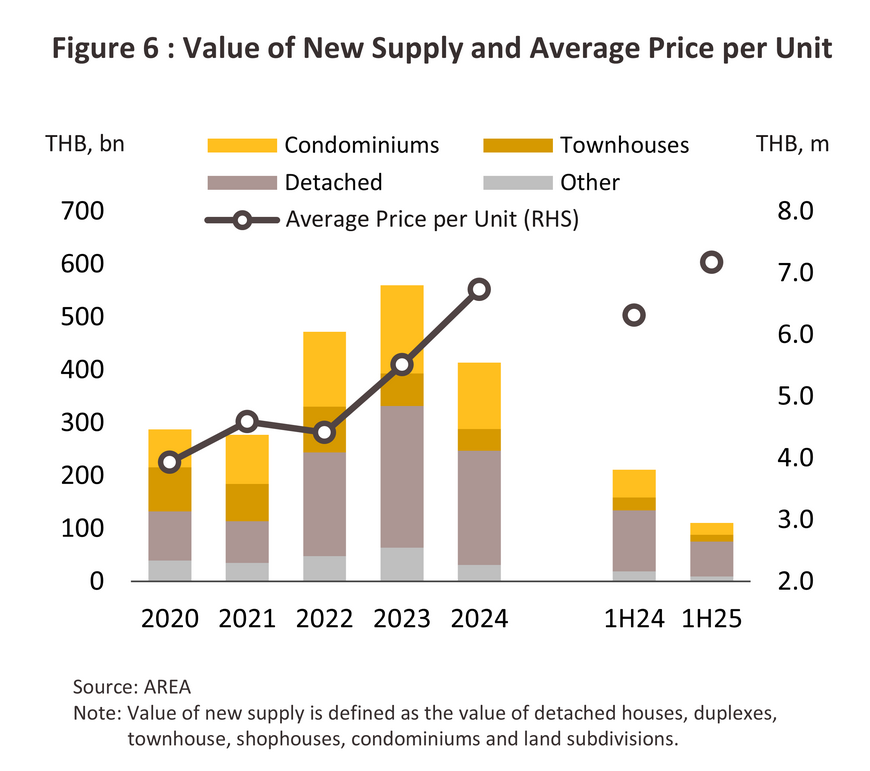

The number of new housing units coming to market slumped -37.8% YoY, dropping to just 55,915 units (Figure 5). 50% of new units were condominiums, 28% were detached houses, and 22% were townhouses. However, by value, declines were less precipitous, dropping -22.9% to a total of THB 380 billion (Figure 6). Developers adopted a more cautious approach to launching new projects, especially with regard to location and target buyers, in order to minimize risks associated with high levels of unsold inventory and intense competition. By housing type, declines were thus strongest among condominiums and townhouses, the supply of which was down by respectively -43.0% and -41.5% YoY, while for detached houses, the drop came to -20.8%. Most of the new launches were in the upper-middle to high-end segments, targeting buyers with strong purchasing power and continued access to mortgage lending, as they were less affected by the economic slowdown. As a result, average per-unit prices in fact rose from THB 5.5 million in 2023 to THB 6.7 million in 2024.

-

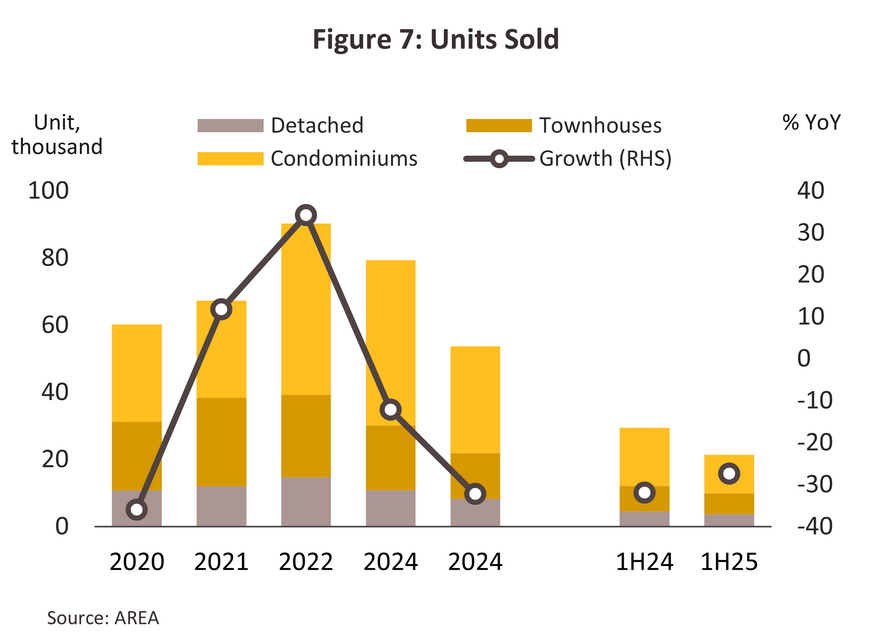

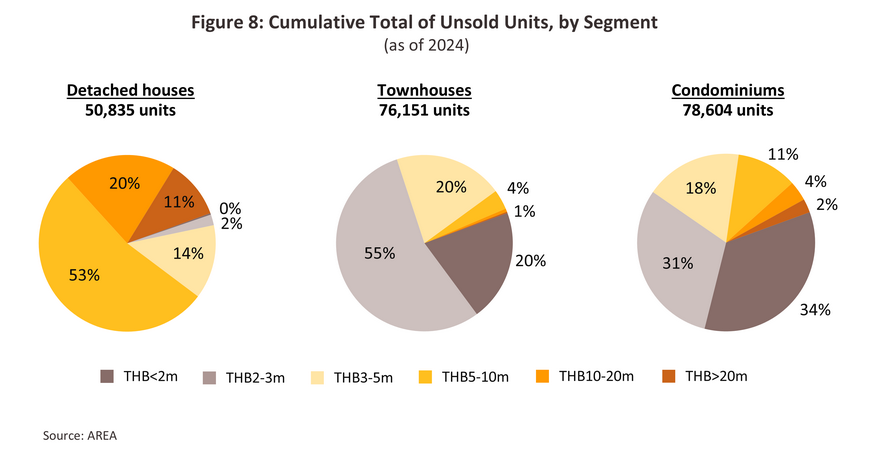

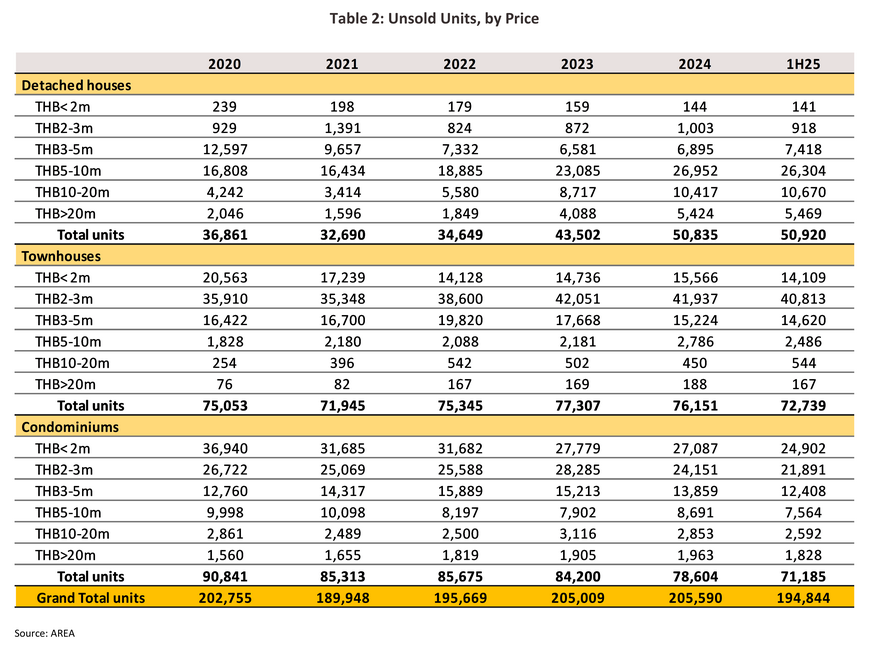

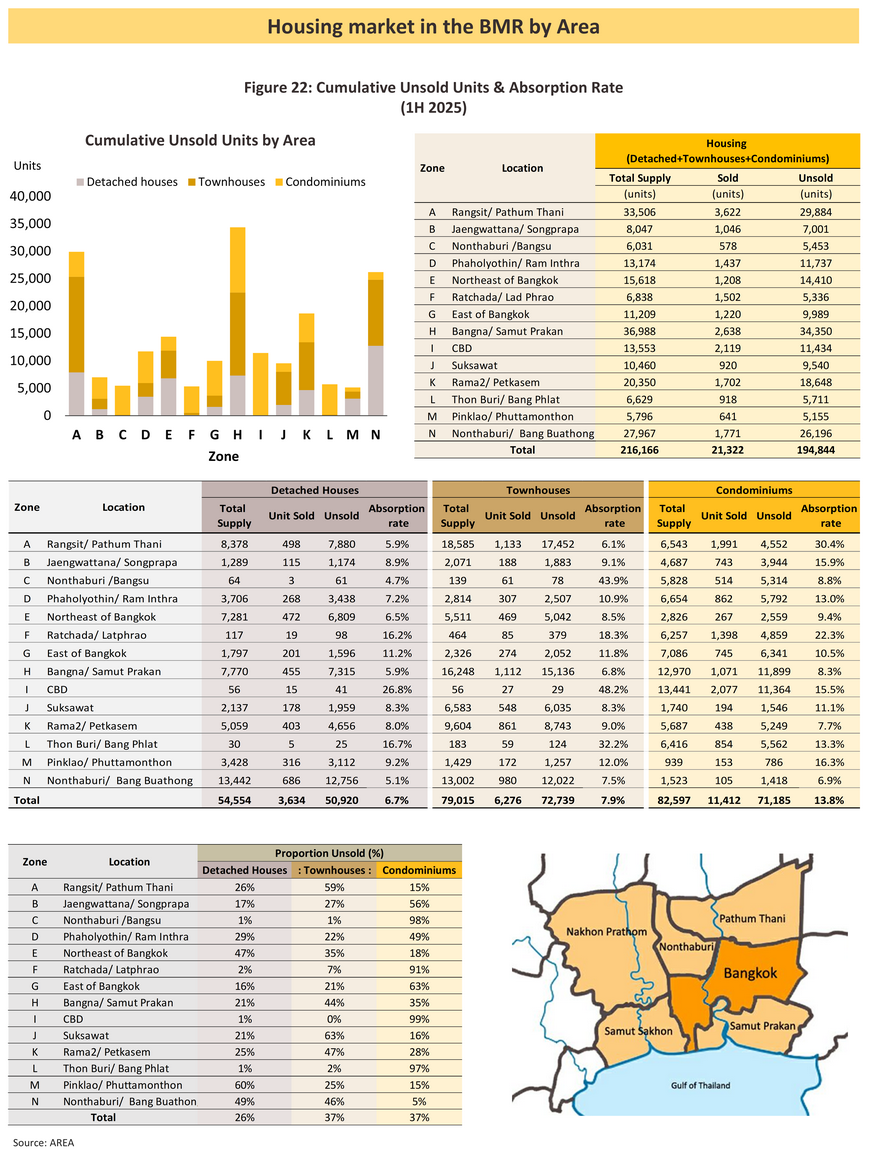

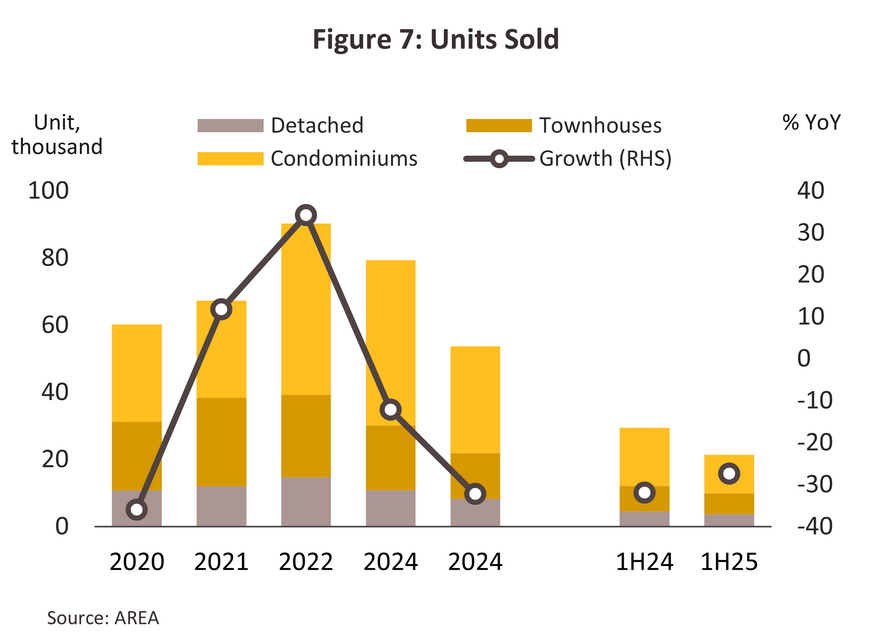

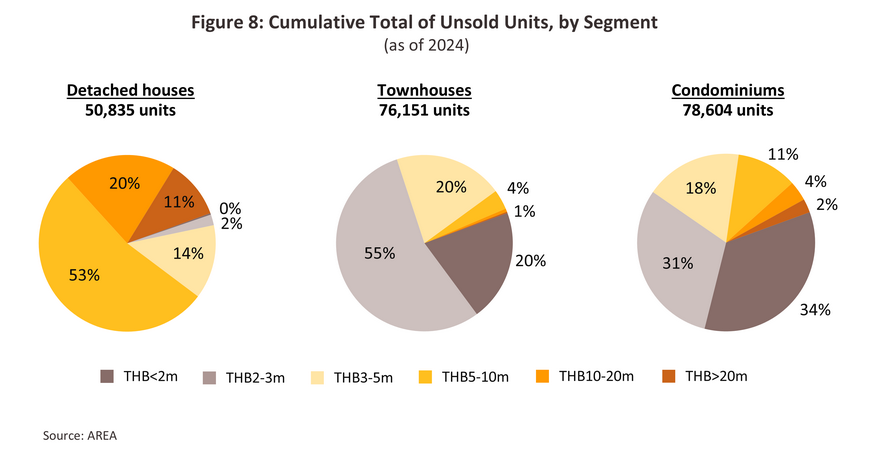

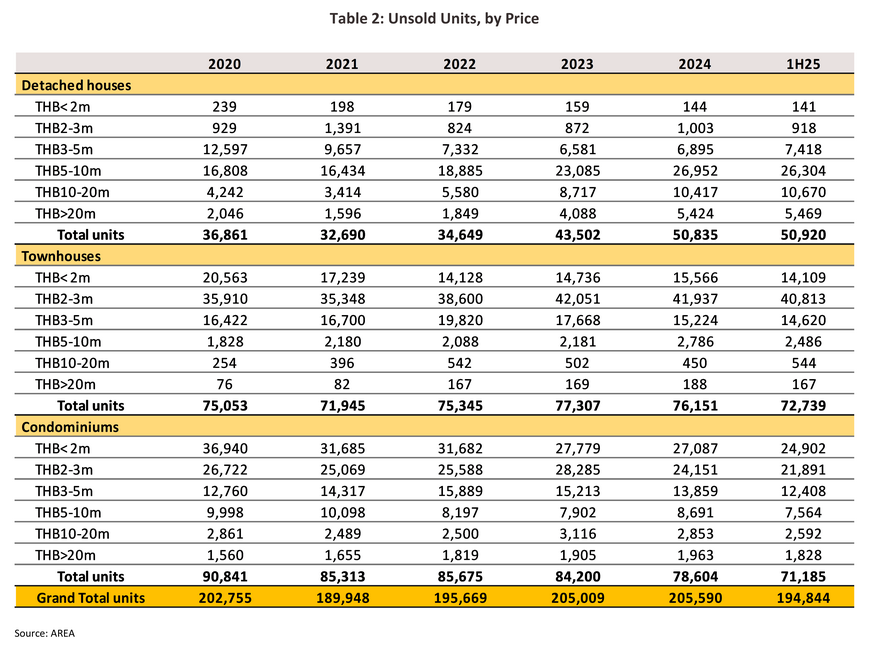

Sales slumped -32.3% from their 2023 level to 53,705 units (Figure 7), though declines were most pronounced for condominiums (down -35.2%), followed by townhouses (-29.5%) and detached houses (-23.7%). The market was affected by weak purchasing power, especially among lower- and middle-income groups, the heavy burden of household debt, which has impacted the ability of borrowers to secure home loans, and prices that rose by 5.0-10.0% on higher costs. These factors led to a rise in the cumulative number of unsold units to 205,590 units, or a rise of 0.3%from 2023 (Table 2). 53% of these unsold properties were priced at under THB 3 million, and most of these were townhouses and condominiums (Figure 8)

-

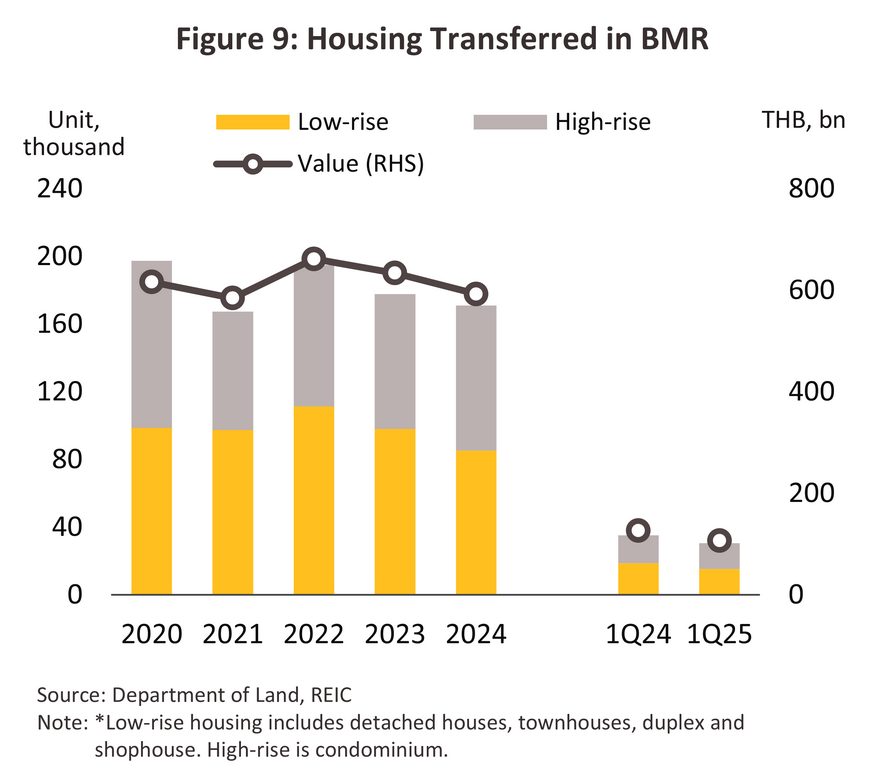

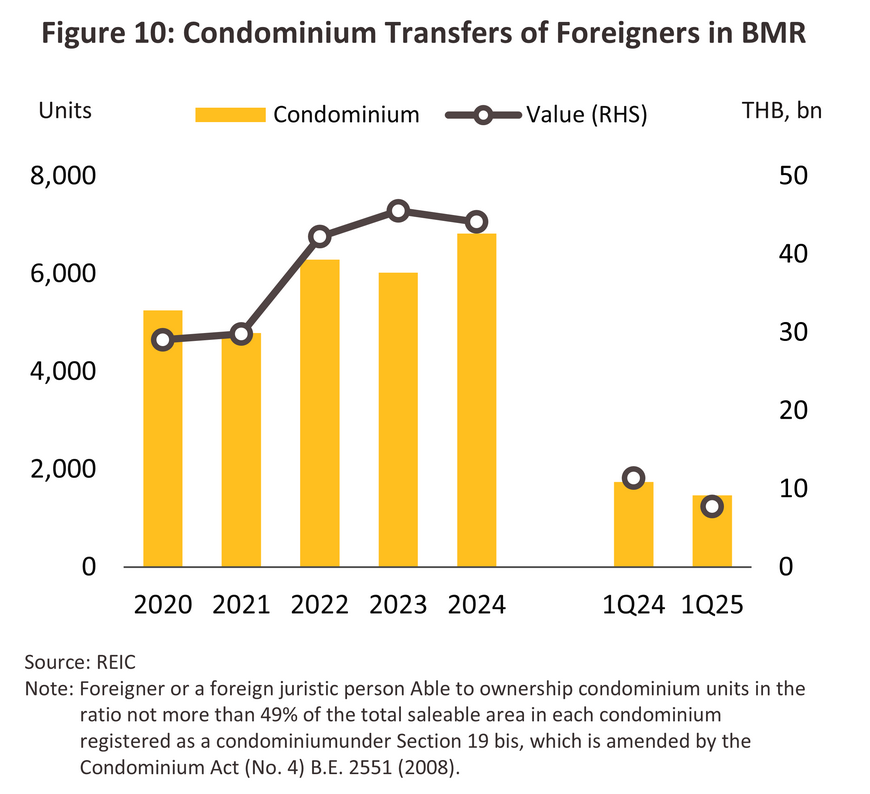

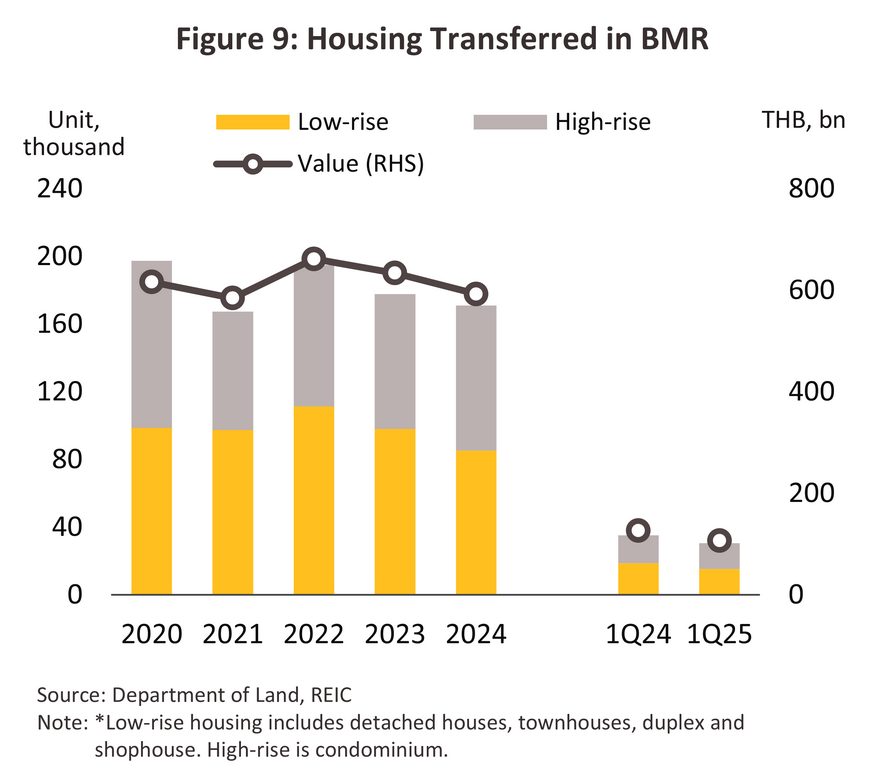

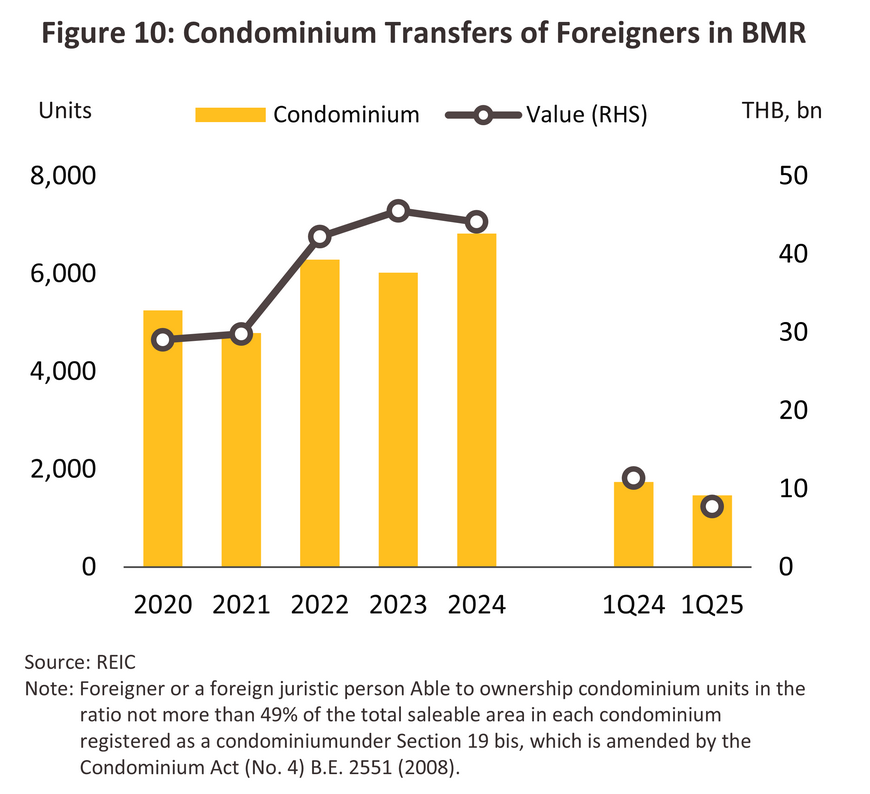

A total of 171,093 transfers of ownership were completed in 2024, down -3.8% YoY, though by value, these declined -6.5% (Figure 9). For all types of low-rise properties, the number of completed transfers of ownership completed dropped -12.9%, split between declines of -16.9% for townhouses (26% of all transfers of ownership), -7.6% for detached houses (15% of the total), and -8.8% for semi-detached houses and shophouses (9%). Condominiums accounted for the highest share at 50% of the total, and so for the first time in 4 years, this came close to matching the number of transfers for low-rise properties. Transfers of ownership of condominiums climbed 7.4% driven by (i) the desire to complete transfers before year-end 2024 and the termination of stimulus measures; and (ii) a 13.3% increase in the number of transfers of ownership made by foreign buyers (for 6,821 units valued at THB 44.10 billion, down -3.2% YoY). Buyers from China were the most important group making these transfers (these prefer condominiums in the BMR to those in tourist destinations) followed by buyers from Myanmar, Taiwan, the United States, and India (Figure 10).

-

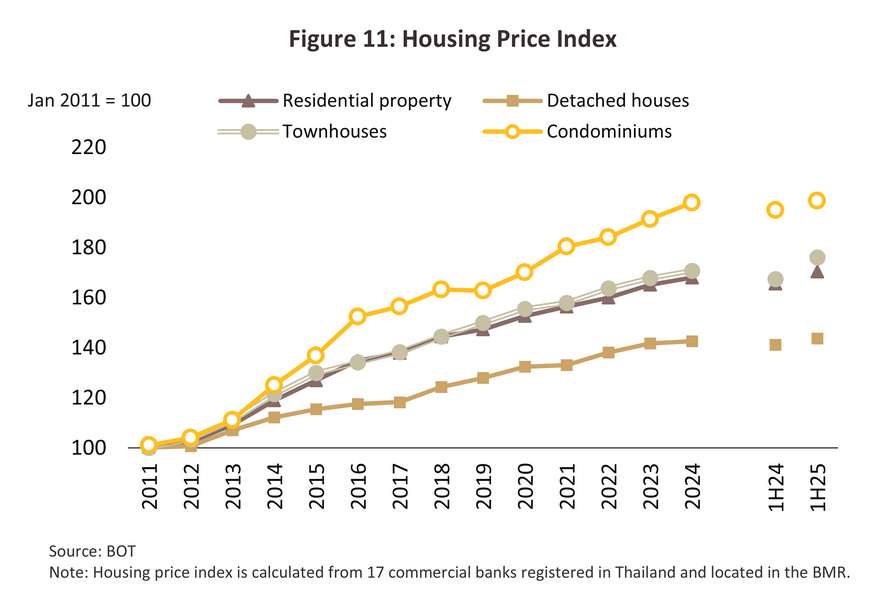

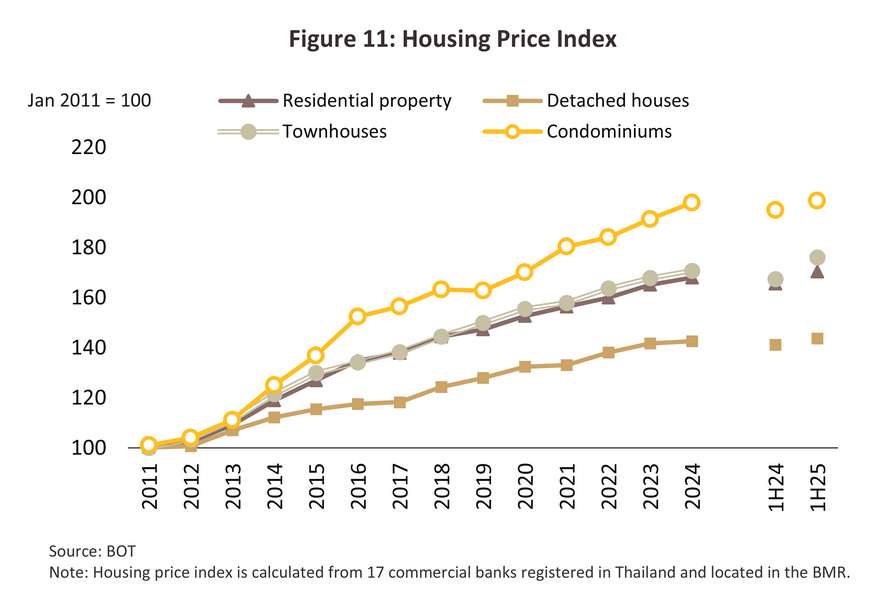

Prices have tracked steadily higher and so the index of residential property prices is up 1.9% from its 2023 level (Figure 11). Prices are being lifted by the increase in development costs, in particular for land in prime locations, as well as higher construction materials costs and labor wages. As a result, developers raised selling prices to reflect these cost increasing, while managing new projects cautiously to preserve demand amid a sluggish economic recovery. By property type, condominiums recorded the sharpest price rises at 3.4%, followed by townhouses and detached houses at respectively 1.7% and 0.6%.

Outlook

The housing market in BMR has continued to struggle under the weight of a number of different factors through 2025. (i) Domestic economic growth is expected to slow from 2.5% in 2024 to 2.1% in 2025, as ongoing global trade conflicts weigh on Thai manufacturing and exports. Additionally, the tourism sector seems to be recovering more slowly than anticipated before returning to its pre-COVID levels. (ii) Household debt remains elevated, and with borrowers’ creditworthiness increasingly diverging from lenders’ requirements, buyers’ ability to secure home loans is declining. This is most pronounced among lower- and middle-income groups, or those looking to buy properties valued at THB 5 million or less. (iii) Purchasing power from foreign buyers has shown signs of weakening amid growing global economic uncertainty, leading to more cautious spending behaviors. As a result, there is a decline in interest among non-Thais in tourism and working or investing in the country. This is reflected in the -4.7% YoY drop in tourist arrivals over 1H25 (January-June), with Chinese arrivals seeing a particularly steep decline of -34.1% YoY. This is significant because Chinese buyers accounted for an average of 60% of all foreign transfers of ownership over 2018 and 2019. Additionally, concerns over safety, including the well-publicized earthquake at the end of March, have caused some prospective foreign buyers to delay or postpone property purchases and title transfers. The outlook for the housing market in 2025 is summarized below.

-

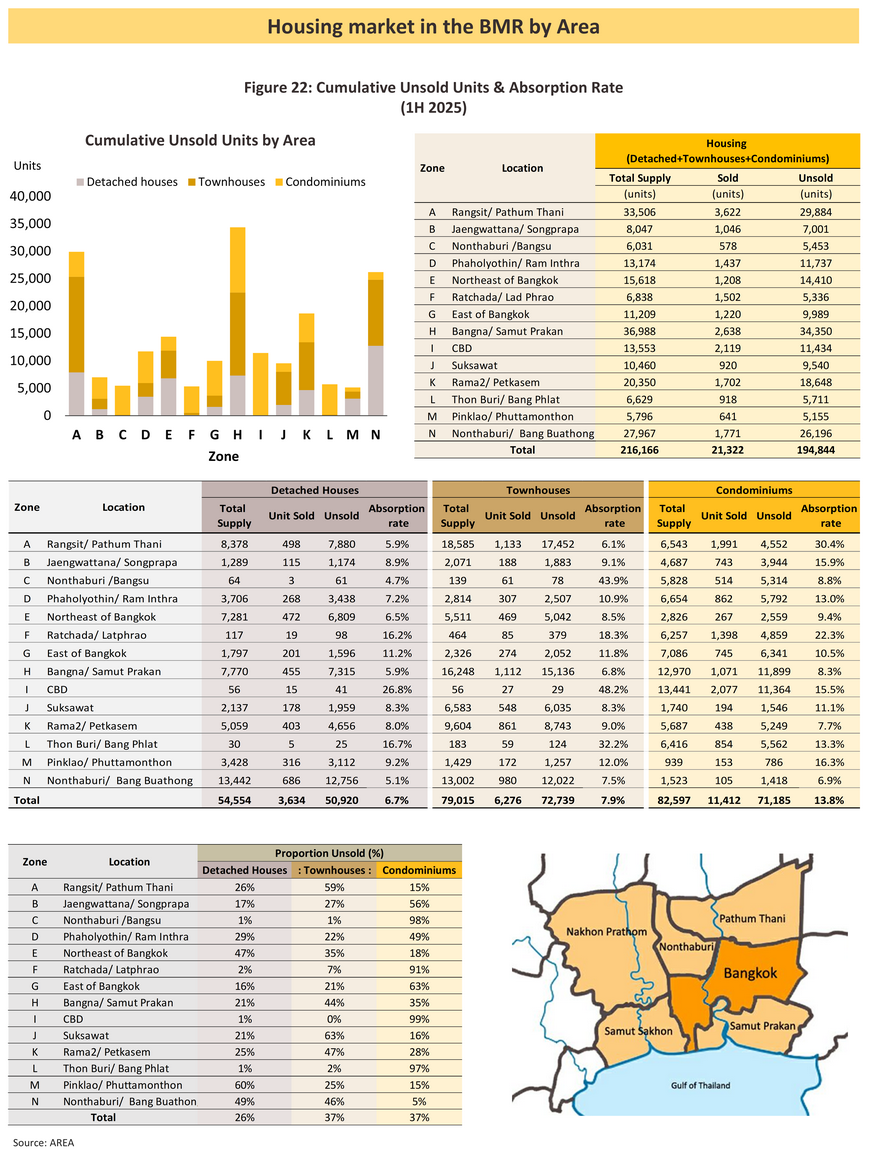

First half of 2025, the market endured sluggish conditions, and this was then reflected in the -27.4% YoY drop in total sales to 21,322 units (Figure 7). On the supply side, developers also attempted to run down their stocks of unsold properties rather than begin work on new projects, so the number of new units coming to market crashed -52.9% YoY to just 14,182 properties. Declines were seen across the major segments, falling -60.1% YoY for townhouses, -57.0% YoY for detached houses, and -46.3% YoY for condominiums, which also saw buyers’ safety concerns following the earthquake in March (Figure 5). In response to fragile market conditions, the government issued a number of stimulus measures (e.g., relaxing the LTV rules5/ and reduced transfer and mortgage registration fees6/).

-

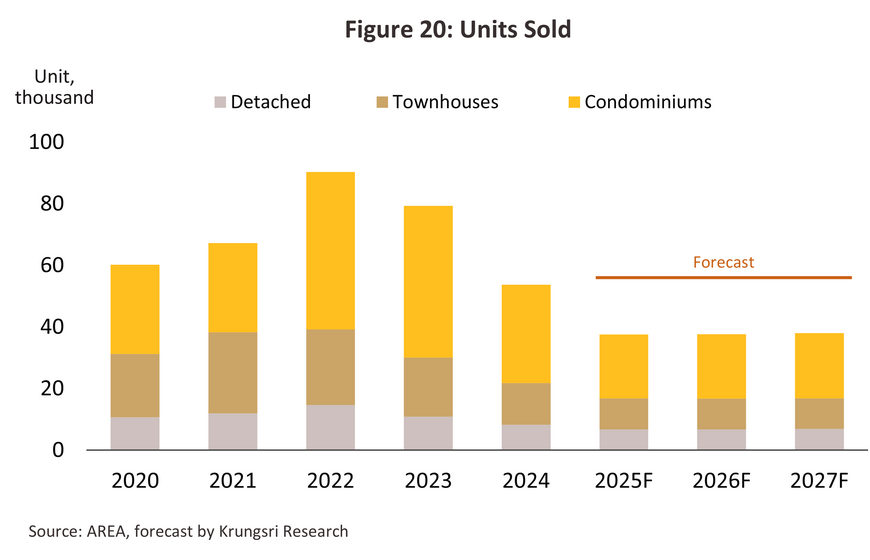

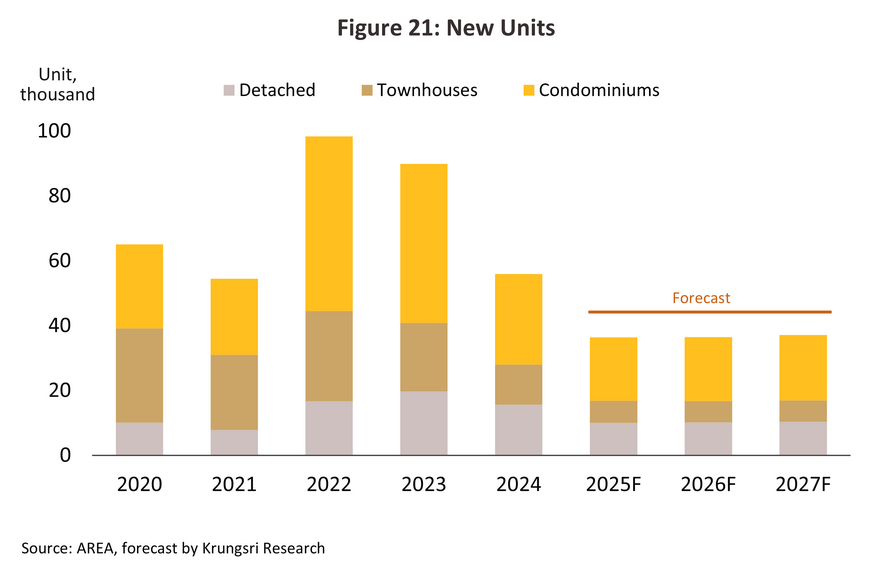

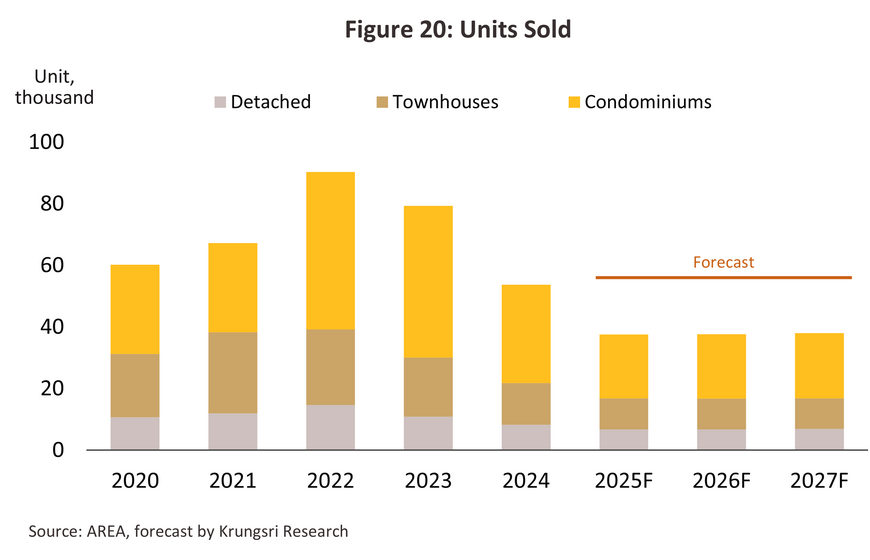

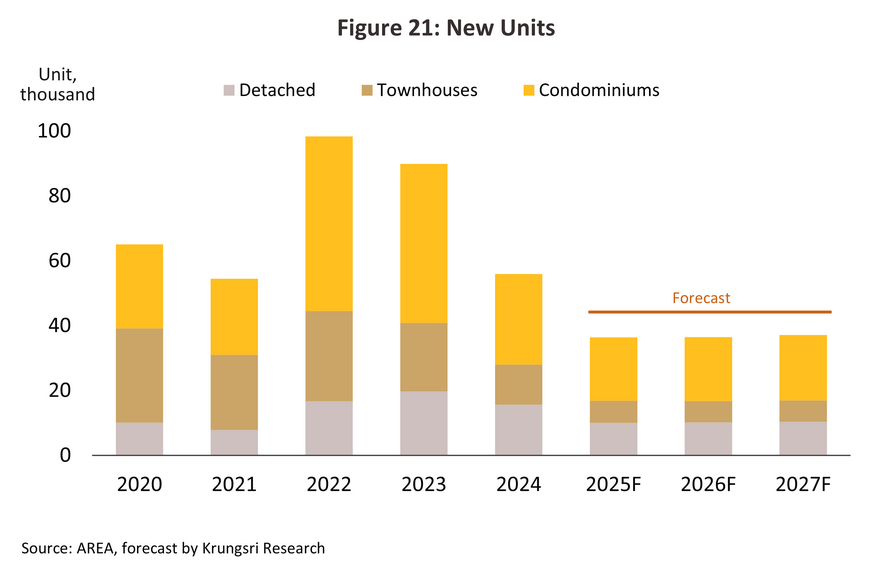

The remainder of the year, the housing market in the BMR continues to struggle due to several headwinds. These include worsening global trade tensions that are weighting on the Thai economy, as well as persistently high levels of household debt, which are unlikely to improve in the short term. Sentiment has thus weakened, and some potential buyers are postponing purchases. This is most pronounced in the sub-THB 3 million segment, which from the supply side is also the most crowded part of the market. Government stimulus measures may help to lift demand partially, but with consumers still worried over future income, their impact will be limited. Added to this, broadening worries over the international economy will negatively affect demand from foreign buyers, especially those looking to buy as an investment. For all of 2025, the expectation is thus that sales of residential properties will contract by -30.0% from 2024 (Figure 20), with the supply of new units also dropping -35.0% (Figure 21).

Krungsri Research expects the housing market to improve slightly over 2026 and 2027

-

The number of newly-launched units should increase by 0.5-1.5% annually, the total thus inching up to around 37,000 new units per year, though this will still be only a third of the pre-pandemic (2017-2019) average of 110,000 new properties entering the market each year. As a result, developers are likely to focus on reducing their stocks of unsold properties, while holding back on launching new projects due to the persistently challenging economic conditions. When new developments do enter the market, they will generally be undertaken by major corporate players that are on a stable financial footing, that are able to better manage risk that comes with economic uncertainty, that can rapidly adjust to changes in demand, and that are able to maintain their growth trajectory by stimulating demand. By contrast, SMEs will typically cut back on their investment plans and instead focus their efforts on smaller, lower risk projects. New projects will encompass both low- and high-rise developments, though these will be concentrated in high-growth areas (e.g., where infrastructure is currently being upgraded or in locations identified for future government spending). These developments will primarily target owner-occupiers and the upper end of the market. To ensure tighter control over costs and quality, the projects will also tend to be relatively small in scale. Beyond this, companies will adjust their sales strategies and will target particular demographics more tightly (e.g., working-age buyers, the elderly, premium buyers, and the expat market). Developers will in addition tend to shift the mix of properties in their portfolio to include a greater proportion of low-rise and luxury units and will attempt to cut costs by holding back on projects in higher risk locations. Companies will increasingly leverage technology to sharpen their sales and after-sales services, for example by offering virtual tours and online booking systems.

-

Overall sales will edge up by 0.2-1.0% annually. (i) The Thai economy is expected to recover gradually, though at an average rate of only 1.5-2.0% annually. This will be driven especially by government investment that will then boost employment and incomes. The tourism sector is also on track to rebound, with 41 million arrivals forecast for 2027, supporting a pickup in domestic purchasing power. Coupled with government stimulus measures that are still in effect, this will then translate into greater housing demand. (ii) The market will benefit from ongoing work on transportation infrastructure, especially the expansion of the mass transit system to routes around the city. The latter will include the Orange Line (from the Thailand Cultural Centre to Minburi) and the Dark Red Line (the extension from Rangsit to the Thammasat University Rangsit Campus), these will improve accessibility in peripheral zones, stimulating residential demand along new transit corridors and appealing to modern, convenience-oriented consumers. (iii) Rising numbers of expatriates including investors, manufacturers relocating to avoid trade tensions, those employed in the country, and retirees are living long-term in Thailand. This will add substantially to demand for properties (both long-term rentals and purchases) at the mid and upper-end of the market. The outlook for the main market segments is given below.

-

Low-rise developments (town- and detached houses)

-

Detached houses: Sales volume should slowly recover as more demand will come from owner-occupiers with the financial capacity to remain active in the market. These buyers are typically looking for accommodation with more usable space, and tend to prioritize quality of life, privacy, and safety. The importance of these factors, especially safety, has grown significantly since the March 2025 earthquake, further boosting interest in low-rise developments. Additionally, the ongoing expansion and integration of Bangkok’s metro system is making affordable units in suburban areas more attractive by reducing the need to live close to workplaces. On the side of developers, players are increasingly offering properties that align with modern lifestyles by providing a much higher degree of flexibility in how they can be used, for example, by including home offices, ground-floor bedrooms for elderly family members, and large kitchens that connect through to living rooms and entertainment areas. Developers are also shifting their location strategies to outer zones of the BMR with high potential, including Krungthep Kreetha Road and Bang Na-King Kaew in eastern Bangkok, Ramintra-Watcharapol and Rangsit in northern Bangkok, and Ratchapruek-Phutthamonthon in the west. In particular, locations that are well served by private hospitals and international schools are in strong demand from young families of business owners and executives.

-

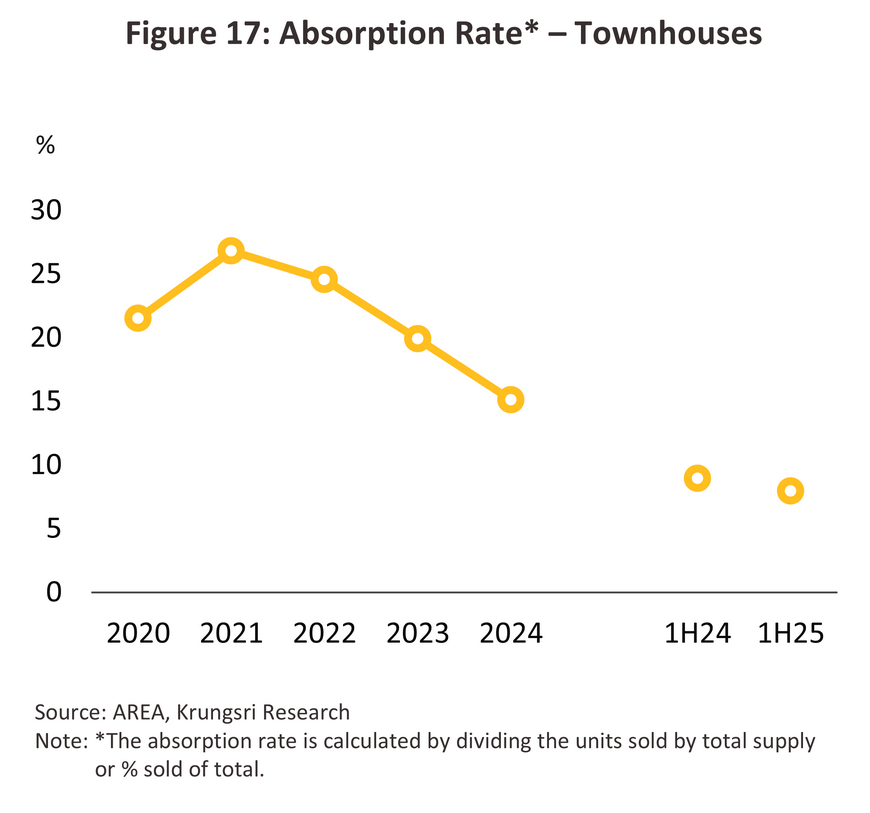

Townhouses: Sales are expected to remain flat due to the large supply of unsold units; as of 2024, almost 40% of all unsold properties were townhouses, with these concentrated especially in the THB 2-3 million segment (this accounted for 55% of all unsold townhouses). In addition, the main buyers of these units are low- to middle-income consumers, who have also been disproportionately affected by the buildup in household debt. They are thus now more cautious about their spending. Relatedly, these individuals are also facing growing difficulties securing financing. Large developers will likely be able to maintain their business in this segment, but SME developers will have to endure stiffening competition, and some players may face liquidity problems.

-

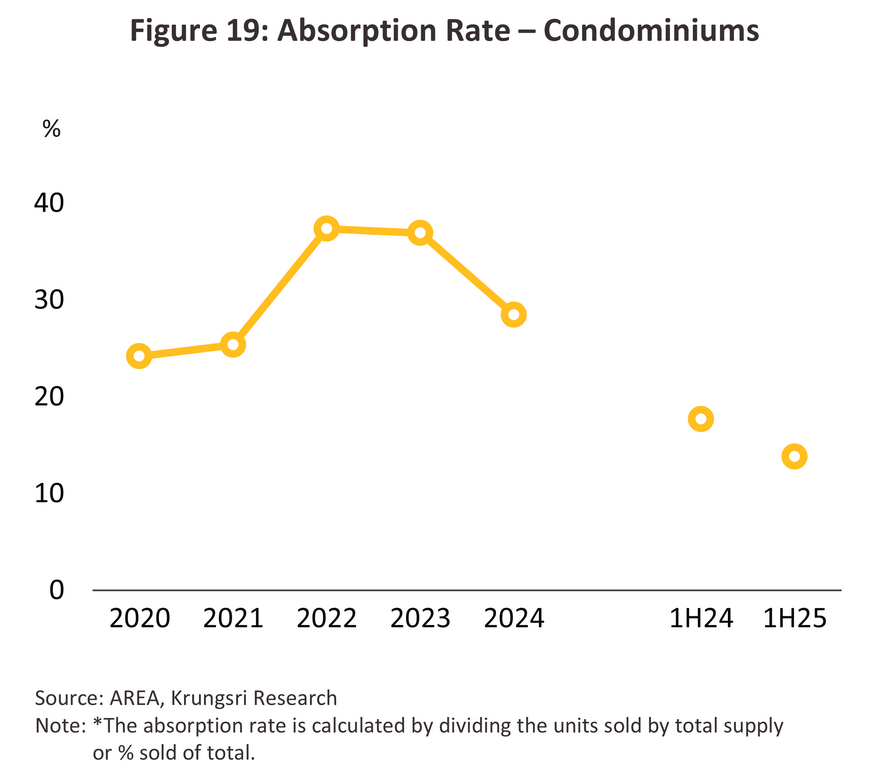

Condominiums: Conditions in this segment are expected to improve, and sales should pick up somewhat given the fact that limited access to land and the resulting high prices makes condominiums the preferred choice for those living in central Bangkok. The ever-growing and increasingly integrated metro system is also making travel between downtown locations and more suburban areas much more convenient, and because this matches the preferences of younger buyers, who prioritize ease-of-travel and urban lifestyles, the supply of condominiums will tend to expand as developments go up alongside these new lines. Likewise, condominiums remain the first choice for buyers looking to generate an income from their property, especially from Gen Z renters, as they tend to prefer renting to buying. Sales will further benefit from strengthening demand from non-Thai buyers, especially those in the market for luxury and super luxury7/ units in downtown and river-front locations. Some overseas buyers may also be attracted to the market by the reduced exposure to geopolitical risk that a second home in Thailand provides. Indirectly, the market will benefit from the implementation of the 4th revision to the Bangkok city planning regulations, expected to be enforced from 2027 onwards. By increasing the floor area ratio (FAR) in orange zones (medium-density residential areas), these changes will help to stimulate the development of average-sized and large condominium developments in suburban areas and in locations with new infrastructure, such as around Srinagarindra and Ram Inthra roads. At the same time, the coverage of low-density residential areas/yellow zones to include more remote parts of the urban areas will enable developers to work on new low-rise developments targeted at middle-income families.

However, demand for condominiums may come under pressure from increased worries about the safety of high-rise buildings, and this may shift some consumer interest towards low-rise developments instead. Moreover, in more outer parts of Bangkok, the market is more focused on townhouses and detached houses, while an oversupply remains high in certain areas, including Chaeng Wattana, Nonthaburi, and Bangna-Samut Prakan and so price competition is especially intense in these locations.

-

Players will need to adapt to a number of challenges in the near future. These will include: (i) ongoing weakness in domestic consumer spending power and the resulting difficulty accessing sources of credit; (ii) rising construction costs, especially for land in prime locations, and continuing labor shortages (a long-running structural problem within the industry), which will tend to generate price rises that will outpace increases in buyers’ incomes; and (iii) Thailand’s transition to an aged society8/, which will reduce demand for new properties, while the shrinking share of the population that are of working age (the main driver of the market) will further erode demand.

1/ From Ministry of Finance

2/ The registration of new properties in the BMR is collected from requests for new house numbers made to district offices in the BMR. In the case of allocated project houses, the developer is the one who applies for the house number, even if the construction is not yet completed or there is no buyer yet (source: REIC). For high-rise projects, it is collected from the Land Office.

3/ To help ease access to home finance, the Bank of Thailand relaxed its loan-to-value (LTV) regulations in 2024. As a result: (i) first-time homebuyers purchasing properties valued below THB 10 million can borrow up to 110% of the value of the property against which the loan was secured (100% of the value of the property and 10% for additional furnishings and decorations); (ii) the minimum down payment for properties valued at up to THB 10 million was cut from 20% to 10% of the total; and (iii) in the case of joint applications, the means of calculating the number of loans was relaxed, with joint applicants no longer considered repeat borrowers if the applicant’s name was not listed on the title deeds and the loan was made with the intention of assisting a member of the family.

4/ The financial sector comprises commercial banks, the Government Housing Bank, the Government Savings Bank, the Islamic Bank of Thailand, the Bank for Agriculture and Agricultural Cooperatives, finance companies, credit fonciers, life insurance companies and the National Housing Authority.

5/ This allows borrowers to take out loans of up to 100% of the value of first or second homes, though for the latter only if these are valued at not more than THB 10 million (in effect from 1 May, 2025 to 30 June, 2026).

6/ The government has reduced registration fees for property transfers and mortgages to 0.01%, down from 2% and 1% respectively. The measure applies to both new and second-hand residential properties with a mortgage amount not exceeding THB 7 million per contract. These reductions apply to new and pre-existing properties bought by an individual Thai national and will run from the date of their publication in the Royal Gazette until 31 December, 2025. It is effective from the date of the Royal Gazette announcement until 31 December 2025.

7/ Luxury condominiums are those with a price of THB 250,000-349,999/sq.m., while more expensive units are classified as super luxury.

8/ An aged society is defined as a society within which at least 20% of the population are aged 60 or over. Data from the National Statistical Office shows that as of 2024, there were around 13 million individuals in Thailand who were at least 60 years old, or 20.2% of the population.

9/ The Building Energy Code (BEC) applies to 9 types of building with a total floor area of at least 2,000 sq.m. The code specifies minimum design standards for energy conservation in 6 systems: the building envelope (OTTV, RTTV), the lighting system (LPD), air conditioning, hot water systems, overall energy usage, and use of renewables. The code has been in force since March 13th, 2023 and its use and enforcement falls under the Department of Alternative Energy Development and Efficiency (DEDE)

.webp.aspx)