EXECUTIVE SUMMARY

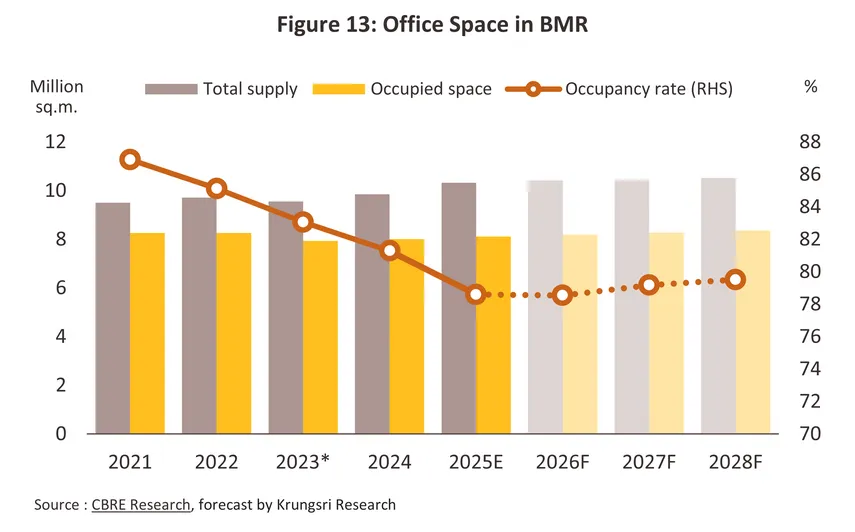

The office rental market is expected to remain under pressure in 2026 due to a persistent oversupply that continues to outpace rental demand. This will occur amid a slowdown in Thailand’s economic growth across both trade and investment, coupled with fragile domestic purchasing power, prompting businesses to delay or scale back office expansion plans. In addition, the continued adoption of hybrid work models is enabling companies to reduce operating costs by downsizing leased office space. As a result, demand for office space is expected to soften further from its 2025 level, while new supply continues to enter the market as planned, exerting additional downward pressure on occupancy rates. In 2027–2028, the office rental market is projected to recover modestly, supported by a gradual economic rebound, sustained demand for modern office space—particularly Grade A and A+ buildings in the CBD—from selected industries (e.g., technology, finance, digital services, and health and beauty), and continued demand from foreign companies investing in Thailand.

Key challenges facing the office rental business stem from the Thai economy’s slow recovery, which is restraining growth in office leasing demand. In addition, office developers are facing higher development costs as they adapt buildings to ESG standards in response to tenants’ sustainability objectives. At the same time, a substantial oversupply of office space in the market is expected to continue to put downward pressure on rental rates over the coming years.

Krungsri Research view

Krungsri Research assesses the outlook for the office rental market over 2026–2028 by location as follows.:

-

Developers of for-sale or rental office space in prime areas1/ of Bangkok: Incomes are expected to rise for developers providing new Grade A and Grade A+ office buildings, particularly those that best meet demand by offering attractive modern design, ESG compliance or certification, effective on-site management, and smart building systems. Supply is dominated by major corporations that benefit from their access to capital and the land banks that they built up when prices were lower. By contrast, the industry’s steep investment overheads and ever-tightening construction standards make it difficult for new entrants to break into the market. Nevertheless, while demand is expected to recover only gradually, this should support a modest improvement in occupancy rates, with rental growth remaining limited.

-

Developers outside the CBD and in the wider BMR region: Income is expected to remain flat or decline, especially for Grade B and older office buildings. Land prices in these areas are relatively low, and suitable development sites are readily available, encouraging a steady inflow of new market entrants and intensifying competition. At the same time, most renters are SMEs, and because they are more sensitive to changes in the economic outlook, it is difficult for landlords to raise rents. To ensure that tenants stay on site, operators may need to leave rents flat, making it difficult for landlords to increase their revenue.

Overview

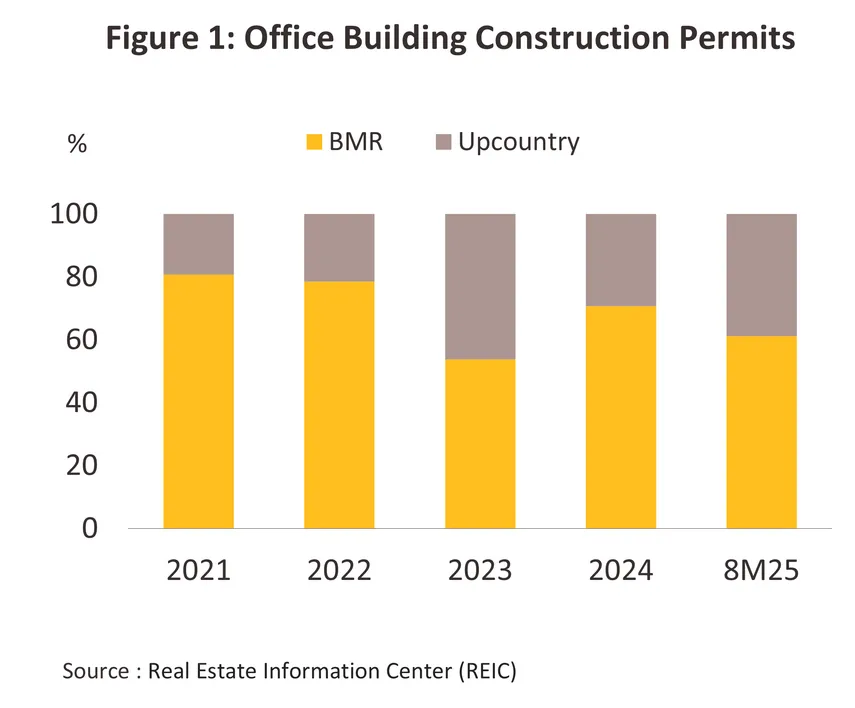

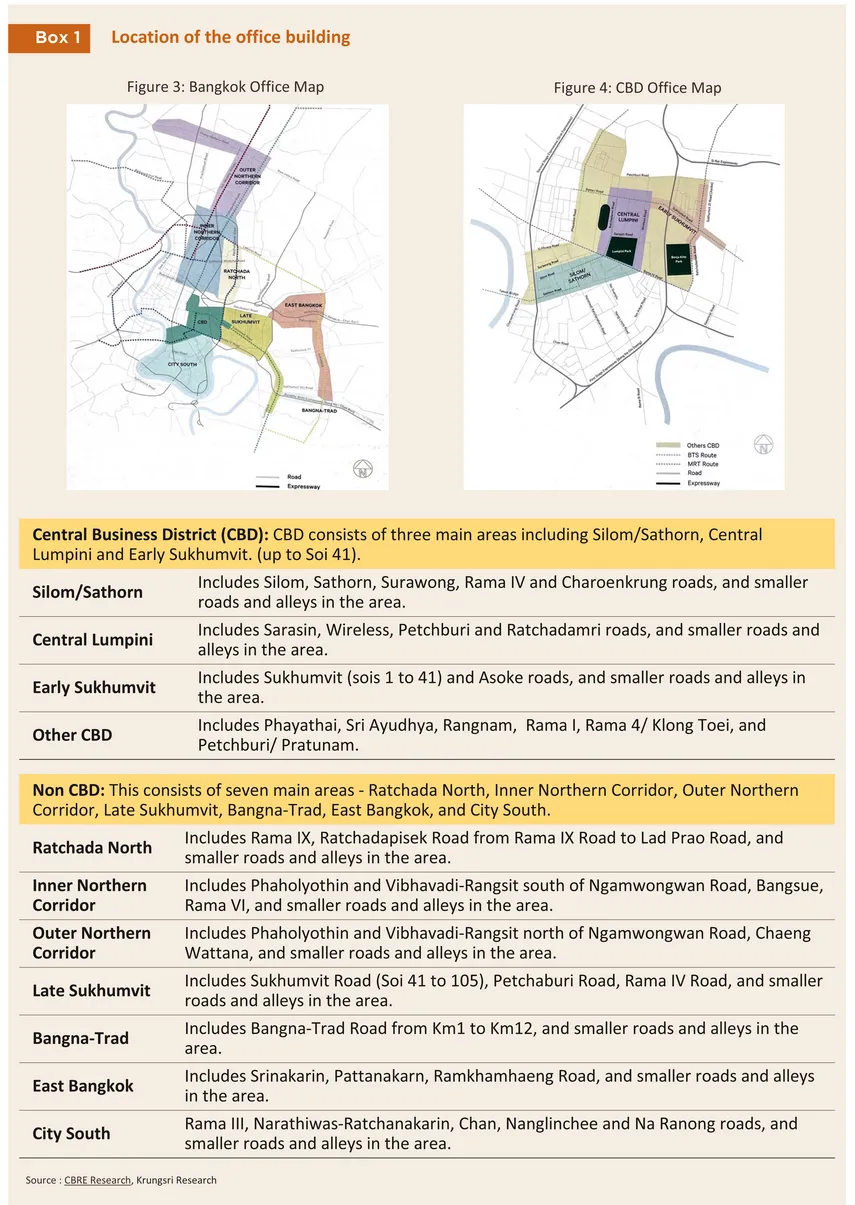

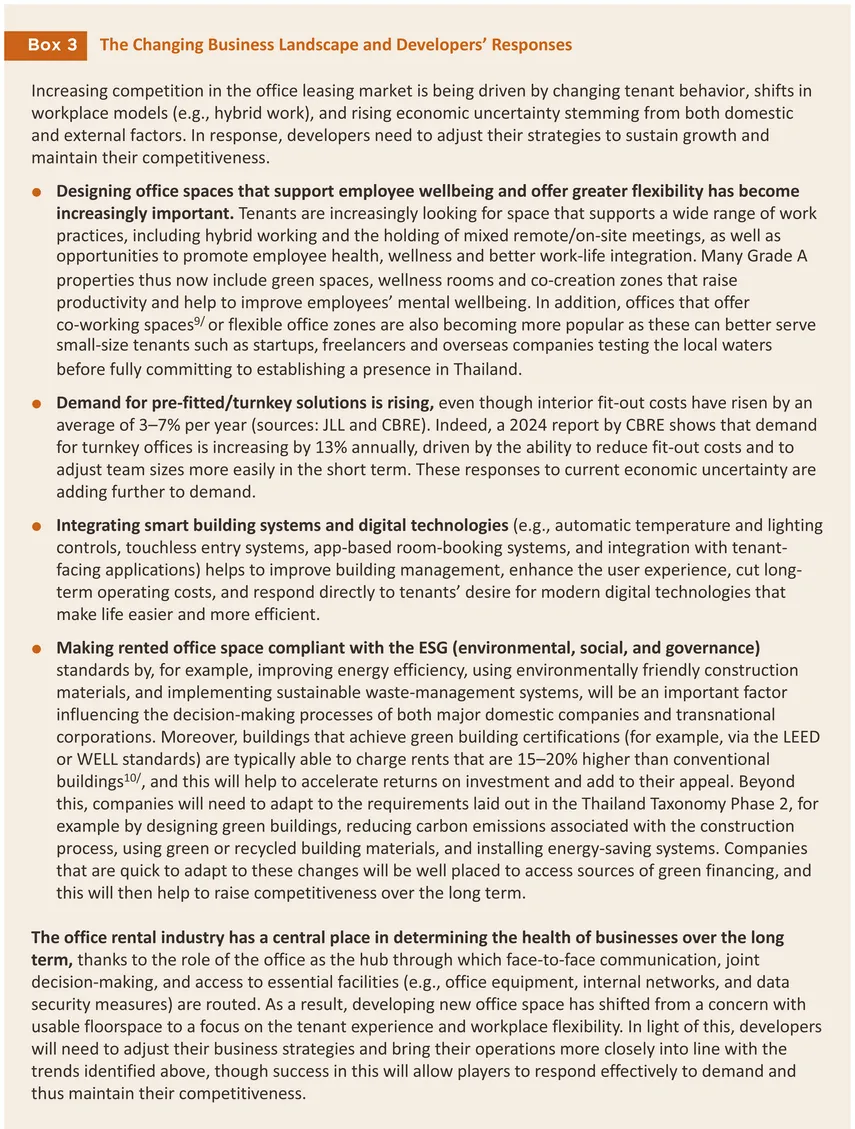

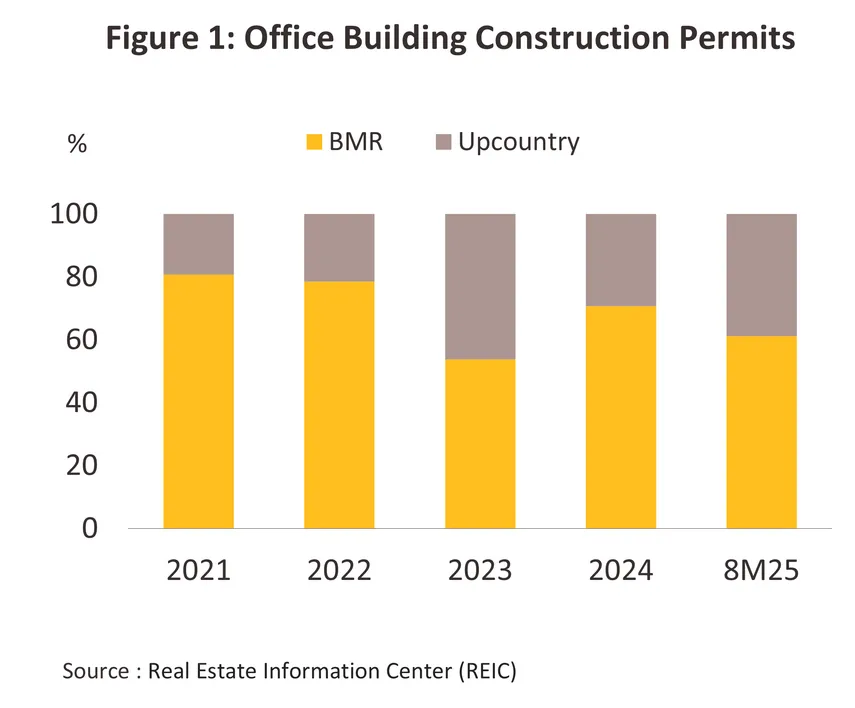

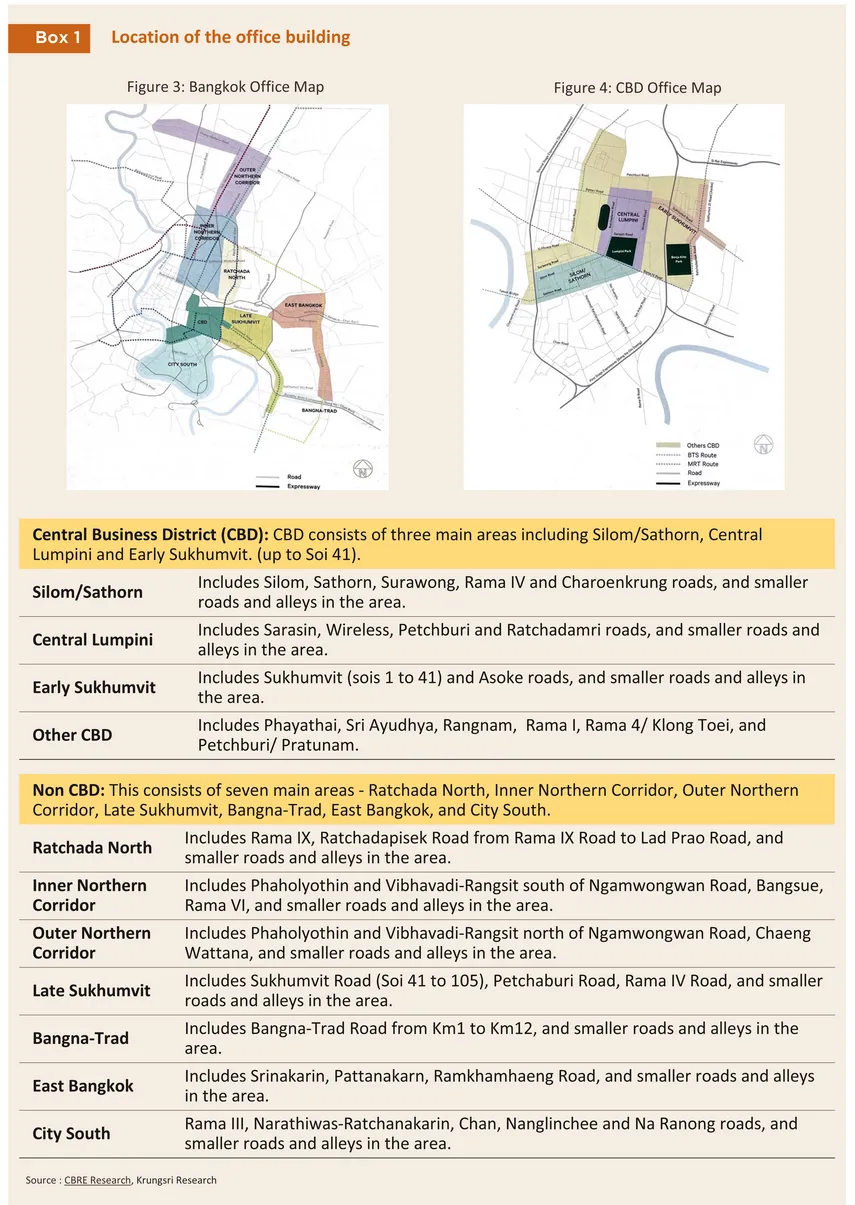

More than 70% of rental office space in Thailand is concentrated in the Bangkok Metropolitan Region (BMR), as reflected in the nationwide office building construction permits (Figure 1). In Bangkok, office properties have tended to be clustered in the central business district (CBD), where office developments are located alongside flagship shopping complexes and high-end hotels and residential units. The CBD encompasses the central districts of Silom, Sathorn, Ploenchit, Wireless Road, Asoke, and the top end of Sukhumvit (up to Soi 24) (Box 1). This area is well served by communication links, including the BTS, MRT and expressways that link it to outer areas of Bangkok. However, continuing growth in supply within the CBD is limited by restricted access to suitable land, prices that rose by 5–7% annually over 2022–2024, and 8–10% annual increases in construction costs (source: AREA, REIC). As such, developing new projects within the CBD has become increasingly expensive.

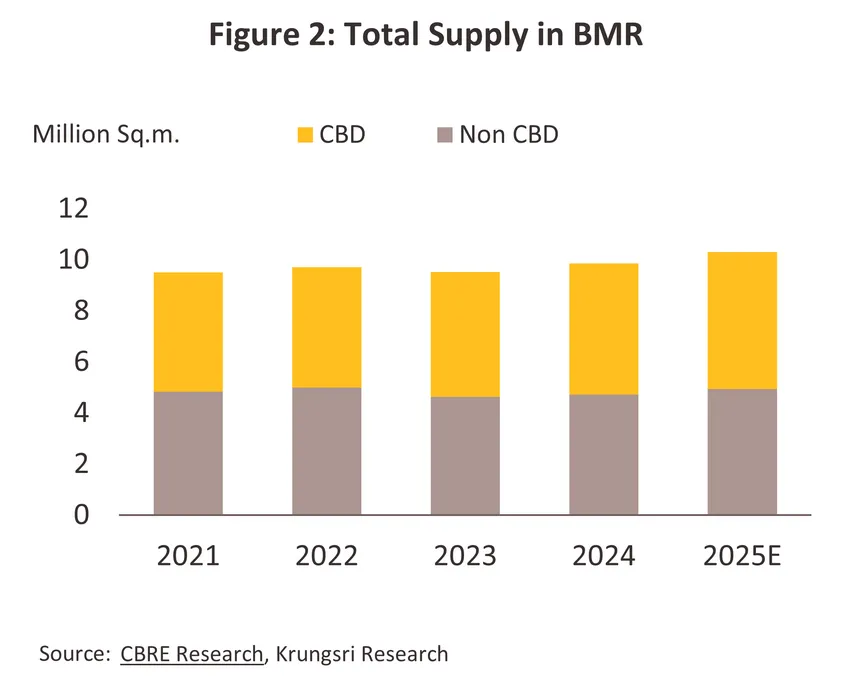

However, improvements to the capital’s road and public transport systems have helped to spread development out of the CBD to areas such as Ratchadaphisek, Phahonyothin, Vibhavadi Rangsit, Rama III, upper Sukhumvit and Bang Na (Figure 2). Properties in these areas are attracting interest from businesses looking for a mix of better value for money, good transport links, and a degree of flexibility over unit sizes, and some of these areas (e.g., Rama IX and Phahonyothin) are expected to evolve into a ‘new CBD’ as developers respond to strong demand growth.

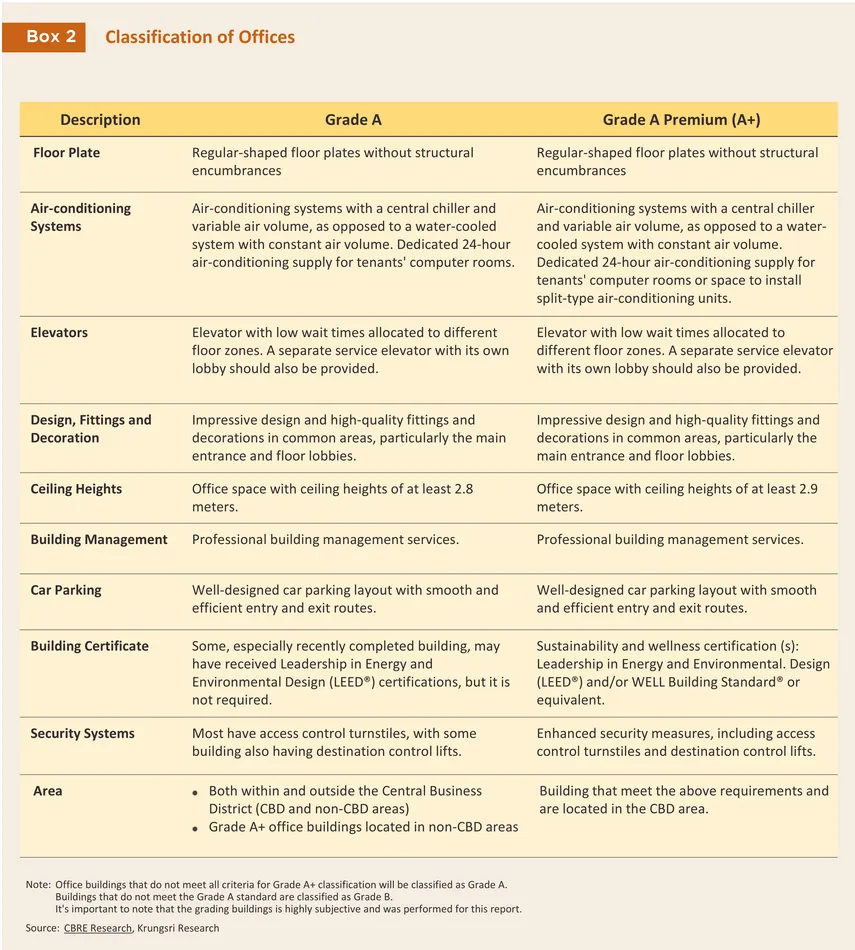

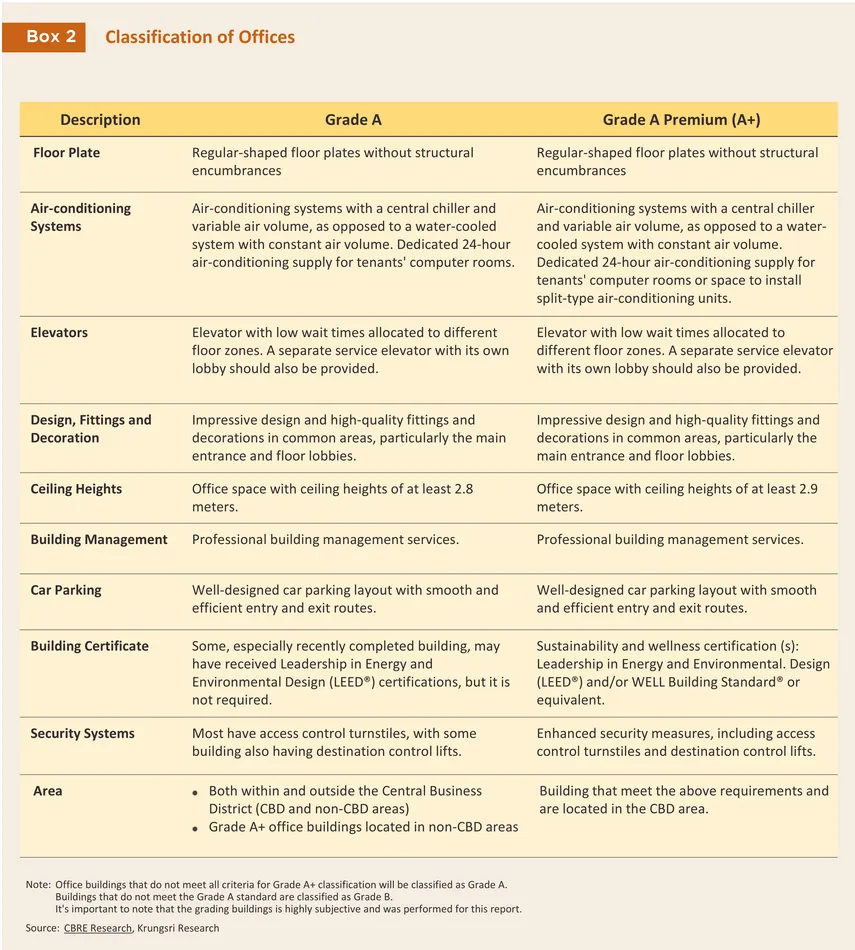

Developing new office space in the CBD is highly capital intensive, especially in the main commercial areas. Under Bangkok’s 2013 comprehensive plan, “red zones” (areas with high concentrations of economic activity) are suitable for office developments. However, the limited availability of vacant land and restrictions on the permissible floor area ratio (FAR)—the maximum total building floor area allowed relative to the size of the land plot—mean that most new projects involve redeveloping existing sites, either through major renovation or by demolishing and replacing older buildings with high-rise²/ or large-scale³/ offices (with a gross floor area of at least 10,000 sq.m.). New offices in the CBD are typically positioned as Grade A+ buildings, with significantly higher architectural standards, energy performance, and smart-building technologies than conventional Grade A developments (Box 2), in order to attract premium tenants. By contrast, developing office buildings outside the CBD involves lower costs for land and construction, and so this opens up new opportunities for mid-sized developers to enter the market and to develop either small or large offices, possibly using part of these themselves and leasing out the rest.

The management of office buildings in the BMR can be split into two types.

-

Single ownership: This category accounts for 80% of all leased office space in the BMR. Buildings in this category are often high-rise structures developed by large developers, which may then manage the space themselves, or they may delegate this to a facility management company with particular expertise in this. These buildings are often leased as whole-building rentals or on a floor-by-floor basis and generally offer comprehensive on-site services and a high degree of flexibility over how internal space is used.

-

Multiple ownership: These account for the remaining 20% of office space and may be thought of as a kind of ‘office condominium’ arrangement. That is, ownership of the building is split between the individual buyers of each unit and so these many different owners have shared access to common areas. These buildings are most often managed through either a management company or a management committee, which is then responsible for ensuring that shared areas are managed in accordance with the relevant agreements and regulations.

Office space may be leased by either Thai or foreign companies (including startups), with renters often coming from the technology, e-commerce, finance or legal industries. For SMEs, which often have limited capital, leasing office space is usually the main option for conducting their business.

Leases may be organized in a number of different ways. Companies requiring sizable units may rent an entire floor, and in this case, they would generally be given more favorable terms than companies occupying space on a floor that was split between multiple tenants. The building’s owner will be responsible for providing and managing utilities and facilities including electricity, air conditioning, lifts, parking facilities, and so on. Generally, most office rental agreements will follow the same format.

-

Lease agreement: This covers two types of cost, ground rent (approximately 40% of the total) and service fees (the remaining 60%). The rental contract will be based on a fee for ground rent, set at a fixed price and quoted per square meter per month, while the contract for services will include all the non-rental fees, which will be payable at a variable rate according to usage (e.g., for electricity, air-conditioning, telephony charges, parking fees, management services and so on).

-

Lease terms: Most leases run for 3 years. This benefits both landlords, since it assures them of continued revenue streams, and tenants, because relocating to new premises incurs moving and setting-up costs. When leases are agreed for longer than 3 years, these need to be registered at the land office and in this case, a registration fee and stamp duty of 1.1% of the total rental value must be paid, which helps to make long-term lease agreements somewhat unpopular.

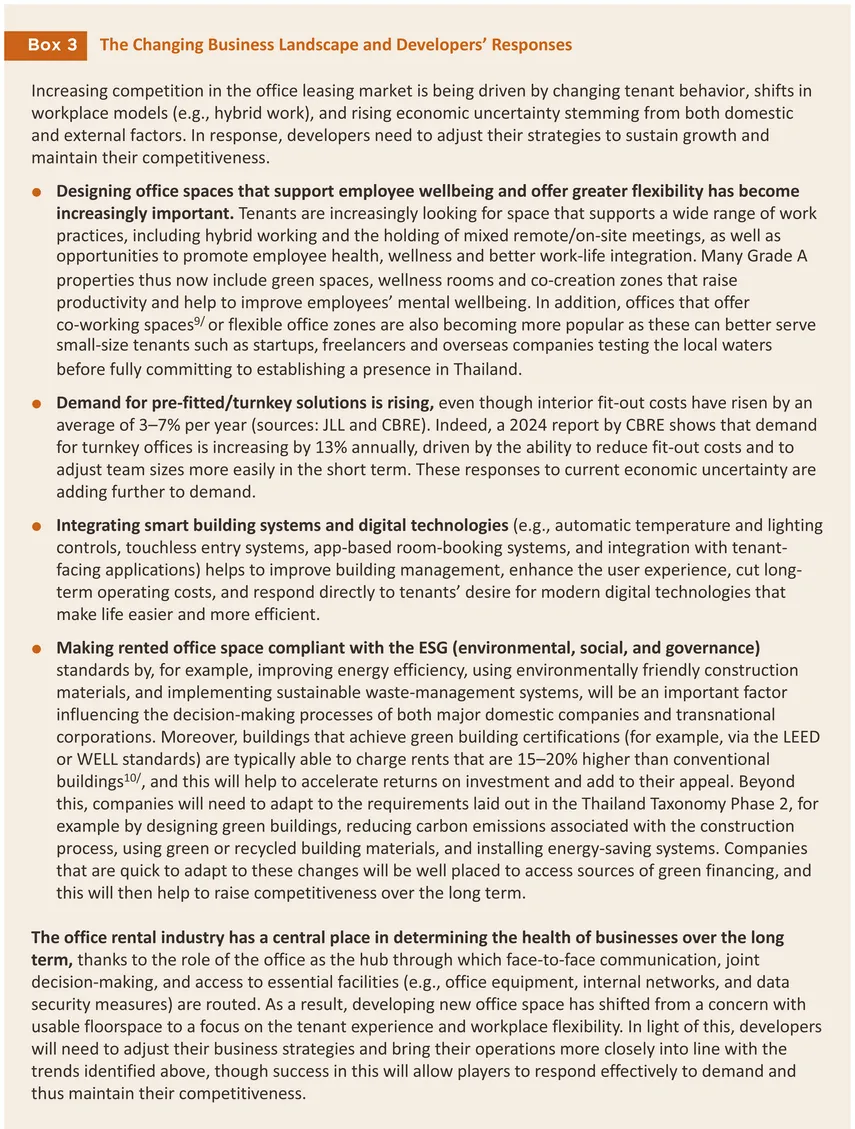

The market for rented office space is seeing significant levels of competition and so landlords are having to adjust their leasing strategies and upgrade the quality of their offerings. These shifts have intensified in the post-COVID-19 period, as office demand has become more diverse. landlords are shifting to offer more flexible arrangements, for example by offering shorter contracts (by the month, or up to a maximum of 2–3 years), being more adaptable over contract extensions, and allowing tenants to change contract details to better suit their circumstances. Grade A and A+ buildings in locations with convenient mass-transit access continue to attract the strongest demand, supported by their modern images, professional managements, workplace-ready designs (e.g., open-plan layouts and smart-building technologies), and robust safety standards. Alignment with the ESG standards (e.g., green building certification such as through the LEED or WELL standards) is also becoming an important consideration for both Thai and foreign companies looking for new premises.

Following the Covid-19 pandemic, the spread of hybrid working patterns has had a strong influence on demand for office space. A report by WorkSmart Asia shows that a full 84% of enterprises in the Asia-Pacific region have put in place working arrangements that mixed on- and off-site work (i.e., hybrid work), with 58% of the total adopting hybrid workplaces4/ and 26% allowing staff to work remotely, policies that have been shown to improve productivity and reduce employee turnover (source: International Workplace Group). The outcome of this is that employees are now more likely to be out of the office and then, rather than having their own permanent desk, to use ‘hot desks’ when they are on-site, and so companies are tending to look for smaller premises. In this environment, providers of office space that supports more flexible usage (e.g., that has multipurpose spaces, modular meeting rooms, and smart management systems) and that comes equipped with modern technology (e.g., smart access controls, IoT sensors, and real-time analysis of usage patterns) will be at an advantage.

Situation

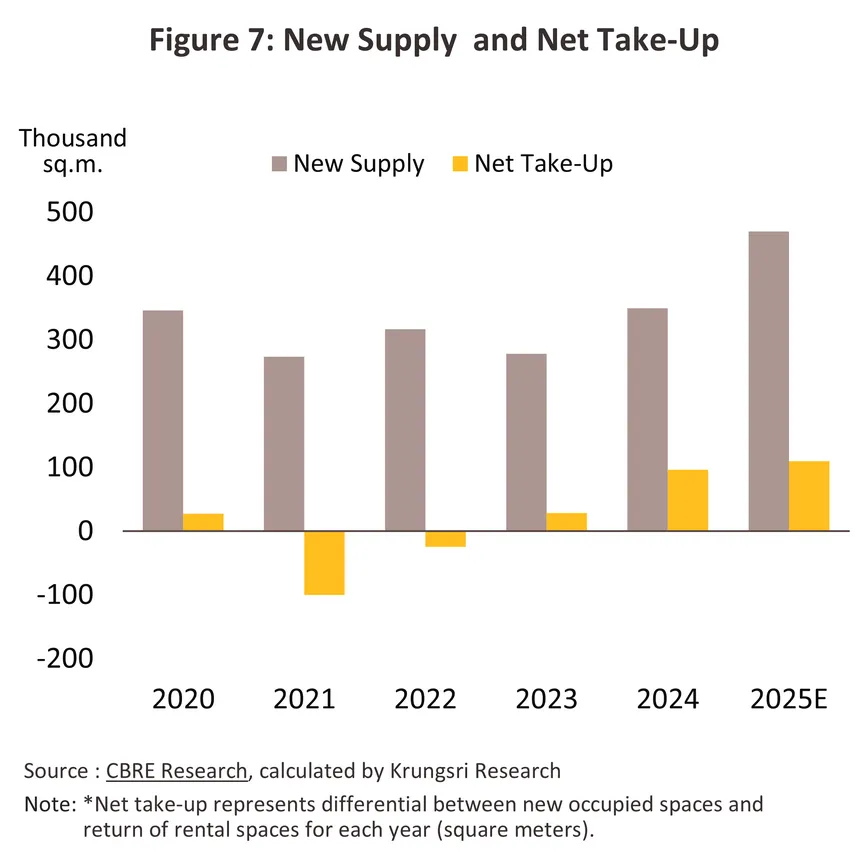

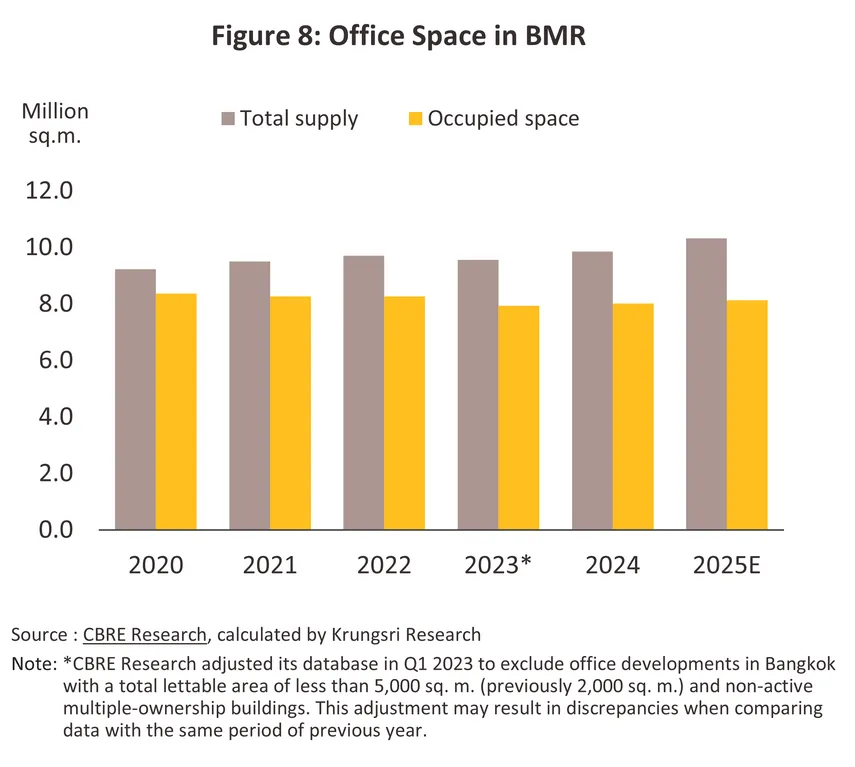

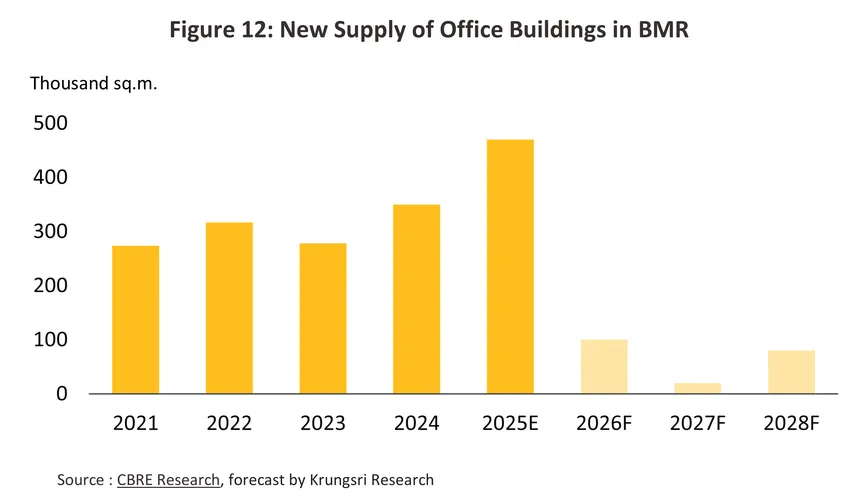

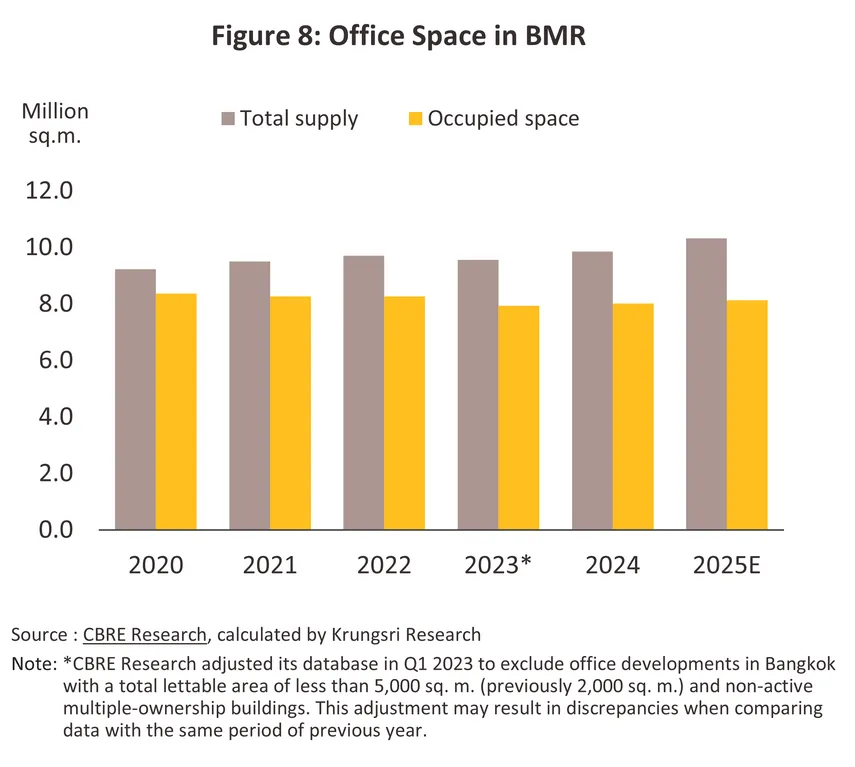

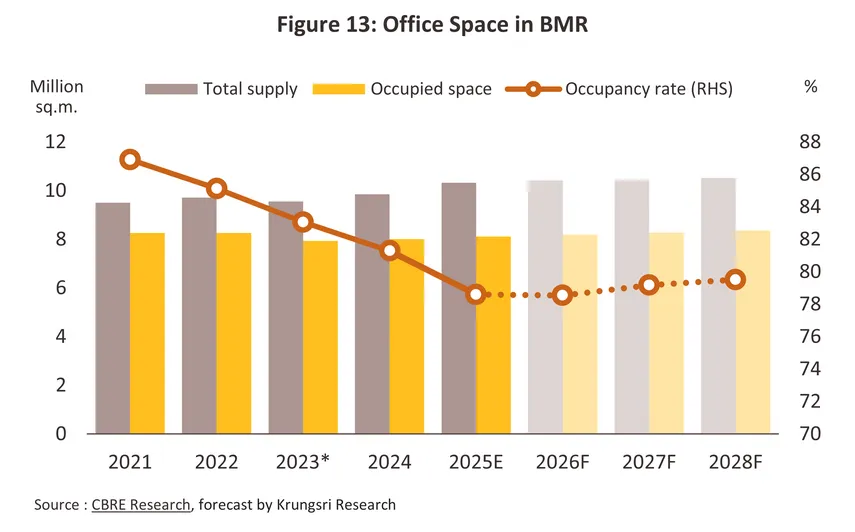

Supply was boosted over 2023 and 2024 by the completion of a number of mixed-use developments in the CBD, some of which would have come to market earlier had work on these not been delayed by the pandemic. This was then sufficient to add an extra 280,000–350,000 sq.m. to supply in these years (source: CBRE), bringing the total to 9.9 million sq.m. as of the close of 2024. However, demand has failed to keep up because while the Thai service sector has rebounded, domestic manufacturing continues to struggle, and this has led to only restrained overall growth in incomes. Moreover, working patterns established during the pandemic have extended into the post-pandemic period and so many companies continue to operate flexible or hybrid workplaces, and the combined effect of these two trends was to restrain demand growth to 96,000 sq.m. per year, down dramatically from the 190,000 sq.m. averaged over 2015-2019. Thus, by the end of 2024, 8.0 million sq.m. of office space was occupied, giving an occupancy rate of 81.3% while average rents declined by -0.3% from 2023 levels.

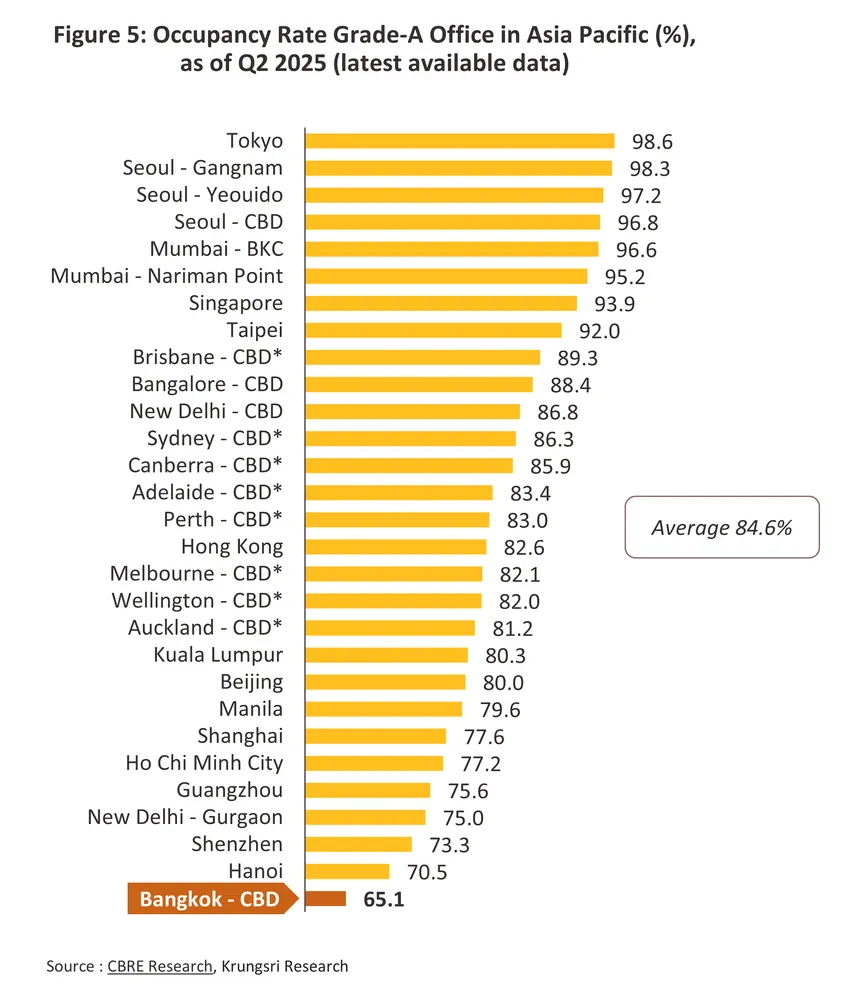

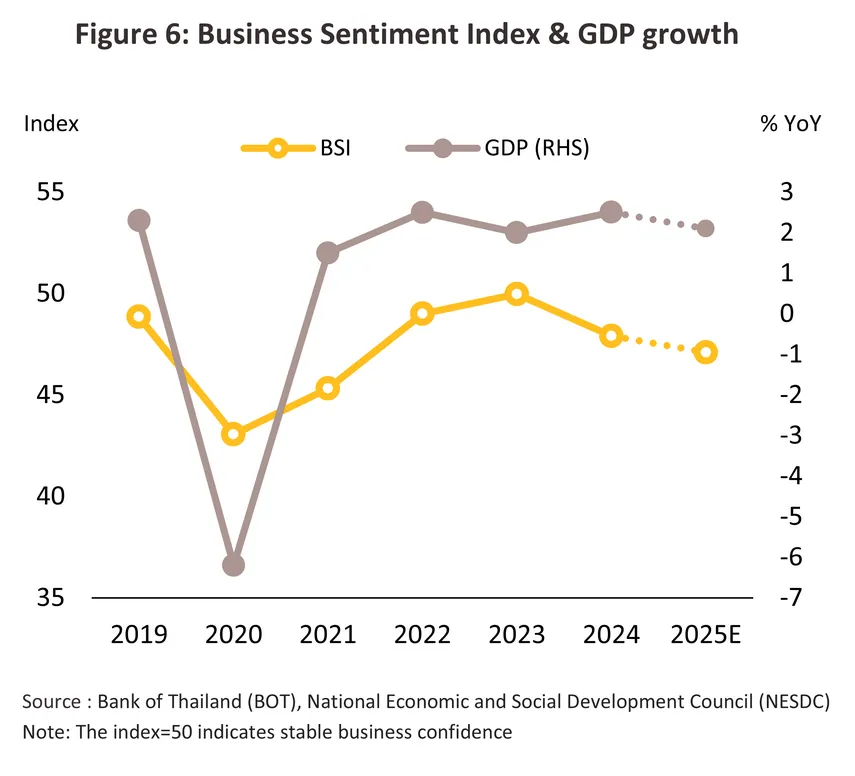

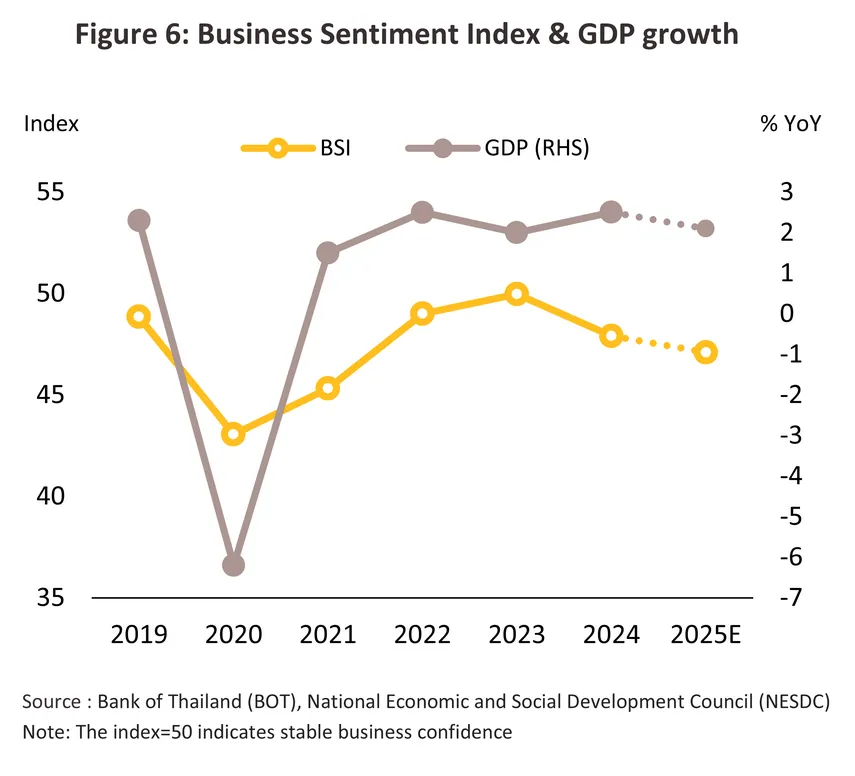

The outlook for the office rental market improved slightly in 2025 thanks to supported by a 15.0% YoY expansion in the export sector in the first half of the year that helped to boost the economy and lift confidence. The latter then showed up in a rise in the Business Sentiment Index to 50.2, its highest since September 2023 (Figure 6). Alongside this, tailwinds came both from Thai companies looking to improve their image by moving into new offices, companies increasingly insisting that staff work on-site, and rents that remained below their pre-pandemic level (for Grade A offices these averaged THB 900–1,200/sq.m./month, source: Knight Frank, and Cushman & Wakefield), which then incentivized companies to relocate to new premises that represented a more attractive proposition or better value for money. However, the economy slowed again through the second half of the year under the impact of US tariffs, sluggishness in the tourism sector (arrivals were down -6.2% relative to 2024), and the effect on consumer purchasing power of high levels of household debt. In response, many companies have placed a hold on recruitment and with the global economy also slowing, overseas companies are reconsidering their investment plans. These trends are naturally impacting demand for office space, though new supply continues to come to market as prior investment plans mature, and so the overall occupancy rate has slipped to a twenty-year low. The summary of the market situation for office rentals in 2025 is given below.

-

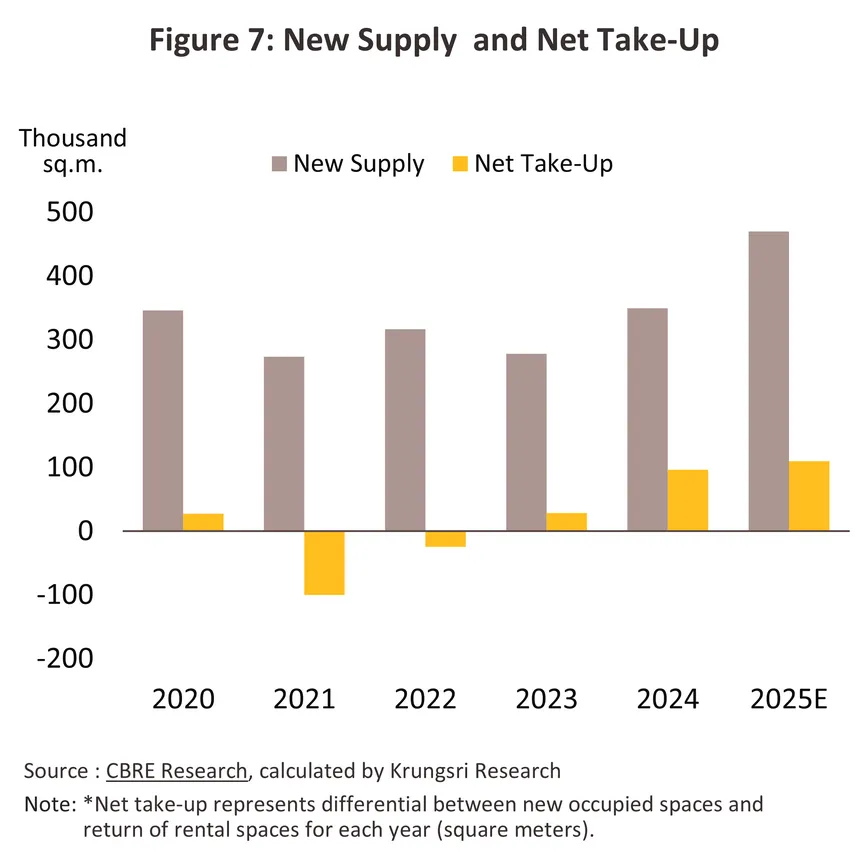

Net take-up5/ increased 7.8% to 104,000 sq.m. (Figure 7) on stronger demand from mid- and large-sized companies (e.g., financial institutions and cosmetics manufacturers) looking to move into new offices in the CBD that offered convenient travel connections and competitive rents. Moreover, while SMEs have tended to move out of central locations in search of cheaper sites, additional demand has come from foreign companies relocating production facilities to Thailand, typically either to hedge against escalating risks to international trade or to take advantage of investment promotion schemes targeting the EV, electronics, digital services, or advanced medical industries. The total occupied space thus inched up 1.3% YoY to 8.1 million sq.m. (Figure 8), with renters increasingly looking for Grade A+ office buildings that meet ESG standards (i.e., green buildings). By contrast, landlords offering older or lower-quality units are having difficulty holding on to their tenants since these are increasingly tempted by newer, more modern and better equipped office space that may have better transport connections and, moreover, be priced at a 20-30% discount relative to their existing leases, leading to a meaningful reduction in overall occupancy costs.

-

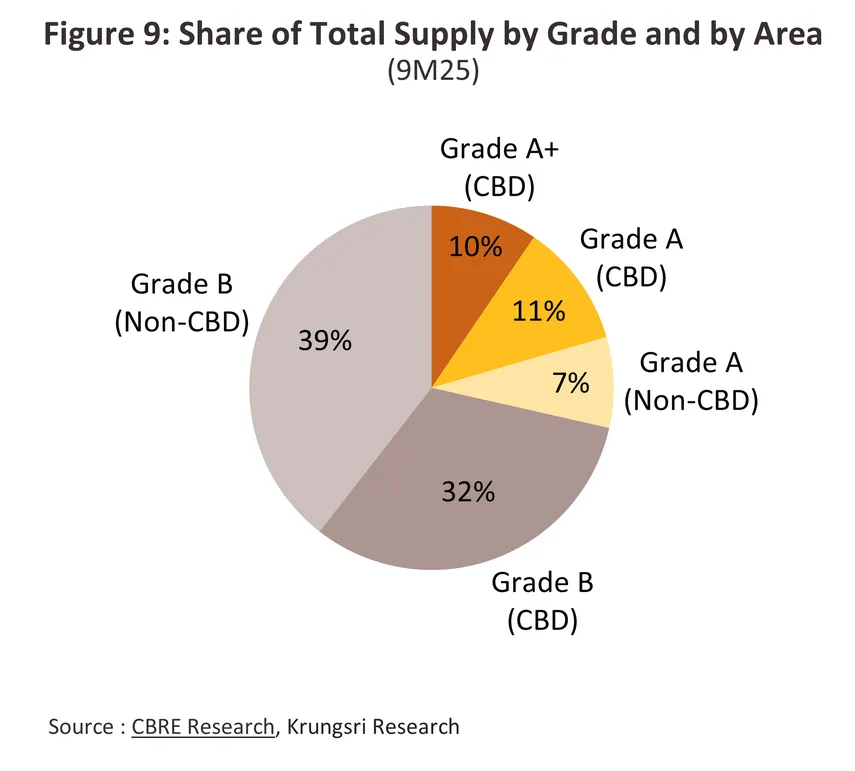

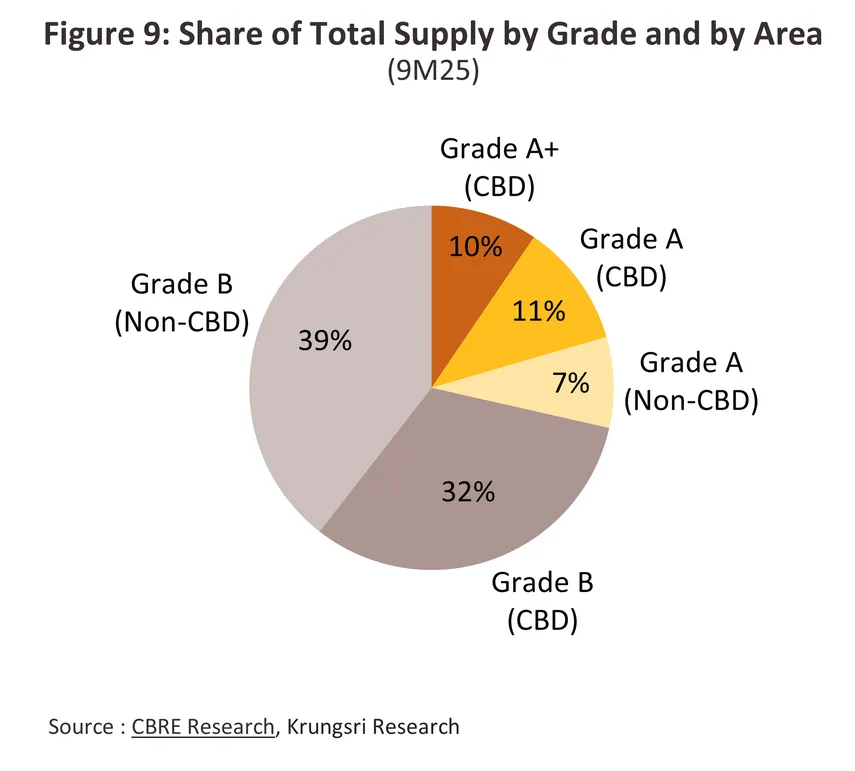

A substantial volume of new office space—totalling 470,000 sq.m. came to market in the year (up 34.4% from 2024) (Figure 7), making this the second consecutive year during which new supply exceeded 300,000 sq.m. Much of this was Grade A and Grade A+ projects located in the CBD that meets ESG standards (e.g., towers 3, 4, and 5 at One Bangkok, Supalai Icon Sathorn, Ratchayothin Hills, KingBridge Tower, APAC Tower, One Origin Sanampao, and WorkLab@Grande Centre). As of 2025, the total supply of office space thus rose 4.8% from a year earlier to reach 10.3 million sq.m. (Figure 8), split 71% Grade B, 19% Grade A, and 10% Grade A+ (Figure 9).

-

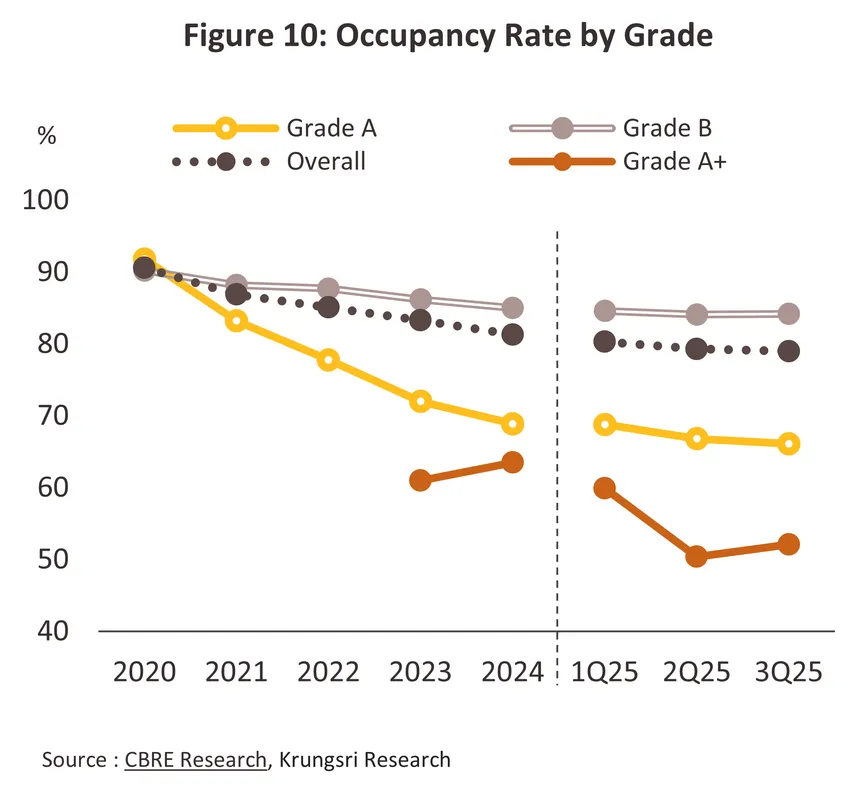

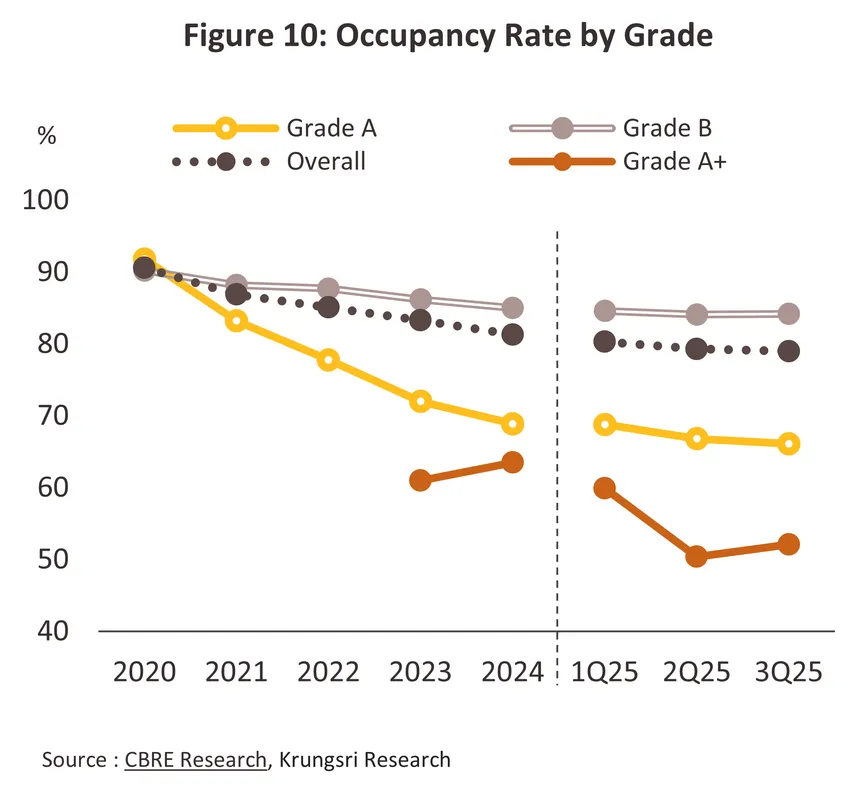

The average occupancy rate slipped from 81.3% in 2024 to 78.6% in 2025, a sharp decline from the pre-pandemic norm of over 90.0%. This is a result of strong growth in supply, especially of Grade A and Grade A+ buildings, coupled with only weakly expanding demand, and the result of this has been to strengthen renters’ hands when it comes to negotiating both rents and terms and conditions. Occupancy rates declined across all office Grades, with the sharpest falls recorded in Grade A+ (-8.5%) and Grade A (-3.8%) buildings. but less for Grade B offices (down -1.1%), demand for which benefited from renters attempting to cut their overheads by moving into cheaper premises (Figure 10).

-

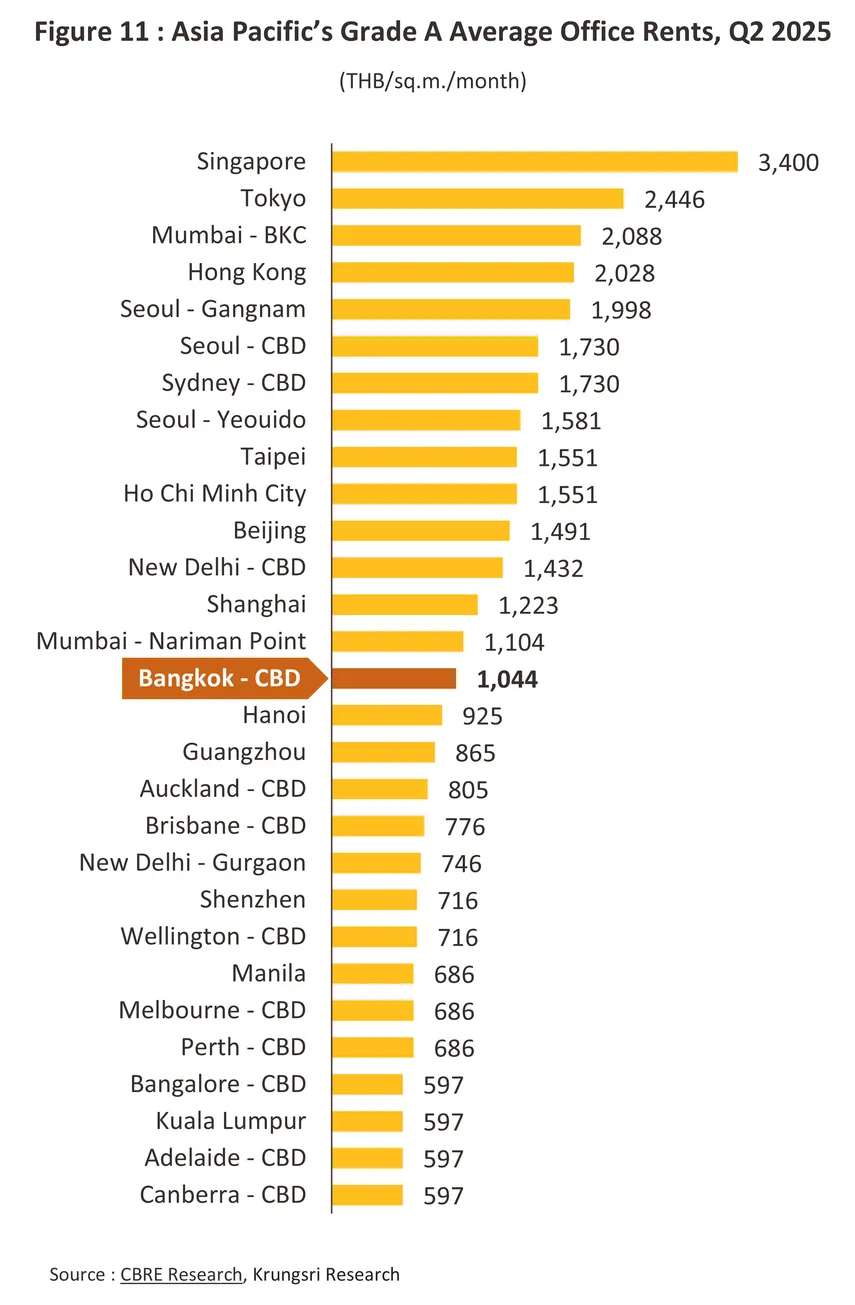

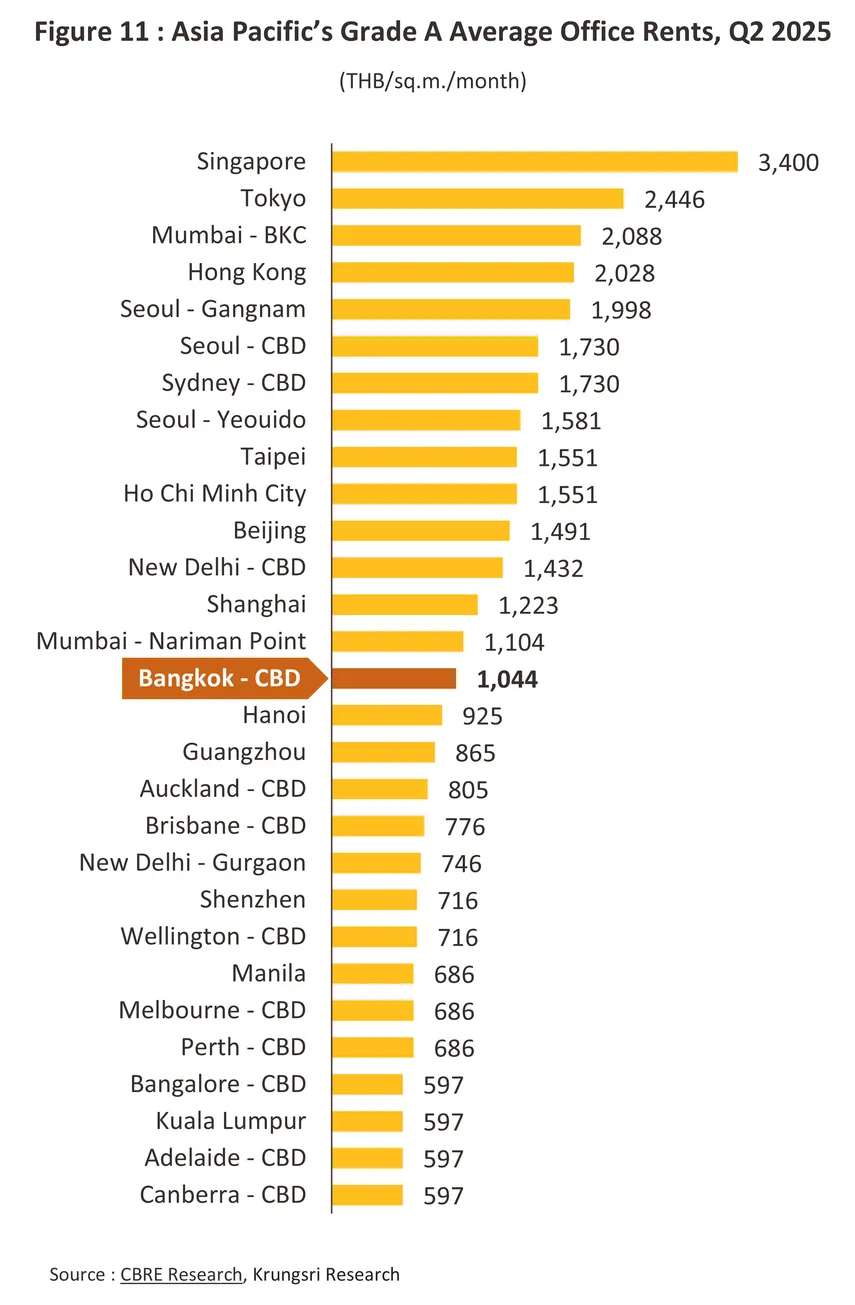

Average rents for Grade A and Grade B office buildings declined by -0.1% and -3.3% YoY, respectively, pushing rents to their lowest level in a decade. This reflected a significant oversupply of office space relative to demand, prompting landlords to compete aggressively for tenants through rent reductions and a range of incentives, including rent reductions or waivers, leaving rents unchanged when leases are extended, pre-fitted or turnkey office space, and fit-out allowances. Grade B offices are facing a distinct set of challenges since these typically serve the SME segment, and because smaller companies are more sensitive to economic volatility, these tenants are more likely to move into smaller sites or to give up their leases entirely when difficulties arise. By contrast, Grade A+ offices edged up by 1.3% YoY, supported by sustained demand from large domestic and multinational corporations. These buildings benefit from prime CBD locations, modern design, and increasing compliance with ESG and wellness standards, which align well with the evolving requirements of modern organizations. In addition, average office rents in Bangkok remain approximately 1-3-times lower than those in other major cities in the region (e.g., Singapore, Hong Kong, or Ho Chi Minh City) (Figure 11) and this is helping to attract interest from transnational companies looking to cut costs or to spread risk away from high-rent markets.

Outlook

The office rental market will remain under pressure throughout 2026 due to a continued oversupply relative to leasing demand. This will play out against a backdrop of weak economic growth in Thailand (forecast at +1.8%, slower than growth in 2025), a -1.8% drop in exports, an increase of just 2.2% in private investment, soft consumer purchasing power, and an uncertain outlook for the global economy, which, taken together will encourage companies to defer or rethink their investment plans. In addition, the continued adoption of hybrid working arrangements enables many companies to downsize their office space to control costs and improve workforce flexibility, further weighing on demand. As a result, net take-up is expected to remain flat or decline by around -20% to -30% compared to 2025 levels. With 100,000 sq.m. of new supply coming to market, the occupancy rate will fall to 78.5%. Nevertheless, the situation should improve slightly in 2027 and 2028. Details are as follows.

-

Demand for office space is expected to expand by 0.7-1.5% per year, below the 2.5% growth averaged over 2015-2019. Nevertheless, demand will benefit from the following factors. (i) The economy is expected to grow moderately at an average rate of 2.3% per year, led primarily by the expansion of tourism-related service sectors. (ii) Some industries (e.g., tech, finance, digital services, and health and beauty) particularly value projecting a positive image by operating from a modern office space (i.e., Grade A and Grade A+ buildings in the CBD) and this will positively influence demand. JLL’s ‘Future of Work 2024’ survey shows that renters are increasingly tempted to move into more modern offices. With premium offices being opened in the main business areas, this trend should continue through to 2028 at least. (iii) Overseas companies will continue to invest in Thailand, and these will then need accompanying office space. As stated above, companies are also increasingly in the market for premises that have received some kind of sustainability or ESG certification, and so “green buildings” that are energy efficient, low carbon, or support staff wellness, and that have LEED, WELL, or TREES6/ certification to demonstrate this, are in strong demand. The CBRE Thailand (2024) report thus shows that 78% of companies occupying rented office space in Thailand have plans to ensure that by 2030 their premises are aligned with their sustainability goals, which is a major leap from the 22% wishing to achieve this by 2024. This finding underscores the importance of ESG factors as a determining criterion when deciding where to site a business, especially for companies that are keen to align their activities with internationally recognized sustainability standards and to project a responsible and eco-friendly public image.

-

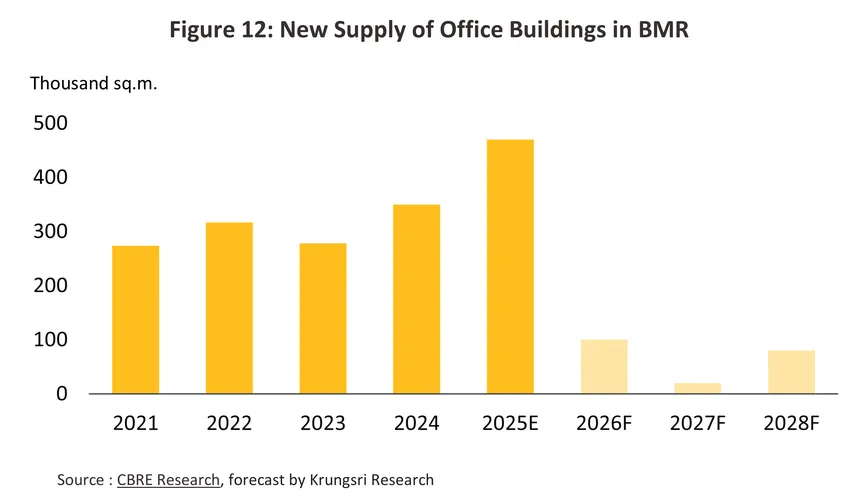

Supply of office space is expected to expand at an average rate of 0.0–1.0% per year (Figure 12). Krungsri Research estimates that around 200,000 sq.m. of office space is currently under construction and that will then become available over 2026-2028, down from the 300,000 sq.m. averaged over each of the past 5 years. Most of the upcoming supply will consist of Grade A and Grade A+ offices within large mixed-use developments that will be launched in phases (e.g., in Tower 2 of the One Bangkok development and the Boonmitr Silom building), which have been fully fitted out with modern technology and have achieved green building certification. According to JLL estimates, occupying a green building helps to cut energy and waste disposal costs by 6% per year, although these also command 14% higher rents. Moreover, to meet commitments to net zero and carbon neutrality, 60% of corporate lease holders also prefer to rent sites that have green building certification or that clearly meet ESG standards. Buildings that are designed to facilitate effective responses to emergencies and to support business continuity plans7/ will be in particular demand. However, the supply glut will continue to tilt market power towards renters and away from landlords, and this will add to the pressure felt by owners of older buildings, particularly those that are more than 20 years old (currently over 60% of supply). To maintain competitiveness, owners of these will therefore need to renovate and to modernize these properties or to offer more flexible terms, such as extended rent-free periods of occupancy.

-

The occupancy rate will remain flat or possibly inch up to 79-80% (Figure 13) as demand gradually recovers. However, oversupply will persist in some locations, particularly in areas where a large volume of new office space has recently been completed, while hybrid working arrangements continue to shape demand. As a result, overall vacant space is likely to decline only modestly. The highest occupancy rates in the CBD in areas will be seen at Silom, Sathorn, and Rama IV, while improved mass-transit connectivity is also supporting higher occupancy in non-CBD areas, including Bang Na and Srinagarindra. In response to challenging conditions, landlords are adopting more aggressive pricing strategies or are offering more favorable lease conditions as they look to maintain existing tenancies and attract new tenants. However, average occupancy rates are still likely to fall in older buildings, prompting operators to increasingly offer rent discounts, lease renewals and renovations to existing tenants, especially in areas where competition is intense. More positively, properties that have achieved environmental or ESG certification or that allow for more flexible use of internal space will attract greater interest, and research by JLL and CBRE shows that in fact, rents for buildings that have an environmental certification are on average 10–15% higher than the market norm.

-

Rents will increase for certified-green Grade A+ office space in the CBD. These are typically high-quality buildings that cater well to the needs of modern occupiers, offering strong functionality, safety, and service readiness. Located in prime CBD areas favored by large domestic enterprises and multinational corporations, most of these buildings also hold internationally recognized sustainability certifications aligned with tenants’ ESG objectives. As a result, tenants are willing to pay premium rents in exchange for enhanced corporate image, higher-quality working environments, and long-term competitive advantages. By contrast, Grade A offices in the CBD will face more intense competition as a result of the significant expansion in supply. Operators are thus trying to hold on to their current tenants by freezing rents, while also offering special discounts to new occupants, especially those looking to rent sizable areas. Grade B offices, those in non-CBD locations, and older buildings are facing the most difficult conditions, with rents for these premises trending downward, This reflects stronger tenant bargaining power and a growing tendency for occupiers to relocate to newer buildings offering better environmental performance, greater flexibility in lease terms, and a more modern image.

-

Going forward, operators will face a range of challenges, including: (i) only slow growth in the economy and the resulting weakness in demand for office space; (ii) 15-20% higher costs for developing the ESG-compliant buildings that corporations are now looking for (in accordance with their broader sustainability goals), which will extend the time taken to break even on these investments; (iii) stronger demand for flexible office space since this is more useful for companies operating hybrid working patterns, although this will also add to the costs borne by operators, as these relate to reconfiguring internal space, design and fitting-out, and building management; and (iv) the significant glut of excess office space, which will continue to drag on rents for a number of years. As a result, developers will need to shift away from a concern with costs and pricing alone and instead focus more heavily on generating value for money, and owners of older buildings that fail to adapt sufficiently to these changes will lose competitiveness, with occupancy rates likely to slide accordingly.

Although the office rental business faces a range of challenges, Bangkok’s office rental market continues to offer stronger growth potential than many other markets in the ASEAN region: (i) Bangkok is in a strategically important location in the center of Southeast Asia, and this then facilitates the development and maintenance of transport and trade linkages with neighboring countries. Thailand is also developing new infrastructure (e.g., high-speed rail, special economic zones (SEZs), and the Eastern Economic Corridor (EEC)) that will add further to the growth potential of the market for office space in Thailand; (ii) Office rents in Bangkok remain competitive compared with other regional business hubs. Data from Cushman & Wakefield and Knight Frank (2025) show that average rents for Grade A offices in Bangkok run to THB 900–1,200/sq.m./month, which is around 1–3 times lower than rents in cities such as Singapore and Hong Kong, and this helps to make Bangkok a cost-effective choice for multinational companies looking to establish offices in the region; (iii) Government support also underpins market potential, including incentives for multinational companies to establish international business centers (IBCs)8/, loosening labor laws to allow foreign staff to work in Thailand, and encouraging investment in targeted real estate projects, such as environmentally friendly or green/ESG-compliant buildings through mechanisms such as FAR bonuses that allow higher floor area ratios than normally permitted. Taken together, these factors enhance the attractiveness of Bangkok’s office rental market for both investors and tenants.

1/‘Prime areas’ are those that developers view as having investment potential, having considered the accessibility of the site through communications and mass-transit networks, together with the infrastructure that is already in place. In Bangkok, prime areas include Silom, Sathorn, Wireless Road, Ratchadamri, and Ploenchit.

2/‘High rise building’ are defined as buildings that are occupied or usable by people and have a height of at least 23.00 meters.

3/‘Large buildings’ are defined as single structures with either (1) a floorspace of more than 2,000 sq.m. on any one floor or in total, or (2) a height of at least 15.00 metres and a floorspace of between 1,000 and 2,000 sq.m. on any one floor or in total.

4/Hybrid work refers to a working arrangement that combines traditional office-based work with flexible off-site or remote work.

5/The net take-up rate refers to the increase or decrease in the total occupied space over the course of that year.

6/LEED (Leadership in Energy and Environmental Design) is an internationally recognized green building certification system that focuses on energy efficiency, water use, sustainable design, indoor air quality, and the use of environmentally friendly construction materials./ WELL (WELL Building Standard) is an internationally recognized building standard that focuses on human health and well-being, covering aspects such as air quality, lighting, sound, comfort, food and nutrition, and the design of the space to promote the health and well-being of residents and users./ TREES (Thai’s Rating of Energy and Environmental Sustainability) is Thailand’s green building certification developed by the Thailand Green Building Institute. It emphasizes energy efficiency, water management, reduced environmental impacts, air quality, and sustainable, and is designed to align with Thailand’s climate conditions and regulatory framework.

7/A Business Continuity Plan (BCP) is a contingency plan prepared by an organization to ensure the continuity of business operations in the event of unexpected disruptions. These may include natural disasters, fire, public health emergencies (such as the COVID-19 pandemic), building-related emergencies (e.g., power outages or IT system failures), and security threats (such as terrorism or political unrest). Buildings with a BCP are typically designed and equipped with backup systems, including emergency power supply, redundant IT systems (data centers and server backups), clearly defined assembly points and evacuation plans, as well as regular risk assessments and emergency response drills.

8/In 2018, the Revenue Department announced tax incentives for companies establishing international business centers (IBCs) in Thailand. These incentives replaced earlier tax schemes designed to promote the establishment of International Headquarters (IHQs), International Trading Centers (ITCs), and Regional Operating Headquarters (ROHs). Companies operating Thailand-based IHQs, ITCs and ROHs have been able to convert these to IBCs from 25 December 2018 onward.

9/Co-working spaces are shared work environments that provide basic office facilities and equipment (e.g., desks, high-speed Wi-Fi internet access, meeting rooms, printers, etc.). Customers are able to choose rental arrangements to suit their needs, which may include using a private working area or meeting in small or large meeting rooms. Likewise, rental arrangements may be made by the hour, the day or the month.

10/LPN Wisdom and Solution Co., Ltd. (LWS)

.webp.aspx)