EXECUTIVE SUMMARY

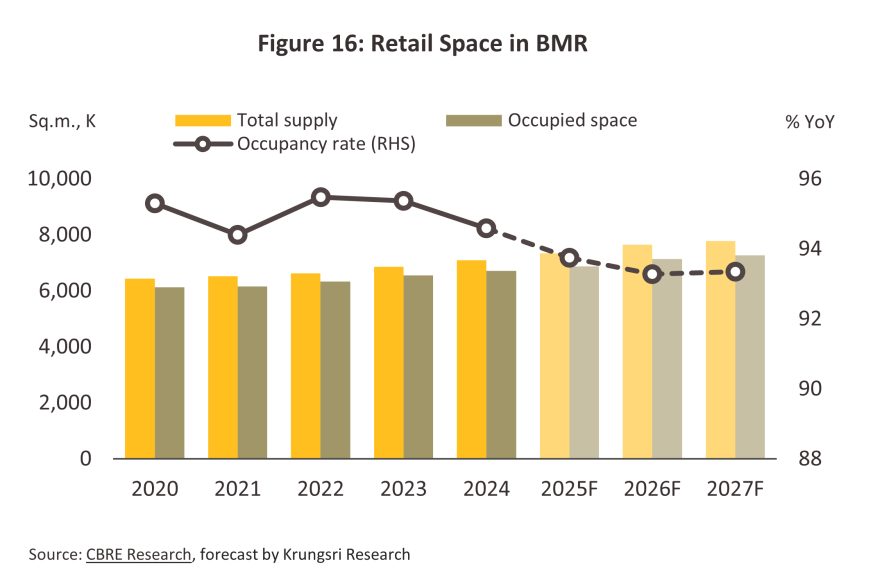

The retail rental market is expected to gradually recover from 2025 to 2027. This recovery will be driven by a slow rebound in consumer purchasing power due to a weakening domestic economic outlook impacted by ongoing escalation of global trade tensions. At the same time, a steady influx of new units from large mixed-use developments is expected to enter the market. As a result, demand is expected to increase at a much slower pace than supply. Nevertheless, well-designed sites in high-potential downtown locations that are popular with tourists and that serve office workers in the CBD will continue to see steady demand, and rents for units in these areas will remain flat or possibly edge up slightly. Leading retail developers and major investment groups continue to expand their retail portfolios into suburban areas surrounding Bangkok, particularly along the expanding mass transit lines, in response to the growing residential population in these corridors. This expansion of new supply is expected to exert mild downward pressure on rental rates in these emerging locations. Krungsri Research thus expects supply to grow by some 0.7 million sq.m. across the Bangkok Metropolitan Region, driving overall occupancy rates down to a historic low. The retail sector also faces several challenges, including: (i) weak recovery in consumer purchasing power; (ii) increasing competition as players from other industries move into the retail rentals space; (iii) the continuing growth and diversity of e-commerce sales; and (iv) growth in standalone retail formats, including outlets located at petrol stations, which may reduce demand for retail space in some locations.

Krungsri Research view

The outlook for the rental retail space market in 2025–2027 can be summarized as follows:

-

Retail space in BMR (not including community malls): Income for developers operating in these areas is expected to grow gradually. Properties in central locations will continue to attract high-quality tenants, including major Thai and international brands, while supply growth will spread to suburban areas, where new housing developments are expanding. (e.g., in Rangsit and Bang Na). Larger developers will continue to benefit from access to capital, land holdings in high-potential locations, and better ability to manage a broader tenant base. On the other hands, owners will tend to invest in the renovation and modernization of existing sites as they look to attract tenants and customers. As a result, rents in central areas are likely to rise slightly, while rents in outer areas are expected to remain stable.

-

Community malls in BMR: Income is expected to remain stable due to the relatively low investment required for developing community malls and the ease of acquiring land suitable for development, particularly in suburban areas (e.g., in Rangsit, Chaeng Wattana and Lat Krabang). This has led to a continuous increase in supply. However, sluggishness in the economy will drag on demand, intensifying competition and limiting the scope for rental increases.

Overview

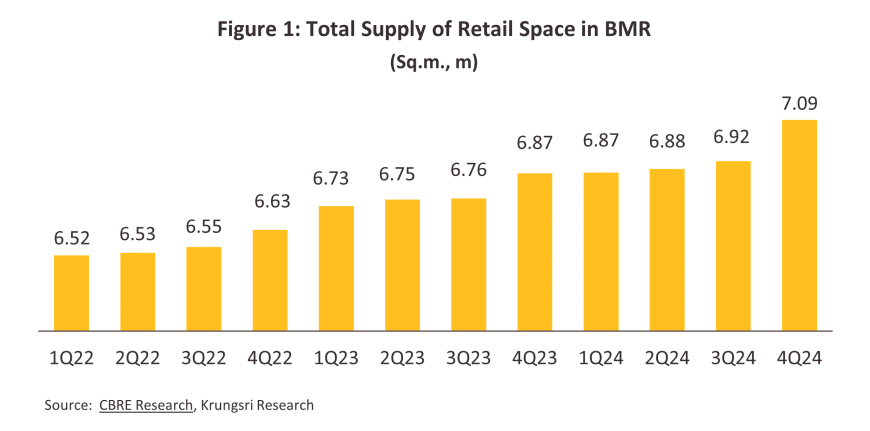

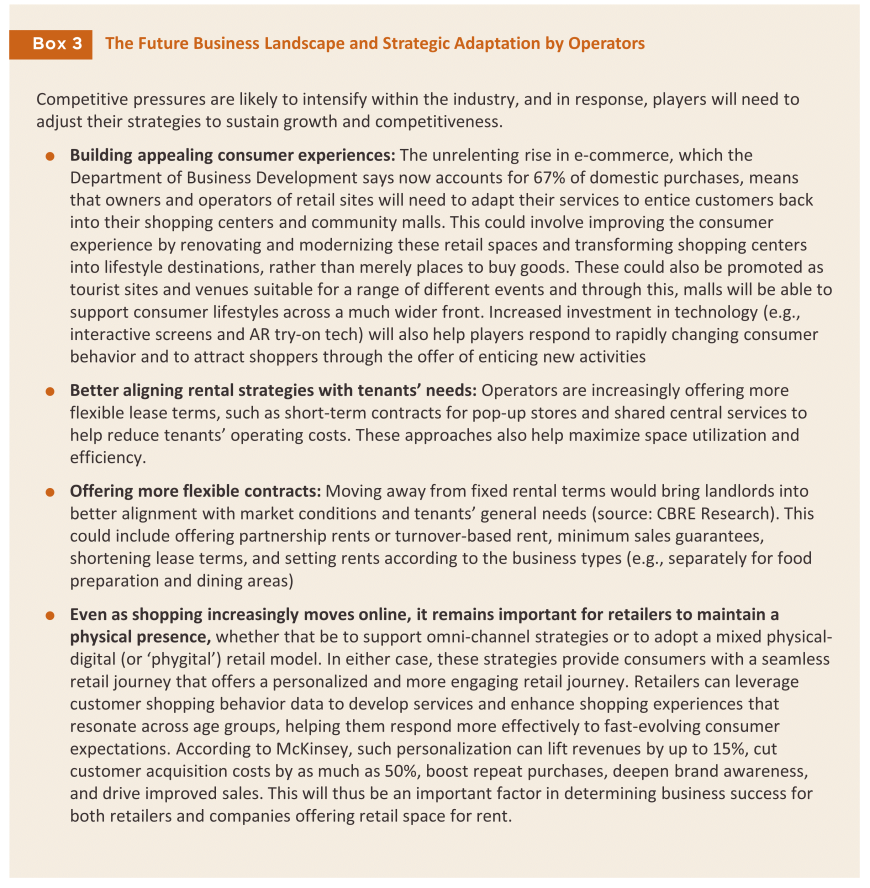

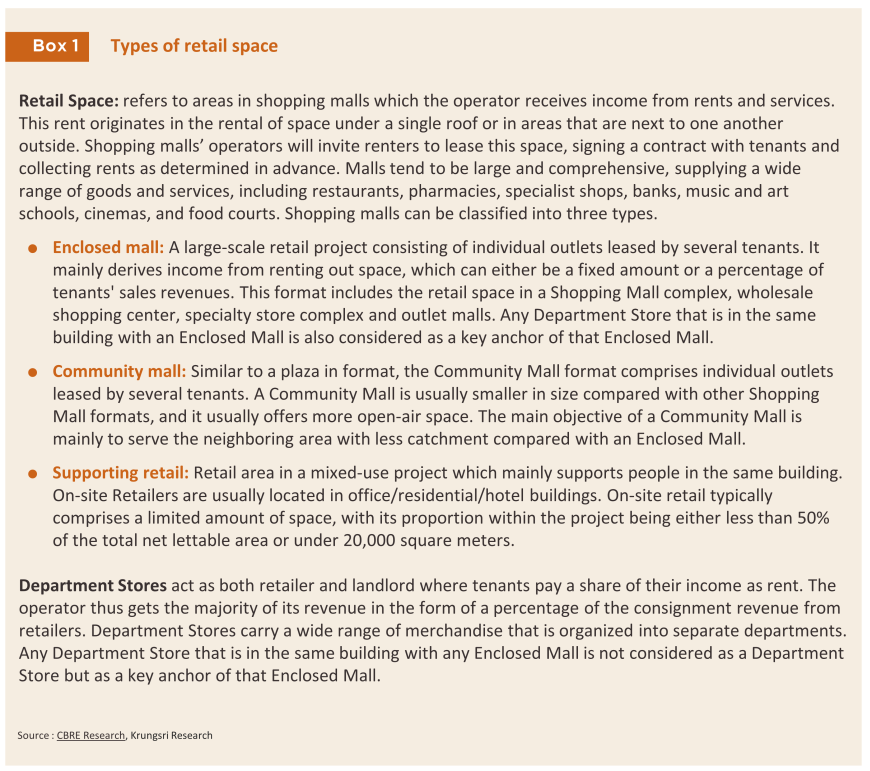

The majority of Thailand’s retail space1/ is located in the Bangkok Metropolitan Region (BMR) and major regional centers2/. As of the end of 2024, the total supply of retail space in the BMR is around 7.1 million sq.m. (Figure 1), with most of this space situated in shopping malls. This figure includes only retail spaces from which operator earn rental income. Shopping malls can be categorized into enclosed malls, community malls and supporting retail spaces (Box 1). Operators generate income by developing project infrastructure and providing amenities to tenants, with rental income serving as their main revenue stream.

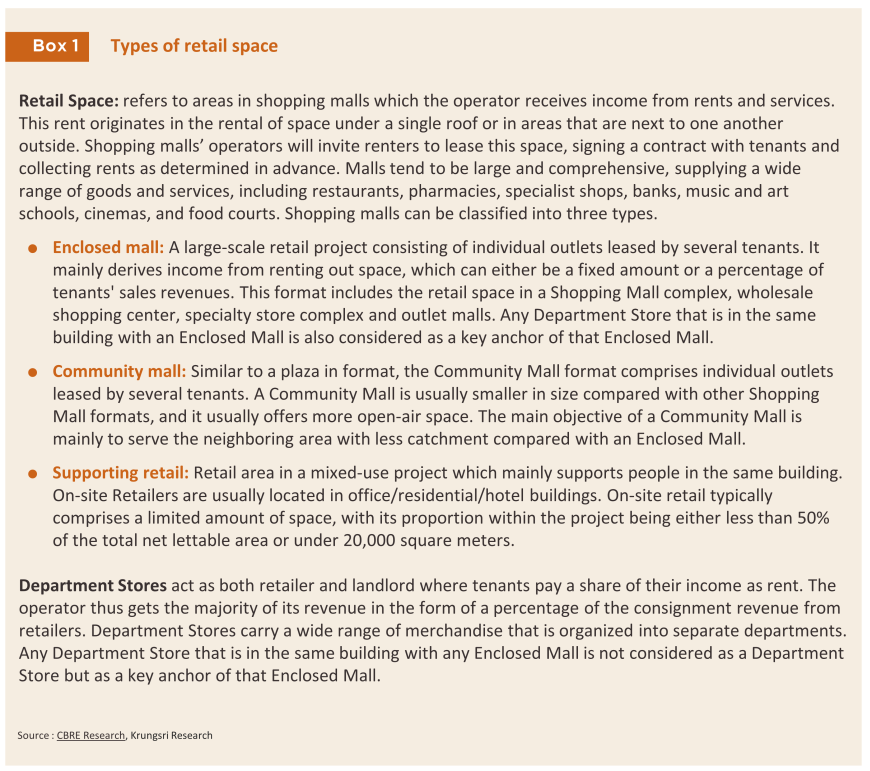

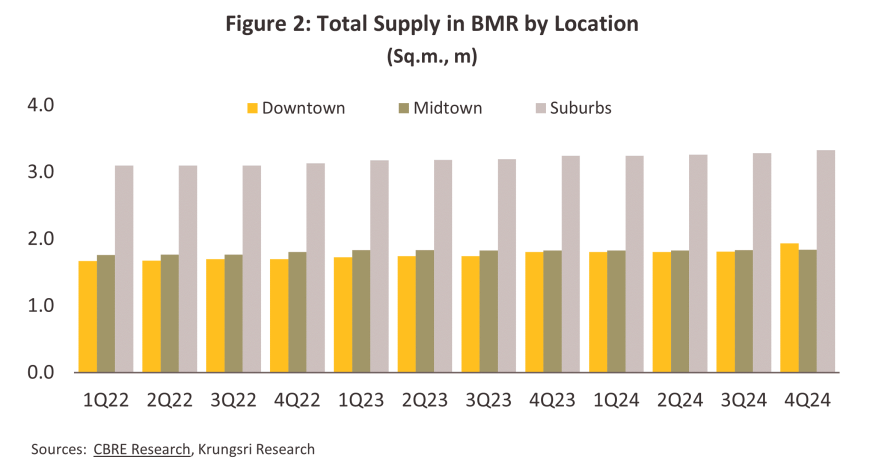

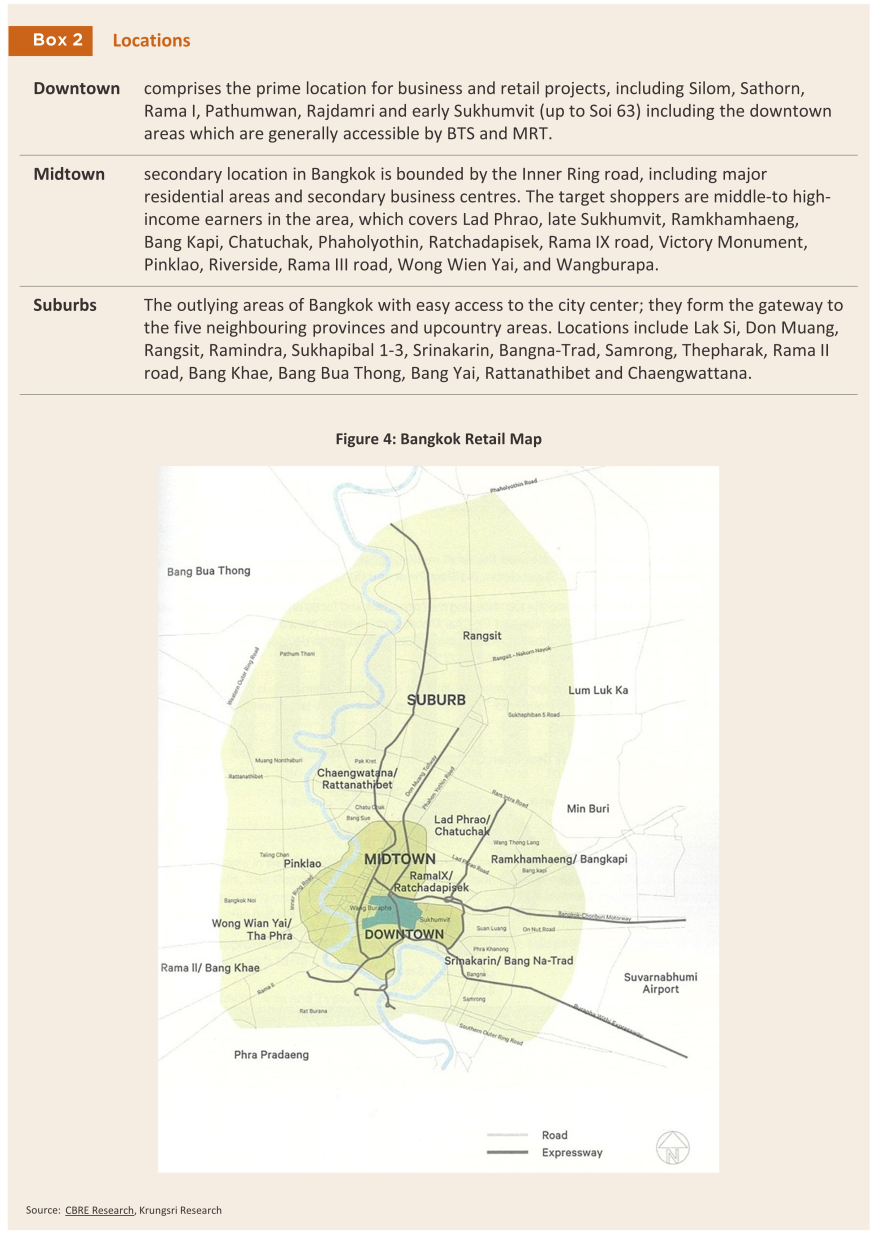

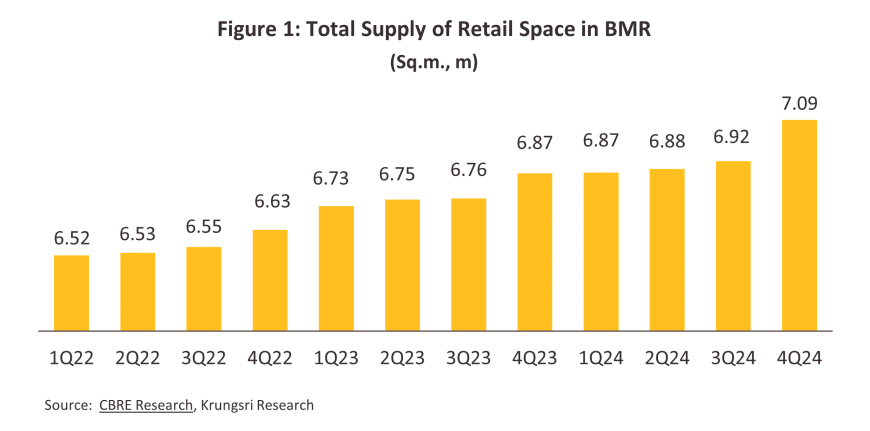

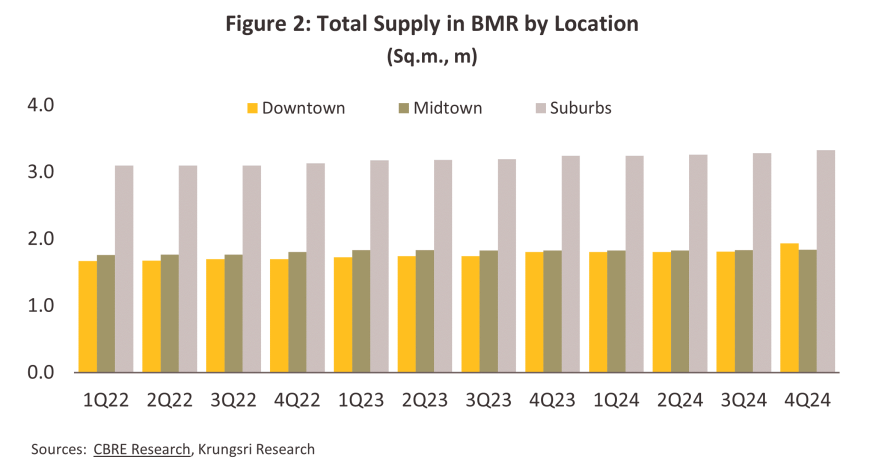

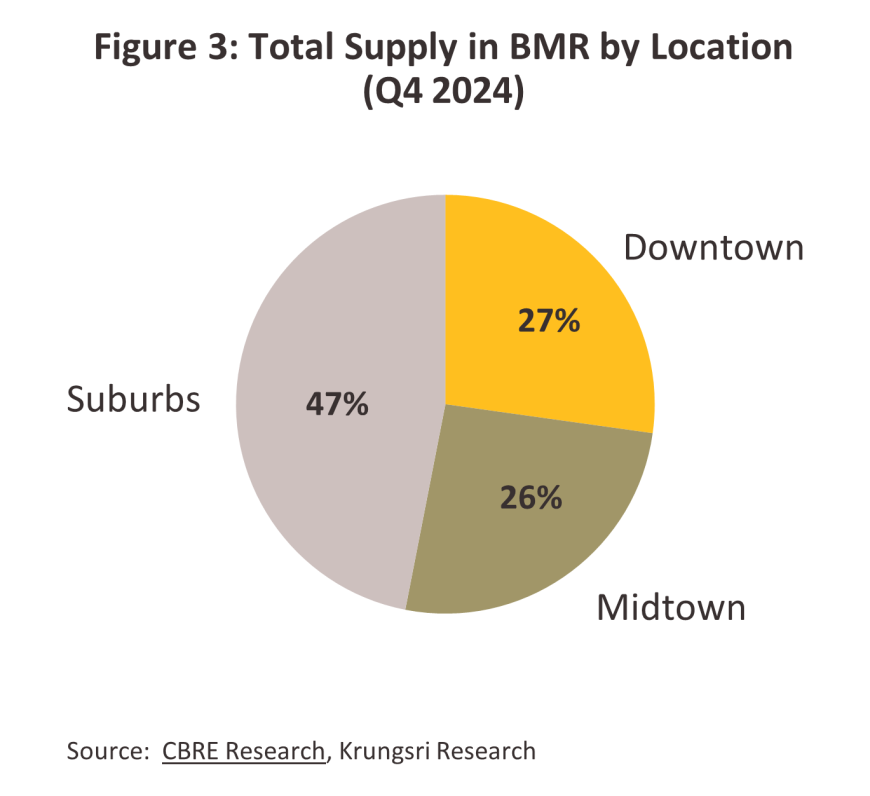

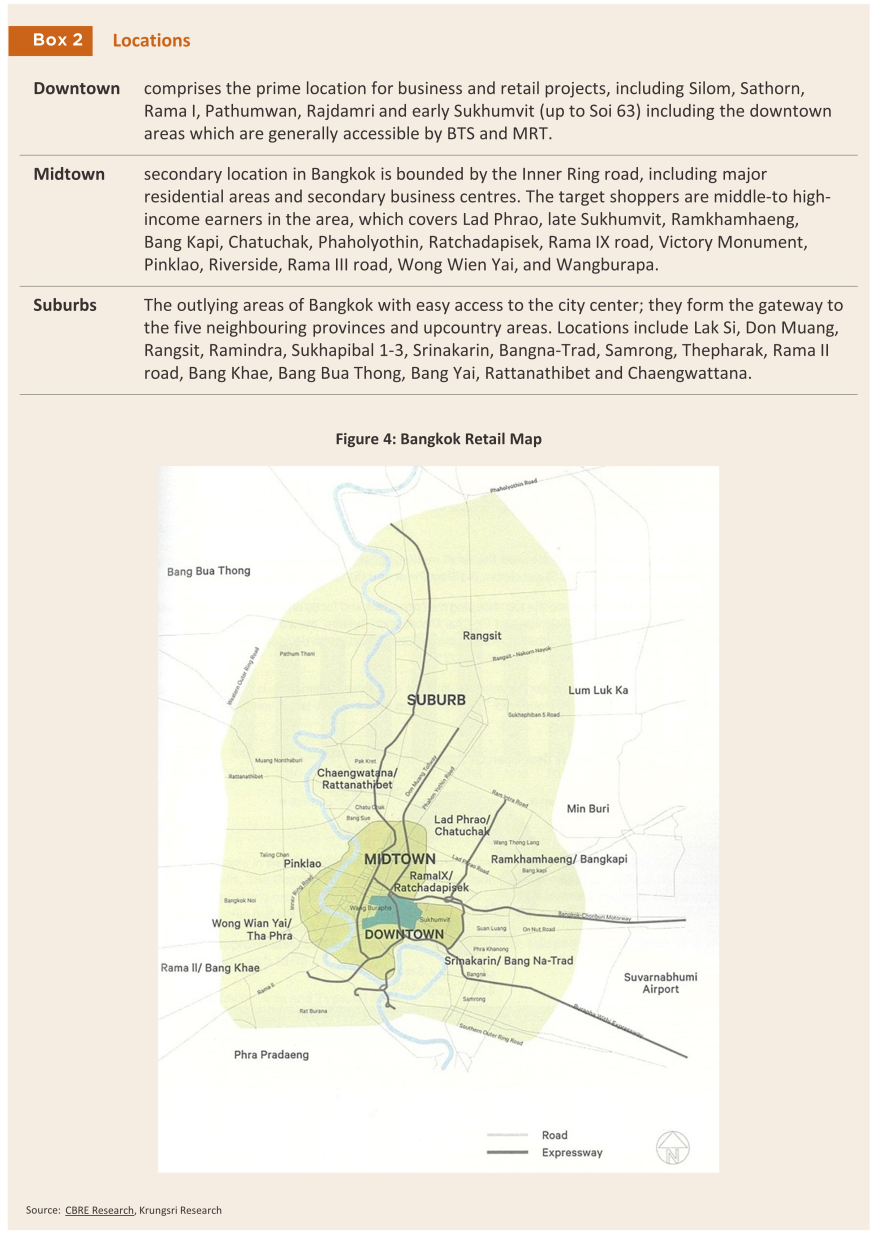

Nearly 47% of the rental retail space in the BMR is located in suburban areas (figures 2 and 3). The accelerated retail space expansion in these areas been driven by improvements in the road network and the expansion of mass transit systems. Meanwhile, city planning regulations have restricted the development of large retail projects in some central areas of Bangkok. Consequently, operators of existing malls in downtown locations such as Silom, Sathorn, Ratchadamri, and early Sukhumvit have focused on renovating their properties to create more modern and luxurious environments, catering primarily to high-income customers, particularly foreign tourists. In contrast, malls in midtown areas tend to target middle-income groups.

Rented retail space may be classified according to both the type of renter and the type of lease.

Typically, leases will cover two types of charges: rental fees (around 40% of the total lease costs) and fees for the provision of utilities and services (60% of lease costs).

1) The rental contract will specify the rental rate per square meter per month. Typically, renters are required to pay one month in advance, which is considered revenue for property owners. The rental rate is determined based on the size of the space and its floor location. Normally, rental rates are reviewed every three years at an average rate of 10%.

2) The service contract will specify additional expenses the rental contract, such as insurance premiums, charges for utilities (electricity, water, telephone, gas, etc.), management fees, VAT. These are variable costs that depend on actual usage. As a result, adjustments to service fees are typically based on increases in utility expenses over time.

Situation

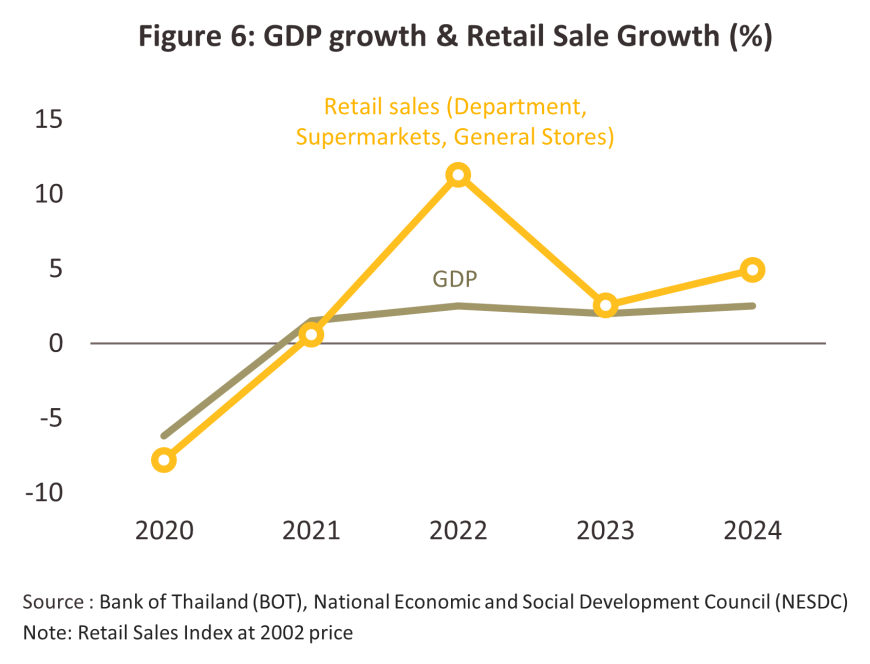

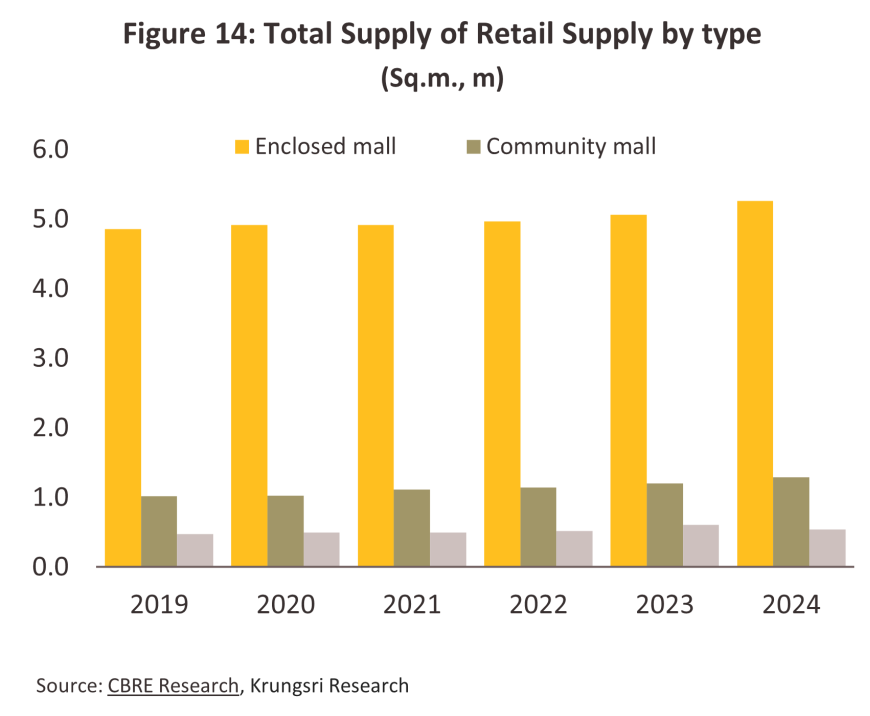

Following the easing of the COVID-19 crisis and the country’s reopening to international tourists in the second half of 2022, the rental retail space market began to gradually recover. In 2023, retail space demand increased by 3.5% from the previous year, reaching 6.5 million sq.m., while total retail supply rose by 3.6% to 6.9 million sq.m. This growth included approximately 230,000 sq.m. of new retail space—the largest annual increase in three years—comprising both newly launched areas and spaces reopened after renovation, such as Central Westgate, Central Ramintra, and Marché Thonglor. As a result, the overall occupancy rate remained relatively stable at 95.4%, compared to 95.5% in 2022.

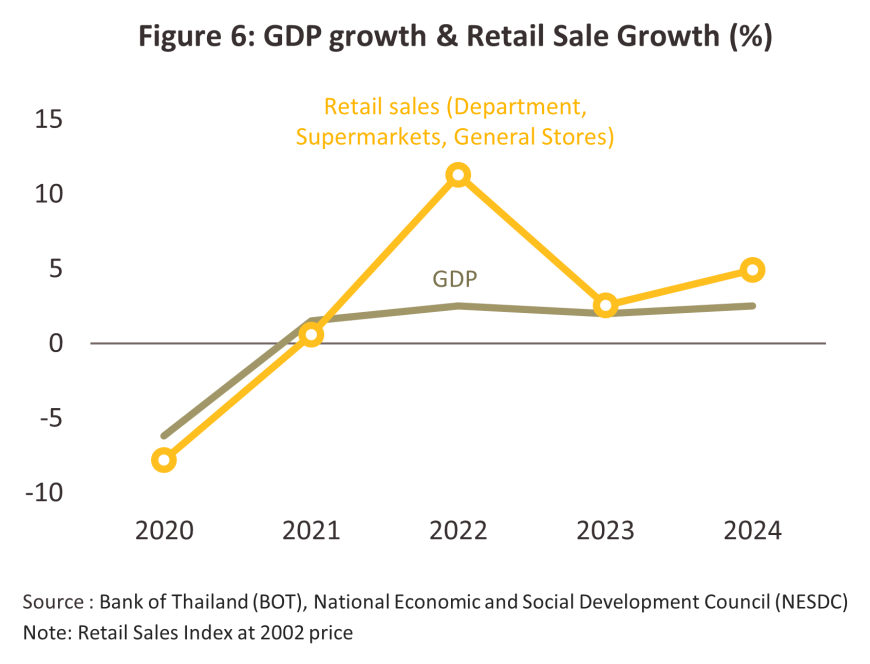

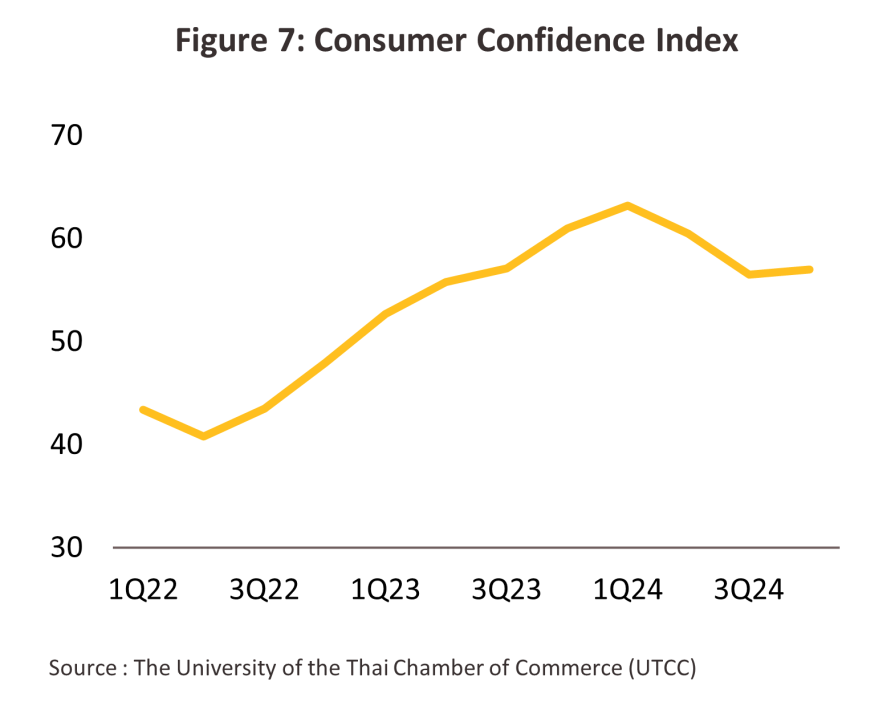

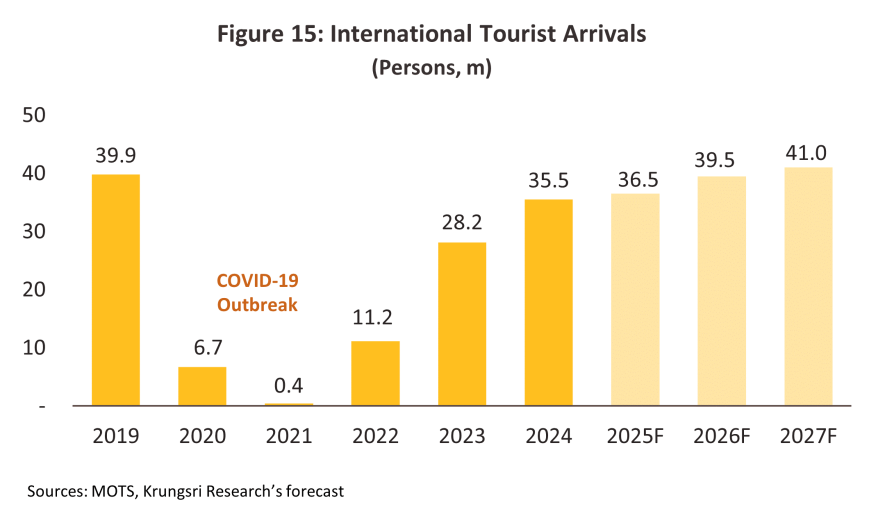

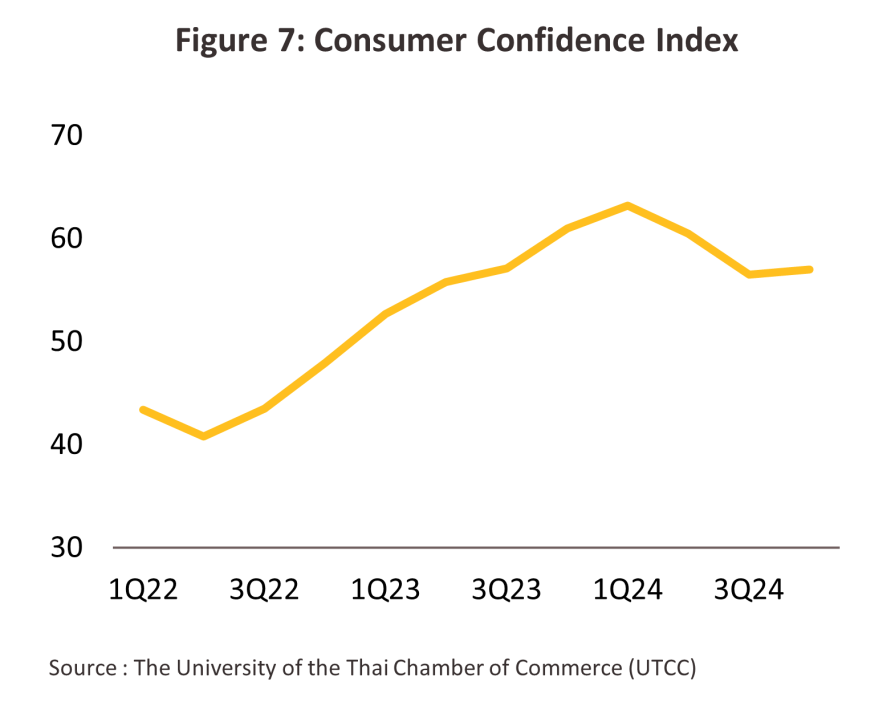

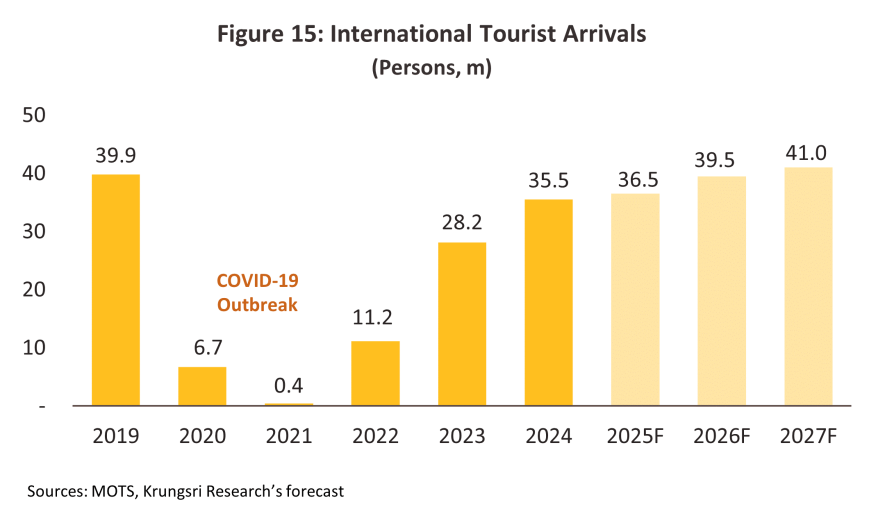

In 2024, the rental retail space market continued to experience steady growth, driven by a significant influx of new retail space—primarily from newly launched community mall projects in both central urban areas and suburban zones—as well as the reopening of previously existing retail spaces that had undergone renovations. Demand growth was supported by the gradual recovery of domestic consumption (+4.4% from 2023), and the continued growth of domestic and international tourists (foreign arrivals reached 35.5 million, equivalent to 89% of pre-pandemic levels in 2019), which helped boost demand for retail space in Bangkok’s central business district, predominantly in large shopping malls. In addition, government stimulus spending, including the Easy E-Receipt program at the start of the year, the We Travel Together scheme, and September’s THB 10,000 payments to digital wallets, contributed to a growth of 4.7% in the Consumer Confidence Index, reaching a three-year high of 63.2 in Q1 2024 (Figure 7). In addition, the expanding and increasingly interconnected mass transit network—most recently with the opening of the Pink Line (Khae Rai–Min Buri section) - has significantly enhanced connectivity and made travel between the city center and suburban areas more convenient. However, demand for retail space remains under pressure due to the slow and uneven economic recovery. Persistently high household debt (88.4% of GDP as of Q4 2024) continued to constrain purchasing power among lower- and middle-income consumers, leading to more cautious spending behaviors. Meanwhile, the baht strengthened to a 30-month high against the US dollar in September 2024. This currency strength encouraged high-income Thai tourists to travel and shop abroad, particularly in visa-free destinations such as Japan and China.

Overall, developers of retail spaces are continuously adapting to the intensifying competition in the market. This includes modernizing their rental spaces, transitioning to an omni-channel business model, developing technology connected to the virtual world, and introducing innovations to capture consumer interest. These efforts are aimed at meeting rapidly changing consumer behavior. Additionally, there is an increased focus on health and safety. Colliers Thailand reports that Thai consumers are willing to pay more for goods or services that ensure hygiene standards. The retail space market outlook for 2024 is given below.

-

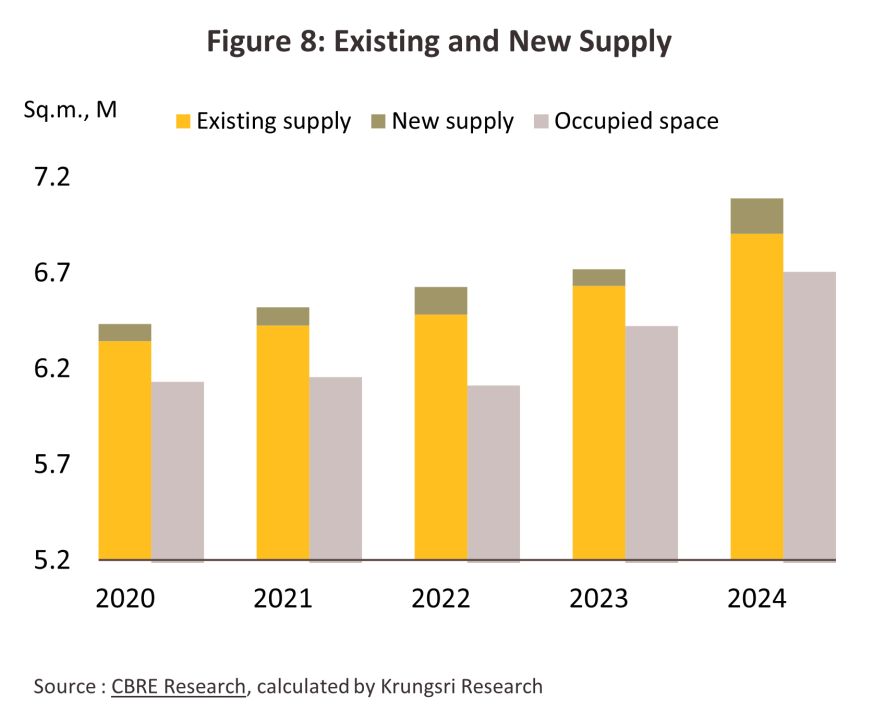

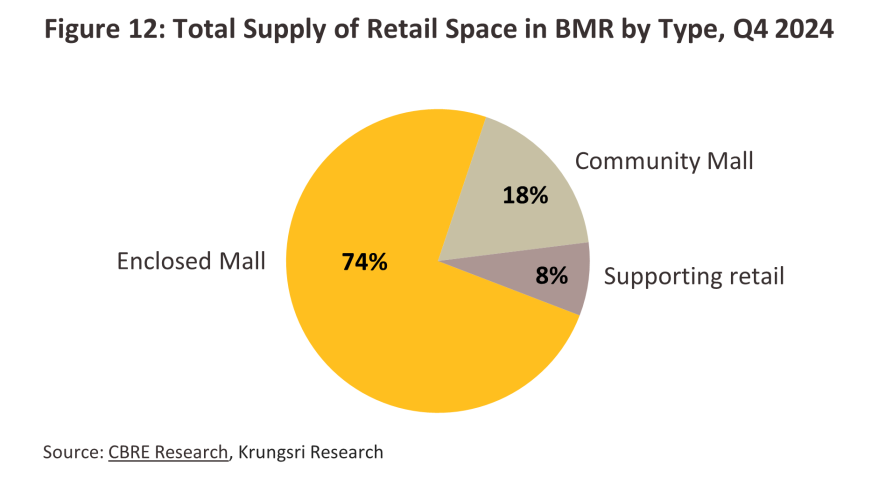

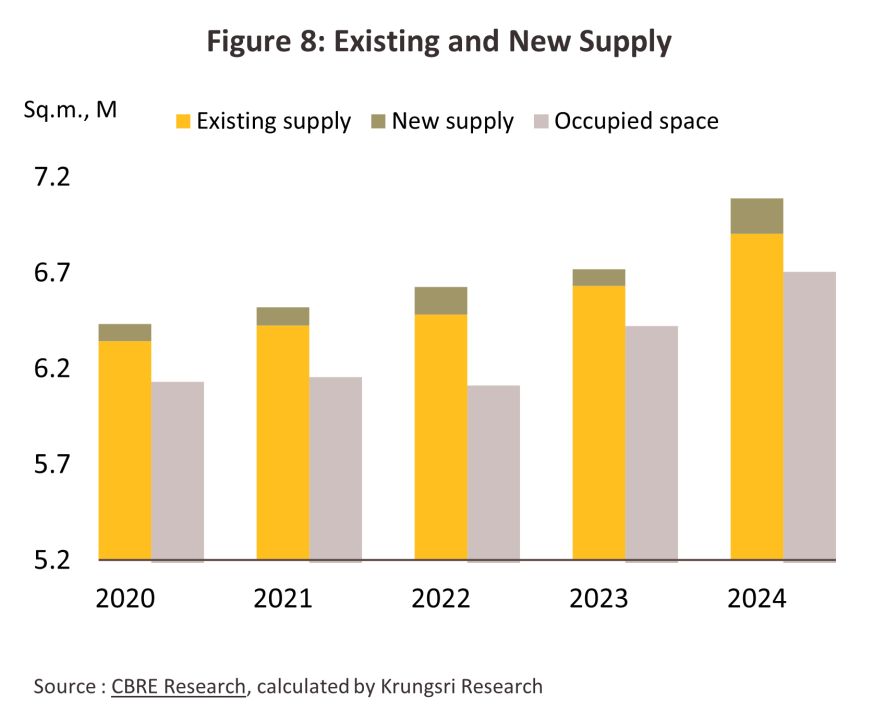

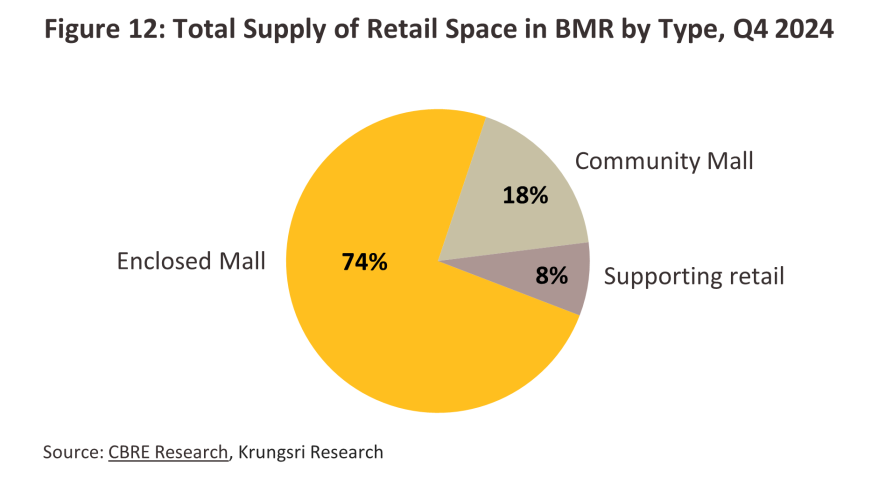

A total of approximately 180,000 sq.m. of new retail space entered the market in 2024. Most of the new supply came from community malls in suburban areas (e.g., Icon 56 @Saimai, JAS Green Village Prawet-Lat Krabang, Yingcharoen Square, The Prom Din-Daeng, Nirvana Porch Community Mall, and MT Khu Khot Lifestyle Mall), and in the One Bangkok enclosed mall. As a result, the total accumulated retail supply rose by 3.3% to 7.1 million sq.m. (Figure 8), of which 74% was in enclosed malls, 18% in community malls, and the remaining 8% in supporting retail spaces.

-

Net take-up totaled approximately 160,000 sq.m. This brought total occupied retail space to 6.7 million sq.m., up 2.4% (Figure 8). The increase in demand was driven primarily by businesses in the food and beverage sector, consumer goods, healthcare, and international retail brands.

-

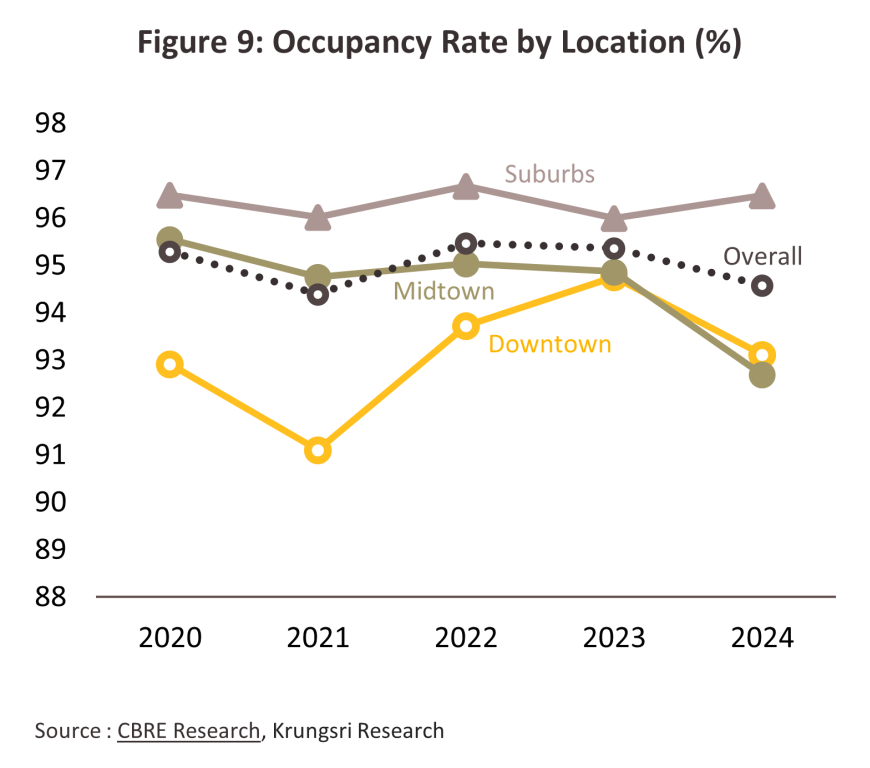

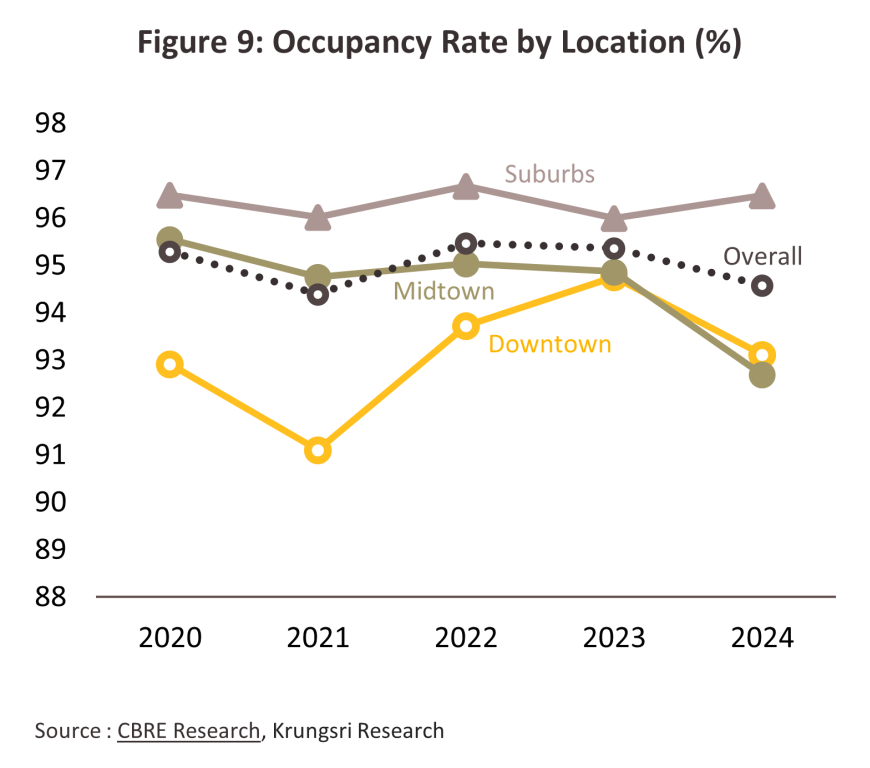

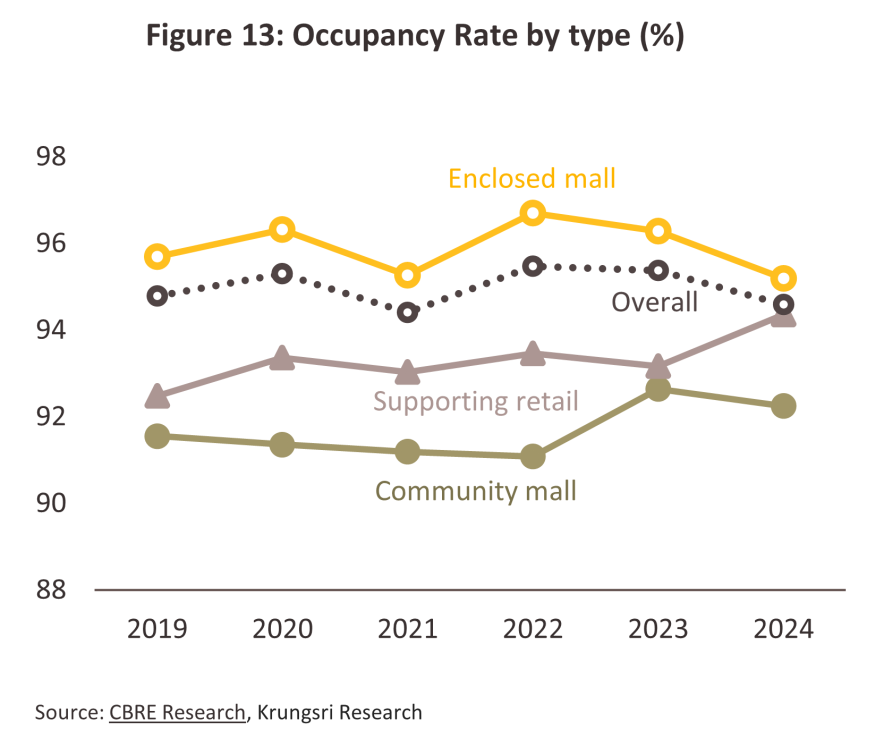

The occupancy rate for retail space edged down slightly from 95.4% to 94.6% (Figure 9) as demand growth lagged behind the expansion in supply. By location, occupancy rates in both downtown and suburban areas continued to increase (Figure 9). In downtown areas, the occupancy rate continued to rise on strong demand from food and beverage operators and international brands seeking prime locations to cater to high-spending tourists. Suburban projects also benefited from the expansion of surrounding residential developments. In contrast, midtown areas saw a decline in occupancy rates due to heightened competition from newly launched retail supply and weaker consumer purchasing power in these locations, which led some tenants to delay expansion plans or relocate to more cost-effective sites.

-

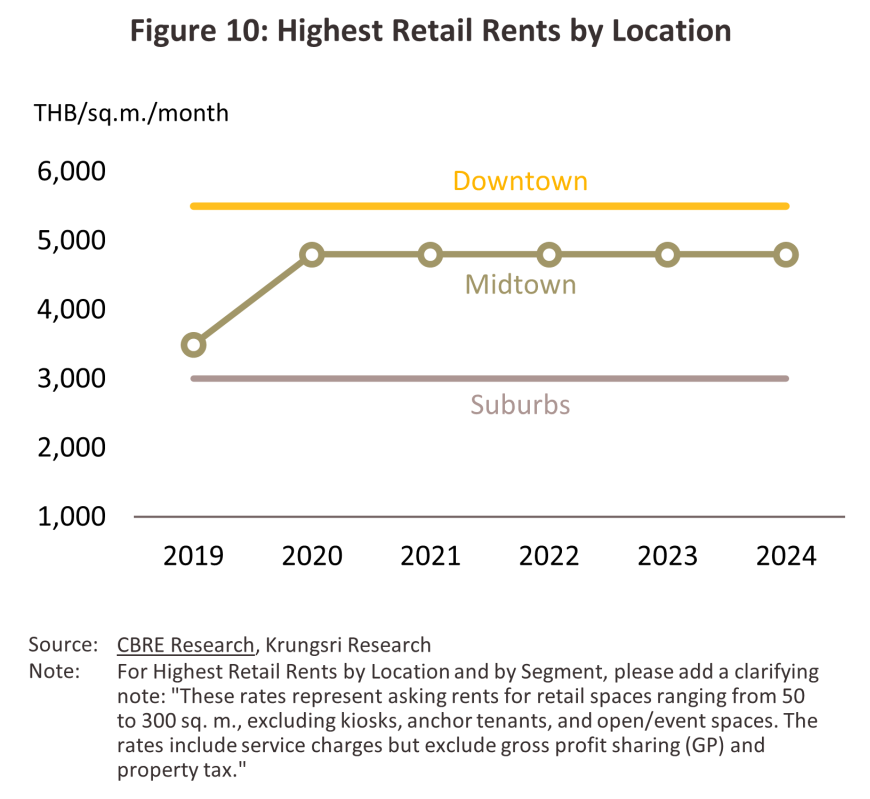

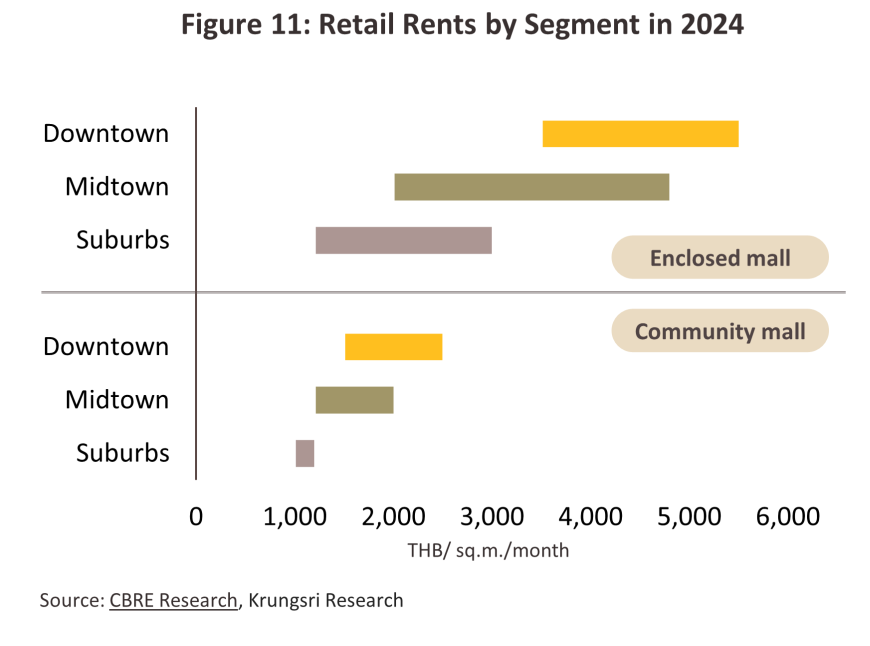

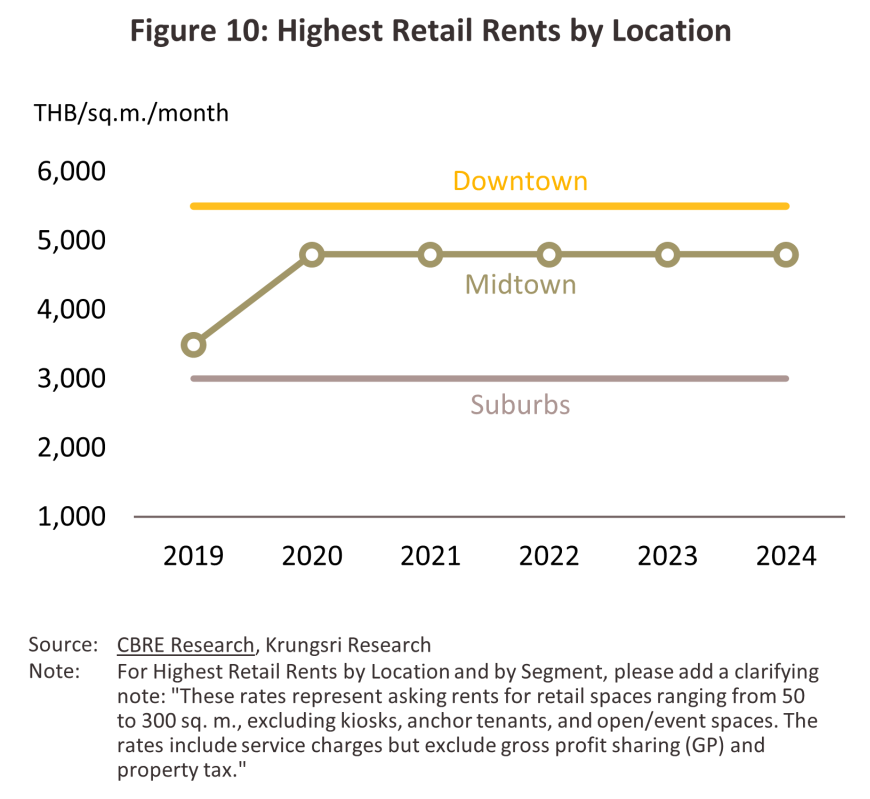

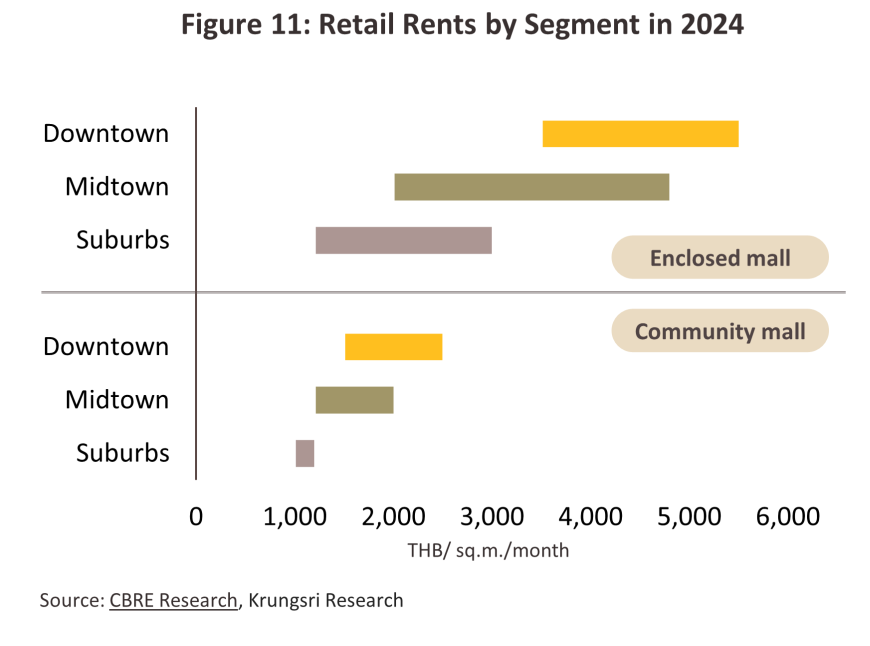

Rental rates remained largely unchanged from the previous year. At THB 5,500/sq.m., downtown locations command the highest rents at THB 5,500/sq.m. thanks to their positioning in economically vibrant areas and proximity to large, popular shopping centers that attract a high volume of international tourists. This was followed by midtown (THB 4,800/sq.m.) and suburban (THB 3,000/sq.m.) rents, both of which have remained stable since 2018 (Figure 10). Of all segments, enclosed malls in downtown areas recorded the highest rental rates, exceeding those of community malls by more than twofold (Figure 11).

Conditions within each segment are described below.

-

Enclosed mall

-

The size of each retail project typically ranges between 70,000 and 200,000 sq.m., with developments primarily located in suburban areas to support the expansion of residential projects or key business hubs (examples include Central Westgate, Central Ramindra, Mega Bangna, Central Salaya, and Central Festival Eastville). In contrast, developments in downtown areas face limitations due to restrictions imposed by city planning regulations and restricted availability of land. As a result, operators in these central locations focus on modernizing and reconfiguring existing spaces to attract international tourists and high-income consumer groups.

-

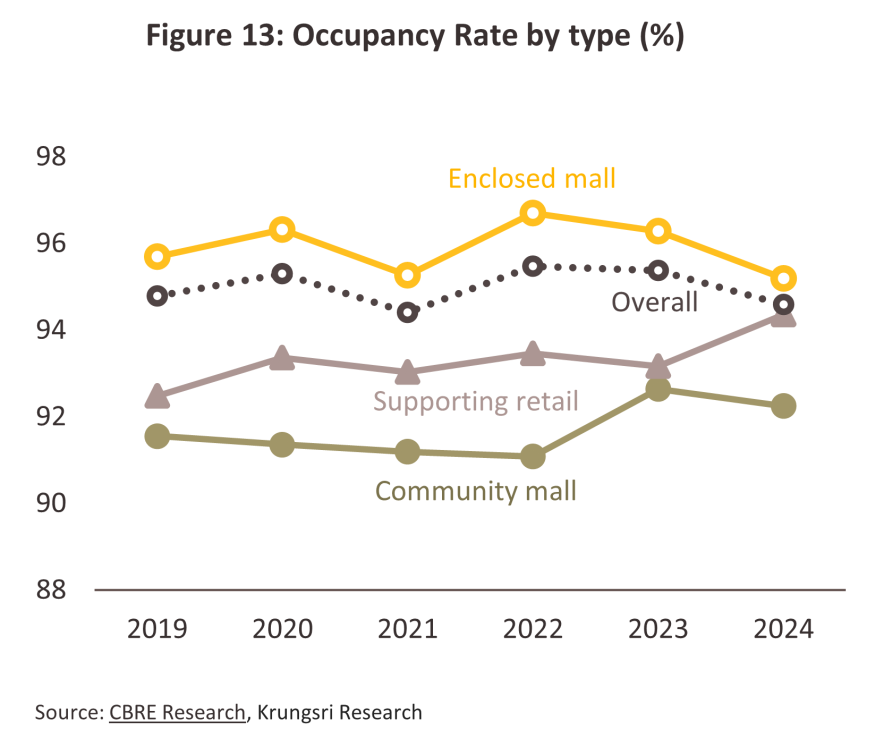

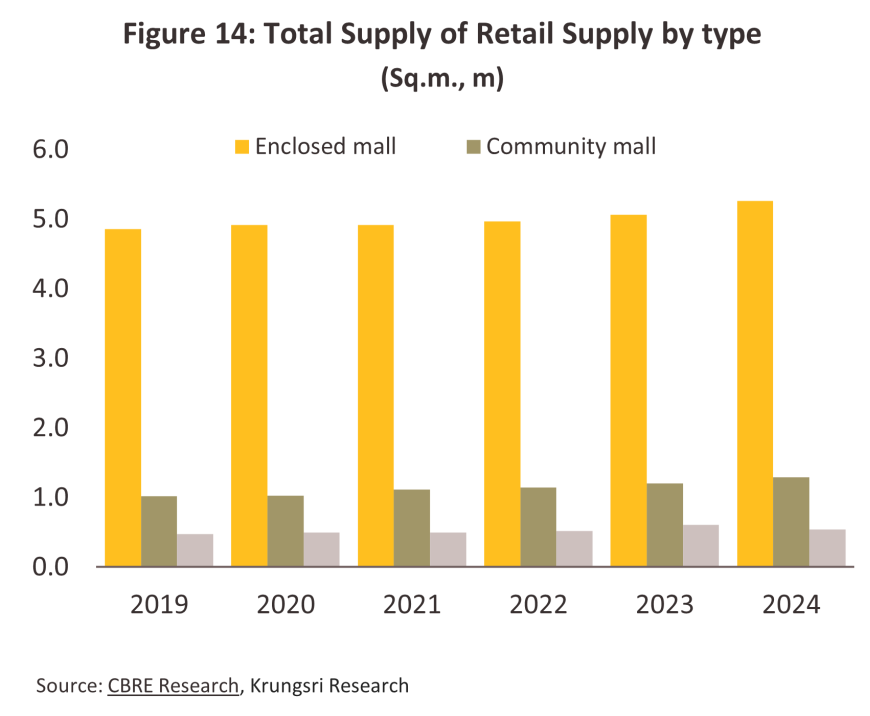

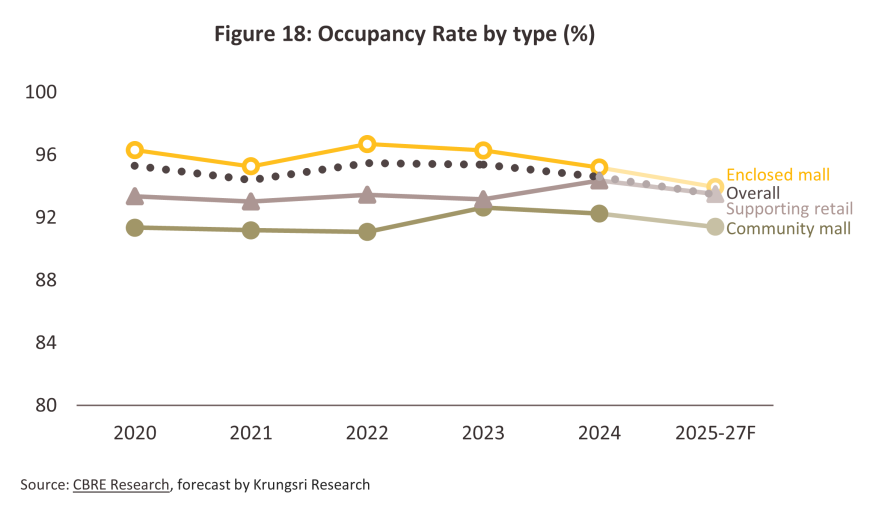

In 2024, the total supply of enclosed malls increased by 4.0%, taking this to a combined 5.3 million sq.m. (74% of total retail space). Demand grew by 2.8% to a total of 5.0 million sq.m. largely driven by expansion from existing tenants, particularly in the food & beverage sector and businesses in health, wellness, and fitness. These segments are increasingly seeking to capture the growing base of health-conscious consumers. However, the gap between supply and demand meant that the occupancy rate edged down from 96.3% in 2023 to 95.2% in 2024.

-

Community mall

-

The project size usually ranges from 3,000 to a maximum of 30,000 sq.m., distributed in suburban areas, accounting for 58% of the total community mall supply). Community malls experienced an oversupply due to rapid expansion during 2012-2016, with the supply increasing by an average of 18% per year. This led to intense business competition, causing many projects to gradually close down, and then an average increase of 2.6% per year during 2017-2020. However, during the pandemic (2021–2023), consumer preferences shifted toward avoiding crowded locations and spending more within their local neighborhoods, improving the outlook for community malls. This, in turn, accelerated the annual supply growth to 5.4%.

-

In 2024, 85,900 sq.m. of new supply entered the market. This was partly from a new community mall project in the Thong Lor area, targeting at upper-income earners, office workers, and expatriates in the neighborhood. Additionally, new developments have opened in the suburban Bangkok in line with the expansion of residential projects. As a result, total supply thus rose 7.1% to 1.3 million sq.m. (18% of total retail space). A 6.7% increase in demand helped maintain a stable occupancy rate of 92.2%, consistent with the level recorded in 2023.

-

Supporting retail

-

These are mostly in mixed-use3/ developments. The retail area typically does not exceed 50% of the total leasable space within the same project, or 20,000 sq.m. Tenants generally align their businesses with the nature of the main property. For example, retail spaces in office buildings are primarily leased to food and beverage operators catering to office workers, while those in hotels are often occupied by souvenir shops targeting tourists.

-

In 2024, total supply contracted by -13.7%, falling to 0.54 million sq.m. (8% of total retail space). This decline was due to the temporary closure of some supporting retail areas for renovation or their conversion into enclosed shopping malls. Some projects exceeded the 20,000 sq.m. threshold, causing them to no longer qualify as supporting retail spaces. Additionally, no new supporting retail areas were opened. Demand also fell, slipping to 0.51 million sq.m.; however, with a decline of -9.2%, demand fell at a slower rate than supply. Therefore, the occupancy rate rose from 93.2% in 2023 to 94.4% in 2024.

Outlook

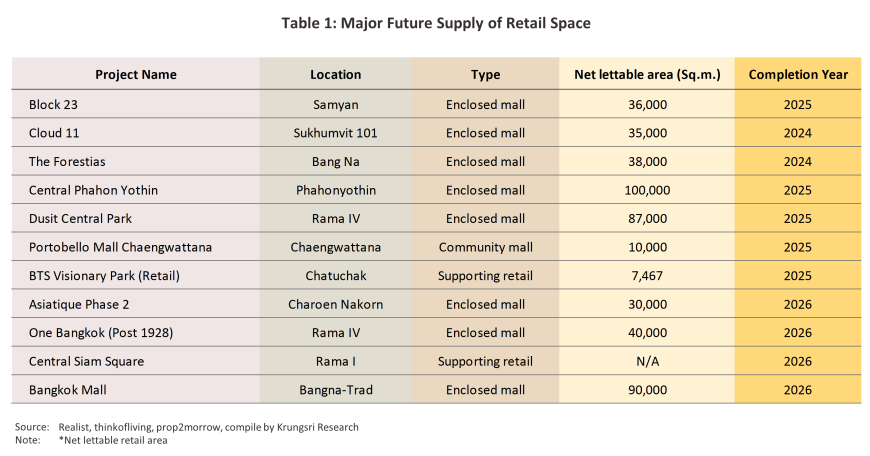

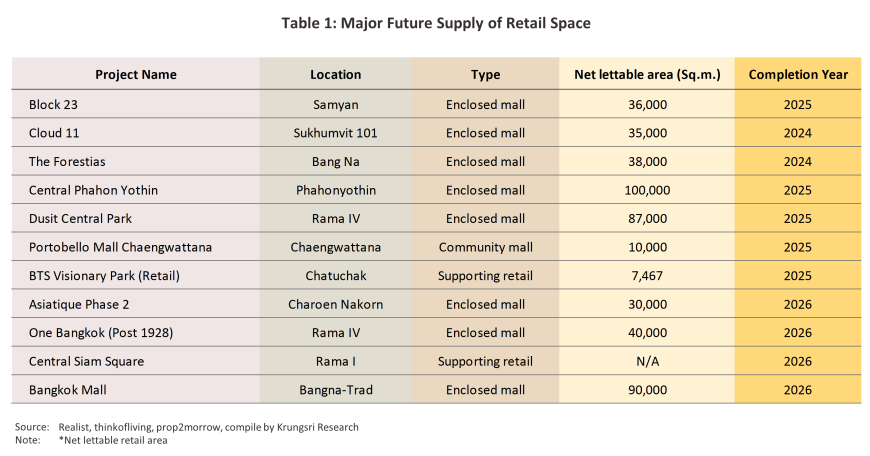

Throughout 2025, the retail rentals market will be impacted by slower growth in the broader Thai economy, with the 2025 GDP forecast revised down to 2.0-2.2%, from 2.5% in 2024. While the tourism industry will remain a major growth engine for the retail sector, which will further benefit from government stimulus measures including the Easy E-Receipt scheme and the 2025 ‘We Travel Together’ program. However, the escalating global trade war, following the US imposition of tariffs on imports from almost all nations (including Thailand), will put pressure on Thailand’s export sector to grow more slowly than anticipated. This will impact retail growth through slower domestic purchasing power recovery and more cautious spending, especially among income groups tied to manufacturing and export sectors. In addition, purchasing power from foreign tourists is expected to weaken, with tourist arrivals projected to increase by only 2.8% compared to 2024 (36.5 million, down from the earlier forecast of 38 million). The Chinese market, which accounted for the highest share of international tourist shopping expenditures in 2023 (16.4%), is expected to be significantly affected by US tariffs. The net effect of this will limit 2025 demand growth for retail space to just 2.5%, while supply will expand by 246,000 sq.m., primarily from the completion of various phases of large-scale mixed-use projects. As a result, total supply will increase by 3.5% from 2024 to 7.3 million sq.m., and as supply growth outpaces demand, the occupancy rate will drop to 93.7%.

The Thai economy is expected to gradually recover through 2026 and 2027, thereby supporting the growth of the retail rental market. The summary is as follows:

-

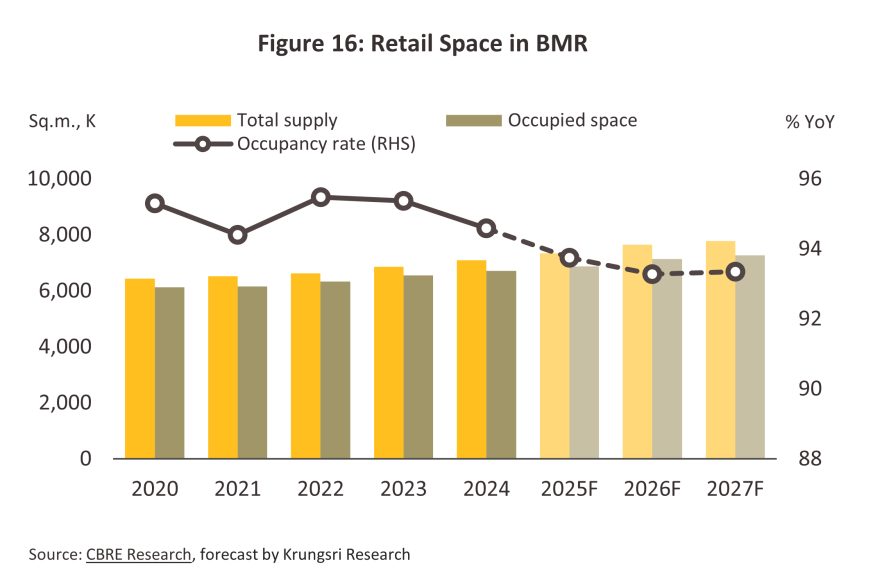

Demand for rental retail space will be supported by several factors. (i) the tourism sector and increased government spending on infrastructure megaprojects, which improve domestic purchasing power through increased employment and income. Foreign tourist arrivals are projected to rise to 41 million by 2027, boosting consumer spending and retail space demand. (ii) Improvements to the transportation network, especially to the capital’s metro system, will help to sustain ongoing urbanization, while new housing development across the broader Bangkok region will help spread out the demand for goods and services. Developers will respond by opening new shopping centers and community malls. (iii) Government measures to stimulate consumption including the second phase of transfer payments to the elderly, the Easy E-Receipt, and “You Fight, We Help” programs, will help to strengthen consumer confidence. Moreover, a February 2024 survey by eMarketer found that younger consumers (especially members of Gen Z) prefer to make purchases in-person in brick-and-mortar stores, especially when they are buying a particular item for the first time. These various factors will combine to boost demand for retail space by an average of 2.8% annually (Figure16), although this will remain below the 3.7% growth averaged over 2017-2019.

-

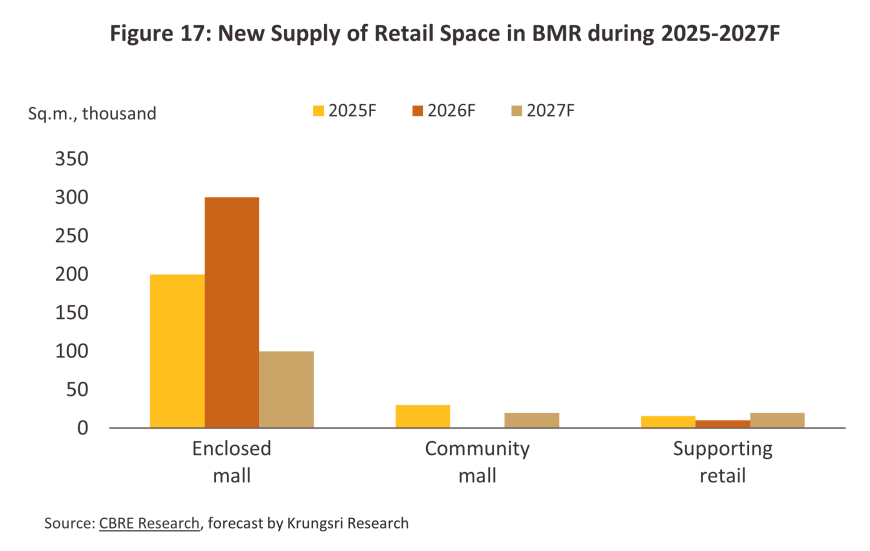

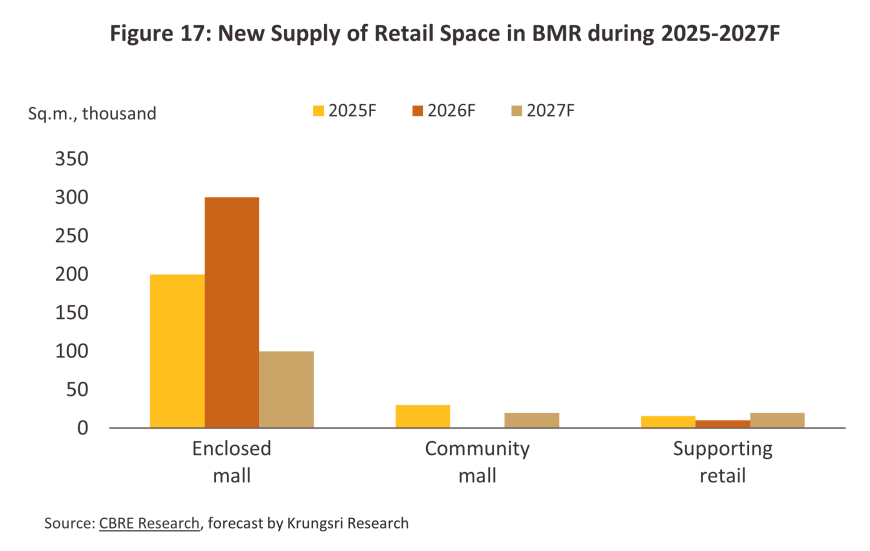

Supply will expand by 0.45 million sq.m. annually, or by an average of 3.0% per year (Figure 17). This will comprise a mix of space in newly renovated or expanded sites that benefit from high footfall and in large mixed-use developments, which will have a significant role to play in meeting future demand for residential and office units, especially from foreign nationals doing business in Thailand. The largest concentration of mixed-use space is in Pathum Wan, followed by Silom, Sathorn and Bang Rak. Among these developments, One Bangkok and Dusit Central Park are likely to be particularly popular with tourists and so these will attract most interest from international brands that appeal to upper ends of the market. However, these areas are already home to a number of large shopping malls and so competition between landlords active in these areas will intensify. In areas outside central Bangkok, demand will benefit from the improved reach and integration of the metro system, encouraging developers to invest more in retail space in these locations (e.g., The Forestias, Bangkok Mall, and Central Phahonyothin).

Owners and operators of retail spaces are also likely to expand their investments along new metro lines, particularly the Orange Line (currently under construction), which will serve both midtown and suburban Bangkok. This expansion will drive investment in residential developments, increase the potential market, and create new opportunities for partnerships with retailers from other industries, while also boosting investment in online distribution channels. Moreover, there is a strong focus on developing environmentally friendly projects to enhance the image and create an attractive atmosphere that draws more customers to the space. These efforts are expected to improve the ability to raise rental rates in the future.

-

The occupancy rate will slip to an average of 94.0% (Figure16) as supply continues to grow faster than demand. Nevertheless, the outlook will vary across different areas, and locations in high-potential zones (e.g., downtown and in areas that are well served by mass transit systems) will continue to attract interest from tenants, especially from leading brands and businesses seeking to expand in order to cater to tourists and upper-income earners. Thus, in these areas, the occupancy rate will likely remain stable or increase slightly. However, retail space in midtown and suburban areas, will face pressure from increased supply, resulting in a greater likelihood of occupancy rates declining compared to other areas. Overall, rents will likely remain stable or decrease slightly in most areas, except for downtown, where strong demand and the development of new high-quality projects could lead to slight rent increases. Additionally, using social media to assist with sales management will also help attract new tenants and customers, which could further support the potential for rent increases.

Outlook for different types of retail space, 2025-2027

-

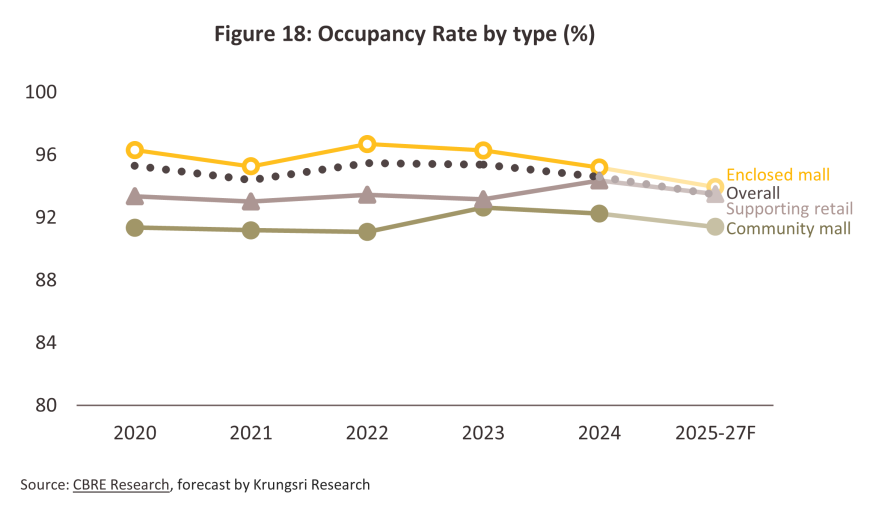

Enclosed malls: Supply will expand significantly in central business district locations as well as in suburban areas, where the expansion of residential developments is growing denser, for example, Rangsit and Bang Na. The majority of these will be large-scale shopping malls designed to cater to consumers who seek convenience and a wide range of services under one roof. Prime downtown locations will be particularly sought after by leading domestic and international brands. However, competition will intensify as new entrants from other industries invest in large shopping mall projects on the outskirts. Demand will grow steadily, and overall, the occupancy rate is forecast to average 94%. Rental rates will also likely to rise slightly.

-

Community malls: Modern consumer behavior increasingly favors shopping at nearby stores that are easily accessible and require minimal travel time, making community malls well-suited to meet these needs. In addition, urban expansion has driven the spread of community malls to suburban areas (such as Rangsit, Chaeng Watthana, and Lat Krabang). This has attracted new entrants—often large corporations from other industries such as real estate and energy—who are investing in building their own community malls. As a result, the sector has become more competitive and challenging, especially amid an economic slowdown that is weakening consumer purchasing power. This reflects a demand recovery that lags behind supply growth. To remain competitive, operators must find ways to attract both customers and tenants, for example by selecting prime locations to develop, forging advantageous business partnerships, generating economies of scale through business growth, and moving into office rentals. Consequently, the occupancy rate in this segment is expected to decrease to around 91%, limiting ability to raise rental rates.

-

Supporting retail: The supply of new space is expected to increase by 20,000 sq.m. annually. However, due to slow economic growth, demand for rental space will rise at a slower pace than supply. As a result, the occupancy rate will soften to an average of 93%, though in downtown areas, rents will remain stable or increase slightly.

-

Going forward, the industry will also need to navigate a number of short-term challenges. (i) Rising economic uncertainty and a likely slowdown in both global and domestic growth will weaken and prompt consumers to become more cautious in their spending, especially those in the lower- to middle-income brackets, who are under pressure from high household debt burdens. Moreover, foreign tourist arrivals may fall short of earlier projections. (ii) With new supply continuing to come to market, competition will intensify. (iii) The range of sellers and product choices available through e-commerce platforms continues to expand (the Department of Business Development projecting market value to rise 8.1%, or from THB 694 billion in 2024 to THB 750 billion in 2025) putting pressure on demand for physical retail space. (iv) The supply of low-rise retail space (i.e., standalone retail units) is expected to expand rapidly, especially in high-income residential areas and rest areas at service stations, which may reduce demand for rented retail space in certain locations.

1/ Retail Space is defined as shopping malls are sub-divided into enclosed malls, community malls and supporting retails.

2/ Major regional centers’ refers to important tourist destinations and centers of economic development in the regions of the country, excluding the five provinces surrounding Bangkok. Examples include Chiang Mai, Nakhon Sawan, Phitsanulok, Khon Kaen, Nakhon Ratchasima, Chonburi, Rayong, Phetchaburi, Prachuap Khiri Khan, Songkhla, Surat Thani, Krabi, Phang Nga and Phuket.

3/ Mixed-use developments combine residential and commercial units, typically including retail, office and residential space within a single development.

.webp.aspx)