EXECUTIVE SUMMARY

Recovery in the tourism sector and the reopening of China will support domestic economic growth through 2023, and this will feed into stronger demand for petrochemical products. Ongoing expansion in both the domestic and global economies will then add to demand growth and widen spreads through 2024 and 2025. However, headwinds blowing against the industry through the next few years will include: (i) potentially worsening geopolitical tensions and an accompanying rise in risk; (ii) lingering shortages of semiconductors; (iii) volatility in global oil markets; and (iv) the risk of oversupply, which may then depress both prices and spreads. These factors may then drag on sales growth and keep profits below prior trends.

Krungsri Research view

Recovery in the tourism sector and the reopening of China will support domestic economic growth through 2023, and this will help to underpin improving conditions for the Thai petrochemicals industry. In 2024 and 2025, Thai producers should be able to maintain satisfactory levels of turnover thanks to ongoing growth in the domestic and international economies. This will translate into strengthening demand, and given this, spreads should widen. Thai players will also look to expand vertically, integrating their operations from upstream through to downstream production and on to related industries. This expansion will take place both at home and abroad (especially in high-potential markets in China, Indonesia, and the CLMV nations), and this will then help to smooth production planning.

-

However, despite this positive outlook, Thai players are exposed to risk arising from the cost of inputs, which is expected to remain elevated. In addition, access to feedstocks may become problematic since natural gas reserves in the Gulf of Thailand will be depleted in the near future. Operators will thus potentially face problems with securing access to inputs and, should these need to be imported, it is likely that manufacturers will have to pay higher costs for both natural gas and crude oil. As such, margins will likely weaken.

-

Another factor that may limit the growth of the sector is the inward-looking policy of governments in major export markets, especially in China, Indonesia and Vietnam, focusing on increasing self-reliance in petrochemical production. At the same time, these countries also benefit from access to resources and rapidly strengthening demand for plastic products. Thai producers may thus need to adjust their business strategies by switching to a policy of engaging in joint partnerships with existing players in these markets. In addition, manufacturers will be able to reduce their exposure to competition on price by moving out of the commodity-grade market and instead shifting up the value chain to produce more specialized products.

-

Over the medium- to long-term, some Thai producers may switch to the production of environmentally-friendly bio-plastics since Thailand has abundant domestic sources of the biomass inputs (e.g., cassava, palm, and sugarcane) that can be used as alternative feedstocks. These high added-value products are currently gaining in popularity worldwide due to their ability to help reduce environmental problems, but as a further incentive to manufacturers to change production, the Thai government is also making entry to this market more attractive by offering investors targeted tax breaks.

Overview

The petrochemical manufacturing business is normally a large-scale operation that employs many complicated and tightly interconnected industrial processes. It involves huge capital investment to establish a petrochemical complex, which requires the use of advanced technology, and the sites that host these complexes need to have access to a wide range of industrial-scale utilities. Given this, the payback period on investment is relatively long.

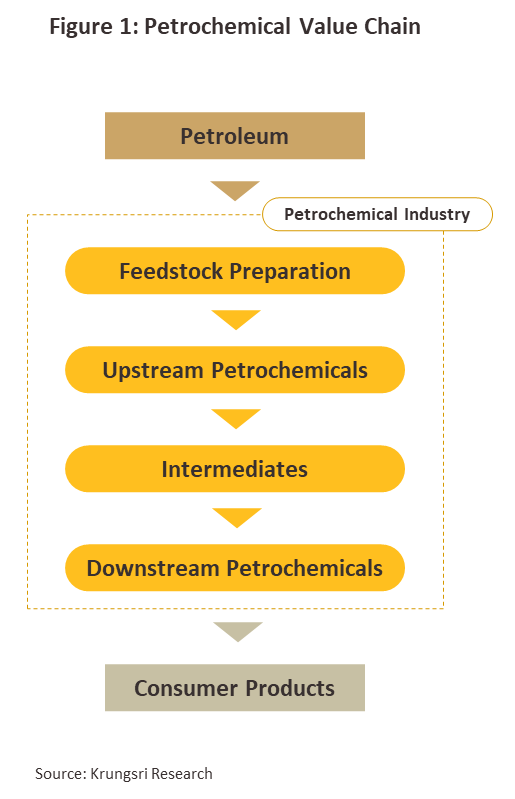

Generally, the petrochemical industry is exposed to cyclical supply-demand conditions and prices, as the desire to exploit economies of scale encourages large and intensive investment to meet anticipated future demand. Decisions to expand existing facilities or invest in new sites are usually made when prices for petrochemicals are high, and this would normally be when an expanding economy is feeding demand for these products or when there is a supply shortage. But construction of a petrochemical complex normally takes 3-7 years, and if the anticipated demand fails to materialize upon completion, there would be excess supply in the market. Global data suggest each natural cycle lasts between 6-9 years, but shocks in the world economy could also affect the supply and demand sides of the equation. Recently, it has thus been harder to identify cyclical movements within the industry at a global scale.

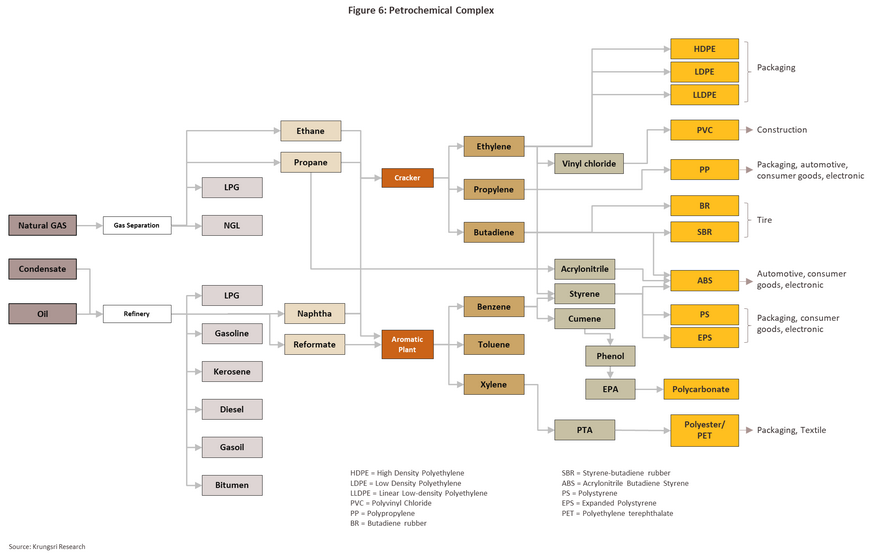

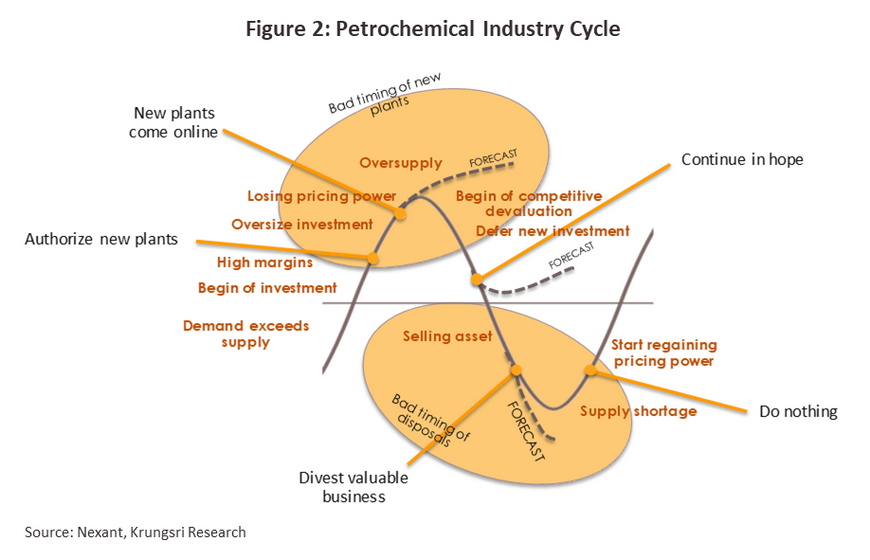

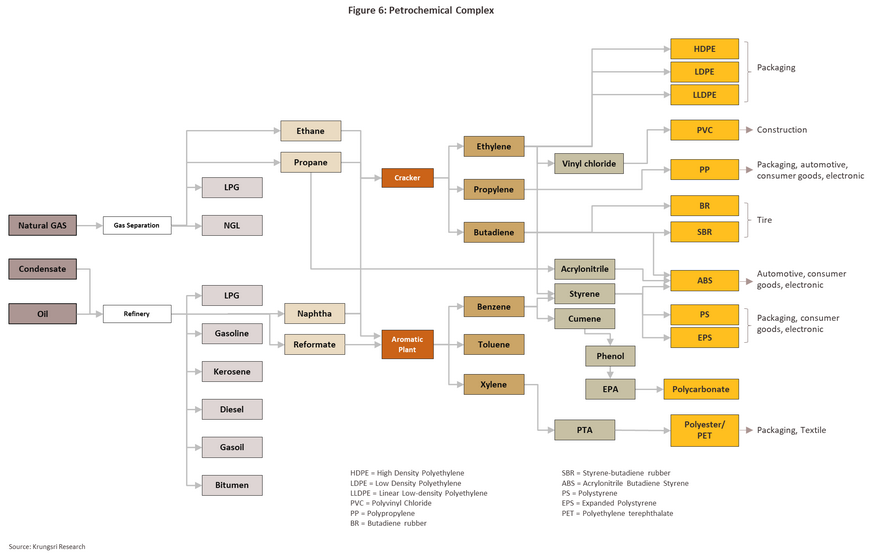

Investments in large global petrochemical complexes are typically made by players in the oil sector that use petroleum products as feedstock. However, some petrochemical output can also be used as feedstock or as primary ingredients in a wide range of industrial processes. The manufacturing process for petrochemicals can be divided into four main stages:

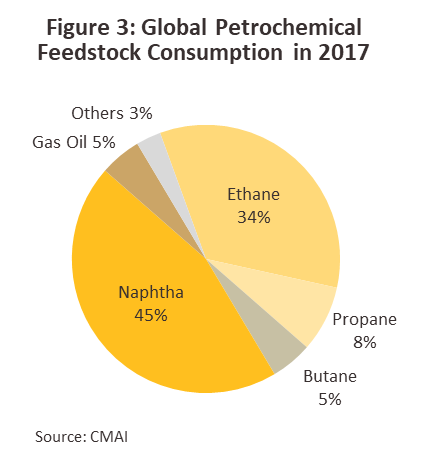

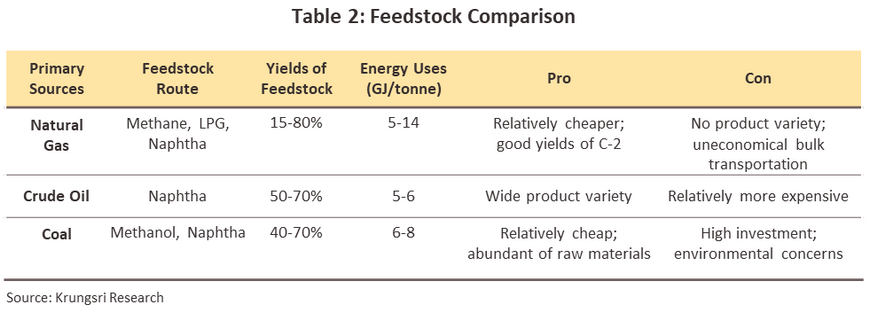

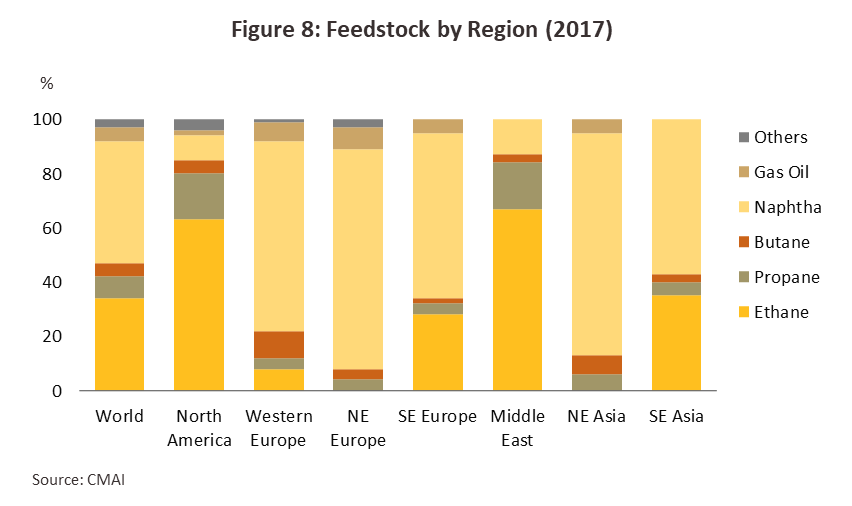

Stage 1: Manufacturers of feedstock typically use products from the petroleum sector, including natural gas, condensates (a product of gas distillation), and naphtha (from the distillation of crude oil). About half the petrochemical production capacity uses naphtha as feedstock, which is especially common in facilities in Asia and Europe. In North America and the Middle East, gas is the preferred feedstock because these areas are rich in natural gas deposits. In addition, recent technological developments are allowing organic products such as sugarcane, cassava and palm to be used as raw material in the production of bioplastics, and investment in these sectors is expected to rise in the future (Figure 3).

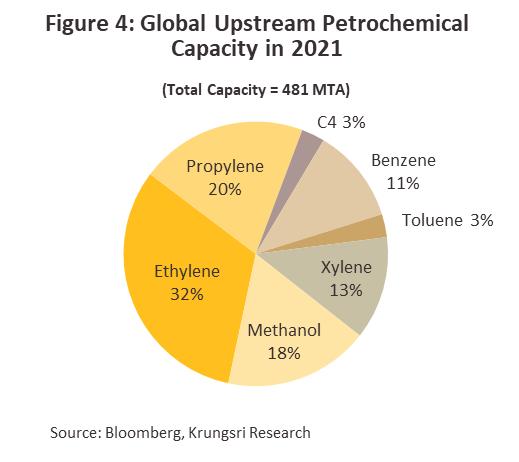

Stage 2: Upstream petrochemical industries take feedstock and use them to produce precursor or preliminary petrochemical products. These may be divided into two groups according to their molecular structure: (i) olefins, which include methane, ethylene, propylene and other chemicals that have a base structure formed from four carbon atoms (so-called ‘mixed C4’ chemicals); and (ii) aromatics, which include benzene, toluene and xylene, and are used as inputs in the manufacture of other petrochemical products.

Stage 3: Intermediate petrochemical industries consume upstream products, both olefins and aromatics, and process or combine them with other chemicals to produce intermediate products. Some major products in this industry are vinyl chloride and styrene. These are sold to downstream industries.

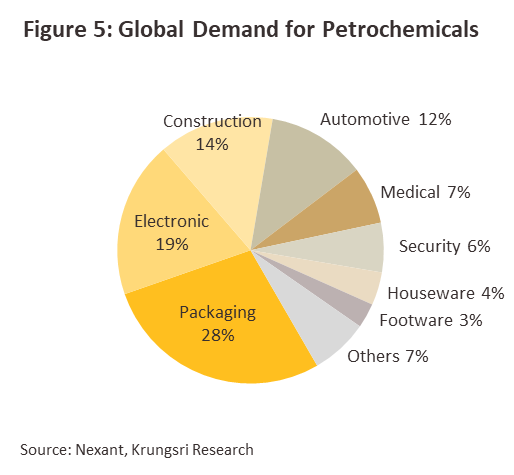

Stage 4: Downstream petrochemical industries take upstream and intermediate goods and use these to make finished products for use in related sectors (Figure 5). Products consumed by the downstream petrochemical industry can be sub-divided into four groups

-

Plastic resin is the most commonly-used product in downstream industries, including packaging, automotive manufacturing, construction material, and consumer goods. The most important plastic resins are polyethylene, polypropylene, polyvinyl chloride (PVC), acrylonitrile butadiene styrene (ABS), polyethylene terephthalate (PET), and polystyrene (PS).

-

Synthetic fibers, for example polyester and polyamide or nylon fiber, are mostly consumed by the textiles and packaging sectors.

-

Synthetic rubber/elastomers are used in the manufacture of automotive parts, tires, and consumer goods. Examples include styrene butadiene (SBR) and butadiene (BR).

-

Synthetic coatings and adhesive materials, which include polycarbonate and polyvinyl acetate, are used in construction and several other industries.

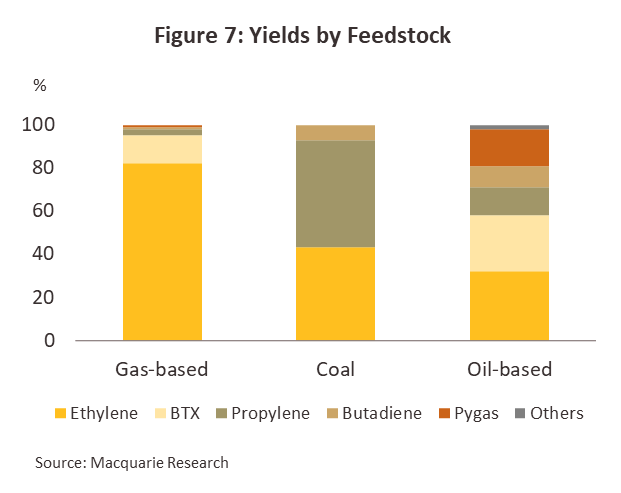

The choice of feedstock made by the individual operator for a particular production process is strongly influenced by the desired output because each feedstock has a different hydrocarbon composition and will produce different petrochemical outputs. For example, using natural gas to produce ethylene yields about 80% ethylene and 20% other products, whereas using naphtha yields only 30% ethylene and 70% other products (Figure 7).

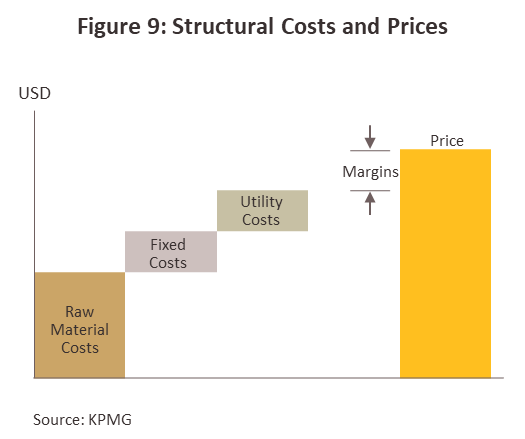

The major cost item in the sector is feedstock which comprises 60-70% of the total production cost. Power and transportation account for another 15-20%, and the remaining 15-20% is attributable to fixed costs. Hence, the production cost is largely dependent on the prices of oil and related products, making this a cost-based industry and producers who are able to keep these under control will have a competitive advantage. More specifically, production overheads, or cash cost, will depend on the type of feedstock used, the production technology employed, and access to feedstock. Therefore, feedstock management is also an important factor in determining costs, and locating production facilities on sites with easy access to raw materials and to markets will reduce transportation overheads and improve competitive advantage.

The ability to manage complex investments is another important factor in determining business success. It would allow manufacturers to better manage costs, reduce exposure to risks arising from fluctuations in product prices, and plan production more effectively. Product flexibility also permits manufacturers to quickly adjust production to meet changing demand, while large-scale operations allow manufacturers to benefit from economies of scale and reduce the marginal cost of production.

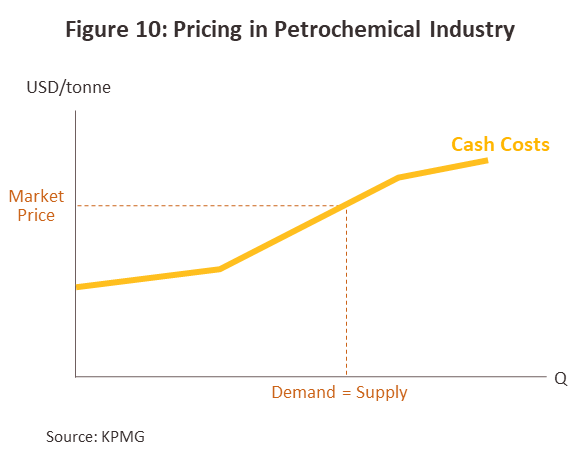

The petrochemical market is extensive and globally interconnected. Hence, prices are normally based on a combination of production costs and supply-demand dynamics on global exchanges. Global prices are largely determined by ‘laggard-driven pricing’, which means the market price is set by the cost of producing the last unit consumed. When the cost of the feedstock used in producing that last unit changes, this will thus have a direct effect on prices of output. Research shows prices of upstream and downstream petrochemical products have a 70–85% and 40-70% correlation, respectively, with the cost of feedstock.

The ‘spread’ of a particular petrochemical product refers to the difference between the product price and the cost of raw material; this represents the gross profit margin for each product. However, most downstream petrochemical industries have a product chain stretching from upstream products through intermediate to downstream outputs, so when calculating profit, we must consider spreads for all the products in the supply chain.

Profitability is normally reflected by gross integrated margin (GIM). This is the difference between the total value of petrochemical products less total cost of production. Hence, the GIM depends on the spreads of all the products manufactured, which could rise or fall according to an operator’s cash cost and capacity utilization. However, product mix will vary for different production sites and for different operators, which makes is complicated to assess competitiveness by simply comparing GIM. This has prompted the use of cash cost as the preferred metric for assessing competitiveness, specifically cash cost for ethylene because it is the world’s most commonly produced upstream product at 32% of total global petrochemical output, and is used as feedstock in a wide variety of processes.

The global petrochemical sector: In 2020, the global petrochemical sector had a market value of around USD 530bn, and that is expected to grow and exceed USD 700bn in 2025 (source: Grand View Research)1/. China was both the biggest producer and consumer of petrochemicals in 2021 at 29% of global output and 28% of consumption. The United States was the world’s single largest source of ethylene, hosting 19.5% of global production capacity, followed by China (19.3%) (Figure 11).

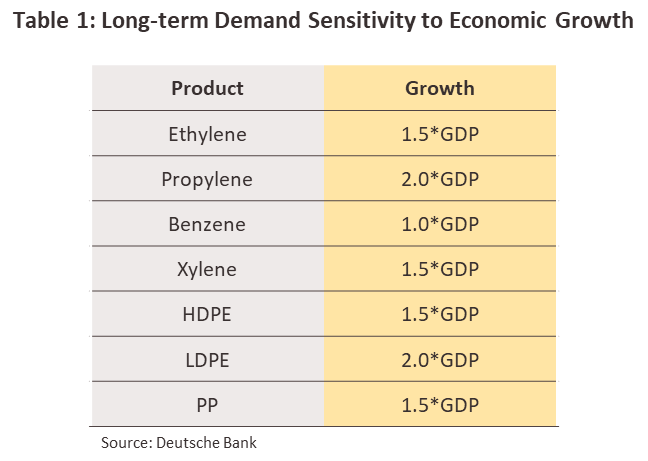

Worldwide, petrochemical products are used in packaging (28% of output), electronics (19%), construction (14%), automobiles (12%), and a range of other related sectors (27%). Demand for petrochemical products typically grow 1-2 times faster than the general rate of growth in the economy.

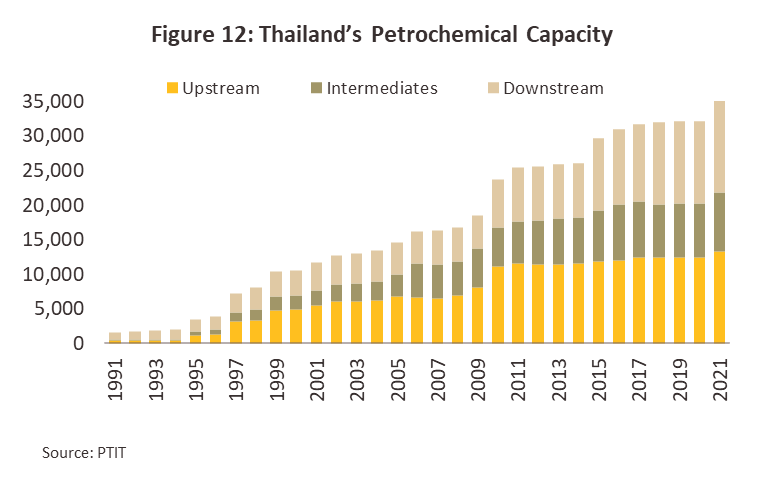

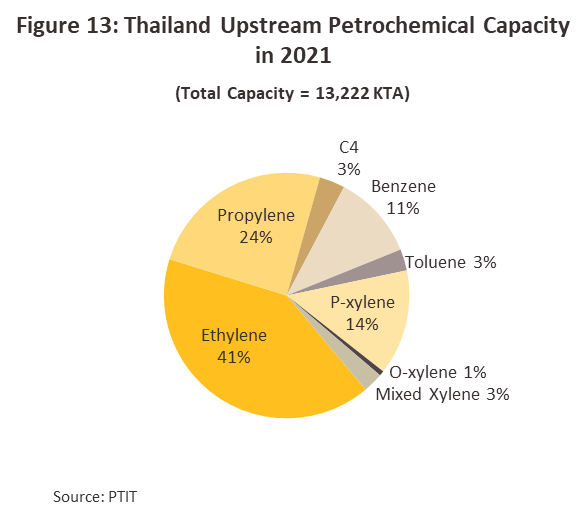

Thai petrochemical sector: In 2021, the Thai petrochemical sector had a total production capacity of 35 million tons, the largest in the ASEAN region and 16th largest in the world.

-

In that year, they produced 13.4 million tons of upstream products, 8.5 million tons of intermediate goods, and 13.3 million tons of downstream outputs.

-

Naphtha is the main feedstock (68% of total feedstock consumption), while 69% of production capacity is for olefins.

-

Over 80% of Thai upstream and intermediate production is for domestic use as inputs for further downstream processes. 45% of the downstream output is consumed within Thailand. The primary consumers of downstream products in Thailand are the packaging sector (38% of the total), textile (18%), automobile (12%), electronics (11%), and others (21%). The remaining 55% goes to the export markets (largely in the form of plastic pellets or nurdles), the most important of which are China (31%), Japan (10%), Indonesia (10%), Vietnam (9%) and India (8%).

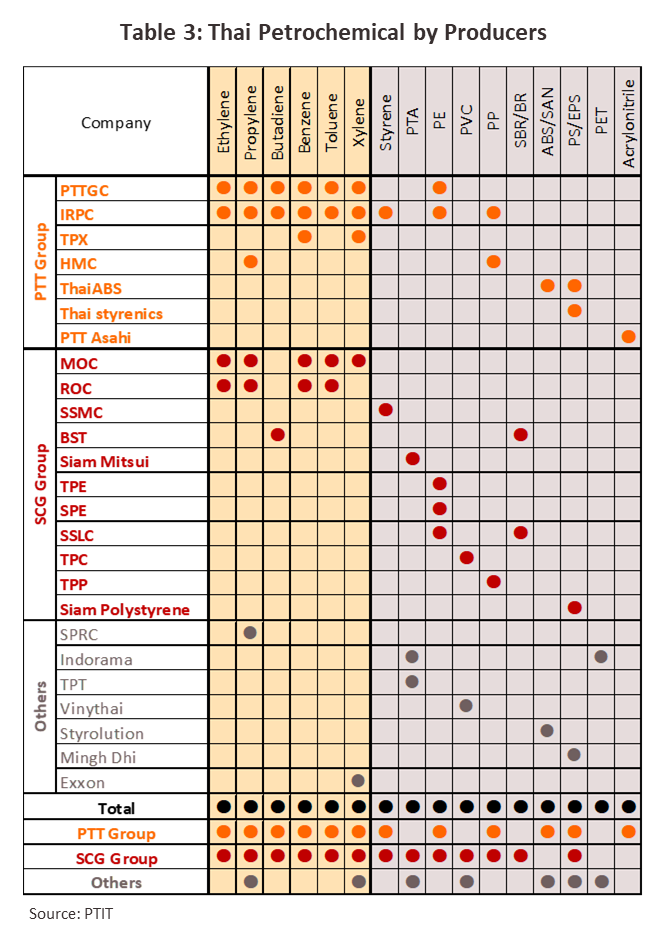

There are two major players in the domestic petrochemical sector: PTT group with 54% market share, and SCG group with 29% share. These two have been competing to gain competitive advantages in manufacturing and marketing by continually investing in related businesses in Thailand and overseas. PTT is linked to upstream industries, including oil drilling, natural gas production, oil refining, and the production of a wide variety of petrochemical products. The SCG group has stakes in companies that consume petrochemical inputs, such as manufacturers of consumer goods and building materials. The smaller players are also active in the sector but tend to focus on the production of intermediate and downstream goods. They include Thai companies, for example Vinythai, and international operators or joint ventures with foreign companies such as Indorama, Exxon, and MingDih.

However, Thailand has limited natural gas reserve, which is expected to be depleted in the near future. This has prompted changes in the domestic petrochemical sector, including:

-

Increasingly switching to using naphtha, a crude oil product, as a replacement feedstock. This will lead to a change in the upstream product mix.

-

Developing a greater range of new downstream products, especially higher value-added goods, and at the same time, moving away from price competition. These are in line with the third phase of the development plan for the sector for 2004-2018.

-

Expanding production facilities in countries with access to raw materials and a sufficiently large domestic market, including Indonesia, China, and America. An example is PTT Global Chemical’s investment to construct a petrochemical complex in the United States to exploit the supply of cheap shale gas in the region.

Situation

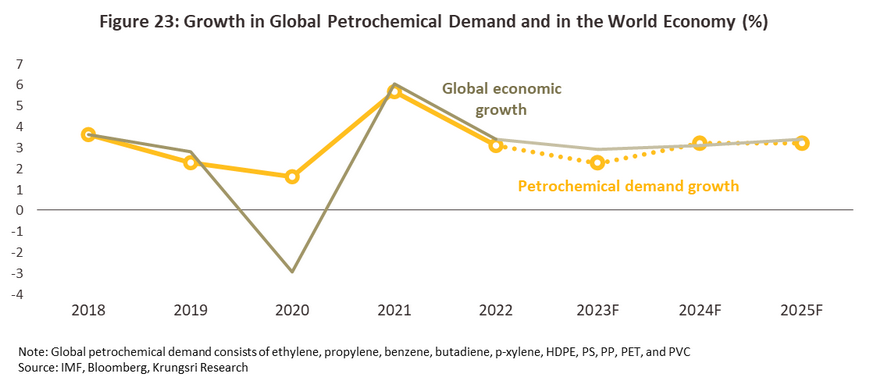

In 2021, the petrochemicals industry recovered significantly, driven in large part by the easing of the Covid-19 pandemic following the successful worldwide rollout of vaccination programs. This resulted in a rebound in economic conditions in the major economies of 6.0% in 2021 from a contraction of -3.3% in 2020. For the petrochemical industry, this meant that growth rates jumped from 1.6% in 2020 to 5.7% a year later as strong pent-up demand in the construction, automobile, and packaging industries was released. However, the world economy’s journey to recovery hit a major roadblock in 2022 with the outbreak of war in Ukraine, and thanks to Russia’s position as a major producer, this had significant impacts on the supply of oil and natural gas. The sudden surge in prices that this supply disruption triggered added pressure on prices worldwide, pushing inflation to 8.8%, its highest in over a decade. This situation was worsened by China’s pursuit of its zero-Covid policy, causing lockdowns of major industrial areas. For 2022, global growth thus slowed to 3.4% (source: IMF), and Krungsri Research estimates that overall demand for petrochemical products expanded by 3.0-3.2%.

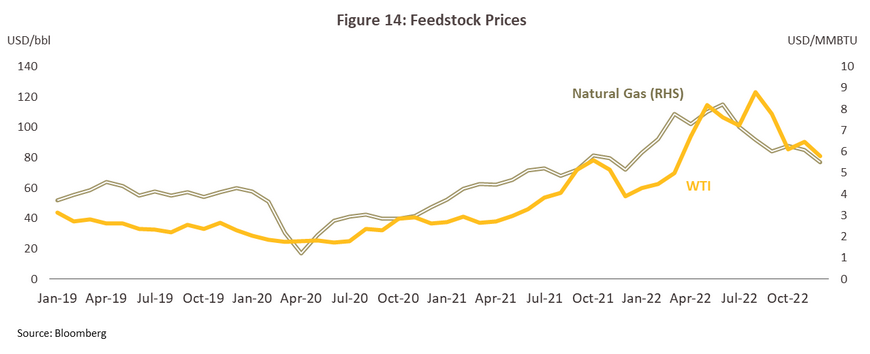

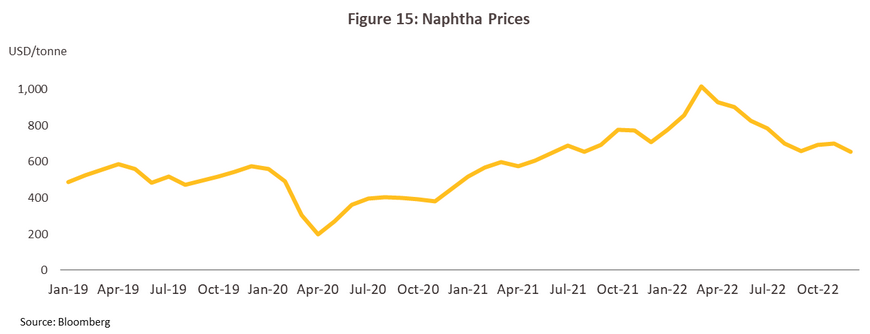

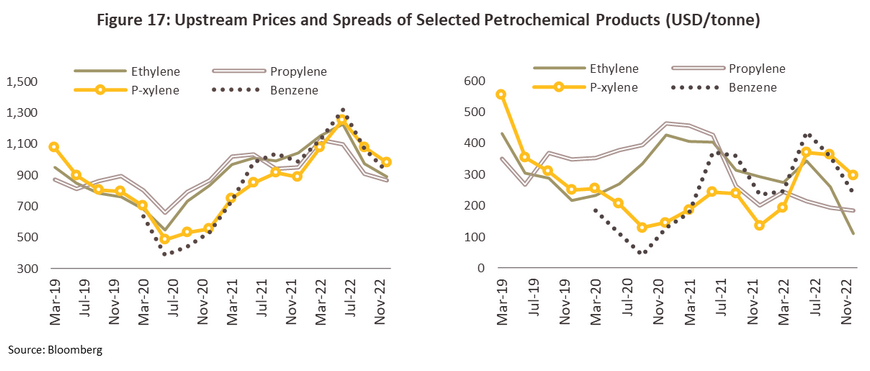

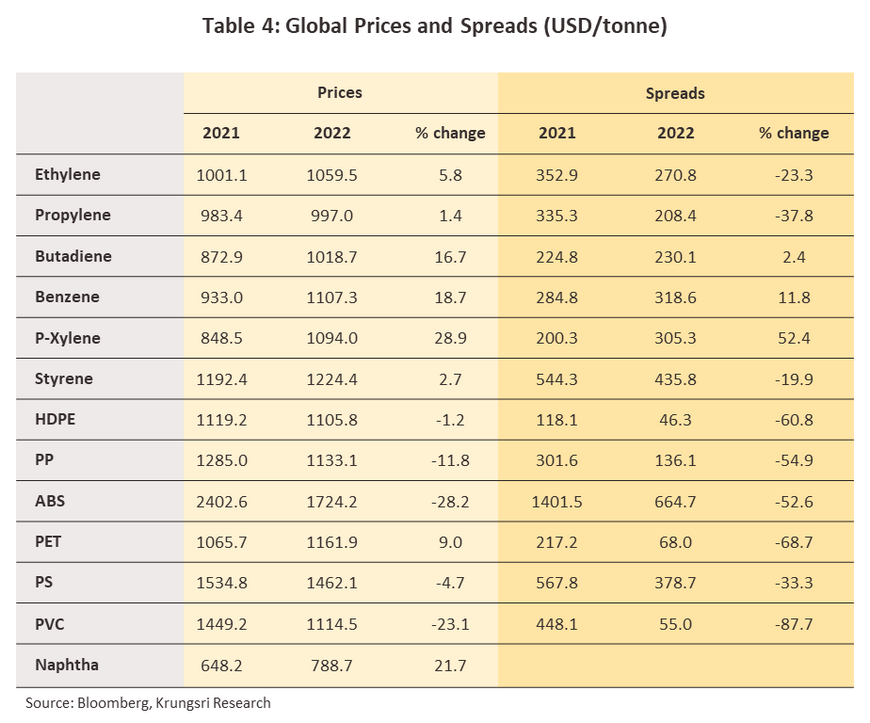

The cost of inputs to the petrochemicals industry climbed through 2022 due to rising prices for crude oil and natural gas from the Russia-Ukraine war. Crude oil prices were also affected by demand growth outpaced the expansion in supply, which remained tight thanks to the limited production quotas that have been kept in place by OPEC+ since 2020. Given this, average prices for Dubai Crude surged by more than 40% to USD 96.3/bbl relative to their 2021 level and this then pushed up prices for naphtha (which is produced from crude) by 21.7% YoY to an average of USD 788.7/tonne. Gas prices also spiked in the year, jumping 75.2% YoY to an average price of USD 6.5 per 1 million BTU (MMBTU) (Figures 14 and 15). As a result of this discrepancy in the price rises for oil and gas, manufacturers using naphtha as their primary input enjoyed cost advantages relative to natural gas-based manufacturers.

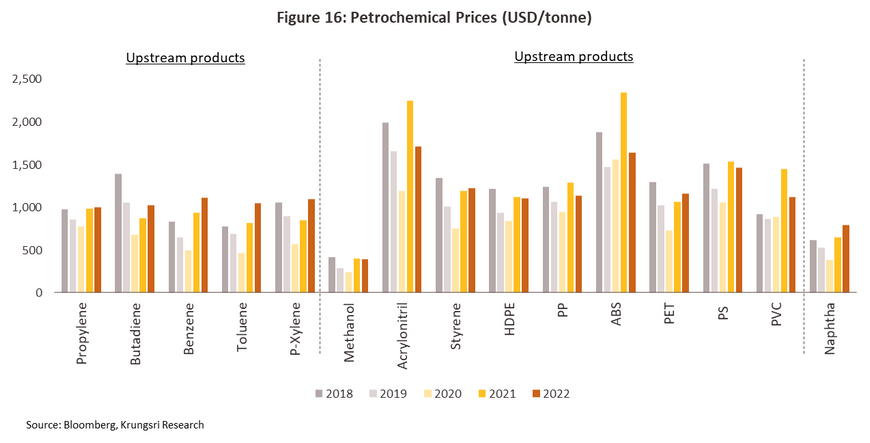

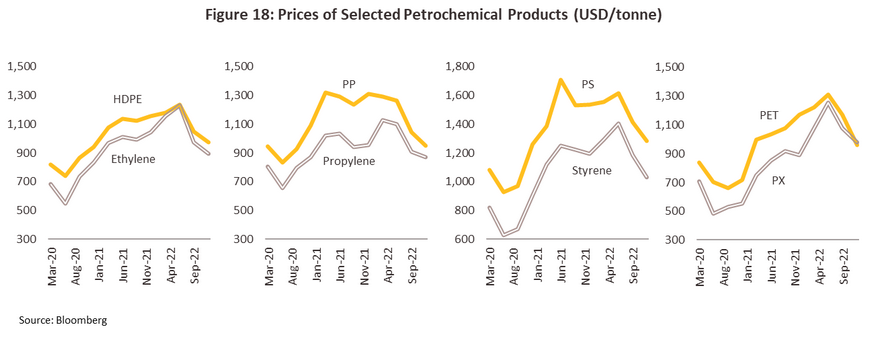

Prices for most of the major petrochemical products in 2022 were pushed up by the higher cost of inputs (Figure 16) as well as tighter supply due to some regional manufacturers with relatively higher cost of production cutting their production capacity since this was no longer cost-effective. However, in the second half of the year, price increases were restrained by a slowdown in demand for petrochemicals from increased fears over the possibility of a recession. This made it increasingly difficult for manufacturers to pass on higher costs to downstream markets, which helped to ease some of the pressure that has kept prices elevated. This downgrade in the outlook was amplified by China’s continuation of its zero-Covid policy and the periodic lockdowns of major urban and industrial centers, which then impacted the manufacturing sector and undercut demand for downstream petrochemical products. In addition, prices were further affected by rising supply that came from: (i) the diversion of exports from China to Southeast Asia by manufacturers in the Middle East, China, and South Korea, and (ii) the new petrochemical facility in Malaysia, which began operations in the latter half of 2022. As a consequence, both average prices and spreads for midstream and downstream products stayed flat or declined. This is with the exception of PET, for which prices benefited from greater demand from the packaging industry.

Upstream petrochemical products:

- Olefins

-

Ethylene: Spreads contracted -23.3% from their level in 2021 to USD 270.8/tonne. The market was impacted by both the global economic slowdown in the second half of the year and the impacts of Chinese pandemic controls on demand for downstream products, while an easing of tight supply helped this return to more normal conditions. The increase in ethylene prices therefore fell behind the run up in the cost of inputs, leading to a tightening of spreads.

-

Propylene: Spreads narrowed -37.8% to USD 208.4/tonne on an increase in Chinese supply (a large Chinese manufacturer has begun commercial operations at a new production facility). Alongside this, the market was undercut by weak demand for downstream products from China and from auto manufacturers worldwide, which continued to be affected by semiconductor shortages.

- Aromatic

-

Para-xylene (PX): Spreads surged 52.4% to USD 305.3/tonne thanks to increased consumer concerns over health and hygiene that translated into a decline in the reuse of packaging and an accompanying increase in demand for the PET resin that is used in the manufacture of single use packaging for food and drinks. Demand from downstream industries, and in particular from textile manufacturers (the largest consumer of PX), also recovered steadily, while on the supply side, although some large manufacturers entered the market, other players cut production capacity, and this too helped to bid up prices.

-

Benzene: Spreads broadened 11.8% to USD 318.6/tonne on: (i) stronger demand from end users for the manufacture of packaging, and electronics and consumer goods; and (ii) a tightening of supply that was driven by a reduction in the US production and controls on energy consumption in China.

Downstream petrochemical products:

-

High density polyethylene (HDPE): Spreads slumped to USD 46.3/tonne, down -60.8% from their level in 2021. Demand for HDPE came under pressure due to the lockdowns imposed on major urban and industrial areas in China, which then weighed on consumption by buyers in construction and piping, as well as from fears over a global slowdown that were triggered by the run-up in inflation. Supply also increased as greater capacity came online in China, Malaysia and the Middle East, while increases in the cost of ethylene outpaced those of HDPE, adding further to pressure on spreads.

-

Polystyrene (PS): Spreads contracted -33.3% to USD 378.7/tonne. The acceleration of Inflation that led to consumers being more cautious over their spending resulted in demand from downstream industries to soften, in particular from producers of electrical appliances, electronics, and auto parts. However, the effect of this on prices was partly offset by the decision by Asian manufacturers to take production capacity offline or to postpone increases in this as they looked to avoid excessive stockholding and to bring this into line with more depressed market conditions.

-

Polypropylene (PP): Spreads tightened to USD 136.1/tonne, down -54.9% on a combination of the general slowdown in the world economy, weaker demand from downstream industries in China, and the tightening of monetary policy in many countries, especially in Vietnam and Indonesia (major markets for PP).

-

Polyethylene terephthalate (PET): Spreads narrowed -68.7% to USD 68/tonne. Manufacturers were not unduly affected by the Covid-19 pandemic since PET is used to manufacture sanitary packaging for food and drinks, while on the production side, constraints on power consumption in China caused supply to tighten. However, the cost of PX, an important input into the manufacturing process, rose substantially and this then impacted spreads.

The Thai petrochemical industry was supported through 2022 by growth in the broader economy, driven mainly by the recovery in the tourism sector, as well as by the abating of the pandemic, which then helped demand recover in downstream industries including packaging, plastics, and medical devices. However, in the second half of the year, markets felt the effects of a slowdown in growth of both the Thai and the global economies, the continuation of China’s zero-Covid policy, which then suppressed demand in downstream industries, and strong inflation that then dragged on domestic consumption and investment. Given this, overall demand for petrochemical products softened. The situation for the industry in 2022 is summarized below.

-

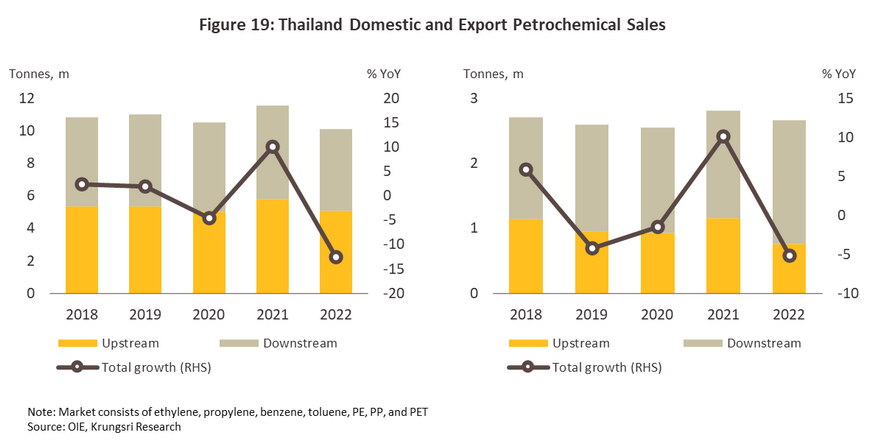

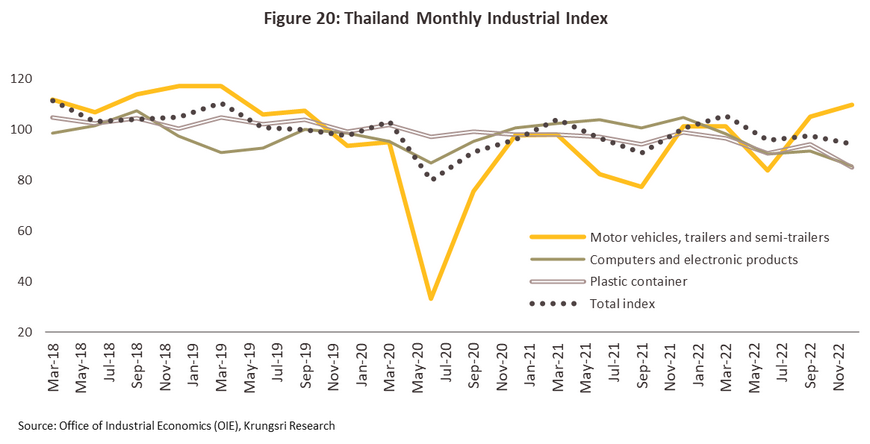

Having risen 10.1% in 2021, in 2022, sales of petrochemical products fell back by -12.5% to a total of 10.1 million tonnes, with sales of upstream and downstream products contracting by respectively -12.1% and -13.0% to totals of 5.1 and 5.0 million tonnes (Figure 19). Exports also slipped -5.2% YoY by volume as a consequence of: (i) the imposition of harsh lockdowns in important industrial regions in China, a major export market for Thai manufacturers; (ii) rate hikes that were implemented around the globe in response to rising inflation and that then suppressed economic growth and demand in industries that use petrochemicals as an input; and (iii) supply chain disruptions that affected downstream consumers including the auto assembly and electronics industries (Figure 20).

-

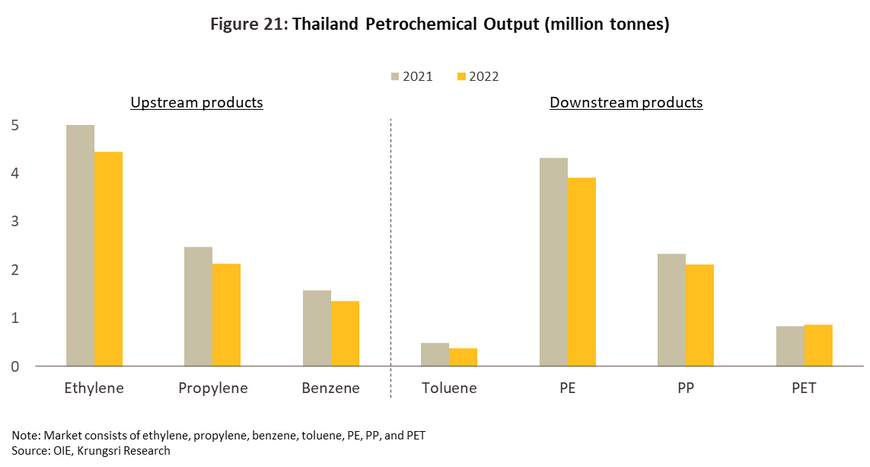

Output of petrochemicals contracted -10.8% to 15.2 million tonnes, with production of the two major upstream products ethylene and propylene falling by -11.2% YoY and -14.2% YoY respectively. Output of downstream goods was also affected by the closure of many facilities for maintenance (Figure 21).

-

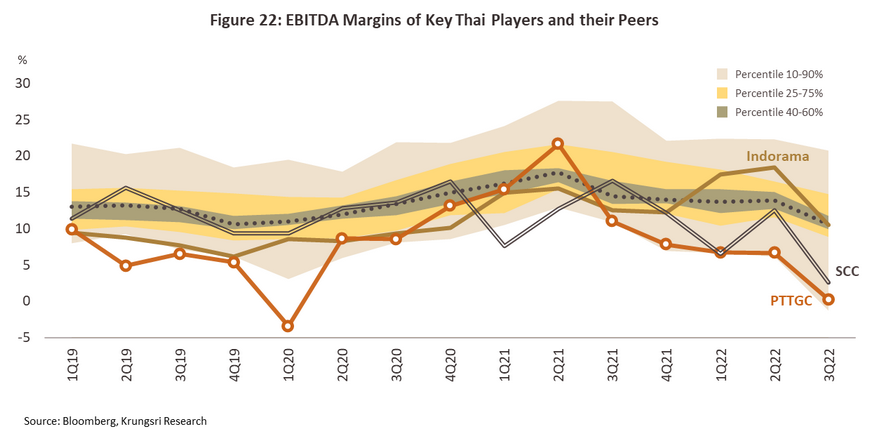

Industry profits narrowed for the major players (Figure 22) as prices and spreads came under pressure from weaker demand, in particular from auto assemblers and manufacturers of electronics goods, which continued to be affected by shortages of semiconductors. Alongside this, producers’ profits were also affected by the continuing high cost of natural gas and crude, which then lifted the price of industrial inputs (Table 4).

Outlook

The IMF sees the global economy expanding by 2.8% in 2023, with growth accelerating to 3.0% and 3.2% in 2024 and 2025, though with volatility in crude oil prices expected due to high uncertainty around the outcome of the Ukraine-Russia war. Nevertheless, the full reopening of China at the start of January 2023 will help to underpin demand for petrochemicals to run to 1.5-2.5% in 2023 and then to 2.5-3.5% annually in 2024 and 2025 (Figure 23).

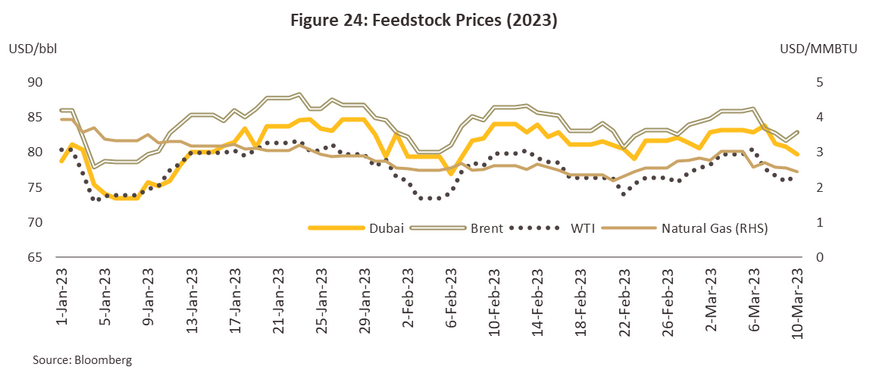

Prices for crude oil (a crucial input into petrochemicals production) are expected to remain elevated. The International Energy Agency (IEA) forecasts demand will average 101.9 MMbbl/day through 2023, up from 100.5 MMbbl/day in 2022, thanks partly to the reopening of China. At the same time, supply will remain constrained by the continuation of sanctions on Russia, which has announced a 0.5 MMbbl/day cut in exports from March 1, 2023, onwards, thus taking around 0.5% of global supply off the market. In addition, to maintain high prices, the OPEC+ group has agreed to a 2 MMbbl/day cut in output to run from November 2022 through to the end of 2023 (Figure 24). In light of these market conditions, Krungsri Research projects that prices for Dubai Crude will average USD 70-80/bbl through 2023 to 2025, while the World Bank sees prices for natural gas averaging USD 6.2/MMBTU in 2023 and then softening slightly to USD 6/MMBTU in 2024 and 2025.

Tightness in oil markets will keep prices for naphtha elevated through 2023-2025, and so Krungsri Research expects these to average USD 652/tonne in 2023 and then to weaken to USD 612/tonne and USD 565/tonne in each of the following two years. This compares to prices that peaked at USD 788.7/tonne in 2022, which then had significant impacts on the prices and spreads for midstream and downstream products.

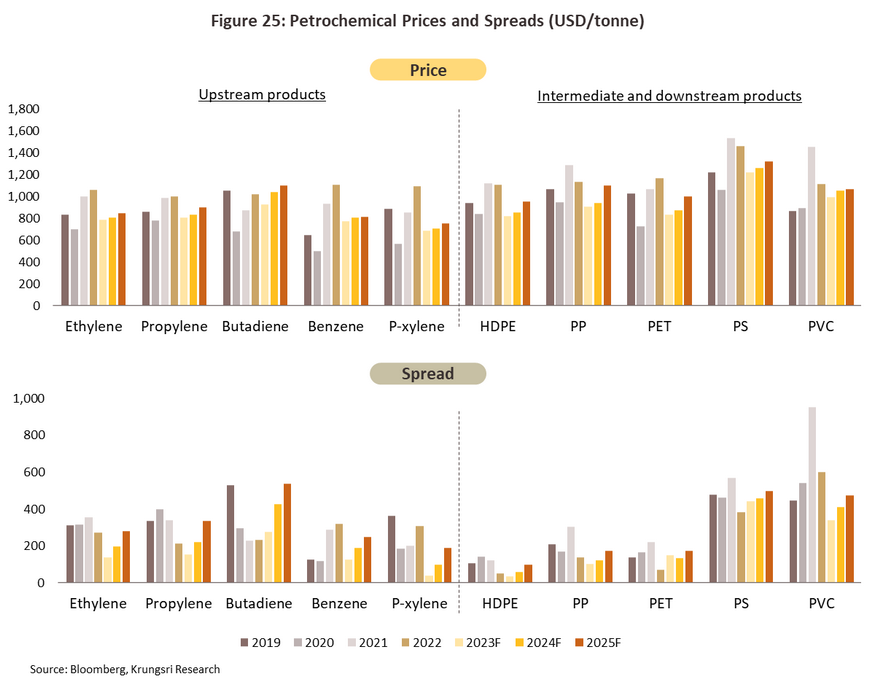

With the global economic growth expected to slow to a historic low of 2.8% this year, prices for many of the major petrochemical products will likely soften across 2023 (Figure 25). The continuing strength of inflation will encourage consumers to be more cautious in their spending, and this will impact demand in some downstream industries from petrochemical producers. At the same time, the market is also affected by oversupply; the new production in China and India will add respectively 2.8 million tonnes and 5.7 million tonnes to overall supply of HDPE and PP, although demand is predicted to expand by just 1.4 million tonnes and 2.8 million tonnes (source: CMA Energies). Meanwhile, the cost of inputs, for example, naphtha and condensates, will decline at a slower rate, and so for many products, spreads will tighten.

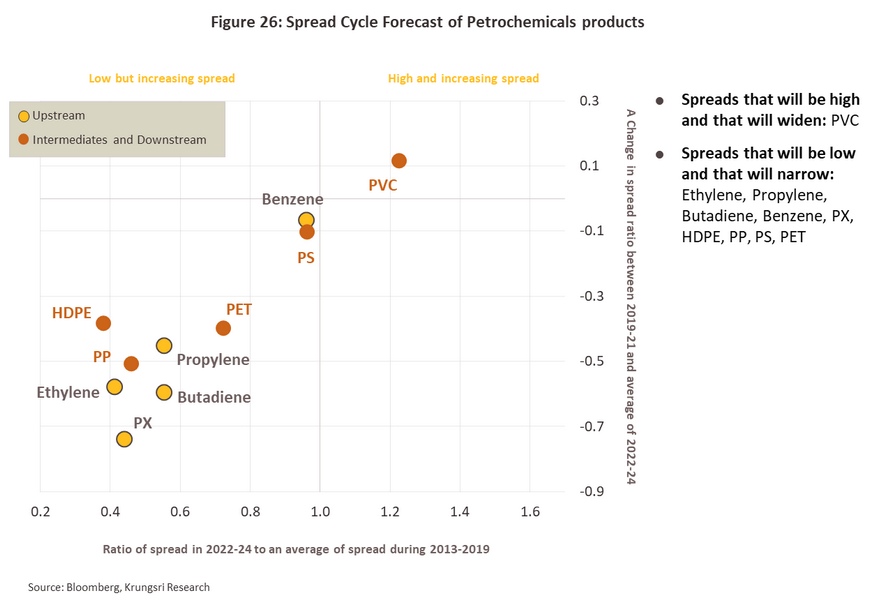

Prices for petrochemical products should recover in 2024 and 2025 on a gradual expansion in the global economy that will lift consumer spending power and boost demand from downstream industries. However, within Asia, supply will continue to be affected by the increase in production capacity in a number of countries. In many cases, this new capacity is either an expansion that had been previously planned but then delayed by the Covid-19 pandemic or a vertical integration into petrochemicals by oil refineries in the Middle East that are moving into the production of olefins (e.g., polyethylene and polypropylene) and aromatics (e.g., PX). This new production is expected to extend capacity by 7-10% annually compared to average growth of just 3-5% over 2011-2019. However, imports of petrochemicals and plastic resins of China will fall from the base chemical self-sufficiency program, and the excess supply affecting some product groups will thus mean that prices will remain flat or edge up marginally, while spreads will strengthen only slowly. Krungsri Research estimates that over 2023 to 2025, spreads for the main products will perform as follows (Figure 26).

Box 1 Outlook for major petrochemical products in 2022-2024

Ethylene is the world’s most widely produced olefin, accounting for a quarter of all upstream production globally. Total annual production capacity runs to some 160 million tonnes, with this split between East Asia (24%), North America (22%) and the Middle East (19%). 60% of output is used as a feedstock in the production of polyethylene, which is then used in packaging. In addition, ethylene is used to produce ethylene oxide, ethylene dichloride and ethyl-benzene, which are also used in packaging and in the construction industry.

The global slowdown is expected to translate into softer demand for ethylene through 2023, but the market should revive over 2024 and 2025 in step with a more positive outlook for the world economy. Demand will therefore increase by an average of 3% annually, but this will be against an expected expansion in production capacity of 5% per year, with much of the latter coming from Asia, and especially from China since the country is now pursuing a policy of cutting its dependence on imports of chemicals. This discrepancy between supply and demand will undercut the price of ethylene, and although the cost of inputs will also decline, the likely strength of crude markets will mean that this will fall at a slower rate than ethylene itself. Given this, the ethylene-naphtha spread will tend to narrow.

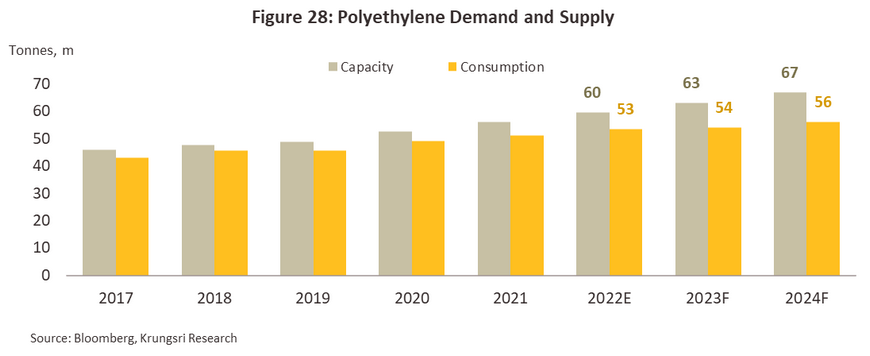

Polyethylene is the most widely produced type of plastic pellet. The product itself is manufactured from ethylene, and 70% of the output is used in the packaging industry.

Demand for polyethylene is expected to move in line with a softening of the global economy and grow at an average rate of 2.8% annually. However, this will lag behind the expansion in production capacity, which is forecast to rise by an average of 6% per year as new facilities come online in China, India, the US, and Southeast Asia. As a consequence, the market will be affected by a supply glut that will keep prices low, and because polyethylene prices will fall faster than those for ethylene, spreads will narrow.

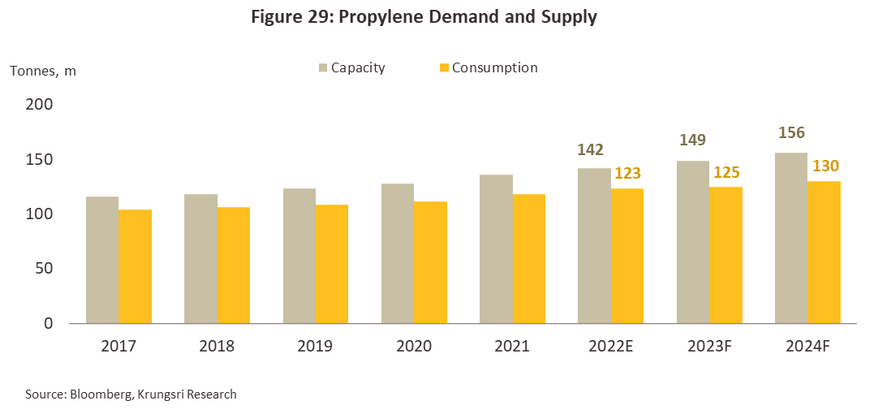

Propylene is the second most widely manufactured olefin (after ethylene), and it can be made from naphtha, LPG and coal. 65% of output is used to make polypropylene, a plastic that is mostly used in auto assembly, although propylene is also used as an input into the production of industrial and consumer goods.

The market for propylene is expected to come under pressure from a combination of weaker demand and a supply glut. Thus, growth in production capacity should average 4.7% per year, with this being especially concentrated in China, while demand is forecast to rise at the lower rate of 3% annually. As such, both propylene prices and spreads are likely to weaken.

This is derived from naphtha, and with 63 million tonnes of production capacity worldwide, it is the most commonly manufactured of the aromatic petrochemicals. Around 50% of output is used as an input into the production of ethyl-benzene, which is in turn used to produce polystyrene. Another 20% goes to the production of cumene, used in packaging, construction materials, and household goods.

Production capacity and demand will grow at average annual rates of around 2.6% and 2.7%, respectively, in line with steady growth in the consumption of downstream products such as PS and ABS. Because problems with oversupply are less pronounced than for olefins, pressure on prices and spreads will be less intense.

This is another downstream aromatic. Polystyrene is produced from styrene monomer, and current global production capacity runs to 11 million tonnes per year. The primary consumers of this are manufacturers of electronics, packaging, and construction supplies.

Demand is forecast to rise by an average of 2.3% per year, while growth in production capacity will fall behind at around 1% annually. The cost of styrene has decreased (styrene is produced from benzene and so prices for these move in parallel) and so spreads will tend to remain stable or broaden slightly.

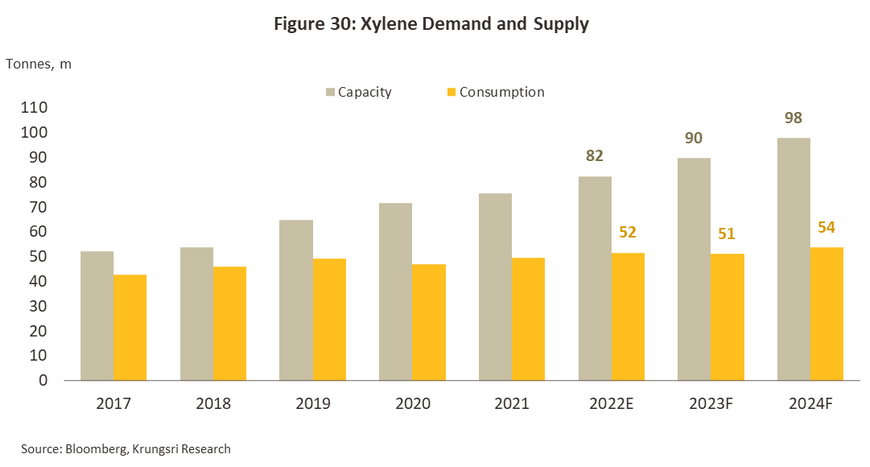

Xylene (an aromatic) is an important product for Thai petrochemical players. More than two-thirds of xylene is produced as a byproduct of oil refining, although this can also be manufactured from naphtha. The most important end uses are in manufacturing polyester (for textiles) and PET (for packaging).

Demand for xylene is expected to increase by 2.8% annually, but at 9%, growth in production capacity will race ahead. Much of this will be in China, thanks to the official policy of increasing national self-reliance in the chemical industry. The market has thus been affected by a worsening supply glut since the 2020-2021 Covid-19 pandemic, and this will pull down prices. Moreover, the cost of inputs is likely to remain high, and so spreads will narrow very sharply.

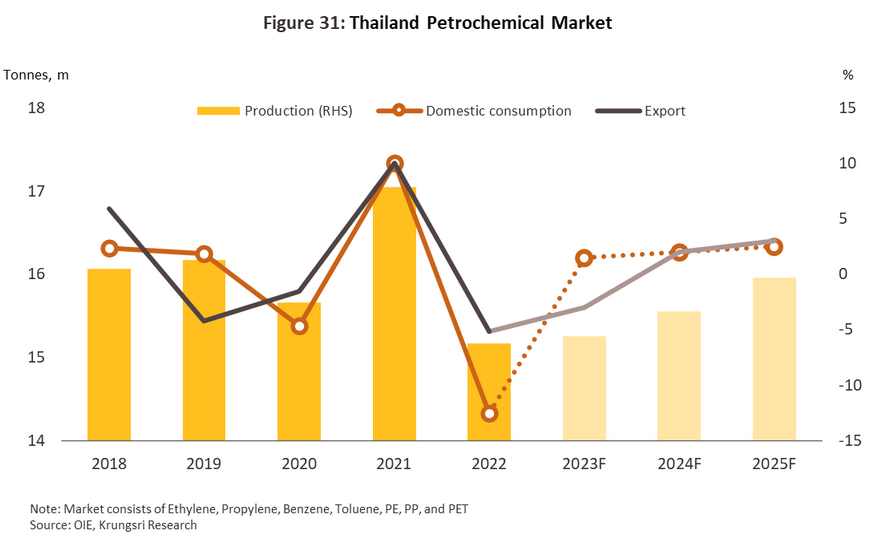

The domestic market for petrochemicals will see a gradual improvement through 2023, helped by recovery in the tourism sector, which Krungsri Research believes will boost foreign arrivals by more than 35% in the year, and the forecast 3.3% growth in the Thai economy (up from 2.6% in 2022). In addition, the reopening of China, a major export market for Thai producers, will also add to demand from downstream industries (e.g., packaging and plastics). However, the world economy is showing signs of weakness, and this together with the expansion in production capacity and resulting supply glut will put pressure on spreads, so any broadening of these will be strictly limited. In 2024 and 2025, an improvement in the global outlook will help to lift the industry, while the expected 3.0-4.0% growth in the Thai economy will add to the demand for petrochemical products and help to absorb the excess supply weighing on the market. This will then support prices and will assist in bringing spreads back to their pre-Covid-19 level.

Factors restricting growth in demand for petrochemical products will include government measures to reduce the consumption of single-use plastics. This will particularly affect manufacturers of downstream products, most notably producers of polyethylene (PE), polypropylene (PP), and polyethylene terephthalate (PET). The domestic industry will also feel pressure from new production capacity coming from China, and so Krungsri Research sees demand on domestic and export markets increasing by respectively 1.5-2.5% and 0.5-1.0% annually over the three years between 2023 and 2025 (Figure 31).

Players will tend to move towards producing high-value-added specialty products to meet stronger demand most obviously from the new S-curve industries (e.g., for the production of EVs and EV parts, batteries, charging stations, robotic units, and medical equipment). Phase 4 of the government’s plan for the development of the petrochemical industry (2022-2026) promotes the production of biodegradable and recycled plastics as a way of improving the industry’s competitiveness, and manufacturers will exploit new market opportunities by making greater investments in the production of these.

A range of factors have the potential to affect prices and spreads of petrochemical products in the coming period. (i) Geopolitical risk may worsen, with this potentially originating from an extension or degradation of the Russia-Ukraine war, the Taiwan dispute, or the deepening polarization of the global economy as it bifurcates into US and Chinese areas of control. This would then add to supply chain disruption and through this, drag on domestic and global growth. (ii) The continuation of sanctions on Russia by Western powers may encourage the country to divert exports of petrochemical products to Asia, especially to China, which would then eat into Thai exporters’ market share. (iii) Problems with semiconductor shortages may last longer than expected, and if this is the case, demand from major downstream consumers of petrochemical outputs (e.g., auto assemblers and manufacturers of electronics goods) may be affected. (iv) Global oil markets may be subject to significant volatility, which would then cause periodic uncertainty over the cost of inputs. (v) Supply will tend to expand, especially from new Chinese capacity. For example, the China National Petroleum Corp., China’s largest oil company, is responding to the need to ‘go green’ and to cut its carbon footprint by shifting from oil production to petrochemicals. Production capacity will thus expand by an estimated 3.1 million tonnes by 2025, with this including raised output of ethylene, propylene, and butadiene, as well as new production of high value-added goods such as polyolefin, ethylene vinyl acetate, and styrene-butadiene rubber. Naturally, this may then affect demand for Thai products. (vi) The US and EU are imposing restrictions on trade that are motivated by their climate change policies, and these will restrict imports to these areas of products that are linked to the emission of greenhouse gases. This will then impact demand for petrochemicals and other products in petrochemical supply chains.

Changing circumstances within the industry and in the wider business world will also pose challenges to players in the petrochemicals sector, and how they respond to these will help to determine their future market position. Within the industry, businesses are increasingly shifting to the use of new technology to add value to their processes and to respond to the need to use renewable energy. This is then helping to support downstream industrial consumers, especially those manufacturing packaging, automobiles and electronics, as these industries evolve in response to the emergence of the bio-circular-green (BCG) economy. The outcome of this is that the market is shifting from an earlier demand for commodity-grade goods to a greater need for specialty products and with this, the petrochemical industry is being forced to change. Deloitte thus estimates that by 2033, although the overall market for petrochemicals will have grown by some 3.0% per year, demand for specialty petrochemical products will have expanded by 4.5% annually. External influences on the sector are developing as a result of the shift from supply-driven consumption to demand-driven production, which is then altering the nature of competition within the sector; whereas in the past, competitiveness was built on an ability to source inputs and control costs, this is increasingly now a result of a player’s ability to produce a wide variety of products that successfully meet market needs, to build relationships with businesses in other sectors, and to develop and exploit new technologies and processes. These latter factors will then help to determine profitability in the coming period.

1/ Grand View Research: Market Estimates and Trend Analysis (2021)

.webp.aspx)