EXECUTIVE SUMMARY

Domestic demand for medical devices has continued to grow through 2025, driven in part by intermittent outbreaks of notifiable diseases (e.g., Covid-19) and air pollution-related diseases. However, exports to Thailand’s main overseas markets have come under pressure from a combination of the introduction of Reciprocal tariffs by the US and the move by China to emphasize the consumption of domestically produced goods. As such, export value has shrunk slightly. Going forward, the continuing aging of Thai society, rising rates of non-communicable diseases, and increasing global interest in health and wellness, buoying the market for medical tourism, will all help to extend growth from its 2025 level. In addition, government support for the industry will add to tailwinds lifting the market, and so domestic sales are forecast to strengthen through 2026 and 2027.

However, the business faces challenges from limitations in capital, technology, and marketing strategies compared with more capable multinational competitors. Additionally, domestically produced medical devices are not yet widely accepted by healthcare professionals in Thailand, and production depends on imported advanced technologies, which is likely to increase product costs due to technological complexity.

Krungsri Research View

Krungsri Research thus sees turnover growing solidly for the industry overall. The outlook for the industry’s two main segments is as follows.

-

Manufacturers: Turnover will continue to track upwards, especially for companies that distribute via public and private healthcare providers since many of these are investing in new hospitals and specialized treatment centers, and as such, demand for medical devices is rising. However, the supply side of the market is becoming increasingly crowded and so competition is likely to worsen, especially from multinational players that have ready access to finance and technology. At the same time, the need to source expensive production technologies from overseas suppliers will drive up costs, while manufacturers that have been reliant on export sales will have to contend with a slowing global economy and rising barriers to trade, and these factors will weigh on profits.

-

Retail and wholesale distributors: Revenue will strengthen gradually since although the market is largely focused on low-cost consumables, demand for these remains steady and consistent. In addition, rising concerns over personal health have added to demand for PPE and portable healthcare products. Nevertheless, growth in the number of players operating within the market will add to competition, while because manufacturer-affiliated stores are able to operate a wider range of distribution channels, these companies will be at a relative advantage. Overall levels of growth will therefore be limited.

-

Importers: Turnover should grow solidly since the majority of players in this segment are large companies that import hi-tech, innovative products that are then distributed to hospitals. These goods include, for example, robotic systems used to assist with microsurgery, automated pharmaceutical production and management systems, orthopedic equipment, and dental supplies (e.g., crowns and implants). Demand for these is increasing rapidly, and this will help to lift growth rates.

Overview

Market value of the medical devices sector includes both medical devices and medical equipment1/. Considered a high-value industry, the sector is accounted for 1.8% of GDP2/ and has continued to grow in line with the number of patients, the elderly and growth of wellness business in Thailand.

Medical devices and medical equipment can be divided into three categories according to use.

1) Single-use devices3/ are used in a wide range of common medical procedures. Manufacturing these typically uses only straightforward production processes, and the products are then used a single time and then disposed of. Examples include syringes, hypodermic needles, tubes, catheters, cannulas, latex surgical gloves, dental and ophthalmic supplies and devices, and dissolvable stitches.

2) Durable medical devices normally have a life-span of at least one year. Examples include first aid kits, wheelchairs, medical beds, technical equipment used in medicine, surgery and dentistry, electrical diagnostic tools, and x-ray machines.

3) Reagents and test kits include equipment used to diagnose illnesses and conditions and chemical kits used to test samples drawn from patients. For example, to test for blood type before dialysis, pregnancy tests, and to detect HIV infection.

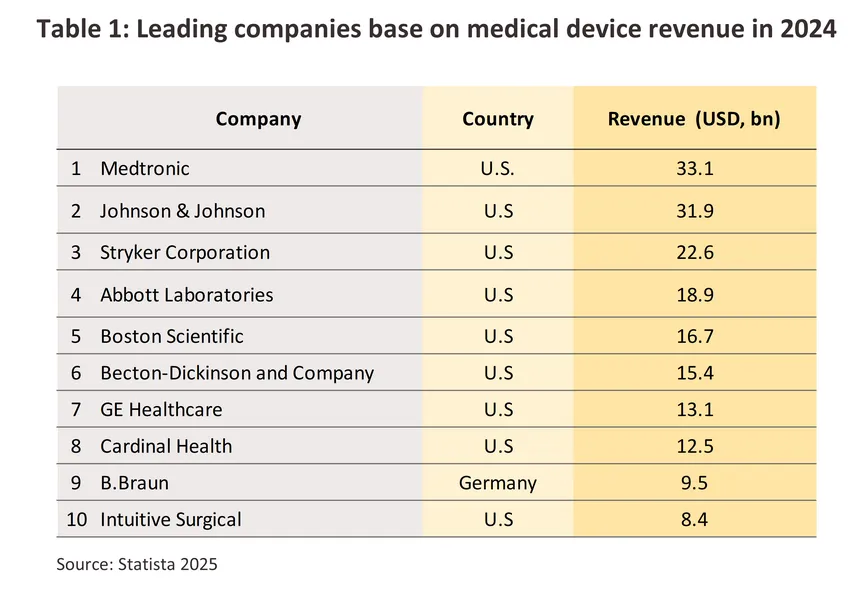

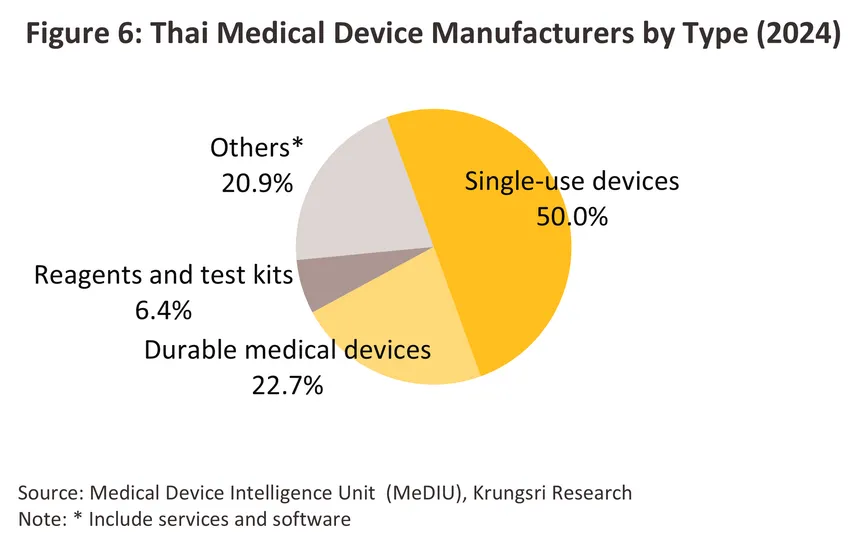

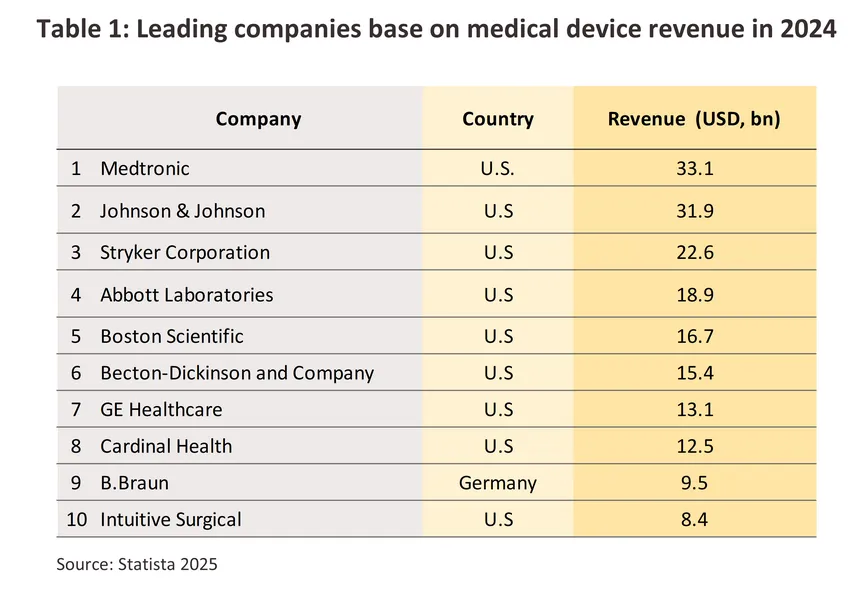

The world’s most important producer of medical devices is the US which is large manufacturer and enjoys the greatest income from the distribution of medical devices of any nation (Table 1). Although production facilities operated by US corporations are geographically dispersed, output from these is focused on high-value products, such as electro mechanical medical devices, equipment used in orthopedic and fracture-treatment settings, X-ray machines, and dental equipment. Also well regarded for the quality of their cutting-edge products are Dutch and German manufacturers, the latter in particular earning plaudits for their ongoing innovation of production processes. Within Asia, given its role as another world-leading center of innovation, Japan is widely regarded as a leader in the medical devices industry, while players in China and the ASEAN zone tend to be much more heavily focused on the production of consumables. In these countries, high-tech appliances need to be imported, most often from the US, Germany and Japan.

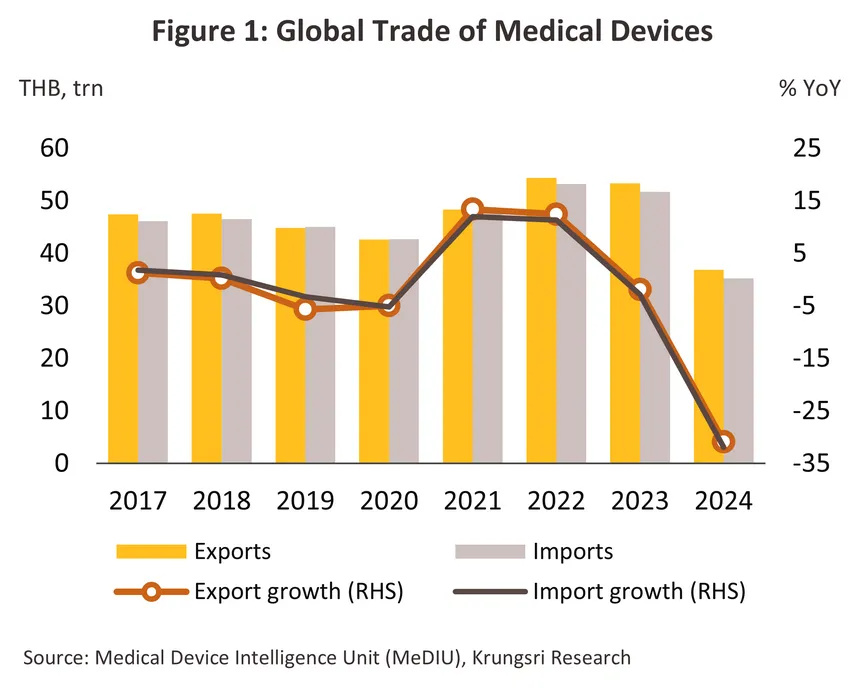

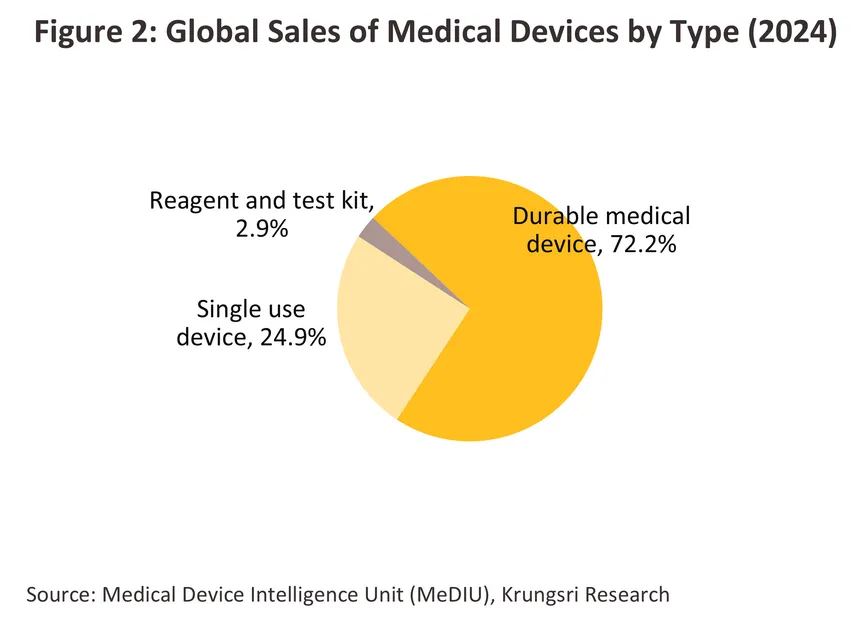

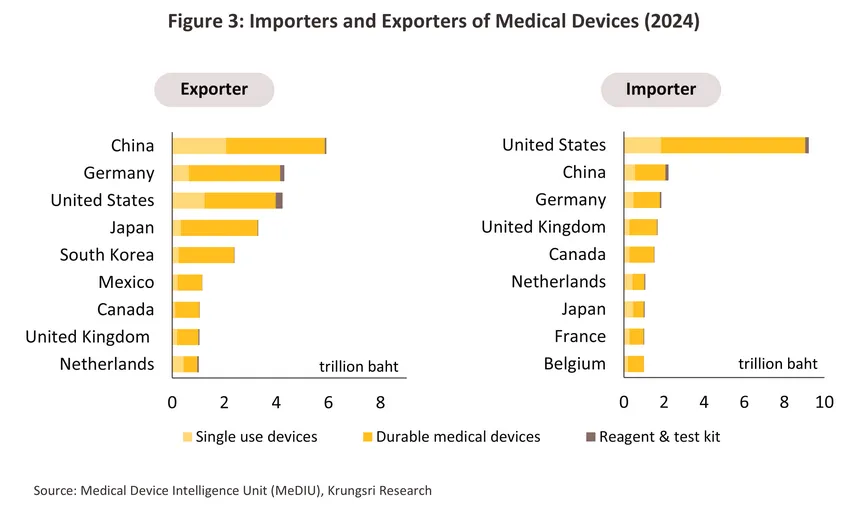

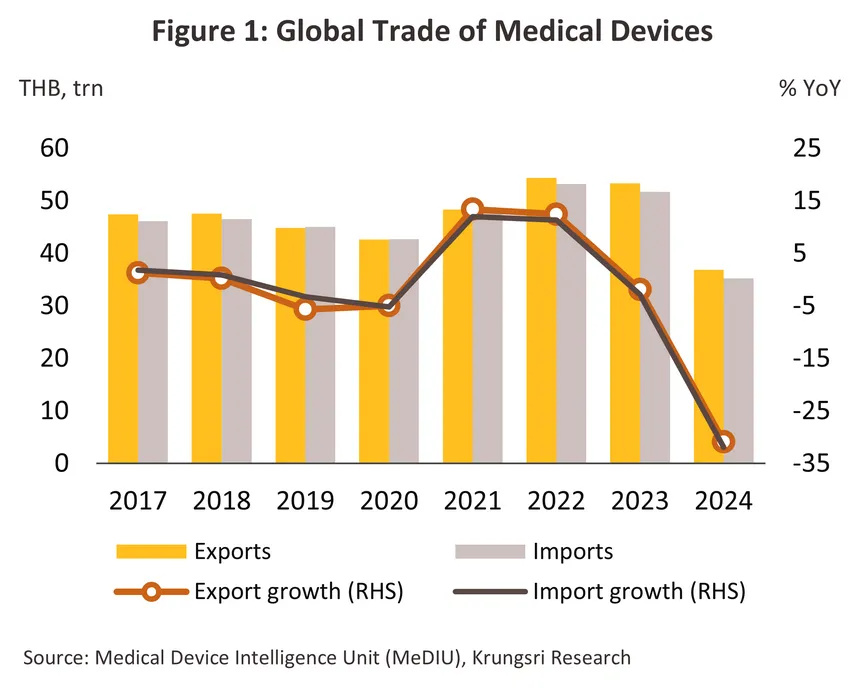

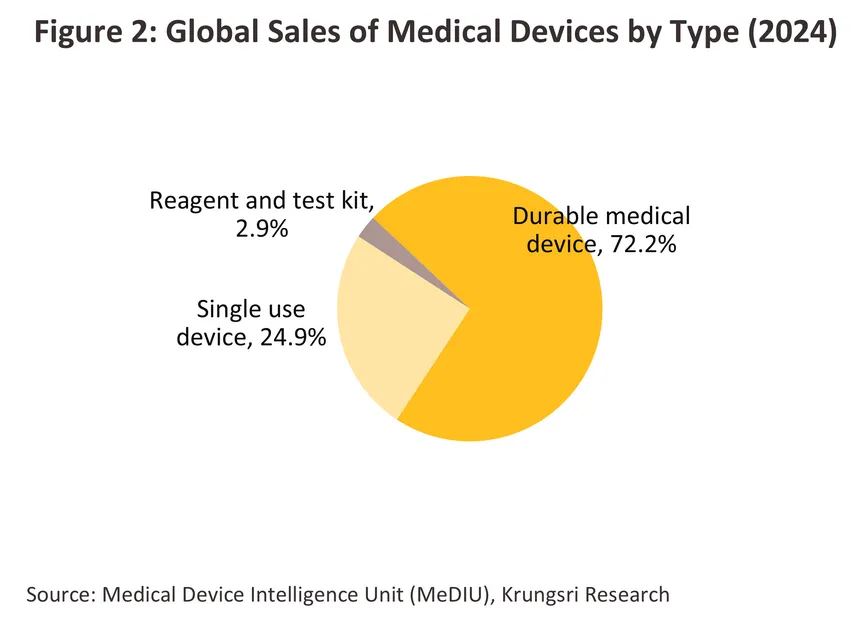

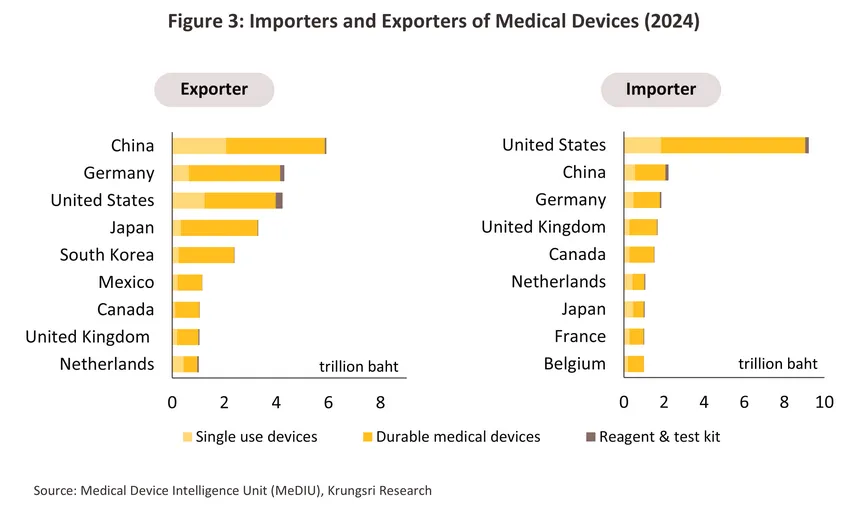

In 2024, the value of the global market for medical devices and equipment (both imports and exports) contracted sharply by -31.4% compared to 2023 (in Thai Baht terms) (Figure 1) as the use of equipment for treatment/prevention of infections and disease diagnosis declined significantly after surging dramatically during the COVID-19 pandemic. By segment, durable medical items (accounting for the largest share of 72.2% of total market value) contracted -31.5% from 2023. Single-use items (24.9% share) declined -30.7%, and reagents and test kits (2.9% share) dropped -32.9%. On export side, the world’s major exporters of medical devices (Figure 3) are China (16.1% share of global medical device export value, up from 12.4% in 2023), focusing on exports of durable medical items and single-use devices, followed by Germany (11.7%), the US (11.5%) and Japan (9.0%). These four countries have a combined export value representing 48.2% of global medical device exports. On import side, the world’s major importers of medical devices are the US (26.2% share of global medical device import value), focusing mainly on importing durable medical devices, followed by China (6.3%), Germany (5.3%) and the UK (4.8%). Thailand is the world's 20th largest exporter of medical devices (1.1% share), mainly in single-use items, and the world’s 33rd largest importer (0.6% share), primarily in durable medical items.

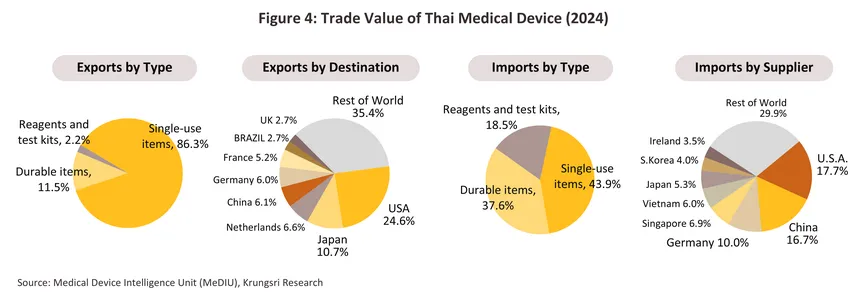

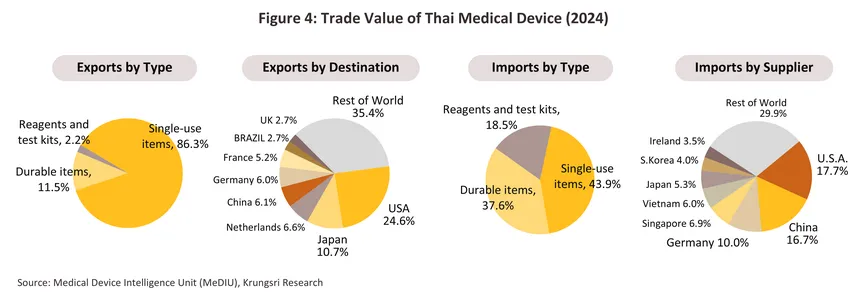

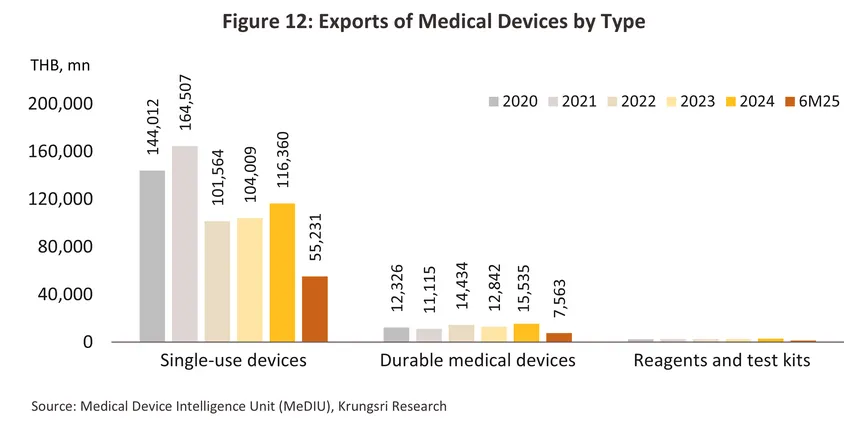

Thai exports of medical devices are dominated by sales of single-use devices (86.3% of all export value in 2024), including latex/medical rubber gloves, catheters, syringes/hypodermic needles, and wound dressings. Thailand's main export markets are the US, Japan, the Netherlands, China, and Germany (together, these five countries absorbed 54.0% of all Thai exports of medical devices). Most manufacturers and exporters are in fact multinationals (such as companies from Japan, the US, and France) that have invested in Thailand as a production base for manufacturing and exporting to other regions. For imported products, the majority are single-use medical devices and sophisticated technology-based durable medical items, including ultrasound machines, X-ray machines, ECG machines, electronic diagnostic equipment, ophthalmic equipment, and radiological diagnostic or treatment equipment (together accounting for 81.5% of all medical device import value). The main sources of these imports are the US, China, Germany, Singapore, and Vietnam (Figure 4).

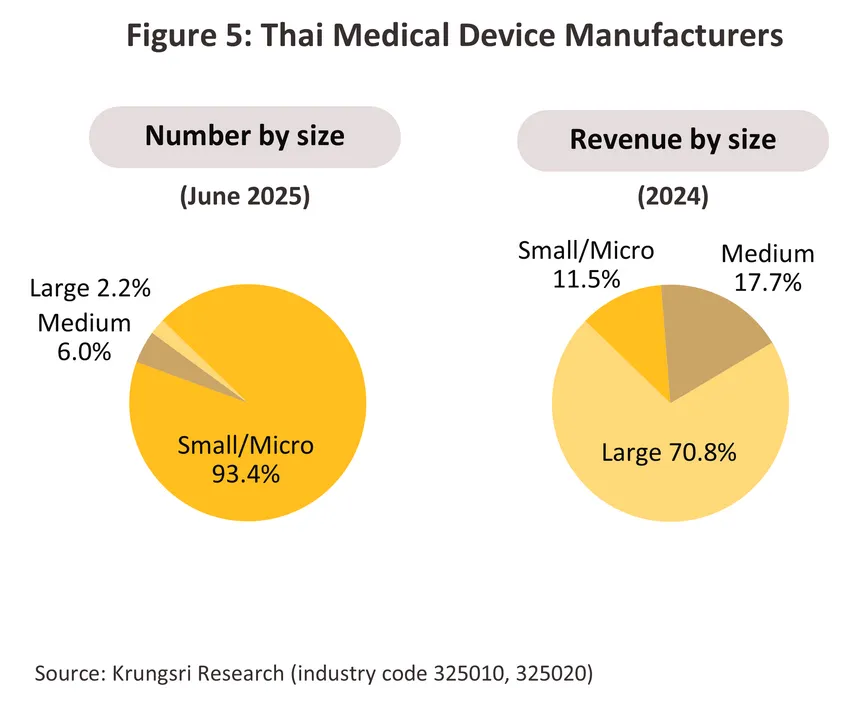

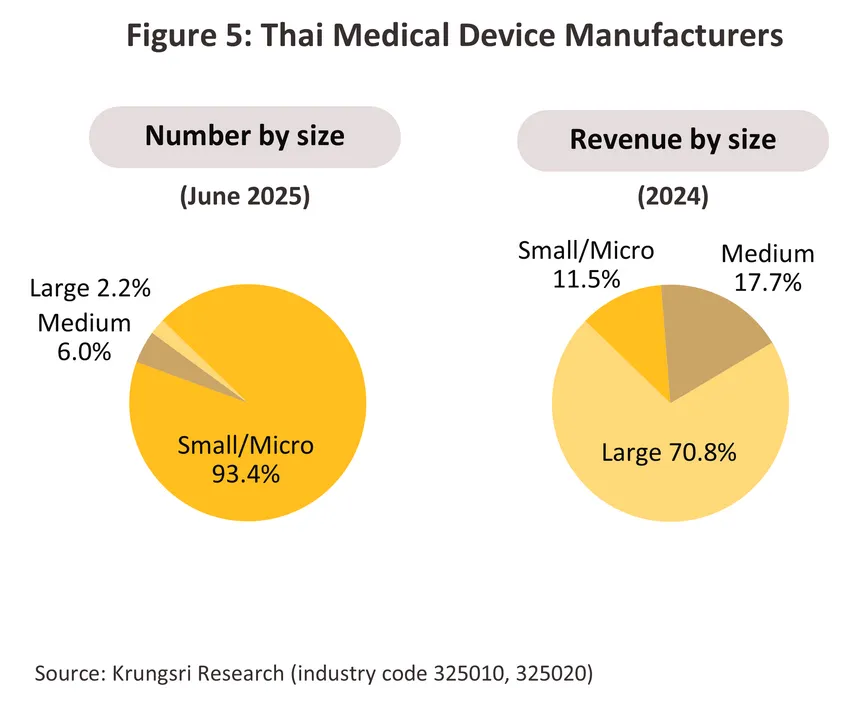

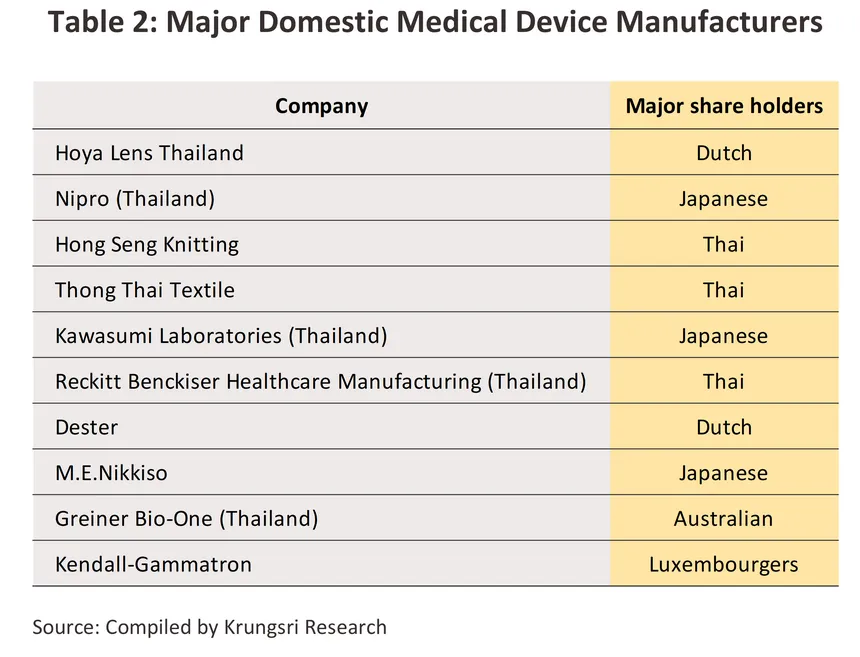

In June 2025, 1,161 companies4/ were registered with the Department of Business Development as manufacturers of medical equipment and devices5/. Of this total, 93.4% were classified as small and micro companies, but these generated just 11.5% of industry revenue (2024), leaving the 8.2% of the market that is composed of mid- and large-sized players (often multinational companies, Table 2) with a 88.5% share of revenue (Figure 5). Over 2,000 companies are registered as importers of medical devices (source: Food and Drug Administration)

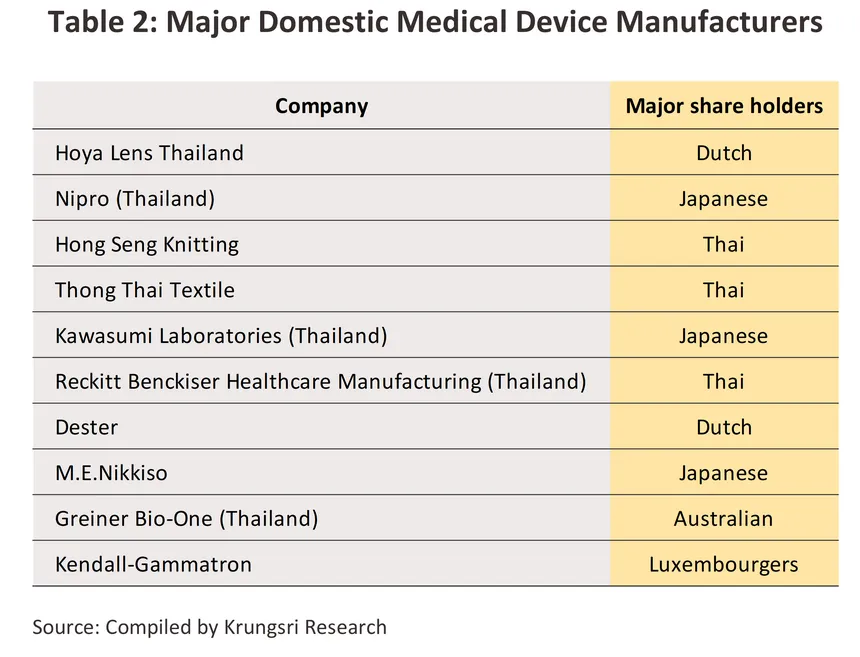

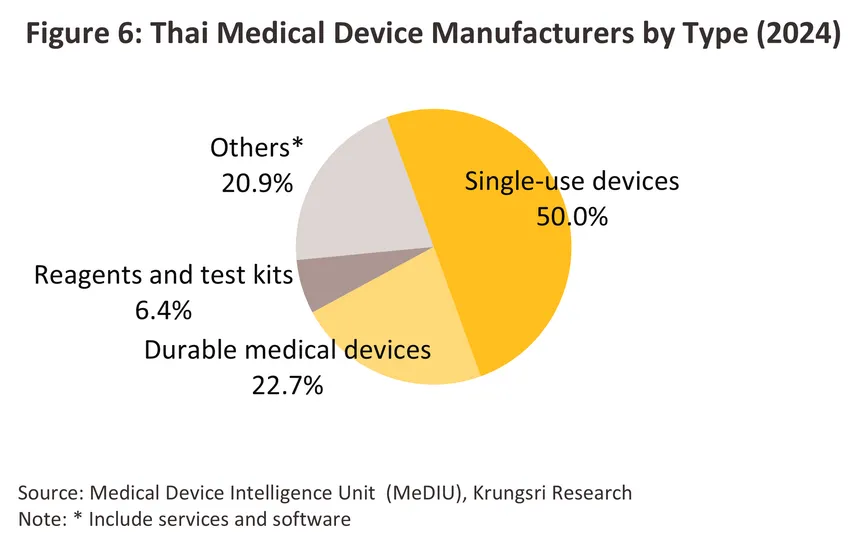

Thai production of medical devices have relatively low innovation and technological complexity. Most production focuses on using locally sourced inputs (e.g., plastics and rubber), with export production accounting for approximately 70.0% of total medical device sales value such as rubber gloves and syringes, which do not require advanced technology. By contrast, production of durable medical devices, reagents and test kits is more reliant on access to the relevant technical know-how, to which is added the additional hurdle of having to meet international standards. Nevertheless, Thailand has successfully developed applications involving more advanced medical technology, including the ‘Dinsaw’ robotic assistant (or pencil robot) for the elderly. Generally, medical devices are divided into the following categories (Figure 6).

1) Single-use medical devices: The number of manufacturers represent about 50.0% of total medical device manufacturers in Thailand. Among these, rubber gloves -- particularly medical-grade rubber gloves -- are products in which Thailand has strong production capabilities and global competitiveness because these do not require sophisticated technology. Thailand is also the world’s major producer of natural rubber (major raw material for production). Therefore, rubber gloves produced are targeted at export markets accounting for 90.0% of total sales volume of rubber gloves. Other high-potential competitive products are catheters and syringes which are partly made of plastics processes by petrochemical industry. Major domestic manufacturers in this group include Infus Medical (producing needles, syringe sets, and blood transfusion sets), Shun Thai Rubber Gloves and Thai Rubber Latex (rubber gloves), and Bever Medical Industry (urinary catheters and saline sets). Multinational companies include Cardinal Health (rubber gloves), Ansell (rubber gloves), and Covidien (breathing tubes, catheters, cotton, gauze and bandages).

2) Durable medical devices: Manufacturers represent 22.7% of all manufacturers of medical devices. The products manufactured and exported are mainly equipment for patient mobility, such as hospital beds, examination tables, and wheelchairs. In addition, there are also certain types of robots such as the ‘Dinsaw’ care robotic.

3) Reagents and test kits: Manufacturers account for 6.4% of all manufacturers of medical devices. Most are joint ventures with foreign companies. Key products in this group include diagnostic reagents for diabetes testing, kidney disease, hepatitis, pregnancy test kits, and COVID-19 detection devices (ATK).

4) Others (including medical device component manufacturing, services, and software): These account for a combined 20.9% of all manufacturers. Important products in this group include temperature measurement devices (camera/scanner type), PPE sets, chest X-ray cameras, respiratory protection mask sets, and installation and after-sales services (maintenance).

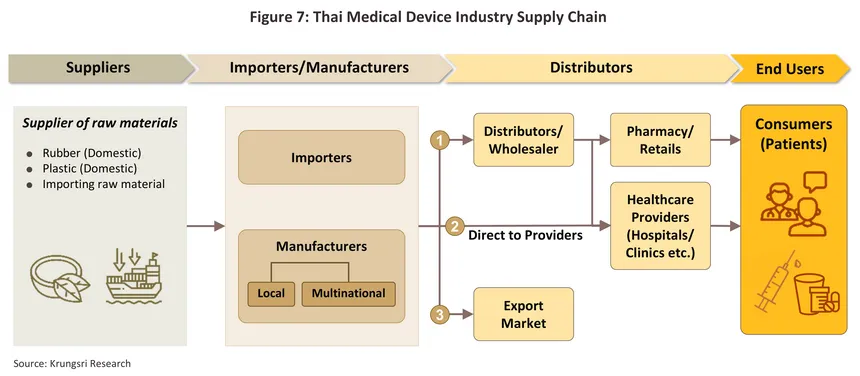

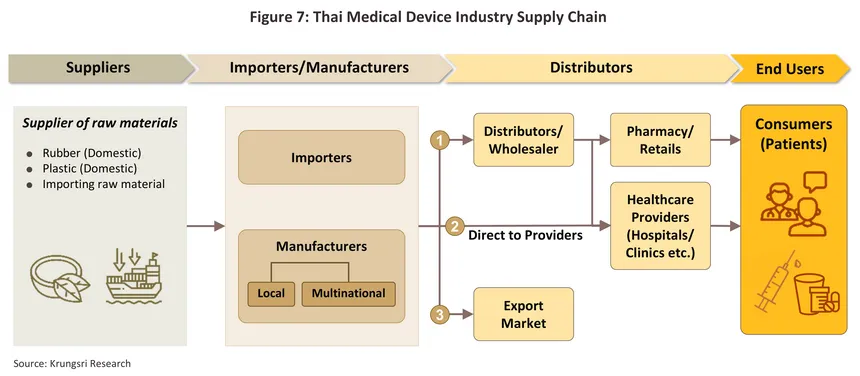

The distribution channels of manufacturers and importers are shown in Figure 7.

1) Distribution to intermediary companies, representatives, or to shops (affiliates and general shops): This aims to reach target customers throughout the country. Players in this group typically have some knowledge of healthcare and are able to exploit a range of distribution channels.

2) Direct distribution to healthcare providers: This includes distribution to public- and private hospitals and clinics. Sales of medical devices to public-sector hospitals is carried out according to government procurement procedures. Currently, the Ministry of Finance has developed the procurement system to electronic market (e-market) and the electronic bidding (e-bidding) process. Under the previous system, purchases below THB500,000 can be conducted under an ‘agreed price’, purchases between THB 500,000 and THB 2 million is subject to the ‘price-checking’ mechanism, and purchase over THB 2 million has to be conducted through competitive bidding. Private hospitals purchasing procedures are not regulated.

3) Distribution to export markets: The majority of goods distributed are single-use devices, notably latex gloves and medical rubber gloves. The main markets are the United States, Japan, and Germany. A major player in this group is the Thai Rubber Latex Corporation (Thailand) Public Company Limited.

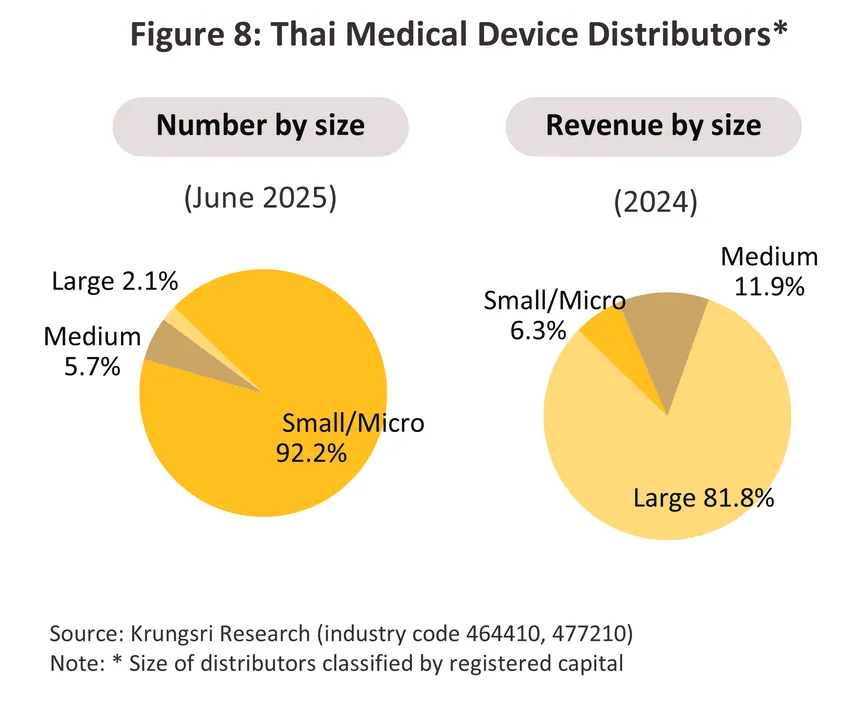

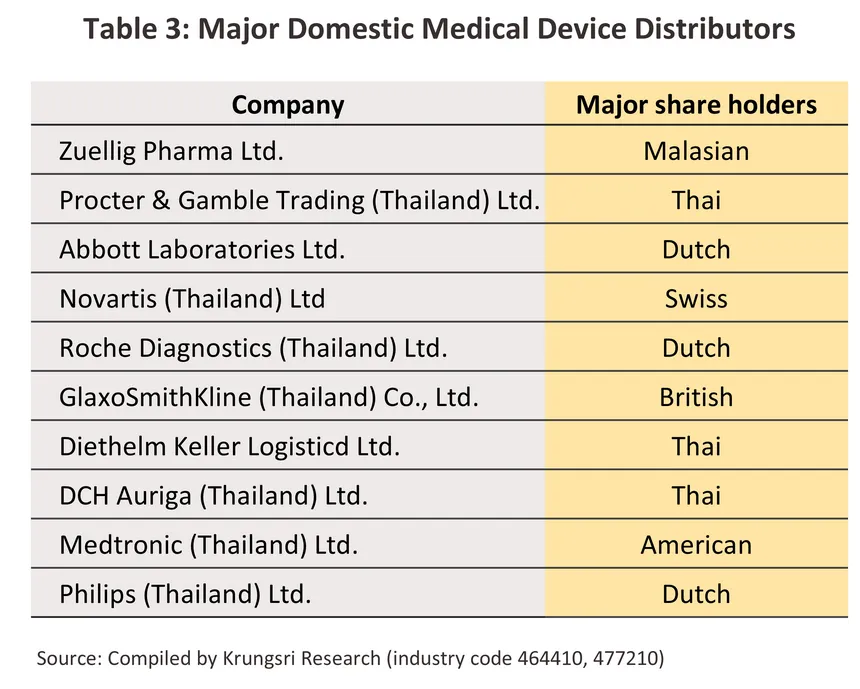

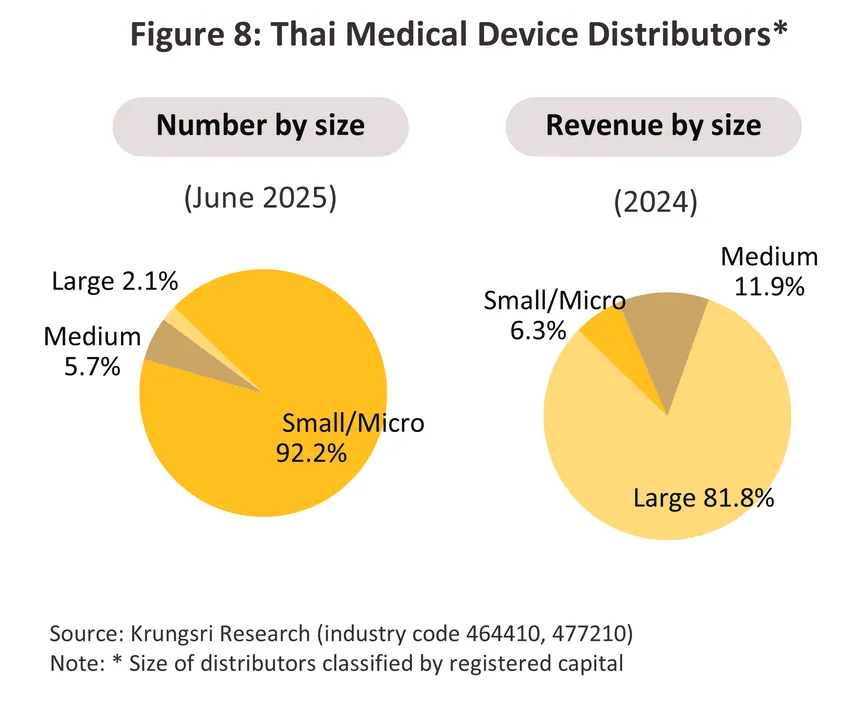

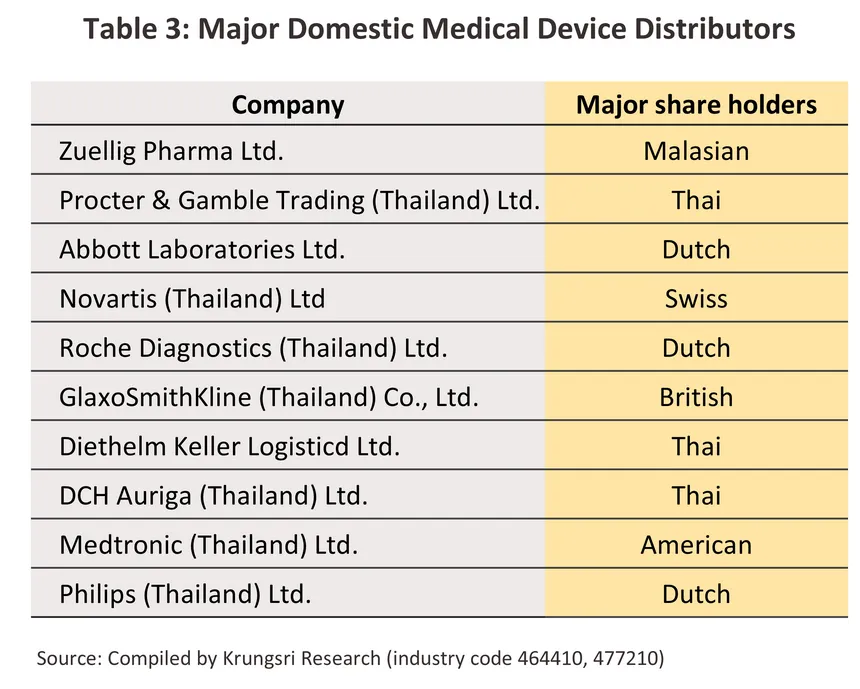

Distributors of medical devices and equipment include both wholesale and retail categories6/, with intense competition due to the large number of distributors -- over 14,000 (as of June 2025). Meanwhile, most products have similar characteristics, allowing consumers to easily substitute products from other manufacturers or distributors. Of all distributors, approximately 92.2% are small and micro-sized businesses (registering as a medical device distributor in Thailand is relatively easy) with a combined revenue share of only 6.3% of total revenue (2024). Medium and large operators represent just 7.8% but hold a revenue share of 93.7% (Figure 8). Major distributors include Zuellig Pharma Ltd. Procter & Gamble Trading (Thailand) Ltd., and Abbott Laboratories (Table 3).

Situation

The industry saw improving business conditions through 2024 thanks to a number of different factors. (i) The Thai economy expanded by 2.5% in the year, with growth coming in particular from the tourism industry. Tourist arrivals thus climbed to 37.5 million (close to the pre-Covid total of 39.9 million), with growth in medical and wellness tourists adding to demand for healthcare services and medical devices. (ii) Cases of seasonal and notifiable illnesses rose significantly (e.g., case numbers were up +35.9% for influenza, +35.3% for pneumonia, and +39.4% for hand, foot and mouth disease). Conditions related to poor air quality also climbed 8.9% to a total of 12 million cases (up 15.2% for bronchitis, 12.3% for chronic rhinitis, and 7.8% for conjunctivitis), thereby boosting sales of PPE. (iii) The coverage provided by the national health system has been expanded to include a wider range of chronic conditions, including extensions to the provision of dialysis services and dental treatments (e.g., extractions, fillings and dentures, which are provided for the elderly under the 30-baht healthcare scheme). Stem cell treatments for some cancers (under the oversight of the Social Security Office) are also now available through state providers. (iv) Rising interest in preventive healthcare is driving stronger demand for testing equipment for use in both professional and domestic settings. Examples of these include tests for Covid-19, influenza and RSV, as well as blood-pressure monitors and pulse oximeters. Details of 2024 industry conditions are given below.

-

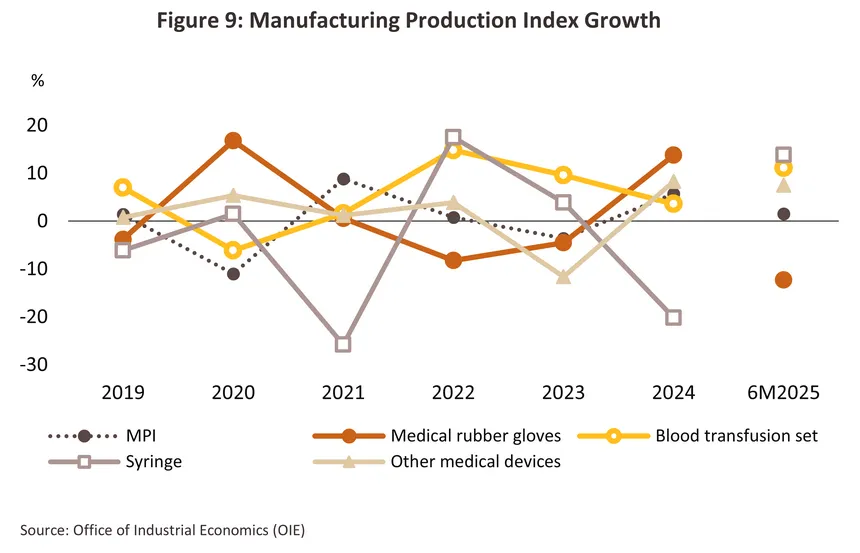

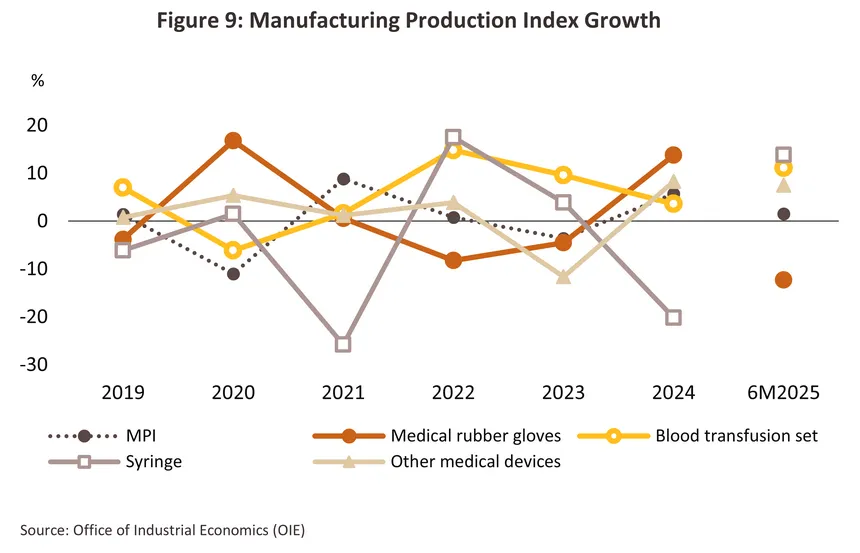

Output continued to rise in the year, especially for surgical gloves and so the industry’s overall manufacturing production index (MPI) climbed 5.7% from its level in 2023 (Figure 9). In particular, the MPI for latex gloves (90% of the industry’s output) jumped 13.8% on an 8.3% increase in the volume of goods sold in the domestic market compared to the previous year, coupled with a 22.2% surge in overseas sales. The main markets for Thai latex gloves are the US, where sales jumped 38.3% (after Malaysia and China, Thailand has the third largest market share), and Asia, where sales were up 18.4%. The MPI for disposable medical equipment (e.g., masks, hats, and gowns) also climbed 38.9% on stronger demand for PPE to protect against the spread of influenza, other respiratory conditions, and the effects of poor air quality. By volume, domestic sales of these goods thus rose 21.0% (source: Office of Industrial Economics).

-

The domestic and international markets both benefitted from strong growth in the year.

-

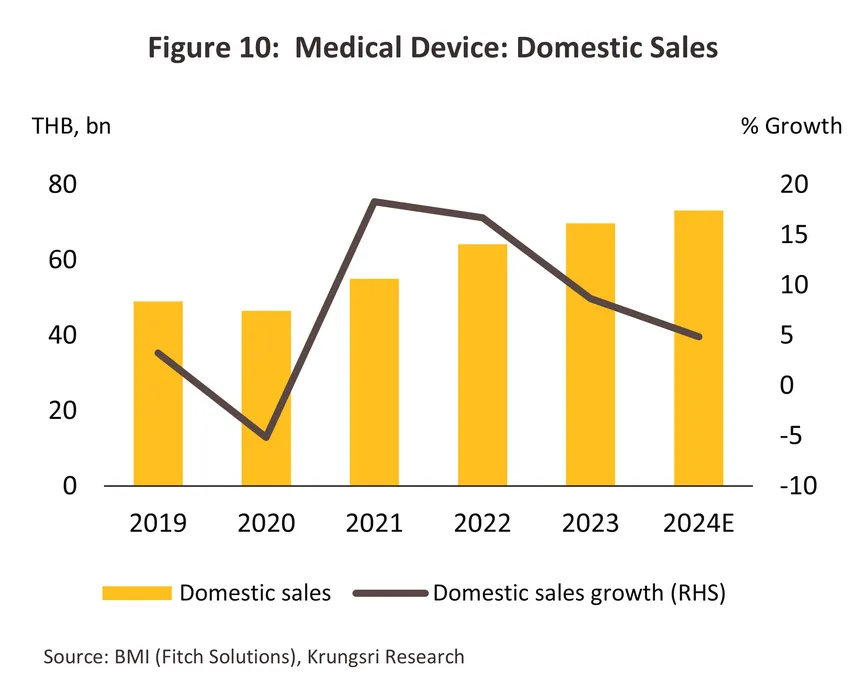

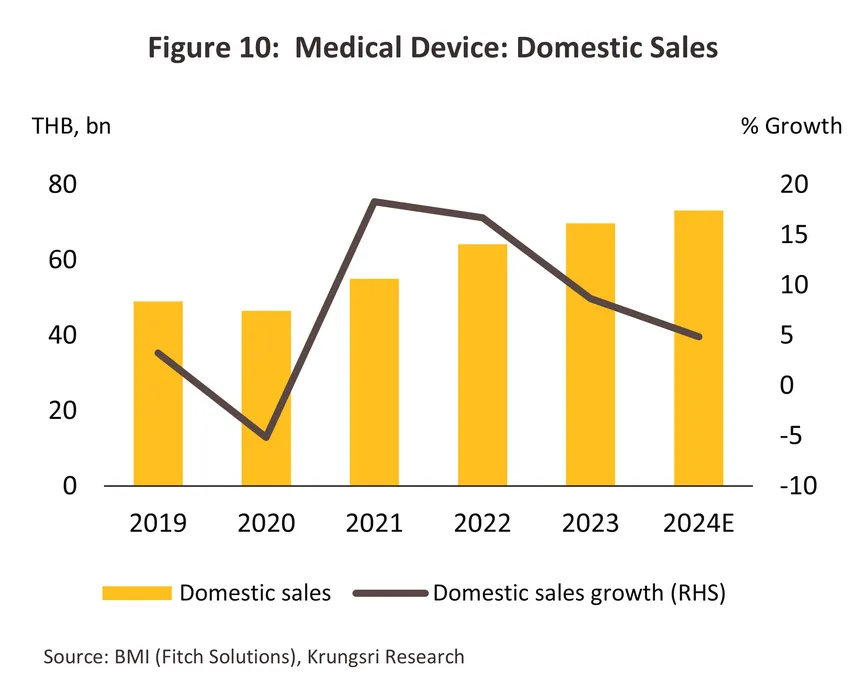

The value of all medical devices distributed domestically rose 5.0% to THB 73 billion in the year (source: Fitch Solutions) (Figure 10). The market benefited from a 5.3% increase in demand for latex/surgical gloves that mirrored rising concerns with public health as well as growth in the healthcare industry more generally. Sales of electrical and radiological equipment (e.g., X-ray, MRI, ultrasound and CT equipment) also rose 4.0% on stronger spending on the expansion of existing and construction of new healthcare sites, which then lifted demand for modern, hi-tech equipment. Lastly, sales of dental equipment edged up 2.8%, partly thanks to an expansion in the range of dental treatments covered by the Gold Card scheme, including better access to dentures and implants (2023-2024), and an increase in the number of private dental clinics that are eligible for these payments.

-

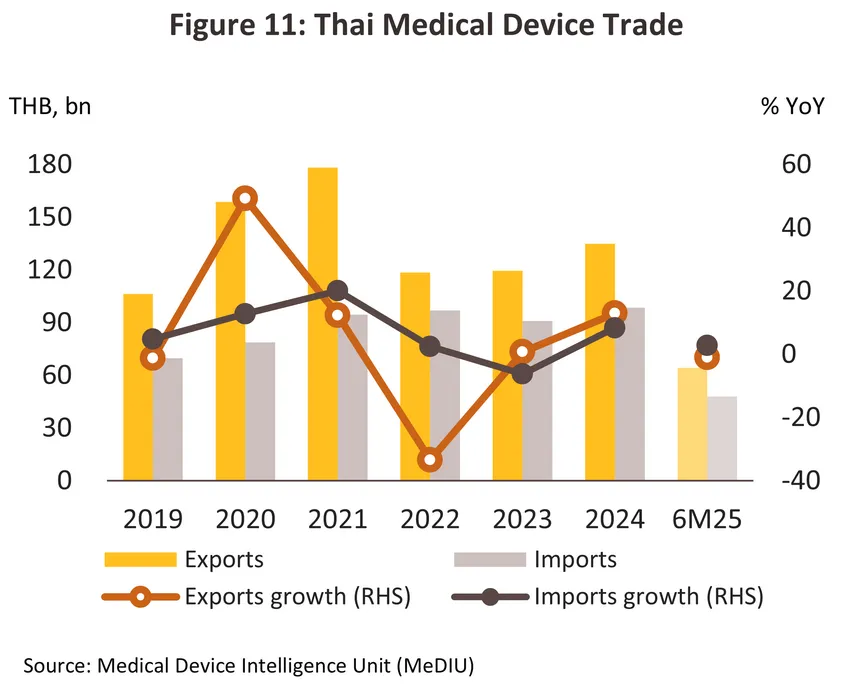

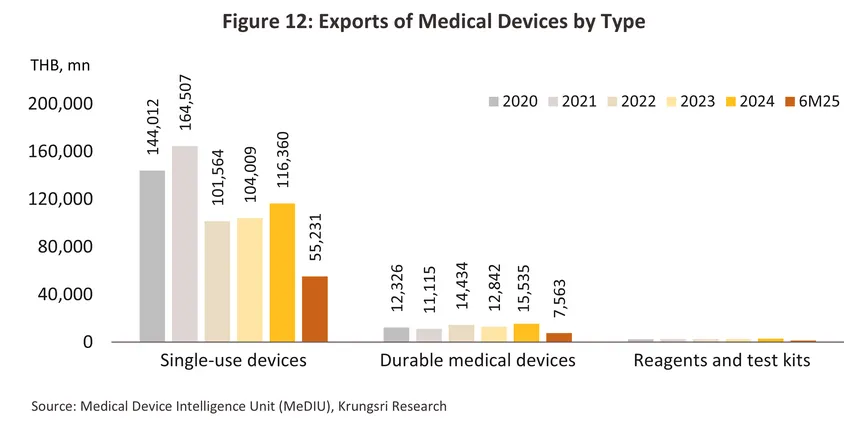

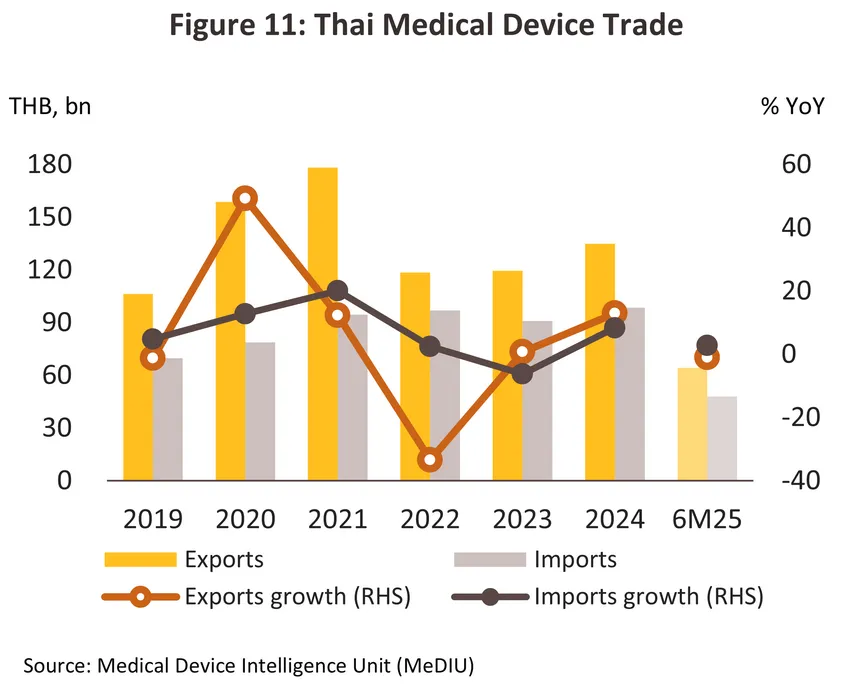

2024 export value7/ climbed 12.9% to THB 130 billion (Figure 11). Helped by Thailand’s low manufacturing costs, exports of single-use devices (86.3% of all exports of medical devices by value) climbed 11.9%. In particular, sales of latex/surgical gloves (24.0% of all exports of medical devices by value) jumped 18.2% on a 6.4% rise in demand from the US (the buyers of 37.0% of Thai exports of latex gloves) and thanks to a rise in medical tourism, a 43.1% surge in exports to Brazil (7.1% of the market). Exports of durable medical devices (11.5% of the exports) expanded by 21.0% as Thai manufacturers increasingly move into the production of more complicated and higher value-added products (e.g., electro-mechanical medical devices (IVD), and diagnostic and therapeutic radiation equipment), while exports of reagents and test kits (2.2% of the exports) also improved, climbing 14.6% on stronger exports into China (+158.2%) and Japan (+31.5%). Exports of these benefited from the aging of these societies8/ and the resulting need for a steady supply of equipment to monitor individuals’ health.

-

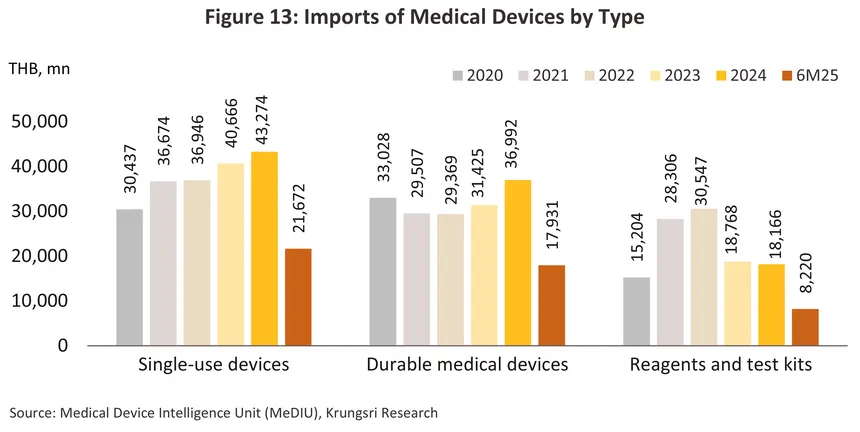

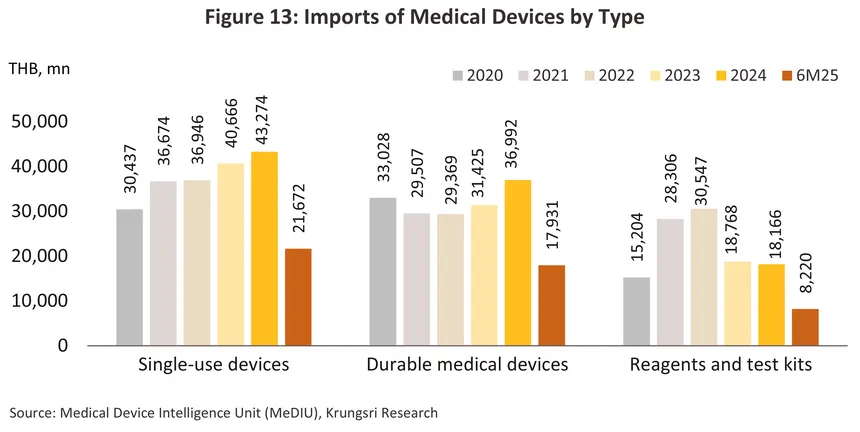

Imports of medical devices7/ came to a total value of THB 98 billion in 2024, a rise of 8.3% from a year earlier (Figure 11). By value, imports were up 6.4% for single-use devices (44.0% of all imports by value) and 17.7% for durable medical devices (37.6% of imports), but imports of reagents and test kits (18.4% of the total) slipped -3.2% as domestic production of these stepped up. The greatest increases were seen for single-use items (e.g., hypodermic, metered-delivery and retractable-needle syringes), which were up 17.9% to THB 18 billion, electronic goods (e.g., oximetry monitors), which rose 26.0% to THB 17 billion, and ophthalmic goods, imports of which rose 4.0% to a total of THB 15 billion. In the year, Thailand’s most important suppliers were Germany and China, from which imports rose by respectively 8.8% and 4.9%, though imports from Singapore (most notably of hi-tech goods such as x-ray, ultrasound, and ECG machines) also surged 140.2%, taking its share of the market from 3.1% in 2023 to 7.0% a year later.

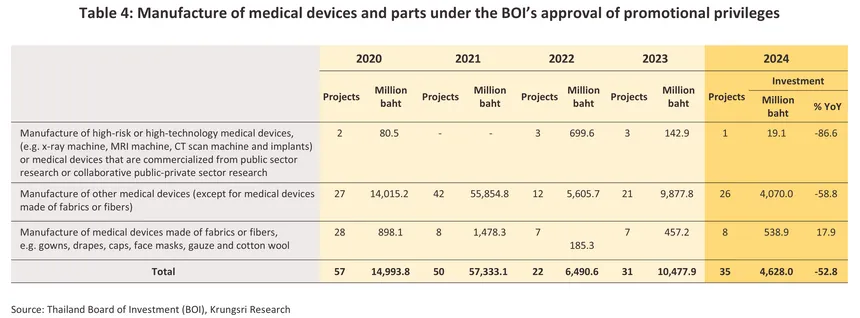

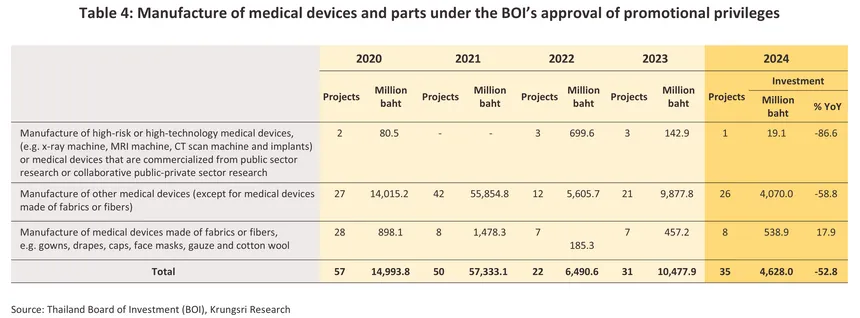

In 2024, the value of investments in the manufacture of medical devices that were approved for support by the Board of Investment (BOI) slumped -52.8% (Table 4), partly because many investment plans had been pushed forward in earlier years. Nevertheless, the situation remained bleak and only one project was approved for investment in high-risk or hi-tech production, and this had a value of just THB 19.1 million. This unfortunate situation reflects the financial and technological limitations faced by Thai players and underscores the challenges the country faces as it tries to accelerate growth in the domestic manufacture of higher value-added products.

However, in other areas, the outlook is better in the production of medical supplies made from fabrics (e.g., masks, bandages, gauze, pads, etc.). Investment in this sector continues to expand. This reflects Thailand’s advantages in the domestic production of inputs to the industry, which helps to suppress manufacturing costs while also providing producers with a stable market into which they can sell.

Outlook

Through the first half of 2025, demand for medical devices expanded due to a mix of the increasing spread of notifiable diseases and ongoing problems with poor air quality. The former included significant rises in reported cases of influenza (+80.4% YoY), pneumonia (+36.6% YoY), and Covid-19, for which case numbers have risen to 0.56 million since the start of the year. Meanwhile, problems with dangerously high levels of PM2.5 pollution continued to trouble both the Bangkok Metropolitan Region and the north of the country. Demand for PPE and test kits thus climbed, and so through 1H25, domestic sales of medical devices expanded by 12.7% YoY. Product categories seeing the strongest demand included latex/surgical gloves (+13.6% YoY), single-use items (+79.7% YoY), and other products (+4.2% YoY). Despite this, an accelerated production in 2024 meant that output of surgical gloves contracted -12.3% YoY through the period. Export markets contracted -1.0% YoY in the first half of the year to generate receipts of THB 64 billion. Overseas exports fell -3.1% YoY for single-use devices (86.0% of all exports by value), though they rose 14.0% YoY for durables medical devices (11.8% of exports) and 10.0% YoY for reagents and test kits (2.2% of the total). Exports into some major markets also slipped in the period, falling -2.9% YoY to Japan (10.5% of exports) and -38.2% to China (5.0% of exports). This came from an increase in imports from Thailand in 2024, though in the case of China, the market was also hurt by the Chinese authorities’ post-pandemic decision to focus more heavily on domestic production of these goods. However, exports into the US (26.9% of exports and Thailand’s most important overseas market) climbed 11.6% YoY as importers rushed to front run the imposition of punitive new tariffs in August.

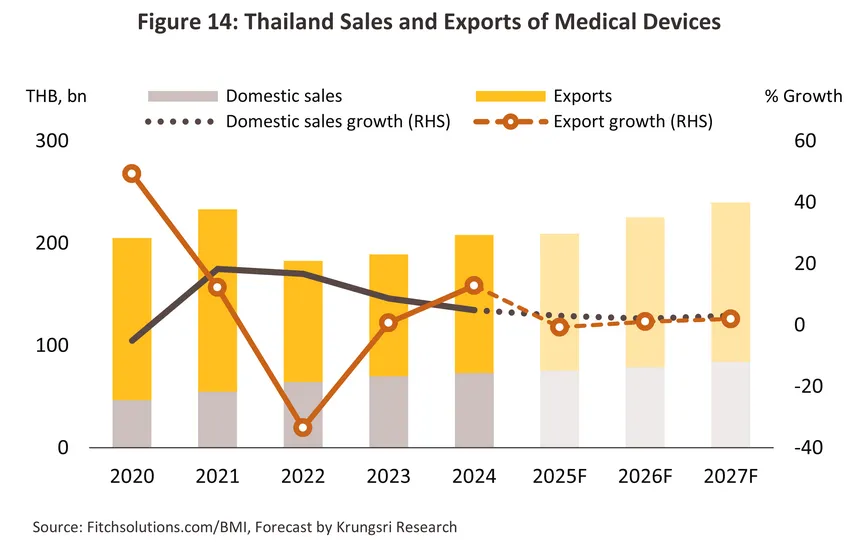

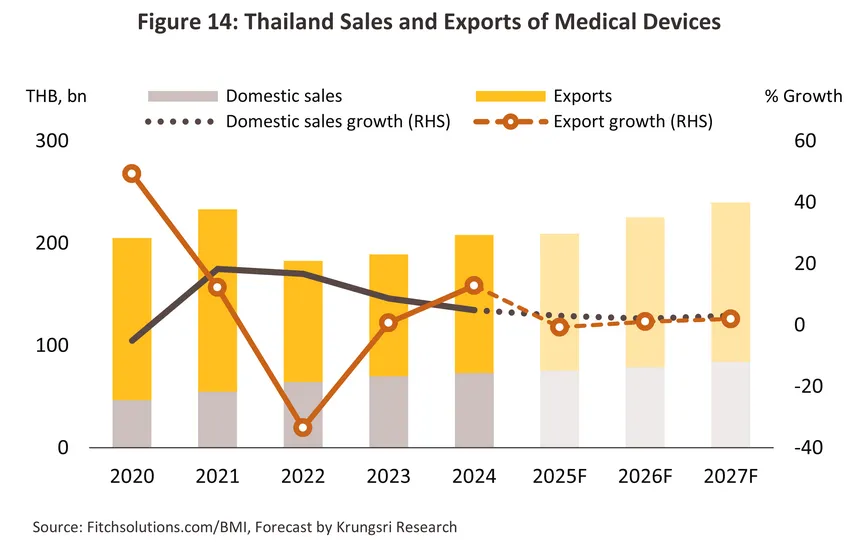

The outlook is expected to worsen in the latter half of the year and with the Thai economy sluggish, consumer spending power weakening, and recovery in tourist arrivals slowing due to a drop off in arrivals among the all-important Chinese segment, the domestic market is now forecast to grow by just 2.5-3.5% in 2025 (Figure 14). Export values are expected to track the general slowdown in the global economy; therefore, by value, exports of medical devices are now forecast to contract by between -1.0% and -2.0%.

The growth rate set in 2025 should remain relatively steady through 2026 and 2027, though this may improve slightly over the next few years. Thus, domestic sales should grow by 2.0-3.0% annually over the next two years, while export value will inch up by 1.0-2.0% per year. Tailwinds supporting growth will include the following.

-

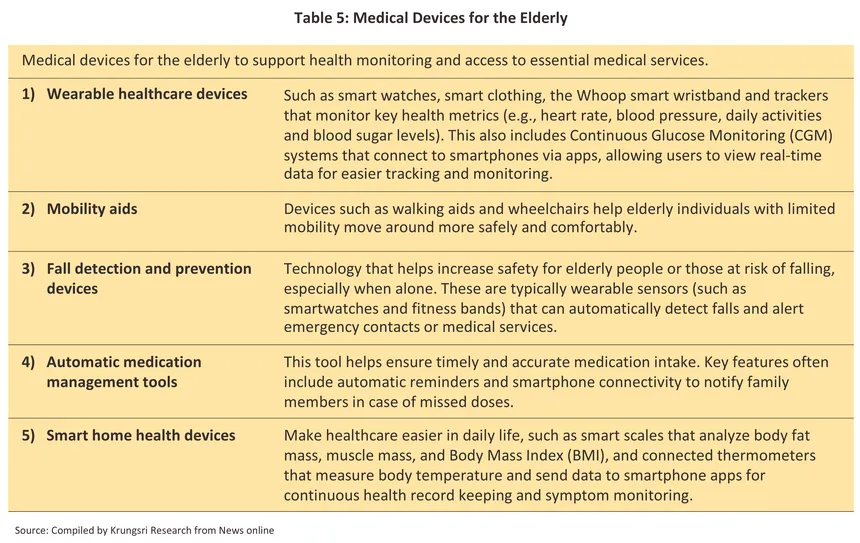

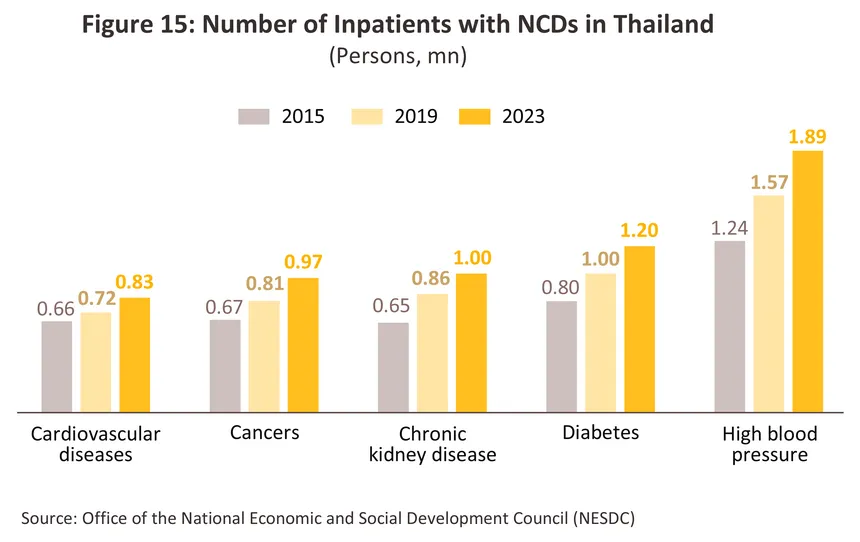

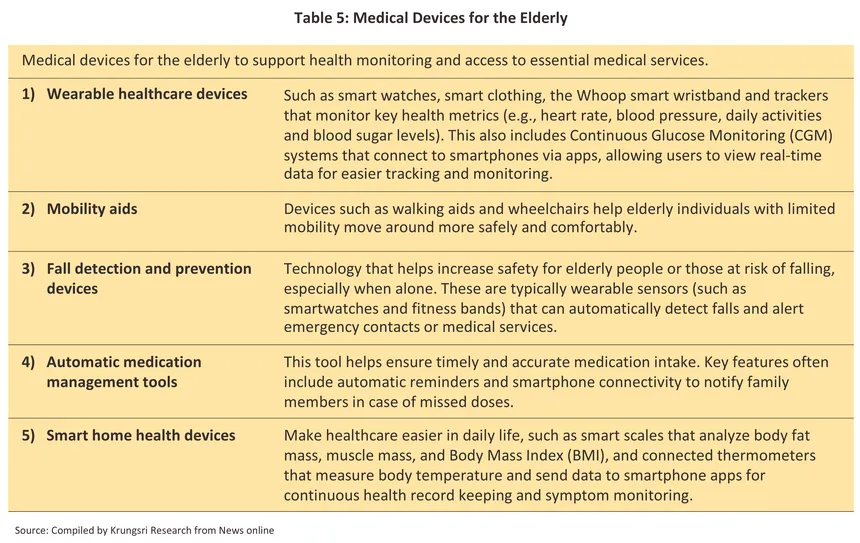

The steady aging of Thai society means that the country remains on track to become a super-aged society (i.e., more than 28% of the population will be over 60) by 2033. This naturally suggests that the incidence of non-communicable diseases (NCDs) will rise, chief among which is hypertension, which affects almost 50% of elderly individuals who have at least one NCD. Likewise, demand for medical devices for the long-term treatment of complex conditions and for associated rehabilitation will increase, including equipment to be used at home and in first-aid and emergency kits. Examples of these will include: (i) mobility aids, such as electric wheelchairs, adjustable walking sticks, and mobility scooters; (ii) health monitors for use at home, including blood pressure and glucose monitors, and pulse oximeters; (iii) beds and similar items, including adjustable beds, pressure-relieving cushions, and equipment to help lift patients; (iv) wearable healthcare devices, such as smartwatches for measuring heart rate and blood pressure, smart clothing that can track and analyze health data, and the Whoop smart wristband with an AI analytics system, can screen for heart conditions using electrocardiograms (ECG) and provide in-depth hormonal analysis specifically for women; and (v) rehabilitation equipment, including electro-therapy or electrical stimulation devices and exercise equipment designed especially for the elderly (Table 5).

-

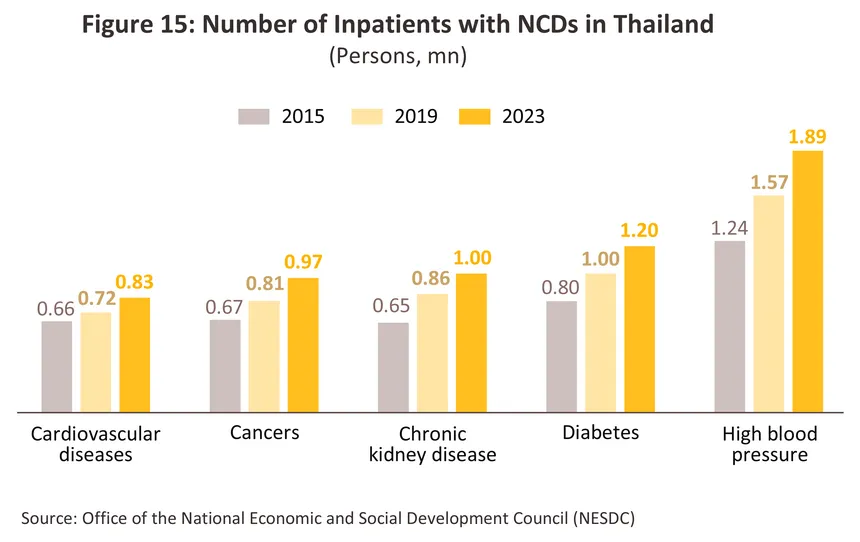

Demand will be stimulated by the rising number of cases of NCDs that require expensive, involved and ongoing treatment, including for hypertension (around 300,000 new cases are reported annually), cardiovascular conditions, chronic obstructive pulmonary disease, cancers and chronic kidney disease (Figure 15). Alongside this, outbreaks of seasonal illnesses and newly emerging/reemerging diseases9/ (e.g., Covid-19) are likely to periodically increase in intensity (e.g., over 0.5 million Covid-19 cases were reported between January and August 2025), while persistent problems with air pollution10/ will drive demand for the treatment of respiratory conditions such as asthma, emphysema and lung cancer. As a consequence, the market for a wide range of medical devices will strengthen, from low-tech face masks to hi-tech machinery capable of providing precise diagnoses and ongoing monitoring. Examples of the latter will include ECG and MRI machines, portable blood pressure monitors, devices for continuous glucose monitoring (CGM), and IoT-enabled healthcare devices that link to an app and that allow for the real-time monitoring and analysis of an individual’s health. There are thus significant market opportunities for investors looking to develop medical devices that will support the treatment of individuals living with NCDs.

-

The domestic medical tourism industry can look forward to solid rates of growth that will draw especially on Thailand’s position as a recognized leader in the global healthcare market. This positive outlook will be further helped by ongoing government assistance for the industry, in particular plans to establish Thailand as a medical and wellness hub over 2025-203411/ and to establish the country at the forefront of the provision of integrated healthcare. To this end, the government has set a target of generating THB 2.2 billion from medical tourism by 2034. Services that are particularly attractive to overseas visitors include dental work (especially popular among European and Scandinavian patients), aesthetic medicine/beauty treatments, fertility/IVF treatments, and health checks. Government policies that aim explicitly to support the development of the industry include: (i) the Andaman Wellness Corridor (AWC) in Phuket and Ko Pha Ngan, which aims to underpin the development of a medical and wellness hub in the south of the country (this will include international-level hospitals and rehabilitation centers targeting the overseas market); and (ii) issuing visas for foreign patients receiving treatment in Thai hospitals or for elderly individuals aiming to take up long-term residence12/ in the country. This will then drive additional and rising demand for medical devices.

-

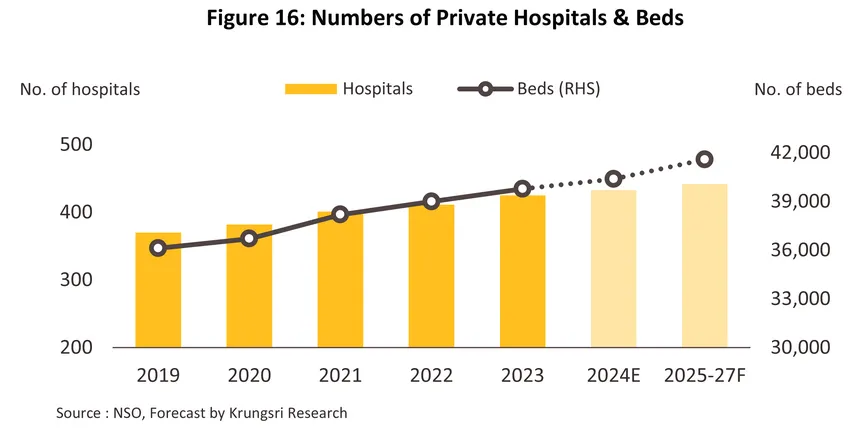

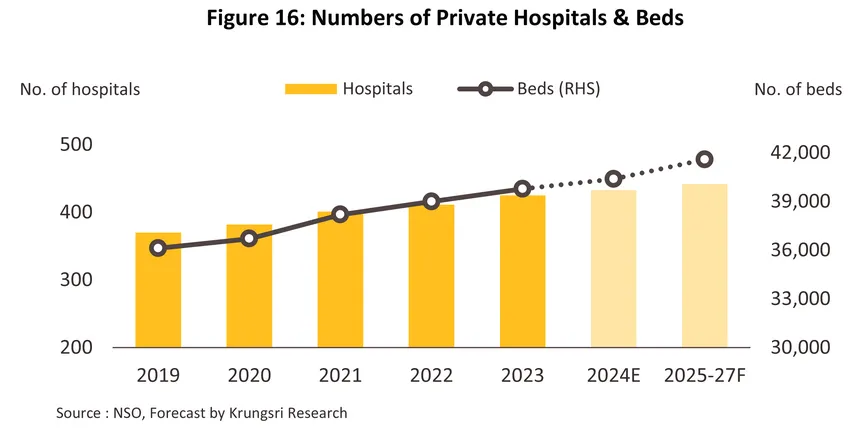

Thailand’s public healthcare system continues to grow, with ongoing investment being made in the buildout of new public- and private-sector hospitals and specialist, comprehensive treatment centers in both urban and upcountry locations. These include clinics providing aesthetic/beauty treatments, demand for which is rising with growing interest in personal health and wellness. Given this, demand for modern, specialist medical devices will likewise strengthen, including hi-tech equipment used in therapy and rehabilitation, patient-specific equipment tailored to use with particular conditions, and advanced diagnostic tools that will facilitate the provision of services that match internationally accepted standards. Beyond this, there is considerable growth potential for centers specializing in post-operative care and rehabilitation and in wellness and beauty treatments. One sign of growth in this market can be seen in the move by the Thai KNA Interpharma to partner with the Taiwanese Diamond Biotechnology to invest THB 2.5 billion in a production site in Pathum Thani. This will manufacture medical devices targeting the aesthetic medicine segment. Ground should be broken on the site in 2026, and production should then start a year later.

-

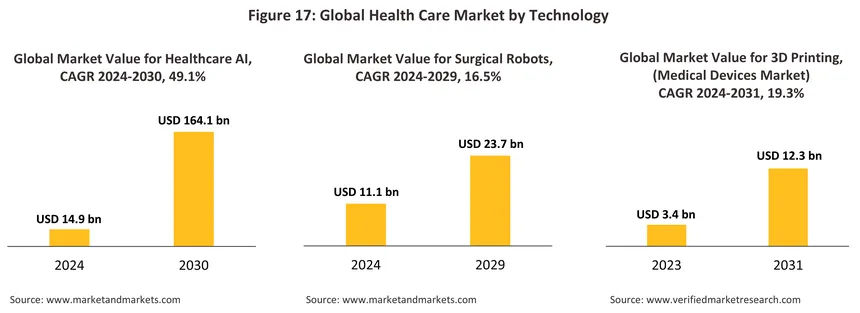

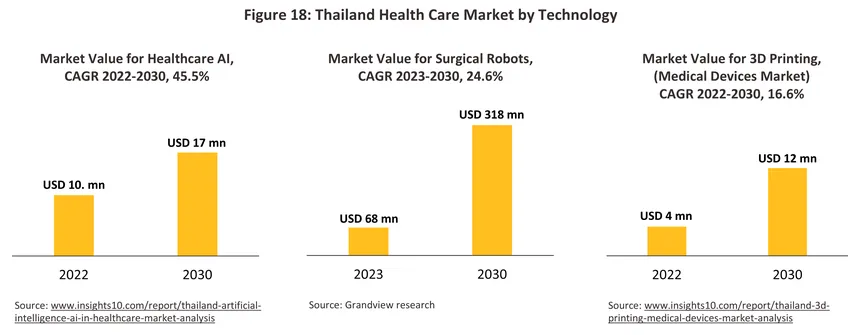

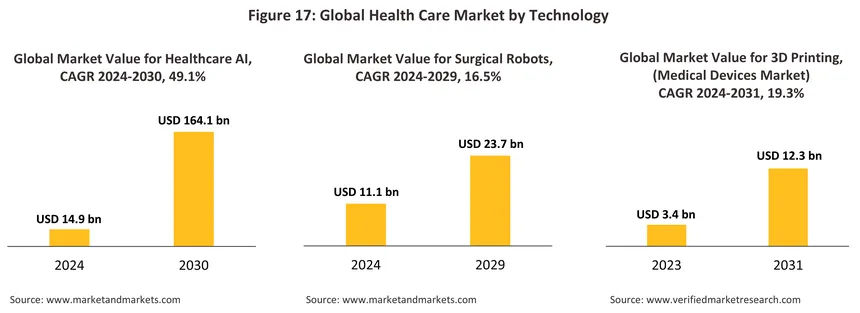

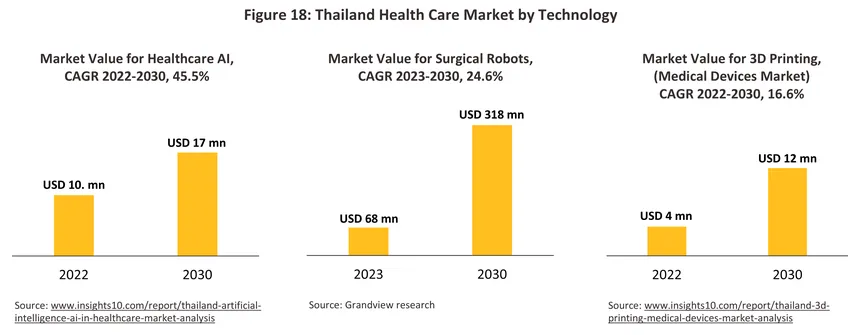

Rapid innovation in the technologies underpinning the development of new medical devices will help to add greater value to the goods coming off domestic production lines. In particular, ‘deep tech’ is expected to enjoy rapid growth globally, and in the context of the medical device industry, this will include the rollout of: AI diagnostics to help facilitate the rapid and precise processing of medical data; genomics, which will open the way to personalized gene-based therapies; medical robotics, which will improve the accuracy of surgical procedures and reduce the room for human error; and advanced biomaterials to produce artificial organs and safer devices and implants. In addition, other important technologies that are rapidly gaining ground include: next generation sequencing (NGS) that uses DNA sequencing to improve diagnoses and the provision of personalized treatments; ‘lab-on-a-chip’ technology, which as its name implies, allows laboratory testing procedures to be digitalized, thereby accelerating and improving their performance; telemedicine services that deliver medical assistance via the internet; 3D printing and 3D bio-printing, which can be used in manufacturing processes to produce personalized bio-devices. Against this backdrop, the public and private sectors have agreed on a goal for the promotion and distribution of innovative medical devices13/ that aims to reach more than 8.5 million people by 2026. Standout examples of innovation include AI-enabled analysis of chest X-rays, which has been certified by The Royal College of Radiologists of Thailand, the Food and Drug Administration, and Singapore’s Health Sciences Authority, and the manufacture of artificial bones and skull plates from titanium (certified by the ISO and the United States Food and Drug Administration). It is hoped that these moves will help to promote Thailand as both a center for the manufacture of medical devices supplying the domestic market and the home of innovative and globally recognized brands.

-

Growth in export value will tend to track expansion in the global market. Exports will benefit from the aging of societies in Japan, South Korea, the US and Europe, the spread of emerging and reemerging diseases, and steadily growing interest in personal health and wellness. Many ASEAN nations, including Indonesia, the Philippines, Vietnam, Cambodia and Lao PDR, are also importing large quantities of medical devices as they look to build up their public health systems, while RCEP membership and economic integration across the ASEAN zone is helping to improve the competitiveness of Thai products in regional markets. Product categories that are likely to see the strongest growth will include surgical gloves, face masks, consumables, diagnostic kits, and equipment for use in the care of the elderly (e.g., mobility aids, health monitoring devices for use in the home, and rehabilitation equipment).

Although the US has hiked tariffs on imports from Thailand to 19% (with effect from August 2025), the effects of this on sales of medical devices will be only limited. Most notably, sales into the US of latex/surgical gloves should be relatively untroubled by the new tariffs since imports from Malaysia (Thailand’s main competitor in this market) now face similarly high rates. Likewise, tariffs on imports of Chinese surgical gloves are now set at 50% and will rise to 100% in 2026 (up from just 7.5% in 2024). There is thus a possibility that Thai exporters may in fact now be able to increase exports into the US, and so Krungsri Research expects that overall exports of medical goods will expand by 1.0-2.0% annually from the 2025 baseline.

-

The government will continue to assist in the development of the industry. (i) The BOI will provide tax breaks for qualifying companies investing in the manufacture of medical devices, especially when this is for projects in the Eastern Economic Corridor, and this should then accelerate domestic and international capital inflows into the industry. (ii) The industry’s transition to the BCG (bio-circular-green) model will support growth in the manufacture of eco-friendly products. Moves in this direction will include the establishment of a sandbox and the creation of the Thai Medical Device Innovation Register, which will help companies develop medical devices that are fully compliant with the relevant environmental and safety regulations. (iii) The creation of medical innovation districts14/ will help to underpin the development of innovation, infrastructure, and cooperation between educational institutions and the public and private sectors. This will extend to include the provision of funding for research on a ‘wheelchair exoskeleton’. Testing of this is being conducted in 2025, and commercial production should follow.

The government is providing additional help for manufacturers of medical devices through the enforcement of rules that require goods to be procured from companies listed in the Thai Innovation Registry. Thus, June 4th, 2025, the National Health Security Office (Gold Card) has specified that at least 30% of its purchases should be for items or from companies listed in the Registry (e.g., for dental implants, colostomy bags, and prosthetic feet). The Office also requires that in the 2025 financial year, AI-enabled chest X-rays are used in 167 public-sector hospitals, with this rising to a total of 887 hospitals in the 2027 financial year. This represents a significant milestone in the adoption by the public healthcare system of innovative medical devices developed in Thailand. This should then open up new opportunities for the domestic manufacture of high-value goods, with the hope that this will then replace imports of these.

Thai manufacturers are also looking to enhance their manufacturing capabilities and to build export competitiveness by forming partnerships or joint ventures with overseas players. Examples of these include those that have been made between Innobic Asia (part of the PTT group) and the Taiwanese Somnics, which are manufacturing iNAP sleeping aids in Thailand for export to other ASEAN countries, and between Namwiwat Medical and players in the healthcare consumer market that are also producing sleeping aids.

Although the overall outlook is for growth, the industry will still face a number of challenges

1) Most manufacturers are SMEs and these have limited access to capital and technology and a reduced ability to market strategically. These players are thus at a significant disadvantage in the market, especially when competing against multinationals.

2) Thai-made medical devices remain somewhat dispreferred within the domestic healthcare system.

3) Manufacturing costs are tracking upwards, partly due to the industry’s heavy reliance on imports of hi-tech inputs for use in production lines. There is thus a risk that inflation, volatility in foreign exchange markets, and increasing technological complexity will feed through into higher costs for Thai players. The latter are also generally in a weak negotiating position relative to their suppliers, while Thai players additionally face the burden of complying with international safety standards, such as those enforced by the US FDA and the European CE Mark. Companies with weaker finances may therefore struggle.

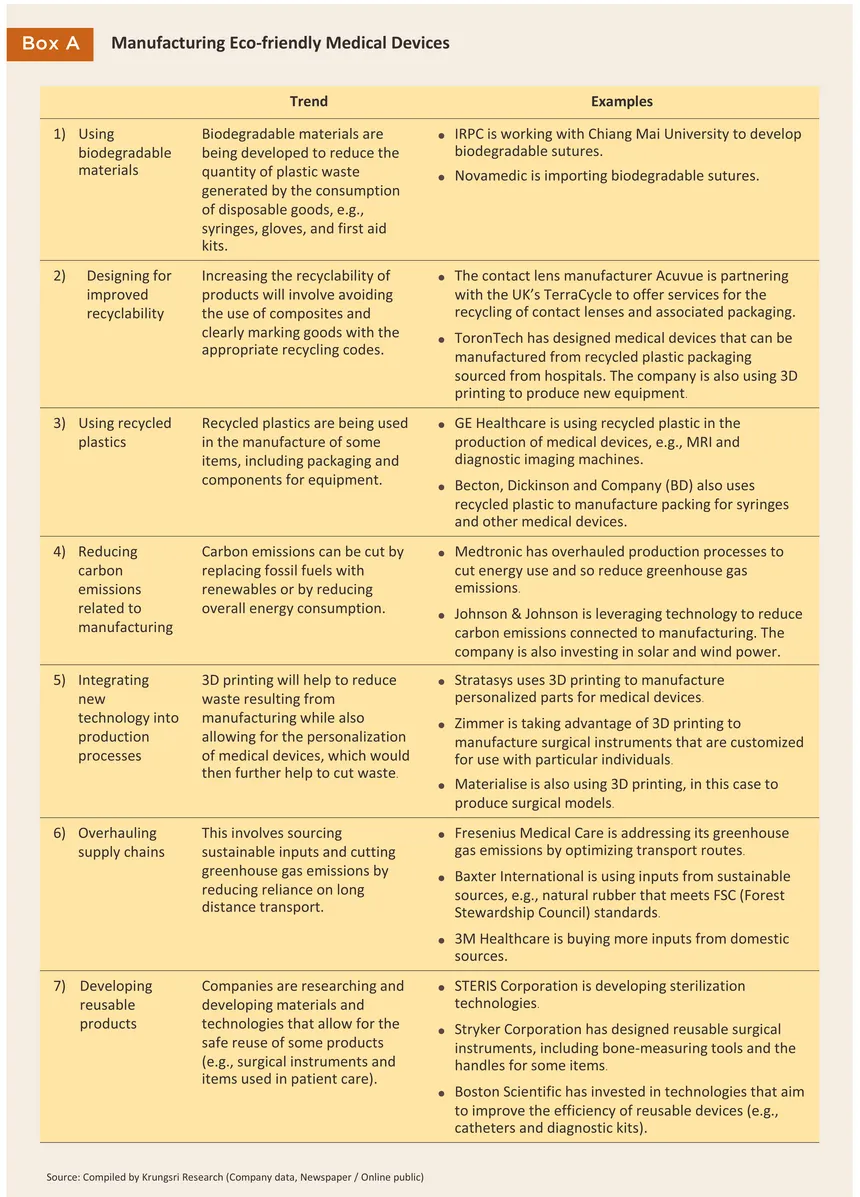

4) Players will need to pay closer attention to environmental and sustainability issues as these impact waste disposal15/, particularly of the ever-growing supply of waste consumables and contaminated products (e.g., masks, syringes, and single-use plastic products). The 2002 ministerial regulations on the disposal of contaminated waste stipulate the use of incineration, steam sterilization, and thermal disinfection, though these methods can potentially impact the environment if not managed properly.

Changes to the industry

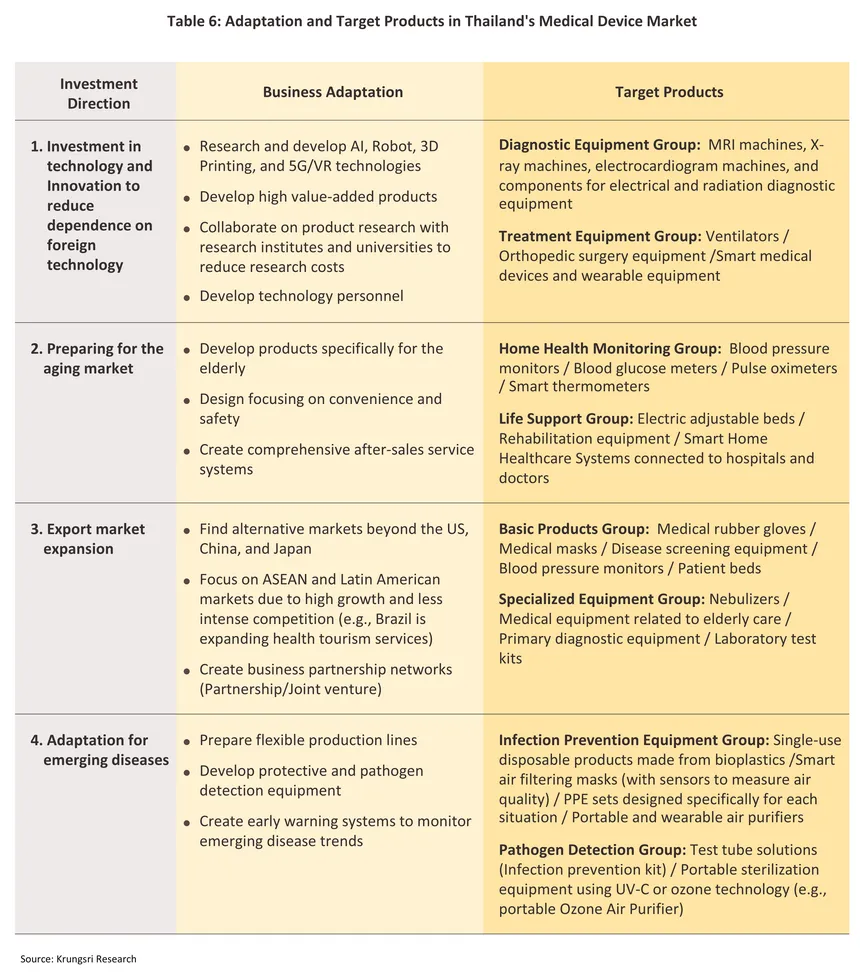

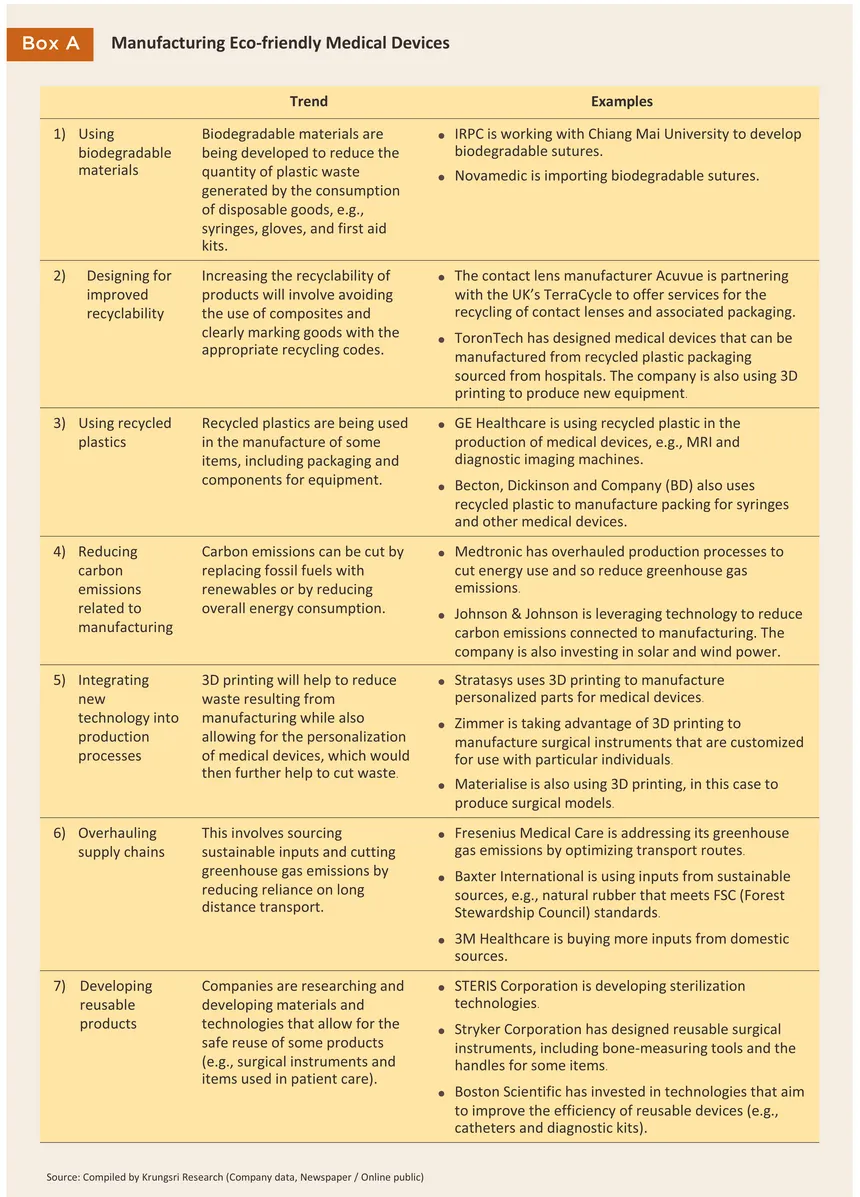

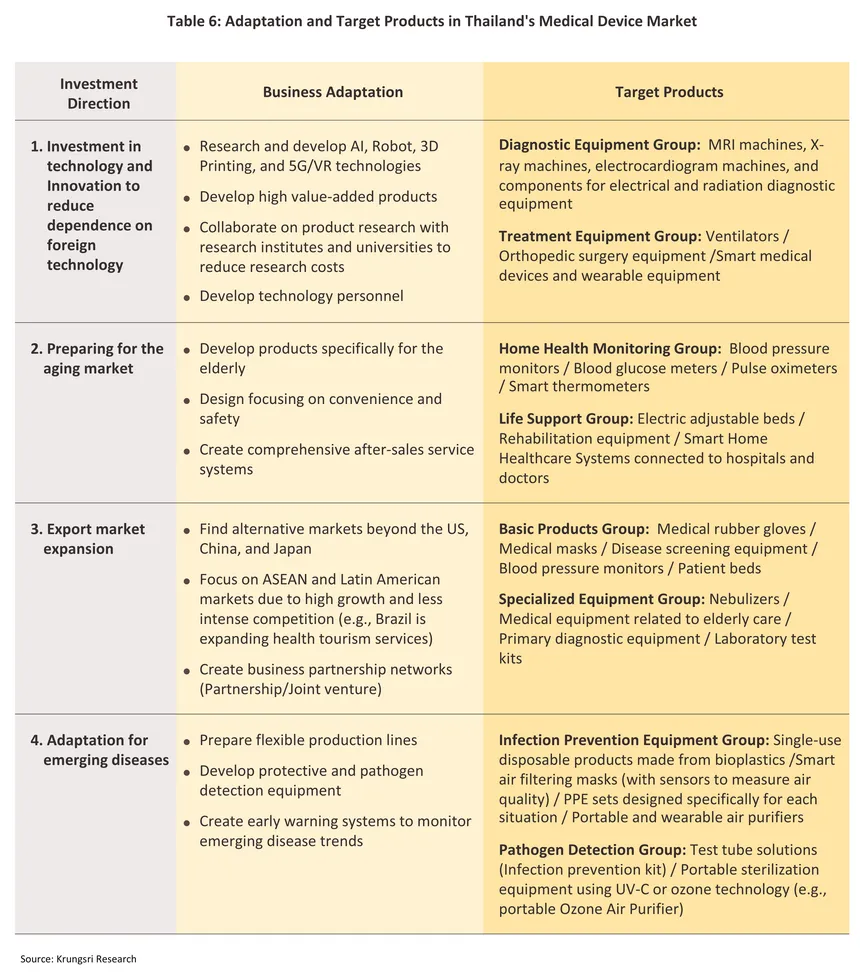

Domestic manufacturers will need to adjust their operations and to adapt to changes in market demand (Table 6). This will involve taking advantage of new production technologies and developing new eco-friendly products, and to align with global megatrends that are shifting the world towards the ‘zero waste society’, this will have to encompass the length of the manufacturing process, from sourcing raw materials all the way through to waste disposal, recycling and reuse (Box A). However, moving in this direction will have the benefit of shoring up the industry’s competitiveness and building its long-term sustainability. Key adaptation strategies are described below.

1/ Medical devices include items which are used in the medical, nursing and midwifery professions to provide treatments for bodily conditions such as X-Ray equipment, ultrasound machines, reagent and test kits, and dental devices. Medical equipment refers to surgical and other equipment e.g. scalpels, thermometers, blood-pressure monitors, and medical supplies such as disposable gloves and masks.

2/ Calculated from domestic sales and export value (average 2019-2024).

3/ These may be divided into: (i) devices that are used externally to the body, e.g., latex gloves worn in examinations and surgery, and syringes; (ii) devices that are temporarily inserted into the body (typically for 6-12 hours), e.g., IV tubes, feeding tubes, and dissolvable stitches; and (iii) devices that are either partially or fully implanted in the body to supplement or replace the function of an organ, or to support orthopedic or ophthalmic functions.

4/ Including dental devices and equipment

5/ Thailand’s medical devices sector operates under the legal provisions of the Medical Devices Act (2008). The Medical Device Control Division under the Food & Drug Administration is the agency responsible for regulating the sector and issuing permits to produce, distribute and import medical devices, subject to specifications and standards laid out by the Thai Industrial Standards Institute. This is aimed at assuring consumers that all medical devices in Thailand meet the same standards, and to build up the competitiveness of the sector and acceptance of Thai products in the domestic and export markets.

6/ This refers to the wholesale and retail of medical products including instruments, tools, equipment, treated bandages, first-aid kits, birth control products, and pharmaceutical products.

7/ Export and import data collected from Medical Device Intelligence Unit, the Plastics Institute of Thailand

8/ In 2024, China had 310 million people aged 60 and above, accounting for 22% of the total population (Source: Department of International Trade Promotion, April 21, 2025), while Japan had 36.2 million people aged 65 and above, representing 29.3% of the total population (Source: Thairath, September 17, 2024)

9/ Emerging infectious diseases include: (i) new infectious diseases that have never occurred before and require time for research to find treatments, caused by newly identified pathogens; (ii) Infectious diseases identified in new geographical areas; (iii) re-emerging infectious diseases, such as SARS, MERS, and avian influenza (in 2024, outbreaks were reported in Cambodia and South Korea); and (iv) antimicrobial resistant organisms (AMR).

10/ In 2024, Thailand ranked 30th out of 134 countries for poor air quality, with an average PM2.5 concentration 5.7 times higher than the WHO standard (Source: 2024 World Air Quality Report).

11/ Under the 13th National Economic and Social Development Plan, the national strategy for enhancing competitiveness aims to position Thailand as a premier destination for quality and sustainable tourism, and as a hub for high-value medical and healthcare services.

12/ The Long-Term Resident (LTR) Visa is a new visa scheme designed to stimulate the economy and attract global tourists to live and invest in Thailand. Launched on September 1, 2022, from September 1, 2022 to August 31, 2023, a total of 4,842 LTR visas were issued to foreign nationals, of which 30% were retirees. Thailand ranked 9th among 16 countries as one of the best places for foreigners to retire (Source: BOI, Tractus-asia.com).

13/ The Thailand Center of Excellence for Life Sciences (TCELS), in collaboration with the Office of National Higher Education Science Research and Innovation Policy Council (NXPO), the National Innovation Agency (NIA), and the Health Systems Research Institute (HSRI), along with key partnersincluding the National Health Security Office (NHSO), private sector stakeholders, and the Thai HealthTech Association.

14/ For example, the Yothi Medical Innovation District has received support from the National Innovation Agency (NIA) to enhance Thailand's capabilities in medical personnel, knowledge, and technology through collaboration among hospitals, academic institutions, and research centers for the development and testing of medical device innovations (Source: BOI).

15/ Medical waste treatment and disposal include: (i) Waste segregation – Healthcare facilities are required to separate hazardous waste from general waste at the source to prevent contamination and reduce the volume of waste requiring special disposal. (ii) Pre-treatment before disposal – Infectious waste must undergo sterilization processes, such as steam autoclaving or chemical disinfection, before being disposed of through other methods. (iii) Final disposal – Incineration using advanced pollution control technology and landfilling for sterilized waste.

.webp.aspx)