EXECUTIVE SUMMARY

Thai manufacturers of medical devices should enjoy solid rates of growth over the period from 2023 to 2025, with the value of goods distributed domestically and internationally forecast to expand by averages of respectively 5.5-7.0% and 6.5-7.5% annually. Markets will be lifted by a number of tailwinds, including the aging of society and the accompanying rise in rates of illness, the threat of newly emerging diseases, growth in demand for medical tourism (a market where Thailand is recognized globally for its high quality of care and low costs), and particularly in the post-Covid era, rising interest in preventative healthcare. Demand for medical devices and equipment is also strengthening on Thailand’s major export markets, though perhaps most important will be the government’s plans to push forward with the development of Thailand as a healthcare hub and ASEAN’s center for the production of medical supplies.

Nevertheless, the industry will face a number of challenges that may restrict growth, including the fact that Thai players are generally SMEs manufacturing disposable goods and these thus have only restricted access to capital and a limited ability to develop more advanced technology. Thai companies are also reliant on imports of manufacturing technology and machinery, and this then exposes them to volatility in foreign exchange markets, while the cost of these imports is likely to track upwards over time. Moreover, as the impacts are felt in Thailand of global trends pushing companies to reduce environmental impacts and to transition to the ‘zero waste society’, players will tend to switch to the production of biodegradable materials and this will add to production costs.

Krungsri Research view

Krungsri Research thus sees turnover growing solidly for the industry overall. The outlook for the industry’s two main segments is as follows.

-

Manufacturers of medical devices: Turnover will tend to strengthen at a good pace, especially for players that distribute their goods through hospitals and clinics (both private and public sector). However, on the supply side, the market is crowded and so competition is worsening. Manufacturers that distribute medical devices and equipment through healthcare facilities will continue to register higher revenues, especially those that sell to private hospitals that are expanding operations. Consumers are also taking a greater interest in their health, and this presents an opportunity for players to develop new products and equipment to meet this burgeoning demand. Operators will also be able to develop export markets in neighboring countries by taking advantage of the government’s efforts to promote investment in the EEC, to complement plans to turn Thailand into a medical hub and a regional center for the export of medical supplies and equipment. On the other hand, competition will also intensify as foreign companies (e.g., from Japan, the US, France, and South Korea) increasingly invest in Thailand-based production facilities, while players will need to hedge against shifts in the exchange rate and adapt to the higher costs entailed in using high-tech production techniques (e.g., AI, robotics, and 3D printing), which may then drag on profits.

-

Distributors of medical devices (including retailers and wholesalers): Revenue will grow in the next few years, albeit slowly. The majority of goods distributed are disposable items that are used regularly in healthcare facilities and by the unwell, but competition is worsening due to the large number of SME distributors in the market. They are fighting for space with agents and retailers that are part of a manufacturer’s commercial network and have access to wider and more comprehensive distribution channels. This would cap growth in this segment countries.

-

Importers of medical devices: The majority of these are large companies that enjoy advantages with regard to costs and marketing, or that benefit from commercial links with manufacturers and distributors. These typically import high-tech, innovative products that are then distributed to private hospitals and specialist treatment units, including, for example, robotic systems used to assist with microsurgery, automated pharmaceutical production and management systems, MRI, X-ray and ECG machines, orthopedic equipment, and dental supplies (e.g., crowns and implants). Demand for these is increasing rapidly, and this will help to support a steady expansion in turnover.

Overview

Market value of the medical devices sector includes both medical devices and medical equipment1/. Considered a high-value industry, the sector is accounted for 1.2% of GDP2/ and has continued to grow in line with the number of patients, the elderly and growth of wellness business in Thailand.

Medical devices and medical equipment can be divided into three categories according to use.

1) Single-use devices3/ are used in a wide range of common medical procedures. Manufacturing these typically uses only straightforward production processes, and the products are then used a single time and then disposed of. Examples include syringes, hypodermic needles, tubes, catheters, cannulas, latex surgical gloves, dental and ophthalmic supplies and devices, and dissolvable stitches.

2) Durable medical devices normally have a life-span of at least one year. Examples include first aid kits, wheelchairs, medical beds, technical equipment used in medicine, surgery and dentistry, electrical diagnostic tools, and x-ray machines.

3) Reagents and test kits include equipment used to diagnose illnesses and conditions and chemical kits used to test samples drawn from patients. For example, to test for blood type before dialysis, pregnancy tests, and to detect HIV infection.

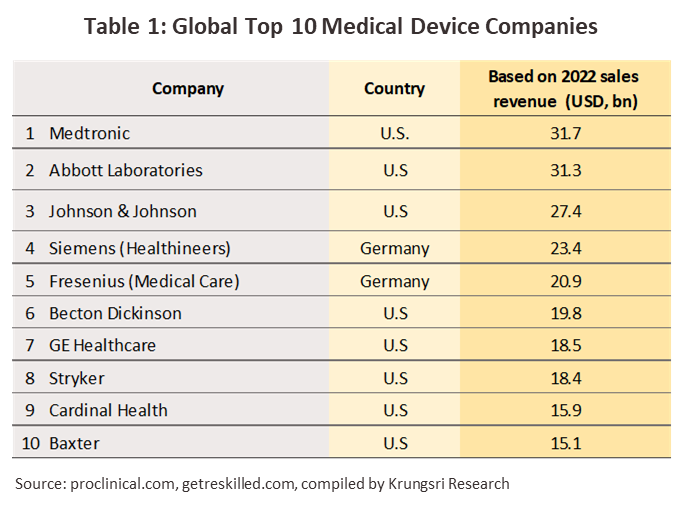

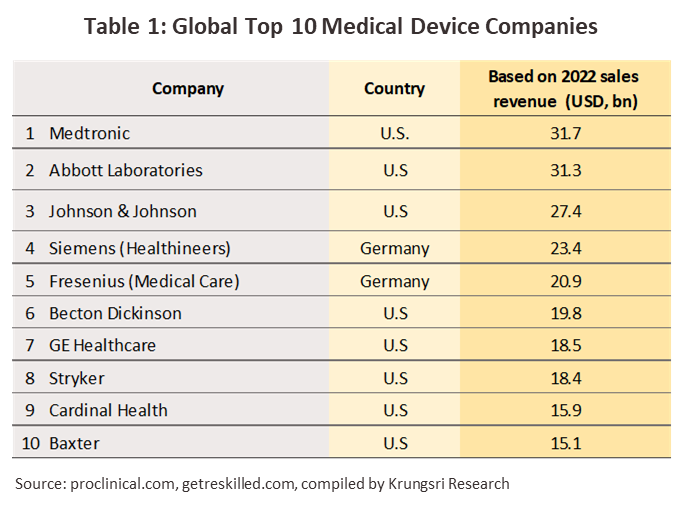

The world’s most important producer of medical devices is the US which is large manufacturer and enjoys the greatest income from the distribution of medical devices of any nation (Table 1). Although production facilities operated by US corporations are geographically dispersed, output from these is focused on high-value products, such as electro mechanical medical devices, equipment used in orthopedic and fracture-treatment settings, X-ray machines, and dental equipment. Also well regarded for the quality of their cutting-edge products are Dutch and German manufacturers, the latter in particular earning plaudits for their ongoing innovation of production processes. Within Asia, given its role as another world-leading center of innovation, Japan is widely regarded as a leader in the medical devices industry, while players in China and the ASEAN zone tend to be much more heavily focused on the production of consumables. In these countries, high-tech appliances need to be imported, most often from the US, Germany and Japan.

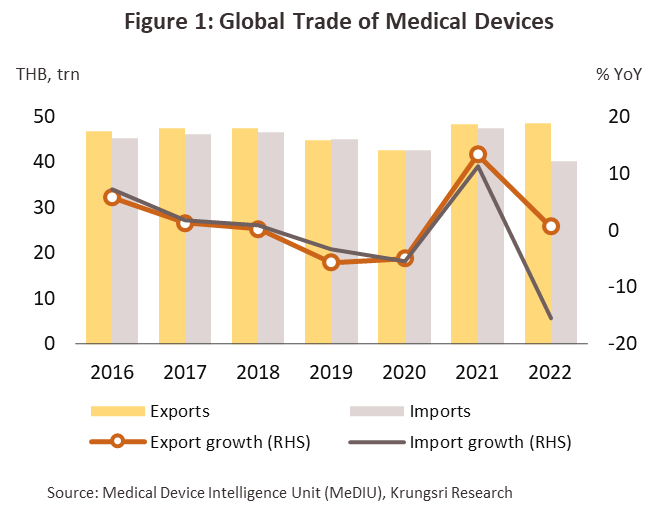

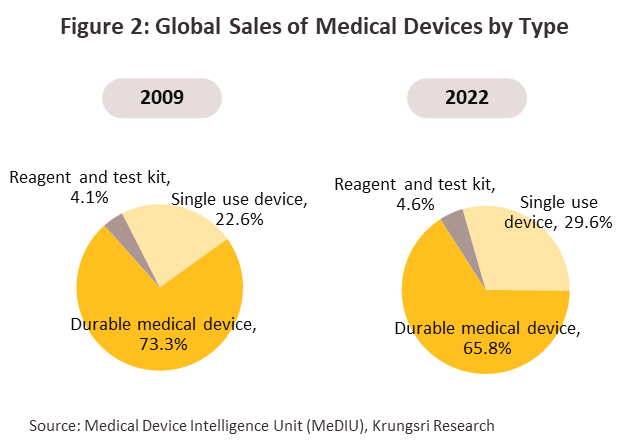

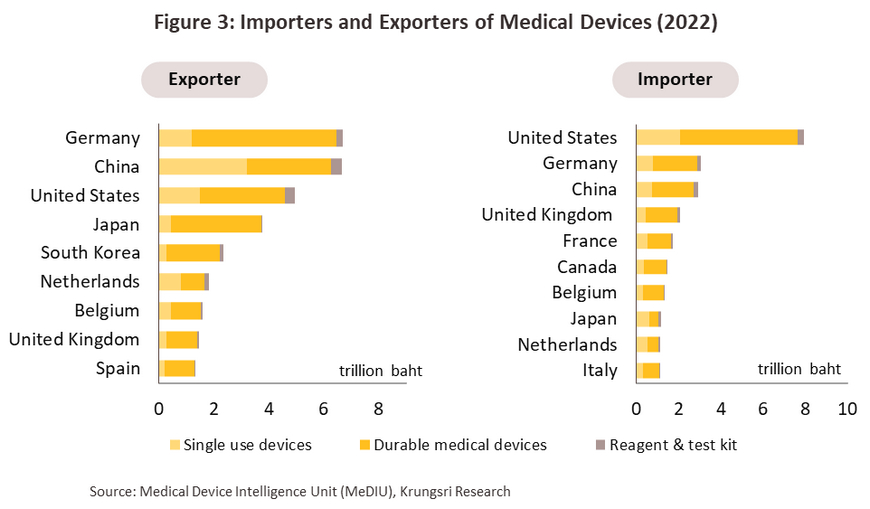

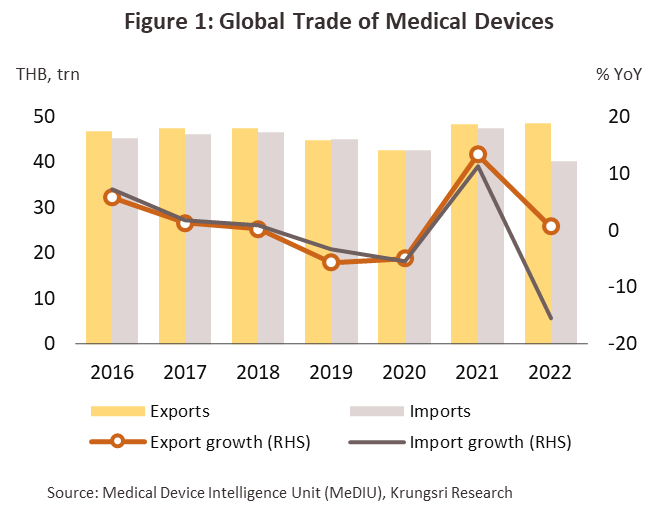

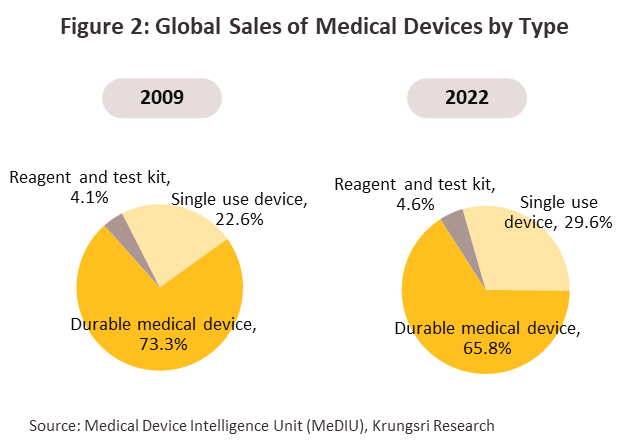

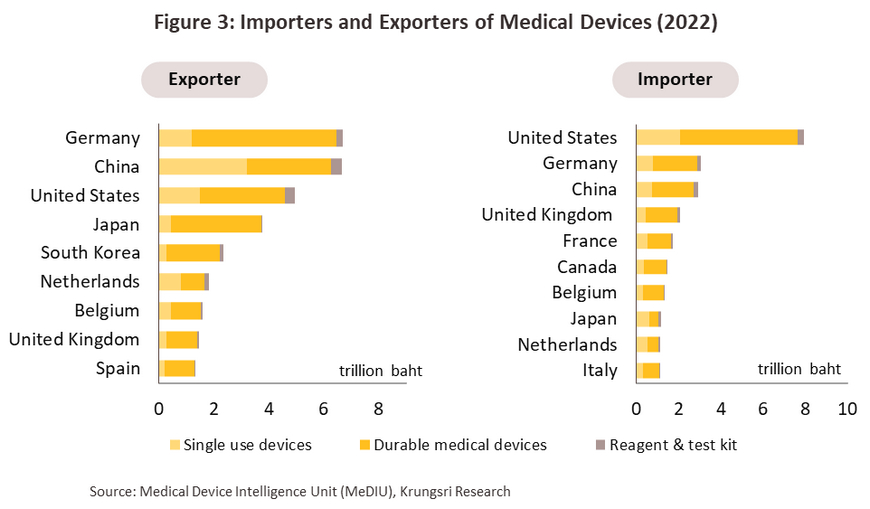

In 2022, the value of the global market for medical devices and equipment (imports and exports combined) shrank -7.3% from its 2021 level (Figure 1) as the easing of the Covid-19 pandemic meant that demand for medical equipment for use in the prevention and treatment of diseases softened. By segment, demand for durable goods, which account for 65.8% of the value of all medical devices distributed globally (Figure 2) contracted -8.1% YoY (compared to growth of 14.0% in 2021). Likewise, revenue from sales of single-use items (29.6% of the market) slipped -7.6% YoY (compared to growth of 6.9% in 2021), while income from the distribution of reagents and test kits (4.6% of the market) rose 8.6% YoY, down from growth of 30.1% a year earlier. Globally, the major exporters are Germany, which has a 13.74% of global exports by value and which is focused especially on durables, followed by China (13.67%, with an emphasis on single-use devices), the US (10.2%) and Japan (7.7%) and in terms of value, players from these four countries have a combined 45.3% market share (Figure 3). The most important importers of medical devices are the US (responsible for 19.8% of global imports by value, mostly of durables), followed by Germany (7.6%), China (7.3%) and the UK (5.1%). Thailand sits in respectively 19th and 36th places in the rankings of global exporters and importers of medical devices, with market shares of 1.3% and 0.7% for each of these; with regard to the former, Thailand’s focus is single-use devices, whereas for the latter, it is on durable medical items.

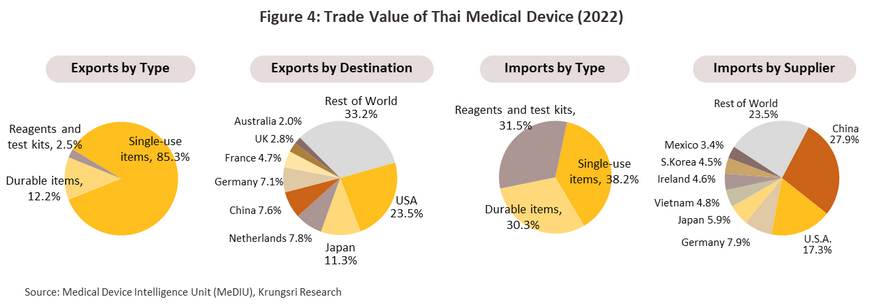

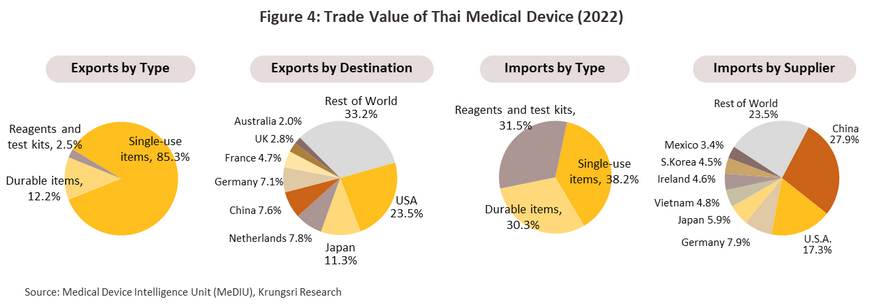

Thai exports of medical devices are dominated by sales of single-use devices, and as of 2022, these accounted for 85.3% of all exports by value. This group includes goods such as latex surgical gloves, catheters, syringes/hypodermic needles, and dressings. Thailand’s main export markets are in the US, Japan, the Netherlands, and France (together, these four countries absorbed 50.2% of all Thai exports of medical devices), though most manufacturers and exporters are in fact multinationals, in particular companies based in Japan, the US and France that have invested in production facilities in Thailand to manufacture for export to other regions. Imports are mostly of medical single-use devices and durable medical items (68.4% of all imports by value) sourced principally from China, the US, Germany, and Japan (Figure 4). These include ultrasound, X-ray, and ECG machines, other types of electronic diagnostic equipment, ophthalmic equipment, and radiological supplies and machinery.

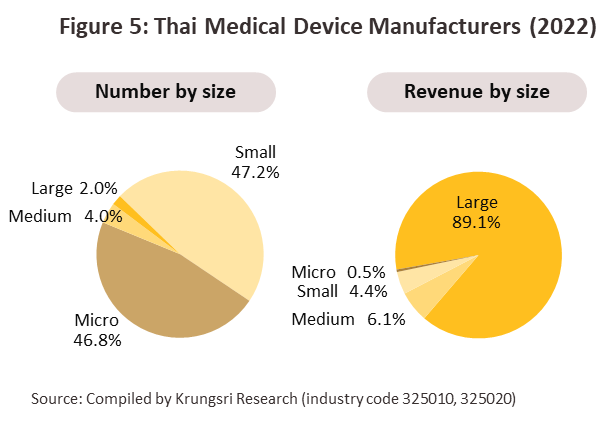

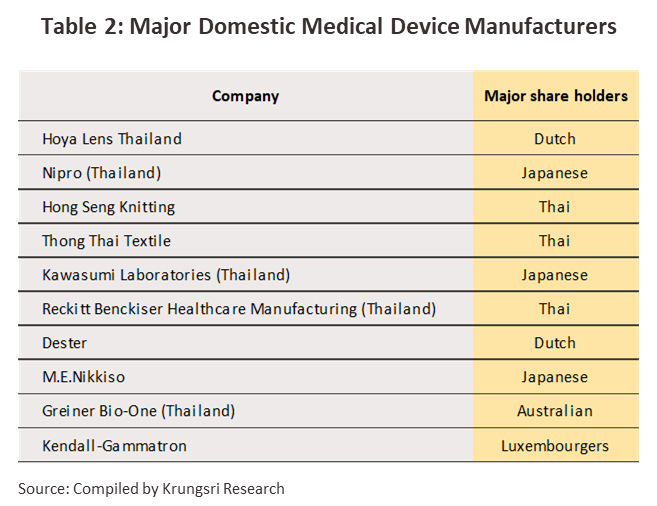

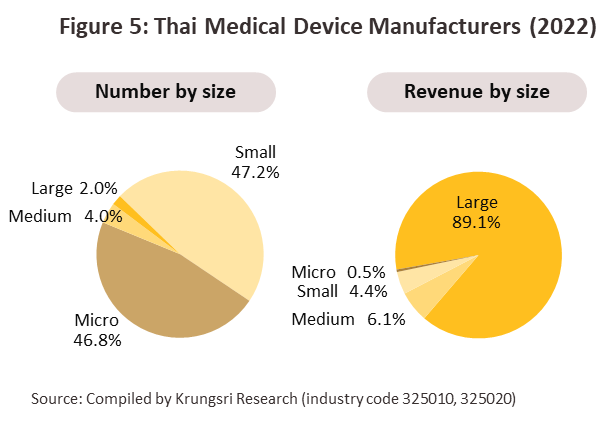

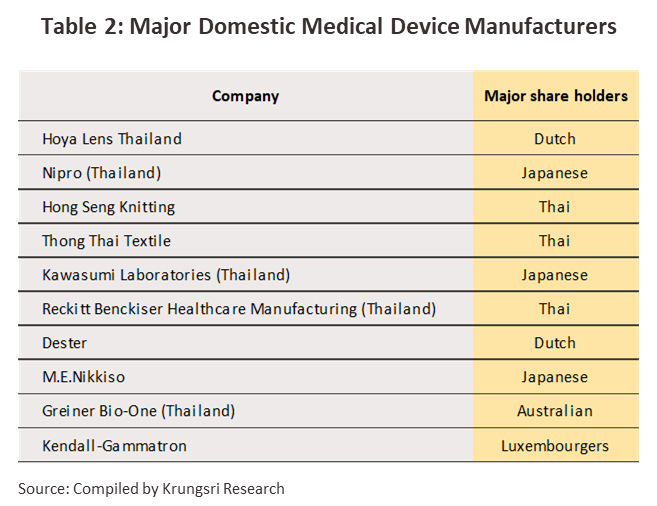

In 2022, 1,068 companies4/ were registered with the Department of Business Development as manufacturers of medical equipment and devices5/. Of this total, 94.0% were classified as small and micro companies, but these generated just 4.8% of industry income, leaving the 6.0% of the market that is composed of mid- and large-sized players (often multinational companies, Table 2) with a 95.2% share of income (Figure 5). Over 2,000 companies are registered as importers of medical devices (source: Food and Drug Administration)

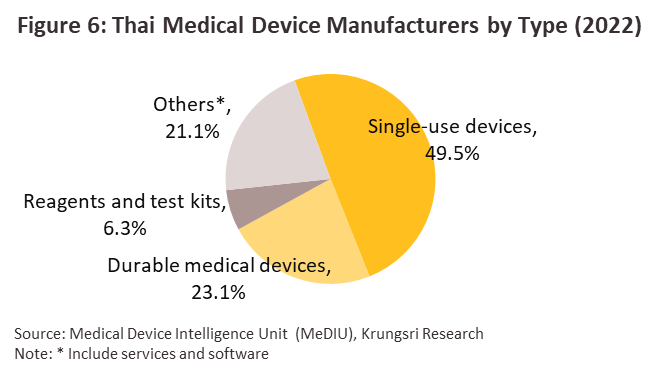

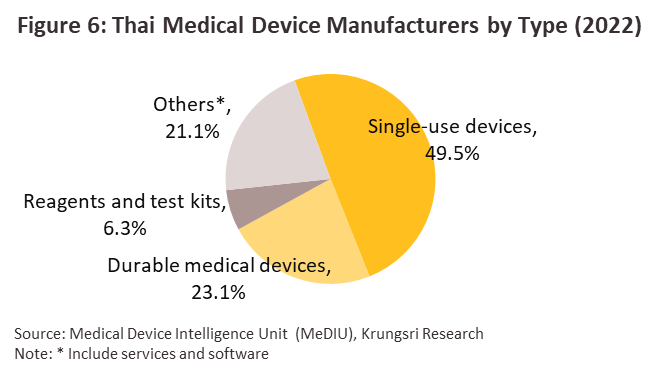

Thai production of medical devices is largely of basic goods that can be manufactured using locally sourced inputs (e.g., plastics and rubber) in relatively simple and technologically unsophisticated processes. Around 70% of production is therefore of goods such as latex gloves and hypodermic needles. By contrast, production of durable medical devices, reagents and test kits is more reliant on access to the relevant technical know-how, to which is added the additional hurdle of having to meet international standards. Nevertheless, despite these difficulties, Thailand has successfully developed applications involving more advanced medical technology, including the ‘Dinsaw’ robotic assistant for the elderly, as well as in areas including robotic assisted surgical systems used to help with minimally invasive surgery. Generally, medical devices are divided into the following categories (Figure 6).

1) Single-use devices: The number of producers represent about 49.5% of total medical device manufacturers in Thailand. The high-potential and globally–competitive products include rubber gloves/medical gloves because these do not require sophisticated technology. Thailand is also the world’s major producer of rubber (major raw material for production). Therefore, rubber gloves produced are targeted export markets accounting for 90.0% of total sales of rubber gloves. Other high-potential competitive products are catheters and syringes which are partly made of plastics processes by petrochemical industry.

2) Durable medical devices: Manufacturers producing these goods represent 23.1% of the total, with exports concentrated in areas connected to the treatment of the elderly, including hospital beds, examination tables, and wheelchairs. Some Thai players also manufacture X-ray and MRI machinery, as well as robotics units such as surgical robotic assistants and the ‘Dinsaw’ care robotic assistant.

3) Reagents and test kits: 6.3% of manufacturers were in this group, up from 4.8% a year earlier thanks to strong demand for Covid-19 tests. This group is dominated by companies that have engaged in joint partnerships with overseas players, and within the group, the major products are for the testing of conditions related to diabetes, kidney disease and hepatitis, and Covid-19 and pregnancy test kits.

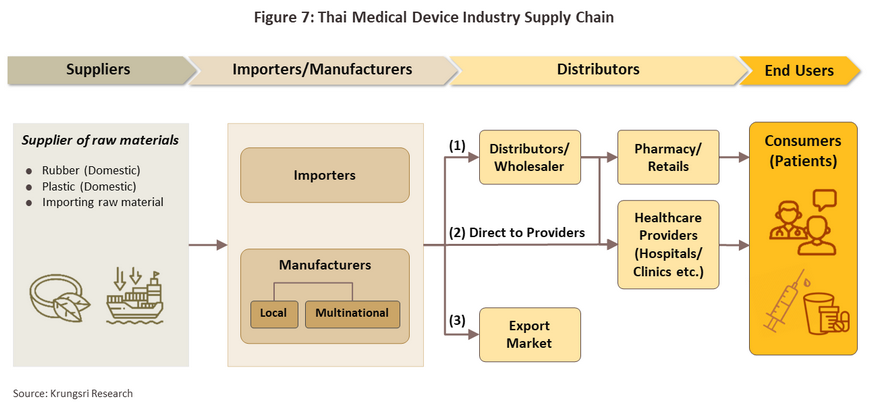

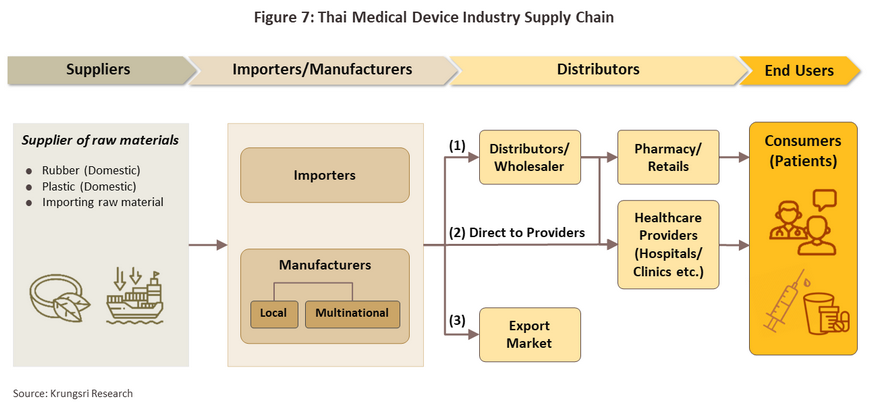

The distribution channels of manufacturers and importers are shown in Figure 7.

1) Distribution to intermediary companies, representatives, or to shops (affiliates and general shops): This aims to reach target customers throughout the country. Players in this group typically have some knowledge of healthcare and are able to exploit a range of distribution channels.

2) Direct distribution to healthcare providers: This includes distribution to public- and private hospitals and clinics. Sales of medical devices to public-sector hospitals is carried out according to government procurement procedures. Currently, the Ministry of Finance has developed the procurement system to electronic market (e-market) and the electronic bidding (e-bidding) process. Under the previous system, purchases below THB500,000 can be conducted under an ‘agreed price’, purchases between THB 500,000 and THB 2 million is subject to the ‘price-checking’ mechanism, and purchase over THB 2 million has to be conducted through competitive bidding. Private hospitals purchasing procedures are not regulated.

3) Distribution to export markets: The majority of goods distributed are single-use devices, notably latex gloves and medical rubber gloves. The main markets are the United States, Japan, and Germany. A major player in this group is the Thai Rubber Latex Corporation (Thailand) Public Company Limited.

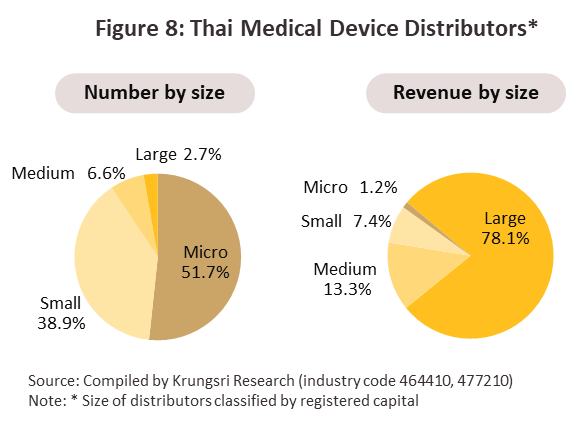

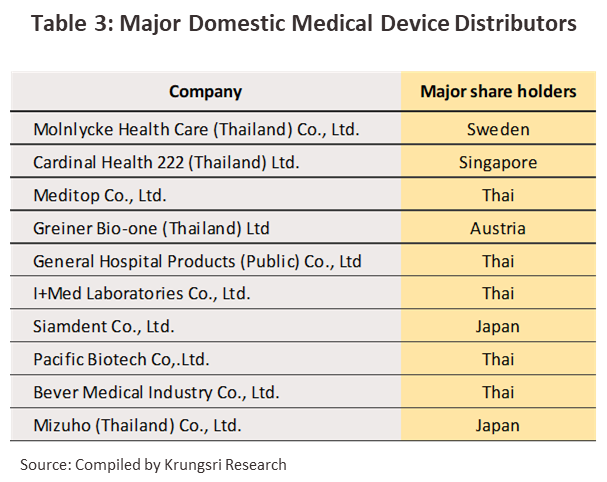

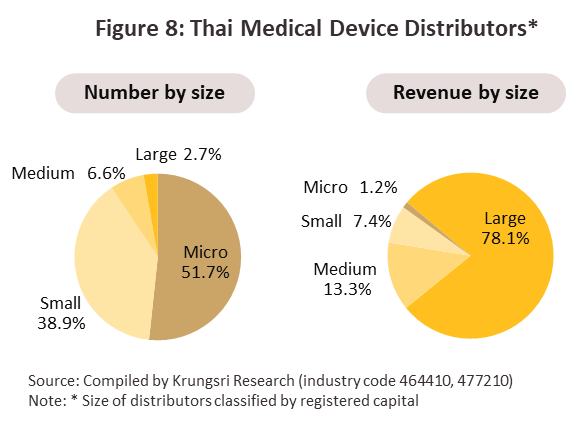

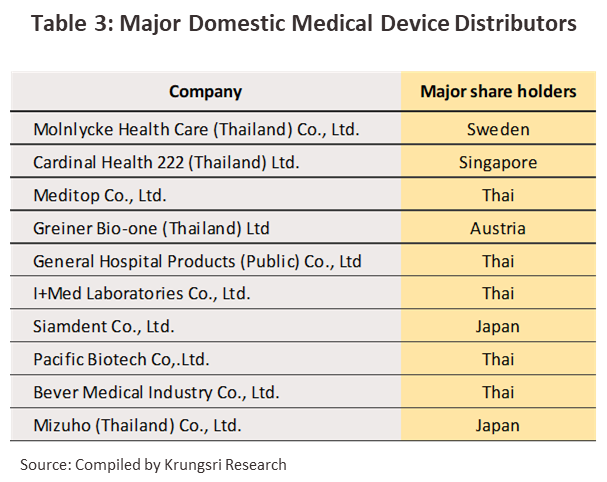

As of 2022, a total of more than 10,000 distributors of medical devices and equipment were targeting the retail and wholesale markets6/. 90.6% of these were small and micro operators, and these had a total market share that amounted to just 8.6% of total sectoral income; the 9.4% of players that were mid- and large-sized operations thus enjoyed a 91.4% market share by value (Figure 8). There is strong competition because of low entry barriers and products are mostly generic, making it easy for consumers to switch to competitor’s products. The major distributors include Molnycke Health Care (Thailand) Co.Ltd., Cardinal Health 222 (Thailand) Ltd., Meditop, Gereiner Bio-one (Thailand) Ltd., General Hospital Products (Public) Co.Ltd., and I+Med Laboratories Co.,Ltd. (Table 3).

Situation

The outbreak of Covid-19 at the start of 2020 fed an enormous surge in demand for medical supplies, and so operators rushed to expand manufacturing capacity, in particular for the production of disposable PPE such as masks (when authorized), surgical and examining gloves, and diagnostic kits. Covid-driven demand was in fact so strong that companies from outside the industry moved swiftly to develop products that were in short supply, including hats, plastic face screens, powered air-purifying respirators, and internet of things-enabled tele-monitoring setups, and high-tech, innovative medical products continue to be developed7/. However, demand for medical supplies for use in the treatment of general conditions and in surgical procedures declined as patients postponed or cancelled treatments. Nevertheless, demand for medical devices and equipment rose simultaneously worldwide, and over 2020 and 2021, this then boosted exports of Thai medical devices by an average of 30.8% per year, with growth seen in single-use devices and reagents and test kits.

Demand for medical devices continued to grow through 2022 on: (i) the return of economic and social life to more normal conditions, which then supported 2.6% YoY growth in the Thai economy and encouraged patients to return to hospitals for treatment; (ii) from 1 July, the full reopening of the country to foreign arrivals, which then allowed overseas patients including medical tourists to return to Thai hospitals following the pandemic-era slump in demand; and (iii) ongoing demand for the treatment of Covid-19 that added to demand for medical supplies, including for testing equipment, vaccination supplies, and PPE (e.g., masks and disposable gloves). As a result of these influences, demand for equipment for the treatment of more complex conditions in healthcare facilities and for screening and diagnosis strengthened (e.g., hospital beds, X-ray and MRI machines, and diagnostic kits). The general situation for the industry is described below.

-

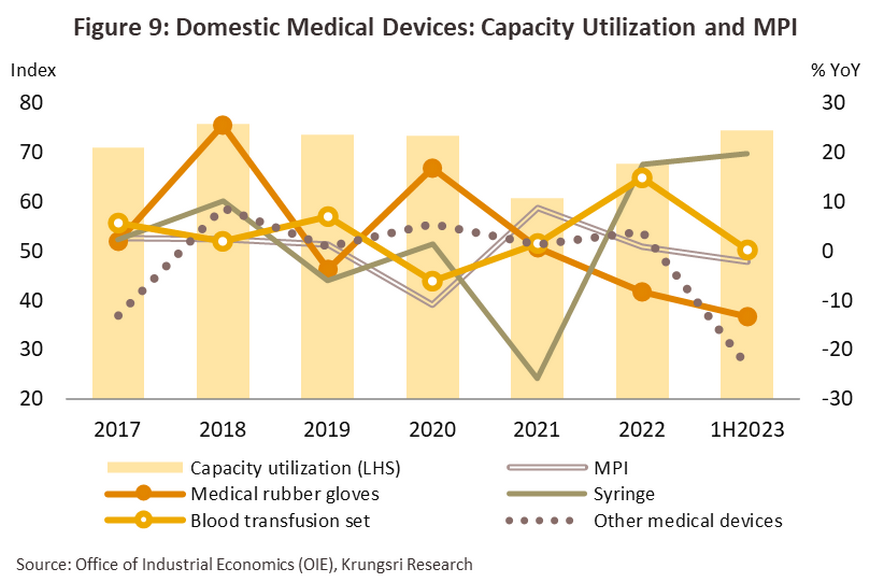

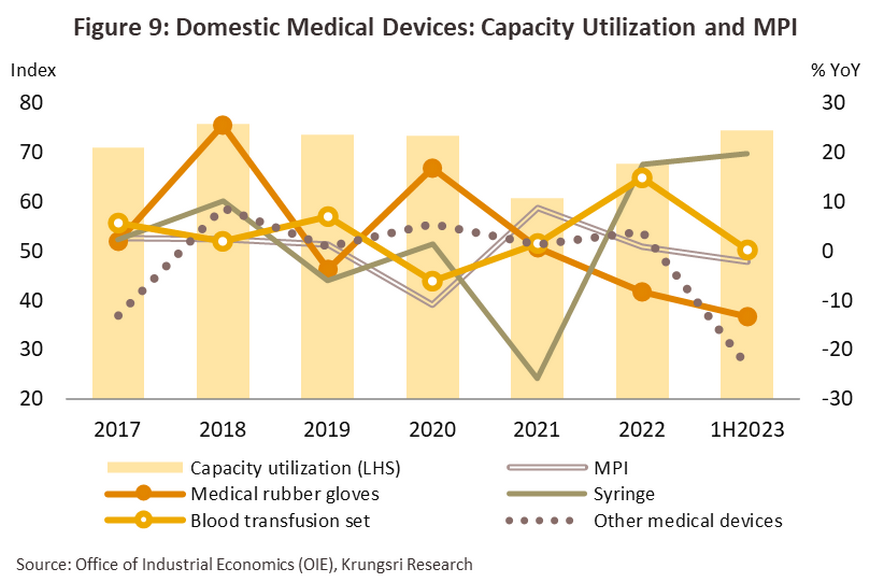

Following the sharp drop in output in 2020 at the start of the Covid-19 pandemic, output of medical devices and equipment rose for the second year running in 2022. This turnaround is reflected in the industry’s manufacturing production index, which went from a low of 94.6 in 2020 to an average of 103.7 in 2022. This was driven especially by growth in production of blood transfusion set (+14.8% YoY), syringes (+17.5% YoY) and ‘other’ medical devices (+3.9% YoY). However, output of medical rubber gloves slipped -8.2% YoY on a steep drop off in global demand as the Covid-19 pandemic eased. Overall, 2022 capacity utilization averaged 67.7%, up from 60.7% in 2021.

-

The total value of goods distributed to the market softened on weaker exports.

-

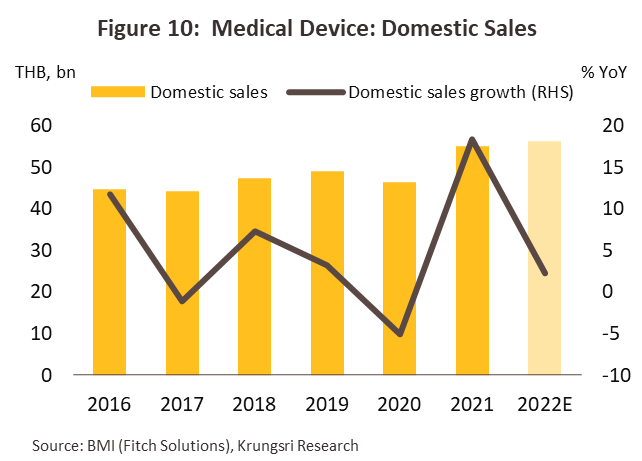

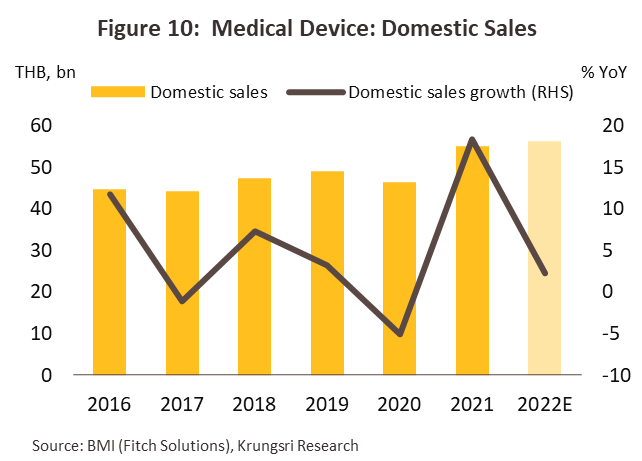

Krungsri Research believes that the value of goods distributed to the domestic market in 2022 will have increased by 2.0-3.0% YoY as the number of patients being treated in hospitals returns to close to normal (Figure 10), though this rate of growth will still be below the average of 3.2% maintained over the 5 years from 2016 to 2020 (source: Fitch Solutions).

-

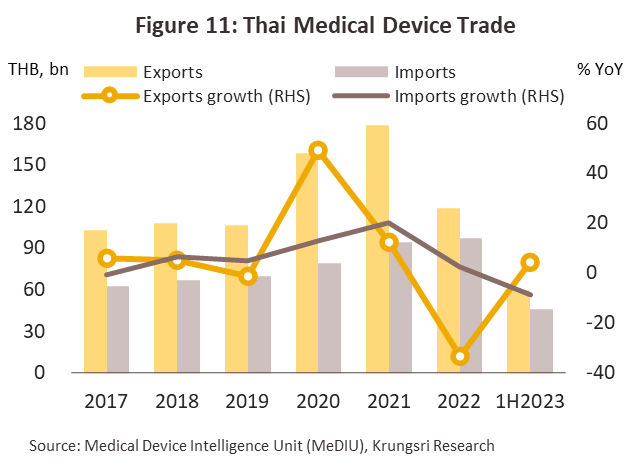

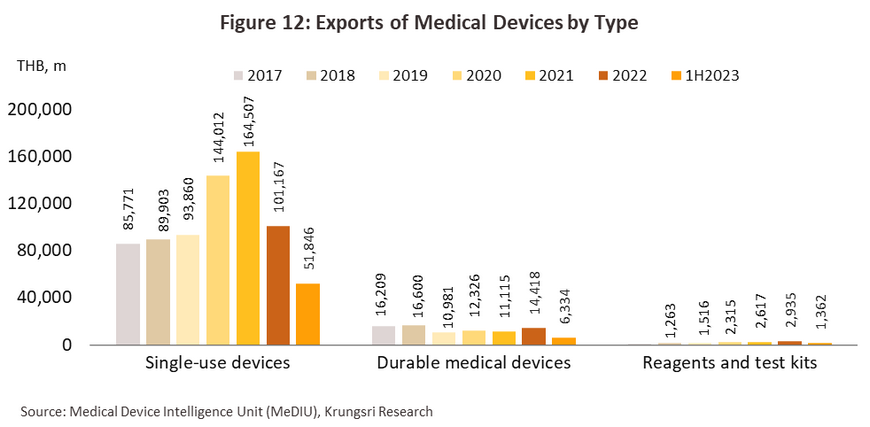

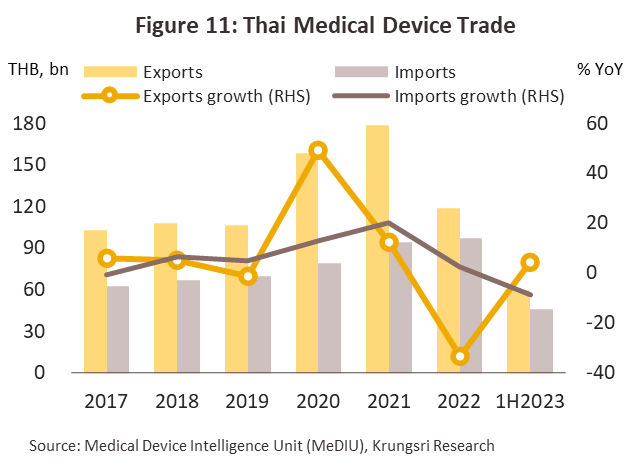

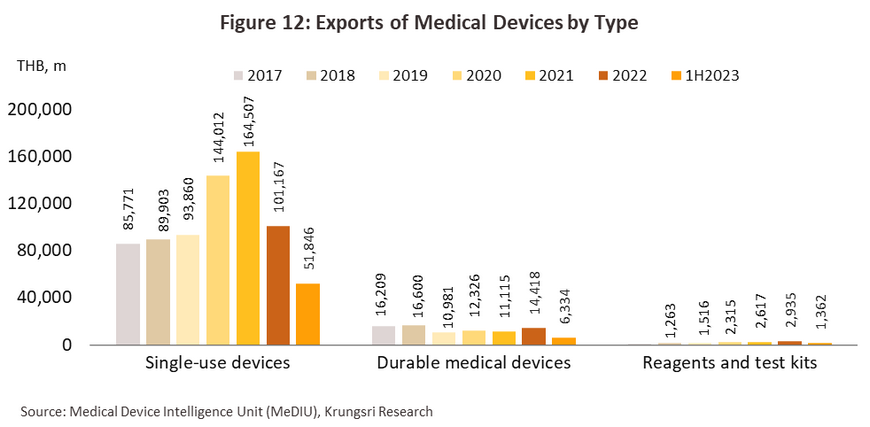

In 2022, the total value of exports of medical devices8/ stood at THB 120 billion, down -33.5% from 2021 (Figure 11), with particularly sharp declines recorded in the major markets of the US (-52.4% YoY), Japan (-22.1% YoY), the Netherlands (-13.3% YoY) and Germany (-22.0% YoY), which together represented 49.7% of the value of all exports of medical devices. Indeed, the only major market to expand was China (7.6% of exports), which enjoyed growth of 6.8% YoY. With regard to particular product groups, declines were most severe in single-use devices (85.3% of exports of medical devices by value), which crashed -38.5% YoY to generate receipts of THB 100 billion. Declines were especially notable in sales of latex or surgical gloves, which fell -72.1% YoY (down from 54.5% of sales in 2021 to just 22.9% in 2022). The sharp downturn in the outlook for the segment resulted from the stimulus effect of Covid-19 on the supply side of the market, which encouraged a rush of companies from many countries (e.g., China and Vietnam) to enter the market, such that in 2021, China overtook Thailand to become after Malaysia the world’s second most important supplier of latex gloves. Moreover, a surge in imports in 2020 and 2021 then fed into a decline in 2022, and thus exports from Thailand to the US (with almost a third of the global market, the US is the world’s biggest importer of latex gloves) crashed -92.9% YoY. In contrast, exports of durable medical devices (12.2% of exports) jumped 29.7% YoY to generate receipts of THB 14 billion, and the Trade Policy and Strategy Office estimates that exports of medical devices and equipment used in the treatment of the elderly surged 19.2% YoY. Exports of reagents and test kits (2.5% of exports) also climbed 12.2% YoY to bring in THB 3 billion (Figure 12). The 3 most important products were: (i) ophthalmic and optical devices (THB 37 billion); (ii) medical gloves (THB 27 billion); and (3) syringes and hypodermic needles (THB 16 billion).

-

-

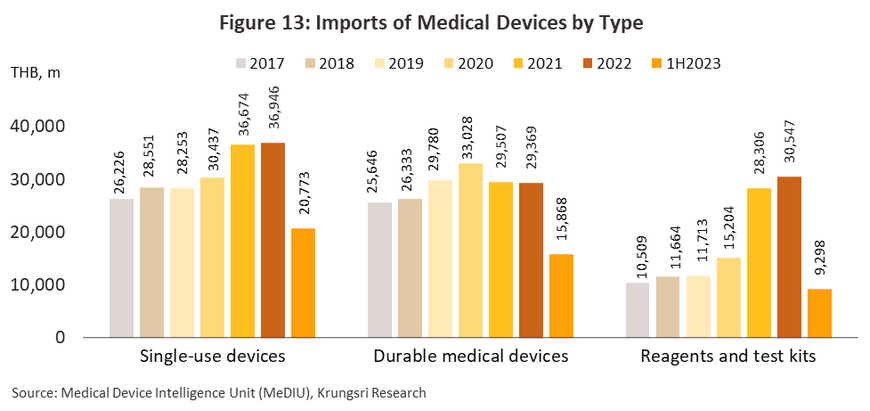

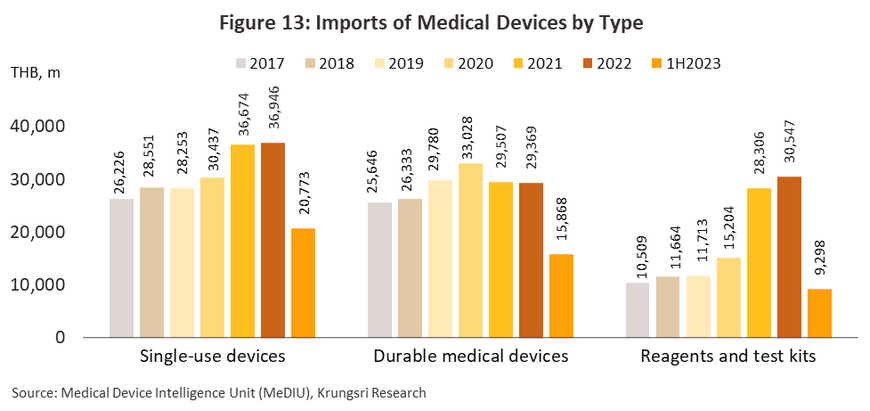

In 2022, growth in imports of medical devices8/ slowed to 2.5% YoY, purchased at a cost of THB 97 billion (down from 20.1% YoY in 2021) (Figure 11 and Figure 13). Imports of single-use devices (38.2% of imports of medical devices by value) inched up 0.7% YoY to THB 37 billion, durable medical devices (30.3% of imports) contracted -0.5% YoY to THB 29 billion, and reagents and test kits (31.5% of imports) climbed 7.9% YoY to THB 31 billion; in the latter case, demand for Covid-19 tests means that this category is now over 3-times its size in 2019. Goods that have seen ongoing growth in imports include: in vitro diagnostic devices (31.4% of imports of medical devices, up 7.6% YoY), ophthalmic and optical devices (13.7% of imports, up 14.9% YoY), electro mechanical medical devices (13.4% of imports, up 4.1% YoY), and diagnostic and therapeutic radiation devices (6.4% of imports, up 9.3% YoY). The most important sources of imports to Thailand are China (27.9% of imports of medical devices by value, up 11.5% YoY), the US (17.3% of imports, up 10.1% YoY), and Japan (5.9% of imports, up 6.7% YoY)

-

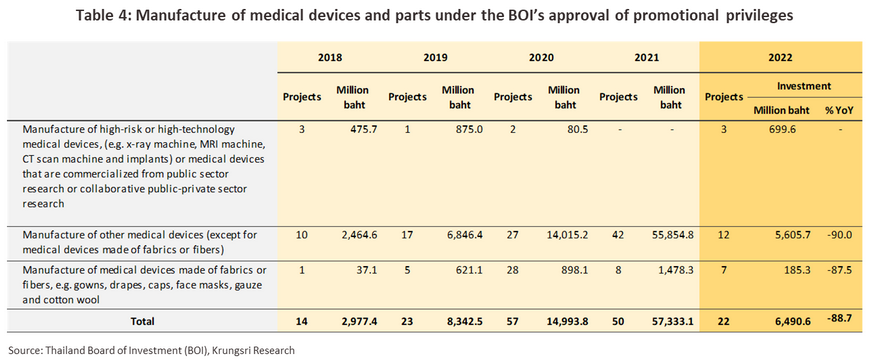

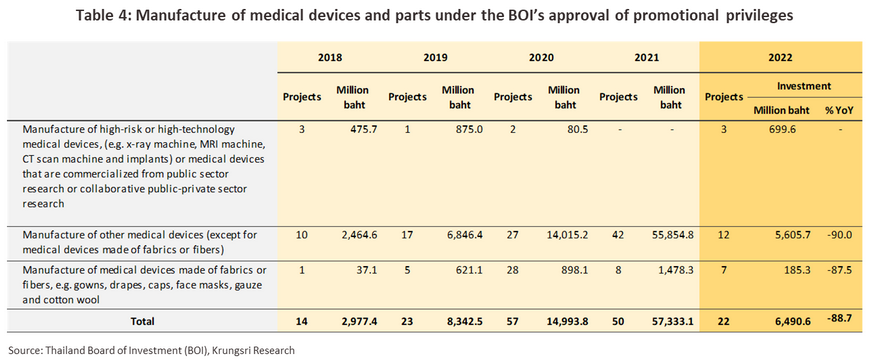

In 2022, the value of investments in the manufacture of medical devices that were approved for support by the BOI slumped -88.7% from its 2021 level. As described above, demand surged on the outbreak of Covid-19 and this then supported a significant increase in investment, meaning that baseline effects show a sharp drop off in 2022. In particular, investment in the production of ‘other’ types of medical devices (excluding the manufacture of goods from fabrics and woven materials) such as medical gloves, diagnostic kits, lenses, and disinfectants crashed -90.0% YoY to just THB 5.6 billion. Likewise, investments in the production of medical supplies from fabrics and woven materials (e.g., surgical masks, cotton swabs, gauze, and dressings) fell -87.5% YoY. However, production of high risk or high-tech medical devices (e.g., stents, dental implants, and medical disinfectants) attracted inflows of THB 699.6 million (Table 4). THB 923.8 million was directed at projects that received special support targeted at boosting investment in goods required to deal with the outbreak of Covid-19, a decline of just -1.6% from the 2021 level. This category includes goods such as pharmaceutical grade alcohol (THB 571.7 million in investments, up 24.1%YoY) and goods made from non-woven fabrics, including hygienic products (THB 352.1 million, down -26.3% YoY).

In the first half of 2023, the market continued to expand thanks to the ongoing rebound in social and economic conditions, which then encouraged the public to relax social distancing measures and to abandon the wearing of masks. The result of this has then been to increase rates of infection, (with data from 1H23 showing a 390.9% YoY surge in influenza cases). In addition, 12.9 million foreign arrivals were recorded in the period, and within this total, a proportion have sought out medical attention in Thai hospitals, while continuing infections with Covid-19 have supported ongoing demand for PPE. Beyond this, demand for medical devices from markets in neighboring countries has strengthened, and Thai manufacturers are important suppliers to these. The overall state of the industry in 1H23 is thus outlined below.

-

The manufacturing production index averaged 103.1 through the period, close to its level in 2022, while capacity utilization climbed from 2022’s 67.7% to an average of 74.5% in 1H23. Overall demand for medical devices and PPE climbed 3.3% YoY, though for medical rubber gloves and blood transfusion set this was up by respectively 5.2% and 17.4% YoY.

-

Exports of medical devices generated receipts of THB 59 billion, up 4.1% YoY on a 28.9% YoY jump in sales to Japan. 87.1% of all exports were of single-use devices, and these then brought in earnings of THB 52 billion (+5.4% YoY). Overseas sales of medical gloves improved, with 1H22’s -76.1% crash in demand softening to a decline of just -0.3% YoY, and in fact sales surged 31.5% YoY in the US and 13.8% YoY in Japan. Exports of ophthalmic equipment were also up 7.2% YoY. Export of durable medical devices (10.6% of exports) slipped -6.4% YoY to THB 6.3 billion, while exports of reagents and test kits (2.3% of exports) strengthened 10.7% YoY to THB 1.4 billion.

-

Imports of medical devices slipped -8.8% YoY to a total of THB 46 billion on a -53.1% YoY drop in purchases of reagents and test kits (20.2% of all imports of medical devices), which then carried a combined price tag of THB 9.3 billion. Within this category, imports of blood reagents crashed -52.9% YoY. Imports of single-use devices (45.2% of the total) increased 19.6% YoY to THB 21 billion, while those of durable medical devices (34.5% of the total) were also up, rising 20.6% YoY to a value of THB 16 billion. Individual product categories that have seen the strongest growth include ophthalmic and optical devices (+14.0% YoY), electro-mechanical medical devices (+18.1% YoY), and diagnostic and therapeutic radiation devices (+56.5% YoY). The main sources of imports to Thailand include the US (+12.4% YoY), Germany (+29.1% YoY), and Japan (+11.5% YoY), with only those from China falling, these dropping -53.9% YoY.

Outlook

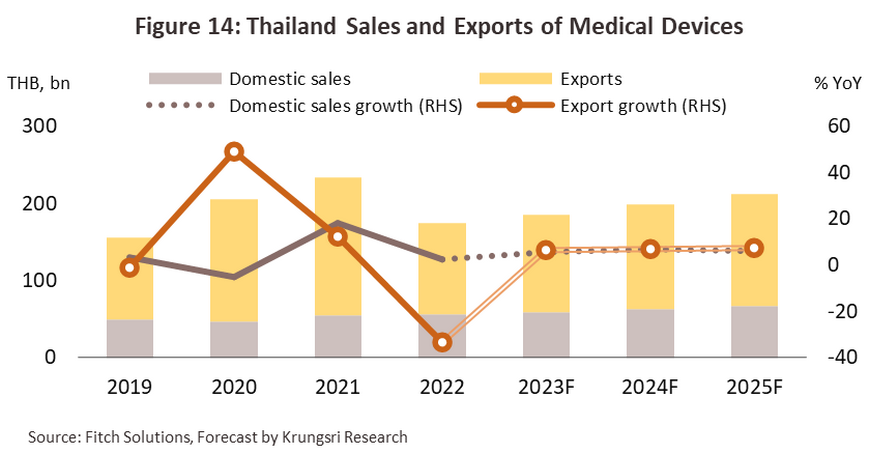

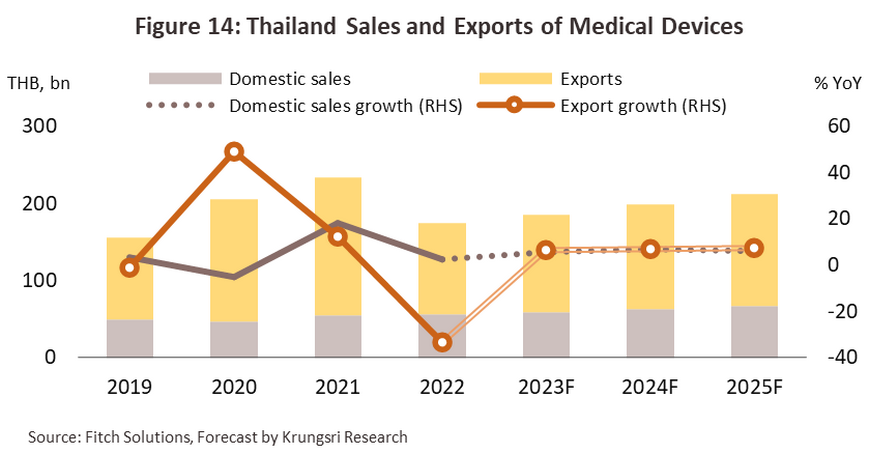

Over 2023 to 2025, the domestic market for medical devices will see solid rates of growth, and the expectation is thus that the market will expand by 5.5% in 2023 before accelerating to growth of 6.0-7.0% annually in 2024 and 2025. The market will be boosted by steady growth in the Thai economy, which will then support increased uptake of hospital services. Alongside this, tourist arrivals are forecast to return to close to their pre-Covid 2019 level by 2025, and among this total will be both travelers who incidentally need treatment and those traveling for medical care (treatment), the latter market benefiting from the widespread recognition of the quality of care available in Thailand. Beyond this, domestic sales of medical devices will benefit from growth in related healthcare industries, including beauty treatments, specialist treatment centers, and providers of comprehensive care for the elderly. Meanwhile, export value should expand by some 6.5-7.5% per year (Figure 14), helped by stronger sales of disposable PPE (e.g., medical gloves), goods such as glass lenses, and reagents and test kits. Growth in the industry will be underpinned by the following factors.

-

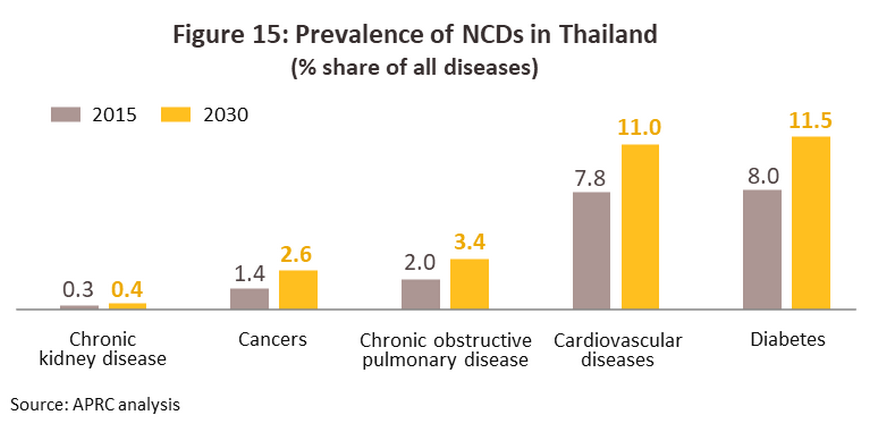

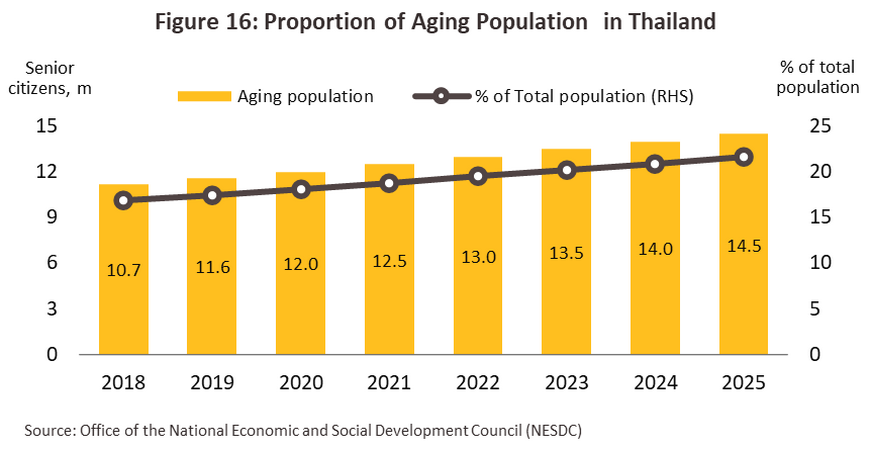

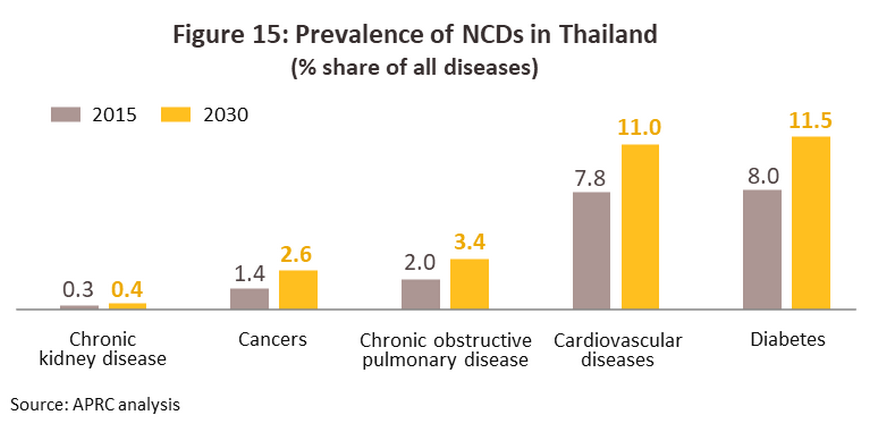

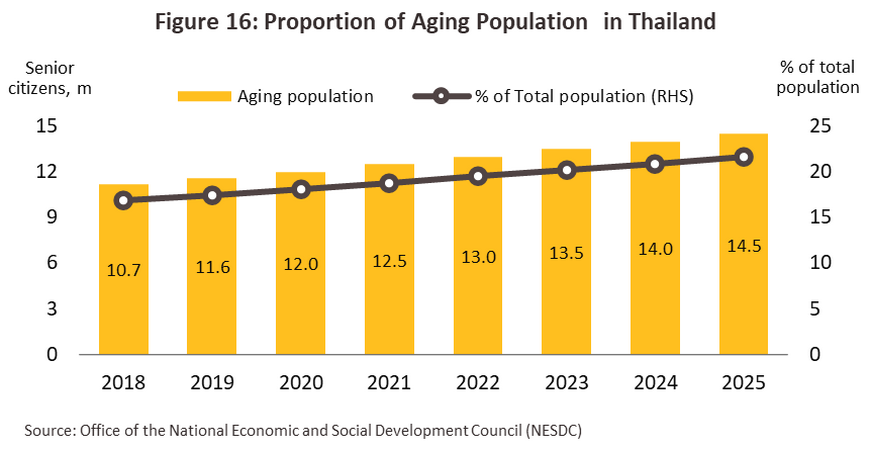

Rates of illness arising from non-communicable diseases (NCDs) such as diabetes, heart disease, strokes, and cancer will tend to track upward because of the transition to an aged society (Figure 15), which will increase demand for the treatment of complicated and/or ongoing conditions. Most common among these will be hypertension (this affects almost half of the elderly in Thailand9/), followed by diabetes, heart disease, stroke, and cancer. The Office of the National Economic and Social Development Council estimates that Thailand will become an aged society (i.e., 20% of the population will be over 60) in 2023 and a super-aged society (i.e., more than 28% over-60) by 2033 (Figure 16). As a result, demand will rise steadily for medical devices and supplies for the treatment of chronic conditions and for use by the elderly in their day-to-day lives (e.g., oxygen concentrators, nebulizers, and handrails). Beyond this, stronger demand for PPE and diagnostic kits will be driven by both newly emerging infectious diseases such as SARS, H1N1 influenza (2009), ebola, zika, Covid-19, and monkey pox, and by the re-emergence of long-standing infectious diseases such as tuberculosis and malaria.

-

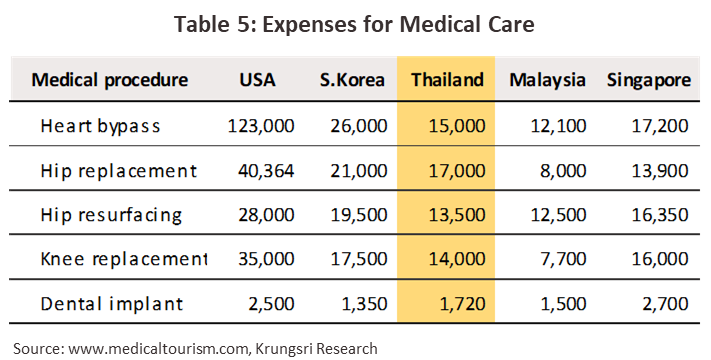

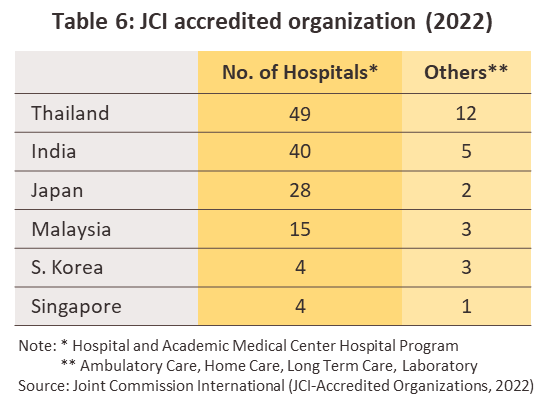

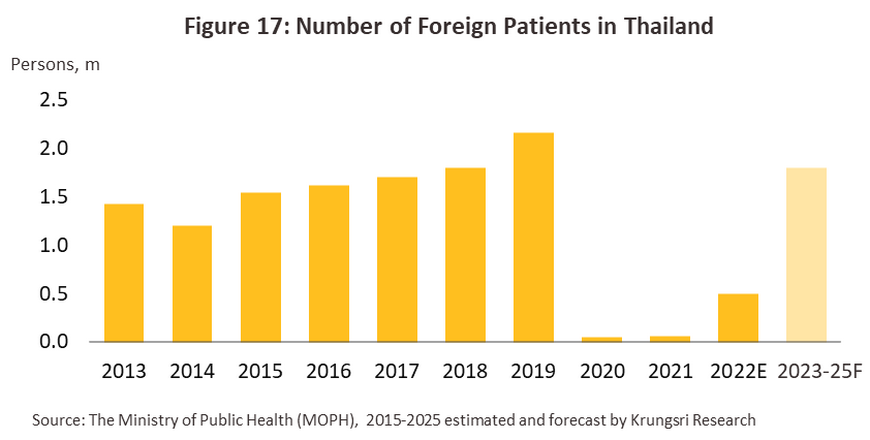

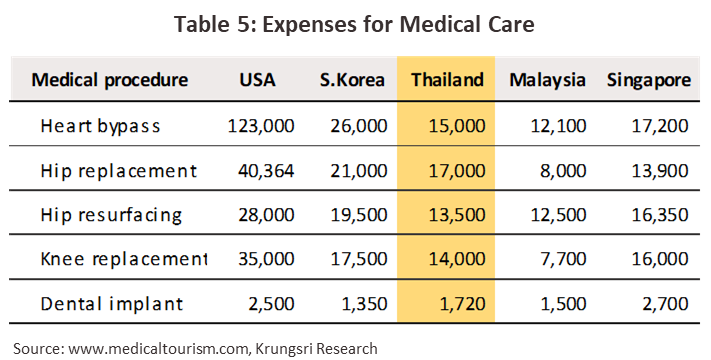

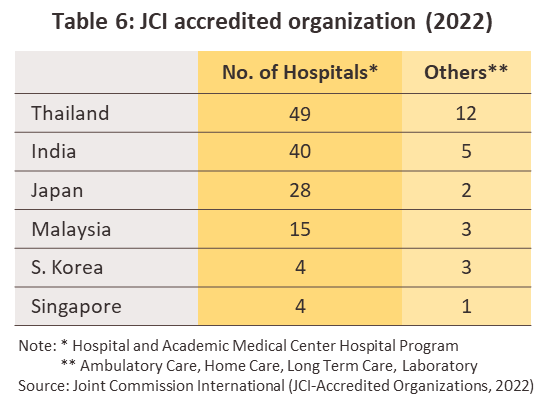

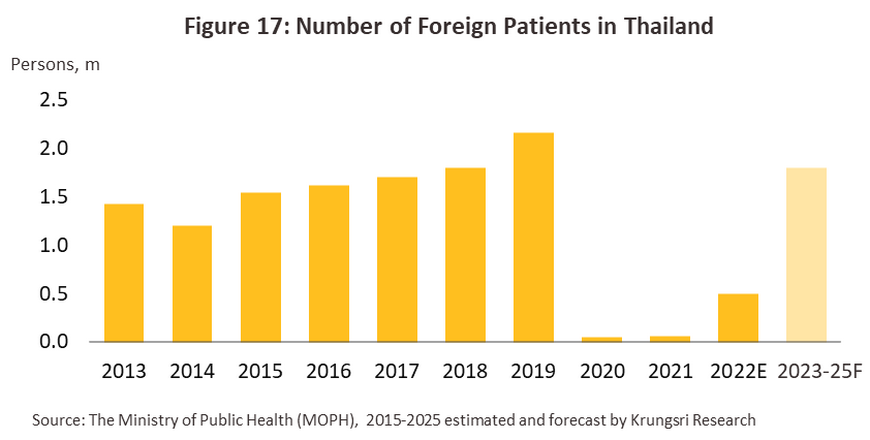

The market for wellness tourism will continue to expand, and the Global Wellness Institute estimates that globally, the value of wellness tourism services will jump from USD 4.4 trillion in 2020 to USD 11.3 trillion in 2025, this thus representing average annual growth of 20.9%. Expansion in the Thai market, which includes medical tourism, should track the global trend thanks in part to Thailand’s high quality of service (Table 5) and the relatively cheap fees charged by Thai institutions compared to those of its competitors for a similar level of service. In addition, Thailand is home to more hospitals accredited by the JCI (Joint Commission International) than its competitors (Table 6), while the Thai healthcare system was rated 5th in the world and 1st in Asia in the Global Health Security Index 2021. Particularly in the post-Covid era, this high level of global trust in the security of the Thai healthcare system will have an important role to play in attracting wellness and medical tourists to the country (Figure 17). Allied Market Research thus sees the value of the market for medical tourism in Thailand expanding from USD 9.9 billion in 2023 to USD 24.4 billion in 2027, with knock-on effects for demand for medical devices and equipment.

.

-

Trends that are feeding an increasing interest in preventive medicine and self-care will tend to gather strength around the globe, especially now that the Covid-19 pandemic has encouraged individuals worldwide to expend greater effort on preventing infection, with accompanying increases in investment in long-term healthcare and rising demand for self-directed programs. This is thus presenting another opportunity to manufacturers of medical devices to expand their markets, especially for equipment that can be used by consumers at home by themselves. Examples of the latter include portable air purifiers, disinfectants, sleep trackers, products that promote better quality sleep, and heart, blood glucose, and wrist-mounted blood pressure monitors. Growth in the market for beauty and healthcare is also supporting stronger demand for related equipment and devices, including face lasers, ultrasonic cavitation equipment, and equipment used in cosmetic surgery. Euromonitor thus estimates that globally, demand for health-related equipment will rise by an average of 5.7% per year over 2021 to 2025, above the 3.4% averaged over the period from 2016 to 2020.

-

Providers of healthcare services, especially hospitals, will tend to increase investment in expanding their operations by setting up new specialist treatment centers, opening new branches, and building new hospitals in second-tier provinces and centers of regional trade and tourism. This will allow players to extend the reach of their offerings and to meet steadily growing demand for healthcare services, thereby boosting sales of medical devices, including PPE.

-

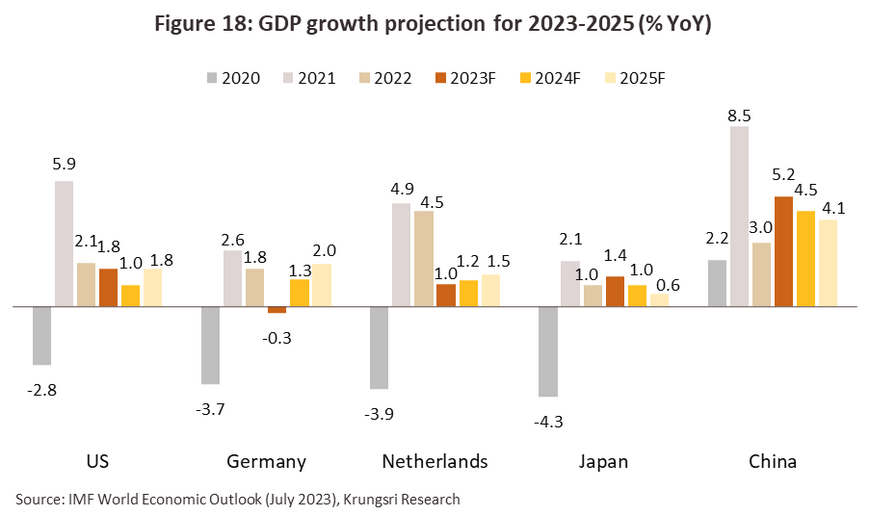

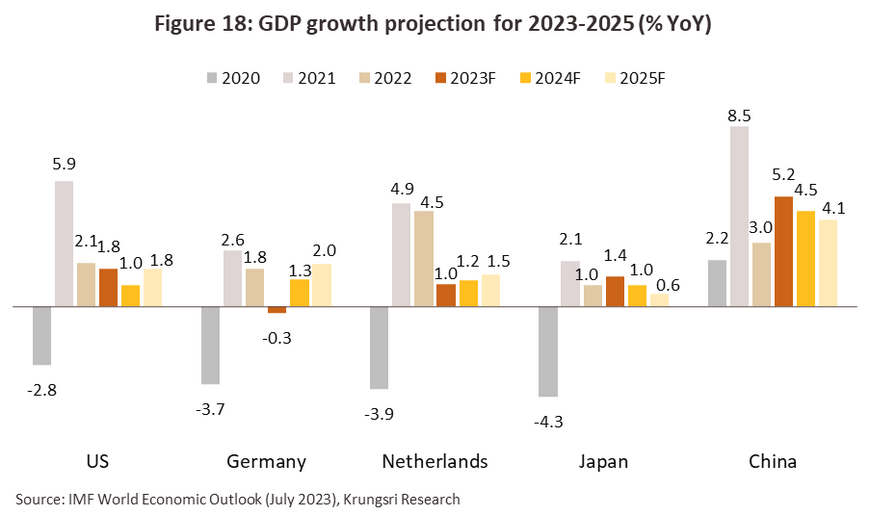

The positive outlook for economic growth in overseas markets will further benefit Thai exporters of medical devices, and the IMF expects that the economies of Thailand’s major export markets of the US, Japan, the Netherlands, China, and Germany (together the destination for 57.5% of all exports of Thai medical devices by value in 2022) will all continue to grow (Figure 18). This will then boost demand for Thai single-use devices and reagents and test kits; in 2022, exports of the latter to China and the US accounted for respectively 27.3% and 15.6% of all Thailand’s exports of these, up from 20.3% and 1.8% over 2019-2021. In Japan, growth will be seen in the market for in vitro diagnostic devices, which rose 18.7% YoY in 2022. Within the durable items, products related to the care of the elderly will perform well, including wheelchairs, dental crowns, hearing aids, and artificial joints (in 2021, exports of these expanded 34.4% YoY to generate income of USD 18.9 million, with the main markets found in the US, the UK, Germany, France, Australia, Hong Kong, Taiwan, and the CLMV countries, especially Lao PDR and Myanmar).

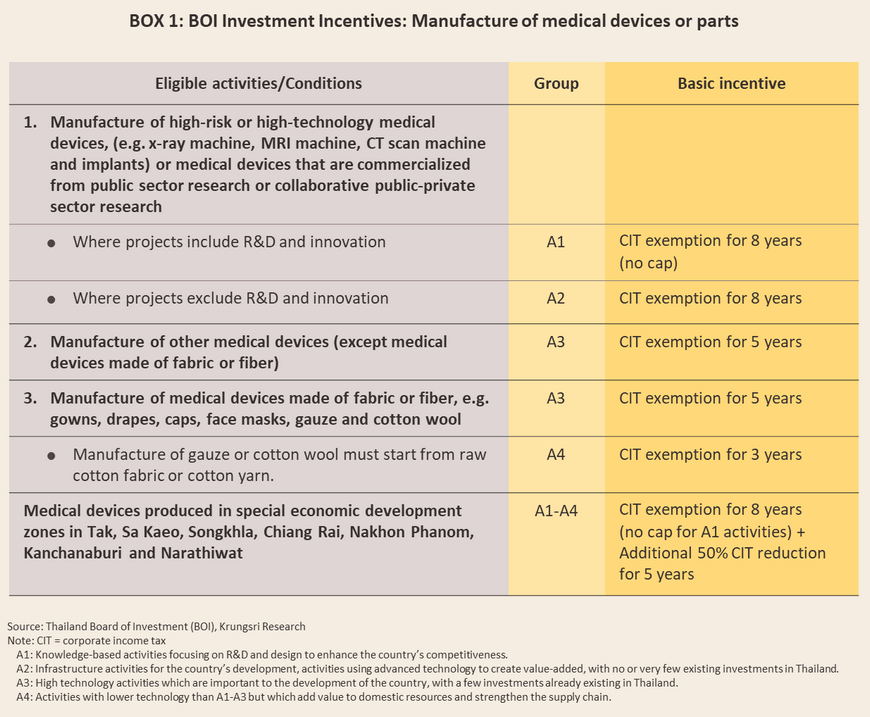

1) Medicine and the establishment of a medical hub have been included in the new S-curve industries, with a particular focus on businesses established in the Eastern Economic Corridor (EEC). 11 product categories within the broader medical devices market have been designated as targets for special investment promotion schemes operated by the BOI10/ and these are thus attracting additional investment inflows from both domestic and international sources11/. The BOI scheme offers tax breaks to manufacturers of high-risk medical devices or those that make use of new innovations and advanced technology, such as implants and X-ray, MRI and CT machines. In addition, the measures also target producers taking advantage of public-sector research breakthroughs or that partner with public-sector bodies to begin commercial operations (Box 1). Moreover, companies manufacturing medical devices that are based in the EEC or in special economic zones in Tak, Sa Kaeo, Chiang Rai, and Nakhon Phanom will also benefit from additional tax breaks (in 2021 and 2022, investment in the production of medical devices hit over THB 80 billion, up from an annual average of THB 8.09 billion in 2018 and 2019).

2) The importance of the medical devices industry has risen with the issuing of the 2021-2027 strategic plan for the development of the bio-circular-green economy (BCG). This includes: (i) enhancing the quality of medical care through the use of precision medicine, in particular by using high-tech genomics and advanced therapy medical products (ATMPs)12/, which will then pave the way to the use of other cutting edge technology; (ii) raising the potential of medical device manufacturers (most of which are SMEs) by accelerating the development of devices and materials that use mid- to advanced technology; and (iii) promoting clinical research as a way of boosting registrations of new healthcare and medical devices. Product areas that have benefited from this include digital radiography, cone-beam computed tomography (CBCT) dental scanners, and synthetic bone grafting materials. These measures will also provide players with opportunities to invest in new industrial clusters, such as the manufacture of high-end medical devices, genomics, biopharmaceuticals, and precision medicine, and this will then help to add value to the Thai medical devices industry, raise the competitiveness of Thai players (including SMEs), and develop the country as a center for the export of medical devices to global markets.

-

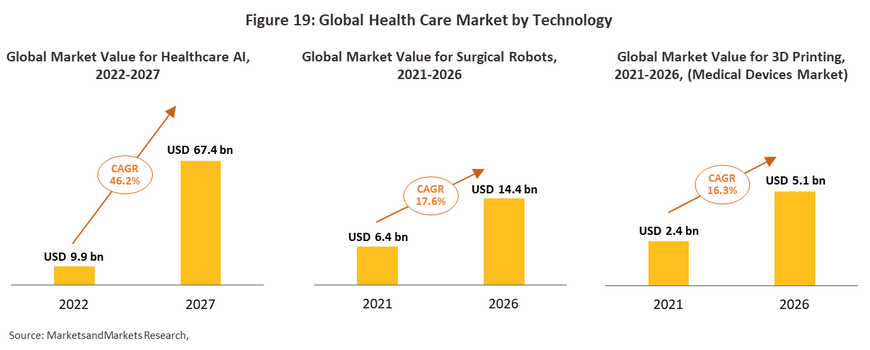

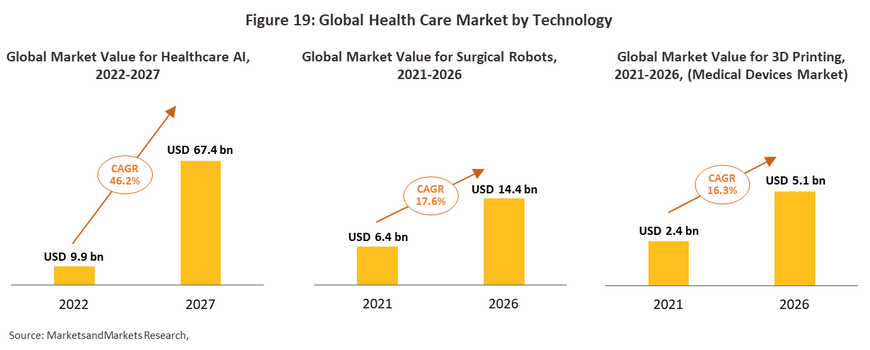

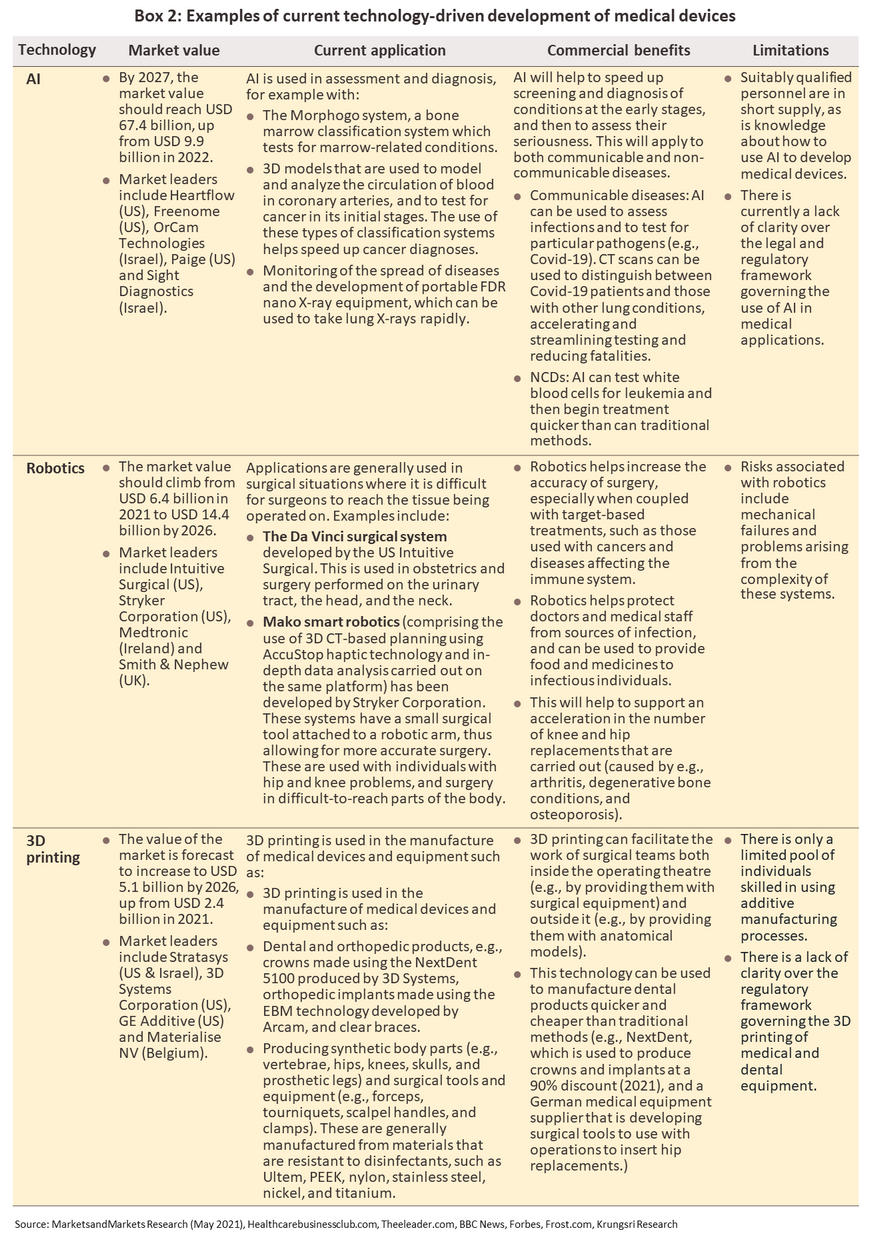

Progress in medical technology and innovation was accelerated further by the Covid-19 pandemic, and new breakthroughs have helped players to increase the value added to medical devices (Figure 19), both by finding commercial applications for new innovations and by increasing the efficiency with which conditions and diseases are diagnosed and treated13/. Key technologies that have played a role in this include the following. (i) Artificial intelligence (AI) is helping to speed up and improve assessment, diagnosis, and screening for conditions while these are still in their early stages. (ii) Robots are being deployed to assist surgeons in reducing the intrusiveness of surgical procedures. Because this then reduces the tissue damage resulting from surgery, hospital stays can be shortened, significantly cutting expenses (Thai public-sector bodies plan to expand research into medical robotics to include areas such as physiotherapy and care of the elderly and those with special needs). (iii) 3D printing is making the work of surgical teams easier by improving the production of surgical tools, anatomical models, and dental products, which can now be manufactured quicker and more cheaply than in the past. (iv) 5G and VR technologies are supporting the provision of telepharmacy services. In addition, genomic medicine and more accurate or personalized medical procedures are making it possible to plan for more individualized treatment, while in the future, a greater role will likely be found for medical robots and automated systems, AI data analytics, and 3D printing of replacement body parts (Box 2). The value of the market for medical devices can thus be expected to increase substantially in the future.

Challenges that the industry will need to face include the following. (i) Thai players are largely SMEs manufacturing single-use devices, and this then places a limit on their ability to develop high-tech production processes or goods. (ii) Thai players are also largely reliant on the import of foreign technology and machinery, and so this exposes them to risk arising from volatility in the value of the baht. The cost of imports is in addition trending upwards, while players’ ability to adjust production processes to be more focused on new innovations and technological advances may be limited by their access to capital. (iii) In the case of single-use medical products, although this can offer a high degree of protection against the transmission of disease, its use can create significant environmental problems, because although used equipment may be sterilized, the materials from which they are made are almost never biodegradable. And so, in China and India, governments are implementing policies to reduce the environmental impact of medical waste and supporting research into new materials. Managing medical waste is also a major hurdle to overcome as the industry moves towards the development of biodegradable products. This process will involve a careful consideration of the materials to be used, how these will degrade, and how materials may be recycled or reused. Nevertheless, this will mark an important step on the path towards reducing the industry’s environmental impacts and joining the global transition to a zero-waste society.

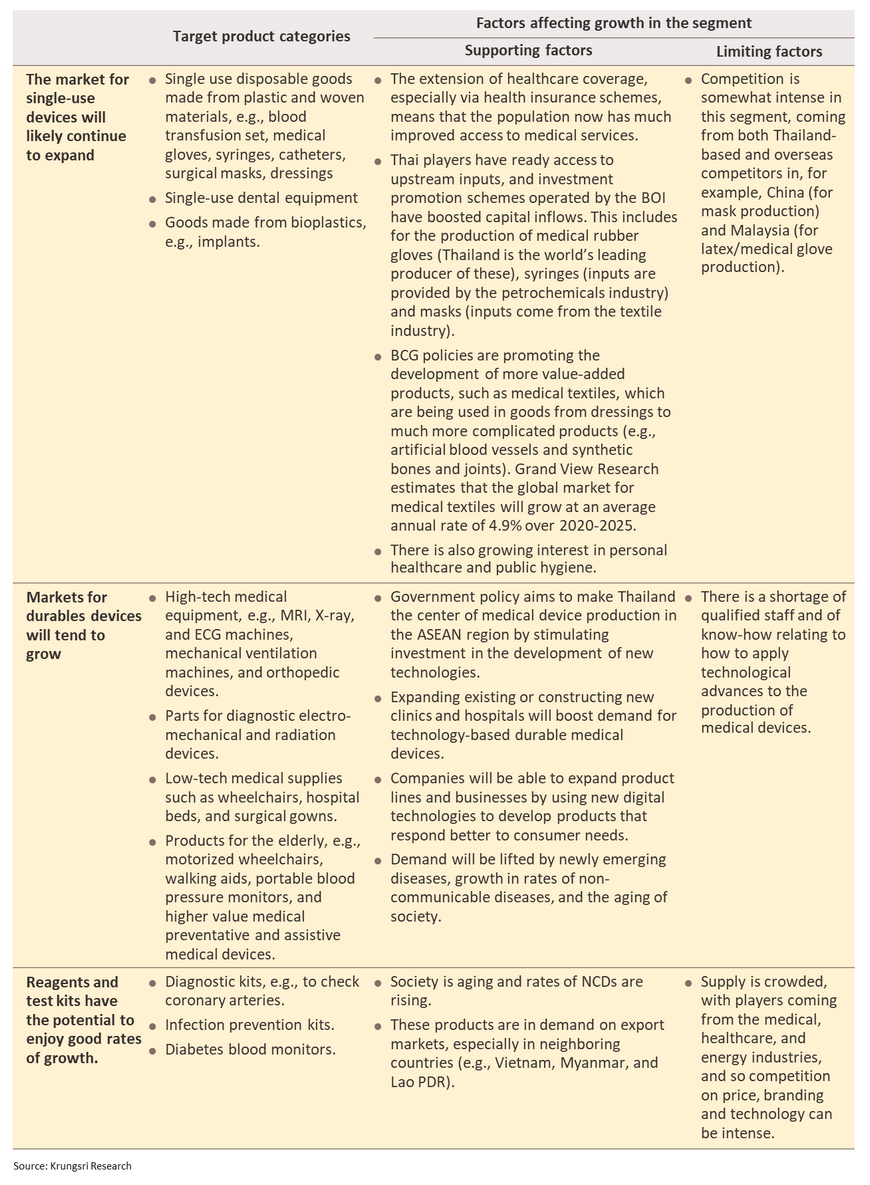

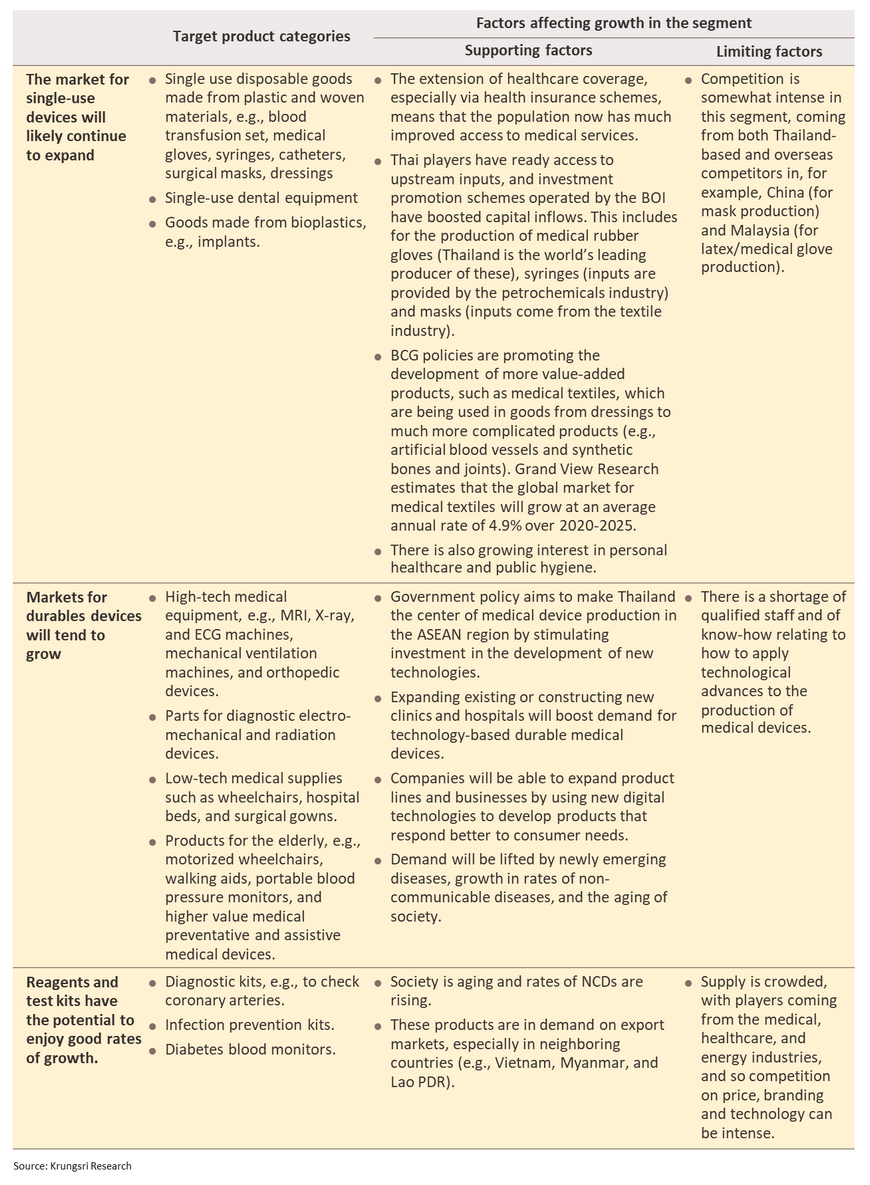

Krungsri Research sees market opportunities emerging for different segments as described below.

1/ Medical devices include items which are used in the medical, nursing and midwifery professions to provide treatments for bodily conditions such as X-Ray equipment, ultrasound machines, reagent and test kits, and dental devices. Medical equipment refers to surgical and other equipment e.g. scalpels, thermometers, blood-pressure monitors, and medical supplies such as disposable gloves and masks.

2/ Calculated from domestic sales and export value.

3/ These may be divided into: (i) devices that are used externally to the body, e.g., latex gloves worn in examinations and surgery, and syringes; (ii) devices that are temporarily inserted into the body (typically for 6-12 hours), e.g., IV tubes, feeding tubes, and dissolvable stitches; and (iii) devices that are either partially or fully implanted in the body to supplement or replace the function of an organ, or to support orthopedic or ophthalmic functions.

4/ Including dental devices and equipment

5/ Thailand’s medical devices sector operates under the legal provisions of the Medical Devices Act (2008). The Medical Device Control Division under the Food & Drug Administration is the agency responsible for regulating the sector and issuing permits to produce, distribute and import medical devices, subject to specifications and standards laid out by the Thai Industrial Standards Institute. This is aimed at assuring consumers that all medical devices in Thailand meet the same standards, and to build up the competitiveness of the sector and acceptance of Thai products in the domestic and export markets.

6/This refers to the wholesale and retail of medical products including instruments, tools, equipment, treated bandages, first-aid kits, birth control products, and pharmaceutical products.

7/ Products that are dependent on the exploitation of advanced technology and new innovations include robotic units for the observation and treatment of the elderly, bacterial and viral disinfecting robots, positive pressure rooms for use by medical personnel, negative pressure rooms for the treatment of patients, powered air purifying respirators, contactless self-service body check-ups, reduced contact basic health screening devices, and products that restrict the spread of airborne viruses such as SARs-COV-2 (the virus that causes Covid-19), HIN1 (or bird flu) and RSV.

8/ Export data collected from Medical Device Intelligence Unit, the Plastics Institute of Thailand

9/ The Ministry of Public Health states that of 9 million elderly, over 4 million have hypertension and over 2 million have diabetes.

10/ There are 11 targeted product categories within the medical devices industry: (i) products for the elderly; (ii) rehabilitation products; (iii) skincare and beauty products; (iv) innovative disposable goods; (v) implants; (vi) parts for diagnostic electro-mechanical and radiation devices; (vii) medical robotics and automated systems; (viii) dental products; (ix) telemedicine; (x) prosthetic eyes and personalized diagnostic tools; and (xi) solutions and diagnostic kits.

11/ Overseas players from a number of countries have invested in Thailand-based production facilities. Japanese companies have invested in Thailand in the manufacture of masks, blood reagents, and stents, while South Korean players have engaged in large-scale (THB 1 billion and up) joint ventures including for example the joint venture between South Korea’s Genexine Inc and the Thai Kingen Holdings to manufacture biopharmaceutical inputs to be used in place of traditional chemicals. Investors have also come from Germany, an example of which is the joint venture between HAASE Investment and Siam Bioscience to produce biological reagents and dental implants.

12/ Advanced therapy medical products (ATMPs) are high tech medical treatments used in the treatment or management of specific diseases, tailored to those conditions or to particular patients. These can be divided into 4 groups: (i) gene-based treatments; (ii) cell-based treatments; (iii) tissue-based treatments; and (iv) combination products produced from cells or tissues in combination with medical devices.

13/ The outbreak of Covid-19 forced businesses to overhaul production processes and to reshuffle supply chains. For example, some players in the chemicals, petrochemicals, and energy sectors adjusted their technological mix and their production lines to switch to the manufacture of medical devices and supplies such as sterilizing equipment, devices for handling contaminated waste, and non-woven fabrics that are melt blown into shape (these are the main materials used in the production of surgical and N95 masks, gowns and air filters), which then helped to cut reliance on imports. Domestically produced goods also include UVC sterilizing equipment that is a tenth of the price of imports, masks and other types of PPE, and non-invasive blood glucose monitors, expected to be ready for distribution in 2023

.webp.aspx)