In the period 2019-2021, the Thai medical devices sector should see average annual growth of 8.0-10.0%. This outlook is supported by: (i) government policy that aims to establish Thailand as both a medical hub and a regional center for the export of medical devices by 2020; (ii) rising rates of ill-health in the Thai population (especially from heart disease, stroke, cancer and diabetes), which, together with the steady ageing of the population, is fueling increased demand for the use of modern, high-tech diagnostic equipment; (iii) the increasing trend for non-Thais (both expatriates and medical tourists) to use Thai medical services as confidence in the standard of care rises; and (iv) the plans put in place by healthcare providers to expand and/or build new hospitals.

Increasing investment in Thailand by foreign producers of medical devices is being driven by the investment support policies of the Board of Investment (BOI), while the waiving of duties for the import of parts and materials used in research and development by manufacturers is also helping to boost investment in the sector. This may, though, increase competitive pressure for players, especially for SMEs, a category that covers the majority of operators in the sector.

Overview

The medical device sector includes both medical devices and medical equipment[1] and is considered a high-value industry. Despite unfavorable economic conditions, the sector has seen ongoing growth, partly because its products are life essentials for a population that is increasingly aged and which thus requires an increasing supply of medical products.

Medical devices can be divided into three categories according to types of use.

- Single-use devices are used in general medical treatments and generally do not rely on high-technology. The majority of these items are used once only and are then disposed of. Examples include syringes, hypodermic needles, tubes, catheters, cannulas, disposable gloves and other items used in dentistry or ophthalmology.

- Durable medical devices are used for durable medical purposes with a life-span of at least one year. Examples include first aid kits, wheelchairs, medical beds, technical equipment used in medicine, surgery and dentistry, electrical diagnostic tools, x-ray machines and so on.

- Reagents and test kits includes equipment used to diagnose illnesses and conditions and chemical kits used to test samples drawn from patients, for example, to check for blood type, in preparation for dialysis, to test for pregnancy and HIV infection, etc.

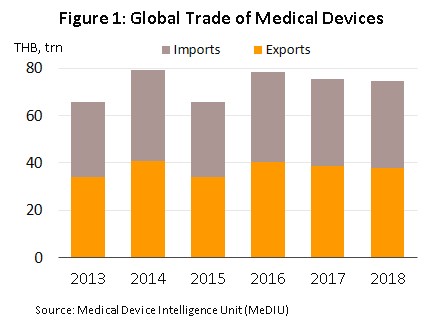

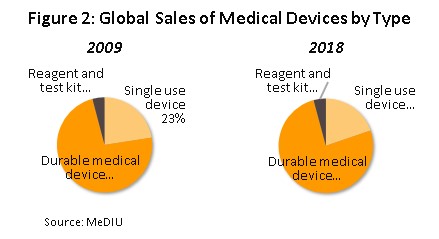

The value of medical devices traded on the global market (combined imports and exports) runs to over THB 70 trn (Figure 1). The majority of products traded are durable items, which in 2018 comprised 76% of the world total by value, up from 73% in 2009 (Figure 2). Second in order of importance is single-use items (20% of the total), followed by solutions, reagents and test kits (4%). In terms of the value of exports,

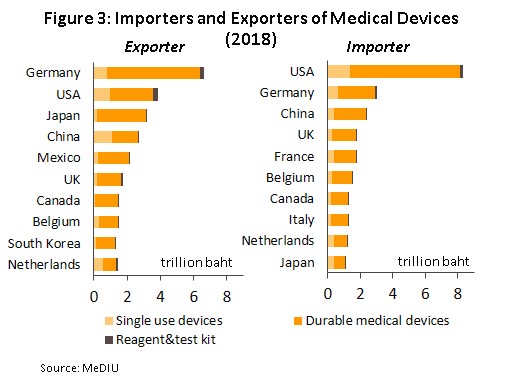

the most important countries globally are Germany, with 18% of world exports of medical devices (Figure 3), followed by the United States (with a 10% market share), Japan (8%) and China (7%).

As regards imports, by value, the United States is responsible for 23% of the total, followed by Germany (8%), China (7%) and the United Kingdom (5%). As for Thailand, the country is in 18th and 33rd place for exports and imports, respectively.

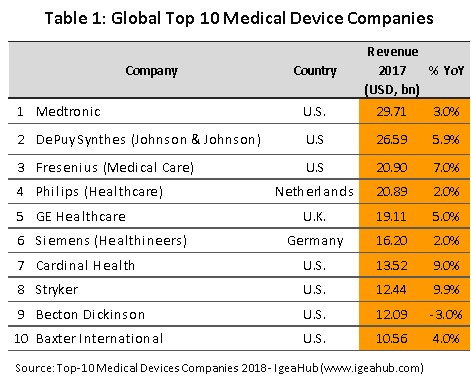

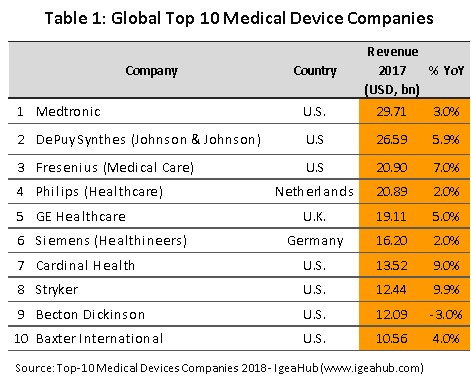

In terms of corporations, the largest manufacturers of medical appliances are multinationals (Table 1) and in terms of nations, the United States earns the most income of any country from the distribution of medical equipment and devices because it has production base scattering around the world and most of them are high-value products such as electro-diagnostic devices, orthopedic and fracture devices, x-ray equipment, and dentistry devices. Within Europe, important producers include Germany, France and the United Kingdom. Germany in particular is regarded as a source of high-quality goods and an important innovator of new products.

In the Asia-Pacific region, Japan is the leading producer of medical devices and has seen continuing growth in exports. With a 8.0% share of the global market, Japan is the world’s third most important exporter thanks to its position as the leading high-tech innovator in Asia and the recognition which Japanese products enjoy worldwide. Japan is followed in importance by China (fourth in terms of global exports with a 7.0% market share), though Chinese medical devices, like those produced in the ASEAN zone, tend not to be high-tech products and in fact almost all high-tech medical devices which are consumed on the Chinese and ASEAN markets are imported from producers in countries such as the United States, Germany and Japan.

Thailand’s medical device sector currently, operates under the legal provisions of the Act on Medical Devices (2008). The Medical Device Control Division under the Food and Drug Administration acts as the agency responsible for overseeing the sector and for issuing permits to produce, distribute and import medical devices according to the specifications and standards laid out by the Thai Industrial Standards Institute. This was with the goal of assuring consumers that all medical devices on the Thai market meet the same standards and to help build both the competitiveness of the sector and acceptance of Thai products on the domestic and export markets.

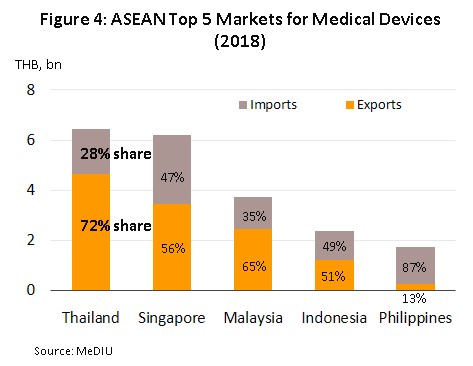

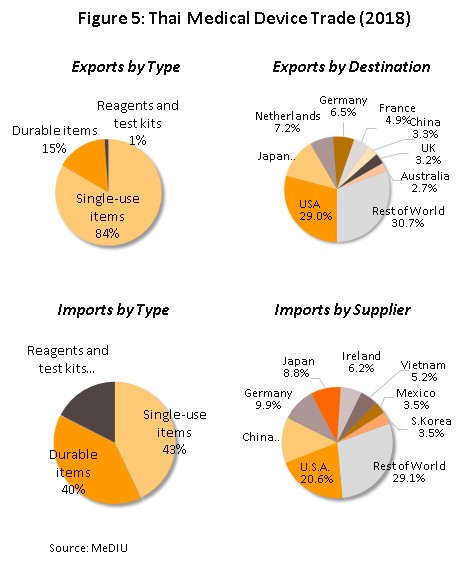

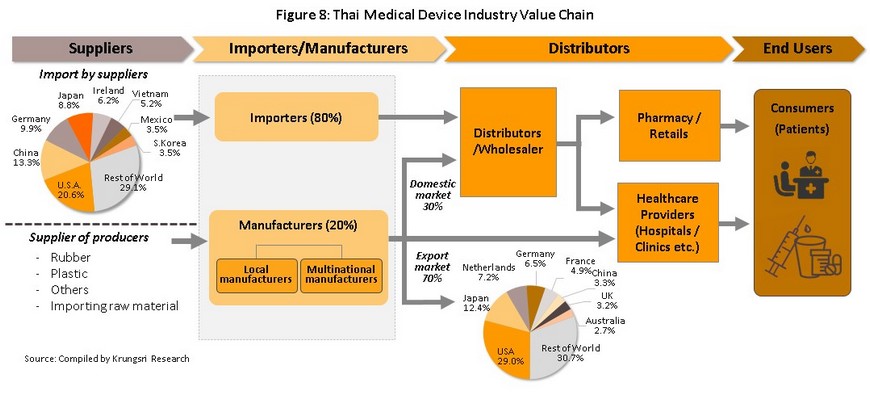

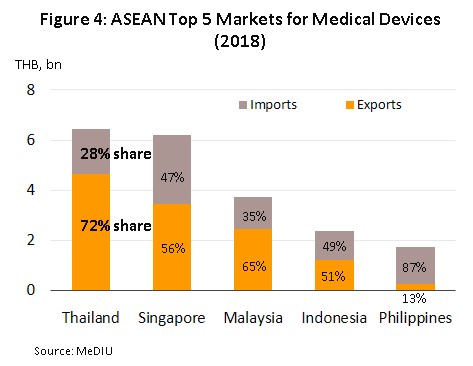

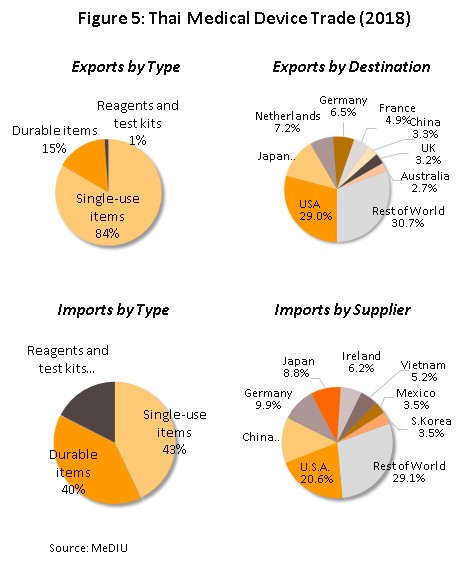

Regionally, Thailand is the most important importer and exporter of medical devices (by value) in the ASEAN zone; the value of Thai exports and imports are split in the ratio 72:28 (Figure 4). Most medical devices produced in Thailand for export fall into the category of single-use devices and in fact, 84% of the value of all medical supplies exported are in this group, which includes disposable medical rubber gloves, catheters and medical tubing, syringes and hypodermic needles, and bandages and dressings. The majority of manufactures and exporters are foreign-owned companies that produce in Thailand for export back to their home countries (for example to Japan, the United States and France). The most important export markets for Thai producers of medical equipment and supplies are the United States (responsible for 29% of all exports of Thai medical supplies by value) followed in order of importance by Japan, the Netherlands, and Germany. With regard to imports, these are mostly single-use devices and durable medical devices (e.g. ultrasound equipment, x-ray machines, electrocardiogram (ECG) and electroencephalogram (EEG) monitors, and ophthalmological equipment) which at respectively 43% and 40% of imports, are roughly equivalent in importance. The United States is the biggest supplier of medical goods to Thailand, providing 21% of all imports, followed by China, Germany and Japan (Figure 5).

The domestic medical device sector is focused primarily on manufacturing for export markets; roughly 70% of the sector’s total sale value comes from exports and only 30% from the domestic market. The sector’s primary output is of basic goods which use raw materials and inputs such as rubber and plastic that are available on the domestic market. These goods may be classified according to their use, as follows:

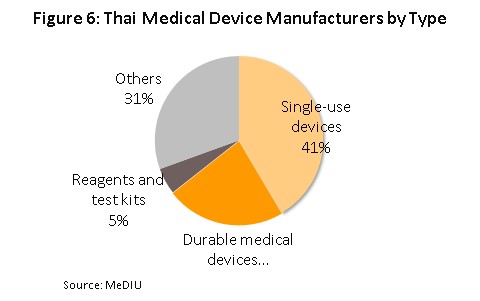

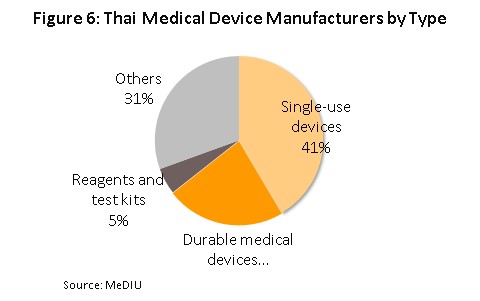

- Single-use devices: The production that Thailand has high potential in terms of production and competition in the world markets include medical gloves since the production of these relies on non-sophisticated technology and Thailand is also an important world producer of rubber, the major input into the production of disposable gloves. Over 90% of the output of medical gloves is bound for export markets, and operators have enjoyed continuously growing demand. Within the single-use devices group, syringes and hypodermic needles are the second most important product. Manufactures of these benefit from the fact that production uses plastic as the main input, costs are not particularly high, and these are widely used products. Overall, according to a survey by the Plastics Institute of Thailand, the single-use devices represent around 55% of the total domestic medical device producers (Figure 6).

- Durable medical devices: Within this group of products, items such as hospital beds, examination tables and wheelchairs are the most important for Thai producers and exporters because manufacturing these goods does not require the use of advanced manufacturing technology. This type accounts for 23% of the total domestic device producers.

- Reagents and test kits: The domestic market for these goods is still somewhat small so only 7% of total manufacturers in this industry, most are joint ventures with multinationals that are interested in entering the Thai market. Examples of items produced in Thailand include diagnostic kits to test for diabetes, kidney disease, and hepatitis, although in the last 1-2 years Thai operators have increasingly produced and exported diagnostic kits to test for serious non-communicable conditions found in the elderly.

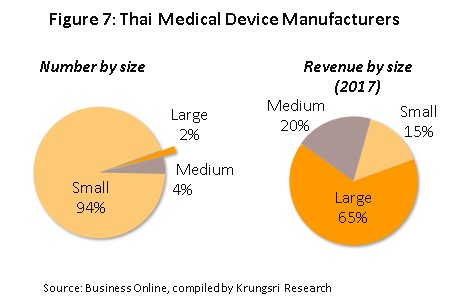

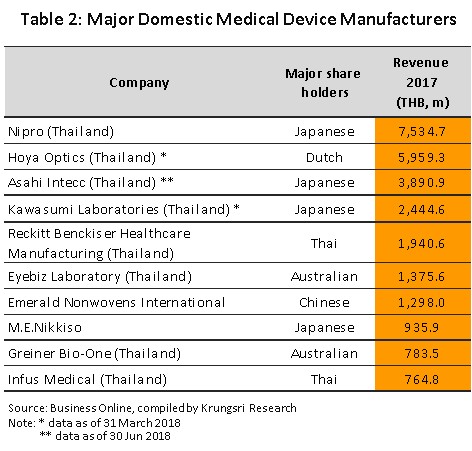

A total of 594 producers of medical devices are registered with the Department of Business Development[2] (Business Online, 2018). Of this total, 584 or 98% are SMEs and only 10 (the remaining 2%) are large-scale operations, In 2017, large-scale producers’ combined revenues accounted for 65% of total revenues of the sector (Figure 7). Many of these producers are multinational companies, examples of which include Nipro (Thailand), Hoya Optics (Thailand), and Kawasumi Laboratories (Thailand) (Table 2). Data from the Food and Drug Administration indicates that there are over 2,000 registered importers of medical devices. As shown in Figure 8,

distribution channels of manufacturers and importers take the following forms:

- Direct distribution to healthcare providers: This type of distribution includes public- and private-sector hospitals and clinics Sales of medical devices to public-sector hospitals is carried out according to government procurement procedures. The Ministry of Finance has changed the old purchasing system, under which purchases up to THB 0.1 m took place under the ‘agreed price’ procedure, between THB 0.1 m and THB 2 m the ‘price checking’ mechanism was in effect, and when a purchase was for a value of over THB 2 m, competitive bidding was arranged. This has now been replaced with an e-bidding process. Private-sector hospitals make purchases according to their own procedures.

- Distribution to intermediary companies, representatives or to shops: This type of distribution may be to companies which are part of the same commercial network as the producer or importer, or to general shops as a way of reaching target customers in the country. Players in this group typically have some knowledge of healthcare and so are able to exploit a range of distribution channels.

- Distribution on export markets: The majority of goods distributed in this way are single-use devices bound for the main markets of the United States, Japan, and Germany. A major player in this group is the Thai Rubber Latex Corporation, which exports disposable latex medical gloves.

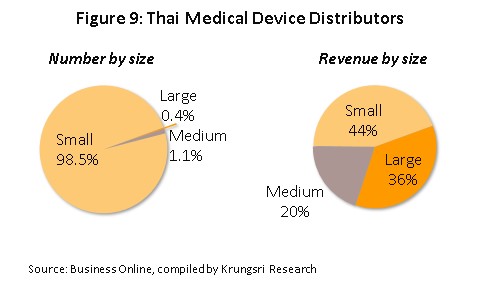

As regards distributors of medical devices in Thailand, there are over 10,000 wholesale distributors and agents and retailers[3]. Again, almost all (99.6%) of these are SMEs (Figure 9) and combined, these take over 60% of income. Major distributors include Zuellig Pharma, Pharmahof, Proctor and Gamble Trading (Thailand), Bionet-Asia, Biogenetech, Medtronic (Thailand), B. Braun (Thailand) and Technomedical. Within this group, competition is fairly strong since there are only low barriers to entry and products tend to lack distinguishing features, making it easy for consumers to switch to products sold by competitors.

Opportunities for profit-making on the Thai producers and importers of medical devices are somewhat limited for a number of reasons. (i) Distributors focus on sales to government-funded hospitals, which entails competitive bidding and this exposes operators to competition on price. (ii) The majority of medical equipment that is imported has a long lifecycle and so new replacements are sourced only infrequently. (iii) Producers and importers of raw materials, parts, and equipment face increased costs as a result of currency hedging, while at the same time, the costs of imports fluctuate in line with changes in technology and innovation and this tends to have an impact on profitability.

The growth of the sector depends on expansion in the provision of healthcare and on support from the government. At present, and to the benefit of the sector, the latter is taking more concrete form with the Board of Investment’s offering of tax incentives to investors in the manufacture of medical devices. In addition, the medical device sector is one of the ‘new S-curve’ industries and as such it is the beneficiary of government support for investment in the Eastern Economic Corridor (EEC). The government also plans for the country to become a medical hub and a center for the export of medical devices to the CLMV countries, which are seeing increasing demand for medical devices. Beyond this, the 12th National Economic and Social Development Plan (2017-2021) specifies the manner in which the medical device sector should develop in order to coincide with the 20-Year National Strategy. Under this, at first, emphasis is to be placed on the development of capabilities in the sector in areas which see high levels of domestic demand and which do not require the mastery of complicated, advanced technologies. This move has attracted the interest of investors, who are increasingly investing in the sector, although the outcome of this is that competition has also increased, driven up by growth in the number of operators.

Situation

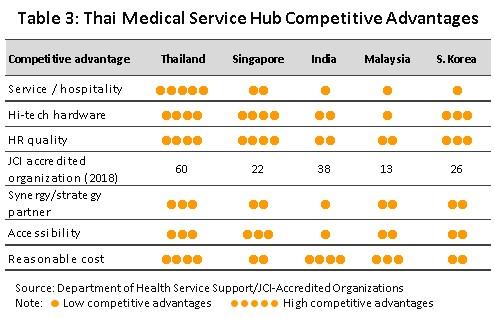

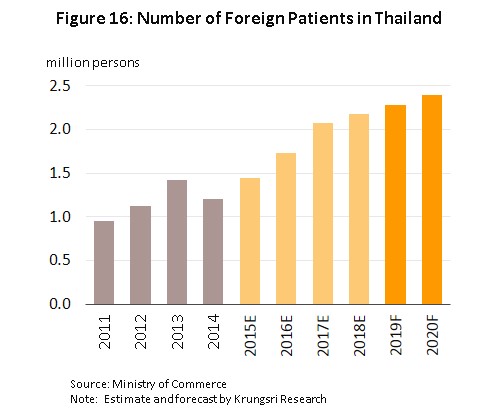

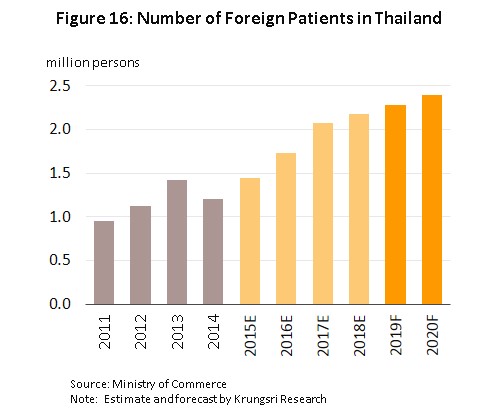

Medical devices production in Thailand gains from the advantages it enjoys in the quality of service, the standard of treatments (Table 3), and government supporting policy towards becoming a medical hub. Which has been in place since 2003, has helped to support continuous growth in medical tourism. In 2017, over 2 million foreign patients received treatment in Thai hospitals[4], up from 1.4 million in 2015. In addition, the decision by the government to establish Thailand as a hub for the export of medical devices to the region (the so-called CLMV nations, which are seeing demand for these goods grow steadily) had the effect of stoking the growth of both the domestic and export markets. Thus, over the 5 years from 2013 to 2017,

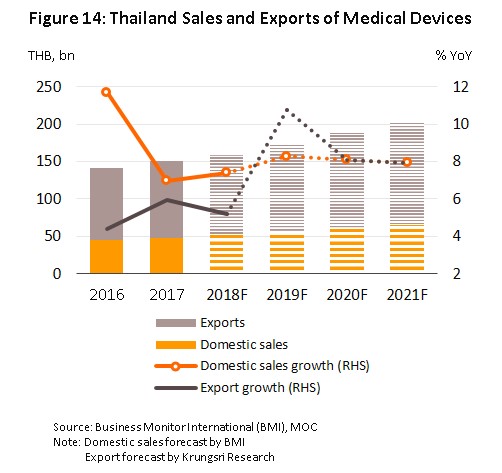

sales within Thailand and to export markets (which are split approximately 30:70) grew by a yearly average of approximately 9.0% and 5.7%, respectively.

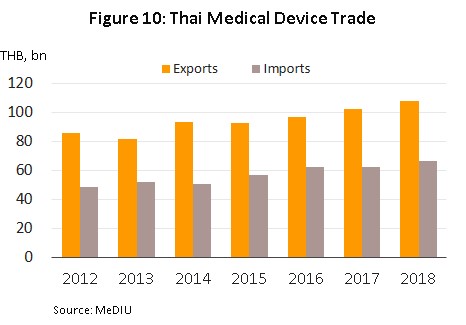

In 2018, the domestic sales grew in value to THB 51.3 bn, an increase of 7.4% YoY, itself an increase on the 7.0% growth in 2017. Exports also rose in the year and these had a value of THB 107.7 bn, up 5.2% YoY, though the 2018 rate of expansion slowed slightly from 2017’s 5.9% YoY growth in the market (Figure 10).

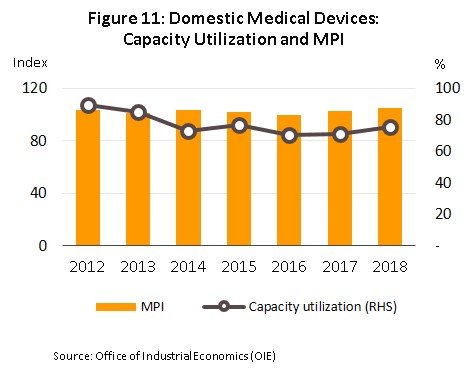

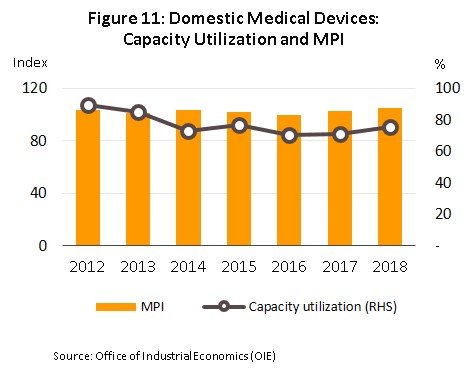

The quantity of medical devices produced within Thailand has risen steadily in step with this increasing demand from domestic and international markets. Growth has been particularly strong in the reagents, solutions and diagnostic kits segment, an area that has especially solid potential given the government’s policy for developing exports, supporting research and establishing Thailand as a center of upstream production of these goods. In 2018, then, capacity utilization for the sector stood at 75.6%, up from the 70.9% recorded in 2017, while manufacturing production index for medical device rose from 102.5 in 2017 to 104.9 in 2018 (Figure 11).

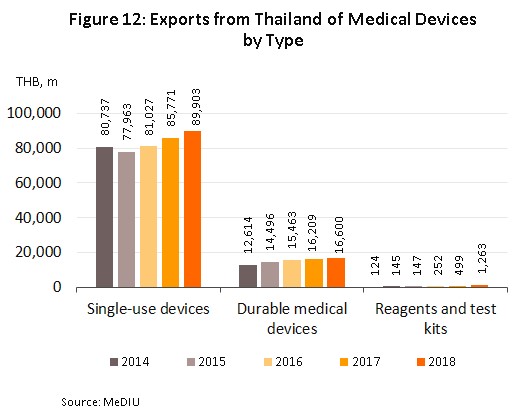

In 2018, exports of medical devices[5] grew 5.2% YoY to a total value of THB 107.76 bn on growth in the primary export markets of the United States, Japan and Germany (which together comprise 48% of the value of all Thai exports of medical devices) of 4.5% YoY. With regard to the different product groups, single-use devices, which with 83.4% of the value of all exports is by far the most important group, had a value of THB 89.90 bn, up 4.8% YoY. In second place was durable medical devices (15.4% of the total export value) with a value of THB 16.60 bn, (+2.4% YoY) and in third place was reagents, and test kits but although this product group contributed only THB 1.26 bn to exports, this segment saw growth of 153% YoY and so its share of the total has jumped from 0.5% in 2017 to 1.2% in 2018. In particular, exports of reagents, and test kits to Japan have seen explosive growth of 590% YoY, thanks to Japanese companies using Thailand as a production base for the export of finished goods back to Japan, where the aging of Japanese society resulting in increasing demand for these items.

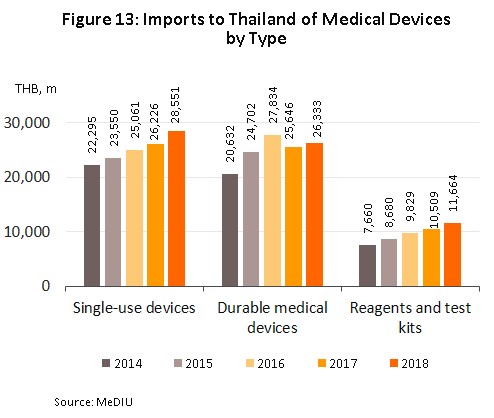

As regards imports of medical devices5/ in 2018 these had a value of THB 66.54 bn. This represented an increase of 6.7% YoY and was a turnaround on the 0.6% YoY contraction recorded the year earlier. Imports of single-use devices (which comprises 43% of the value of all imports of medical supplies) had a total value of THB 28.55 bn (up 8.9% YoY). Behind this came durable medical device (40% of all imports) with a value of THB 26.33 bn, an increase of 2.7% YoY and a turnaround on 2017’s 8.0% YoY decline (Figures 12 and 13) and in third place was the reagents, and test kits group (18% of imports), for which imports grew by 11.0% YoY to THB 11.66 bn. The largest group of imports to Thailand originated in the United States, Germany and Japan, which together supplied 39% of all imports, by value. In the year, imports from these countries grew by 2.5%, following a fall the year earlier, while imports from China (13% of the total) rose 15.7% YoY.

Outlook

For the period 2019 to 2021, the expectation is that combined sales to domestic and export markets will support annual sectoral growth of around 8.0-10.0% (Figure 14). A number of factors relating to both government policy and growth in supply and demand will help to underwrite this outlook.

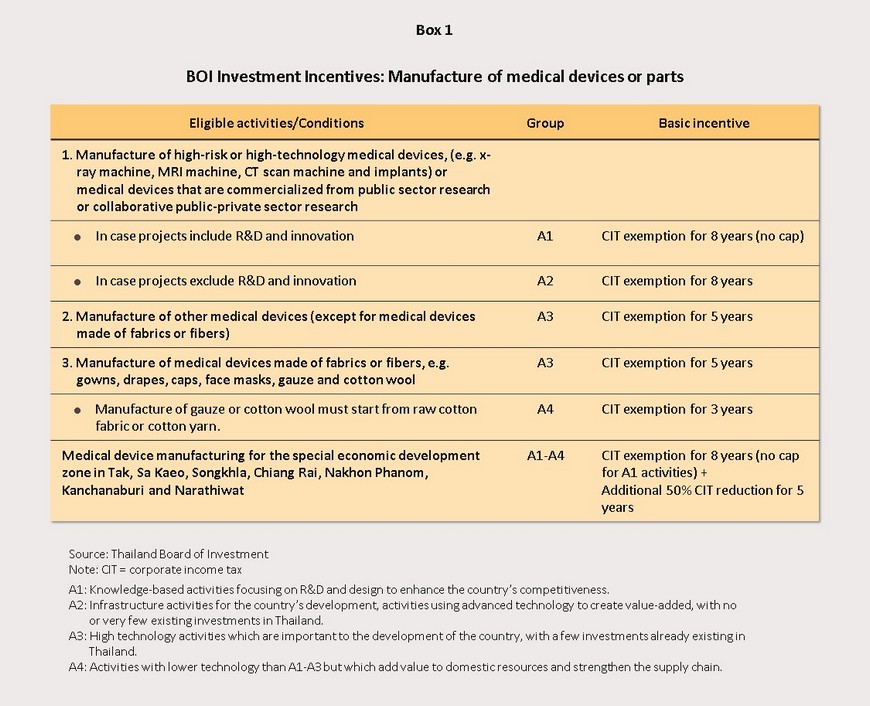

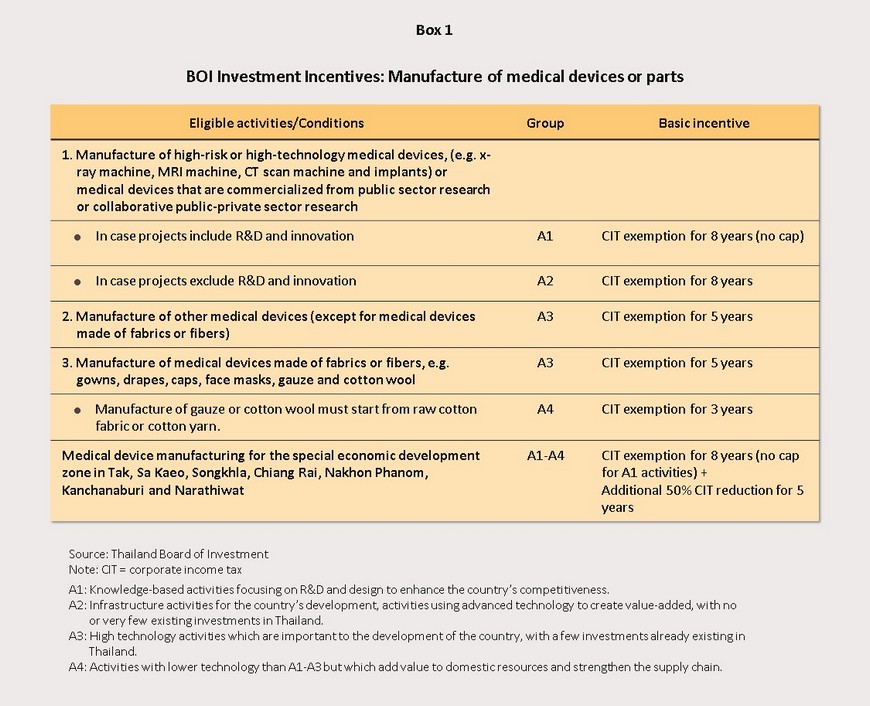

1) The government has put in place policies to support the sector in the form of special tax privileges for investors in the medical devices sector and for importers of medical equipment or components. This includes equipment the use of which poses a certain degree of risk to patients or that uses advanced technology, such as machinery for taking X-rays or for running MRI or CT scans, implants, or that takes government-backed or joint government-private sector research and finds commercial applications for this. Investors in research and development and in new innovation will also be eligible for exemption from corporate tax for 8 years, with no financial cap on this tax waiver. In addition, manufacturers of medical devices that are based in special economic zones (SEZs) in the provinces of Tak, Sa Kaeo, Chiang Rai and Nakhon Phanom will in addition be eligible for a further 5-year 50% reduction in corporate tax (see page 7 for details).

The government’s plans to establish Thailand as an ASEAN medical hub and a center for the export of medical devices by 2020, and the sector’s designation as one of the ‘new S-curve’ group of industries and with that, its inclusion in investment promotion strategies, especially those targeting the Eastern Economic Corridor, will also underpin increased investment and rising exports to neighboring countries.

2) Levels of ill-health in the Thai population, particularly of the patients with certain disease such as heart disease, strokes, cancers, and diabetes tend to continue to increase, as well as the

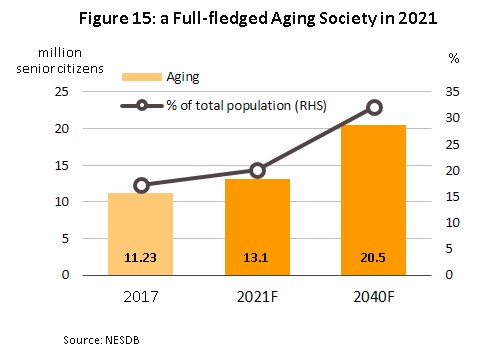

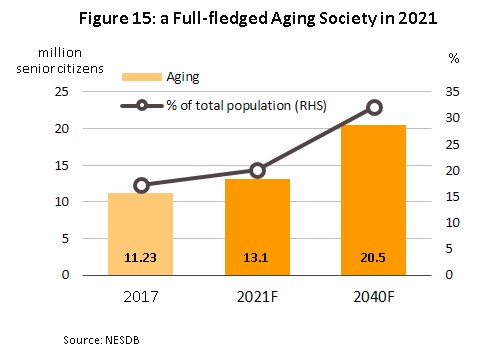

increasing number of elderly in Thai society (Figure 15). This will support increased demand for healthcare and for high-technology interventions. This rapid aging is seen in the fact that the Office of the National Economic and Social Development Board estimates that the number of elderly increase from 11.23 million individuals in 2017 to 13.1 million by 2021. in Thailand (defined as those over 60) is expected to In addition, the elderly’s medical expenses are expected to surge to THB228 bn (2.8% of GDP) in 2022 from THB63 bn in 2010 (2.1% of GDP) (source: the National Health Development plan 2017-2021).

3) The number of foreign patients seeking Thai medical treatment is likely to pick up. Thailand has comparative advantages in terms of the quality and standard of treatment when compared to its competitors in the ASEAN region. In 2016, 6.9% of all patients treated in Thai hospitals were non-Thais, and the number of foreign patients seeking treatment in the country is tending to grow steadily. A portion of these patients were people who were working or living in Thailand (the expatriate market) or in neighboring countries, but about 80% were either general tourists who were in the country already or were medical tourists. It is forecast that following growth of approximately 5.0% in 2018, for 2019 overall, the number of foreign tourists seeking treatment in Thai hospitals are expected to grow by 5.0% again, and then by another 8.0% in 2020 (Figure 16). This growth in the market for treatments will naturally then feed into greater demand for medical devices.

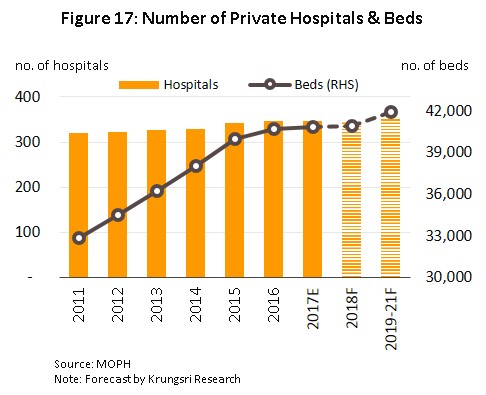

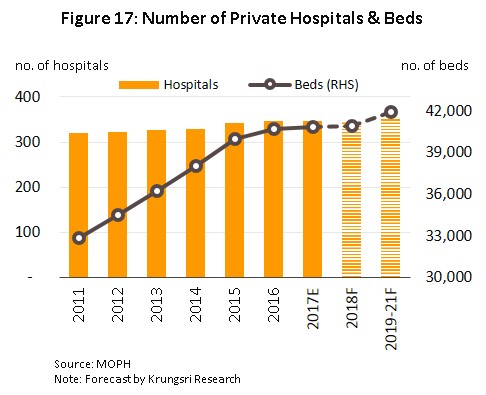

4) To meet growing demand from Thai and foreign patients, Thai operators have plans to expand investment in new hospitals and in new medical equipment, especially in specialized treatment centers for complicated conditions. Larger operations are in particular expecting to increase the number of branches which they run in order to serve a greater number of customers and so over the next three years, (for examples, Bangkok Hospital had plans to have 50 healthcare centers operating by the end of 2018, up from 45 in 2017, while Bumrungrad Hospital is developing its new Phetchaburi Tat Mai branch, which it hopes will be in operation by 2020.) The outcome of this is that the number of hospital beds, and the number of hospitals, will tend to rise steadily. Thus, by 2021, it is expected that there will be a total of at least 1,000 new private hospital beds available, adding to the existing supply (as of 2018) of around 41,000 beds. (Figure 17).

In terms of market openings and export opportunities, producers of durable medical devices, reagents and test kits should see continuing growth, especially reagents and test kits for coronary artery disease which are major products seeing the biggest growth. In addition, demand for such products has risen due to the government’s policy to support new hospital investment and to encourage health checkup in community and Mobile Check Up. At the same time, there are at present only a few domestic producers and other ASEAN countries lack production facilities, so this represents an opportunity for Thai operators. For those producing single-use devices, steady growth will also continue, helped by the increase in the provision of healthcare services and the fact that single-use devices such as disposable gloves and syringes.

Competition is likely to be more intensified as investment by foreign manufacturers expands in response to BOI investment promotion strategies and the waiving of import duty on parts and raw materials for use in research and development (in 2018, a total of 14 projects with a value of THB 3.6 bn applied for investment support compared to 7 projects worth THB 2.2 bn in 2017). Investment in the sector and to help secure Thailand’s position as a medical hub, including those aimed at the elderly, innovative single-use device, implants, and parts for electrical and radioactive diagnostic equipment. Japanese operators are in particular interested in continuing to use Thailand as a manufacturing base. This may therefore increase levels of competition. Simultaneously, large operators will need to import manufacturing equipment and will therefore face financial risks from exposure to currency fluctuations and from changes in costs arising from shifts in technology and innovation. This will be especially so for goods which have to be held in stock and these factors will all tend to put downward pressure on profits.

Krungsri Research’s view

Income for manufacturers and distributors of medical devices is likely to grow at a rate similar to that which has prevailed recently. Operators would be able to make a profit amid higher competition.

- Manufacturers of medical devices: Operators in this group are likely to earn continuing profit with good performance despite rising levels of competition. Manufacturers which supply hospitals, especially private-sector hospitals plan to invest in new buildings and equipment, will be at the higher end of the scale. On the positive side, government support for the development of the Eastern Economic Corridor and the building of Thailand as a ‘medical hub’ presents producers with the possibility of opening new markets in neighboring countries. However, increasing competition, especially from foreign companies which are investing in Thai production facilities to export back to their home countries of, for example, Japan, the United States, and France is likely and producers also face the possibility of rising costs when importing manufacturing equipment.

- Distributors of medical devices (including retailers, wholesalers and importers): Income for this group should grow gradually in an environment of strengthening competition. Single-use devices account for a large share of the income of this group and these items are typically considered essentials in day-to-day operations in hospitals, so demand should remain steady. However, competition is likely to be more intense with a large number of SMEs. Competition will also increase with agencies and shops which are part of large manufacturers’ commercial networks and which are therefore able to exploit a wider range of distribution channels. Importers of medical devices are also typically large operators and these are therefore better able to plan stocking and to manage problems arising from increasing import costs.

[1]Medical devices include items which are used in the medical, nursing and midwifery professions to provide treatments for bodily conditions such as X-Ray equipment, ultrasound machines, reagent and test kits, and dental devices. Medical equipment refers to surgical and medical equipment e.g. scalpels, thermometers, blood-pressure monitors, and items such as disposable gloves and masks.

[2]Including dental devices and equipment

[3]This refers to the wholesale and retail of medical products including instruments, tools, equipment, treated bandages, first-aid kits, birth control products, and pharmaceutical products.

[4]Estimated by Krungsri Research

[5]Export data collected from Medical Device Intelligence Unit, the Plastics Institute of Thailand

.webp.aspx)