EXECUTIVE SUMMARY

The airline industry should see conditions return to their pre-COVID state by 2025, helped by an improving outlook for the global economy that will boost consumer spending power and add to the uptake of tourism services. On the domestic front, the Thai economy will benefit from the ongoing rebound in the tourism sector, while the government will help to maintain growth trends by rolling out stimulus measures targeting high-potential consumer groups including long-term residents, the elderly, those traveling in support of their personal wellness, competitors in sports competitions, and individuals arriving for MICE and health tourism. Foreign arrivals are thus expected to hit 43 million by 2026, and to meet this increase in flights and passenger numbers, the government plans to upgrade airports and supporting infrastructure. At the same time, airlines will expand fleet sizes, lay on extra flights, and open up new routes as players look to maintain income and market share over the long term.

Headwinds blowing against the industry over the next few years will include: (i) sluggishness in the global economy; (ii) the possible loss of market share to competitors, which would cut arrivals to Thailand and reduce demand for Thai carriers; (iii) ongoing geopolitical tensions around the world that may keep crude prices elevated and erode demand for travel from some consumer groups; (iv) stiffening competition among major airlines and new entrants to the market; and (v) increased costs arising from a tightening of international rules and regulations. These factors thus all have the potential to drag on industry profits.

Krungsri Research view

Krungsri Research sees the business outlook as described below:

-

Airport operators: The increasing number of passengers and flights will lift income for airport operators, and this will then be boosted by the expiry of temporary pandemic-era measures that aimed to ease the financial burdens placed on airlines and airport shops through the crisis. Operators also derive benefits from their monopolistic market position and the charges that they collect from airlines for landing and parking, and for the provision of passenger and aircraft services. A further source of income is the granting of concessions to outside providers, for example, food and kitchen services for airlines and baggage handling services, as well as from the leasing of retail space to on-site shops and restaurants. Government plans to invest in air travel infrastructure will provide further support for operators, and so income can be expected to grow steadily over the coming period.

-

Passenger carriers: An improving economic outlook and a strengthening tourist sector will boost passenger numbers and cargo carries, and this will then feed into a steady increase in operators’ income. Receipts from related and ancillary services will also improve, including that coming from goods handling and distribution, selling souvenirs and other similar items, managing passengers and goods, and processing customs fees. In addition, to expand the territory that they can cover, players that are able to will increasingly look to sharpen their competitiveness by partnering with other airlines. Nevertheless, competition on price will worsen as both Thai carriers and overseas airlines expanding into Thailand fight to grow market share.

-

Freight services: Operators in this segment should see their income rise as manufacturing output expands and overall business conditions improve, especially for the e-commerce industry. Some players have partnered with logistics companies that have access to both a wide customer base and volume , and this is helping to strengthen their growth potential. Nevertheless, operators of smaller aircraft generally have to contend with tighter financial constraints and these now face greater competition from passenger carriers that are moving cargo too. With sea freight rates now falling back to their pre-COVID level, some customers will also return to using sea freight services, and with conditions challenging, some providers of air cargo services may become insolvent.

Overview

Air transport forms a crucial part of national infrastructure and the industry plays a major role supporting international trade and investment. Transporting goods and passengers by air has the advantage of speed, its ability to make access to far-flung locations considerably easier than is the case when using other transport modalities, its high level of safety (it is in fact the safest form of transport1/), and of delivering passengers and goods to destinations according to fixed schedules. Air travel is thus an increasingly favored form of transportation globally, and its growing popularity is reflected in the continuing construction of new airports worldwide, the ongoing development of the large-capacity aircraft that are needed to meet the rising demand placed on cargo and passenger carriers, the roll-out of new, modern transportation tools and equipment, and the upgrade and expansion of warehousing facilities near airports, which is then improving the efficiency of carriers’ operations. However, air travel has its downsides, most notably the high per-unit costs and the need for extensive infrastructure to support the industry.

The overall air transport industry can be divided into four categories.

1) Passenger carriers use aircraft that have their cabins fitted out with all the features necessary to provide regular passenger services. These players’ main source of revenue is from ticket sales, boosted by additional income generated from on-board services, though to maintain a steady income stream, passenger carriers may sell a portion of their tickets annually to tour agents at wholesale prices.

2) Cargo and air express services use freighters aircraft installed with the machinery and equipment needed for goods handling, and within this segment, income comes principally from shipping charges and fees for customs clearance. Most operators carry general cargo, cargo that has special handling requirements, service cargo (i.e., aircraft parts and equipment), and diplomatic cargo and mail.

3) Combined carriers use additional space in the belly holds of passenger aircraft to carry cargo, thus generating income from both ticket sales and shipping fees.

4) Other air services target niche markets, such as sightseeing flights, training flights, skydiving, aerial filming and photography, and so on. These services often require the use of specific types of aircraft, such as helicopters, balloons, and smaller airplanes.

Most companies run combined passenger and freight operations, though they will also work with freight forwarders to sell additional space in their holds. Players will in addition form business partnerships with domestic and overseas players to prevent operations competing directly, thereby ensuring that a full range of cargo services is provided across all flights.

Airline services can typically be classified as one of the following three types:

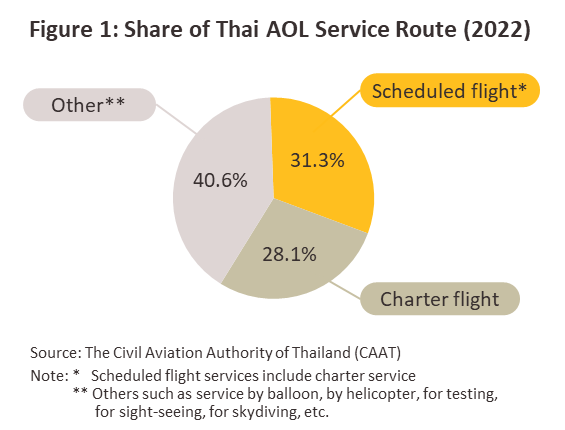

1) Scheduled services run on fixed routes to a pre-arranged timetable, allowing operators to allocate planes for passenger and freight in advance, although charter flights may be arranged in addition. 31.3% of operators run services of this type (Figure 1).

2) Non-scheduled or charter flight services operate intermittent or one-off flights. These kinds of services are provided by 28.1% of Thai operators, most of which are small companies that may only have a single aircraft, and so these are not able to exercise a great deal of discretion over the services that they offer. The government has issued regulations specifying that players that operate only a single plane are restricted to providing ad hoc charter flights, while those that run at least two aircraft may provide program charter flight services.

3) Specific flight services include sight-seeing and training flights, skydiving, air ambulances services, and communication and other services (e.g., for traffic reporting or meteorological purposes). 40.6% of Thai operators provide these services.

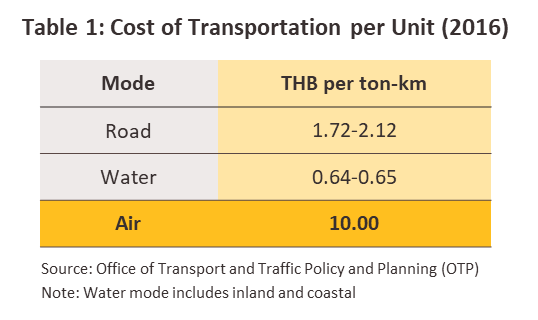

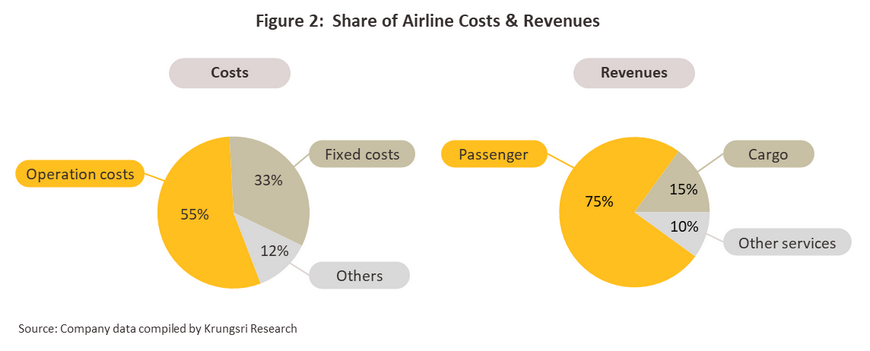

Generally, it is more expensive to move goods by air than by other transport modalities (Table 1). Airline business costs are split between: (i) operating costs, which comprise 55% of the total and include purchases of aviation fuel (30-35% of all business costs, though this may rise to 40-45% when oil prices spike2/); (ii) fixed costs (33% of the total), including staff costs (which can be especially high for those with specialist skills), the cost of purchasing or leasing aircraft, and fees for managing flight information and related systems; and (iii) other costs, such as those incurred for regular aircraft checks and maintenance, scheduled maintenance fees, and charges for the use of airports and parking facilities. Income is split approximately 75% from passenger services, 15% from airfreight, and 10% from other services (Figure 2).

Operators in the industry are of two types. The first hold and air operating license (AOL) and an air operator certificate (AOC), either own or lease their own aircraft, and run scheduled or charter services. The second type do not operate their own planes but instead work as agents selling space on aircraft run by the first type of business to, for example, tour companies and freight forwarders. As of 2022, 217 airline operators were registered in Thailand, though this includes both entirely Thai companies and joint ventures with overseas operations (Figure 3) (source: Department of Business Development). On the supply side, the market is split between the following.

-

Passenger carriers are 89 companies (41.0% of all registered companies) in Thailand. 70 of these operate scheduled services, and 23 of these are major players, most notably Thai Airways, Nok Air, and Thai Smile Airways. Joint ventures with overseas companies include Thai AirAsia X (Thai-Malaysian) and Thai Vietjet (Thai-Irish and Vietnamese). Of the 19 companies not offering scheduled services, only 1 is a large company, namely Thai Lion Mentari (a Thai-Indonesian joint venture).

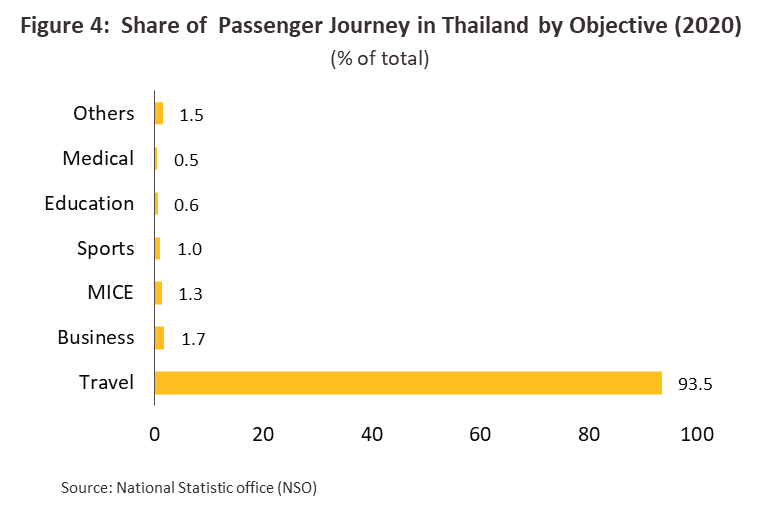

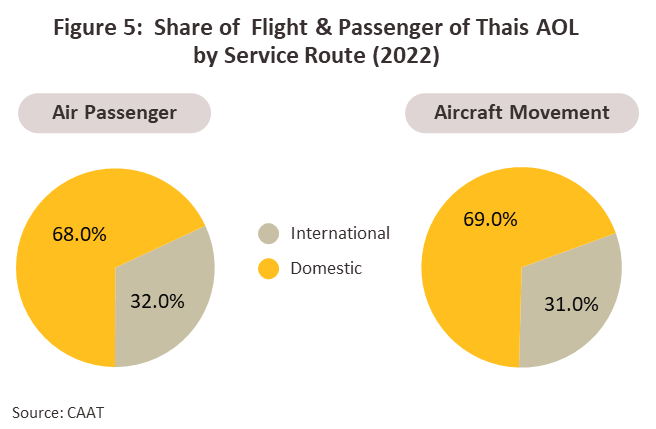

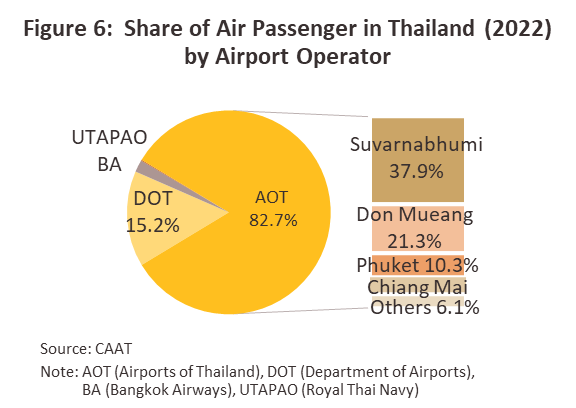

Growth in this segment is largely determined by the outlook for the tourism sector since 93.5% of travel is tourism related (Figure 4). Unfortunately, the outbreak of COVID-19 in 2020 posed a major challenge to the industry since strict pandemic controls placed restrictions on inter-province travel and largely halted international flights outright. In response, larger carriers shifted the focus of their operations and moved to a greater reliance on servicing domestic routes (Figure 5) and carrying cargo (Figure 6). The most important domestic airports are Suvarnabhumi and Don Muang, which in 2022, handled 59.2% of Thai air travelers.

-

The airfreight segment is serviced by 128 companies (59.0% of the total). 67 companies offer regular scheduled services, and 11 of these are large companies, including Bangkok Air (the company operates warehouse facilities at Suvarnabhumi Airport as well as 3 of its own privately operated commercial airports), FedEx Express International (Dutch-owned), K-Mile Air (Thai-Swiss), DHL Express International (Thai-German), and Teleport (part of the Malaysian-owned AirAsia). Among the 61 operators not running regular flights, only Santi Bhum, part of the RCL Group, is classed as a large company. Joint ventures include Air Mail Logistics (Thai-Hong Kong), Rise Again (Thai-Chinese), Teicent Logistics and Trading (Thai-Chinese), Everfleet Freight and Logistics (Thai-Malaysian), and Tiger Express International Shipping and Trading (Thai-Vietnamese).

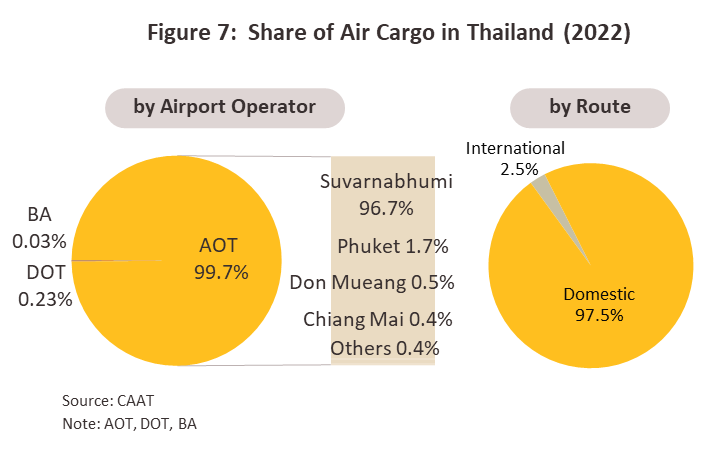

Goods that are shipped by air are typically light, small, have a high value, and/or require special handling, such as gems and jewelry, fresh cut flowers, vaccines, antiques and artworks, computer parts, and electronic equipment. 97.5% of airfreight is bound for overseas markets (Figure 7) since domestically distributed goods are generally moved by road, while sea routes are usually used for goods that are moved in bulk internationally. The market is also strongly influenced by the fact that airfreight is significantly more expensive than other means of shipping goods. The overwhelming majority of goods shipped by air in or from Thailand (98.9% of the total) do so through international airports operated by the AOT, namely Suvarnabhumi (96.7%), Phuket (1.7%), and Don Muang (0.5%) (source: CAAT, as of 2022).

Airlines operators of civil aviation services must first acquire an air operator’s license (AOL) from the Civil Aviation Authority of Thailand (CAAT), and in 2022, 38 companies held licenses, though only 32 of these were active, 10 companies run passenger and cargo services on both scheduled and charter flights, and these are fully functioning operations with regard to aircraft, personnel, and the scope of their business partnerships. The remaining 21 companies are mostly SMEs offering only charter services and particular services, so these do not run flights according to regular schedules, one of which was a new company (Sky Extreme) that provides in ‘specific flight services’. 6 companies that are not active have let their operating licenses lapse, are in the process of applying for new licenses, or have ceased trading either temporarily or permanently (the number of companies active in this space dropped sharply during the pandemic).

The Thai airline industry has seen steady growth since 2008 thanks to: (i) liberalization of the industry, first for airfreight (2008), then for domestic inter-city passenger transport (2010) and finally with the implementation of the Asian Economic Community in 2015, the liberalization of travel between the ASEAN zone and other regions; and (ii) the expansion in the number of services offered by low-cost carriers (LCCs), which typically offer tickets priced at a 40-50% discount relative to those of full-service carriers (FSCs), thus making mass air travel much more widely available. These factors have enticed a greater number of players into the market, but with this, competition has increased from both low-cost and full-service carriers. Players have responded to these changing circumstances by investing heavily in growing market share, for example by expanding their fleet capacity and the efficiency of their operations3/, the number of routes that they serve, and their marketing to specific groups, for example for offering charter flights.

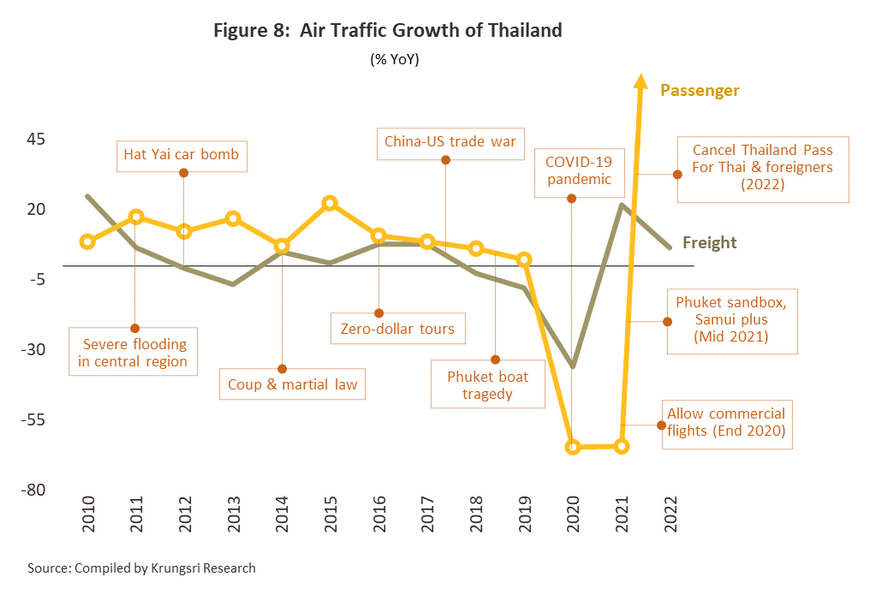

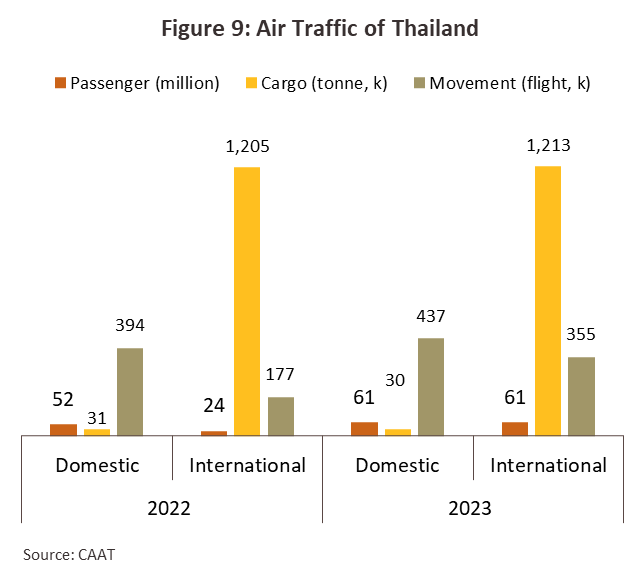

The outbreak of COVID-19 during 2020 and 2021 forced airlines to make dramatic changes to minimize their operating costs. These included canceling passenger flights, transferring a share of the aircraft in Thai fleets back to parent companies abroad, canceling leases, and converting passenger planes for use to transport cargo. However, the lifting of restrictions on foreign travel in 2022 combined with significant pent-up demand, which had built up through the preceding two years, accelerated recovery of demand for air travel services (Figure 8). Thus, in 2022, the number of passengers flying domestically and internationally grew by respectively 166.6% to 51.5 million trips and 1,424.8% to 24.3 million trips. The three top destinations for international air travelers were Singapore, South Korea, and Malaysia, which were also the most important tourism markets for Thailand following the reopening of the country.

Generally, because most Thai operators are combined service carriers, they have the flexibility to rapidly reallocate schedules and space in their aircraft between passenger and cargo operations (Figure 8), and therefore as demand for passenger services rises and falls, operators can apportion space to cargo services as the market dictates. This then allowed players to efficiently manage their income flows through the crisis.

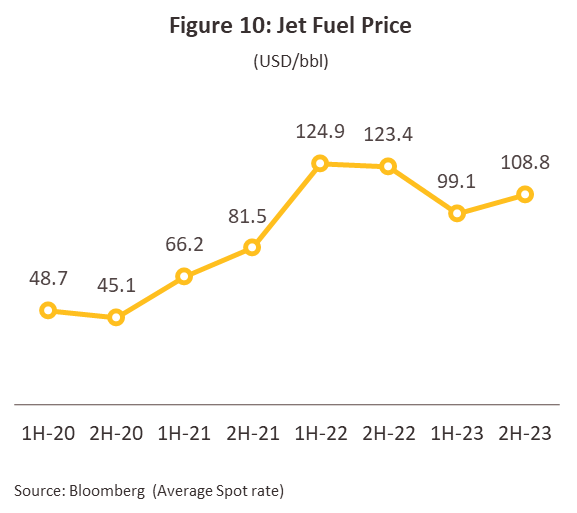

Situation

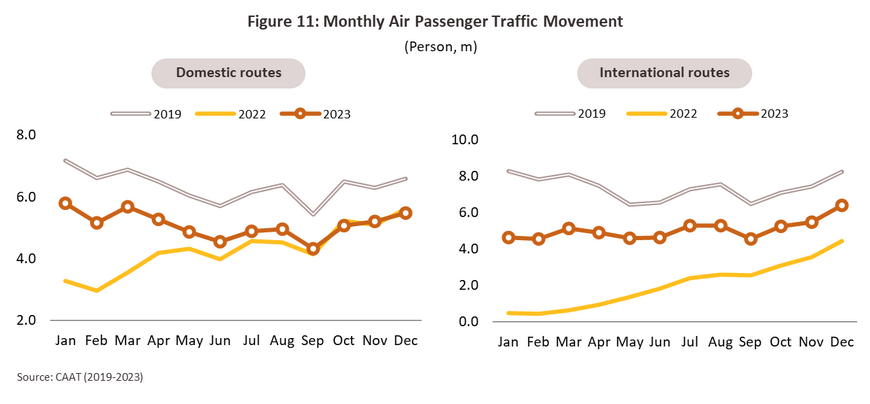

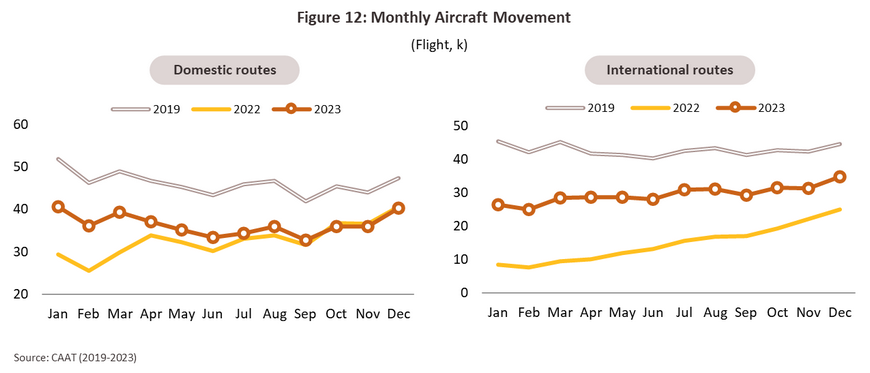

The Thai airline industry continued to see improvements through 2023 thanks to a number of factors. (i) The worldwide rollout of COVID-19 vaccines allowed countries (including Thailand) to relax public health controls and to lift restrictions on international travel. This included even China, where from 8 January 2023 onwards, officials allowed Chinese tourists to travel outside the country and tour companies to sell package tours to 20 destinations (including Thailand), and Japan, which reopened in Q4 of 2022 and then lifted COVID-19 controls for foreign tourists in May 2023. To meet the recovery in demand that had built up over the previous years and which was now being released, airlines reopened previously suspended lines and so over summer’s flight schedule 20234/, the number of outbound flights from Thailand increased 111.5% YoY to Japan, 173.4% YoY to South Korea, and 249.8% YoY to Taiwan. (ii) The Thai authorities have continued to implement stimulus measures targeting domestic and international tourism, including phase 5 of the ‘We Travel Together’ program, which in March and April helped to subsidize the cost of travel within Thailand, the ‘Visit Thailand Year 2023: Amazing New Chapters’ campaign, and the promotion of experience-based tourism, all of which has helped to lift domestic tourism to 175 million trips and boost foreign arrivals to 28.1 million. (iii) Driven in particular by the rebound in tourism, the Thai economy expanded by 2.5% YoY in 2023, and this has added to incomes and raised spending power, in particular for those working in tourism and related areas. (iv) World oil prices have softened through 2023 as the global economy has slowed (jet fuel price declined by -16.3% YoY in 2023) (Figure 10). Domestic carriers have also benefited from cuts to the duties payable on aviation fuel, which were reduced to THB 0.20/liter until 30 June 2023, and this then allowed players to better manage fuel costs. Partly thanks to these tailwinds, both domestic and international tourism received a major boost in the year, while carriers are adapting to an improving outlook by increasing the number of flights that they operate (especially on international lines), opening up new routes, and expanding their fleet sizes.

Nevertheless, despite this broadly positive outlook, headwinds continue to blow against the industry. Specifically, sluggishness in the world economy is dragging on growth, and the cost-of-living crisis that has manifested in many countries is encouraging consumers to carefully spending on discretionary purchases such as airline travel. Alongside this, air fares remain expensive relative to the pre-COVID period, and aircraft, staff, and facilities are insufficient to meet demand in some areas. These problems have then been amplified to a certain extent by the decision of some countries to implement their own tourism promotion schemes. For example, Hong Kong has given away 500,000 free airline tickets to foreign tourists, and Taiwan has likewise given 500,000 cash prizes to overseas visitors, which on the one hand, has increased demand for travel from Thailand to these countries, but on the other, this has also stolen market share from the country. The overall situation for 2023 is described below.

-

Passenger numbers were up 61.0% YoY to 122.0 million. For domestic flights, passenger numbers rose 19.0% YoY to 61.3 million, while for international flights, numbers surged 150.2% YoY to 60.7 million (Figure 11) on greater demand and the effect of government stimulus packages. The latter included an extension to the length of stay permitted in the country for those traveling visa-free or being issued visas on arrival (from October 2022 to Q1 of 20235/) and a supporting program through "2023-2024 Korea-Thailand Mutual Visit Years“ that make South Korea become the third most important source of arrivals to Thailand after Malaysia and China.

-

Flight numbers were up 38.8% YoY to 791,900 as airports and airlines expanded their ground service capacity from June 2023 onwards. Carriers brought 7 new planes into operation in the year and so the combined fleet size rose to 181 aircraft (source: CAAT), thus allowing players to lay on extra flights as needed. The number of domestic flights was therefore up 11.1% YoY to 437,300, or to an average of 36,000 per month, though this was still below the 2019 monthly average of 47,000. International flights jumped 100.7% YoY to 354,600 in the period (Figure 12), During the first 9 months of 2023, the latest data showed that growth was especially strong in flights from China during the summer season, which exploded 1,322.5% YoY, while the number of Thais traveling abroad climbed 42.7% YoY (based on passport applications, source: Department of Consular Affairs). Nevertheless, expansion in staffing and fleet sizes has been gradually increased, and so overall flight numbers are still 74.1% of their 2019 level.

- Airfreight volume were up 0.5% YoY to 1.2 million tonnes. Domestic freight volume contracted -3.1% YoY to 30,000 tonnes, Nevertheless, international airfreight was up 0.6% YoY to 1.2 million tonnes (Figure 13), airfreight volume increased in line with the export growth which rebounded in August and so the outlook is positive for the remainder of 2023. In addition, the recovery in passenger travel in fact expanded total freight capacity.

Outlook

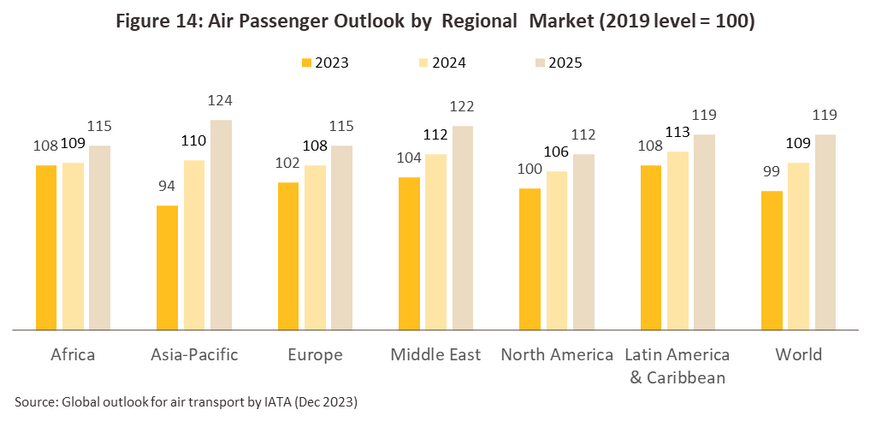

The International Air Travel Association (IATA) estimates that in 2023 and 2024, the global airline business will generate net profits of respectively USD 23 billion and USD 26 billion. The outlook is somewhat mixed at the moment, and although air travel numbers are expected to hit a historic high of over 4.7 billion in 2024 (against the 2019 total of 4.5 billion), the costs of financing are currently high and tourism has yet to recover in some parts of the world (Figure 14), most notably in China, which lagged the rest of the world in lifting pandemic restrictions. In addition, global imbalances and especially ongoing geopolitical tensions may push up the price of crude, and with fuel accounting for 31% of airlines’ operating costs, this would have serious consequences for the industry.

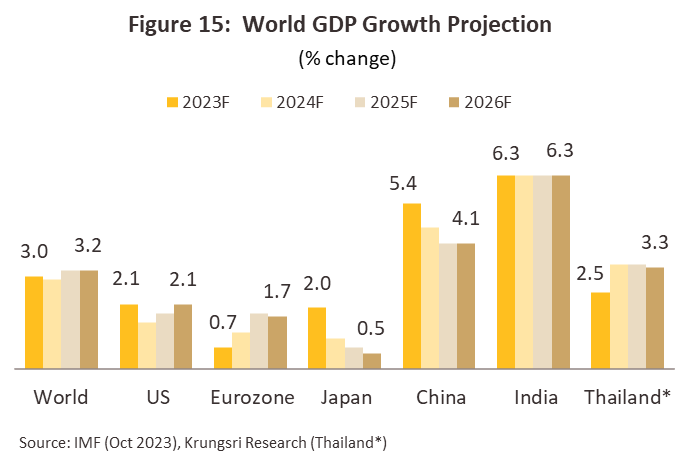

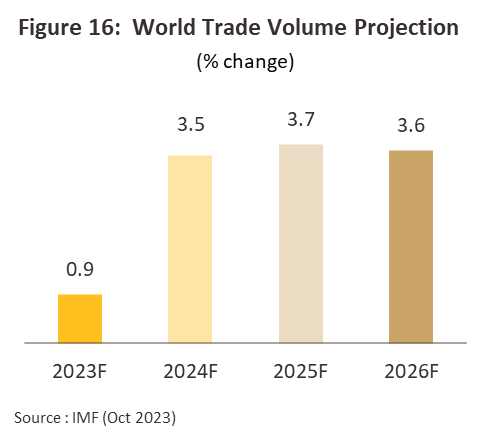

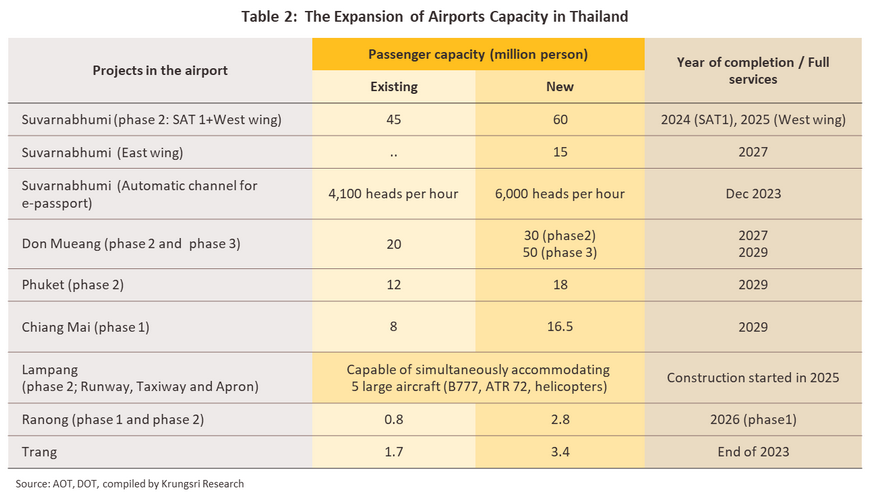

Krungsri Research sees the Thai airline industry returning to its pre-COVID level of health by 2025 thanks to strengthening demand that will in turn be lifted by a number of factors. (i) The outlook will improve for both world trade and the global economy (Figures 15-16), and over 2024-2026, the IMF predicts that the global economy will grow by 2.9-3.2% annually, compared to growth of 3.0% in 2023. Over the same period, world trade will expand by 3.5-3.7% per year, up sharply from 2023’s growth of 0.9%, and this will then boost spending power and add to demand for travel services. (ii) Having grown by 2.5% in 2023, the Thai economy is forecast to enjoy annual growth of 3.0-4.0% over the next 3 years. The rebound in the tourism sector will continue to be an important driver of this, and thus foreign arrivals are expected to reach 43 million in 2025, while the export sector will grow on the brighter outlook for Thailand’s trade partners. (iii) The government is promoting travel to Thailand for members of high-potential groups including long-term residents, the elderly and those travelling for personal wellness, competitors in sports competitions, those travelling for MICE events or for medical treatment, and LGBTQ+ individuals, who typically travel more often than general tourists (source: TAT). The government is also offering visa-free travel to higher spending tourists, including Chinese and Indian arrivals, who spend an average of USD 197 and USD 180 per person per day when in the country. Other plans to promote tourism include the provision of 24-hour entertainment services in the Eastern Airport City (the EECa), the waiving of excise taxes for purchases made in the EECa (for a period of 10 years, expected to start in 2024), and the ability to make duty-free purchases there up to a total of THB 200,000 per person per year, all of which should incentivize travelers and tourists to make greater use of the Eastern Airport City. (iv) Officials plan to upgrade airports and supporting infrastructure to meet the stresses created by additional air traffic and the expansion in passenger numbers. This will include the beginning of soft operations at Suvarnabhumi Airport’s Satellite 1 building at the end of 2023, which will increase the airport’s annual capacity from 45 million to 60 million passengers, improvements to existing airports and the construction of new departure lounges (Table 2), the opening up of airspace in the northeast and south of the country to allow more flights to and from Ubon Ratchathani, Buriram, and Krabi (to be upgraded to international status in early 2024), and extensions to the U-Tapao-Map Ta Phut motorway (the M7 extension, scheduled to be opened at the end of 2025).

Airlines will tend to respond to this rise in demand by expanding their fleet sizes, increasing the number of flights that they offer, and opening up routes to new destinations. Players that are able to will look to build new income streams by partnering with other service providers as a way of expanding into international markets, and this will help them to grow passenger volume and extend the reach of their commercial operations without having to operate or invest in long-haul flights. However, these changes will intensify competition and new players will increasingly enter the market, for example, Really Cool Airlines, Landarch Airlines, P-80 Air and Siam Seaplane.

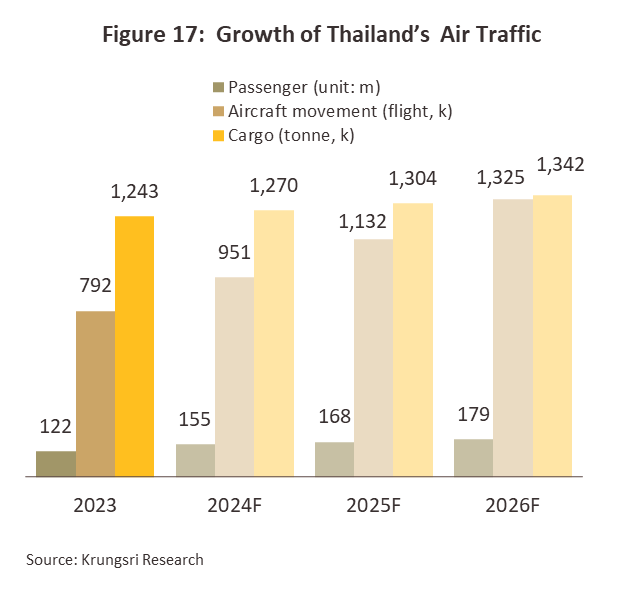

In light of the above, the outlook for the Thai airline industry over 2024 to 2026 will continue to improve (Figure 17).

-

Combined arrivals and departures should grow by 13-15% per year to reach 168 million in 2025, ahead of the 2019 total of 165 million, and then hit 179 million in 2026. Global demand for travel remains high, and a survey by Amadeus (providers of tourism services to customers worldwide) reveals that 47% of respondents consider international travel a top personal priority, up from 42% in the previous survey. The market will thus be increasingly vibrant through 2024, and with Thailand among Asia’s top 10 destinations (source: Travel Industry Trends 2023), a portion of these travelers will naturally visit the Kingdom. In addition, demand for outbound tourism from Thailand remains strong among mid- to upper-income earners, though tickets are expensive relative to their pre-COVID level, and this will weigh on demand growth.

-

The total number of flights is expected to rise by an average of 10-20% annually, and having been cut during the pandemic, fleet sizes will expand again as demand strengthens. Airlines will respond to improving conditions by opening new routes (i.e., direct flights between major Thai tourist destinations and cities across the Asia-Pacific region) and laying on additional flights on existing lines, especially on international routes. In addition, from 2024 onwards, 9 new airlines offering both passenger and cargo services are expected to enter the market6/, but because the increase in the number of planes servicing Thai destinations will be only gradual, demand is likely to outpace supply through at least some of 2024, and this will help to buoy ticket prices. Krungsri Research thus sees the domestic flights returning to normal in 2024, while on international routes, the situation will stabilize in 2025.

-

Air freight volume is expected to grow by 3-5% per year over the next 3 years. The domestic air freight market will benefit from the development of the infrastructure needed to facilitate transshipping using road, rail and sea travel modalities, and this will then support an expansion in the options available for goods freight. Players will also partner with other businesses to improve the coverage and integration of their air cargo service offerings and to build joint business possibilities (see for example the partnership between Thai Airways and PTT). International air freight will benefit from improving prospects for the global economy, growth in world trade, and ongoing expansion in e-commerce sales, with Euromonitor seeing the Thai e-commerce industry enjoying an average annual 16% expansion over 2024 and 2025. In particular, using air cargo services for the delivery of food and express parcels is increasingly popular. More broadly, the government is pushing forward with plans to establish Thailand as a regional hub for the air freight of agricultural goods, and to this end, a distribution center for the handling of these was opened in the duty-free section of Suvarnabhumi Airport in September 2023. This combines a perishable goods distribution center and a facility for carrying out quality control and goods processing prior to export, and it is hoped that by 2027, this will have boosted the volume of these perishable goods passing through the system by 25%.

-

Prices for Jet A1 aviation fuel will likely remain high on the back of the ongoing war in Ukraine and the move by the OPEC+ group of the world’s major oil producers to throttle output and so keep crude prices elevated. Going forward, Krungsri Research sees demand for aviation fuel continuing to strengthen as the market for travel services expands and the number of flights worldwide heads north. Total consumption of aviation fuel should thus reach 12-15 million liters/day in 2024 and 16-19 million liters/day in 2025 and 2026, compared to the 2019 level of 16.5 million liters/day.

Although the overall outlook is positive, players will nevertheless have to contend with a number of challenges. (i) Slow growth in the world economy will somewhat decrease consumer purchasing power and undercut demand for travel and tourism. (ii) Measures to attract tourists to Thailand’s competitors will take market share from the country and reduce uptake of Thai aviation services. (iii) Geopolitical tensions, and especially the continuation of the Russia-Ukraine war, may periodically push oil prices up. (iv) Increased competition from both large incumbents and new entrants to the market will tend to weaken carriers’ market share (with regard to both passenger volume and flights) and constrain the room within which players’ will be able to raise ticket prices, and this would then have consequences for profitability. (v) Limitation of Airlines’ resource ability to meet demand because of, for example, staff shortages and a gradual expansion in fleets capacity. (vi) The cost of adaptation to meet the international regulatory requirements will rise7/, and need to purchase carbon credits in accordance with "the Carbon Offsetting and Reduction Scheme for International Aviation" (CORSIA), while the Thai authorities have also introduced new regulations, and so to accelerate the transition to the use of clean fuels, by 2027, 1% of carriers’ fuel consumption will need to be of sustainable aviation fuel (SAF)8/, (planes entering EU airspace will be required to use 2% SAFs from 1 January 2024), although SAF is 3-5 times more expensive than regular aviation fuel (source: Bangkok Aviation Fuel Services PCL; December 2023). Moreover, to meet the government’s ‘Fly Net Zero Carbon’ plan, by 2050, players will be required to use modern new planes that release less CO2. Carriers will also have to invest in ongoing automation and the use of high-tech products to facilitate service provision (for example by using drones to make deliveries), and so companies will need to adapt to rapidly changing market conditions. Unfortunately, due to their limited access to financing, reduced fleet sizes, and tighter market share, smaller players will find it more difficult to compete in this new business environment.

1/ 320 airlines are members of the International Air Transport Association (IATA). These members carry 83% of global air traffic, and IATA data show that 5 aviation accidents in 2022 resulted in fatalities, a decrease from 7 in 2021. As a result, the fatal accident rate improved from 0.27 per million sectors in 2021 to 0.16 for 2022, while in terms of loss of life, air travel remains significantly safer than other types of travel (i.e., cars, buses, motorcycles, trains and boats).

2/ Airlines typically reduce the risk of being adversely affected by price spikes by hedging against changes in the price of jet fuel.

3/ This is calculated from the cost per available seat kilometers (CASK), which is obtained by taking the total operating costs and dividing this by the total number of seats multiplied by the distance travelled (the ‘available seat kilometers’, or ASK).

4/ For 2022, the summer season ran from 27 March to 29 October, while for 2023, this ran from 26 March to 28 October (source: Aviation Service Center, operated by the CAAT).

5/ For tourists permitted to enter the country visa-free, the length of stay was extended from 30 to 45 days, while for those issued a visa on arrival, the length of stay was doubled from 15 to 30 days. These changes were in effect between 1 October 2022, and 31 March 2023.

6/ The 9 new airlines that will begin operating in or after 2024 are: (i) Asian Aerospace Services, (ii) Siam Seaplane, (iii) RC Airlines (Really Cool), (iv) Avanti Air Charter, (v) M-Landarch, (vi) Bangkok Helicopter Services, (vii) Pattaya Airways, (viii) Asia Atlantic Airlines, and (ix) P-80 Air.

7/ These have originated from a number of different organizations overseeing aspects of international air travel, and include the International Civil Aviation Authority’s changes to the rules on Significant Safety Concerns (SSCs) and Full ICAO Coordinated Validation Mission checks (Full-ICVM), the Federal Aviation Administration’s changes to its International Aviation Safety Assessments (IASA), and the European Union Aviation Safety Agency’s certification of airlines’ safety standards for carriers operating in the EU. Domestically, the government has also set the goal of reaching carbon neutrality by 2050 and net zero by 2065, as per the COP26 agreement, signed in November 2021.

8/ Under the Oil Plan (2023) and the revised AEDP 2023, Airports of Thailand has laid out a plan to cut CO2 emissions by 50% over the 4 years from 2024 to 2027, or from 300,000 tonnes/year to 150,000 tonnes/year. The AOT aims to achieve net zero by 2033.

.webp.aspx)