EXECUTIVE SUMMARY

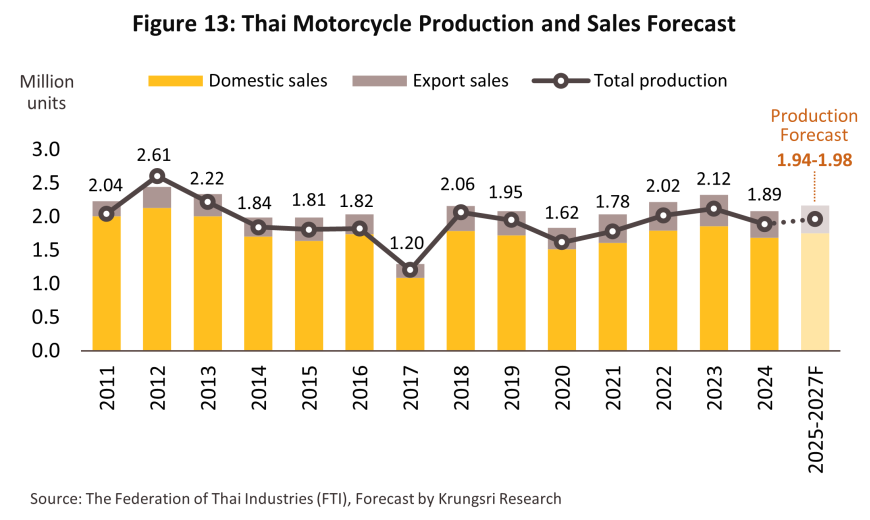

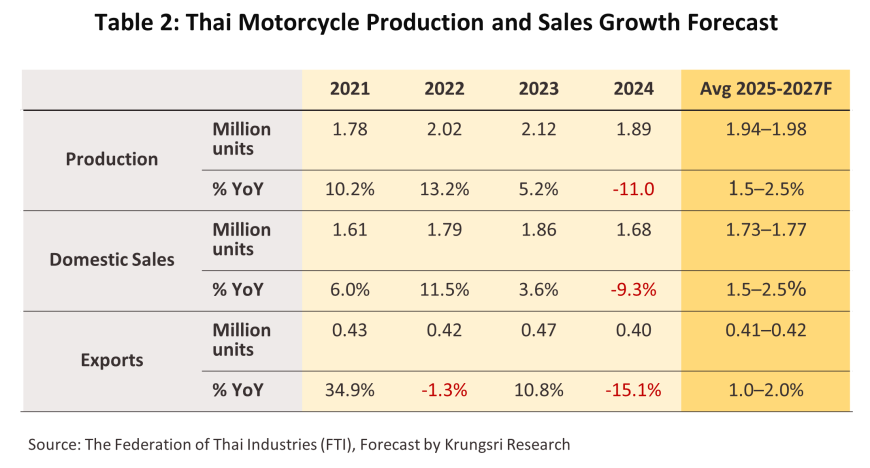

From 2025 to 2027, the number of motorcycles produced in Thailand is expected to rise by 1.5-2.5% annually due to growth in both the domestic and export markets. The production volume of electric motorcycles is projected to increase in alignment with recent investment trends, supported by the EV 3.0 and 3.5 initiatives. However, the market faces several risk factors, including heightened competition, persistently high household debt levels, and stringent lending approvals by financial institutions, which continue to constrain market growth. Domestic sales are forecast to rise by 1.5-2.5% per year, helped by ongoing growth in the economy, the strength of the tourism sector, the onset of La Niña conditions and the boost that this will give to agricultural yields, ongoing expansion in ride-hailing and food and goods delivery services, the strength of middle- and upper-income segments and the impact of this on sales of ‘big bikes’, and continuing growth in demand for electric motorcycles. Similarly, motorcycle export volumes are anticipated to grow at an average annual rate of 1.0-2.0%, despite the impact of increased U.S. tariffs. This growth is bolstered by the gradual economic recovery in other key trading partners, including Japan, Europe, China, and ASEAN.

Krungsri Research view

Motorcycle manufacturers are poised to benefit from the gradual market recovery expected between 2025-2027. However, export markets may face challenges due to U.S. tariff measures, particularly in 2025.

-

ICE-powered models: Production of competitively priced, fuel-efficient sub-250 cc motorcycles will be boosted by the strength of the domestic market and ongoing growth in demand for food-delivery and ride-hailing services. Sales of ‘big bikes’ (i.e., those with a capacity of 250 cc or more) will be lifted by strong demand from middle- and upper-income consumers, recovery in export markets, and the development of the more advanced software that is being deployed in new models (especially as regards connectivity).

-

Electric models: Demand will benefit from the implementation of the EV 3.5 measures, which cut excise duties and provide subsidies of up to THB 10,000 per vehicle, and growing consumer interest in EVs at home and abroad. The latter is, in turn, benefiting from intensifying global worries about the environment, the growing availability of charging and battery-swapping stations, attractive and affordable pricing, lower running costs, and an expansion in the budget rental schemes offered by ride-hailing companies. Overseas markets that show the greatest potential are concentrated in Europe and Asia.

Overview

The government has long provided support to the motorcycle industry, both as a means of meeting domestic demand (the industry’s main market) and as a way of developing new export opportunities. This assistance has come in the form of tax cuts for investors, the development of the domestic supply chain through the enforcement of local content requirements, measures to attract foreign direct investment, investment support schemes targeting production for export (especially of ‘big bikes’) and electric motorcycle production. The major stages in the development of individual segments are described below.

Smaller motorcycles (sub-250 cc)1/

Government support for the manufacture of small-capacity motorcycles began in 1964 when the Board of Investment rolled out measures that aimed to encourage the substitution of imports with domestically produced models, and as part of this, local content requirements were enforced that required that by value 50-70% of inputs were sourced domestically. These ran from 1971 to 1996, and between 1971 and 1976, imports of motorcycles were also banned2/. This then helped to encourage the development of a comprehensive domestic supply chain and so although local content requirements were abandoned in 1996, Thai motorcycle manufacturers still source almost all components domestically. Thailand has thus established itself as a center for the manufacture of sub-250 cc motorcycles within the ASEAN zone.

Big bikes (250 cc engines and larger)

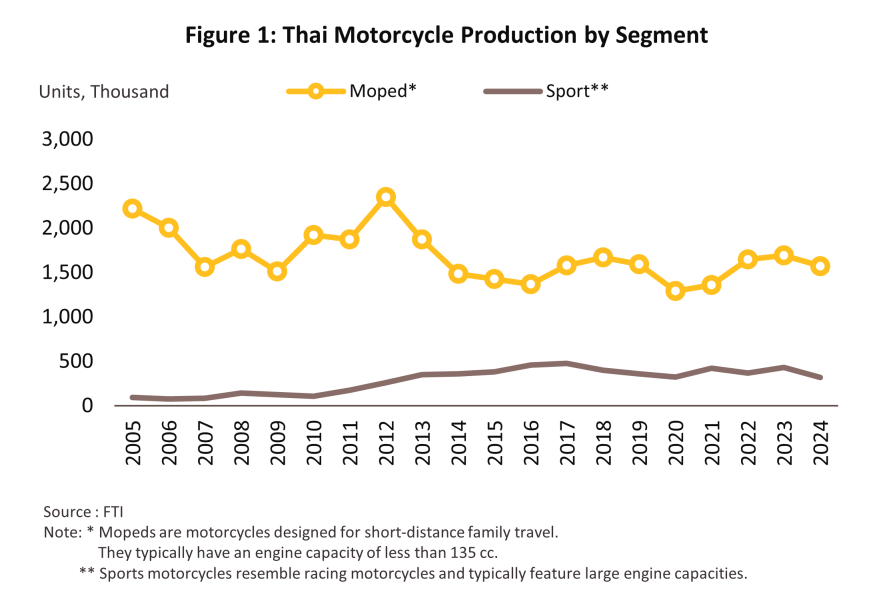

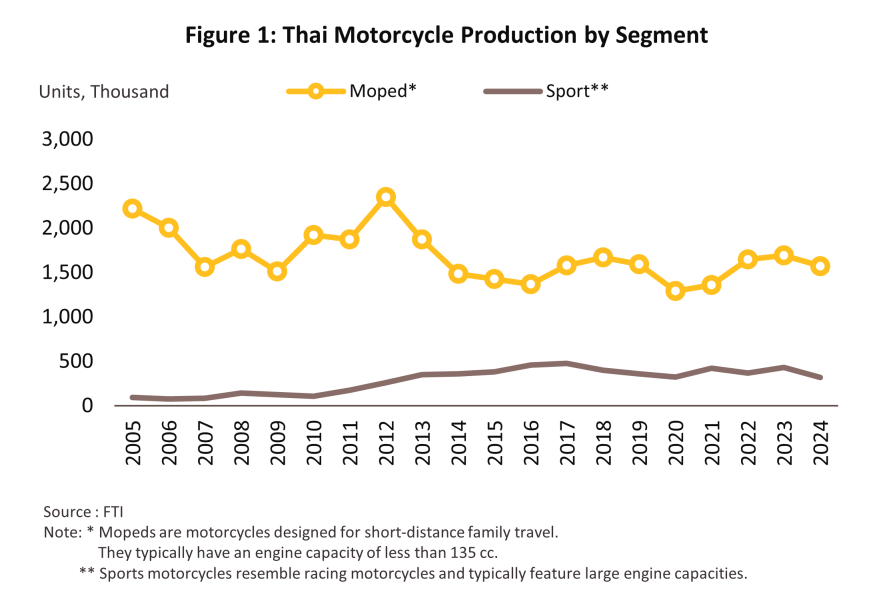

In 2012, the government began to encourage foreign manufacturers to invest in Thailand-based production facilities for motorcycles with engine capacities of more than 248 cc. This largely involves the relocation of large motorcycle manufacturing bases by European and U.S. brands to Asia, including Thailand, to reduce labor costs and support export production. As such, domestic production of larger models grew at an average rate of 21.4% CAGR over 2011-2016 (Figure 1), up from the 13.9% CAGR recorded over 2005-2010.

Electric motorcycles

Promoting the market for electric vehicles (EVs) is helping to reduce consumption of fossil fuels and accelerating the transition to the use of green energy within the transportation sector. This is then forming an important step on the road to net-zero carbon emissions, which Thailand hopes to reach by 2065-2070. To this end, the National EV Policy Committee has laid out its ZEV (zero emission vehicle) 30@30 plan. This has set a target of production and sales of EVs developing through three stages.

-

2025: EVs account for 10% of production and new vehicle registrations.

-

2030: EVs account for 30% of production and 40% of new vehicle registrations.

-

2035: EVs account for 50% of production and 100% of new vehicle registrations.

These goals have been supported by the EV 3.0 (2022-2025) and EV 3.5 (2024-2027) initiatives. These have been implemented with the aim of stimulating growth in sales and an uptick in investment, which they have done by offering subsidies of up to THB 10,000 per vehicle (under the EV 3.5 scheme), adjusting excise rates, and requiring importers of electric motorcycles to compensate for earlier imports with increased domestic production when these benefited from the EV 3.0 and EV 3.5 measures. (For more details on the EV 3.0 and EV 3.5 schemes, please see Thailand Industry Outlook 2024-26: Electric Vehicle Industry)

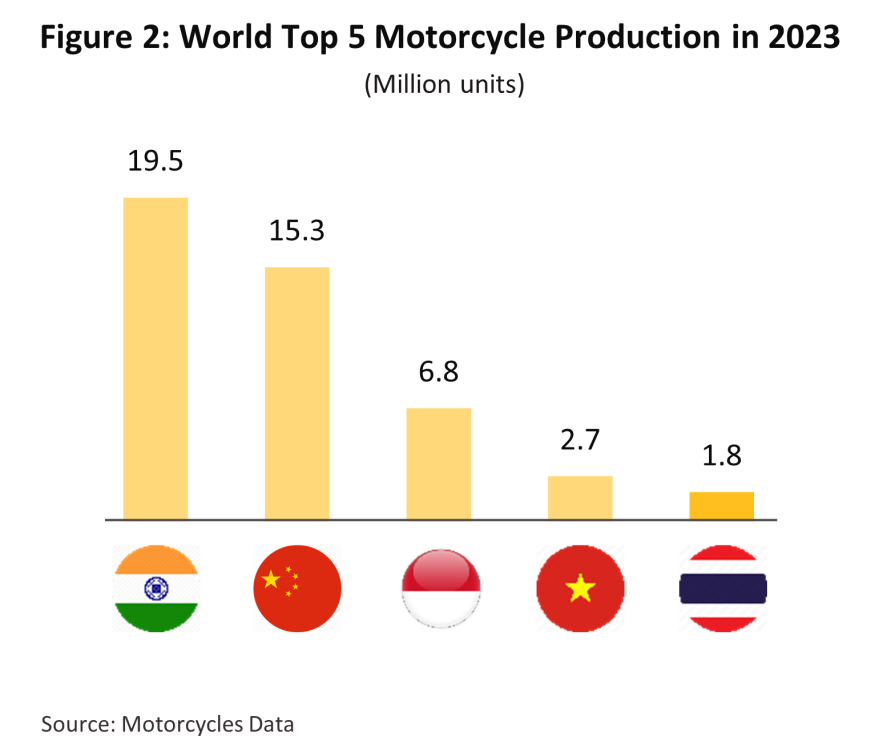

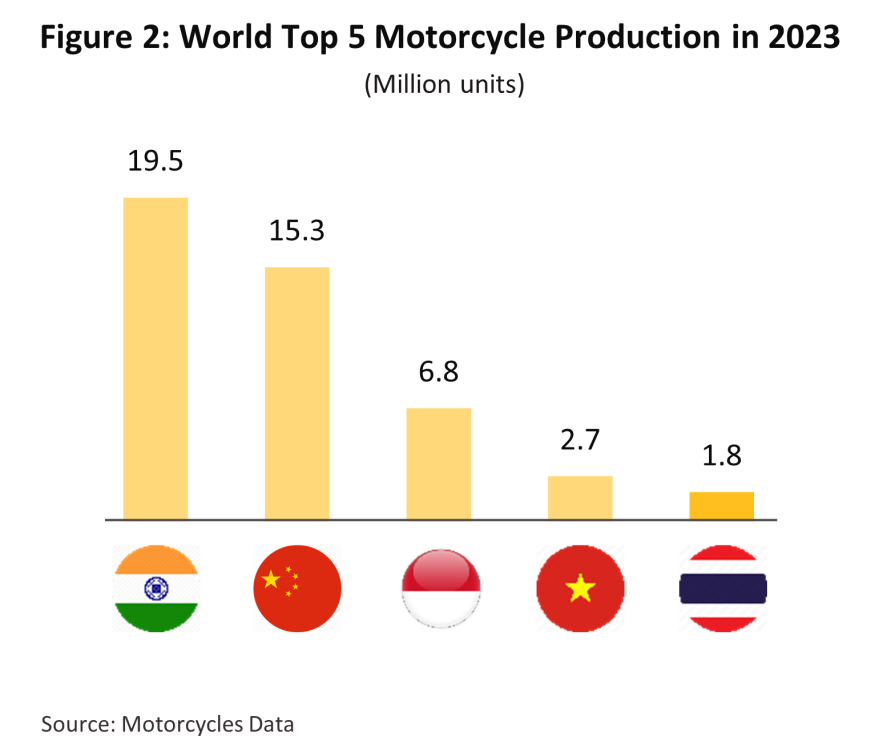

As of 2023, Thailand ranked 5th globally with regard to production of all types of motorcycles and 3rd within the ASEAN region (Figure 2). Details of the market are given below.

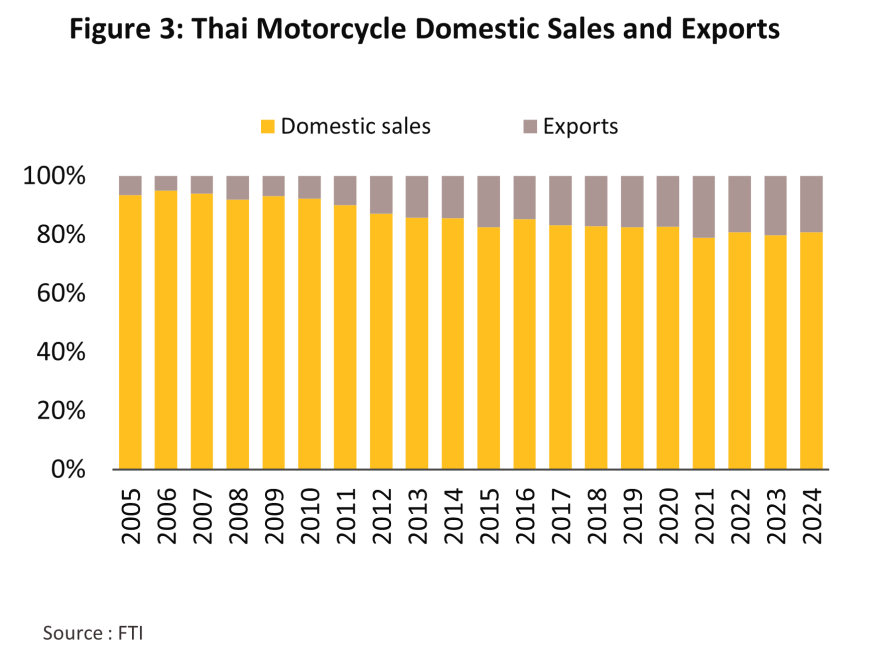

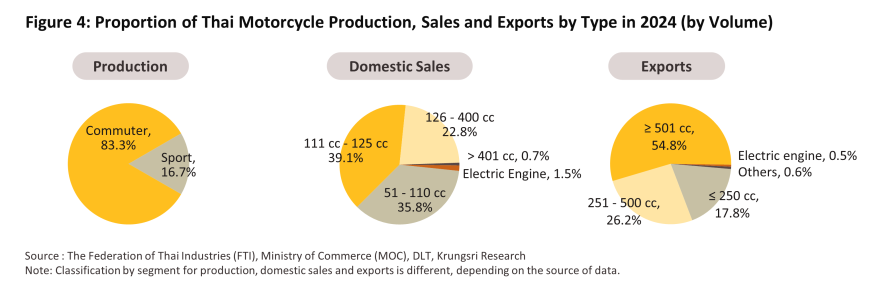

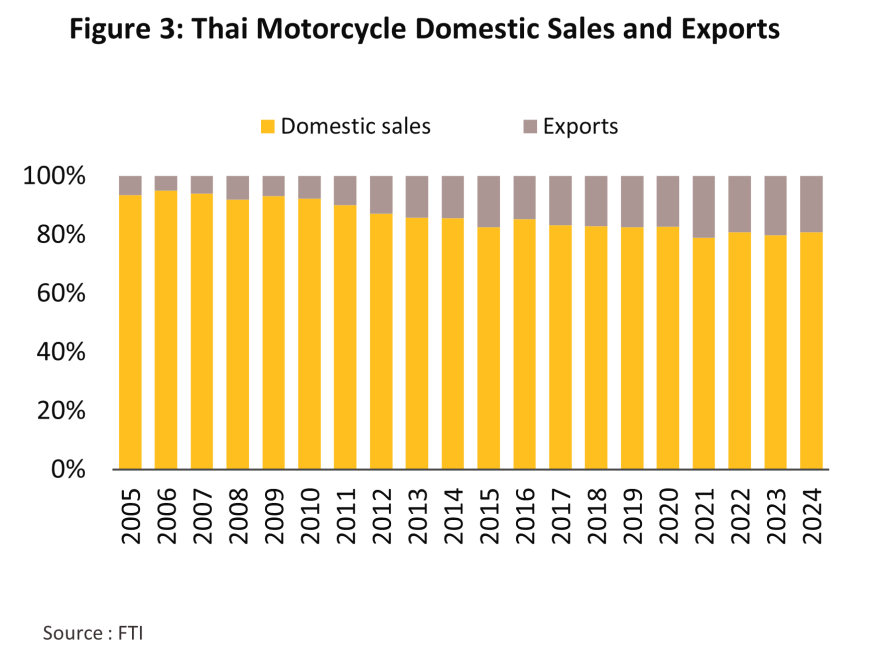

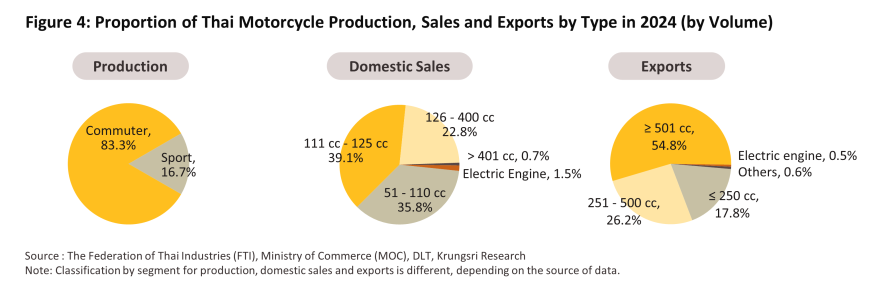

Production: The Thai motorcycle industry is primarily focused on the domestic market since this absorbs more than 80% of output (Figure 3). During earlier phases of the industry’s development, exports were largely of smaller capacity vehicles (engine sizes of 50-250 cc.) that were sold within the ASEAN zone, but the size of the Indonesian and Vietnamese markets pushed leading global manufacturers to step up their investments in these countries and this has then upset the regional dynamic. Thus, as a result of these investment inflows, Indonesia and Vietnam have a combined output that is now greater than Thailand’s and with this then generating economies of scale for Indonesian and Vietnamese manufacturers, imports of completely built-up vehicles from Thailand have declined. Thai manufacturers have therefore shifted to a greater reliance on the export of completely knocked down (CKD) units for assembly in overseas markets. At present, the domestic market still favors smaller (100-150 cc) commuter models, and so as of 2024, 83.3% of Thai production was of these, split approximately 50-50 between automatic and manual units. The remaining 16.7% of output is of sports models with engines larger than 150 cc (including big bikes), though these are mostly manufactured for export (Figure 4).

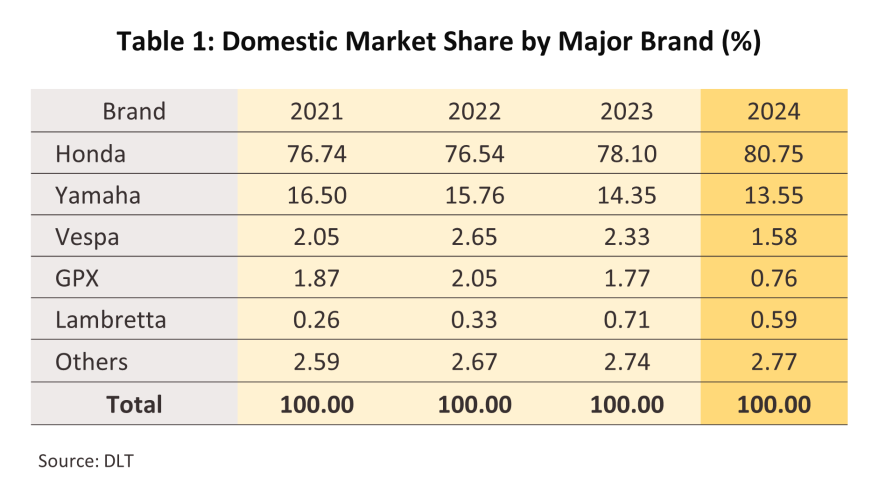

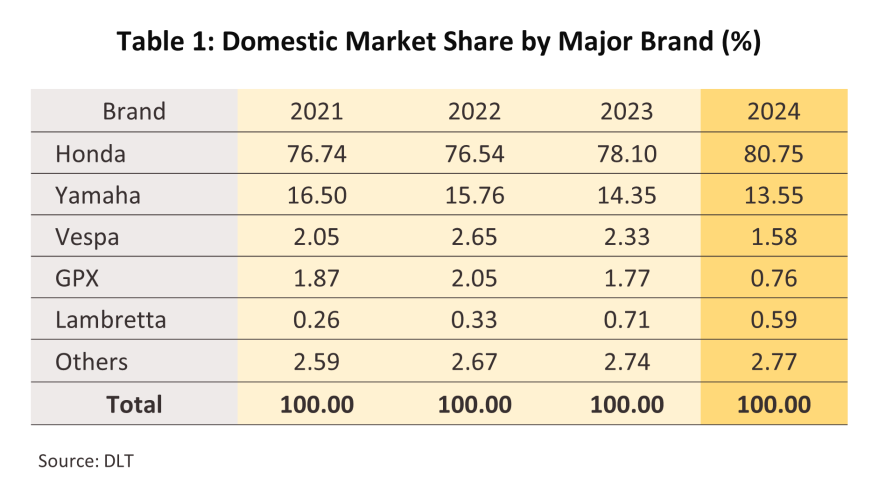

Domestic market: Motorcycles are broadly preferred over other vehicles by Thai consumers and so for many years, these have been ubiquitous. As of 31 December, 2024, there were 22,943,490 motorcycles registered within the country3/. Motorcycles offer a number of advantages over the alternatives, including: (i) their lower cost compared to other types of vehicles; (ii) their fuel cost savings; (iii) the wide range of models that are available and the positive impact on prices of Thailand’s development as a hub of motorcycle production; (iv) ongoing urbanization and problems with traffic congestion, which is encouraging individuals in the capital to use motorcycles instead of cars; and (v) the widespread availability of motorcycle taxi services in the country’s major cities (Statista (May, 2024) and Statista (October, 2024)). Sub-125 cc models priced at THB 40,000-70,000 therefore dominate the domestic market, with sales of these totaling 1,280,875 units in 2024, or 74.9% of the total market. The two most popular marques are Honda (80.8% of all new registrations) and Yamaha (13.6%) (Table 1).

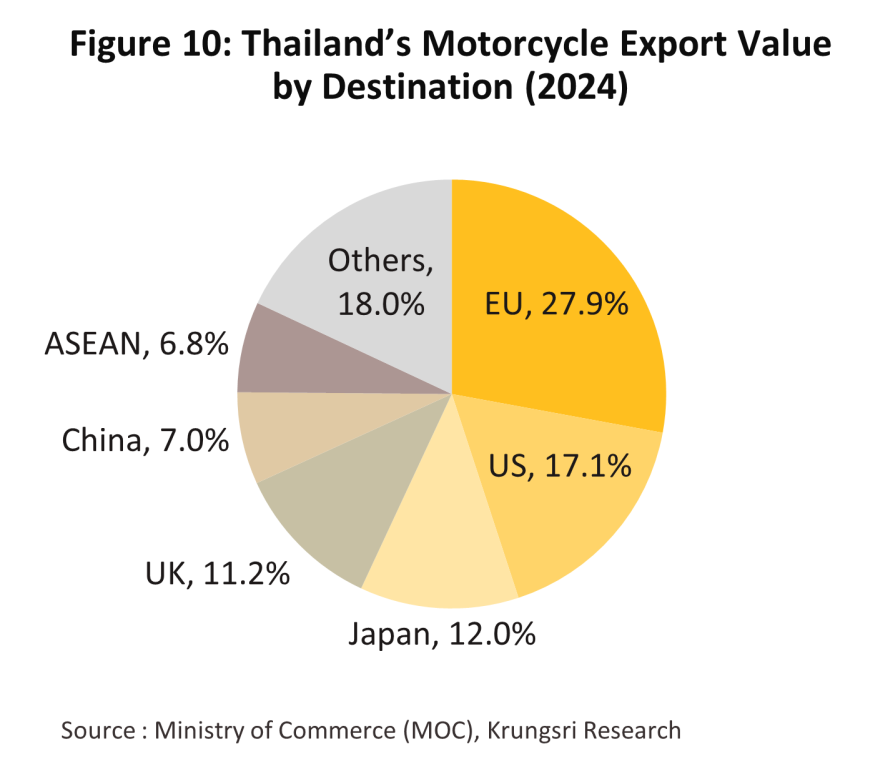

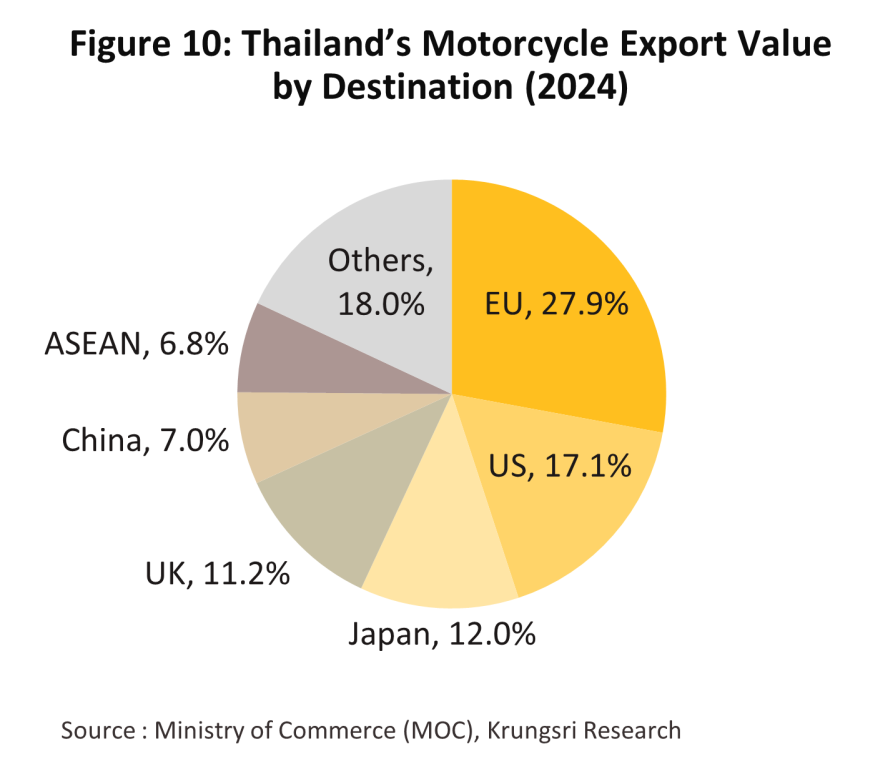

Export market: The decision by major global manufacturers to set up production facilities in Thailand has established the country as a center for the production of big bikes, and so from 2013 onwards, there has been a clear uptick in exports of these. The structure of the export market has thus shifted, with finished large-capacity models replacing the earlier dependency on smaller vehicles. Alongside this, Thai exporters have moved from the earlier concentration on the ASEAN zone to selling into a broader and more geographically diverse range of markets. As such, over-500 cc models now comprise the majority of exports, reaching 54.8% of total export value by 2024, with the most important export markets being the US (17.1% of the value of all motorcycle exports), Japan (12.0%) and Belgium (11.9%).

As a consequence of earlier government-led efforts to attract investment into the industry, as of 2025, there are now 25 companies manufacturing motorcycles in Thailand (this includes new entrants to the market that are still investing in their production facilities) (source: Thailand Automotive Institute). 10 of these manufacture internal combustion engine-powered models, namely: BMW (German), Ducati (Italian), GP Motor (Thai), Harley-Davidson (US), Honda (Japanese), Kawasaki (Japanese), Stallion (Thai), Triumph (UK), Yamaha (Japan) and Zongshen (Chinese). A further 15 manufacturers produce electric motorcycles. These are: AJ Advance (Thai), Deco Green Energy (Thai), Edison Motor (Thai), Etran (Thai), H Sem Motor (Thai), I-Motor Manufacturing (Thai), Siam Green Energy (Thai), Smartech Motor (Chinese), Strom (Thai), Swag EV (51% Thai-49% Singaporean), Takuni Group (Thai), Tatung (Taiwan), Thunder EV (China), TTS Connect (Thai) and Zapp Scooters (UK).

Situation

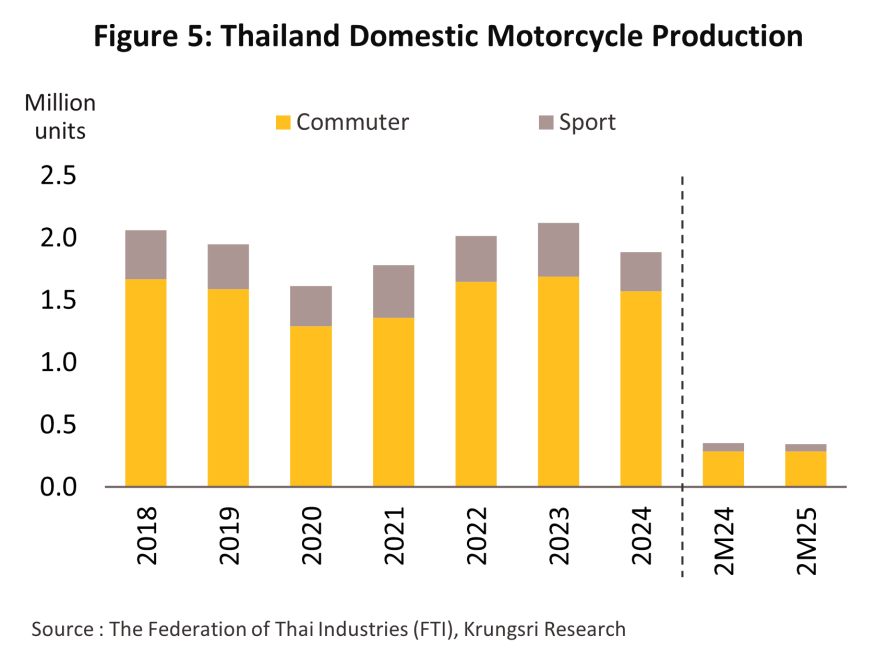

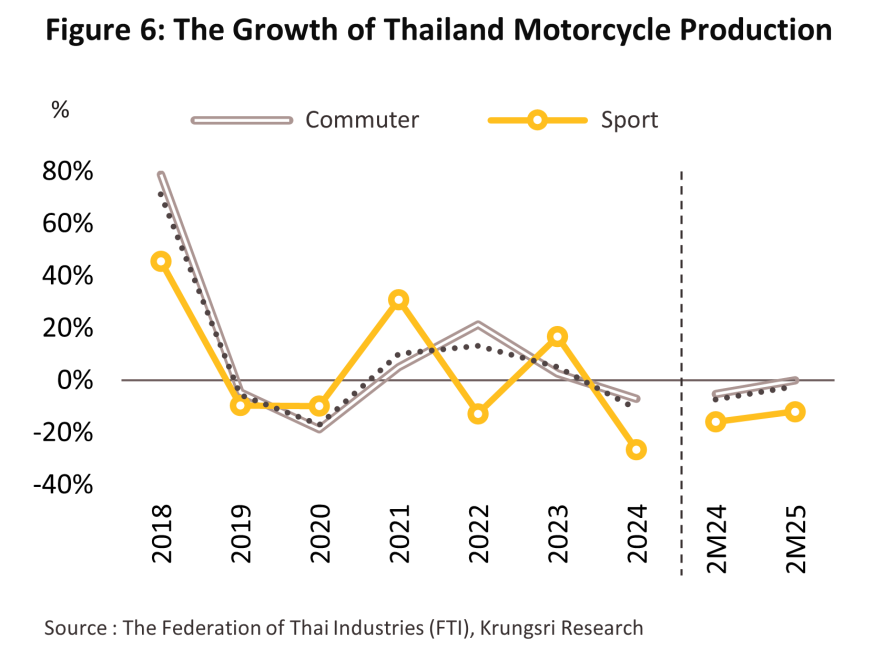

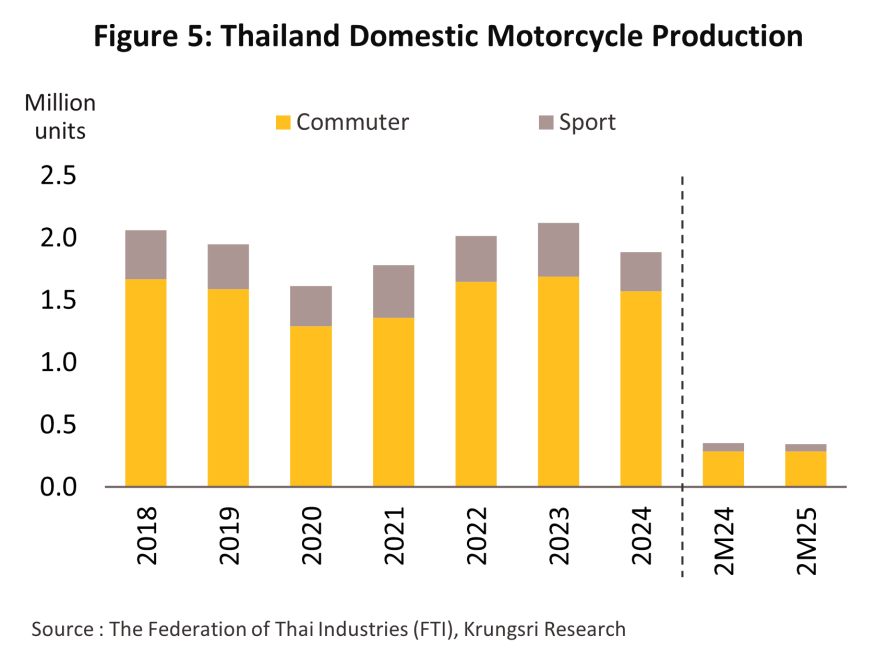

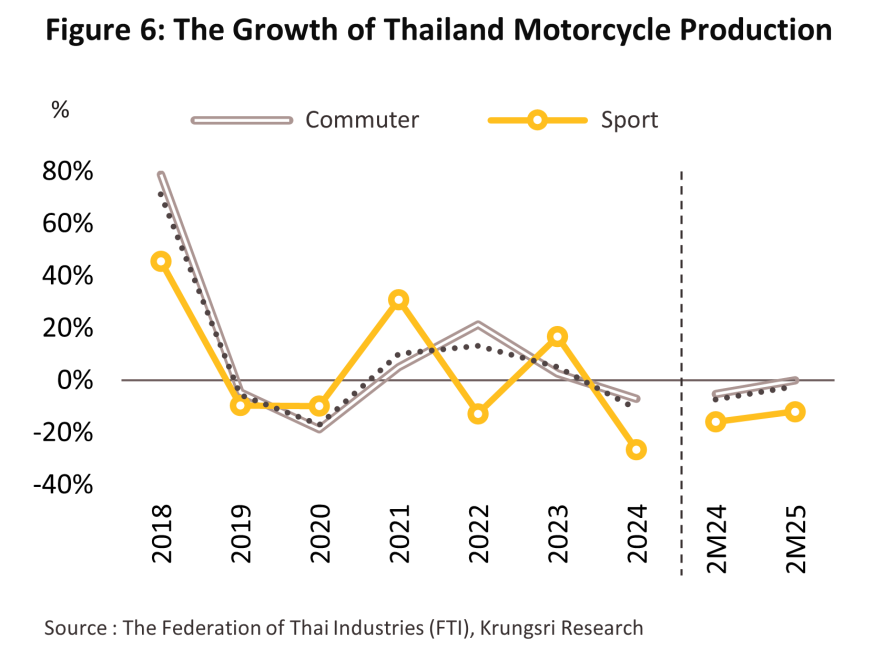

Production slipped -11.0% to 1,887,208 units in 2024 (Figure 5 and Figure 6) due to weakness in domestic and overseas markets and a 20.2% increase in inventories (up from an average of 47,993 units/month in 2023 to 57,683 units/month in 2024, Office of Industrial Economics). The latter resulted from softness in consumer spending power, encouraging some manufacturers to run down their stocks. Market conditions are described in more detail below.

Output of commuter models (i.e., with an engine capacity of less than 150 cc) fell -7.0% to 1,518,765 vehicles, these thus comprising 80.5% of total output. This is a result of the following factors: (i) production of cheaper manual models4/ slumped to 718,851 units, down -24.0% on sluggishness in the economy and the impacts of first drought and then flooding on the spending power of lower- and middle-income households, while (ii) the number of automatic motorcycles5/ coming off production lines rose 8.3% to 799,914 units thanks to the popularity of new models that are equipped with more advanced technology and that are easy to drive. These are proving to be particularly favored among younger buyers and providers of ride-sharing services.

Production of sports models (i.e., with an engine larger than 150 cc) crashed to 315,187 units, a drop of -26.7%. This segment therefore accounted for 19.5% of output. Declines were split between: (i) a -54.4% crash in production of relatively more expensive mid-sized models (151-400 cc) (down to 83,772 units) that was driven by weak consumer spending power and a tightening of lending conditions; and (ii) a -5.9% decline in output of motorcycles with an engine capacity in excess of 400 cc (down to 231,415 units) as weak economic growth undercut demand for big bikes in overseas markets, most notably in China (-57.7%), Japan (-34.5%) and Belgium (-21.4%).

Declines continued through the first 2 months of 2025, falling to 345,427 units but at -2.3% YoY, the pace of decline slowed from 2M24’s drop of -7.5% YoY. Manufacturers are now benefiting from signs of recovery in the market for the commuter models that form the core of domestic sales, and so with demand for the commercial use of these improving, output came to 287,905 vehicles, down just -0.1% YoY. By contrast, the market for sports models remains weak and so just 57,522 of these came off production lines in the period, a fall of -12.0% YoY.

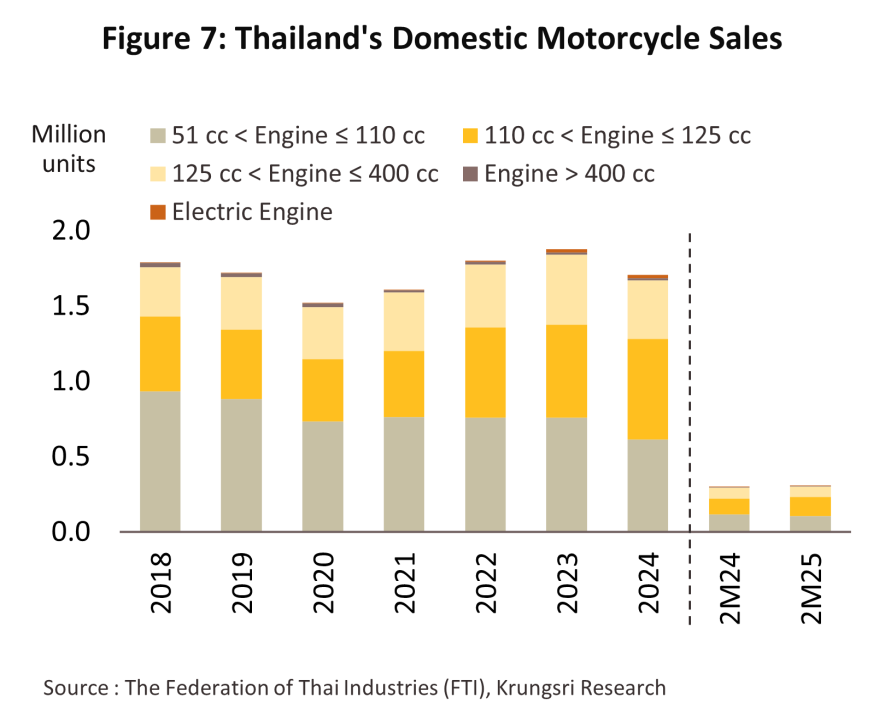

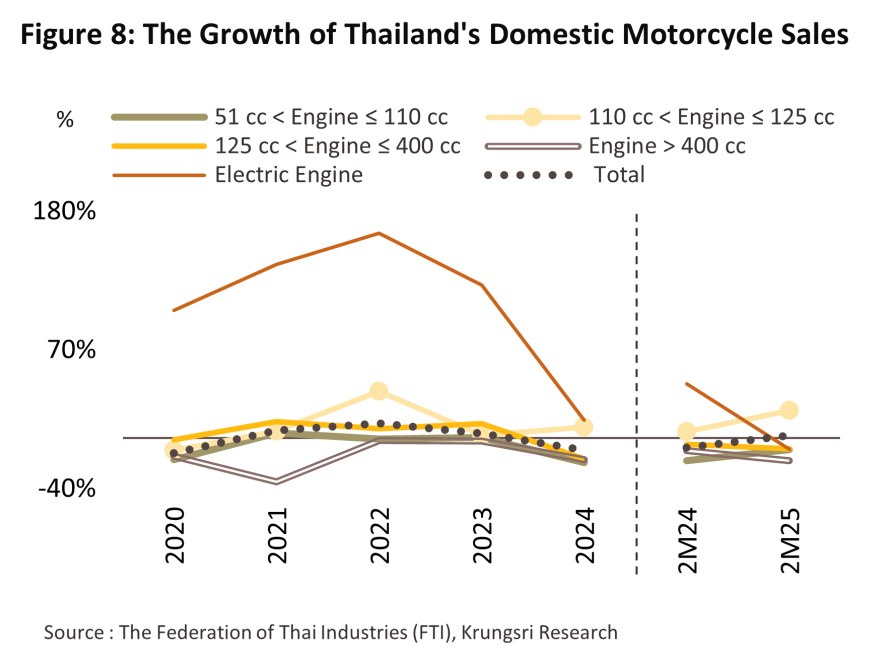

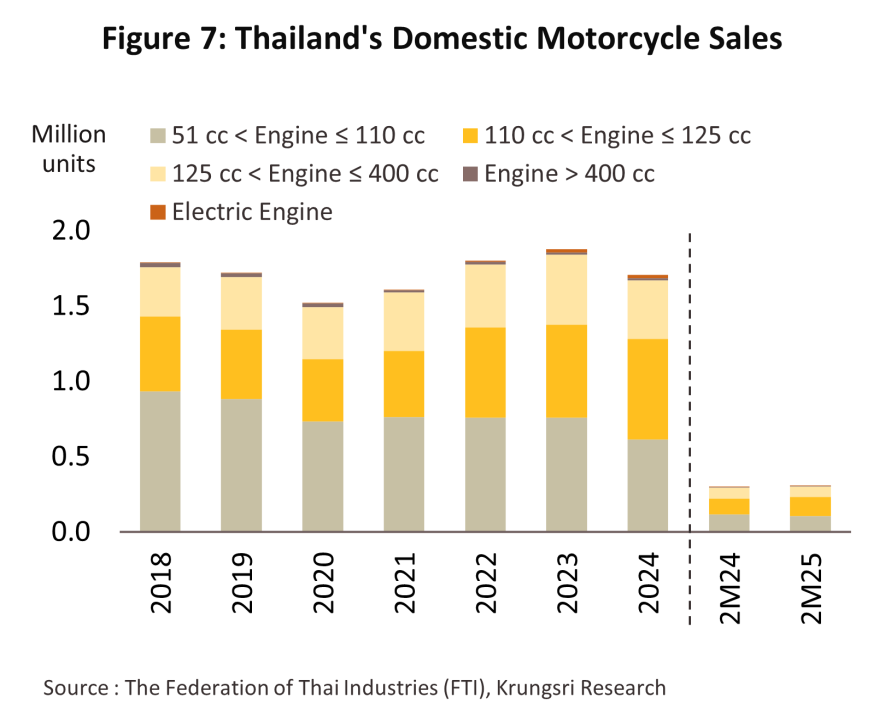

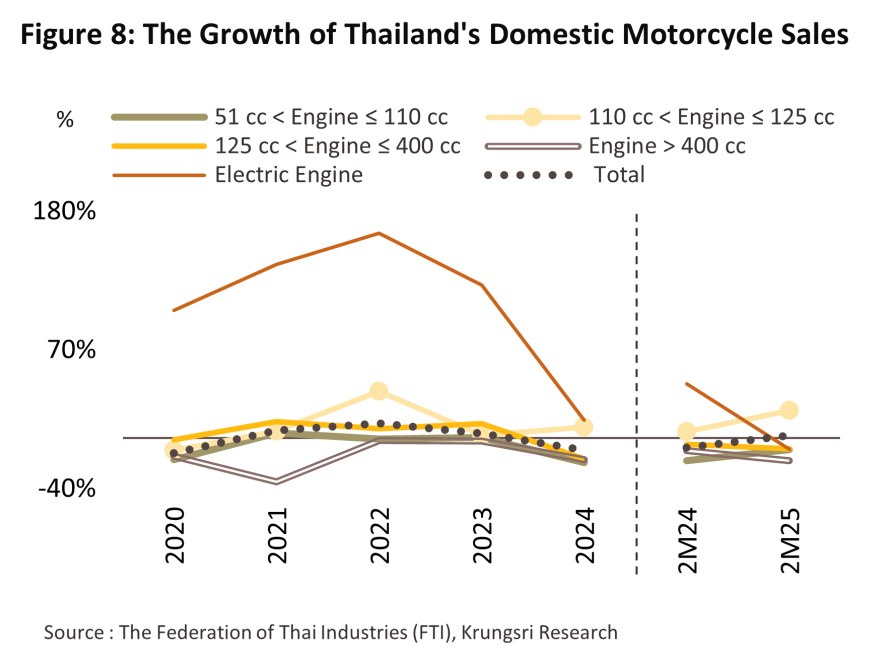

Domestic sales slumped -9.4% to 1,683,239 vehicles in the year (Figure 7 and Figure 8) as the market came under pressure from a combination of only slow economic growth and weak consumer spending power that then amplified the effects of high levels of debt. In addition, lenders have restricted the release of new credit, further dragging on sales growth. Details of market segments are given below.

-

51-110 cc models: At 612,247 vehicles (36.4% of all motorcycle domestic sales), domestic sales were down -19.5%. This was a consequence of ongoing high levels of indebtedness, drought, and then floods in some areas. The latter negatively impacted the spending power of those in the agricultural sector and other low-income earners, who typically favor cheaper-priced motorcycles (generally, these sell for THB 40,000-50,000) with lower running costs. Models suffering especially sharp falls in sales included the Honda Wave 110i, down -15.2% to 433,652 units, and the Honda Scoopy, down -26.7% to just 159,893 units.

-

111-125 cc models: With domestic sales rising 8.8% to 668,628 units, these accounted for 39.7% of all domestic sales. This segment benefited from two factors. (i) The continued growth of food delivery and ride-hailing businesses6/ has driven demand for this segment of motorcycles, thanks to their commercially suitable engine size, affordable price point (averaging THB 60,000–70,000), and low fuel costs. (ii) Some lower- to middle-income consumers have increasingly shifted to using motorcycles in this segment as their primary mode of transport, replacing larger motorcycles or passenger cars, which face stricter loan approval from financial institutions. Increases in sales have been most notable for the Honda Giorno Plus (up 417.6% to 137,690 units) and the Yamaha Grand Filano (up 26.7% to 106,335 units).

-

Models with an engine capacity in excess of 126 cc: Sales fell back -16.4% to 402,364 units, these larger models thus comprising 23.9% of all domestic distribution. The market struggled under the impact of weaker than expected economic growth and tighter lending conditions, the latter a result of high levels of debt default and special mention loans in the auto loan segment7/. As such, some middle-income earners delayed purchases of larger motorcycles or instead bought smaller more economical models that are cheaper to run. During the period, sales of the Honda PCX 160 thus fell -8.6% to 145,349 units, while for the Honda Click 160, these were down -21.5% to 70,023 vehicles.

-

Electric motorcycles: Sales rose 14.1% to hit 25,020 units. Demand growth was boosted by: (i) subsidies of up to THB 10,000 to buyers of electric motorcycles provided by the EV 3.5 measures; (ii) the steady improvement in access to charging points and battery-swapping facilities; (iii) progress in battery technology that has extended the range per charge; (iv) an increasing number of companies active in the segment and the diversification in the models that are available; and (v) strengthening demand for low-cost rentals of electric motorcycles from ride-sharing services, which are themselves growing8/. Models that attracted greater interest from consumers through 2024 included the EM Legend and the Lion SKS Z2, for which new registrations jumped by respectively 324.9% (to 3,229 units) and 141.6% (to 5,494 units). Nevertheless, despite strong growth, the electric segment represents just 1.3% of all new motorcycle registrations, far from the government’s 2025 target of 10%.

303,913 motorcycles were sold domestically over the first two months of 2025, a rise of 2.1% YoY. Growth came from improvements in the 111-125 cc segment, where sales jumped 22.0% YoY to 129,733 units on the strengthening purchasing power of some middle-income consumers and ongoing expansion in the food delivery and ride-hailing markets. However, other segments continued to be affected by the same factors that dragged on sales through 2024. Thus, with household debt high and purchasing power soft, the 51-110 cc segment contracted -9.0% YoY to 104,399 units, while difficulty accessing financing contributed to the -8.9% YoY decline in sales in the over-126 cc segment (down to 69,781 vehicles).

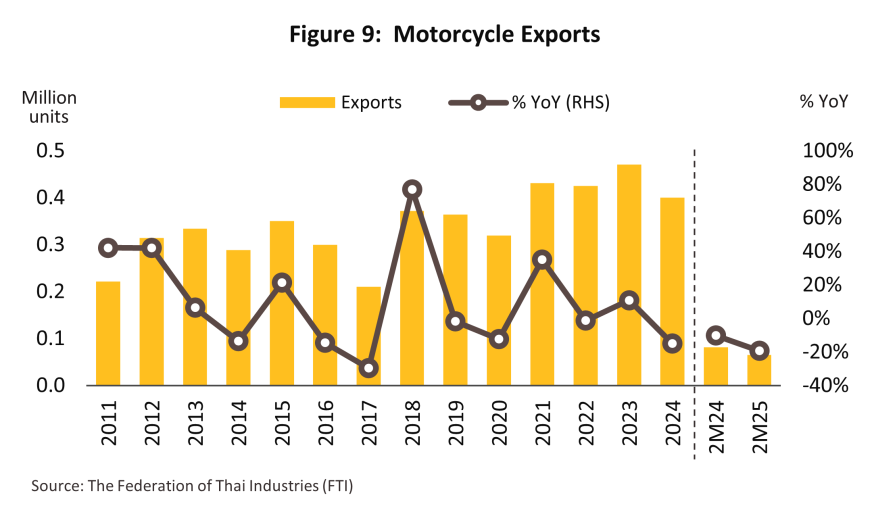

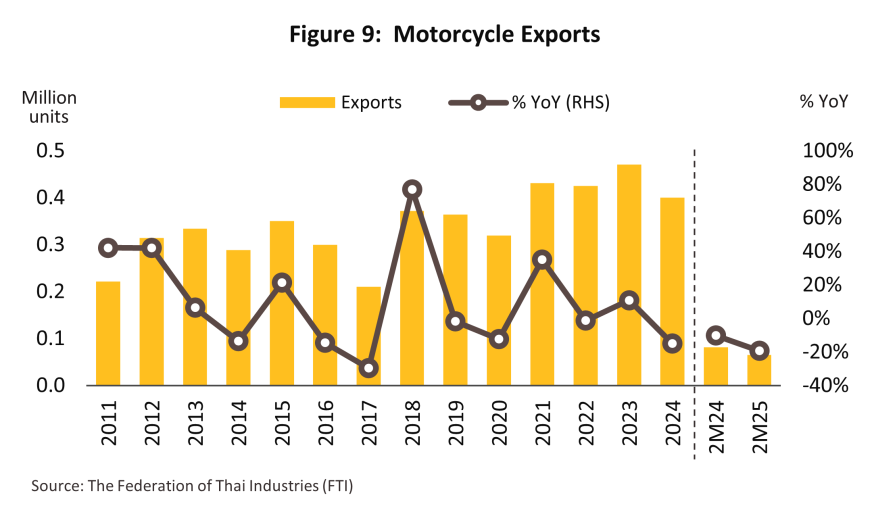

Exports also performed poorly in 2024, pulling back -15.1% to a total of 399,603 vehicles (Figure 9 and Figure 10). Export value contracted at the same rate, declining to USD 2.3 billion (source: MOC) on a mix of: (i) economic weakness in overseas markets that undercut consumer spending power; (ii) strengthening output in export markets, with imports of CKD units for assembly into finished vehicles up 53.1% to 539,159 units; and (iii) the entry to global markets of insurgent manufacturers of electric motorcycles, which unlike Thai players that are still focused on ICE-powered vehicles, are able to respond to growing demand for these.

However, 2024’s declines are also partly attributable to the 10.8% jump in orders seen in 2023 (to 470,474 vehicles), when the easing of supply chain disruptions and improved access to semiconductors allowed manufacturers to clear backorders. Moreover, exports to some markets improved in 2024, as seen in growth of 23.4% in deliveries to the US (thanks to its 17.1% share, Thai manufacturers’ most important market), 24.0% to the Netherlands (the 5th most important export market, with an 8.8% share) and 81.5% to Brazil (a 2.7% share, placing the country in 9th position) (Figure 10).

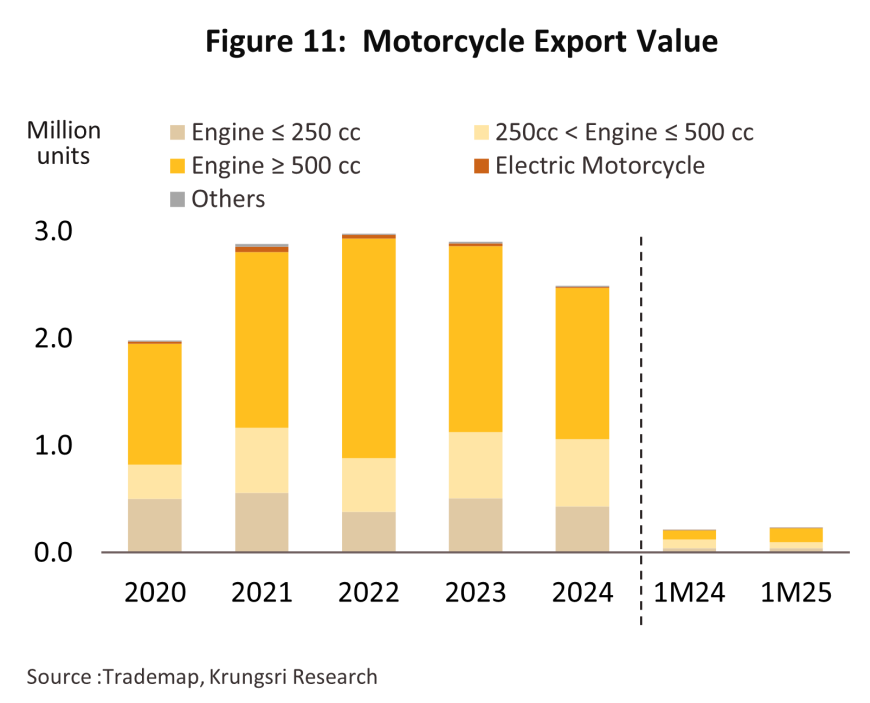

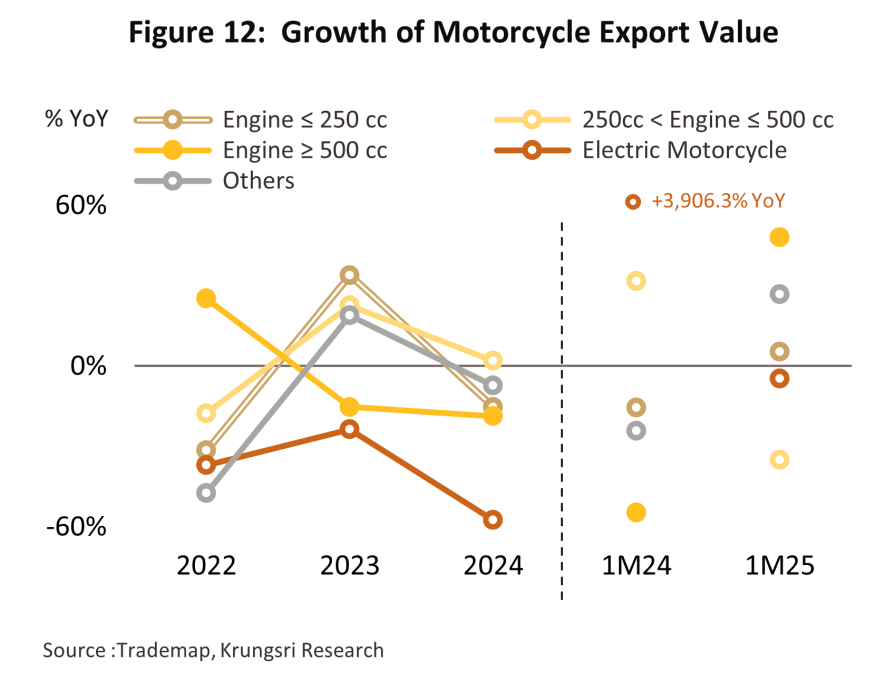

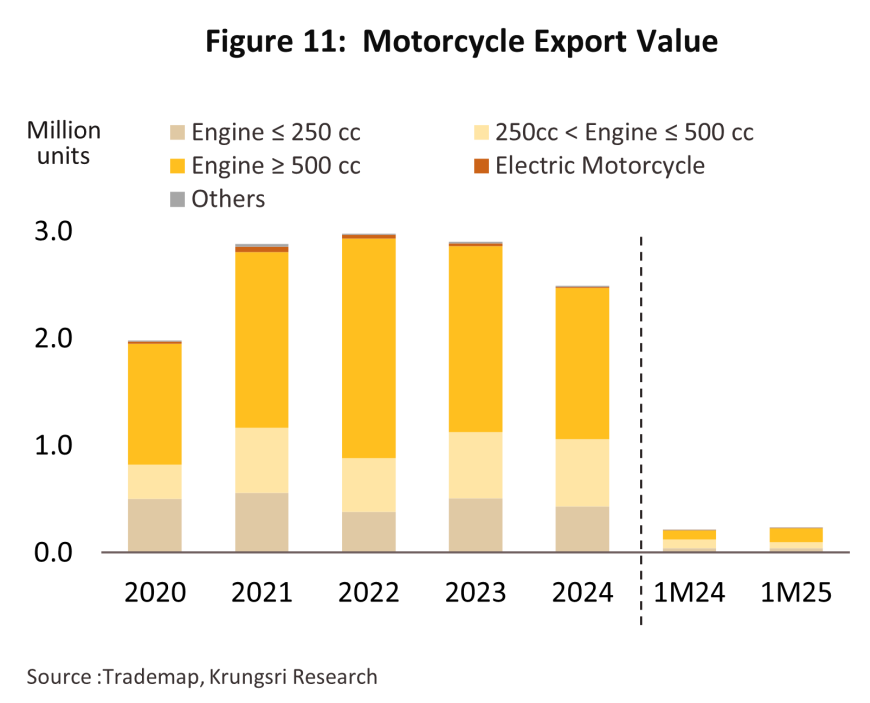

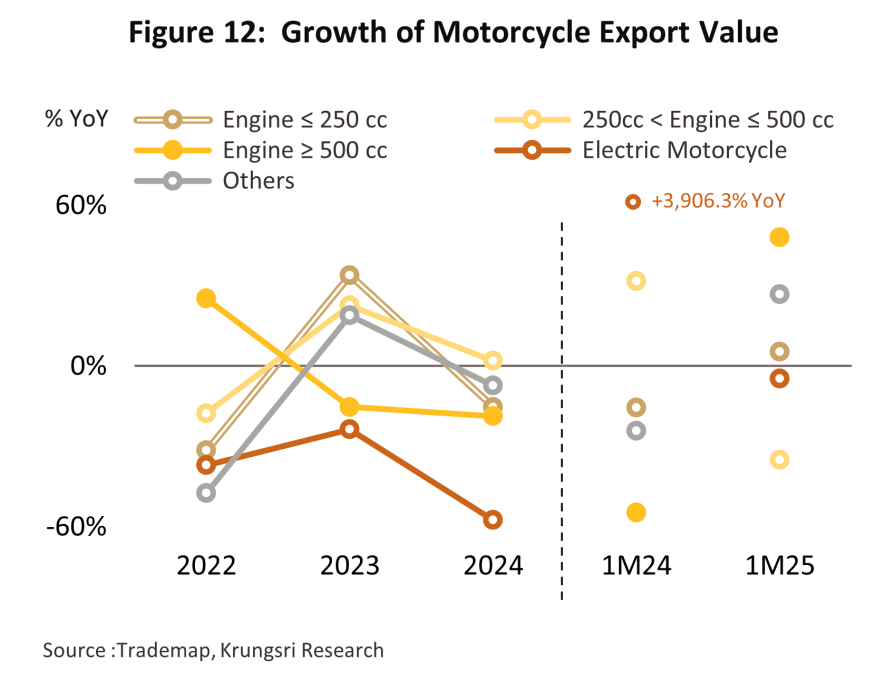

Analysis of exports according to the Trade Map (Figure 11 and 12) product types shows the following. (i) The value of exports of ICE motorcycles declined by -13.7% to USD 2.5 billion due to the general effects of economic weakness on demand. This was most pronounced for models with an engine capacity in excess of 501 cc, for which export value slumped to USD 1.4 billion, or a drop of -18.7%. However, thanks to their lower prices and reduced costs relative to bigger models, exports of motorcycles sized 250-500 cc moved against trend and the headwinds coming from continuing sluggishness in overseas markets to edge up 1.9% to a total value of USD 0.6 billion. (ii) Receipts from exports of electric motorcycles crashed -57.6% to generate receipts worth just USD 0.01 billion. Thai exports are still focused primarily on ICE models and as yet, Thai EVs are not popular on international markets. As a result, some 99.5% of all income from the export of motorcycles from Thailand comes from the sale of ICE models.

By volume, exports continued to contract over the first two months of 2025, sliding by -19.5% YoY to 64,969 vehicles. Markets remained under pressure from weak demand from lower- and middle-income consumers and the growing supply of electric motorbikes to overseas markets, though declines were primarily attributable to weakness in the main markets of Japan (-49.1% YoY) and China (-45.5% YoY). Nevertheless, exports of ‘big bikes’ (i.e., those with an engine capacity over 501 cc) jumped 48.0% YoY as purchasing power strengthened in the middle and upper end of overseas markets.

Outlook

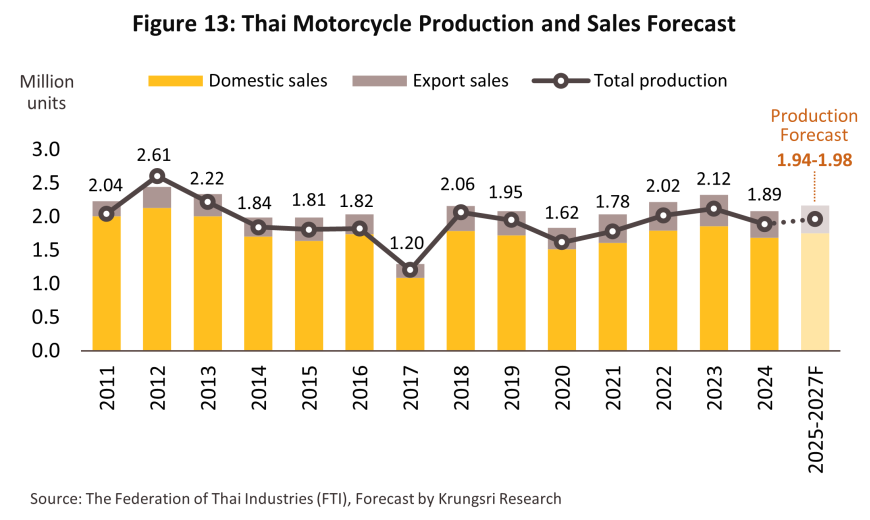

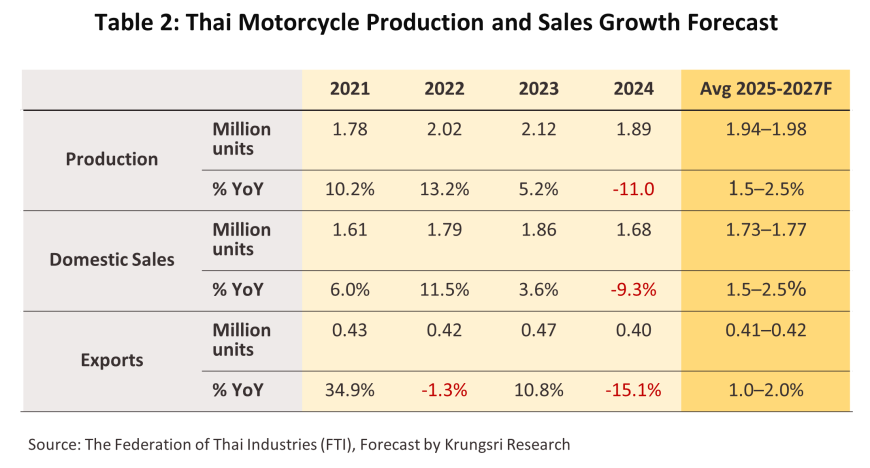

Domestic production is expected to expand by an average of 1.5-2.5% annually over 2025-2027, totaling 1.94-1.98 million vehicles annually (Figure 13 and Table 2). Tailwinds lifting the industry will include: (i) gradual recovery of demand in domestic and trading partner countries despite low market expansion rate in 2025 (the domestic market is constrained by strict lending approvals from financial institutions, and the export market is impacted by U.S. tariff policies); (ii) widening supply that will come as a result of an earlier expansion in investment (as of January 2025, 15 manufacturers had invested a total of THB 922 million in Thai electric motorcycle production facilities, sufficient to support output of 550,000 vehicles annually (Thailand Automotive Institute and Thansettakij, 2-4 January, 2025)); and (iii) the need to meet the conditions laid out in the EV 3.0 and EV 3.5 measures, which require that earlier imports of electric motorcycles are compensated for with the domestic production of respectively 1.5-times (in 2025) and 2-3-times (in 2026-2027) imports.

However, the growth rate of production may face pressure from competition with low-cost imported electric motorcycles, especially from Chinese manufacturers looking for new markets that can absorb excess supply, and the more general growth in worldwide production capacity. Pressure to cut production costs (McKinsey, September 2024) may thus also drag on profits and limit growth in domestic output.

Domestic sales are forecast to rise to 1.73–1.77 million units per year, which would translate into annual growth of 1.5-2.5%. Stronger demand will come from: (i) growth in the tourism industry and in the broader economy, which will then add to demand for local travel; (ii) the onset of La Niña conditions and the resulting boost to agricultural yields, thus lifting demand for smaller models; (iii) ongoing growth in ride-hailing and food and parcel delivery services that will add to sales of electric and sub-125 cc models; (iv) an expansion in demand for larger models as spending power rallies among mid- and upper-income earners; and (v) the effects on EV sales of increasing access to battery swapping stations and charging points, continuing government support for the industry, and the development of more advanced models.

However, still-high levels of household debt and rising rates of auto loan delinquencies are making it more difficult to access credit and this will weigh on growth in domestic sales.

Exports should also strengthen by 1.0-2.0% annually, which would then bring these to a total of 0.41-0.42 million units per year. Overseas markets will be affected by U.S. tariff measures, with Thailand's exports making up approximately 16.4% of the total motorcycle export value in 2024. Despite this, economic recovery in other key trading partners, such as Japan, Europe, China, and ASEAN, provides support. Notably, the big bike and electric motorcycle segments continue to have growth opportunities in these markets.

-

Global sales of big bikes is forecast to expand by 2.2% CAGR through the period 2023-2029, rising from 32.2 million to 36.7 million over these years. Sales will benefit from a combination of strong purchasing power among mid- to upper-income consumers and the development of new technologies for larger models. These will focus in particular on connectivity features such as touchscreens, GPS navigation, and mobile phone connection and integration (Statista, November, 2024).

-

Worldwide electric motorcycle sales are expected to surge by 21.6% CAGR over 2024-2030, taking these from 65 million to 210 million by the start of the next decade (IEA, 2024). Growth will be strong in Thailand’s core markets of Europe and the ASEAN zone, which are the sources of respectively 27.9% and 6.8% of Thai export value, and McKinsey (September 2024) thus sees sales of electric (mostly premium) models growing by 33.4% CAGR in Europe and 19.6% CAGR in the ASEAN area over 2023-2030. This would then lift the sales in each of these two zones from 0.1 million to 0.5-1 million and from 1 million to 3-4 million.

1/ For more details, see pages 1-3 of Industry Outlook: Motorcycles (2019-2021)

2/ Following Thailand’s signing of the General Agreement on Trade and Tariffs (GATT), which promotes free trade, the country was required to lift its ban on the import of assembled motorcycles. This happened in 2000.

3/ Source: Department of Land Transport

4/ From data on family-type commuter models classified by the Federation of Thai Industries

5/ From data on AT/scooter-type commuter models classified by the Federation of Thai Industries

6/ For example, uptake of LINE MAN Bike services jumped 390% in 2024 on greater demand during the rush-hour (Prachachat Turakij, 20 December 2024)

7/ For more details, please see page 15 of the Thailand Industry Outlook 2024-26: Automobile Industry

.webp.aspx)