EXECUTIVE SUMMARY

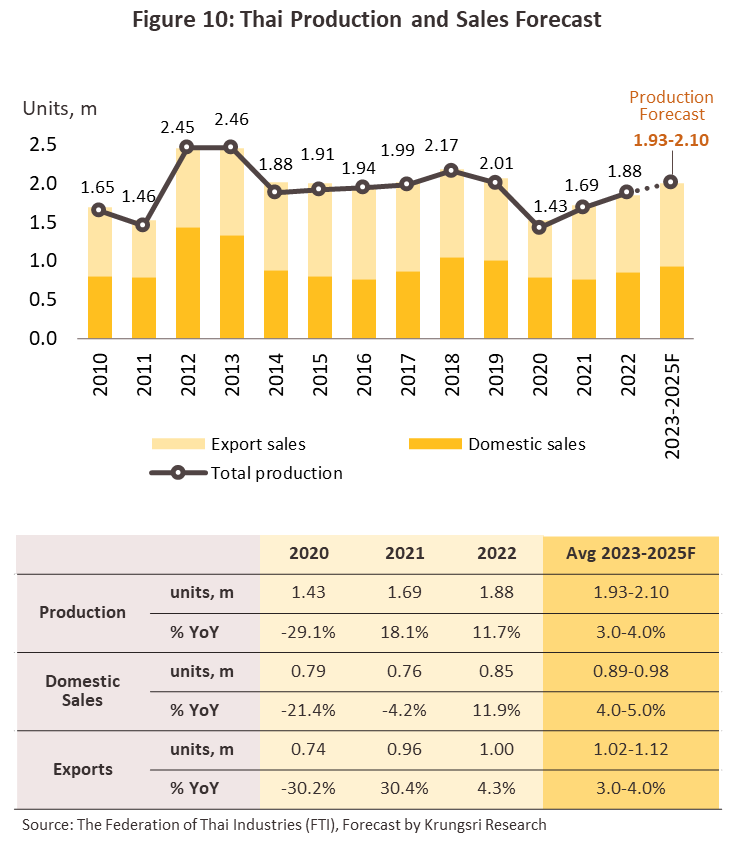

The auto industry will see continuing growth through the period 2023-2025 thanks to a combination of factors. (i) The recovery in the overall economy and purchasing power with softer inflationary pressure (ii) Although conflicts between the US and China over access to technology will mean that periodic problems with chip shortages will persist through 2023, greater investment in production capacity in the US, Germany, and Japan will translate into increased output, and so in 2024 and 2025, semiconductor supply problems should ease. (iii) Government measures to stimulate demand for battery electric vehicles will continue to support the market. (iv) Government spending on infrastructure development, growth in logistics and online retail, and the rebound in the tourism sector after the full reopening will all support stronger demand for commercial vehicles. (v) The market should be further boosted by the release of new models, and as manufacturers move to meet the requirements imposed by government support for the industry, this will include new electric vehicles. However, exports will remain sluggish through 2023 due to weak consumer spending power in export markets, though the situation should improve in 2024 and 2025. Nevertheless, Thailand’s auto exports are largely still of internal combustion engine-powered vehicles, and in many countries, the authorities are moving to restrict the sale or use of these.

Krungsri Research view

During 2023-2025, the auto industry and related businesses will enjoy growth that will move in step with an improving economic outlook. Ongoing government efforts to stimulate purchases of battery electric vehicles (BEVs) will also continue to bear fruit, and so income for manufacturers and distributors will grow solidly. However, second-hand car dealers will likely fare worse and with competition stiffening and the supply of second-hand cars increasing, income is expected to soften.

-

Auto manufacturers: Income from both the domestic and export markets will rise through 2023-2025. Recurrent problems with chip shortages will continue to be seen in 2023 as the US-China tech conflict worsens, but increased investment in semiconductor production in the US, Germany, and China will pay off in the form of greater supply of chips to world markets over 2024 and 2025, and this will help to lift income for the industry.

-

Manufacturers of passenger vehicles and 1-tonne pickups: Sales will benefit from ongoing growth in the domestic economy, continuing expansion in the online retail sector (which will add to demand for pickups), and government measures to support demand for BEVs that will run from 2022 to 2025. Sales will also be helped by the release of new models, especially of EVs, and although sluggish consumer spending power in overseas markets means that only weak growth in exports is expected for 2023, this should improve in 2024-2025.

-

Manufacturers of trucks, and articulated and semi-articulated vehicles: The market for these will be boosted by government spending on the construction of infrastructure networks, with spending likely accelerating to meet phase two of the EEC development plan for 2023-2027. Sales will also benefit from growth in the logistics sector, while exporters can look forward to the prospect of greater opportunities to penetrate regional markets thanks to expanding economies and government plans to step up investment in infrastructure projects.

-

Manufacturers of buses and other large transport vehicles: In this segment, recovery will move in line with a return to growth in the tourism and transport sectors over 2023 to 2025, as well as by continuing demand from public sector transport bodies, for example from the Bangkok Mass Transit Authority, and from players in the private sector in Bangkok. Moreover, as government measures that dictate the transition to the use of EVs for public transport are implemented, demand will increase by around another 6,000 vehicles. Exports will also tend to rise, especially to markets in the ASEAN zone.

-

Distributors of new vehicles (passenger vehicles and pickups) and official importers: Income will rise on stronger domestic sales and greater demand for servicing and repairs. However, with consumer spending power still soft, there is a risk of vehicle owners switching to cheaper general-purpose mechanics. In addition, manufacturers also require that distributors and agents invest in upgrades to showrooms and service centers, train their staff, and invest in EV charging stations to better respond to growth in this segment, and this will add to operators’ overheads.

-

Distributors of trucks and other large vehicles: The forecast here is for good rates of growth in sales thanks to progress on the government-backed build out of new infrastructure and increased demand for the transport of goods, the latter a result of the development of national communications networks within Thailand and linking Thailand to nearby countries. Growth in online retail and logistics will also help to support additional demand for trucks, especially for two-tonne and six-wheel vehicles. Beyond this, most players in this segment offer a comprehensive range of services, including supplying spare parts, servicing and repairing vehicles, selling second-hand vehicles and providing hire-purchase arrangements, and these will all help to build additional income streams in the coming period.

-

Independent importers (or “Gray market” importers): Independent importers will likely face mounting difficulties in carrying out their business. Competition is worsening from both official and unofficial distributors, while the government is tightening controls on gray imports, and these factors are tending to push costs to levels where players can no longer compete on price with official dealers. To deal with this changing business environment, gray importers are having to distinguish themselves from their competitors by shifting their focus to imports of vehicles that are not otherwise available. Players are also adjusting their operations and building consumer trust by offering a more comprehensive range of services (e.g., after-sales services and repairs), and generating profits from this and the sale of spare parts will help to diversify and strengthen income streams. Unfortunately, independent importers that fail to adapt to these changing conditions or that have insufficient access to capital may be forced out of business.

-

Second-hand dealers: Income from sales is expected to weaken as a result of the strengthening supply of new vehicles now that problems with chip production are easing. In addition, consumers are increasingly turning to EVs, but because almost all second-hand vehicles are ICE-powered, demand for these is falling. Supply has also widened with the cost-of-living crisis since the latter has forced some owners to default on their repayments and these vehicles have then been repossessed and resold. To make matters more complicated, an increasing number of new players are entering the market for secondhand vehicles (especially overseas sellers, companies that are part of auto manufacturer’s commercial networks and online platforms for buying and selling used cars), and this will add to the pressure on operators’ profits.

OVERVIEW

The automobile sector has long been considered an important part of the Thai economy and has for many years been the recipient of government support. At first, in the period 1961-1970, this assistance took the form of emphasizing production as an import substitution measure with a variety of government tools to attract investment to the industry. This included offering tax breaks and reducing the import duties for auto parts that were used in ‘completely knocked-down’ (CKD) units, which were then reassembled in-country. Meanwhile, the government also restricted imports of finished automobiles by raising import duties on ‘completely built-up’ (CBU) autos.

From 1971 onwards, the government switched to encouraging the domestic production of vehicle parts with the hope that this would lead to the development of the Thai automotive sector. The authorities achieved this by: (i) raising import duties on CKD parts and fully assembled vehicles; (ii) laying out local content requirements that from January 1, 1975, stipulated the proportion of locally-produced parts to be used, though Thailand also then steadily increased local content ratios as time went by; and (iii) putting in place policies to attract foreign investment and encourage technology transfer from multinational operators to domestic businesses. These policies resulted in steady growth in investment in the production of auto parts and this in turn has helped to build and to strengthen the supply chain of the whole automotive sector, a strength that is reflected in the fact that, by value, over 80% of all parts used in the manufacture of vehicles are now sourced domestically.

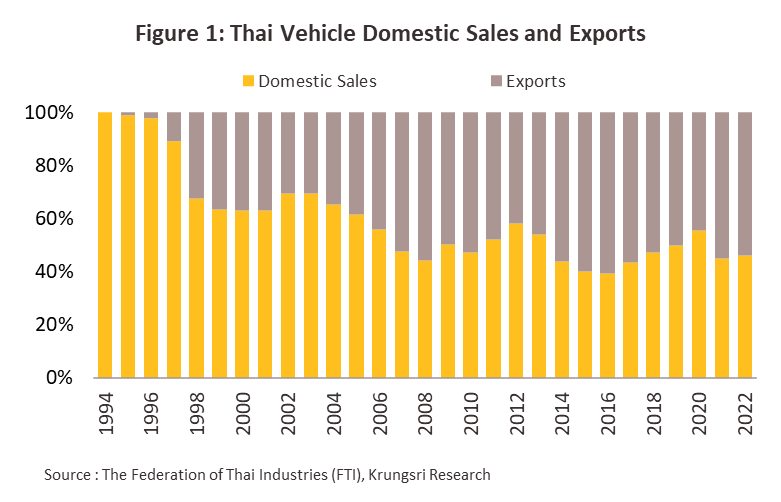

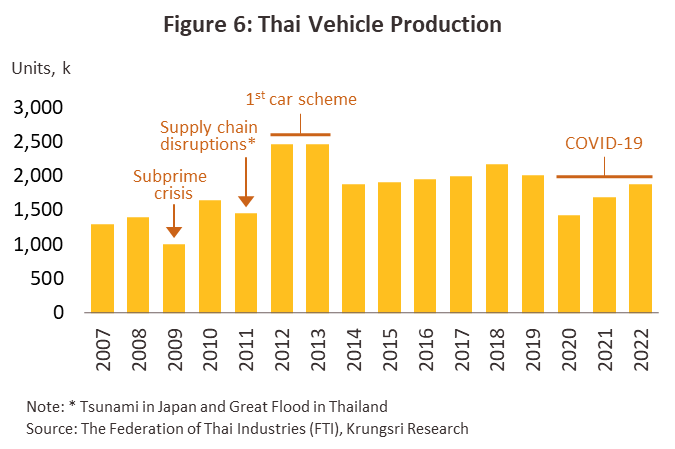

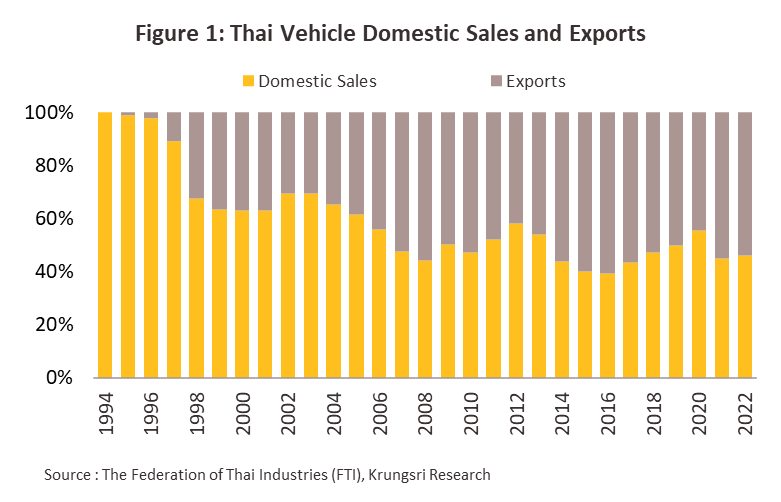

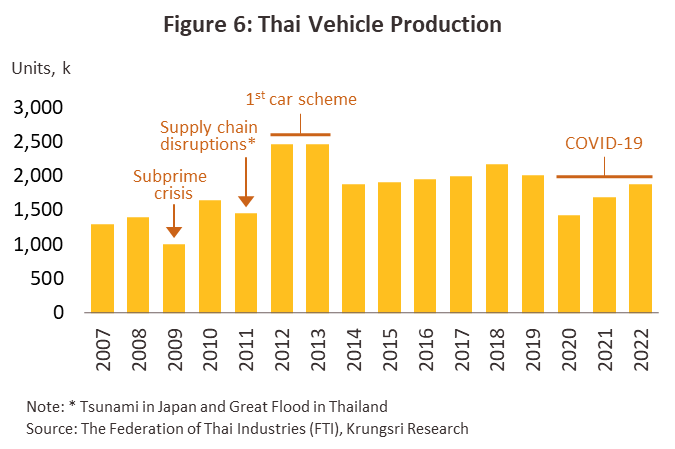

Investment in Thailand by multinationals increased substantially following the 1987 Plaza Accord, especially from Japanese players. This was because the Yen had strengthened, imposing significant costs on Japanese automobile manufacturers and making plants located in Japan uncompetitive, thus encouraging Japanese players to look for investment targets overseas. The development of the auto industry was also helped by the fact that following the Asian financial crisis of 1997, officials relaxed the rules on non-Thai entities holding stock in Thai companies. This happened simultaneously with their setting out plans for the development of the automotive sector and of building its export potential, with the intention of making the country the so-called ‘Detroit of Asia’. This then led to two decades of growth that took annual output from 0.36 million vehicles in 1997 to 1.88 million in 2022, a compound annual growth rate of 9.8%. At the same time, the automotive sector switched its primary focus to the export market and since 2007, sales into overseas markets have steadily increased (over 2007-2022, on average, distribution has been split 48% domestic and 52% overseas).

Beyond this general overview, official support has at different times had significant impacts on the production of particular types of vehicles.

-

Through the period 1997-2008, the government encouraged the production of 1-tonne pickups, a class of commercial vehicle that is typically diesel-powered, and by putting in place policies to encourage large global manufacturers to establish pickup production facilities in Thailand, the authorities made this class of vehicle the country’s number one ‘product champion’. Official efforts were also undertaken to stimulate the domestic market for pickups, for example, by using the oil fund to keep the price of diesel low relative to that of gasoline and cutting duty on pickups to 3%, which compared to rates of 30-50% for regular cars or passenger vehicles. As a result, sales of 1-tonne pickups grew substantially and at one time commercial vehicles accounted for over 70% of all Thai production.

-

Since 2009, the Thai government has eased off on promoting 1-tonne pickups and instead cars have become the national product champion. This move has helped to encourage increased investment in the manufacture of these, and so production has risen from 28% of total output in 2007 to 40% in 2022. In detail, policies to support the industry in recent years have consisted of the following:

-

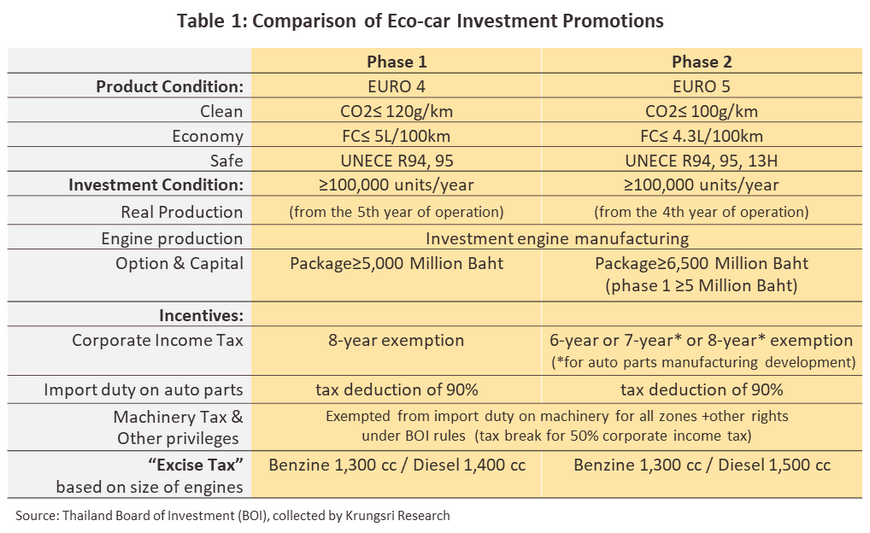

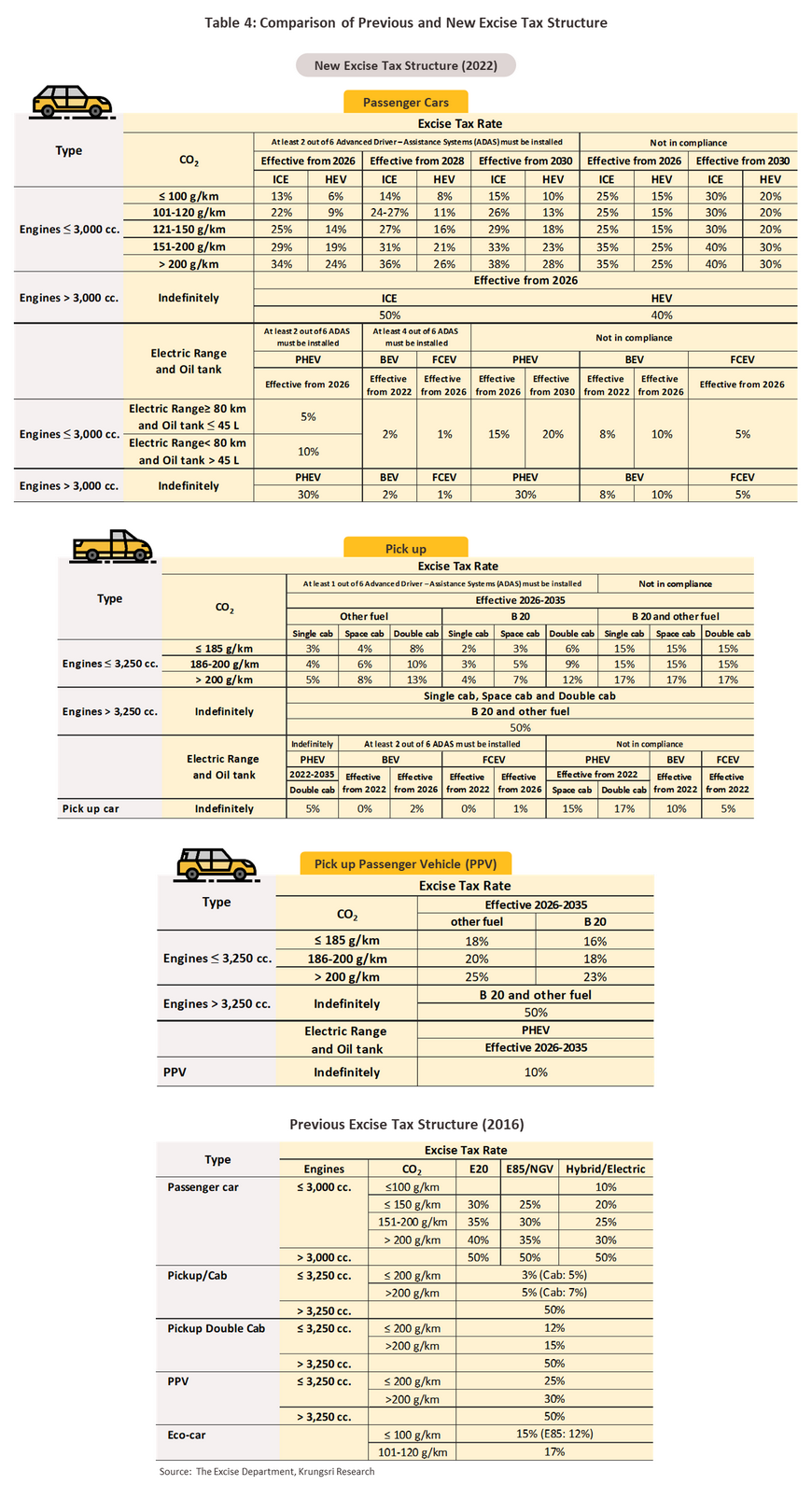

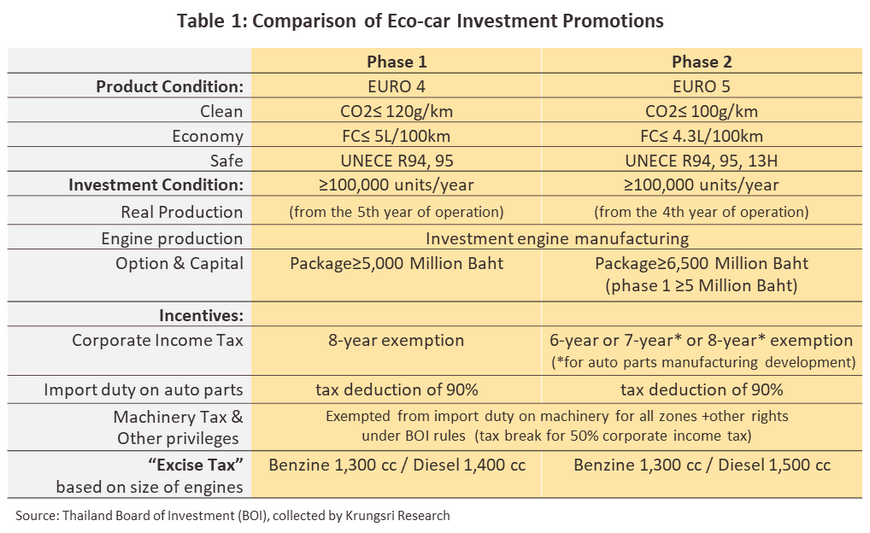

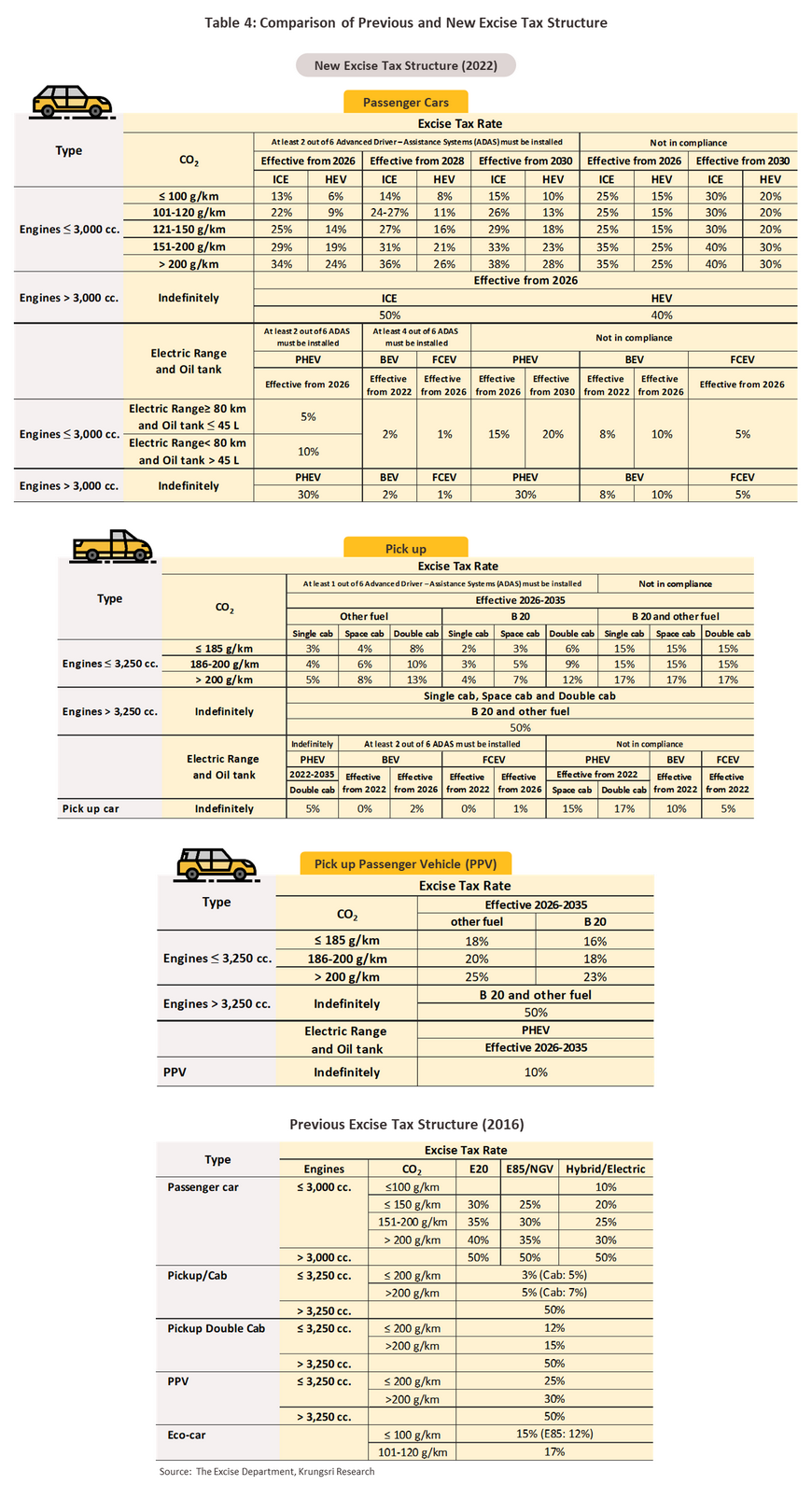

Measures to encourage the domestic production of small, economical cars (so-called ‘eco cars’) included designating this category as the country’s second ‘product champion’ for the period 2009 to 2015. To encourage interest from major producers, the government put in place a series of tax incentives to attract investment, while specifying conditions that set export targets that needed to be met to qualify for these tax breaks. These incentives came in the form of ‘Eco car Phase I’ (with effect from 2009) and ‘Eco car Phase II’ (which came into effect in 2015) (see Table 1). In addition to this, other factors have also helped to extend the domestic market for eco cars, including: (i) improvements in gasoline engine technology that are allowing increasing use of ethanol-based fuels (or ‘gasohol’); (ii) the decision by the Thai government to support the domestic consumption of biofuels by using the oil fund to keep prices for gasohol relatively low; (iii) the inclusion of eco cars in the categories of vehicle included in the 2012-2013 first-car buyer scheme, thus temporarily allowing buyers to reclaim the vehicle duty on these items1/; and (iv) from 2016, the reform of vehicle duty, which has henceforth been calculated on the vehicle’s CO2 emissions and the size of its engine. The latter resulted in larger-sized vehicles generally becoming more expensive, while growth in the market for small automobiles was stimulated through lower increases in vehicle duty, especially for low-emission eco cars, for which duty was cut from 17% to 12-15%. However, these favorable rates will soon expire and from 2025, for eco-cars that release less than 100 grams of CO2 per 100 kilometers (as per phase II of the eco-car program) and that have at least two of six advanced driver-assistance systems (ADAS) installed, duty will be set at 13% in 2026. This will then increase by 1% every two years to reach 15% in 2030, thus bringing the level back to close to what it had been. For cars without ADAS installed, duty will rise to 25% in 2026 and then to 30% in 2030 (Table 4).

-

Official support for the production of electric vehicles (EVs) covers three categories: hybrid electric vehicles (HEVs), plug-in hybrid electric vehicles (PHEVs) and battery electric vehicles (BEVs). These have been designated as Thailand’s third ‘product champion’ for the period from 2016 to 2036, and in pursuit of this, the government has provided the following support for this segment.

- The process for making applications for investment support under Phase I and Phase II of the Eco-car scheme has been amended and so when making investment support submissions, manufacturers may now aggregate the number of EVs that they have produced and other types of eco cars. (Counting these separately under the different phases would lead to production numbers failing to meet the conditions specified for support by the Board of Investment).

- In May 2019, to encourage greater production of EVs, the government announced that manufacturers applying for BOI investment support for BEV production would also be eligible for this when manufacturing HEVs (for applications submitted by 31 December, 2019) on the condition that HEV production had to start within 3 years of the day on which the investment promotion certificate was issued and that production of BEVs then had to commence no later than 3 years from the day on which HEV production began.

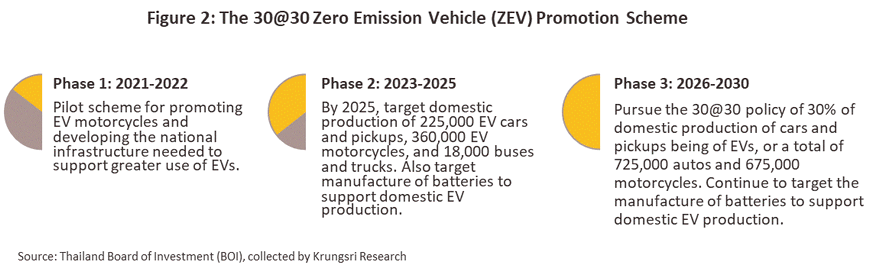

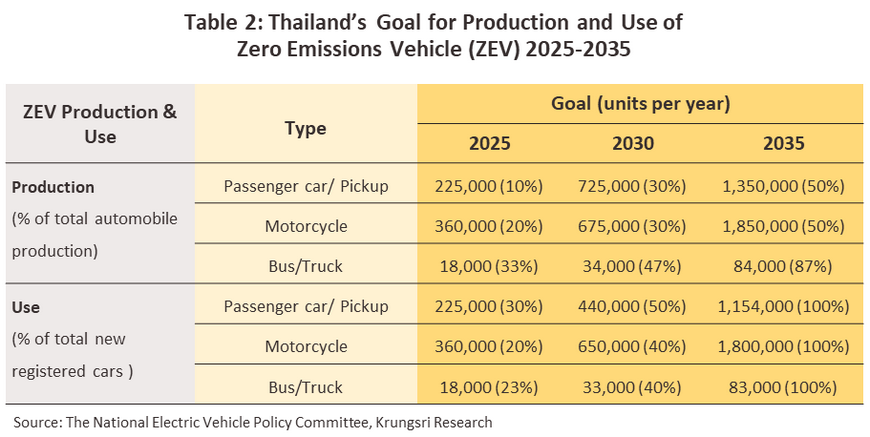

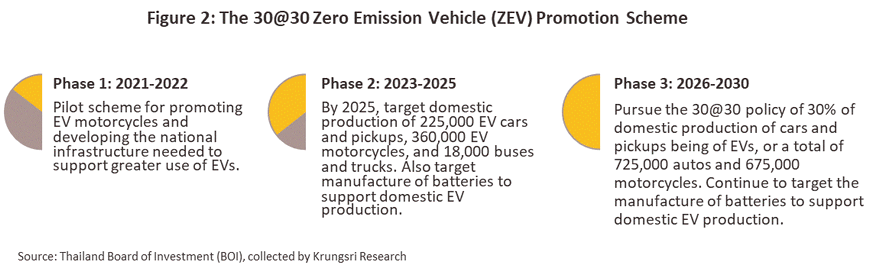

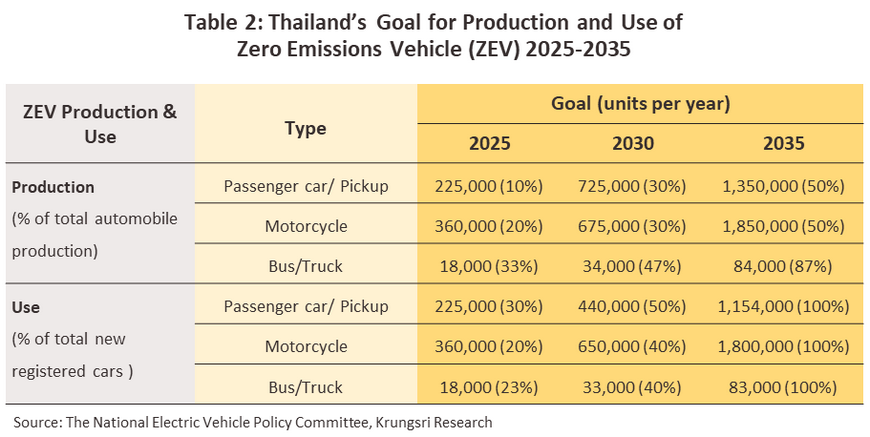

- On May 12, 2021, the National EV Policy Committee published its ‘30@30’ policy for the promotion of zero emission vehicles (ZEVs)2/. This has the goal of ensuring that by 2030, at least 30% of new autos will be ZEVs, though the overall target for increasing production and use of EVs is to be reached in 3 stages, as per Figure 2. For 2025, the target is for 10% of newly manufactured cars and pickups to be EVs, and for these to account for 30% of newly registered vehicles. For 2030, these rise to 30% and 50% respectively, and for 2035, 50% of new cars and pickups and 100% of new registrations should be of EVs. To support this, the government has put in a number of measures that will help to ensure that the market moves rapidly towards mass adoption of EVs and that these goals are reached.

1) To make use of EVs more convenient, the government is encouraging public and private sector bodies to expand access to EV charging stations. Data from The Electric Vehicle Association of Thailand from December 2022 show that at that point, there were 1,239 charging stations in the country, with a total of 3,739 chargers available. These were split between 2,404 standard alternating current units, and 1,342 fast direct current chargers.

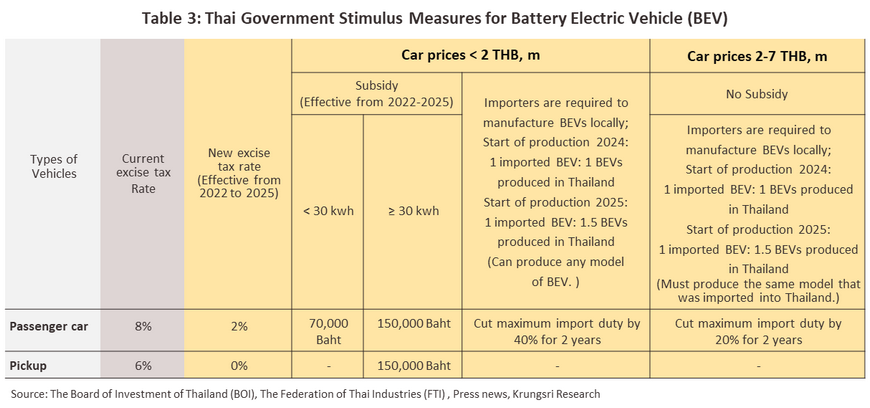

2) For 2022 and 2023, import duties on fully assembled BEVs have been cut to 40% for manufacturers participating in the government’s BEV promotion scheme. Under the latter, manufacturers are able to import and distribute BEVs to the Thai market at this discounted rate before making up for this by increasing their Thailand-based production of EVs, as per the specifications of the program.

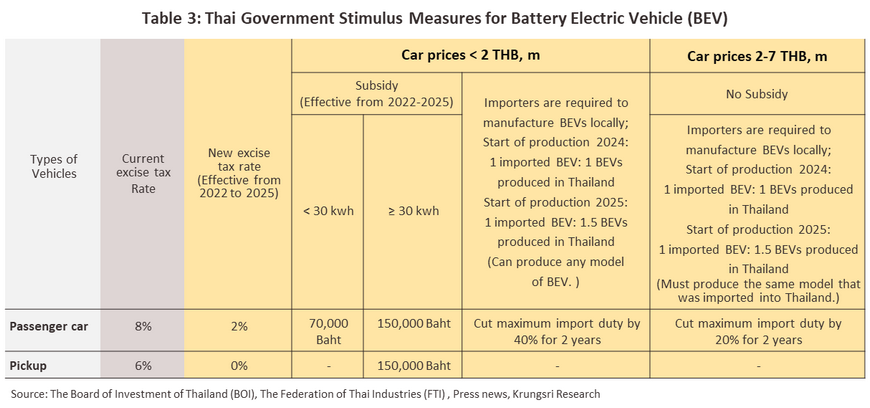

3) During February 2022 – December 31, 2025, the government will provide subsidies worth THB 70,000-150,000 per vehicle for BEV autos and pickups that are manufactured in Thailand. As part of the scheme, participating manufacturers are permitted to import BEVs for distribution to the domestic market in 2022 and 2023, but in 2024, they will need to increase domestic production to compensate for these imports on the basis of ‘1 imported, 1 manufactured locally’, while for 2025, this will change to ‘1 imported, 1.5 manufactured locally’. Moreover, conditions of participation in the scheme also state that: (i) for BEVs with a capacity of less than 30 kWh and a price of less than THB 2 million, any locally produced BEV will count towards this quota, but (ii) for BEVs with a capacity of more than 30 kWh and a price of THB 2-7 million, locally produced vehicles must be the same model as the imported vehicles for which they are compensating. For pickups to be covered by the scheme, they must be manufactured in Thailand over 2022-2025, have a capacity of 30 kWh or more, and cost no more than THB 2 million. It is hoped that this will then support the development of the domestic BEV market and encourage manufacturers to increase the number of BEVs coming off Thai production lines. This would also then increase demand for BEV auto parts (Table 3). As of December 2022, nine companies (5 Chinese, 2 Japanese, and 1 each German and Thai) were participating in this scheme: MG, GWM, Neta, Mine Mobility, Volt, Toyota, BYD, Mercedes-Benz and Honda.

4) The basis for calculating vehicle excise is being revised, and the new regime will help to promote greater use of EVs and encourage manufacturers to invest in converting production facilities that are currently being used to assemble ICE-powered vehicles to the production of EVs. Excise rates will thus be set in accordance with a vehicle’s CO2 emissions, resulting in low rates for electric vehicles. The new rates will be applied to ICE-powered vehicles from 2026 onwards, and for models that have high emissions, excise rates will ratchet up by 1-2% every 2 years between 2026 and 2030. For standard hybrids, excise rates will be raised to levels close to those for ICE vehicles, but for plug-in hybrids, the increase will be less marked (Table 4).

5) For new EVs registered between October 1, 2022 – September 30, 2025, annual road tax will be cut by 80% for one year from the date of registration.

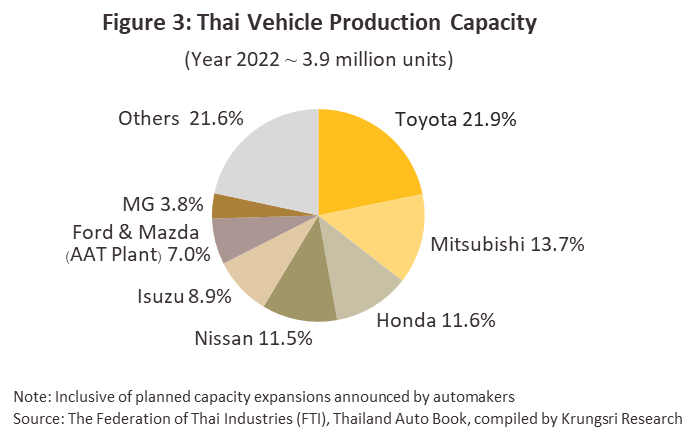

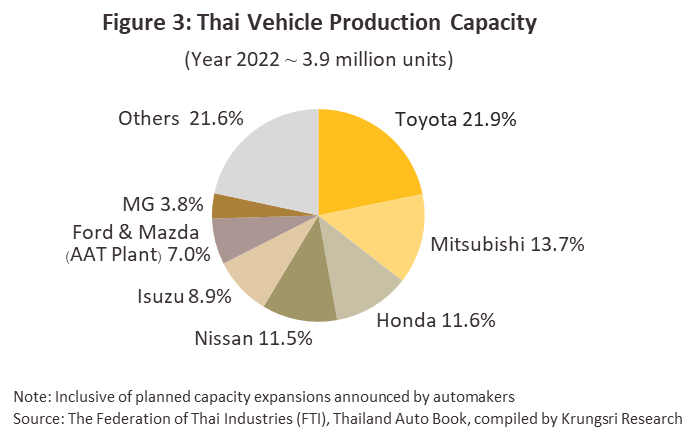

As of 2022, for all types of vehicles, domestic production capacity came to 3.9 million vehicles3/. 40% of this was for car production and 60% was for commercial vehicles, though over 90% of the latter was accounted for by production of 1-tonne pickups. Around 80% of all capacity was under the control of Japanese manufacturers (Figure 3).

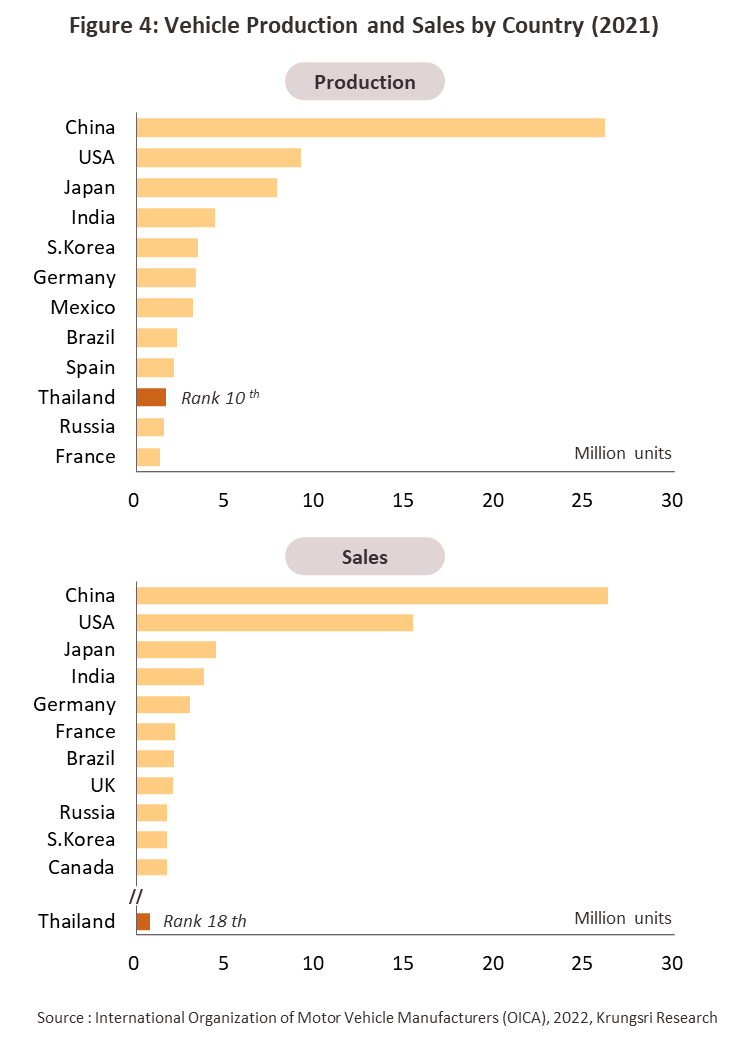

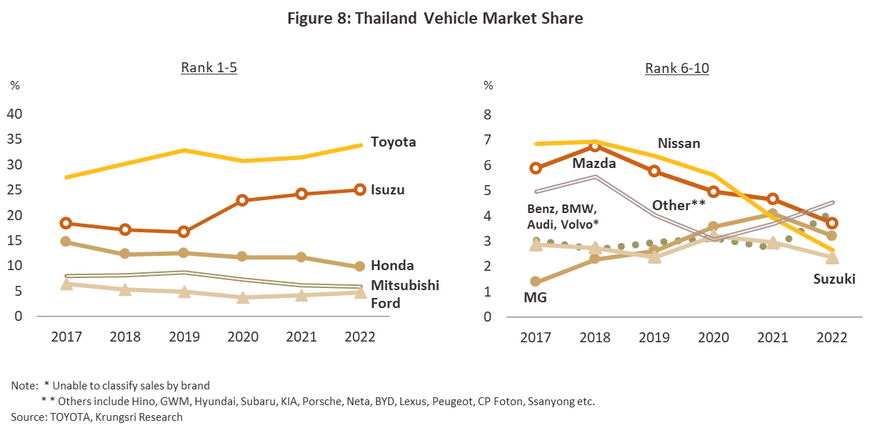

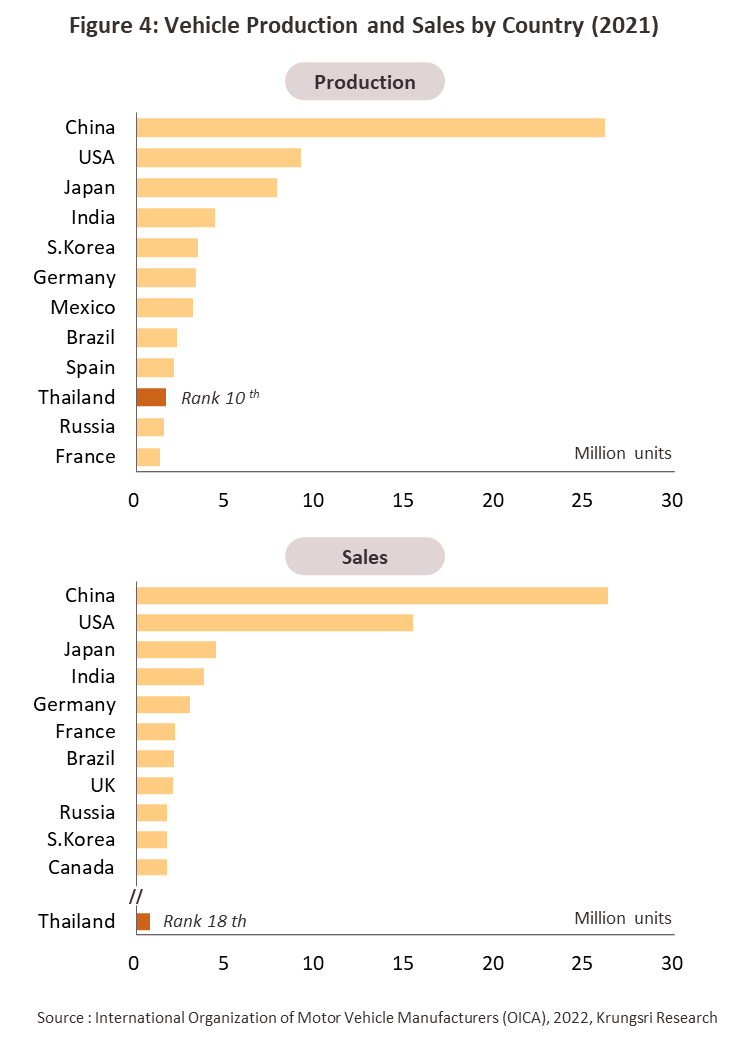

As of 2021, total output of all vehicles by the Thai auto sector was sufficient to place it 10th in the world rankings, 5th in Asia, and 1st in the ASEAN zone. On the other hand, the domestic auto market is the 18th largest in the world (by volume), the 6th largest in Asia, and the 2nd largest in the ASEAN zone (Figure 4). The market is split between the following segments.

-

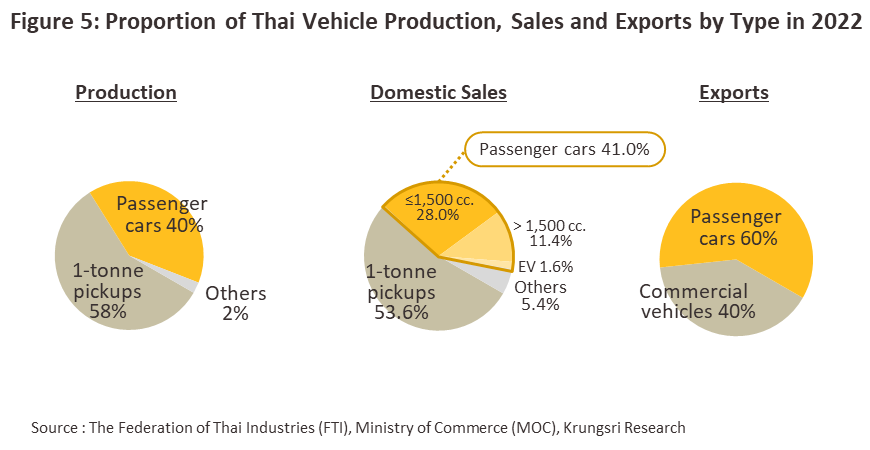

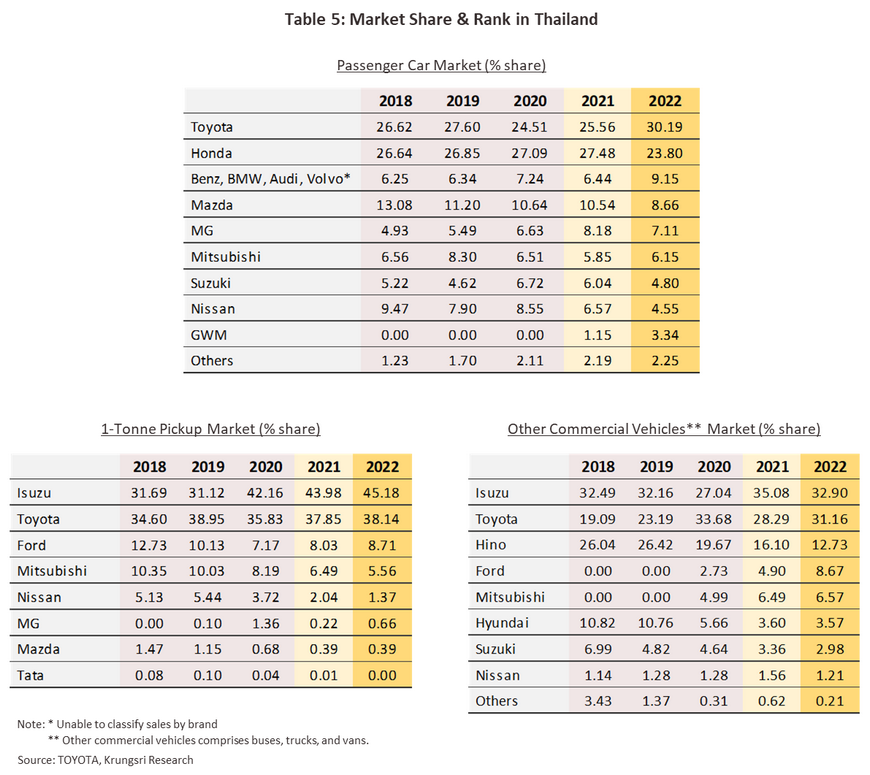

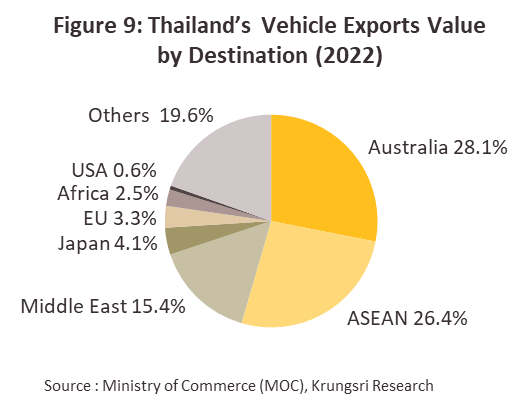

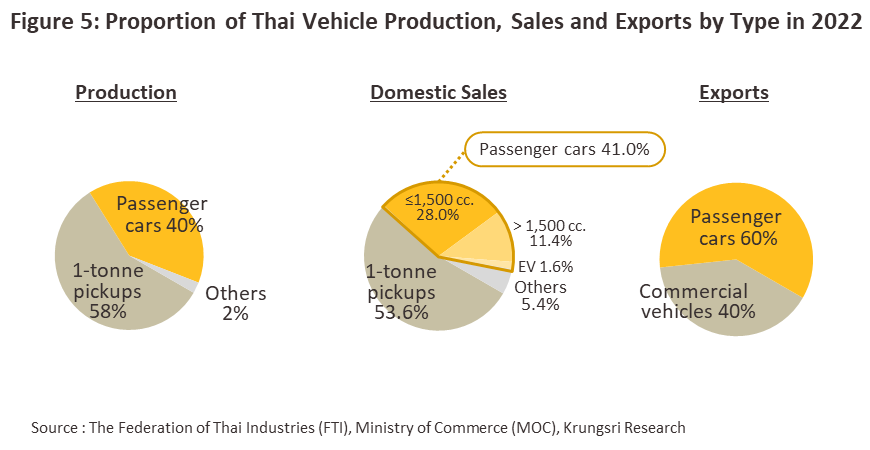

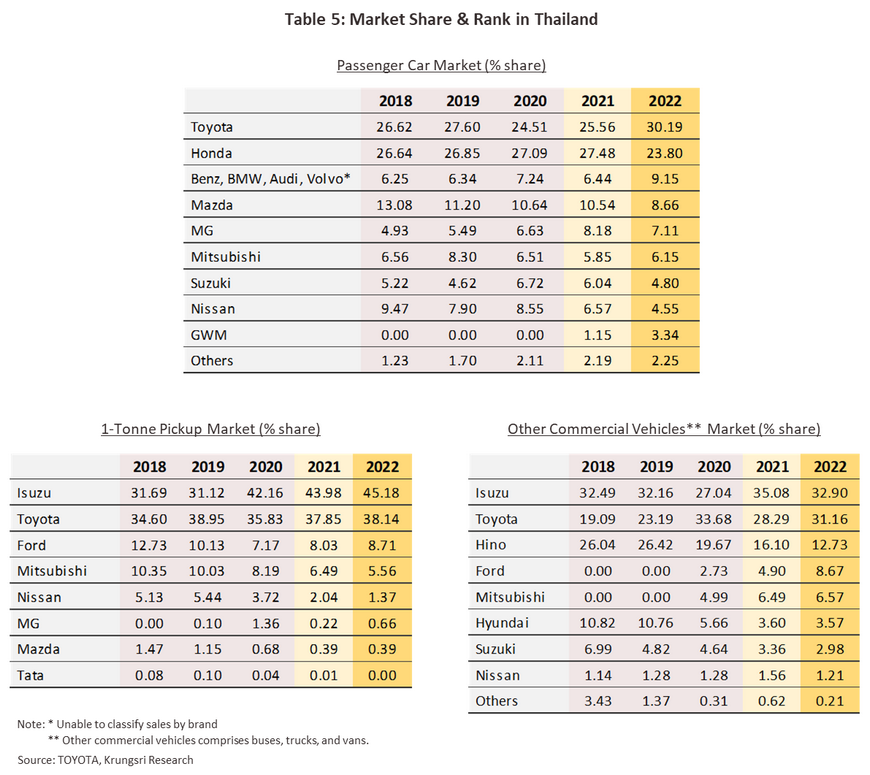

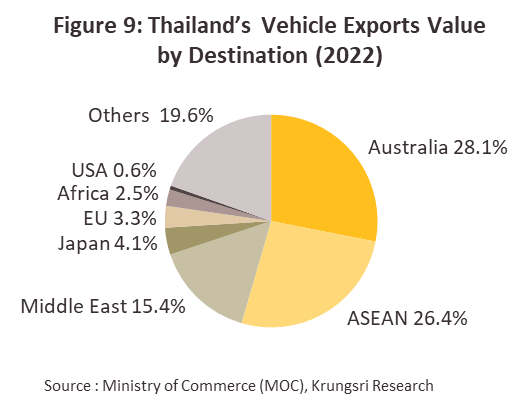

Passenger vehicles: These accounted for 41% of domestic sales as of 2022, with this total comprising 28.0% eco-cars (i.e., those with an engine capacity smaller than 1,500 cc.), 11.4% vehicles with an engine capacity greater than 1,500 cc, and 1.6% EVs. However, passenger vehicles comprised around 60% of the value of exports and around 50-60% of all vehicles coming off Thai production lines. The main export markets are in the ASEAN region, Australia, the Middle East, and Japan.

-

Commercial vehicles: As of 2022, these represented 59.0% of vehicles distributed to the domestic market (53.6% 1-tonne pickups and 5.4% other commercial vehicles including trucks, buses, and minivans). 40% of total export value was generated from the sale of commercial vehicles (Figure 5), most of which came from the export of 1-tonne pickups (50-60% of output is of these) and for which the most important export markets are Australia, the ASEAN regions, the Middle East, and New Zealand. Sales of other commercial vehicles were less important, accounting for some 10-15% of total output of these.

SITUATION

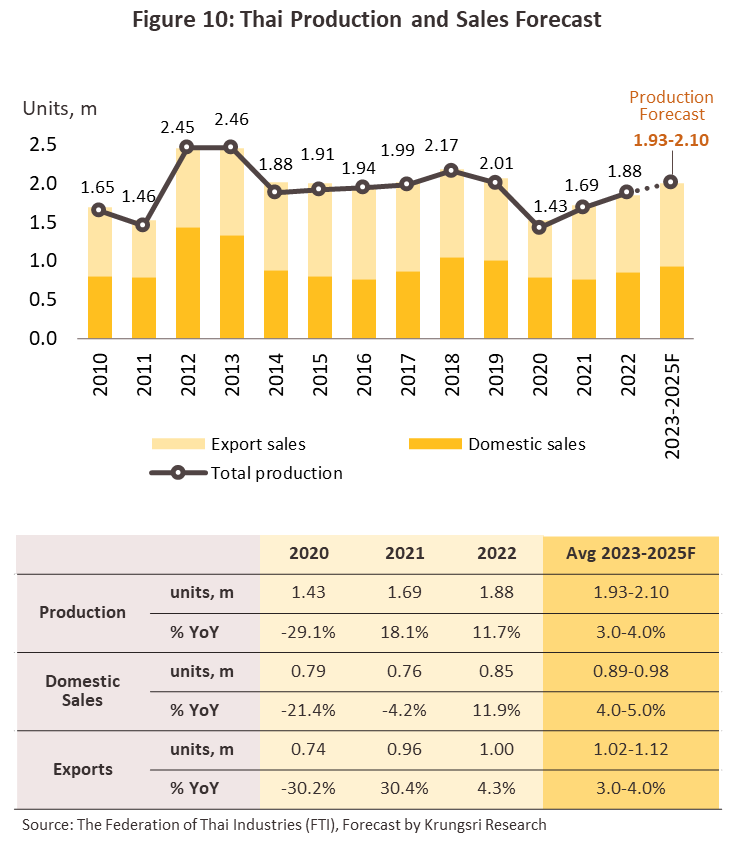

Output continued to strengthen across 2022, but because global chip shortages caused periodic shutdowns in production, growth rates were sluggish. This was especially pronounced during the first half of the year, when output increased by just 3.0% YoY (down from 39.3% YoY in 1H21). Headwinds blowing against the industry included: (i) the problems with chip shortages, which were exacerbated by the imposition of a lockdown in Shanghai (a major center of chip production) between March 28 – June 1, 2022, as the authorities tried to control the spread of COVID-19; and (ii) the outbreak of war in Ukraine at the end of February. The situation improved in the second half of the year, and growth accelerated to 20.5% YoY thanks to: (i) the ending of the Shanghai lockdown in June; and (ii) greater access to auto parts and to some chips. Output for all of 2022 thus increased by 11.7% to 1.88 million vehicles, compared to 2021 growth of 18.1% and output of 1.67 million vehicles. Production was split between 0.75 million passenger vehicles (+4.1%), 1.1 million 1-tonne pickups (+17.6%), and 0.05 million other commercial vehicles (+14.7%). Most of this increase can be attributed to an expansion in the domestic market, which returned to growth for the first time since 2019, while export markets remained weak.

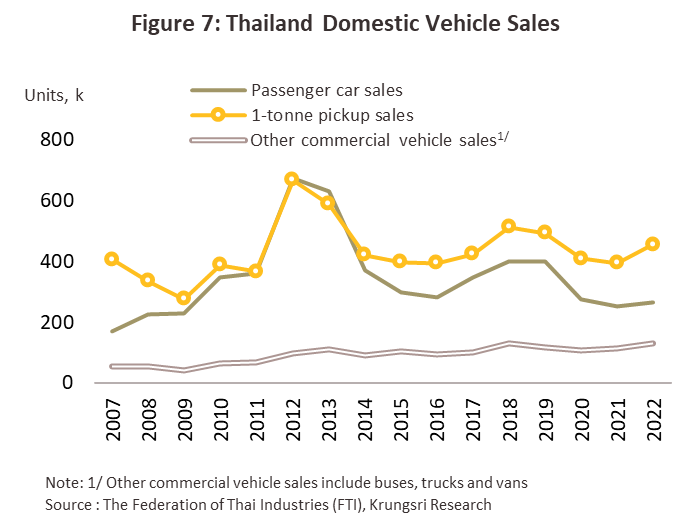

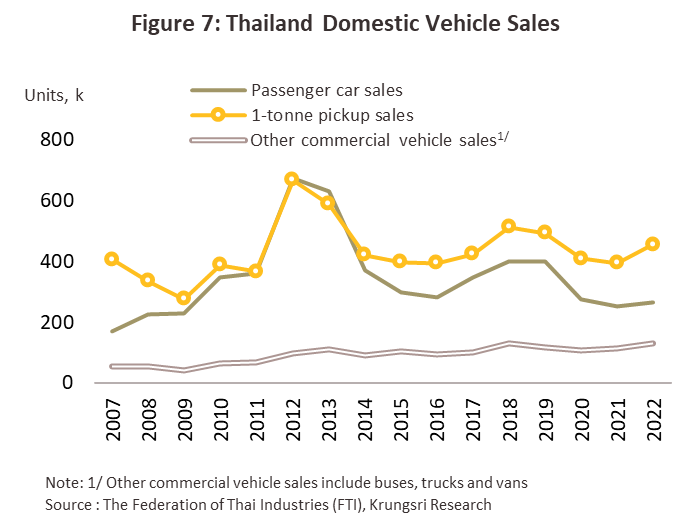

0.85 million vehicles were distributed to the domestic market in 2022, a rise of 11.9% (compared to a drop of -4.2% to 0.76 million in 2021). Sales were boosted by the relaxation of COVID-19 restrictions, which then allowed economic activity to return to normal. In addition, government subsidies for battery electric vehicles have lowered prices for these and with this, demand has lifted. However, the year’s surge in inflation and, to counter this, the rise in interest rates have added substantially to the cost of living and this has eaten into spending power. As such, many consumers remain cautious about their spending, especially when taking on high levels of long-term debt for purchases such as new autos.

-

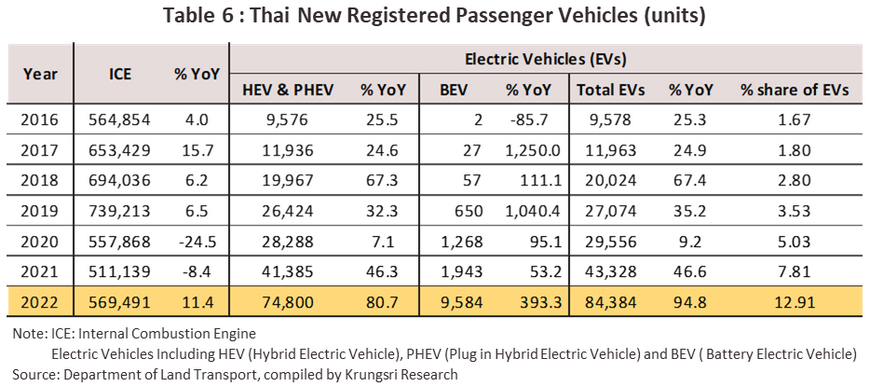

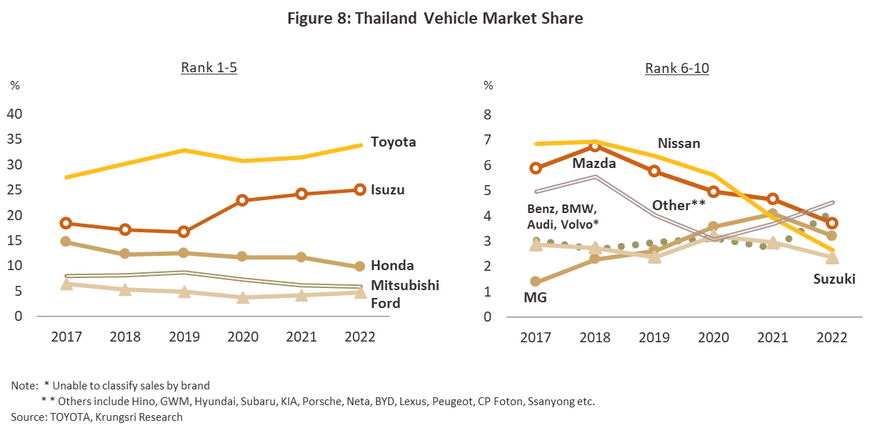

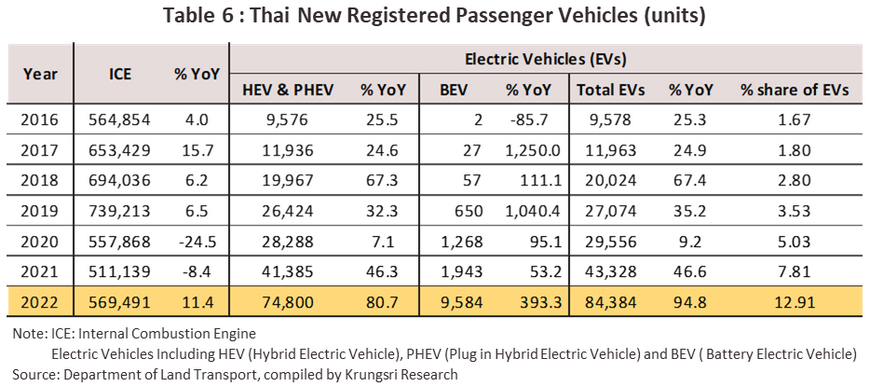

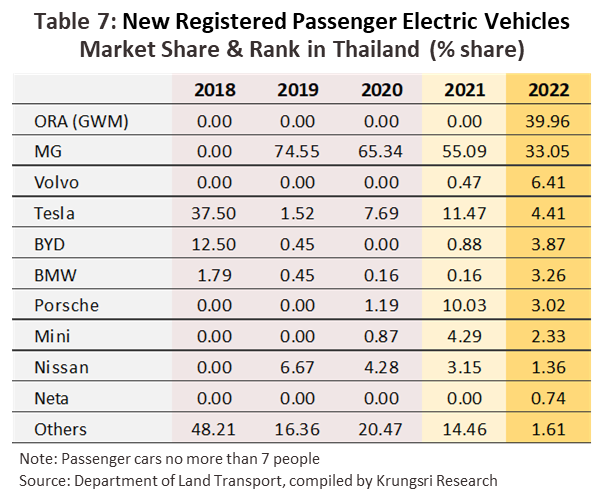

Passenger vehicles: Sales increased 5.3% to 270,000 vehicles, principally due to growth in the sub-1,500 cc. market, which includes eco cars (68% of passenger vehicle sales) whose sales rose 5.9%. By contrast, sales of vehicles with engines greater than 1,500 cc. slumped -15.6% due to the impact of higher oil prices and stronger inflation on consumer spending power. Manufacturers continued to try to stimulate sales through the release of new models, especially of SUVs (sports utility vehicles), which remain popular among consumers. Measured by new registrations, sales of internal combustion engine (ICE) - powered vehicles returned to growth of 11.4% in 2022, after having shrunk by -24.5% in 2020 and by another -8.4% in 2021. At the same time, registrations of EVs surged 98.4% to 84,000 vehicles, and these now comprise 12.9% of all new passenger vehicle registrations, up from just 1.67% in 2019, when the government first began to promote the domestic EV market (Table 6).

-

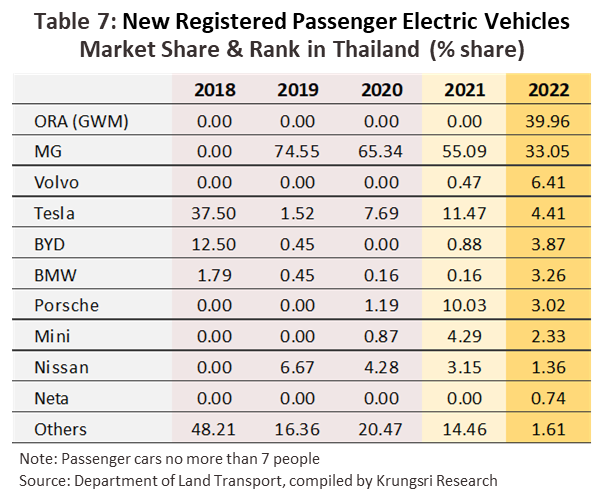

Within the general category of EVs, registrations of hybrids (HEVs) and plug-in hybrids (PHEVs) were boosted by the requirements in government support for these, which state that participating manufacturers need to begin Thailand-based production of EVs within 3 years of being approved for investment support by the BOI. Companies therefore gradually increased production of hybrids from the start of 2020 through to 2022, bringing new models onto the market including the Toyota Corolla Cross Hybrid, the Honda HR-V e:HEV, the Nissan Kicks e-POWER, the Mitsubishi Outlander PHEV, and the MG HS PHEV, as well as the Haval H6 Hybrid and the Haval Jolion Hybrid from China’s Great Wall Motors. As such, registrations of hybrids jumped 80.7% in the year.

-

For manufacturers of battery electric vehicles, sales growth was even stronger, and new registrations exploded 393.3% in 2022 from falling prices that brought the cost of BEVs close to those of traditional ICE-powered vehicles. This was at least partly a result of the aforementioned subsidies that were worth THB 70,000-150,000 per vehicle. At present, 9 manufacturers are participating in the government’s BEV promotion scheme (see page 8 for details). Many different models covered by this include the MG ZS EV, the MG EP, the ORA Good Cat, the Neta V, the MINE MT 30, the Volt City EV, the Toyota bZ4X, and the BYD ATTO 3. In addition, some auto manufacturers are not participating in the government scheme but are nevertheless importing and distributing BEVs in Thailand, including the Nissan LEAF, the BMW i3s, and the Tesla Model 3 and Model Y. As of the end of 2022, with an over-80% market share of new registrations, Chinese manufacturers had a stranglehold on the passenger EV market

-

1-tonne pickups: In 2022, domestic sales of 1-tonne pickups rose 15.6% to 450,000 vehicles on: (i) stronger prices for agricultural goods that strengthened incomes for farming families and upcountry consumers; (ii) growth in e-commerce that then added to demand for pickups to use in delivery services; and (iii) the release of new models by manufacturers, including the new Ford Ranger. Many consumers thus bought new vehicles in the year, despite some segments of the market experiencing a drop in their purchasing power as a result of floods in September and October that caused widespread damage to agricultural and industrial areas across 56 provinces in the north, northeast, center, and east of the country.

-

Other commercial vehicles: 2022 sales totaled 130,000, a rise of 13.7%. In the year, the market benefited from: (i) the ending of the COVID-19 pandemic, the lifting of restrictions, and the reopening of the country that allowed the tourism sector to rebound, boosting demand for transport services and the vehicles needed for this; and (ii) growth in the logistics and e-commerce segments, which then added to demand for trucks.

Export volume strengthened by 4.3% to a total of 1.0 million vehicles in 2022, though by value, exports contracted -3.7% to USD 18 billion (Table 8), split between USD 11 billion from sales of passenger vehicles (up 2.1%) and USD 7.3 billion from exports of commercial vehicles (down -11.3%). Exports underperformed as a result of rising inflation in Thailand’s main export markets, which then dragged on consumer spending power and undercut auto sales. In addition, the market was affected by the tight supply of auto parts, especially chips, that caused production to slow down. Meanwhile, distribution was impacted by congestion on global shipping lines that extended delivery times. Given this, exports into the main overseas markets suffered, with these down -12.1% in Australia (with a 38.9% share of all vehicle exports, this is Thailand’s most important market), -30.5% in Japan (a 4.1% market share), -43.5% in the EU (3.3%), and -43.5% in the US (0.6%). However, exports to the ASEAN region (26.4% of exports by value) grew 8.5% thanks to the absence of difficulties with transport and distribution and the average 5.2% growth maintained in the region, substantially ahead of advanced economies’ growth of just 2.7% (IMF, January 2023). The Middle East market (15.4% of exports) also did well, thanks to high energy prices and the stimulus this gave to incomes and demand, exports there thus jumped 31.0%.

OUTLOOK

Over 2023-2025, the auto industry should enjoy favorable business conditions thanks to: (i) Thailand’s economic growth of 3.3%, 3.7% and 3.5% in each of these years (as per the February 2023 forecast), which will then support an increase in activity in the transport and logistics sectors in particular; (ii) the rebound in the tourism sector, now that the pandemic is over and travel restrictions have been lifted; and (iii) the likely improvement in consumer spending power as inflationary pressures ease. Nevertheless, chip shortages will continue to periodically affect production through 2023, due in part to the intensification of the US-China conflict over access to technology, most recently with the block on Chinese access to advanced chips and chip manufacturing equipment. In addition, as of March 2023, companies that receive funding under the CHIPS and Science Act are now subject to a 10-year ban on new investment or expansion in the production of chips in China. Despite this, though, the supply of chips is expected to improve over 2024 and 2025 as investments made over the previous 1 to 2 years begin to bear fruit and new chip production capacity comes online. This includes investments totaling USD 52 billion in the US, USD 10 billion in Europe, and USD 6.8 billion in Japan, as well as USD 12 billion in Taiwan, made by TSMC (Taiwan Semiconductor Manufacturing Company Limited) to expand their production lines (Source: Reuters). Overall, the number of autos produced in Thailand is therefore forecast to increase by an average of some 3.0-4.0% over the next three years, reaching an annual total of 1.93-2.10 million vehicles. This would then bring production back to the pre-COVID level of around 2 million vehicles per year by 2024.

-

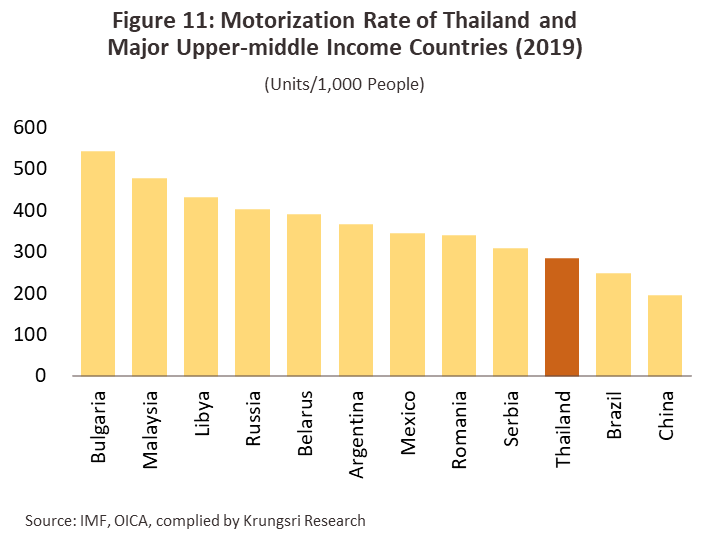

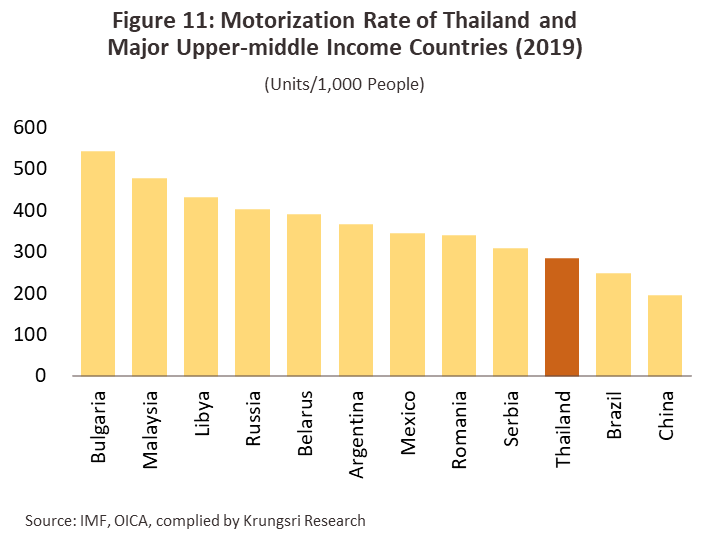

Domestic sales are expected to increase by an average of around 4.0-5.0% annually to 0.89-0.98 million vehicles per year on a combination of factors. (i) The reopening of the country is supporting an improving domestic economic outlook, lifting consumer purchasing power and boosting travel, transport and tourism. (ii) Government efforts to stimulate the market for BEVs will run from 2022 to 2025 and these will continue to incentivize purchases of these. (iii) Manufacturers will continue to release new models and to run marketing promotions that aim to stimulate sales. (iv) Activity will tend to pick up in the construction sector with heavier government spending, especially for work on infrastructure networks that are connected to phase 2 of the EEC development (this runs from 2023 to 2027). As spending on the latter accelerates, this will add to demand for commercial vehicles used in the transport of construction materials. (v) The development of new roads both within Thailand and linking to neighboring countries, and the expansion in logistics and online retail will add to demand for small and medium sized commercial vehicles. (vi) At 285 vehicles per 1,000 population, Thailand’s motorization rate is still relatively low for an upper-middle income country and is below that of Malaysia (478 vehicles/1,000 population), Russia (403 vehicles/1,000 population) and Argentina (366 vehicles/1,000 population). Given this, the domestic market can be expected to continue to expand over the next few years (Figure 11).

Nevertheless, sales of ICE-powered vehicles will come under pressure from the changes to excise rates described above (Table 4) since these aim to encourage manufacturers to switch investment from the assembly of ICE-powered vehicles to the production of EVs. Thus, manufacturers should follow consumers in moving from more expensive traditional autos to cheaper EVs, which produce no or only low levels of air pollution (mainly of particulates in the form of PM 2.5 and greenhouse gases, principally CO2). Because manufacturers will need to develop new and more efficient engines, this will add to production costs, and so some will focus much more heavily on developing EVs. By doing so, they will be able to benefit from government support for the BEV market that is helping to reduce prices. The switch to EVs is also in line with changing global consumption patterns and greater consumer interest in owning and running environmentally friendly transport.

-

Exports will also strengthen over the coming period, and these are predicted to increase at an average annual rate of 3.0-4.0% to a yearly total of 1.02-1.12 million vehicles. In 2023, overseas sales will remain somewhat weak due to the global economic slowdown and the effects of inflation on the cost of living that has been experienced in many export markets. The situation should improve in 2024 and 2025, and exports are now expected to return to their 2019 pre-COVID level of 1.05 million vehicles by 2024. Despite this positive outlook, negative factors will continue to drag on growth in the market through the next three years, including (i) barriers to international trade (e.g., from the end of July 2022, Myanmar has forbidden the import of autos), and (ii) moves to reduce the sale or use of ICE-powered vehicles in many countries (in 2022, 97% of autos exported from Thailand were ICE-powered).

Over the long term, the industry will move to a much tighter focus on the development of the technology needed to manufacture EVs, especially since the overt target of current government policy is to establish Thailand as a regional center to produce these. As part of this, the government is encouraging an increase in the domestic manufacture and purchase of zero emission vehicles (Figure 2). Krungsri Research thus expects that going forward, the domestic market for EVs will see rapid growth. In the first quarter of 2023, there were 20,000 BEVs on back order, that is, these had been ordered but manufacturers had not yet been able to deliver these to buyers due to continuing problems with chip shortages. The more complex and advanced chips that are used in BEVs have been particularly affected by supply interruptions, and so production lines have been subject to delays. For all of 2023, the number of newly registered BEVs is expected to jump 295%, although this would still bring the total growth in the BEV fleet to just new 43,000 vehicles (in 2022, 11,000 new BEVs were sold, an increase of 416.4%). Nevertheless, problems with chip shortages should begin to clear at the end of 2023 or the start of 2024, and this will then allow growth in new BEV registrations to accelerate, reaching an expected 100,000 new vehicles by 2025; in addition to the likely resolution of problems with chips, the government has attracted manufacturers to participate in its program to stimulate sales of BEVs, and over 2024 and 2025, these will now need to increase domestic production of BEVs to offset their earlier imports. The domestic supply of BEVs is thus rising at the same time as the government is subsidizing purchases of these.

One obstacle in the way to the development of the domestic market for BEVs is the poor state of supporting infrastructure. (i) Access to charging stations is insufficient at the national level, and as of December 2022, data from The Electric Vehicle Association of Thailand show that at that point, there were just 1,239 charging stations and 3,739 charging points in Thailand. These have to serve a fleet of BEVs and plug-in hybrids that at that point numbered 78,752 vehicles (as of April 2023), giving a ratio of 1 charging point to every 21 vehicles. This is not sufficient to meet demand and is significantly worse than the situation in China, where there is 1 charging point for every 6.5 plug-in hybrids and BEVs. The current supply of charging facilities also falls short of government targets, which has set a goal of reaching 1,394 charging stations and 13,251 charging points by 2030. (ii) Thailand also needs to upgrade the national electricity grid and to equip users with smart meters4/ that can use modern IT systems to manage loads more effectively. This would then allow consumers to use EVs and take advantage of much more efficient vehicle-to-home (V2H) systems.

1/ The first-car buyer scheme was a government-run program that helped to boost auto sales. Under the program, vehicle duty (up to a value of THB 100,000) was refunded to individuals buying their first automobile, provided that they kept possession of that vehicle for the next 5 years. The scheme ran from September 16, 2011 to December 31, 2012 and covered vehicles with a value of up to THB 1 million, including passenger vehicles with engines not over 1,500 cc, regular pickups and pickups with double cabs (though the government failed to specify delivery times in the legislation for the project.)

2/ ZEVs, or zero emission vehicles, do not have a standard ICE engine and so they do not produce the emissions and pollution normally associated with cars and trucks. ZEVs include battery electric vehicles (BEVs) and fuel cell electric vehicles (FCEVs).

3/ From investment plans announced by Thailand-based auto manufacturers

4/ The smart grid development plan lays out a vision for adapting the national grid by using IT communication systems to manage and control the production and distribution of electricity. By using smart meters, it would be possible for sources of alternative energy to be connected to the grid as a distributed energy resource (DER), and this would then improve the efficiency of the overall system.

.webp.aspx)