EXECUTIVE SUMMARY

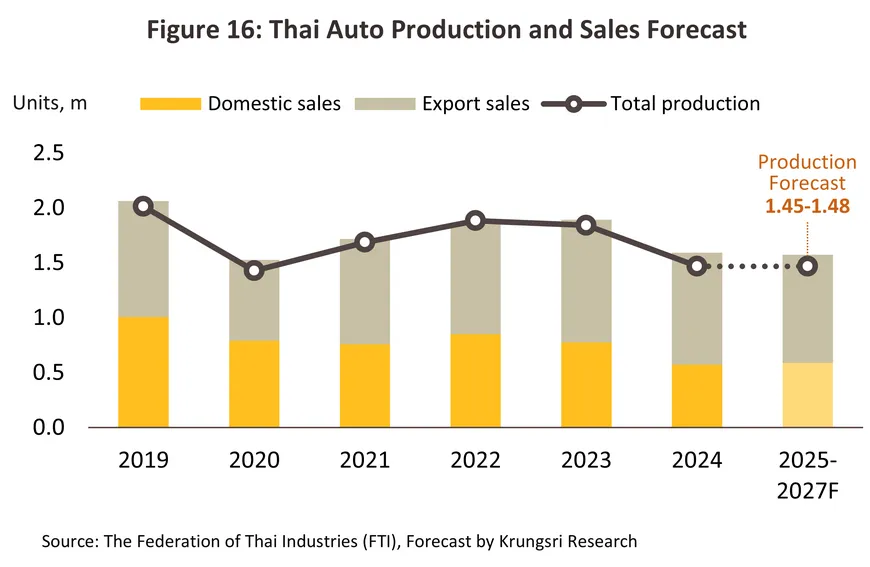

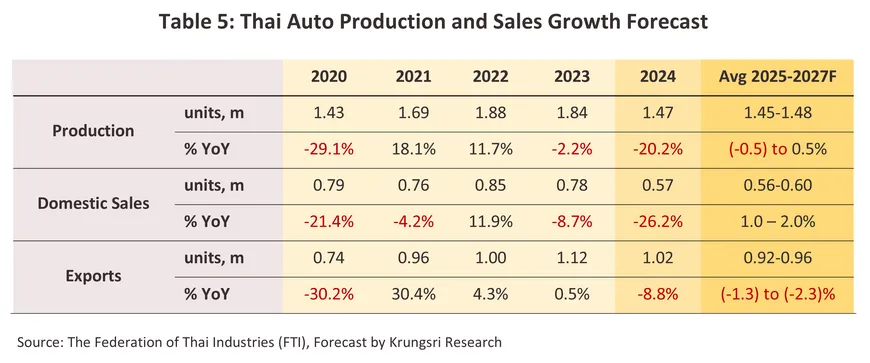

Automobile production growth is projected to remain flat at around -0.5% to 0.5% annually during 2025–2027, constrained by sluggish domestic demand and a shrinking export market, amid supply chain risks that could be disrupted by trade conflicts. Domestic sales are expected to grow 1.0–2.0% per year, although a contraction is still likely in 2025 amid economic uncertainty, weaker consumer confidence and spending, lower agricultural prices, and potential delays in government budget disbursement in the second half. Sales are anticipated to stabilize in 2026 before recovering in 2027, supported by: (i) infrastructure investment that will gradually revive private sector spending, (ii) continued expansion in tourism, transport, and e-commerce, (iii) rising used-car prices encouraging new car purchases, and (iv) the launch of new EV models. By contrast, exports are expected to decline by -1.3% to -2.3% annually, weighed down by slow demand recovery among trading partners and intensifying competition from Chinese automakers, which is expected to erode Thailand’s export market share. Exports in 2025–2026 are likely to be particularly affected by U.S. tariff measures and tightening environmental standards across many countries.

Krungsri Research view

During 2025-2027, financial performance among automakers is expected to remain stable, with profitability likely under pressure, particularly in 2025 and 2026, before gradually recovering in 2027. Each industry segment will face distinct challenges and opportunities, as outlined below:

-

Internal Combustion Engine (ICE) passenger car manufacturers will face headwinds from the accelerating shift toward EVs, which is dampening demand for eco-cars. Stricter safety technology requirements and the enforcement of Euro 6 standards from 2024 onward are also driving up production costs.

-

Electric Vehicle (EV) manufacturers will benefit from the EV 3.5 scheme for BEVs, along with government incentives promoting HEV and MHEV production. The easing of EV price wars and growing consumer acceptance of higher-performance models further support the segment.

-

1-ton pickup truck manufacturers will continue to face weak domestic demand, especially among lower- to middle-income consumers, as well as delayed investment from SMEs due to the sluggish economy and persistently high household debt, despite some support from the 'Pickup with Credit Guarantee' scheme.

-

Other commercial vehicle manufacturers (including trucks, buses, and vans) will be challenged by subdued private sector investment and potentially weaker-than-expected tourism recovery in 2025–2026. However, gradual recovery is possible in 2027, supported by infrastructure investment.

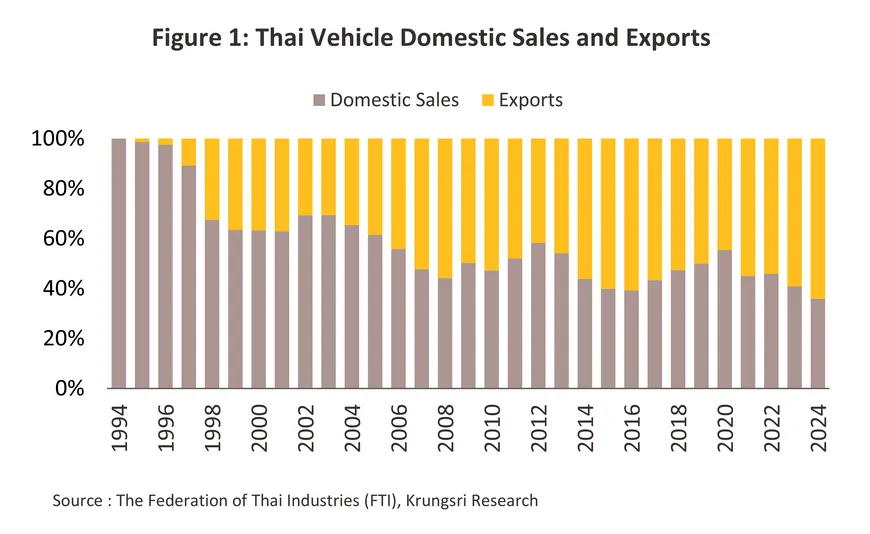

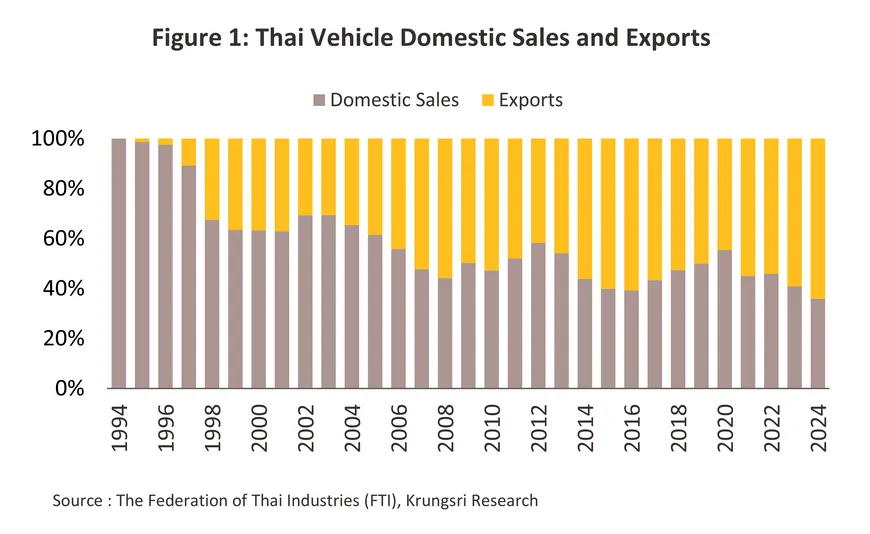

Overview

Thailand’s automotive industry has consistently received government support, with a range of key measures introduced to attract investment in vehicle assembly. These include tax incentives, local content requirements to strengthen the supply chain, promotion of foreign direct investment and technology transfer from multinational firms, and support for export-oriented production. As a result, the industry has become increasingly export-driven, with exports accounting for an average of 53% of total production between 2007 and 2024 (Figure 1). Investment promotion policies have helped Thailand build supply chain advantages in different periods, as follows:

Promoting the production of 1-tonne pickups

From 1997 to 2008, the Thai government promoted 1-ton pickup trucks as the country’s first Product Champion, offering incentives to attract global automakers to set up production bases. Domestic demand was also stimulated through measures such as keeping diesel prices lower than gasoline and setting a low excise tax for pickup trucks at just 3%, compared to 30–50% for passenger cars. As a result, commercial vehicles accounted for over 70% of Thailand’s total auto production.

Promoting the production of eco cars

From 2009 to 2015, the Thai government promoted small fuel-efficient passenger cars, or Eco-cars, as the country’s second Product Champion. Two rounds of tax-based investment incentives were introduced—Eco-car Phase I (2009) and Phase II (2015), with export requirements attached. Several supporting factors include: (i) advancements in gasoline engine technology enabled the use of ethanol-blended fuels (gasohol); (ii) government subsidies keeping gasohol prices low to promote biofuel usage across all vehicle types, including Eco-cars; (iii) eligibility for excise tax rebates under the first-car buyer scheme1/ (2012-2013); and (iv) the 2016 excise tax restructuring, which linked tax rates to CO2 emissions and engine size, lowering Eco-car tax rates to 12–15% (from 17%). However, under the new structure effective in 2026, Eco-cars emitting less than 100 g/km CO2 and equipped with Advanced Driver-Assistance Systems (ADAS) under Phase II conditions will face a 13% tax rate, increasing by 1% every two years to 15% by 2030, similar to the previous structure. Without ADAS, the rate will be 25% in 2026 and rise to 30% by 2030.2/

Promoting the production of Battery Electric Vehicles (BEVs)

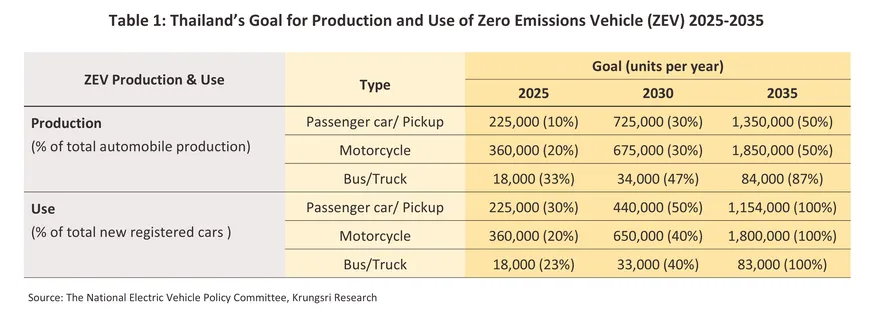

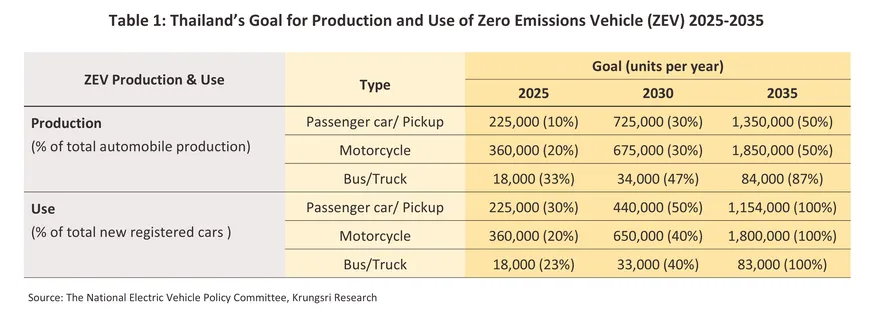

The policy to promote EV production aims to shift the transport sector toward green energy through EV technology. It is a key part of Thailand’s energy strategy to achieve net-zero carbon emissions by 2065–2070, in line with the country’s ratification of the United Nations Framework Convention on Climate Change (UNFCCC) in 2016. Under the direction of the National EV Policy Committee, the government has introduced the 30@30 policy to promote Zero Emission Vehicles (ZEVs), with production and adoption targets divided into three phases (Table 1), as follows:

-

By 2025, the government set a target for electric passenger cars and electric pickup trucks to account for a combined 10% of total vehicle production, and 30% of newly registered vehicles.

-

By 2030, the production target will rise to 30%, with electric vehicles accounting for 50% of newly registered vehicles.

-

By 2035, electric vehicles are expected to represent 50% of total production and 100% of new vehicle registrations.

Under the EV 3.0 scheme (2022–2025) and EV 3.5 scheme (2024–2027), which are designed to stimulate market growth and promote investment, the government offers various incentives such as subsidies of 70,000–150,000 baht per vehicle under EV 3.0 and 50,000–100,000 baht per vehicle under EV 3.5, import duty reductions, restructuring of excise tax, and a requirement for BEV importers to compensate by producing BEVs domestically within a specified period. (Details of the EV 3.0 and EV 3.5 schemes are available in Krungsri Research’s analysis on Thailand Industry Outlook 2024-26: Electric Vehicle Industry)

However, on December 4, 2024, the National Electric Vehicle Policy Board resolved to allow BEV manufacturers to postpone their compensatory production under the EV 3.0 scheme, due to lower-than-expected BEV sales in 2024. Manufacturers receiving support under EV 3.0 are permitted to compensate by producing in 2025 at a ratio of 1.5 times the number of BEVs imported and sold during 2022–2023, or defer the compensatory production to 2026–2027 under the EV 3.5 scheme at a ratio of 2–3 times. Additionally, on July 30, 2025, the Board approved a revision to the compensatory production criteria, allowing EVs produced for export to be counted as “1 vehicle produced equals 1.5 vehicles compensated,” in order to incentivize manufacturers to expand their export markets.

Policy to Promote Hybrid Electric Vehicle (HEV) Production

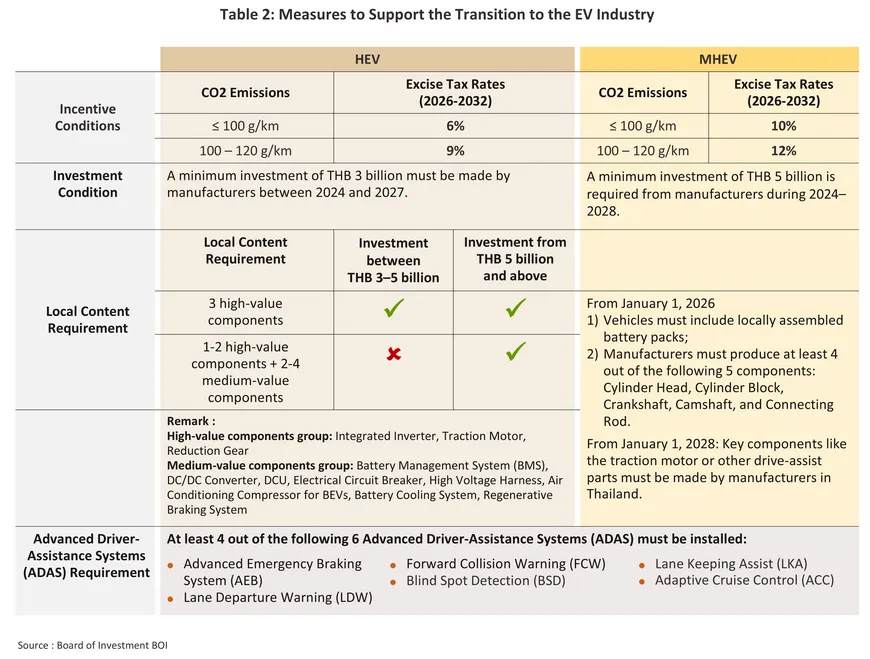

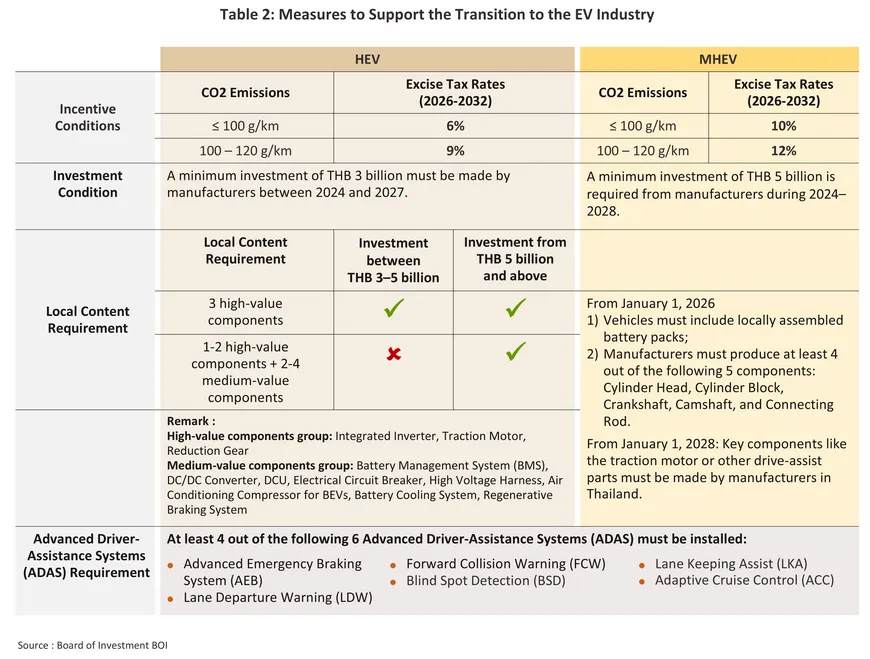

The Board of Investment (BOI) and the National Electric Vehicle Policy Board (EV Board) approved measures to support the transition toward the electric vehicle industry by reducing the excise tax rate for hybrid passenger cars and passenger vehicles with seating capacity not exceeding 10 persons for a period of 7 years (during 2026–2032) (Table 2), aiming to stimulate domestic investment. The measures are divided into:

-

HEVs with CO2 emissions not exceeding 120 g/km are subject to an excise tax rate of 6–9%. To qualify for investment promotion, manufacturers must meet the following conditions: (i) allocate a minimum of THB 3 billion for investment during 2024–2027, (ii) use domestically produced battery packs and key components as specified by the BOI, and (iii) install at least 4 of the 6 Advanced Driver Assistance Systems (ADAS) as defined by the BOI.

-

MHEVs (Mild Hybrid Electric Vehicles), or HEVs powered by low-voltage direct current below 60 volts, with CO2 emissions not exceeding 120 g/km, are subject to an excise tax rate of 10–12%. To qualify for investment promotion, manufacturers must meet the following conditions: (i) allocate a minimum of THB 5 billion for investment during 2024–2028, (ii) use domestically produced battery packs and carry out key component manufacturing processes as specified by the BOI, and (iii) install at least 4 of the 6 ADAS as defined by the BOI.

Prior to the implementation of the EV 3.0 scheme, Thailand’s vehicle production capacity stood at approximately 3.9 million units in 20223/ , comprising 40% passenger cars and 60% commercial vehicles (over 90% of commercial vehicle production was 1-ton pickup trucks). Japanese automakers accounted for around 80% of total production capacity. As the industry transitioned toward electric vehicles under the EV 3.0 and EV 3.5 schemes, which encouraged manufacturers of electric passenger cars and pickup trucks to establish EV production bases, 16 and 10 companies respectively entered the market. As a result, Thailand’s EV production capacity increased to 386,000 units per year as of July 20254/, with nearly all capacity contributed by Chinese manufacturers. However, rising consumer interest in EVs and intense price competition have led some existing automakers without new EV models to shift their business strategy from local production to vehicle imports, such as Suzuki and Subaru. Meanwhile, others have restructured their production lines to reduce costs and improve efficiency, such as Nissan5/.

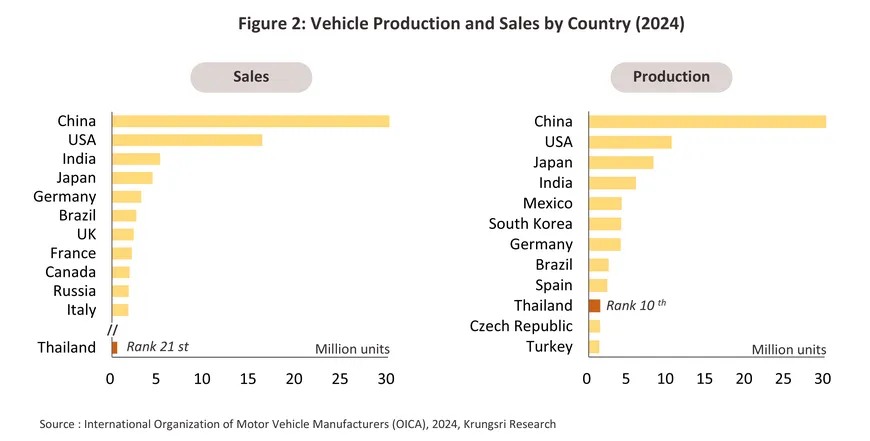

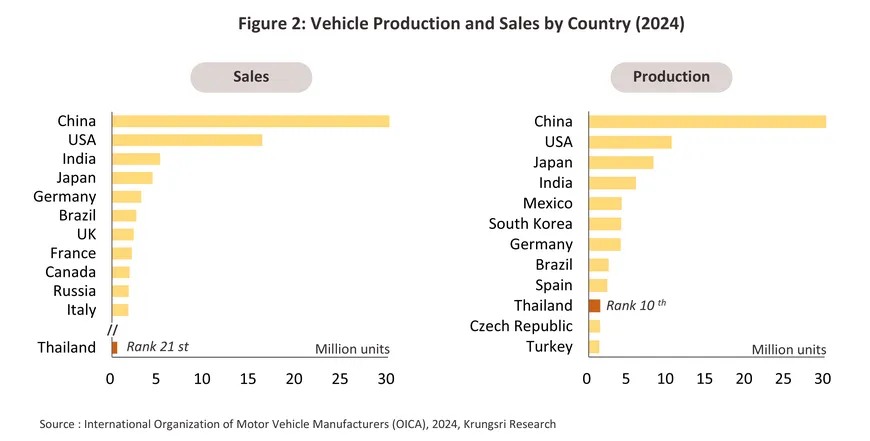

Regarding Thailand’s position in the global automotive industry (based on 2024 data), the country ranked 10th worldwide, 5th in Asia, and 1st in ASEAN in terms of total vehicle production across all categories. In terms of domestic sales, Thailand’s automotive market ranked 21st globally, 6th in Asia, and 3rd in ASEAN (Figure 2), broken down as follows:

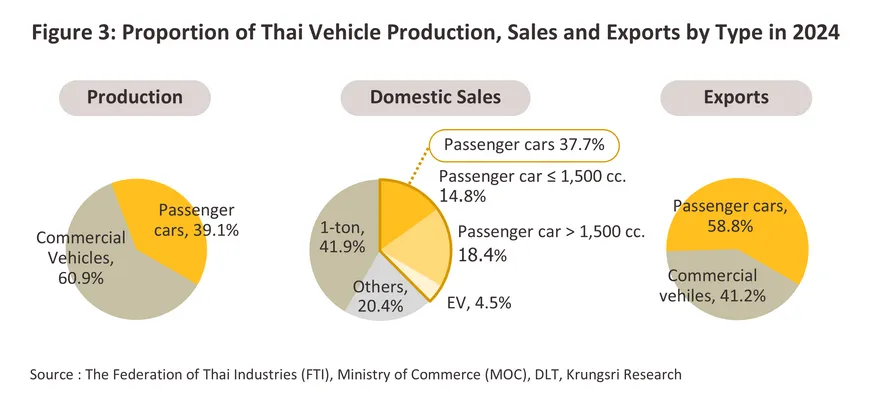

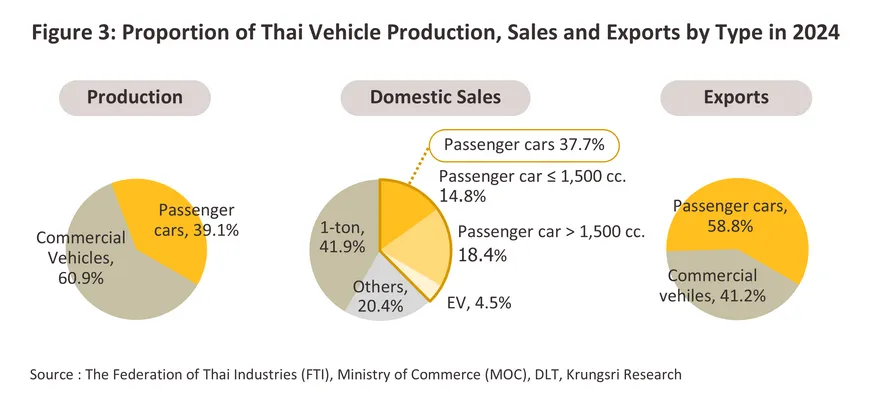

Passenger cars (2024): Domestic sales accounted for 39.1% of total domestic vehicle sales. Passenger cars with engine capacity below 1,500 cc (including Eco-cars) represented 16.5%, those above 1,501 cc accounted for 17.1%, and electric vehicles made up 5.5%. In terms of export value, passenger cars contributed 58.8% of total vehicle export value, while export volume represented 50–60% of total passenger car production. Key export markets included ASEAN, Australia, and the Middle East.

Commercial vehicles (2024): Domestic sales accounted for 60.9% of total domestic vehicle sales, comprising 35.0% from one-ton pickup trucks and 25.9% from other commercial vehicles such as trucks, buses, and vans. In terms of export value, commercial vehicles contributed 41.2% of total vehicle exports (Figure 3). Export volume of one-ton pickup trucks represented 50–60% of total one-ton pickup production. Key export markets included Australia, Malaysia, and the Philippines. Meanwhile, export volume of other commercial vehicles (e.g. trucks, buses, vans) accounted for 10–15% of production.

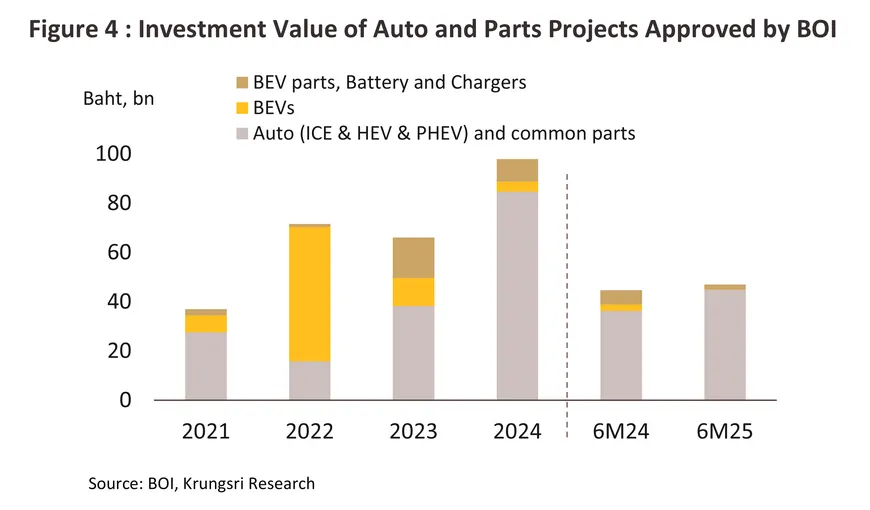

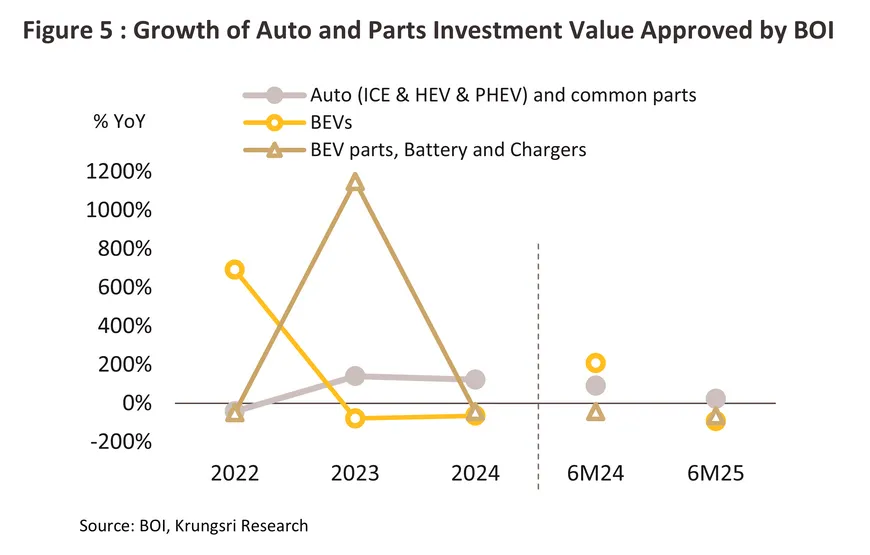

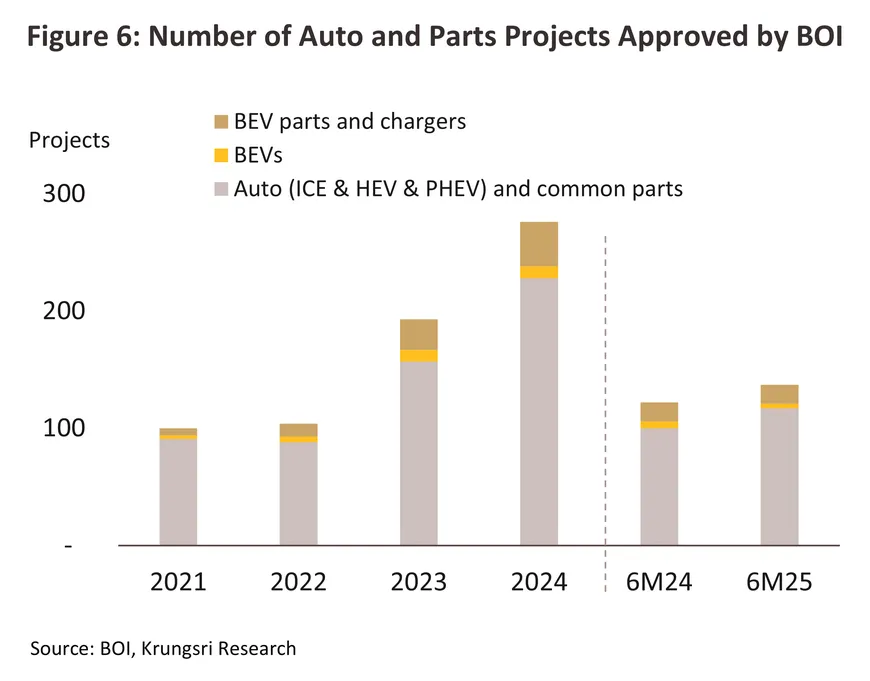

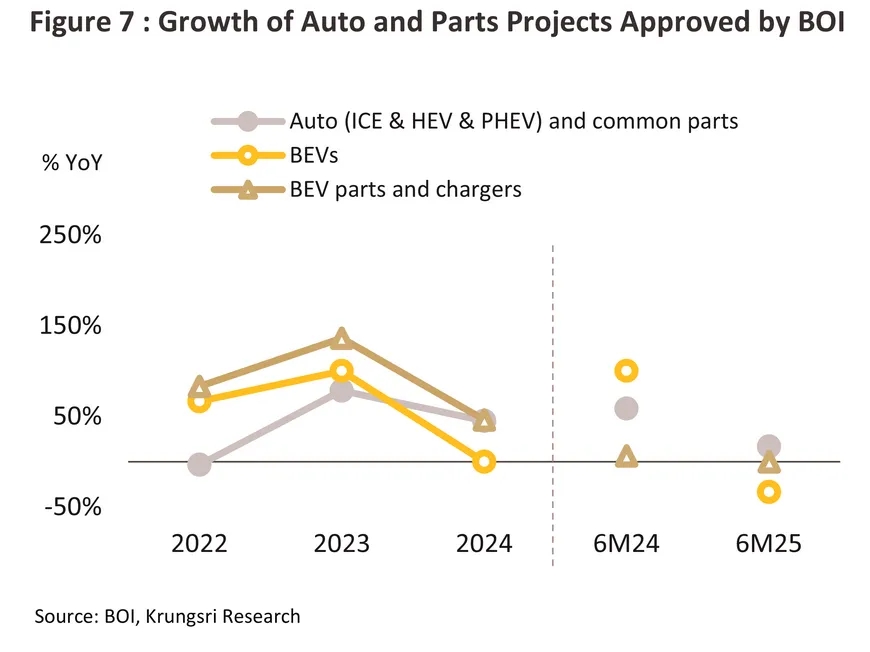

Investment promotion in the automotive industry

In the first half of 2025, during the implementation of the EV3.5 scheme supporting BEVs and the excise tax reduction measure promoting HEV production, Thailand’s investment promotion in the automotive value chain, covering both vehicle and part production, rose 5.0% YoY to THB 47.0 billion. A total of 137 projects received investment promotion, up 12.3% YoY, with most focusing on HEV and MHEV production, as well as high-value parts manufacturing to support these vehicles (e.g., integrated inverters, traction motors, and reduction gears). Meanwhile, investment in BEV production and related components such as batteries and other EV equipment declined -92.1% and -66.0% YoY respectively, to THB 0.2 billion and THB 2.0 billion. This marked a continued slowdown following the rapid expansion in 2022, when the BOI emphasized promoting EV production and related components under the EV3.0 scheme (Figures 4–7).

Situation

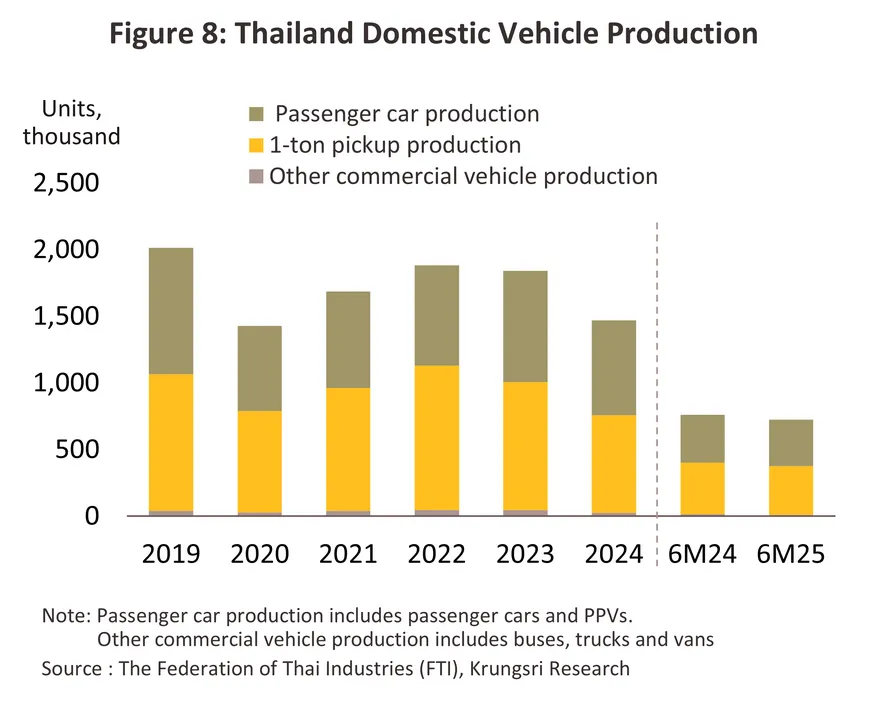

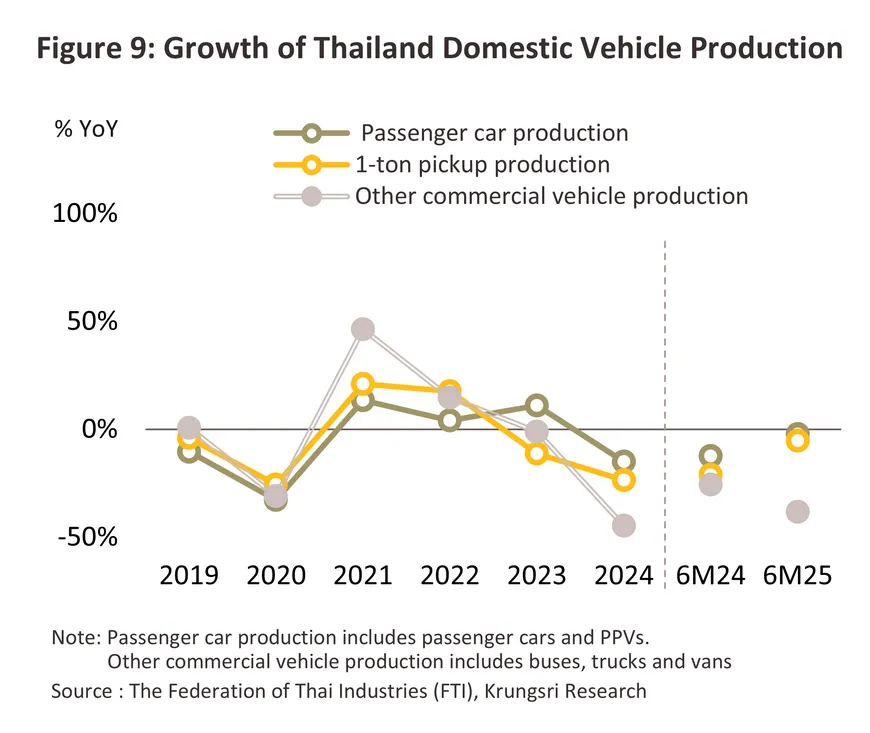

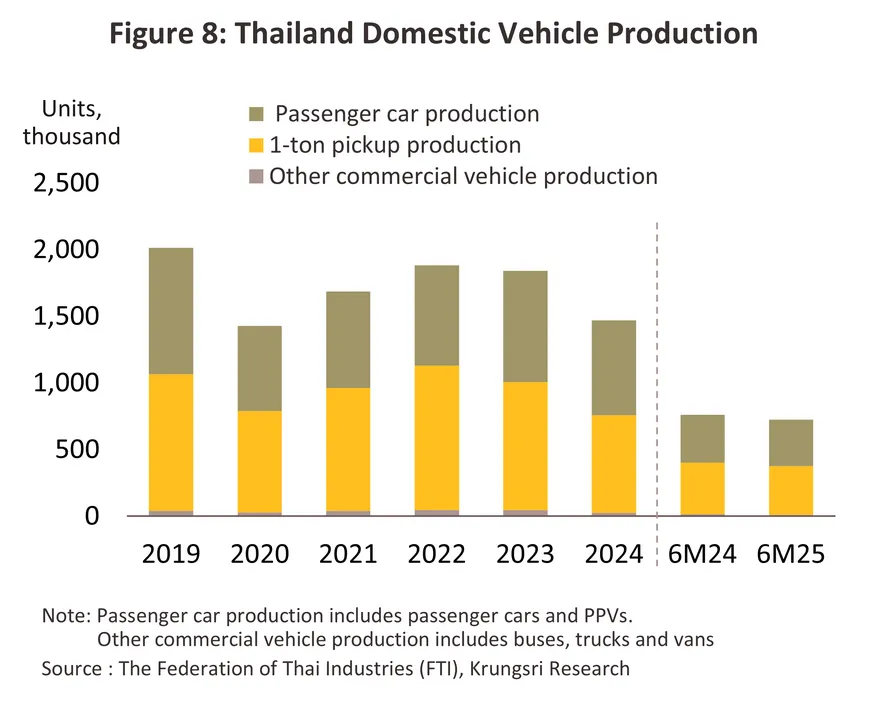

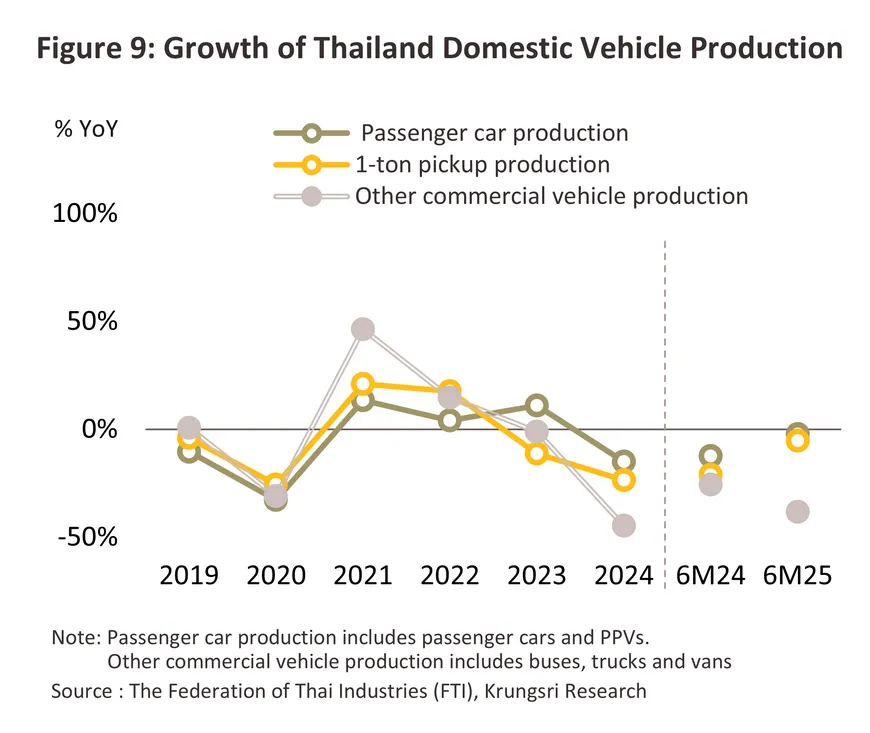

Total outputs by the auto industry in the first half of 2025 declined -4.6% YoY to 726,158 units (Figures 8 and 9), in line with contractions in both domestic sales and exports. However, production in May 2025 showed signs of recovery for the first time after 21 consecutive months of decline (from August 2023 to April 2025). This rebound was partly driven by a pickup in domestic demand starting in April 2025, along with a gradual increase in EV production to meet offset requirements under the EV3.0 scheme.

-

Passenger car production dropped -2.3% YoY to 350,260 units. This included a -17.6% YoY decline in vehicles with engine sizes below 1,500 cc, totaling 156,667 units, mainly due to the continued contraction in eco-car production. The global shift toward electric vehicles has led consumers to favor more affordable and energy-efficient EVs. In contrast, production of vehicles with engine larger than 1,500 cc rose 5.7% YoY to 61,826 units, supported by strong purchasing power from middle- to high-income consumers, and a surge in PHEV and HEV production, which increased 211.6% (9,937 units) and 14.8% (112,203 units) YoY, respectively, to serve growing demand from consumers who were not yet ready to fully transition to 100% EVs. Meanwhile, BEV passenger car production jumped 380.5% YoY to 23,798 units, mostly for domestic sales. This surge was driven by EV manufacturers ramping up production to meet the 1.5 times offset requirement for EV imports during 2022–2023 under the EV3.0 scheme, despite an approved extension that allows shifting compliance to EV3.5 conditions with an additional 1–2 years (effective on 4 December 2024).

-

1-ton pickup truck production declined -5.4% YoY to 366,334 units, driven by a drop in output for domestic sales due to weak purchasing power among lower- to middle-income consumers. Single-cab pickups, typically used for commercial purposes, fell -6.2% YoY to 73,197 units, while double-cab pickups for multi-purpose use dropped -5.2% YoY to 293,137 units.

-

Production of other commercial vehicles dropped -38.2% YoY to 9,564 units, mainly due to a sharp decline in truck output, which fell -61.2% YoY to 4,369 units. No bus production was recorded during the period, reflecting a slowdown in the domestic market, which is the primary demand source. In contrast, van production rose 23.5% YoY, compared to a low base in the same period last year.

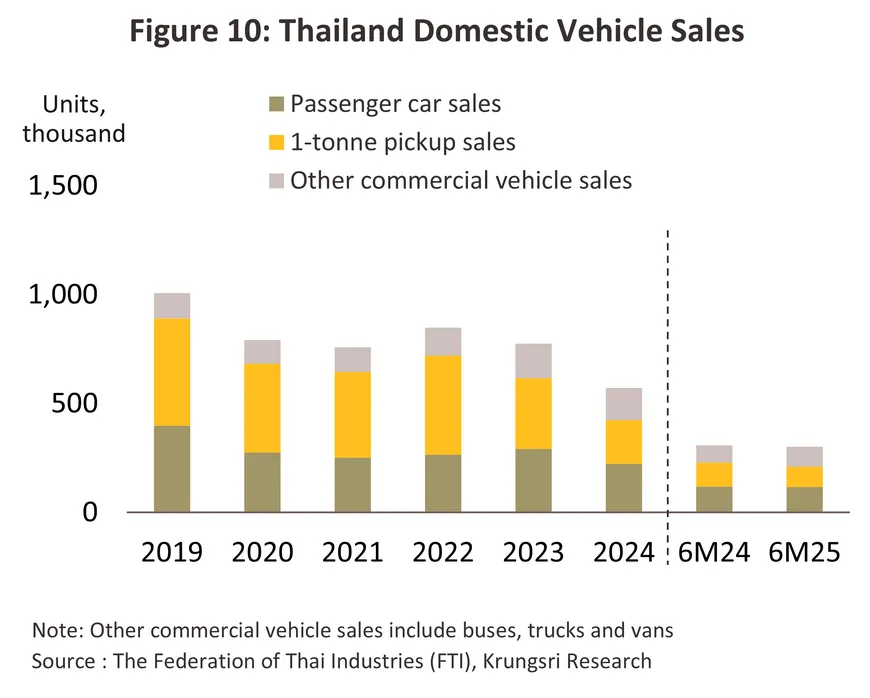

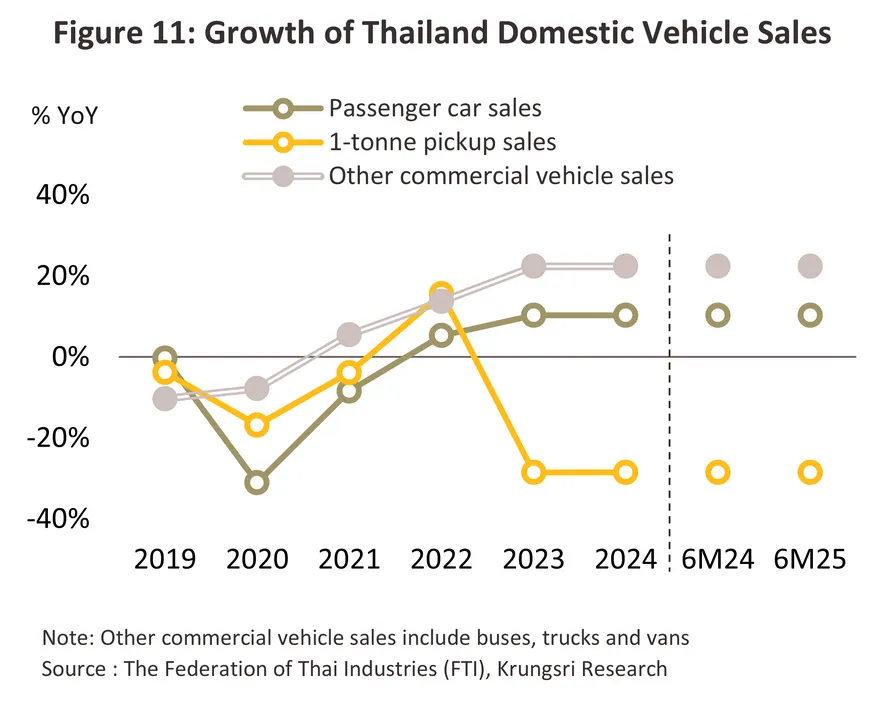

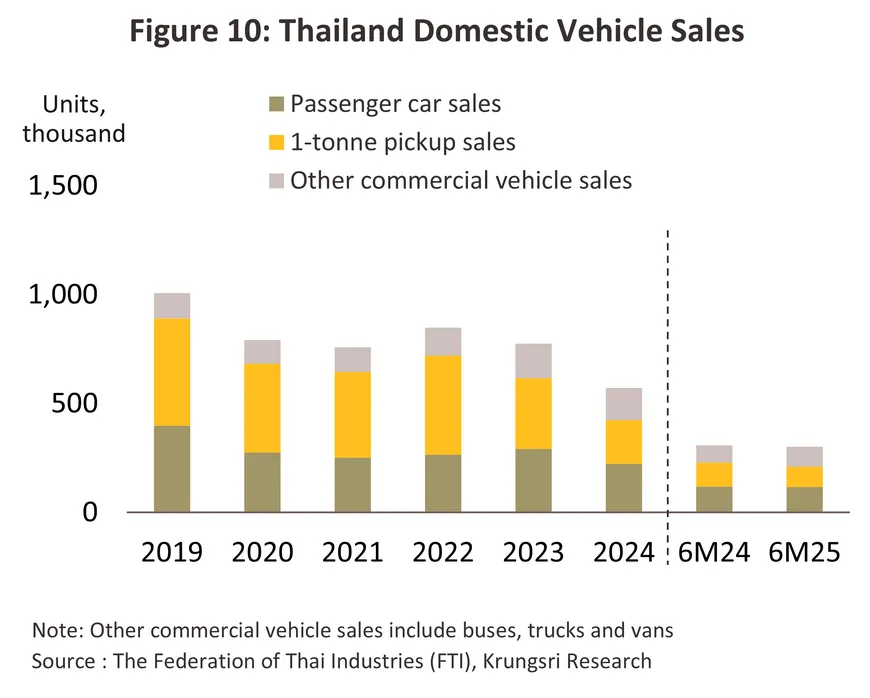

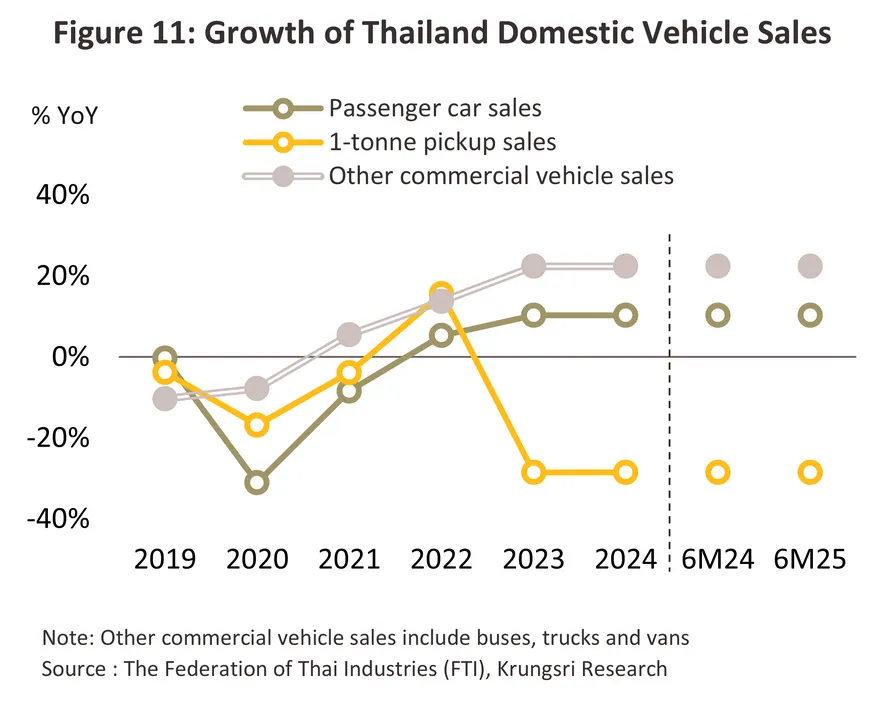

Domestic sales volume in the first half of 2025 declined -3.0% YoY to 252,625 units (Figures 10 and 11), broken down as follows:

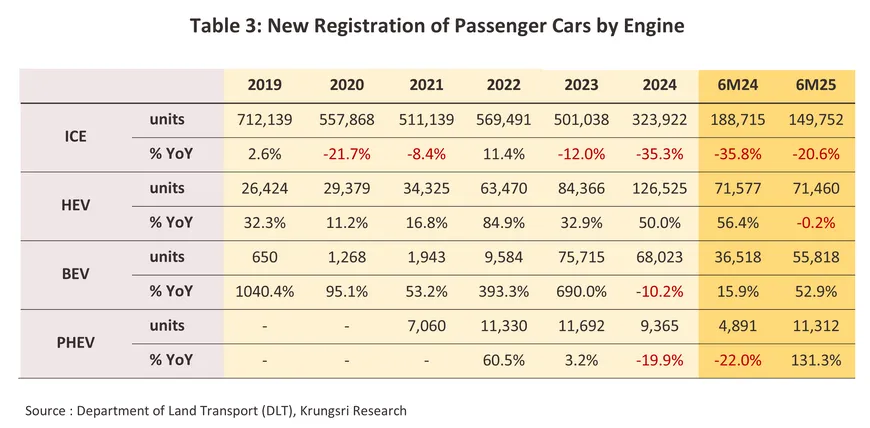

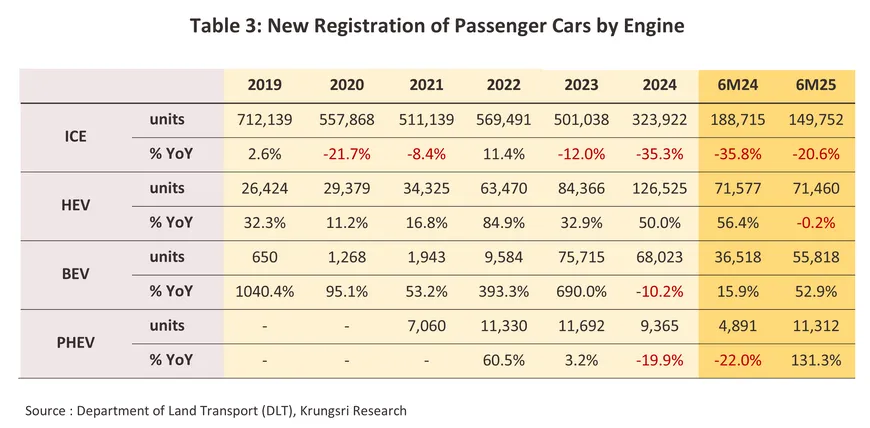

1) Passenger car sales contracted -1.5% YoY to 117,494 units, pressured by subdued demand amid ongoing economic uncertainty. However, domestic sales began to recover from April 2025 onward6/ , following a 22-month consecutive decline (from June 2023 to March 2025), supported by: (i) easing of loan approvals by financial institutions as NPL and SML trends continued to improve; (ii) rising used car prices due to lower supply, prompting some consumers to sell their old cars to fund new purchases; and (iii) aggressive promotional campaigns across all passenger car segments7/ to maintain competitiveness amid the intensifying EV price war. New passenger car registrations by fuel type (Table 3) are summarized as follows:

-

New registrations of ICE passenger cars dropped -20.6% YoY to 149,752 units, weighed down by the sluggish economic recovery and persistently high living costs. The decline was further exacerbated by the growing popularity of electric vehicles, driven by government incentives that encouraged the import of affordable, small-sized Chinese BEVs, which offer a cost advantage in terms of fuel efficiency compared to ICE passenger cars.

-

New registrations of HEV passenger cars contracted slightly by -0.2% YoY but remained highly popular, totaling 71,460 units (accounting for 51.6% of total XEV passenger car registrations). Meanwhile, PHEV passenger car registrations surged 131.3% YoY to 11,312 units, thanks to its flexible technology, appealing to buyers who were not yet ready to switch to BEVs. The market was also stimulated by the launch of new models from both Japanese brands and affordable Chinese brands, aiming to expand the still-small segment.

-

New registrations of BEV passenger cars rose 52.9% YoY to 55,818 units, supported by: (i) pent-up demand from consumers looking to purchase BEVs amid signs of easing in the EV price war in early 2025, following intense competition throughout 2024. This was reflected in the stabilization of Chinese EV prices showcased at the 2025 Motor Show (March–April 2025), compared to the year-end 2024 Motor Expo. As EV manufacturers’ profit margins have continued to shrink since the price war began in late 2022, further price cuts had become increasingly difficult; (ii) the launch of new models featuring advanced technology at more affordable prices; (iii) the expansion of charging station infrastructure; and (iv) the growing trend of consumer acceptance toward EV technology.

2) Sales of 1-ton pickup trucks declined -13.9% YoY to 93,398 units, despite support from the 'Pickup with Credit Guarantee' scheme, which aimed to improve loan accessibility for SMEs under a budget of 5 billion baht. The program, launched on April 1st, 2025, had disbursed only 320 million baht by June 2025 (accounting for just 6.4% of the total budget)8/, due to several limiting factors such as (i) weak demand from middle- to low-income consumers, particularly farmers affected by depressed agricultural prices and persistently high household debt; and (ii) delayed replacement of single-cab pickup trucks used for goods transportation among SMEs, as the economy has yet to show signs of recovery.

3) Sales of other types of commercial vehicles increased 14.4% YoY to 91,812 units, broken down as follows:

-

Sales of multipurpose vehicles or four-wheel-drive commercial vehicles (including PPVs, SUVs, MPVs, and 4WD pickups) rose 19.0% YoY to 77,516 units, supported by strong demand for 4WD pickups, driven by resilient purchasing power among middle- to upper-income consumers.

-

Sales of buses, trucks, and vans declined -5.4% YoY to 14,296 units, dragged down by several factors: (i) the number of international tourists fell -4.7% YoY in the first half of the year, leading to lower demand for buses and vans used for tourist transportation; and (ii) registrations of public buses continued to drop from 2023–2024, as the government rolled out a large number of new buses following the initial wave of the COVID-19 outbreak.

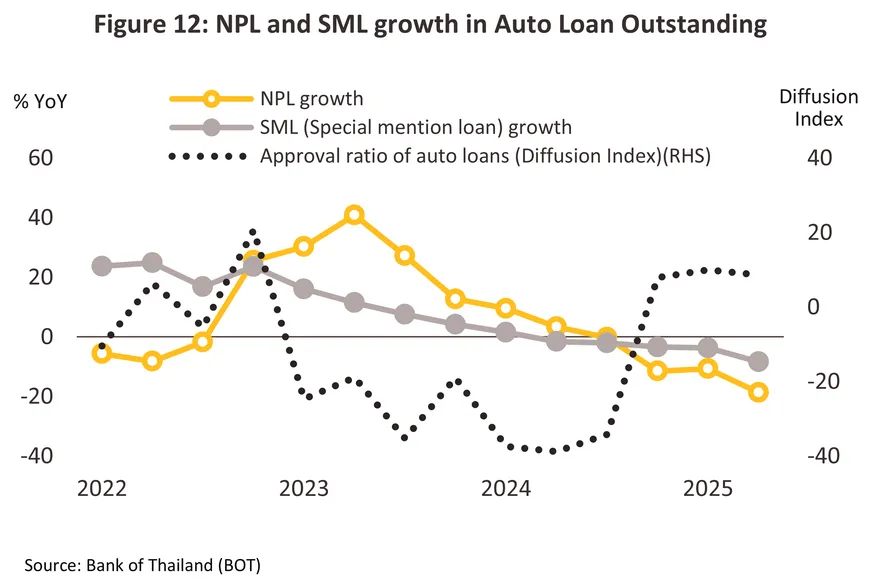

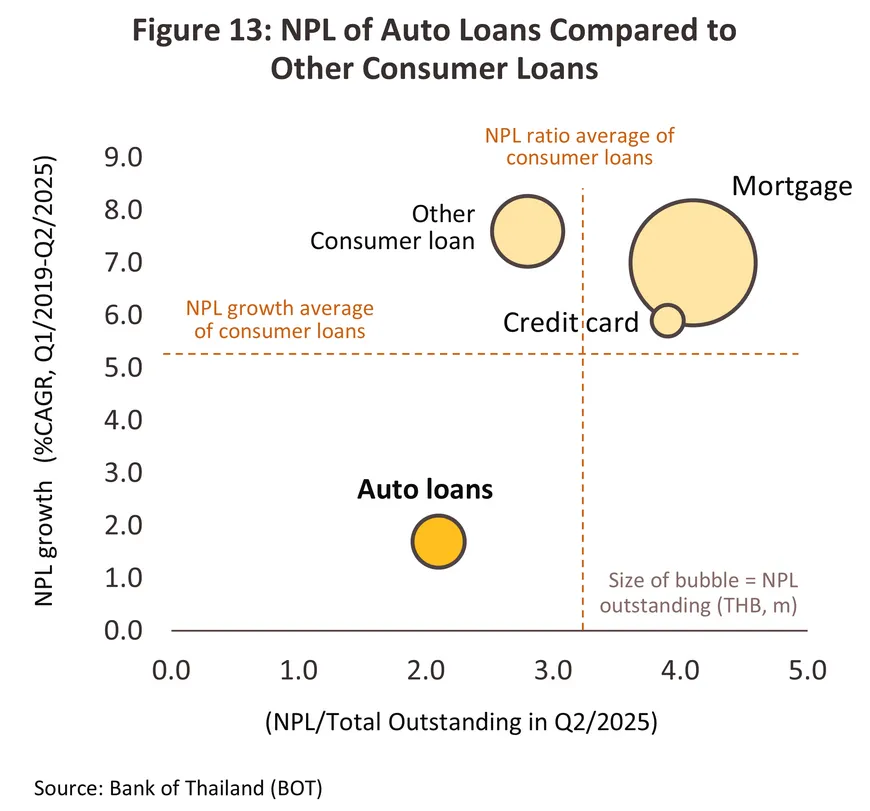

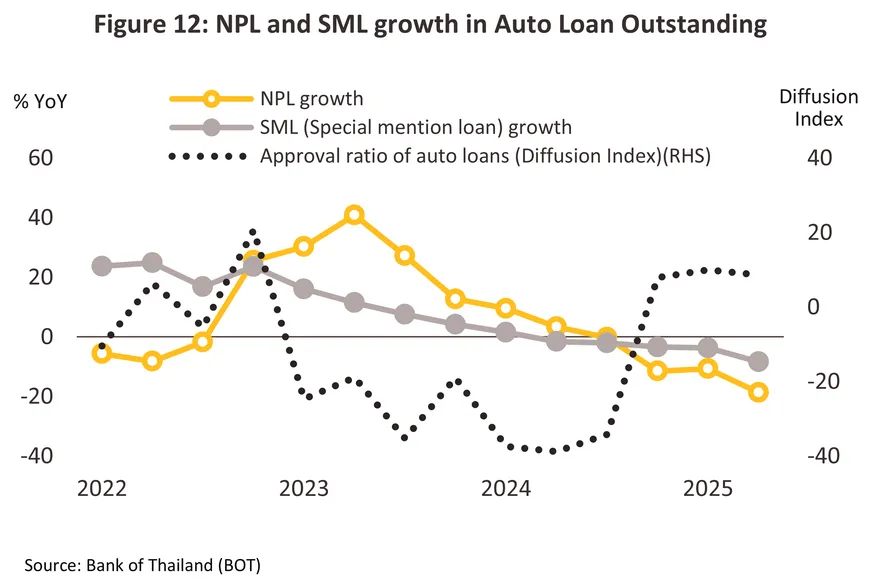

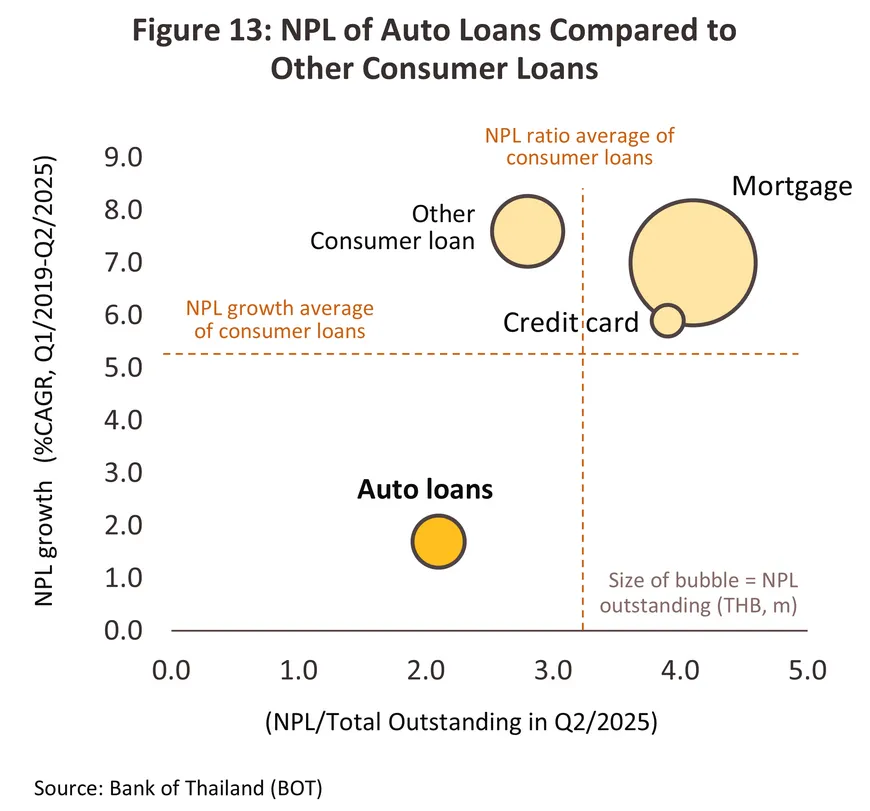

Non-Performing Loans (NPLs) and Special Mention Loans (SMLs) in auto hire-purchase continued to decline from their peak in Q2/2024. In Q2/2025, NPL dropped -18.6% YoY to THB 210 billion, accounting for 2.1% of total auto loan value, while SML fell -8.4% YoY to THB 160 billion, representing 15.5% of total auto loan value (Figure 12). The improvement was supported by ongoing measures from financial institutions aimed at reducing NPLs, such as debt moratoriums, debt restructuring, and stricter loan approvals. Moreover, when comparing NPLs in auto loans with other types of personal loans, auto loan NPLs showed stronger recovery, with a growth rate of only 1.7% CAGR during 2019–2025, which is lower than that of other personal loans at 7.0% CAGR. The NPL ratio to total outstanding auto loans in Q2/2025 stood at 2.1%, also lower than that of other personal loans at 3.6% (Figure 13). These trends prompted financial institutions to gradually ease auto loan approvals starting from Q4/2024, as reflected by the diffusion index of auto hire-purchase loan approvals, which continued to rise 8.6% QoQ in Q2/2025.

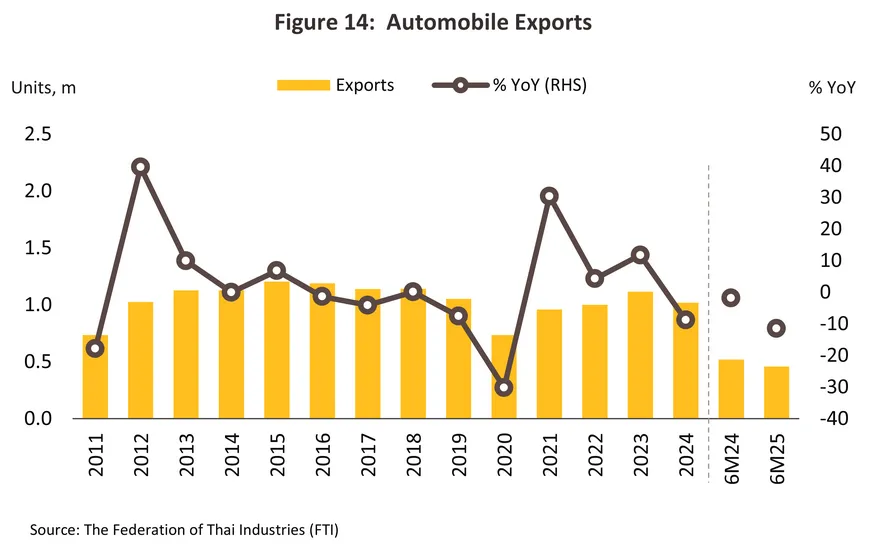

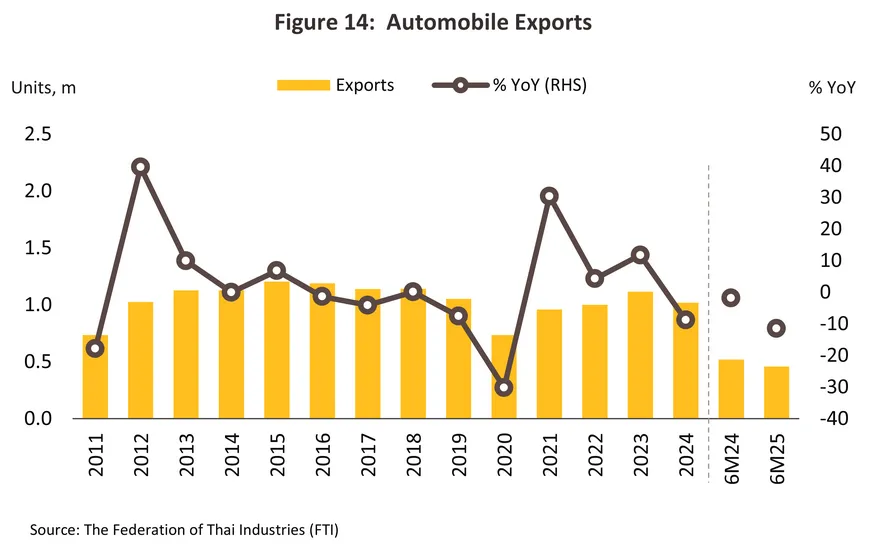

Exports declined -11.5% YoY to 459,444 units (Figure 14), weighed down by several headwinds: (i) sluggish demand from trading partner countries amid ongoing global economic uncertainty; (ii) intensifying competition in the global automotive market, particularly from the expansion of export activities by Chinese EV manufacturers, which has led to a loss of market share for Thailand in some partner countries; (iii) stricter environmental regulations, limiting Thailand’s ability to export certain ICE models due to emission levels exceeding importers’ standards; and (iv) tighter safety standards in the U.S. and Europe, which have restricted the export of certain passenger cars that lack required driver-assistance safety features.

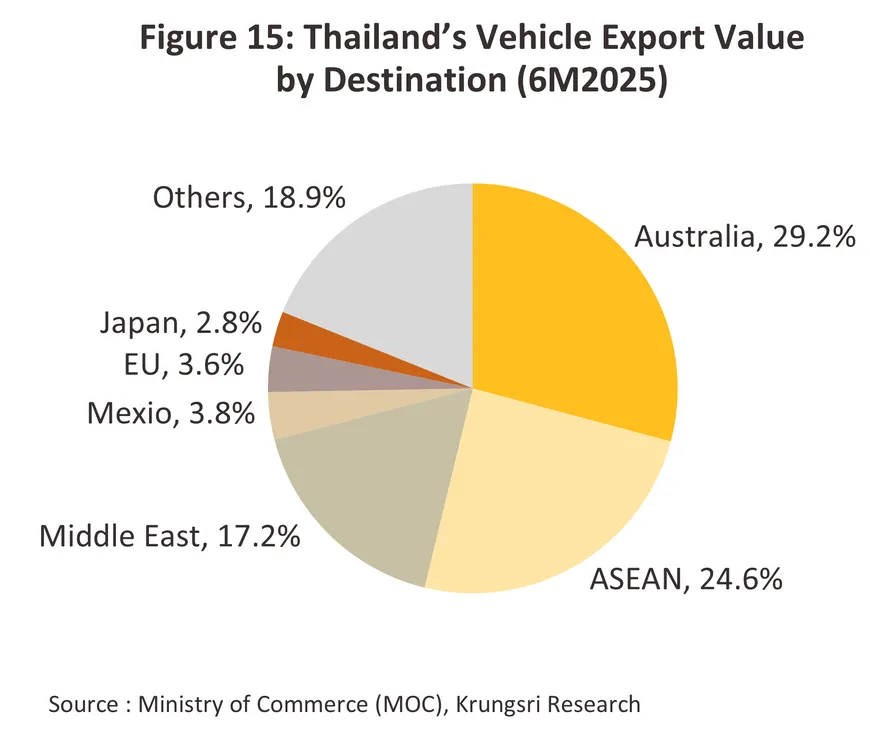

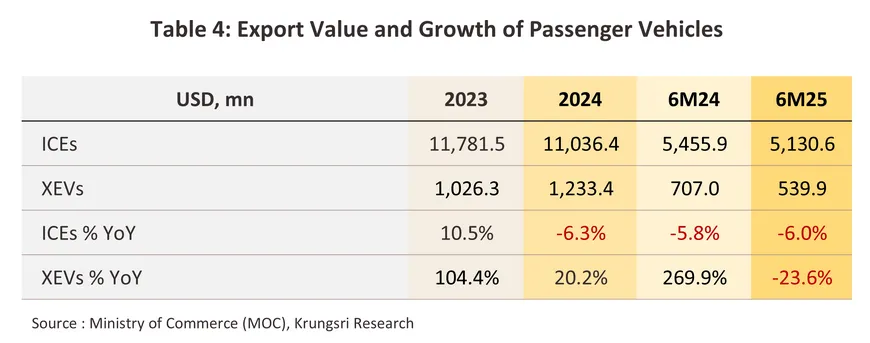

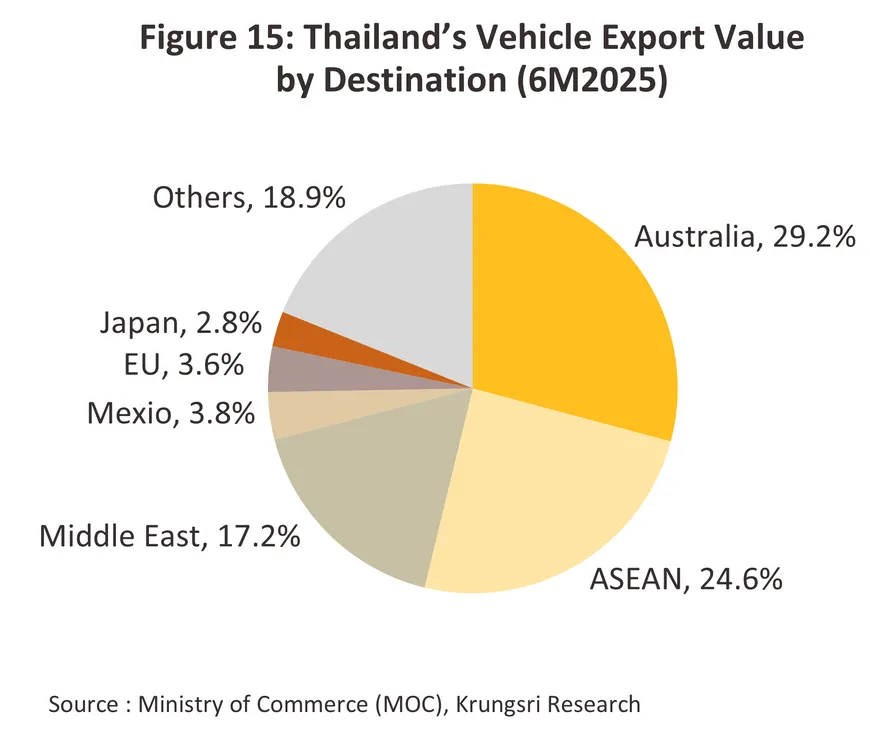

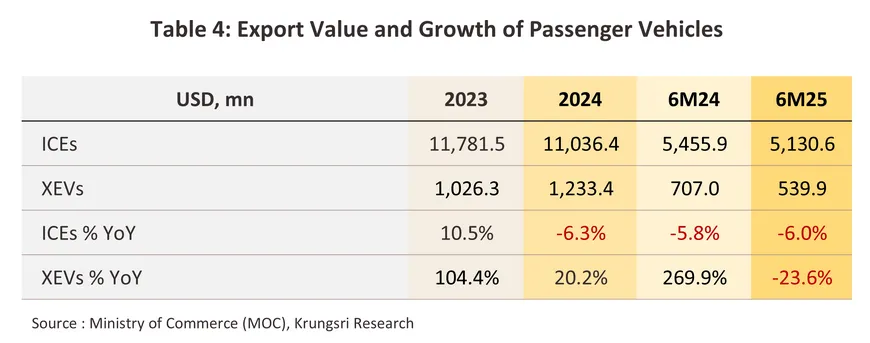

An analysis by export market (Figure 15) showed that Australia, ASEAN, and the Middle East remained Thailand’s top three destinations, accounting for 29.2%, 24.6%, and 17.2% of total automobile export value, respectively. Export value to Australia, the largest market, fell sharply by -15.6% YoY, driven by a -17.7% YoY contraction in pickups, buses and trucks, and a -13.2% YoY decline in passenger cars. By vehicle type (Table 4), export value of ICE passenger cars dropped -6.0% YoY to USD 5,130.6 million, while XEV passenger cars (mostly HEVs) declined -23.6% YoY to USD 539.9 million, compared to a high base in the same period last year. Nevertheless, Thailand began exporting BEV passenger cars for the first time in April 2025, with total exports reaching 664 units in the first half of the year.

Outlook

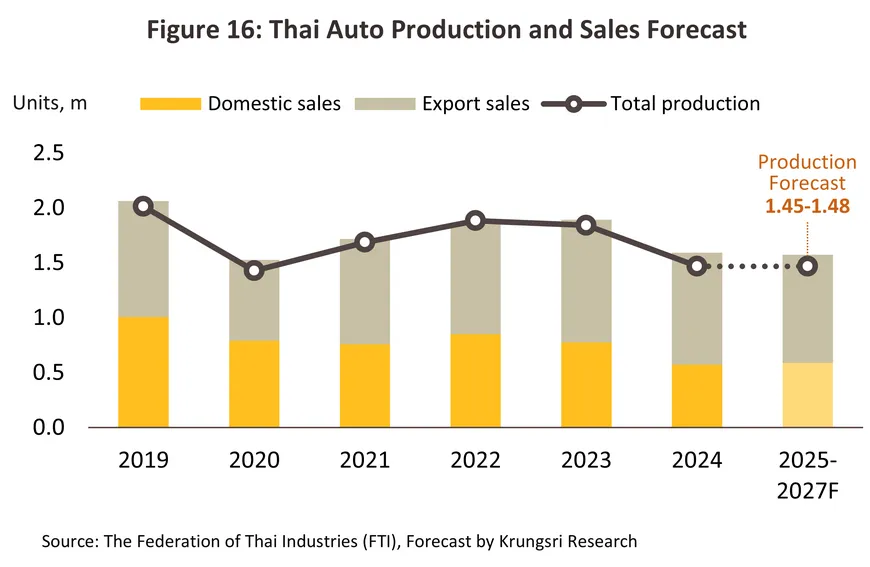

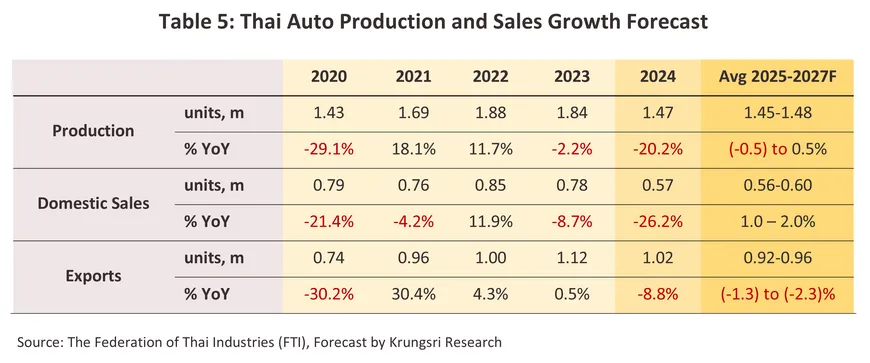

Automobile production growth between 2025 and 2027 is forecast to remain flat, ranging from -0.5% to 0.5% annually, with expected output of 1.45–1.48 million units (Figure 16 and Table 5). The outlook is weighed down by: (i) the U.S. tariff hike measures, which have weighed on both domestic and export markets, slowing the pace of recovery; and (ii) risks of future disruptions in the global automotive supply chain9/ due to China’s export controls on rare earth minerals10/. Modern vehicles rely heavily on rare earth components11/ particularly EVs, which require roughly twice as much rare earth material as ICE vehicles12/.

However, EV production in Thailand will be supported by key government policies, including: (i) investment promotion for domestic BEV production to offset imports under the EU 3.0 and 3.5 schemes, which is likely to drive up local BEV output while imported BEVs for sale continue to decline; and (ii) support for HEV and MHEV manufacturing through fixed-rate excise tax reductions, HEV at 6–9% and MHEV at 10–12% during 2026–2032, which is expected to support domestic hybrid vehicle production during the transition toward the EV industry.

Domestic sales are forecast to grow by 1.0–2.0% annually, reaching 0.56–0.60 million units. However, sales are expected to contract in 2025 due to several headwinds, including: (i) indirect impacts from the U.S. reciprocal tariff, under which Thailand faces a 19% rate effective from 7 August 2025, weighing on economic recovery and dampening consumer confidence in the second half of the year; (ii) potential delays in government budget disbursement amid domestic political uncertainty, which could affect infrastructure investment and private sector spending; and (iii) weak purchasing power among farmers and SMEs, driven by declining agricultural prices. Consequently, despite support from the 'Pickup with Credit Guarantee' scheme, recovery in demand for 1-ton pickup trucks remains sluggish.

However, domestic sales are expected to remain flat in 2026 before recovering in 2027, supported by: (i) Infrastructure investment, which is expected to support a gradual recovery in private sector investment and drive stronger demand for commercial vehicles; (ii) continued expansion in tourism, transportation, and e-commerce sectors; (iii) rising prices of used cars, driven by a decline in the number of repossessed vehicles entering auction yards, encouraging some consumers to sell their old cars to finance new purchases13/; (iv) the launch of new EV models, particularly from Japanese and Chinese brands, which offer more affordable prices and advanced technologies; and (v) ongoing promotional campaigns from automakers amid intense competition in Thailand’s automotive market.

Exports are forecast to decline by an average of -1.3% to -2.3% annually, reaching 0.92–0.96 million units, due to several headwinds: (i) U.S. tariff hikes, which exert both direct and indirect impacts. These consist of: (a) direct impacts from the U.S. sectoral tariff increase on automobiles and parts to 25%, effective April 3, 2025. However, the direct impact is limited, as the U.S. is not a major export destination for Thai vehicles14/, (b) indirect impacts from reciprocal tariffs, which have weakened purchasing power in export markets as U.S. trading partners face varying tariff hikes effective from August 7, 2025, is expected to further dampen demand in partner countries, particularly during 2025–2026; (ii) intensifying competition from Chinese automakers, who are aggressively offloading excess EV supply, especially in developing markets where affordable Chinese EVs are gaining popularity; and (iii) increasingly stringent environmental standards in many countries, which may affect exports of certain ICE models from Thailand. Nevertheless, EV exports are expected to benefit from both demand and supply-side factors. On the demand side, global sales of BEVs and PHEVs are projected to grow at an average CAGR of 26.6% during 2024–203115/ (IEA, 2025). On the supply side, Thailand’s revised EV 3.0 and EV 3.5 policies now allow manufacturers to count one exported BEV sedan as 1.5 units toward their local production offset quota, incentivizing more EV production for export. (Source: Bangkokbiz (July 30, 2025))

1/ The “First Car Program” was a tax rebate scheme offering up to THB 100,000 in excise tax refunds (after a 5-year ownership period) for first-time car buyers between 16 September 2011 and 31 December 2012. The program covered vehicles priced up to THB 1 million, including passenger cars with engine sizes not exceeding 1,500 cc, pickup trucks, and double-cab pickups. The government did not specify a delivery deadline for vehicles under the scheme.

2/ Further details are available in Industry Outlook 2024–2026: Automotive Industry, Table 1 on page 6 and Table 3 on page 7.

3/ Compiled from news reports on investment plans announced by automotive companies in Thailand.

4/ Source: Prachachat (July 30, 2025)

5/ Nissan (Thailand) restructured its production process in Q1 2025. Previously, the company operated two manufacturing plants in Bang Sao Thong District, Samut Prakan Province. Under the new plan, only one plant will continue vehicle production, while the other will be converted into a parts manufacturing facility, focusing on components such as car bodies, plastic parts, and stamped parts. (Source: Thansettakij (February 17, 2025)

6/ Passenger car sales in April, May, and June 2025 increased by 3.6%, 17.4%, and 9.4% YoY, respectively (Source: DLT).

7/ For example, Ford offering installment support of 2,000 baht per month for 29 months along with discounts of up to 200,000 baht; Isuzu giving buyers a chance to win a 2-salung gold pendant; and Mazda offering 0% interest financing, free first-class insurance, free scheduled maintenance packages, or cash discounts ranging from 70,000 to 500,000 baht (Source: Prachachat (July 16, 2025).

8/ Source: Thansettakij (March 23, 2025) and Prachachat (July 5, 2025)

9/ According to the European Association of Automotive Suppliers (CLEPA), several auto supplier plants in Europe have already shut down

due to a shortage of rare earth materials following China’s export restrictions. CLEPA also warned that more facilities may be forced to halt production in the coming weeks if the situation persists. (Source: Reuters (June 9, 2025))

10/ China accounts for as much as 70% of the world’s rare earth mining and up to 85% of global rare earth refining capacity. (Source: Reuters (June 9, 2025))

11/ Examples of such components include side mirrors, audio speakers, engine oil systems, windshield wipers, fuel leakage sensors, and brake sensors. (Source: Reuters (June 9, 2025))

12/ According to the International Energy Agency (IEA), an electric vehicle uses approximately 0.5 kilograms (around 1 pound) of rare earth materials per unit on average, which is about twice the amount used in a conventional gasoline-powered car. (Source: Reuters (June 9, 2025))

13/ The number of used cars entering auction yards averaged 18,458 units per month during the first half of 2025, down -26.2% YoY. (Source: Prachachat (July 18, 2025))

14/ During the first seven months of 2025, Thailand exported passenger cars to the U.S. worth USD 43.4 million, accounting for only 0.7% of total passenger car export value.

15/ According to the IEA (2025), the global stock of electric vehicles, specifically BEVs and PHEVs, excluding two- and three-wheelers, is projected to increase from 61.1 million units in 2024 to 251.7 million units by 2030.

.webp.aspx)