EXECUTIVE SUMMARY

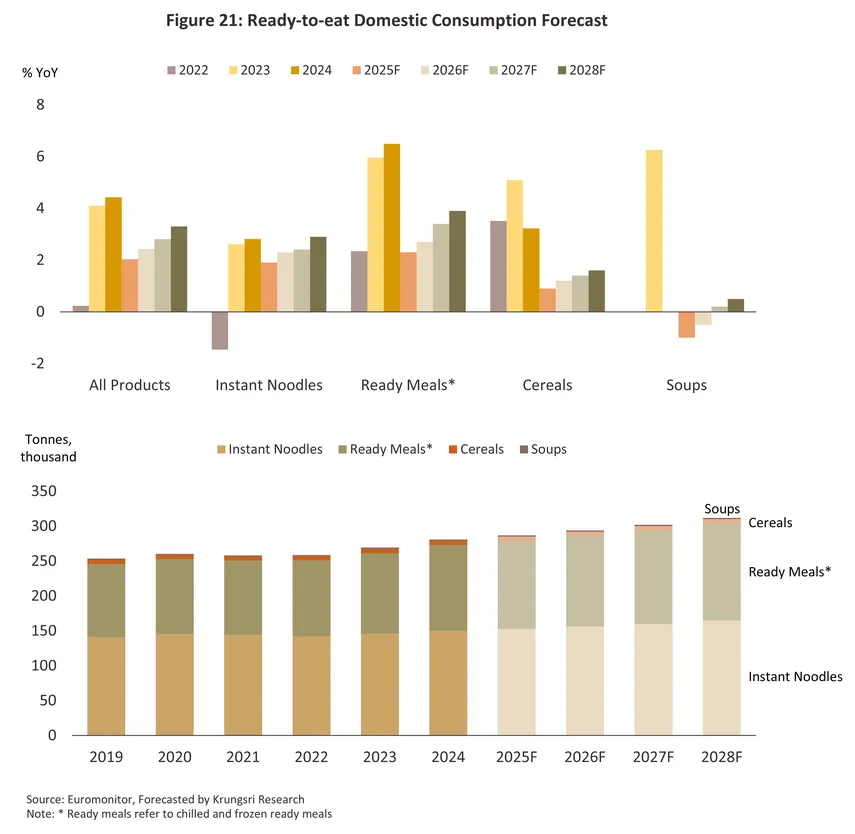

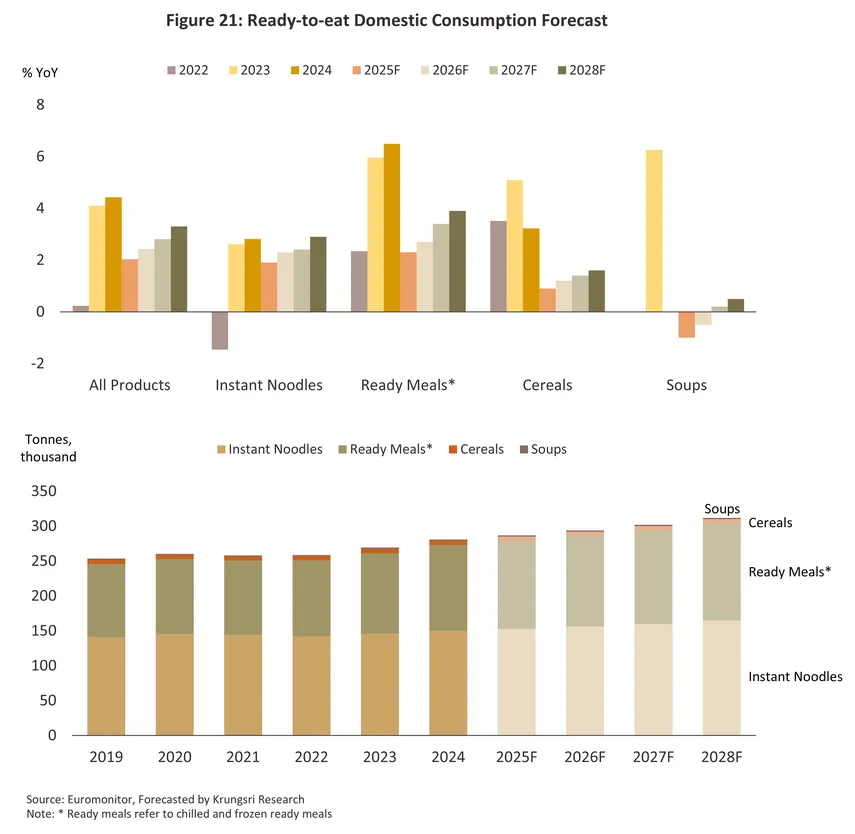

During 2026–2028, Thailand’s domestic sales volume of ready-to-eat (RTE) foods is expected to expand by an average of 2.3–3.3% annually. Growth in 2026 will likely remain subdued as the domestic economy decelerates amid political uncertainty, elevated household debt and living costs, and a deceleration in tourism. However, recovery momentum is projected to improve in 2027–2028, driven by: 1) increasingly fast-paced lifestyles that fuel demand for convenient RTE options; 2) wider adoption of data analytics technologies that enable manufacturers to better capture consumer insights; 3) continued expansion of convenience stores enhancing distribution reach; and 4) ongoing product innovation that enriches the consumer experience.

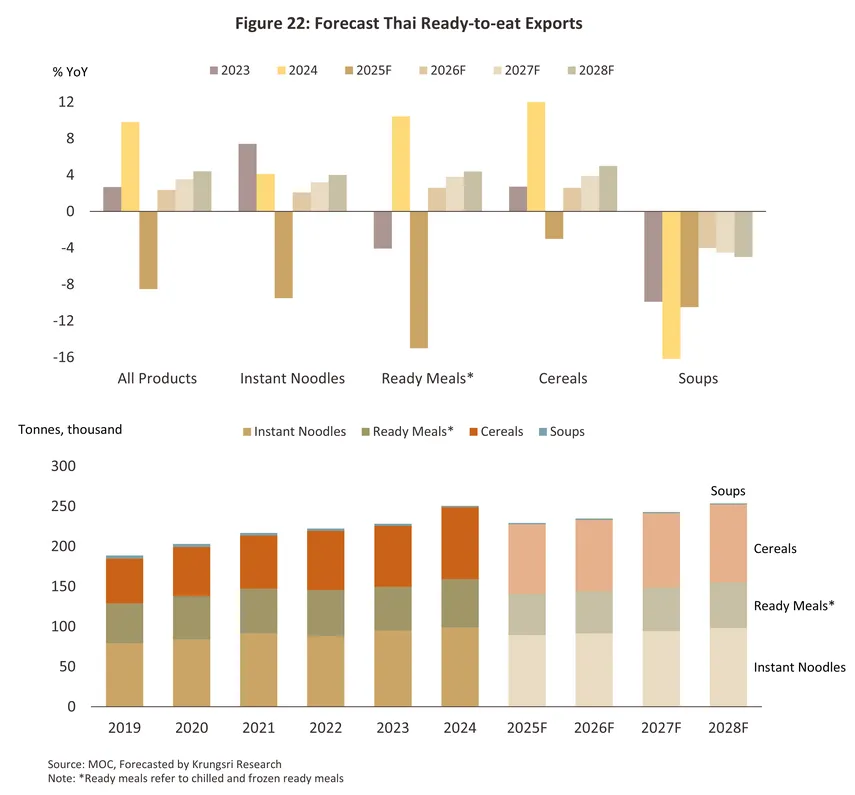

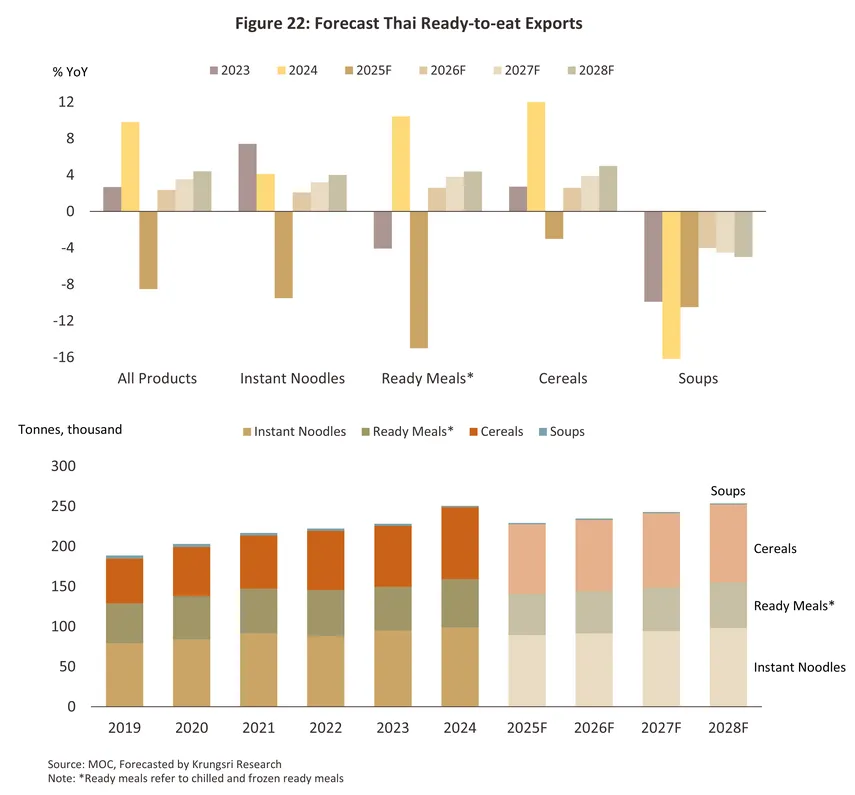

Meanwhile, export volume is forecast to expand by an average of 2.9–3.9% annually. In 2026, growth will likely remain constrained by several headwinds: 1) a continued slowdown in the global economy; 2) the impact of U.S. reciprocal tariffs imposed on Thai products, with the U.S. being one of Thailand’s key export markets; and 3) weaker exports to Cambodia—a major destination for Thai instant noodles—amid conflict along Thai-Cambodian border. Nevertheless, export growth is expected to gain momentum during 2027–2028, supported by a gradual recovery in purchasing power among trading partners and the expansion of market presence across Asia, particularly in countries with free trade agreements (FTAs, RCEP) with Thailand. Additional growth potential is also seen in Europe, where younger urban consumers are showing stronger preferences for authentic international cuisines. In the U.S. market, Thai producers are expected to focus on the premium segment, catering to consumers with strong purchasing power.

Krungsri Research view

-

Manufacturers of instant noodles: Revenue is expected to maintain an upward trend, supported by the industry’s ability to introduce innovations creating high-value products and to sustain marketing strategies that target younger, lifestyle-oriented consumers and the premium segment, where purchasing power remains resilient. At the same time, the mid- to lower-income market continues to offer growth opportunities amid a slowing economy, as affordability remains a key driver of demand. Export prospects in Asia and Europe also appear promising, driven by both household consumption and foodservice operators who incorporate instant noodle products to manage costs. However, price volatility in key raw materials, particularly wheat, poses a risk to production costs and profitability, given potential fluctuations caused by climate variability and droughts in major supplier countries such as Australia and Canada.

-

Manufacturers of chilled and frozen meals: Ongoing urbanization has enhanced the accessibility of diverse RTE product channels, particularly through convenience stores and hypermarkets that remain the primary retail channels. Moreover, consumers’ increasingly fast-paced lifestyles—driven by the full recovery of economic activities—continue to underpin robust demand for convenient meal solutions.

-

Manufacturers of ready-to-eat cereals: Rising health-consciousness among consumers, who increasingly value multi-grain-based and nutritious foods, together with ongoing product diversification that caters to busy lifestyles, continues to underpin steady revenue growth prospects for producers. Nevertheless, the industry faces challenges from intensifying competition in export markets, as well as volatility in grain prices and transportation costs, which could weigh on profitability.

-

Manufacturers of ready-to-eat soups: The market remains confined to a relatively narrow consumer base, given the higher price compared with soups offered at restaurants or prepared at home. Moreover, rising health consciousness and consumers’ efforts to reduce sodium intake are expected to put downward pressure on revenue performance.

Overview

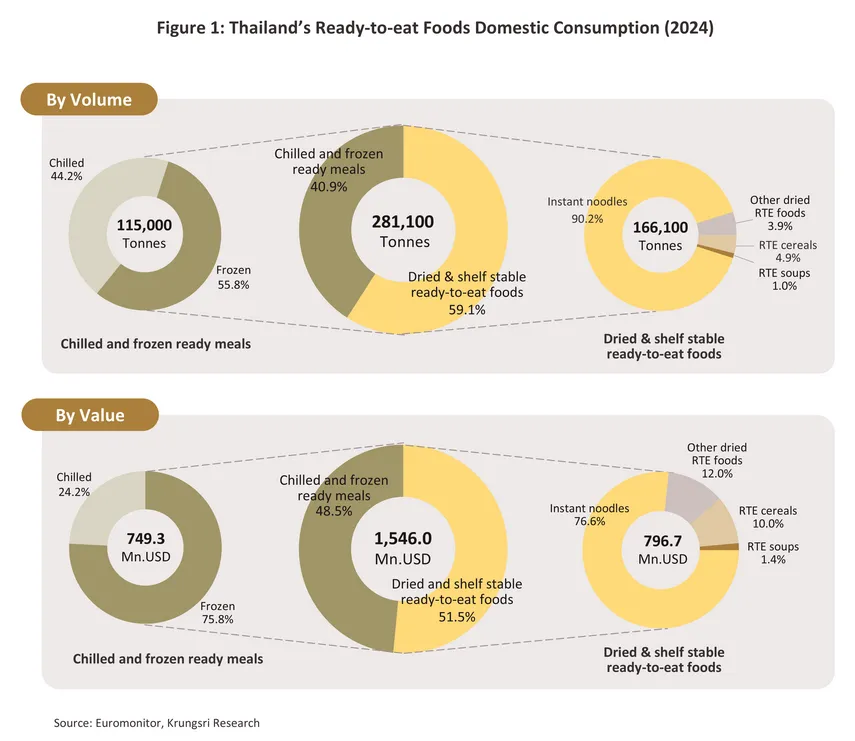

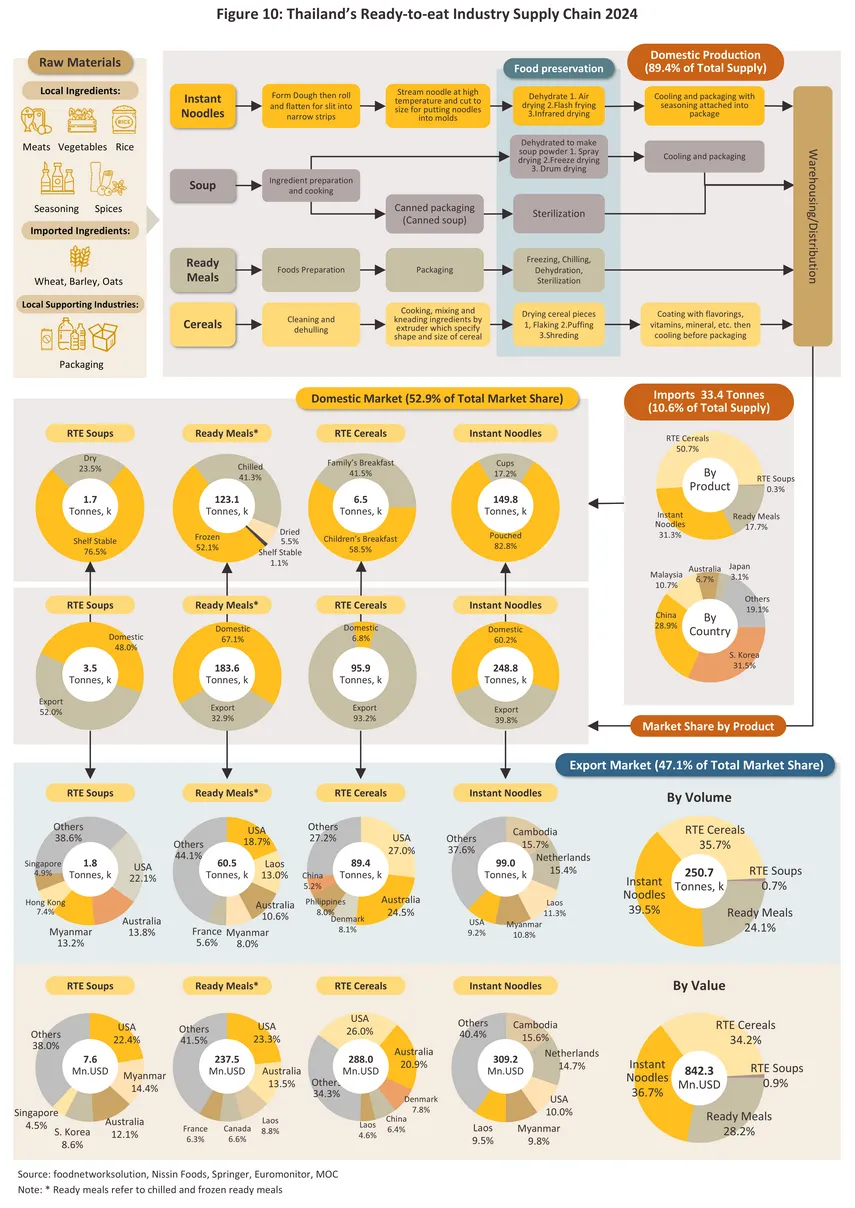

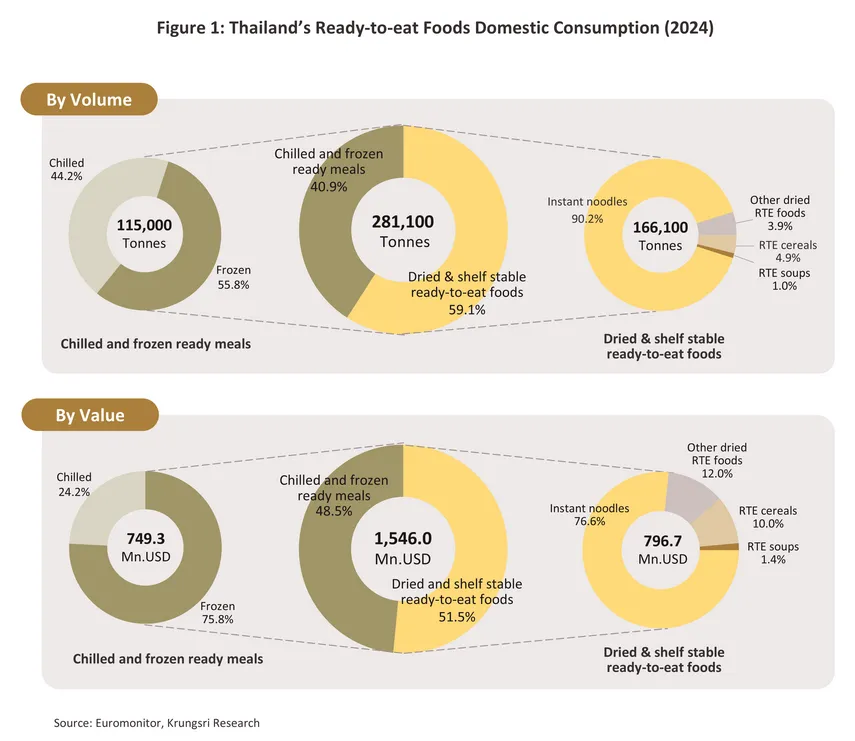

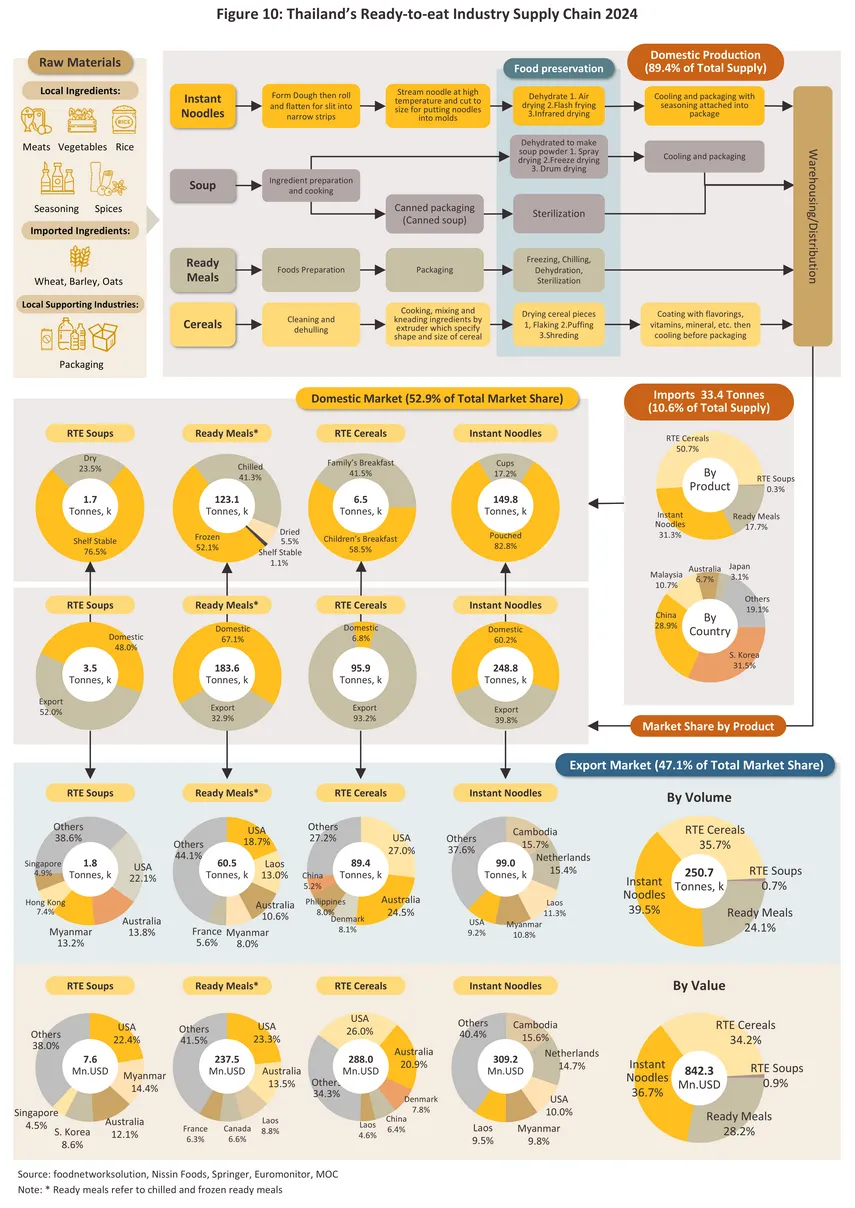

Ready-to-eat (RTE) food refers to meals that have been pre-cooked or processed for convenient consumption. Before serving, they can be reheated to enhance freshness, offering consumers speed and ease in meal preparation. In 2024, Thailand’s RTE food industry reported a combined domestic and export sales volume of 531.8 thousand tons, valued at USD 2.4 billion. The domestic market accounted for 281.1 thousand tons, representing 52.9% of total sales volume, and contributed USD 1.5 billion, or 64.7% of total sales value. Domestically sold RTE foods can be categorized into two main segments (Figure 1):

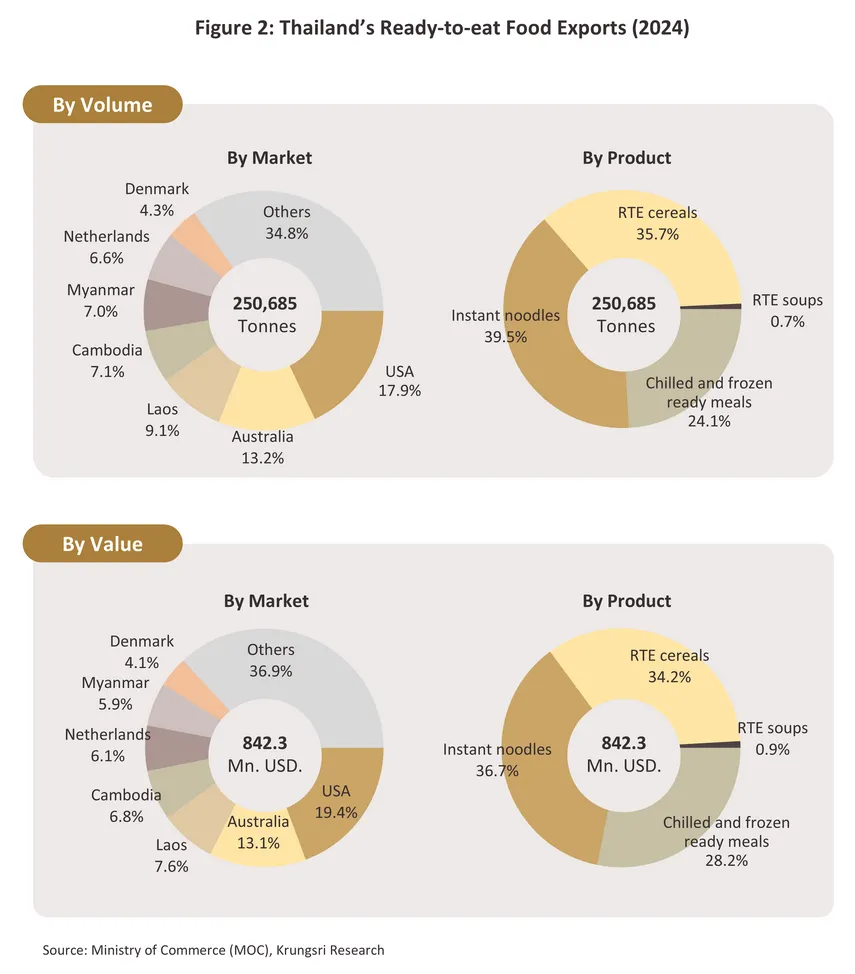

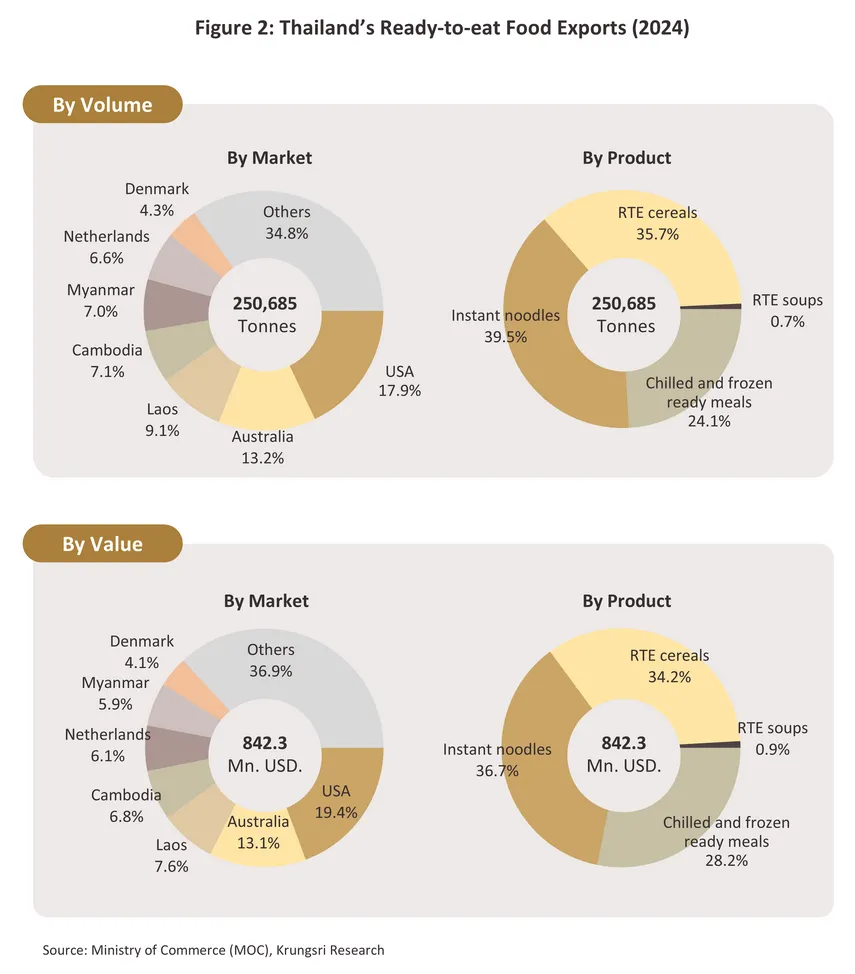

In 2024, Thailand’s ready-to-eat food exports stood at 250.7 thousand tons, accounting for 47.1% of total RTE food sales volume. The total export value reached USD 842.3 million, representing 35.3% of total sales value (Figure 2). The United States remained Thailand’s largest export market, accounting for 17.9% of export volume, followed by Australia (13.2%), Laos (9.1%), Cambodia (7.1%), and Myanmar (7.0%). Exports can be categorized into the following product groups:

-

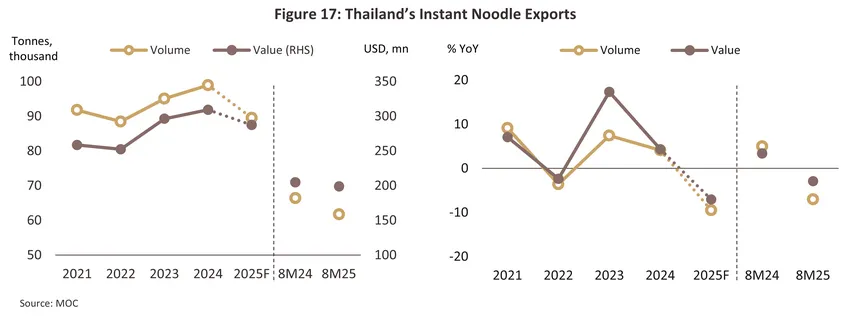

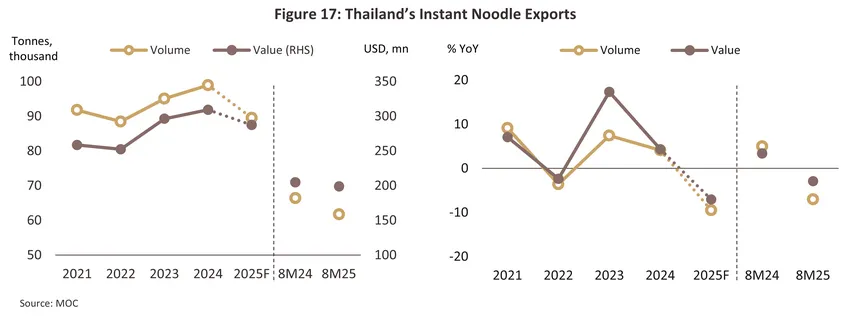

Instant noodles6/ reported an export volume of 98.9 thousand tons, valued at USD 309.2 million, accounting for 39.5% of total RTE food export volume and 36.7% of total export value. Cambodia remained the largest export market, representing 15.7% of total instant noodle exports, followed by the Netherlands (15.4%), Laos (11.3%), Myanmar (10.8%), and the United States (9.2%).

-

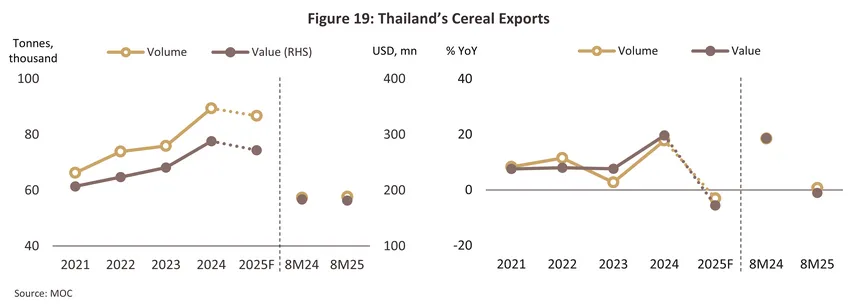

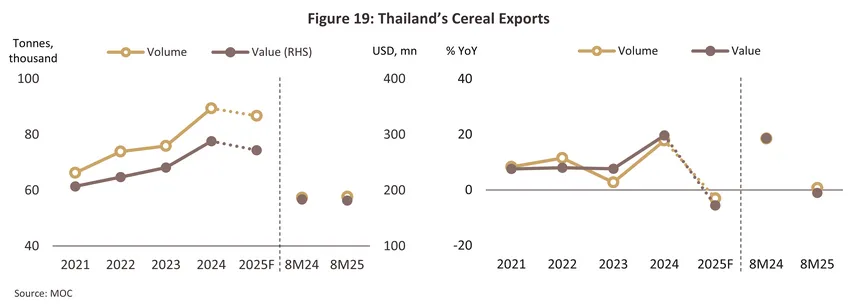

Ready-to-eat cereals7/ reported an export volume of 89.4 thousand tons, valued at USD 288.0 million, accounting for 35.7% of total RTE food export volume and 34.2% of total export value. The United States remained the largest export market, representing 27.0% of total cereal exports, followed by Australia (24.5%), Denmark (8.1%), the Philippines (8.0%), and China (5.2%).

-

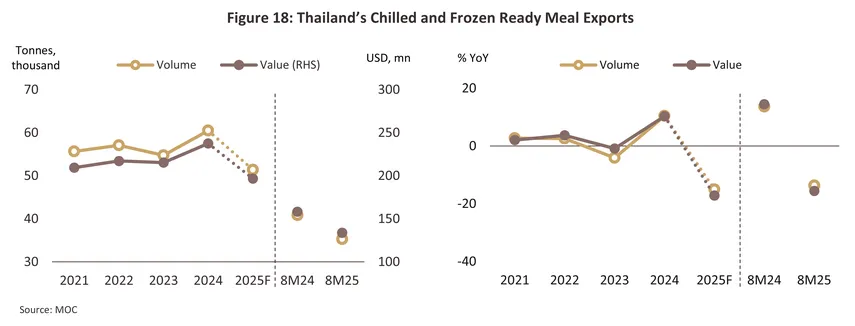

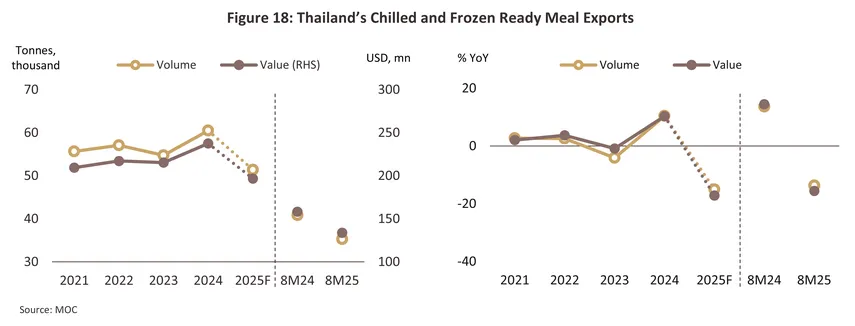

Chilled and frozen ready meals8/ reported an export volume of 60.5 thousand tons, valued at USD 237.5 million, accounting for 24.1% of total RTE food export volume and 28.2% of total export value. The United States remained the largest export market, representing 18.7% of total chilled and frozen RTE food exports, followed by Laos (13.0%), Australia (10.6%), Myanmar (8.0%), and France (5.6%).

-

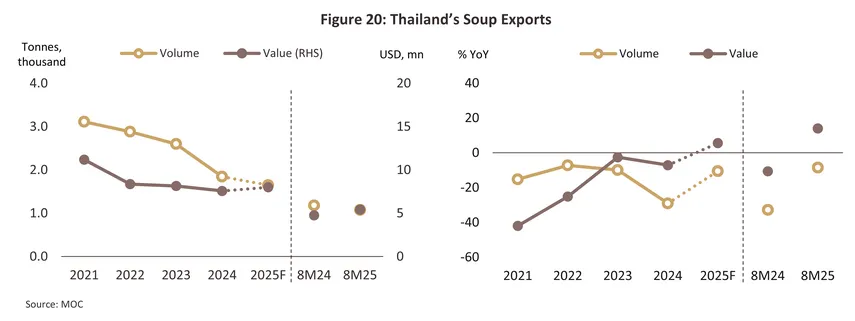

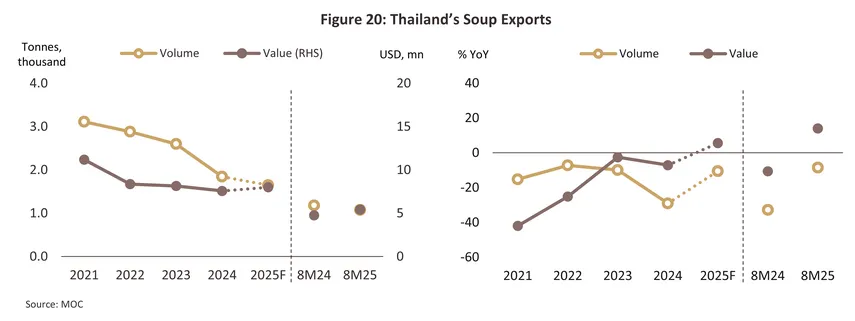

Ready-to-eat soups9/ reported an export volume of 1.8 thousand tons, valued at USD 7.6 million, accounting for 0.7% of total RTE food export volume and 0.9% of total export value. The United States remained the largest export market, representing 22.1% of total soup exports, followed by Australia (13.8%), Myanmar (13.2%), Hong Kong (7.4%), and Singapore (4.9%).

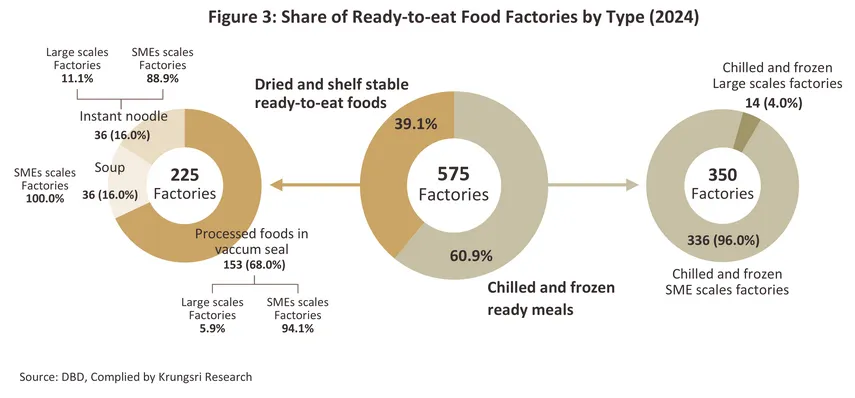

In 2024, Thailand’s RTE food industry10/ comprised 575 factories registered and actively operating under the Department of Business Development (DBD). The majority were small and medium-sized enterprises (SMEs), totaling 548 factories. These can be categorized into two main groups: 1) Dried and shelf-stable RTE food manufacturers, numbering 225 factories or 39.1% of all RTE food producers. Among these, 212 were SMEs and 13 were large-scale factories. By product type, this group included 153 manufacturers of RTE foods packaged in vacuum-packed, 36 manufacturers of instant and semi-instant flour-based foods, and 36 manufacturers of soups and specialty foods. 2) Chilled and frozen ready meals manufacturers, totaling 350 factories or 60.9% of all RTE food producers. Of these, 336 were SMEs and 14 were large-scale factories (Figure 3).

The overall structure of Thailand’s ready-to-eat food industry in 2024 can be classified by product category as follows:

Instant Noodles

-

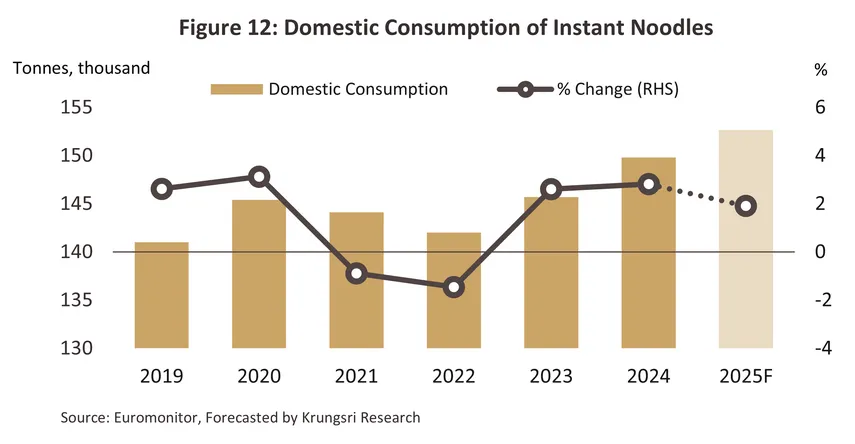

The domestic instant noodle market was valued at USD 610.5 million, accounting for 66.4% of total instant noodle sales value. Major manufacturers11/ comprise Saha Pathana Inter-Holding PCL. (Mama brand), Thai Preserved Food Factory Co., Ltd. (Wai Wai brand), Ajinomoto Co., Ltd. (Yum Yum brand), Samyang Foods Co., Ltd. (Samyang), Nongshim Co., Ltd. (Nongshim brand), and Nissin Foods (Thailand) Co., Ltd. (Nissin brand). Collectively, these producers account for over 93.4% of Thailand’s instant noodle market value. Overall consumption volume grew at a compound annual growth rate (CAGR) of 2.0% during 2019–2024, demonstrating steady growth during weak purchasing power. Instant noodles remain affordable and are often consumed as substitutes during periods of fresh food shortages. The category also continues to enjoy widespread popularity across all age groups, supported by continuous product innovation and the introduction of a wider range of distinctive flavors.

-

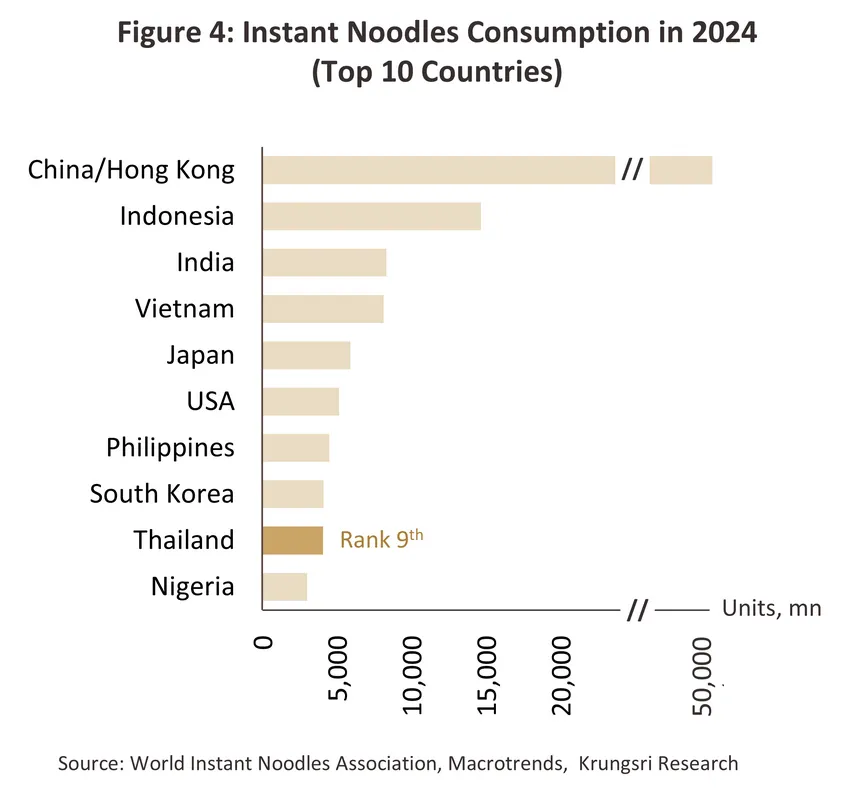

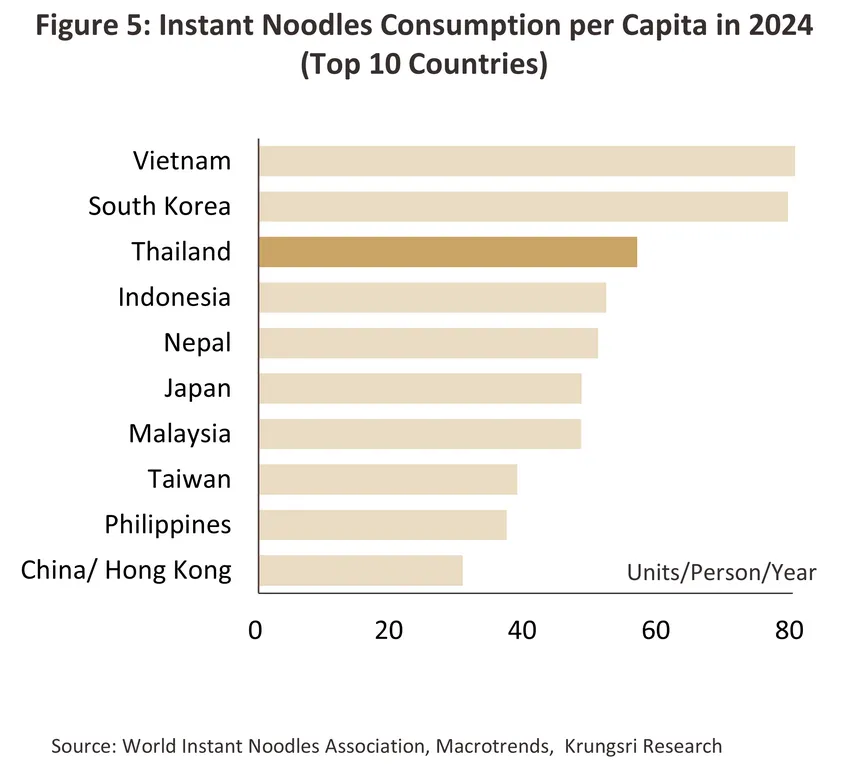

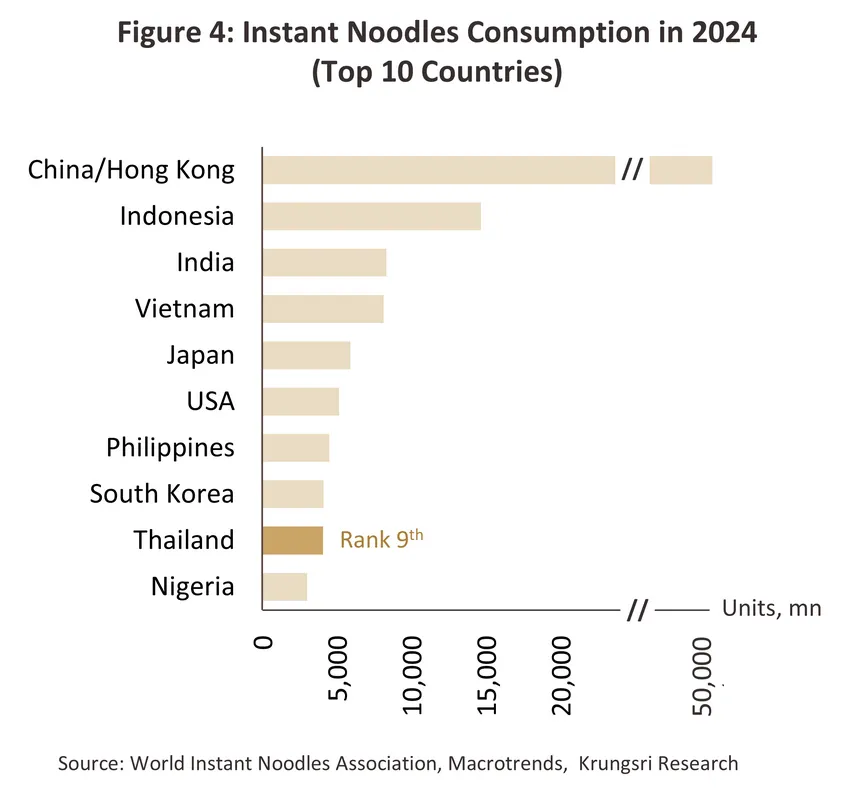

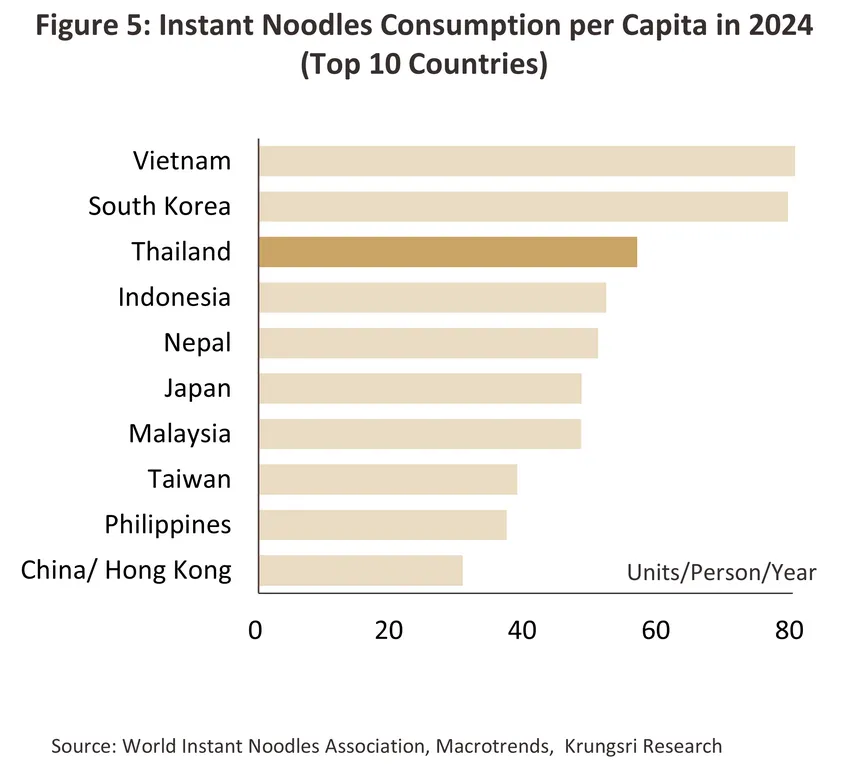

Domestic sales volume stood at 149.8 thousand tons, accounting for 60.2% of total instant noodle sales volume. Thailand ranked as the world’s 9th largest instant noodle market, with total consumption reaching 4.08 billion servings and a per capita consumption rate of 56.7 servings per year, placing it third globally after Vietnam (81.3 servings per person per year) and South Korea (79.3 servings per person per year). In comparison, the global average stands at 15.0 servings per person per year (Figures 4 and 5).

-

Export volume stood at 99.0 thousand tons, accounting for 39.8% of total instant noodle sales volume, with an export value of USD 309.2 million, representing 33.6% of total sales value. This indicates continued expansion of manufacturers’ distribution networks into markets such as Cambodia, the Netherlands, Laos, and the United States, where purchasing power is gradually recovering.

-

Market competition remains intense, particularly for products sold in pouches, which is driven largely by price competition and continuous product innovation aimed at attracting consumers. The competitive landscape is concentrated within the mid- to lower-income segments, where purchasing power remains fragile. At the same time, manufacturers are shifting their focus toward younger, higher-income consumers by introducing new flavors emphasizing premium ingredients and enhancing packaging design to support premium price positioning.

-

Production costs have remained volatile, largely driven by fluctuations in wheat flour prices—the primary raw material, which accounts for 50–80% of total inputs and is mostly imported. Other major cost components include palm oil and seasoning ingredients. As instant noodles are classified as price-controlled goods under the Department of Internal Trade, Ministry of Commerce, manufacturers have limited flexibility in adjusting retail prices in line with cost changes. Consequently, overall profitability depends heavily on cost management efficiency. In 2024, prices of key raw materials, particularly wheat flour, declined following sharp increases during 2021–2023, thereby supporting improved profit margins for manufacturers.

Ready-to-eat Cereals

-

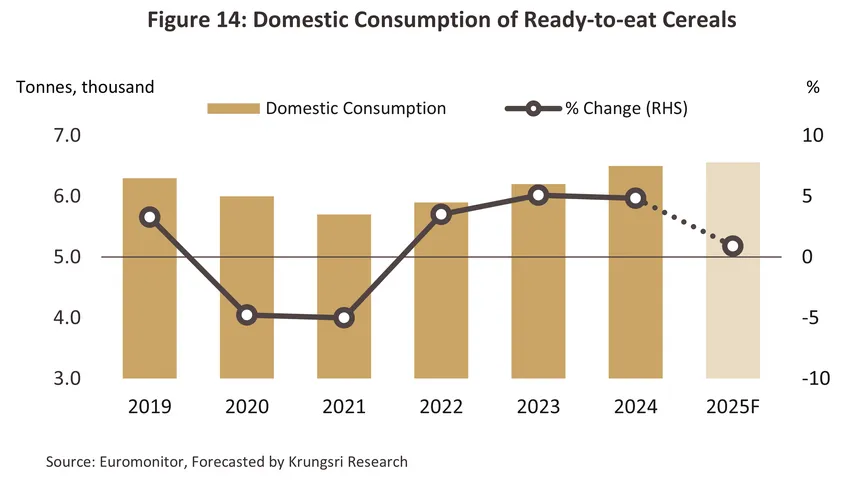

The domestic RTE cereal market was valued at USD 79.4 million, representing 21.6% of total RTE cereal sales value. Major manufacturers and distributors include Nestlé (Thailand) Co., Ltd. (Koko Krunch, Fitness, Milo, and Honey Stars brand), Kellanova (Thailand) Co., Ltd. (Kellogg’s), European Snack Foods Co., Ltd. (Coppa brand), and Brunch Time Co., Ltd. (Diamond Grains brand). Collectively, these players account for over 75.6% of Thailand’s total cereal market value. Overall consumption volume remained flat, with a slight decline at a CAGR of –0.1% during 2019–2024, as consumers increasingly shifted toward other ready-to-eat food categories offering greater variety, innovation, and convenience—particularly for breakfast, reflecting today’s fast-paced lifestyles. Most RTE cereal products are made from diverse grains, including cornflakes, wheat flakes, oatmeal, rice cereal, and granola.

-

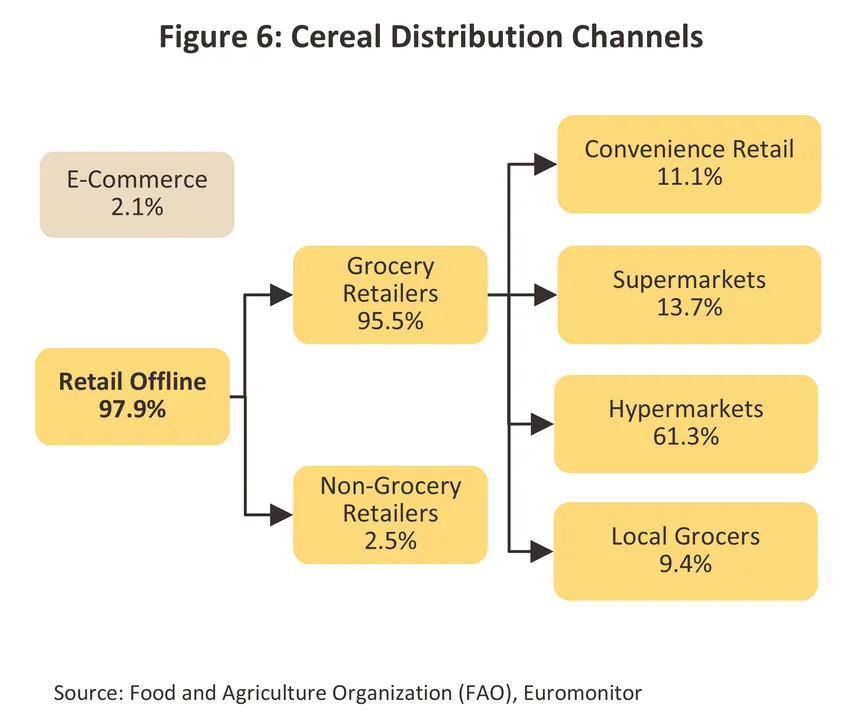

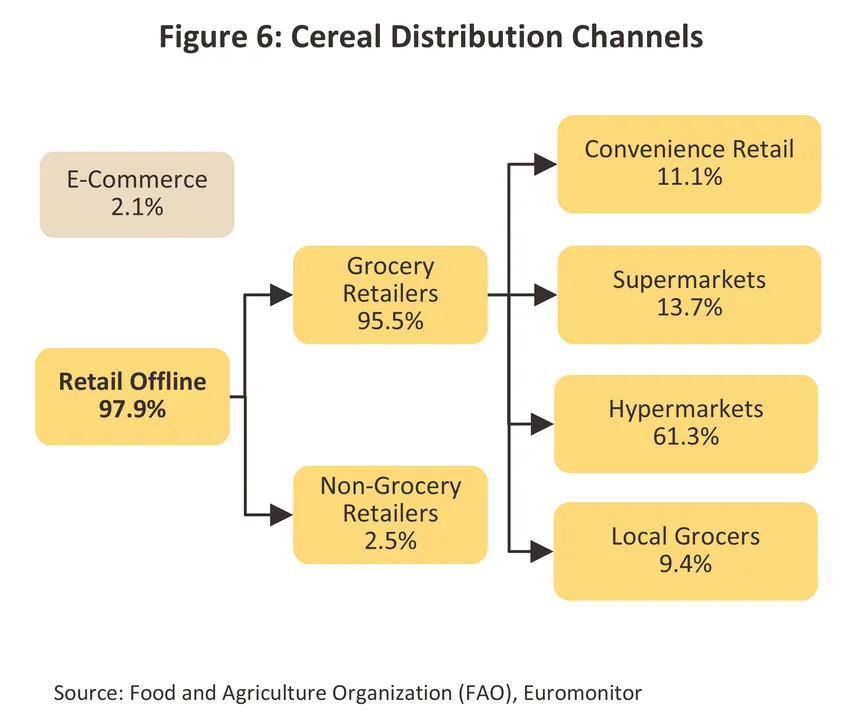

Domestic sales volume stood at 6.5 thousand tons, accounting for 6.8% of RTE cereal sales volume. Manufacturers continue to develop new products to compete with other RTE food categories, focusing particularly on health-conscious consumers. Recent innovations highlight smaller and more portable product formats, catering to on-the-go consumption as snacks or single-meal options. Currently, modern trade outlets remain the primary distribution channel, representing over 75.0% of total domestic RTE cereal sales, followed by convenience stores (11.1%) and local grocery stores (9.4%) (Figure 6).

-

Export volume stood at 89.4 thousand tons, accounting for 93.2% of total RTE cereal sales volume, with an export value of USD 288.0 million, representing 78.4% of total sales value. Exports were primarily supported by strong demand in major markets such as Australia and the United States, where the health-conscious consumer segment continues to expand, driving demand for nutritious, low-fat RTE foods. This trend has been particularly evident in affordable health-oriented products, which remain competitive compared with other health food categories amid persistently high living costs and broader economic pressures.

-

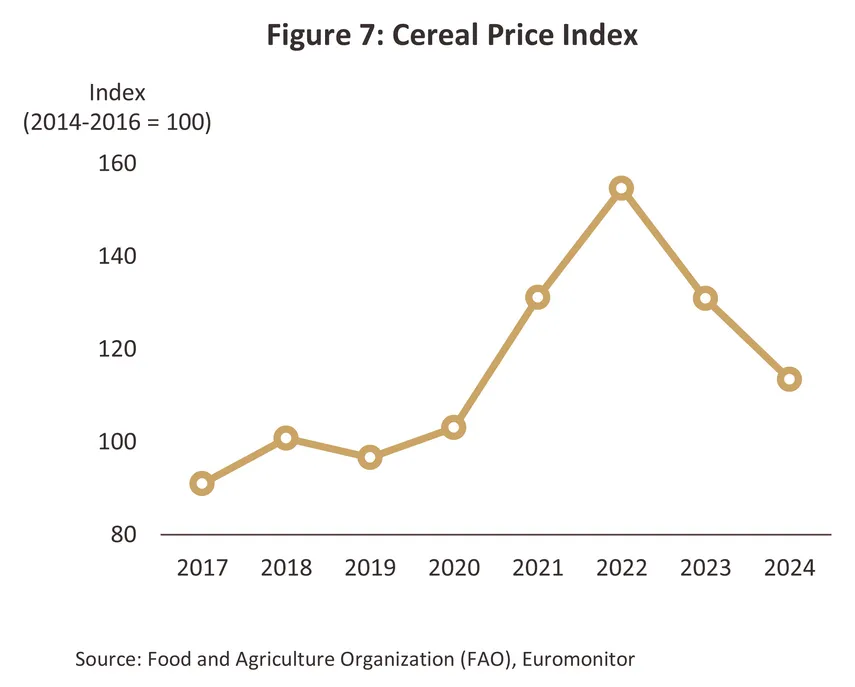

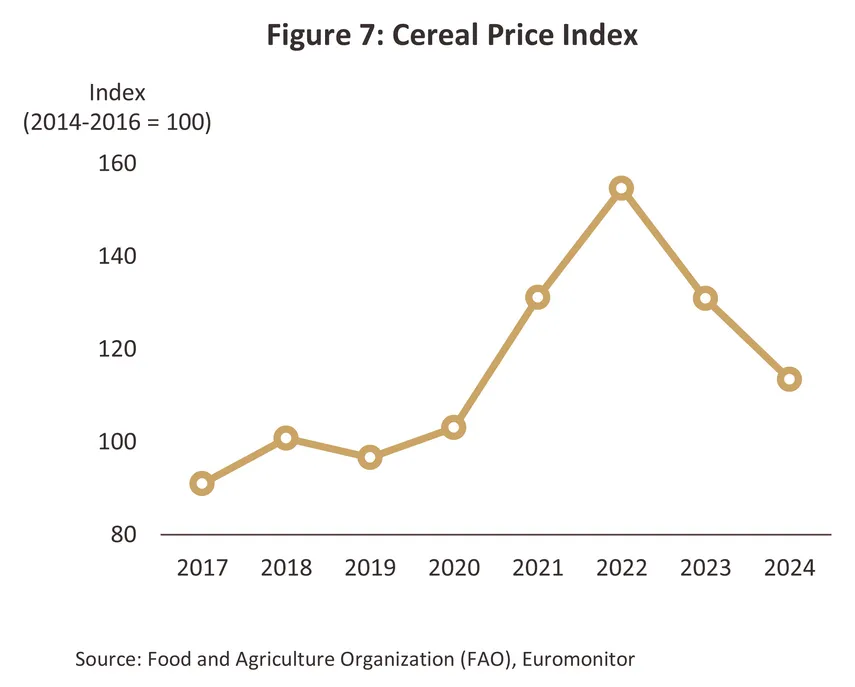

Production costs have fluctuated in tandem with the prices of key grain ingredients—wheat, barley, and corn—which are largely imported. Major sources of Thailand’s grain imports include Myanmar, Ukraine, Australia, the United States, and Bulgaria, jointly accounting for over 80.8% of total import volume. In 2024, global grain prices declined at an average CAGR of –14.3% from their 2022 peak, which had been driven by supply disruptions linked to COVID-19 and the Russia–Ukraine conflict (Figure 7). Consequently, production costs for RTE cereals eased in line with lower raw material prices. Nevertheless, grain prices in 2024 remained elevated compared with levels observed during 2017–2020.

Chilled and Frozen Ready Meals

-

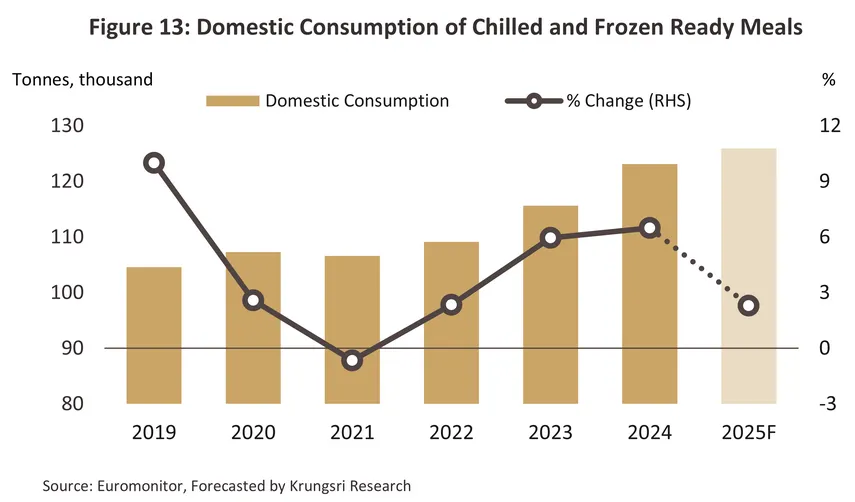

The domestic chilled and frozen ready meals market was valued at USD 834.7 million, representing 77.8% of total ready meal sales value. Major manufacturers and distributors include Charoen Pokphand Group (EzyGo, 7-Fresh, EzyChoice, CP, and Jade Dragon brand), Surapon Foods PCL. (Surapon brand), Unilever Thailand Group (Knorr brand), S&P Syndicate PCL. (Quick Meal brand), and Thai Agri Foods PCL. (Little Chef brand). Collectively, these players account for over 81.8% of Thailand’s chilled and frozen ready meals market value. Overall consumption volume grew at a CAGR of 6.3% during 2019–2024, driven by urban expansion and the increasingly fast-paced lifestyles of city consumers. In 2024, amid signs of economic recovery, demand for convenient ready meals strengthened further. Market growth was also supported by the nationwide presence of convenience stores and a diverse product range, offering a wide variety of cuisines—including Thai, Chinese, Japanese, and Italian dishes.

-

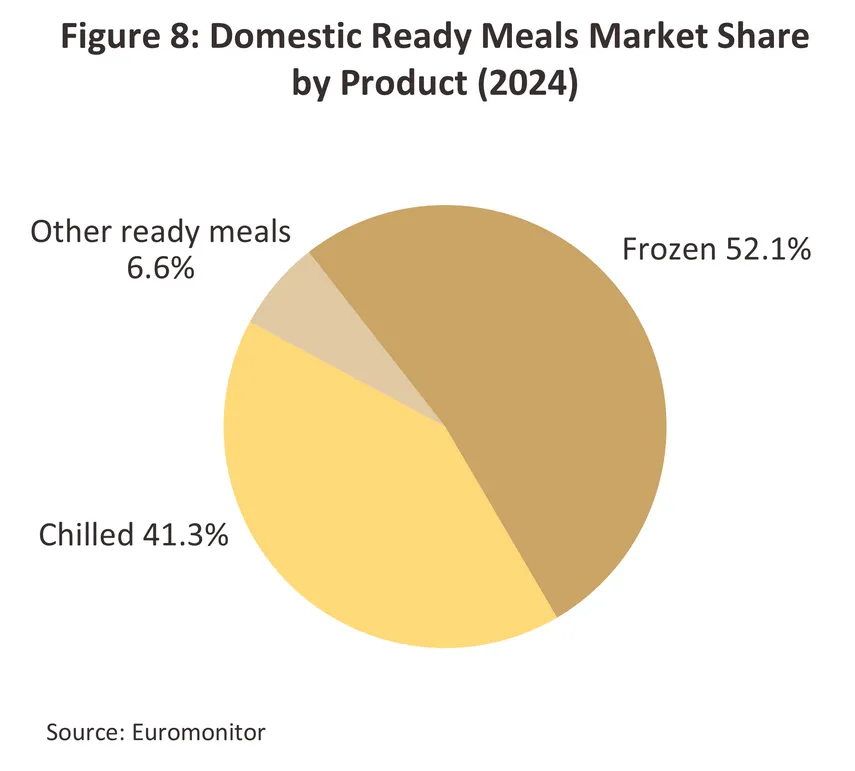

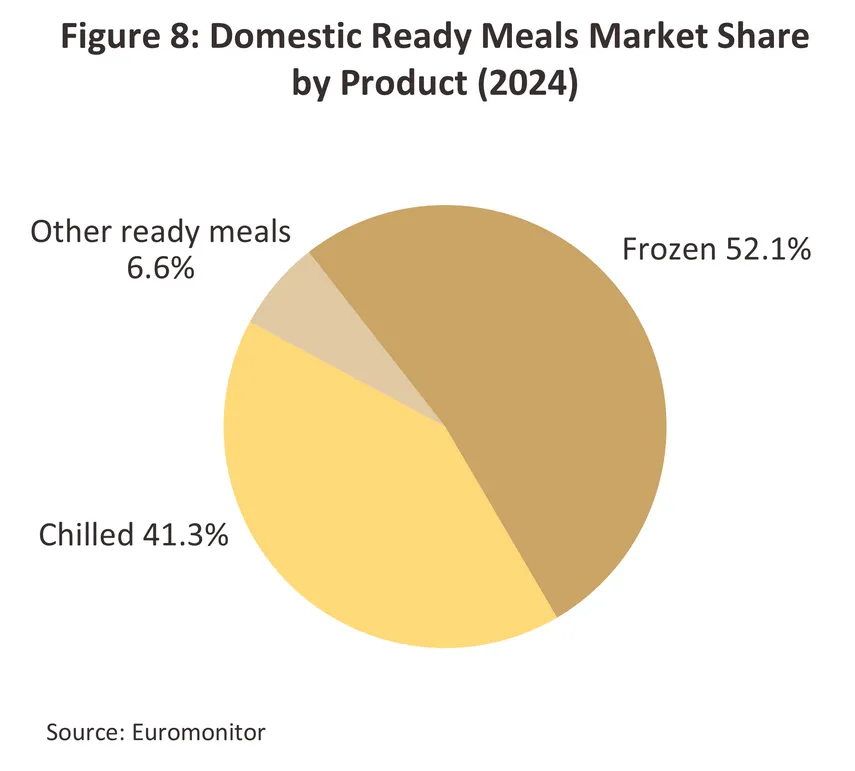

Domestic sales volume stood at 123.1 thousand tons, accounting for 67.1% of total chilled and frozen ready meal sales volume. Most market leaders leverage proprietary distribution channels, enhancing direct consumer access and benefiting from economies of scale, which allow them to offer products at prices comparable to regular meals in the market. In addition, regular promotional campaigns further stimulate consumer demand. Combined, chilled and frozen ready meals accounted for over 93.4% of total ready meal sales volume (Figure 8).

-

Export volume stood at 60.5 thousand tons, accounting for 32.9% of total chilled and frozen ready meal sales volume, with an export value of USD 237.5 million, representing 22.2% of total sales value. Exports were primarily directed to major markets such as the United States and Australia, where demand for chilled and frozen ready meals is growing rapidly, driven by younger consumers’ increasing preference for convenience-oriented meals.

-

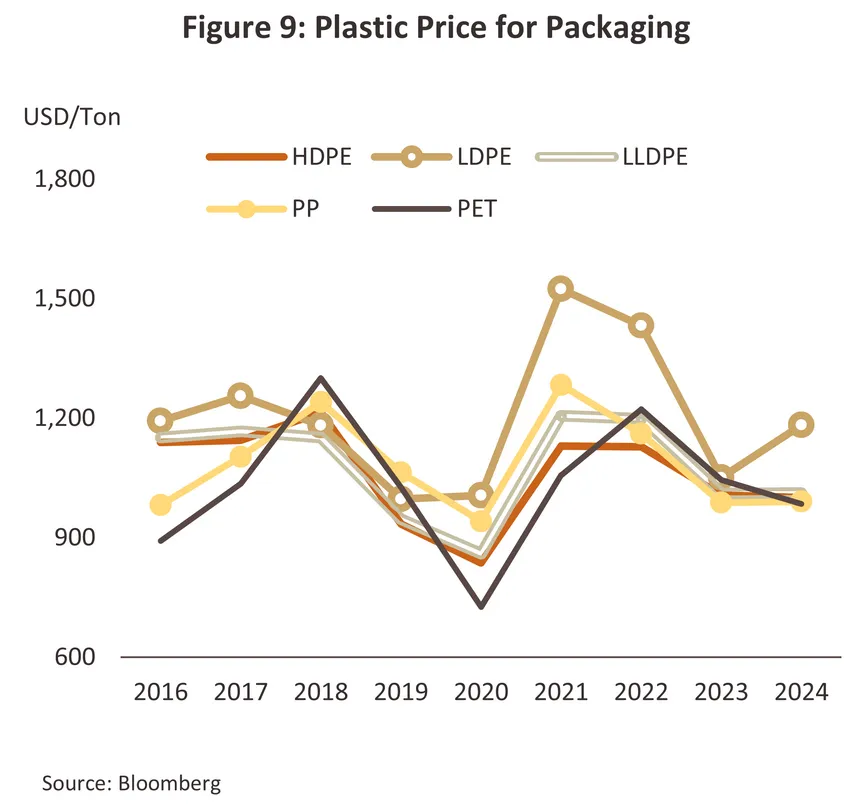

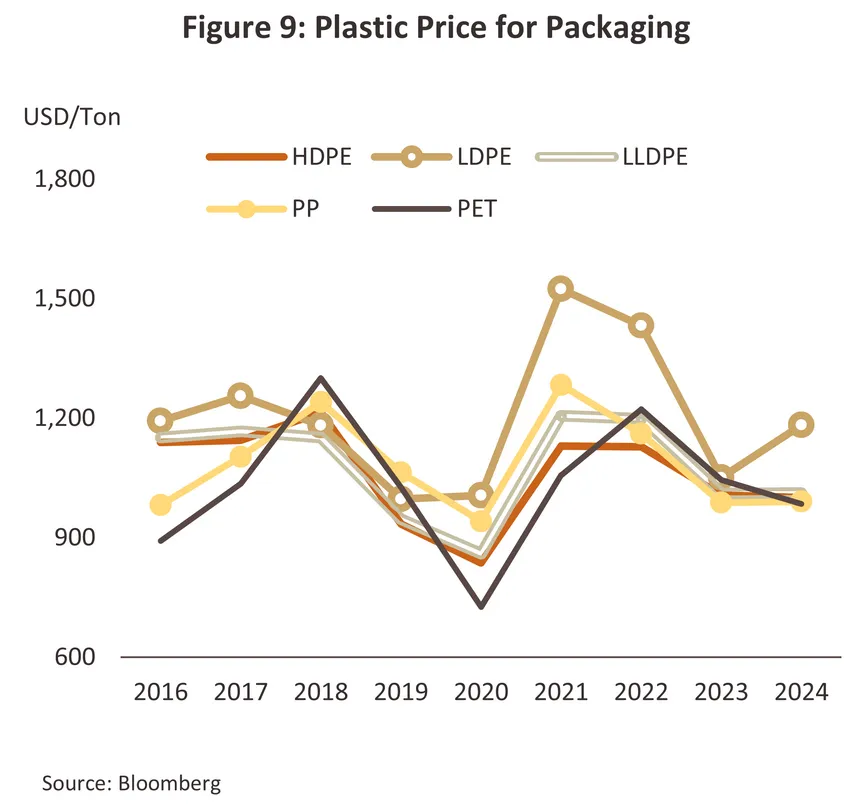

Production costs are largely driven by the use of diverse domestically sourced agricultural raw materials, while the remainder comprises seasonings and other locally available ingredients. Manufacturers can adjust their product offerings in line with the seasonal availability of agricultural produce, enabling most producers to manage supply chains and input costs effectively throughout the year. However, since plastic remains the dominant packaging material, the industry remains exposed to fluctuations in oil prices (Figure 9).

Ready-to-eat Soups

-

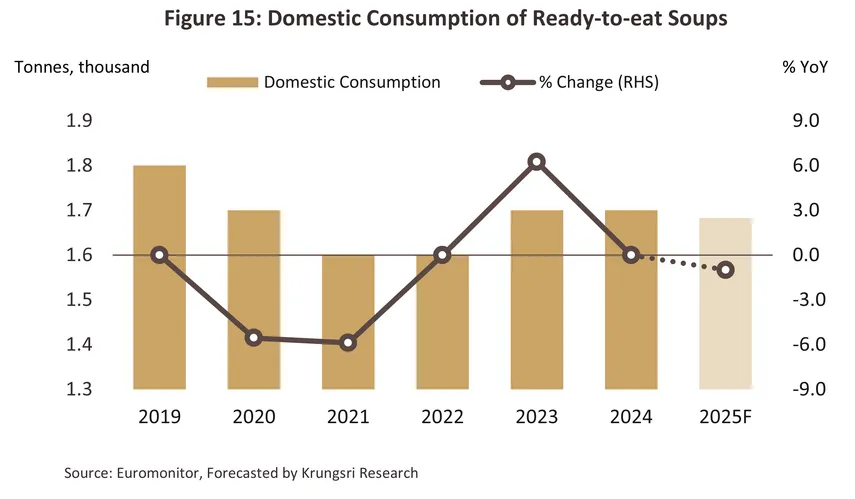

The domestic dry and shelf-stable soup market was valued at USD 11.4 million, representing 60.1% of total market value. Major manufacturers and distributors include Sino-Pacific Trading (Thailand) Co., Ltd. (Campbell’s brand), Jims Group Co., Ltd. (Lady Anna brand), and River Kwai International Food Industry Co., Ltd. (River Kwai brand). Collectively, these players account for over 53.4% of Thailand’s total dry and shelf-stable soup market value. Overall consumption contracted at a compound annual growth rate (CAGR) of –2.0% during 2019–2024, as domestic consumers shifted toward fresh, health-oriented soups made with natural ingredients and lighter, broth-based varieties, reflecting the broader health-conscious consumption trend. By comparison, most ready-to-eat soups remain cream-based, appealing to a narrow segment of consumers who prioritize convenience over dietary preferences.

-

Domestic sales volume stood at 1.7 thousand tons, accounting for 48.0% of total dry and shelf-stable soup sales volume. Domestic demand remains confined to specific consumer segments, as these products are positioned in the premium category with relatively high prices, leading to a relatively narrow consumer base in the domestic market.

-

Export volume stood at 1.8 thousand tons, accounting for 52.0% of total dry and shelf-stable soup sales volume, with an export value of USD 7.6 million, representing 39.9% of total market value. Exports continued to record a downward trend, pressured by both shifting health-conscious consumer preferences and subdued purchasing power. In major markets such as South Korea, public health campaigns promoting lower sodium intake have curbed demand, while in Myanmar, ongoing political unrest has weakened consumers’ purchasing capacity for higher-priced products.

-

Production costs have been on an upward trend, driven primarily by 1) higher costs of ingredients used in soup bases, non-dairy creamers, and other seasonings, in line with rising raw material prices, and 2) increased packaging expenses amid rising fuel prices.

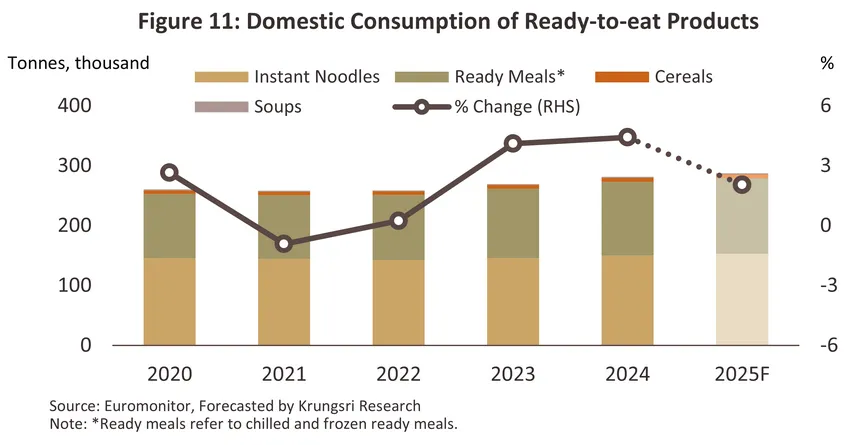

Situation

The domestic market for ready-to-eat food products

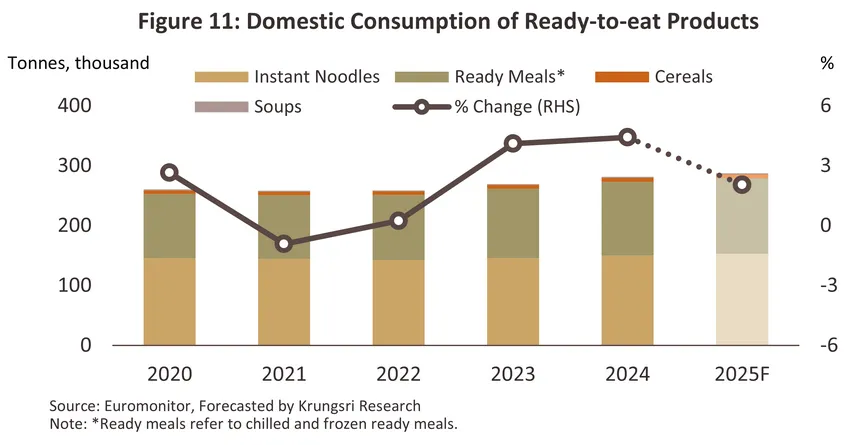

In 2024, domestic sales of RTE food products expanded by 4.4% in volume and 4.6% in value, driven by fast-paced lifestyles that encourage consumers to seek convenient and time-saving meal options. RTE foods—widely available through convenience stores and competitively priced against freshly cooked meals—continued to capture this growing demand segment. Additional momentum was supported by the gradual recovery of the tourism sector and heightened marketing competition among producers aiming to attract modern consumers. Key strategies included the development of health-oriented products made with quality ingredients and modern packaging, expansion of sales channels via social media, and promotional campaigns through discounts and giveaways. Looking ahead to 2025, domestic RTE food sales are projected to grow at a slower pace of 1.5%–2.5%, amid a domestic economic slowdown driven by U.S. retaliatory tariff measures, a decline in tourist arrivals, and ongoing political uncertainty. Nevertheless, sustained demand for affordable, accessible, and convenient food options aligned with modern consumer lifestyles will continue to support moderate sales growth.

-

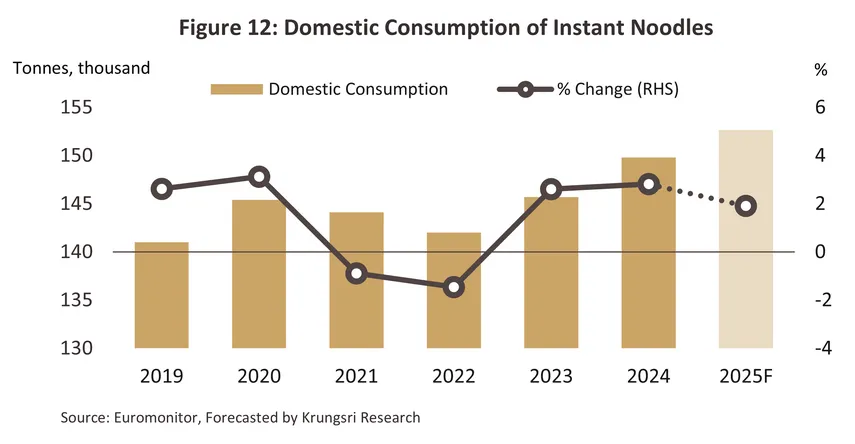

Instant noodles: In 2024, sales volume grew by 2.8%, while sales value increased by 1.6%, supported by 1) effective marketing strategies that more efficiently reached target consumer groups, the launch of new flavors that better matched consumer preferences, and the use of younger brand ambassadors to modernize brand image and attract younger consumers; and 2) the recovery of domestic economic activity driven by rising tourist arrivals compared with the previous year. In 2025, instant noodle sales volume is expected to continue expanding by 1.4%–2.4%, despite domestic economic challenges, political instability, and tensions along the Thai–Cambodian border. These factors are likely to encourage middle- to lower-income consumers, whose purchasing power remains weak, to spend more cautiously and turn to affordable semi-prepared foods. However, growth in the premium product segment may slow compared with the same period last year, as consumers become more cautious in their spending.

-

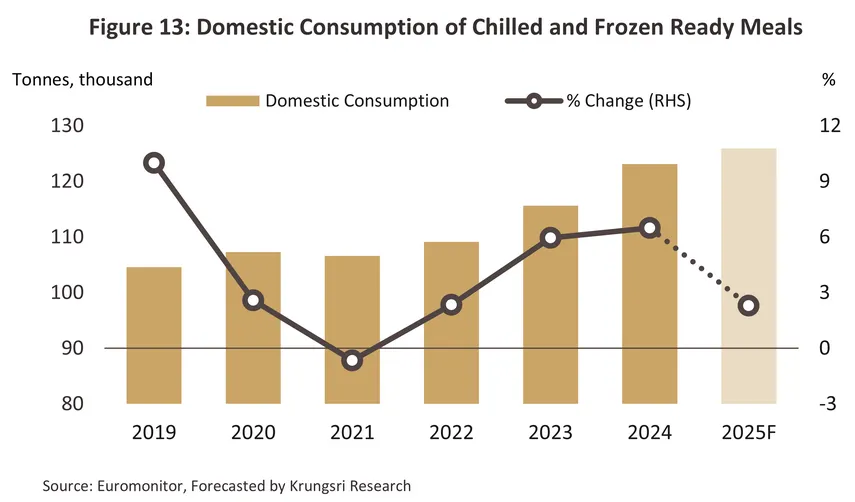

Chilled and frozen ready meals: In 2024, sales volume expanded by 6.5%, while sales value rose by 7.0%, driven by: 1) the gradual recovery of the tourism sector, which stimulated overall spending and consumption; 2) consumers’ return to fast-paced lifestyles, boosting demand for convenient, time-saving meal options; and 3) the introduction of new product designs that cater to health-conscious preferences and offer greater flavor diversity. Looking ahead to 2025, sales volume is projected to expand at a slower pace of 1.8%–2.8%, amid weakened purchasing power, declining consumer confidence, and heightened economic uncertainty. The market also faces intensifying competition from restaurants and freshly prepared food providers entering the segment. Nevertheless, chilled and frozen ready meals are expected to maintain growth momentum, supported by their value-for-money proposition and time-saving convenience—key advantages particularly appealing to urban working consumers and middle-income households.

-

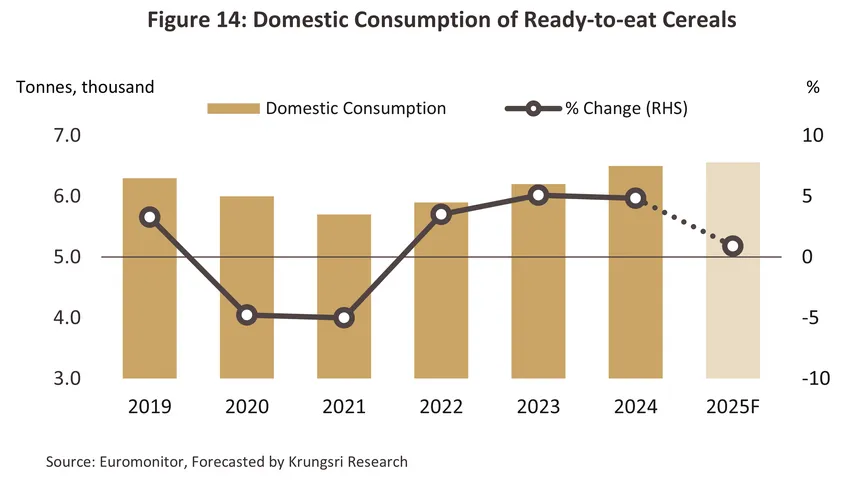

Ready-to-eat cereals: In 2024, sales volume expanded by 4.8%, while sales value rose by 4.3%, driven by: 1) a strengthening health-conscious consumption trend, prompting consumers to seek nutritious, long-shelf-life breakfast options; and 2) a shift toward convenience-oriented and time-saving consumption patterns. Looking ahead to 2025, sales volume of ready-to-eat cereals is projected to grow at a slower pace of 0.4%–1.4%, amid weakening economic conditions and softer purchasing power, as consumers increasingly prioritize filling and cost-effective meal options. The segment also continues to face intensifying competition from alternative breakfast choices—including rice boxes, ready-made meals, bread and sandwiches, and high-protein or energy beverages—which are often perceived as offering greater value for money.

-

Ready-to-eat soups: In 2024, sales volume remained stable, while market value edged up by 0.9%. The market remains confined to a relatively narrow consumer segment, as RTE soups are priced higher than restaurant or home-cooked alternatives. Consequently, volume growth stagnated, while value increased slightly in line with higher raw material and packaging costs. Looking ahead to 2025, sales volume is projected to contract by 0.5%–1.5%, as heightened economic uncertainty prompts consumers to tighten discretionary spending. In addition, a growing share of health-conscious consumers is shifting toward freshly prepared soups, further weighing on overall demand.

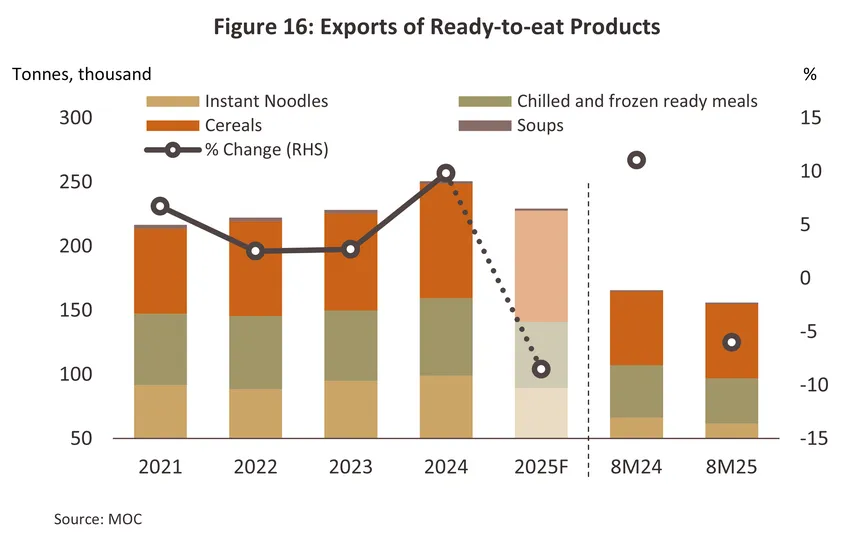

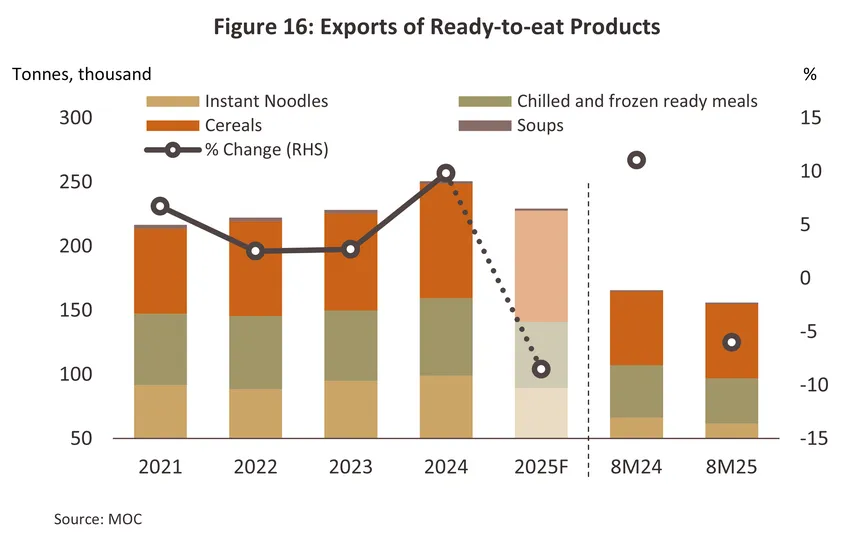

Exports of ready-to-eat food

In 2024, exports of RTE food products expanded by 9.8% in volume and 10.7% in value, driven by: 1) increasingly fast-paced lifestyles that boosted demand for convenient, time-saving meal solutions across major trading partners; 2) rising food security concerns amid ongoing geopolitical tensions, prompting countries to increase imports of Thai RTE products; and 3) Thailand’s strong export competitiveness, supported by price advantages, abundant agricultural resources, and diversified product innovation. During the first eight months of 2025, exports contracted by 6.0% in volume and 5.8% in value. Over the full year, exports are projected to decline by 8.0%–9.0% in volume and 8.7%–9.7% in value, driven by downward pressures from: 1) U.S. retaliatory tariff measures, which have weakened Thailand’s price competitiveness and dampened consumer purchasing power in the U.S. market—Thailand’s largest export destination (Figure 2); and 2) escalating tensions along the Thai–Cambodian border, which have disrupted cross-border trade and fueled anti-Thai product sentiment in Cambodia, directly impacting instant noodle exports, for which Cambodia remains a key market. Exports of ready-to-eat food products by category are as follows:

-

Instant noodles: In 2024, export volume expanded by 4.1%, while export value rose by 4.3%, underpinned by strong growth in key markets such as Cambodia (+3.9%), the Netherlands (+3.9%), the United States (+11.0%), and the United Kingdom (+82.5%). This growth was supported by an emerging trend among consumers and foodservice operators to creatively adapt instant noodles into various dishes as a cost-saving alternative12/ . During the first eight months of 2025, instant noodle exports recorded a contraction of 7.0% in volume and 2.9% in value. For the full year, exports are projected to decline by 9.0%–10.0% in volume and 6.6%–7.6% in value, pressured by: 1) U.S. tariff measures, which have raised import costs and weakened consumer purchasing power amid a slowing U.S. economy. The United States remains Thailand’s fifth-largest export market, accounting for 9.2% of export volume in 2024; and 2) rising tensions along the Thai–Cambodian border, leading to temporary checkpoint closures and anti-Thai product sentiment, which have directly affected exports to Cambodia—Thailand’s largest market, representing 15.7% of export volume.

-

Chilled and frozen ready meals: In 2024, export volume expanded by 10.4%, while export value rose by 10.3%, underpinned by solid growth across most major markets. Notably, exports to the United States—Thailand’s largest export destination—surged by 38.0%, driven by heightened demand for convenient and affordable meal solutions amid the gradual recovery of economic activity. Shipments to the Laos and Australia also recorded robust growth, rising 20.6% and 8.9%, respectively. During the first eight months of 2025, exports of chilled and frozen ready meals contracted by 13.7% in volume and 15.6% in value. For the full year, exports are projected to decline by 14.5%–15.5% in volume and 16.7%–17.7% in value, primarily driven by the direct impact of U.S. reciprocal tariff measures, which are expected to erode consumer purchasing power as imported Thai product prices rise. Similarly, other major export markets are likely to experience softening demand, reflecting broader economic slowdowns and weaker household purchasing power.

-

Ready-to-eat cereals: In 2024, export volume expanded by 17.8%, while export value rose by 19.6%, underpinned by robust expansion across key export destinations such as the United States (+59.0%) and Australia (+17.5%). This was driven by the global shift toward healthier eating habits, fueling demand for high-fiber, low-sugar, and plant-based cereals made from oats and other grains. Thai export prices remained competitive in global markets, supported by advantages in raw material availability—notably rice, sugar, and palm oil—although premium or specialty variants such as organic or gluten-free cereals continued to face higher production costs due to their dependence on imported inputs. During the first eight months of 2025, exports edged up by 0.7% in volume but declined by 1.0% in value. For the full year, exports are expected to contract by 2.5%–3.5% in volume and 5.1%–6.1% in value, as shipments to the United States—Thailand’s largest cereal export destination, accounting for 27.0% of total export volume in 2024—are likely to decline in the second half of the year following a front-loaded surge in exports ahead of the U.S. retaliatory tariff measures that took effect on 7 August 2025. At the same time, Thailand faces heightened competition from other major exporters, including India, Canada, Mexico, and South Korea, as the country remains a relatively minor supplier to the U.S. market, holding only a 6.1% share of total U.S. cereal import volume in 2024.

-

Ready-to-eat soups: In 2024, export volume contracted by 29.1%, while export value declined by 7.1%, pressured by sharp downturns in key markets such as South Korea (–79.3%) and the Philippines (–84.9%), which together accounted for 7.9% of Thailand’s total ready-to-eat soup exports. The decline was largely driven by health-driven campaigns advocating reduced sodium consumption, particularly targeting ready-to-eat and processed soup categories. During the first eight months of 2025, exports fell by 8.5% in volume but rose by 13.9% in value. For the full year, export volume is projected to decline by 10.0%–11.0%, reflecting softening purchasing power across key trading partners amid heightened global economic uncertainty. In parallel, consumers are increasingly shifting toward low-sodium and freshly prepared meal options, reinforcing the broader health-conscious consumption trend. Nevertheless, export value is expected to expand by 5.0–6.0%, supported by rising input costs and a strategic pivot among producers toward premium-grade soup products aimed at higher-end markets. These premium variants increasingly highlight organic, high-protein, and high-fiber ingredients, catering to health-conscious and elderly consumers, while demand in the mid- to lower-tier market segments continue to soften in line with global economic conditions

Outlook

During 2026–2028, the domestic ready-to-eat food market is forecast to expand by an average of 2.3–3.3% per year, comprising: 1) instant noodles, projected to grow by 2.0–3.0% annually; 2) chilled and frozen ready meals, by 2.8–3.8%; 3) ready-to-eat cereals, by 0.9–1.9%; and 4) ready-to-eat soups, expected to remain broadly stable within –0.6% to 0.6% per year. Growth will be supported by: 1) increasingly fast-paced urban lifestyles, which drive demand for convenient and long-shelf-life meal options; 2) greater adoption of data analytics and digital technologies, enabling producers to better understand consumer preferences, develop targeted niche products, and enhance marketing and distribution efficiency; 3) the continued expansion of convenience stores, improving product accessibility nationwide; and 4) innovation through partnerships with retail chains and renowned chefs, helping to differentiate offerings and elevate brand perception among modern consumers. However, downside risks remain, as domestic economic expansion is expected to slow amid political uncertainty, elevated household debt, and rising living costs, all of which will constrain discretionary spending. Moreover, growing health awareness—with consumers increasingly concerned about additives and sodium content in ready-to-eat products—and a slow tourism recovery may limit short-term growth in 2026, before momentum strengthens gradually in 2027–2028

Exports of ready-to-eat foods are forecast to expand by an average of 2.9–3.9% per year during 2026–2028, comprising: 1) instant noodles, projected to grow by 2.6–3.6% annually; 2) chilled and frozen ready meals, by 3.1–4.1%; 3) ready-to-eat cereals, by 3.3–4.3%; while 4) ready-to-eat soups are expected to contract by 4.0–5.0%, due to ongoing public health initiatives promoting lower sodium consumption. In 2026, overall export growth is expected to remain modest, weighed down by several headwinds: 1) a slow global economic recovery, which continues to suppress purchasing power in key trading partners; 2) the impact of U.S. retaliatory tariff measures, Thailand’s key export market, which has raised product prices and intensified competition; and 3) sluggish exports to Cambodia, a major market for Thai instant noodles, amid conflict along Thai-Cambodian border, checkpoint closures, and lingering anti-Thai sentiment. Nevertheless, export momentum is expected to improve in 2027–2028, supported by: 1) a gradual rebound in purchasing power across trading partners; 2) the expansion of export channels across Asia, especially in countries with formal trade agreements (FTAs, RCEP) with Thailand—such as ASEAN, Japan, and China—where logistics costs are relatively low and Thai flavors are highly favored; as well as in Western Europe, Australia, and New Zealand, where young urban consumers increasingly embrace international cuisine, particularly Thai food, which remains affordable and accessible through modern retail outlets. In the U.S. market, Thai producers are expected to focus on the premium segment, catering to consumers with strong purchasing power. According to Mordor Intelligence, the global Thai cuisine market is projected to grow at a CAGR of 8.39% during 2025–2030. ; 3) fast-paced lifestyles that sustain global demand for convenient meal solutions; and 4) Thailand’s enduring strength as the “Kitchen of the World,” supported by diverse agricultural resources and high product development capacity.

Challenges

-

The U.S. reciprocal tariff measures have directly affected Thailand’s exports of RTE food products, as they have increased the prices of Thai goods in the U.S.—a key export market—thereby weakening Thailand’s price competitiveness. This impact is evident when compared both to similar products manufactured domestically within the U.S. and to competing products from countries that are either exempt from the tariffs, subject to lower tariff rates, or have free trade agreements with the U.S. As a result, Thai exporters’ price competitiveness is expected to decline. Meanwhile, the ability to adopt price-cutting strategies to maintain market share is limited because 1) domestic production costs remain elevated due to rising labor costs and higher prices of raw materials and packaging, and 2) Thailand’s market share in the U.S. remains relatively small, giving American consumers greater bargaining power and the ability to substitute Thai products with those from alternative sources.

-

The border conflict between Thailand and Cambodia has increased uncertainty for Thailand’s ready-to-eat food exports. Heightened political tensions have weakened consumer confidence in purchasing Thai products, while stricter border control measures have raised transportation costs. In addition, growing anti-Thai sentiment has prompted Cambodian consumers to shift toward importing goods from competing countries instead.

-

Increasingly volatile weather conditions have led to 1) more frequent droughts and heatwaves both domestically and abroad, resulting in uncertainty in grain output, and 2) rising sea temperatures, which have contributed to a decline in fish catch volumes. These factors may affect raw material costs and pose risks to the stability of production supply chains.

-

Policies promoting sodium intake reduction—both in Thailand and globally—align with the World Health Organization (WHO) guidelines, which encourage food manufacturers to reduce sodium content in processed foods to lower health risks. The recommended daily sodium intake is 2,000 milligrams, equivalent to no more than 5 grams of salt per day; however, Thai consumers currently consume an average of 10.8 grams per day13/. Moreover, the Thai government is expected to implement a “salt tax” or sodium tax in the future to further support this initiative14/.

-

The global health-conscious trend, which emphasizes the consumption of more nutritious foods, has led consumers to choose products that offer balanced nutritional value and carry certified quality labels. This, in turn, increases costs for manufacturers as they must invest in upgrading their products to meet higher quality and certification standards.

-

Growing attention to environmental and sustainability factors15/ has influenced global trade policies. For example, the European Union has implemented measures to promote packaging recycling, setting a target to recycle at least 75% of all packaging by 2030. As a result, products sold in the EU market are increasingly labeled as recyclable to attract environmentally conscious consumers and to comply with EU regulations16/.

-

Prolonged geopolitical conflicts in several regions may lead to periodic disruptions in global production and transportation supply chains, affecting costs related to raw materials, packaging, and logistics.

1/Sterilization is a heat treatment process conducted at temperatures above 100 degrees Celsius, in which all microorganisms in the food are destroyed. This allows the product to have a long shelf life and be stored at room temperature. (Source: technosoft.eu)

2/Pasteurization is a heat treatment process conducted at temperatures below 100 degrees Celsius, in which only part of the microorganisms in the food are destroyed. As a result, the product has a shorter shelf life compared to sterilized foods and must be stored at low temperatures. (Source: technosoft.eu)

3/Ready-to-eat foods and shelf-stable ready-to-eat soups.

4/Retort pouch is a flexible packaging material with heat-resistant, light- and moisture-proof, and impermeable properties. It allows consumers to conveniently reheat the food either in a microwave or by boiling in hot water. (Source: Office of Industrial Economics)

5/The packaging material commonly used by manufacturers is Crystallized Polyethylene Terephthalate (CPET), a product developed from PET that can withstand temperatures ranging from –40 to 220 degrees Celsius and offers a low-cost solution. (Source: Office of Industrial Economics)

6/HS Code: 19023040

7/HS Code: 1904

8/HS Code: 190220,19023020, 19023030, 19023090, 190240

9/HS Code: 21042019, 21042099

10/The ready-to-eat food industry in this context is classified based on producer categories as follows: 1) manufacture of frozen prepared foods 2) manufacture of ready-to-eat foods packaged in hermetically sealed containers using vacuum methods 3) manufacture of soups, broths, and specialty foods, and (4) manufacture of instant and semi-instant flour-based food products (Source: DBD)

11/According to the GBO (Global Brand Owner) classification, or companies that own brands at the global level.

12/Source: Department of International Trade Promotion (DITP)

13/Source: worldpopulationreview

14/Source: National Health Foundation, Excise Department

15/Source: Department of International Trade Promotion (DITP)

16/Source: Department of European Affairs, Ministry of Foreign Affairs

.webp.aspx)