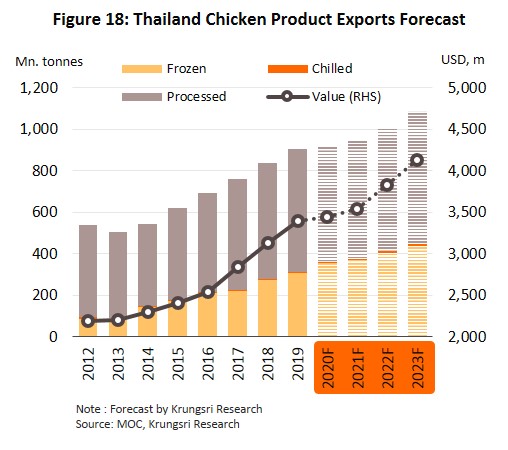

Krungsri Research expects output of chilled, frozen and processed chicken products to increase by an annual average rate of 3-5% during 2021-2023 supported by a gradual recovery in consumer purchasing power. Chicken is low in fat and is attractively priced relative to other meats, which will help to lift domestic sales. Exports will be boosted by strong consumer demand in overseas markets, including China and Japan. Thai chicken exports will also benefit from international confidence in Thailand’s high production standards and the free-trade agreements with several trade partners, which would help to sustain competitive advantages for Thai products in world markets. Nevertheless, operators could face rising cost of inputs (principally chicken meat) which is being affected by the price of animal feed and stiffer competition from other chicken-exporting nations. This may weigh on industry profits but that should remain healthy.

Overview

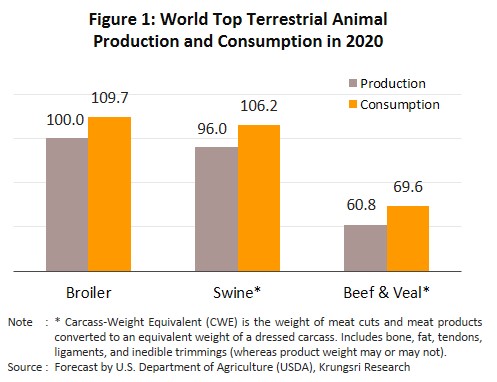

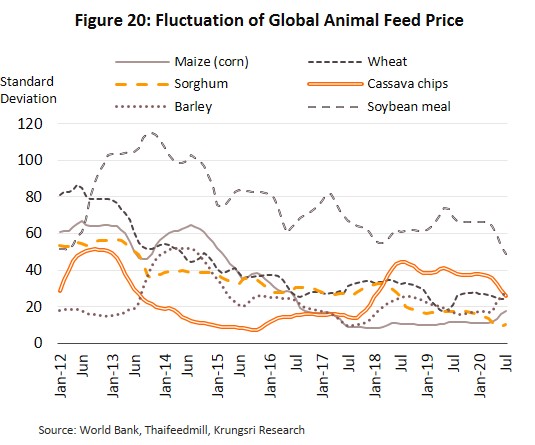

Chicken has the advantage of having the richest protein content than any commercially-farmed land animal[1] (pork and beef are in 2nd and 3rd place, respectively) and has low fat content. And because they mature quickly, chicken flocks return profits over a short time-span. As a commercial undertaking, raising chickens also benefits from the animal’s high conversion rate[2] and relative resistance to disease. The result is that chicken is farmed and consumed in greater quantities than any other animal (Figure 1); per capita global consumption[3] averages 14.8 kilograms/person/year, compared to 11.1 kilograms for pork and 6.4 kilograms for beef (2019 data). The bulk of the consumable output of the chicken industry is in the form of (i) chilled chicken products, (ii) frozen chicken products, and (iii) chicken that is cooked or flavored and then frozen. Each of these product group involves a different process.

- Chilled chicken: Chilled chicken products include whole chicken, filleted chicken meat and offal, and other parts of the carcass, which are preserved at 0-5 degrees Celsius.

- Frozen chicken: Frozen chicken products include whole chicken, filleted chicken meat and offal, and diced and minced chicken meat, which is then stored at below 0 degrees Celsius.

- Processed chicken: These are downstream products from which manufacturers are able to generate added value. Processed chicken products can be split into two main classes: (i) uncooked processed chicken, which needs to be cooked before consumption, and (ii) semi- or fully-cooked chicken products, such as grilled chicken legs, smoked chicken wings, chicken satay, chicken burgers, chicken nuggets, chicken steaks, chicken karaage, chicken meatballs, battered and fried chicken, and marinated chicken.

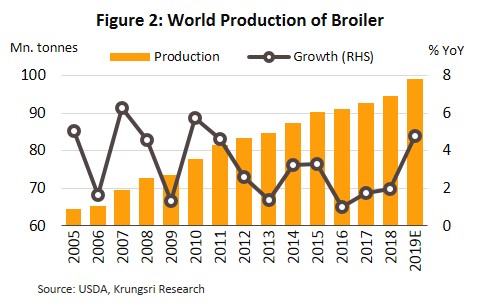

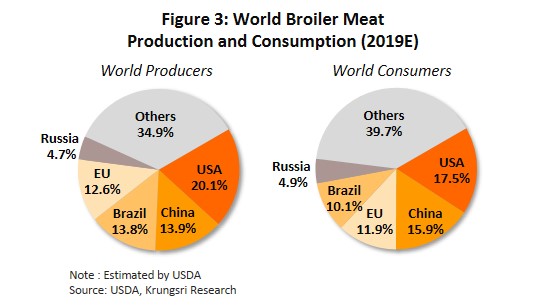

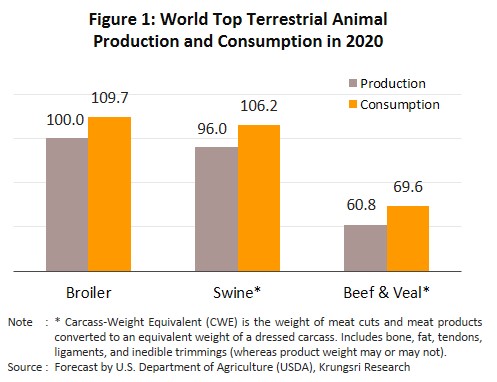

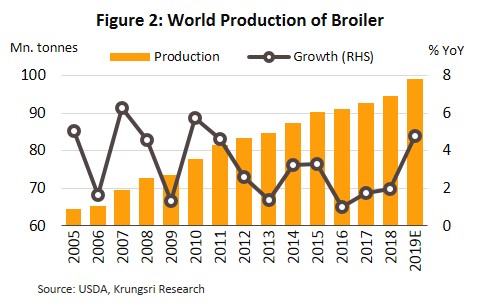

Global chicken meat output rose 4.8% YoY in 2019 to 99.0 million tonnes (Figure 2). The Americas is the world’s primary source of chicken, accounting for 43.8% of global production, followed by Asia (39.6% of output), Europe (12.6%), Africa (2.7%) and Oceania (1.3%). By country, the USA is in first place, producing 19.9 million tonnes of chicken per year (20.1% of global output), followed by China with 13.8 million tonnes (13.9%), Brazil 13.7 million tonnes (13.8%) and the European Union 12.5 million tonnes (12.6%) (Figure 3). Thailand’s annual production of chicken meat comes in at 3.3 million tonnes which is 3.3% of world output, and places the country in 8th position globally.

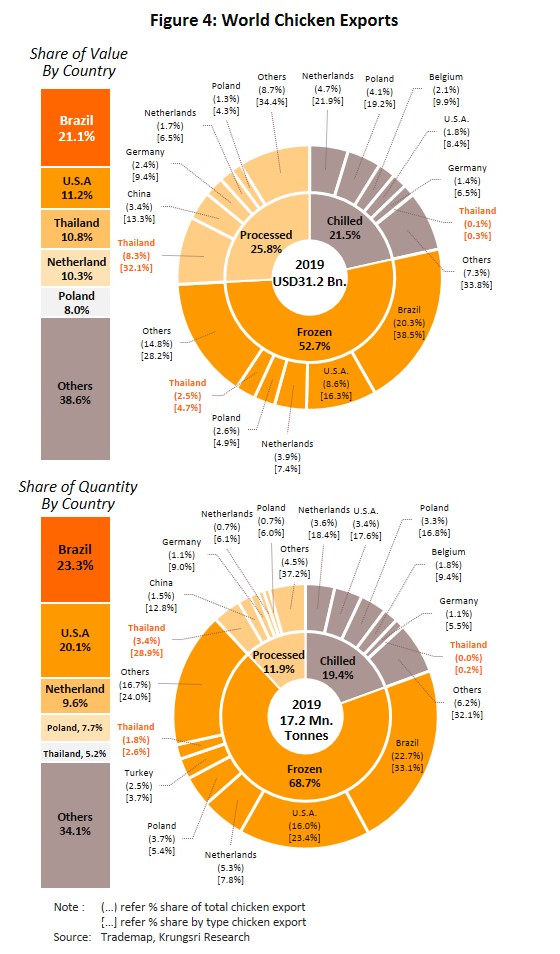

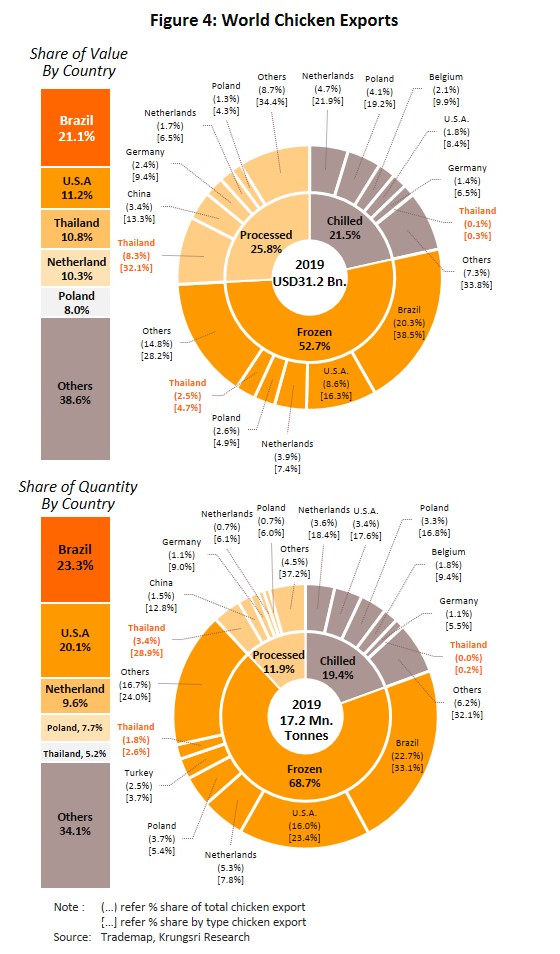

Over 90% of global chicken production is sold in domestic markets, the largest being the United States which consumes 16.7 million tonnes of chicken annually or 17.2% of global consumption. This is followed by China which consumes 13.9 million tonnes (14.3% of global output), the European Union, at 11.6 million tonnes (12.0%) and Brazil at 9.9 million tonnes (10.2%). This leaves 17.2 million tonnes of chicken products that is sold on the world market and generates annual receipts of USD31.2 bn. With 23.3% share of this market, Brazil is the world’s biggest exporter of chicken products, followed by the US, the Netherlands, Poland and Thailand (Figure 4). Details of exports of different product groups are given below:

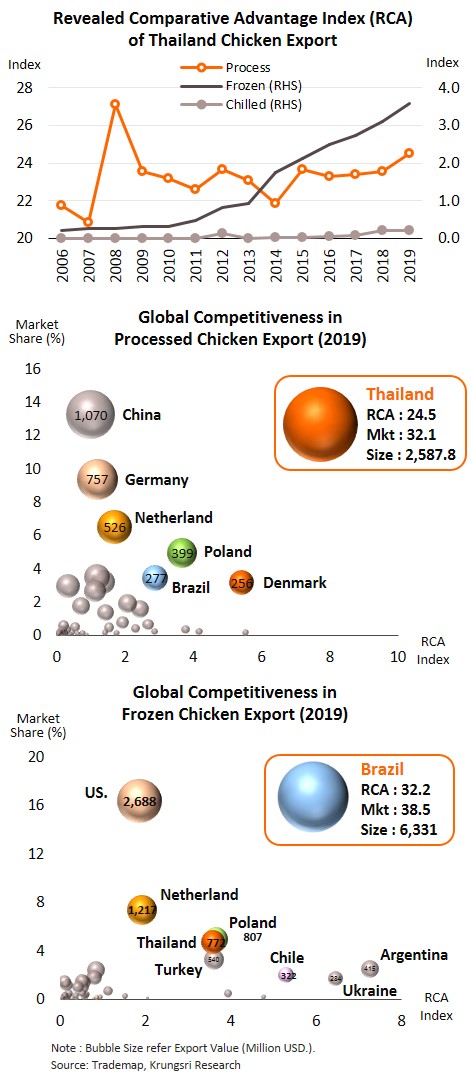

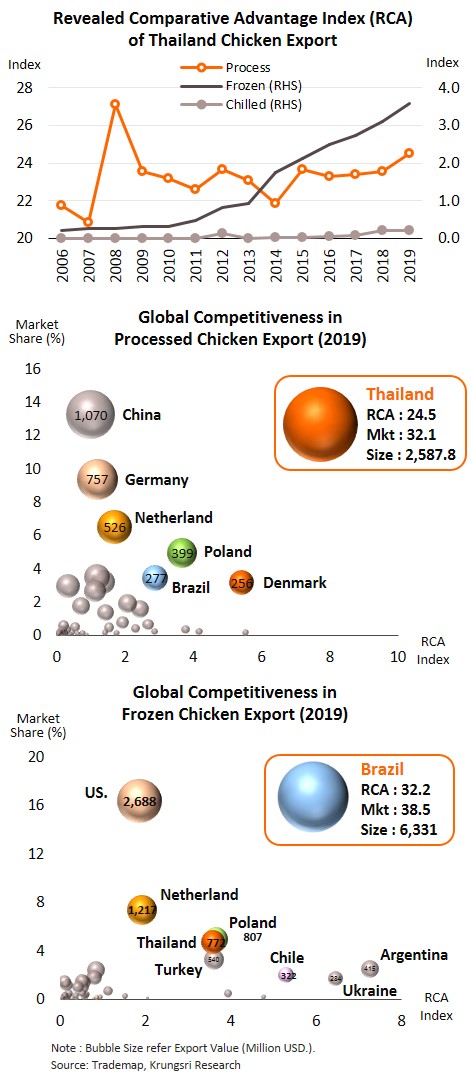

- Frozen chicken: By volume and value, this accounts for 68.7% and 52.7% of global chicken exports, respectively. By value, 83.2% of all exports is filleted chicken products, and the rest is whole chickens. The world’s 3 biggest exporters of frozen chicken products are Brazil, the US and the Netherlands which collectively have more than 60% market share, while Thailand has a 2.6% slice of the market, putting it in 6th place in the global rankings.

- Processed chicken: By volume, only 11.9% of global exports is processed chicken, but this jumps to 25.8% by value. Thailand is the world’s biggest exporter of processed chicken, enjoying 28.9% market share by volume, followed by China (12.8%), Germany (9.0%) and the Netherlands (6.1%).

- Chilled chicken: By value and volume, these account for 21.5% and 19.4% of global exports of chicken products. By volume, 85.0% of all exports is filleted products, and the rest is whole chicken. With an 18.4% market share (by volume), the Netherlands is the world’s biggest exporter, followed by the US (17.6%) and Poland (16.8%). Thailand’s presence in this market is small, the country being in 30th place in the world rankings with just 0.2% market share.

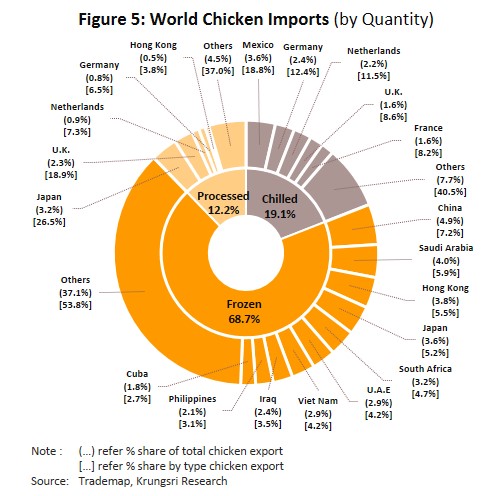

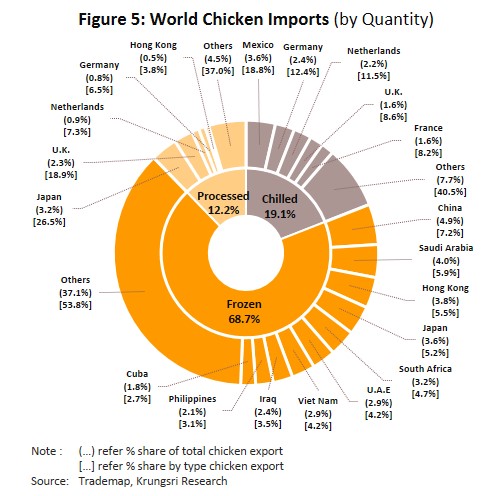

However, the leading importers of chicken products are diverse (Figure 5).

- Frozen chicken: This accounts for almost 70% of global demand for chicken, and the most important markets are China (7.2% of total imports of frozen chicken worldwide), Saudi Arabia (5.9%), Hong Kong (5.5%) and Japan (5.2%).

- Chilled chicken: Importers generally buy from within their own region. Within Europe, the biggest importers are Germany (12.4% of global imports of chilled chicken), the Netherlands (11.5%), the United Kingdom (8.6%) and France (8.2%). In North America, Mexico absorbs 18.8% of global exports and Canada another 3.2%, with these products largely originating in the US.

- Processed chicken: The world’s biggest importers are Japan (26.5% of all imports of processed chicken), the United Kingdom (18.9%), the Netherlands (7.3%), Germany (6.5%) and Hong Kong (3.8%).

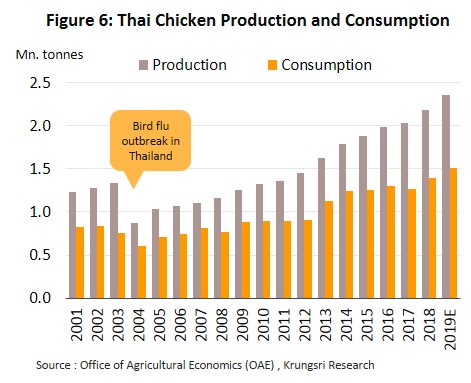

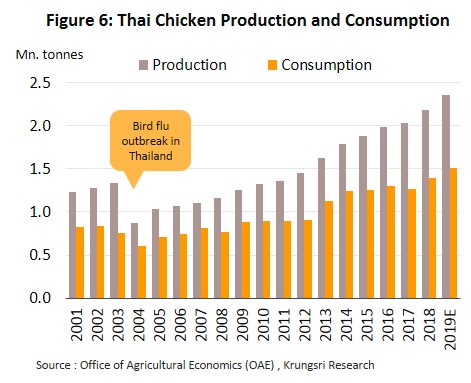

Thai chicken production reached 2.36 million tonnes in 2019[4], making Thailand the world’s 8th biggest producer and giving the country a 3.3% share of global production. The domestic market bought 1.51 million tonnes (or 62%) of national output (Figure 6), with most being consumed as fresh filleted products. The remainder was consumed by the chilled and frozen chicken industry as input for further processing, mostly for export. By value, Thailand is the world’s biggest exporter of chilled chicken and it the 5th biggest exporter of frozen chicken (source: Trademap 2019).

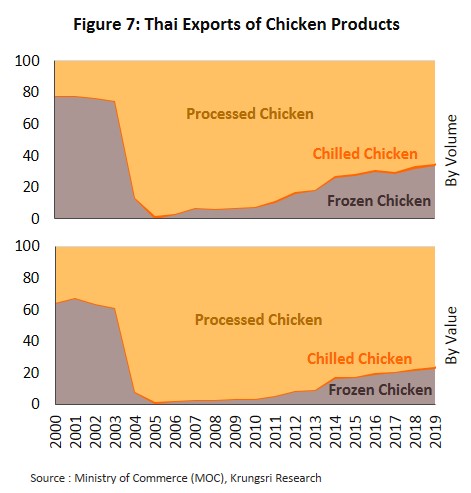

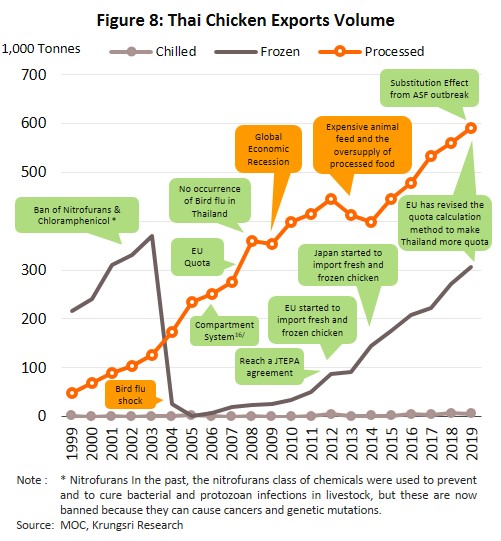

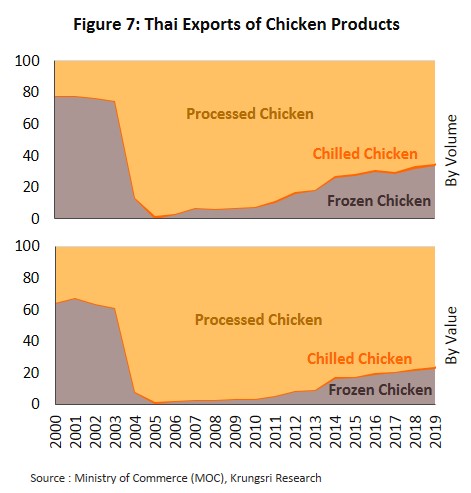

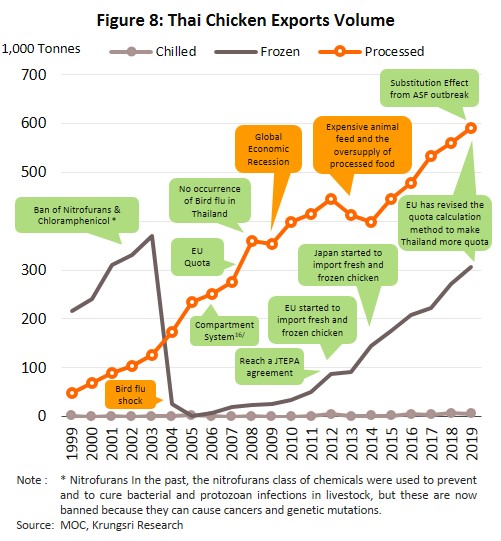

The industry has undergone significant changes since 2004, when Thailand was affected by a severe bird flu outbreak[5]. Concerns over possible infection and thus, the safety of raw chicken originating in Thailand, prompted authorities in some countries to restrict the import of Thai frozen chicken. This had a significant effect on the industry because in the period 2000-2003, frozen chicken represented an average of 76% of all exports (by weight) of chicken from Thailand. In response to this, Thai producers overhauled their operations and placed greater emphasis on the production and output of processed chicken, which was still accepted in Thailand’s export markets[6]. This then led to the establishment of processed chicken as the sector’s primary product (Figure 7), such that at present, processed chicken account for 86.8% of all Thai exports and Thailand has 28.9% share of the global market for processed chicken products.

The situation for export of frozen chicken returned to a more positive state after 2010 and the abating of the bird flu outbreak. In addition, the development of evaporative air-cooling systems (EVAPs)[7] for use on Thai chicken farms also helped to cut infection rates, in particular in flocks managed by the major players and on contract farms[8]. The introduction of the World Organisation for Animal Health compartment system[9] was another important factor that helped to support the industry, as was the signing of the JTEPA agreement. As such, there was a surge in the exports of frozen chicken from Thailand to the EU (from 2012) and Japan (from 2014) (Figure 8).

Thus, by 2019, Thailand had secured 4.7% share of the global market, returning the country to 5th place in the world rankings in the exports of frozen chicken by value.

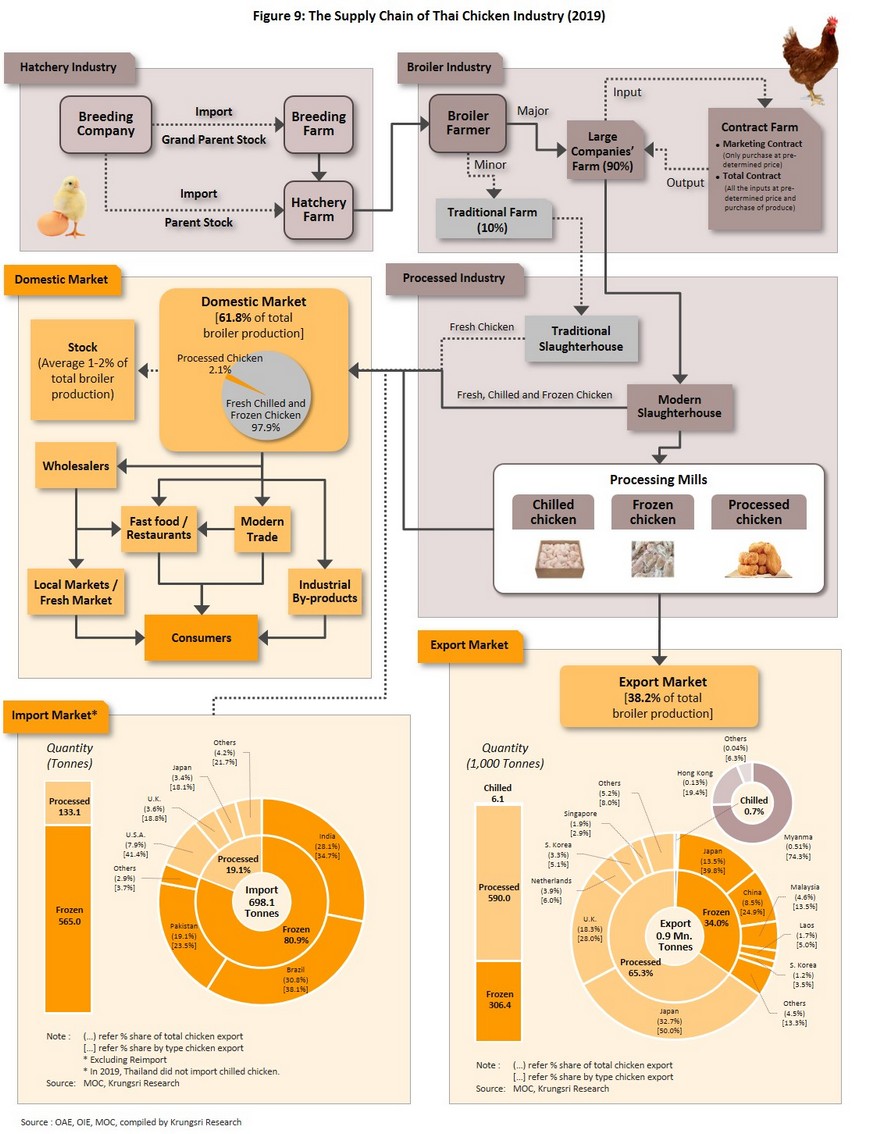

By volume, Thai exports of chicken products comprise 65% processed products, 34% frozen, and 1% chilled (2019 data). The main export markets for this are Japan which imports mostly processed and frozen chicken, and the EU which imports processed chicken (Figure 10). Thailand’s main competitor is Brazil, the world’s biggest exporter of frozen chicken. Details for the exports of individual product categories are given below:

- Processed chicken: This accounts for 65.3% of all exports of chicken products from Thailand. The main markets for these goods are Japan (50% of all exports of processed chicken), the United Kingdom (28%), the Netherlands (6.0%) and South Korea (5.1%).

- Frozen chicken: 34.0% of chicken exports are frozen goods, and these go to Japan (almost 40% of all exports of frozen chicken products), China (24.9%), Malaysia (13.5%) and Laos PDR (5.0%).

- Chilled chicken: Only 0.7% of exports are chilled chicken products, and the main markets are all bordering or near Thailand. Thus, Myanmar takes 74.3% of exports of chilled chicken, followed by Hong Kong (19.4%), Cambodia (3.3%) and Laos PDR (1.7%).

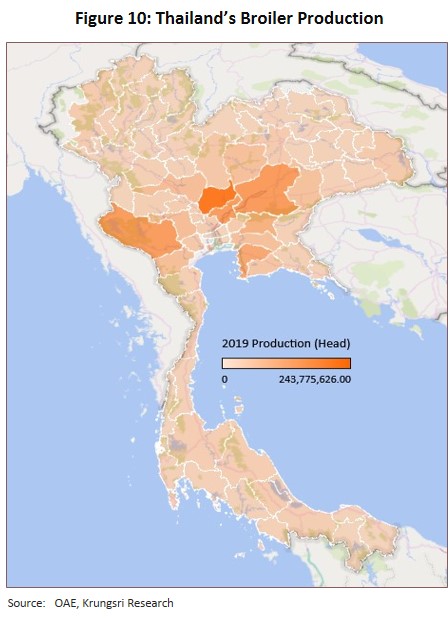

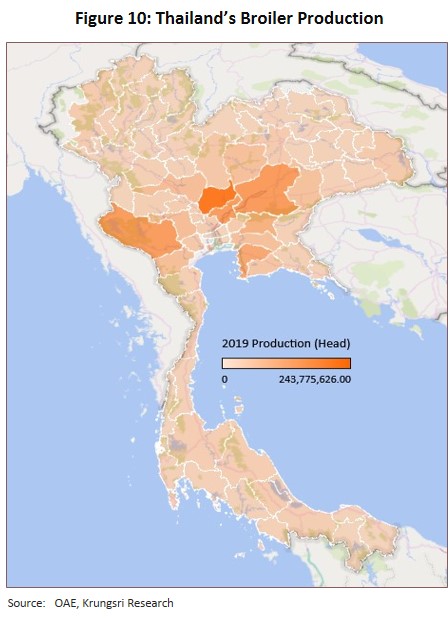

The large players in the industry typically invest in operations through the length of the supply chain, from upstream production of animal feed, through to raising chicken (both via their own, directly-managed operations and independent farmers that operate under contract farming arrangements) to slaughterhouses and downstream food processing plants that operate according to recognized standards. This then gives these producers advantages with regard to their more efficient cost control, and they also benefit from greater economies of scale. As such, large operations are the source of about 90% of all chicken produced in Thailand, while the remaining 10% is produced by small operations and almost entirely sent for processing and sale in the domestic market (Figure 10). In terms of the geographical distribution of flocks, these are overwhelmingly found in the central region (the source of 66.4% of all chicken produced in Thailand)[10], followed by the northeast (19.4%), the north (9.4%) and the south (4.8%). By individual province, Lopburi is the most productive (15.6% of all national chicken output), followed by Nakhon Ratchasima (9.5%), Kanchanaburi (9.2%) and Saraburi (9.2%) (Figure 9).

Overall, Thai operations are able to draw strength from their advantages in the skill of the workforce, their access to manufacturing technology, the use of modern production techniques, their ability to develop products that effectively meet market demand, the high standards of their farms, and success in controlling and preventing disease outbreaks. Beyond this, the fact that Thailand has signed FTAs[11] with many of its trade partners has also helped to strengthen the competitiveness of Thai operations and widened the spread of markets for Thai chicken products.

Situation

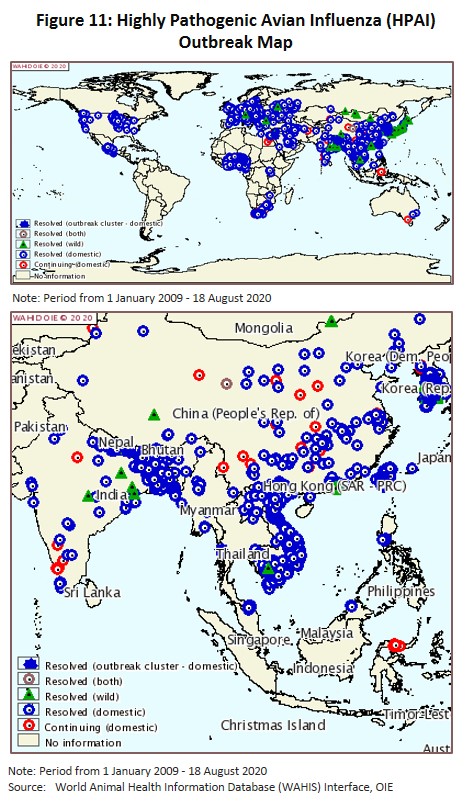

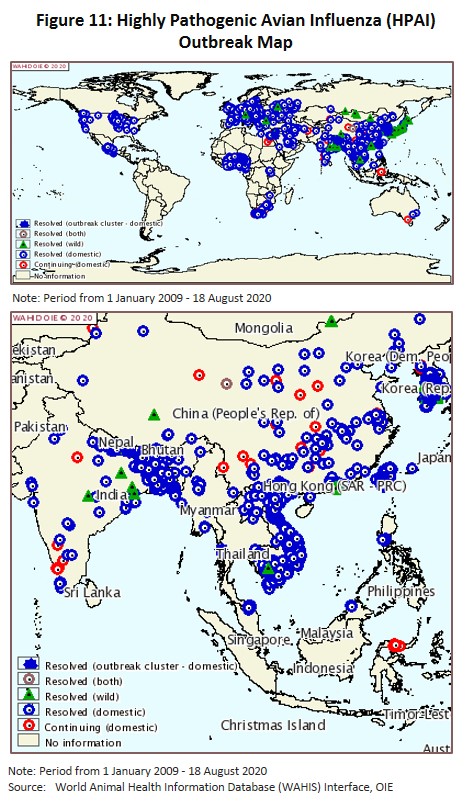

Since 2004, the frozen and processed chicken industry has suffered from intermittent outbreaks of bird flu worldwide and this has caused periodic losses to the global industry (Figure 11, upper). However, Thailand has been free of outbreaks since 2007 (Figure 11, lower) and this has presented

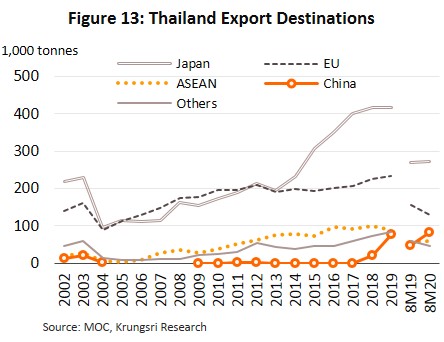

an opportunity for Thai exporters to rapidly expand their markets and to meet steadily growing demand for chicken products, the latter rising due to higher consumption by Thai households and stronger demand from business consumers, especially from fast-food retailers and export markets. In fact, exports of frozen chicken products have grown significantly since 2013, thanks to (i) the relaxation of restrictions put in place by trade partners on the imports of frozen chicken from Thailand, and (ii) the bird flu outbreak in chicken flocks in other exporting nations, including the US, China and South Korea, which had diverted orders to Thailand. As a result of this, between 2014 and 2017, exports of Thai frozen chicken rose at an average annual rate of 15.4%, while during the same period, exports of processed chicken grew at the lower but still very healthy annual rate of 10.1%. Thailand’s most important export markets for these products are now Japan and the ASEAN zone, although sales to the EU have not strengthened substantially since import quotas for all types of chicken products from Thailand are limited to 0.25 million tonnes annually[12] (compared with a yearly quota of 0.50 million tonnes for Brazilian imports).

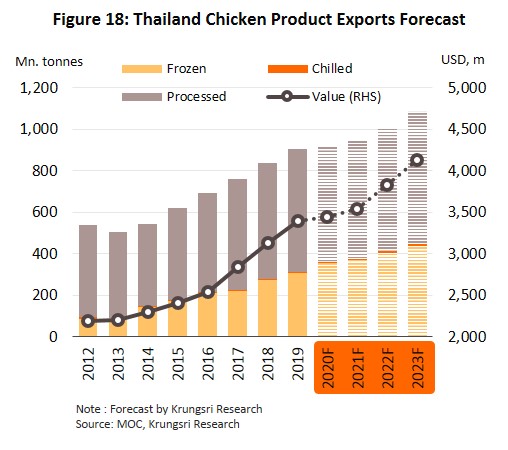

Business conditions continued to improve for Thai producers in 2019 and in the year, domestic consumption of chicken rose by 7.7% to 1.51 million tonnes (64% of all chicken produced in the country). This jump in sales can be partly attributed to relatively lower price for chicken compared to other meats such as pork and beef, and an increase in demand for low-fat foods, including chicken and fish. Growth in the tourism and restaurant sectors also helped to boost consumption. Exports of chicken products also performed exceptionally well in 2019, and the combined overseas sales of chilled fresh, frozen and processed chicken rose 7.5% by volume to a historic high of 0.9 million tonnes, or by 8.5% by value to a total of USD3.4 bn, comprising 0.31 million tonnes of frozen chicken (up 12.6%) and 0.59 million tonnes of processed chicken (up 5.3%). This success was driven by three major factors. (i) Bird flu continues to be a problem in commercial chicken flocks across Asia (especially China), the Middle East and Africa, and this has helped to boost additional demand for imports from Thailand to replace losses in infected flocks. (ii) China has increased imports of chicken from countries including Thailand as it looks to make up for losses to protein supply caused by severe problems with the spread of African swine fever (ASF)[13], and Chinese officials have thus licensed 16 Thai chicken slaughterhouses and processing plants. In addition, the imposition of retaliatory tariffs between China and the chicken-exporting countries of the US and Brazil (from where China sourced over half of its chicken imports in the period 2012-2016) created an opportunity for Thai exporters to respond to this unmet demand and so penetrate deeper into the Chinese market. As such, in 2019, exports of chicken products from Thailand to China jumped by 259.6% to a record high of 77,000 tonnes and by 252.1% to a value of USD2.2bn. This significantly increased China’s importance as an export market, pushing the country into 3rd place as an importer of Thai chicken14/, behind only Japan and the EU. (iii) The EU increased quotas for chickens and other poultry imported from Thailand[15].

Greater demand from domestic and export markets helped to push up prices. In 2019, within Thailand, the average price of chicken rose 11.6% to THB33.7/kilogram, while export prices rose by an average of 1.9% relative to 2018.

BOX 1: The competitiveness of the Thai chicken industry

An analysis of the 2019 revealed comparative advantage (RCA) index shows that the Thai chicken industry is competitive on world markets since RCA values above 1 indicate a comparative advantage relative to competitors, and in the processed chicken segment, Thailand’s RCA stands at 24.5 (with an average of 23.2 in the period 2014-2018), while in the frozen chicken segment, its RCA is 3.6 (averaging 2.4 in the years 2014-2018). However, for chilled chicken products, this drops to 0.2, which points to Thailand having a comparative disadvantage in this market.

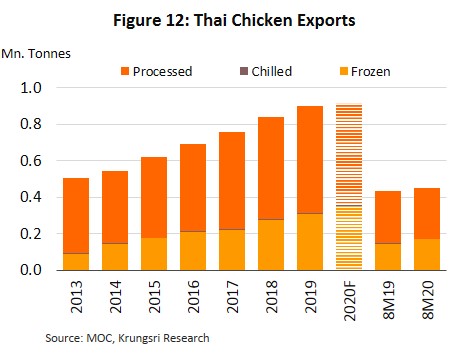

In the first 8 months of 2020, the Covid-19 outbreak worsened conditions for the chicken industry. By volume, exports of chicken shrank 0.1% YoY to 0.59 million tonnes (Figure 12), although by value they rose 0.5% YoY to USD2.2 bn. Exports to Japan (Thailand’s most important market) grew by 1.0% due to the implementation of the JTEPA and AJCEP free-trade agreements[16]. Although exports to China (+75.0%), Singapore (+95.0%) and Hong Kong (+21.1%) strengthened, exports to the EU (Thailand’s second most important market) fell 17.7% as the EU tightened checks on imports following the discovery of salmonella in frozen chicken imported from some countries (Figure 13).

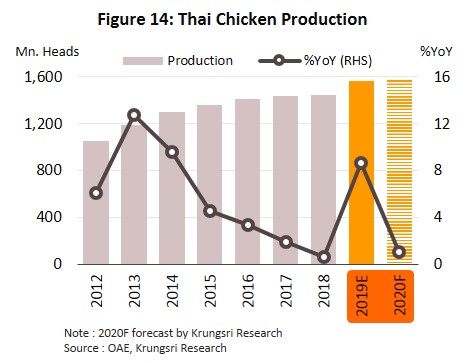

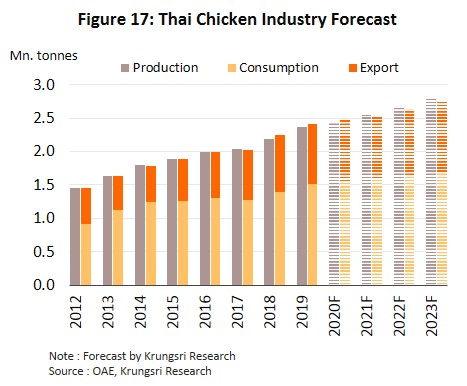

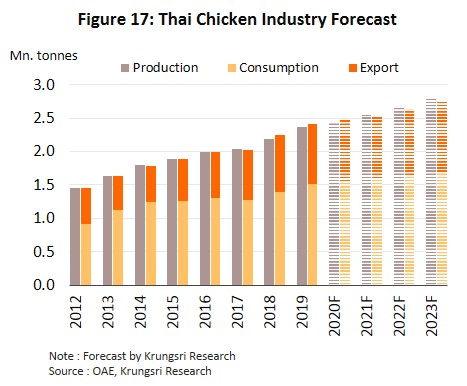

For all of 2020, the output of chilled, frozen and processed chicken is forecast to grow by 3.1%.

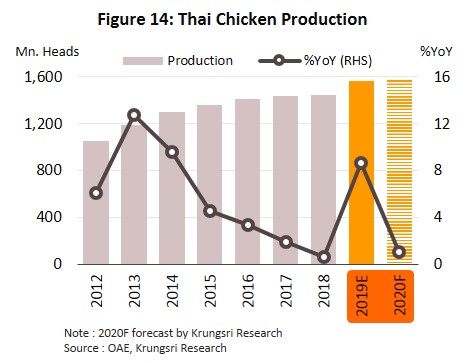

- 2020 domestic output should total 1.58 billion chickens, up 1.1% from 2019 total (Figure 14), which would translate into 2.42 million tonnes of chicken meat[17] (up 2.3%).

- Total domestic consumption of chicken meat is forecast to reach 1.55 million tonnes, rising 2.9% but slower than 7.7% growth in 2019. The weaker growth rate was caused by the national shutdown and slower economic activity in the first half of the year, which cut into consumer spending power and held back sales of chicken in restaurants and fast-food outlets. However, in the second half of the year, the easing of the lockdown, abating of the Covid-19 crisis, and the return to more normal economic conditions, increased consumption of chicken again.

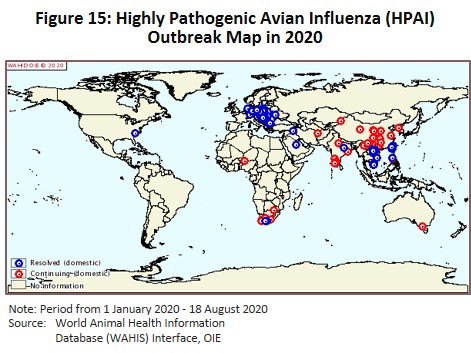

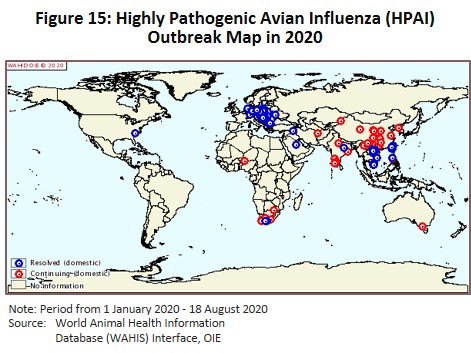

- Exports are forecast to grow by 1.5% this year to 0.92 million tonnes. The Covid-19 pandemic slowed or halted chicken processing in many countries, while bird flu outbreaks were reported in major chicken-producing areas, including the US, the EU and China (Figure 15), which is also among the Asian countries most affected by widespread infection of African Swine Fever. These have encouraged many countries to reduce imports from countries affected by disease[18] and instead turn to Thai producers, who also benefited from operating under recognized international standards. Given this, exports of processed and chilled chicken are expected to fall by 5.7% (to 0.56 million tonnes) and 9.3% (to 5,600 tonnes), respectively, but exports of frozen chicken should rise by 15.5% to 0.35 million tonnes.

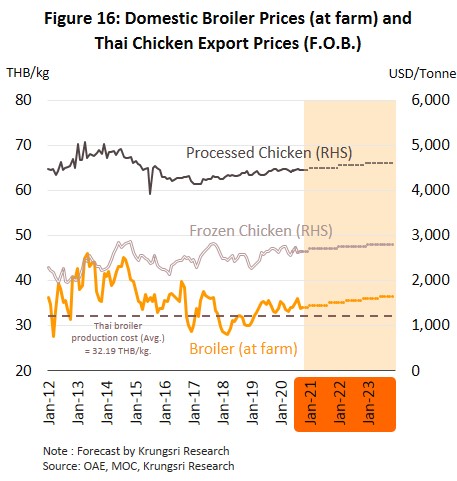

- 2019 farm gate prices for chicken meat should average THB34.0-34.5/kilogram. These are being lifted by stronger demand in the second half of the year and they remain above production costs of THB32.2/kilogram (source: Office of Agricultural Economics) (Figure 16).

Outlook

For the period 2021 to 2023, global chicken production is expected to rise by an average of 4-5% annually. In Thailand, output of chilled, frozen and processed chicken will increase by 3-5% per year. Domestic consumption of chicken will rise in line with annual economic growth, by 2.5-3.5%. Export growth will depend on markets with a strong consumer base such as Japan and China, though this will be supported by international confidence in the high standards of Thai chicken processors. This will translate into forecast average annual growth in exports of 5-7%.

- Annual domestic production should grow by 4.0-5.0% per year to 1.66-1.82 billion chickens, which would then yield 2.54-2.79 million tonnes of chicken meat (Figure 17). Operations will be incentivized to expand their flocks as prices are forecast to rise to THB34.5-36.5/kilogram (Figure 16) on stronger domestic and export demand.

- Through 2021-2023, domestic demand for chicken is forecast to strengthen by 2.0-3.5% per year (Figure 17) as the economy gradually recovers and life returns to the tourism, hotel and restaurant industries.

- Exports are forecast to rise by 5-7% per year (Figure 18), an outlook that is supported by the following factors.

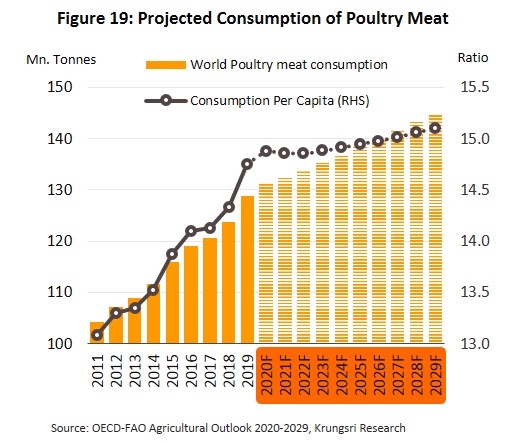

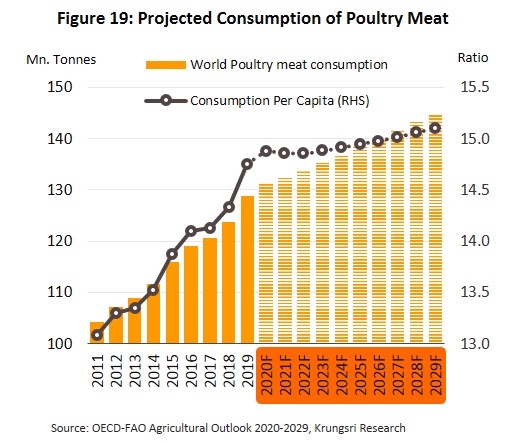

- Over the years 2021-2023, global demand for chicken is projected to rise by an annual average of around 1.0%. Consumption would expand to 135 million tonnes annually from the 131 million tonnes consumed in 2020 (Figure 19). This growth is partly being driven by greater concern for personal health[19] and the ensuing increase in demand for low-fat foods to replace pork and beef.

- The periodic resurgence of bird flu and African Swine Fever will hold back domestic output in some chicken producing and exporting countries (e.g. Brazil, China, the EU and the US) and it will take some time for these to recover. Indeed, in the case of African Swine Fever infection in pig herds in China and Vietnam, the industry will not return to its pre-infection supply level for at least 3 years. At the same time, Thai chicken production and processing is widely recognized as adhering to international standards and Thai produce is free from disease which has afflicted humans (e.g. Covid-19) and animal pathogens (e.g. HPAI and ASF). The result is that demand for imports from Thailand would rise in many countries.

- Free-trade agreements (FTAs) signed between Thailand and its trade partners would benefit Thai producers by helping them to raise their competitiveness. In 2019, exports of Thai livestock products to countries with which it is negotiating FTAs reached USD3.3 bn, or 82% of the value of all exports of livestock products. But exports of fresh and processed chicken meat increased by an average of 15% and 7%, respectively, when they were governed by an FTA. And in the coming period, the Department of Trade Negotiations will engage in discussions about signing FTAs that will include liberalization measures. This would increase trade in meat products with Turkey, Pakistan, Sri Lanka, the UK and the EU. And assuming these negotiations are successful, exports of Thai chicken is likely to rise in the coming period.

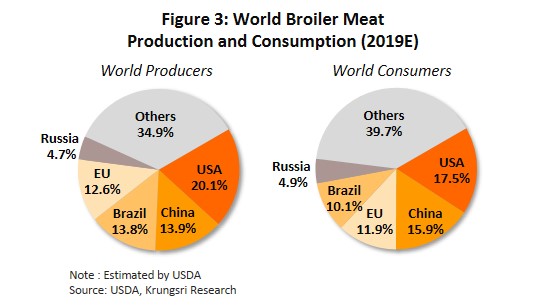

this potentially leading to more expensive chicken. Costs may be driven up by pricier soy and corn (used as animal feed)[20] (Figure 20). Additionally, competition will stiffen in world markets as more countries expand their chicken industries and players in other countries develop products to meet demand in export markets (e.g. from Brazil, China, Ukraine and Vietnam). Some Middle Eastern countries do not accept Thai production methods[21],

and because of this, profitability may be lower but should remain healthy.

Moreover, over the next 5-10 years, Thailand is at risk of losing its current advantages in export markets because within the industry, cost of labor and other factors of production are rising. Costs at Thailand’s biggest competitors, e.g. Brazil, are significantly lower, production is organized into larger units, and production systems are more modern and less labor-intensive. Thailand is also exposed to greater risk through its dependency on imported stock, mostly from Europe and the United States. And if disease affects distribution in these countries, this would limit Thailand’s ability to expand production for a period of time.

Krungsri Research’s view:

Demand for chilled, frozen and processed chicken is forecast to grow in both domestic and export markets. This will provide players with an opportunity to generate new sources of earnings, and would especially benefit chicken farms and producers that are linked to industrial supply chains. Unfortunately, costs could also rise and drag industry profits.

- Frozen and processed chicken producers: Expect income to surge thanks to continued growth in demand in export markets and Thailand’s key strength (high production standards). Given this, profits will remain at satisfactory even if competition worsens.

- Chicken farms: Steadily rising demand for chicken meat could lift revenues of chicken farms, especially large operations that benefit from economies of scale, effective cost control, and well-established markets, or players that are connected to the supply chains of frozen and processed chicken producers. However, small independent operations will face greater challenges due to lower production standards and their restricted access to markets. The primary risks facing chicken farms would be uncertainty and rising operating costs, and these could hurt profitability, especially for smaller operations.

[1] Based on animal protein conversion efficiency (PCE) and energy conversion efficiency (Source: Alexander et al. and information available online from Our World Data).

[2] The feed conversion rate (FCR) refers to the ratio of the animal weight to the weight of its feed. Chicken farming typically produces 1 kilogram of meat per 3.3 kilograms of feed, whereas producing 1 kilogram of pork, sheep and beef requires respectively 6.4, 15 and 25 kilograms of animal feed (source: Alexander et al. and information available online from Our World Data).

[3] Source: OECD-FAO Agricultural Outlook 2020-2029

[4] Source: Office of Agricultural Economics

[5] Bird flu is caused by an avian virus but the severity of the illness depends on the strain. The H5N1 and H7N9 strains are potentially serious variants that can infect humans who are in close contact with infected flocks.

[6] Shows that the bird flu virus cannot survive temperatures above 70 degrees Celsius so cooking chicken by frying, boiling, steaming, baking or grilling will kill the virus and render the meat safe for human consumption (source: Department of Disease Control, Ministry of Public Health).

[7] EVAP systems are used on farms to provide a temperature- and humidity-controlled environment for the raising of commercial livestock. The use of these systems helps to reduce the risk of infection and death from communicable illnesses. They also have the advantage of allowing for higher stocking ratios, raising average animal weight and providing protection against infestation by animals and insects that can act as disease vectors.

[8] Contract farming is an arrangement under which farms are contracted to produce chickens for large agribusinesses. The latter supply the smaller contracting farm with technology and support, and agree to buy a fixed quantity of chickens at a pre-determined price.

[9] The compartment system was developed by the World Organisation for Animal Health (OIE) to help maintain comprehensive hygiene and

biosecurity standards in the food processing industry.

[10] Based on the quantity of chicken meat produced and sold in a year.

[11] Thailand has agreed to 13 free trade agreements with 18 countries, and 9 of these allow for duty-free imports of meat products from Thailand: Australia, Brunei, China, Hong Kong, Indonesia, Malaysia, Myanmar, New Zealand and Singapore.

[12] In 2019, the EU established quotas for the import of Thai chicken products as follows: (i) 160,000 tonnes of processed chicken, with import duties set at 8% and excess-quota imports incurring a fee of EUR1,024]tonne; and (ii) 92,610 tonnes of frozen salted chicken, with import duties set at 15.4% and excess-quota imports incurring a fee of EUR1,300]tonne.

[13] China’s Ministry of Agriculture and Rural Affairs (MARA) confirmed the first ASF outbreak in Liaoning Province on 3 August 2018 (Source: FAO)

[14] The General Administration of Customs of the People’s Republic of China (GACC) announced the registration of 7 Thai poultry slaughterhouses in 2018, of 9 more in 2019 and of a further 8 in 2020.

[15] The EU (Thailand’s second most important export market) announced that with effect from April 1, 2019, Thailand would be granted new quotas for 4 categories of chicken and other poultry meat. (i) For imports of prepared chicken and poultry (HS code 1602.32.11), quotas were set at 340 tonnes]year and in-quota import duties at to be levied at EUR 630]tonne (a new quota). (ii) For imports of processed or cooked poultry containing at least 57% poultry meat or offal by weight (HS code 1602.32.11), quotas were set at 60 tonnes]year and in-quota import duties are to be levied at 10.9%. (iii) For imports of processed poultry containing 25-57% poultry meat or offal by weight (HS code 1602.39.85), quotas were set at 60 tonnes]year and in-quota import duties are to be levied at 10.9%. (iv) For imports of processed and cooked chicken (HS code 1602.32.19), quotas were set at 5000 tonnes]year and in-quota import duties are to be levied at 8%. (source: MOC)

[16] The Japan-Thailand Economic Partnership Agreement (JTEPA) is signed by Japan and Thailand. The ASEAN-Japan Comprehensive Economic Partnership (AJCEP) is also an economic partnership, signed by Japan and ASEAN.

[17] This is on the assumption that 1 chicken yields an average of 1.53 kilograms of meat (excluding waste generated in the fileting process) (source: Office of Agricultural Economics).

[18] Trade partners affected by outbreaks of bird flu include Australia, China, Germany, India and the Philippines. Those hit by African Swine Fever include Cambodia, China, Hong Kong, India, Laos PDR, Myanmar and South Korea. Trade partners where Covid-19 infections have disrupted chicken processing facilities include the United Kingdom, whereas Brazil and the US are among the competitors where chicken processors have been adversely affected by the pandemic.

[19] Research by the US National Cancer Institute shows that individuals who prefer to eat chicken rather than other meats tend to be healthier and live longer, and that eating chicken is linked to lower risk of cancer and heart disease because chicken has lower levels of cholesterol and saturated fats than red meats such as pork, beef and lamb. Chicken is also a valuable source of protein, vitamins, minerals (e.g. iron and zinc) and essential amino acids.

[20] 72% of the costs of chicken farming is attributed to animal feed. This is followed by the cost of buying new stock (19%), and the remainder is cost of services and other expenses (source: Suwanvajokkasikit Animal Research and Development Institute, Kasetsart University).

[21] Some Middle Eastern countries do not accept imports of meat products that are not prepared in accordance with Islamic teachings on the slaughter of animals; haram meat products must come from animals that must be alive immediately being butchered.

.webp.aspx)