The credit card sector is forecast to see ongoing growth through the period 2019-2021 on an anticipated strengthening of spending on credit cards. The latter will be driven by changing consumer behavior and the spread of new technology and innovations in payment systems that will make their use more convenient but, at the same time, the market will be buffeted by rising levels of competition, with this coming from both existing providers of payment services and new entrants to the market. Against this background, understanding consumer behavior and using this knowledge to provide customers with services that are superior to those of other operators using modern technology and innovation will be an important factor in maintaining competitiveness.

Overview

Credit card companies issue consumer credit to customers by sanctioning the release of funds via credit cards up to a pre-approved limit, and credit card holders can then use their cards in place of cash to purchase goods or services, or to withdraw cash from ATMs to a value up to this pre-agreed limit. Credit card issuers may also extend other benefits or offer incentives to credit card holders. When purchases are made or money advanced on a credit card, the ensuing debt is a form of unsecured or non-collateralized loan. This debt can then be paid off in installments, with the interest on this typically calculated from the day of purchase.

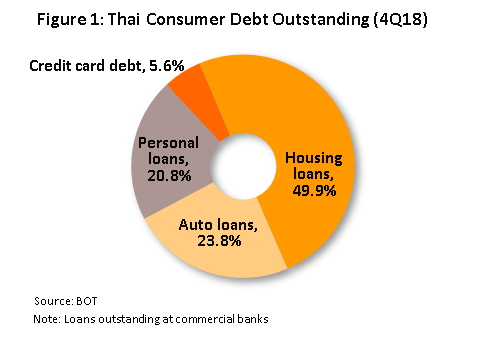

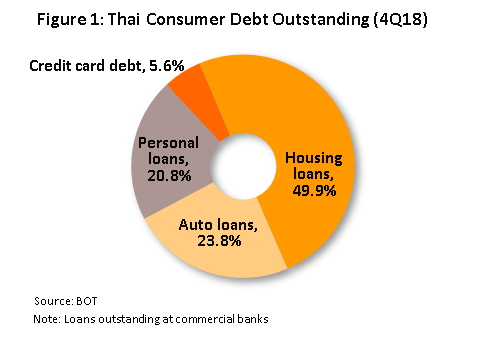

The credit card sector plays an important role in supporting private-sector consumption in Thailand, and in terms of the value of total outstanding debt, credit card debts sits behind home loans, car loans and personal loans; in 2018, credit card debt represented 5.6% of all consumer debt in Thailand (Figure 1)

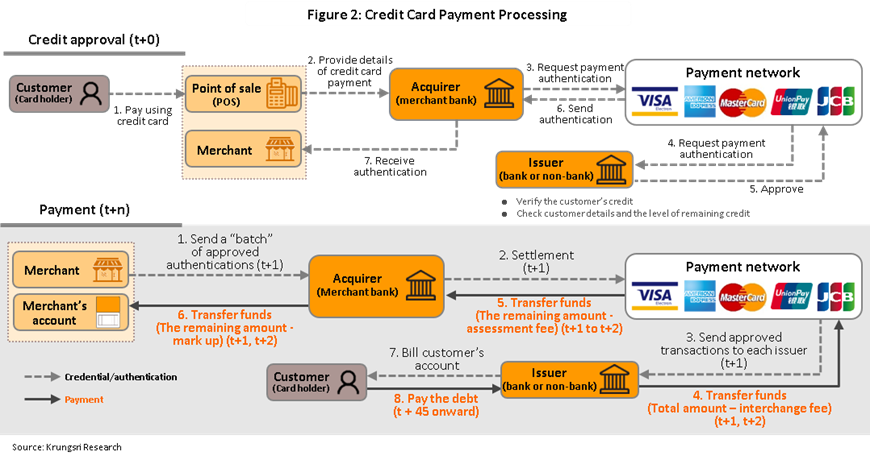

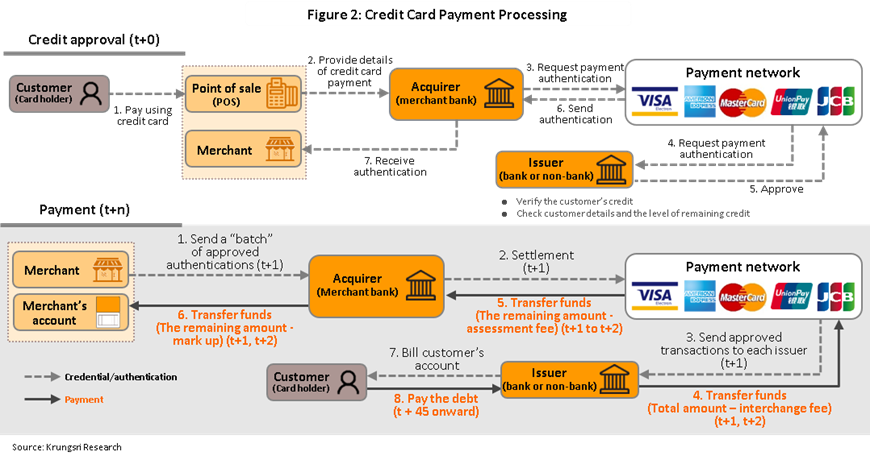

Every time a consumer makes a purchase of goods or services on a credit card, a number of separate parties will be connected through the ensuing transaction, from approving the issuing of credit to the making of the payment. Approving the release of credit for a sale typically happens instantaneously (t+0) whenever a card is used, and this makes the experience both convenient and seamless for consumers. Clearing and settlement between a seller and the credit card company usually takes 1-2 days (t+n) and credit card holders will often have a 45-day period before interest is applied to this new debt

(Figure 2).

Parties connected through the transaction will thus include the credit card holder, the issuing bank or business, the bank or business that receives the payment, the shop to which the payment is made, and the payment network. Details of each of the links in this chain are given below.

- Card holders: Credit card holders may either pay off the entire balance of their card in its entirety on or before the due date, or pay off the outstanding balance in installments. For consumers, the benefits of using a credit card are that: (i) it is more convenient to use a credit card and this helps to reduce the need to carry cash; (ii) it provides access to credit, thus reducing the impact of fluctuations in personal income and allowing consumers to spread purchases more evenly in a given time period; and (iii) credit card issuers may provide additional incentives to encourage holders to use their cards to make purchases. The latter might include making ‘cashback’ offers, offering points which holders can collect and then exchange for discounts or prizes, being billed for purchases in installments, offering benefits for making automatic monthly payments, providing travel insurance and so on.

- Issuers: Banks or credit card companies issue cards to applicants and it is the issuer which, having already vetted card holders and set credit limits, authorizes or denies payment requests. At present, there are a variety of different types of cards. These include: (i) general credit cards, which are part of general payment networks, such as Visa, MasterCard, American Express, China Union Pay (CUP) and Japan Credit Bureau (JCB); (ii) co-branded cards, which involve banks or credit card companies issuing cards jointly with another company (Thai or foreign) so that card holders are granted additional benefits from using the card to make purchases from the co-branded company, for example the Citi M Visa Reward card, which offers additional benefits to card holders when they use it to make purchases in The Mall, Emporium, or Paragon department stores; (iii) affinity cards, which are issued jointly with non-profit making organizations, e.g. the cards issued by The Thai Pilots Association and The Thai Red Cross Society in association with Krung Thai bank; and (iv) corporate cards, which are issued by organizations to pay for business expenses, such as travel and for which special discounts are offered to organizations that partner with merchants. Examples of these include Krungsri Corporate Credit Card, KTC Visa Corporate Gold Card and KBank Corporate Executive Card.

- Acquirers: Banks or other organizations that process transactions receive requests for payments from businesses when those businesses have conducted a credit card transaction with a customer, and when these payments are made, the acquirer will impose a fee for the provision of this service, with the amount charged having been specified in the service contract. Banks and payment processors try to build networks of member merchants, with consideration given to the volume of transactions being made by a shop or business and how this will likely grow, since merchants with a steady income will help to build business for the bank or payment processor that handles this trade. In addition, the fees levied by banks and processors for handling transactions may vary, though the extent of this variation will depend on individual businesses and the level of competition between service providers, who may set a minimum fee for merchants. In addition, banks and payment providers will cooperate with retailers to offer different means of processing transactions, including: (i) electronic data capture (EDC), (ii) mobile point of sale (m-POS), (iii) one-time passwords (OTP), and (iv) automatic deduction from accounts.

- Merchants: Taking payments by credit card offers a number of advantages to merchants, whether this is done at point of sale terminals or via the internet. Allowing customers to make payments by credit card makes purchases more convenient, especially for high-value goods, since customers paying by credit card will no longer face the inconvenience of carrying large amounts of cash. It is also much easier to manage electronic payments than payments made with physical cash, and card payments do away with the need for retailers to worry about maintaining supplies of coins and small change. However, some smaller businesses prefer not to take payment by credit card since this incurs a processing fee and this therefore means that merchants will not receive the full value of the goods or services sold. In Thailand, merchants in this situation may specify a minimum amount for payments made by credit card (THB 500, for example) or they may shift the burden of paying the fee to the customer by imposing an additional charge to cover processing fees.

- Payment networks: When a merchant processes a credit card transaction, the relevant payment network will receive the request from the Thai business carrying out the transaction. These networks are based outside Thailand and are global in scope, receiving requests from around the world to make deductions to one account and balancing credits to another within the network. After the transaction information is received and evaluated, accounts will be debited and settled, and monies transferred to the relevant merchant in Thailand. The major players in this area are Visa, MasterCard, American Express, China Union Pay (CUP) and Japan Credit Bureau (JCB) but the fact that the most important players are outside Thailand ensures that fees for Thai transactions are higher than they would otherwise be, since these fees need to be paid to non-Thai processors. Local payment networks (so-called ‘local switching’) are capable of handling debit card transactions[1], but using credit cards issued by foreign companies is more convenient for Thai customers, especially when traveling abroad.

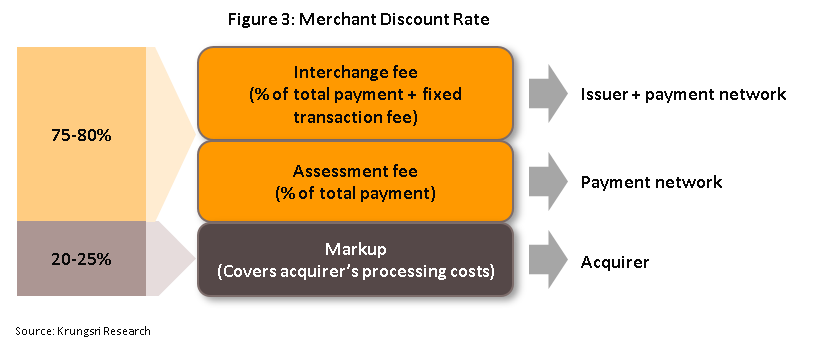

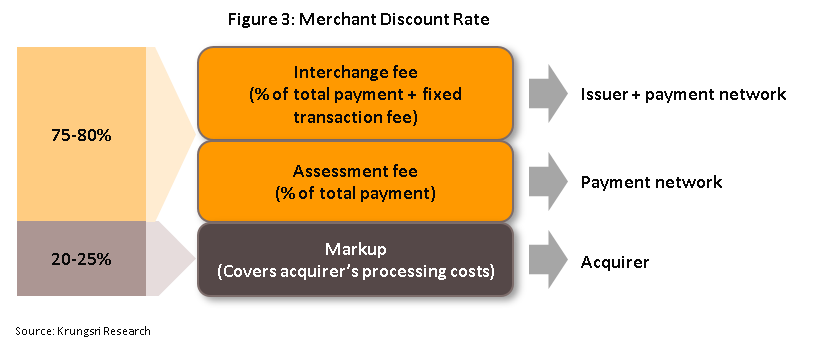

Usually, a fee (or merchant discount rate) of 1.5-2.4% is imposed on Thai merchants for processing credit card payments, though the exact amount will depend on the type of credit card. This fee has several sub-components.

(i) The interchange fee covers the costs the card issuer incurs in marketing and encouraging card holders to use that issuer’s particular card, extending credit to card holders, processing payments by card holders, and covering and pursuing bad debts.

(ii) The assessment fee goes to the payment network, which acts as a middleman and which has the lowest costs. This is because these networks benefit from the volume of business that they conduct and this gives them considerable economies of scale.

(iii) The markup fee goes to the acquirer for its role and the costs incurred in managing and receiving the transfer of monies from the merchant that has taken the payment. On average, interchange and assessment fees will comprise 75-80% of the total fee paid by a merchant, with the markup fee accounting for the remaining 20-25% (Figure 3).

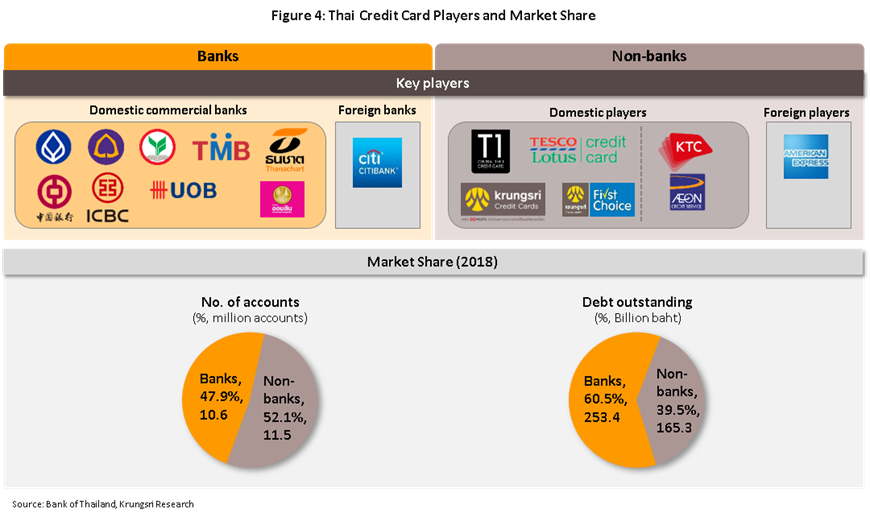

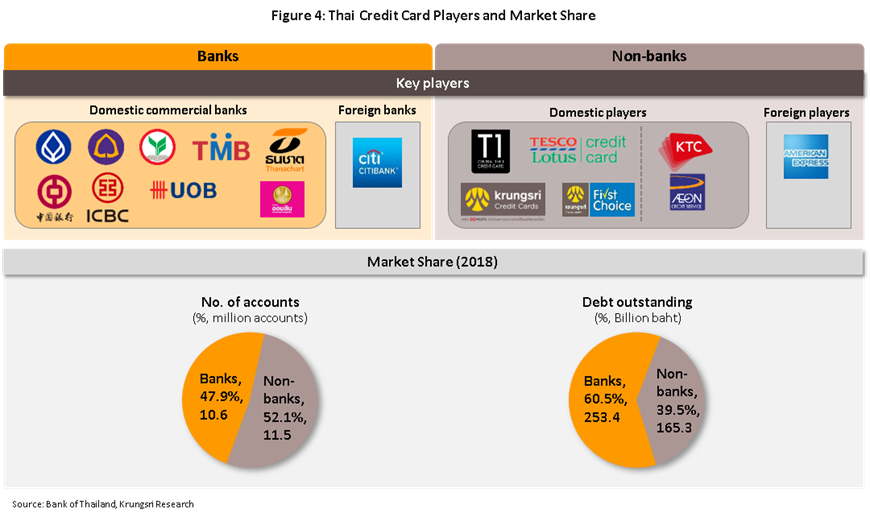

Credit card issuers operating in Thailand can be split into two groups. These are: (i) nine commercial banks, of which eight are Thai (Bangkok Bank, Kasikorn Bank, TMB, Siam Commercial Bank, Thanachart Bank, UOB (Thailand), ICBC (Thailand), and The Bank of China (Thailand)), and one foreign (Citibank),[2] together with one further specialized Thai financial institution, the Government Savings Bank; and (ii) non-banks offering credit card services, of which there are seven. These are: two subsidiaries of Krungsri Bank, Krungsri Ayudhya Card and Ayudhya Capital Services; co-brands between Krungsri Bank, operating as General Card Services, to offer the Central The 1 Credit Card and, with Tesco, to offer Tesco Card Services; the KTC credit card, part of Krungthai Bank; Aeon credit card, part of AEON Thana Sinsap (Thailand); and American Express,

a foreign non-bank (Figure 4).

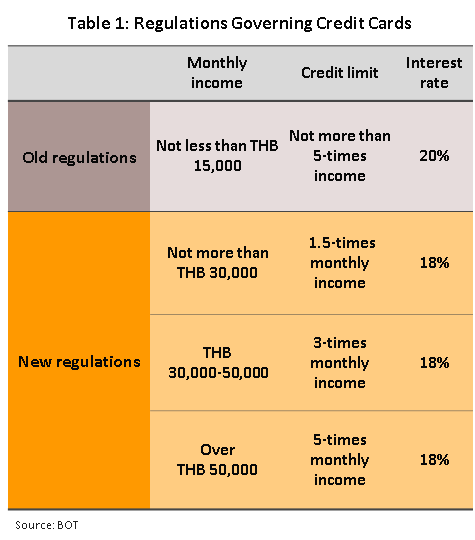

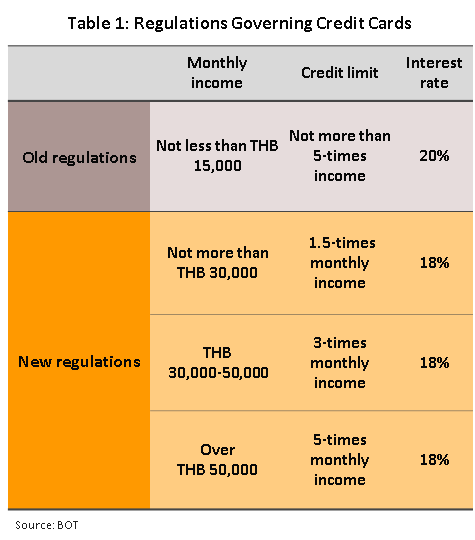

The Bank of Thailand regulates the credit card market and has laid out similar regulations for banks and non-banks regarding the issuing of credit cards. (i) In terms of income or wealth, card holders should have one of: a monthly income of not less than THB 15,000; deposits in a bank account which over at least a 6-month period average not less than THB 15,000 per month; cash deposits at a commercial bank or a debt instrument issued by a commercial bank, a state organization or a state industry to act as collateral against the full value of the credit limit; fixed deposits held at a financial institution with a value of at least THB 500,000 that have been on deposit for no less than 6 months; fixed deposits at a savings cooperative with a value of at least THB 1,000,000 that have been on deposit for no less than 6 months; or deposits or bonds or investments in private or mutual funds or fixed deposits at a financial institution with an individual or combined value of at least THB 1,000,000 that have been deposited or held for no less than 6 months. (ii) Credit limits are set according to the following regulations: For individuals who have applied for a credit card secured against deposits held at a commercial bank or against a debt instrument, credit limits will be set at a level no higher than the value of the collateral against which the card debt is secured. For card holders who apply for a credit card against fixed deposits, money held in savings accounts, bonds, or private or mutual funds (as described above), credit limits are set at a maximum of 10% of the value of the aforementioned deposits, bonds, or funds. The Bank of Thailand has also specified that in order to make debt burdens more manageable, with effect from September 1, 2017, for those with monthly incomes less than THB 30,000, between THB 30,000 and THB 50,000 and over THB 50,000, credit limits will be set at respectively, 1.5-, 3- and 5-times monthly income. (iii) Monthly payments made by card holders on the outstanding balance of a credit card should be for at least THB 500, and no less than 10% of the outstanding debt, while interest should be charged at no more than 18% per annum (the effective rate). The latter is lower than that specified in the earlier regulations, which set a maximum rate of 20% per annum (Table 1).

Looking at market share, in terms of the number of cards issued, non-banks have a slight edge over commercial banks and at the end of 2018, non-bank cards accounted for 52.1% of all credit cards in use. This difference stems from the fact that some non-banks market their services to low-income earners and so need to widen their customer base to reduce risk and to gain economies of scale (by reducing marginal costs). Non-banks may also be slightly laxer or more generous than commercial banks in assessing credit-worthiness and when considering applications and credit scoring, which in turn means that it may be easier to gain credit from non-banks and so these card issuers have greater access to the low-income market. However, in terms of outstanding balances, banks have a greater market share, with 60.5% of the total (Figure 4).

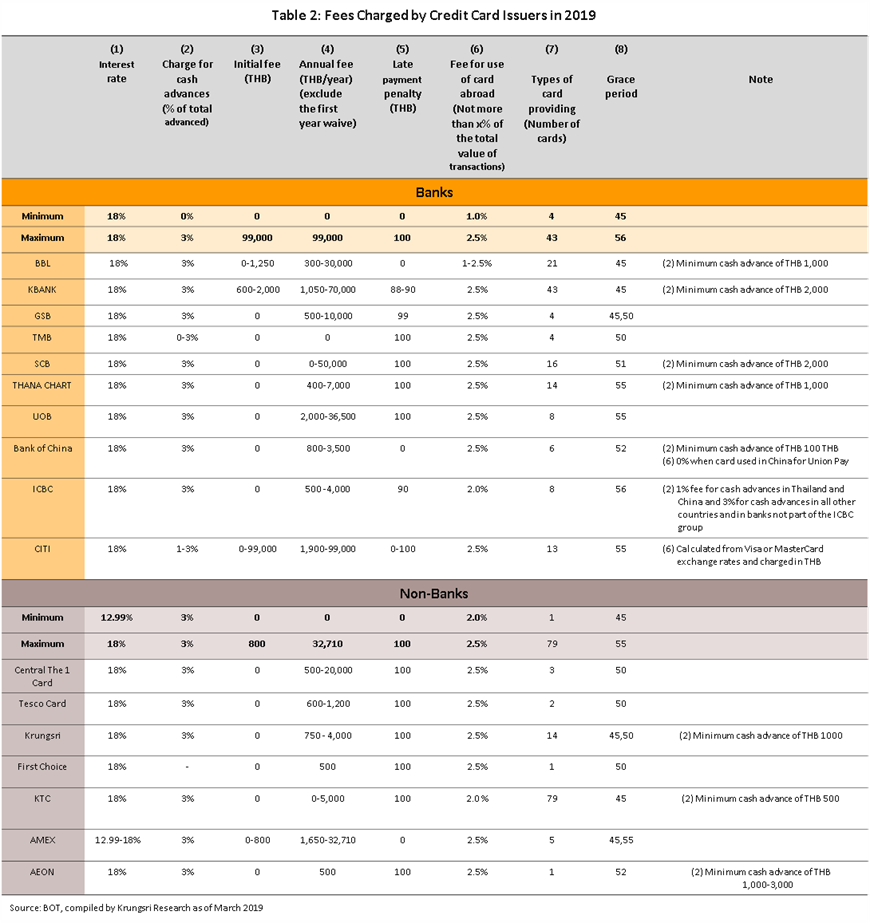

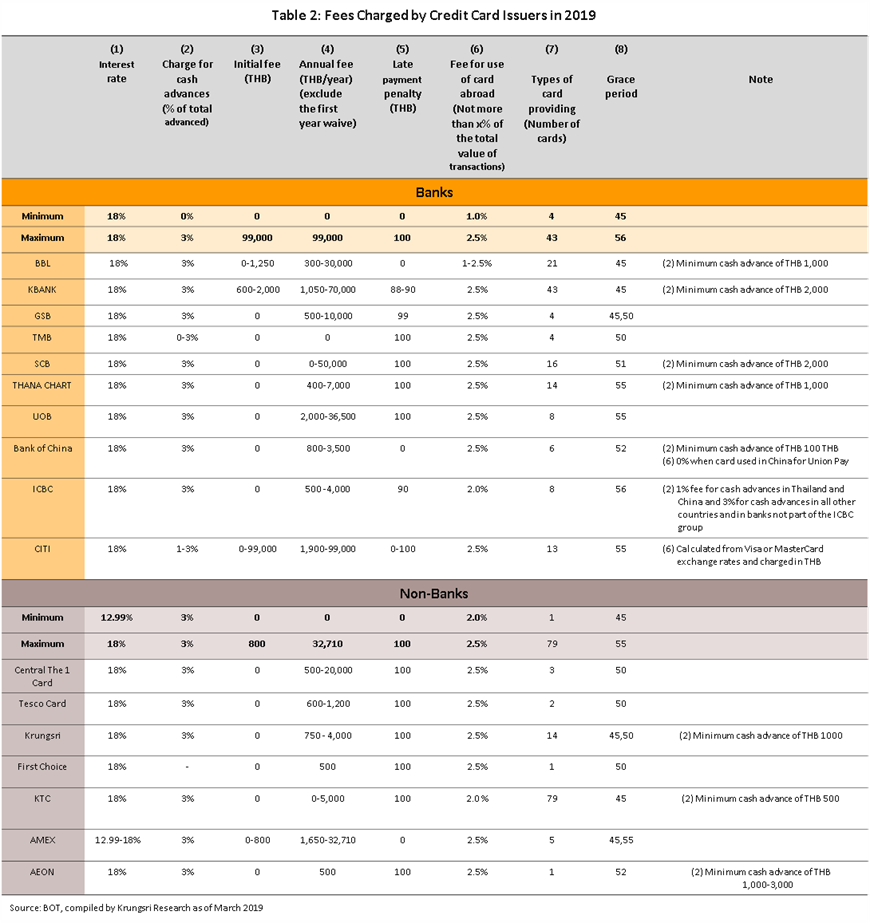

As regards the costs incurred by credit card holders, these may be split into fixed and variable expenses, although overall, these tend to be lower for cards issued by non-banks.

- Fixed costs include fees for issuing the card, annual fees, and penalty fees for demands for late payments. A comparison of charges shows that where banks levy these fees, the rates are higher than they are for non-banks but in 2018, the majority of both bank and non-bank issuers waived initial fees and when demands were sent for payments which were in arrears, the fees for these were fixed at THB 100. However, many card issuers have also imposed higher annual fees as they have expanded their customer base into higher-end markets. At THB 99,000, Citibank currently charges the highest annual rates of all card issuers (Table 2), this being for its Citibank Ultima Metal card, which is reserved for invited clients who spend over THB 3,500,000 per year.

- Variable costs are dependent on how much the credit card is used and more particularly on the rate of interest on payments, fees for cash advances, and charges for transactions carried out in foreign currencies. As regards the first of these, both banks and non-banks are prevented by law from charging more than 18% annual interest rates on outstanding balances, although in 2018, only the foreign non-bank American Express charged interest at below market rates (American Express set interest at 12.99% per annum on some of its cards). The majority of both commercial banks and non-banks charge 3% for cash advances, while banks typically charge an extra 2.5% of the total value of transactions carried out in a foreign currency (Table 2).

In addition, individual card issuers may also offer a range of other card-related services and incentives to their customers so, for example, KTC has 79 separate card offerings, the most of any issuer, while issuers will also tend to offer interest-free periods (or grace periods) of different lengths, although these usually fall in the range of 45-56 days.

Situation

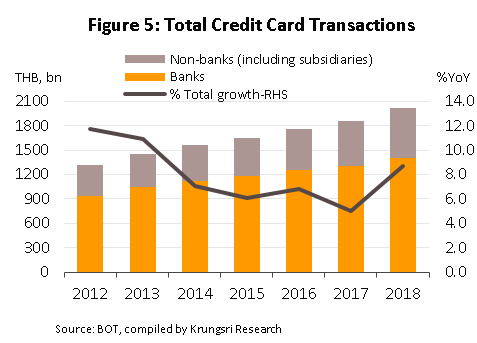

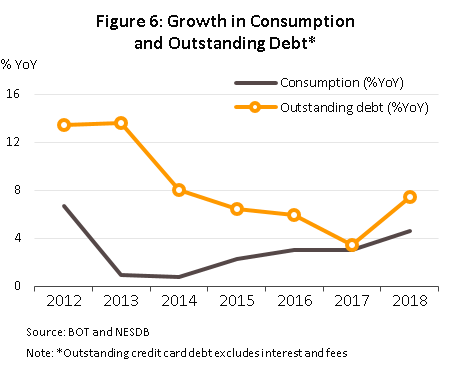

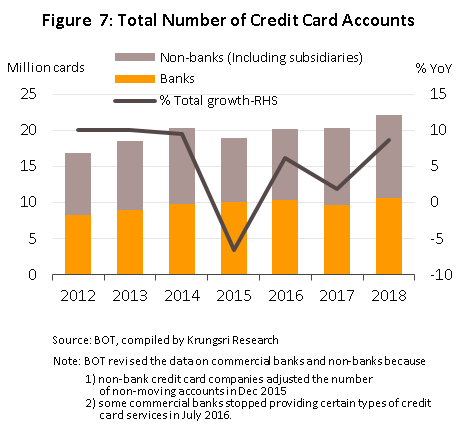

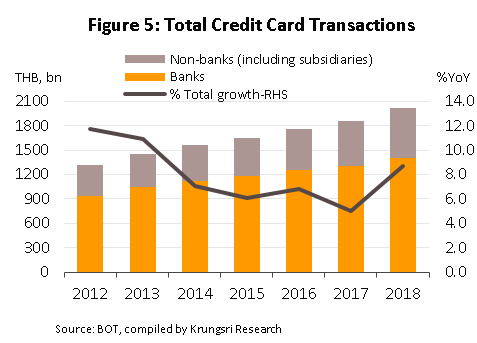

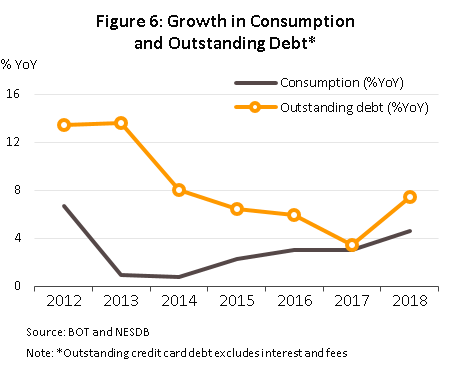

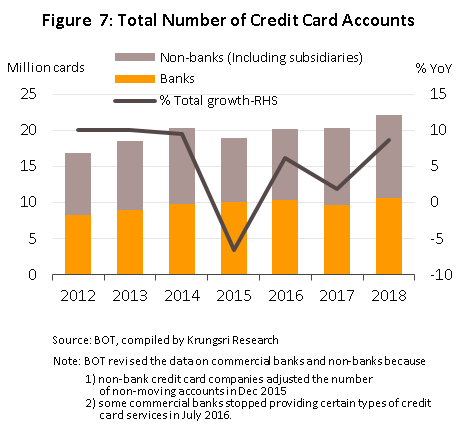

In 2017, growth slowed for the credit card sector on a sluggish and incomplete recovery in the economy, as was made evident in the relatively weak growth in credit spending, which softened to 5% YoY (Figure 5). At the time, high levels of preexisting household debt generally restrained the ability of consumers to take on fresh debt, while consumer spending power in the agricultural sector was negatively affected by the low farm-gate prices. Beyond this, during the first half of the year, the purchasing power of households outside the agricultural sector failed to benefit from an improving situation with exports and as a result of the combination of these factors, total outstanding credit card debt rose by just 3.4% YoY (Figure 6). In response, lenders switched their attention to consumers at the higher end of the market, while at the same time worries over a possible rise in non-performing loans (NPLs) pushed them to cut back on releasing credit to new borrowers. As such, the number of new credit card accounts increased by only 1.9% YoY (Figure 7).

In 2018, business conditions improved for the credit card industry and growth was recorded that was in line with the general strengthening of the private sector. In particular, non-farm incomes rose, benefitting from the overall improvement of the economy and the positive effects of government policy and private investment. In addition, the fact that many cars purchased under the First Car Buyer scheme have now reached the end of the 5-year period during which they could not be sold helped to reduce existing repayment burdens and this also boosted some sectors of the economy. Thus, improving purchasing power lifted the total spend on credit cards by 8.7% YoY (Figure 5), a figure that precisely matched the 8.7% YoY growth in the total number of credit card accounts, which stood at 22.1 million for the year (Figure 7). As for outstanding credit card debt, this rose by 7.4% YoY (Figure 6).

In addition, continuous competition between card issuers to encourage consumers to spend on their credit cards has also helped to expand the market. The most noteworthy strategies used by issuers include: (i) partnering with shopping malls and department stores to run joint promotions such as offering 0% interest on purchases, giving consumers cashback when making purchases on a credit card over a certain value, and offering points for credit card users to collect and then exchange for prizes or discounts at participating stores; (ii) focusing marketing efforts on the ‘generation Y’ group, especially those members who have recently entered the workforce as these consumers typically spend heavily on travel, shopping and eating out, and so this makes it relatively easy to use promotions and other marketing strategies to stimulate higher spending on credit cards; and (iii) trying to increase the penetration rate of high-end markets, that is, consumers with a monthly income of over THB 50,000, as these card holders have not been affected by the Bank of Thailand’s September 2017 revision of the rules determining credit limits.

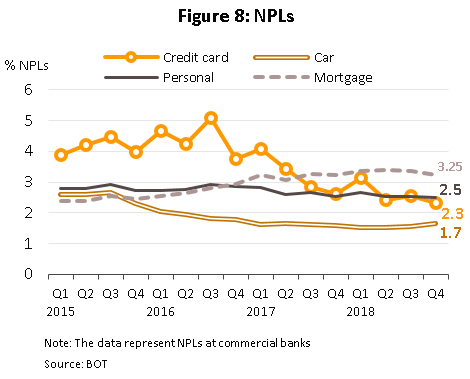

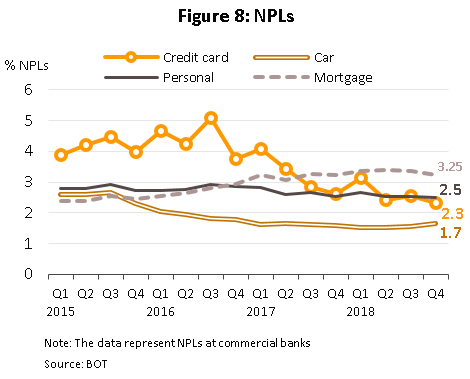

Because of a combination of there requirements placed on commercial banks to adjust their lending policies for new accounts (IFRS 9) to meet these new Bank of Thailand regulations and the high level of household debt, lenders have exercised caution in releasing new loans as well as acting swiftly to remove bad loans from their books once borrowers have fallen 3-6 months into arrears. The effect of this has substantially contributed to reduce the proportion of NPLs continuously to 2.3% of all debt by the end of 2018 (Figure 8).

Major trends in the credit card sector, 2019-2021

Positive factors supporting the ongoing growth of the sector will include the following:

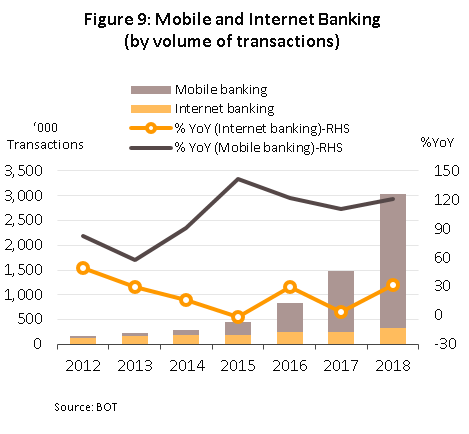

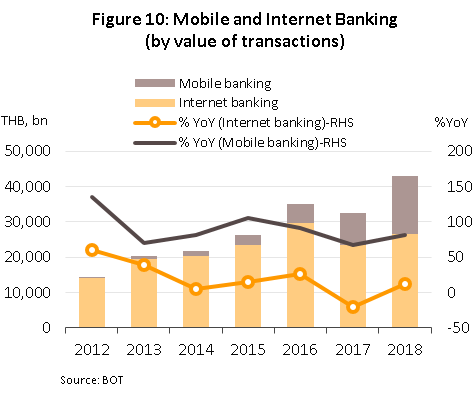

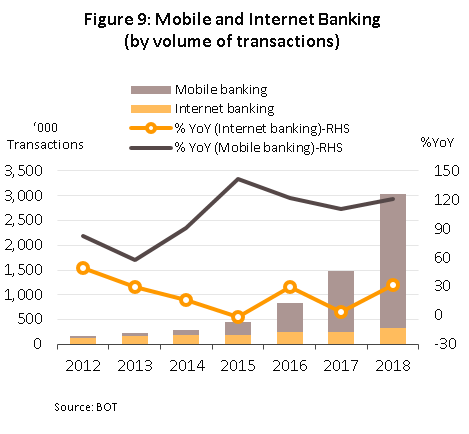

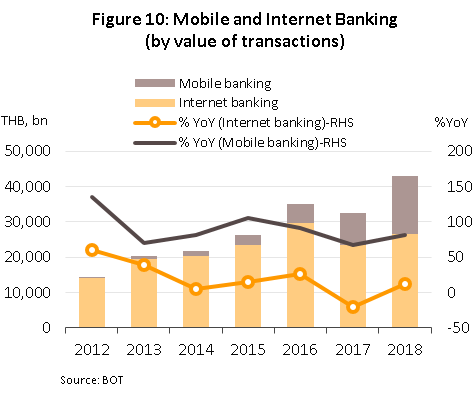

- Consumers increasingly prefer to make payments by electronic means rather than by cash, with mobile banking being a particularly popular form of electronic payment. Thus, in 2018 the volume of transactions made by means of mobile banking payment systems grew at the breakneck pace of 120.8% YoY (Figure 9), while in terms of value, mobile banking grew at the slightly slower though still impressive rate of 81.5% YoY (Figure 10).

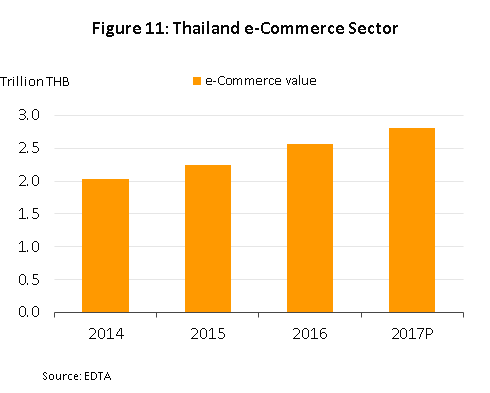

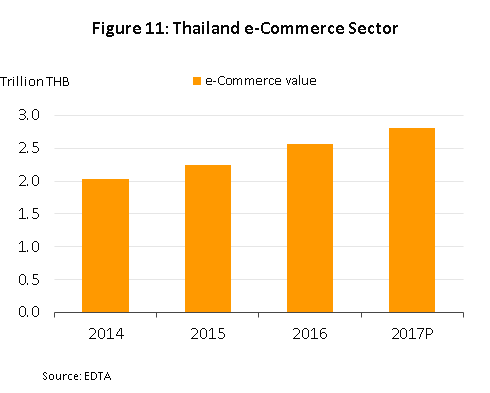

- The rapid expansion of e-commerce is also supporting continuing growth in the use of electronic payment systems and this is changing earlier patterns of payment, when buyers tended to pay cash on delivery. In particular, consumers are now tending to use credit cards in conjunction with the e-wallet services offered by a number of players from outside the financial sector when making purchases in e-marketplaces run directly by these operators. This increase in use is partly explained by the promotions offered by merchants and credit card issuers, which give discounts to those paying by credit card, and the result has been to lift growth in the number of transactions in the Thai e-commerce sector in 2017 to 9.8% YoY, lifting its value of THB 2.8 trn (Figure 11).

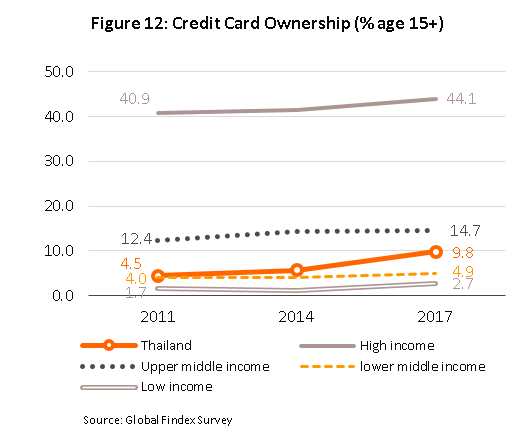

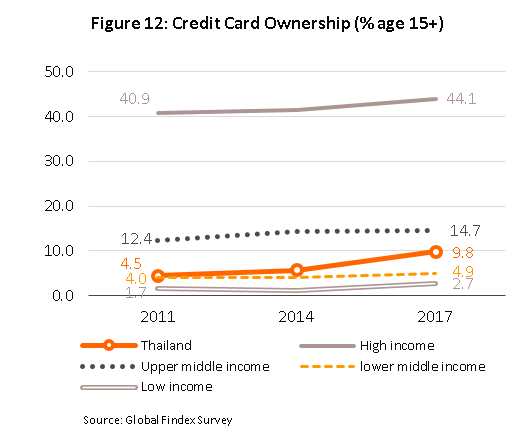

- The rate of credit card ownership in Thailand is relatively low. In 2017, the average rate of credit card ownership for countries at a similar level of economic development as Thailand and that were similarly in the class of upper middle-income countries stood at 14.7%, while in Thailand the rate was only 9.8%. Moreover, in the recent past, the rate of ownership has tended to increase more rapidly and in just six years, the rate has more than doubled from 2011’s ownership rate of 4.5% (Figure 12). This partly explained by Thailand’s status as a middle-income country that means a greater number of middle-class consumers will likely enter employment in the formal sector. Thus, this tend to provide greater opportunities for credit card sector to grow in the future.

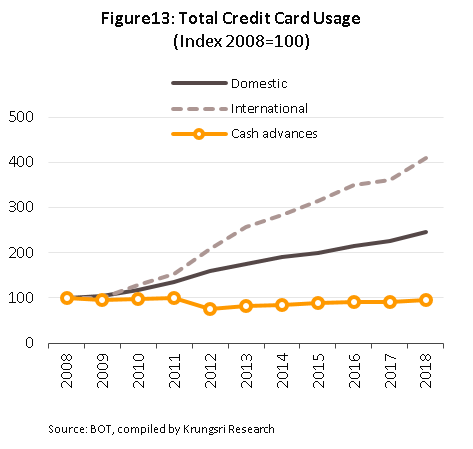

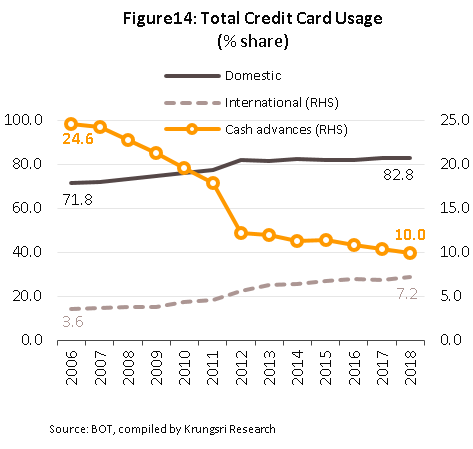

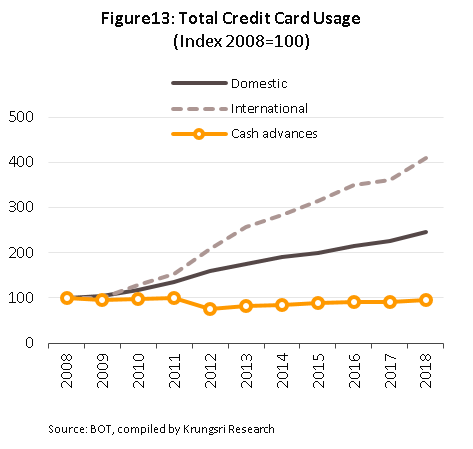

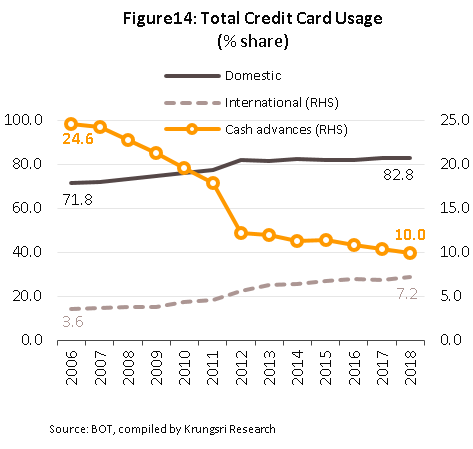

- Spending on travel and tourism made through credit cards has also tended to grow substantially over the past decade, especially for travel abroad (Figure 13); travel accounted for 3.6% of all spending on credit cards in 2006 but by 2018, this had grown to 7.2% (Figure 14). Over the past few years, airlines have expanded the number of routes that they operate both domestically and internationally and have periodically cut prices to encourage greater uptake of their services, with this being a favored marketing technique of low-cost airlines. At the same time, consumers have increasingly turned to independent travel and in doing so have relied on the use of a number of different applications to buy airline tickets. Using particular credit cards to make these purchases can then qualify travelers for discounts.

- The development of new technology and innovative payment applications that are connected to the use of credit cards is another driver of growth in the market. (i) Many of the banks issuing credit cards have cooperated with Visa in the development and deployment of QR systems for use when paying by credit card, and the outcome of this has been to facilitate the making of low-value purchases by removing the requirement for minimum payments. Small retailers thus benefit from being able to operate more convenient payment systems, despite perhaps not having the facilities for taking credit cards. In addition, consumers can use the same payment system in a number of different countries, including India, Taiwan and Vietnam and some countries in Africa. (ii) The increasing use of chatbots (automated communication systems) in place of human-staffed call centers to communicate with and to provide information to customers inquiring about the status of credit applications is helping to speed up and streamline services. (iii) Building e-marketplaces on banks’ mobile applications by credit card issuers that are part of commercial banks. They may cooperate with retailers to offer products or services for sale directly through bank’s application. In addition, card holders may redeem the points that they have collected via their credit cards and then use these to claim discounts for future purchases.

Negative factors that will tend to restrict growth in the credit card sector will include the following:

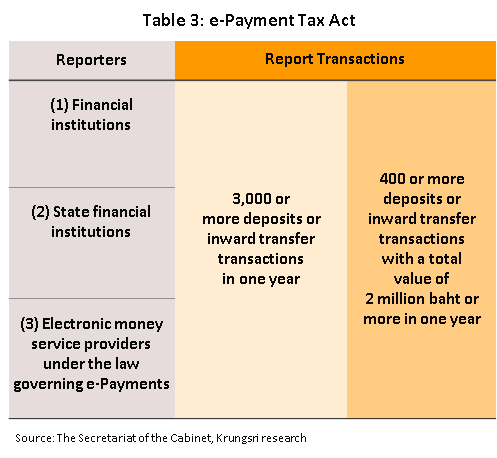

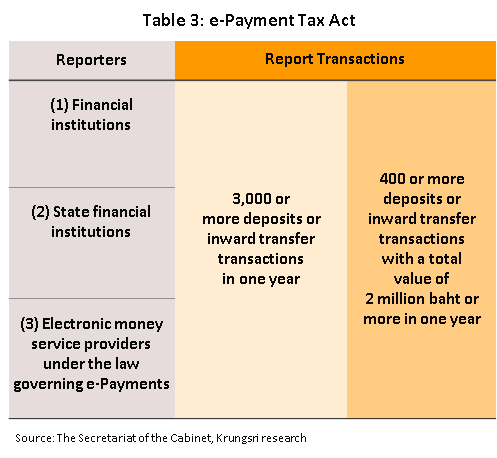

- Official regulation of the market may have negative impacts on the confidence of investors and traders with regard to electronic payment systems. In particular, the new law on taxing e-payments[3], which has been enforced since March 21, 2019 is likely to affect the future uptake of e-payment systems. This law states that financial institutions and providers of e-payment services are required to report to the authorities all transactions that occur in accounts if the volume of transactions meets one of the following criteria: (i) the account (or accounts combined) receives more than 3,000 deposits per year; or (ii) the account (or accounts combined) receives over 400 deposits in a year and the value of deposits to the account (or accounts) is over THB 2,000,000 (Table3). It is expected that this law will reduce the confidence of investors and traders, especially of SMEs, over the short- and medium-term, as these individuals will fear the tax consequences of the new reporting requirements, and as a result, they may switch to taking payments in cash instead of by e-payment systems. This would then likely delay Thailand’s transition to a cashless society.

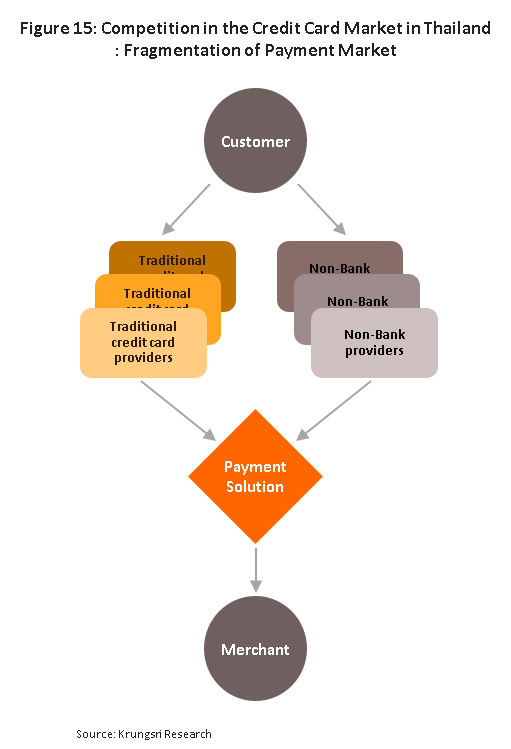

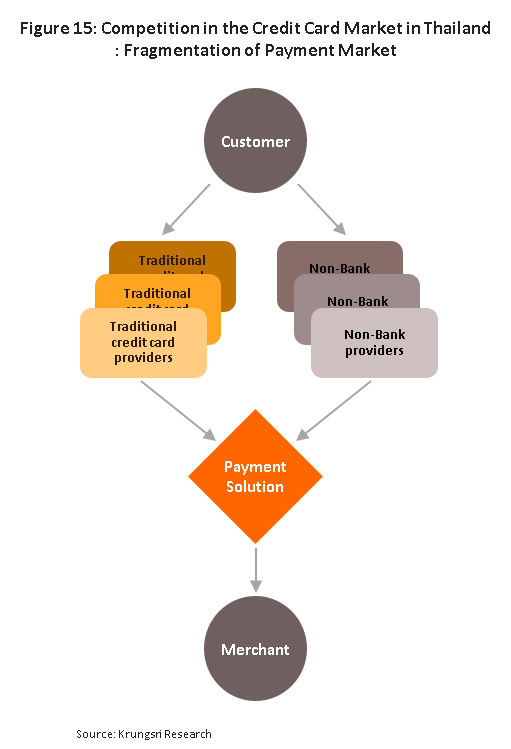

- Meanwhile, the growing importance of alternative payment gateways will tend to eat into the market share of existing credit card issuers, while at the same time, competition will also intensify because: (i) financial institutions will compete harder to preserve their position as providers of consumers’ main credit cards; and (ii) non-bank players will play an increasingly important role in the market by, for example, providing e-wallet services that allow consumers to make payments directly through a number of applications. In addition, tech companies are also beginning to compete in the provision of financial services. For example, Apple has made a move into this territory with the release of the Apple credit card for purchasers of goods and services from Apple, with the additional incentive of cashback offers on some purchases (Figure 15).

- Competition on price and special offers and promotions will also tend to multiply within the sector, and this will have negative consequences for operators’ margins. FinTech startups are also developing applications that consumers may utilize to compare credit card promotions. An example of this is Primo, a startup that uses data analytic technologies together with artificial intelligence to gather and analyze credit card users’ behavior with regard to the purchase of products that they are interested in, and the application then provides these users with information on relevant credit card promotions in locations where they routinely make credit card purchases. So, that they are able to use the credit card that offers them the greatest benefits and the greatest value for money.

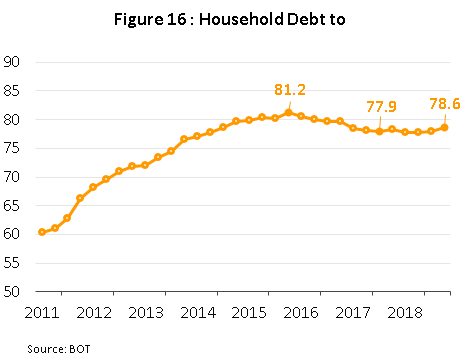

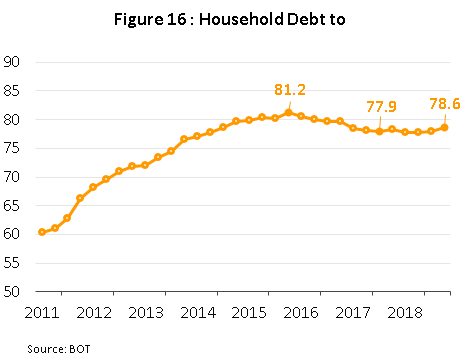

- Household debt remains at high levels and this is expected to drag on consumer spending and to reduce the willingness of consumers to incur greater credit card debt in the coming period. After household debt hit a four-year high in 2015 of 81.5% of gross domestic product (GDP), the economy saw a period of deleveraging by households. Following seven straight quarters of falling debt, however, the trend lines stabilized and from the end of 2017, debt has started to edge up again so that by the end of 2018, household debt represented 78.6% of GDP (Figure 16). The fact that household debt is already high and is tending to rise again shows clearly that debt is expanding faster than household income and as such, the ability of households to take on new debt will be reduced if their repayments rise.

Krungsri Research view:

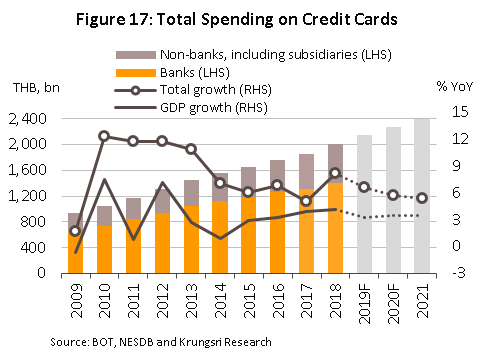

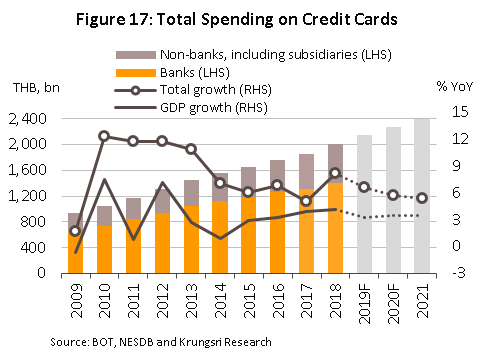

The credit card sector is expected to see continuing expansion over the next three years (2019-2021), with growth in the value of purchases made on credit cards forecast to run in the range of 5.4-6.6% YoY in these years (Figure 17), this being in line with the generally increasing consumer preference for the use of electronic payment systems. Positive factors supporting growth in the sector will include the continuing expansion of e-commerce sales channels, increasing spending on domestic and international tourism, and the low level of credit card usage in Thailand relative to other countries at a similar stage of economic development. However, issuers of credit cards will also feel the effects of non-bank providers of payment services entering the market, while the impact of the new regulations on tax and e-payments may be to encourage shops to return to a greater use of cash. The net effect, though, of these positive and negative factors will be to amplify competition between providers of credit card services and in light of this, players will tend to adjust their business strategies in the following ways (Figure 18).

- Players will move to exploit markets with growth potential by analyzing big data to extract insights into consumer behavior. This will be especially the case for consumers who are self-employed or who run SMEs as in the past, card issuers lacked extensive information on these groups and because of this, were wary about releasing credit to them. However, the rapidly shifting technological environment is allowing new non-banks and tech companies to penetrate these markets and increasingly to compete in offering payment services to these customers by exploiting data that players gather from within their own online ecosystems. In addition, card issuers are also expected to try to build their market presence by increasing the number of cards held by high-income earners.

- Expanding the market for using credit cards when making online payments will be another major strategy in encouraging consumers to continue to use a credit card issued by a particular bank and to make that card the consumer’s primary credit card. This will be done by establishing niche benefits that distinguish one card from another and so in the future, this will give consumers a wider range of choice over which credit card to use. However, the effect of the new e-payment tax regulations may pull in the opposite direction by causing shops to hesitate over taking credit card payments, with clearly negative consequences for the sector in the immediate future.

- The markets for using credit cards to make offline payments, in particular for making payments in shops, will also be boosted by the development of new payment innovations, such as QR codes for payments made by credit card and contactless payment methods, that will allow customers to make low-value payments more conveniently. It is therefore expected that card issuers will try to increase the use of credit cards by building partnerships with smaller shops, especially with better known and more popular market leaders, where consumers tend to make credit card purchases already and that will be less affected by the new rules on tax.

- Meeting consumer expectations regarding the benefits of credit card use by increasing the level of spending on marketing and customer rewards will naturally raise operating costs. At the same time, strengthening competition may lead to a loss of market share for some issuers due to the ability of consumers to make better informed decisions about which credit cards to use to extract the greatest benefit from the rewards system of each, a development that is then

making the clarity and ease of use of application-based rewards systems a major factor in attracting customers and encouraging them to spend more on particular credit cards. In addition, the use of in-depth analysis of data on consumer spending to understand consumer behavior more fully will allow card issuers to offer rewards and benefits that are better tailored to individual consumers and more in line with the lifestyle of each individual. This will then increase consumers’ positive experiences of credit card use, which will in turn have an important influence on card issuers’ competitiveness in the coming period.

- Credit card issuers are however exposed to a degree of risk arising from their focus on certain target consumers, such as the ‘generation Y’ group, some members of which may experience a decline in their ability to make their credit card debt payments. Data from credit bureaus indicates that in 2018, ‘generation Y’ consumers accounted for 60% of the total value of combined credit limits but that at the same time, this group was also most likely to see problems with debt defaults. Thus, card issuers’ strategy of trying to stimulate growth in this market may have paved the way to a greater number of future bad debts, and to counter this, pricing strategies will play an important role in helping consumers meet repayment schedules, whether this involves reducing fees for missed payments or cutting the interest rates on carried over credit card debt. However, consumers’ discipline regarding the use of credit cards and to ensure that they will be able to continue to make their repayments will be the important factor that may help card holders establish greater control over their spending in the long-term. This might be achieved by building systems that make it possible to see credit bureau reports via the card issuer’s application or through fintech applications that show their total spending on all credit cards in real time.

Against this background of rapidly changing market conditions and rising competition between existing players and new entrants to the market, the development of innovative new technologies that may be used to better understand consumer behavior and then adjusting card issuers’ offerings in light of this will play an important role in deciding whether players in the credit card sector will be able to maintain their competitiveness into the future.

[1] With effect from September 1, 2013

[2] Citibank took over the Always credit card company on September 23, 2018

[3] The proposed bill to revise the revenue code will support the tax system and the use of electronic documentation of business transactions in line with the National e-Payment Master Plan.

.webp.aspx)