EXECUTIVE SUMMARY

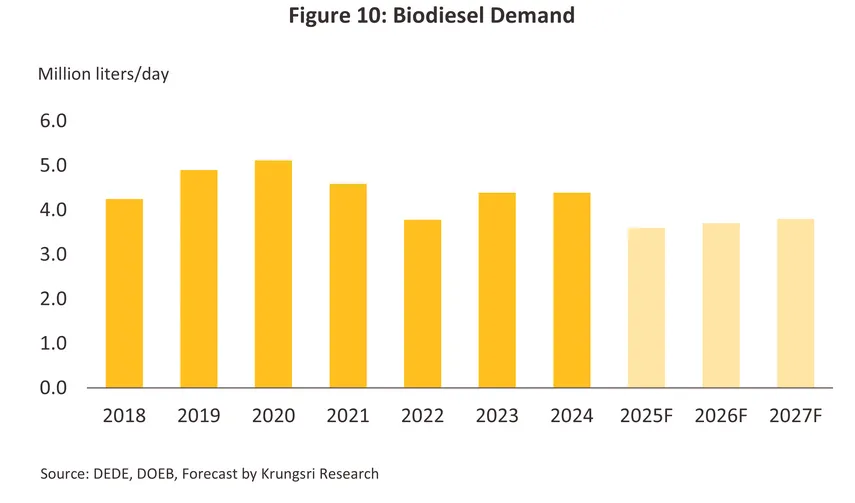

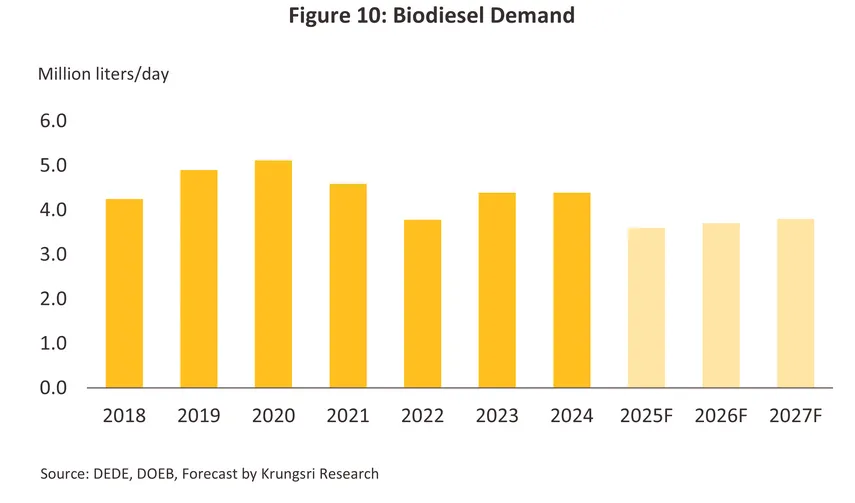

In 2025, the biodiesel industry is expected to experience slower growth in line with the sluggish domestic purchasing power and the slowdown of the Thai economy, particularly in the tourism sector, which faces pressure from fewer international tourists visiting Thailand compared to the previous year. Meanwhile, global trade conditions remain highly uncertain due to US tax policies. These factors have led to a decline in the consumption for biodiesel to blend with diesel fuel for transportation and economic activities. However, in 2026 and 2027, biodiesel consumption is expected to stabilize or increase slightly, averaging 3.7–3.8 million liters per day, with an average annual growth of 1.5–2.5%. This growth is driven by the slow but steady expansion of the Thai economy, mainly supported by tourism, the continuous growth of the e-commerce sector at an average of 15% per year, and the increasing number of diesel engine vehicles in response to demand. Additionally, government policies promote the biodiesel sector, including plans to increase the proportion of biodiesel blended into diesel fuel to B7 and the draft Fuel Action Plan for 2024–2037, which allows for flexible adjustments in biodiesel blending ratios over time.

The challenges facing the industry stem from the slow growth of the Thai economy due to structural problems that are difficult to resolve. Meanwhile, the price of diesel fuel blended with biodiesel tends to rise following the cessation of price subsidies from the Oil Fund in 2026 and the management of biodiesel production costs over time, especially when the price of crude palm oil increases.

Krungsri Research view

Krungsri Research assesses the performance of the industry as follows:

-

Biodiesel Producers: The revenue of operators is expected to remain stable due to the consumption for biodiesel supported by government policies, combined with the increasing trend of using clean energy in economic activities. This includes blending biodiesel as fuel for aircraft and marine vessels. However, increasing the biodiesel blending ratio in diesel fuel may become more challenging after the government ends biofuel price subsidies in 2026, which will cause the price of diesel fuel to rise. This could limit revenue growth. Additionally, the price of crude palm oil, the main raw material, is volatile and may increase due to reduced exports from competing countries amid ongoing global demand. This may put additional pressure on the operators' profit margins.

Overview

Biodiesel, or alternatively B100, is a fuel that can be produced from a range of biological inputs including plant matter, animal fats, and waste cooking oil. By using alcohol-based chemical processing, these raw materials are converted into ethyl ester or methyl ester, which have properties similar to regular mineral diesel. Biodiesel can then be mixed with the latter, saving on the import of some oil products and, thanks to this, biodiesel production provides the country with a means of achieving a greater degree of security over its energy supplies.

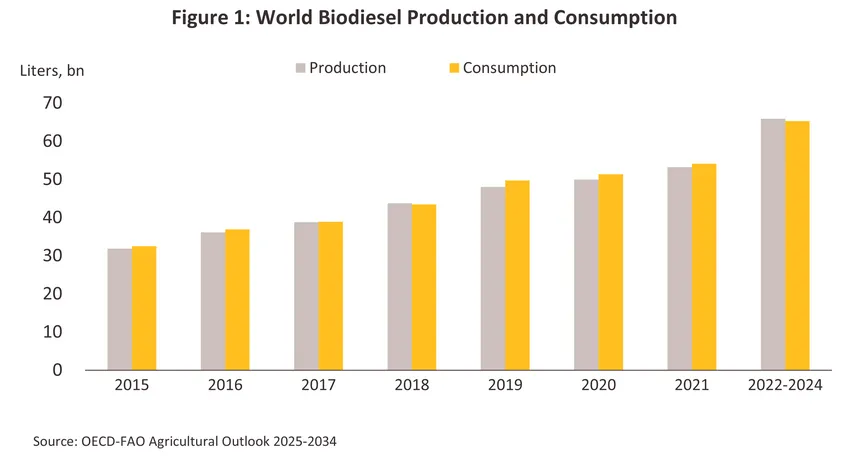

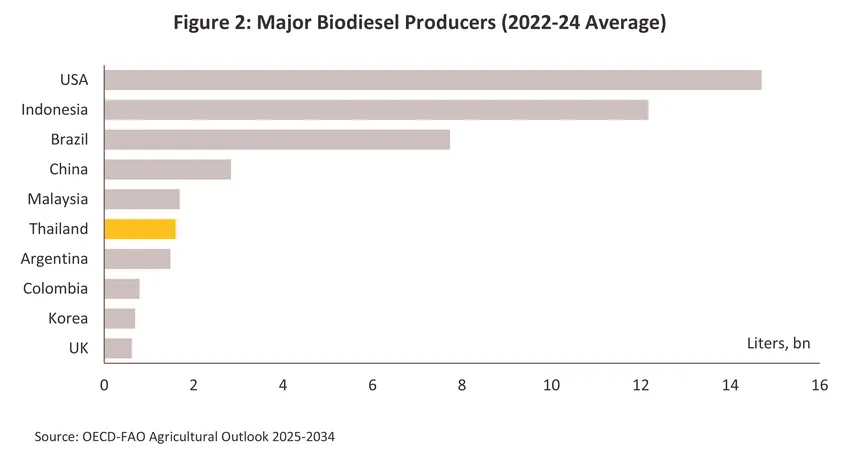

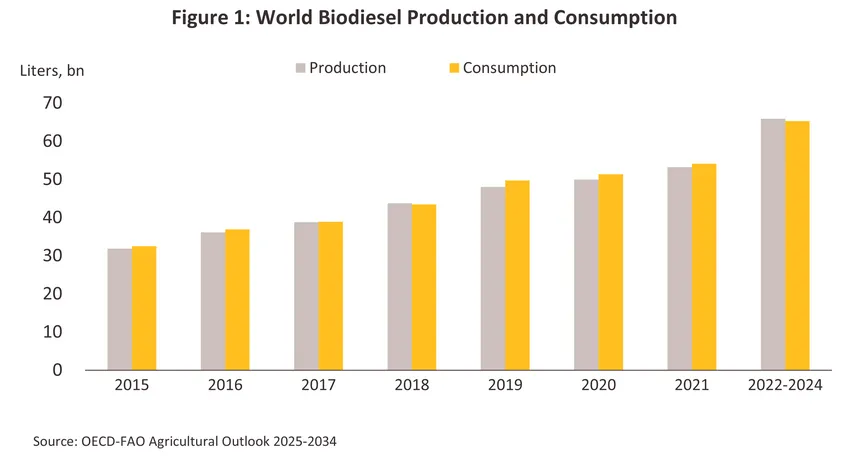

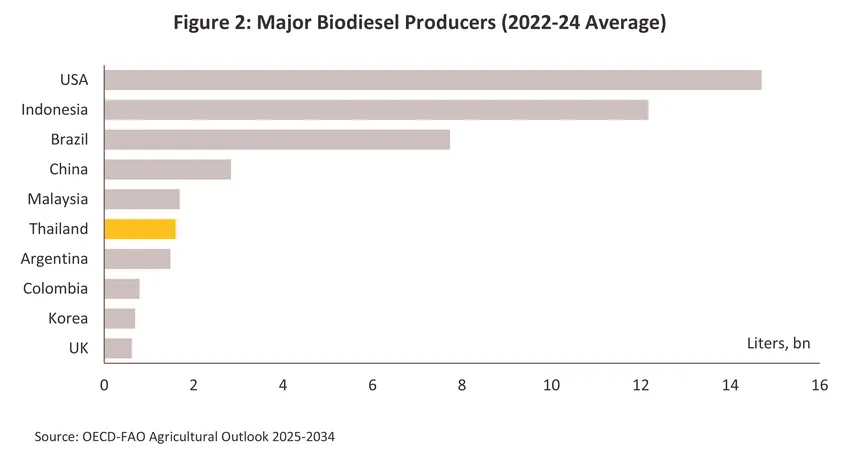

Globally, both demand and production of biodiesel have been increasing steadily, and between 2015 and 2022-24, world consumption rose from 32.4 to 65.3 billion liters (or average growth of 7.8% per year) (Figure 1), with biodiesel now widely used in Europe, the United States, Canada, Latin America, Australia, Japan, and some other Asian countries. At the same time, production rose at a slightly slower though still rapid annual rate of 8.3%, output jumping from 31.9 to 65.9 billion liters over the same period. The United States, Indonesia and Brazil are the world’s largest producers (Figure 2), with this biodiesel typically produced from rape seed, sunflower, coconut, soy bean, oil palm and jatropha. As for Thailand, the country currently sits in 6th place in the global production rankings, using crude palm oil as the primary input.

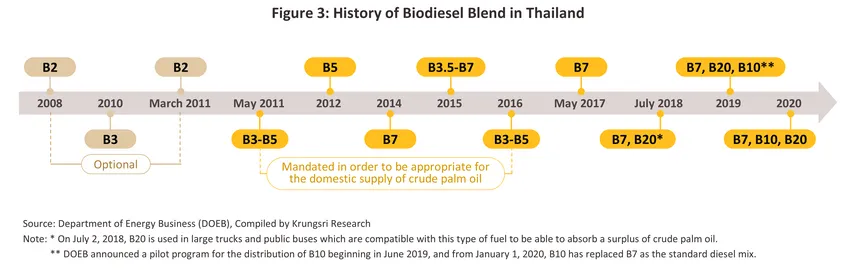

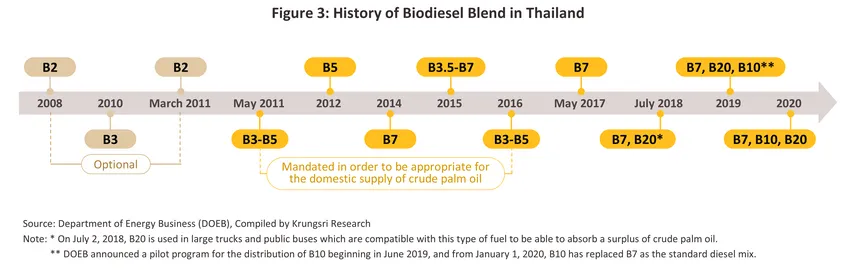

The production of biodiesel for mixing with standard diesel began in Thailand in 2007, although at first, this was restricted to a 2-3% mix (or B2). This then increased to 5% (B5) in 2011, 7% (B7) in 2014 and 10% (B10) in 2019 (Figure 3). Naturally, this steady increase in the proportion of biodiesel mixed in standard diesel has fed a rise in demand for biodiesel overall, but the government has adapted the mix to the quantity of oil palm available on the domestic market and when there have been shortages, the mix has been reduced. Thus, in 2016, the mix was cut from 7% to 5% in July and then again to 3% in August as the market tightened and the government tried to maintain stability and prevent a shortage of palm oil, but as supply improved, the mix was increased again, rising to 5% in November of the same year. Thai biodiesel production is almost entirely consumed domestically, while imports of biodiesel need to be approved by the Department of Energy Business.

Government support for the industry is laid out in the Alternative Energy Development Plan, or AEDP, and this is extremely important in determining how the biodiesel sector develops, particularly with regard to ensuring that the domestic supply of oil palm is sufficient to cover demand from the industry and that investment is promoted. The sector has thus been the recipient of investment support policies carried out under the auspices of the Board of Investment (BOI), and for investors in biodiesel production, this has included an 8-year exemption from corporate income tax, a 5-year 50% reduction in tax on profits, and the waiving of import duties for machinery used in biodiesel production.

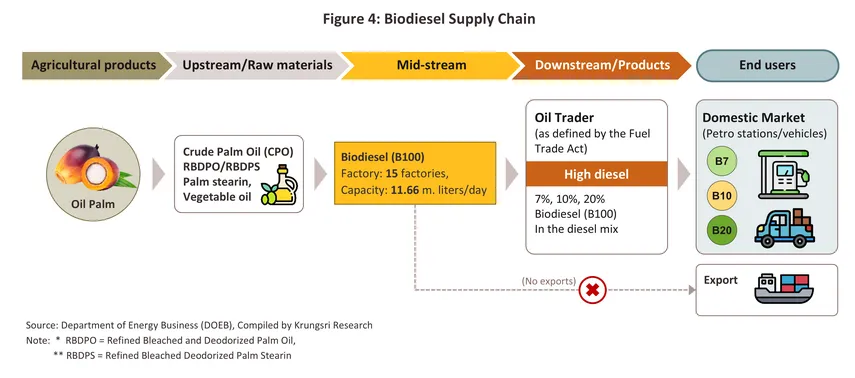

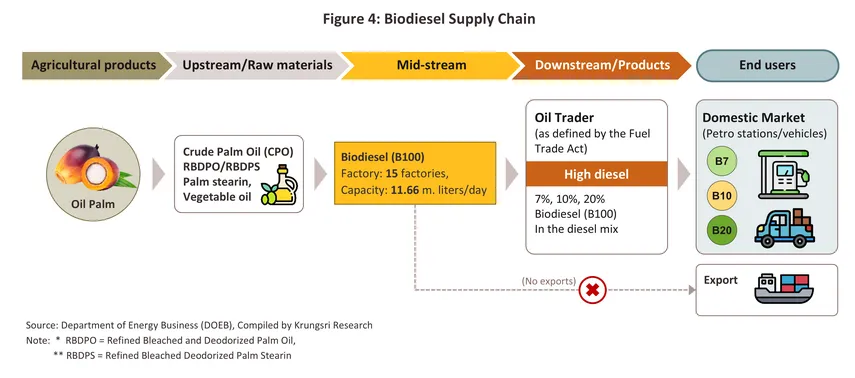

In Thailand, biodiesel is mostly produced from crude palm oil (CPO), although Thai manufacturers also use refined bleached and deodorized palm oil (RBDPO), palm stearin and other vegetable oils (Figure 4). In 2024, a total of 6.3 million rai was given over to oil palm production, and this yielded 18.6 million tonnes of raw oil palm, which in turn produced 3.3 million tonnes of CPO. Of this, 1.05 million tonnes, or 31.8% of all national production of CPO, was directed to biodiesel refiners, with the rest going to household consumption.

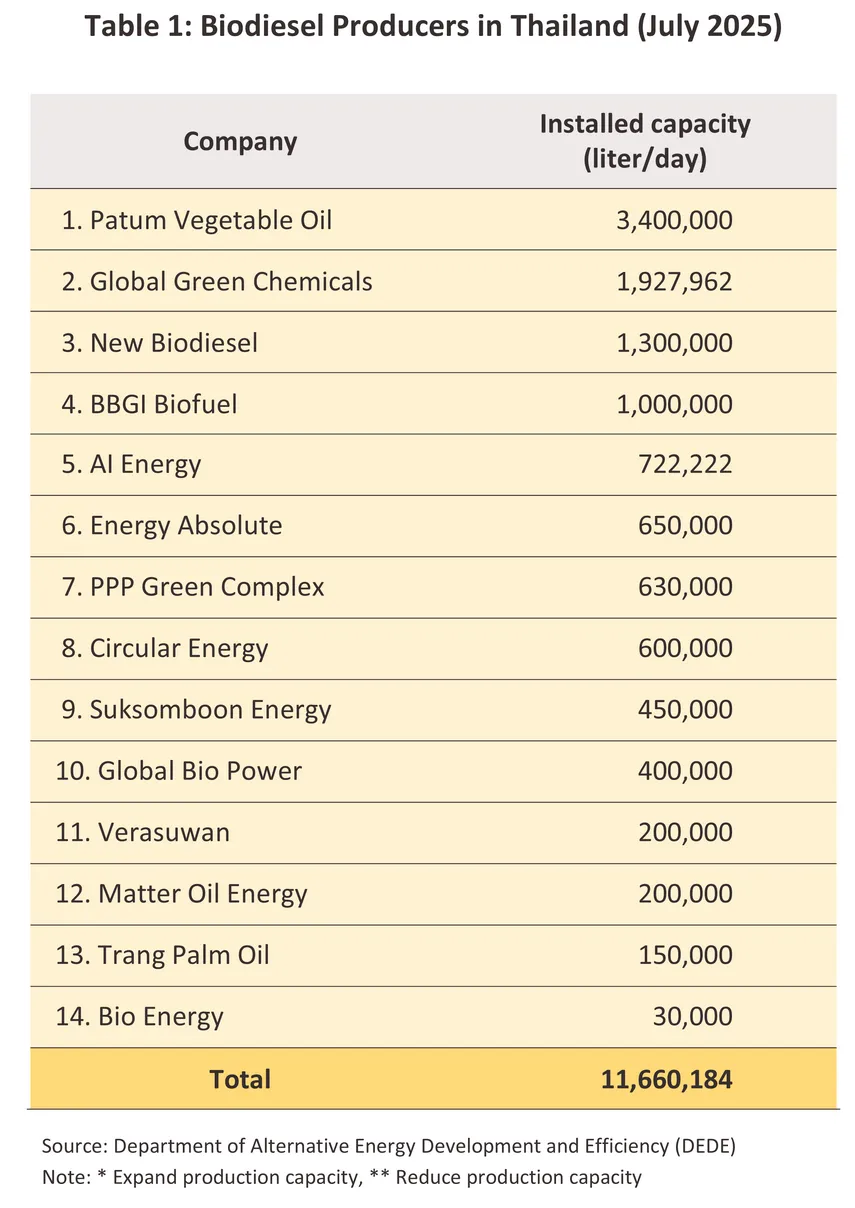

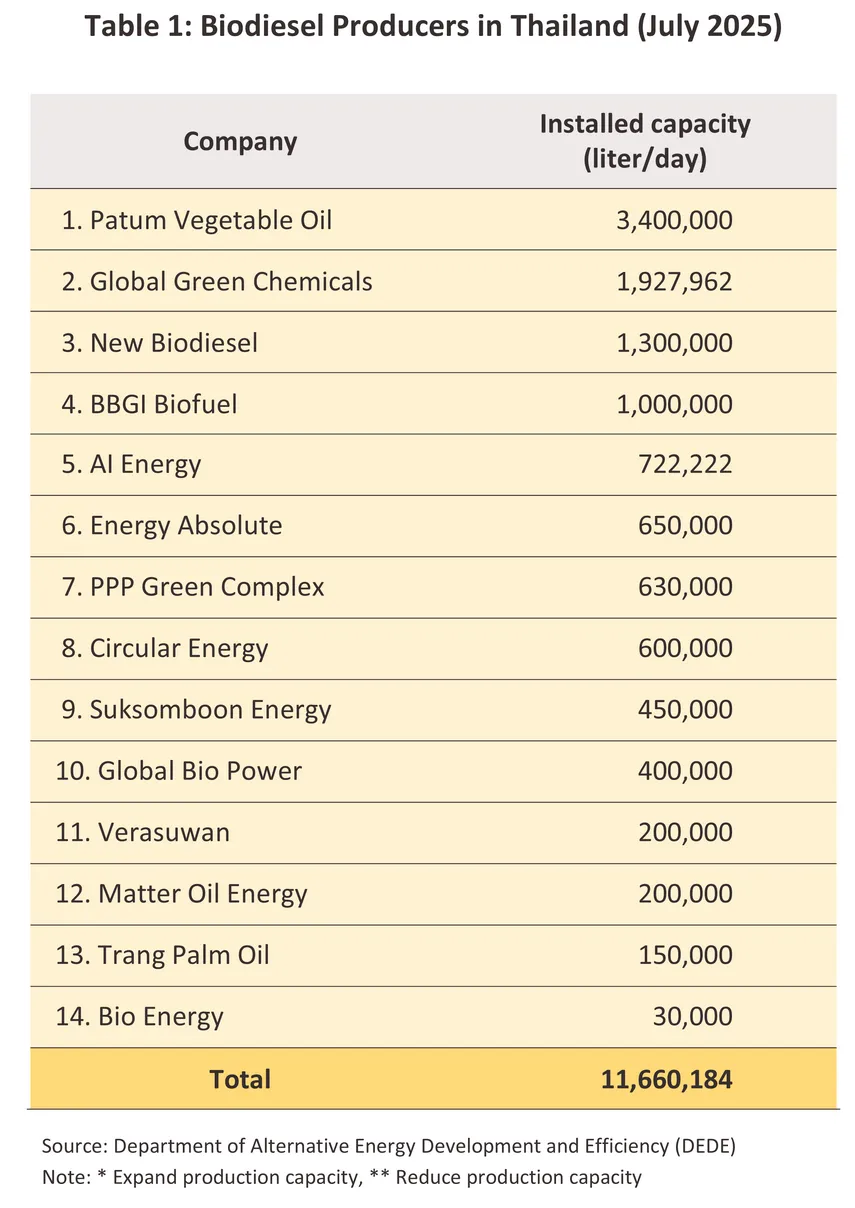

The relatively low number of players active in the industry means that the biodiesel market is not affected by high levels of competition, and as of July 2025, there were only 15 biodiesel producers registered with the Department of Energy Business, the majority of which are downstream companies that are part of commercial groups active in growing palm oil, oil refining or petrochemicals. These have a combined production capacity of 11.7 million liters per day, down from 11.9 million liters per day in 2024. In order of capacity, the most important players are Patum Vegetable Oil, Global Green Chemicals, New Biodiesel, Bangchak Biofuel, and Energy Absolute (Table 1). Their output is consumed primarily by the domestic market, while community-level small-scale biodiesel production1/ is mostly used by the agricultural sector in the north, northeast and south of the country.

For manufacturers, the largest share of production costs goes to raw materials, in this case usually CPO, which accounts for some 70% of the total. Chemical inputs run to another 20%, and the remaining 10% goes to operating costs. As set out in the 2000 Fuel Trade Act, the domestic price of pure biodiesel is determined by the Committee on Energy Policy Administration, and this is used as the reference price2/ in trade by distributors and refineries.

Operators’ profits are determined by two major factors: (i) government policy towards alternative energy3/ and the setting of a biodiesel mix that matches demand with the supply of raw materials4/, and (ii) the difference between the sale price and the cost of inputs. (Oil refineries and traders may have a stronger negotiating position than biodiesel producers and so they may be able to set purchase prices at a level that diverges from the reference price.)

Situation

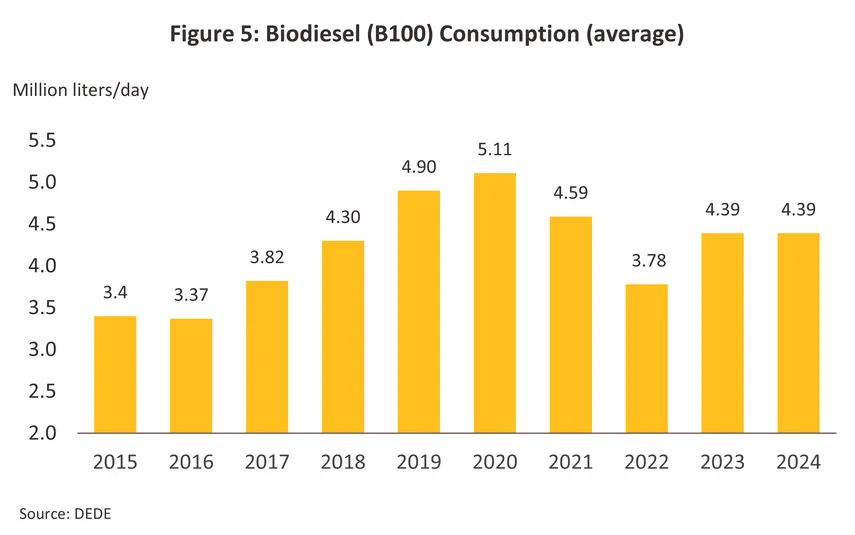

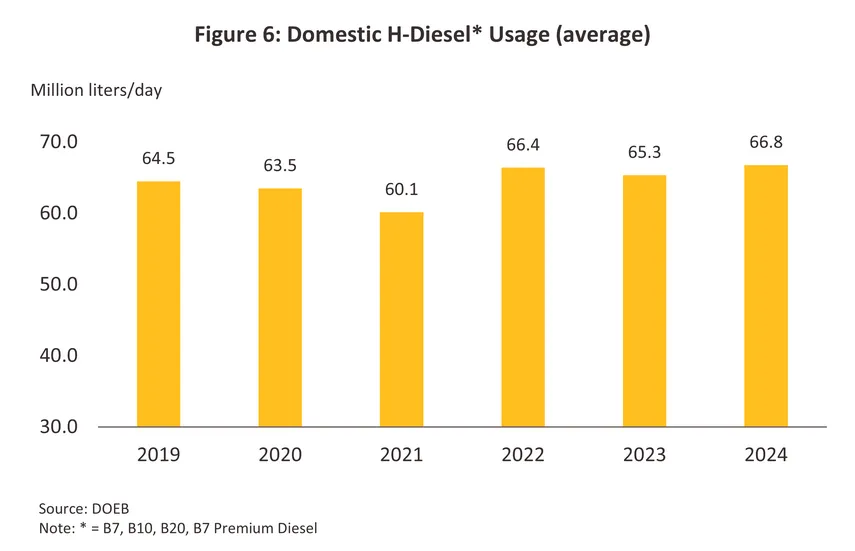

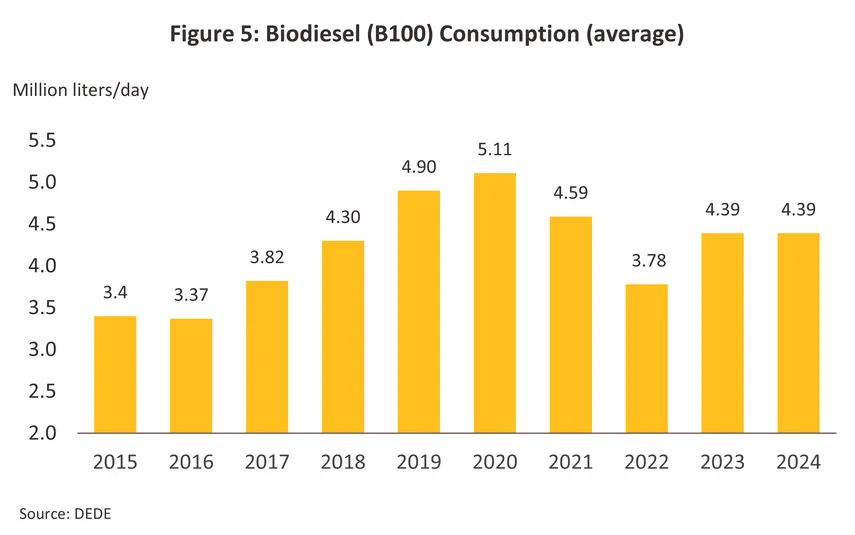

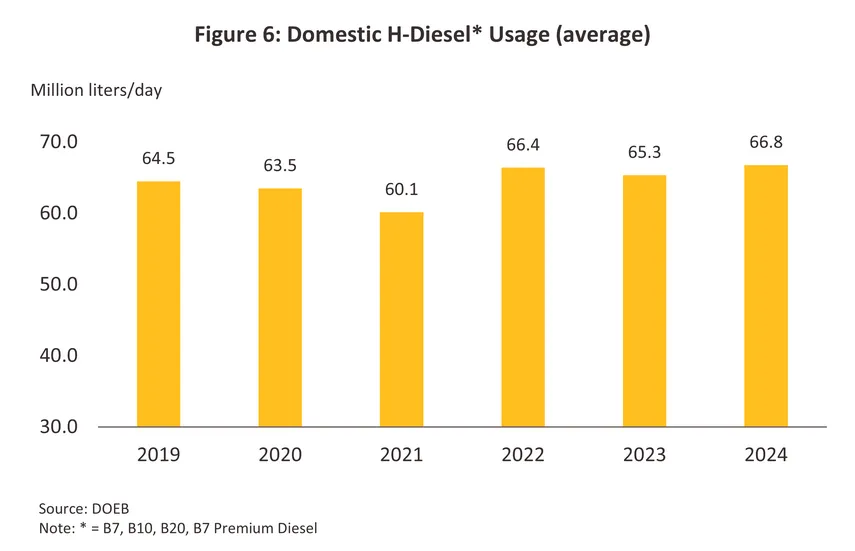

In 2022, the biodiesel industry faced challenges from the severe COVID-19 pandemic, which caused disruptions in economic and social activities. As a result, the government reduced the biodiesel blending ratio in B7 diesel fuel to only 5% (B5) before increasing it back to 7% (B7) in October 2022 to absorb the excess crude palm oil stock. This increase followed a rise in crude palm oil production, driven by prices that incentivized farmers. Meanwhile, B20 remained in use for large trucks, which caused biodiesel consumption to drop to only 3.8 million liters, compared to the peak level of 5.1 million liters in 2020. However, the gradual reopening of the country to foreign tourists in the second half of the year and the resumption of various activities increased the demand for high-speed diesel fuel by 10.4% compared to 2021. This pushed biodiesel consumption up again in 2023 to 4.4 million liters per day, an increase of 15.8% from 2022 (Figures 5 and 6). Meanwhile, the average biodiesel price throughout the year stood at 34.1 baht per liter.

In 2024, biodiesel consumption was strongly supported by the recovery of the tourism sector, which led to an increase in travel. Meanwhile, the growth of the e-commerce business resulted in higher usage of commercial transport vehicles, reflected in a 2.3% increase in high-speed diesel fuel consumption compared to 2023. However, biodiesel prices continued to rise during the last quarter of the year due to reduced palm oil production caused by hot and dry weather conditions (from late 2022 through May 2023), as well as flooding in several areas of the southern region. These factors affected the harvesting and transportation of oil palm. Additionally, demand for palm oil increased as a substitute for soybean oil, which had higher prices. These factors drove crude palm oil (CPO) prices up to THB 40-45 per kilogram, compared to an average price of THB 30-33 during the previous three quarters. Meanwhile, palm oil stocks decreased to 200,000 tons, resulting in an average annual CPO price increase of 13.4% from 2023, reaching THB 35.5 per kilogram. This pushed biodiesel prices even higher, reaching 1.5 times the refinery price of diesel fuel (B0) in July and 2.5 times in late October, causing an increase in domestic high-speed diesel production costs.

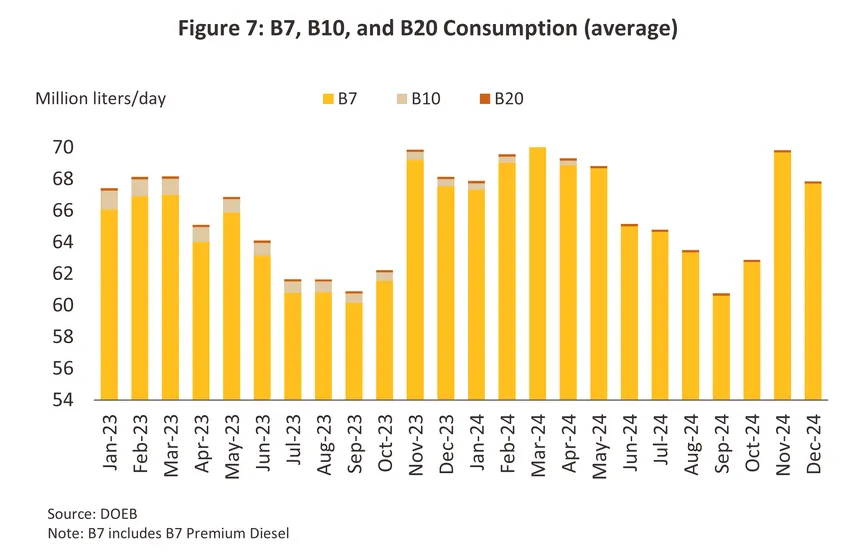

To alleviate the impact on the cost of living for the public and reduce the subsidy burden on the Oil Fund, the government has mandated a reduction in the biodiesel blending ratio in B7 diesel fuel to no less than 5% (B5), down from 7% (B7), effective November 21, 2024. This measure has resulted in a decrease in CPO usage in the energy sector by approximately 28,000 tons per month, while the production cost of high-speed diesel fuel has been reduced by about 0.46 baht per liter. The biodiesel situation in 2024 can be summarized as follows:

-

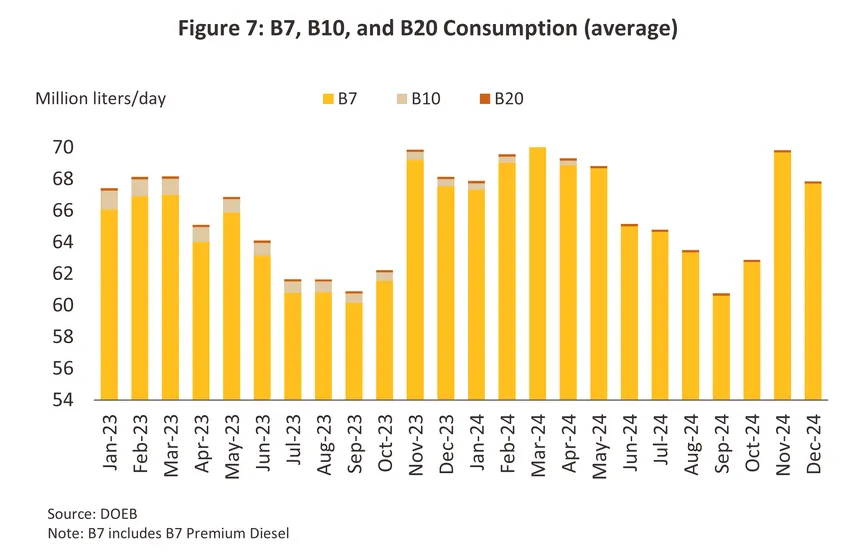

The average consumption for pure biodiesel (B100) was 4.4 million liters per day, similar to the level in 2023 but down by -10.5% compared to the pre-COVID-19 period in 2019. Meanwhile, the volume of B7, B10, and B20 diesel fuel sold at service stations averaged 66.8 million liters per day, representing a 2.2% increase from 2023 (Figure 7).

-

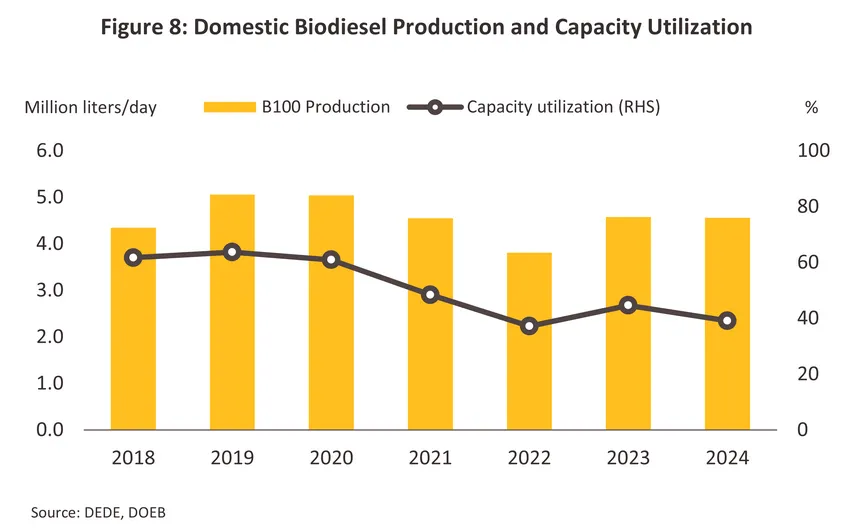

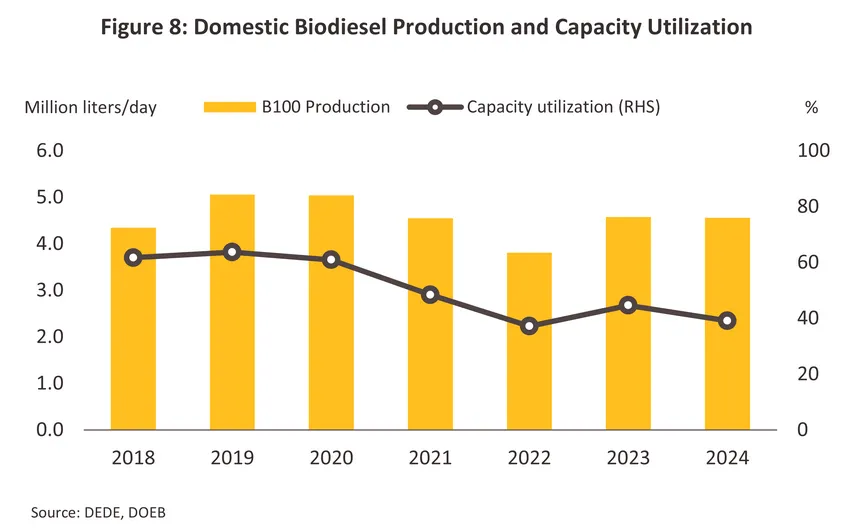

Biodiesel production decreased slightly by -0.4% from 2023, averaging 4.6 million liters per day. The main reason was stable biodiesel consumption, combined with accelerated production in 2023 due to a drop in CPO prices caused by high output. This is reflected in the biodiesel industry’s capacity utilization rate, which stood at 44.6% before declining to 39.1% in 2024, consistent with the reduced market demand in the second half of the year. Meanwhile, palm oil stocks at the end of December totaled 204,194 tons, down -28.9% from 2023 (Figure 8).

-

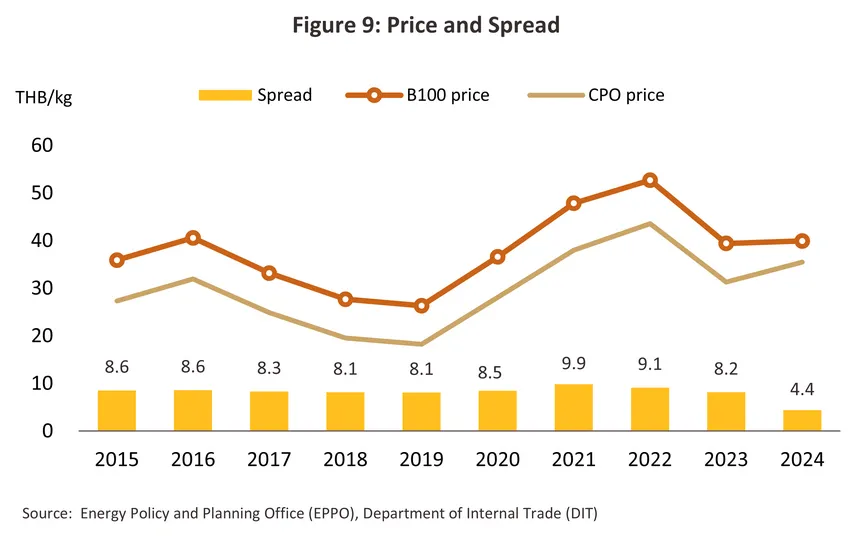

The reference selling price from biodiesel producers (B100) to fuel traders averaged THB 37.7 per kilogram, an increase of 10.5% from 2023, in line with the rising price of CPO, as well as palm stearin (+12.9%). The drought caused a reduction in the palm oil extraction rate. Additionally, crude palm oil exports increased by 3.3% from 2023 due to reduced supply from Malaysia, a major global exporter, caused by drought and labor shortages. Meanwhile, demand from trading partner countries remained steady. The higher average CPO price caused the spread between the reference selling price of biodiesel (B100) and the CPO price to shrink sharply by -45.8%, reaching a record low of THB 4.4 per kilogram (Figure 9).

Outlook

In 2025, biodiesel consumption is expected to continue declining due to the slow recovery of domestic purchasing power amid signs of a weakening Thai economy, especially in the tourism and related service sectors. This is reflected in a -7.2% YoY decrease in the number of foreign tourists during the first eight months of the year. Private consumption is forecasted to grow by only 2.4%, slowing down from 4.4% the previous year. Furthermore, global trade conditions remain highly uncertain due to U.S. tax policies. These factors have partially reduced travel demand and economic activities. Coupled with the government maintaining the biodiesel blending ratio at B5, the demand for CPO for biodiesel production remains limited, putting downward pressure on CPO prices since the second quarter, coinciding with the harvest season when palm oil supply enters the market. The biodiesel situation can be summarized as follows:

-

In the first half of the year, the average price of CPO increased by 15.0% YoY, while biodiesel prices rose by 14.1% YoY. However, CPO prices gradually declined in the second quarter to an average of THB 32.8 per kilogram, down -25% QoQ, causing the average price of biodiesel (B100) to fall to THB 40.9 per liter, a -23% QoQ decrease. Meanwhile, the average biodiesel demand was 3.5 million liters per day, down -24.6% YoY, resulting in record-high accumulated CPO stocks during the period from the second quarter to early third quarter, reaching 475,865 tons.

-

In the second half of the year, the Thai economy is expected to slow down compared to the first half. However, the year-end festival season is likely to boost tourism and economic activities, increasing the demand for high-speed diesel fuel for travel and freight transportation. Additionally, the government has signaled an increase in the biodiesel blending ratio (B100) from 5% to 7% to support crude palm oil prices and assist farmers. As a result, biodiesel consumption in 2025 is projected to average 3.6 million liters per day, a decrease of -18% from the previous year.

For 2026–2027, Krungsri Research forecasts that biodiesel consumption will remain stable or improve slightly, averaging 3.7 to 3.8 million liters per day, representing an average annual increase of 1.5–2.5% (Figure 10). This growth is supported by the following factors:

-

The Thai economy is expected to recover slowly, growing at an average rate of about 1.5–2.5% per year, driven by tourism growth (with the number of tourists projected to increase to 38 million by 2027), leading to higher travel demand.

-

The continued growth of the e-commerce business, with e-Conomy SEA 2024 forecasting that Thailand’s e-commerce market value will increase to USD 60 billion by 2030, up from USD 26 billion in 2024, representing an average annual growth of 15.0%. This will support increased demand for commercial transport vehicles, especially pickup trucks.

-

The accumulated number of diesel engine vehicles is expected to increase by an average of 3.0–4.0% per year, benefiting from the La Niña phenomenon (2025–2026), which supports agricultural planting. This is expected to lead to higher agricultural output, including crude palm oil production, which is projected to grow by 2.5–3.5% per year, thereby boosting the demand for pickup trucks to transport agricultural products.

-

Government support policies include (i) increasing the biodiesel (B100) blending ratio in diesel fuel to B7, expected to take effect by the end of 2025, and (ii) the draft Fuel Action Plan 2024–2037 (Oil Plan 2024), which sets the initial biodiesel blending ratio at 6.6–7.0%. This level is approved by automakers under the Euro 5 standard. In the next phase, once all automakers provide additional certification, the blending ratio can be increased within a range of 5.0–9.9%, depending on price and palm oil stock conditions at each time.

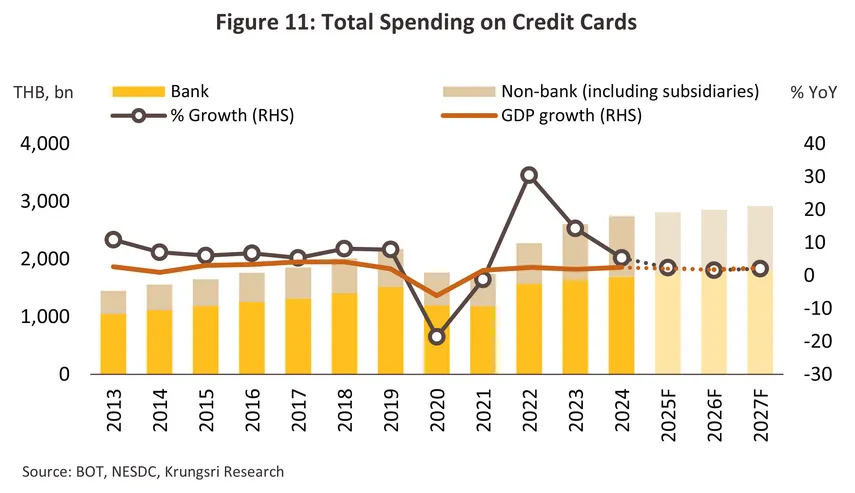

The above factors are expected to result in an average annual increase of 1.0–2.0% in domestic diesel fuel consumption, with B7 diesel usage rising to 67–68 million liters per day compared to 66.5 million liters in 2024. Additionally, the government has designated B7 as the primary diesel fuel and is likely to permanently phase out B20 diesel. This is reflected in oil retailers gradually reducing or discontinuing B20 sales since 2022. Data from the first quarter of 2025 shows a significant decrease in B20 usage, averaging only 34,000 liters per day. The increasing demand for biodiesel blending in diesel fuel is expected to keep the biodiesel industry's capacity utilization rate at around 39.0–40.0% of total production capacity, compared to 39.1% in 2024 (Figure 11), indicating a continued issue of excess production capacity.

In the future, opportunities for the industry will come from blending biodiesel with very low sulphur fuel oil (VLSFO) to produce biofuel for vessels (Bio-VLSFO). Currently, this biofuel is made by blending VLSFO with oil derived from used vegetable oils and serves as an alternative fuel for marine transportation worldwide. However, used vegetable oil is also used to produce sustainable aviation fuel (SAF), which may result in insufficient supply to meet future demand. If palm biodiesel gains sustainability recognition, it could be efficiently used to produce Bio-VLSFO. Shipping operators are required to blend biofuels at a ratio between 17.6% and 23.3% with their fuels by 2028. In Thailand, some private companies are already commercially producing B24-VLSFO (blended with 24% biodiesel). The Department of Energy Business forecasts that the global market share of B24 VLSFO5/ will increase to 29.2% of the fuel used by international cargo ships by 2030, up from 8.3% in 2025.

Challenges facing the biodiesel industry include (1) slower economic growth in Thailand compared to the pre-COVID-19 period due to structural issues and a slower-than-expected recovery in the tourism sector, coupled with uncertainty from the US reciprocal tariff policy impacting Thailand and its trading partners, especially China. (2) Additionally, diesel fuel prices blended with biodiesel are expected to rise as biofuel price subsidies from the Fuel Fund are phased out by 2026, and the planned increase in biodiesel blending ratios (from the current B5) will further push prices higher, affecting demand. (3) Furthermore, managing biodiesel production costs is complicated by intermittent shortages of CPO, leading to periodic price increases, particularly after Indonesia, the world’s largest palm oil producer, increased its export tax on palm products from 7.5% to 10% effective May 17, 2025, to support raising biodiesel blends from B35 to B40 in 2025 and B50 in 2026. Malaysia is expected to follow suit, with the World Bank projecting a 2% increase in CPO prices in 2026.

In the long term, it is necessary to monitor the growth direction of electric vehicles, which may impact the consumption for biodiesel. The Ministry of Energy aims to produce zero-emission vehicles (ZEVs), such as electric vehicles and hydrogen-powered vehicles, to account for 30% of total vehicle production by 2030. Additionally, the ministry plans to promote the installation of electric charging stations nationwide, including installing 12,000 public fast-charging outlets and establishing charging stations at 2,239 service stations between 2025 and 2027 to support the use of electric vehicles. This may result in a slowdown in the consumption of oil, including biodiesel.

1/ There are over 70 such community production centers across the country. The majority of these are teaching centers or organizations that promote the production and use of biodiesel by local communities.

2/ The regulations for specifying the biodiesel price reflect the real costs of production by considering the costs of 3 main inputs: crude palm oil (CPO), refined bleached and deodorized palm oil (RBDPO), and palm stearin.

3/ The Alternative Energy Development Plan (2018-2037), or AEDP 2018.

4/ The Department of Energy Business is responsible for setting the proportion of biodiesel in the diesel mix in line with the amount of palm oil available after household consumption has been taken into account.

5/ B24 is a marine biofuel composed of 24% methyl ester (UCOME), which is synthesized from used cooking oil classified as waste, blended with very low sulfur fuel oil (VLSFO) containing no more than 0.5% sulfur. This type of fuel is notable for its low emissions and can directly replace fossil fuels without requiring modifications to ship engines or fuel infrastructure.

.webp.aspx)