EXECUTIVE SUMMARY

Over 2023 to 2025, strengthening economic conditions both at home and in export markets will help improve the outlook for the Thai sugar industry, especially in 2024 and 2025. Consumption will be lifted by the recovery in the tourism sector, which will add to demand from downstream industries like food and beverage manufacturers. On the other side, output will benefit from improved sugarcane outputs, thanks to the favorable climatic conditions and the positive effect of price guarantees on the total area of sugarcane under cultivation. Nevertheless, the Thai sugar industry will be impacted by increased Brazilian output, which is adding to the global sugar glut, and this will likely depress prices. In addition, the ratcheting up of Thailand’s sugar tax and the introduction of similar measures in other countries will add to growing consumer concerns with personal health, and this may then drag on demand. Likewise, uncertainty continues to surround government regulation of the industry, especially the reform of the Sugarcane and Sugar Act and the potential impacts of this on operators’ ability to generate profits.

Krungsri Research view

Players will see their incomes strengthen over 2023-2025 on an overall rise in the volume of sugar distributed to the market, although Thailand’s heavy reliance on export sales will expose the industry to the risk of fluctuation.

-

Sugar mills: Income will grow in the coming period with rising consumption, the latter supported by: (i) economic growth that will strengthen purchasing power in the domestic market and markets abroad, especially over 2024-2025; (ii) recovery in downstream industries (most notably for food and beverage manufacturers) as the COVID-19 pandemic fades; (iii) continuing worries about infection that will sustain demand for disinfectant alcohol; and (iv) a rebound in activity across the economy that will create an uptick in the transport sector, and with this, demand for ethanol will rise. Additionally, the industry also benefits from its strong and secure supply chains, its ability to develop a wide variety of products, and ongoing investment in high-value downstream industries that involve the commercial exploitation of waste and byproducts arising from the sugar milling process. Although this will help players remain profitable, operators are exposed to risk arising from changes to the industry’s profit-sharing scheme and the possible reclassification of molasses as a sugar processing by-product.

-

Traders: Traders selling into export markets are expected to benefit from increasing sales, but they may also face greater risks arising from price variability and uncertainty over global supply. Traders on the domestic market will also have to contend with more unpredictable market conditions now that domestic prices are moving with those on global exchanges, and this will mean that they may have to absorb higher stock management costs.

-

Sugarcane growers: Improved climatic conditions should raise yields and boost the sugar content of Thai-grown sugarcane, but farmers may have to contend with greater price volatility as domestic prices move with those set on world markets. In addition, farmers are in a weak bargaining position relative to sugar mills, while production costs are rising with more expensive cost of energy, fertilizer, pesticides and herbicides, and labor, especially during the “fresh sugarcane” harvesting period. This will then impact net profits and may negatively affect future planting decisions.

Overview

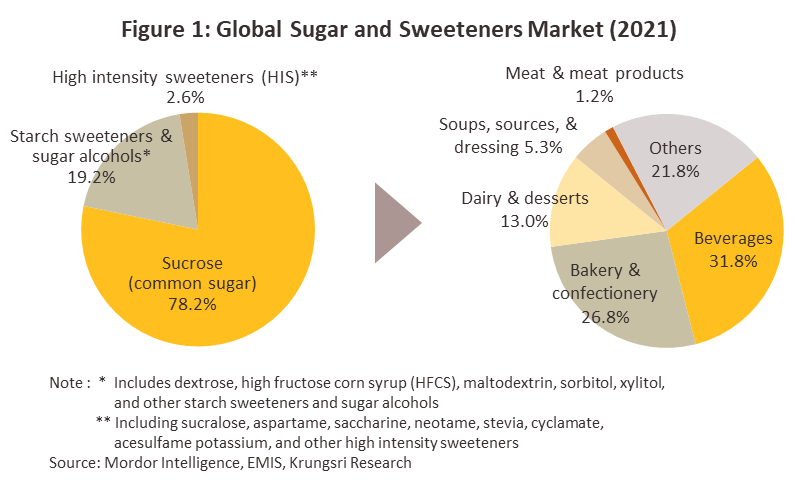

Sugar is a plant-derived product that is used worldwide as a sweetener1/. Global demand for sugar remains strong, with sugar consumed both directly and indirectly, in the latter case as an additive or flavoring in a wide range of other products, including foods, beverages, processed dairy products (milk, butter, yogurt, etc.), candy, baked goods and so on. In 2021, 78.2% of all sweeteners2/ consumed globally were sucrose-based, with the remainder being accounted for by several non-nutritive products. These include natural items such as honey, stevia, and monkfruit (also called luohan guo), high-intensity sweeteners such as aspartame cyclamate and neotame, and starch sweeteners and sugar alcohols (e.g., maltodextrin fructo-oligosaccharides and inulin) (Figure 1).

Products derived from sugar processing can be split into the following.

-

Raw sugar: This is brown, though the color can range from light to dark, has moderate moisture and high molasses content, exhibits a tightly packed crystalline structure, and tends to contain large quantities of impurities and residues. Raw sugar is subject to further processing, and this then results in white sugar, refined sugar and other sugar-derived products including ethanol, alcohol, and bioplastics. This refining process is what converts raw sugar into a product fit for human consumption.

-

White sugar: This is obtained by removing impurities from raw sugar. White sugar is crystalline, colored white to pale yellow, has a low molasses and moisture content, and is loosely aggregated and more friable than raw sugar. White sugar is favored for domestic household consumption and is also used as a raw material in food and drinks processing.

-

Refined sugar: This goes through the same refining process as white sugar but has fewer impurities and tends to be in the form of clear white granules. Refined sugar is very pure, with zero molasses content, and very low or zero moisture content. Refined sugar is generally produced for household consumption and for industrial processes that require very pure sugars, such as making carbonated and energy drinks, and producing pharmaceuticals.

-

Byproducts of sugar refining: Byproducts or value-added products that arise from sugar refining include molasses3/, bagasse4/, filter cake5/, vinasse6/ and steam7/.

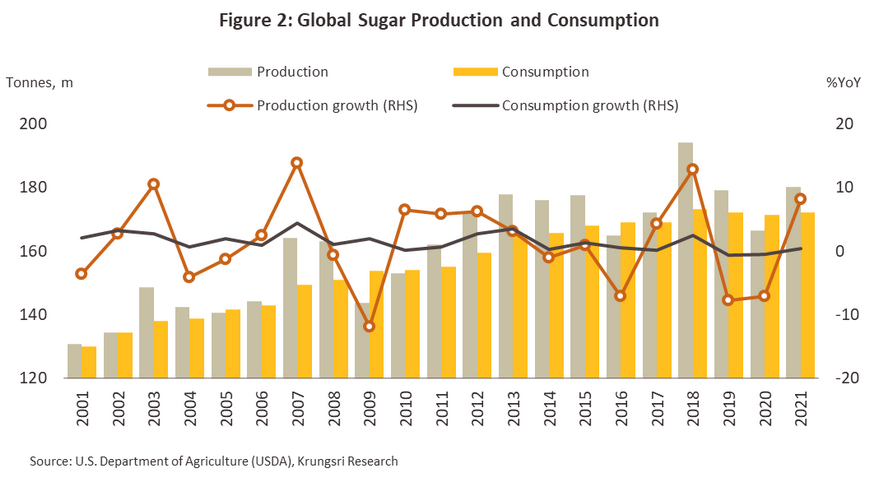

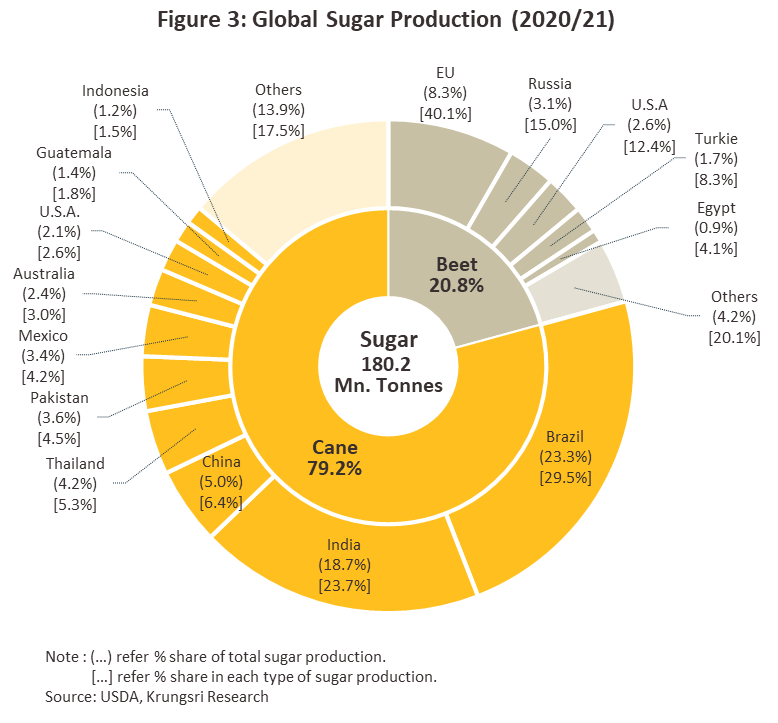

Over the two decades (2001-2021), global output and consumption of sugar climbed steadily (Figure 2) caused by the growth of the world’s population, which went from 6.2 billion in 2001 to 7.9 billion in 2021, which has led to increased demand for sugar by industrial consumers, especially for use by food and beverage manufacturers and producers of ethanol. In 2021, global sugar production topped out at 180.2 million tonnes (measured as raw sugar), with the biggest producers being Brazil (with 23.3% of global production), India (18.7%), the European Union (8.4%), China (5.9%), the US (4.7%), and Thailand (4.2%). Production can also be categorized according to the type of input used. (i) 79.2% of global output comes from sugar produced from sugarcane, with most of this grown in countries near the equator, including Brazil (the source of 29.5% of all sugarcane-produced sugar) and countries in the Asia-Pacific region, namely India (23.7% of all sugarcane-produced sugar), China (6.4%), Thailand (5.3%) and Pakistan (4.5%). (ii) The remaining 20.8% of the world’s supply of sugar comes from sugar beet, 40.1% of which originates in the European Union, with the EU followed in importance by Russia (15.0%), the United States (12.4%), Turkey (8.3%) and Egypt (4.1%) (Figure 3)

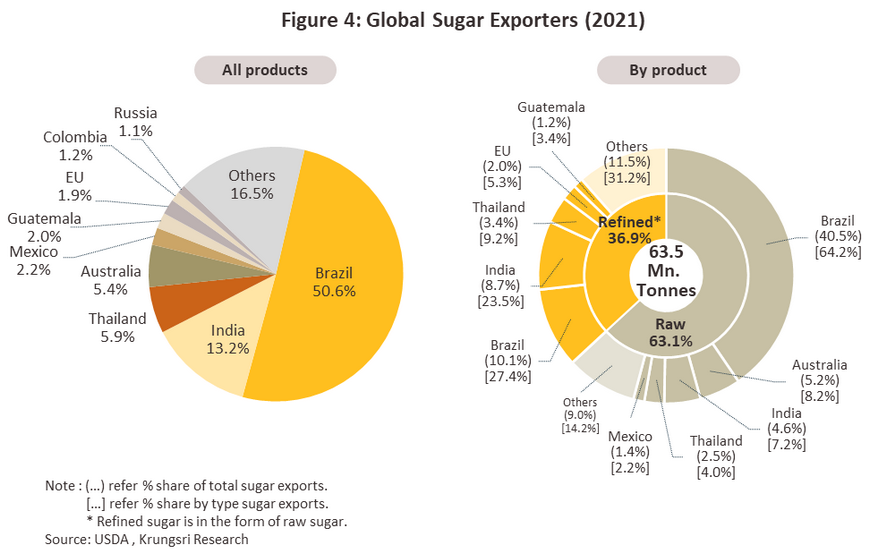

In 2021, 63.5 million tonnes of sugar (measured as raw sugar) were traded on world markets, this representing 35.2% of global production. The largest exporter, controlling over half of the market, is Brazil, followed by India (13.2%) and Thailand (5.9%) (Figure 4). By product type, exports are split between: (i) raw sugar (63.1% of all exports globally), for which Brazil is the main originator (64.2% of all exports of raw sugar), followed by Australia (8.2%), India (7.2%) and Thailand (4.0%); and (ii) refined sugar (36.9% of exports), for which the main exporters are Brazil (27.4% of exports of refined sugar), India (23.5%), Thailand (9.2%), and the European Union (5.3%) (Figure 4).

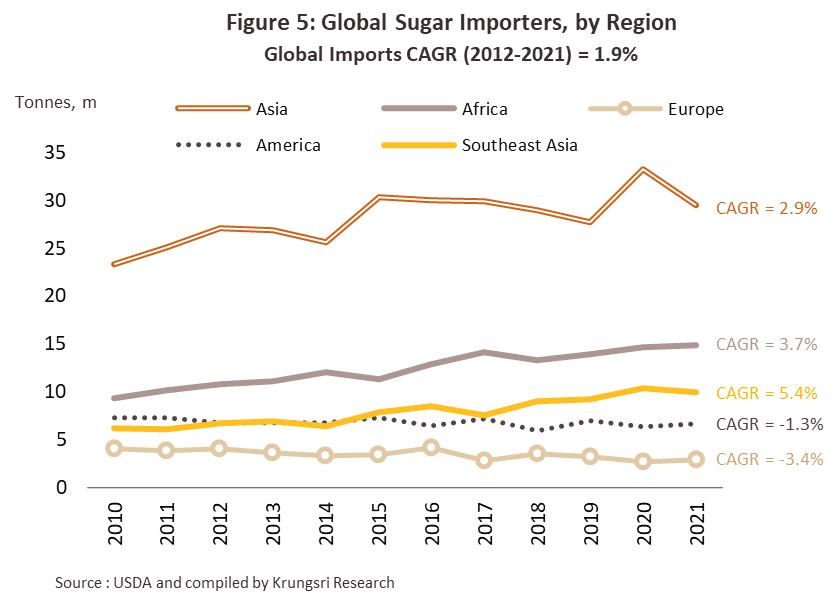

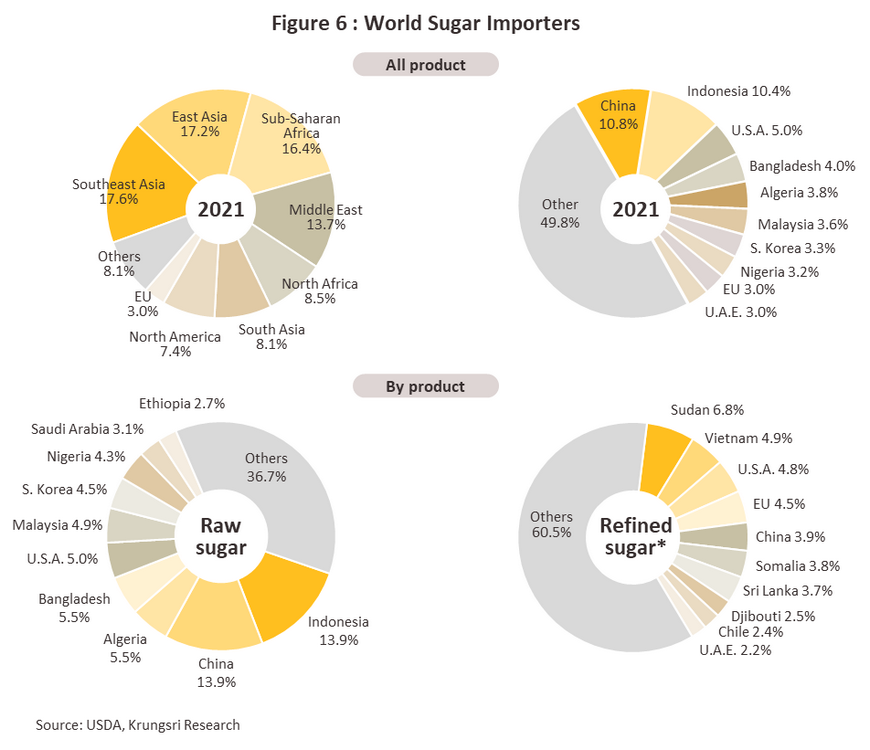

The world’s most important importers of sugar are in Asia, and China is the world’s leading market, buying 10.8% of all sugar traded on global exchanges (Figure 5 and 6). In order of importance after China are Indonesia (10.4%), the United States (5.0%), Bangladesh (4.0%) and Algeria (3.8%). Considered by type, for raw sugar, Indonesia is the world’s largest importer (13.9%), followed by China (13.9%), Algeria (5.5%), Bangladesh (5.5%), and the United States (5.0%), while for refined sugar, the biggest importers are Sudan (6.8% of all global sales of refined sugar), Vietnam (4.9%), the United States (4.8%), the European Union (4.5%), and China (3.9%).

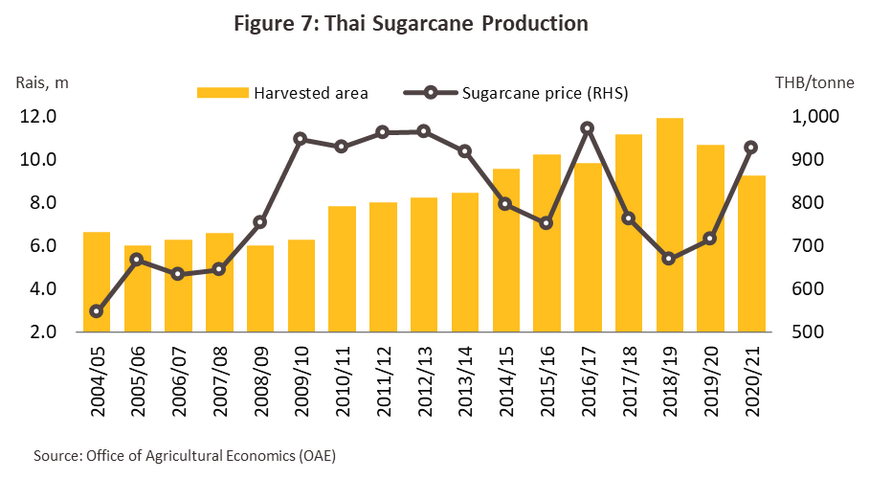

Sugarcane cultivation in Thailand expanded by almost half between 2010 and 2021, from 6.3 million rai to 9.3 million rai with an average annual increase of 3.6% (Figure 7). This rapid expansion in supply was spurred by a combination of attractive prices and steadily rising domestic and international demand from both consumer and industrial end-users, in the latter case most notably the food and drinks industries and dairy processors.

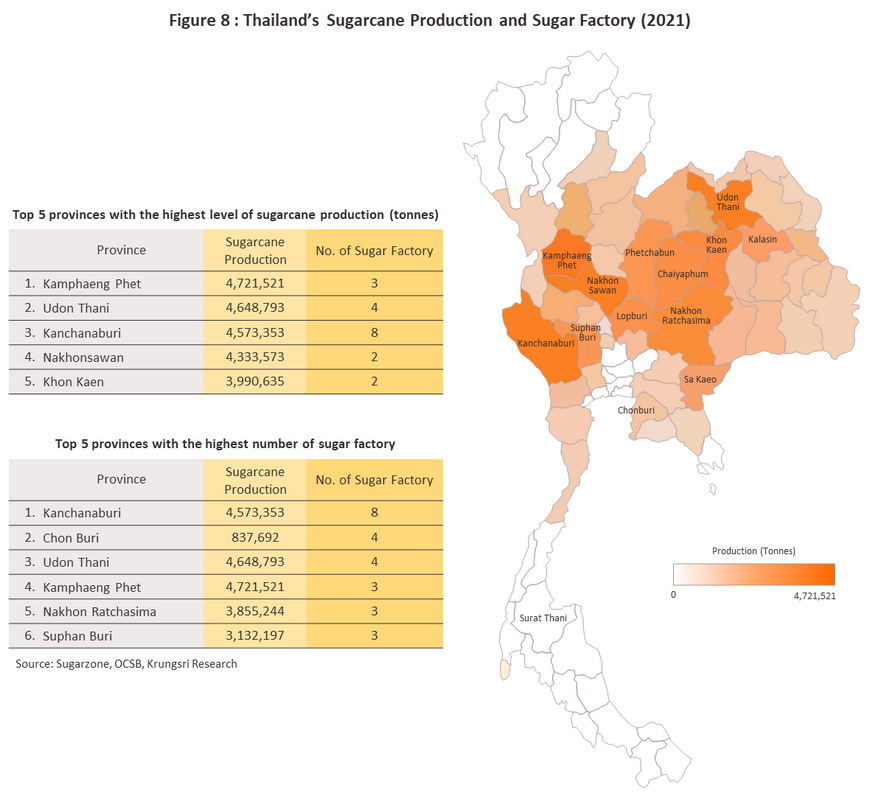

Within Thailand, cultivation of sugarcane is concentrated in the Northeast (40.9% of all sugarcane plantation area), followed by the North (28.8%), the West (15.1%), the Central Region (10.3%) and the East (5.0%). The most important sugarcane-growing provinces are therefore Kamphaeng Phet (7.5% of all Thai sugarcane farms), Nakhon Sawan (7.5%), Kanchanaburi (7.0%), Lopburi (6.3%), and Udon Thani (6.2%) (Figure 8).

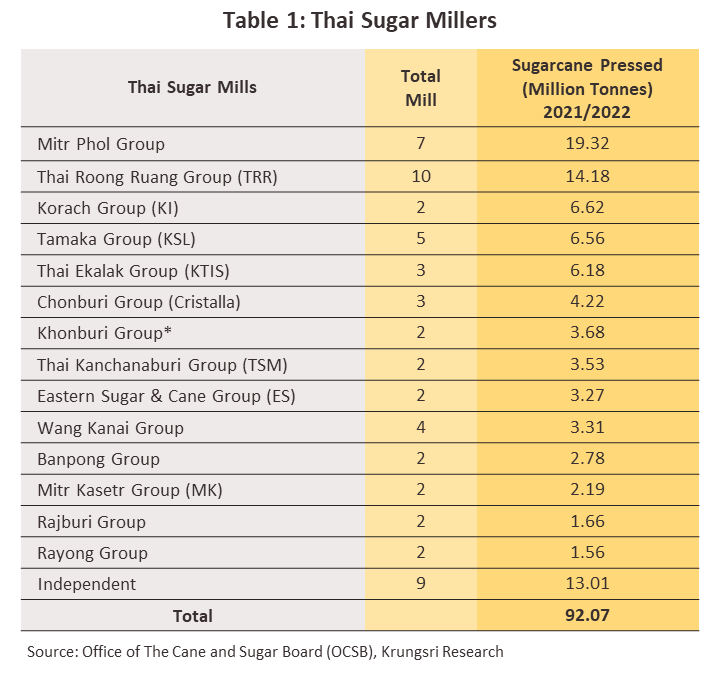

At present, there are 57 sugar mills in Thailand8/ (Table 1), the majority of which are located close to sugarcane growing areas since this: (i) facilitates the sourcing of inputs according to production plans; (ii) cuts transportation costs; and (iii) makes it easier to communicate with growers, or to offer them help and assistance. In addition, considerations related to logistics often have an influence on the location of mills, so they will often be close to urban areas, ports, and centers of trade. Thus, the greatest concentration of sugar mills is in Kanchanaburi, which is home to 8 mills, followed by Udon Thani and Chonburi, with 4 each.

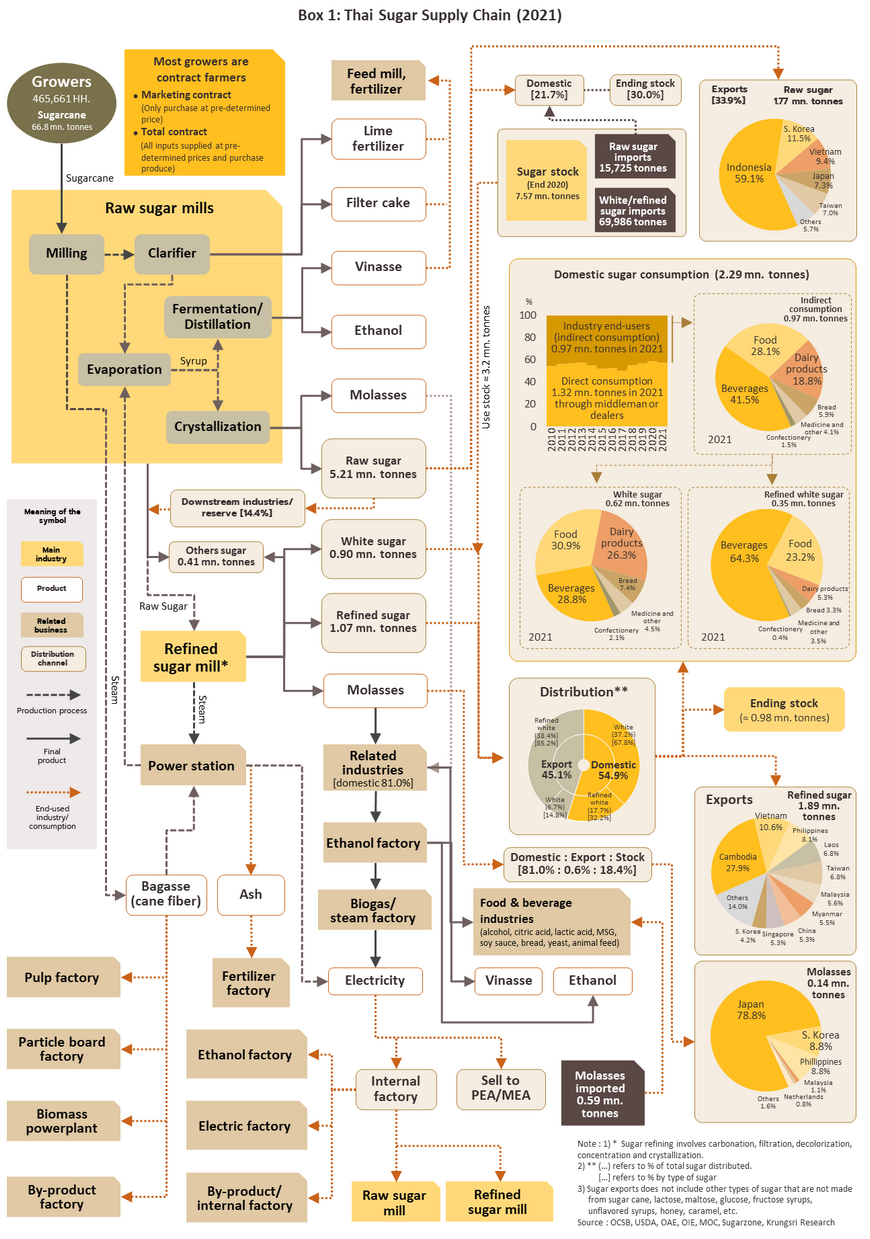

With 61% of output sold overseas, the Thai sugar industry primarily serves export markets, of which the most important are Indonesia (18.9% of Thai sugar exports), Cambodia (9.0%), Vietnam (6.2%), South Korea (5.0%), and Taiwan (4.3%). The state of export markets for the main product groups in 2021 is outlined below.

-

Raw sugar: Exports of raw sugar comprised 46.6% of all Thai sugar exports in 2021 or a total of 1.8 million tonnes. The main markets for this were Indonesia (59.1% of Thai exports of raw sugar), South Korea (11.5%), Vietnam (9.4%), Japan (7.3%), and Taiwan (7.0%).

-

White sugar: 1.9 million tonnes of white sugar were exported in 2021 (49.8% of sugar exports), for which the biggest markets were Cambodia (27.9%), Vietnam (10.6%), and the Philippines (8.1%).

-

Molasses: Molasses exports amounted to 3.6% of all Thai sugar exports in 2021 or 0.1 million tonnes. This was bought principally by the three countries of Japan (78.8% of Thai molasses exports), South Korea (8.8%) and the Philippines (8.8%).

Domestic consumption absorbed 39% of the industry’s output9/, split between 57.7% that was sold to the consumer market for household consumption and 42.3% that went to industrial buyers for use in beverage production (41.5%), food processing (28.1%), processed dairy products (18.8%), and others (11.6%).

Companies can generate income not only from the sale and distribution of sugar but also from the commercial exploitation of byproducts arising from the sugar refining process. These include molasses, which is now used to produce ethanol, and thanks to government promotion of ethanol use (mainly by specifying the proportion of ethanol to be mixed with gasoline to sell as gasohol)10/, demand for this is growing. Many sugar mills have also invested in downstream businesses that use byproducts of sugar milling as inputs, including biomass energy production11/ and the manufacturing and production of paper pulp, particle board, and fertilizer (Box 1).

Situation

The situation for the global sugar industry is described below.

-

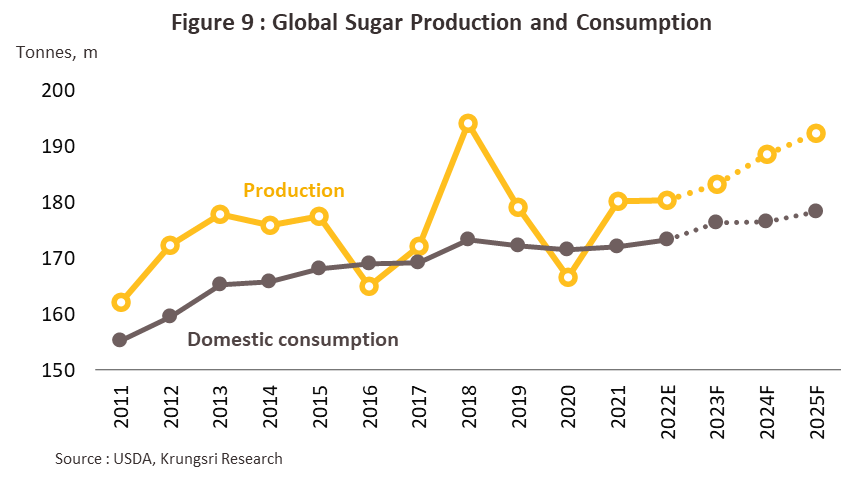

Global supply edged up just 0.1% to 180.4 million tonnes in 2022 (Figure 9). Growth was held back by the war in Ukraine and the hike in crude prices, which then encouraged major producers to hold back on exports as they focused on building domestic food and energy security. Brazil, in particular, (the world's largest producer), used a greater share of the sugarcane crop to produce ethanol as demand for alternative energy rose, while sugarcane outputs were also down as a result of drought and frost, and so sugar exports dipped accordingly. This led to a -15.7% drop in Brazil’s sugar production. However, the sugar supply from the next largest sugar producers, such as India, the European Union, and Thailand, still expanded thanks to favorable weather conditions and rainfall help limit the impacts on global supply.

-

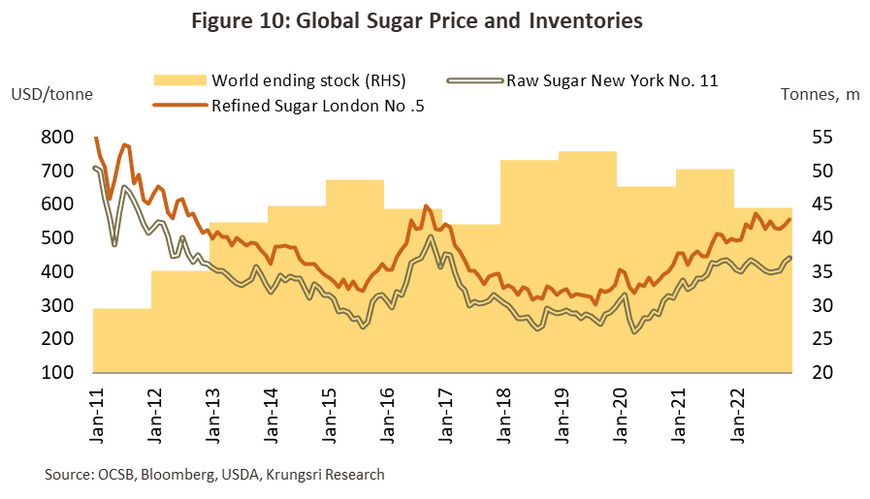

Global demand for sugar increased 0.6% to 173.2 million tonnes in the year (Figure 9), while world exports were up 6.8% to 67.8 million tonnes. With growth in demand outpacing that of supply, global stocks were drawn on to make up the difference and so these shrank -11.7% to 44.5 million tonnes (Figure 10). This drove up global sugar prices in December 2022 to their highest in almost 6 years. Thus, in the month, the New York No.11 and the London No. 5 sugar prices averaged respectively USD 441.4/tonne and USD 554.4/tonne. For all of 2022, the New York and London prices averaged USD 414.9/tonne (+5.4%) and USD 534.7/tonne (+14.1%) (Figure 10).

The state of the domestic sugar market in 2022 is described below.

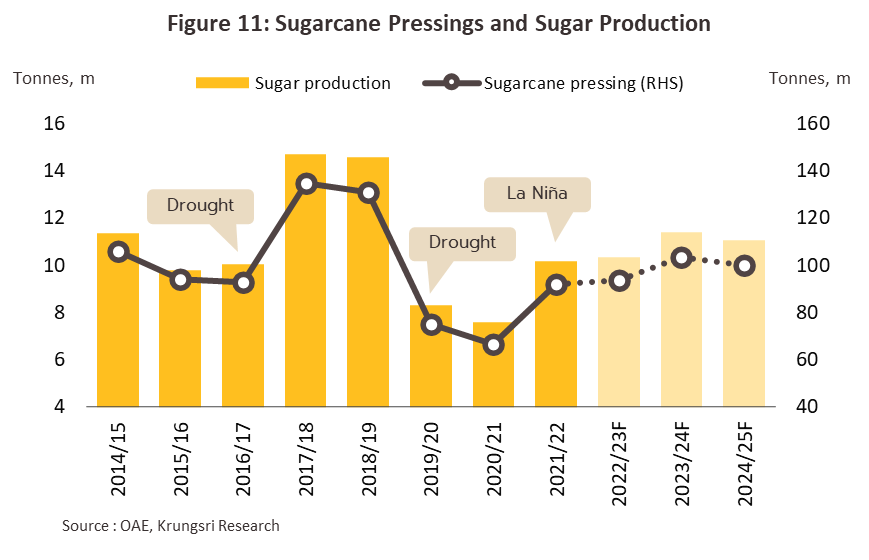

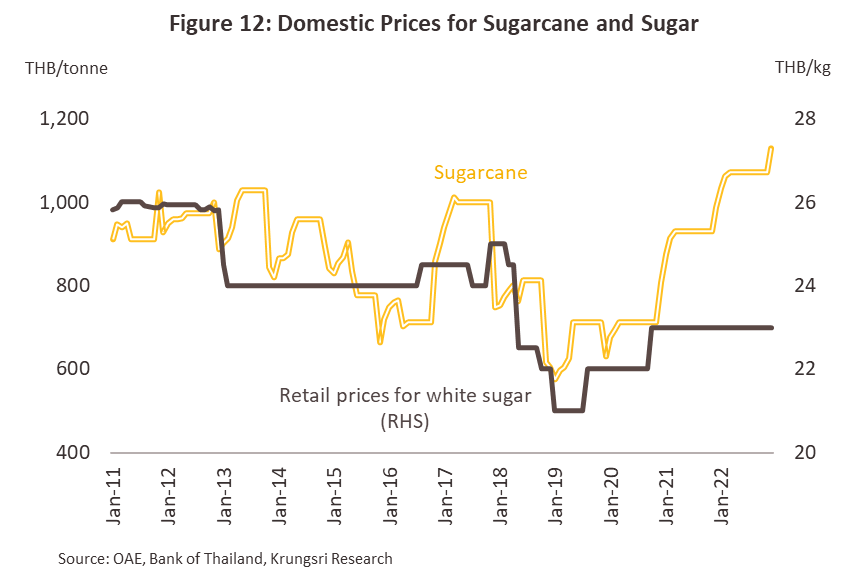

- 92.1 million tonnes of sugarcane were pressed in the 2021/2022 season, an increase of 37.7%, resulting in total sugar output jumping 33.9% to 10.2 million tonnes (Figure 11). This sharp increase is attributable to (i) heavier rainfall, and (ii) the impact of price incentives (both mills’ minimum price guarantees and the global price of sugar) on the total area of sugarcane that was cultivated. The price paid for sugarcane, therefore, rose 15.6% in 2022 to THB 1,073.5/tonne, a substantial increase from the 5-year low of THB 668.2/tonne reached in 2019 (Figure 12). However, with the costs of energy, fertilizer, pesticides, herbicides, and labor rising (especially during the fresh sugarcane harvested), this was still below average production costs of around THB 1,100/tonne12/. In the year, average retail prices for white sugar stood at THB 23.0/kilogram (THB 23,000/tonne), largely unchanged from a year earlier.

-

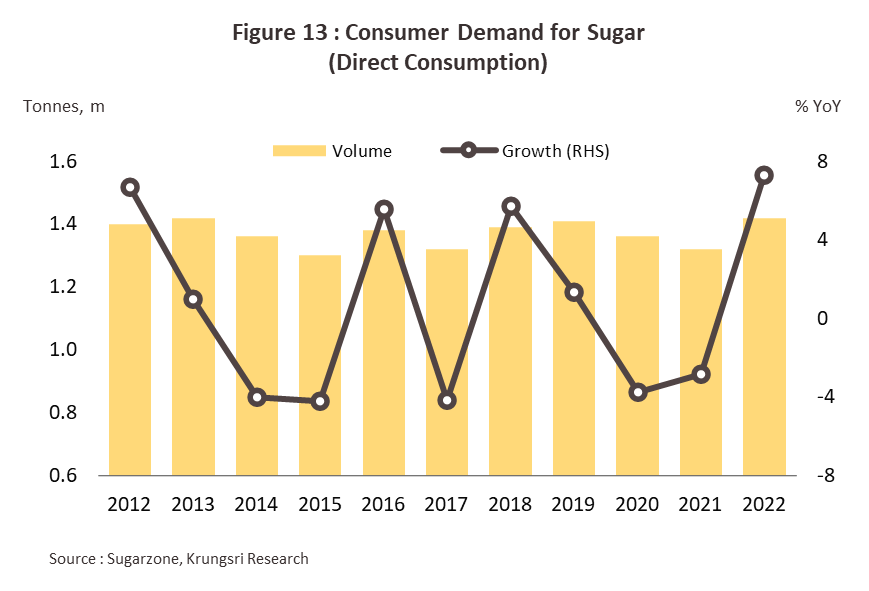

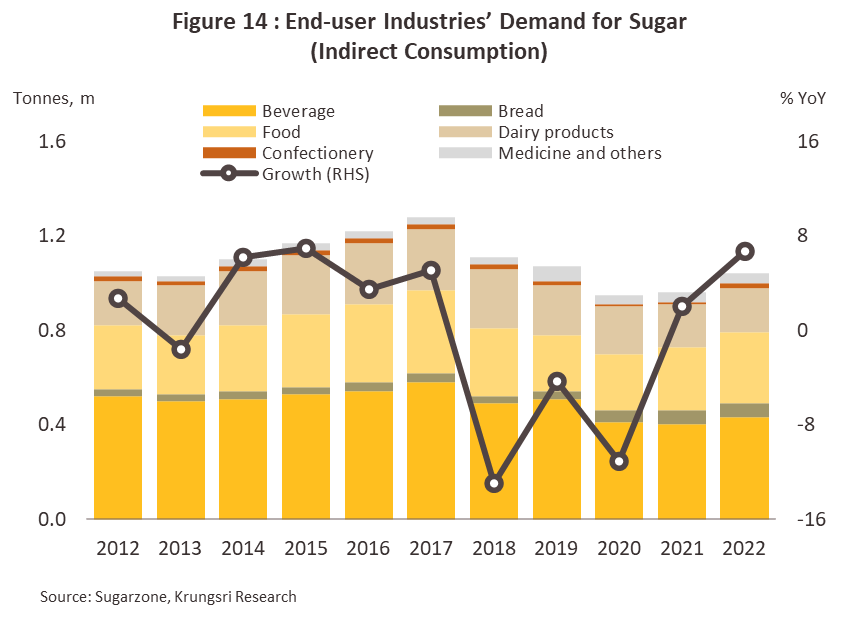

In 2022, Domestic consumption of white and refined sugar jumped 7.0% to 2.45 million tonnes. Demand was boosted by the relaxation of COVID-19 controls and the reopening of the country, which has then allowed the economy and especially the tourism sector to recover. Direct consumption of sugar, particularly in restaurants, has improved with strengthening purchasing power, while indirect consumption in downstream industries has also climbed. Thus, demand for sugar has risen 6.1% in the drinks industry, 9.7% in the food processing industry, and 11.5% in the pharmaceuticals production industry (Figure 13 and 14). However, the introduction of phase 2 of the sugar tax (from October 1, 2019 – March 341, 2023)13/ is restraining growth in demand from industrial consumers, especially from manufacturers of sweetened and carbonated drinks.

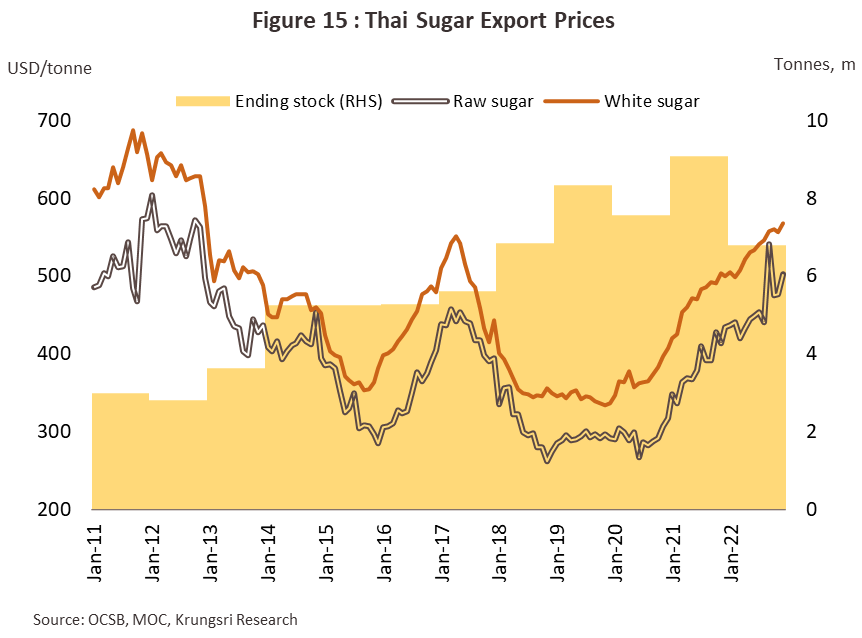

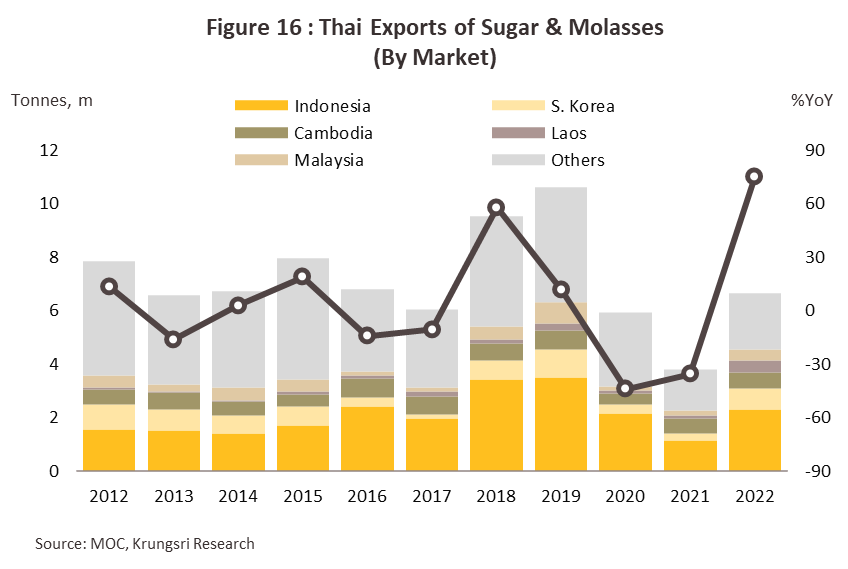

- Exports of sugar and molasses surged 74.7% in 2022, reaching a total of 6.6 million tonnes and generating receipts of USD 3.2 billion (+97.9%). Improvements were seen in almost all the main markets, including Indonesia (+105.0%), South Korea (+165.5%), Cambodia (+10.5%), Lao PDR (+239.4%), the Philippines (+145.1%), and Malaysia (+164.3%). This strong performance was driven by: (i) ongoing 1.0-3.0% annual growth in global demand that is being driven especially by the food, drinks, ethanol, and alcohol industries; (ii) a drop in exports from major producers including Brazil (the world’s leading sugar exporter), where the sugarcane harvest was affected by drought and frost, and India, which has blocked exports of sugar between June 2022 – October 2023; and (iii) the resolving of supply chain disruptions and the easing of international freight charges, which then freed up the flow of exports from Thailand to its trade partners. As a result of this, export prices rallied 16.1%, which helped to lift the value of exports by 97.9% YoY to USD 3.2 billion (Figures 15 and 16).

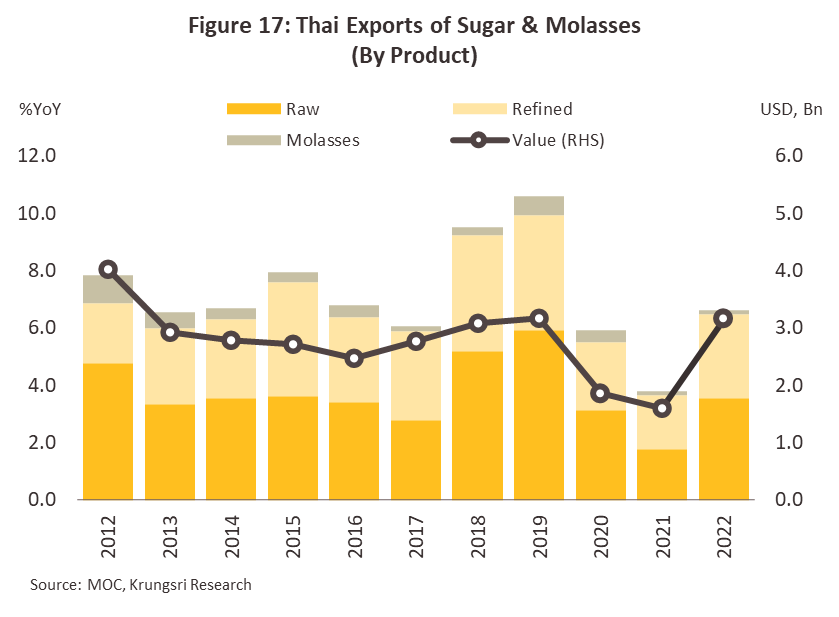

2022 export volumes and prices for the main product categories are given below (Figure 17).

-

Raw sugar: 3.6 million tonnes of raw sugar were exported in the year (+101.4%), and this then brought in USD 1.6 billion (+129.9%). Improvements were seen in all markets, including Indonesia (2.1 million tonnes, +102.0%), South Korea (0.7 million tonnes, +224.6%), Malaysia (0.4 million tonnes, +585.6%), and China (0.1 million tonnes, +1,741.4%). Export prices averaged USD 459.4/tonne in the period (+19.0%).

-

White sugar: Exports totaled 2.9 million tonnes (+54.2%), which generated receipts of USD 1.6 billion (+75.1%). Again, sales rose into almost all markets, including Cambodia (0.6 million tonnes, +9.9%), Lao PDR (0.4 million tonnes, +220.4%), the Philippines (0.4 million tonnes, +144.7%), and Indonesia (0.2 million tonnes, +146.0%). 2022 white sugar export prices averaged USD 535.4/tonne (+13.6%).

-

Molasses: In the year, exporters earned USD 26.0 million (+23.6%) from the sale of 0.2 million tonnes of molasses (+13.9%). Exports to the main market of Japan (around 61% of total exports) slipped -11.8% to 94.9 thousand tonnes on the country’s only slow economic recovery, which then dragged on demand in the downstream industries of ethanol, biomass energy, and animal feed production. Export prices also softened, dropping -7.8% to USD 179.3/tonne

Outlook

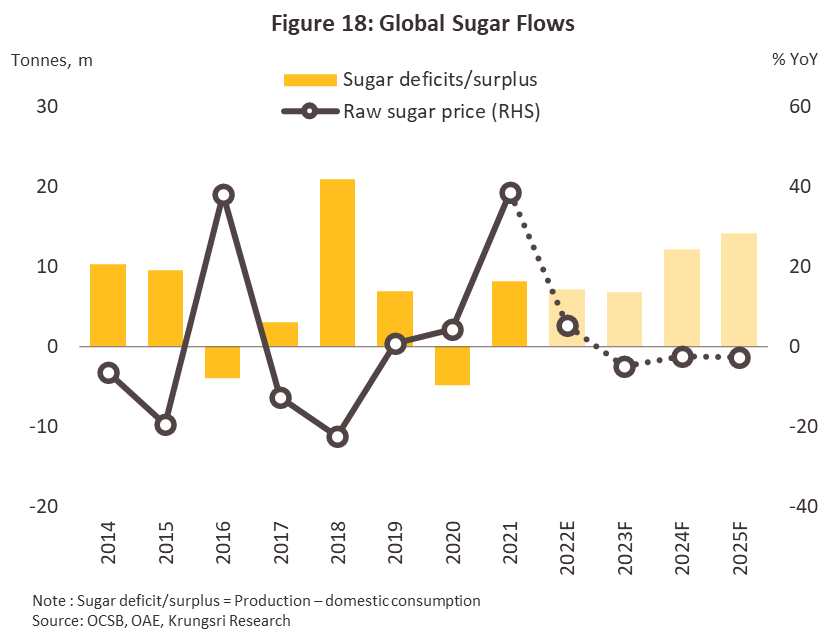

The USDA predicts that global sugar output will rise 1.6% in 2023 to 183 million tonnes, while Krungsri Research sees production expanding by another 2.0-3.0% annually over 2024 and 2025. Brazilian output is expected to jump 7.3% in 2023 to reach 35.8 million tonnes and then continue to strengthen in the years beyond, as the beneficial effects of better weather and rising demand in downstream industries are felt. Over 2023 to 2025, as the impacts of the COVID-19 pandemic fade, the global tourism sector recovers, and demand builds in the food and drinks industry, consumption of sugar should expand by 0.5-1.5% annually. However, because global supply growth will outpace that of demand, prices will come under pressure, and so over the next 3 years, world prices for raw sugar are expected to soften to an average of USD 370-395/tonne (Cent 16.9-17.9/lb), down from USD 414.9/tonne (Cent 18.8/lb) in 2022 (Figure 18).

The Thai industry will move with global trends, strengthening as growth spreads through both the domestic economy and export markets. The outlook for the next three years is given below.

-

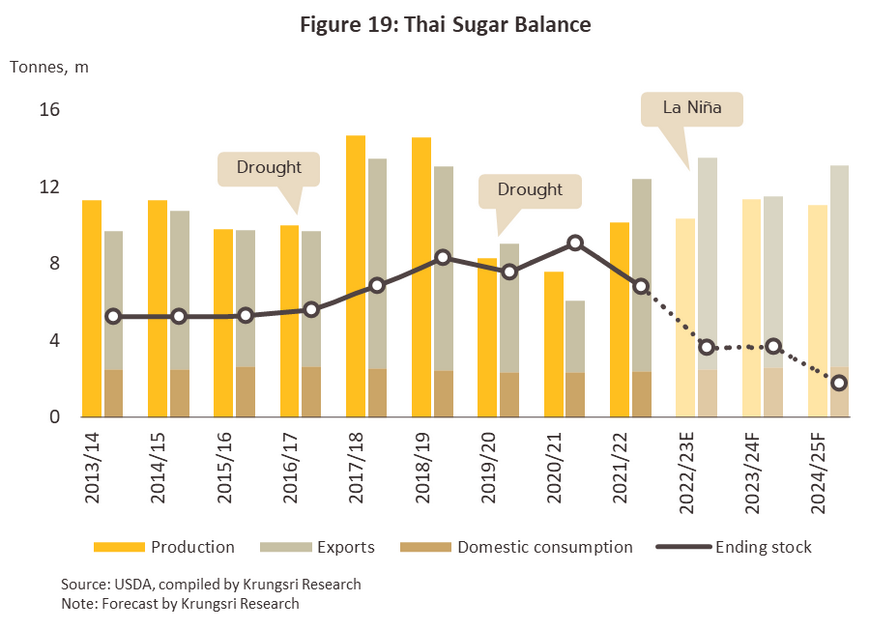

Sugarcane outputs are expected to increase by 2.0% to 93.9 million tonnes in the 2023 growing season, which should then lift sugar output to around 10.5 million tonnes (Figure 19). This positive outlook is supported by: (i) favorable climatic conditions and plentiful access to water; (ii) stronger yields from sugarcane planted a year earlier; and (iii) the positive impact of high prices on the total area under cultivation. However, growth rates will slow to 3.0-4.0% over 2024 and 2025, when sugarcane outputs of 100-103 million tonnes should translate into the annual output of 11.1-11.4 million tonnes of sugar. This slowdown in growth will be due to: (i) the transition to ENSO neutral conditions14/, which is expected to lead to lower rainfall than in the recent past, and because most sugarcane is grown in areas without irrigation, this will impact yields; (ii) the rising cost of energy, fertilizer, pesticides, herbicides, and labor, which will drag on farmers’ profits; and (iii) weaker global sugar prices that will then pull down the domestic price of sugarcane. The latter is therefore predicted to slip by between -4% and -7% to THB 950-1,000/tonne. However, the price guarantees offered by mills will help to encourage some farmers to expand the area planted and this will keep outputs on an upward track.

-

Domestic demand for sugar should increase by 2.0-4.0% per year to 2.5-2.7 million tonnes (Figure 19), helped by: (i) recovery in the economy generally and the tourism sector in particular; (ii) continuing demand from downstream industries, especially from food and drinks processors; (iii) COVID-related changes to consumer behavior that continue to support solid demand for disinfecting alcohol (made from molasses); (iv) demand for ethanol15/ for use as a transport fuel that is being lifted by the rebound in economic activity, accelerated spending on infrastructure, and stronger performance by the tourism sector; and (v) government measures that require ethanol to be mixed with petrol for sale as gasohol, together with the growing number of vehicles on Thai roads that can run on this. Nevertheless, the enforcement of the sugar tax continues to drag on growth in domestic sales of sugar.

- Exports of sugar and molasses are expected to climb by 2.5-3.5% a year to 9.5-10.5 million tonnes annually, helped by: (i) higher yields outputs and an expansion in the total area planted with sugarcane, which will help to overcome earlier problems sourcing inputs and so ensure supply to trade partners is maintained; (ii) stronger world economy that will support firmer demand from downstream industries in export markets, especially over 2024 and 2025; (iii) the diversion of Indian sugarcane from exports (a major competitor to Thai producers) to the production of ethanol as India pursues a policy of stimulating domestic consumption of the latter; and (iv) progress on negotiating new free trade agreements (FTAs)16/. However, despite this positive outlook, Thai exporters will still face challenges in the form of stiffening competition from Brazil, where players are responding to stronger demand from the domestic and international food and drinks industries by switching from ethanol distillation back to the production of sugar. In addition, Brazilian sugarcane yields are also expected to improve on better weather.

Several challenges will also be faced by players in the Thai sugar industry in the coming period. (i) The high level of global stockholdings is expected to increase further, putting downward pressure on sugar prices. (ii) The rising global consumer concerns over personal health and wellness will put pressure on demand for sugar consumption, while the introduction of sugar taxes on drinks in Thailand and overseas is reducing demand from drinks manufacturers. (iii) Uncertainty over government regulation of the industry is being stoked by two factors: (a) The Sugar and Sugarcane Act is currently being revised (the 2nd amendment, 2022), and as part of this, farmers have proposed that bagasse be redefined as a byproduct resulting from the manufacturing process. However, doing so would have an impact on the profit-sharing scheme17/ and on mills’ income since this would then oblige them to share income from the sale of bagasse with farmers, rather than keeping this for themselves as happens at present. These issues are currently under consideration and a decision has yet to be reached18/. (b) Current regulations stipulate that no more than 0-5% of burnt sugarcane accepted for pressing by mills in 2022, but in the 2022/2023 season, 30% of burnt sugarcane coming in for pressing19/, and so the rules will need to be revised.

1/ Sugars are found in low quantities in most plant tissues but sugarcane and beet have sufficiently high concentrations that they can be cultivated for the commercial production of sugar.

2/ Considering only sugar.

3/ Molasses is produced from boiling down sugarcane or beet during the sugar refining process. This results in a viscous, dark brown liquid that is used as an input into ethanol production (which is then mixed into gasohol) or in the food and drinks industry to make products including alcohol, yeast, monosodium glutamate, pet food, vinegar, and a range of different sauces.

4/ Although bagasse is a waste product resulting from the pressing of sugarcane, it is one of the main inputs into biomass energy production. Bagasse is also used to produce packaging and different construction materials including fiber board, particle board, melamine faced chipboard, medium-density fiberboard (MDF), synchronous MDF, lacquer high gloss MDF, and pure cellulose.

5/ As its name suggests, filter cake is produced from the filtering of liquid sugarcane extracts. The residue left behind by the filtering processing contains nutrients and minerals that can be used to make fertilizer or animal feed, or processed further into biogas.

6/ Vinasse is used to make organic fertilizer and animal feed.

7/ Surplus steam can be used to power machinery or to generate electricity for use within the sugar mill.

8/ As per an announcement in the Royal Thai Government Gazette on August 17, 2015, the earlier requirement that sugar mills be sited at least 80 kilometers away from one another was henceforth reduced to a distance of 50 kilometers.

9/ This does not include imports of raw sugar that are used to make white sugar or stocks of raw sugar held in the country.

10/ In 2022, installed production capacity for the manufacture of ethanol from pressed sugarcane and molasses came to 3.43 million liters per day (this does not include another 1.05 million liters per day of capacity in facilities that use both cassava chip and molasses). This then generated annual demand for molasses of over 3.4 million tonnes (+8.3%) and for 0.8 million tonnes of pressed sugarcane (-9.8%).

11/ Energy produced from bagasse-powered biomass facilities is generally consumed within the sugar mill itself or sold to nearby consumers.

12/ From the Thailand Sugarcane Planters Federation, which estimates that production costs averaged THB 1,100/tonne in 2021/2022 and THB 1,500/tonne in 2022/2023.

13/ At present (October 1, 2019, to March 31, 2023), the sugar tax is at phase 2 of its implementation, with the tax set at six rates: (i) A sweetness level of 0-6 grams per 100 milliliters is tax exempt; (ii) a sweetness level of 6-8 grams per 100 milliliters incurs a duty of THB 0.1/liter; (iii) a sweetness level of 8-10 grams per 100 milliliters incurs a duty of THB 0.3/liter; (iv) a sweetness level of 10-14 grams per 100 milliliters incurs a duty of THB 1/liter; (v) a sweetness level of 14-18 grams per 100 milliliters incurs a duty of THB 3/liter; and (vi) a sweetness level of 18 grams per 100 milliliters and over incurs a duty of THB 5/liter. In the future, the rates of tax within these bands will be stepped up, with phase 3 running from 1 April 2023 to 31 March 2025 and phase 4 then being implemented from 1 April 2025 onwards. This tax has had the effect of prompting manufacturers to cut the quantity of sugar in their drinks but its impacts on domestic sugar production have been limited by the fact that the tax rates are relatively light and only some 4-6% of the output of the domestic sugar industry is consumed by Thai drinks manufacturers.

14/ The National Oceanic and Atmospheric Administration (NOAA) estimates that for March-July 2023, there is a greater than 50% chance that La Niña conditions will weaken and neutral conditions will emerge, resulting in a transition from heavier-than-normal to normal levels of rainfall (source: Weekly ENSO Evolution, Status, and Prediction Presentation, NOAA, 6 February, 2023).

15/ Krungsri Research believes that demand for ethanol will strengthen by an average of 3.5% annually to a total of 4.0-4.5 million liters/day. This outlook is supported by: (i) recovery in the transport sector and in the level of overall economic activity; (ii) the government’s plan to establish E20 gasohol as the main petrol-based transport fuel; (iii) the average 1.5-2.5% annual increase in the size of the Thai vehicle fleet capable of running on gasohol; and (iv) stronger demand for ethanol for export for use as an aviation fuel, for the production of bioplastics, and as an alternative to synthetic rubber.

16/ The Department of Trade Negotiations is currently in discussion over FTAs with Pakistan, Turkey, Sri Lanka, and the EFTA (the European Free Trade Area, which includes Iceland, Lichtenstein, Norway, and Switzerland), as well as negotiating the ASEAN-Canada agreement. The Department also has plans for a future FTA with the EU, and many of the countries involved in these FTAs are major importers of sugar.

17/ A revenue-sharing system (the ‘70:30 system’) has been established by law to split revenue between sugarcane growers and sugar millers. In each growing season, the system divides net profits from distribution to domestic and export markets between farmers, who receive 70% of net profits as ‘compensation for the sugarcane price’, and processors, who receive 30% as ‘compensation for production’. These proportions are set by the 1984 Sugarcane and Sugar Act.

18/ The Office of the Cane and Sugar Board pushed forward with the amendment to the Act by publishing an announcement in the Royal Gazette with effect from 24 December 2022. In response, sugar mills brought a case to the Administrative Court, with the Thai Sugar Millers Corporation acting on their behalf.

19/ To reduce problems with pollution arising from burning sugarcane prior to its harvest, sugar mills’ purchases of burnt sugarcane were not to exceed 50% of all purchases in the 2019/2020 growing season, dropping to no more than 20% in 2020/2021, and just 0-5% in 2021/2022.

.webp.aspx)