EXECUTIVE SUMMARY

Thai rice production in 2026 is projected to remain stable, supported by the La Niña phenomenon transitioning toward neutral conditions (ENSO-neutral), and reservoir water levels that are conducive to cultivation. However, the industry still faces downward pressure from a declining trend in rice prices, which serves as a disincentive for farmers to maintain or increase planting areas. However, production is expected to contract during 2027-2028 due to the anticipated return of drought conditions. Regarding domestic consumption, demand for rice during 2026-2028 is expected to gradually increase, bolstered by i) the expansion of tourist arrivals, which supports demand from the restaurant and hotel sectors, and ii) the steady recovery of downstream industries that utilize rice in their production processes in line with the gradual improvement of economic activities, particularly during 2027-2028. Nonetheless, rice exports for 2026-2028 are projected to contract. In 2026, exporters will continue to face intense price competition due to increased supply in the global market, while demand from importers is expected to decline as production rises within trading partner countries. During 2027-2028, the return of droughts induced by El Niño is expected to cause damage, leading to a supply shortage within the rice industry. Consequently, exporters will face insufficient raw materials to meet production requirements and fulfill purchase orders from international trading partners.

Krungsri Research view

The overall rice industry is projected to face intensifying challenges during 2026–2028 due to volatile weather conditions, encompassing both floods and droughts, which will adversely impact outputs. The export market will encounter price competition from surplus, while demand from trading partners is likely to decrease, resulting in a downward trend for prices. Additionally, rising business costs under both tariff and non-tariff trade barriers will exert pressure on the profitability of operators throughout the Thai rice value chain, ranging from farmers and rice millers to silo operators and rice retailers, particularly affecting small and medium-sized enterprises.

-

Farmers: Rice production volume is expected to be supported by favorable weather conditions and improving water levels in dams throughout 2026. However, during 2027-2028, the risk of drought is projected to return and cause damage to outputs. Nevertheless, the overall production costs over the next three years are expected to remain high across labor, energy, and fertilizer expenses. Furthermore, market bargaining power remains low, leading to price suppression by middlemen, which will further diminish already thin net profit margins.

-

Rice Millers: Even though production volumes are trending upward, profitability remains constrained by the issue of high excess milling capacity within the system. Small-scale operators, in particular, often find themselves at a disadvantage compared to medium and large-scale players regarding bargaining power for raw material procurement, resulting in higher acquisition costs. Consequently, the competitive groups consist of large-scale or integrated rice mills and medium-sized mills that demonstrate effective cost management capabilities.

-

Producers of packaged rice: Business revenues are projected to gradually increase, particularly for large-scale operators with integrated operations (encompassing both rice mills and export companies) as consumption demand from the household, restaurant, and tourism sectors improves. However, competition is expected to remain intense due to the entry of new market players. Meanwhile, the costs of bringing products to market through modern trade channels are trending upward, driven by both marketing fees and slotting allowances.

-

Traditional rice retailers: Revenue trends and profitability continue to be constrained by intense competition within the packaged rice market, including price wars, management systems, and factors such as convenience and storage quality. Traditional retailers often find themselves at a disadvantage compared to modern trade outlets, while the increasing diversity of distribution channels further exacerbates the difficulty of remaining competitive.

-

Exporters: Businesses are expected to face persistently intense competition in 2026 due to an increase in the global supply following India's resumption of exports, which may cause Thailand to lose its price advantage against competitors. During the 2027-2028 period, rice outputs are projected to decline as drought conditions begin to set in, leading to higher costs for raw materials and subsequently impacting overall profitability.

-

Silos: Revenues for silo operators are expected to gradually recover during 2026, driven by an upward trend in rental demand in line with the increased volume of rice and other cereal yields. However, in 2027–2028, outputs are projected to decline, contrasting with the high existing supply of silo storage space. Furthermore, customers who are both exporters and rice millers have increasingly established their own silo facilities, thereby gaining higher bargaining power. This situation will lead to intensified competition and exert downward pressure on the profitability of operators.

Overview

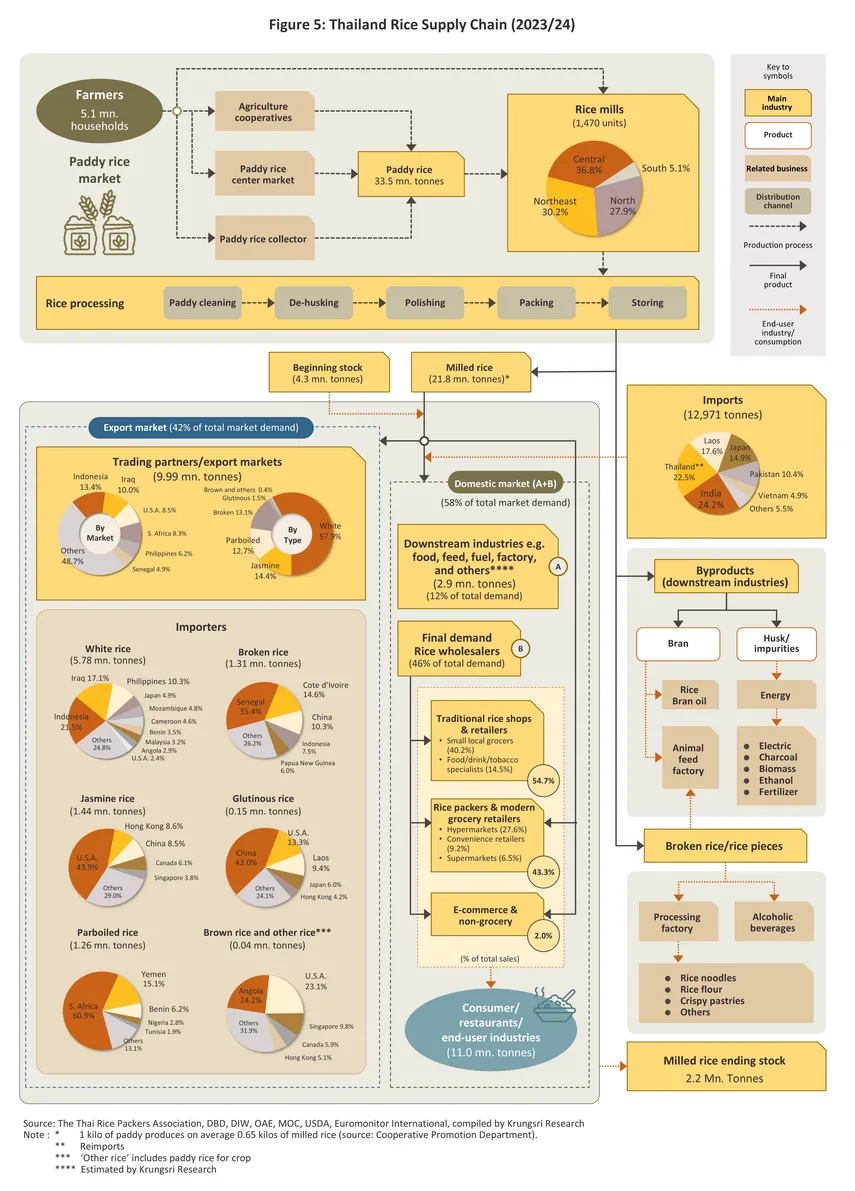

Rice cultivation accounts for 43.3% of all Thai farmland1/ and 5.1 million households (or 65.8% of those in the agricultural sector2/) are involved in the industry, making this Thailand’s most important crop and its major agricultural export. Given their dominance within the agricultural sector, rice farmers have naturally long been the recipients of government aid. This has included assistance with production costs, harvesting and crop improvement schemes, the provision of credit related to inventory building and the creation of added value, and projects that aim to improve management and quality control procedures.

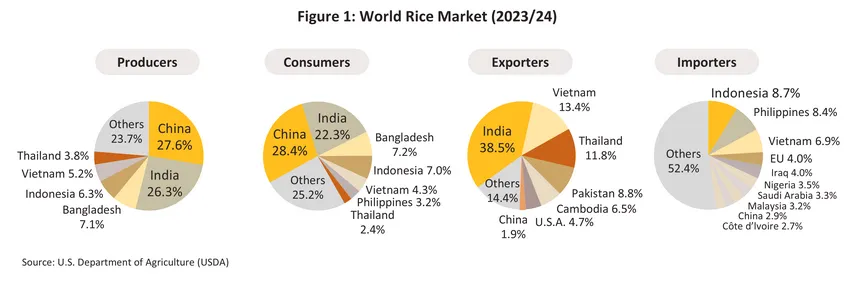

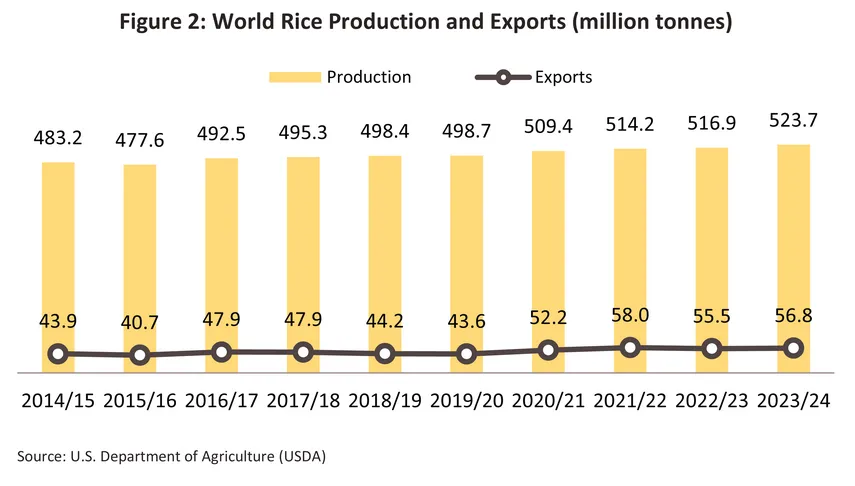

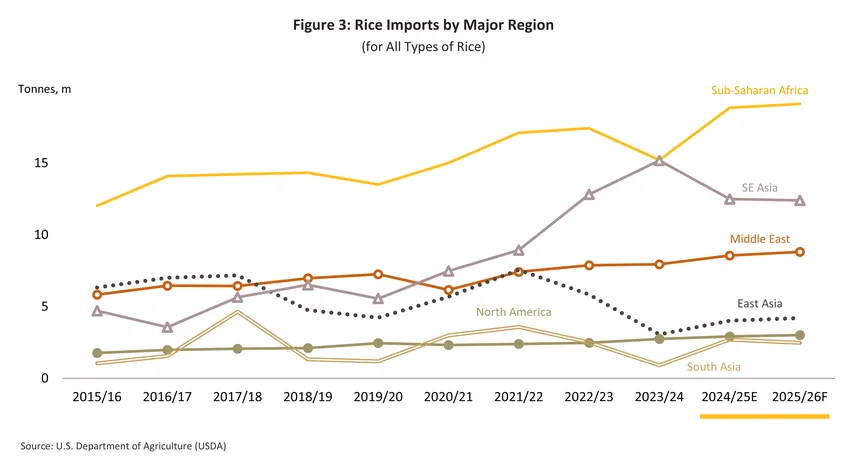

Thailand is a globally important producer and exporter of rice, and in the 2023/2024 growing season, Thai outputs were sufficient to place the country 6th in the world rankings of production; by volume, Thai-grown rice accounted for 3.8% of global outputs, coming after China (27.6%), India (26.3%), Bangladesh (7.1%), Indonesia (6.3%) and Vietnam (5.2%). Considering just exports though, Thailand ranked 3rd globally, having a 11.8% share of the global market after India (38.5%), and Vietnam (13.4%). Other competitors that Thailand faces on global markets include Pakistan, and Cambodia (Figure 1). However, because rice is overwhelmingly grown for domestic consumption and to ensure domestic food security, only 10.9% of global outputs finds its way to world markets (Figure 2), with exports coming from any surplus that is available after domestic markets have had their share. Imports are mostly made by countries in Africa and Asia (Figure 3).

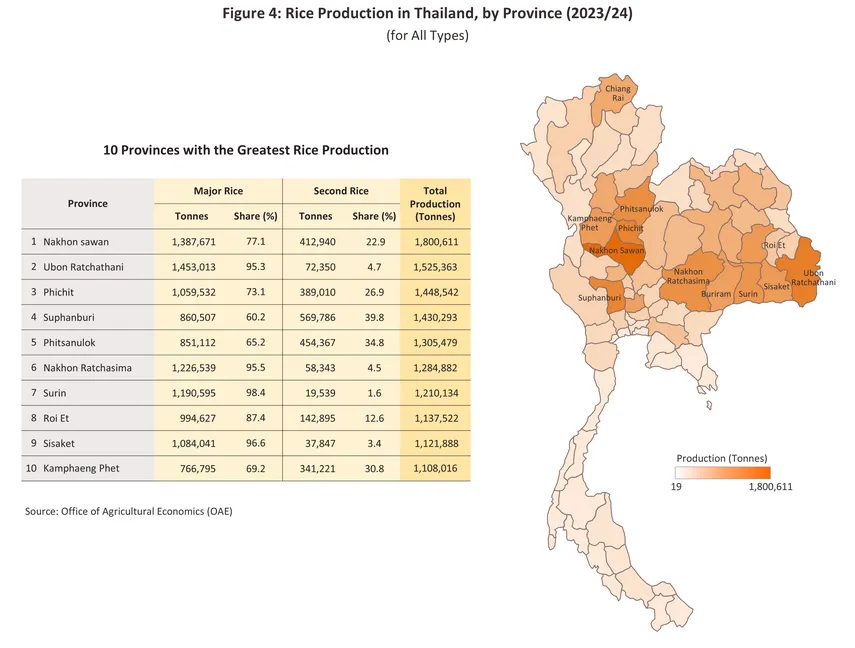

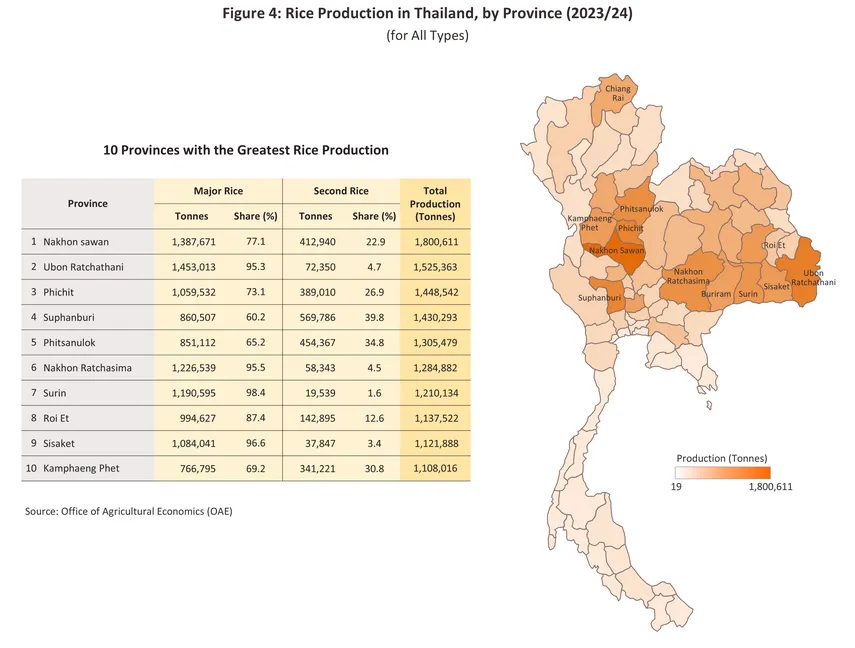

During the 2023/24 growing season3/, rice cultivation covered 72.16 million rai of farmland clustered in the northeastern, lower northern and central parts of the country (Figure 4). Thai rice is typically rainfed and so the major growing season begins in May-July (the start of the rainy season) and the crop is then harvested towards the end of the year (usually in November). This is ‘seasonal’ or ‘on-season’ or ‘Major’4/ rice and during the main growing season, regular white rice, jasmine rice and glutinous rice are all grown. 80% of the national yield is produced during this period, with the remaining 20% coming from ‘off-season’ or ‘Second’4/ rice, that is, rice grown during the dry season. This is generally planted in November to January, but because this is dependent on artificial irrigation5/, cultivation is largely restricted to the central and northern regions6/.

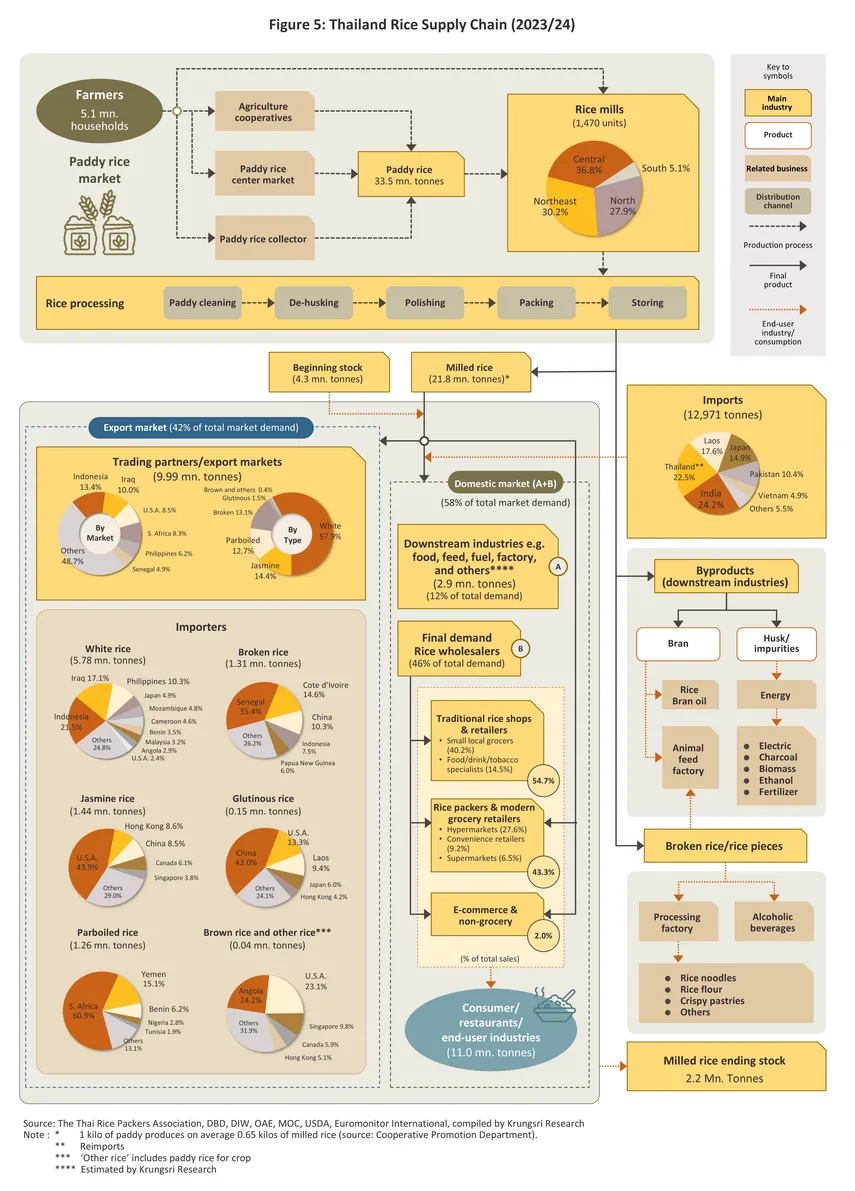

Over the last decade, annual outputs of rice paddy have averaged 31-32 million tonnes, which after processing produces 20-21 million tonnes of milled rice. The domestic market absorbs around 13-14 million tonnes of this, with the balance either being exported or used to build stocks. This is split between the following:

1) Direct consumption accounts for around 44.5% of Thai paddy demand7/. At present, rice is distributed to consumers through three main channels.

1.1) 43.3% of rice distributed to Thai consumers is sold pre-packed in bags. Hypermarkets are the most important channel through which pre-packaged rice is distributed (responsible for 27.6% of all rice distributed directly to Thai consumers), followed by convenience stores (9.2%) and supermarkets (6.5%).

1.2) Rice is also sold in small local grocers and specialty shops8/. These shops account for respectively 40.2% and 14.5% of domestic sales of rice to consumers.

1.3) Distribution through non-grocery and e-commerce operations accounts for another 2.0% of sales.

2) Rice is used as an input into downstream processing, and so about 11.6% of Thailand’s paddy demand is consumed as a raw material in other industries7/. This is split between the following.

2.1) Rice processing industries including rice flour, glutinous rice flour, instant porridge, noodles, snacks, alcohol, beverages, rice bran oil, and cosmetics account for approx 61.2% of total Thai industrial rice demand.

2.2) Animal feed industries primarily for livestock such as swine, poultry, and ducks along with feed raw material substitutes account for approx 38.8% of total Thai industrial rice demand.

3) Exports soak up the remaining approximately 40.2% of Thailand’s paddy demand7/ (Figure 5).

4) Rice saved as seeds for the next planting accounts for a further 3.7% of Thailand’s paddy demand7/.

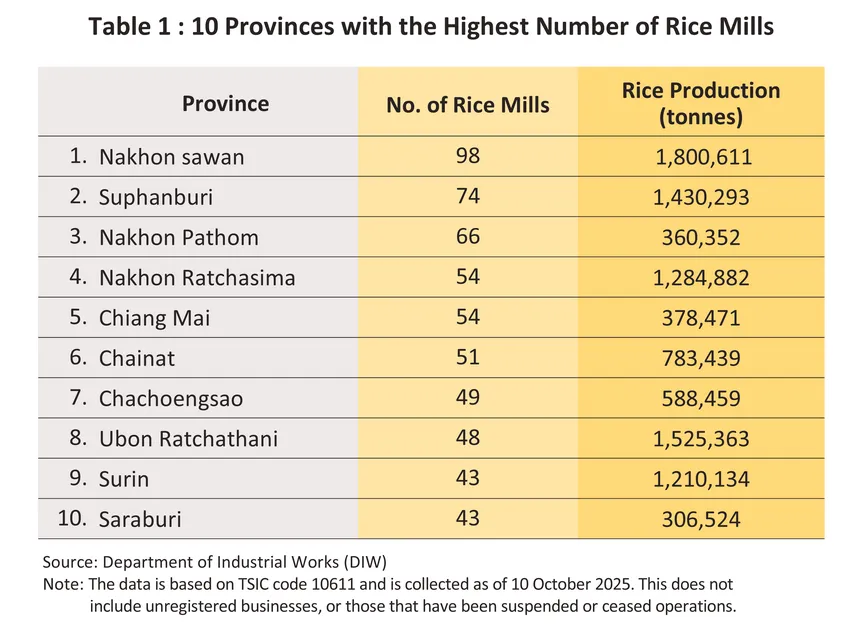

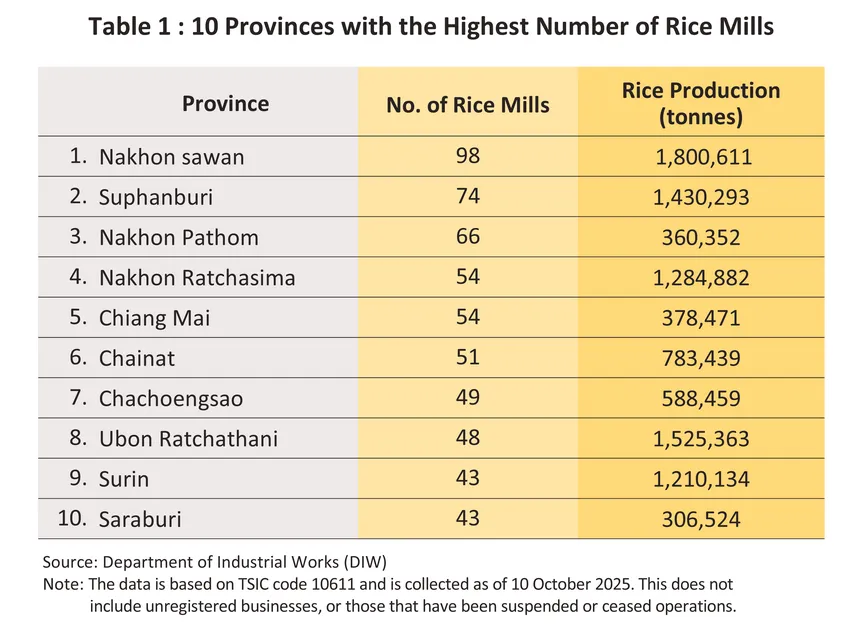

There are 1,470 rice mills registered in Thailand. These are typically sited near rice-growing areas since this: 1) makes it easier to source inputs; 2) cuts transportation costs; and 3) is more convenient when contacting or providing assistance to growers. The greatest concentration of these is in the central region (541 mills), followed by the Northeast (443), the North (410), and the South (75). By individual province, the largest number are in Nakhon Sawan (98 mills), which is followed in importance by Suphanburi (74), Nakhon Pathom (66), Nakhon Ratchasima (54) and Chiang Mai (54) (Table 1).

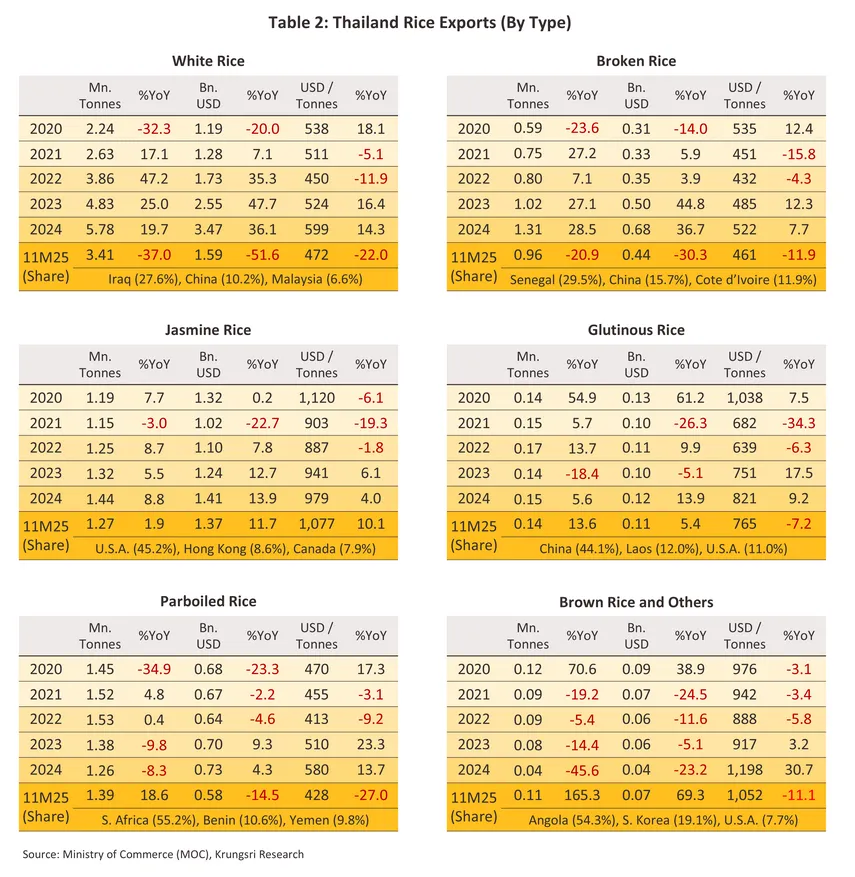

By volume, 2024 export markets consumed 45.9% of Thai milled rice outputs. Because Thai rice is recognized globally for its high quality, it remains in demand in a large number of countries, though the most important export markets are Indonesia, Iraq, the United States, South Africa, the Philippines, and Senegal. A wide range of rice products are exported from Thailand, but the main export categories are in order, white rice, jasmine rice, parboiled rice9/, broken rice10/, glutinous rice, and brown and other varieties (Figure 5). These individual segments of the overall export market are described below.

-

White rice: This is the most widely traded type of rice on global markets. Thai exports totaled 5.78 million tonnes of milled white rice in 2024, or 57.9% of all overseas sales of Thailand-grown rice, for which the main markets were in Asia and Africa. Indonesia was Thailand’s most important purchaser of white rice in the year, taking 21.5% of white rice exports by volume, followed by Iraq (17.1%), the Philippines (10.3%), Japan (4.9%), Mozambique (4.8%), and Cameroon (4.6%). White rice is graded according to the quantity of broken rice that it contains. Cheaper varieties containing a higher proportion of broken rice11/.

-

Jasmine rice: In the year, 14.4% of Thai rice exports were of jasmine rice (or 1.44 million tonnes of milled jasmine rice). The US was the biggest buyer of this, taking 43.9% of all exports of jasmine rice by volume, followed by Hong Kong (8.6%), China (8.5%), Canada (6.1%), and Singapore (3.8%).

-

Parboiled rice: In 2024, Thailand exported 1.26 million tonnes of parboiled rice, and so this accounted for 12.7% of all Thailand’s rice exports. Export markets are concentrated in Africa, with the single most important of these being South Africa (60.9% of all exports of parboiled rice by volume), followed by Yemen (15.1%), Benin (6.2%), Nigeria (2.8%), and Tunisia (1.9%).

-

Broken rice: Thailand exported 1.31 million tonnes of broken rice in 2024, and this thus comprised 13.1% of all overseas sales. The largest buyers were Senegal (35.4% of Thai exports of broken rice by volume), Côte d’Ivoire (14.6%), China (10.3%), Indonesia (7.5%), and Papua New Guinea (6.0%). Broken rice is typically used to produce rice flour and animal feed.

-

Glutinous rice: Only 1.5% of rice exports were of glutinous rice (these totaled 0.15 million tonnes of milled glutinous rice). The main buyers for this were in China (43.0% of Thai exports of milled glutinous rice by volume), the US (13.3%), Lao PDR (9.4%), Japan (6.0%), and Hong Kong (4.2%).

-

Brown and other types of rice12/: This was the smallest category of exports and with total 2024 sales of just 0.04 million tonnes of milled rice, it comprised only 0.4% of the total. The most important markets were Angola (24.2% of milled brown and other types of rice by volume), the US (23.1%), Singapore (9.8%), Canada (5.9%), and Hong Kong (5.1%).

Situation

In 2024, the Thai rice industry faced natural disasters that damaged outputs, while sales expanded both domestically and internationally. (Figure 6) Climate volatility, encompassing both droughts and floods, caused significant damage to domestic production. Meanwhile, domestic sales were supported by direct consumption and indirect demand through downstream industries, which expanded in line with rising tourist arrivals. Similarly, exports benefited from several factors: i) India's suspension of rice exports to ensure sufficient domestic reserves, which provided opportunities for Thailand to increase its market share; ii) the depreciating trend of the Thai Baht, which facilitated rice exports; and iii) the increased demand for imports to ensure food security amid the El Niño phenomenon, which adversely affected yields in many countries.

-

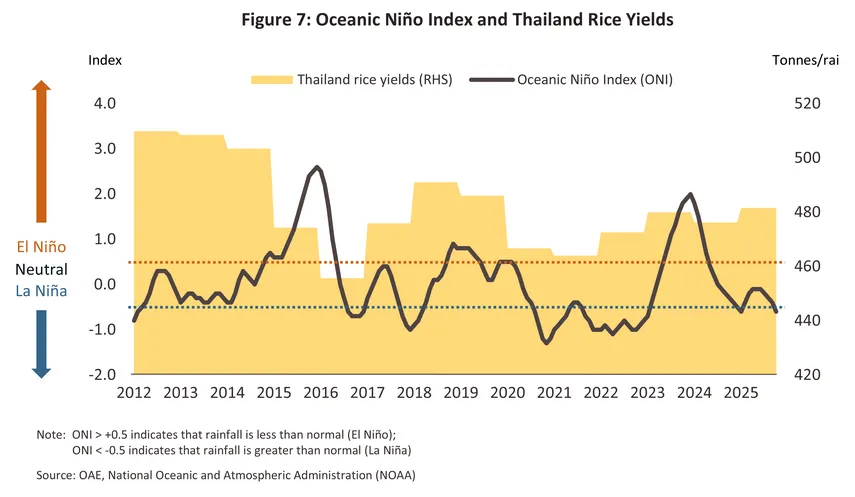

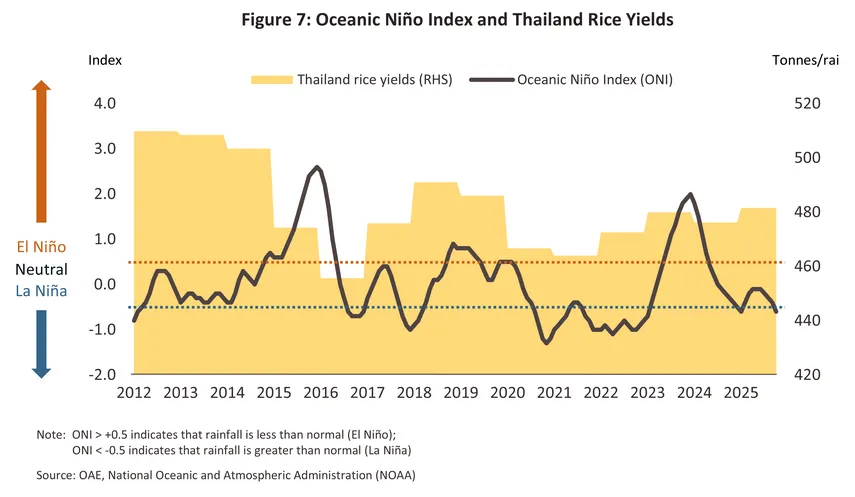

Rice production in 2024 declined to 33.5 million tonnes of paddy, or 21.8 million tonnes of milled rice, representing a decrease of -0.4%. The contraction was driven by several factors: i) Farmers in certain areas suspended cultivation due to reduced water levels in reservoirs and natural water sources resulting from the El Niño phenomenon during the first half of the year (Figure 7), while the second half of the year saw floods in many regions, particularly in the North and Northeast. Consequently, the planted area in 2024 stood at 72.2 million rai, a decrease of -1.8% from 2023, which is consistent with the -1.7% decline in the number of rice-farming households to 5.1 million households13/. ii) Yield per rai decreased by -0.8% to 476.2 kg14/ due to hot weather and reduced rainfall during the first half of the year under the influence of El Niño. iii) Farmers continued to face high costs for energy, fertilizers, and labor, prompting some to scale back maintenance and planting activities.

During the first 11 months of 2025, the supply of Thai rice expanded due to: i) Global climate conditions began shifting from El Niño to ENSO-neutral from the second half of 2024 through 2025, resulting in favorable weather conditions, rainfall, and dam water levels in Thailand, which supported increases in both total production and yield per rai. ii) Farmers were motivated by price incentives, particularly for Hom Mali rice, which continued to grow by 2.0% YoY, encouraging a return to cultivation. As a result, the paddy production index for the first 11 months of 2025 expanded by 6.4% YoY. It is expected that these supporting factors will persist throughout the remainder of 2025, leading to a forecast that total rice production for the full year 2025 will increase by approximately 5.8-6.8%, reaching 35.4-35.8 million tons of paddy, or 23.0-23.3 million tons of milled rice.

-

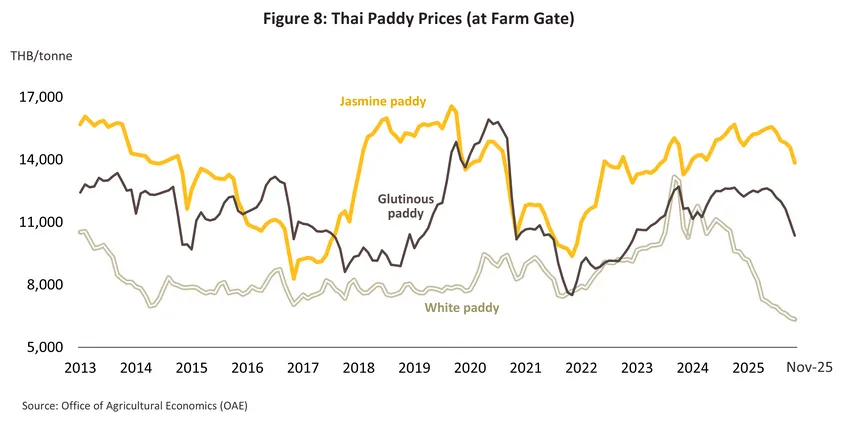

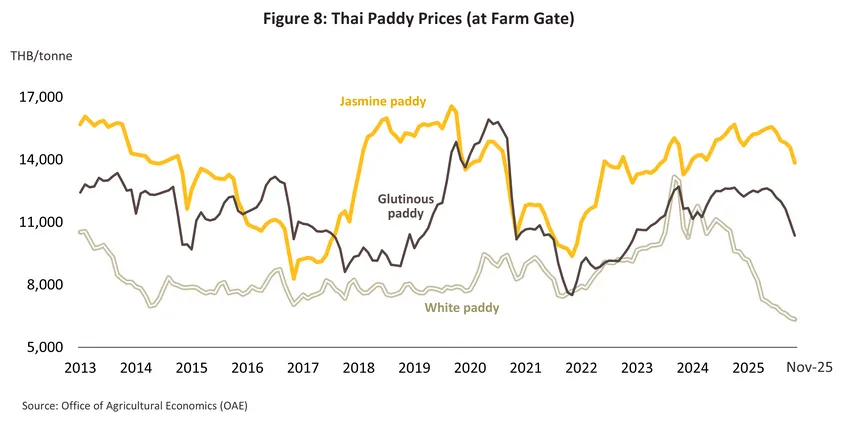

Domestic demand in 2024 increased to 13.9 million tonnes of milled rice, expanding by 5.6%. This growth was driven by both direct domestic consumption and the expansion of the tourism sector, following a significant rise in tourist arrivals to 35.5 million people (+25.9%), which subsequently increased the demand for rice in downstream industries. These factors contributed to an approximately 2.9% rise in average domestic rice prices during the first three quarters, with Hom Mali rice prices increasing by 6.5% to 14,744 baht/tonne and glutinous rice prices rising by 6.3% to 12,123 baht/tonne, aligning with price trends in both Thailand and the global market. However, during the fourth quarter, India lifted its rice export ban and accelerated its rice supply into the global market, resulting in a slight overall decrease in Thai white rice prices for the full year 2024 of -0.7%, at 10,632 baht/tonne (Figure 8).

In 2025, domestic demand for rice is expected to decrease to 13.6-13.7 million tonnes of milled rice, representing a contraction of -1.3% to -2.3%. The decline is driven by demand from downstream industries and animal feed sectors, which is forecasted to shrink by -9.1% to -10.1%, reaching 2.5-2.6 million tonnes of milled rice, in line with stagnant economic conditions and domestic spending. Meanwhile, demand for direct consumption is expected to remain stable or increase slightly by 0.0-1.0%, at 11.0-11.2 million tonnes of milled rice, reflecting generally weak domestic purchasing power and a decline in tourist arrivals. These factors pressured the overall paddy price index during the first 11 months of 2025 to decrease by -14.8% YoY, primarily due to the drop in white rice and glutinous rice prices, which stood at 7,324 baht/tonne (-31.9% YoY) and 12,025 baht/ton (-0.7% YoY), respectively. Conversely, the price of Hom Mali rice grew to 15,042 baht/ton (+2.0% YoY) (Figure 8).

-

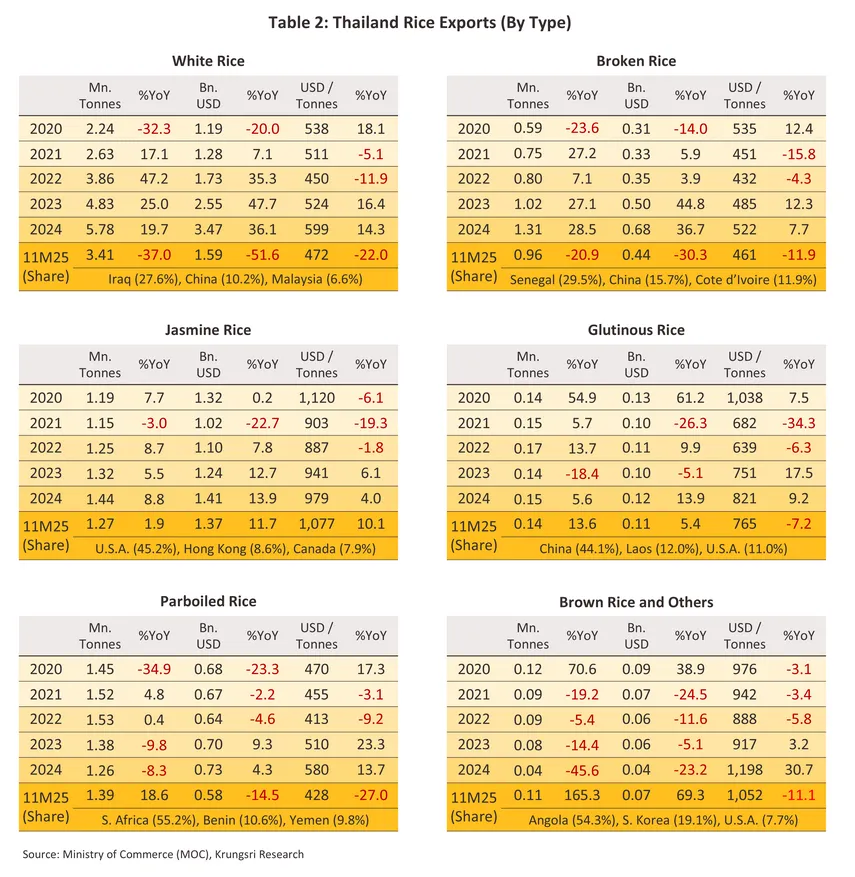

The export market in 2024 continued to expand, with rice export volume reaching 10.0 million tonnes of milled rice, an increase of 13.9%, valued at USD 6.5 billion or a 25.4% growth. This expansion was driven by: i) India's continued suspension of rice exports from 202315/ to maintain domestic price levels and food security, which caused a significant amount of rice supply to vanish from the global market (Figure 9). ii) A depreciating Thai Baht trend reached levels conducive to rice exports, making Thai export prices comparable to or lower than competitors, particularly Vietnam and Pakistan, during certain periods (Figure 10). iii) Increased demand for rice imports to build stocks and ensure food security among major global importers such as the Philippines, Senegal, Iraq, and the United States. This demand stemmed from the El Niño phenomenon affecting production in many countries (creating global supply concerns), geopolitical conflicts including the Russia-Ukraine war16/, global economic uncertainty among trading partners, and supply uncertainties from major exporting nations17/.

-

During the 11 months of 2025, the Thai rice export market contracted due to intense price competition. This decline was driven by several factors: i) favorable global climatic conditions for cultivation boosted outputs in major rice-producing nations - including China, India, Indonesia, Vietnam, Thailand, Pakistan, Brazil, and the United States - resulting in a high expansion of global supply and increased downward pressure on prices. ii) India, a key competitor, lifted export taxes and restrictions to liquidate its high levels of production and existing stocks. iii) import demand decreased as major importing countries, such as Indonesia and the Philippines, saw significant increases in their own production and stock levels, while African nations slowed their purchases due to volatile rice prices. Finally, iv) the appreciation of the Thai Baht further diminished the price competitiveness of Thai rice.

-

Thai rice export volume for the 11 months of 2025 contracted to 7.3 million tonnes of milled rice (-21.0% YoY), valued at USD 4.2 billion (-30.3% YoY). Iraq remained the primary market, accounting for 13.0% of total Thai rice export volume, followed by South Africa (11.3%), the United States (10.1%), China (8.3%), and Senegal (3.9%). The main drag came from the contraction of Indonesian market, which had been Thailand’s top export market in 2024; it contracted by more than -92.2% YoY during the 11 months of 2025, falling to just 0.09 million tonnes from 1.21 million tonnes during the same period the previous year. This was due to a substantial increase in Indonesia's domestic rice output and stocks resulting from favorable weather conditions similar to those in Thailand, leading to a sharp contraction in Thai white rice exports. Conversely, export volumes for Jasmine rice, parboiled rice, glutinous rice, brown rice, and other varieties continued to expand (Table 2). For the remainder of the year, total Thai rice export volumes, particularly for white rice, are expected to continue contracting due to the significant increase in supply. Consequently, the total export volume for the full year 2025 is projected to shrink by approximately -19.0% to -20.0%, reaching 8.0 to 8.1 million tonnes of milled rice.

Outlook

-

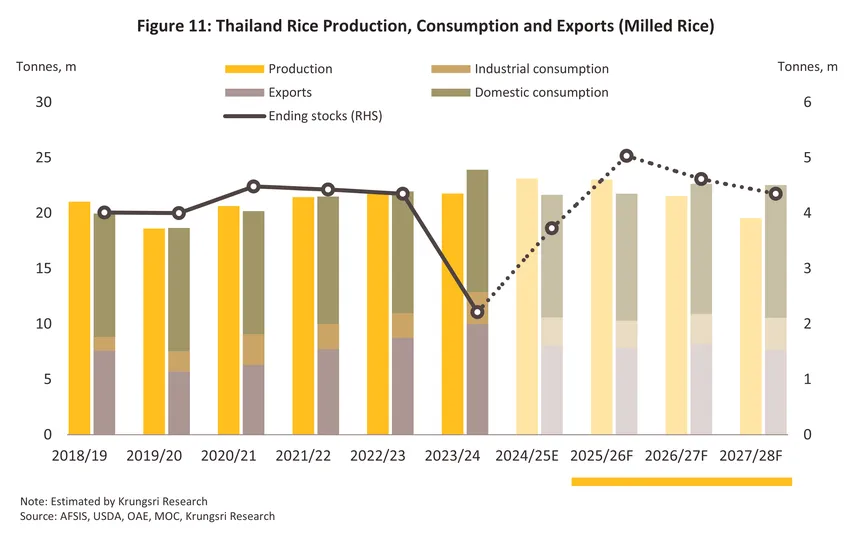

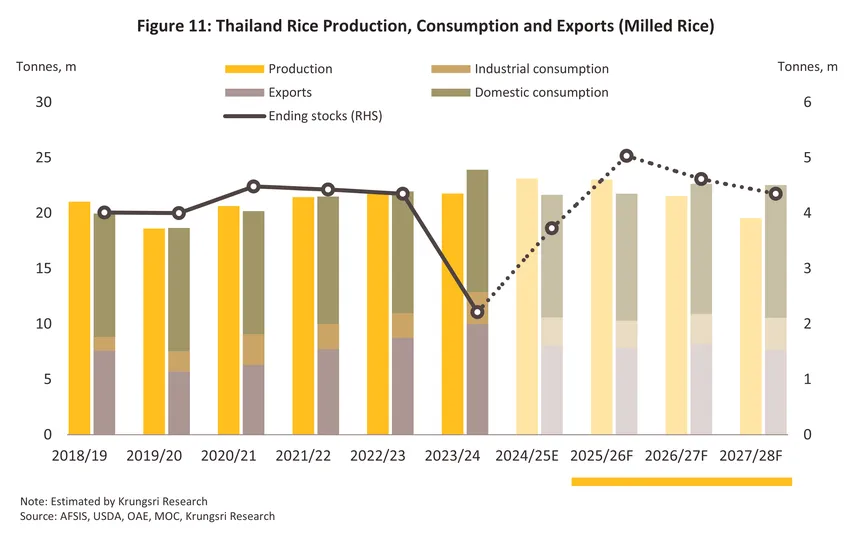

Thai rice production in 2026 is projected to remain stable, with growth ranging from -0.7% to +0.3%, equivalent to 35.4-35.7 million tonnes of paddy, or 23.0-23.2 million tonnes of milled rice (Figure 11). This stability is supported by several factors: i) La Niña conditions in the first half of the year, transitioning toward ENSO-neutral in the second half, are expected to result in sufficient rainfall and reservoir water levels to support crop cultivation. ii) The favorable price levels for Jasmine rice in 2025 continue to incentivize farmers to plant this crop. iii) Support from government policy measures under the crop year 2026/27 plan, such as credit for delaying the sale of on-season paddy, loans for rice aggregation and value addition, the rice industry stabilization plan, and production cost assistance measures. However, supply still faces a significant drag from unattractive prices for white paddy and glutinous rice farmers, causing producers in some areas to switch to alternative cash crops. Meanwhile, during 2027–2028, production is expected to trend downward by -7.4% to -8.4%, falling to 30.1-33.1 million tonnes of paddy per year, or approximately 19.6-21.5 million tonnes of milled rice (Figure 11). This decline is attributed to drought conditions, rising temperatures, and reduced or intermittent rainfall caused by the El Niño phenomenon, which is expected to return and cause damage or reduce yields per rai, particularly in chronically drought-prone areas outside irrigation zones where water shortages may force farmers to leave land fallow. Additionally, production costs remain high for labor, fuel, fertilizers, and pesticides; specifically, high fertilizer prices have led some farmers to reduce usage, potentially lowering yields per rai and limiting overall production growth.

-

Domestic consumption demand from 2026 to 2028 is expected to gradually increase by 2.6-3.6% per year, reaching levels of 14.0-14.9 million tonnes of milled rice annually. This growth is supported by several drivers: i) The expansion of tourist arrivals bolsters demand from the restaurant and hotel sectors. ii) Demand from downstream industries, particularly food manufacturing, will require more rice as a raw material for food processing. iii) There is a gradual recovery in consumer demand as purchasing power begins to improve, especially during 2027-2028, following employment trends in various business sectors such as chain restaurants, franchises, licenses, industrial plants, health businesses, and educational institutions, despite persistent challenges from the high cost of living. iv) The destocking of high existing domestic rice inventories will influence the market.

-

Rice exports during the period of 2026-2028 are projected to trend downward to 7.6-8.1 million tonnes, representing an average annual contraction of -1.3% to -2.3%. This decline is constrained by several factors: i) During the 2025/26 crop year, favorable weather conditions and rainfall levels are expected to boost production in major exporting countries, leading to intense price competition due to a market oversupply. Simultaneously, demand from consumers and importers is expected to soften as domestic production increases, following significant previous procurement for inventory stockpiling. ii) During the 2026/27 and 2027/28 crop years, the return of El Niño-induced drought is anticipated to cause damage, potentially leading to a shortage in Thailand. This could result in an insufficient volume of paddy raw materials to meet production requirements for fulfilling international orders.

Future challenges for the rice industry include: i) price competition is expected to intensify during 2026-2027, as Thailand continues to struggle in competing with India and Vietnam due to higher production costs and lower yields per rai. ii) climate volatility directly impacts production volumes. And iii) non-tariff barriers (NTBs) and environmental regulations are gaining global importance, particularly in major markets like the European Union (EU), which are tightening environmental and sustainability (ESG) regulations. This includes the EU’s Carbon Border Adjustment Mechanism (CBAM), which, although not yet directly covering rice, may represent a future target for environment-related trade barriers.

Future developments within the rice industry

-

Future strategic directions focus on establishing product standards, expanding the customer base, and increasing product options. As rice is an essential commodity operating within a perfectly competitive market, entrepreneurs throughout the production chain must emphasize differentiating rice quality (such as through GI-certified rice18/, low-glycemic health-oriented varieties, and rice developed for enhanced shelf-life) to cultivate niche markets or build consumer brand loyalty. Marketing efforts should prioritize reaching all consumer segments by utilizing both offline channels, including modern and traditional retail, and online platforms. Additionally, developing a diverse range of packaging sizes is necessary to align with the purchasing power of various consumer groups, such as small-scale packaging for convenience stores and large-format sacks for the restaurant industry.

-

Organizations are increasingly adopting new innovations and technologies, such as the implementation of automation systems to enhance production capacity, the integration of AI to reduce product inspection times, and the transition to electric-powered machinery within production and logistics processes to replace fuel-based equipment.

-

Efforts involve supporting ESG goals and the SDGs19/ to build trust among the environment, communities, and stakeholders, including through the following pillars:

-

Environment: The focus is on reducing greenhouse gas emissions, optimizing the efficient allocation of energy, fuel, and water, ensuring wastewater treatment complies with established standards, and implementing waste and refuse segregation across every stage of the business value chain.

-

Social: The initiatives include promoting agricultural knowledge within communities, collaborating on local environmental and safety management, supporting community-based procurement, adhering to local laws, and providing food assistance to the community.

-

Governance: The emphasis is placed on ensuring transparency and accountability in all procurement and sourcing processes, advancing product research and development, treating employees with fairness and equality, supporting individuals with disabilities, and establishing robust anti-corruption regulations within the organization.

1/ 2023 data on the ratio of rice planted area to Thailand’s agricultural land use comes from the Office of Agricultural Economics.

2/ Data on the number of households planting on- and off-season rice in 2023/2024 is supplied by the Office of Agricultural Economics and the Ministry of Agriculture and Cooperatives.

3/ 2024 outputs are calculated from on- and off-season rice planted in the 2023/2024 growing season.

4/ Seasonal rice is generally grown from strains that produce grain on a predictable timetable since these varieties use the day length to determine their growth, and as the days shorten (i.e., as the climate moves from the rainy season into winter), seasonal rice varieties will switch from vegetative growth to reproduction. These types of rice are thus classified as ‘photoperiod sensitive’, and in Thailand, favored varieties include Khao Dawk Mali 105, RD 15, RD 6, and Prachinburi 1. However, because of the time of year during which off-season rice is grown, day length is not an appropriate determinate of the growing cycle and so growers instead use rice that produces grain after a fixed period of time (generally 90-150 days) regardless of the planting season. Preferred varieties for off-season rice include Phitsanulok 2, Suphanburi 1, Pathumthani 1, and Chainat 1.

5/ The main irrigated areas in Thailand (accounting for 80-90% of all the country’s irrigated farmland) receive water from the Bhumibol and Sirikit dams, which are located in the Chao Phraya watershed.

6/ In the 6 south-eastern provinces of Nakhon Si Thammarat, Phatthalung, Songkhla, Pattani, Yala, and Narathiwat, seasonal rice is grown from mid-June to the end of February in the following year. Off-season rice is thus grown from March to mid-June.

7/ Source: Comprehensive Rice Production and Marketing Action Plan (2023/2024), and analysis by Krungsri Research.

8/ ‘Specialty shops’ includes food, drink, and tobacco retailers (e.g., bakeries, sellers of fresh fruit, etc.)

9/ Parboiled rice is prepared by soaking paddy rice until it has a moisture level of 30-40%. The rice is then steamed or boiled until cooked, dehydrated and then milled to remove the husk. The parboiling process improves the quality of the milling, reduces the proportion of broken rice, and because the soaking pulls nutrients out of the bran and germ and into the grain, it also raises the final product’s nutritional value. Parboiling gives the rice a pale-yellow color.

10/ Broken rice is rice that is damaged during processing and that has a length from 2.5 parts or partially damaged in any parts up to 80% of full grains. Broken rice is mostly consumed by mixing with whole grains to make 25% white rice, though some is also used in downstream industries for the production of animal feed, flour, and beer.

11/ As per the 1997 Ministry of Commerce guidelines on rice quality, sample grades are as follows: i) 100% white rice is the highest quality and Level 1 100% white rice contains no more than 4% broken rice; ii) 5% white rice is 5-7% broken rice; and iii) 25% white rice is 25-28% broken rice.

12/ Brown rice comprises the majority of this category, with the remainder consisting of other types of rice and rice products, including rice seed for planting.

13/ The combined total of families growing on- and/or off-season rice. Source: Office of Agricultural Economics.

14/ Thailand continued to benefit from the La Niña through the first half of 2023, and so with access to irrigation water holding up, outputs of off-season rice rose. However, through the second half of the year, the temperature rose, the rains were disrupted, and in some areas, water shortages set in. Outputs for the year’s main seasonal rice crop thus suffered.

15/ India suspended the export of all rice varieties except for Basmati. Additionally, it set a minimum export price for Basmati rice at 1,200 USD per ton and imposed a 20% export tax on parboiled rice, effective immediately from July 20, 2024, until September 27, 2024. Subsequently, tax measures were eased, although a Minimum Export Price (MEP) remained in effect until October 23, 2024, when all rice export control measures were officially lifted.

16/ The war, which began in early 2022, caused global cereal prices, such as corn and wheat, to rise, leading consumers to switch to rice as a substitute product. Additionally, some importers were required to increase rice imports because domestic cultivation areas in their countries had shifted toward planting corn and wheat instead, providing further support for increased Thai exports.

17/ For example, banning exports of rice in response to rising inflation and the impacts of changes to government policy.

18/ At present, 23 rice products are registered as a ‘geographical indication’ or GI. These include Surin Hom Mali Rice, Khao Leuang Patew Chumphon, Sang Yod Phattalung Rice, Khao Hom Mali Thung Kula Rong-Hai, Khao Rai Leum Pua Petchabun, Khao Niew Khiaw Ngoo Chiang Rai, Khao Jek Chuey Sao Hai, and Khao Kum Lanna (source: Department of Intellectual Property, 16 July 2024).

19/ The Sustainable Development Goals (SDGs) are grouped into 5 primary areas (the ‘5Ps’): i) people, which is focused on the eradication of poverty and hunger, and the reduction of social inequality; ii) planet, or the protection of natural resources and the preservation of the climate for future generations; iii) prosperity, which is concerned with promoting well-being for all in harmony with the natural environment; iv) peace, which is concerned with the maintenance of stable coexistence among all peoples, and the preservation of peaceful and inclusive societies; and v) partnership, or the promotion of cooperation between all parts of society to push for sustainable development (source: Office of the National Economic and Social Development Council).

.webp.aspx)