EXECUTIVE SUMMARY

The cassava industry will face a challenging environment over the period 2024 to 2026. Supply will tend to contract as the effects of the El Niño-induced drought take their toll on domestic outputs, and these problems will be further compounded by the spread of cassava mosaic disease and a shortage of cassava stem cuttings for use in planting. However, demand from downstream industrial consumers, especially the food processing and ethanol industries, will strengthen due to the ending of the pandemic, the reopening of the country, and the resulting return to growth of the economy. Demand will be further boosted by the ongoing rebound in tourist arrivals, which is then supporting growth in the restaurant and food processing industries, while greater uptake of travel services is feeding through into an uptick in sales of ethanol, with further positive consequences for demand for cassava. Worldwide, the post-COVID rebound in economic activity and recovery in the tourism industry will also lift global demand for cassava, which will in addition be affected by deepening worries over the impacts of drought and geopolitical tensions on food and energy security that are then encouraging countries to build up their stocks of inputs and raw materials. However, Thai exporters will face problems with supply shortages and the consequent reduced domestic output of cassava products, and as such, export volume will slide. As a result, the mismatch between supply and demand will tend to lift both domestic and export prices.

Krungsri Research view

Overall, the outlook for the cassava industry is broadly negative for the years from 2024 to 2026. The drought will cut outputs and reduce income, even though demand on both domestic and export markets will strengthen. The industry will adapt to these changing circumstances by importing raw materials from neighboring countries for processing into finished goods and reexport, but pressure on margins from import costs will threaten profitability.

-

Producers of native starch: The drought will undercut outputs and so income will tend to weaken, although an improving outlook for food and drinks processors, paper manufacturers, and ethanol distillers (produced from cassava starch slurry) will support stronger demand on domestic and overseas markets.

-

Producers of cassava chip: Income will fall on shortages in the domestic supply of fresh cassava and intensifying competition for access to this. Although demand is rising in the Chinese market for cassava as an input into food processing and the production of ethanol, alcohol, and animal feed, exporters remain highly dependent on this market, leaving them exposed to changes in demand or purchasing policies, a situation that has been made more precarious by rising competition from cassava exporters in the CLMV region.

-

Producers of modified starch: Contraction in the domestic supply of inputs will undercut income and lead to a shortage of products for export over 2024 and 2025. Players will also face stronger competition from starches produced from other sources but that have a wide range of desirable qualities, although at the same time, demand will grow from buyers in downstream industries, especially in Asia, that include manufacturers of medicines, cosmetics, food, paper, sweeteners, and chemicals, and from expansion into new markets.

-

Producers of cassava pellets: Income will decline because of the industry’s supply shortages and worsening competition for inputs of fresh cassava. This will then amplify pre-existing risk arising from uncertain market conditions and the fact that demand tends to rise only when alternatives are in short supply, especially when geopolitical stresses are widespread. Nevertheless, demand for cassava pellets for use as an animal feed and as a biofuel remains strong in China, the Netherlands, and Japan.

-

Distributors of cassava products: As elsewhere, the effects of the drought on outputs will undercut income growth, although possibilities for generating profits will remain given strong domestic and international demand and the higher prices paid for cassava, and this may then incentivize some farmers to expand the area under cultivation.

-

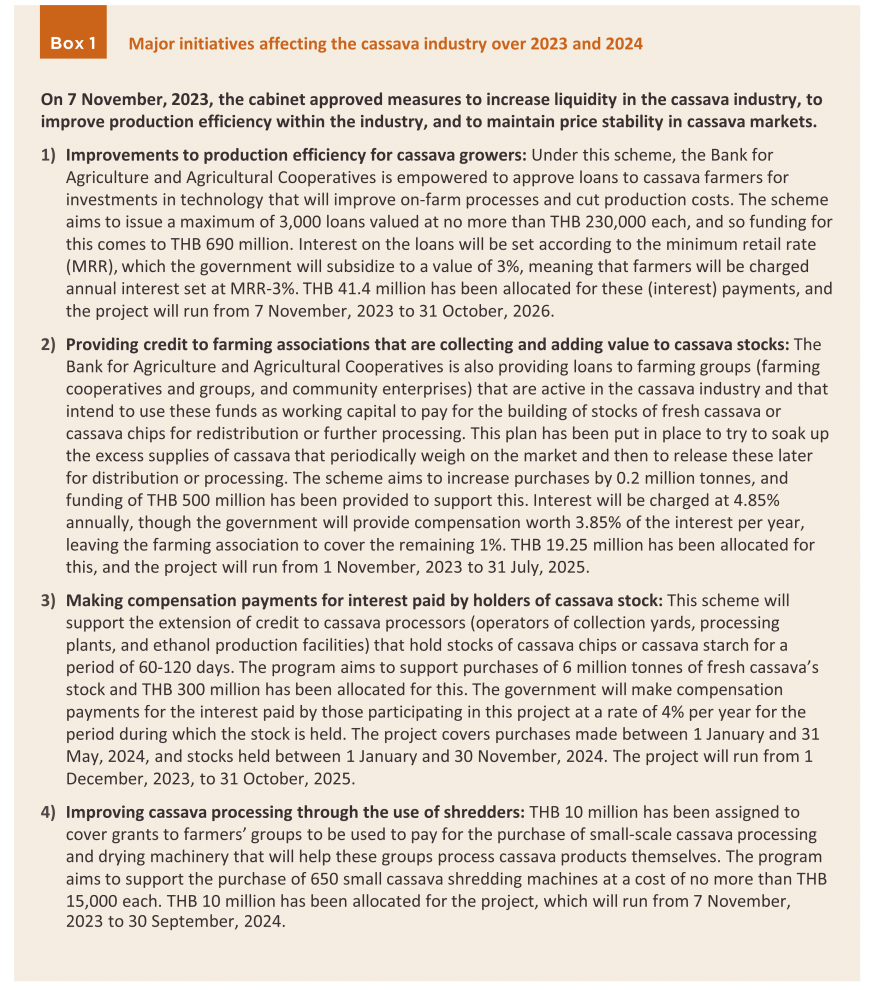

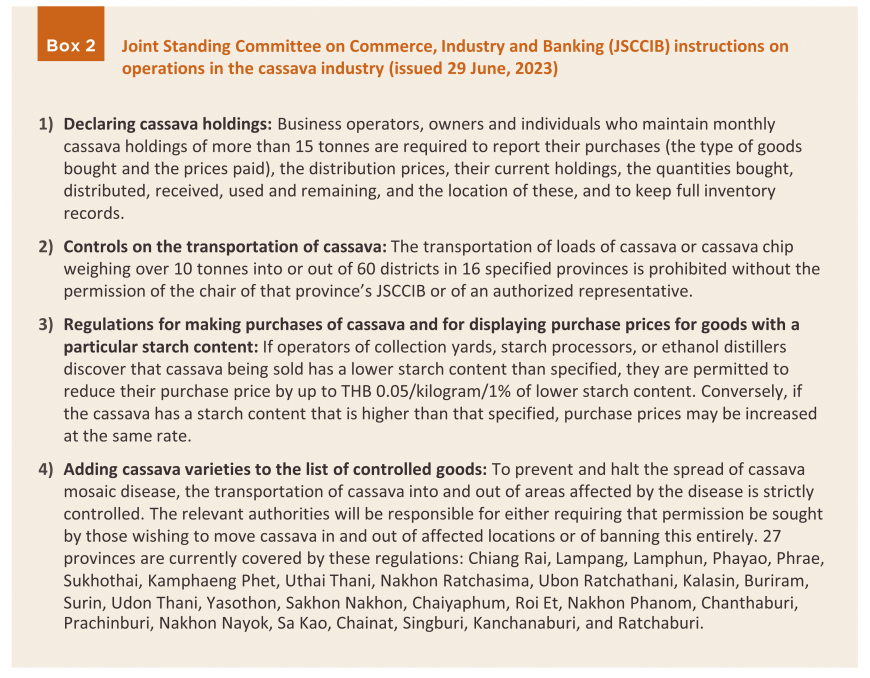

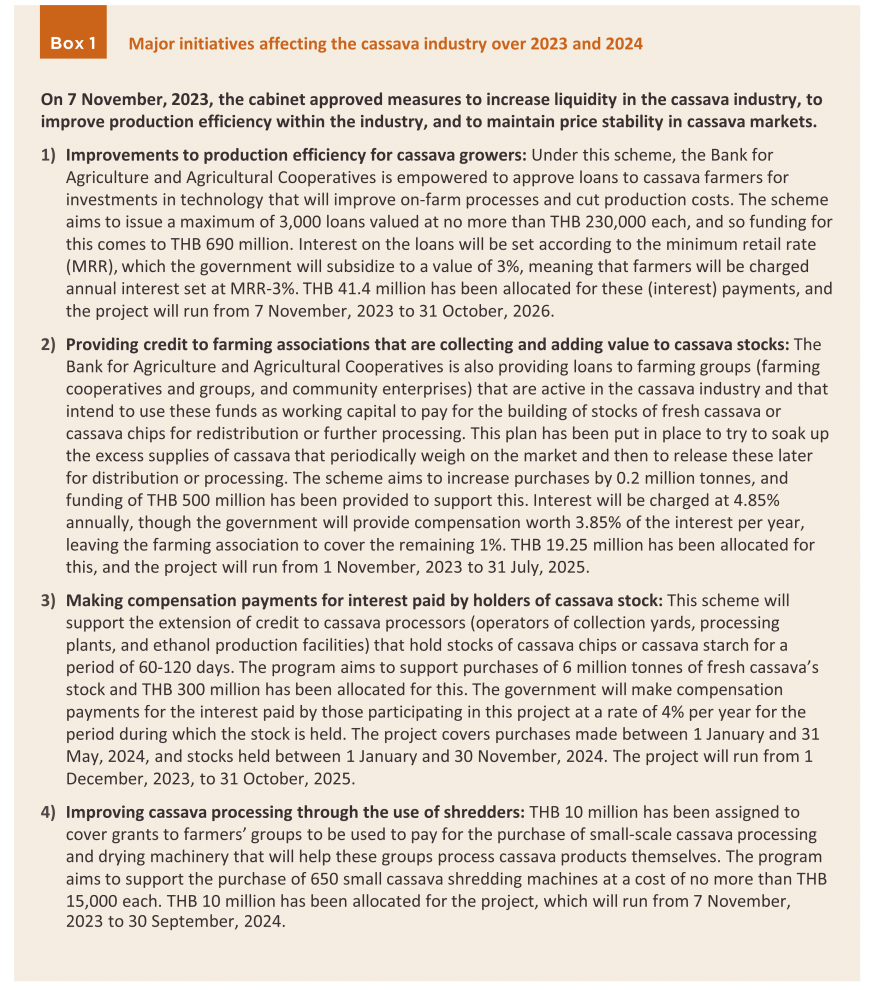

Cassava growers: Incomes will soften despite strong demand for fresh cassava from downstream industries that will then result in higher prices, potentially encouraging farmers to expand the total area planted. In addition, farmers will benefit from government support for the market in the form of projects to improve farm efficiency, loans to help with the costs of building stocks and adding value to cassava products, interest subsidies for the costs associated with stocking cassava, and projects to improve cassava processing. However, the impacts of the drought, outbreaks of cassava mosaic disease, shortages of cassava stem cuttings from which to grow cassava, and rising costs associated with fertilizer and labor will combine to drag on profits.

Overview

Cassava is a carbohydrate-rich crop that has a wide range of uses in the so-called ‘4Fs’ of: (i) food for human consumption, (ii) feed for animals, (iii) fuel in the form of ethanol, and (iv) factories, where cassava is used to produce, for instance, alcohol, citric acid, clothing, medicines, paper, and chemicals.

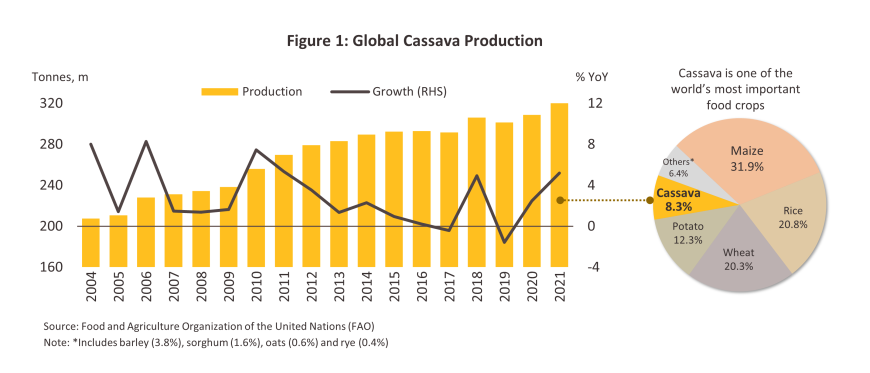

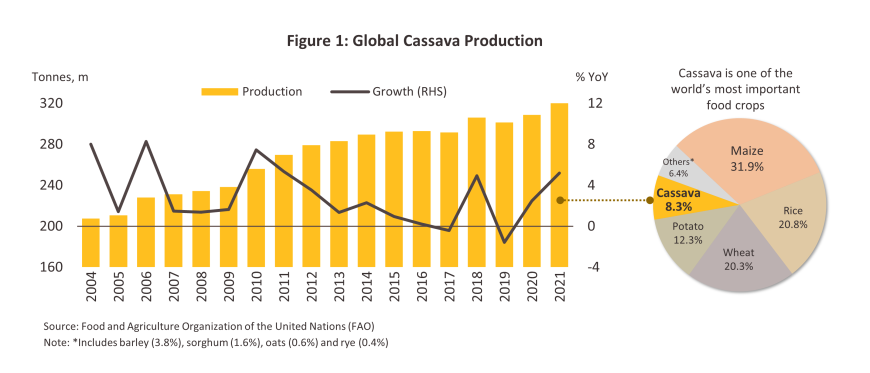

For many years, global demand for cassava has grown strongly thanks to its many industrial uses and the fact that it has often been cheaper than other starchy crops. This has then lifted it to the status of being the world’s 5th most important crop by output, after only corn, rice, wheat and potatoes.

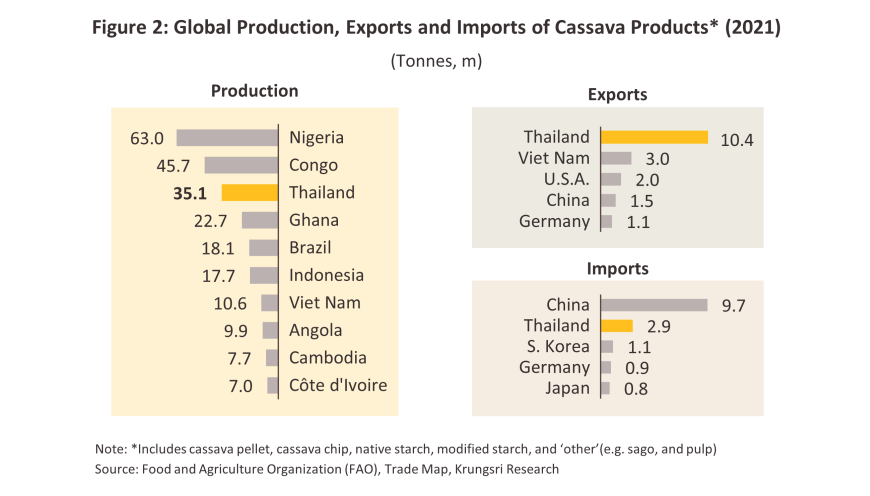

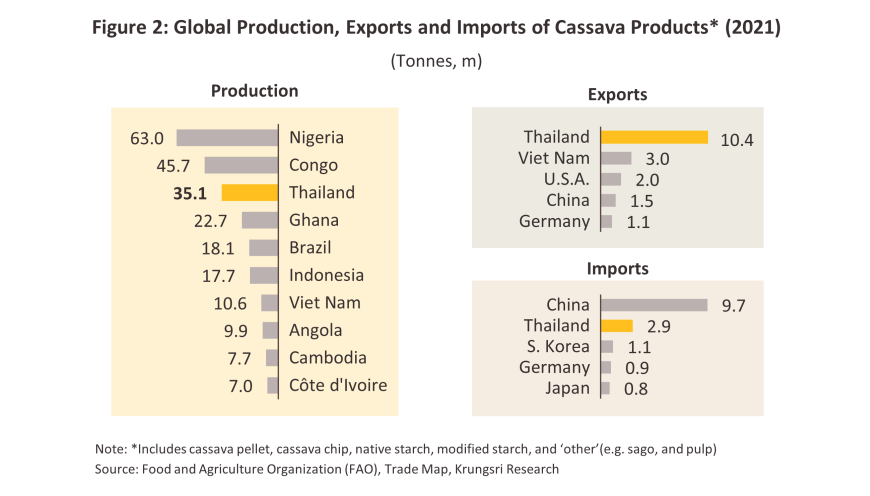

As of 2021, a total of 324.7 million tonnes of cassava were produced globally (Figure 1). Contributing 64.7% of the total, Africa was the most important cassava-producing region, followed by Asia1/ (26.7% of the total), the Americas (8.5%) and Oceania (0.1%). By individual country, Nigeria was the world’s biggest producer, with 19.4% of all outputs globally, followed by the DR Congo (14.1%), Thailand (10.8%), Ghana (7.0%), Brazil (5.6%), and Indonesia (5.5%) (Figure 2), although heavy investment by Thai and Chinese players in production in Cambodia and Vietnam has meant that annual outputs in these two countries has risen by an average of 9% and 2% respectively over the past 10-15 years.

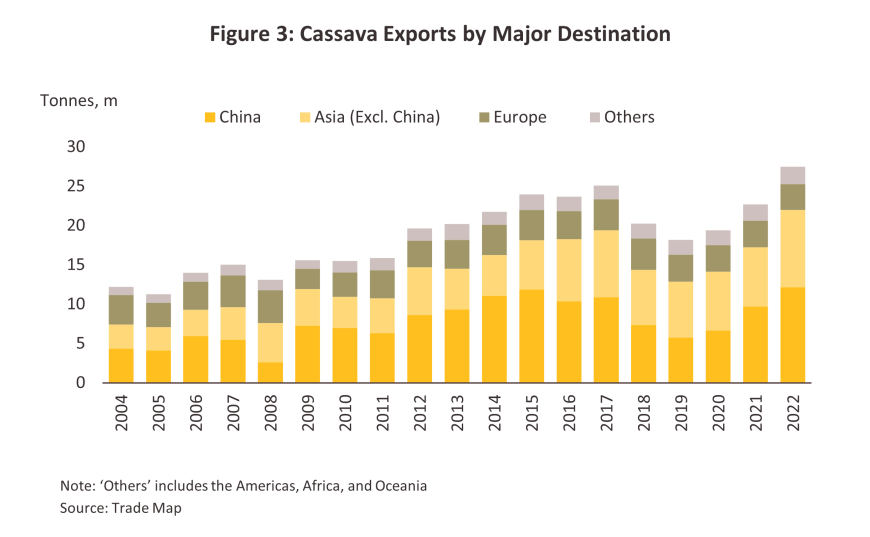

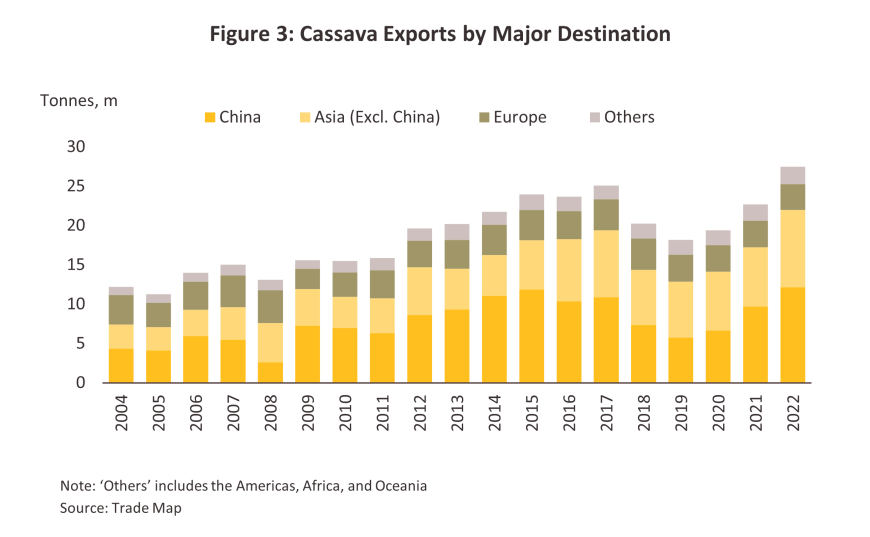

However, although Africa is home to the world’s most important cassava-producing nations, African production is largely for domestic consumption since in these countries, the crop plays an important role in local diets and in ensuring food security and supporting economic activity. African-produced cassava is therefore principally consumed as fresh and processed products that are distributed on domestic markets. By contrast, Thai production is oriented towards overseas markets and the country is thus the world’s most important exporter (Figure 2). In terms of export destinations, global markets for cassava are largely supported by demand from Asia, especially China, which alone accounts for 44.2% of all cassava imports made worldwide (Figure 3).

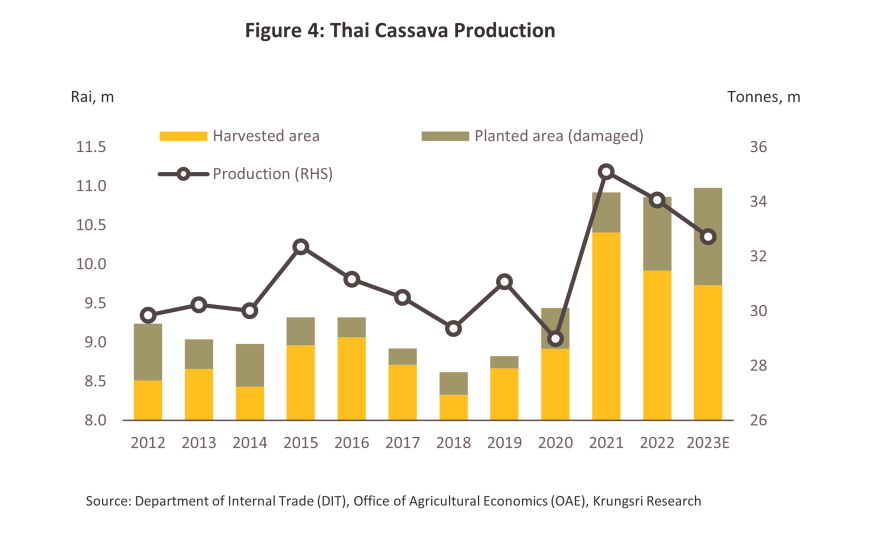

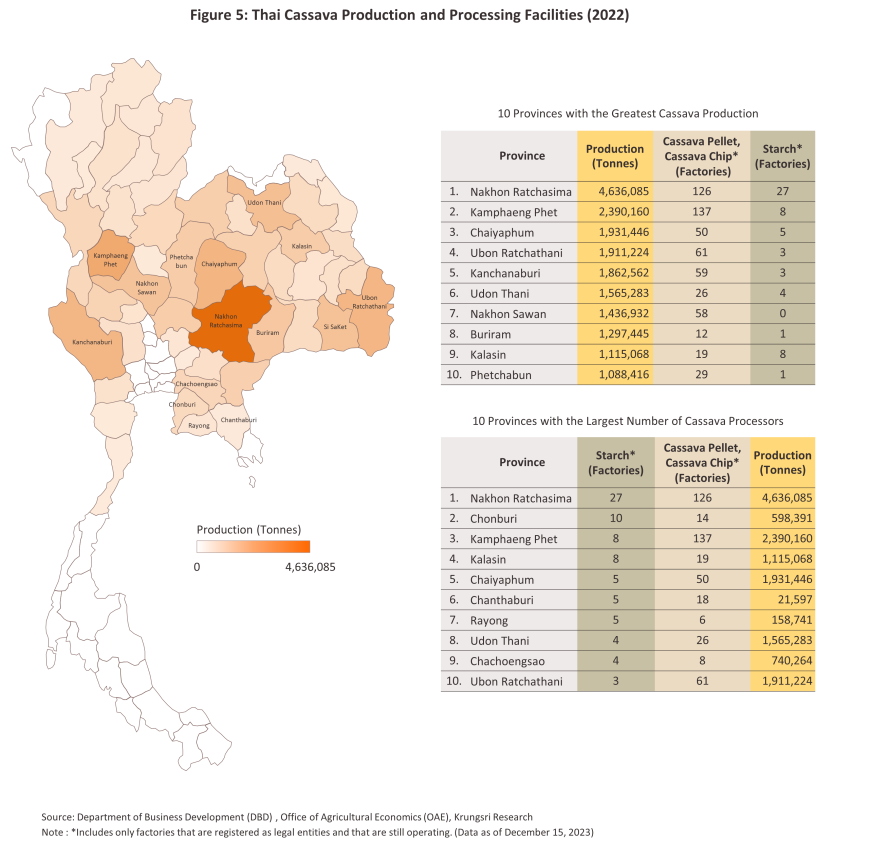

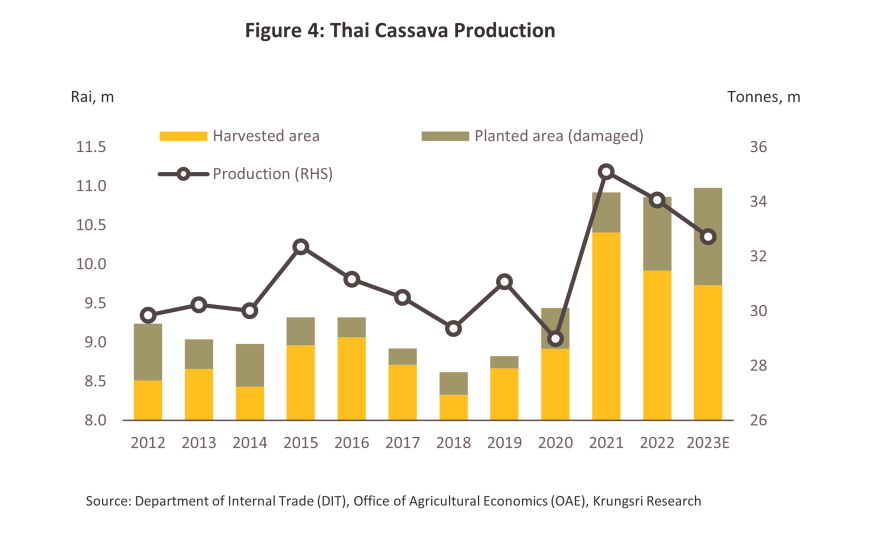

Over the past two decades, rising demand on export markets has fed into an expansion of Thai cassava processing capacity and through this, into a steady rise in the total area planted with cassava. Thus, as of 2022, 0.74 million households farmed a total of 9.9 million rai of harvested area (the average harvest area rate is 13.5 rai per family), and this yielded roughly 34.1 million tonnes of raw product2/ (Figure 4). Cassava cultivation is concentrated in the northeast of the country (54% of all harvested area), with this clustered most heavily in Nakhon Ratchasima (13.3% of all Thai cassava harvested, by area), followed by Kamphaeng Phet (7.3%), Chaiyaphum (6.0%), Kanchanaburi (5.4%), and Ubon Ratchathani (5.3%).

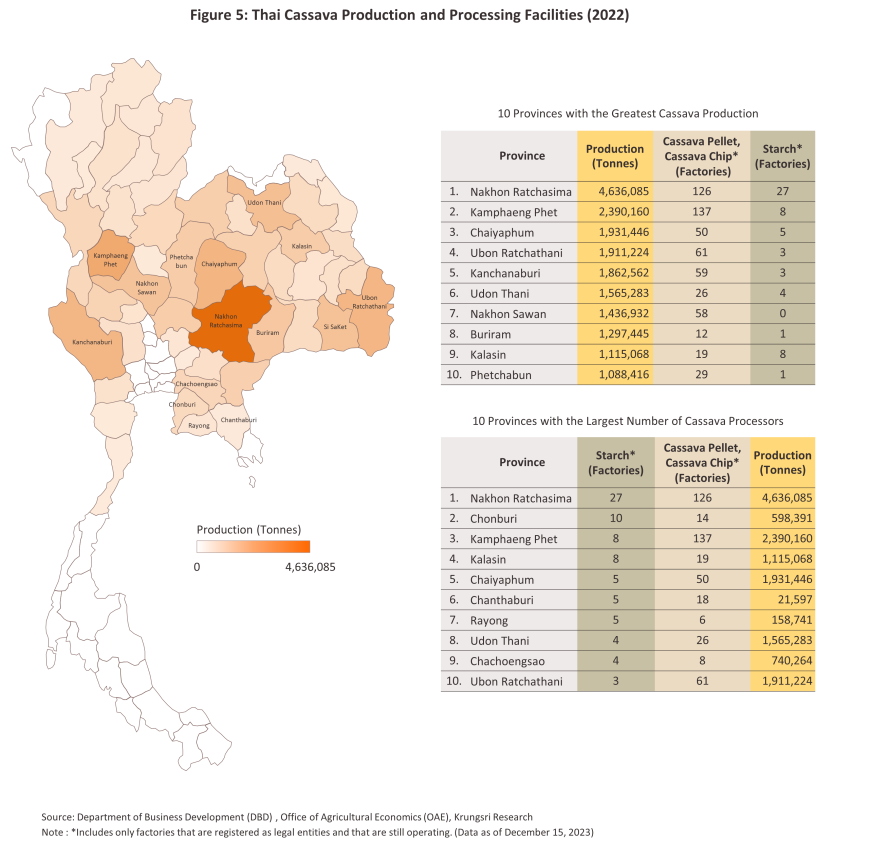

As of 2023, Thailand was home to 1,102 cassava processing facilities3/, which for convenience and to save on transportation costs are generally located close to cassava producing areas, and so with 153 plants, Nakhon Ratchasima has the highest concentration of all of Thailand’s provinces. Nakhon Ratchasima is followed by Kamphaeng Phet (145 plants), Nakhon Sawan (58 plants), and Chaiyaphum (55 plants). Thai players have also sited facilities in positions that allow them easy access to imports from neighboring countries, especially Lao PDR, Cambodia and Myanmar, though to ensure secure supplies of inputs, players have in addition established basic processing facilities in these countries. Thus, there are 64 cassava plants in Ubon Ratchathani, 62 in Kanchanaburi and 49 in Sa Kaeo, while to make exports more convenient, there are a further 24 facilities in Chonburi, 12 in Chachoengsao and 11 in Rayong, these locations having the advantage of ready access to major ports (Figure 5).

Thai cassava products can be divided into two principal categories.

-

Dried cassava products: The most important product in this group is cassava chip, which is used as an input into the manufacture of animal feed, alcohol and citric acid. Thailand is currently home to 937 facilities (95.0% of all cassava processing plants) that produce dried cassava chip. A further 28 (2.9%) process cassava pellets4/, and 14 (1.4%) provide drying yards4/. Other cassava processing involves conversion of this into cassava chip snacks and crushing or milling it for use as an animal feed.

-

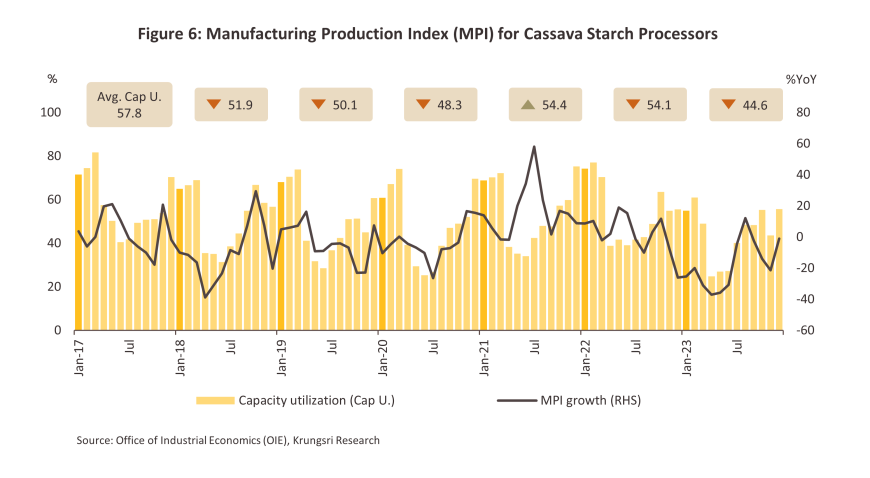

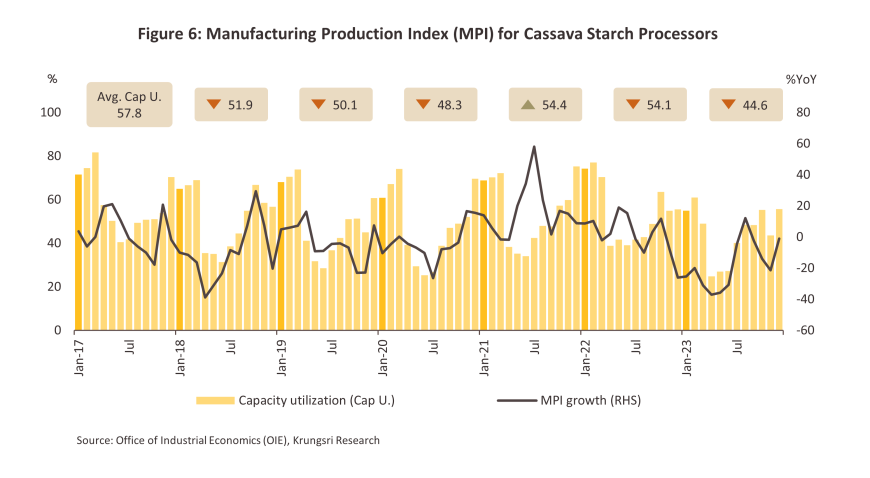

Cassava starch products: The initial output of cassava starch processing is ‘native starch’, which may be sold for household consumption as a cooking ingredient, or used in the manufacture of ‘modified starch’5/, a high value-added good that is an input into a wide variety of downstream industries, including the production of monosodium glutamate, sweeteners, sauces, cosmetics and medicines. At present, there are 29 facilities in Thailand producing native starch and a further 87 producing modified starch. Generally, the initial processing of cassava into starch occurs at the end of the year or the start of the next year because this period follows on immediately from the main harvest. Thus, both the cassava starch manufacturing production index and the industry’s capacity utilization typically peak between November and March (Figure 6).

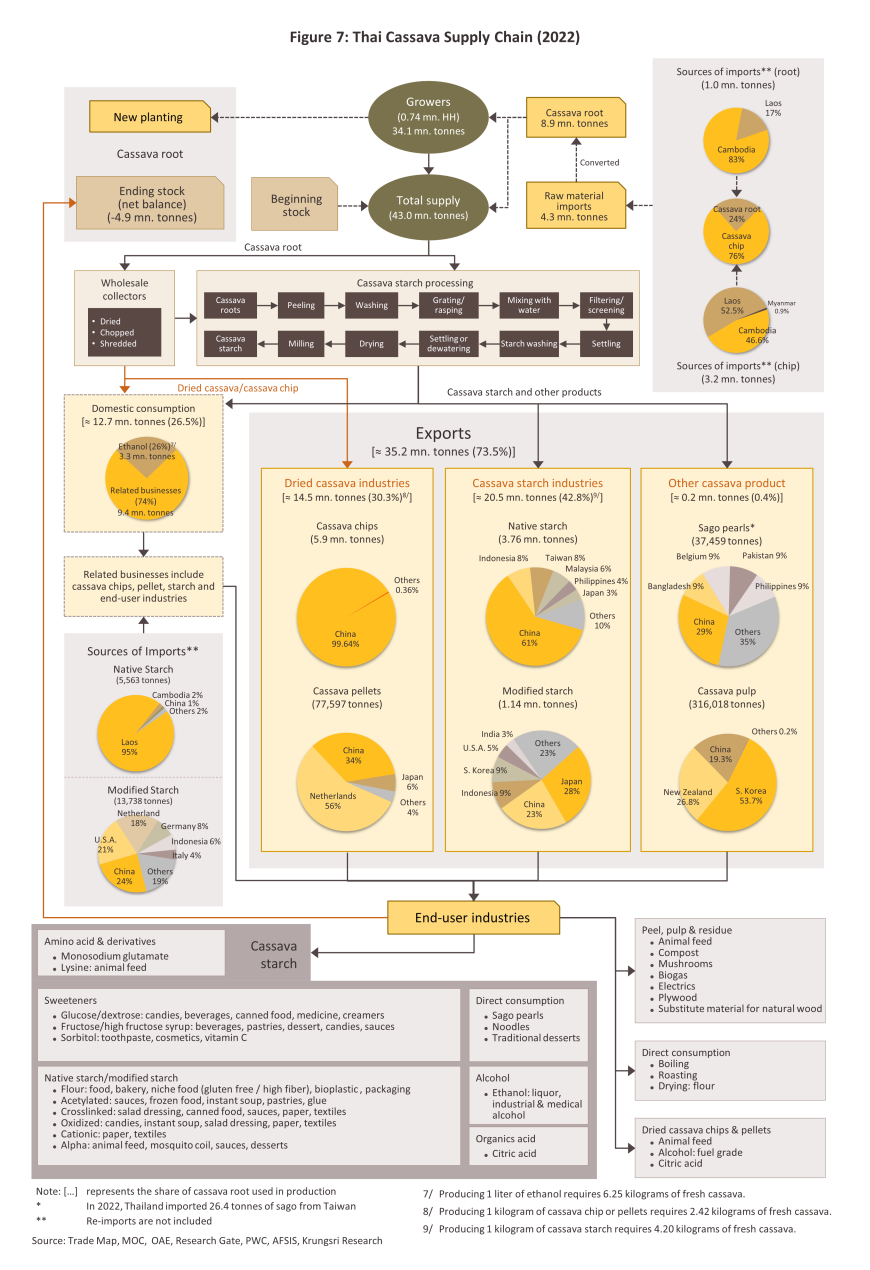

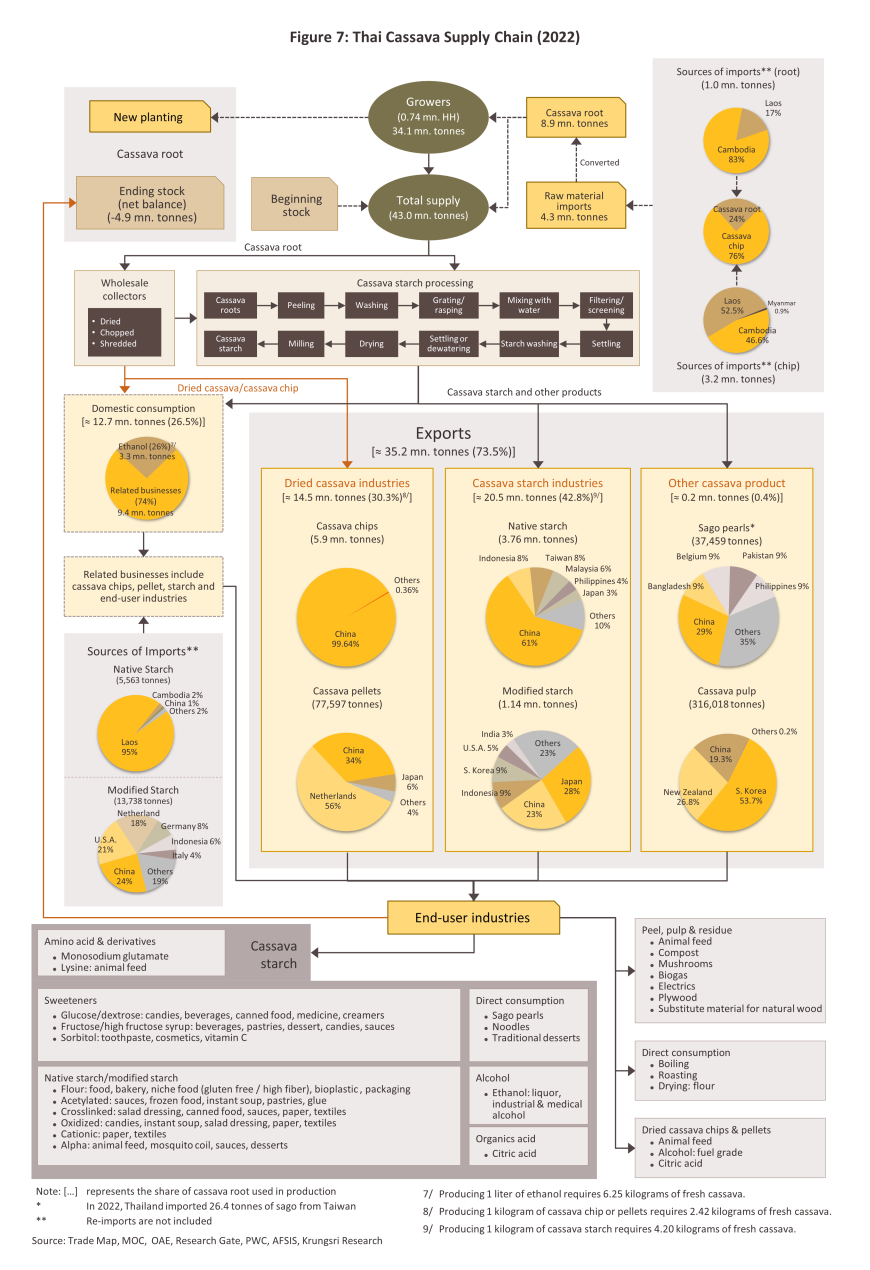

Considering the Thai cassava supply chain as a whole, in 2022, 71.1% of inputs to cassava processing was sourced domestically and only 18.6% came from imports, 99.1% of which was sourced in neighboring countries. These supplied 3.2 million tonnes of cassava chip6/ and 1.0 million tonnes of fresh cassava, and together these accounted for 99.5% of all cassava imports by volume. The balance of supply (10.3%) came from stocks held from the previous year. In total, 73.5% of Thai cassava output was used to supply export markets, with the remainder being distributed domestically, either for direct consumption or for use as an input into industrial processing (Figure 7).

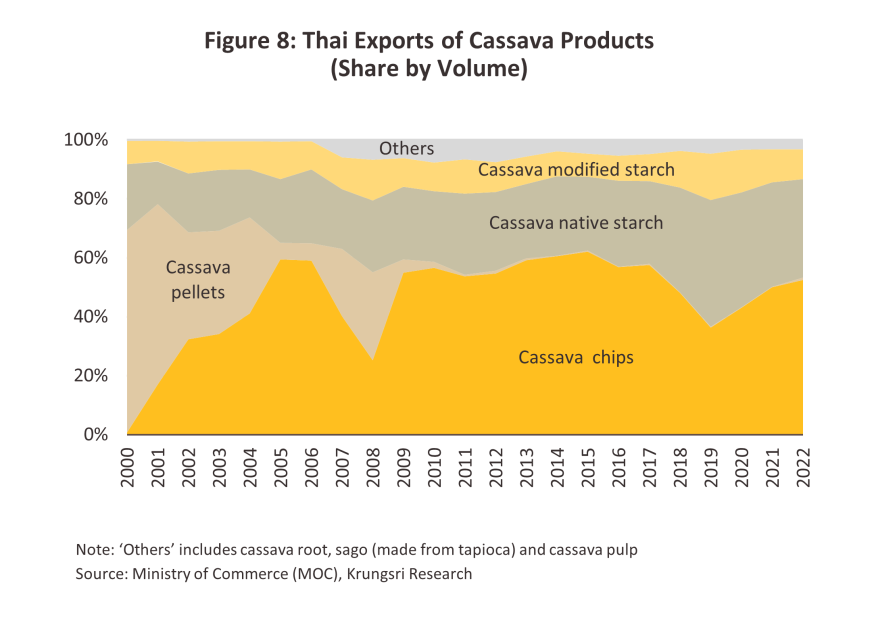

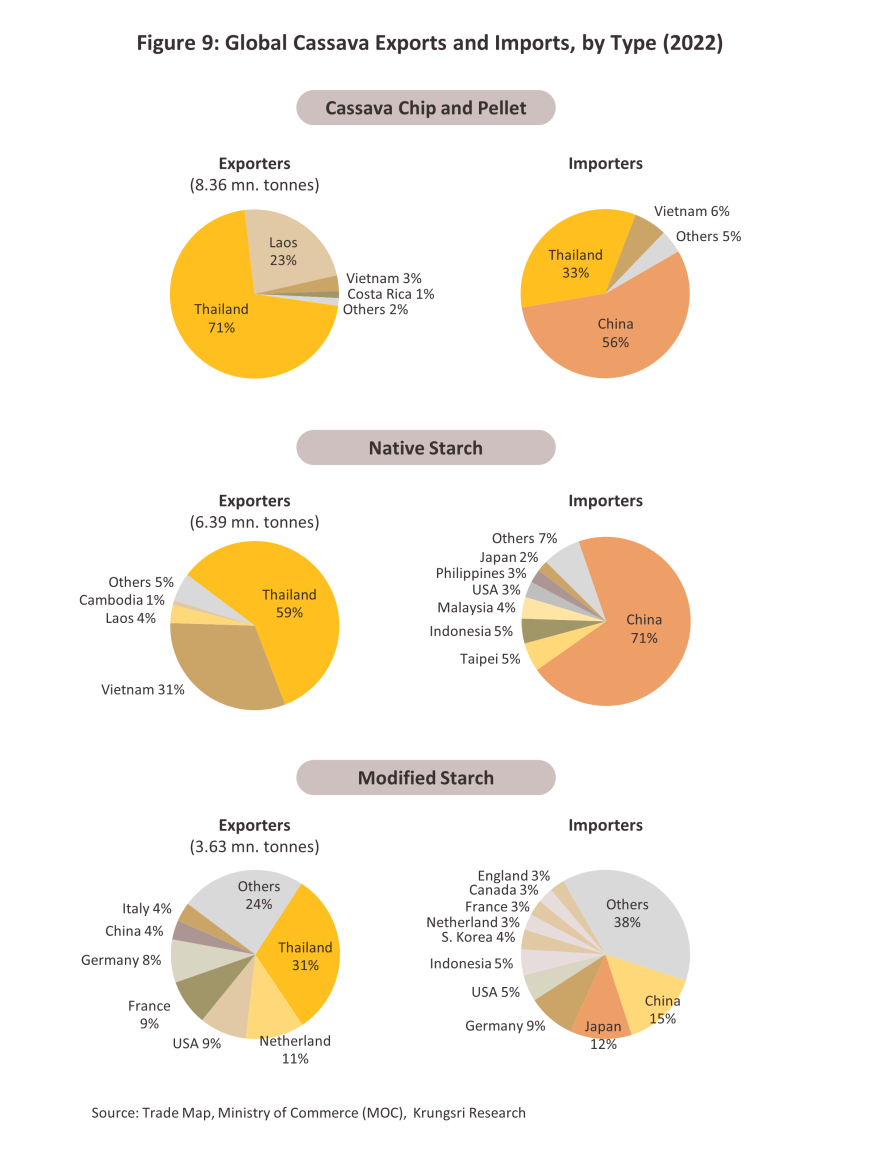

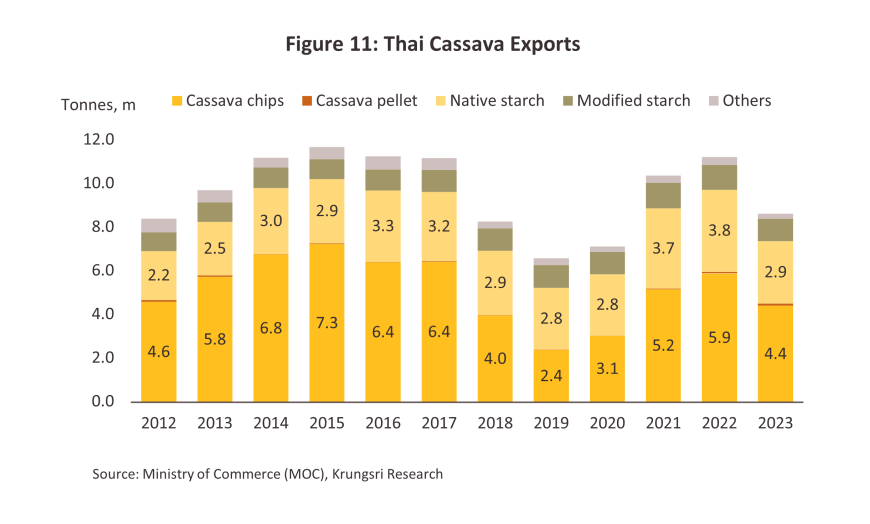

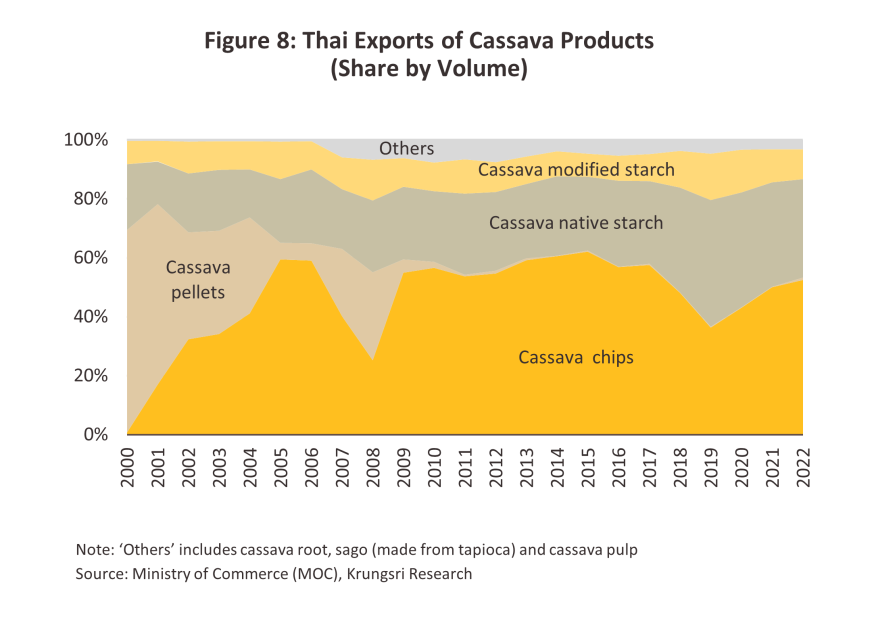

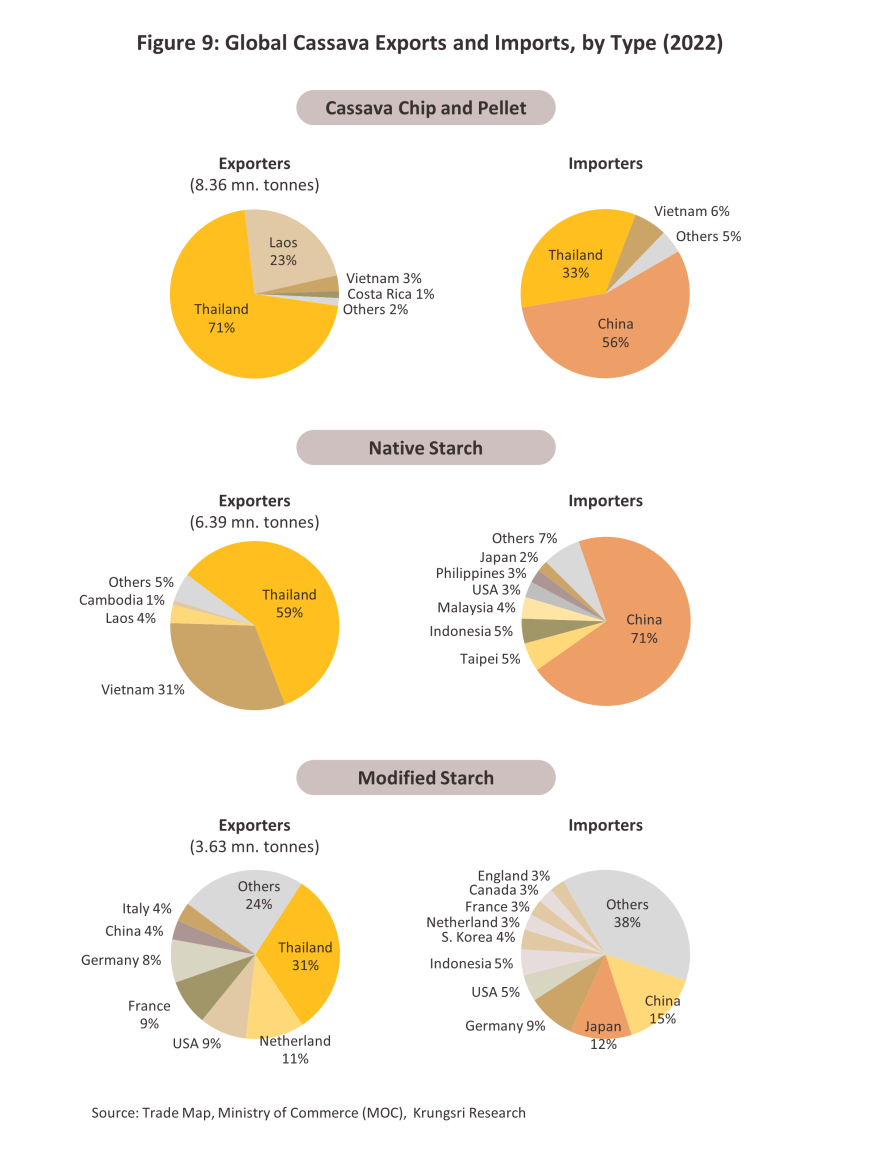

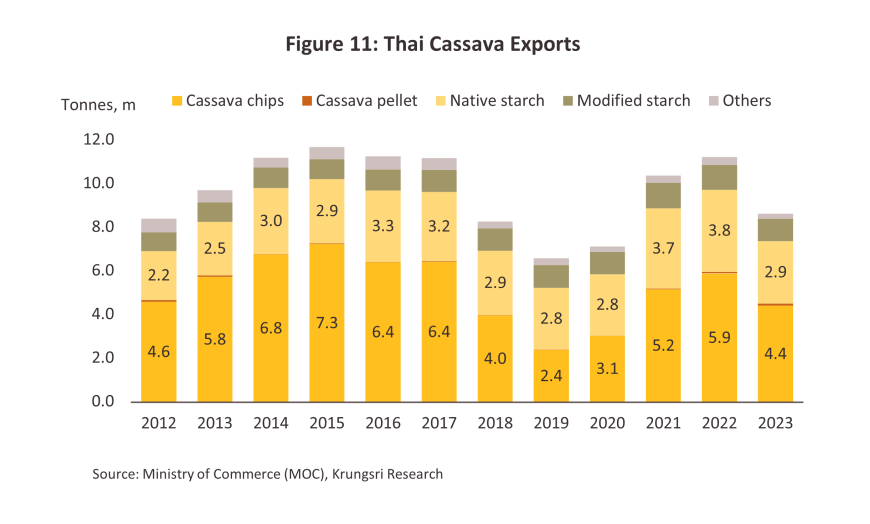

Thanks to its ready access to inputs, Thailand is the world’s leading exporter of cassava products, and the country’s share of global export markets now extends to 71% for cassava chip, 59% for native starch, and 31% for modified starch. However, following the 2005 decision by the EU to stop imports of cassava pellets10/ (the EU had until then been a major importer) and to switch to the use of alternatives, exports of these from Thailand have dropped to very low levels (Figure 8). The change in EU policy also had the effect of significantly altering the structure of Thai exports, which moved to an almost total dependency on Asian export markets, and in particular on sales to China11/, which with a 76% share of all Thai exports of cassava products is by far Thailand’s most important market. Markets for individual cassava products are detailed below.

-

Cassava chip: In 2022, 52.5% of Thai cassava product exports by volume were of cassava chip (Figure 8), almost all of which went to China (the destination for 99.5% of Thai exports of cassava chip in the year), where it is used to manufacture alcohol, ethanol, animal feed12/, and citric acid. However, the structure of the export market and the extreme concentration of purchasing power means that Thai suppliers have only a weak bargaining position and they are in addition exposed to significant levels of risk should there be a change in Chinese policies towards sourcing imports. This is in fact what happened in 2018-2020, when China cut its imports of cassava chip and switched instead to using corn, with significant knock-on effects for Thai exporters.

-

Native starch: This accounted for 33.5% by volume of all exports of cassava products from Thailand. The main markets for this again include China (which took 61% by volume of all exports of native starch), followed by Indonesia (8%), Taiwan (8%), Malaysia (6%), and the Philippines (4%), although the exact state of export markets depends on the health of the industries that use native starch as an input. These include food processing, paper production, beverages, and textiles.

-

Modified starch: This represents another 10.2% of Thai cassava product exports by volume. Strong global demand has been sustained by a positive outlook for downstream industries, including producers of food products, medicines and cosmetics. The main export markets for modified starch are Japan (which bought 28% of all 2022 exports of modified starch by volume), China (23%), Indonesia (9%) and South Korea (9%).

-

Cassava pellets: The 2005 decision by the European Union to cut imports of cassava pellets had profound impacts on exporters, and pellets now account for just 0.7% of total cassava product exports by volume, though this has increased from 0.2%. This segment has in addition been handicapped by the difficulty Thai players have in competing with similar products made from other crops (e.g., corn, wheat, and barley). The main export markets are now the Netherlands (56% by volume of cassava pellet exports), China (34%), and Japan (6%).

-

Other cassava products: The remaining 3.1% of cassava product exports comes from sales of fresh cassava, sago (made from cassava starch), and cassava pulp. In 2022, the main buyers of these products were South Korea (48% of exports of these, by volume), New Zealand (24%), and China (20%).

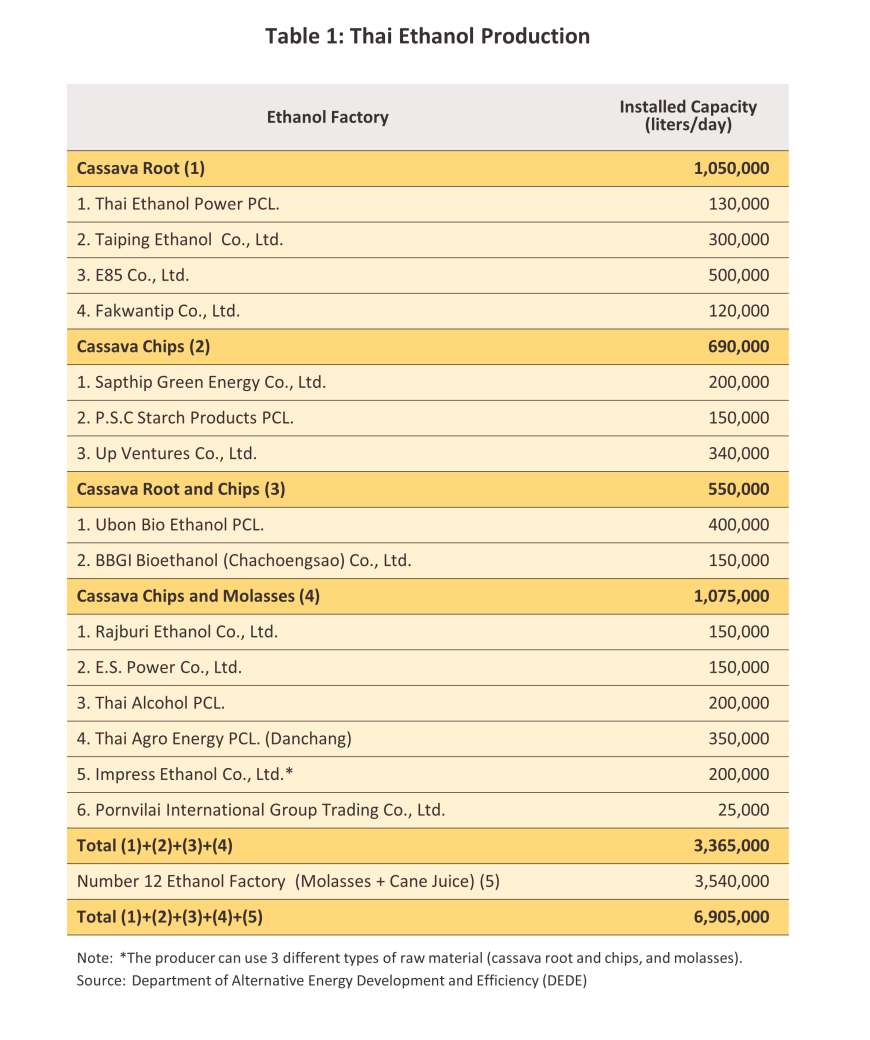

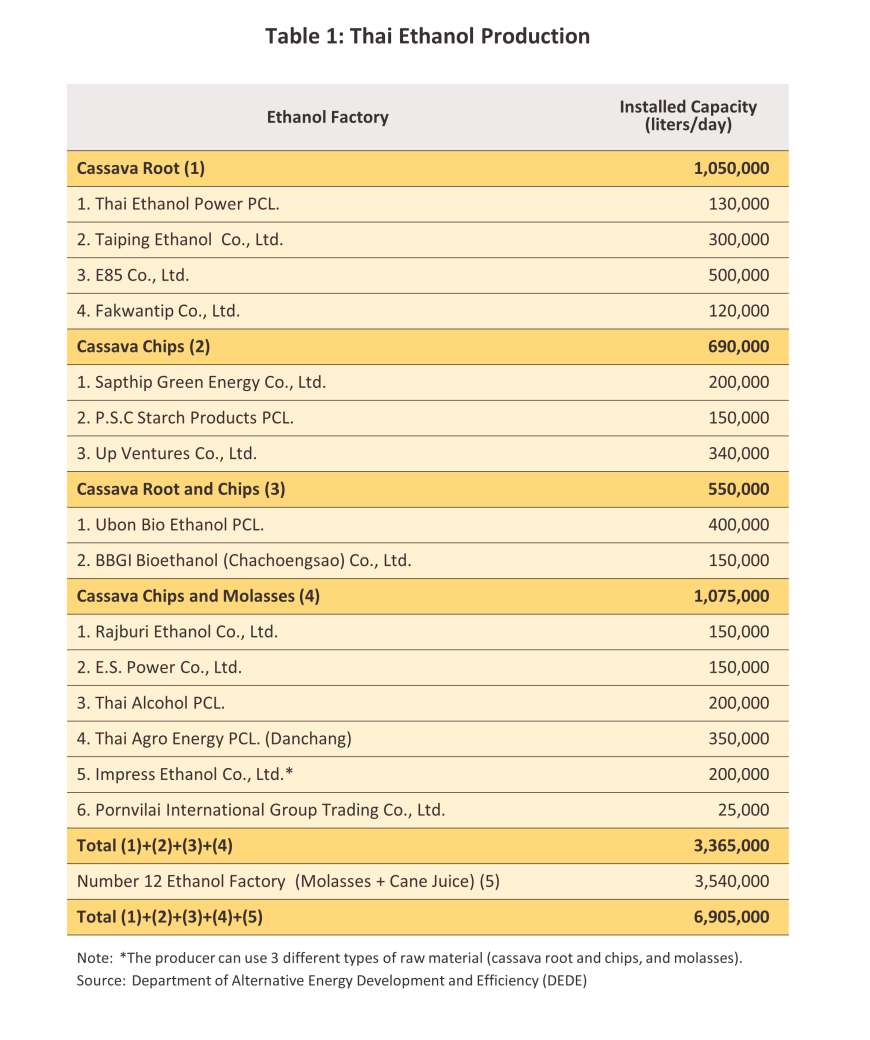

In addition to being consumed directly by households and processed into animal feed, cassava is also used domestically as an input into other industries, including the processing and production of food and beverages, medicines, cosmetics, chemicals, and alcohol. Large players have also invested in downstream industries, including ethanol production and the generation of bioenergy from cassava pulp and other waste products. The electricity that is produced from this may then be sold on or used by the cassava processor itself (Table 1).

Situation

Output weakened in 2023, with a combination of floods and drought impacting outputs and depriving the industry of inputs for further processing. Tight supply then dragged on exports, although recovery in downstream industries meant that demand remained strong, which was further boosted by worries over food and energy security. As such, cassava prices strengthened.

-

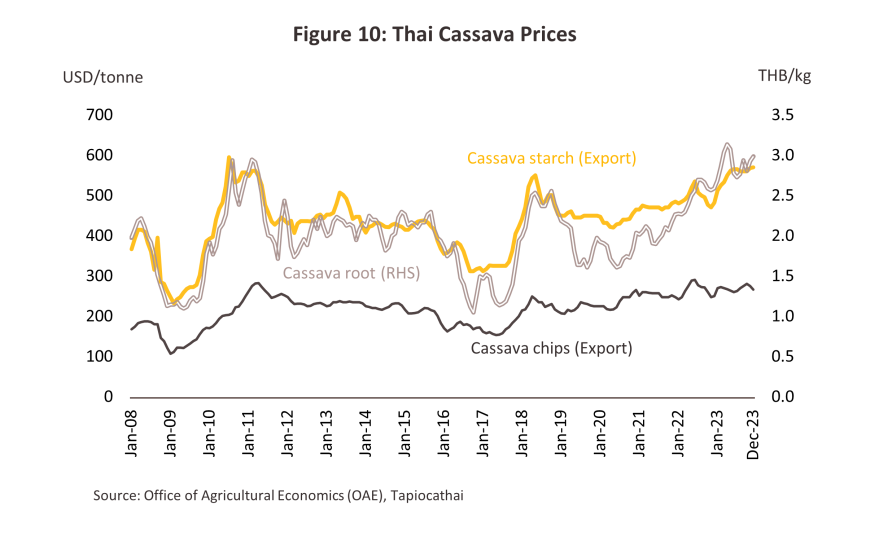

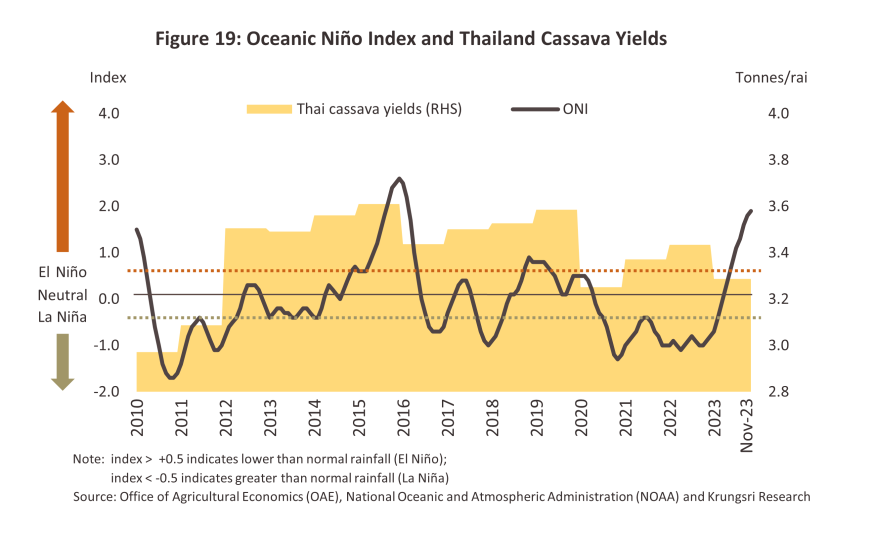

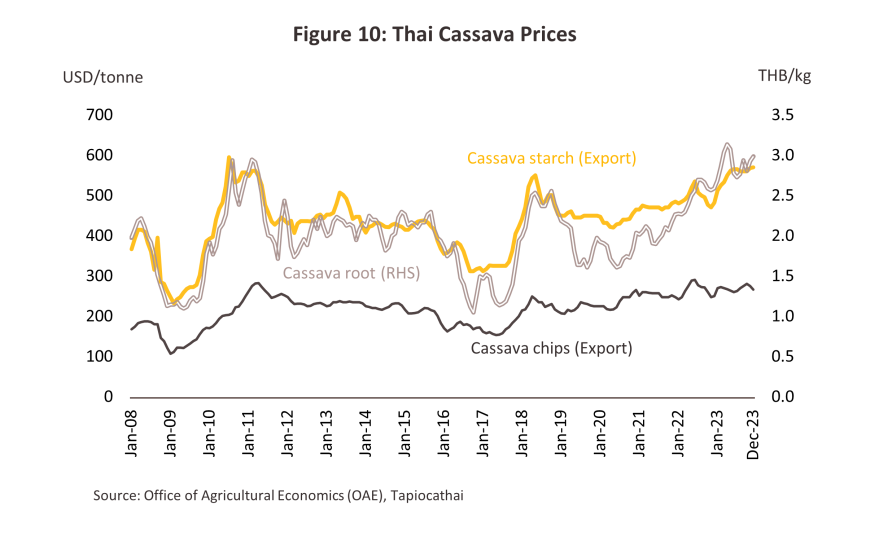

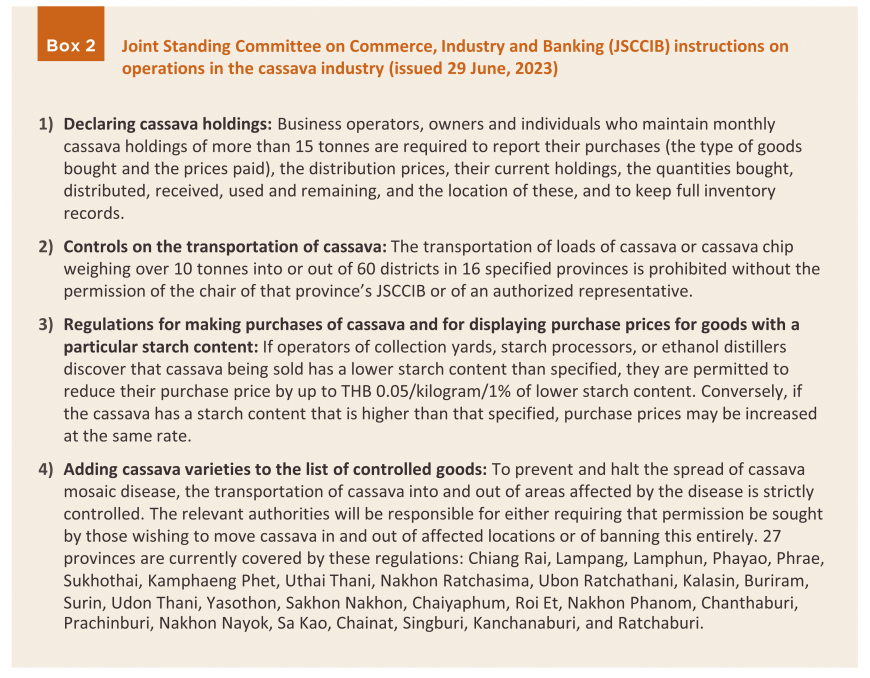

Cassava outputs fell through 2023, and the Office of Agricultural Economics estimates that in the year, these totaled 30.7 million tonnes, down -9.8%. The harvested area also contracted -5.8%, falling to 9.4 million rai, thus indicating that yields were down -4.3% to 3,287 kg/rai. This decline was a result of: (i) the impact of Typhoon Noru, which in September 2022 led to flooding in some areas that damaged crops due to be harvested at the start of 2023; (ii) the delayed start to the rainy season in Q2 2023 and then below average rainfall due to the onset of the current El Niño, which damaged or killed crops planted at the end of 2022; (iii) the spread of cassava mosaic disease and infestation with pests; and (iv) a shortage of the cassava stem cuttings needed for planting, which then reduced the total area under cultivation. Thus, despite being incentivized to expand the area planted by prices for cassava that have risen from the second half of 2020 onwards (Figure 10), the outputs in fact shrank (Figure 4).

-

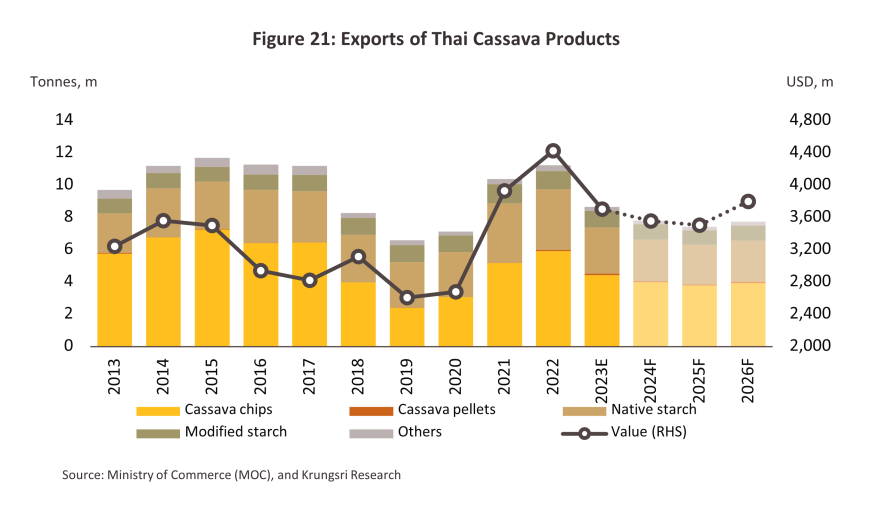

Exports also contracted in 2023, these were down -23.0% to 8.7 million tonnes, with receipts from these down -16.4% to USD 3.7 billion (After these expanded by 8.2% by volume and 12.7% by value in 2022). Declines were driven principally by the supply shortfalls described above, and with access to inputs limited, capacity utilization by midstream starch producers slipped from 54% in 2022 to just 45% a year later, even as overall demand grew. (i) In China, demand for cassava for use in the production of medical alcohol, food products, chemicals, and animal feed strengthened following the ending of the zero-COVID policy and the reopening of the country, but with Thai outputs down, Chinese buyers switched to sourcing goods from other countries, including Indonesia and Lao PDR. (ii) Worsening geopolitical tensions intensified to the point that these posed a threat to transport and logistics, and this added to worries over food and energy security, pushing up prices for cassava products across the board. The situation for individual product categories is given below.

-

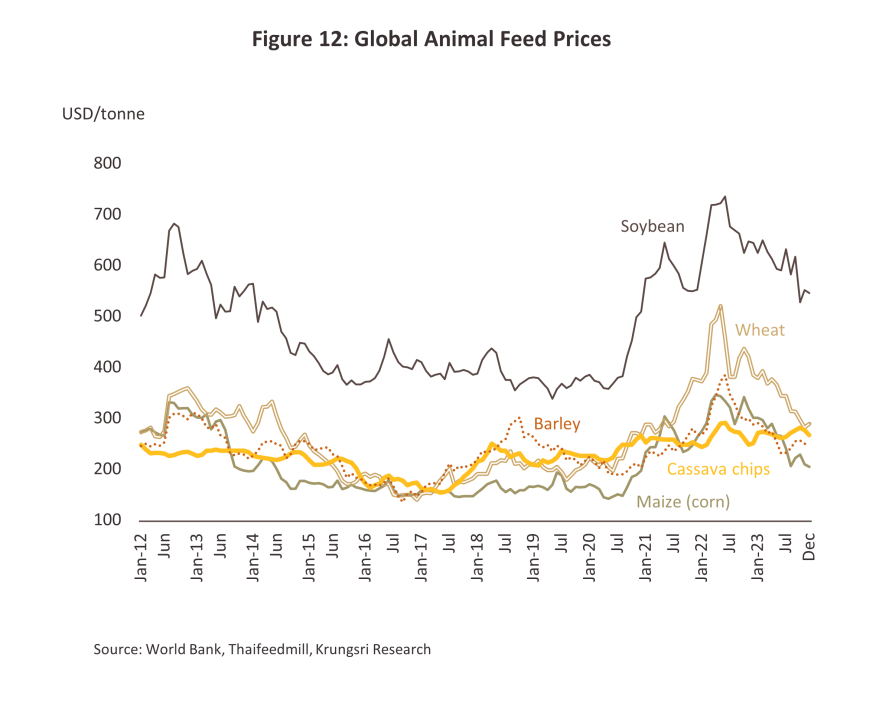

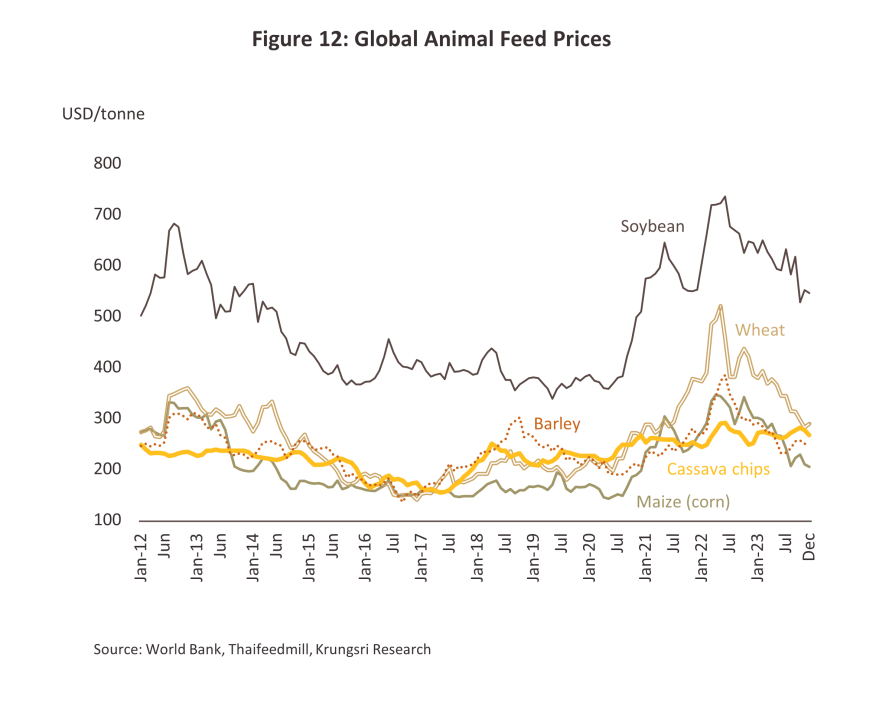

Native starch: exports were down by -23.7% by volume and -17.2% by value to totals of respectively 2.87 million tonnes and USD 1.52 billion. This is a result of: (i) shortages of inputs for processing; and (ii) the 1.5% rise in cassava prices, which ran against the trend for crops used as alternative starches and that saw supply expand and prices fall (e.g., barley (-19.3%), corn (-20.8%) and wheat (-20.8%) (Figure 12). Exports to the main markets of China, Taiwan, Malaysia, and the US thus slid, although demand grew for use in the processing and production of food and beverages, paper, glue, textiles, and composite wood products, and this then pushed up the average export price of Thai native starch by 8.4% to USD 530/tonne.

-

Cassava chip: By volume and value, exports of cassava chip were down by respectively -25.6% and -25.0%, bringing these to totals of 4.38 million tonnes and USD 1.13 billion. As with other product categories, this was caused by widespread supply shortages, although sales were lifted by: (i) stronger demand from China for cassava chip for use in the production of alcohol, ethanol, and animal feed; and (ii) demand for use as a replacement for other starches for which prices had risen or which were less available due to geopolitical conflicts. Overall export prices thus edged up 0.9% to USD 259/tonne.

-

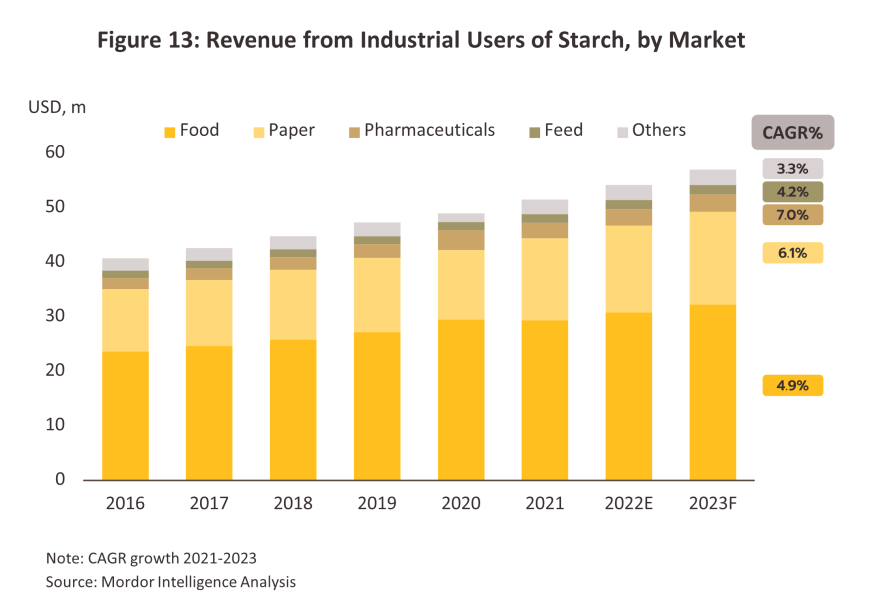

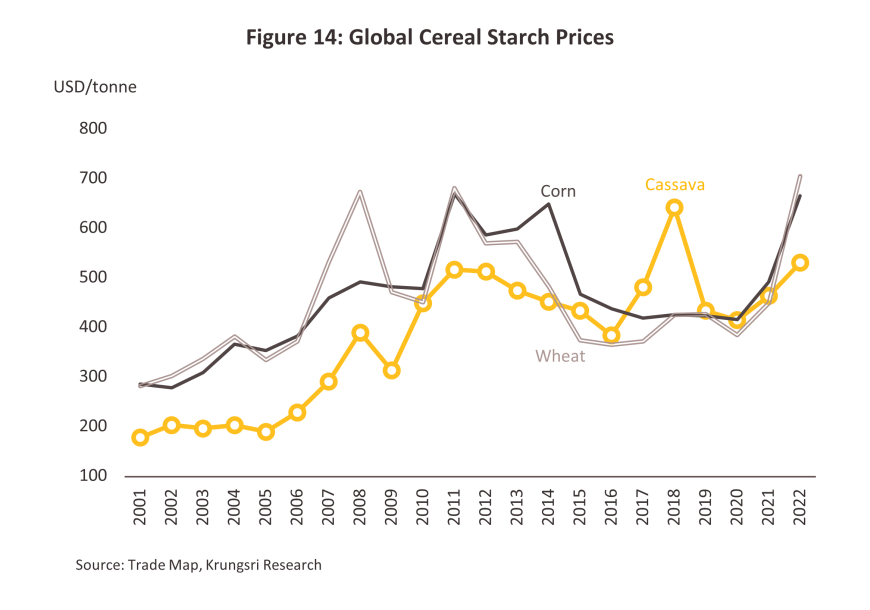

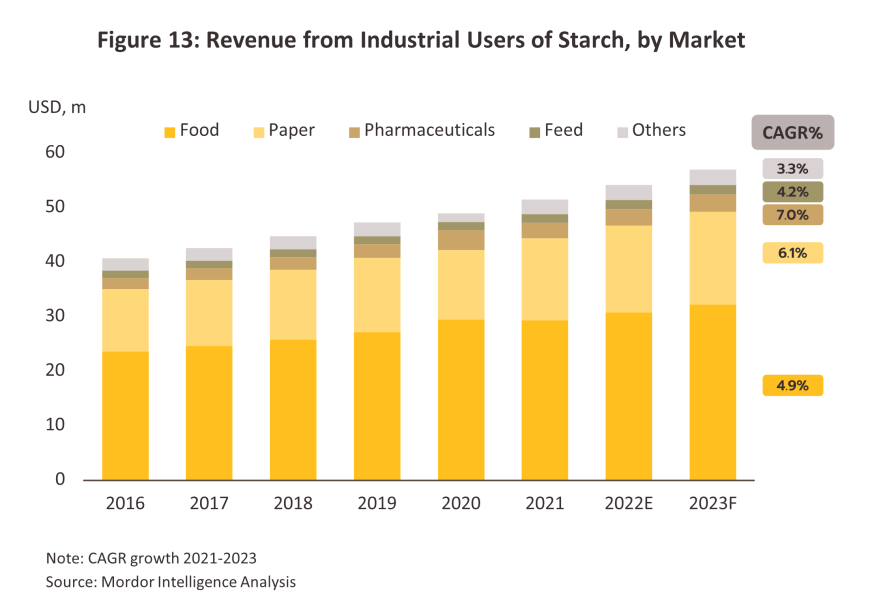

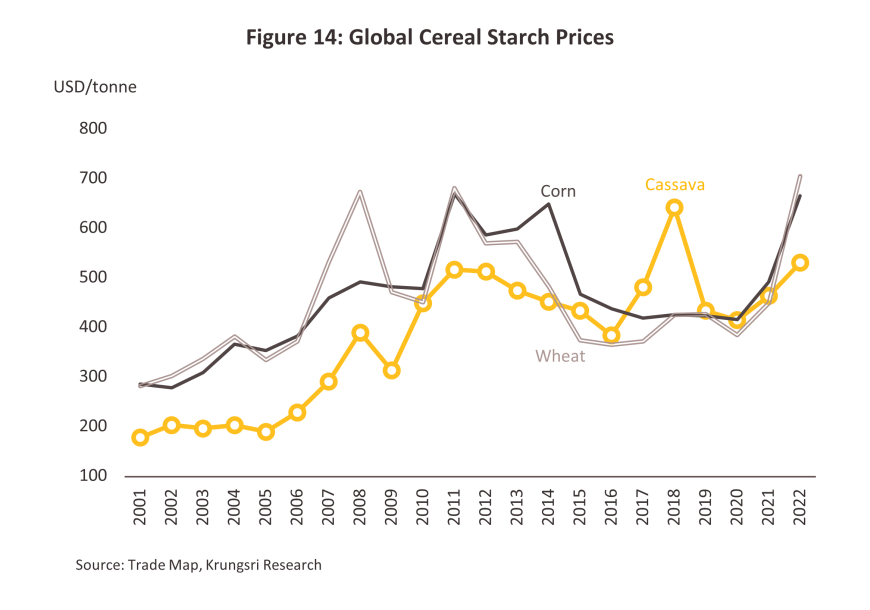

Modified starch: Exports of modified starch have totaled 1.02 million tonnes, which then brought in USD 0.93 billion, and these figures thus represent falls of respectively -10.2% and -2.6%. Declines were especially pronounced in the primary markets of China, Japan, South Korea, Indonesia, and the US, though rising prices for modified starches produced from other crops that have a similar profile to cassava starch (Figure 14) indicate that global demand for starch for use in the production of food, sweeteners, paper, medicines, and cosmetics continued to grow (Figure 13). Average 2023 export prices for Thai modified starch are expected to have risen 8.5% to USD 909/tonne.

-

Cassava pellets: Unlike other products, exports of cassava pellets rose, jumping 22.1% to 94.8 kilo tonnes and bringing in earnings of USD 27.4 million (up 23.8%). Demand from China for use in animal feed and energy production strengthened in the period, partly due to the difficulty sourcing cassava chips, and this helped to lift average prices by 1.4% to USD 289/tonne.

-

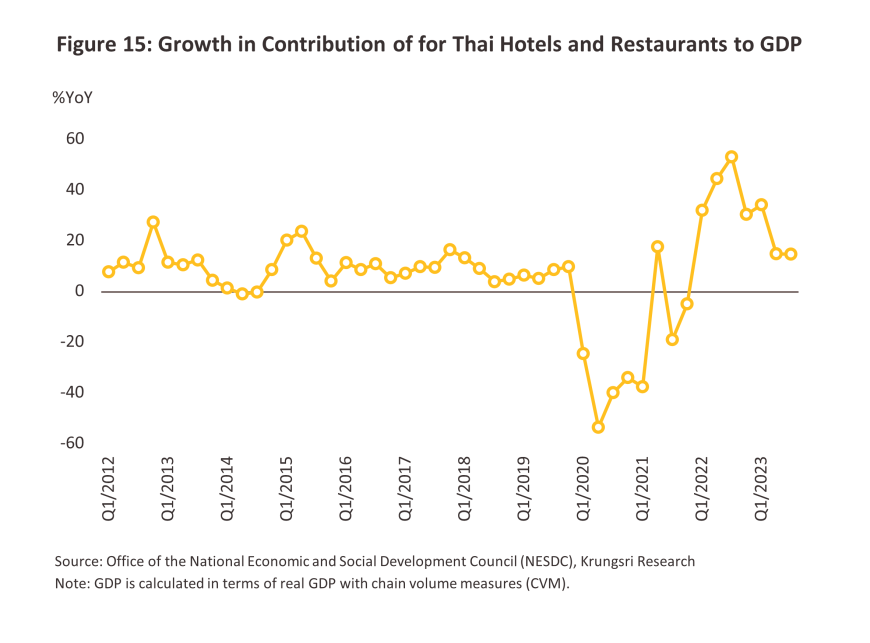

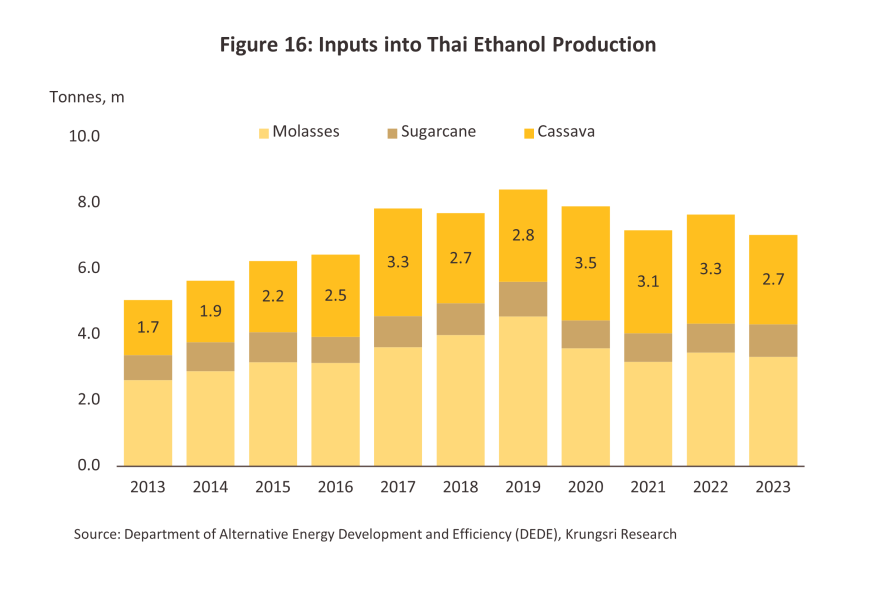

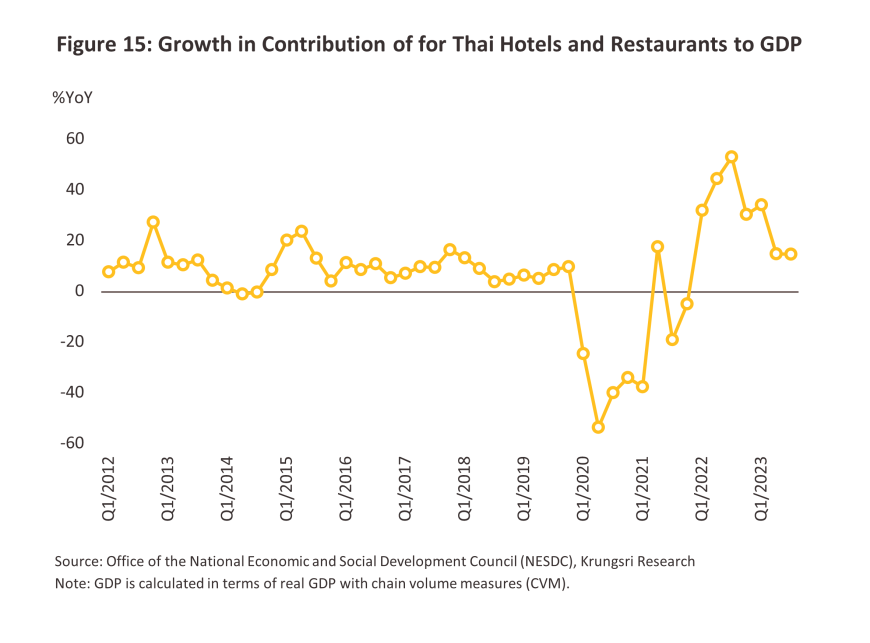

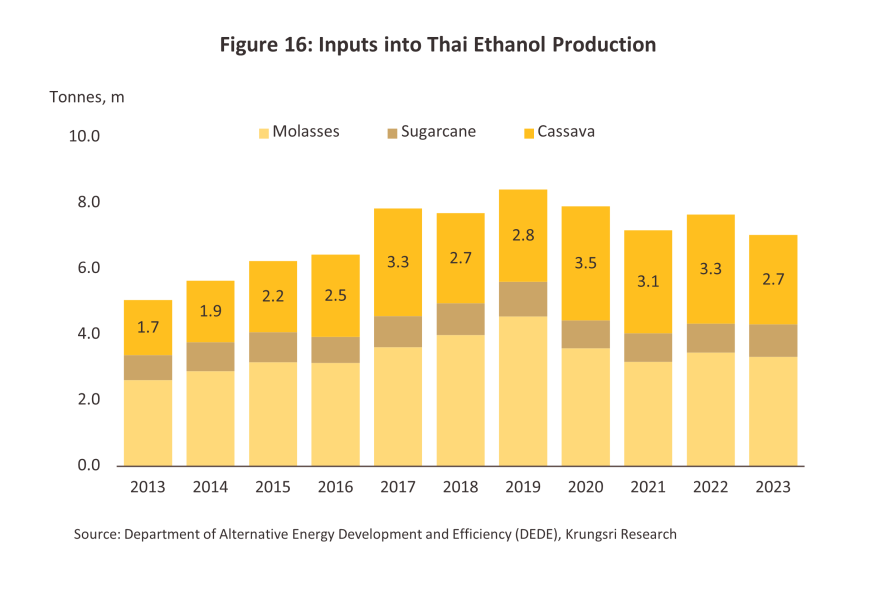

Domestic consumption rose through the year on an uptick in activity in downstream industries, in particular among food processors. Thus, having expanded by 5.5% a year earlier, 2023 demand is expected to have grown by 3.0-4.0% to 13.1-13.2 million tonnes of fresh cassava, split between: (i) 10.4-10.5 million tonnes of fresh cassava that were used by households and industry, up 10.5-11.5% on the resumption of normal service in restaurants and an increase in consumption following the recovery in the tourism industry (Figure 15); and (ii) 2.7 million tonnes of fresh cassava that was used by the energy sector, though this was down by -17.9% (Figure 16) as a consequence of the supply shortage and declining consumption of gasohol. The latter was itself a result of the decision by the Oil Fund to withdraw subsidies for E85 in 2022, which then encouraged cassava-based ethanol producers to cut back on production.

-

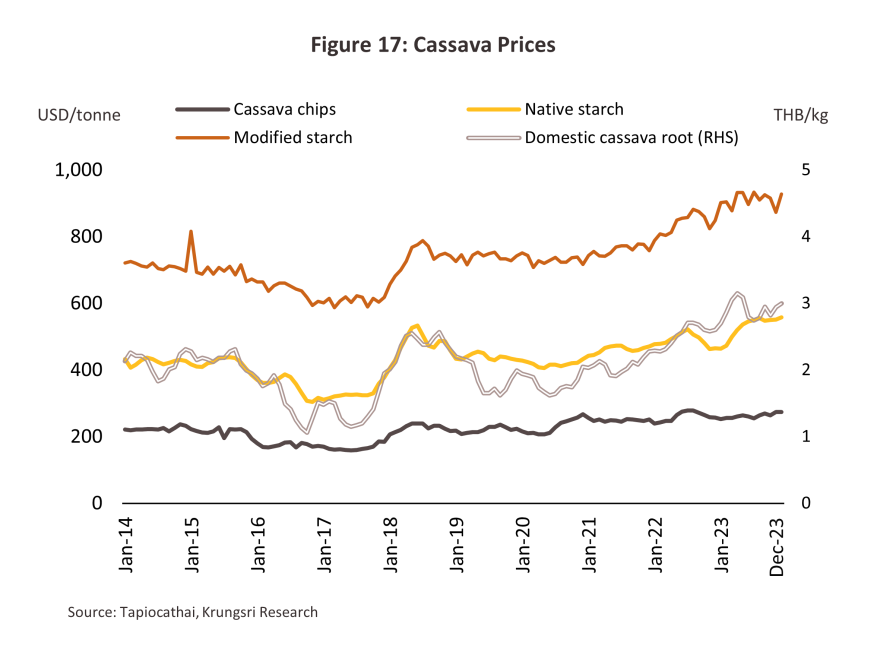

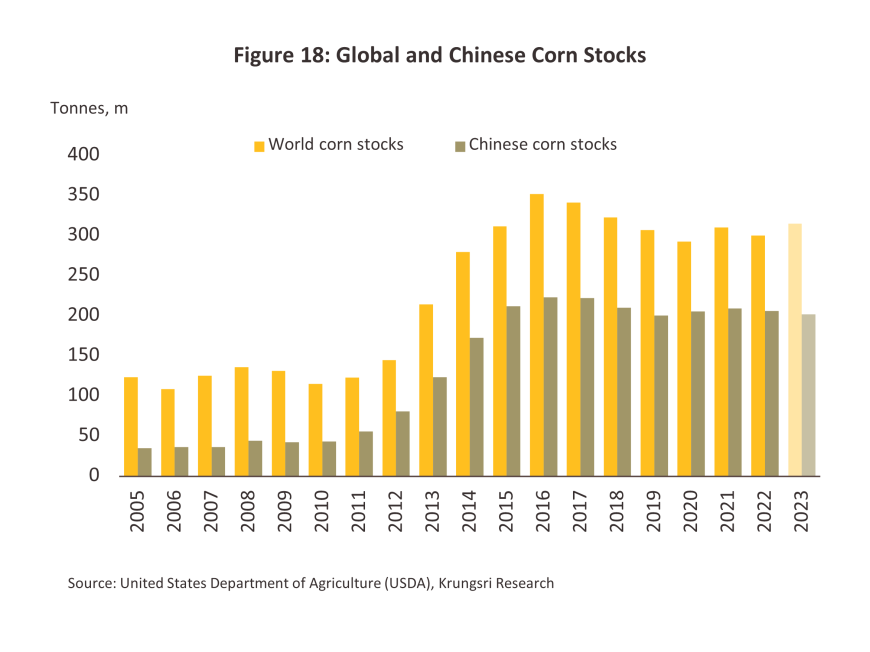

Domestic prices for fresh casava climbed 15.2% in 2023 to THB 2.91/kg, down slightly from 2022’s 22.0% jump (Figure 17). Prices were lifted by strong domestic consumption for use in downstream industries, in particular in the production of alcohol, ethanol and energy, as well as by solid demand in export markets, in particular in China, where cassava was used in place of declining corn stocks that were insufficient to meet demand for use in the manufacture of food products, alcohol, ethanol, and animal feed (Figure 18). Markets also benefited from intensifying worries over food security and the overall impact of extended geopolitical stresses.

Outlook

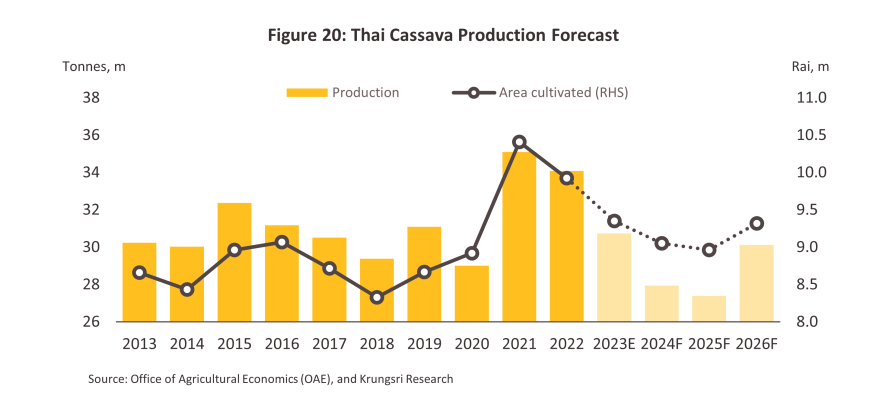

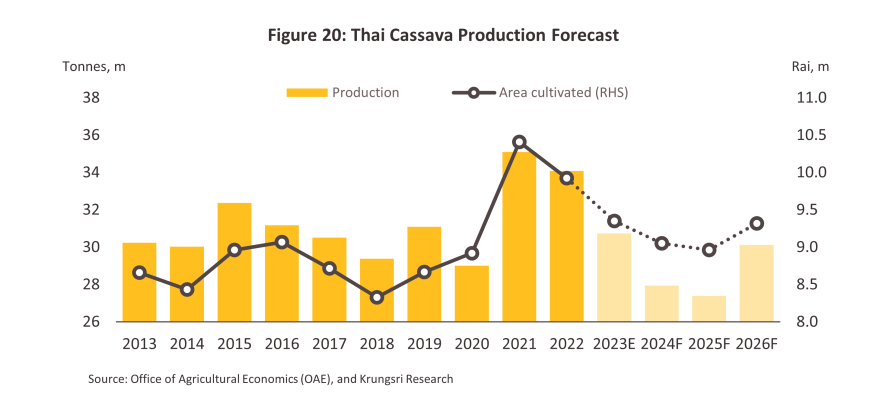

Outputs: Over 2024-2026, outputs are expected to slip by between -0.5% and -3.5% annually, having already slumped -9.8% in 2023.

-

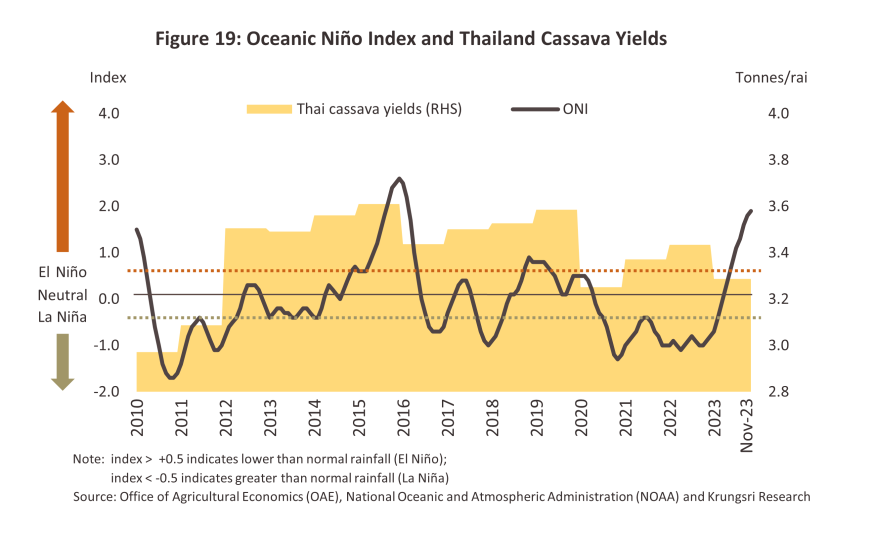

Outputs are forecast to contract by between -5.0% and -6.0% over each of 2024 and 2025, bringing these down to 27.4-27.9 million tonnes of fresh cassava. Output will be hurt by the current El Niño (Figure 19), whose impact is expected to last over the next 1-2 years, coupled with problems generated by outbreaks of cassava mosaic disease and the ongoing shortage of cassava stem cuttings. Nevertheless, tailwind to support expanding supply will come from: (i) strong prices that will encourage farmers to expand the cultivation area, (ii) sufficient levels of water in reservoirs to allow planting to continue in farmland near irrigation ystems, and (iii) ongoing growth in downstream industries in export markets. In addition, worsening international tensions are pushing many countries to improve their food security by expanding their food stocks.

-

Supply should return to growth in 2026 thanks to (i) the lessening influence of El Niño once peak impacts have passed, in comparison with the low baseline set in the previous two years; (ii) the strong incentive provided by high prices; and (iii) the expansion of cultivation areas coupled with increased yield per rai is showing a positive trend. Outputs are therefore expected to bounce back to growth of 7.5%-11.5%, which would pull the harvest back up to a total of 29.5-30.5 million tonnes of fresh produce (Figure 20).

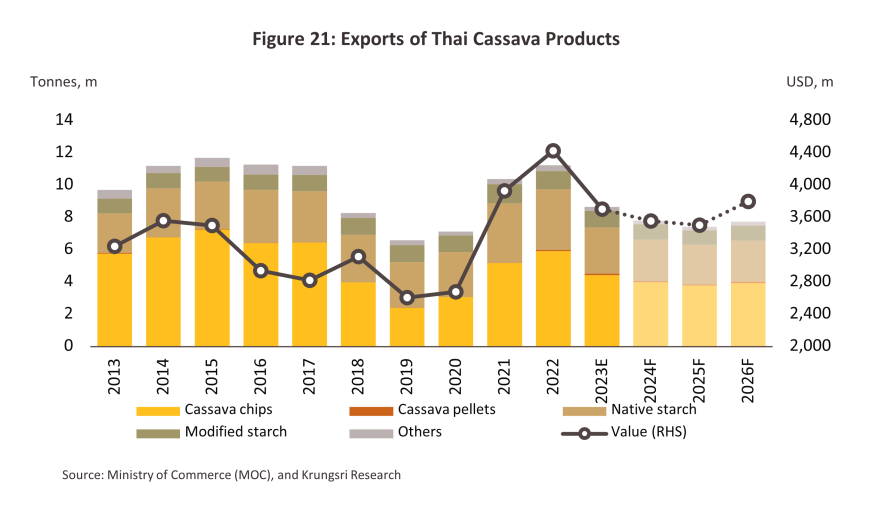

Exports: Having already slumped by -23.0% in 2023, exports are forecast to slip by another -3.0% to -5.0% annually. Overseas sales will contract in 2024 and 2025 as a result of domestic supply shortages, which will result in insufficient downstream goods being available to meet overseas demand. These problems will likely be amplified by outbreaks of disease and the continuing shortage of cassava stem cuttings for planting, which may encourage farmers to switch to alternative crops. However, exports should return to growth in 2026 as the El Niño abates, while the earlier steady run-up in export prices indicates that demand will remain solid. The Chinese market will be especially strong thanks to ongoing demand from producers of medicine, cosmetics, food, paper, sweeteners and textiles. The outlook for individual product categories follows (Figure 21).

-

Native starch: Exports are forecast to fall by an average of -3.5% to -5.5% per year to a total of 2.4-2.6 million tonnes. The Chinese market will remain strong but domestic problems sourcing inputs will mean that overall exports will slide. Sales of native starch will also come under pressure from: (i) strong competition on price from other starches, especially those made from corn; (ii) China’s increasing ability to substitute cassava starch with domestically produced corn starch products; and (iii) Chinese investment in cassava cultivation and basic processing facilities in the CLMV countries, which is now supporting an expansion in sales from these to China13/.

-

Cassava chip: Annual exports will drop to 3.8-4.0 million tonnes, declining by between -3.0% to -5.0% per year as the effects of the lack of access to raw materials impact sales to China. Chinese demand will, though, continue to benefit from: (i) the post-COVID reopening of the country; (ii) the recovery in economic activity and the positive effects of this on demand for cassava-based ethanol for use in the construction and energy industries; and (iii) the easing of the African swine fever epidemic, which will then support stronger demand for animal feed.

-

Modified starch: As with other segments, exports will weaken, falling by -2.5% to -4.5% to 0.89-0.95 million tonnes annually on the effects of the supply shortfalls that are expected to materialize over 2024 and 2025. Nevertheless, downstream demand will remain solid, coming in particular from producers of medicine, cosmetics, food products, paper, sweeteners, and textiles. Mordor Intelligence therefore sees the global market for starch derivatives and sweeteners expanding by 5.4% annually (CAGR) over 2023 to 202614/.

-

Cassava pellets: Annual exports will be down by between -6.5% and -10.5% to a total of 0.07-0.08 million tonnes. Again, domestic interruptions to supply will drag on exports, even though demand will remain firm in the important markets of China, the Netherlands, and Japan, where cassava pellets are used in animal feed and as a source of energy. However, demand for cassava pellets is volatile and this is generally only strong when other crops are in short supply, especially when this coincides with widespread geopolitical tensions.

Domestic market: Demand for cassava products will expand by 3.0-5.0% per year on: (i) economic recovery that will drive 3.0-4.0% annual growth in demand from the food industry; (ii) rising tourist numbers and increased spending on infrastructure that will feed stronger demand for E20 and E85, and this will then support a 5.0-6.0% expansion in demand for cassava for use in the production of ethanol; and (iii) the proportionately worse effect of the drought on production of sugarcane and molasses, and because prices for these will rise and supply tighten at a quicker rate than for cassava, ethanol producers will increase their consumption of fresh cassava, cassava chips and cassava slurry.

Prices for fresh cassava: Problems sourcing inputs of cassava for processing and export will tend to lift prices, and so these are expected to increase to an average of THB 3.10-3.30/kg in 2024 and 2025. However, the easing of El Niño conditions in 2026 will bring with it more favorable weather and with yields rising, prices should fall to THB 2.8-3.0/kg.

Headwinds facing the industry will include the following.

-

The intensifying fight for inputs will be driven by supply shortages, and as processors struggle to access cassava from domestic sources and markets in neighboring countries, production costs will rise. There is also a risk that disease may be spread through cassava stem cuttings or some processed products.

-

Competition is stiffening thanks to the availability of alternative products, the entry to the market of new players, and an expansion in production capacity by processors already active in the industry. Thus, over 2020-2023, capacity utilization averaged just 50.3%, down from 57.7% in 2016-2017.

-

Players will overhaul production lines and will increasingly invest in the manufacture of higher value-added products (e.g., bio-plastics and renewable bio-polymers) and the expansion of their clean energy production capacity (e.g., ethanol production and bio-mass energy). Investment will grow across manufacturing supply chains and because this will help companies to expand their income base and to reduce their marginal production costs, they will be better placed to shore up their competitiveness and profitability. Nevertheless, as downstream demand strengthens, players will be exposed to the risk of increased competition for inputs, especially as El Niño conditions undercut outputs and non-tariff barriers (NTBs) disrupt trade. The latter will include measures related to environment, social, and governance (ESG) issues, and the water and carbon footprints associated with imports.

-

Government measures to promote the use of EVs include setting the target that zero emission vehicles (ZEVs) comprise at least 30% and 50% of auto production by respectively 2030 and 2035. This will then reduce the number of vehicles on the road running on gasohol, which will in turn negatively impact demand for ethanol.

-

Energy prices have been pushed up by geopolitical stresses, including most notably the Russia-Ukraine war and the ongoing fighting between Israel and Hamas. This may then add to operating costs for farmers planting cassava and undercut demand for transport fuels.

1/ In Asia, cassava is used principally as an input into downstream industries rather than being consumed directly by humans. However, many countries have been moving to strengthen their food security, especially India, Indonesia and the Philippines, and in these countries, cassava has been promoted as an alternative to rice, while in Latin America, governments have promoted the commercial cultivation of cassava mainly for use as an input to industry.

2/ Data is provided by the Office of Agricultural Economics. Cassava can be grown in poor soils and is drought tolerant so it can be planted year-round, although in Thailand this usually occurs between March and May for harvesting in the period from January to March in the following year.

3/ Data correct as of 15 December 2023, though this does not include unregistered businesses, those that may have suspended or ceased operations, or those that have a size as determined by the Factory Act (No. 2). The data includes cassava processing facilities that output products including pellets, chips, starch, pulp and other goods (source: Department of Industrial Works).

4/ This does not include processing into cassava chip or other cassava-related businesses.

5/ Modified starch is made from native starch that has its physical and chemical properties altered through the application of heat, enzymes, and/or chemicals. This gives the modified starch particularly desirable qualities that then make it more useful in industrial applications, such as making its viscosity less variable, increasing its stability at a wider range of temperatures, and altering its acidity and shear strength.

6/ Equivalent to 7.9 million tonnes of fresh cassava.

7/-9/ See Figure 7

10/ The 2005 reform of the Common Agricultural Policy (CAP) encouraged member states to increase the area given over to crops that could be used as alternatives to imported cassava. In addition, prices for the former were low, and as such, EU-based producers of animal feed switched from using cassava pellets to different products, most notably potatoes.

11/ China sources of supplies of cassava for use in its food, energy, ethanol, and animal feed industries are from overseas markets since Chinese farmers prefer to grow other crops (cassava growing imposes high costs, farmers benefit from only weak incentives, and it is difficult to mechanize production). In addition to domestic supply being unable to fully meet demand, the opening of the China-ASEAN Free Trade Area means that importers benefit from favorable duties, though they are still liable for 9% VAT on fresh cassava and cassava chips, and 13% VAT on starch products. Given this, inputs of cassava to Chinese industry are largely imported (source: Thai Biz in China Business Information Center).

12/ To produce a nutrient profile similar to corn, animal feed is made by mixing 87% cassava chip with 13% soy pulp.

13/ Chinese players have invested in growing cash crops and basic processing facilities in countries in the region, including Cambodia (rubber, acacia, cassava and sugarcane), Lao PDR (rubber, sugarcane, corn for animal feed, bananas, cassava, teak and eucalyptus, with most investments being made in the north of the country in areas close to the Chinese border) and Myanmar (rubber, cassava, sugarcane, bananas and watermelons). Source: Chinese Agriculture in Southeast Asia: Investment, Aid and Trade in Cambodia, Laos and Myanmar.

14/ This includes starches made from corn, wheat, cassava, potatoes, and other products (source: Mordor Intelligence Analysis).

.webp.aspx)