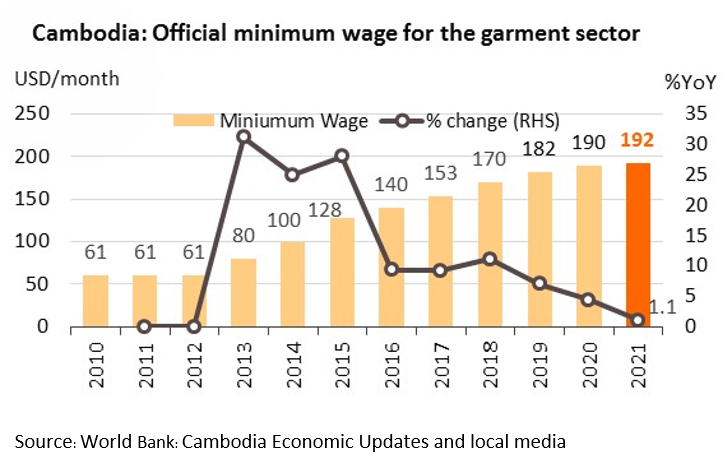

Cambodia’s minimum monthly wage for garment industry workers raised to USD192 for 2021

Facts:

On 12 September, the Cambodian government announced the minimum wage for garment & footwear industry workers will be raised from USD190 to USD192 per month (+USD2) effective 1 January 2021. Previously, the National Council on Minimum Wage (NCMW) had decided to leave minimum wage at USD190 following lengthy negotiations between members of trade unions who demanded USD12 increment, and manufacturers’ representatives who asked for it to be reduced by USD17.

On top of the current minimum wage of USD190 per month, workers receive other monthly benefits including USD7 accommodation allowance, USD10 for regular attendance, USD0.5 food allowance per day for overtime work, and USD2-10 seniority payment for workers with at least 2 years of work experience. That means each garment worker receives at least USD209-220 per month.

Krungsri Research’s view:

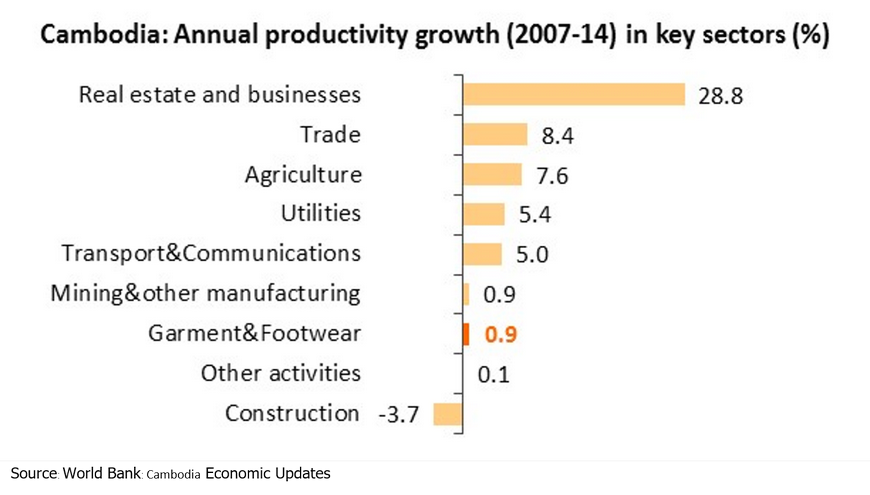

This development is line with our view that the government would support the minimum wage hike for garment sector workers for both political and economic reasons. We understand the marginal hike is to help those workers to keep up with ballooning cost of living without impairing the country’s export competitiveness. But it would hurt competitiveness over the longer term if labor productivity is not improved substantially in the labor-intensive and export-oriented garment sector.

- If minimum wage continues to rise in the next few years, it could harm Cambodia’s appeal as a low-cost labor-intensive production base for foreign investors against Vietnam, Indonesia, and Bangladesh. It is getting more challenging for Cambodia which desperately needs foreign direct investment inflows to finance its persistent current account deficit (CAD) and spur industrialization which is at a nascent stage.

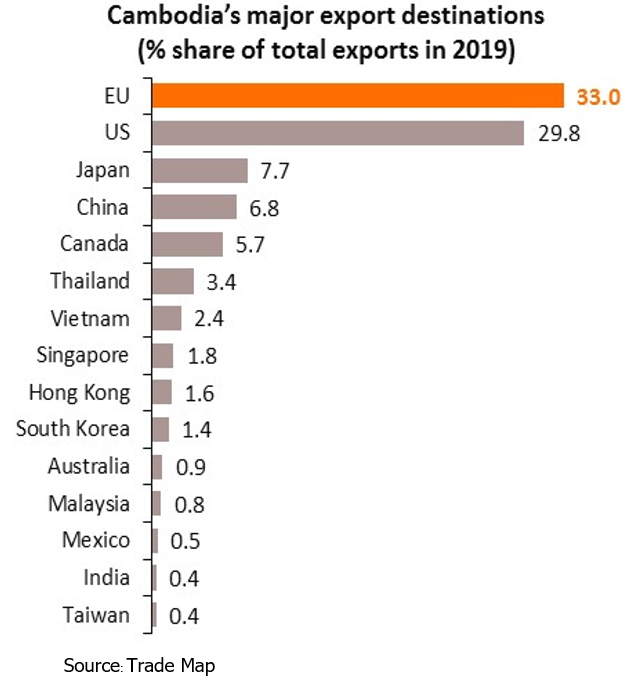

- The wage hike will be another headwind for Cambodia’s economy amid the Covid-19 pandemic and weak global demand, especially in advanced economies. Cambodia has a narrow export structure. The major sources of foreign receipts are tourism and exports of garment, textile, & footwear (GTF) products, the latter accounting for 92.8% of total merchandise exports in 2019. The major export markets are the European Union (EU) and the US, which accounted for 62.8% of total exports in 2019.

Prior to the annual wage review, there had been substantial external pressure on Cambodia. On 12 August, the EU had partially suspended tariff-free access to its single market. Some trade preferences have been temporarily revoked due to alleged violations to human rights and the democratic process in the country. The suspension included some garments, footwear and travel goods which together account for 20% or USD1b of Cambodia’s annual exports to the bloc. While Cambodia still export those products to the EU, they will be subject to higher tariffs. For example, textile products would be slapped with 2.4% effective tariff rate compared to 0% before the suspension.

Amid rising external and internal pressures, the wage hike for garment sector workers could erode the country’s export competitiveness in the years ahead if labor productivity is not improved.