Global: Uncertainty and war risk have cast a shadow over reopening

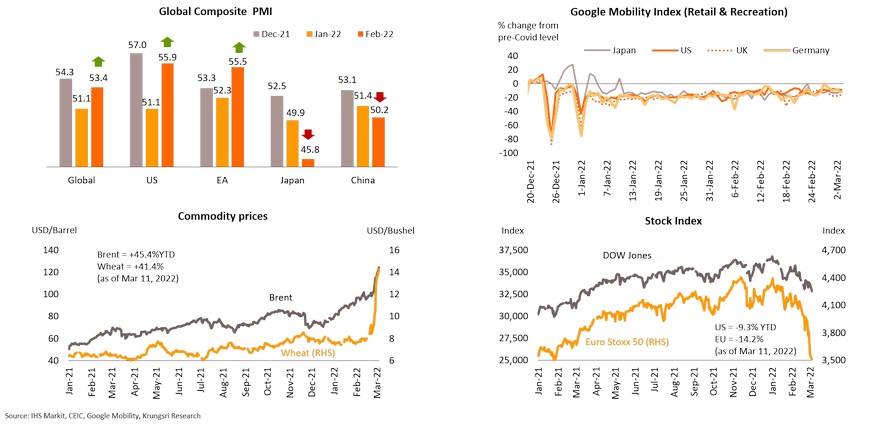

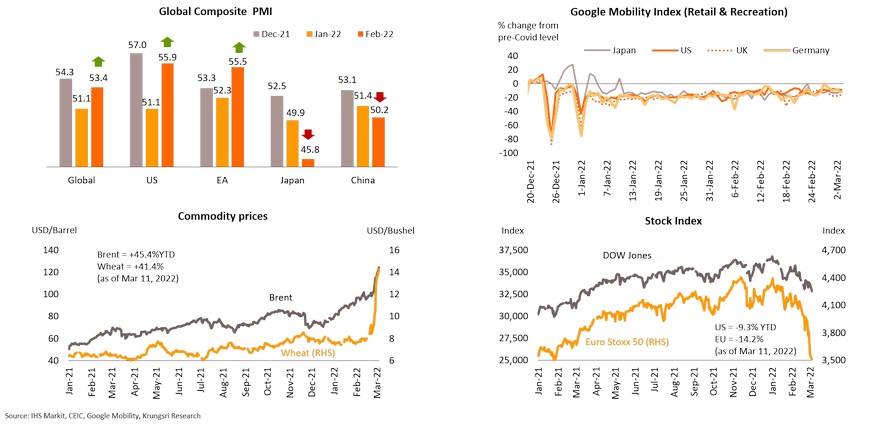

Global PMI and Mobility Index reflect recovery from Omicron but Ukraine crisis has pushed up commodity prices, disrupted supply chains, shaken sentiment, and slowed down recovery

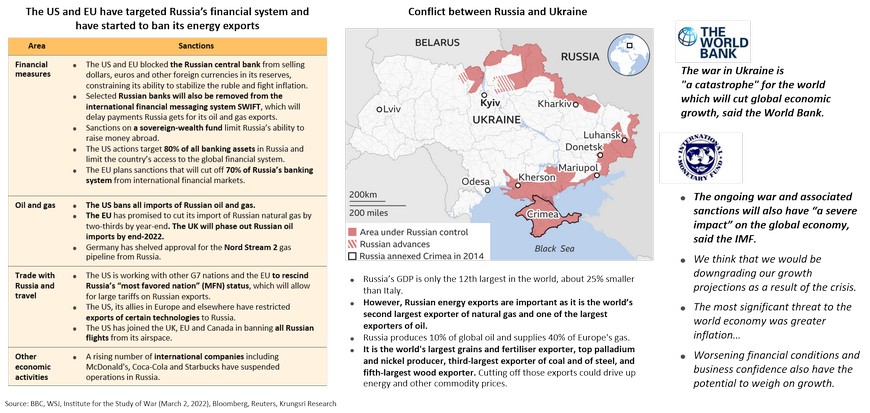

War in Ukraine, tougher sanctions, and more retaliatory measures increase concerns over inflation and economic growth, raised risk of global stagflation

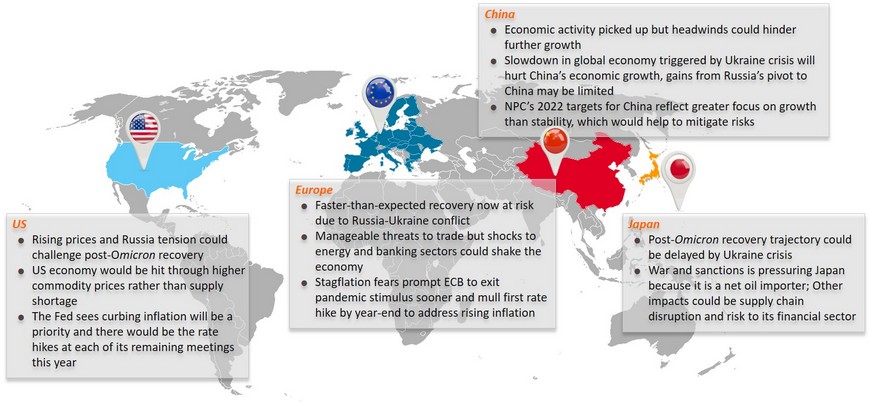

US: Rising prices and Russia tension could challenge post-omicron recovery

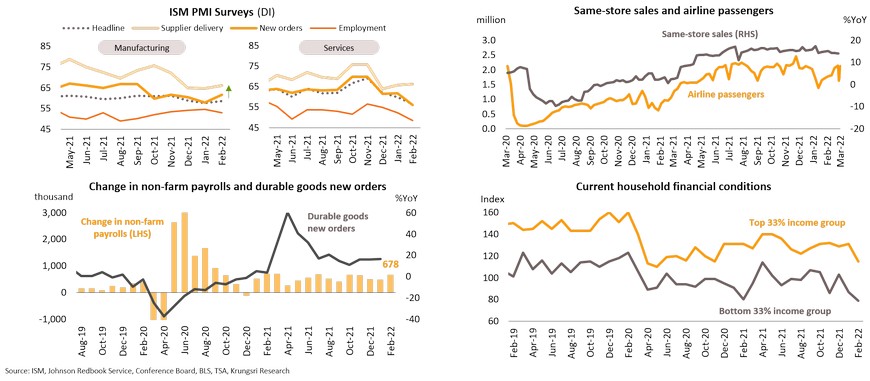

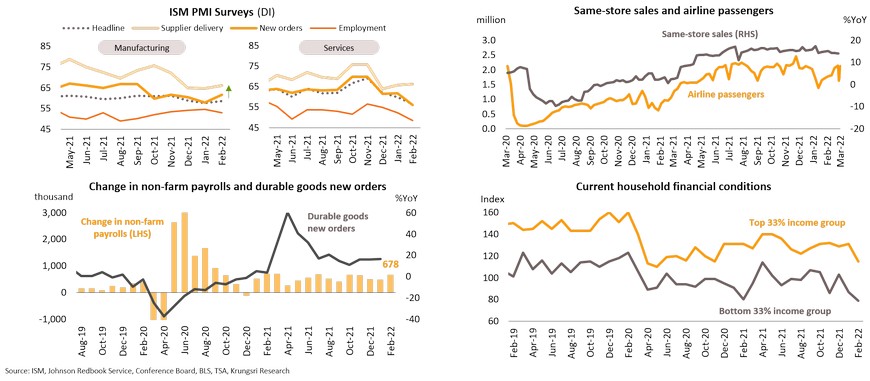

US economy has improved since the first omicron outbreak. Manufacturing PMI inched up in February, led by new orders. Economic activity in the services sector expanded for the 21st month in a row. Firms continue to be hurt by supply chain disruptions, logistical jams, and inflation, which have affected their ability to meet demand. Restaurant and travel industries were key recovery drivers as omicron cases declined. Same-store sales remained above pre-pandemic levels and improved 14.1% YoY in early-March driven by the online channel, reflecting strong consumer spending despite omicron. Travelling activity also improved significantly. For businesses, new orders for durable goods rose 15.6% YoY in January, reflecting a strong start to investment spending. And, businesses continued to hire more workers, particularly in the services sector as non-farm payrolls increased by 678k in February and unemployment rate fell. Although the economy is recovering, there is new risk to inflation and economic growth from the Russia-Ukraine tension. Further price rises would push up cost of living and soften consumer demand ahead. Both the wealthiest and poorest households reported lower confidence about future financial prospects because of inflationary pressure.

US economy would be hit through higher commodity prices rather than supply shortages

The Russian invasion in late-February triggered widespread volatility in financial markets and economies worldwide. The impact on the US economy will differ from that in European countries because the US has smaller trade and investment exposure to Russia. Some domestic producers could also gain from rising commodity prices because they are able to produce more. The invasion has pushed up global food prices to record highs because Russia and Ukraine are major producers of agricultural products. Current data show American farmers plan to reduce soybean planting in favor of corn to benefit from higher corn prices despite surging fertilizer costs. The ban on Russian oil imports will affect the US through rising prices rather than supply shortages. Higher US oil production could mitigate some of the shortages but businesses will face a spike in production costs and households will experience higher cost of living. In addition, barring some of Russia's banks from the SWIFT system could slow liquidity flows to the economy especially through energy trade, as most transactions are conducted in USD. This would intensify upward inflationary pressure which could prompt the Fed to curb inflation. Looking ahead, preventing Russia’s central bank from conducting USD transactions would not diminish the dollar’s reserve currency status but could reduce Russia’s dependence on the USD.

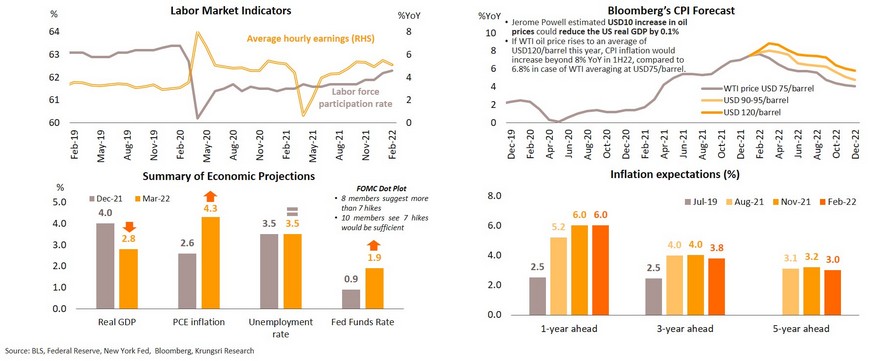

The Fed sees curbing inflation will be a priority and there would be the rate hikes at each of its remaining meetings this year

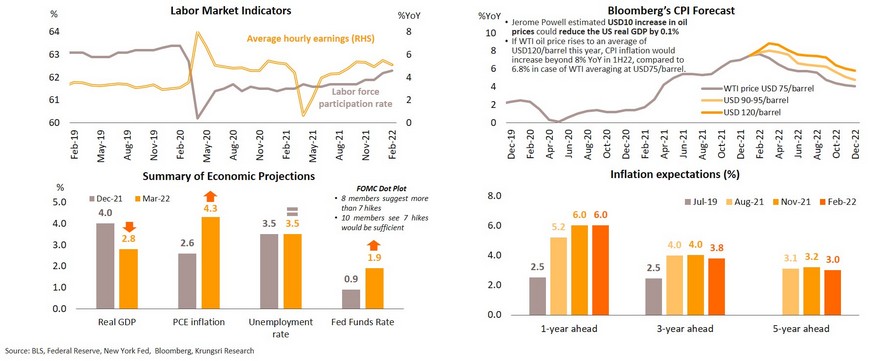

Slow wage growth and rising prices after the Russian invasion could lessen consumer purchasing power. Softer consumer demand caused the Fed to deliver a 25-bps hike in March but they signaled 6 more hikes this year because of higher inflation risks. Despite a possible slowdown, inflation would remain high at above 4% in 2H22. The Fed revised up PCE inflation forecast to 4.3% in this year from 2.6%. Although the central bank downgraded GDP forecast to 2.8% in 2022, they stated the economy remains strong and “probability of recession is not particularly elevated”. They also see “the risks of further upward pressure on inflation and inflation expectations”. Latest surveys on inflation expectations show household expectations are still anchored but remain high. Latest Dot Plot suggests more hawkish views on raising rates which 8 members expect more than 7 hikes this year. In our view, this hawkish turn, coupled with the resilient economic rebound and robust labor market would push the Fed to prioritize curbing inflation over growth. Then, the Fed is expected to hike rate 7 times in 2022, by 25-bps each; the magnitude could change in some months depending on inflationary pressure. The rate would hit around 1.75-2.0% by year-end. However, in the extreme case of a full-blown war, we expect a large impact on energy and commodity prices, risk-off sentiment in global markets, negative income effect, financial turmoil, and possibly a global recession. These could push the Fed to be more dovish and shift their focus back to economic growth.

Europe: Faster-than-expected recovery now at risk due to Russia-Ukraine conflict

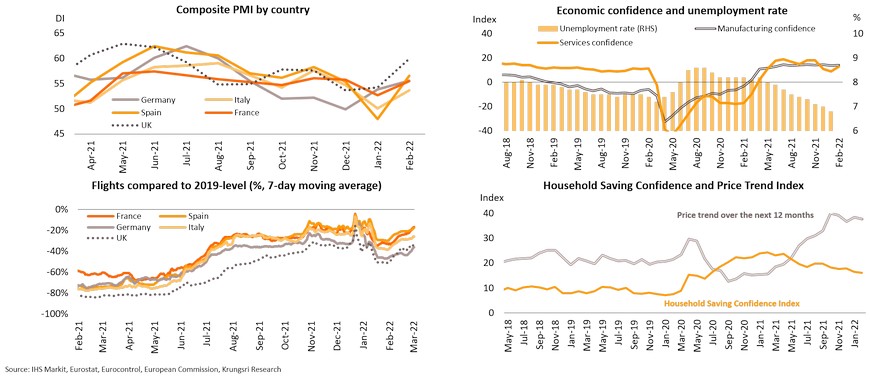

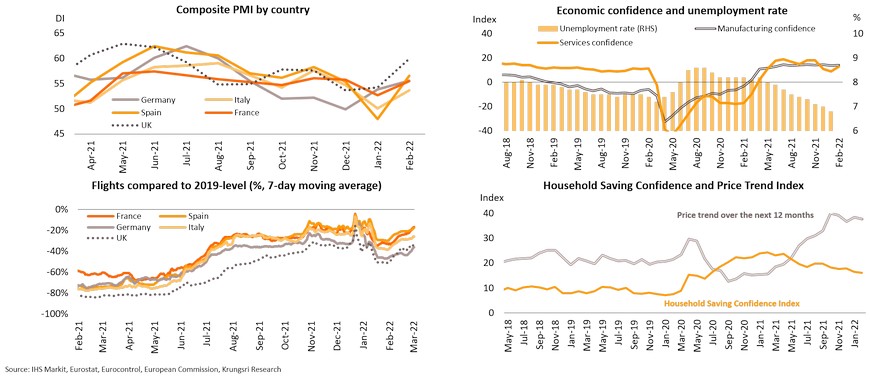

Latest economic data confirm the Eurozone economy is handling the omicron wave better. Business activity accelerated in February as Composite PMI surged led by the UK and Spain. Firms reported soaring consumer demand and strong demand for employment, particularly in the leisure and hospitality sectors, suggesting omicron had a short-lived impact. Confidence improved in both manufacturing and services sectors while unemployment rate has dropped to a record-low following easing Covid-19 restrictions. These surveys were conducted before Russia invaded Ukraine, so the anticipated economic recovery could be hampered by worsening sentiment. The number of passenger flights picked up in early-March especially in Spain and France. We do not expect the number of flights between EU countries to drop despite the geopolitical tension. However, air travel activity between regions could drop due to security concerns. Apart from the conflict, rising inflation would also be a major issue this year. Higher production costs are being passed through to consumers, resulting in declining Household Saving Confidence to tackle high prices relative to pre-pandemic levels. Risks to inflation arising from the conflict could dent the consumption recovery trend and pressure policymakers to adopt a gradual tightening of monetary policy to prevent further impacts on the overall economy.

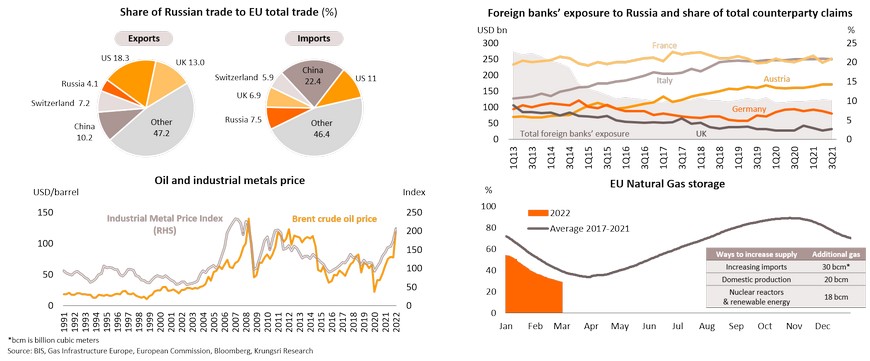

Manageable threats to trade but shocks to energy and banking sectors could shake the economy

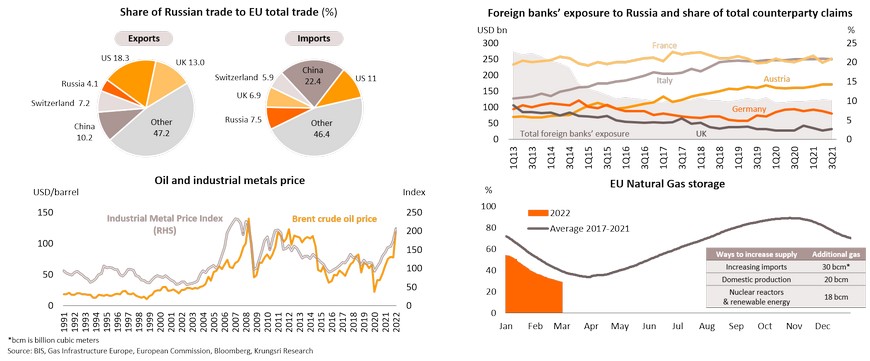

The Ukraine-Russia conflict has raised concerns over European economies because they have had long-standing relations with Russia. Russia is one of the EU’s largest trade partners, especially in energy, machinery and vehicles. Due to the large trade exposure, we expect the conflict to disrupt supply chains but it would be manageable because Russian input accounts for only 0.5% of the EU’s output and they could increase trade with other countries such as the US, UK and China. For banks, EU exposure to Russia has been trending down since the annexation of Crimea but barring Russian banks from the SWIFT platform could make it harder for EU banks to collect loans. Plus, the sharp depreciation of the ruble might increase risk of a run on Russian banks overseas and government default. In addition, rising tension would also harm the energy sector through higher utility prices and supply concerns although there are solutions. Europe’s seasonal gas output is below 2017-2021 average. At current levels, Europe could survive at least until 1Q23 without additional energy imports but they need to ramp up measures to avoid shortages, including (i) filling up gas to 90% of total capacity by 1 October; (ii) increasing natural gas imports from Azerbaijan and Norway, (iii) keeping nuclear reactors open, and (iv) accelerate use of renewable energy. If they comply with the plan to increase gas supplies, they will also overcome energy shortages in the following years. Risk from halting Russian gas exports to the region would remain and could push up prices substantially. Then, rising prices would be a major concern as it could lead to the second-round effects to the real economy.

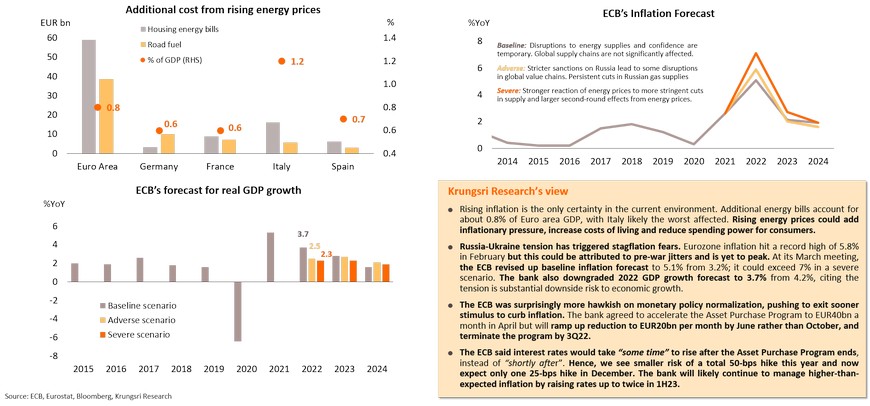

Stagflation fears prompt ECB to exit pandemic stimulus sooner and mull first rate hike by year-end to address rising inflation

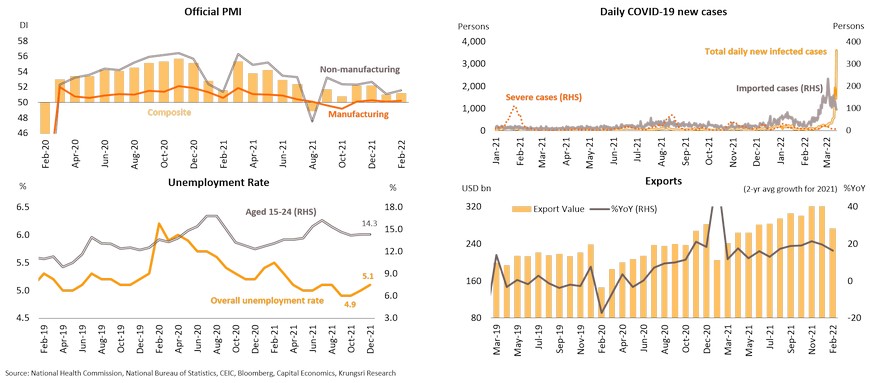

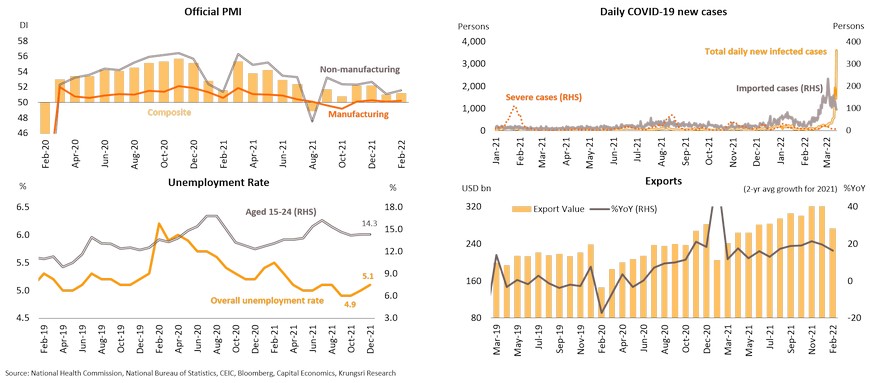

China: Economic activity picked up but headwinds could hinder further growth

China’s economic growth improved following less stringent containment measures in some areas and the positive effects of monetary and fiscal policy. February’s Composite PMI inched up to 51.2 from 51.0, led by an improvement in Non-Manufacturing PMI to 51.6 from 51.1. It reflected better performance of both services and construction activities driven by spending during the Lunar New Year and ramping-up of infrastructure investment together with policy supports. However, further growth could be hindered by lingering uncertainties: (i) recent outbreak and following lockdown in Shenzhen and Guangdong, the tech hub and global marine gateway which account for 11% of GDP, could disrupt supply chains; (ii) weaker labor market since the recent outbreak, especially in the 15-24 age group where there is stronger competition for jobs, which would decelerate spending; and (iii) decelerating export growth because of the Ukraine crisis.

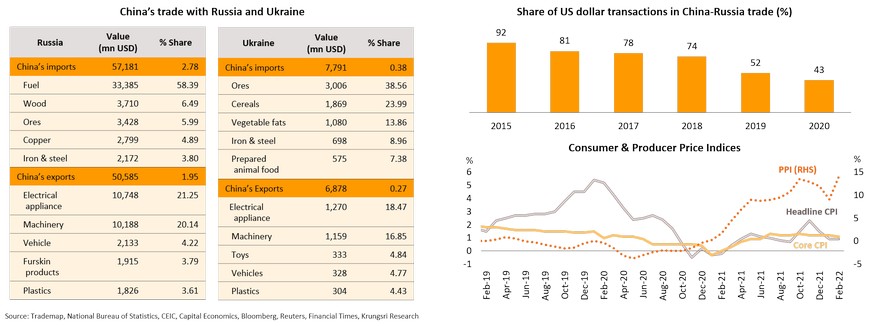

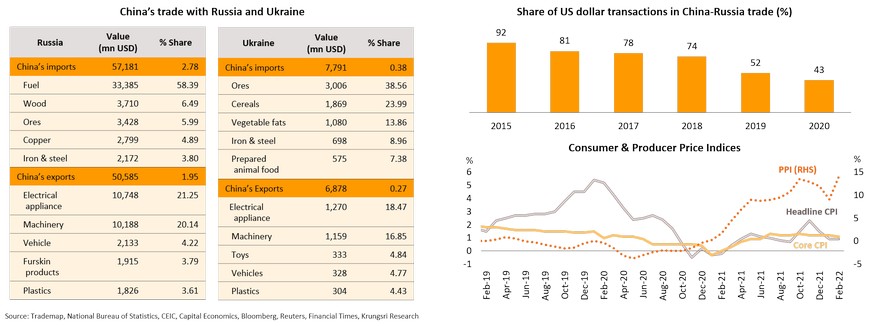

Slowdown in global economy triggered by Ukraine crisis will hurt China’s economic growth, gains from Russia’s pivot to China may be limited

The Ukraine war could affect China through the trade, finance and price channels, albeit the impact will differ. In trade, Russia and Ukraine contributed only 1.95% and 0.27% of China’s total exports, respectively. However, China’s exports could encounter indirect impact from the Ukraine war and sanctions which would hurt global economic growth and trade. In addition, the impact on economic growth and transportation could disrupt trade with Europe which accounts for 20.6% of China’s total exports. Looking at financial risk, current US dollar transactions between Russia and China are still high at 40% of total trade, but it has dropped. On the inflation front, surging global commodity prices would be a threat to China but it could be manageable due to (i) weak demand-pull inflationary pressure, and (ii) strong government measures to mitigate the impact by releasing commodity reserves and cracking down on speculation, as well as stabilizing supply and prices with more coordination between upstream and downstream companies. Based on Oxford Economics estimates (as of 4 March), China’s inflation is projected at 2.3% in 2022, far below forecast global inflation of 6.1%, implying limited inflationary risk. With regards to strengthening economic ties with Russia, gains from trade diversion and substitution effect are likely to be modest since (i) only 17% of bilateral trade is conducted in Chinese Yuan (CNY); (ii) China’s exports to Russia would be affected by weaker Russian demand due to the economic fallout and a weaker Russian ruble; and (iii) there are concerns over the US’s warning against providing assistance to Russia, which has caused China to be more cautious of its next moves. Overall, the Ukraine crisis would mainly threaten European economic recovery and cause the global economy to slow down, which could be risks for China’s exports and economic growth.

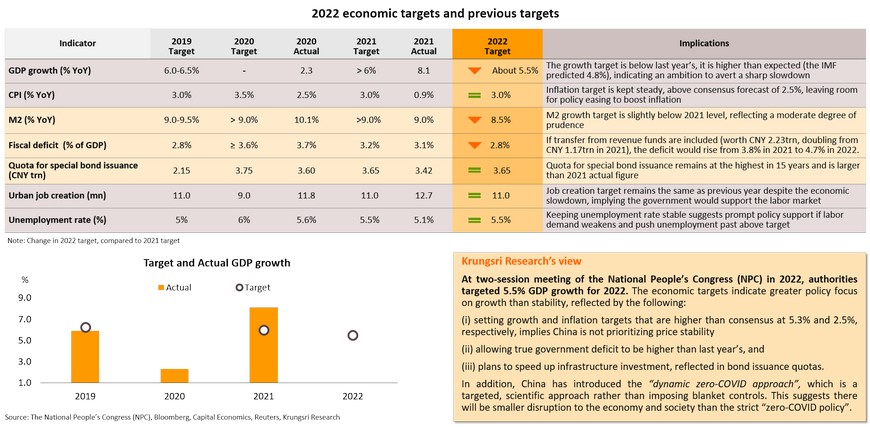

NPC’s 2022 targets for China reflect greater focus on growth than stability, which would help to mitigate risks

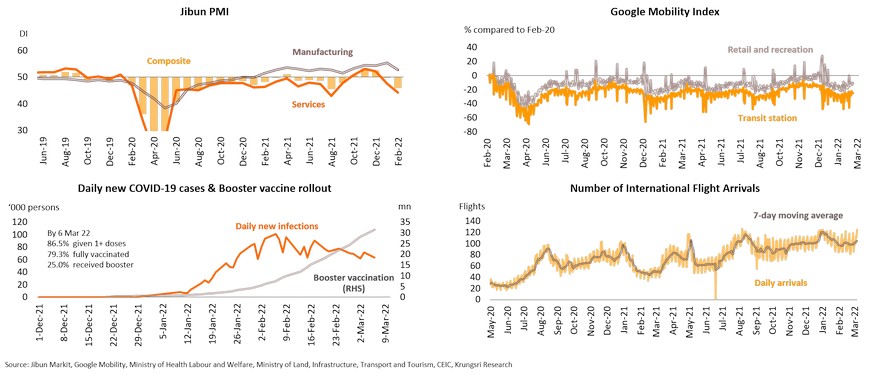

Japan: Post-Omicron recovery trajectory could be delayed by Ukraine crisis

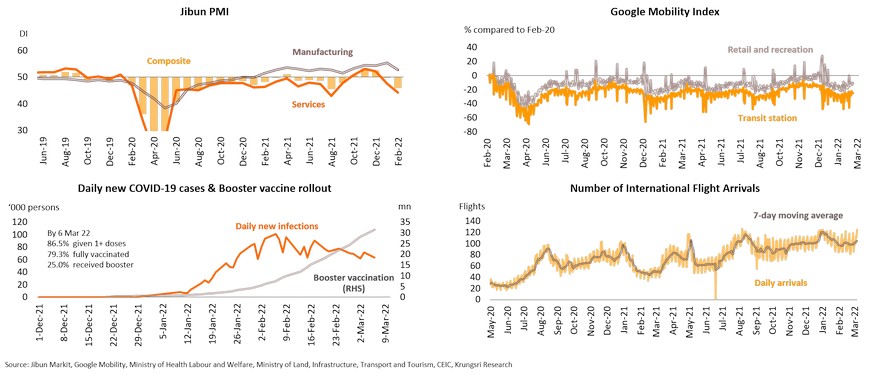

February PMI data suggested the 6th wave of infections has slowed the pace of economic recovery but domestic activity has shown signs of improvement since March supported by the following: (i) improving Covid-19 situation as daily cases have started to drop following progress in booster shots; (ii) a rebound in economic activities reflected in high-frequency data for retail sales and traffic in early March; (iii) gradual easing of restrictions with the lifting of nationwide quasi-state of emergency by 21 March, and (iv) an improving labor market, reflected by rising average cash earnings to an 8-month high, which would support purchasing power. Nonetheless, recovery is still in the the early stages and could be derailed by an extended Russia-Ukraine war and related sanctions. Looking ahead, the war could extend to 2Q22, implying the West and its allies, including Japan, are likely to impose more severe sanctions. This would raise risks of global stagflation and threaten gains from the post-Omicron recovery.

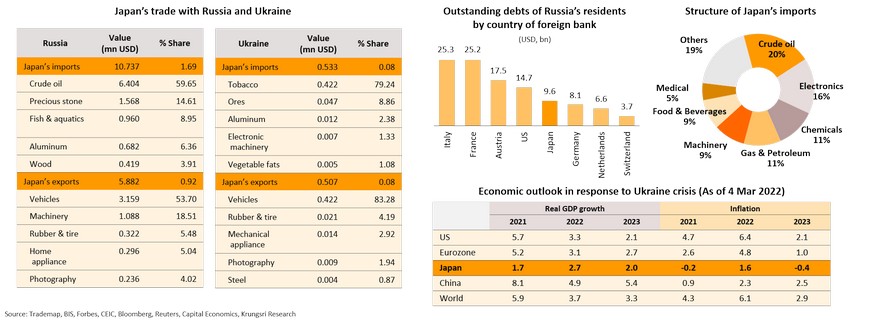

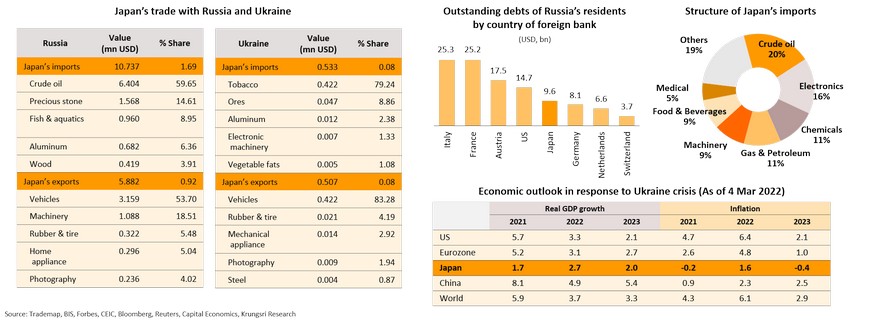

War and sanctions is pressuring Japan because it is a net oil importer; Other impacts could be supply chain disruption and risk to its financial sector

The Ukraine crisis would mainly affect trade, supply chains, financial stability and inflation. There should be limited impact through the trade channel because Japanese exports to Russia and Ukraine were only 0.92% and 0.08% of Japan’s total exports respectively, while only 1.69 and 0.08% of Japan’s goods imports come from Russia and Ukraine. However, supply chain disruptions could lead to severe shortage of semiconductors and disrupt automakers because Russia is a major exporter of key raw materials such as platinum and palladium. Looking at financial risk, Japan is the fifth largest creditor to Russia among 25 countries the BIS collects data on; the consequences of unpaid dues from Russia remains unclear. Looking at price effect, escalating energy prices could hurt Japan because of its dependence on imported fuel, the top dependent among OECD countries. Japan’s imports of crude oil and petroleum & gas accounted for 31% of Japan’s total imports in 2020. However, there would be limited upside to inflation because the government subsidizes oil distributors to control wholesale prices. The extended conflict would hurt global trade, exacerbate supply chain disruption, raise inflation and undermine purchasing power. Despite higher-than-expected inflation, the BOJ is unlikely to raise policy interest rates this year given still-low demand-pull inflationary pressure and a weak economic recovery.

Thailand: Russia-Ukraine crisis dims hopes of stronger recovery

-

Before the Ukraine war, the Thai economy had been slowly recovering from the Covid-19 pandemic impact, reporting upbeat 4Q21 GDP data and improving domestic activity early this year, backed by rising vaccination rate, easing lockdown restrictions, reopening effect, and supportive fiscal and monetary policies.

-

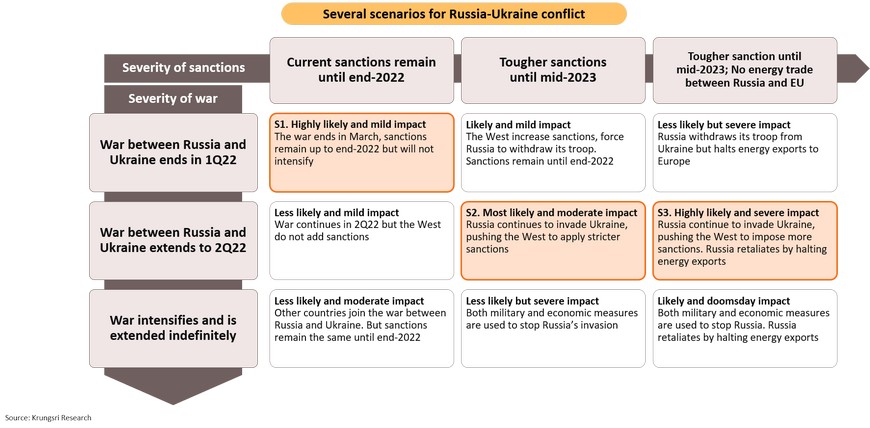

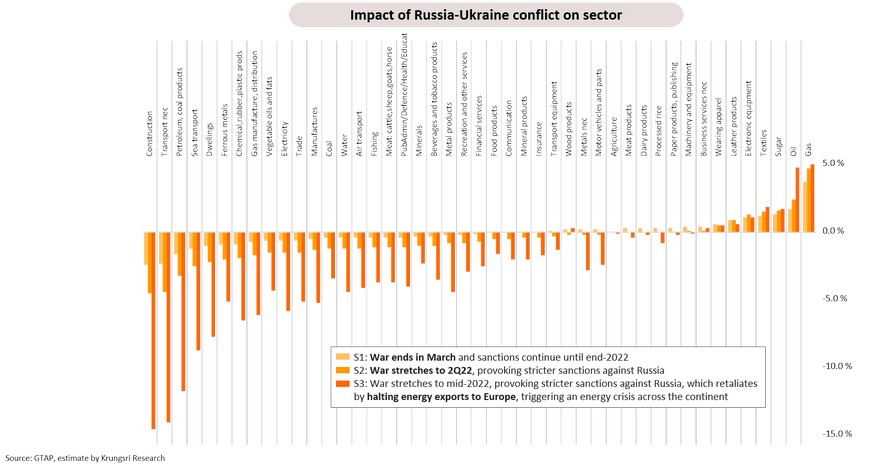

However, given emerging risks from the Russia-Ukraine crisis, economic prospects could worsen moderately or markedly depending on the severity and duration of both war and sanctions. To assess the impact, Krungsri Research has identified three main scenarios: Scenario 1 - war ends in March, with sanctions on some of Russia’s trade and finance activities continuing until end-2022. Scenario 2 – war extended into 2Q22, provoking stricter sanctions against Russia. Scenario 3 – war continues into mid-2022, provoking stricter sanctions against Russia which would prompt Russia to block energy exports to Europe, triggering an energy crisis across the continent. The impact would be transmitted through four main channels: trade & transport, energy security, price stability, and income effect & capital markets.

-

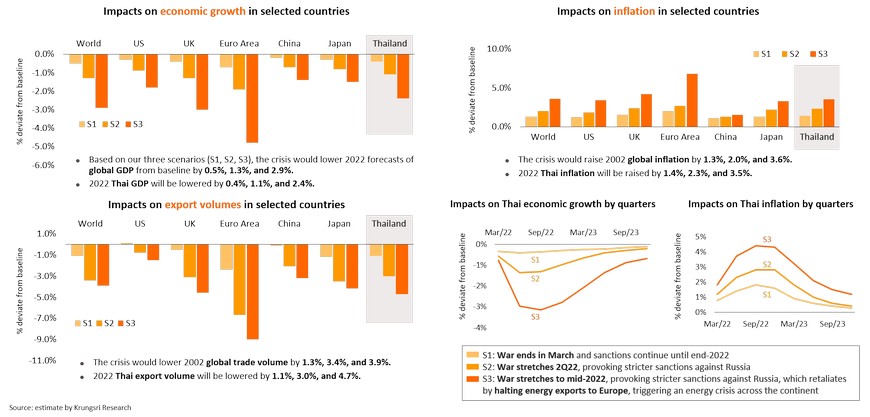

We applied a dynamic stochastic general equilibrium (DSGE) model to quantify the impact of these 3 scenarios on the global and Thai economies. The conclusion is the Russa-Ukraine crisis would reduce baseline 2022 global GDP growth by 0.5, 1.3 and 2.9 percentage points (ppt), raise inflation rate by 1.3, 2.0 and 3.6 ppt, and reduce global export volume growth by 1.1, 3.4 and 3.9 ppt, respectively. For Thailand, the crisis would reduce baseline 2022 GDP growth by 0.4, 1.1, and 2.4 ppt, push up inflation by 1.4, 2.3, and 3.5 ppt, and reduce export volume growth by 1.1, 3.0 and 4.7 ppt, respectively.

-

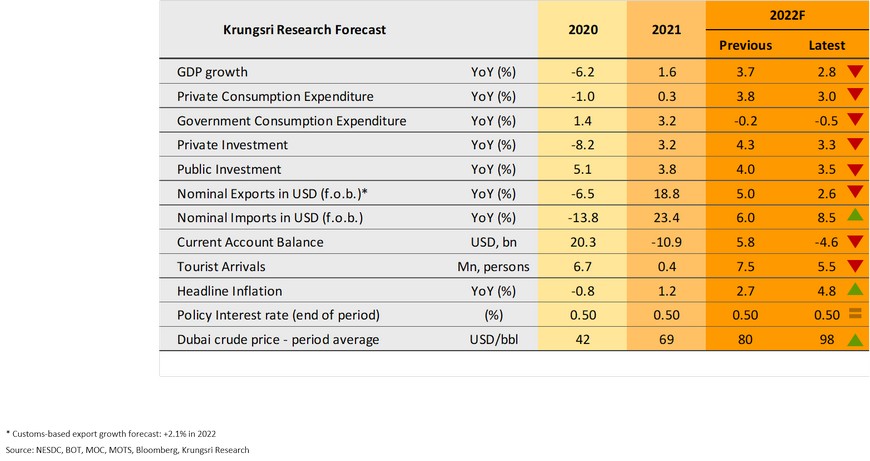

Our base case (most likely to happen) is Scenario 2. Based on our assessment of the impact of the Ukraine crisis and government measures to ease the negative impact, we revised down 2022 GDP growth forecast to +2.8% from +3.7% previously, and raised inflation forecast to 4.8% from 2.7%.

-

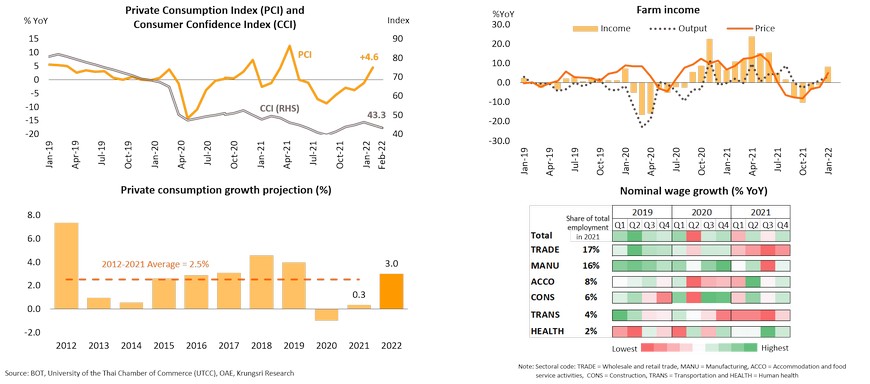

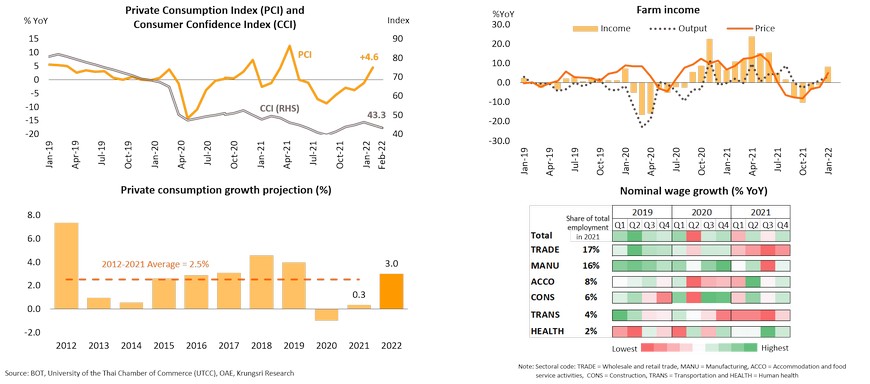

We revised down 2022 export value growth to +2.6% from +5.0% in the previous forecast. Weaker exports, surging import prices, and smaller tourism income, could lead to a current account deficit this year. Surging inflation would reduce purchasing power and cause a more uneven recovery in consumption among the different income classes. We reduced 2022 forecast for private consumption growth to 3.0% from 3.8%, although spending could be supported by rising farm income, reopening effect, and supportive policies.

-

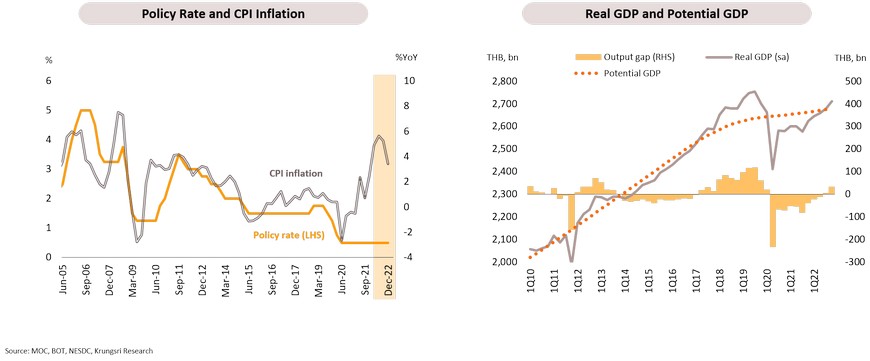

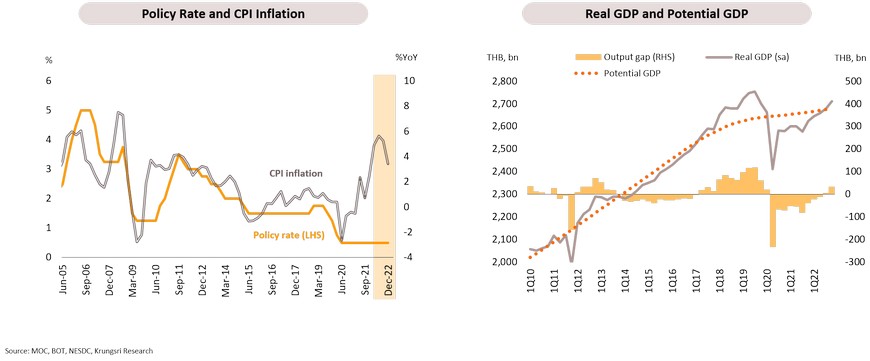

The spike in inflation to above the BOT’s target would make it increasingly difficult for policymakers to strike a balance between managing risk to economic growth and risk to price stability. The MPC is likely to give priority to support still-fragile economic recovery, which means they would keep policy rate at a record low this year.

Krungsri Research Forecasts for 2022

Russia-Ukraine conflict: Economic prospects could worsen moderately or markedly depending on the severity and duration of sanctions and war

Russia-Ukraine crisis could hurt economies worldwide via four main channels: trade & logistics, energy security, prices & inflation, and income effect & capital markets

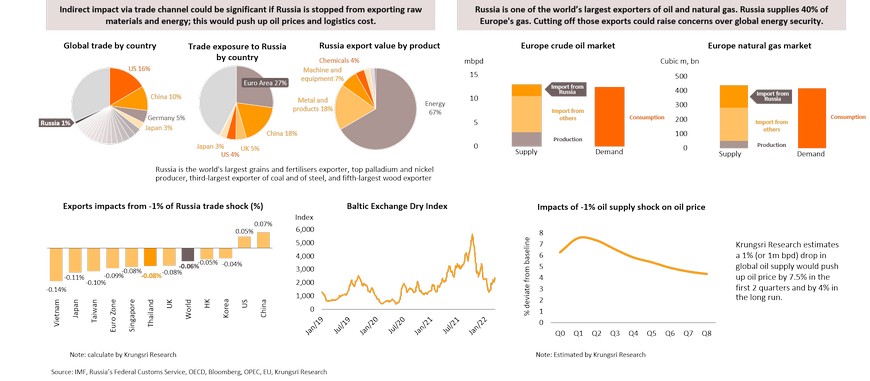

Limited direct impact via trade channel but indirect impact could be significant; war in Ukraine is pressuring global energy security

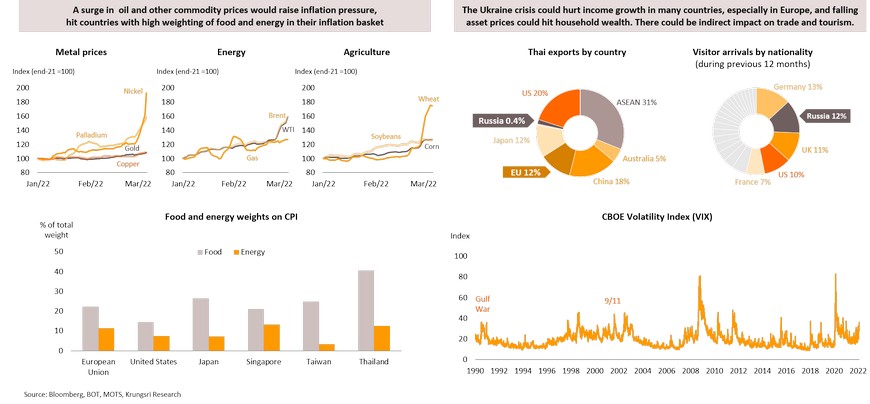

Rising inflation would hurt purchasing power and slow consumption recovery; negative income effect and high market volatility would also hurt trade and tourism

Russia-Ukraine crisis would not only harm global trade and economic growth but also push up inflation, increasing risk of stagflation

By sector, top gainers are oil & gas, sugar and textiles due to price hikes and trade diversion; construction is the top loser, followed by transportation due to higher costs

We trimmed 2022 GDP growth forecast to +2.8% from +3.7%

Our base case is Scenario 2, where Russia-Ukraine war continues into 2Q22 and there are stricter sanctions against Russia. We expect the government to implement supportive policies and subsidies to alleviate the negative impacts but they would only help marginally. Hence, we revised down 2022 GDP growth forecast to +2.8% from +3.7% previously. However, if Scenario 1 pans out (war ends in March and sanctions continue until end-2022), our projection for 2022 Thai GDP growth would be reduced to +3.3%. If Scenario 3 pans out (war continues into mid-2022 and Russia to block energy exports to Europe), we project the Thai economy would grow by only 1.3% this year.

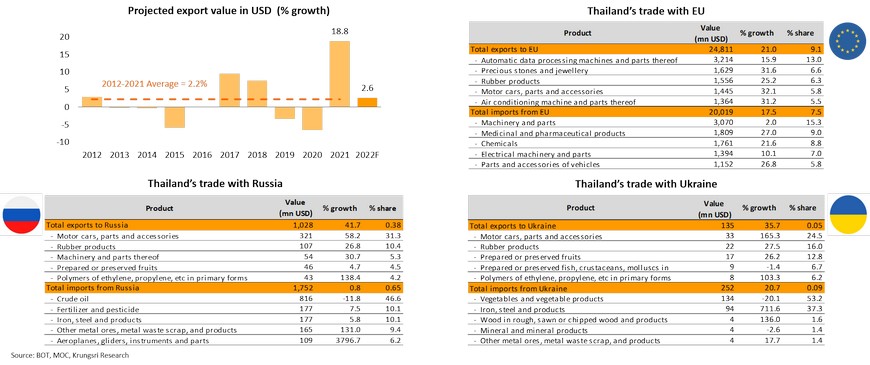

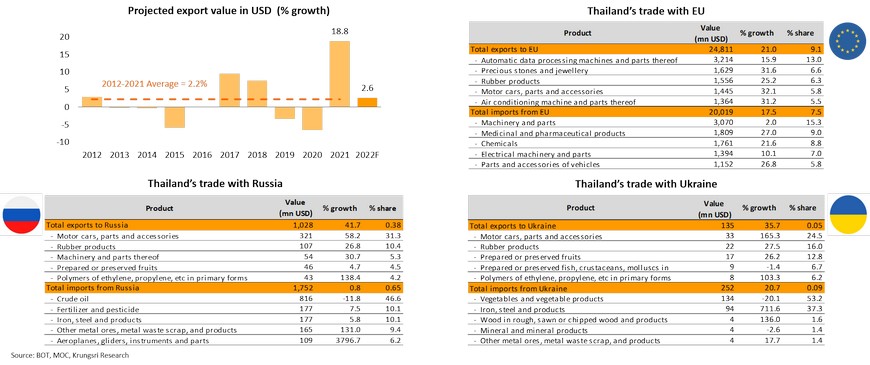

Ukraine crisis will hurt Thai exports; despite rising prices, we trimmed 2022 forecast export value growth to +2.6% from +5.0%

The Ukraine crisis should have limited direct impact on Thailand’s exports because exports to Russia and Ukraine accounted for only 0.38% and 0.05% of total Thai exports in 2021, respectively. However, there will be more substantial indirect impact from (i) higher cost of production and transportation following a spike in global energy and commodity prices; (ii) sanctions on Russia, which could disrupt supply chains in several industries as Russia is a major exporter of key raw materials; and (iii) negative income effect would hurt global economic growth, especially in Europe. In our base case scenario, the war would reduce baseline Thai export volume by 3.0%. And given rising commodity prices, we reduced 2022 forecast export value (in USD) growth to +2.6% from +5.0% in the previous forecast.

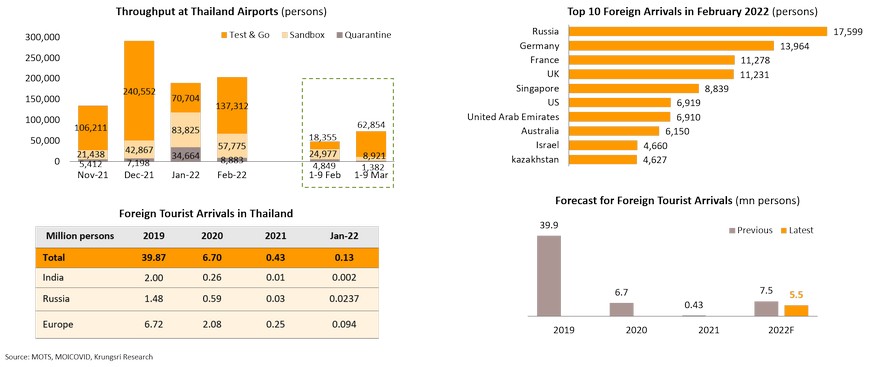

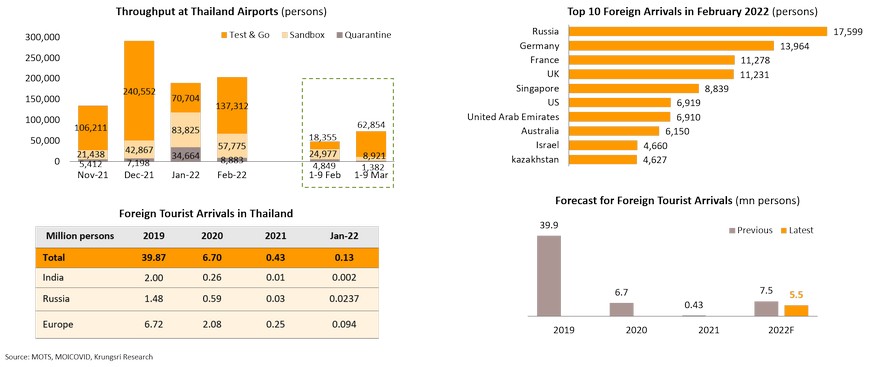

Russia-Ukraine conflict is expected to reduce foreign tourist arrivals to 5.5 mn in 2022 from previous forecast of 7.5 mn

Thailand resumed the Test and Go program on February 1. That attracted 203,970 inbound foreign visitors through Thailand’s airports in February, up from 189,193 in January. Foreign arrivals under the Test and Go program accounted for more than 65% of total arrivals, led by arrivals from Russia, followed by Germany, France and the UK. Hence, the conflict between Russia and Ukraine will reduce Russian tourist arrivals in the rest of 2022. The energy price crisis would also have negative income effect and discourage travel activity. However, Thailand’s tourism sector will be supported by the travel bubble program with India which allows flights to resume after being suspended since March 2020. In addition, the Thai government has relaxed restrictions under the Test and Go program by simplifying the process and Covid-19 test requirements for tourists, effective 1 March. The gradual easing of border controls and restrictions in many countries should also encourage more foreign tourist arrivals, especially in the second half of this year.

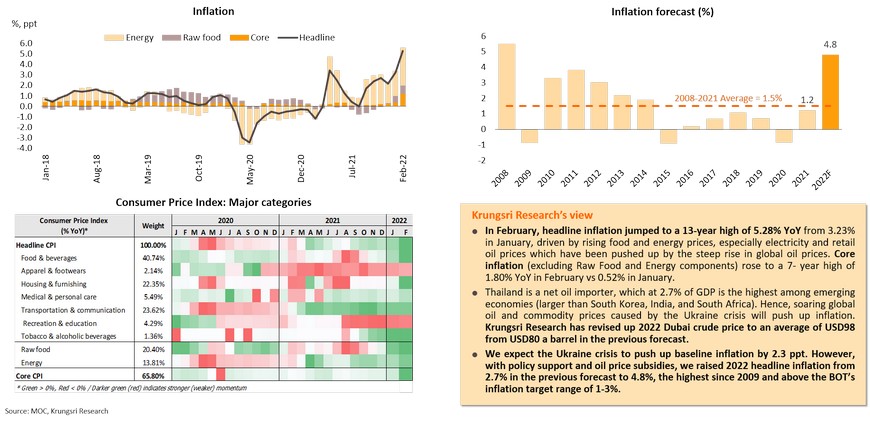

2022 inflation is expected to hit a 14-year high of 4.8% driven by a surge in global oil and commodity prices; domestic policy could ease some of the impact

Accelerating inflationary pressure will undermine private consumption recovery

Private Consumption Index (PCI) reversed to contraction for the first time in 5 months (-0.3% MoM sa) in January since Omicron fears dampened domestic economic activity. However, on a YoY basis, PCI improved for the first time in 9 months (+4.6%). Looking ahead, although private consumption could be supported by several factors including (i) stimulus measures worth THB53bn, (ii) higher farm income following rising global commodity prices, and (iii) improving nominal wages in some sectors, we expect escalating inflationary pressure triggered by the Russia-Ukraine crisis could undermine purchasing power and consumer confidence. Therefore, we trimmed 2022 forecast for private consumption growth to +3.0% from +3.8% in the previous forecast.

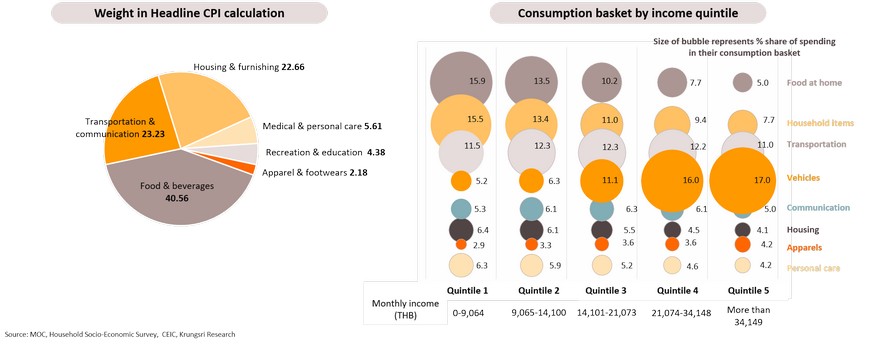

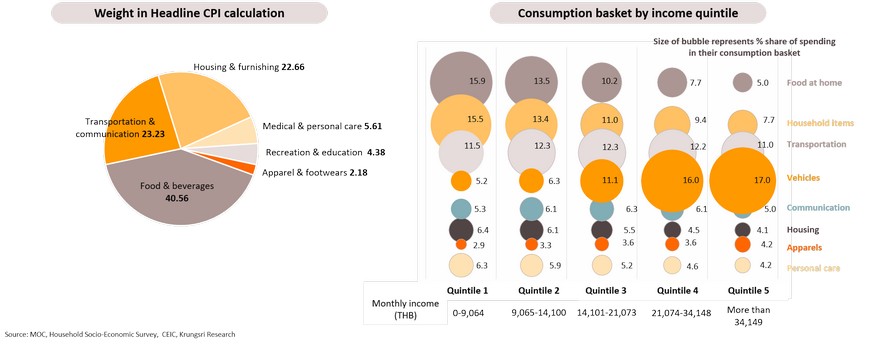

Different consumption baskets indicate uneven inflation burden across households; low-income group would be worst-hit by rising prices of food and transportation

As inflation accelerate, households in different income brackets would experience an uneven rise in cost of living because of different weightings in their consumption baskets. To analyze consumption expenditure by category, we classified households into 5 quintiles based on income. We found the largest expenditure category for the lowest-income group was food-at-home (15.9% of their total spending), followed by household items (15.5%) and transportation (11.5%). In contrast, the highest-income group’s spending was led by vehicles (17.0%) while spending on food-at-home was only 5.0% in their consumption basket. This suggests the low- to medium-income groups would be worst-hit by rising inflation this year because of soaring prices of food and transportation.

MPC is likely to hold policy interest rate this year, giving priority to support still-fragile economic recovery instead of price stability

Headline inflation is likely to exceed the BOT’s target range this year mainly due to skyrocketing oil and commodity prices triggered by the Ukraine crisis. This also poses downside risks to the Thai economy which depends on oil imports. In addition, the recent rebound in domestic activity could be disrupted by rising Covid-19 cases. As a result, the economic recovery is more vulnerable and Thailand’s GDP could remain below pre-covid level this year. The current situation makes it increasingly difficult for policymakers to strike a balance between managing risks to economic growth and to price stability. We expect the MPC to give priority to support the still-fragile economic recovery, implying they would keep policy rate at a historical low of 0.50% this year.