Global: Coronavirus Crisis Scars

Global: IMF slash 2020 global growth to lowest since 1930’s Great Depression amid the Great Lockdown

Despite early signs of a rebound, coronavirus crisis will leave economic scars; rising debt could delay recovery

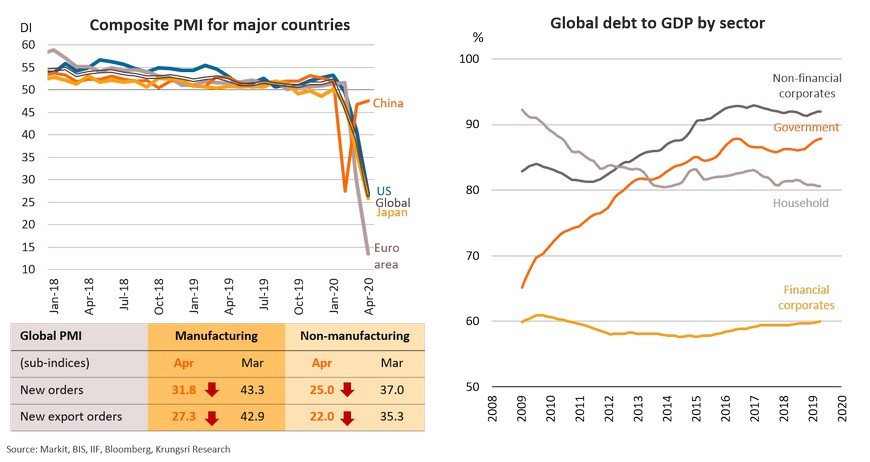

April Global Composite PMI plunged to 26.5, the lowest in the index’s 22-year history and significantly below the 36.8 recorded during the global financial crisis. PMI data for individual countries have also crashed to their lowest since 2009. Of the PMI components, new orders, overseas orders and employment registered the sharpest drops, reflecting weak domestic demand, contraction in global trade, and falling purchasing power. Despite signs of a recovery after easing lockdown measures, the coronavirus crisis will leave economic scars such as high unemployment and rising debt. Even before the Covid-19 pandemic, global debt had hit a new high of 322% of GDP in 3Q 2019, with total debt reaching USD253trn, according to the Institute of International Finance (IFF). Rising global debts were led by non-financial corporate and government sectors. The Covid-19 impact would push up debt levels, which would dampen private sector (future) spending and delay an economic recovery.

US: 1Q20 GDP saw sharpest contraction since 2009; other indicators signal a deeper downturn in 2Q

In the first quarter of 2020, US GDP shrank by 4.8%, the first negative reading since 2014. This was led by weaker private consumption (-7.6%) and exports (-8.7%) due to the sharp drop in demand during Covid-19 following a global lockdown since mid-March. The growth in residential investment was insufficient to prevent the contraction. Real disposable income fell in March. In April, the Consumer Confidence Index plunged to 86.9, the lowest since 2015. April ISM Manufacturing and Non-Manufacturing PMI data were at their lowest since 2009 at 41.5 and 41.8, respectively, led by weaker production and employment. Non-farm payrolls plunged by 20.5 million and unemployment rate surged to a post-war high of 14.7%. These suggest the US economy would register a larger contraction in 2Q20.

Key economic indicators have started to rebound but a full-fledged recovery would take time

Rising government and non-financial debts, and credit rating downgrades, could drag economic recovery

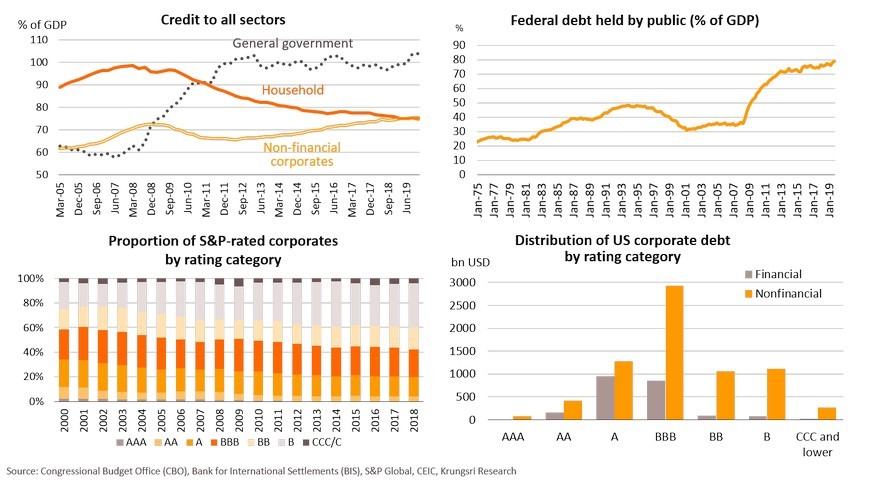

Total debt in the US has continued to rise, led by credit to government and non-financial corporates. The CBO estimates federal government debt would increase from 80% of GDP in 2019 to 101% this fiscal year and 108% next year due to stimulus programs. Meanwhile, the shift in the Fed’s policy - from buying Treasuries to corporate bonds - reflects a vulnerable corporate sector. Credit rating downgrades would lead to a larger proportion of speculative grade debts, which would escalate risks to financial stability. By rating category, non-financial corporate debt is the largest at 77% of total debt, led by BBB-rated debts. Rising government and corporate debts – if left unchecked – could delay economic recovery after the US reopens its economy.

EU: Major economic indicators have tumbled to record lows; economy could enter a deep recession

Eurozone GDP shrank by 3.8% QoQ and 3.3% YoY in 1Q20, the sharpest decline since 1995. GDP for major EU countries also contracted sharply, including Italy (-4.7%), France (-5.8%), Spain (-5.2%) and Germany (-2.2%). And this only reflects less than one month of lockdown (since mid-March). Markit PMI data has hit new lows in April. Manufacturing PMI dropped to 30.5 in Spain and 31.1 in Italy. Non-manufacturing index plunged deeper to 7.1 in Spain and 10.2 in France, implying great pressure on the services sector. Economic confidence index has dropped to its lowest, led by services (-35) and industrial (-30.4) due to forced closures and lower household spending. The outlook for the EU economy is worse in 2Q20 and the crisis could extend if the pandemic is not contained soon.

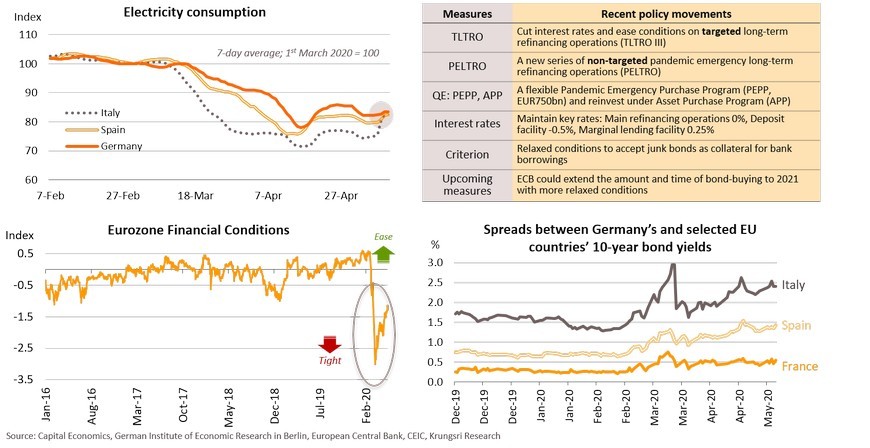

Mild improvements in the real economy and financial markets, but lingering problems in the peripheries

After several countries started to ease lockdown measures, economic activity such as electricity consumption, has been picking up, albeit slowly. The large monetary stimulus has injected liquidity into the banking sector, leading to a loosening of financial conditions. However, troubles in peripheral countries, especially Italy and Spain, continue to pressure their economies and the region. Bond yield spreads between Italy and Germany have widened since the pandemic started, which limits fiscal policy space. In addition, Germany’s judges recently ruled that the QE program is not backed by EU treaties, raising questions about future monetary stimulus. The limited policy space could hinder the region’s growth prospects.

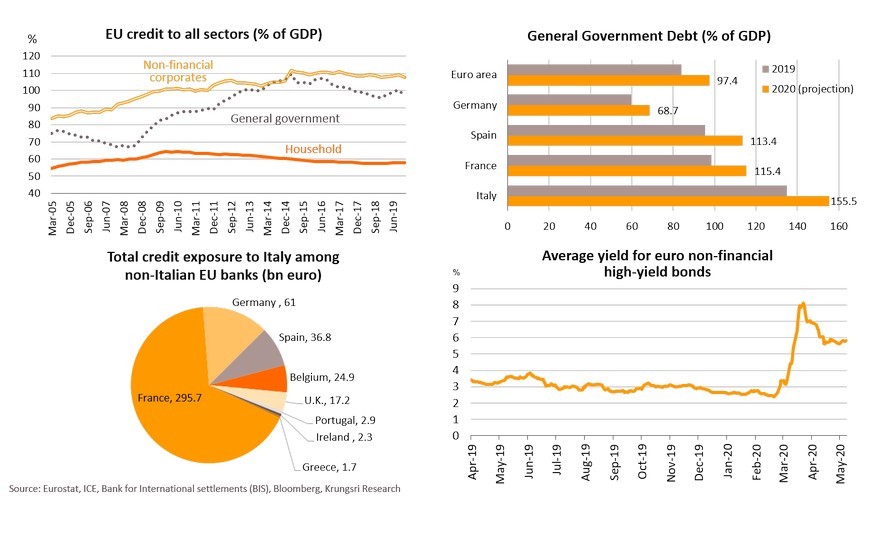

Relatively high sovereign and non-financial debts could limit policy space and haunt the EU economy again

The pace of economic recovery could be markedly different between countries, depending on how well they contain the Covid-19 outbreak, and their respective economic fundamentals and policy space. The pandemic would leave countries with high unemployment as well as surging debts. Even before Covid-19, debt outstanding in this region had been high, led by non-financial corporate debts (110% of GDP) and government debts (100% of GDP). While rising government debt is led by Italy, its government bonds are also held by other EU countries, implying risks could spread across the region. Private sector debt is another concern, with rising funding costs. The pandemic, structural problems (with high and rising debts), and limited policy space in periphery countries could cause this region’s economic recovery to trail behind other major countries, particularly the US and China.

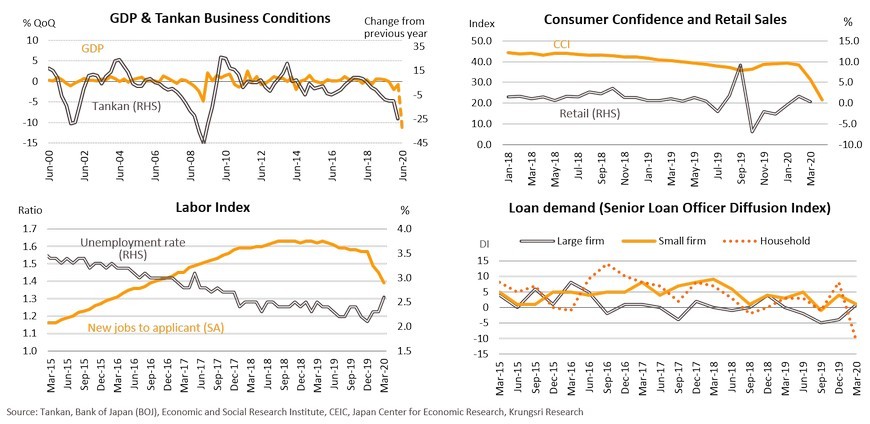

Japan: Economy could contract for the third consecutive quarter in 2Q20

1Q20 GDP is expected to shrink by -0.7% QoQ, following a -1.9% QoQ drop in 4Q19. This implies the economy is technically in a recession. March unemployment rate is the highest since March 2019, at 2.5%, and job-to-applicant ratio is at the lowest since September 2016. The economy is likely to get worse in 2Q20, after the PM declared a state of emergency on 7 April and extended it to 31 May. In April, consumer confidence index plunged to a new low of 21.6, suggesting a drop in private consumption ahead. Hence, 2Q20 GDP could see a larger contraction of -11.9% QoQ. Although Japan is likely to ease lockdown measures in 2H20, economic recovery would be slow due to (i) elevated unemployment, which would hurt purchasing power, and (ii) sluggish business investment following weak global trade and bankruptcy risks. And despite subdued economic activities, loan demand had soared recently, indicating tight liquidity in the business sector. Besides, the credit guarantee program is insufficient (only 5% of total loans outstanding) and the program has been delayed. For the whole of 2020, the economy could see a deep contraction. The BOJ projects 2020 GDP growth at between-5.0% and -3.0%, the slowest in 11 years or since the Global Financial Crisis.

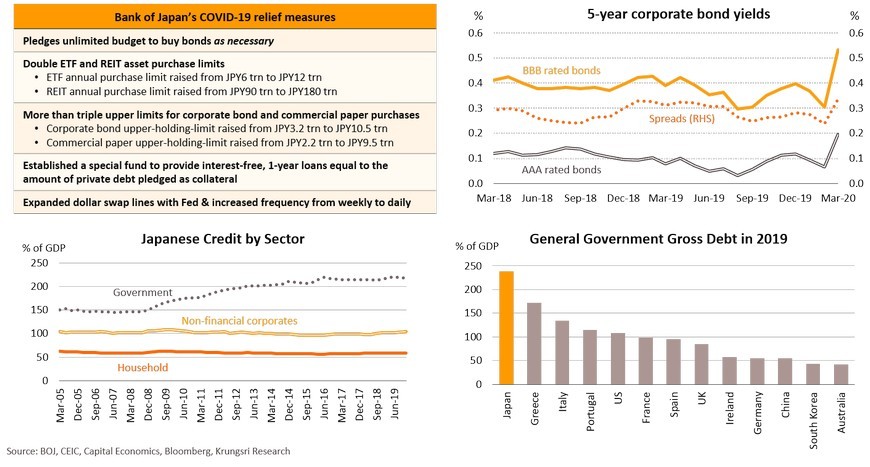

BOJ shifts its policy stance to battling the crisis

The Bank of Japan (BOJ) is shifting its policy focus from reflation to battling the crisis to support the affected corporate and household sectors. At the April meeting, the BOJ stepped up monetary stimulus, including (i) tripling the size of corporate bond and commercial paper purchases, and (ii) accepting household debt as collateral for lending to commercial banks. Before the Covid-19 pandemic, non-financial corporate debts had reached 103.9% of GDP. The adverse impact of Covid-19 is liquidity shortage, which could cause highly-leveraged firms to go bankrupt. Corporate bond spreads have also widened due to perceived greater default risk. A Bloomberg article claims the existing fiscal measure would boost GDP growth by only 1.1 ppt and thus, Japan needs additional stimulus. Since Japan’s public debt (238% of GDP in 2019) is relatively higher than in other major economies, its fiscal space is limited. Looking ahead, Krungsri Research projects the BOJ would continue to channel its resources to battling the crisis by providing more liquidity for corporate and household sectors to prevent insolvencies.

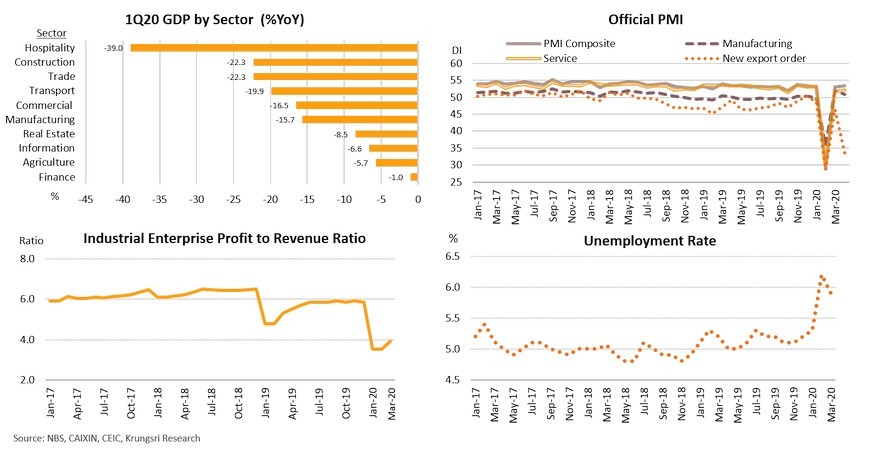

China: Economic activity remains muted due to sluggish demand and a slump in global trade

1Q20 GDP data show the hospitality, construction, trade and transportation sectors had been hit hard by the COVID-19 pandemic. Industrial profit to revenue ration has fallen from 5.9 in December to 3.9 in March, far below pre-Covid level. Despite easing lockdown measures, China’s supply side economy continues to see a slow recovery mainly due to weak domestic demand and sharp drop in exports. April data also indicate the manufacturing sector has deteriorated again, after picking up in March. The official Manufacturing PMI data dropped to 50.8 and Caixin Manufacturing PMI has dropped to 49.4. The weaker manufacturing production was driven by a plunge in new export orders because Covid-19 has hurt global demand. The sluggish recovery would leave unemployment rate above pre-Covid-19 level. Urban unemployment rate had risen from 5.2% in December to 5.9% in March. Some migrant workers have yet to return to work in the cities, leading to less than 80% of work resuming in some cities (as of 7 April), including Guangzhou 77%, Beijing 68%, and Wuhan 38%.

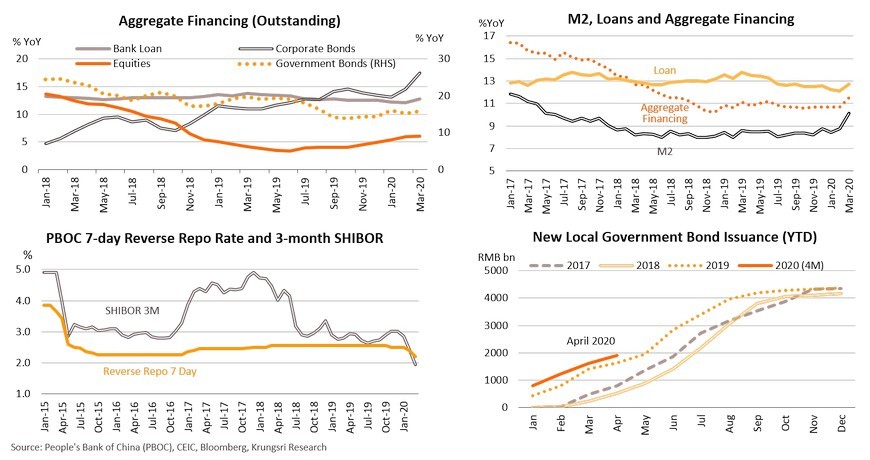

Easing measures by PBOC has boosted market liquidity but there is emerging risk from higher leverage

To accelerate economic recovery, China’s economy required a large liquidity injection to offset the liquidity drain. This led the PBOC to make the unprecedented move to apply an accommodative monetary policy by cutting reserve requirement ratio and interest rates. The supply of government bonds has surged following the fiscal stimulus ,and there will be more to come. Credit has expanded across the board, not only bank loans but also bond and equity issuances, which raised money supply (M2) by 10.1% in March. Noticeably, lower policy rates have transmitted to market interest rates, as 3-month SHIBOR has dropped, following a cut in the 7-day reverse repo rate. On its fiscal stance, local government bond issuances have surged since the beginning of 2020, to boost demand through infrastructure investment. The synchronized monetary and fiscal stimulus could rebuild sufficient liquidity to support a sustained recovery.

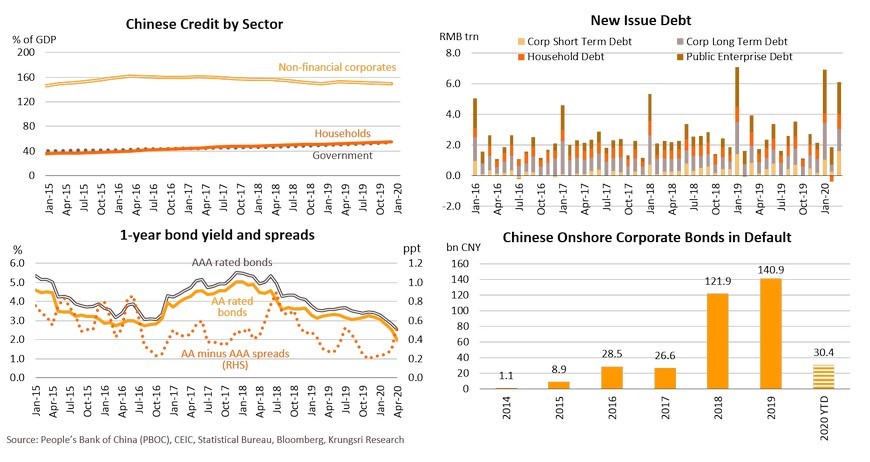

Downside risk from mounting private debt and unemployment could derail economic recovery

In China, credit to non-financial corporate sector has reached 149.3% of GDP, although this has dropped moderately following strict regulations since 2017 to contain risky lending. Nonetheless, the large corporate credit could expose higher default risk in the wake of coronavirus pandemic. After the outbreak of COVID-19, not only has public enterprise debt risen, but also debt in the non-financial corporate sector. Moreover, yield spreads between AA-rated and AAA-rated bonds have widened. Tight liquidity could escalate corporate bond defaults; total corporate bonds in defaults have reached CNY30.4bn in the first four months of 2020, compared to CNY140bn for all of 2019. Meanwhile, household debt could increase following a drop in income and rising unemployment. Looking ahead, China’s economic recovery could be derailed by mounting private debt, rising unemployment, and external headwinds, especially weak global demand and the new round of China-US trade tension.

Thailand: Covid-19 pandemic has affected all economic sectors

A wide range of economic activities has been halted

- Following lockdown measures since late-March to contain the Covid-19 pandemic, March private consumption shrank for the first time since June 2014, private investment contracted for the eighth consecutive month, and unemployment surged. April consumer and business confidence is at a record low.

- March industrial output dropped by the fastest rate since the severe flooding in Thailand at the end of 2011, due to a sharp decline in domestic and international demand. March exports of major items tumbled. Tourist arrivals collapsed by 76% YoY in March as many countries, including Thailand, restricted international travel.

- There are some early signs of recovery but with high uncertainty and permanent economic scars.

Economic recession and negative inflation put pressure on the MPC to cut policy rate

- Krungsri Research assess that negative inflation could prompt the MPC to cut policy rate by 25bps to a new low of 0.50% at the May 20 meeting, although the use of targeted monetary policy could reduce chance of this happening. Nevertheless, cutting interest rates would help to ease the severe Covid-19 impact on the economy. Meanwhile, the BOT has disbursed about Bt50bn of the THB500bn soft loan package. Besides, lower interest rates would reduce business costs and strengthen fiscal measures while the economy still lacks supporting factors to stimulate the domestic private sector.

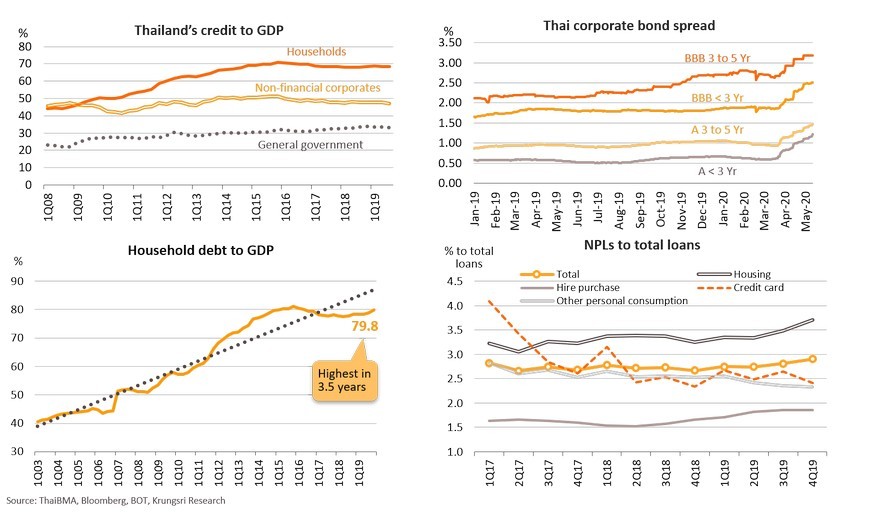

Covid-19 crisis increases household economic vulnerability

- Covid-19 shock is escalating Thailand’s debt levels, especially in non-financial sectors. In Thailand, rising debt is led by the household sector; that could rise further due to the Covid-19 shock. Even before Covid-19, Thailand’s households had been vulnerable to shocks, as total household debt has risen to c.80% of GDP, close to a 3-year high. Asset quality of consumer loans has deteriorated in almost all segments. For low- to medium-income households (earnings less than THB50,000 a month), on average, total expenditure (personal expense plus debt payment) has been higher than income.

- After the Covid-19 shock, based on a two-month lockdown, total expenditure to income ratio of indebted employees would increase from 106% to 111%. For indebted non-farm self-employed workers, it would jump from 114% to 129%.

- Covid-19 would increase the share of vulnerable employees by 8ppt to 46% of total employees, and of non-farm self-employed by 16ppt to 62% of total non-farm self-employed. Indebted farmers, already vulnerable to shock, would be hit hard by the drought crisis rather than Covid-19 impact. Unserviceable household debts would increase by 9%, which could delay an economic recovery.

Krungsri Research Forecast

Containment measures have severely hurt consumption, investment, confidence and employment

Sharp drop in domestic and external demand caused industrial output to shrink at steepest pace since 2011 flood

Exports of major items tumbled in March; full-year exports could see deepest contraction since 2009

Tourist arrivals fell 76% YoY in March as most countries, including Thailand, restricted international travel

Economic recession and negative inflation might pressure the MPC to cut policy rate by another 25bp

There are early signs of recovery but with high uncertainty and permanent economic scars

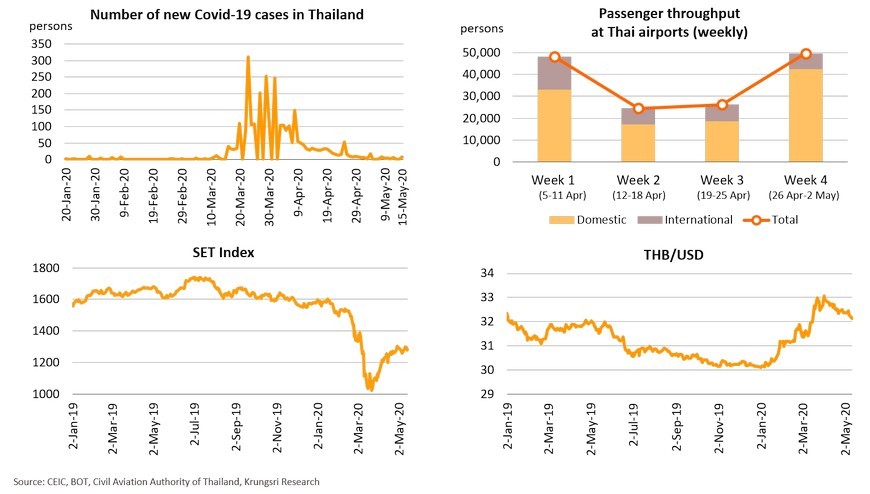

The number of new Covid-19 cases in Thailand has dropped to zero recently and the government has started to ease lockdown measures. This has fueled hopes of an economic recovery. Passenger throughput at Thai airports has rebounded slightly. The SET Index has risen above 1,200 points after touching a low of 969. The Thai baht has appreciated since mid-April. However, these signs are insufficient to indicate a sustainable economic recovery and there are permanent economic scars such as high unemployment, weaker purchasing power, high excess capacity, and surging debts.

Lingering obstacles on the path to recovery, including rising debts, especially household debt

In Thailand, the rising debt is led by the household sector. This sector will see higher debt levels due to rising unemployment and lost of income due to the Covid-19 pandemic. Pre-pandemic, household debt to GDP had risen to over 3-year high of 80%. Asset quality of consumer loans has deteriorated in almost all segments. Looking ahead, these figures could worsen and make the economy more vulnerable in the longer term.

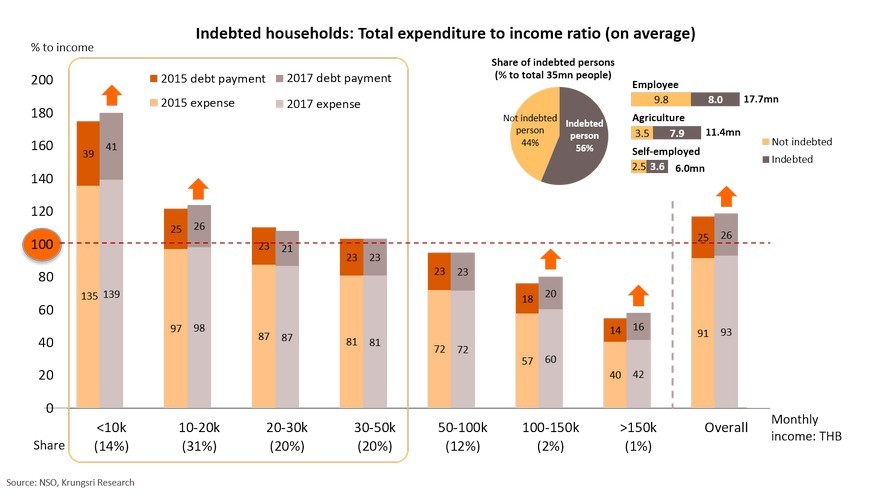

Even before Covid-19, indebted households with income below THB50k has had difficulty repaying debts

In Thailand, the number of households totaled 21 million (or 35 million workers). Out of total, 10 million households (or 19.6 million workers) were indebted, accounting for 48% of total households (or 56% of total workers). For low- to medium-income households (earnings less than THB50,000 a month), on average, total expenditure (personal expense plus debt payment) has been higher than income. The segment which found it most difficult to repay debts were households with a monthly income of less than THB10,000, which expenses (excluding debt repayment) normally already exceed their income.

Covid-19 shock: Total expenditure to income ratio of indebted employees would increase from 106% to 111%

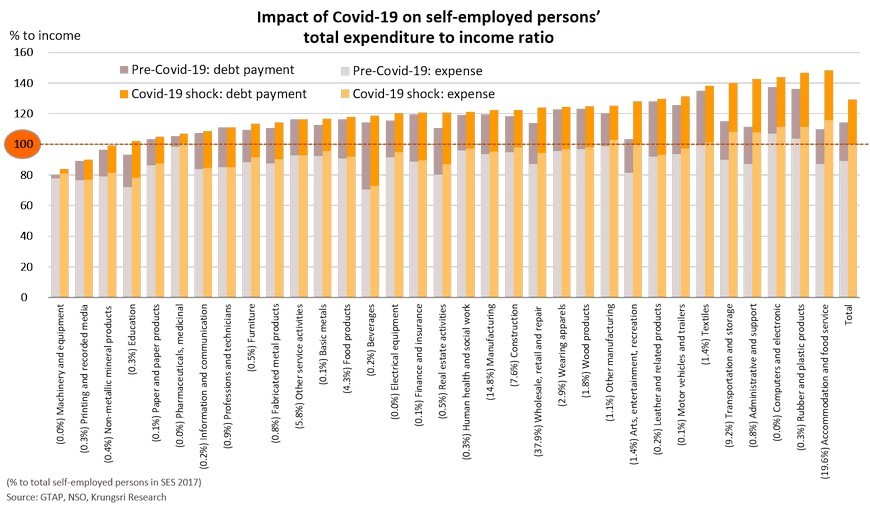

Non-farm self-employed workers in most sectors are vulnerable after Covid-19 shock

Before the Covid-19 pandemic, non-farm self-employed workers’ total expenditure was already high at 114% of total income, led by self-employed in the rubber and plastic products, computer and electronics, textiles, and motor vehicle sectors. The Covid-19 shock would push up the ratio to 129% of total income, led by accommodation & food services.

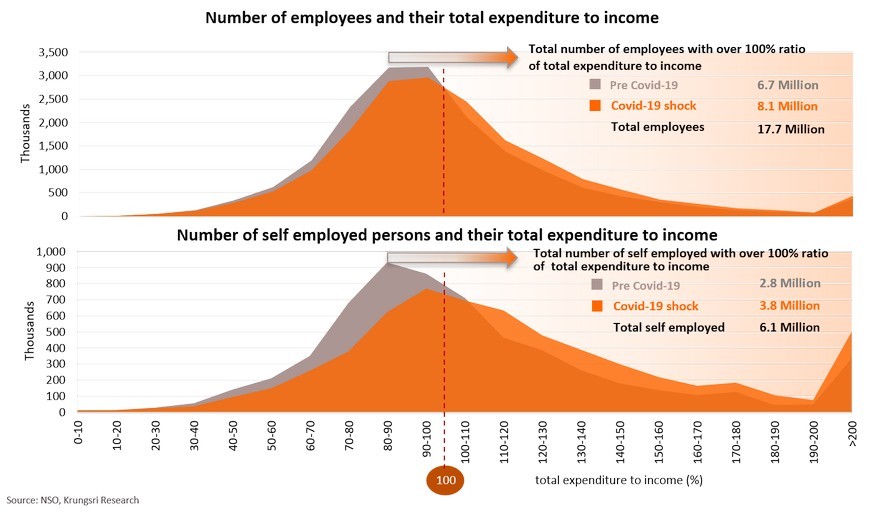

Pandemic has raised the share of vulnerable employees by 8ppt to 46% and non-farm self-employed by 16ppt to 62%

The number of employees who have insufficient income to meet monthly expenditure would increase sharply from 6.7mn (38% of total employees) to 8.1mn (46% of total employees) after Covid-19. The number of non-farm self-employed workers in the same situation would rise from 2.8mn (46% of total non-farm self-employed) to 3.8mn (62% of total non-farm self employed).

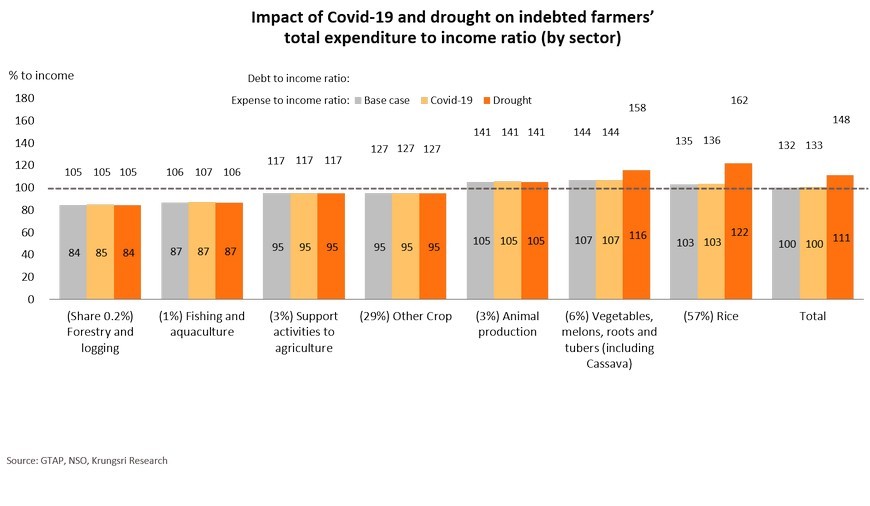

Indebted farmers, already vulnerable to shock, would be hit harder by drought crisis rather than Covid-19

There are 7.9 million indebted famers in Thailand, accounting for 70% of total farmers (11.4 million). Before the pandemic, indebted farmers’ total expenditure was already high at 132% of total income, led by those involved in vegetables & root (including Cassava), rice producers, and animal products. The Covid-19 shock would increase the ratio by 1ppt to 133% because there will still be demand for agricultural (food) products. But, the drought crisis could hurt rice and cassava producers severely. This would raise total expenditure to 148% of total income due to smaller harvests, especially rice and cassava.

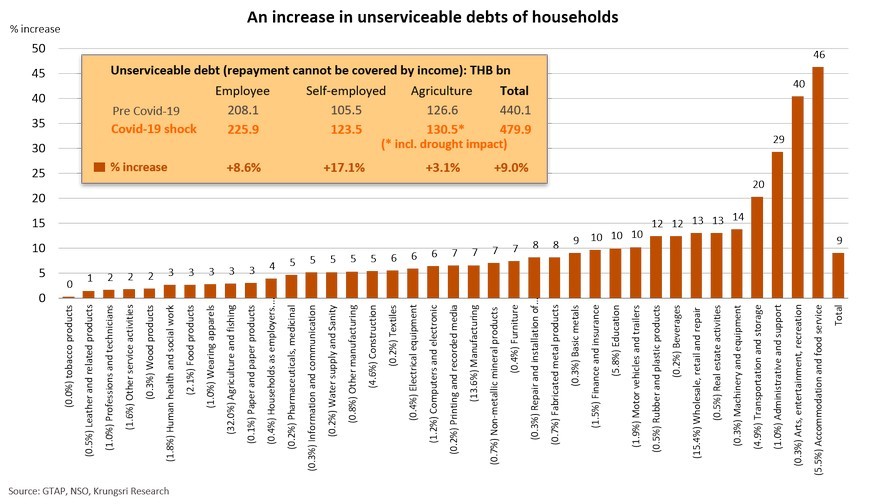

Unserviceable household debts would increase by 9%, which could delay economic recovery

The Covid-19 shock is expected to increase unserviceable household debts by 9% to THB480bn from THB440bn. The sharp increase would be led by self-employed (+17.1%) and employees (+8.6%). For agricultural households, most could not service their debts even before Covid-19. Looking ahead, these households would be vulnerable, which would dampen purchasing power, reduce private spending, and possibly derail economic recovery in Thailand.

Regional Economic and Policy Developments in May 2020

ASEAN: Mixed successes in containing COVID-19 suggest an uneven timeline to reopen economy

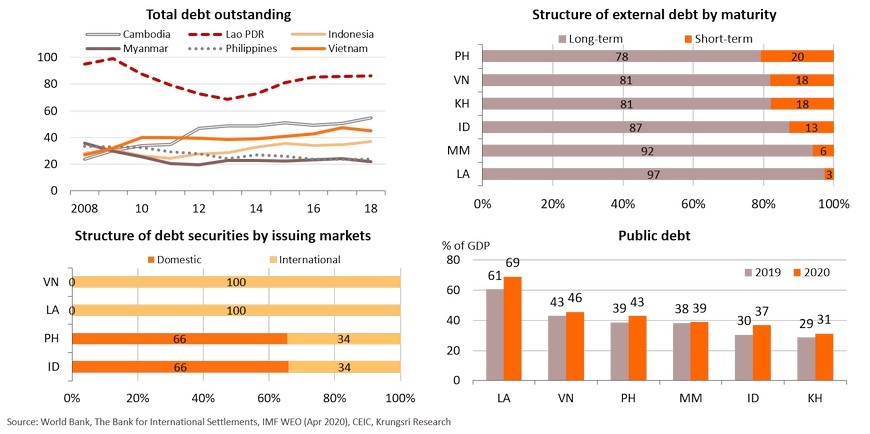

Surging debt could threaten countries with weak fundamentals

- SE Asian countries are among the Emerging Markets that will see higher debts as governments seek additional financing to cushion the Covid-19 impact on their economies. And in most countries, government bonds is the largest source of debt, at between 75% (Vietnam) to 95% (Philippines) of total debt outstanding.

- We observe that (i) debt outstanding has surged in some countries compared to 4Q19, such as Philippines (+9.4% YTD); (ii) countries with a large share of short-term debt as well as a large share of bonds issuing outside the country face looming uncertainties that could trigger sudden capital outflows, such as Philippines, Laos, and Vietnam; and (iii) countries with weak fundamentals, especially high external and public debts as well as large fiscal deficits, face a deterioration in debt sustainability and fiscal stability. These will ultimately pressure sovereign credit ratings if the pandemic is not contained soon. They include Laos, Cambodia, and Vietnam.

Cambodia: Real estate and construction sectors would face serious risks in 2020

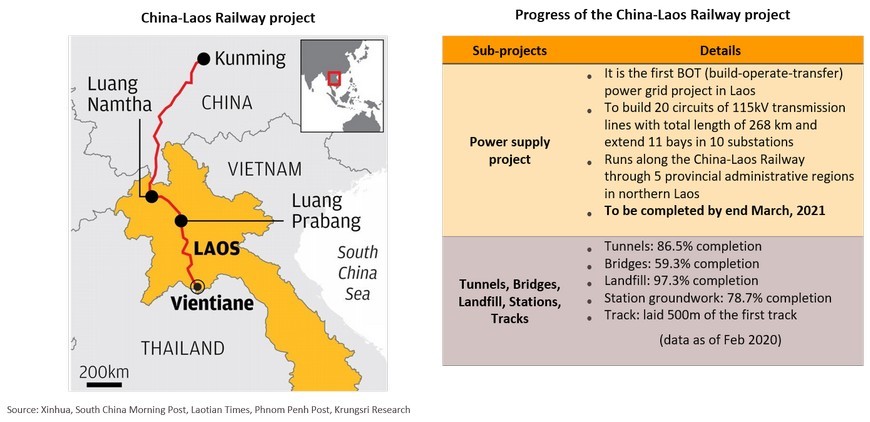

Lao PDR: Construction of China-Laos Railway project is on track for completion by Dec 2021

- The China-Laos Railway project has resumed after a temporary suspension to curb the spread of Covid-19. It is a strategic docking project between the China-proposed Belt and Road Initiative and Laos’ strategy to turn the land-locked nation into a land-linked country.

- By end-2019, the project was 78% complete. It is expected to start operating in December 2021, as scheduled. Several sub-projects are also progressing well. For example, construction of a power supply facilities to supply electricity to the rail system is scheduled to be completed in March 2021. Looking ahead, the completed project would help Laos to attract more Chinese tourists (its largest source of visitor arrivals) into the country. When the China-Laos railway project connects with Thailand’s high-speed rail project (expected to start operations in 2027), it would facilitate greater trade activity, investment and tourism across the region.

Myanmar: Another wave of banking sector liberalization; promoting trade and investment

Vietnam: Government adjusts 2020 growth target to +5%, an ambitious target amid a deteriorating global outlook

Vietnamese government to boost domestic tourism by introducing stimulus packages and campaigns

Indonesia: 1Q20 GDP growth slows to +3.0%, weakest since 4Q01; full-year growth could contract

Philippines: Economy shrank 0.2% in 1Q20 due to weaker demand; things will get worse

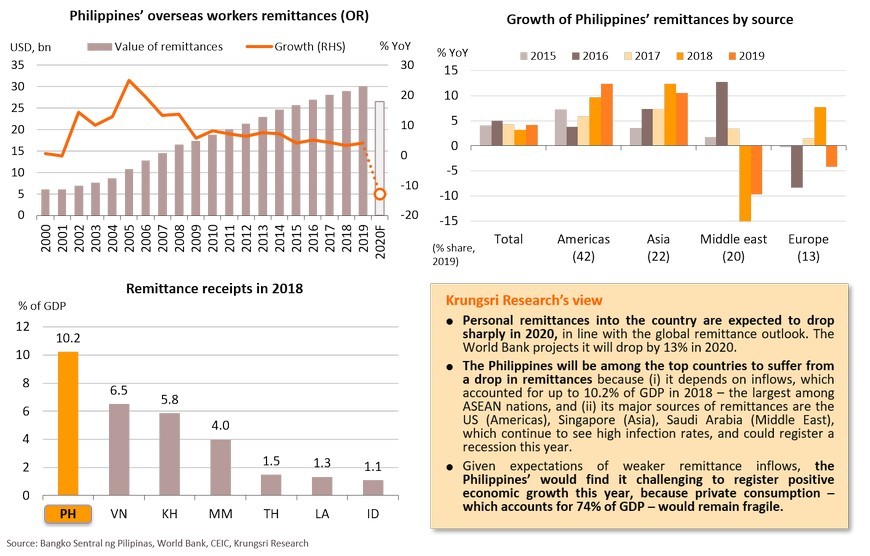

Philippines inbound remittances will drop sharply due to weak outlook for the key source countries