Global: Between light and shadow

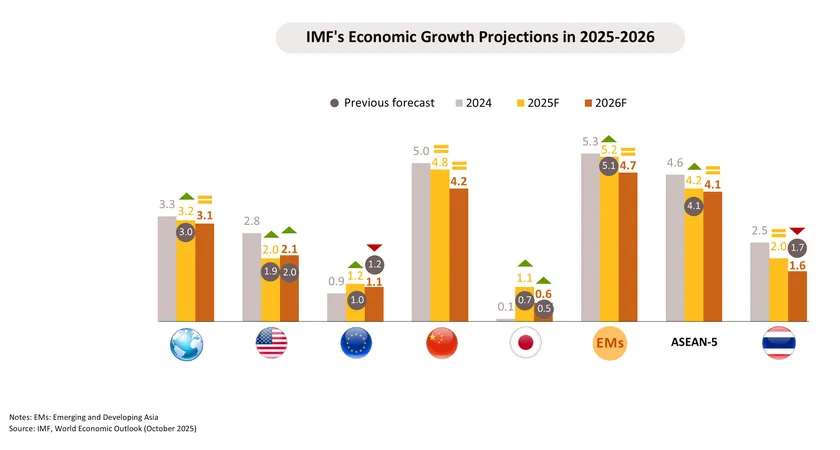

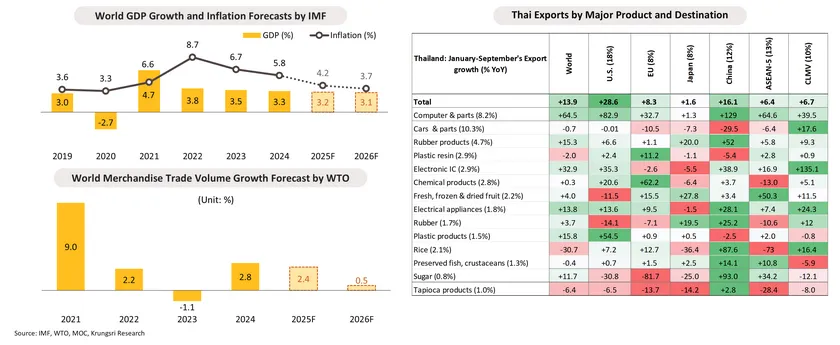

Dim global growth prospects: The IMF projects a slowdown in 2026, with risks skewed to the downside amid fading front-loading, prolonged uncertainty, and rising protectionism.

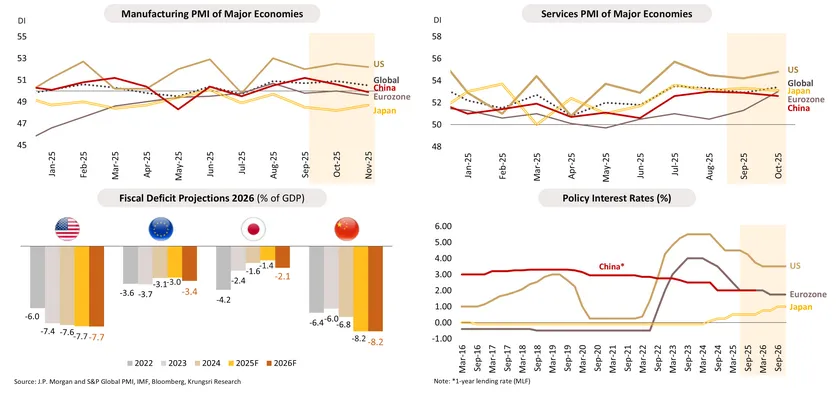

Global activity is expanding modestly, led by services, but tariff pressures may increasingly weigh on trade and manufacturing despite policy support.

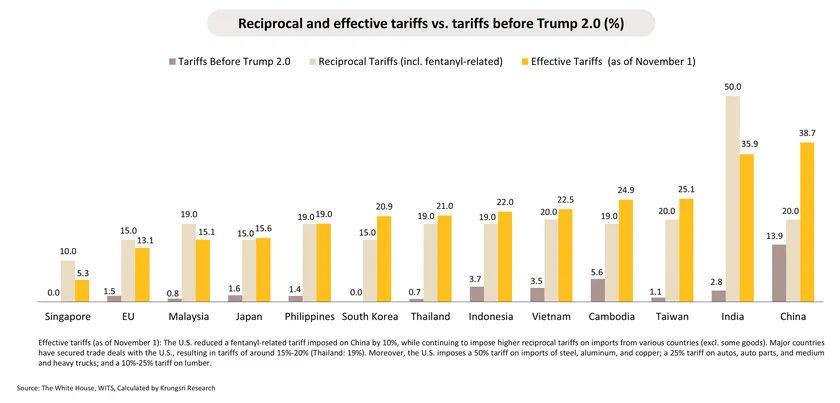

U.S. Tariffs: Most countries see an effective tariff higher than reciprocal tariff rates; higher tariffs will likely dampen 2026 economic growth and affect global supply chains.

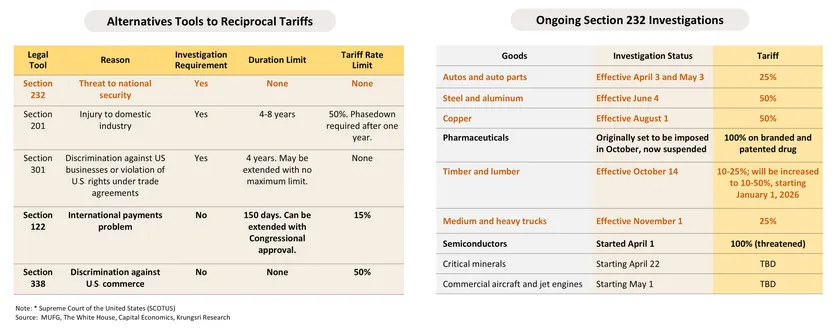

Although the IEEPA-based universal and reciprocal tariffs face legal challenges, Trump administration can still resort to other tools, such as sector-specific tariffs under Section 232.

Reciprocal tariffs, imposed under the International Emergency Economic Powers Act (IEEPA), are under legal dispute. On August 29, the U.S. Federal Circuit upheld the Court of International Trade’s ruling that the Trump administration’s reciprocal tariffs were unconstitutional. Nonetheless, reciprocal tariffs remain temporarily in effect, with

the Supreme Court granting a fast-track review starting in early November and a final ruling expected by mid-2026. Even if struck down, the Trump administration can still resort to other tools, such as Sections 201, 301, and 232. Particularly, section 232 has already been implemented to impose industry-specific tariffs, currently 25% on autos and parts, and 50% on steel, aluminum, and copper, with potential expansion to other products. As such, U.S. tariff pressures are expected to persist in the foreseeable future.

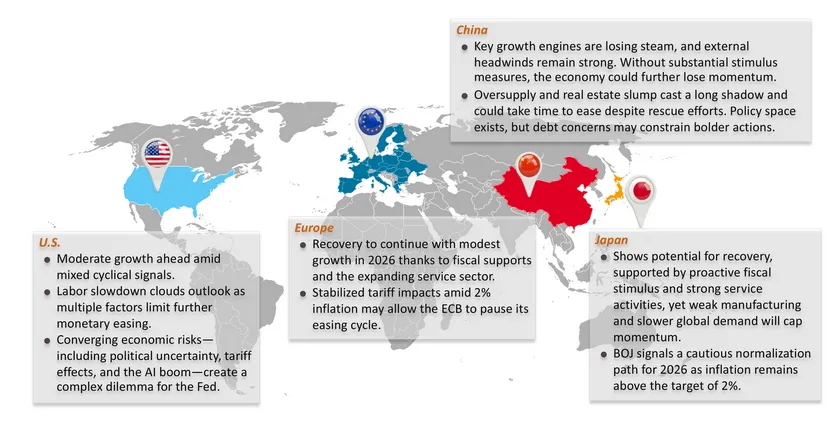

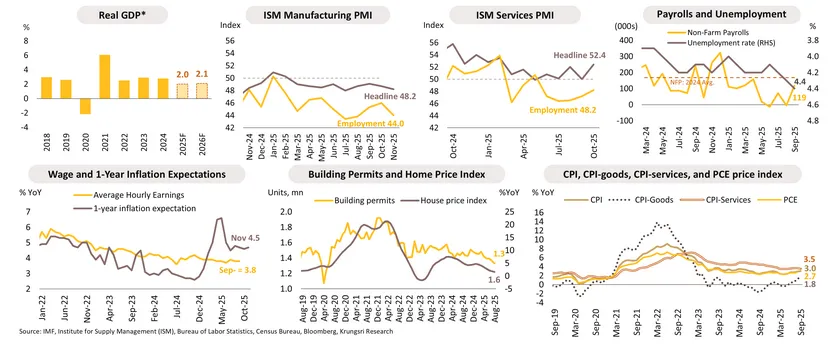

U.S.: Moderate growth ahead amid mixed policy and cyclical signals; labor slowdown clouds outlook as multiple factors limit further Fed easing.

The U.S. economy is expected to grow moderately at 2.1% in 2026, compared to 2.0% in 2025. Services activity, fiscal expansion, and recent rate cuts should continue to support growth.

However, overall momentum will be tempered by a weakening labor market and softer wage gains. A continued contraction in manufacturing activity and a further weakness in the property sector could further erode cyclical tailwinds. Signs of a broader slowdown – amplified by the impact of tariff policies and risks of a renewed government shutdown – point to a gradual policy easing ahead, though sticky inflation may limit the Fed’s ability to ease monetary policy.

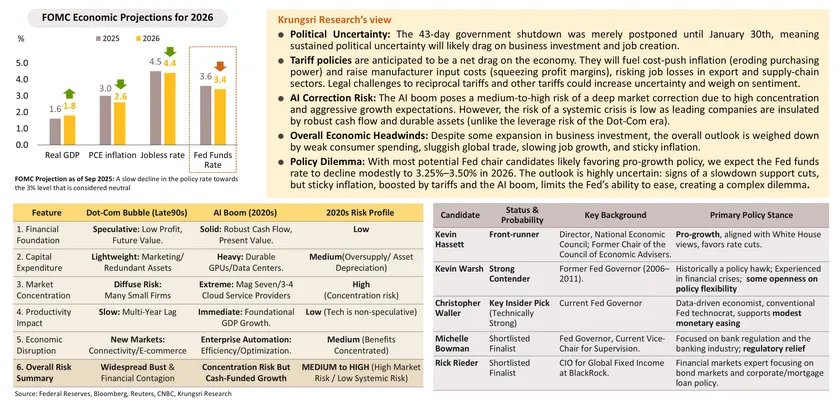

Converging economic risks—including political uncertainty, tariff effects, and the AI boom—create a complex dilemma for the central bank.

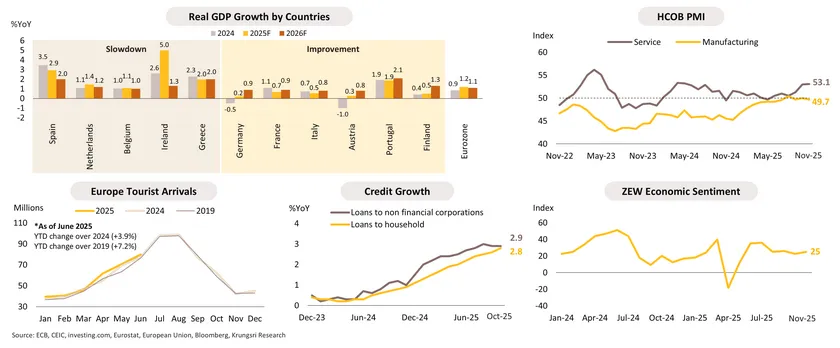

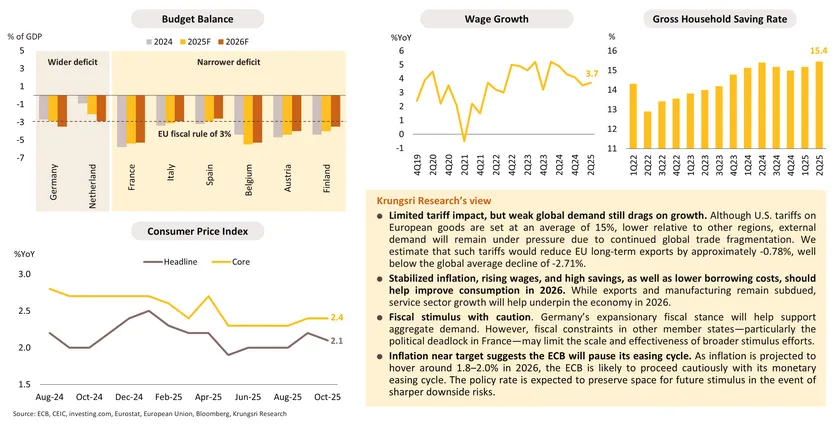

Eurozone: Recovery to continue with modest growth in 2026 thanks to fiscal supports and expanding service sector.

The eurozone economic recovery is projected to continue in 2026, albeit slowly, with GDP growth projected at 1.1%, compared to 1.2% in 2025, supported by improving performance in major countries, led by Germany, France, Italy, and Portugal. Tailwinds include looser fiscal policy in Germany and ongoing expansion in tourism and high-value-added services, including finance, real estate, information and communications technology, and professional services. However, persistent weakness in manufacturing activity and slowing global trade, exacerbated by ongoing geopolitical tensions and weak external demand, will continue to weigh on overall growth.

Stabilized tariff impacts amid 2% inflation may allow the ECB to pause its easing cycle.

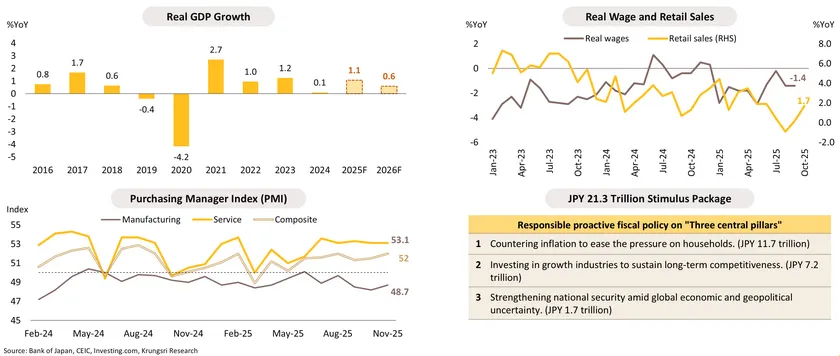

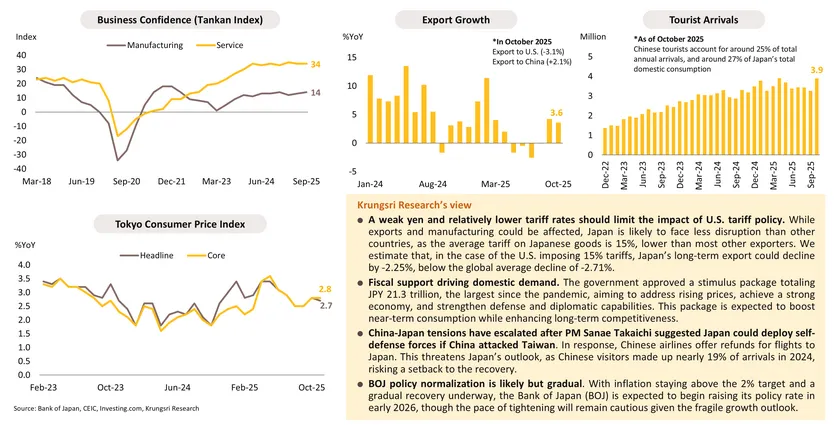

Japan: Shows potential for recovery, supported by proactive fiscal stimulus and strong service activities, yet weak manufacturing and slower global demand will cap momentum.

Despite a lower growth estimate in 2026, Japan's economy shows potential for recovery, supported by improving consumer sentiment and aggressive fiscal stimulus. The government’s efforts to address cost-of-living pressures and promote sustainable wage growth are beginning to ease deflationary concerns. However, the growth momentum will be constrained by weak manufacturing activity and subdued external demand—particularly from the U.S. and China, which together account for over 40% of Japan’s exports. Escalating trade tensions and uncertainty regarding U.S. trade policy pose further risks.

BOJ signals a cautious normalization path for 2026 as inflation remains above target of 2%.

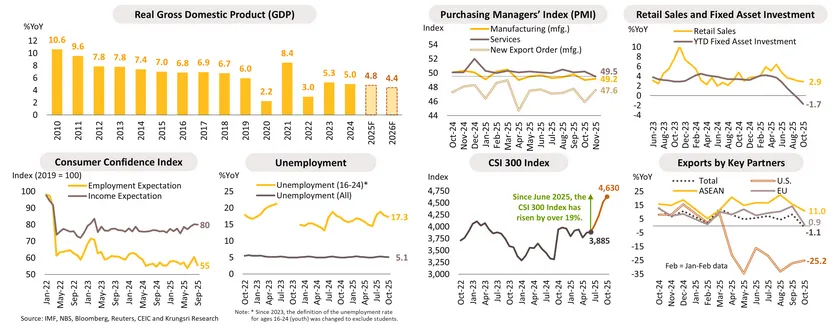

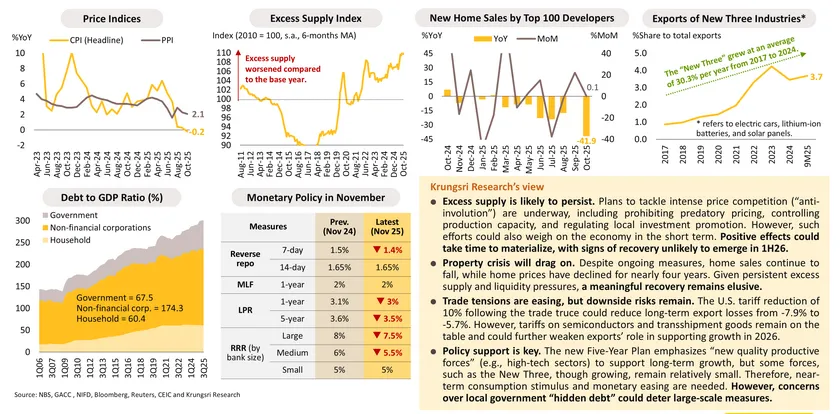

China: Key growth engines are losing steam, and external headwinds remain strong; without substantial stimulus measures, the economy could further lose momentum.

The economy has weakened. Manufacturing has shrunk for seven months, the longest streak in over nine years. Consumption may struggle to pick up in 2026, as the property crisis and a weak labor market weigh on wealth and income. Despite stimulus measures, especially trade-in subsidies and a recent stock market recovery, retail sales grew just 2.9% YoY in October, far below the 8-10% growth recorded during 2017-2019. Weakness in investment may persist due to still-weak demand and large excess supply. While the U.S.-China trade truce lasting until November 2026 may ease some pressures, prior gains from front-loading are likely to substantially wane.

Given these signals and ongoing structural issues, China needs to step up its efforts to boost consumption and targeted investment. Otherwise, growth could further decelerate from the projected 4.8% in 2025 to just 4.4% in 2026.

Oversupply and real estate slump cast a long shadow and could take time to ease despite rescue efforts; policy space exists, but debt concerns may constrain bolder actions.

Thailand Economic Outlook 2026:

In the Shadow of Transition

Krungsri Research Forecasts for 2025-2026

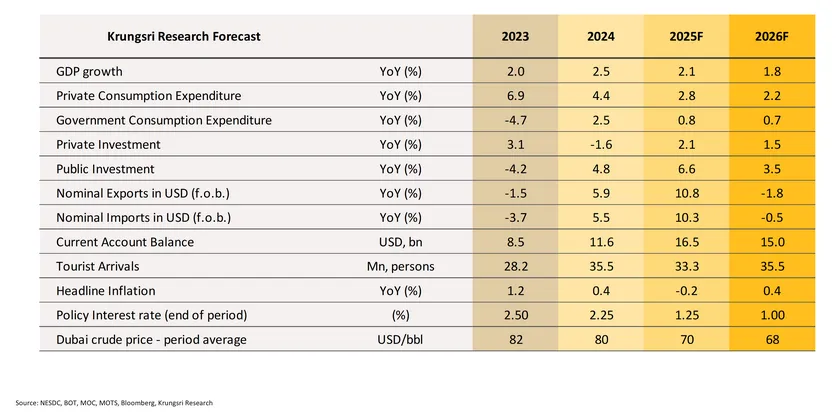

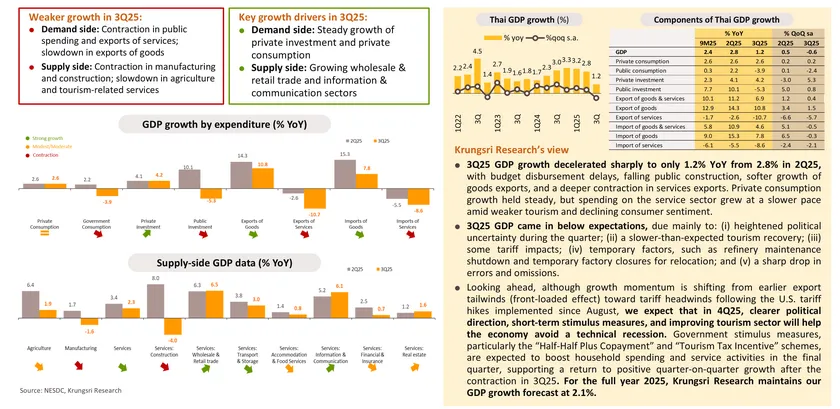

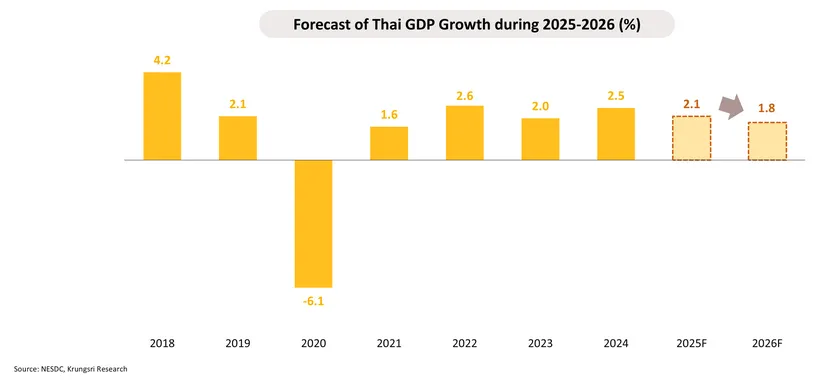

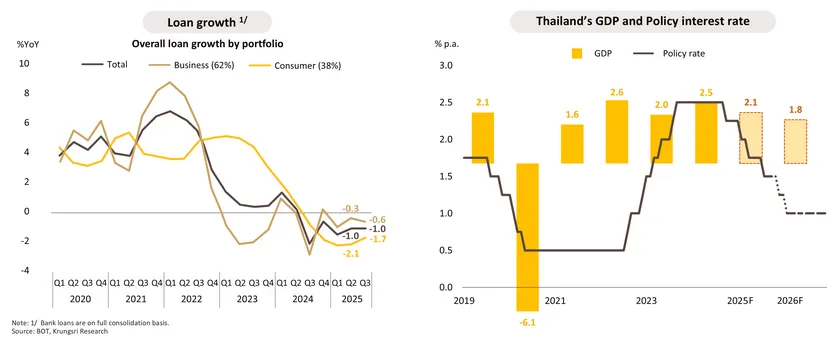

3Q25 GDP growth slowed sharply to 1.2% YoY from 2.8% in 2Q25, weighed down by softer exports, contracting public spending, and weaker tourism sector.

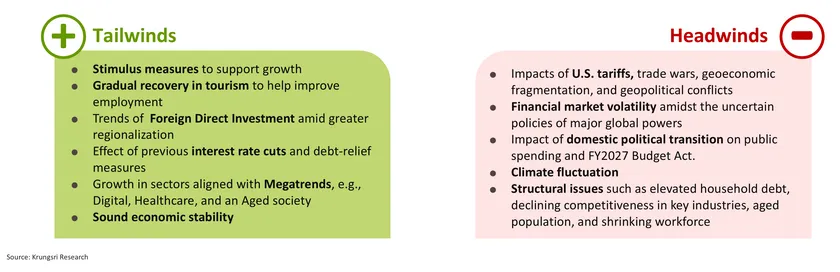

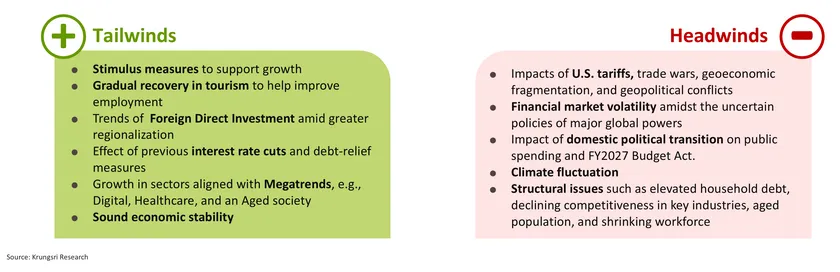

Thailand’s 2026 economic growth likely to moderate, facing tariff pressure and political uncertainty.

In 2026, Thailand’s economic growth is expected to soften compared with 2025. The full-year impact of US tariffs on key exports could weigh on export performance, while renewed political uncertainty from February through mid-year may constrain public spending, particularly the disbursement of capital budget, and dampen the overall economic activity, posing challenges to the country’s broader growth prospects.

2026: Thailand in the Shadow of Transitions — Low Growth With Small Rays of Hope

-

Under the shadow of political and policy transitions, the Thai economic growth is expected to slow down to a 5-year low of 1.8% in 2026 from an estimated 2.1% growth in 2025.

-

Thai exports are likely to weaken substantially under both the full impact of U.S. tariffs and the resulting payback effect, pressured by global trade tensions and fragmented globalization.

-

Tourism is recovering slowly from the shadow of past disruptions but is still below pre-Covid levels. Safety concerns continue to weigh on arrivals, though global tourism momentum supports the outlook.

-

Politics will play a key decisive role. Timely government formation and policy continuity are crucial as political uncertainty may cast a long shadow.

-

Private consumption growth will soften as key drivers fade, underscoring the need for new growth engines in this period of change.

-

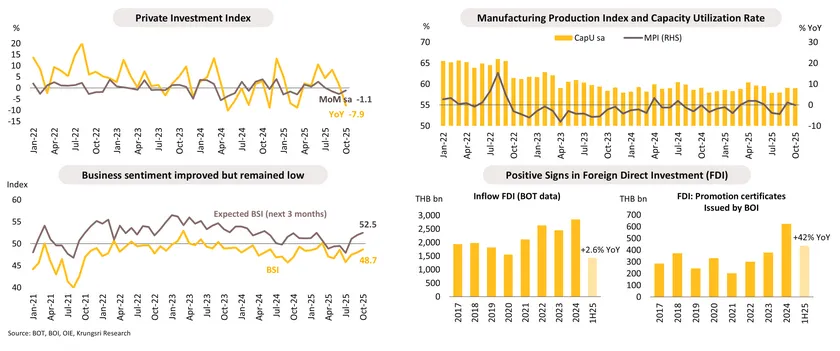

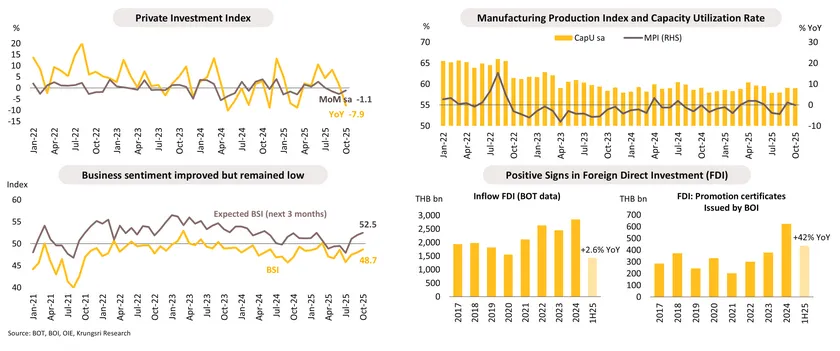

Business investment may grow gradually. Lingering global and domestic challenges keep investors cautious despite encouraging FDI and BOI data.

-

MPC likely to cut policy rate to 1.00% by 1H26 amid weak momentum and tight credits, pointing to policy easing under the shadow of subdued growth.

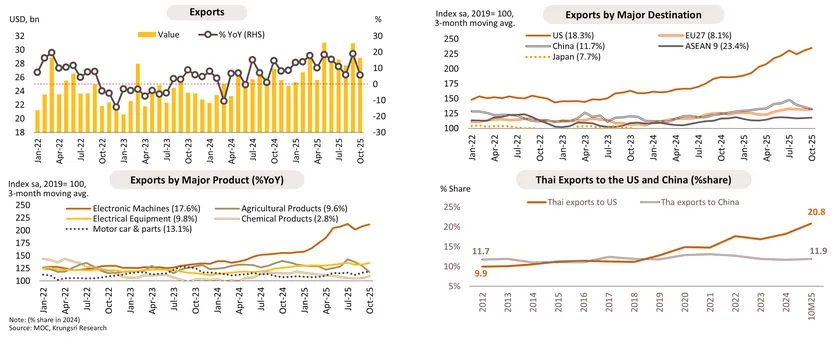

Following abnormally high, front-loaded growth in 2025, Thai exports are likely to weaken in 2026 under both the full impact of U.S. tariffs and the resulting payback effect.

Although Thai exports are expected to lose momentum in the remainder of 2025, full-year growth is still projected to exceed earlier expectations, expanding by nearly 10%. This reflects (i) front-loading of orders ahead of tariff implementation and (ii) stronger demand for AI-related technology products, which has boosted shipments of electronics and components.

However, in 2026, the reciprocal tariff hike on Thai goods to 19% (since Aug-25) and the sectoral-specific tariffs are expected to exert pressure throughout the year. Higher tariffs will erode Thailand’s price competitiveness, particularly for sectors heavily reliant on U.S. demand. As a result, Thai exports in 2026 face a significant risk of contracting from the elevated levels seen in 2025.

Exports are expected to face headwinds from U.S. tariffs and weaker global trade, although the tech sector may continue to provide some support.

The IMF projects global economic growth at 3.1% in 2026, a slight slowdown from the previous year, while the WTO forecasts global trade volume to expand by only 0.5%, decelerating from 2.4% in 2025. This reflects mounting pressure from intensifying trade protectionism, particularly the U.S. tariff measures, which are expected to have a more pronounced impact on exports in 2026. Nevertheless, continuing demand for technology and electronics products, driven by ongoing trends in digital transformation, AI, and semiconductors, should help cushion the tariff impacts on Thai exports.

Overall, export growth in 2026 is likely to weaken sharply after the strong expansion in 2025.

Thailand recently agreed with trade framework with the U.S., but significant concessions were made for a 19% tariff, leaving Thailand with tied hands in conducting trade policy.

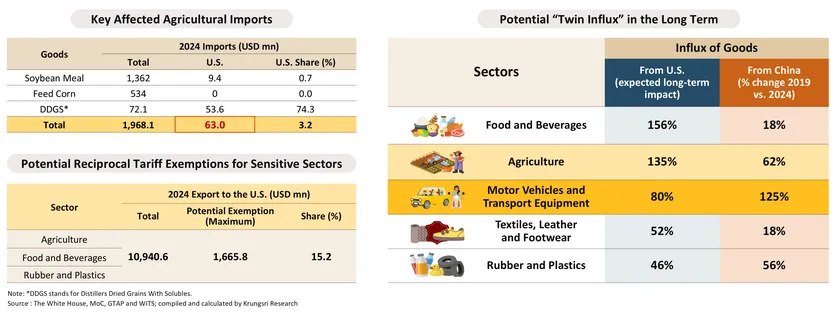

On Oct 26, 2025, the U.S. and Thailand agreed on a Framework for an Agreement on Reciprocal Trade. Within this framework, in exchange for a reciprocal tariff reduction and further exemptions on some goods, Thailand will eliminate tariffs on almost all U.S. goods, increase purchases of animal feed, energy, and aircraft, and broaden market access for certified meat, poultry, vehicles, medical devices, and pharmaceuticals. Separately, both nations also signed an MoU that allows for rare earth exploration and possible investment in the future. However, this trade deal might not be worth the cost. It could harm Thailand’s domestic producers, given that we are exchanging to a considerable extent for a 19% tariff that did not exist before this administration, while also constraining our trade policy space.

More-give-than-get trade deal raises concerns for domestic producers and could lead to “Twin Influx”. Additional tariff exemptions and transshipment tariffs remain to be seen.

Given Thailand’s various concessions in the trade deal, several issues need to be carefully considered.

First, we offer to increase the purchase of animal feed from the U.S., including soybean meal, feed corn, and DDGS, by USD 2,600 mn/year. This is substantial compared to the actual imports from the U.S. of such goods in 2024, which were only USD 63 mn, and about 32% higher than the total animal feed imports in 2024.

Second, eliminating tariffs on almost all U.S. goods could lead to a surge in total imports from the U.S. This comes on top of the existing influx of Chinese goods and could lead to the “twin influx.”

Third, the MoU on rare earths also raises concerns about cost-effectiveness and potential environmental impacts.

Fourth, even if the U.S. extends reciprocal tariff exemptions as set out in the PTAAP, the maximum coverage of goods to be exempted in sensitive sectors, including Agriculture, Food and Beverages, and Rubber and Plastics, accounts for only 15.2% of Thailand’s sensitive-sector exports to the U.S.

Additionally, Thailand still faces a risk of transshipment tariffs in the coming period.

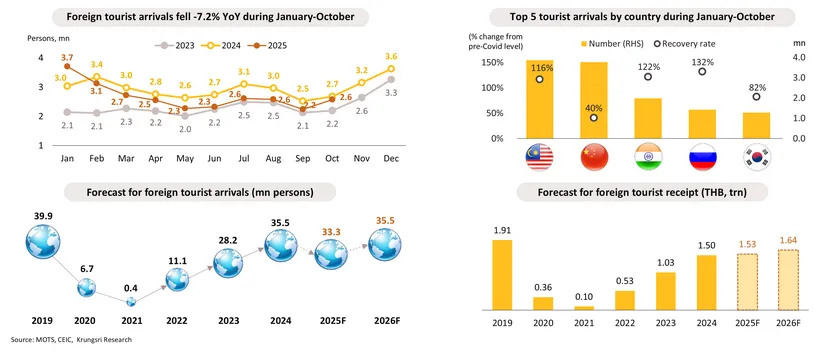

Tourism: 2025 arrivals fall; modest recovery expected in 2026, still below pre-Covid levels.

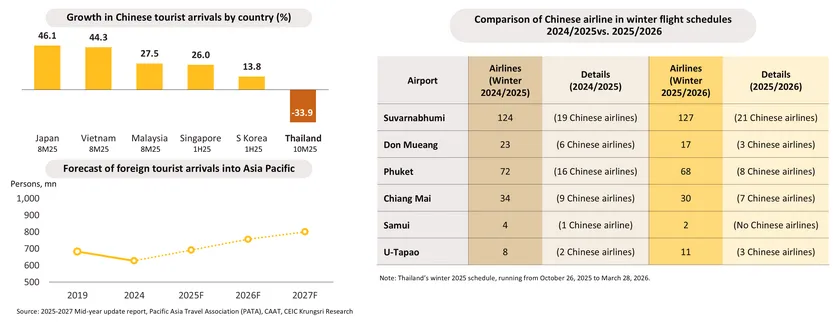

Although foreign tourist arrivals are expected to pick up in the final quarter of 2025 due to the high season, the recovery of Chinese tourists remains slow, with arrivals contracting by nearly -34% in the first ten months of 2025 and falling behind those from Malaysia as Thailand’s largest source market. As a result, total foreign arrivals in 2025 are projected at 33.3 mn, marking the first annual decline since the post-pandemic recovery.

In 2026, international tourist arrivals are expected to gradually recover to around 35.5 mn, generating tourism revenue of an estimated THB 1.64 trn, up from THB 1.53 trn in 2025. This reflects a gradual improvement in both visitor numbers and tourism income.

Nonetheless, foreign tourist arrivals in 2026 are expected to remain well below the pre-COVID level of 39.9 mn in 2019.

Safety concerns continue to weigh on Chinese arrivals, while global tourism momentum and new flight routes support Thailand’s 2026 outlook.

Concerns over travel safety continue to weigh on Chinese tourists’ willingness to visit Thailand, hindering the sector’s recovery. In the first ten months of 2025, Chinese arrivals to Thailand fell more sharply than to competing destinations such as Japan and Vietnam, reflecting stronger regional competition and shifting post-pandemic travel preferences. Even so,

global tourism remains supportive. The Pacific Asia Travel Association (PATA) projects Asia-Pacific tourist arrivals to reach 756 mn in 2026 and 800 mn in 2027, providing a positive backdrop for tourism-dependent economies.

Thailand’s Winter Flight Schedule 2025/2026 also shows signs of improvement. Although overall international flight frequencies remain slightly below last year’s levels, key airports such as Suvarnabhumi are seeing increased flights from China. New routes, including Haikou–Udon Thani, as well as growing flight capacity from India, are expected to help diversify Thailand’s source markets and partially offset the slow recovery of Chinese tourists.

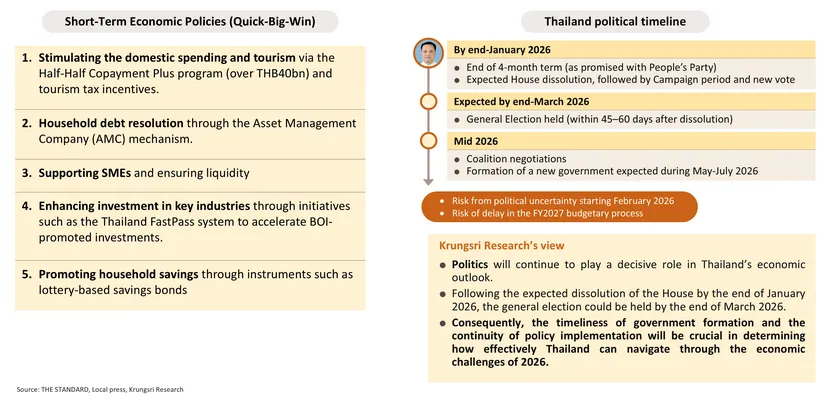

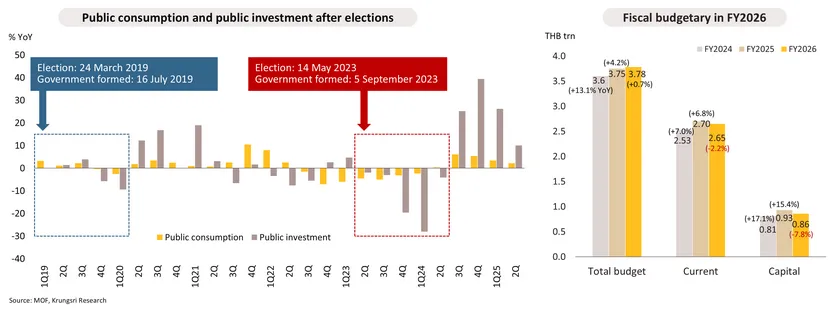

Political developments will play a decisive role in Thailand’s economy in 2026; timely government formation and policy continuity remain crucial.

Public spending in 2026 could be at risk, as a prolonged caretaker government may postpone approval of the next fiscal year’s budget.

Although both current and capital budget expenditures in FY2026 will decline from FY2025, overall spending is expected to increase due to the use of carry-over funds resulting from delayed disbursements in FY2025. However, in 2026, Thailand’s economy could face the risk of losing fiscal momentum if the country enters an extended caretaker government period before and after the general election. Legal and institutional constraints during this phase typically prevent the government from introducing new policies or accelerating investment and spending programs, creating a temporary “fiscal gap” that weakens economic support. Historical patterns from the 2019 and 2023 election periods show that

government spending often slows noticeably, particularly through (i) delayed capital budget disbursement caused by the postponed government formation, which affects the approval process for the annual budget bill;

and (ii) restricted disbursement of current budget, which remains at essential levels with no new measures to support incomes or business confidence.

A similar environment in 2026 may once again weigh on economic activity and contribute to slower overall growth.

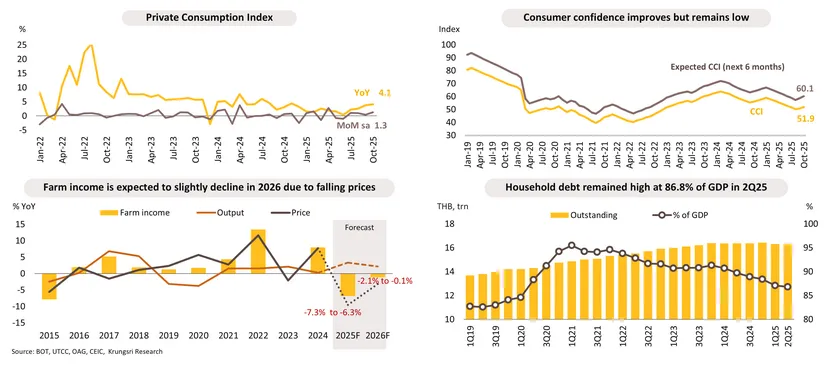

Private consumption is likely to face multiple headwinds in 2026 as key drivers ease.

In 2026, private consumption is expected to grow at a slower pace due to several headwinds.

(i) Diminishing fiscal support, as the Co-payment Plus scheme is likely to end in early 2026, reducing momentum for household spending;

(ii) Low consumer confidence, amid heightened concerns over renewed political uncertainty ahead of the general election in the year;

(iii) An uneven labor market recovery, with the tourism sector to improve only gradually, and export-related sectors to weaken;

(iv) Still-weak farm incomes, reflecting lower agricultural prices across several key commodities; and

(v) Structural constraints from high household debt, which continue to weigh on purchasing power.

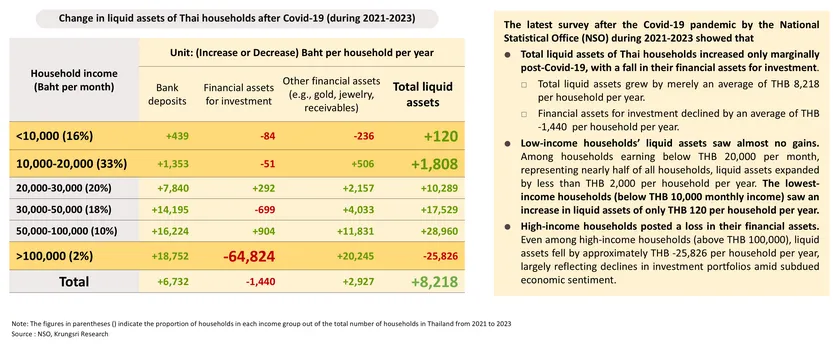

Liquid assets of households posted stagnate growth, suppressing Thailand’s post-Covid consumption recovery.

Thailand’s economy has been gradually recovering from the COVID-19 crisis, but the recovery has not been strong enough to boost household consumption. Over the past 3-4 years, spending has remained weak because households are still burdened by high debt and stagnant income that limit their ability to spend. This weak purchasing power reflects deeper structural issues, such as low income, unstable jobs, and household assets that are not growing fast enough to keep up with rising living costs. These issues continue to hurt consumer confidence and delay a full economic recovery.

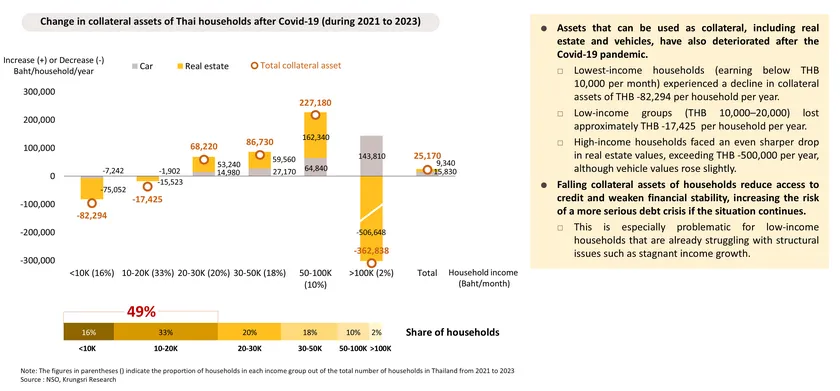

Post-covid change in households’ collateral assets reflects vulnerability of low-income groups and the problem of lacking financial buffers.

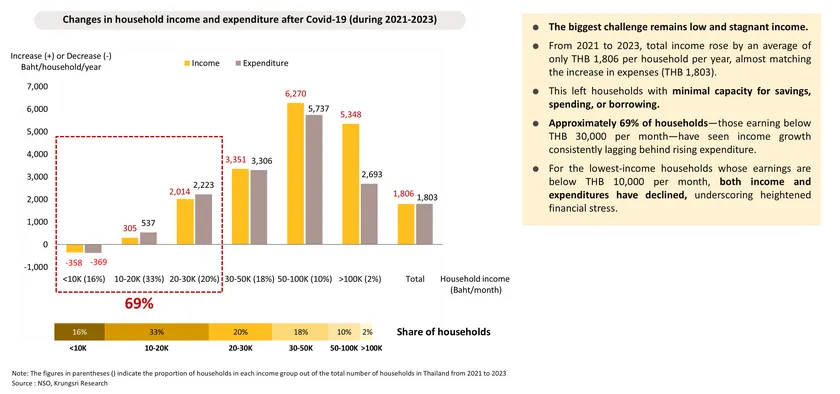

Weak income growth leaves Thai households with little room to save or spend, particularly those earning below 30,000 baht per month.

Private investment to grow at a gradual pace as global and domestic challenges persist.

Private investment in 2026 is expected to expand gradually, supported by several factors: (i) continued growth in FDI and investment in targeted industries benefiting from BOI incentives; (ii) ongoing relocation of production from China to Southeast Asia, from which Thailand may gain due to its strong infrastructure; and (iii) the recovery of tourism and related service sectors, which may boost investment in hotels, retail, logistics, and urban transport.

However, investment growth will remain constrained by: (i) the full-year impact of U.S. tariff measures, which could pressure export-oriented manufacturing and delay capacity expansion; (ii) weaker domestic demand amid high household debt; and (iii) political uncertainty in an election year, which may postpone public investment and delay some investment decisions.

Overall, private investment is likely to grow in 2026, but the pace will be limited by external risks and structural domestic challenges.

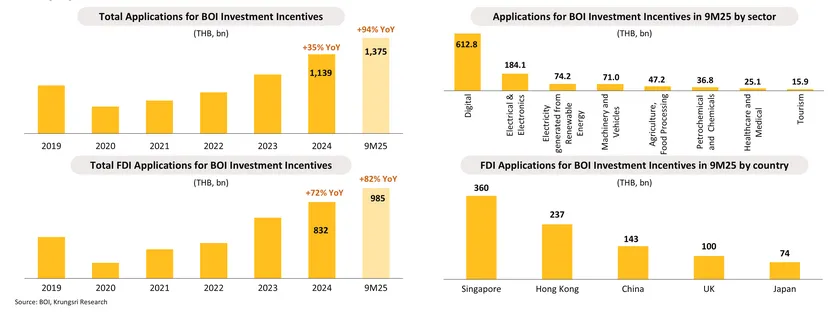

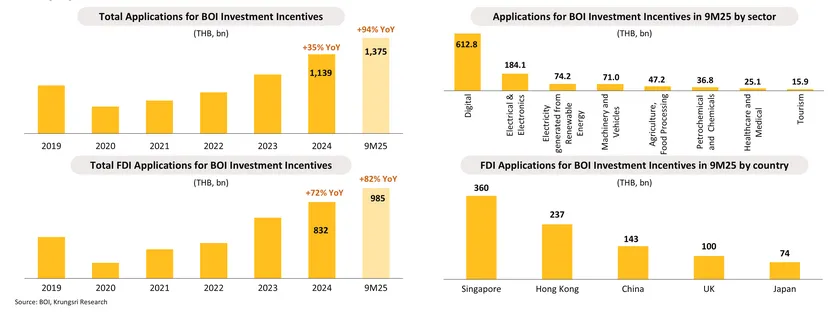

BOI applications surge, and ‘FastPass’ rollout is set to support private investment momentum.

Private investment continues to show positive momentum. In the first nine months of 2025, the Board of Investment (BOI) received applications for investment incentives with a total investment value of THB 1,375 bn (+94% YoY). The three industries with the highest investments were Digital, Electrical & Electronics, and Electricity generated from renewable energy. Foreign direct investment (FDI) applications for BOI incentives valued at THB985 bn (+82%), led by Singapore, Hong Kong, and China. Meanwhile, the BOI has approved with a total investment value of THB 1,115 bn (+49%). The investment value of promoted certificates, which are closely linked to actual investment, totaled THB 948 bn (+41%). In addition, the BOI introduced the ‘Thailand FastPass’ system to accelerate the implementation of around THB 480 bn in projects that received investment promotion during 2023–2025. Overall, despite the broader economic slowdown, private investment, particularly in technology and new energy industries, should be one of key economic drivers going forward.

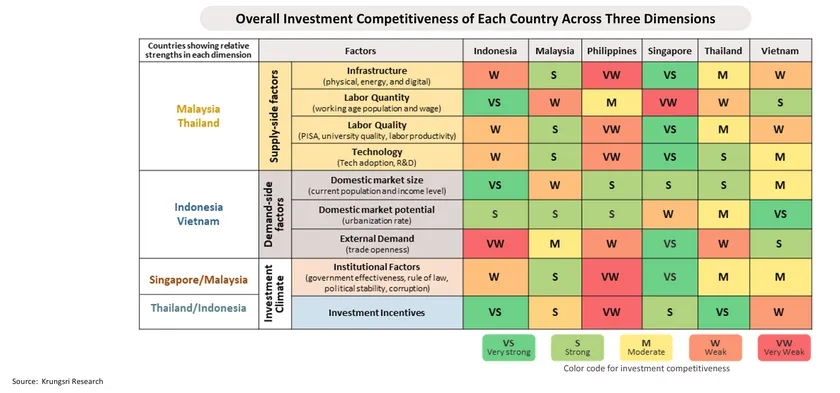

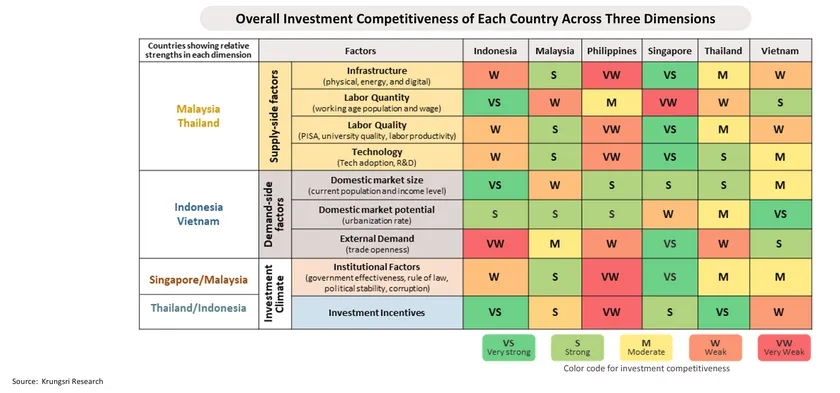

Thailand’s strong infrastructure and incentives still bolster the investment attractiveness.

Foreign direct investment in Thailand will be supported by both strong infrastructure foundations and comprehensive investment incentives. Thailand demonstrates high infrastructure readiness for manufacturing, relatively effective technology adoption, and stable energy-related systems—key factors that reduce operational risks for investors. On the incentive front, Thailand offers broad and targeted measures, particularly those linked to strategic zones and special economic areas designed to match the needs of priority industries. Given that each country attracts different investor groups based on distinct strengths, Thailand is especially appealing to investors who prioritize infrastructure readiness and deep supply-chain integration.

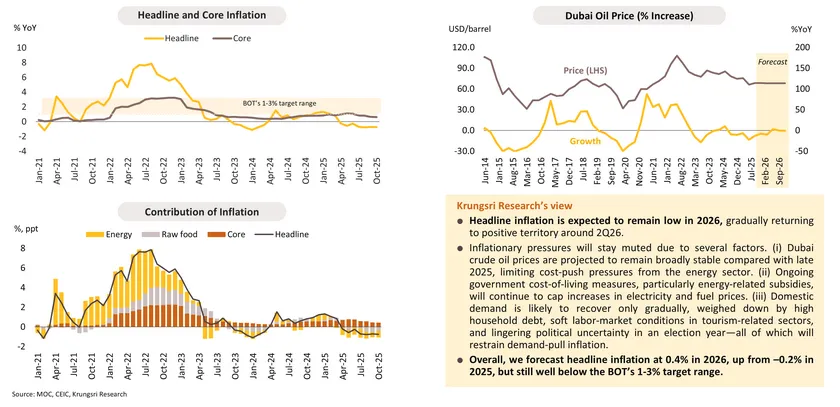

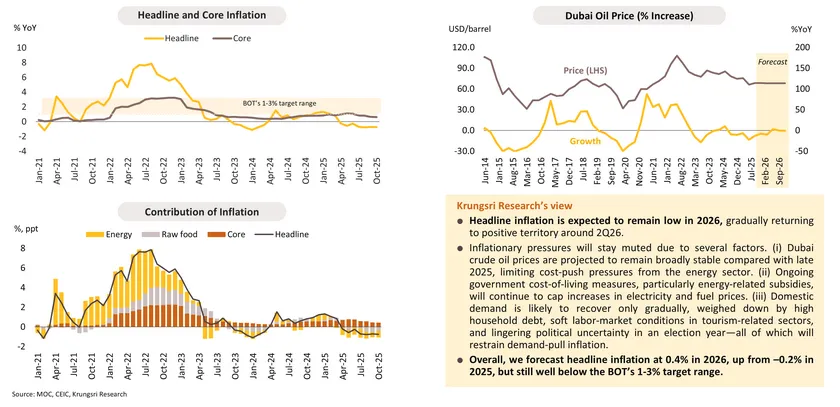

Headline inflation may turn positive in 2Q26, but 2026 annual average will stay below the official target range.

MPC expected to cut rate to 1.00% by 1H26 amid subdued growth and tight credit conditions.

We expect the MPC to cut the policy rate to 1.00% by the first half of 2026, as below-potential economic growth and rising downside risks create both the room and the need for further monetary easing. The case for additional rate cuts would become even stronger if signs of a political vacuum in 2026 emerge or if tariff-related pressures intensify, as both factors could erode confidence and weaken economic activity. Further easing would help support growth momentum, reinforce the MPC’s credibility in maintaining its inflation-targeting framework, and alleviate credit constraints that have tightened due to earlier deleveraging measures. Importantly, 1H26 appears to be the most strategic window for policy easing, before mounting downside risks begin to weigh more heavily on private investment, weaken domestic sentiment, and further restrict Thailand’s cyclical recovery.