Key environments influencing the outlook of Thailand’s industry

2024-2026 economic outlook: Cyclical recovery momentum would be impeded by external headwinds and structural problems.

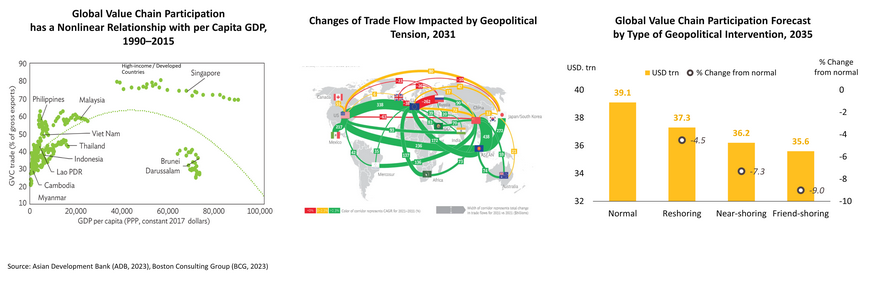

Decoupling between the major economies on the intensifying tech war will result in shortening global value chains.

-

The intense competition between the major economic powers, most obviously China and the US, for technological hegemony will continue to persist.

-

Governments in those major countries have reacted to intensifying pressures by attempting to build domestic capabilities while blocking competitors’ access to core technological inputs. As a result, global manufacturing supply chains are tending to shorten.

-

The shortening GVCs may happen in three ways:

-

Re-shoring, or moving production facilities back to the home country (i.e., made-at-home production);

-

Near-shoring, or building intra-regional supply chains; and

-

Friend-shoring or creating supply chains based on political or economic alliances

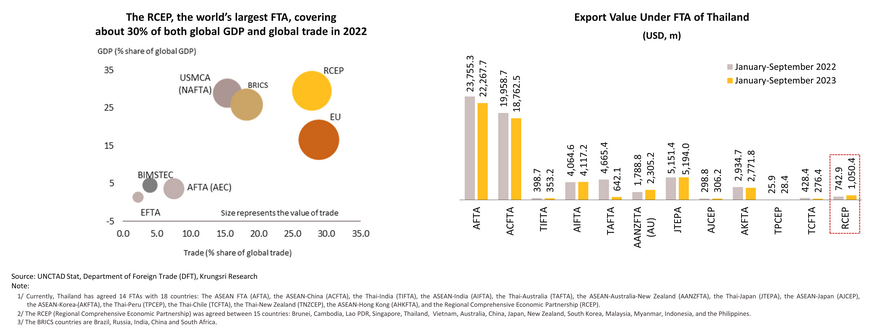

Joining trade blocs and signing bilateral and multilateral FTAs has helped to boost the competitiveness of Thai goods on world markets.

-

Thailand has agreed 14 FTAs with 18 countries1/, the most recent of which was the Regional Comprehensive Economic Partnership (RCEP)2/. In 2022, trade with these countries accounted for 60.9% of all Thailand’s exports.

-

At present, RECP import duties are still higher than under other FTAs, and so exporters tend to use the latter for selling into markets in RCEP member states, rather than the RCEP agreement itself. Nevertheless, duties covered by the RCEP agreement will steadily fall, and so in the coming period, use of these tax and import benefits will increase.

-

Thailand would also like to begin trade negotiations with several other partners, including the EU, Turkey, Pakistan, and the BRICS group3/, which combined account for 26% of world trade and more than 40% of the global population. Signing agreements with these would provide a significant boost to Thai international trade.

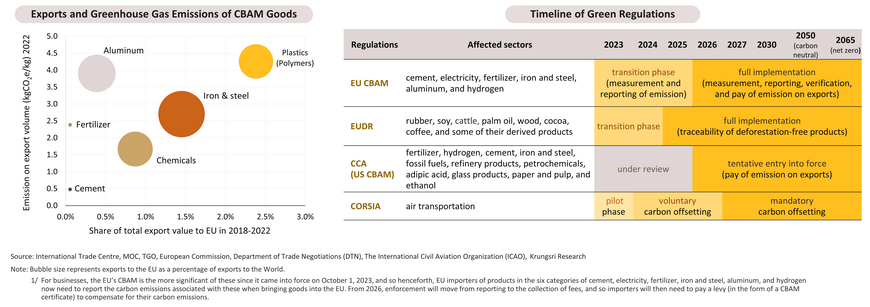

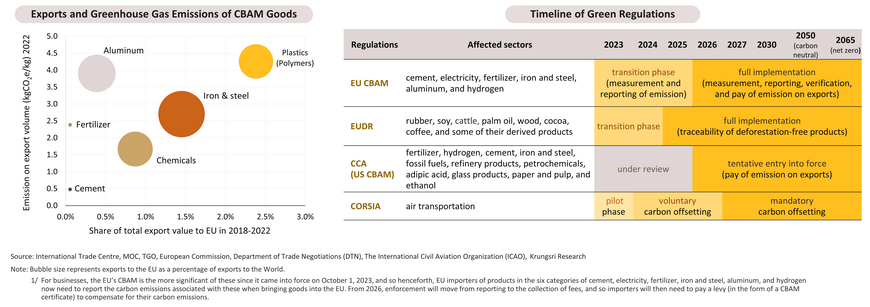

Driving ESG through international measures to combat environmental threats is becoming more stringent.

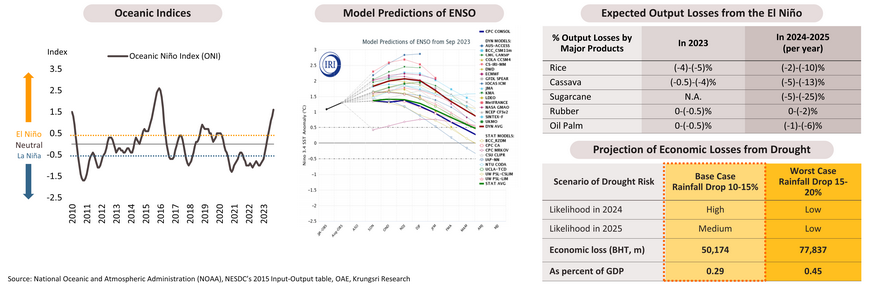

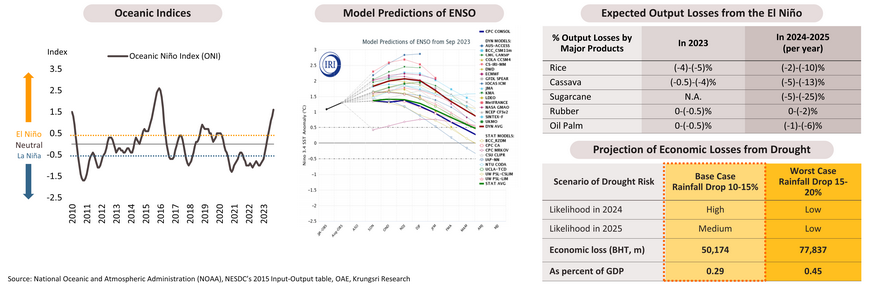

Drought will disrupt food supply chains, as El Niño conditions have officially been in effect since June 2023.

-

The Oceanic Niño Index (ONI) is determined by sea-surface temperatures in equatorial regions of the Pacific. A value greater than 0.5 indicates El Niño conditions and a value of less than -0.5 reflects the emergence of a La Niña. As of September 2023, the ONI stood at 1.6, which is classified as ‘strong El Niño’.

-

Krungsri Research sees this El Niño extending over the next 1-2 years, with impacts on the economy over 2023-2025;

-

Impacts on agricultural outputs and food security: Declining outputs will trigger supply shortages in downstream industries, which would then drive-up prices for agricultural products and other consumer goods.

-

Impacts on manufacturing supply chain: With agricultural output declining, supply chains will weaken, and players will need to respond to this either by lowering their capacity utilization or by sourcing alternative inputs, both of which will add to unit production costs.

- Expected impacts of the drought on Thai GDP: Krungsri Research estimates that rainfall will decline by between -10% and -15% over 2023 to 2025, and this will then cut GDP relative to the baseline case by -0.13% in 2023 and -0.3% in each of 2024 and 2025.

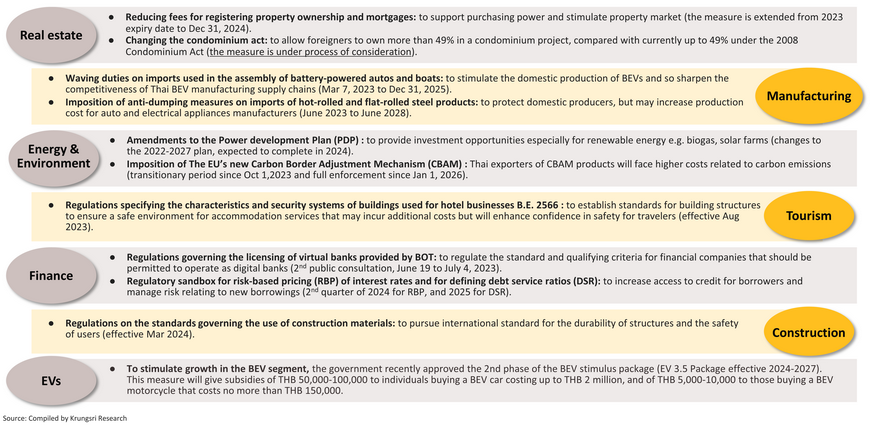

Changes in regulatory environment have impacts on Thai industry

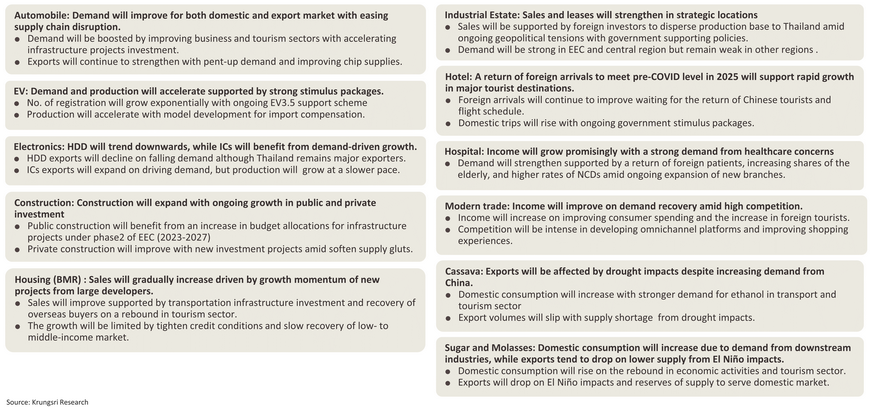

The outlook of major sectors represents growth momentum in step with normalizing economic activities.

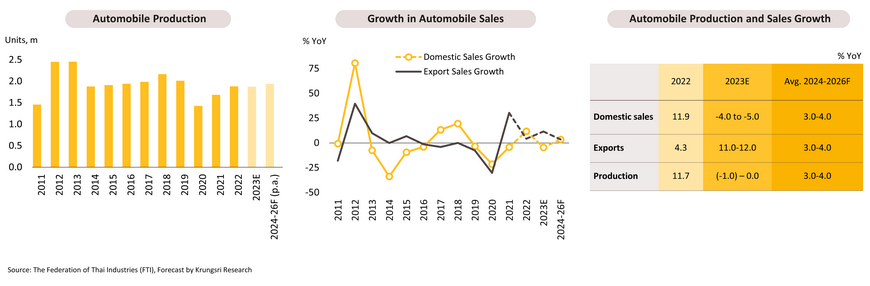

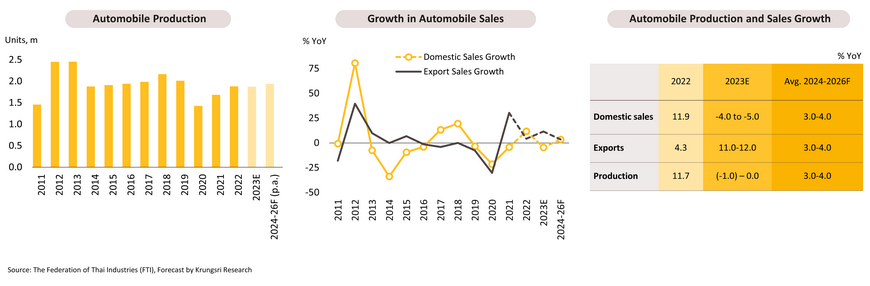

Automobile: Demand will improve for both domestic and export market, with easing supply chain disruption.

-

Auto output will increase as investments by major manufacturers in new chip fabs pay off and supply to world markets improves. The implementation of government measures to support EV production over 2024 and 2025 together with the requirement to increase domestic production of EVs to compensate for earlier imports will mean that the share of these in total industry output will rise rapidly.

-

Domestic orders will tend to increase on an uptick in economic activity and the continuing rebound in the tourism sector, which will add to demand for passenger vehicles. Accelerating government spending on infrastructure will also drive additional demand for delivery trucks, though the El Niño will likely cut crop output, and this will eat into sales of commercial vehicles in the provinces.

- Exports will continue to strengthen, helped by a combination of economic growth in overseas markets and the release of pent-up demand now that chip supplies have improved, and manufacturers are able to tackle the backlog of orders.

- Given the impact of these factors, output and domestic and international sales should all strengthen by 3.0-4.0% annually.

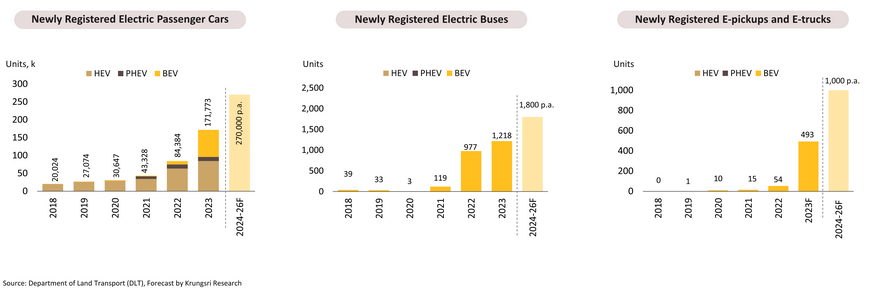

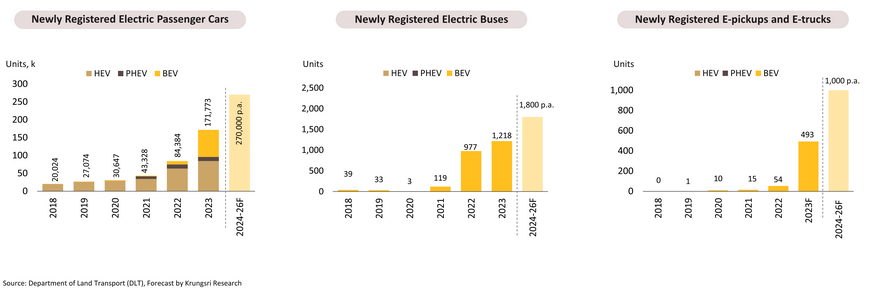

Electric vehicles: Demand and production will accelerate, supported by strong stimulus packages.

-

Registrations of new EV cars, buses and commercial vehicles are expected to increase by an annual average of 270,000, 1,800 and 1,000 vehicles each over the next 3 years, benefit from: (i) the government’s EV3.5 support scheme (2024-2027), which will subsidize purchases of EVs by THB 50,000-100,000 per vehicle over 2024-2027; (ii) falling prices as more models become available and more manufacturers begin EV production; (iii) expanding domestic BEV car production over the next 4 years aligned with BOI’s incentive packages to produce for import compensation; (iv) a hike in excise rates in 2026 that will pull demand forward; and (v) increasing usage of public and private EV buses (e.g., plans for the EEC see the number of EV buses on the road there increasing to 6,000 by 2028).

-

However, the market will have to contend with several headwinds, including: (i) the likely insufficient increase in the number of charging stations; (ii) restrictions on approvals for EV car loans; (iii) all EV buses domestically produced are air-conditioned, while the Department of Land Transport still restricts the proportion of air-conditioned buses to control transportation costs for the lower- to mid-income consumers; and (iv) the continuing limited range of EVs, which restricts their use in inter-province transportation.

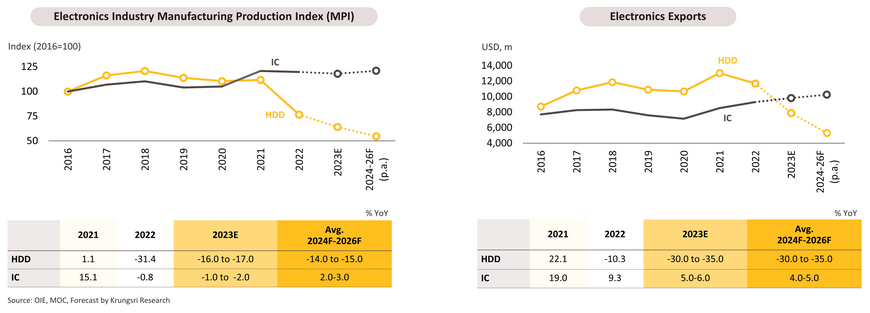

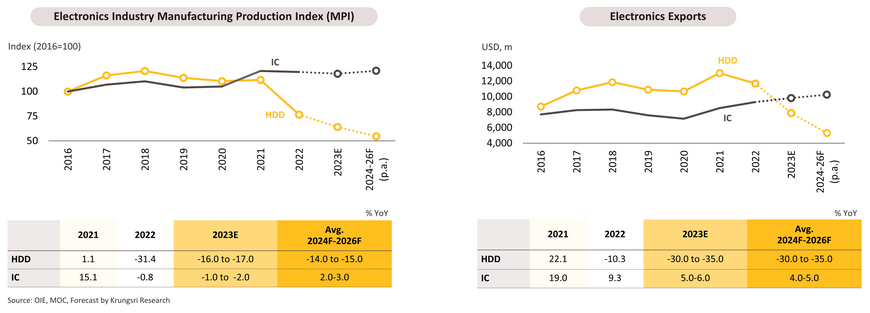

HDD and IC: HDD will tend downwards, while ICs will benefit from demand-driven growth.

-

Sales of HDDs will continue to soften on falling global demand for IT equipment, although Thailand will retain its position as one of the world’s major producers and exporters of HDDs. Over the short term, demand will be lifted by upgrades to Windows 11 and the post-Covid surge in purchases of new PCs, which will rise by 4.9% globally in 2024 (source: Gartner), but through 2024-2026, output and exports of HDDs will contract by respectively -14.0% to -15.0% and -30.0% to -35.0% annually.

-

Global semiconductor sales will strengthen on several positive trends. (i) Demand for AI chips for use in AI-based applications will increase (e.g., in data centers, edge infrastructure, and endpoint devices). Gartner thus estimates that sales of AI chips will jump 25.6% in 2024. (ii) Demand for use in EVs will continue to rise especially with increasing progress on EV full driving automation (the IEA sees global EV sales surging by 18.9% annually over 2023-2030). (iii) A round of PC upgrades is expected in 2024. Stronger global sales and increased investment by overseas players in Thailand-based electronics manufacturing will further support expansion in both domestic production and exports. Over 2024-2026, the production and export are therefore expected to expand by respectively 2.0-3.0% and 4.0-5.0% per year.

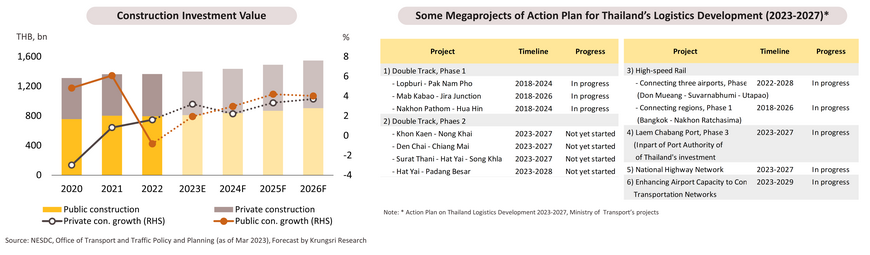

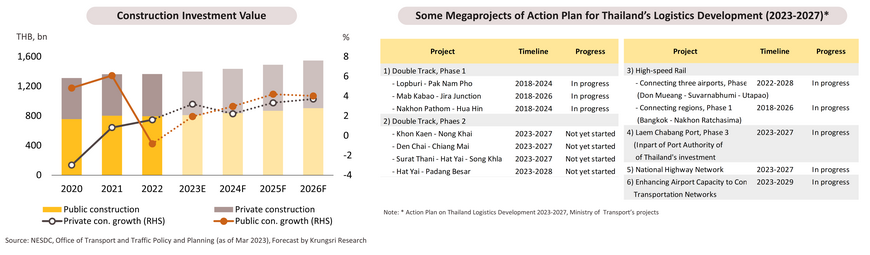

Construction: Construction spending will expand with ongoing growth in public and private investment, driven by government megaprojects development.

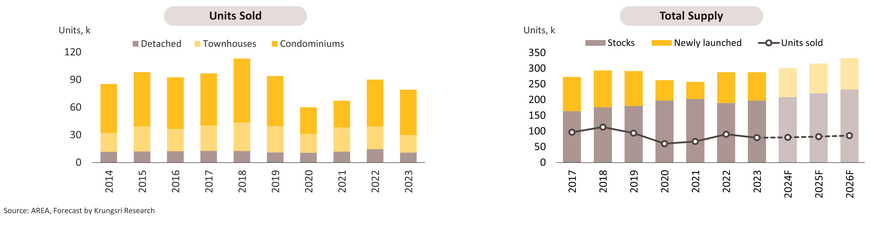

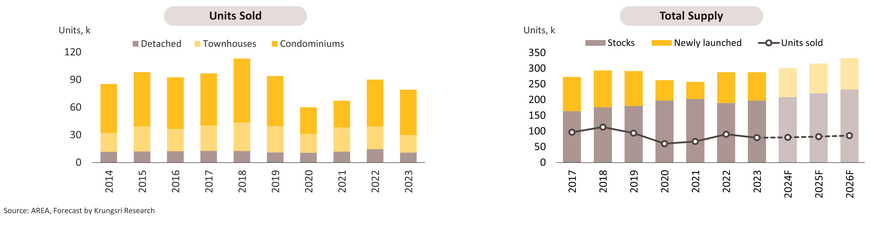

Housing (BMR): Sales will gradually increase, driven by growth momentum of new projects from large developers.

-

Sales will gradually pick up by 2.0-3.0% per year on: (i) ongoing government spending on infrastructure, especially in transportation infrastructure, will increase the demand for housing along metro lines and in areas accessible by metro lines; and (ii) recovery in the tourism industry (arrivals are forecast to return to their pre-Covid level by 2025), which will boost demand from overseas buyers. On the supply side, the number of new units will grow by 3.0-4.0% per year, most of this will come from major developers that are on a strong financial footing and will be in projects with a limited number of units. The outlook for the main market segments is given below.

-

Low-rise housing (detached housing and townhouses): The sales of detached houses continue to strengthen, especially at the upper end of the market for properties in areas close to international schools or that are in the north and east of Bangkok (near New Krungthep-Kreetha Road). For townhouse, sales are showing a stable trend due to a relatively high remaining supply, while buyers are typically mid- to lower-income earners, and these have been more seriously affected by rising interest rates and the high debt burden. These thus have lower purchasing power, and although large developers will be able to maintain growth momentum, SME developers will have to contend with intense competition on the costs of both construction and financing.

-

Condominiums: Supply will respond to stronger demand from long-term investors since, as a result of rising oil prices and the overall increase in the cost of living, renters are increasingly favoring condominiums. Demand from non-Thai buyers looking to acquire a second home as a personal hedge against rising geopolitical tensions will also add to demand for units in downtown locations. However, the demand for condominiums in suburban areas continues to lag behind low-rise developments, while in some locations (e.g., Phet Kasem, Chaeng Watthana, Nonthaburi, and Bang Na), the market is still struggling under a supply glut.

-

Challenges to the market that will need to be tracked closely will include: (i) the high level of household debt, which will likely remain elevated, encouraging lenders to tighten credit conditions; and (ii) the only slow recovery in purchasing power for low- to middle-income buyers, which has resulted in a significant oversupply of properties in some areas. In addition, as Thailand transitions to an aged society, demand will likely weaken further, while younger buyers (especially gen Z) tend to prefer renting to buying.

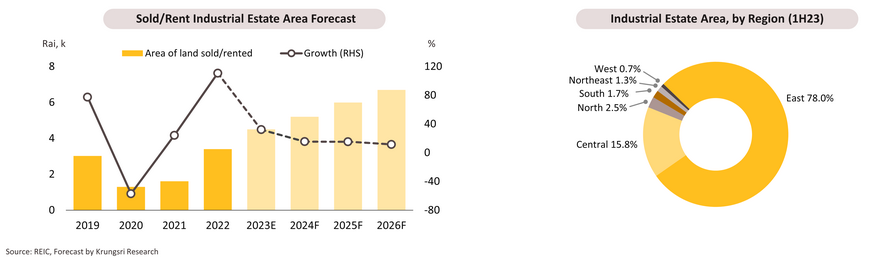

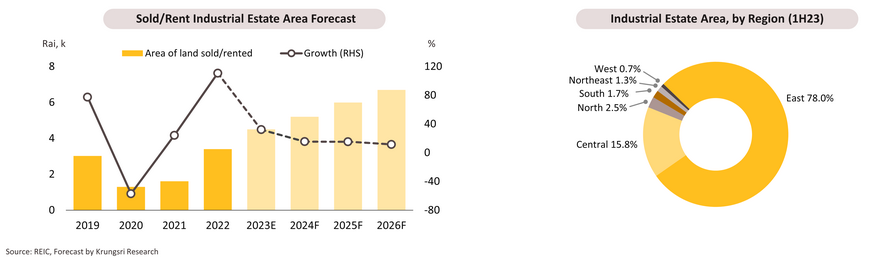

Industrial Estate: Sales and leases will strengthen, especially in strategic locations including EEC and central region.

Over the next three years, annual sales and leases are predicted to expand by 10.0-15.0% per year to 5,000-7,000 rai. The market will be boosted by: (i) a stronger global economy and improving sentiment among foreign investors, which will help to lift Thai exports even as these come under pressure from potentially worsening geopolitical tensions; (ii) the tendency among leading global manufacturers to reduce risk by dispersing their production bases, and because Thailand is one of the ASEAN zone’s leading targets for this, the country will likely benefit from additional FDI; and (iii) government spending on new infrastructure, especially in the EEC, where progress will accelerate. Operators of industrial estates will tend to develop ‘smart parks’ that are equipped with new manufacturing technologies and modern transport, communications and energy systems. In addition, players will respond to government efforts to shift to the bio-circular-green (BCG) economy and to meet rising demand from new target industries by developing environmentally friendly industrial estates.

-

Eastern region: Demand for space on these will expand rapidly thanks to government spending on new infrastructure in the EEC, and so income will increase more rapidly than in other parts of the country. However, rising land prices and limited access to suitable plots will mean that growth in supply (in both new and existing sites) will be only limited.

-

Central region: Industrial estates in the central region will continue to benefit from their access to communication networks, and so demand will strengthen further. Income will thus rise, especially from leases and the provision of utilities.

-

Other regions: Demand for space to buy or lease will remain weak since industrial estates outside the eastern and central regions are still waiting for the government to take action to stimulate investment by the private sector. This applies in particular to investment in the special economic zones in the North, Northeast, Centre/West, and South (these cover 16 provinces) and in large-scale projects to connect communication networks to the major economic areas. Given this, income for operators in these areas will only grow slowly.

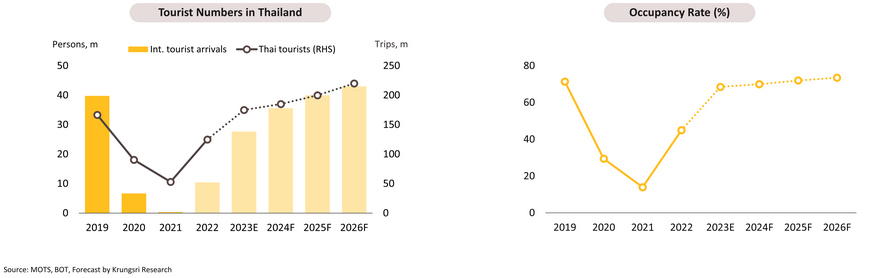

Hotel: A return of foreign arrivals to meet pre-COVID level in 2025 will support rapid growth in major tourist destinations.

Conditions will continue to improve thanks to growth in foreign arrivals that is expected to hit 35.6m, 40m, and 43m over each of the next three years. While geopolitical tensions will weigh on the market (most recently with fighting in the Gaza Strip), growth will be supported by: (i) gradual strengthening in the main markets, although in the case of China, unfavorable economic conditions will convince many potential tourists to travel domestically; (ii) the return of flight schedules to normal; and (iii) ongoing efforts by the government to promote tourism, for example by extending visa-free travel for Russian arrivals from 30 to 90 days (from 1 Nov.2023, to 30 April 2024). Likewise, the number of domestic trips should rise to 185m in 2024, 200m in 2025, and 220m in 2026, partly due to ongoing government measures to stimulate the market. Given this, the hotel occupancy rate is expected to rise to 70% in 2024, 72.0% in 2025, and 73.5% in 2026.

- Hotels in major tourist destinations (Bangkok, Pattaya, and Phuket): Income will rise rapidly with the overall growth in the market, and given increasing arrivals, average occupancy rates may reach 80%.

- Hotels in tourist destinations and regional centers: Income will steadily strengthen as the market expands and the government rolls out stimulus packages targeting the tourism industry.

- Hotels in other provinces: Income will likely remain flat and occupancy rates will stay relatively low since these hotels generally serve as stop-offs for visitors en route to tourist areas or regional centers.

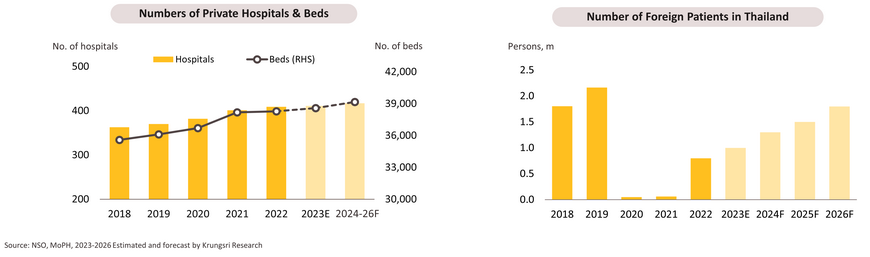

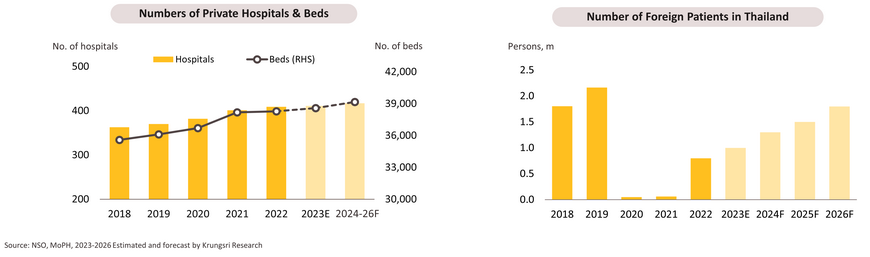

Private Hospital: Income will grow promisingly with a strong demand from healthcare concerns.

The income of private hospital businesses will continue to trend upwards by 9.0-10.0% annually over the next three years.

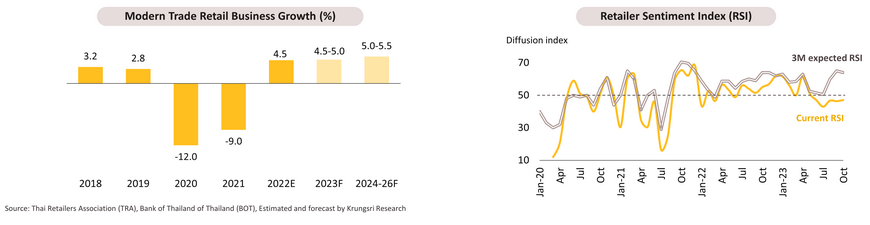

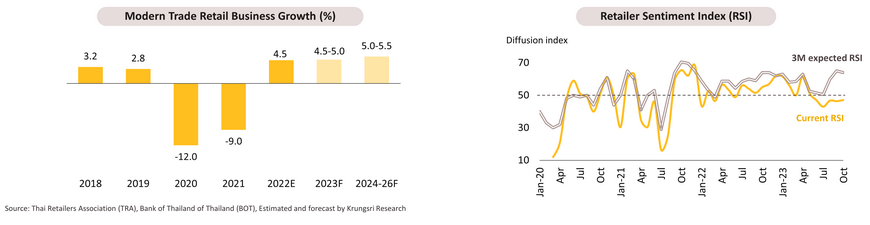

Modern trade: Income will improve on demand recovery amid intense competition to develop omnichannel platforms.

-

Income is forecast to rise at an average annual rate of 5.0-5.5% on: (i) domestic economic growth of 3.0-4.0% per year and the effects of this on consumer spending power; (ii) the increase in foreign tourist arrivals to 43m by 2026, adding further to purchasing power, especially in the major tourist areas; (iii) ongoing growth in e-commerce (Euromonitor sees Thai retail e-commerce expanding by 15.4% CAGR over 2024-2027); (iv) progress on the buildout of government infrastructure megaprojects, thus boosting employment and incomes and encouraging investment in new modern trade branches in areas where residential communities are expanding; and (v) growth in neighboring countries (the IMF sees the CLMV countries enjoying annual growth of 2.6-6.8%) that will lift retail sales in border regions. Players will also continue to expand their branch networks, develop their online presence, and diversify their business models as they build new income streams and target diverse consumer groups more precisely.

-

The outlook for individual segments is as follows.

-

Department stores: Income will rise by 4.0-5.0% per year (+3.6% in 2023), as department store customers are mid to upper-income earners with stable spending power. Players will develop omnichannel platforms, improve the shopping experience by exploiting new digital technologies (e.g., AR), and open new outlets in high-potential areas (including in neighboring countries).

-

Discount stores: Income will rise by 3.0-4.0% per year (+2.0% in 2023) on mid- to lower-income consumers’ gradually strengthening purchasing power. Players will also develop premium branches to attract wealthier customers.

-

Supermarkets: Income is up 6.0% in 2023, and because they appeal to consumers with strong purchasing power, supermarket income will rise by another 6.5-7.0% pa over 2024-2026. Operators will try to expand their market share by modernizing their branches and focusing more on high-end products (e.g., premium, health, and organic produce).

-

Convenience stores: Income growth will continue from 2023’s 5.0% at a rate of 4.5-5.5% annually over 2024-2026. Players will benefit from their branch networks’ almost complete national coverage and their move to develop online and delivery services, as well as the shift to selling a broader range of beverages and fresh food.

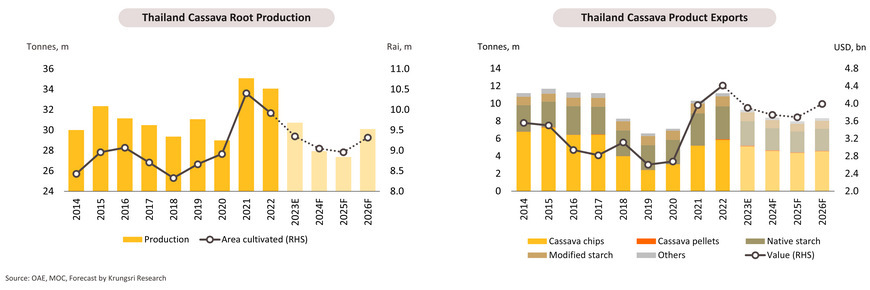

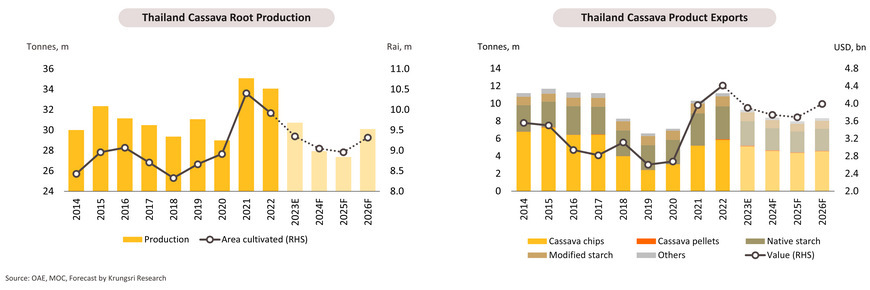

Cassava: Exports will be affected by drought impacts despite increasing demand from China.

-

Outputs of fresh cassava are expected to contract by between -1.0 and -2.0% annually as the effects of the El Niño on access to water worsen over 2024 and 2025 and outbreaks of cassava mosaic disease continue to occur.

-

However, volumes of domestic consumption of cassava product should increase by 3.0-5.0% per year on: (i) the boost given to food processors by general economic growth; and (ii) stronger demand for ethanol as the domestic transport and tourism sectors strengthen and spending on infrastructure increases.

-

On the other hand, although demand from Chinese manufacturers of pharmaceuticals, cosmetics, food, paper, sweeteners, and textiles will increase, annual export volumes will slip by an average of -3.0% to -4.0% because the impacts of drought, disease, and the switch by farmers to growing other crops will extend supply shortage problem. This will cause business to face difficulties due to a shortage of raw materials for production to deliver to trading partners. In addition, prices for cassava products will track the higher price of inputs, and so buyers in export markets will tend to switch to alternative products. Given this, annual export volumes are expected to fall by -3.0% to -4.0% for cassava chip (to 4.3-4.5m tonnes), by -10.0% to -11.0% for cassava pellets (to 0.07-0.08m tonnes), by -3.0% to -4.0% for native starch (to 2.4-2.5m tonnes), and by -2.5% to -3.5% for modified starch (to 0.8-0.9m tonnes).

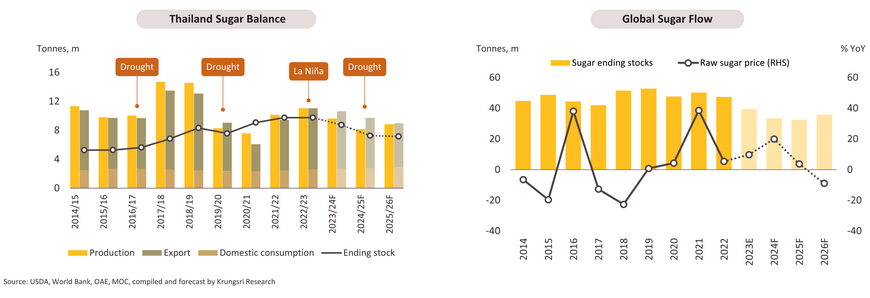

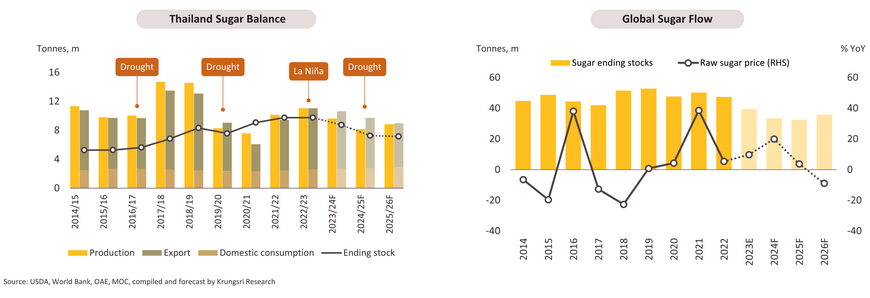

Sugar and molasses: Domestic consumption will increase due to demand from downstream industries, while exports tend to drop on lower supply.

-

Outputs will tend to decline as a result of: (i) the intensification of the El Niño, which will lead to drier weather and reduced access to irrigation water; and (ii) continuing high production costs. As a result, some farmers will switch to growing alternative crops (e.g., cassava and corn), though ongoing supply shortages will lift global prices for sugar and so some farmers will in fact expand the area under cultivation as they look to meet demand from sugar mills. Average outputs should thus fall to 75-85m tonnes of sugarcane, which will then produce 8.2-9.6m tonnes of sugar annually (a fall of -6.5% to -7.5%).

-

Exports of sugar and molasses will drop by between -10.0% and -11.0% to 6.0-8.0m tonnes annually. Overseas sales will slow under the impact of: (i) restricted access to sugarcane for pressing; and (ii) reserves of supply to serve rising domestic consumption following domestic economic recovery. However, Thai players will benefit from the decision by the Brazilian and Indian governments to promote the domestic consumption of ethanol, thus reducing sugar exports to world markets coming from these major producers. Domestic consumption is forecast to rise by 3.5-4.5% per year to 2.7-2.9m tonnes thanks to an uptick in economic activity and the rebound in the tourism sector, which will then spur additional demand from downstream industrial consumers. Nevertheless, the increase in the sugar tax on beverages will restrict growth in domestic demand.

Thailand Industry Outlook 2024-2026

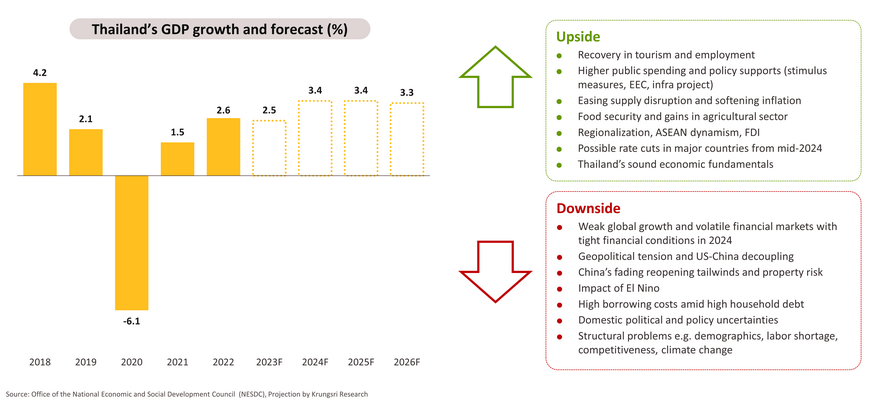

Macroeconomic environment: Slow global growth in 2024 before normalizing in 2025-2026, while the domestic economy will be boosted by tourism and policy support in the short term.

-

Global economy (2024-2026): Slow recovery in 2024 with greater regional divergence, challenging to return to pre-covid output trends; policy tightening will ease inflation but bite growth. Growth will normalize in 2025-2026.

-

The Thai economy( 2024-2026): Economic expansion is on the horizon, propelled by recovering public expenditure, policy support, improving tourism activity, and rising employment, but structural problems will limit medium-to-long-term growth.

Structural changes: Shortening global value chains, trade blocs and multilateral FTAs, stringent ESG measures, El Niño effects, modern technology and regulatory changes are the key issues to drive the transformation of Thailand’s industry.

-

Thai industry is poised to be impacted by challenging global megatrends, which will likely limit growth opportunities of Thai products in the global market. These trends include the shortening of global value chains, the formation of trade blocs, and the increasing stringency of ESG measures. Additionally, uncertain factors arising from the intensifying El Niño, will have impacts on Thailand food supply chain. To enhance overall competitiveness, Thai industry need to expedite transformation, particularly through the adoption of modern technology and joining multilateral Free Trade Agreements (FTAs).

2024-26 Thai industry outlook: The growth of industries will continue to recover in step with a rebound in economic activities.

-

During the recovery period, Thailand’s industries have the potential to grow, but in a different pace. Of the 105 industries covered in this report, 1 is given a “positive” outlook. 27 are “rather positive”. Meanwhile, industries tagged “rather negative” and “negative” outlook numbered at 19 and 1, respectively.

Hits and Misses

-

With a path of recovery, some industries will have a growth potential, driven by some tailwinds including improving economic activities, the return of international tourists, accelerated investment in infrastructure, government stimulus policies, and pent-up demand in export markets. Those include EV, Automobile, Private Hospitals, Industrial Estates, Hotels, Modern Trade, Construction, and Cassava.

-

However, some businesses still face some challenges from a slow recovery of purchasing power, excess capacity, and other uncertainties.

.webp.aspx)