Key environments influencing the outlook of Thailand’s industry

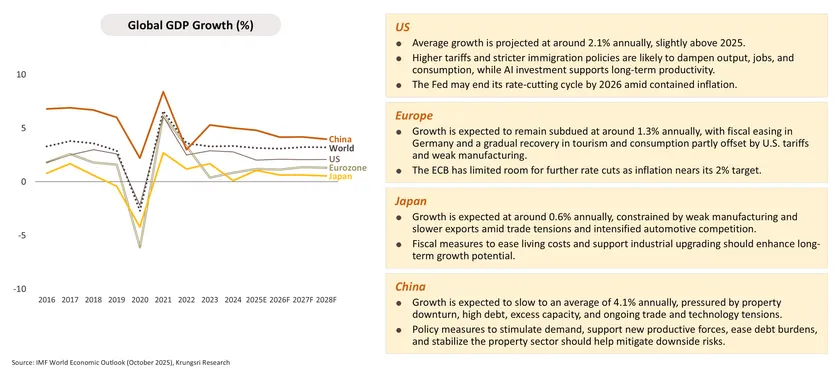

The global economy in 2026-2028 is expected to grow by 3.2%, below the pre-COVID average, constrained by trade protectionism, geopolitical risks, and structural headwinds, despite fiscal stimulus and investment in digitalization.

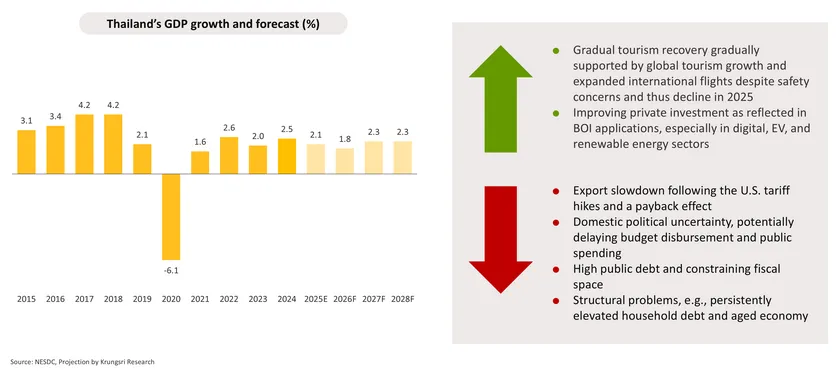

2026-2028 Thai economic outlook: Growth is expected at a modest pace, averaging 2.1% p.a., constrained by domestic and external headwinds, broadly in line with 2025 but well below the pre-COVID 10-year average of 3.6%.

Upstream resilience: Strengthening supply chains through sustainable upstream industries will become more vital for developing Asian economies.

-

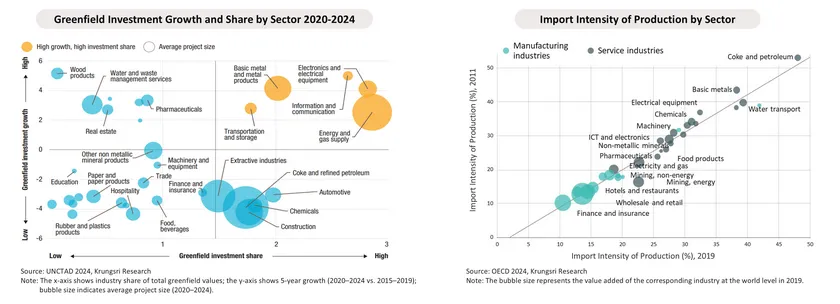

Shift toward sustainable and upstream-oriented production: Continued global economic uncertainty, rising trade barriers, especially U.S. tariffs, and recurring geopolitical tensions are heightening supply-chain risks and encouraging major economies to expand investment into developing Asia.

-

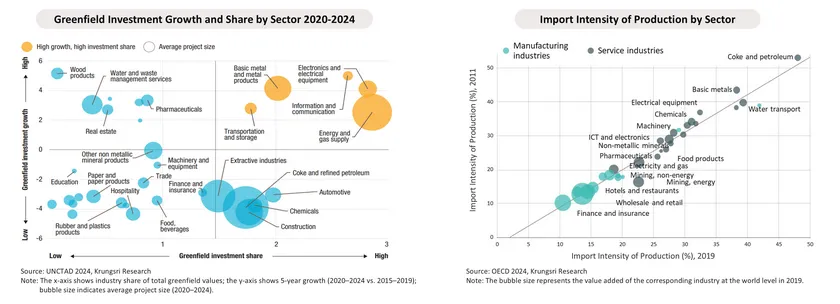

Growth driven by new greenfield investments in technology- and sustainability-focused sectors such as electronics, IT/digital products, clean energy, and advanced materials. These industries strengthen upstream production capacity and reduce reliance on imported inputs.

-

This aligns with pre-COVID global supply-side adjustments, reflected in declining import intensity for these products during 2011–2019. Since then, FDI into developing Asia, including Thailand, has increasingly targeted upstream rather than downstream industries, with China rapidly rising as a key investor alongside the U.S.

-

Upstream investment will become even more pivotal as Asian developing economies adapt to sustainability requirements and navigate heightened trade and technology tensions.

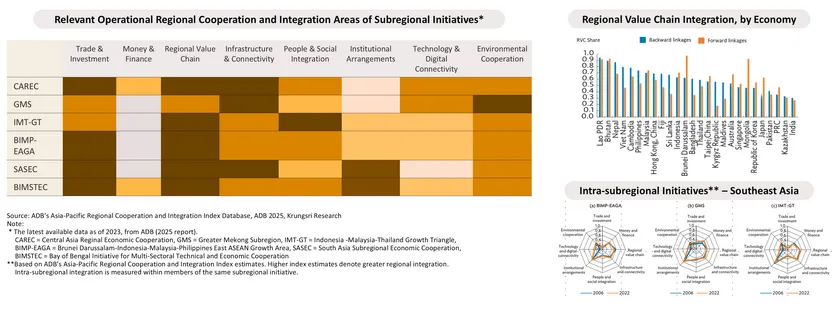

Regional Cooperation and Integration (RCI): Value chain development is increasingly shifting toward deeper, integrated collaboration within the region.

-

Regional alliances and integration will play a growing role in strengthening collective bargaining power and sustaining competitiveness amid rising inter-regional trade barriers, with an emphasis on reinforcing regional value chains.

-

Cooperation tends to extend beyond trade to include investment, infrastructure, logistics, and environmental initiatives. In Asia, partnerships increasingly focus on strategic sectors—semiconductors, IT and digital industries, clean-energy equipment, medical products, and key raw materials—aimed at bolstering upstream production.

-

Future regional cooperation will shift toward technology and digital connectivity. ASEAN has expanded collaboration in areas such as fiber-optic networks, cross-border data exchange, and other digital initiatives to support high-tech industry development, though many efforts are still in early stages.

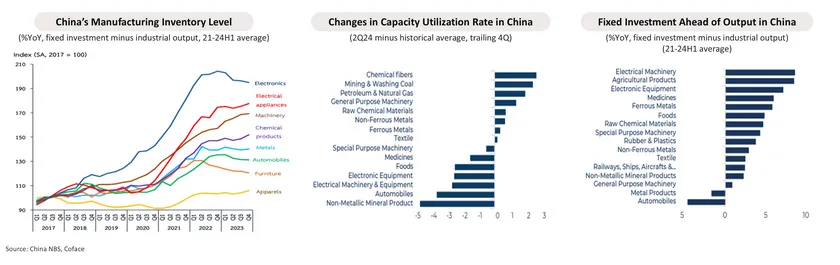

Influx from China overcapacity: China’s export surge to offload excess capacity continues to pressure local industries worldwide.

-

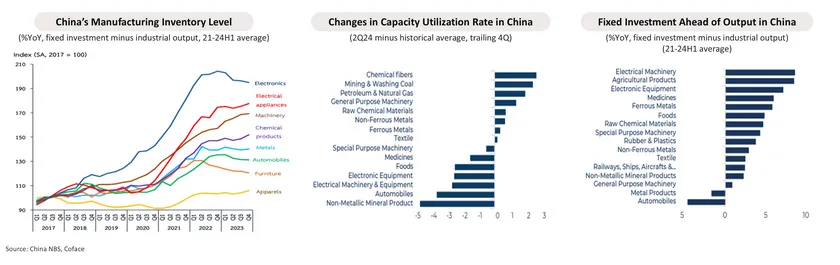

China’s efforts to offload excess industrial supply continue to pressure local producers worldwide. Rising inventories, declining capacity-utilization rates, and persistent overinvestment highlight China’s industrial overcapacity, especially in high-tech sectors such as electronics, EVs, and electrical machinery, as well as in food, pharmaceuticals, and certain chemicals. Coupled with cost advantages from economies of scale and escalating U.S.–China trade tensions, these factors are driving a stronger push for Chinese surplus goods into global markets.

-

Key challenges for Thai businesses include:

-

The continued influx of low-cost Chinese imports, which pressures local producers—especially SMEs with limited scale; Rising Transshipment risks, both from re-exporting Chinese goods through Thailand and from heavy dependence on Chinese inputs, also increase the likelihood of U.S. circumvention findings and potential trade penalties.

-

China’s relocation of excess production capacity to ASEAN, including Thailand; While this could strengthen certain supply chains, it also poses headwinds by (i) disadvantaging existing Thai firms that cannot compete on cost, and (ii) positioning Thailand primarily as an assembly base that relies almost entirely on imported Chinese parts and labor—resulting in only limited value added to the domestic production chain.

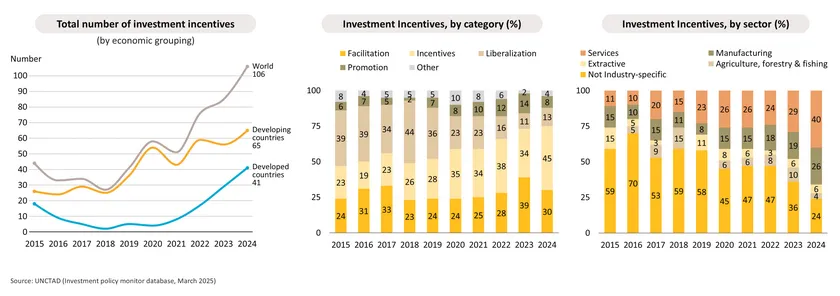

Investment-incentive war: The race to offer investment incentives has become a new form of competition among manufacturing-based economies, especially in Asia.

-

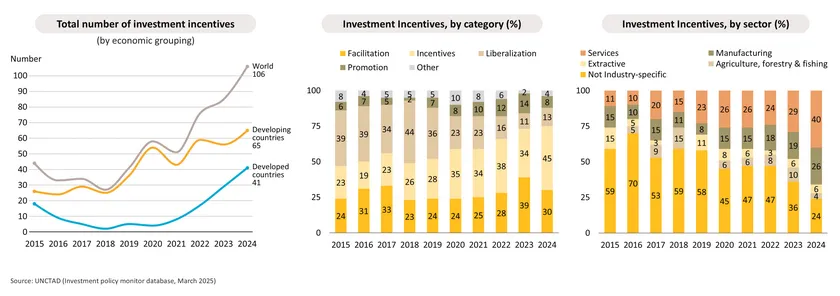

Competition through investment incentives has become a key strategy for manufacturing-based economies—particularly in Asia—amid rising global protectionism. This investment-incentive war is driving developing countries to expand incentive packages for manufacturing and services (see figure), including tax exemptions, reductions, and extended tax-holiday periods.

-

The escalating incentives race prompted the OECD to introduce the Global Minimum Tax (GMT), requiring countries to impose a minimum 15% tax on multinational firms with annual revenues above EUR 750 million. Implementation began in 2024–2025, depending on each country’s readiness, to promote fairer competition.

-

Despite GMT’s moderating effect, competition for foreign investment will persist in developing economies, including Thailand. Investment-promotion measures will therefore remain essential for sustaining global competitiveness.

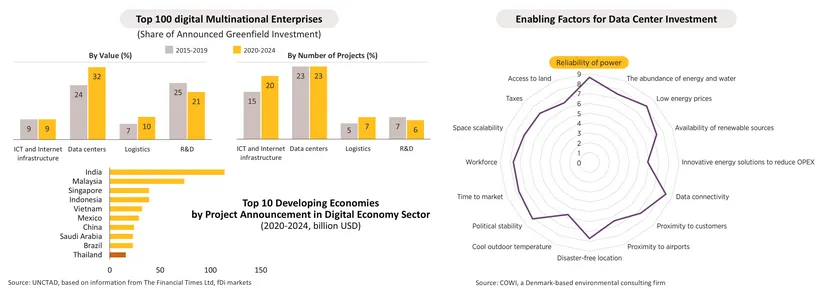

Digital solution: Digital technologies and data centers will serve as key drivers supporting modern industries in developing Asia.

-

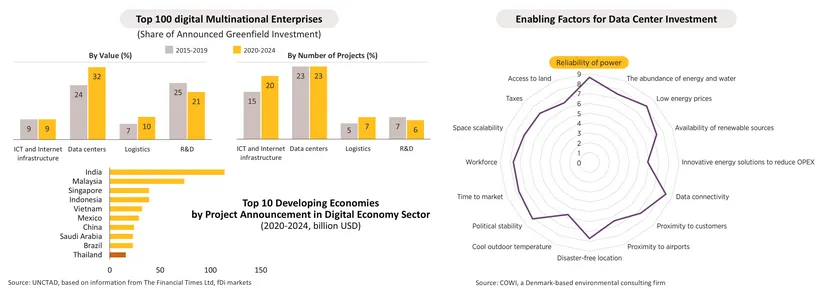

Digital investment continues to grow at 10–12% annually despite a broader slowdown in global FDI and GDP. Data centers represent the largest and fastest-growing share of greenfield projects by multinationals in developing economies during 2020–2024.

-

Thailand ranks among the top 10 destinations for data-center investment by multinational firms (Source: UNCTAD, 2025), supporting the adoption of AI, cloud computing, and big data, and strengthening upstream industries such as electronics, semiconductor components, digital infrastructure, and e-commerce—critical to reinforcing supply chains in targeted advanced-technology sectors.

-

Key challenges remain, particularly energy adequacy, which is vital for data-center operations. While clean energy is needed to meet long-term sustainability goals, Thailand’s renewable supply must expand significantly to lower costs. Progress is hindered by climate-related disruptions and delays in establishing clear regulations for Direct Power Purchase Agreements (Direct PPAs).

Silver economy and wellness: The transition into an aging society, along with rising health-conscious trends, supports the development of modern health-service value chains.

-

Global population aging presents both opportunities and challenges for businesses worldwide. The United Nations projects that the population aged 65 and over will rise to 1.7 billion by 2054, up from 830 million in 2024, with over 1 billion older adults in Asia.

-

Thailand is set to become a super-aged society by 2030, with over 25% of the population aged 60 and above, creating opportunities for the health sector. The health economy reached USD 40.5 billion in 2023, up 28.4% from 2022. Key growth areas include medical and wellness tourism, medical devices, high-value medical products (ATMPs), personal health and beauty, health-focused real estate, and preventive health foods. Government initiatives, including tax incentives, support Thailand’s goal to become a global medical and wellness hub.

-

However, a major challenge is the worsening shortage of working-age labor and rising personnel costs, especially for SMEs with limited capital to invest in technology to compensate for labor gaps. Meanwhile, efforts to position Thailand as a wellness and medical hub are constrained by a shortage of qualified professionals—such as physicians, nutritionists, and wellness experts—and intensified competition from regional economies pursuing the same goal.

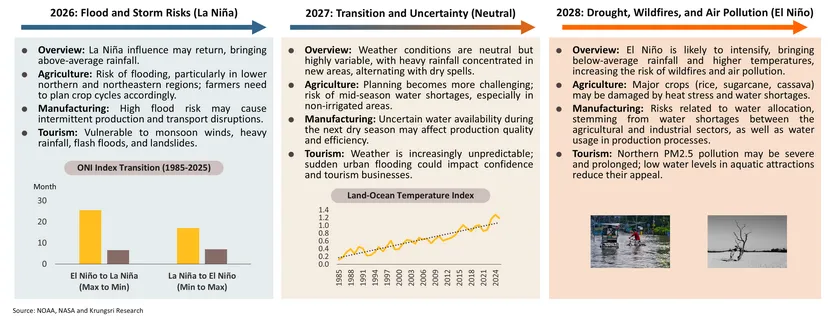

Global climate disruption: Shortened La Niña and El Niño cycles will disrupt the supply chains of agriculture and related industries.

-

Intensifying climate variability stemming from increasing greenhouse gas concentrations will raise global temperatures and disrupt the Earth’s water cycle. Greater atmospheric moisture causes heavier rainfall and floods, while faster evaporation worsens droughts. Over the past 40 years (1985–2025), intervals between El Niño and La Niña events have shortened to only 6–8 months (2002-2025) from the previous 24–26 months (1985-2001), signaling higher risks of rapid, extreme swings between floods and droughts.

-

During 2026–2028, Thailand is likely to face climate disruptions that could impact the economy. Krungsri Research has assessed the potential effects of these disruptions across various sectors, from agriculture to downstream industries, as follows:

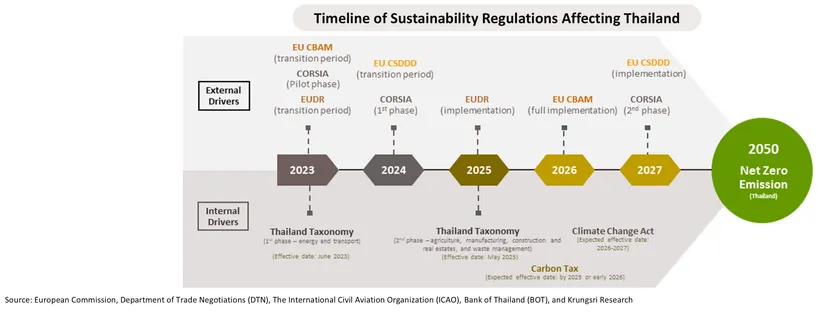

Sustainable drive: Achieving sustainability under the Mission for Global Sustainability presents both opportunities and challenges for the industrial sector.

-

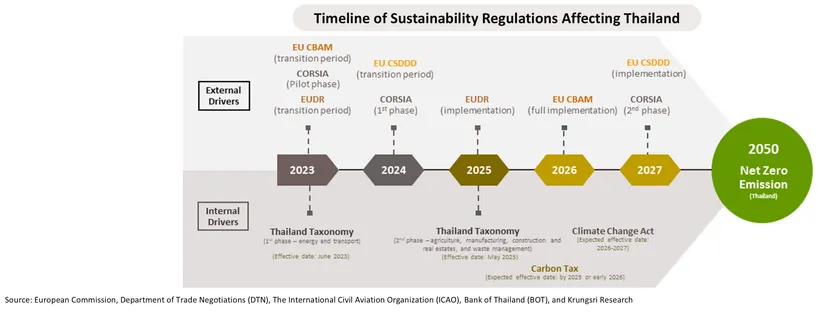

The transition toward a Net Zero economy is compelling businesses to adapt rapidly as compliance costs rise amid tighter environmental regulations and growing responsibility requirements across value chains. Thai businesses will face stricter domestic measures aligned with global trends and Thailand’s updated Net Zero target for 2050. Key developments include:

-

Mandatory measures: The draft Climate Change Act would require emission reporting and advance carbon pricing instruments—such as carbon taxes on petroleum products and an emissions trading system (ETS)—targeting high-emission sectors like cement, metals, and petrochemicals.

-

Voluntary measures: The Thailand Taxonomy, covering six sectors (energy, transport, agriculture, manufacturing, real estate, and waste), encourages firms to align with environmental standards to support competitiveness and access to sustainable finance.

-

Krungsri Research expects global and domestic sustainability measures to bring both challenges and opportunities for Thai businesses. The main challenges arise from higher costs associated with: (1) carbon measurement, reporting, and verification (MRV) or due diligence requirements; (2) carbon pricing; and (3) the transition to sustainable operations. Firms that adapt more quickly will gain advantages in trade, investment, and access to sustainable finance, while MRV providers, sustainability consultants, and climate-tech companies stand to benefit from the Net Zero shift.

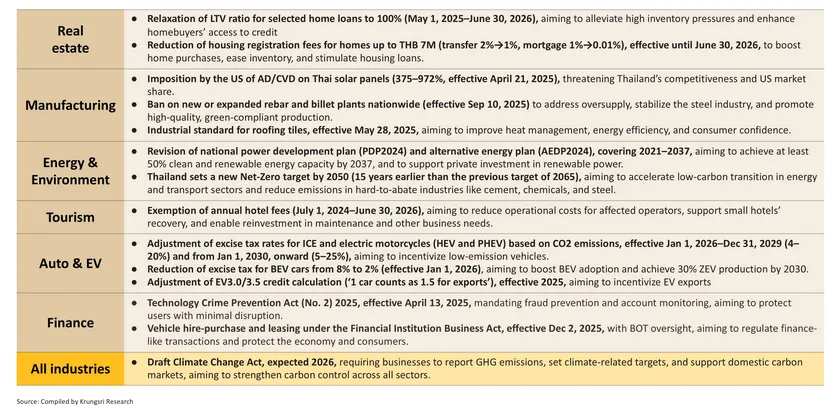

Changes in regulatory environment have impacts on Thai industry.

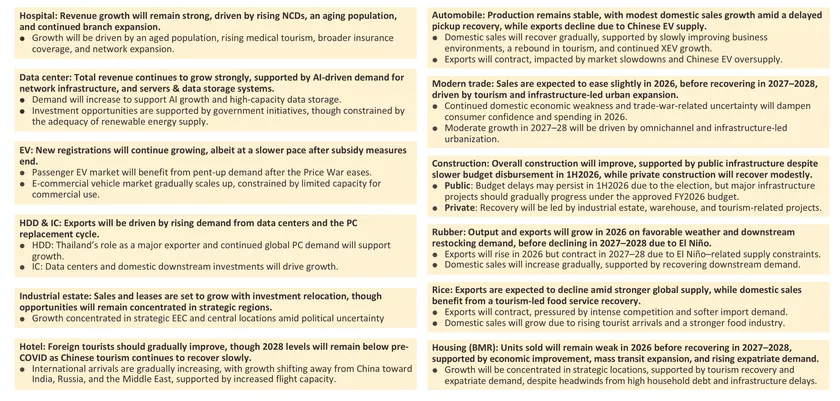

Major sectors will remain subdued in 2026, with gradual improvement in 2027–2028 due to recovering demand and investment amid political uncertainty and US tariffs.

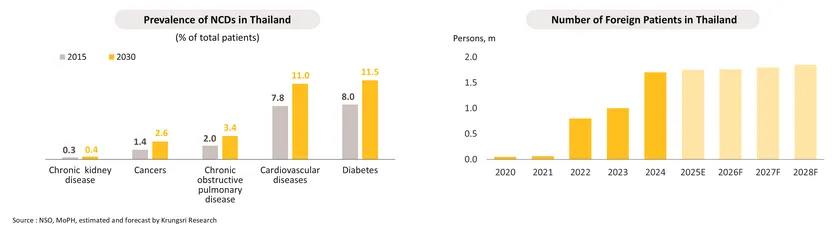

Private Hospital: Revenue growth will remain strong, driven by rising non-communicable diseases, an aged population, and continued branch expansion.

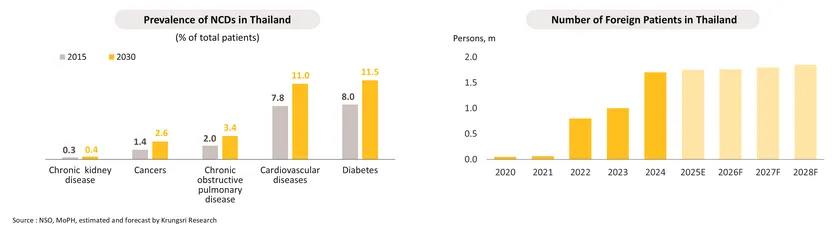

During 2026–2028, revenue is projected to grow by 5.0–7.0% annually, though this will be tempered by slower economic expansion and the impact of elevated household debt on overall consumption. Nevertheless, growth will be underpinned by the following factors:

-

The proportion of the elderly population (aged over 60) will increase from 22.4% in 2026 to 30% by 2040, driving higher spending on chronic and complex health conditions.

-

Cases of non-communicable and seasonal diseases are expected to rise, alongside growing numbers of foreign patients and medical travelers. The latter will be supported by continued tourism growth and the unfolding of global health-and-wellness megatrends.

-

Broader coverage for self-insured patients will enable private providers to increase their fees. For example, social security benefits for dentures and wisdom-tooth treatments have been expanded, and a new payment formula taking effect in 2026 will raise reimbursement levels.

-

Hospital operators are likely to expand their branches, service areas, and treatments for complex conditions to increase their capacity to accommodate patients.

-

Major providers: These will benefit from economies of scale, while they will also be able to grow their customer base by opening new branches and extending treatment to cover more complex conditions.

-

Small and mid-sized operations: Serving social security patients will help to reduce income volatility, but for hospitals that are not part of wider commercial groups, stiff competition will drag on growth opportunities.

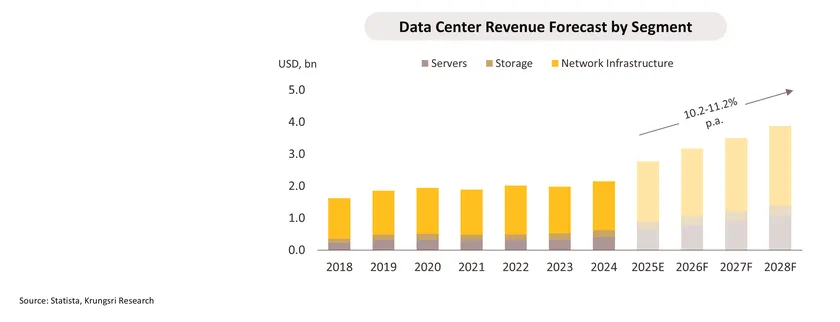

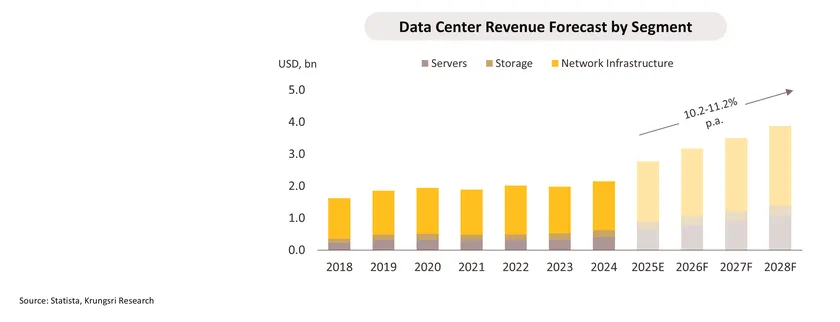

Data Center: Total revenue continues to grow strongly, supported by AI-driven demand for network infrastructure, and servers & data storage system.

The total revenue is expected to grow at an average of 10.2-11.2% per year during 2026-2028. Revenue classified by type is as follows:

-

Network Infrastructure: Revenue is expected to grow by 7.8-8.8% per year from increasing internet usage demand and the continuous development of 5G networks by internet service providers in Thailand, which will increase demand for data connection networks between data centers and users. This requires investment in network infrastructure that supports massive data transmission volumes, as well as the investment entry of foreign technology companies that will support investment in digital infrastructure development and be conducive to revenue growth.

-

Server Systems: Revenue is expected to grow by 16.1-17.1% per year from consumer and business demand for AI and cloud systems, resulting in related companies needing to invest in high-performance server systems to support usage, as well as the growth of Internet of Things (IoT), which is a technology that requires large volumes of data for efficient real-time processing, leading to increased server demand in both quantity and variety.

-

Data Storage Systems: Revenue is expected to grow by 10.4-11.4% per year from the increase in large-scale data resulting from AI usage, the expansion of E-commerce and E-payment, which require substantial data storage capacity. Operators will need to invest further to ensure security and speed. In addition, the increasing enforcement of personal data protection laws, particularly the Personal Data Protection Act (PDPA), is another key factor driving sustained growth in demand for data storage systems.

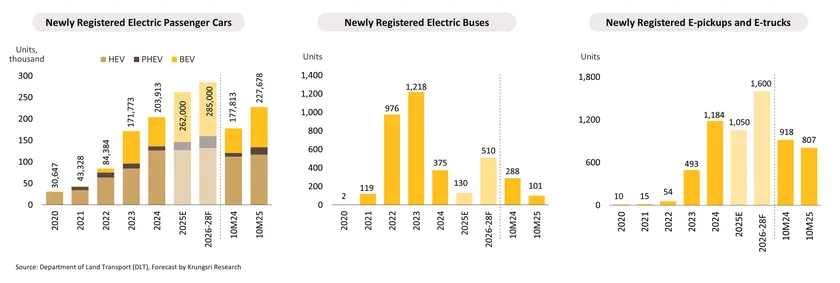

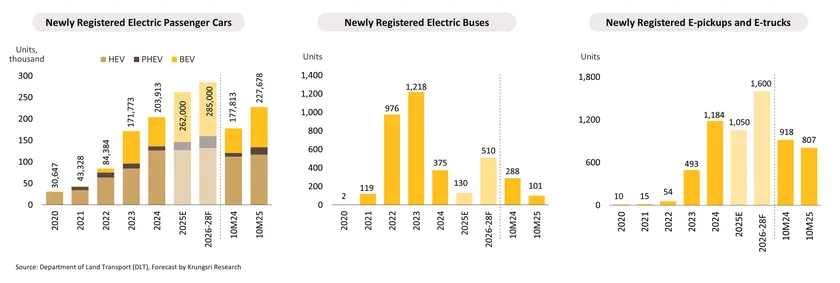

Electric vehicle: Passenger XEV registrations will continue to rise as an easing price war and longer driving ranges stimulate pent-up demand, while the e-commercial vehicle market gradually scales up.

-

Passenger XEV new registrations are expected to average 285,000 units, comprising 125,000 BEVs, 132,000 HEVs, and 28,000 PHEVs. Growth will be driven by: (i) new model launches with better technology and longer ranges, with global BEV/PHEV models projected by IEA (2025) to grow at a 13.0% CAGR to 1,130 models by 2030 while ICE models remain flat at around 1,378; (ii) full Euro 6 enforcement in 2026, which will raise ICE vehicle costs relative to EVs; and (iii) an easing of Thailand’s EV price war.

-

Registrations of electric buses and electric commercial vehicles are expected to average 510 and 1,600 units, respectively. Key drivers include: (i) renewed investment through a 1,520-unit procurement-for-lease program, with deliveries starting in late 2026; (ii) new model launches, particularly BEV pickups from major Japanese brands; and (iii) declining battery costs from economies of scale, with IEA (2025) expecting electric truck prices to fall 15–35% by 2030 and reach total cost-of-ownership parity with diesel trucks.

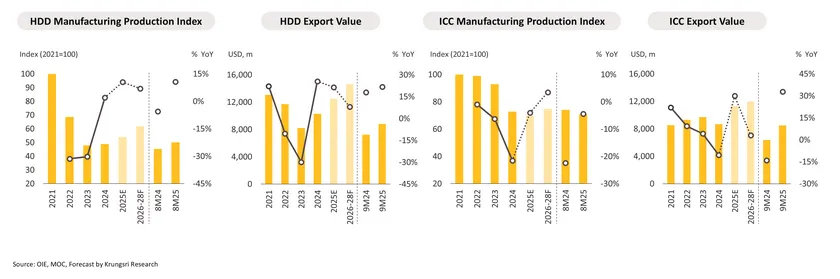

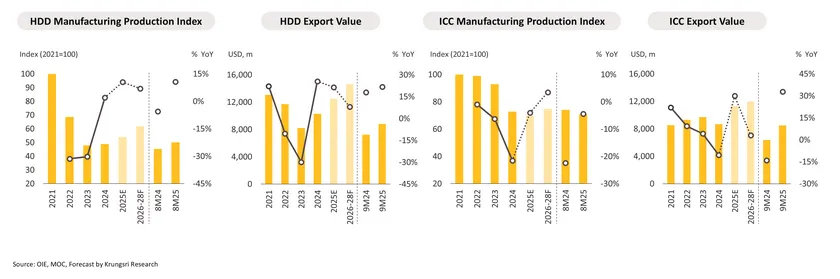

HDD and IC: Exports are expected to continue growing, driven by rising demand from AI, data centers, and the PC replacement cycle.

-

HDD: Production and exports are projected to keep growing, supported by (i) cloud and data center expansion, sustaining global storage demand; Statista (2024) projects the global storage device market to grow at 1.7% CAGR during 2024–2031; (ii) Thailand’s role as a major HDD base, with exports expected to account for 16.4% of global HDD exports, the second largest after China in 2024; and (iii) continued growth in global PC sales in 2026 as part of the post-COVID-19 replacement cycle. Given these trends, HDD production is expected to increase 6.5–7.5% per year, and export value is projected to rise 7.5–8.5% per year during 2026–2028.

-

IC: Thailand’s IC industry is expected to benefit from two key drivers: (i) the continued global expansion of AI and data center businesses, supporting demand for processing and memory chips; and (ii) domestic investments in midstream and downstream industries using ICs as inputs, such as electronics, appliances, and EVs. However, IC production may face risks from supply chain disruptions due to China’s critical mineral export controls. As a result, the IC production index and export value are projected to grow 3.0–4.0% and 2.5–3.5% per year, respectively.

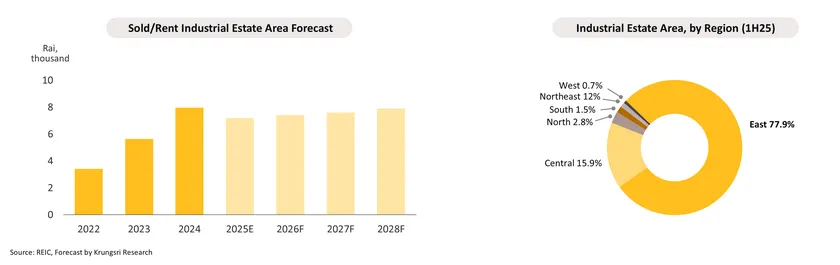

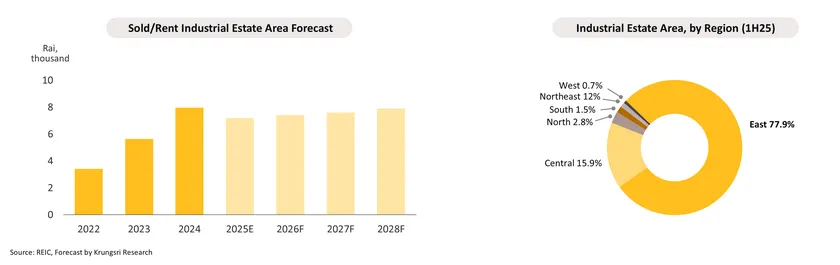

Industrial Estate: Sales and leases are set to grow with investment relocation, though opportunities will remain concentrated in strategic regions.

-

Industrial land sales and leases are expected to grow by 3.0–4.0% annually (7,500–7,600 rai). Growth will be supported by investment relocation driven by geopolitical tensions, ongoing infrastructure development that strengthens Thailand’s strategic position—particularly in the EEC—and the rollout of Smart Parks with integrated technology and environmental standards. Leading indicators are supportive, with BOI applications in the EEC up 67.5% YoY in number and 69.2% YoY in value in 1H25.

-

Key supply-side constraints include: (i) political and economic uncertainty that may disrupt project continuity; (ii) zoning restrictions that limit land availability for large-scale investment; (iii) rising land prices that elevate investment costs; and (iv) intensifying competition from Vietnam, Indonesia, and Malaysia, which are actively strengthening incentives to attract foreign investors.

-

Eastern region: Demand for industrial land and rental space is expected to grow steadily, supported by Thailand’s strategic location and EEC investment incentives. However, new industrial estate expansion will remain constrained by rising land prices and limited land supply.

-

Central region: Demand for land purchases and leases is expected to remain strong, supported by robust transport connectivity and resulting growth in utility and rental revenues.

-

Other regions: Demand for land purchases and leases remains low, as the area still depends on further development of transport links to major economic zones.

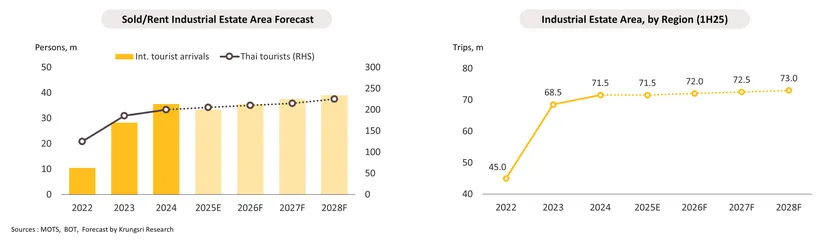

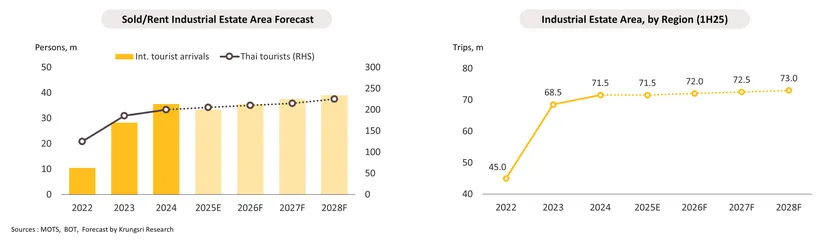

Hotel: International arrivals should gradually improve, though 2028 levels will remain below pre-COVID as Chinese tourism continues to recover slowly.

-

International arrivals are expected to recover gradually, driven mainly by travelers from India and Europe and supported by more direct flights, though overall growth will remain limited by (i) a global economic slowdown and the impact of U.S. tariff increases, which could weigh on travel spending—especially in 2026, (ii) domestic concerns over safety and political stability, (iii) a weakening value-for-money perception amid high living costs, and (iv) stronger competition from Asian destinations such as Vietnam.

-

Looking ahead, international arrivals are projected at 35.5 million in 2026, 37.5 million in 2027, and 39.0 million in 2028, while domestic trips are expected to average 215–220 million p.a., keeping nationwide occupancy at roughly 72–73%.

-

Hotels in major tourist destinations (Bangkok, Pattaya, and Phuket): Revenue is expected to grow strongly as average occupancy approaches 75% annually, supported by a steady increase in international arrivals.

-

Hotels in tourist destinations and regional centers: Revenue is expected to improve gradually in line with the recovery of the domestic tourism market, particularly the rebound in the meetings and events (MICE) segment.

-

Hotels in other provinces: Revenue is expected to remain stable, with occupancy rates inching up, following expected government measures that are set to continue promoting secondary-city tourism.

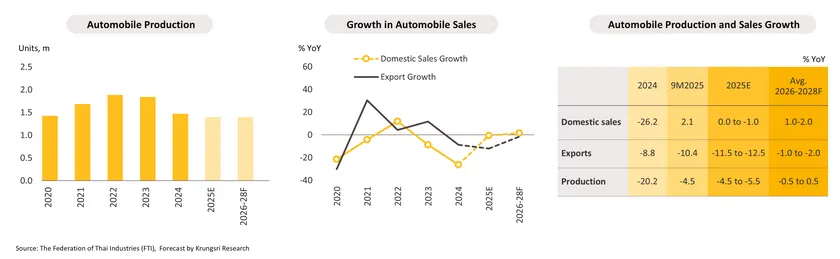

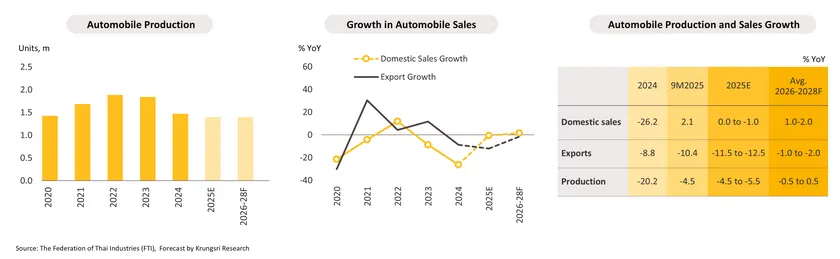

Automobile: Production remains stable with modest domestic sales growth, amid a delayed recovery in pickups; Exports decline due to Chinese EV supply.

-

Production volumes are expected to remain flat, as declining ICE vehicle output is offset by rising XEV production. Growth is supported by (i) BEV offset production under the EV 3.5 scheme—at 2–3x prior import sales—during 2026–27, and (ii) policy support for HEV and MHEV manufacturing through excise tax reductions over 2026–32.

-

Domestic sales are expected to edge up. In 2026, vehicle sales are likely to remain subdued, weighed down by weak pickup truck demand due to low agricultural purchasing power and U.S. tariff-related business headwinds. Domestic demand is expected to recover gradually in 2027–28, supported by an improving business environment, a rebound in tourism, and continued XEV growth.

-

Export volumes are expected to contract, weighed down by (i) a continued slowdown in key trading partners, particularly in 2026; (ii) accelerated clearing of excess supply from Chinese EV producers; and (iii) increasingly stringent environmental standards tied to CO₂ reduction targets in export markets, which constrain Thailand’s ICE vehicle exports. However, BEV exports are expected to benefit from revised BOI criteria allowing each EV produced for export to count as 1.5 units of offset production.

-

The above factors are expected to keep automotive output flat, with domestic sales projected to grow 1.0–2.0% annually and exports to decline -1.0% to -2.0% per year.

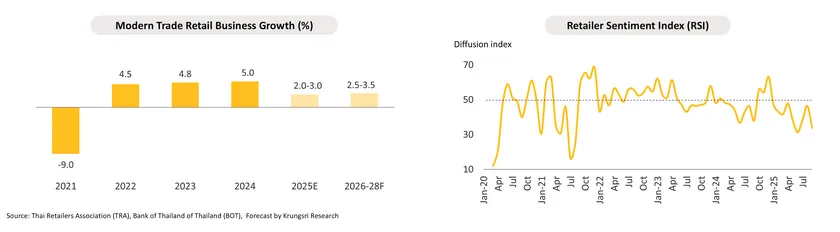

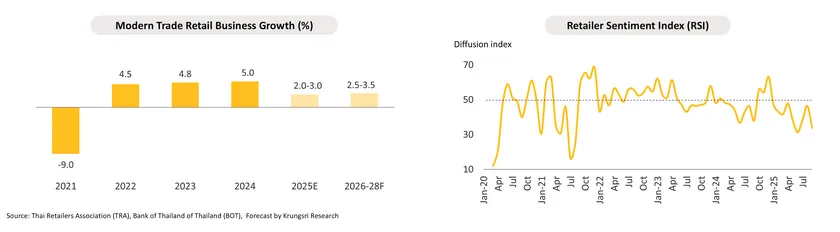

Modern trade: Sales are expected to ease slightly in 2026, before recovering in 2027–28 driven by tourism and infrastructure-led urban expansion.

-

2026 retail sales will remain flat or possibly contract slightly due to continuing weakness in the Thai economy and the ongoing trade war. The latter is adding to uncertainty over the outlook for the global economy and undermining consumer confidence, with negative impacts on spending by foreign visitors. However, the sector should return to annual growth of 3.0-3.5% in 2027 and 2028 due to: (i) rising tourist arrivals, which should reach 39 million by 2028; (ii) works on infrastructure projects (e.g., the metro and real estate developments) that will accelerate urbanization and open up new markets; and (iii) growth in the customer base driven by the development of omnichannel strategies that seamlessly integrate on- and offline distribution, and by expansion into CLMV markets, thereby creating new sources of long-term income growth.

-

The outlook for individual segments is as follows.

-

Department stores: Revenue is projected to grow 1.5–2.5% p.a., supported by resilient spending from mid- to upper-income consumers and tourism, with growth driven by AR/VR engagement, app-based memberships, and mega mixed-use developments targeting high-spending shoppers.

-

Discount stores: Revenue is expected to expand 1.2–2.2% p.a., underpinned by a value-for-money focus and expansion into smaller cities, alongside AI and big data adoption, though competition from online and cross-border e-commerce remains intense.

-

Supermarkets: Revenue is forecast to grow 3.0–4.0% p.a., supported by strong purchasing power and a wider range of premium, organic, and health products, amid intensifying competition from convenience stores.

-

Convenience stores: Revenue is expected to rise 4.5–5.2% p.a., driven by branch expansion in urban areas, new communities, and transport hubs, as well as quick-commerce adoption, despite increasing cross-segment competition.

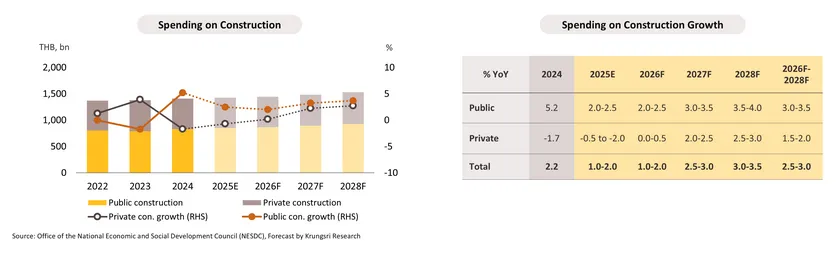

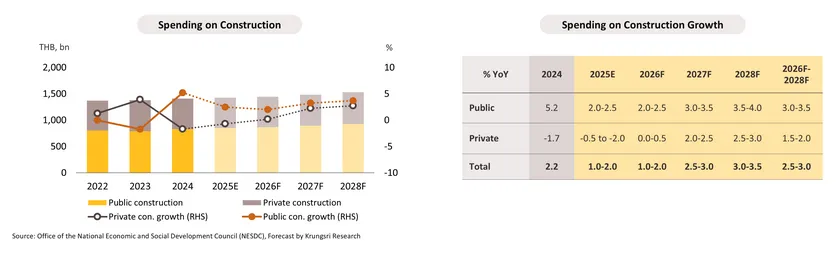

Construction: Overall construction will gradually improve, supported by public infrastructure despite slower budget disbursement in 1H2026, while private construction will recover gradually.

Overall construction investment is projected to grow by 2.5–3.0% annually, led by public-sector construction. Budget disbursement may remain delayed in 1H 2026 following the parliament dissolution on 12 December 2025, but major infrastructure projects are expected to gradually progress thereafter under the FY2026 budget. The Ministry of Transport has already secured THB 185.3 billion in approved funding as of August 2025 (Source: Thansettakij, Aug 13, 2025), covering both new and ongoing highway network projects. Private-sector construction is expected to grow modestly after contracting in 2025–2026, with recovery concentrated in key industrial and tourism areas. Industrial estate and warehouse construction will continue to expand, supported by foreign manufacturing relocation and Thailand’s strategic location.

-

Public construction investment is expected to grow by 3.0–3.5% annually, supported by large-scale infrastructure spending under the 2023–2027 action plan. Key projects include double-track railway developments (Phases 1 and 2) and new double-track routes, which will enhance connectivity with industrial estates and logistics hubs, alongside ongoing progress in EEC-related projects.

-

Private construction investment is expected to grow by around 1.5–2.0% annually, supported by several factors: (i) increased construction of factories and office buildings in industrial estates within the EEC, in line with improving investment sentiment; (ii) ongoing hotel development, particularly among major chains that continue to expand; (iii) a gradual recovery in residential projects after the sharp slowdown in 2024–2025; and (iv) demand for repair and restoration work on buildings affected by flooding in the South.

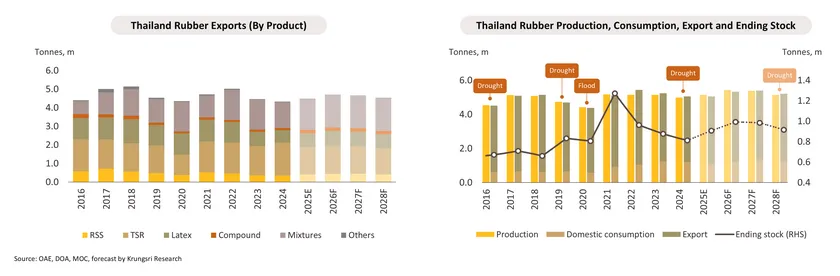

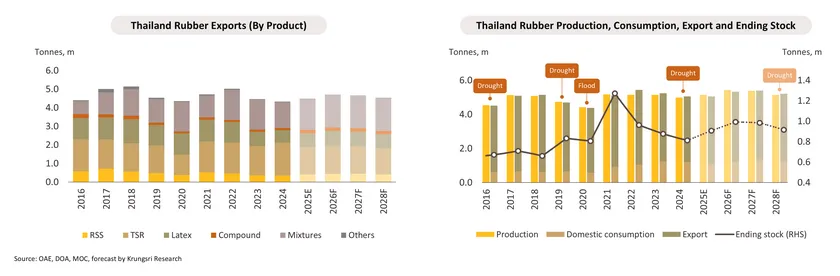

Rubber: Output and exports will grow in 2026 due to favorable weather and downstream restocking demand, before declining in 2027–2028 from El Niño.

-

In 2026, rubber output is projected to expand 4.1-6.1%, supported by (i) favorable weather and rainfall, leading to higher yield, and (ii) elevated prices incentivizing farmers to tap and maintain trees for increased production. Conversely, output is anticipated to contract by an average of -1.6% to -3.6% per year in 2027-2028, constrained by warmer weather and reduced rainfall associated with the onset of El Niño conditions, and the new strain of natural rubber leaf fall disease.

-

Export volume is projected to expand 3.8-5.8% in 2026, driven by restocking demand in related industries of trading partners, particularly automotive, tires, and parts, in anticipation of a market recovery. In contrast, volumes are expected to contract by -0.8% to -2.8% annually in 2027-2028, constrained by (i) the return of El Niño conditions causing raw input supply shortages, and (ii) slower purchasing by downstream rubber product manufacturers following prior stockpiling to mitigate rising raw material cost risks amid supply constraints.

-

Domestic consumption is projected to grow 2.2-4.2% annually, supported by (i) gradually recovering demand from downstream industries, particularly automotive parts and tires; (ii) a gradual rebound in both public and private construction demand; and (iii) ongoing government measures to absorb output to maintain price stability.

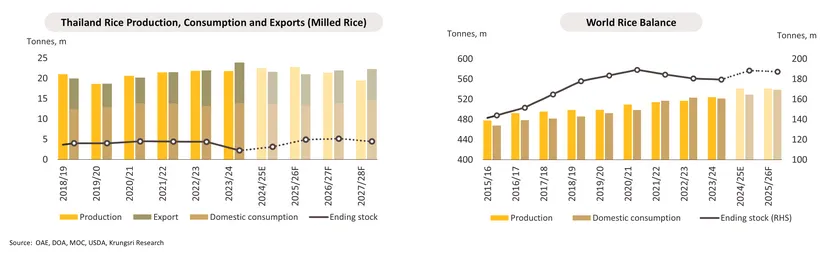

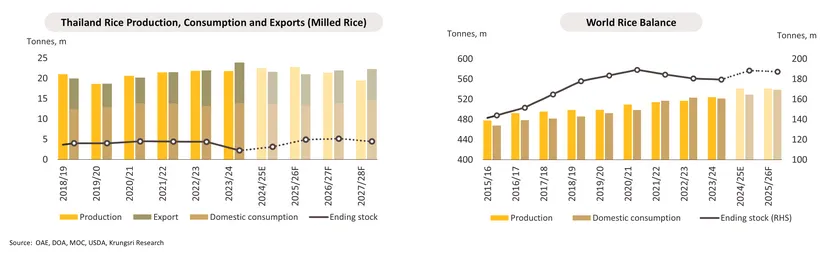

Rice: Exports are expected to decline amid stronger global supply, while domestic sales benefit from a tourism-led food service recovery.

-

In 2026, output is projected to expand 0.8-1.8%, reaching 34.9-35.2 MT of paddy rice or approximately 22.7-22.9 MT of milled rice. Positive factors include La Niña and normal climate conditions expected to provide favorable weather, rainfall, and sufficient reservoir water for cultivation. Conversely, 2027-2028 rice output is projected at 29.9-32.9 MT of paddy rice or 19.4-21.4 MT of milled rice, a decline of -7.2% to -8.2% per year, primarily due to the anticipated return of El Niño conditions causing damage and reduced yield.

-

Rice exports are projected to contract by -1.3% to -2.3% per year, totaling 7.5–8.0 MT of milled rice per year. Constraints include (i) severe competition from increasing global rice supply, particularly from key competitors (e.g., India, Vietnam, and Pakistan), and (ii) reduced import demand from trading partners due to higher domestic production and significant prior advance/stockpiling purchases.

-

Domestic rice consumption is projected to grow 2.1-3.1% per year, totaling 13.3-14.8 MT of milled rice annually. Demand-side drivers include: (i) gradually increasing tourist arrivals, boosting demand from restaurants and hotels; (ii) rising demand from downstream industries, particularly food manufacturing, which requires larger volumes of rice as processing inputs; and (iii) a gradual improvement in consumption, supported by rising purchasing power in line with broader economic improvement. On the supply side, increased market supply will be supported by the destocking of elevated domestic rice inventories.

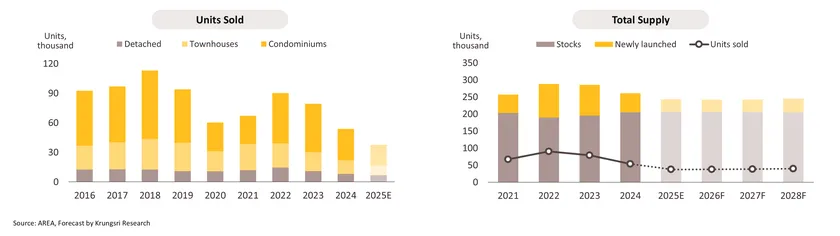

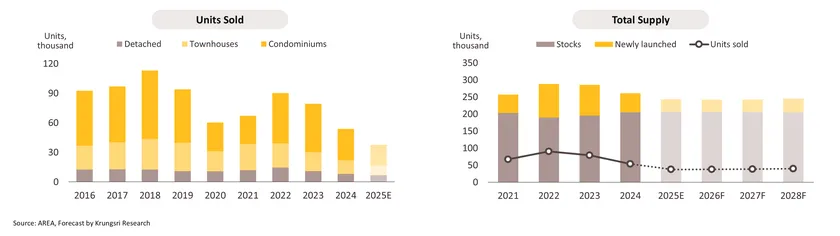

Housing (BMR): Units sold will remain weak in 2026 due to high household debt, before recovering in 2027–2028, supported by economic improvement, mass transit expansion, and rising expatriate demand.

-

In 2026, residential demand will remain constrained by a sluggish economic outlook, high household debt, and budget disbursement delays affecting infrastructure investment. Although the tourism sector will help support housing demand to some extent, it will not be enough to drive broader business expansion. Nevertheless, the mid-to high-end residential market will remain a key focus for developers.

-

From 2027–2028, the residential market is expected to recover gradually, supported by stronger economic conditions, government-led investment, tourism recovery, expanded mass transit network, and rising demand from expatriates and long-term residents. New launches are projected to grow 3.0–4.0% annually (around 38,000 units), while sales increase 1.5–2.3% per year.

-

Low-rise housing (detached housing and townhouses): Sales should improve gradually, driven by real demand from mortgage-accessible buyers. New projects will concentrate in the suburbs, especially near international schools. Townhouse sales are expected to remain broadly flat, constrained by a large unsold supply, particularly in the THB 2–3 million price segment. High household debt and tighter credit will continue to constrain lower-income buyers. Large developers will maintain moderate growth, while SMEs face tougher competition and financial pressure.

-

Condominiums: Sales are expected to rise slightly, supported by mass transit expansions and demand from both end-users and rental investors. Foreign buyers will continue to bolster luxury, super-luxury, and branded residences in prime locations. Condominiums in the outskirts will lag behind low-rise housing, with several zones weighed down by substantial unsold stock.

-

The business challenges include: (i) low growth in the economy and the heavy burden of household debt, which is restricting access to new loans; (ii) rising costs, especially for land in prime locations, and continuing labor shortages, which will tend to generate price rises that will outpace increases in buyers’ incomes; and (iii) Thailand’s transition to a fully aged society that will reduce demand for new properties, as the shrinking share of the working-age population further weakens demand.

.webp.aspx)