Thai Industry: How Competitive is Thailand on the World Stage?

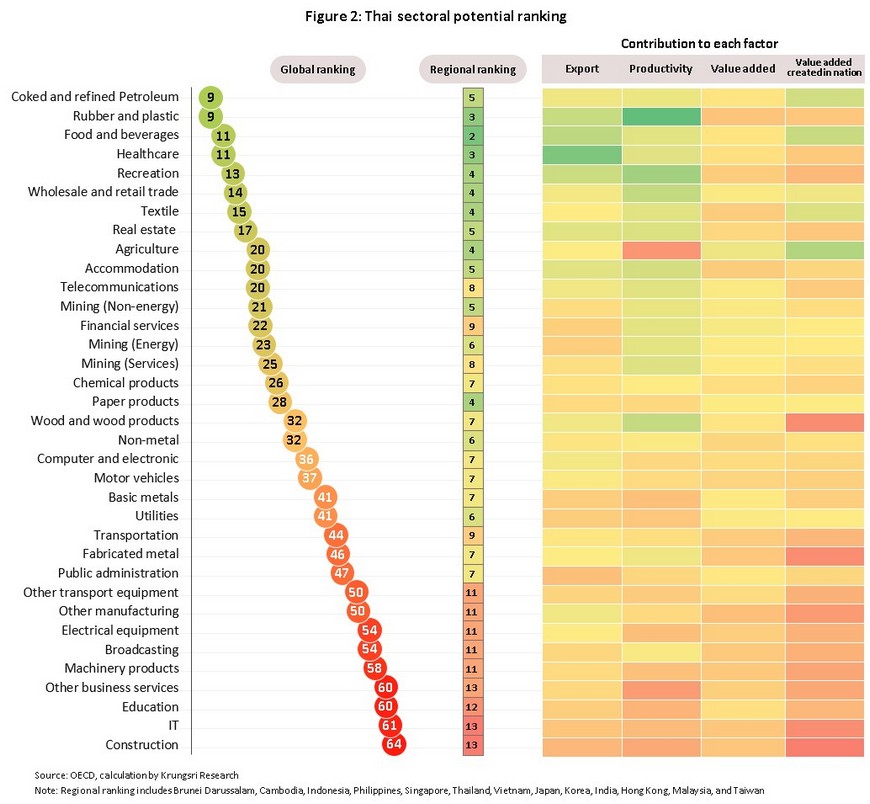

The sectoral potential of an industry refers to the ability and expertise of players within that industry to manufacture or supply goods and services that satisfy demand on global markets, while at the same time being able to generate profits for those involved in this same industry and the nation. Because this will help to shed light on the structure of the economy and the growth potential of the country, Krungsri Research has constructed an index of sectoral competitiveness that is based on four factors: productivity, export share to world markets, value-added creation in that sector, and domestic value-added creation in other sectors. This analysis shows that overall, Thailand ranks 35th of the 64 countries investigated for industrial competitiveness, with the country’s strongest industries including the production of coke and refined petroleum (9th in the group of nations studied), rubber and plastics production (9th), food and beverage processing (11th), and healthcare (11th). However, looking into the details of the analysis, although Thailand has ready access to resources and the country’s industries are actively involved in world markets, they are not able to add value to the extent that might be expected and this will limit the potential growth of industry itself and Thai economy. In addition, competition is expected to stiffen in almost all sectors investigated and players will thus need to engage in an ongoing process of raising sectoral capabilities.

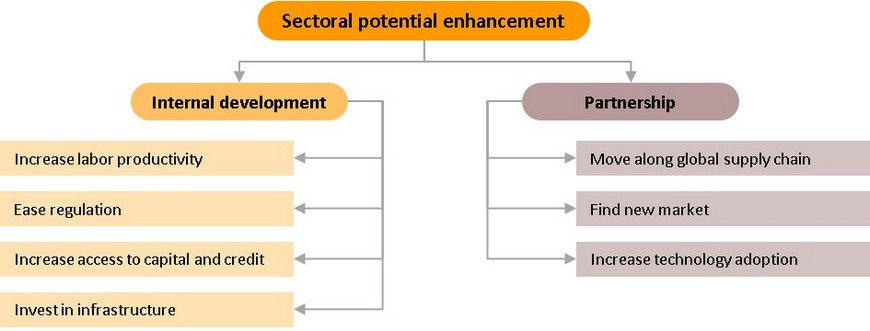

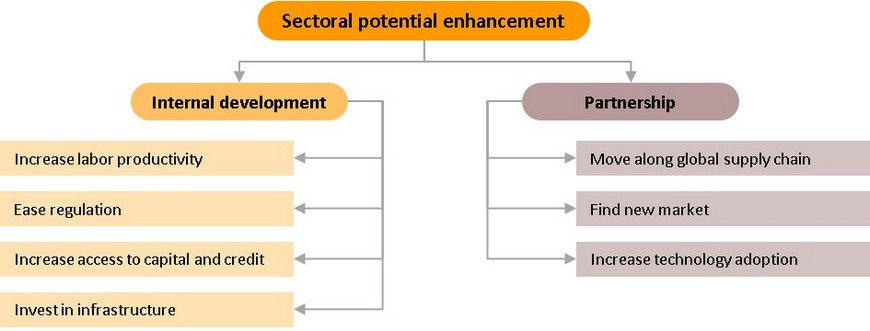

Strategies for raising sectoral competitiveness fall into two strands: internal development and partnership with external players. Deciding which of these two paths to take will depend on current sectoral capabilities and factors that affect the sector’s potential for development. Krungsri Research’s analysis shows that internal development is more suitable when industrial activities are dependent on the state of transportation infrastructure, the ease of doing business and the regulatory environment, and access to capital, and/or its being a sector in which Thailand has been regionally competitive since its inception. In the case of partnerships, this is appropriate for sectors that are relatively uncompetitive, that need to reposition themselves in the GVC, and that are looking for access to new technology and/or new markets.

The outbreak of COVID-19 has helped to highlight in a particularly dramatic way how risk is generated within highly integrated economies and how supply disruption can rapidly propagate between countries. This has then led to greater discussion over the possibility of ‘deglobalization’, and when this is added to the unfolding over longer timeframes of a set of global megatrends, it has become clear that global trade and manufacturing is going through a period of profound change as new industries rise in prominence and established industries sink into relative insignificance, while within individual sectors of the economy, the types of goods produced and sold are changing, business models are being revolutionized and production facilities are being relocated. It is thus becoming imperative that companies raise their potential as they look to navigate a changing business environment and rising levels of competition, and Krungsri Research believes that as part of this, it is necessary to identify the extent of sectoral capabilities and the factors that will help to raise this. Armed with this information, players will be able to more precisely develop their industry, which will then raise potential and provide benefits for businesses, workers and the economy overall.

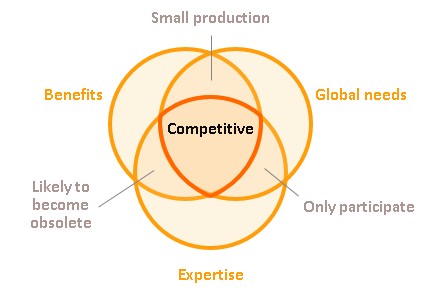

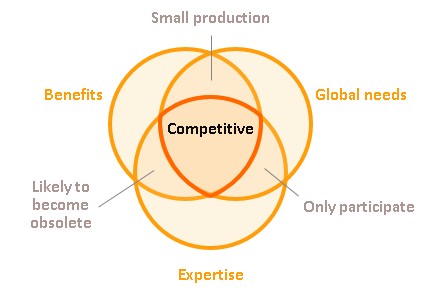

Sectoral competitiveness can be assessed by looking at a sector’s expertise, its ability to meet market demand, and the value that it adds to its products

An industry’s competitiveness may be measured in a number of different ways, including for example, manufacturing efficiency, cost structure, use of technology, value added by business processes, sales, and market size. The International Monetary Fund (IMF), the World Bank, and the Organization for Economic Cooperation and Development (OECD) have all converged on similar definitions of competitiveness that revolve around three factors: price competitiveness, quality competitiveness, and outcome competitiveness.

- Price competitiveness considerations are based on a comparison of manufacturing costs, whether that be for labor or for total costs, since industries or countries that enjoy low production costs will enjoy corresponding competitive advantages. Variables that are used to judge price competitiveness include unit labor costs and average total costs, though the influence of economic policy, the extent of research and development, and rate of capital accumulation may also be considered since these have an important influence on both the cost of labor and of finished goods (Collignon and Espacito, 2017). Assessing competitiveness with regard to price is most appropriate when comparing sectors or manufacturers that are outputting similar goods or when analyzing resource-intensive industries.

- Assessing quality competitiveness involves comparing industrial potential across a range of different areas, including manufacturing efficiency, levels of research within the industry, extent of technological uptake, and the level of exports. This approach is based on the assumption that industries that have high potential in these areas will also be highly competitive (WIFO, 2013), and thus, industries that show high levels of technological adoption will tend to have greater growth potential and show greater levels of competitiveness than those that are less technologically intensive. Considering industrial sectors in terms of their quality competitiveness is most appropriate when analyzing industries that are relatively technology intensive, though this can also be used to compare and assess industries that have different structures.

- Judging outcome competitiveness entails a comparison of the wider environment and how this affects businesses and so usually this is measured in terms of company income and the rate of business failures within the sector since in countries that are more competitive, that sector will tend to be marked by higher returns and fewer business failures. Outcome competitiveness may be used to compare the competitiveness of manufacturing industries that have both similar and dissimilar structures.

It is immediately clear that industries at the global level have different structures in different countries and so to make it easier to make valid international comparisons of sectoral competitiveness, Krungsri Research has used an assessment of quality and outcome competitiveness to construct its Sectoral Potential Index (SPI). In this context, sectors that exhibit high levels of potential are those that make the most efficient use of resources in their production processes, that make the most extensive use of domestically sourced inputs, that are best able to respond to demand on world markets, and that are most capable of generating income both within the sector and for the wider economy. The Sectoral Potential Index thus takes into account four separate factors:

- Productivity is measured through the value of goods or services produced by labor per unit of time. This thus reflects the average efficiency or expertise that the industry is able to deploy in generating these same goods and services.

- Export share to world exports is calculated from the exports of each sector in each country as a share of the total exports within the sector globally, and this therefore provides a proxy for assessing the ability of the industry in that country to respond to demand set on world markets.

- Value added creation in that sector is assessed by considering the value added in each sector as a share of the total output by that sector, and so this provides a means of measuring returns to players within the industry.

- Domestic value-added creation in other sectors is a measure of how much value is added in other industries in the country that are connected with the sector under consideration (through manufacturing connections and participation in global value chains). This then allows an assessment of overall returns to the country by that sector to be made.

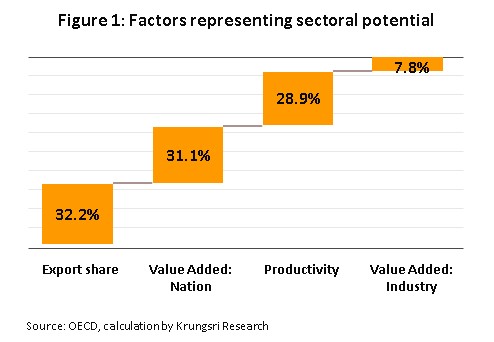

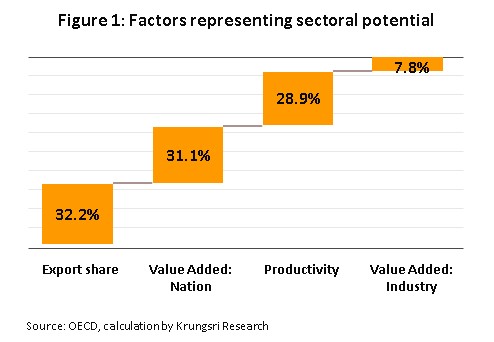

Krungsri Research has calculated its Sectoral Potential Index from the four factors described above using Principal Component Analysis (PCA) and data supplied by the OECD’s Input-Output Tables. The data cover 35 different industries in 64 countries and collectively account for around 93% of the value of world trade. It was found that sectoral potential was most heavily influenced by export share (accounting for 32.2% of sectoral potential), followed by domestic value-added creation (31.1%) and productivity (28.9%), while sectoral value-added creation was significantly less important (7.8%) (Figure 1).

Although developing economies generally had lower potential than developed economies, they are able to lead the chart in some sectors

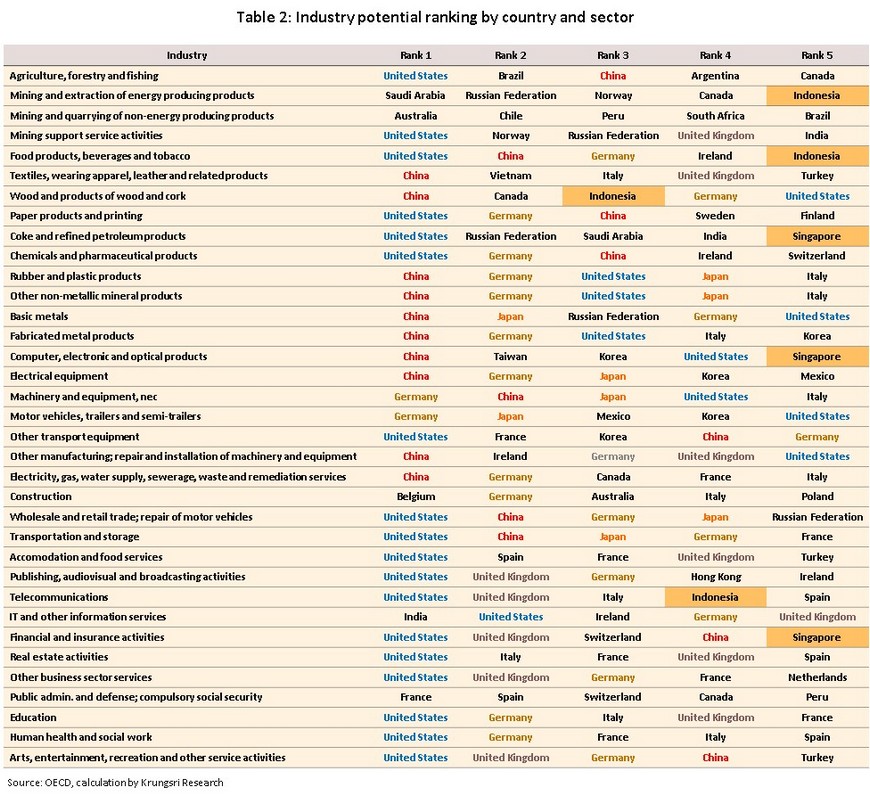

The SPI shows that overall, developed economies are more competitive than developing economies, with the former led in order by the United States, China, Germany, the United Kingdom and Japan, but each of these excelled in a different area. The United States performed best in services, and especially in retail and wholesale, accommodation, financial services, real estate, and healthcare. China was most competitive in complex, high-tech industries such as computer manufacturing and electrical equipment and parts, while Germany and Japan were notably strong in motor vehicles. For its part, the United Kingdom performed best in media and telecommunications.

As regards developing economies, while it is true that overall, these countries’ competitiveness lagged behind that of the developed economies, this was not universally the case, and some developing and newly industrialized countries stood out with, for example, Chile and Vietnam coming in second in the rankings of sectoral potential for respectively mining and textiles (Table 2). In fact, the nature of the leading industries in a nation can help to illuminate the overall structure of the economy in that country and given this, clearly identifying target industries and developing their potential is an important step on the road to national development.

The potential of Thai industry on the world stage

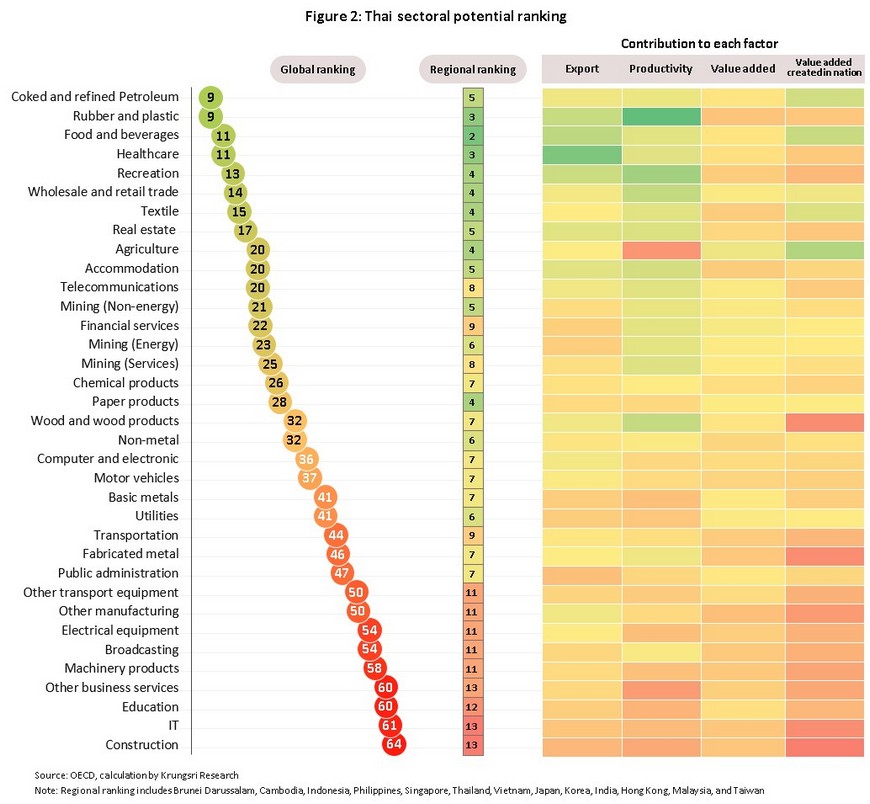

Overall, Thailand came 35th out of the 64 countries assessed, putting it in 2nd place among the ASEAN nations, and in 7 sectors, Thailand achieved a ranking in the top 15 countries globally. These were: coke and refined petroleum products (9th); rubber and plastic products (9th); food and beverages (11th); healthcare (11th); recreation (13th); wholesale and retail trade (14th); and textiles (15th). At the same time, in some sectors, Thailand performed very poorly and development of these industries is essential. These included education (60th), information technology (61st) and construction (64th) (Figure 2).

Looking at Thailand’s standing relative to the rest of the Asia-Pacific region (which includes 13 economies), the country achieved a top-three place in rubber and plastics, food and beverages, and healthcare. However, in a significant number of industries, Thailand’s competitiveness lags behind that of its neighbors, and in the ASEAN group, unlike Thailand, 3 countries numbered in the world’s top 5, these being Vietnam (for textiles), Singapore (for financial services and computers), and Indonesia (for food and beverages, and mining). In the wider Asian region, Japan, Hong Kong, South Korea and Taiwan also stood out for respectively their motor vehicles manufacturing, broadcasting, computer and electronic manufacturing industries. On the positive side, the gap between Thailand’s current level of competitiveness and that of these countries presents an opening to Thai industry, and the country now has the opportunity to connect through trade to its neighbors and to use this to overcome national weaknesses, increase manufacturing efficiency and raise industrial competitiveness.

The details of the SPI for Thai industries show that generally, the majority of Thai industry has sufficiently high levels of expertise in supplying goods and services and that it is able to respond effectively to demand set on global markets. However, Thai industry is weak in adding value to its production, as is seen for example within its rubber and plastics, and recreation sectors, and so although Thai players have access to resources and participate actively in global manufacturing and trade, actual returns to business owners and to labor is lower than it should be, as is the rate of local content. The result of this is that rates of capital accumulation are low, which then restricts the ability of businesses to invest in new technology, ultimately limiting the development of the sector and holding back the overall economic growth ahead.

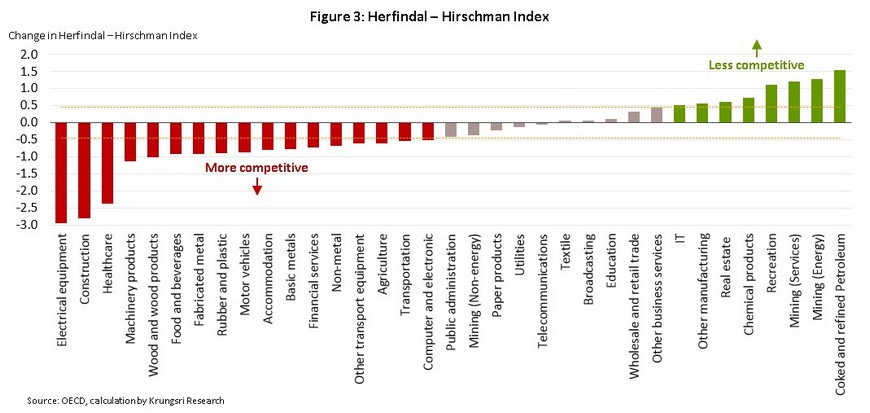

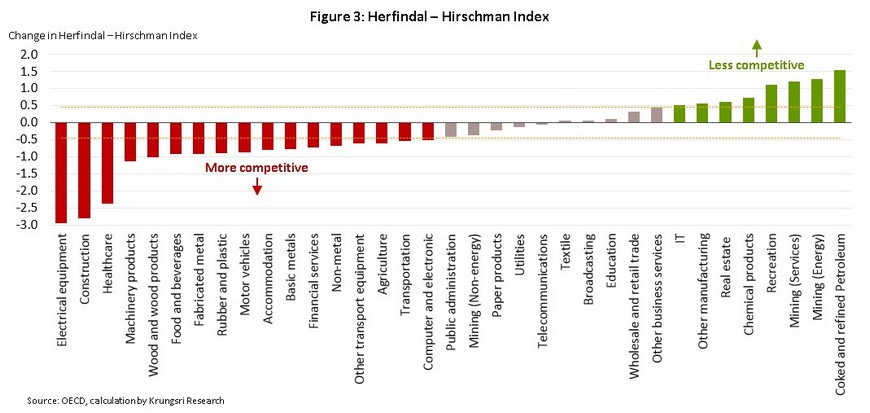

Competition is tending to stiffen in some industries and this will present a risk to Thai players, though the outlook for services is improving

Krungsri Research has forecast changes in levels of competition on world markets over the next 5 years and has predicted how this will affect Thai industry using the Herfindal–Hirschman Index (a decline in the value of this index indicates a rise in competitive pressure). This reveals that in 17 industries, competition can be expected to worsen in the coming period, with this most pronounced for players in electrical equipment production, construction and healthcare. In contrast, competition will likely slacken in just 8 sectors, affecting most noticeably coke and refined petroleum products, mining (energy) and mining (services) (Figure 3).

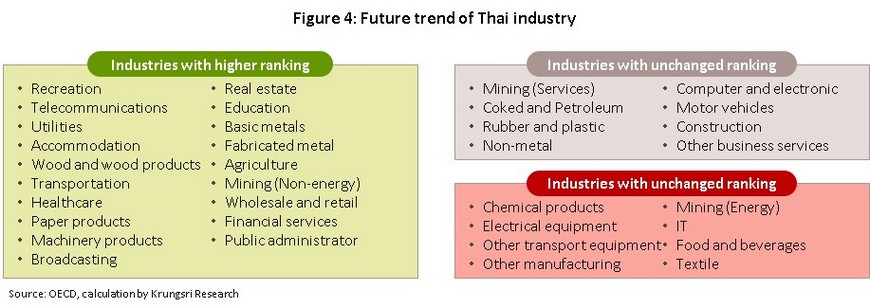

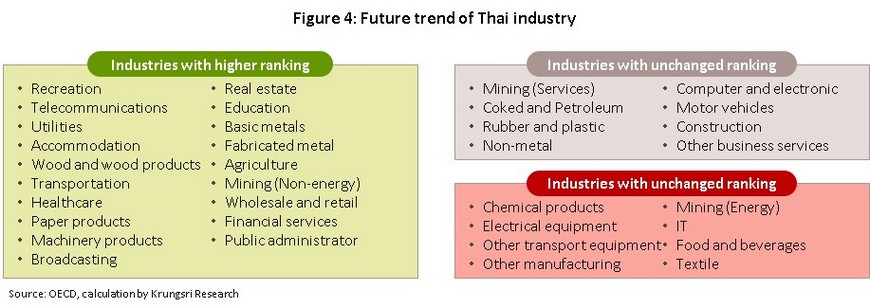

The outlook for Thai industry will also tend to improve in 19 sectors, most of which are service industries, including in recreation, accommodation, healthcare, and transportation. This improvement will be based on increasing labor productivity and the business acumen of established players. However, at the same time, the outlook is for conditions either to remain unchanged or to worsen for another 16 sectors. The majority of these industries are in manufacturing, especially in areas that require the use of high-tech production processes, and include the manufacture of computers and electronics, motor vehicles, electrical equipment, and the manufacture of chemicals. These latter are also important export industries, as well as being areas where Thai players add only a limited value to industrial processes (Figure 4).

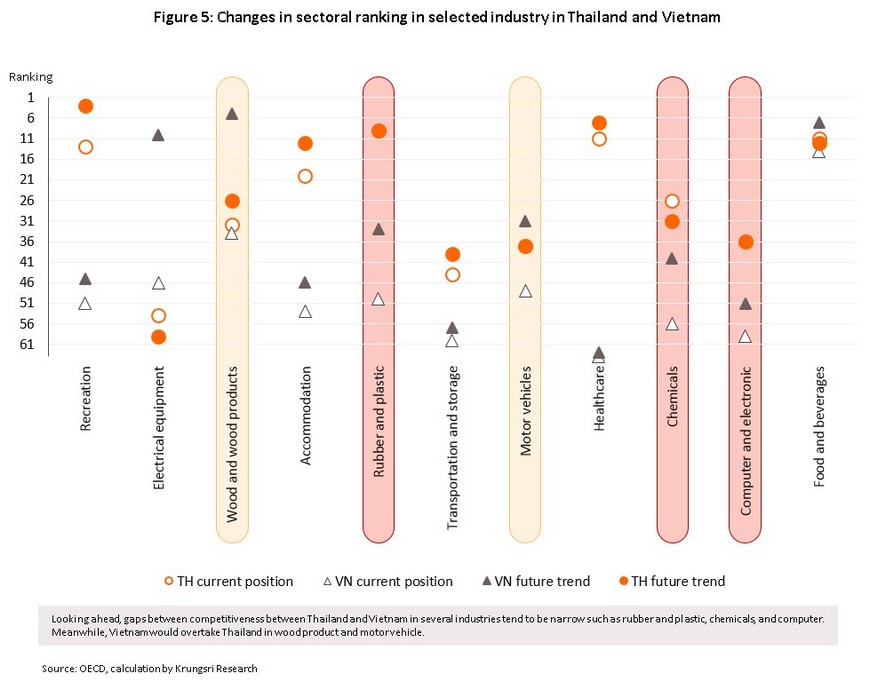

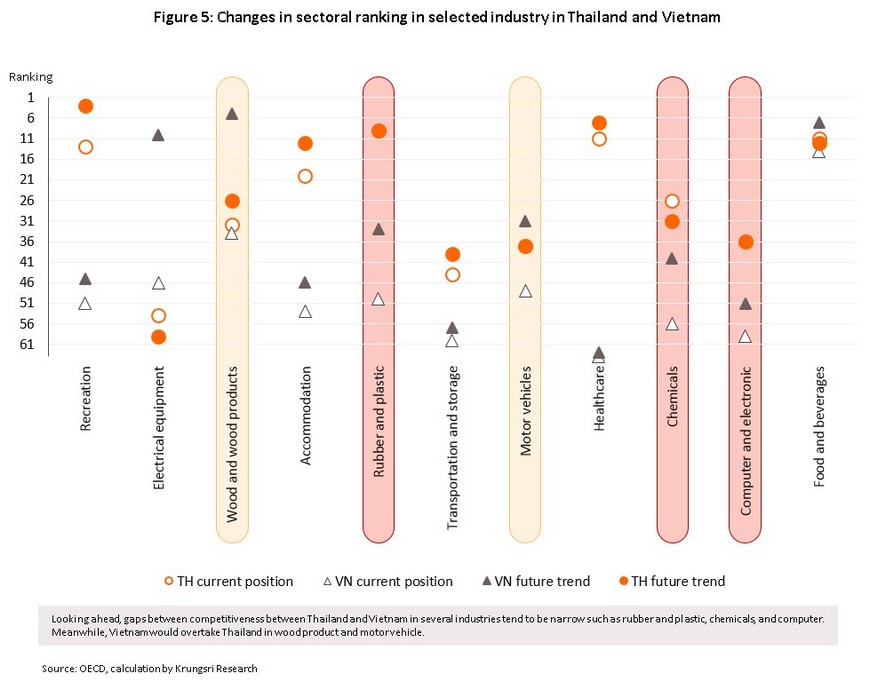

The rapid development of Thailand’s neighbors, including Vietnam, Cambodia, Malaysia and Indonesia, is another factor that will pose a growing threat to the country’s economic welfare in the future. In another 5 years, in accord with its goal of becoming a major global production center for modern, high-tech industries, Vietnam is expected to improve its standing in almost all sectors, though this will be most pronounced in the production of electrical equipment, motor vehicles, computers and chemicals (Figure 5). Elsewhere in the region, Cambodia is also expected to become more competitive in agriculture (rising from 27th to 21st), Indonesia will go from 37th to 27th in education, and Malaysia will go from 45th to 35th in the manufacture of machinery and from 55th to 45th in telecommunications. Although in many sectors, the competitiveness of these countries is still weaker than Thailand, rapid economic growth in the region is closing the gap and reducing Thailand’s comparative advantages. Looking forward, Thai industry in fact now runs the risk of being overtaken by these players, with negative impacts on Thailand’s manufacturing potential, and on the country’s level of investment and economic growth.

Supply chain structure, technology and transportation infrastructure are most important factors shaping industrial competitiveness

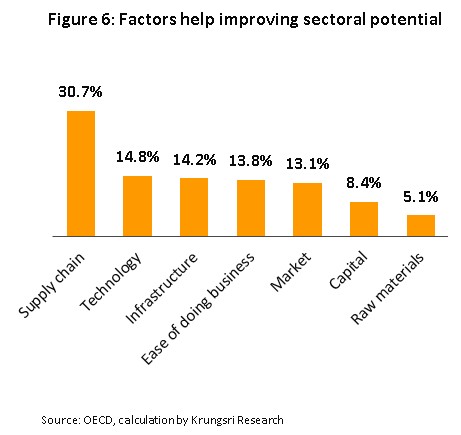

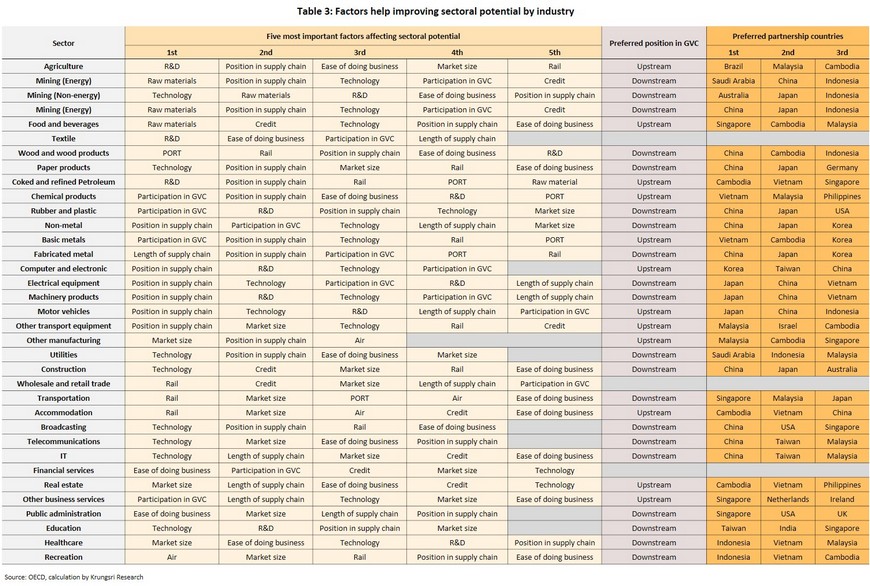

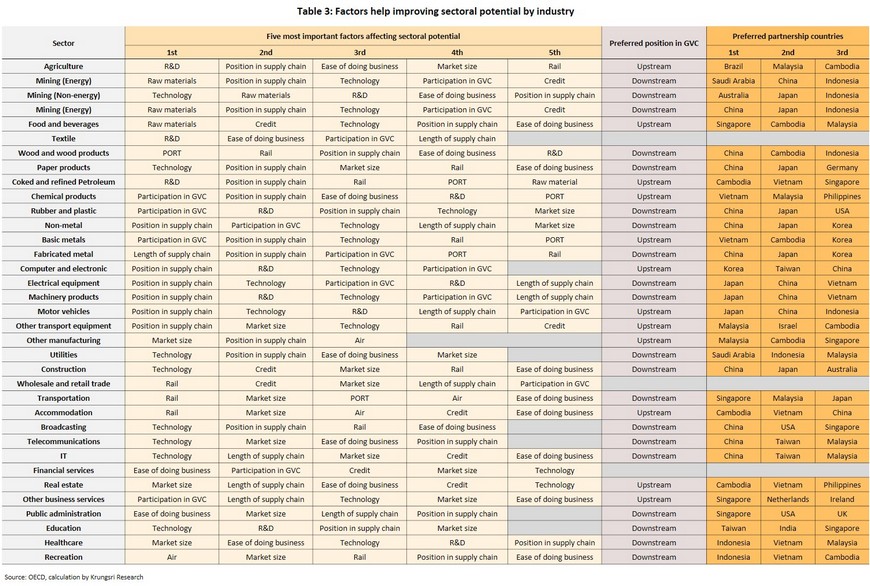

To help better target measures aimed at developing industrial competitiveness, Krungsri Research has carried out an econometric analysis of the factors that contribute to the latter. This reveals that there are seven of these: supply chain structure, technology, transportation infrastructure, ease of doing business, market size, capital, and access to inputs. The first three of these account for respectively 30.7%, 14.8% and 14.2% of sectoral potential (Figure 6).

Supply chain structure: Here, the state of supply chains is considered with regard to three aspects.

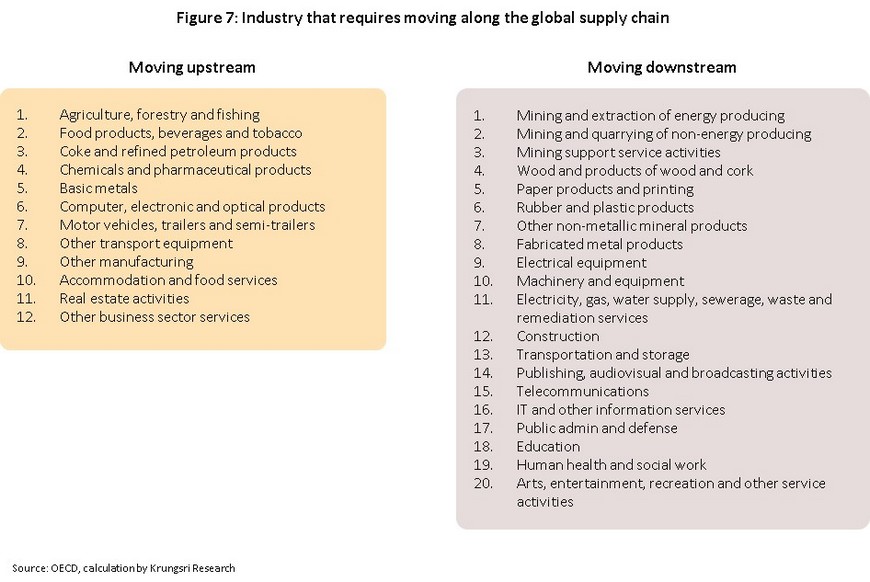

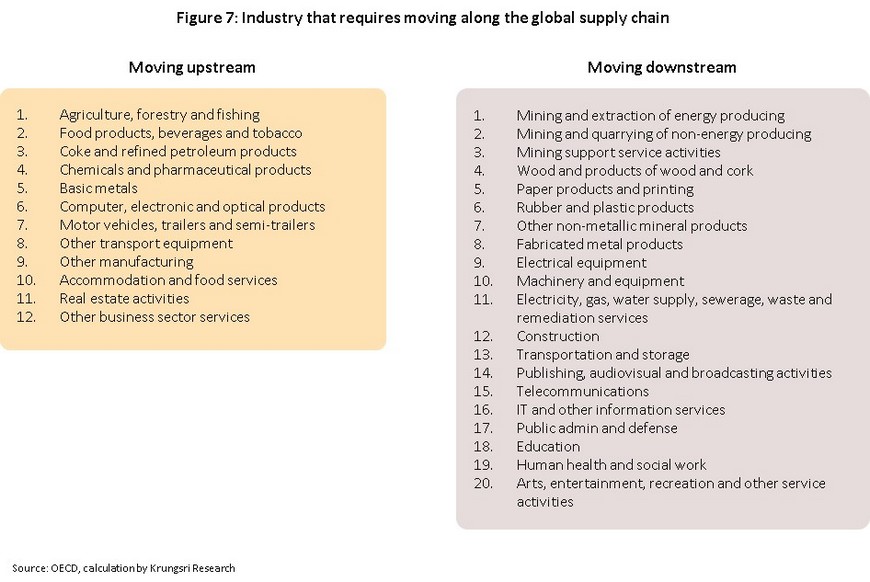

- Position in the Global Value Chain: The structure of production varies by sector but according to the ‘smiling curve’ theory, a common feature across the supply of goods and services is that the upstream (e.g., research, development and design) and downstream (e.g., transport and sales) sections of these processes have higher value-added than do midstream activities. Given this, the position of an industry within wider sectoral supply chains may have an important impact on its potential, and it was discovered that for Thailand, of the 35 sectors studied, 32 would see an improvement in competitiveness if they shifted their position within supply chains. Of which, 12 sectors would benefit from moving upstream, with this especially the case for petroleum refining, computer manufacture and motor vehicles, and 20 would be better off relocating downstream, this including electronics manufacturers, utility providers, and producers of machinery (Figure 7).

- Participation in global supply chains: It helps industries to expand production, increases economies of scale, facilitates the sourcing of raw materials, inputs and other resources, increases access to technology, raises manufacturing efficiency, and adds additional value to output, although using an excessively high proportion of inputs that originate overseas may erode an industry’s ability to add value. Our result has also shown that participating in global supply chains raises an industry’s potential, and this is especially the case with primary manufacturing and resource-intensive production, for example, chemicals production, rubber and plastics manufacture, and basic metal industries.

- Length of supply chains: The length of a supply chain is a measure of the number of stages in the production process, from the first upstream stage to the final downstream activity. Longer supply chains usually arise where there is a division between the level of skill required for work processes, which will be particularly noticeable when products are manufactured in clearly identifiable stages. However, long supply chains are also associated with higher management costs and analysis by Krungsri Research shows that shortening supply chains will in fact increase the potential of all the sectors studied, with the exception of only motor vehicles and chemical production.

Technology is considered in two aspects

- Technology and innovation: The application of both of these helps to increase manufacturing efficiency, raise players’ ability to respond successfully to global demand, and cut production costs. This research shows that the successful deployment of technology and innovation has an important role to play in raising the potential of almost every sector, most especially in manufacturing for the production of computers, motor vehicles and the manufacture of machinery; the output of these three industries share similarities that make businesses’ cost structure and the quality of manufactured goods determinate factors in deciding competitiveness.

- Research and development: Spending on research and development has a direct effect on increasing sectoral potential, and this analysis shows that this holds in a wide range of industries, especially manufacturing industries that are heavily dependent on technology (Table 3). This is because additional expenditure on research will help to increase technology usage and deployment, which will then allow manufacturers to better meet future global demand by producing goods that are themselves more technology intensive.

Transportation infrastructure: Transportation is a central plank of national development, increasing access to resources and markets, building opportunities for new economic activities to get underway, and reducing logistics costs. Better access to rail transport will help to increase the potential of many industries, especially primary manufacturing and services, while expanding access to air travel would have positive effects on transportation, accommodation, and recreation. More extensive water transportation networks would mostly be beneficial to primary manufacturers.

Ease of doing business: Increasing the ease of doing business helps to cut costs, makes competition more equal, allows resources to be allocated more efficiently and overall, this then develops the competitiveness of players within a sector, though this research shows that making it easier to do business affects the potential of services more strongly than it does manufacturing (Table 3). This is because the rules and regulations that govern the activities of players in service industries are more complicated and comprehensive, especially for financial services and healthcare, and so streamlining the regulatory environment has a correspondingly greater impact in these areas.

Market size: A consideration of market size encompasses both the number of population and their income per capita, with larger markets naturally reflecting the existence of higher demand for those goods and services. Large markets are also beneficial in terms of the economies of scale that they give rise to, though the effect of market size has a more noticeable effect on sectoral potential for services than it does for manufacturing. Industries that are especially affected by this include healthcare, real estate, education, transportation, construction and accommodation, most of which are also industries that are more sensitive to changes in buyers’ income.

Capital: This factor includes both accessibility and the cost of capital, and improving both these factors makes it easier for companies to engage in business and to expand, while these also affect the overall efficiency of resource allocation within the country. This research shows that increasing formal access to capital has an important effect on sectoral potential for almost all the industries studied, though this was most important for accommodation, retail, and construction, all sectors in which it is necessary to maintain high levels of working capital. Conversely, the costs of funding seem to be less significant to sectoral potential

Access to inputs: Increasing access to raw materials and inputs helps to reduce production costs and increase the opportunities for doing business. As shown in Table 3, this research reveals that increasing access to inputs has the greatest impact on potential for resource-intensive industries such as mining and the extraction of energy resources.

An industry’s potential and its position in manufacturing supply chains are strong indicators of that sector’s future development

Strategies for developing sectoral potential will vary according to the specific structure of each. For example, in the recreation sector, potential is strongly influenced by transportation infrastructure and so developing the air and rail networks within Thailand would help to make this industry more competitive. This is in contrast to, for example, computer and electronics manufacturing, for which it is much more important for the industry to reposition itself within wider supply chains, if its potential is to be raised.

Methods for increasing sectoral potential and competitiveness may be split into two broad groups. (i) Internal development will normally be the starting point for leveling up an industry, and this might include approaches such as increasing the efficiency of the workforce, easing business regulations, investing in infrastructure, and increasing access to sources of capital. (ii) Partnering with overseas players is an alternative route to industrial development, for example by changing participation in manufacturing supply chains, looking for new markets, and encouraging technology transfer from overseas.

The internal development is most appropriate for those (i) in which competitiveness is strongly determined by transportation infrastructure, market mechanisms and capital, and/or (ii) where Thailand is already established in a strongly competitive position in comparison to the rest of the region but the level of competitiveness and hence sectoral potential is being raised further. This type of development may come from investment within the sector itself or from the public sector and is most suited to the food and beverages, rubber and plastics, accommodation, healthcare, and recreation sectors. Strategies for approaching internal sectoral development may include the following.

- Increasing labor productivity: This will help industries produce higher-quality outputs at a lower cost, and may be achieved by greater spending by the public and private sectors on research and development, though stakeholders should also support and encourage technology transfer from overseas since this will help increase overall industrial efficiency. Examples of sectors where this approach is most appropriate include agriculture, food and beverages, and healthcare; these industries are already efficient compared to the rest of the region but despite this, within them, labor productivity still lags.

- Easing business regulations: Making progress in this area depends on action by the government to reform the legal framework and to promote investment in a sector, for example, by allowing foreign investors to hold a greater share of stock in Thai companies, stimulating investment in targeted areas by offering tax incentives to investors, and repealing unnecessary or excessively onerous laws. Having made these moves, the government can then leave market mechanisms to determine the correct level of investment and returns.

- Increasing access to capital: This analysis shows that being able to access formal financing is a more important factor than is its cost, while Manova and Yu (2012) show that if an industry does indeed have difficulty accessing financing, the resulting lack of investment will tend to restrict production to low-value-added items and prevent operators from moving into more profitable areas. This approach is most appropriate for sectors that are at least moderately competitive and for which greater access to capital would have a strong influence on sectoral potential, e.g., accommodation, food and beverages, and wholesale and retail trade.

- Increasing investment in infrastructure: Investment in expanding rail, air and water travel networks would help businesses by making it both easier to acquire raw materials and inputs and to distribute finished goods, as well as providing a direct boost to hoteliers by making travel and tourism more convenient. Although at present, the public sector determines and controls how investments are made, joining with private-sector players may be an attractive way of increasing spending in this area, and if investment plans are flexible and investors are not exposed to an excessively high degree of risk, it may be possible to attract greater investment inflows from the private sector.

Partnerships with overseas players: This offers an alternative route to development that may be faster and more direct than the internal approaches described above. Sectors for which this approach is most appropriate include those for which competitiveness is (i) not especially high, though the sector would benefit from moving its position in manufacturing supply chains, and (ii) strongly affected by factors related to technology and market size. However, players may have a range of different goals when joining with overseas partners (Box 1), and these may include the following.

- Changing the role played by the sector in wider value chains: As shown in Figure 7, moving either up or down supply chains would help the majority of the sectors studied, though the effect is generally strongest for export industries or those that show only lower levels of competitiveness. This includes, manufacturers of electrical equipment, motor vehicles, machinery, and computers. Development within these industries is dependent on cooperation with other players in the sector, as well as on additional support from the government. The most suitable countries to partner with are those that are currently in positions on supply chains to which Thai players would like to move, as well as those that will provide the greatest added value to both countries (Table 3).

- Machinery and equipment: This analysis shows that moving downstream within the supply chain would help to boost this sector’s potential since the industry is focused on exporting directly to consuming countries, and the sector should therefore increase its efforts with regard to transport and after-sales services. Given its expertise in this area, Japan (3rd in the global rankings) is the most appropriate country for Thailand to partner with, though the sector would also be helped by additional research and development on how to add value to downstream activities, for example, by better planning marketing in export targets and by offering comprehensive installation services. By expanding in this direction and by not remaining simply a manufacturer of parts at the final stage of the production process, the sector could then significantly increase its competitiveness.

- Acquiring new technology: Partnering with another country as a means of gaining access to new technology is an appropriate strategy for industries that show middling levels of competitiveness and for which competitiveness is strongly determined by technology. This includes the education sector, which should join with a country that is more competitive than Thailand.

- Education: Compared to the rest of the region, the Thai educational sector is uncompetitive, and the first step to be made in addressing this is to find a partner with a high profile globally. This partner would then be able to pass on knowledge about the structure of the industry, assist with planning and management, and develop the industry at all stages from hiring through to assessment, which in the process, would then help to add value to the sector. Countries that could potentially play this role include Taiwan and India.

- Establishing new markets: Breaking into new markets is another way of increasing competitiveness. This requires identifying a suitable trade partner or markets that are sufficiently large (in terms of both buyers and purchasing power) and so industries that are suited to this approach are those for which competitiveness is based on income per head of the population and the total population size. Looking for new markets is also appropriate for sectors that already have a relatively high degree of competitiveness and that are ready to compete with other countries. These include the healthcare sector.

- Healthcare: The Thai healthcare sector is ranked 11th of the countries covered in this analysis. This is an industry for which market size and spending power is important in setting competitiveness, and so given this, the sector should partner with a country that has a large population or that has a per capita income that is strong enough to lift the industry’s potential, for example, Indonesia or Vietnam.

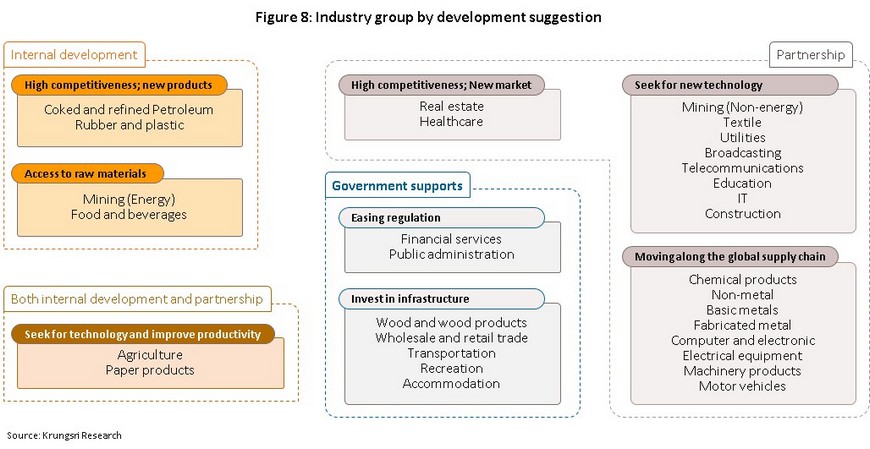

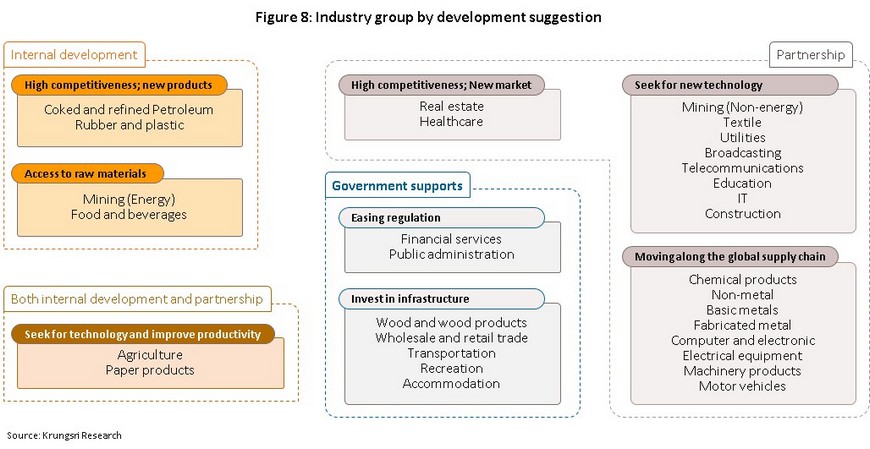

The findings of this analysis show that developing sectoral potential resembles a long climb that begins at the national level with investment in infrastructure that supports industrial development, and then moves on to increasing productivity. The process then progresses to improving a sector’s interaction with manufacturing value chains as the industry moves to a position that best allows it to develop its expertise in the supply of goods and services and to match these against demand set on global markets, as well as to generate attractive returns for domestic manufacturers. Given the results of this research, that is the potential of Thai industry (Figure 2) and the factors that help to determine this (Table 3), it is now possible to divide Thai industry into 8 groups, according to how the potential of each may best be improved. These are summarized below (Figure 8).

- Industries that require public investment: This includes recreation, accommodation, the manufacture of wooden products, wholesale and retail businesses, and transportation. For these sectors, the national transportation infrastructure is important in determining potential, in particular with regard to rail transport, though development of air transport will also have a positive effect on recreation and accommodation businesses.

- Industries that would benefit from easing business regulations: This group includes banking and insurance, and public administration, which are in respectively 22nd and 47th position in this survey. Relaxing the rules that govern activities in these areas would raise the potential of both sectors.

- Industries that need to raise their productivity: This covers paper manufacturing and agriculture, which are in respectively 28th and 20th place in this analysis. Both sectors need to improve across a range of indicators but this is especially true for their productivity. Raising these sectors’ potential could start with internal strategies, for example increasing their labor and resource-use efficiencies, before moving on to partner with another country as a way of facilitating technology transfer and improving the position of these sectors in their respective supply chains.

- Industries that need to establish greater security over the supply of inputs: This group includes food and beverages production, and mining (energy), which are in respectively 11th and 23rd positions in the analysis. These two sectors are thus already reasonably competitive and it is not necessary for them to move either up or down their supply chains, but because both industries are resource-intensive, sectoral potential is strongly affected by the availability of inputs and so securing access to these should be a priority.

- Industries that are able to invest in finding the sweet spot in manufacturing supply chains: These sectors are already highly competitive but would benefit from shifting their position in supply chains. This group includes rubber and plastics producers and petroleum refining, both of which are in 9th place in the analysis, but while rubber and plastics producers would benefit from greater investment in downstream production, petroleum refiners would do best to move upstream.

- Industries that need to partner with other countries as they look to adjust their place in value chains: This group includes fabricated metal and non-metal products, electronics, machinery, computers, motor vehicles, basic metals, textiles, and chemicals. For all these industries, factors related to technology and their position in value chains are important in setting their level of competitiveness, which is not high in any of these sectors. When looking for a country to partner with, the most important considerations are that it should already have significant expertise in that area, it should have advantages in terms of its application of technology within the industry, and it should be in a position within supply chains that is similar to that which Thai players would like to occupy.

- Industries that need to partner with other countries to facilitate technology transfer: This group encompasses telecommunications, mining, education, public utilities, and broadcasting. In all these areas, sectoral potential is significantly influenced by the extent to which players can master and deploy technology and so it is important for these to partner with equivalent sectors in technologically advanced countries, which can then help to develop Thai industry.

- Industries that need to partner with other countries to expand into new markets: Healthcare (11th in the analysis) and real estate (17th) fall into this group since for both, potential is closely connected to market size. Both sectors are already competitive and so it is recommended that both expand overseas and work with players in healthcare and real estate in these countries to develop new markets. Because Thailand’s neighbors are relatively weak in these areas, these make especially attractive targets.

Against a backdrop of the damage wrought by COVID-19, the playing out of global megatrends and a steady rise in competitive pressure, enhancing Thai sectoral potential is essential. Given this, assessing current capabilities and the factors that influence industry’s potential competitiveness will help stakeholders lay out a clearer and more productive path for future development. This will also help to raise industry’s potential, support ongoing development and guide policy in a way that will balance the input and needs of different organizations. In this way, the economy will be the key to enabling Thai industry to continue to compete in global value chains that are seeing standards steadily rise, and this will then sustain long-term economic growth for the country and allow it to escape the middle-income trap.

Box 1: Examples of foreign partnerships and sectoral change

Electrical equipment: For these operators, the factors that are most important in determining competitiveness are use of technology and position in value chains, and so modernizing production and moving into a more downstream position in supply chains would benefit the sector. To this end, manufacturers could increase their value-added by shifting from being simply manufacturers to instead becoming operators of brands, while as regards potential partners, players could join with either Japan or China since in both of these countries, the electrical equipment sector is large, technologically advanced, and levels of expertise are high. In addition, partnering with just a single major economy will likely generate greater direct benefits since this will result in shorter supply chains that will in turn do more to raise sectoral capacity.

Motor vehicles: This analysis shows that the Thai auto industry should increase its competitiveness by moving upstream as well as extending its participation in supply chains. Thus, in addition to playing a role as a manufacturer of auto parts for use in assembly, the sector should also play a greater role in designing these and generating prototypes, which could be achieved with an increase in spending on research and development. Beyond this, a relaxation of the rules governing investment would also help to attract new investors to the industry, and it may be worth following China’s lead in promoting the development of ‘self-owned brands’, rather than having domestic players remain subsidiaries of a multinational corporation. Here, the government has a role to play in applying special tariffs to these companies for both production and for exports (through an export tax rebate) and in supporting cuts in the rates for leases for sites hosting production facilities (Tang, 2019). When looking abroad, Thailand could join with partners that have expertise in upstream manufacture (e.g., Japan) but with regard to assembly, it might be better to look to countries including China and Indonesia. Another possibility worth exploring is moving into the production of inputs to the assembly of electrical vehicles, which would then not just help the automotive industry adapt to changing demand but would also lay the groundwork for a future step up in competitiveness.

Computer, electronics and optical equipment: Participation in global supply chains is the most significant consideration for assessing competitiveness in the computer and electronics sector. Players should therefore look to increase their income by finding new trade partners or by breaking into new markets, as well as extending into a more upstream position in supply chains. The latter could be accomplished by Thai players switching from being Original Equipment Manufacturers (OEMs) to becoming instead Original Design Manufacturers (ODMs). This is similar to the strategy adopted by Taiwan, where the industry began life as a host for production facilities run by international players before having parent companies transfer technology to Taiwanese players. The country has also invested in research and development and in the development of transport systems as a way of encouraging the production of a more varied and higher quality range of products. Taiwan has added to this by using tax incentives to encourage companies to hire highly skilled staff to work on the design of new products, as well as by establishing multiple-stakeholder setups that coordinate the work of academics, members of industry and representatives from the wider society, and through its strong commitment to education, infrastructure and expertise in production, the country has laid solid foundations for industrial success. Another approach that the Thai computer and electronics sector may consider is to expand its market by manufacturing a wider range of computer parts that better meet current global demand, which would then help to develop the downstream market. This might include producing semiconductors since demand for these has escalated dramatically with the outbreak of Covid-19 and production has added considerable extra value for countries across Asia, including South Korea, Taiwan and China.

Transportation and storage: Currently, the Thai transportation sector is situated in a downstream position in supply chains, which helps to ensure that the sector maintains its competitiveness. Thailand should therefore partner with Singapore since the market there has high purchasing power relative to the rest of the region and the Singaporean sector competes strongly on the world market. However, infrastructure factors (e.g., the provision of ports and the state of the rail network) are most important for ensuring that travel and transport is convenient and seamless. The Thai transportation sector should therefore increase its investments in this area, while it may also be possible to increase investment opportunities for players from Singapore or from other countries if regulations on the participation of overseas companies are eased.