In the coming period, the success factors for hoteliers will not be limited to the conventional criteria such as location, quality of rooms, pricing, and facilities available to guests. They will include the extent to which hoteliers cooperate and work together with local communities and other businesses, as well as how quickly and effectively they respond to change and manage risks. On this note, operators need to urgently review and make adjustments in their business playbooks ahead of the reopening of international borders and return of foreign tourists. This will allow players in the tourism and hotel industry to secure the required foundation to capture maximum gains from the strong recovery in foreign tourist arrivals to pre-pandemic levels, and to ensure this remains sustainable.

Before the pandemic, the Thai tourism and hotel industry had enjoyed strong growth for decades, which established the industry as a key driver of the Thai economy. The pandemic has posed a challenge to the industry unlike any it has faced, and the impacts will last for a long time. This research analyses the path to recovery for the industry against the backdrop of a changing socio-economic environment and identifies possible options for hoteliers to respond to and address these changes. To help players adapt to the imminent transformation in this industry, this paper also investigates several prominent features in the post-pandemic tourism environment.

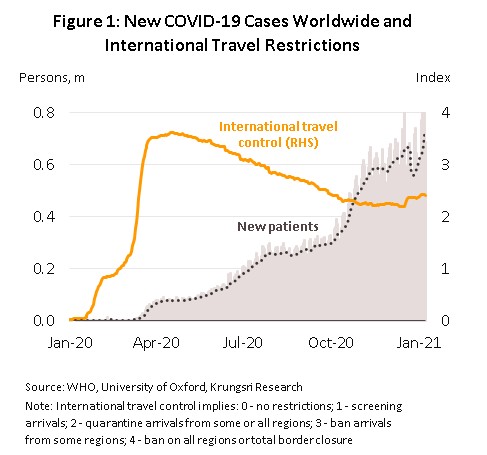

The pandemic continues to have extremely severe impact on the community and economy. Overcoming these problems will also be an extended process because of the following: (i) uncertainty over the efficacy of vaccines and issues with manufacturing and distribution on a global scale; (ii) although vaccination programs are underway in many countries, WHO projects herd immunity will require 65-70% of the population to be vaccinated; this will require both time and considerable expenditure; and (iii) a slow recovery in confidence among travelers even when the pandemic ends; a University of California survey claims fears of contracting COVID-19 will persist for at least 3-6 months after the pandemic ends and continue to deter leisure travel. In addition, tourism is normally considered a luxury; the job and income losses triggered by the pandemic would severely reduce travel demand.

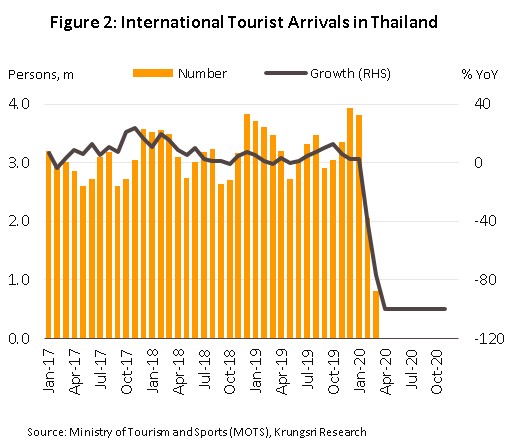

Like many other countries, the Thai tourism industry has been devastated by the COVID-19 pandemic. Following the declaration of a state of emergency on 25 March 2020 and the temporary closure of Thai borders to inbound tourists (from 3 April to 30 September) there was zero foreign arrivals in Thailand. In October, the situation improved slightly when the government introduced the Special Tourist Visa (STV) which allows foreign tourists to enter the country, subject to strict conditions that include a 14-day quarantine on arrival, testing for COVID-19 before and after arrival, and proof of valid health insurance cover. But overall, in the first 11 months of 2020, tourist arrivals plunged 81.4% YoY, led by tourists from China (-87.7% YoY) and India (-85.5% YoY). Krungsri Research estimates that the tourism sector lost about THB1.5trn in foreign tourist receipts in 2020, based on THB1.9trn total receipts in 2019.

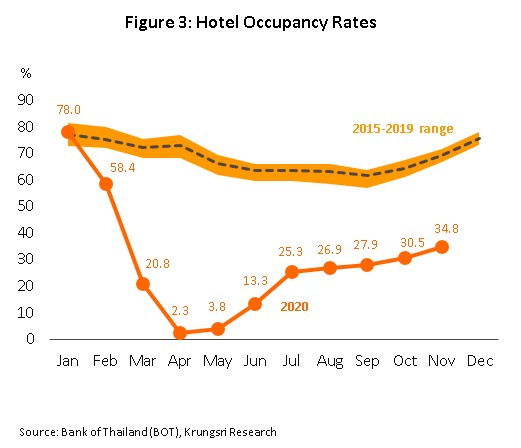

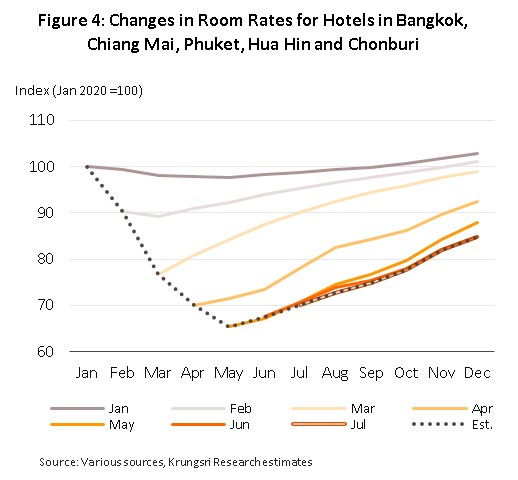

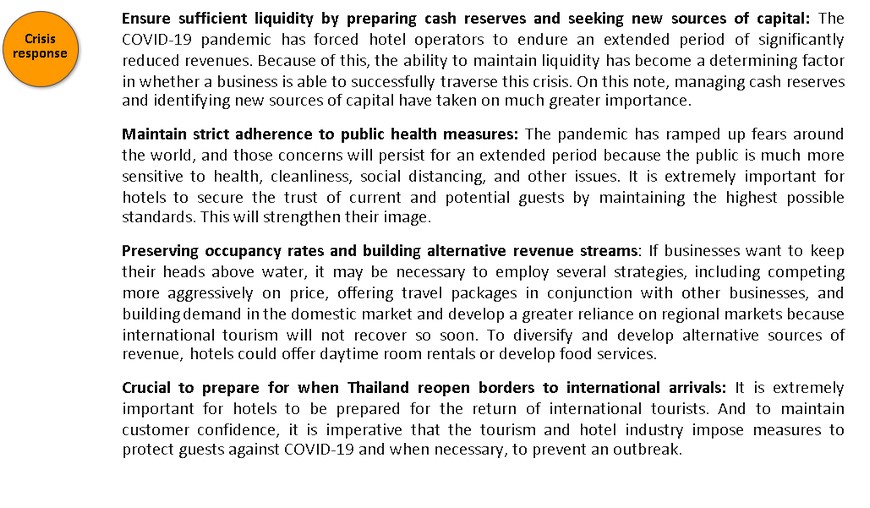

Hoteliers are facing unprecedented disruption. From January to November 2020, average occupancy rate slumped to 29.3% from 69.7% in the same period in 2019. Average revenue per room across the country fell 73.6%.

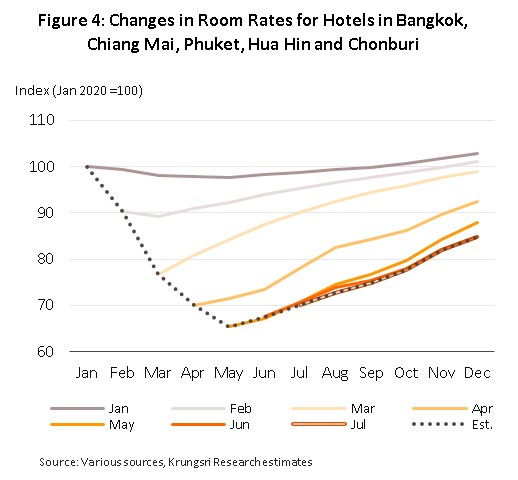

Operators have adopted a variety of responses to address these challenges. That included slashing room rates, overhauling the kinds of services they offer, placing greater emphasis on domestic tourists and cutting overheads. They are also trying to build alternative revenue streams, for example, offering attractive ‘work-from-hotel’ packages to tap on the work-from-home policy, and working with online delivery services to get revenues for on-site restaurants, though this is largely only an option for 4- or 5-star hotels. Many hotels in the Bangkok Metropolitan Region – some of which have cooperated with clinics and hospitals – have also tapped on the quarantine requirement to offer ‘alternative state quarantine’ (ASQ) facilities. Some hotels in the other 9 provinces – Phuket, Suratthani (Kho Samui), Chonburi (Pattaya), Prachinburi, Buriram, Mukdahan, Chiang Mai, Phang Nga and Chiang Rai – have also been able to generate revenues from offering ‘alternative local state quarantine’ (ALSQ) facilities (information correct as of 8 January 2021). But unfortunately, most small and medium-size hotels have had to shutter their business, either temporarily or permanently.

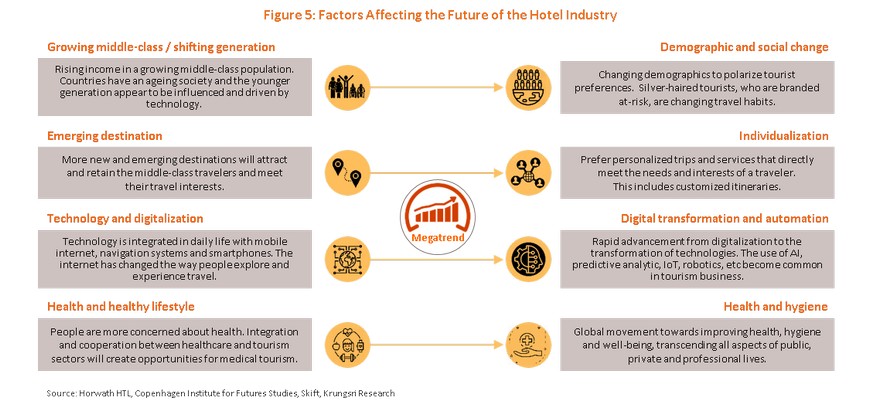

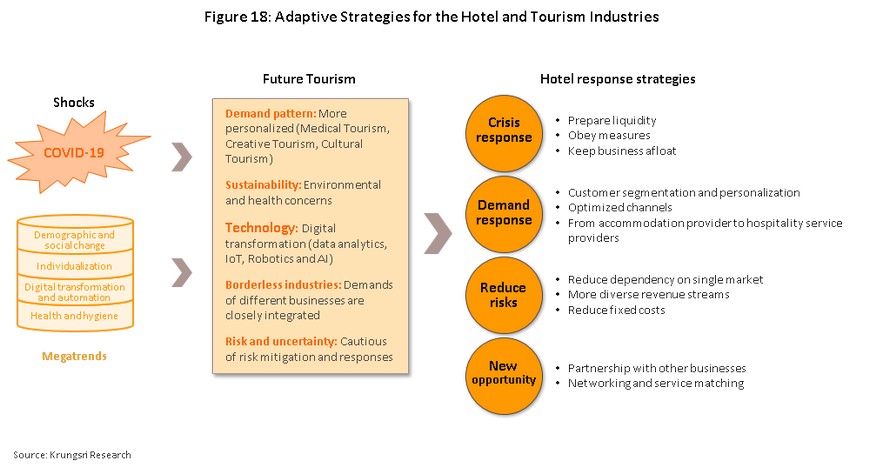

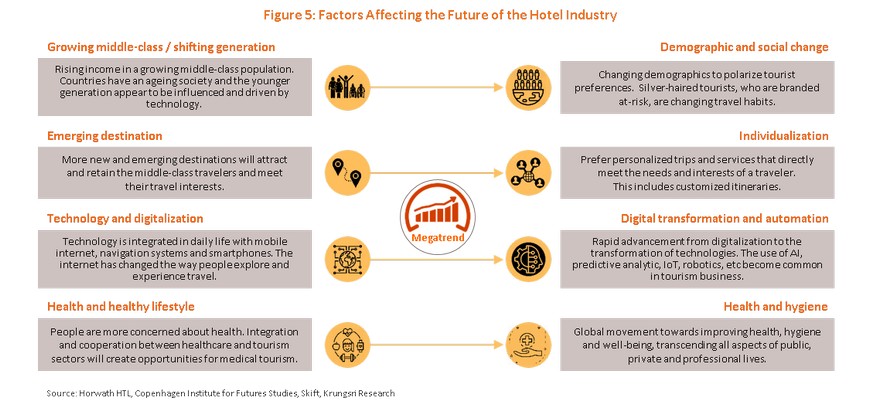

COVID-19 is causing a shift in how megatrends are impacting tourism

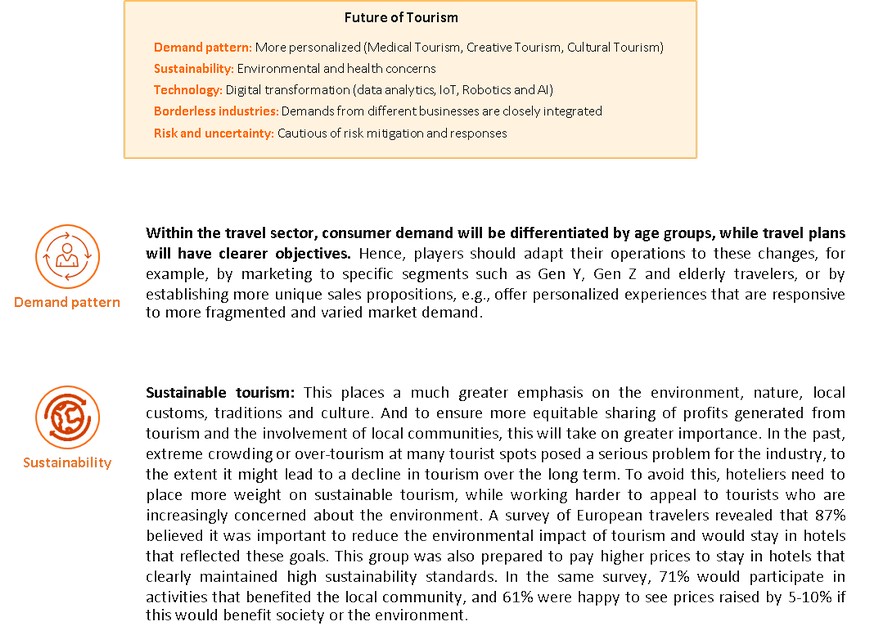

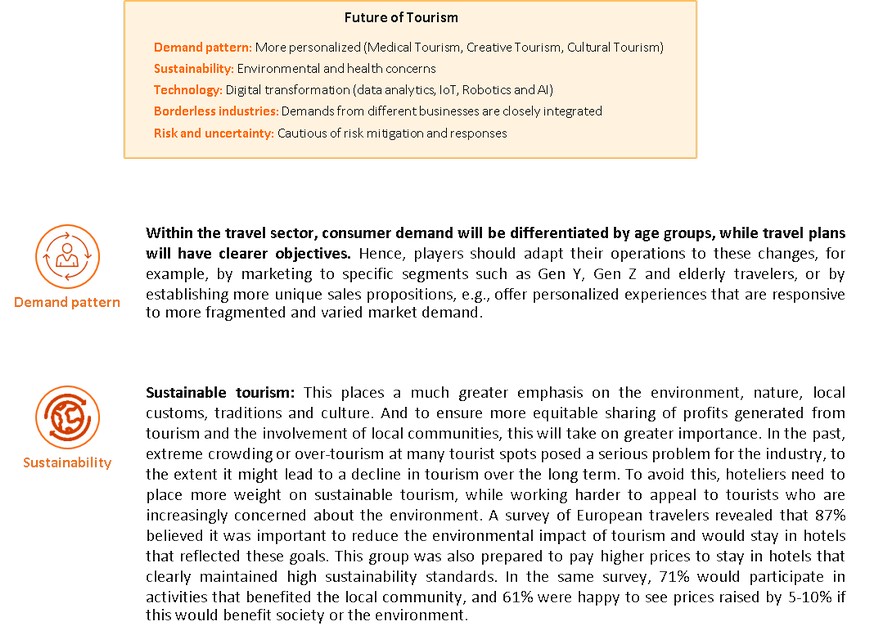

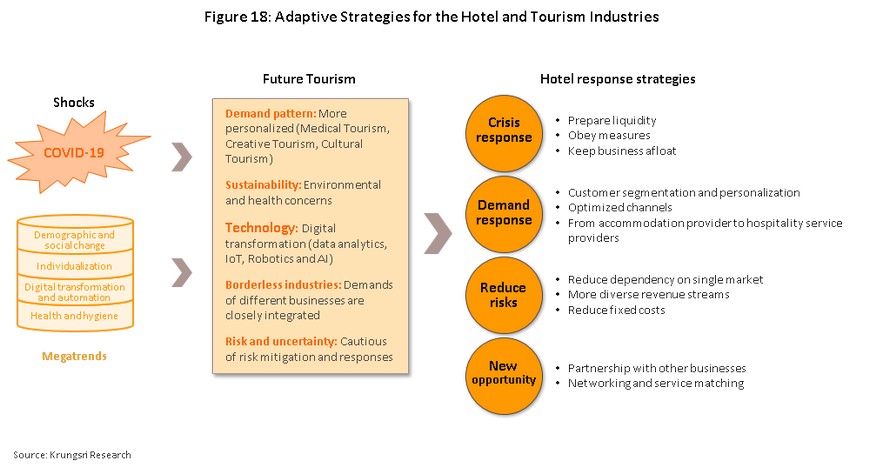

Over the recent past, the travel industry has been strongly influenced by the development of global megatrends that extend into changes in the realms of society, economics, politics, the environment and technology, but among the many effects of the COVID-19 pandemic has been its impact on just these megatrends. Prior to the outbreak, the tourism sector was deeply affected by megatrends including the growth in the middle-class population worldwide, the growing pressure for new tourist sites, the increasing impact of technology on the sector, and the rising profile of health-related tourism, but COVID-19 has reshuffled this deck such that in some cases, the likely impacts have been accelerated, while in others, they have been slowed down. Krungsri Research has thus analyzed the factors that will most likely affect hoteliers in the near future and has identified the 4 most prominent aspects: (i) demographic and social change; (ii) individualization; (iii) digital transformation and automation; and (iv) health and hygiene.

I. Demographic and social changes

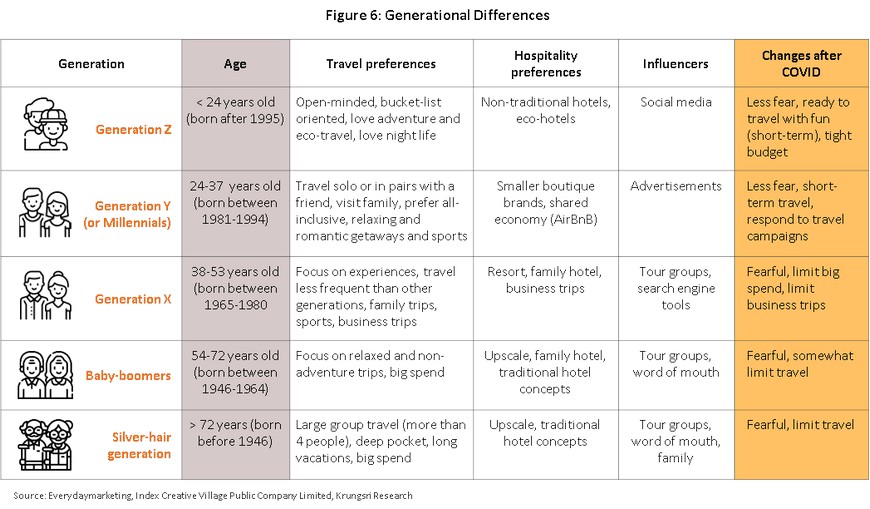

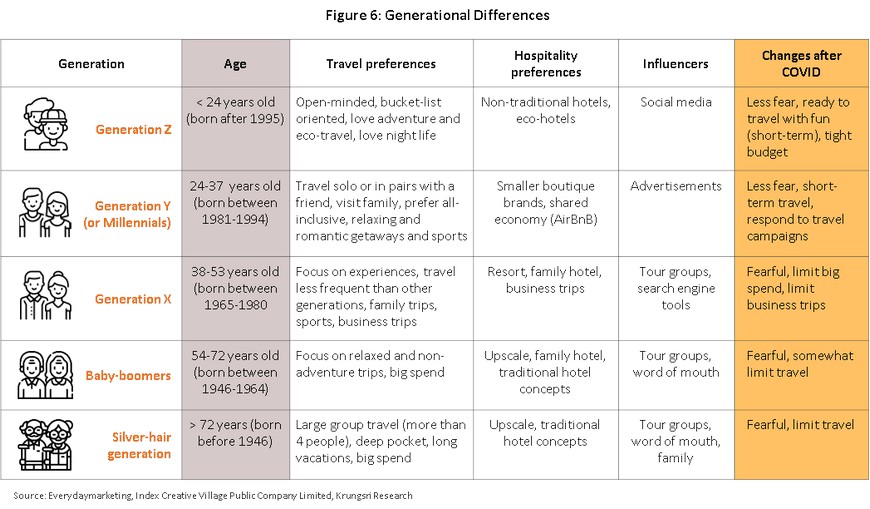

For many years, the most significant demographic or social megatrend was the strong growth of the global middle-class population, especially how this was taking shape in emerging markets. It was assumed this would be the major driver of future growth of the tourism industry. However, this assumption has been upended by the COVID-19 pandemic. And with the sudden rise in unemployment and lost incomes (source: World Bank), the importance of this segment has dropped substantially. We need to conduct a fundamental review of the industry’s future growth drivers. Before the pandemic, it was believed growth would come from a broad-based approach. But now, a targeted approach seems more appropriate, tailored to the demands and behavior of different age groups.

- Gen Y and Gen Z groups: These individuals are comfortable with modern technology and tend to use it to make travel easier and more convenient. They also like adventure tourism and often seek experience-based travel. Gen Y and Gen Z tourists may travel alone, in pairs or in small groups. Although they might also worry about contracting COVID-19, they will likely be the first groups to resume travel. However, this could be tempered by their often-limited budgets and their hotel stays are relatively short.

- Gen X: These travelers seek impressive new experiences on their holidays. They may travel with their families, go on sporting holidays or travel for business. But even when the COVID-19 pandemic ends, the economic impact of the crisis will continue to affect this group, and they will be cautious of spending on leisure. Gen X travelers likely have families to consider, and many might also carry the responsibility of looking after aged parents, so they will be more wary of traveling than Gen Z or Gen Y tourists. Overall, Gen X travelers are expected to spend lightly on travel and tourism, and to travel mostly during holidays and to nearer destinations.

- Baby-boomers’ and ‘silver hair’ travelers: These were considered the high-potential, high-spending group before the crisis, because they tend to have higher purchasing power and can travel for longer periods. But following the pandemic, this group is much more hesitant to travel for leisure because data show the elderly are a high-risk group; they form a large percentage of COVID-19 fatalities and cases with severe symptoms. On this note, hoteliers need to develop new strategies to appeal to this group by building confidence in health and safety standards at their premises.

II. Individualization

The tourism sector has hitherto been focusing on developing new and emerging destinations[1] that appeal to tourists, regardless of age. But the COVID-19 crisis has exposed and deepened differences in needs and behaviors between the age groups. And, developing new tourist attractions is resource-intensive in time and capital, both human and financial. Following the pandemic crisis, this might no longer be an appropriate strategy. Instead, operators need to carefully analyze the varied consumer needs in the market. This will place operators in a better position to respond to the group-specific needs, including individual travel plans, preferred activities, and/or budget. To do this, players can now exploit recent technological advances that make collecting and analyzing data much easier and more efficient. Hoteliers will be able to develop and offer more customized services, for example, by building awareness through public relations and marketing activities targeted at specific groups and attracting tourists who would benefit from government measures to stimulate domestic tourism.

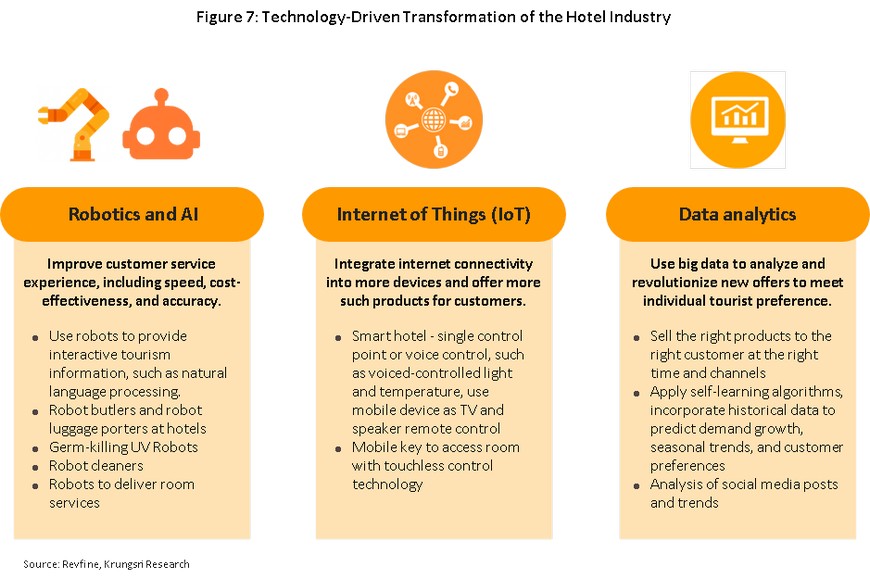

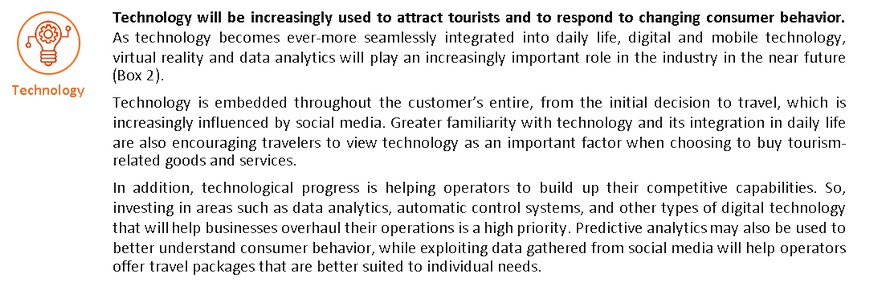

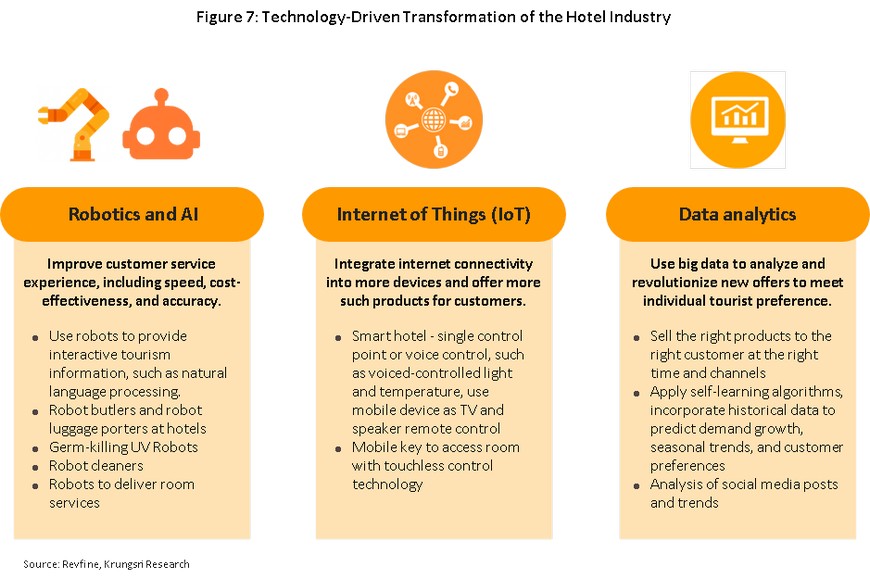

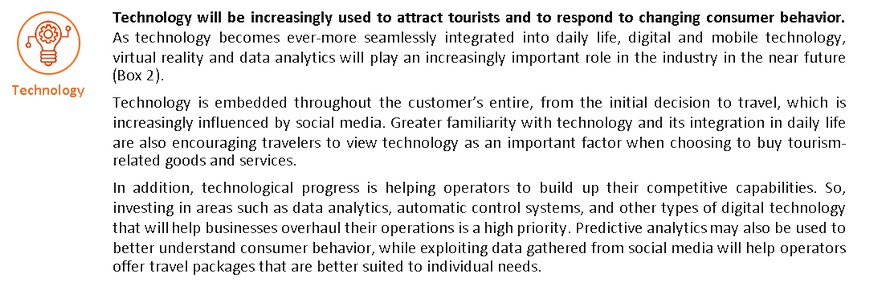

III. Digital transformation and automation

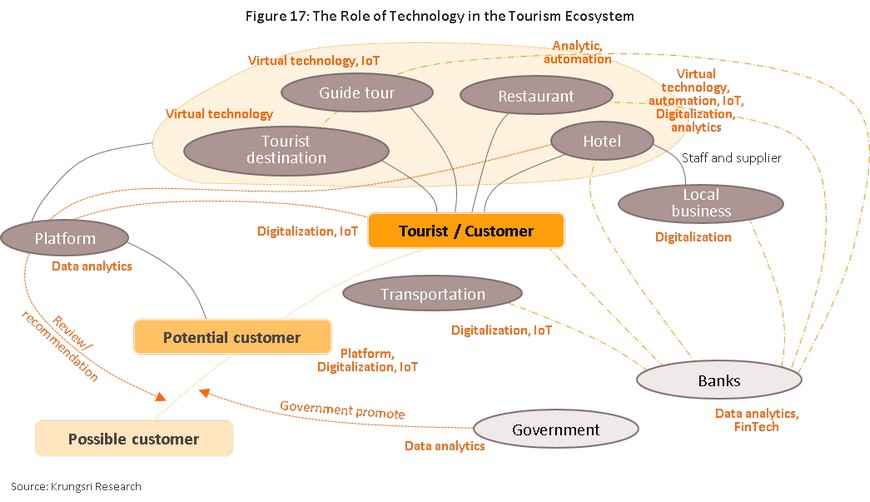

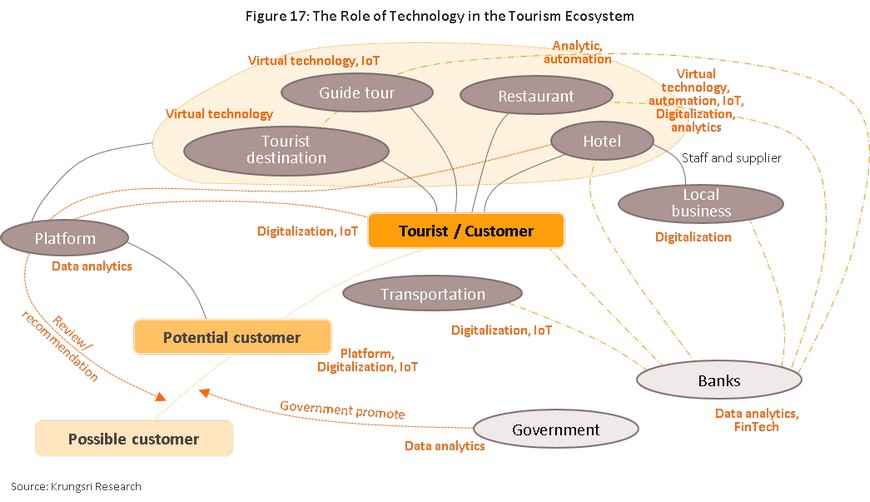

Technology is playing an increasing role in daily life, whether in communication, education or consumption. Hoteliers have been benefiting from this by expanding technology applications in tourism operations, for example, to make online bookings and payments. Technology also has an important role to play in supporting marketing efforts, from creating interest in and demand for hotel services, to making hotel stays more convenient and comfortable, organizing and collecting customer assessments of services, and encouraging return visits. And, with social distancing and reduced physical contact being the new normal, hotels and other players in the travel sector can be expected to make greater use of technology to build confidence in their services and to remain competitive. New technology is also finding a role in developing complicated tourism value chains that involve complex linkages between players active in a wide range of areas, including hotels, guides, transport companies, restaurants, retailers, suppliers of raw materials, and local businesses. Technology provides a way for this disparate group to connect on different platforms and to generate new business by responding to diverse and varied consumer needs.

Examples of how technology may be used to overhaul hotel operations.

- Robotics and AI: These are already being applied at reception, check-in, to translate travel information in several languages, to move luggage to/from guest rooms, to provide in-room services, and to disinfect rooms with UV and other types of robotic equipment. In addition, computers are getting better at mimicking human interaction and can soon be deployed in applications that demand speed, accuracy, skill and efficiency.

- Internet of Things (IoT): This may be deployed to make stays more pleasant and to meet the challenges of social distancing measures. It will also allow travelers to enjoy the experience of staying in ‘smart’ hotel rooms, for example, allowing guests to control electronic devices in the room (e.g. lighting, heating/cooling, and television and music services) through a central control unit or voice-activation, or the guest’s mobile devices.

- Data analytics: This involves the systematic analysis of big data resources to design goods and services that better meet the individual needs of travelers and guests, for example, by suggesting packages that closely match their needs and requirements. Data analytics is also used to analyze historical data to predict demand growth, seasonal variations, and tourist preferences, and to analyze data mined from social media to identify market trends and changing consumer interests.

IV. The primacy of health and hygiene

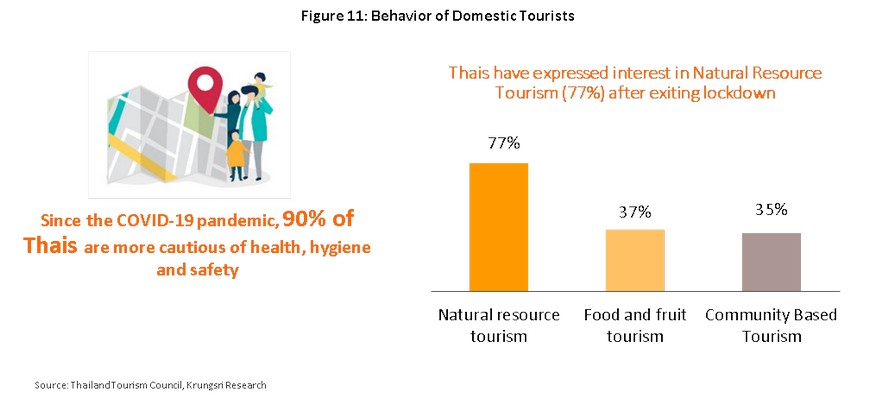

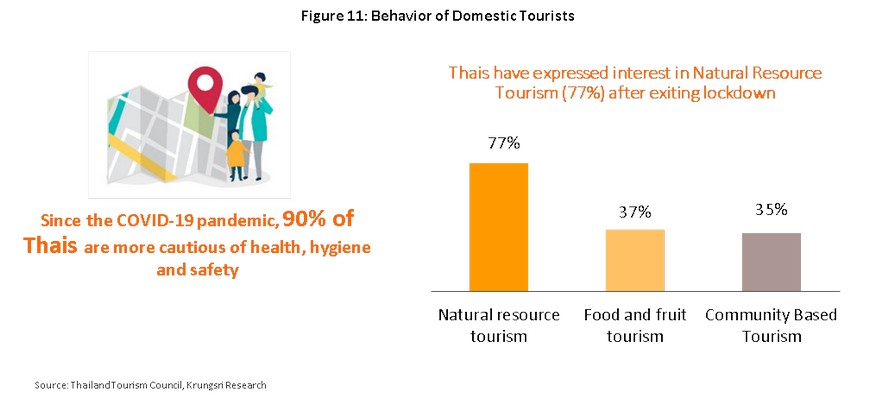

In the future, health and hygiene will be much more important within the tourism and hotel industry. Indeed, there was already a significant uptick in interest in personal health and wellness several years before the pandemic. This was reflected in the growing trend for health and sports tourism (e.g., bicycle tours, marathons) and the rising number of people who exercise regularly. However, when the COVID-19 crisis ends, tourists will likely show greater interest in hygiene and public-health standards in travel destinations, including accommodation facilities. At the same time, to avoid enclosed, cramped or crowded places, outdoor activities are likely to become more popular. So, operators will need to work with local communities to develop the local area and to keep it safe and clean and reduce risk of infection.

The 4Bs – Paths to recovery for the Thai tourism and hotel industry

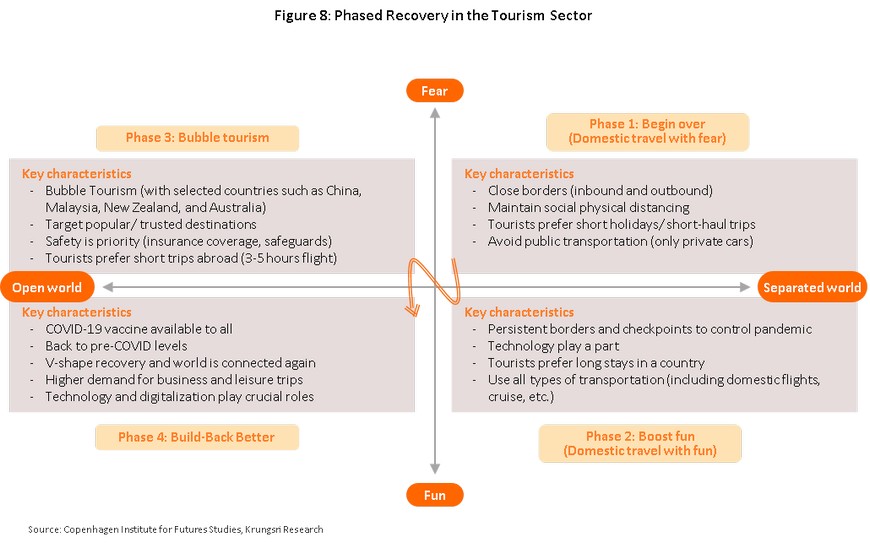

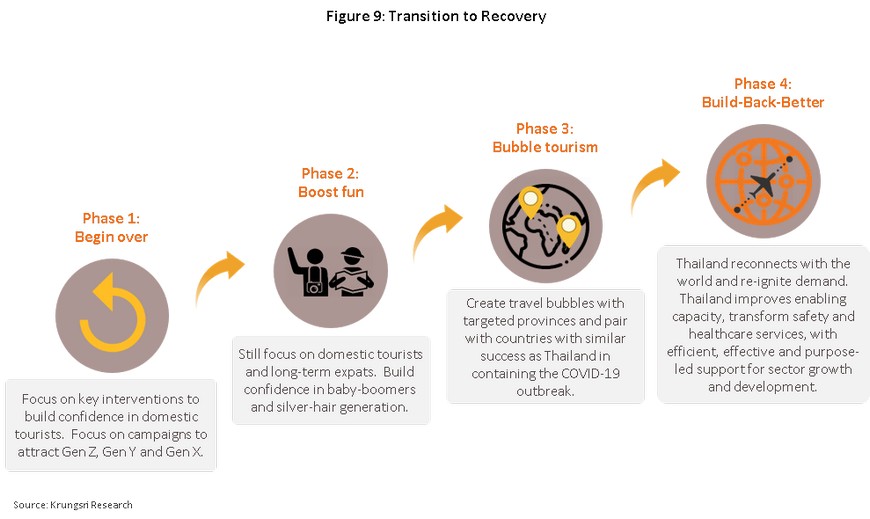

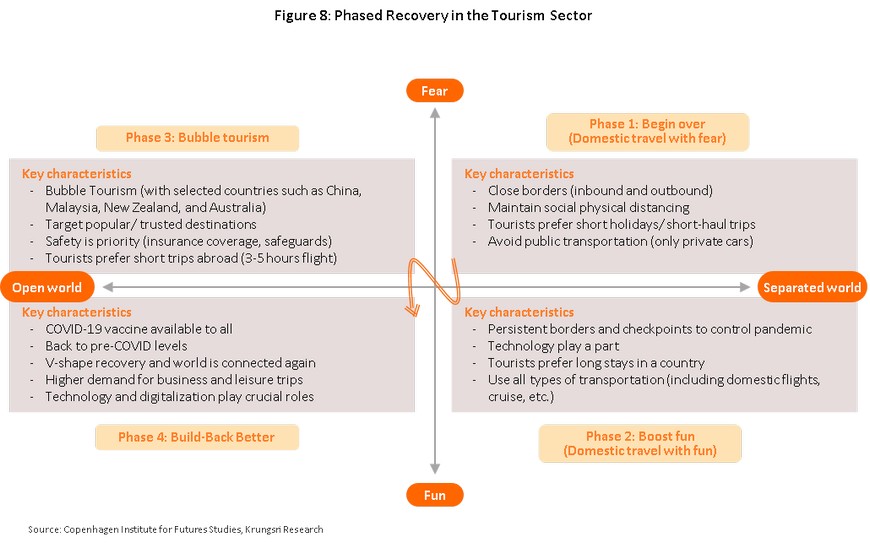

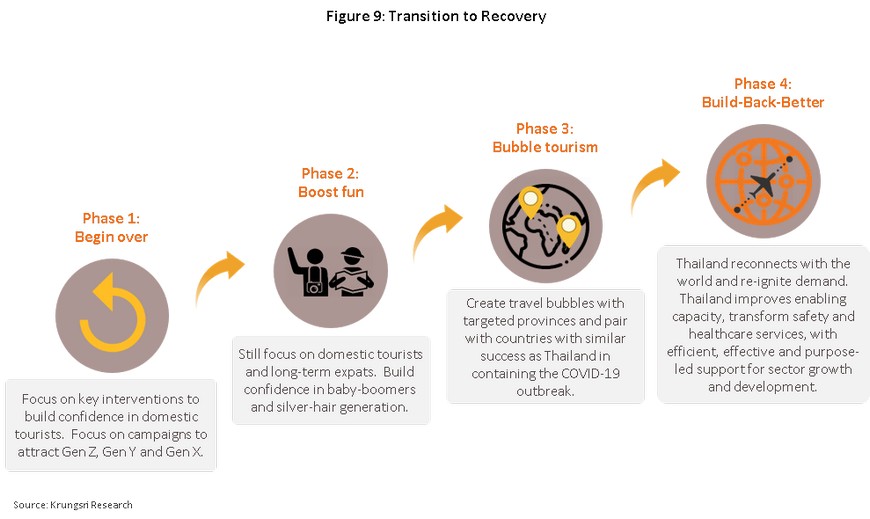

Against a worsening COVID-19 situation worldwide, Krungsri Research analyzed the paths to recovery for the Thai tourism sector and how hoteliers might adjust themselves to this. The analysis is based on two principal factors, the degree of travel mobility (i.e., extent of entry restrictions on foreign tourists) and the level of fear of contracting COVID-19. The results are summarized in Figure 8. On this, the horizontal axis represents travel mobility, with the left side indicating an ‘Open world’ and the right a ‘Separated world’. The vertical axis represents the degree of fear of travel – it is high above the horizontal axis (‘Fear’) and low below it (‘Fun’). Hence, the recovery matrix is split into 4 phases.

Phase 1: Travel to Thailand … begin over

The first phase of the path to recovery would be marked by continuing and widespread fears of contracting COVID-19, which would deter many people. At the same time, international travel is still restricted, and the domestic population has to maintain strict social distancing. During this phase, tourism would be restricted to brief trips to nearby destinations, with travelers preferring to drive (rather than take public transportation) to areas that are relatively uncrowded.

During this phase, hoteliers should focus on maintaining high standards of hygiene, while attempting to stimulate demand in all parts of the domestic market, although, Gen Z and Gen Y travelers are generally less worried about COVID-19 than the other groups. However, hotels should also enforce social distancing rules as this would help to attract Gen X and baby boomer guests.

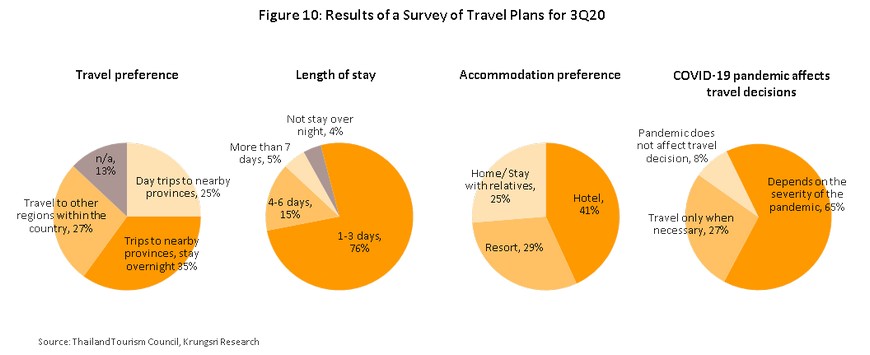

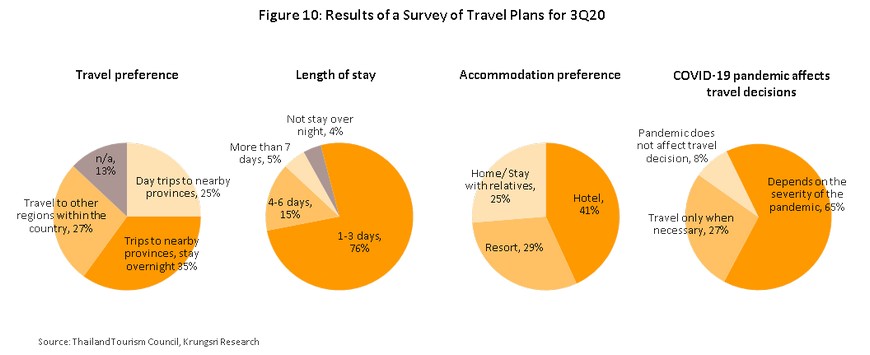

Most residents are prepared to travel within the country in the near future, but most would be short trips (2-3 days) to nearby destinations, according to a survey by the Tourism Council of Thailand (TCT) carried out from 10 to 25 May 2020. The respondents, comprising 400 Thai nationals who earn more than THB10,000/month, were asked about their travel plans for the 3rd quarter of last year. 64% of respondents plan to travel, with 35% of these planning to take a multi-day trip to a nearby province, 27% plan to go to another region, and 25% would make a day trip to a nearby province. Among those who planned to travel for more than one day, 76% intended to stay for 1-3 days, 15% for 4-6 days, and 5% for a week or longer. On accommodation choices, 41% planned to stay in a hotel, 29% in a resort, and 25% in their own or a relative’s home. Thus, although this survey was carried out some time ago, it shows that even when the lockdown and COVID-19 fears were most intense, a large proportion of respondents remained positive and still had plans to travel in the near future. Given this, it is reasonable to assume the latest wave of COVID-19 cases will have temporary and limited impact on the tourism sector and could recover in the 2nd quarter of this year.

Actions required at phase 1 of the recovery:

- Build confidence in the provision of public health (Amazing Thailand Safety & Health Administration, SHA) and raise the safety standards for tourists to assure them that they are visiting an area that is free from the risk of infection with COVID-19.

- Use pricing strategies to attract Gen Z, Gen Y and Gen X visitors and entice them to extend their stays to 4-5 days.

- Adjust services to reduce the risk of physical contact, for example by providing online check-in services and by making sure that cashless payment systems are available.

- Work with the local community to produce a plan for the recovery of local tourism and natural resources, develop a plan for local community tourism[2] , and create a bookings or reservations plan so that local tourist attractions do not become overwhelmed by huge numbers of tourists arriving simultaneously.

Phase 2: Strengthening Thai tourism … boost fun

At this stage, international borders remain largely closed to reduce imported COVID-19 cases. But, domestic travelers’ fears are starting to abate and this could prompt tourism operators to offer a wider range of activities to attract to a wider group of travelers, including those from further away. Domestic travel would include longer distances and longer stays, and more tourists would be willing to travel on public conveyances such as plane or boat, in addition to private vehicles.

Krungsri Research suggests that during Phase 2, industry players should try to attract more tourists, and possibly returning to pre-COVID levels. The most important target groups will be the baby-boomer and silver hair groups because they have relatively higher purchasing power and can travel for longer periods. A research by Dusit Thani College into the travel behavior of elderly travelers shows that most travel to rest and recuperate, often travel with their families, and enjoy cultural, healthy and relaxing holidays. The research also revealed older tourists take longer to make purchasing decisions when it comes to travel services, because they are more concerned about getting value for money and high quality and safe services.

Another path to recovery may be through the development of ‘creative tourism’. This is an extension of cultural tourism but emphasizes learning about arts and culture through direct experience and interaction with a local community and their daily life, as expressed in the local identity. Two successful examples of this kind of creative tourism are: (i) Ban Rai Kong Khing in Chiang Mai, where visitors can stay in high-quality homestays or home-lodges, make organic products, try famous local dishes, and receive blessings through a performance of the khan dok dance; and (ii) the Buddhist Votive Tablets Learning Center in Sukhothai, where visitors can learn about Thai Buddhism material culture, participate in artistic, handicraft and weaving activities, learn the local dance, and also how to make celadon ceramics and Buddhist votive tablets. Interesting cultural and local-community-centric tourist sites such as these are dotted across the country. And so, to benefit the local communities and extend tourism receipts throughout the length of the industry’s value chain, players might need to develop creative local tourism projects with the cooperation of all stakeholders.

Actions required during Phase 2 recovery:

- Increase domestic tourists’ confidence, especially among silver hair travelers who are typically more worried about contracting COVID-19.

- Use data analytics technology to better understand the particular needs of tourists in each segment of the market.

- Work with local communities to develop local tourist attractions, including e.g., famous local temples and restaurants. This will help provinces build their own unique attractions.

- Because foreign arrivals will remain extremely low at this stage, it may be necessary to continue to cut costs.

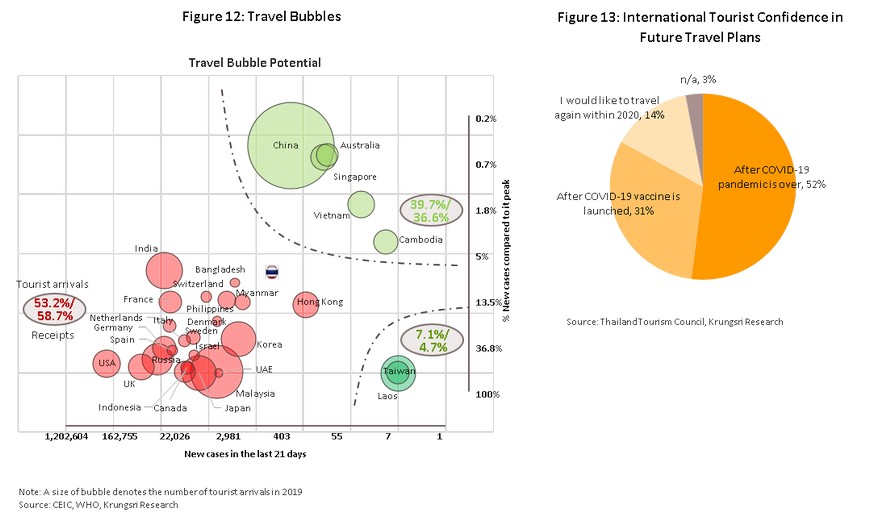

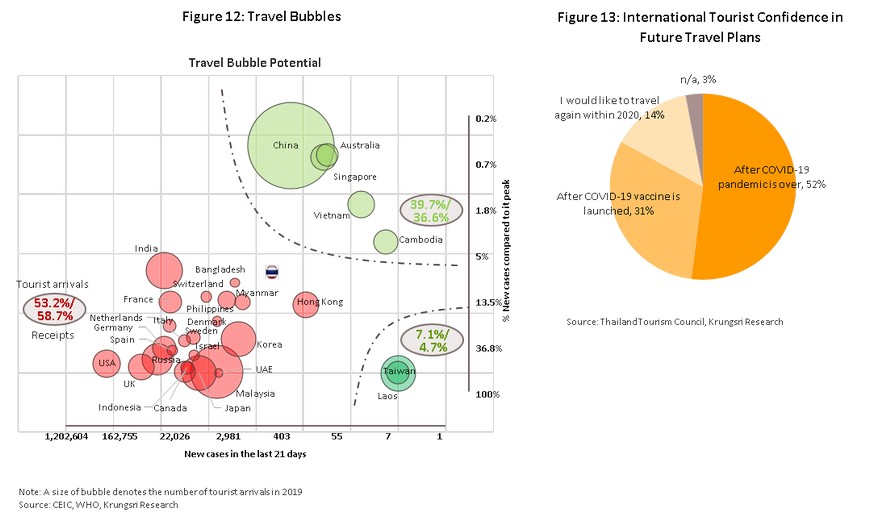

Phase 3: Pairing up ... bubble tourism

During Phase 3, countries would start to reopen borders to international arrivals but there would still be fears of contracting COVID-19, and local communities would still worry about the arrival of outsiders. Because of this, travel may be restricted to ‘bubble tourism’ with bilateral agreements to allow free travel (e.g., travelers from participating nations would be exempt from quarantine rules). Thailand might agree to open its borders to visitors from low-risk countries where domestic transmission is contained, and from countries which were once Thailand’s major source of inbound tourism such as China, Singapore, Vietnam and Australia (Figure 12). During Phase 3, it would be necessary for the government to maintain high safety and hygiene standards, including working with insurers or issuing clear policies to prevent the emergence of new clusters of COVID-19 infections.

Foreign tourists will be increasingly confident about overseas travel during this phase but they will continue to exercise a degree of caution. A survey of 200 foreign tourists by the TCT over 1-20 May 2020 revealed that 52% of respondents planned to travel again when the COVID-19 pandemic ends and 31% when vaccines were available (Figure 13). Research by figgy.com and Ctrip (China’s leading online travel website and the 2nd biggest in the world) also revealed that when the crisis passes, the most popular overseas destinations for Chinese travelers would be Thailand, followed by Japan and Singapore (as of May 2020).

Krungsri Research expects Thailand to establish travel bubbles with several countries this year. However, to keep risks contained, Thailand may restrict leisure travel to domestic destinations that are highly dependent on foreign tourism, for example Phuket and Surat Thani (for onward travel to Kho Samui). The travel bubbles may not attract pre-pandemic tourist numbers but would be an important milestone in paving the way towards full reopening in the coming period.

Actions required during Phase 3 of the recovery:

- Continue to build and maintain confidence in public health and hygiene standards and Thailand’s ability to manage COVID-19 risks (recognized as exemplary by the WHO). Emphasize that many operations have been awarded the Safety and Health Administration stamp of approval, which assesses hotels’ health and safety standards for tourists.

- Establish tourism clusters or pilot provinces as models to find the best way to restart the inbound tourism industry. These should be areas whose revenue is heavily dependent on foreign tourism and, to make management easier, that are somewhat self-contained (e.g., Phuket and Kho Samui).

Phase 4: Recovery … build-back-better

Phase 4 represents the return to normality for the tourism sector. By this point, the country would be fully reopening to international arrivals, travelers would be able to travel freely, and there would be less fears of contracting COVID-19 following worldwide immunization programs. Air traffic would return to normal, as will the number of arrivals and popular activities, whether traveling for pleasure, business, or attending international conferences and trade shows. It is still unclear when we would reach this stage of the recovery. If Phase 3 is successful and most countries reopen international borders, this would mean recovery is underway. Thai hotels and other businesses linked to the tourism industry should work to enhance their capacities and competitiveness by developing their strengths and overcoming their weaknesses (see Box 1 for details). This would help players to prepare for a future that will be shaped by 5 principal factors, as described below.

Box 1: Potential of the Thai Tourism Sector

Thailand benefits substantially from the strong competitiveness of its tourism sector. The Travel & Tourism Competitiveness Index, published by the World Economic Forum (WEF), placed Thailand 31st place in 2019 out of 139 countries, a slight improvement from its 2017 ranking at 34th place. On the positive side, Thailand has a strong natural resource base, its tourism infrastructure is well-developed, and costs are relatively low. But on the negative side are concerns about safety, hygiene and the environment (Figure 14).

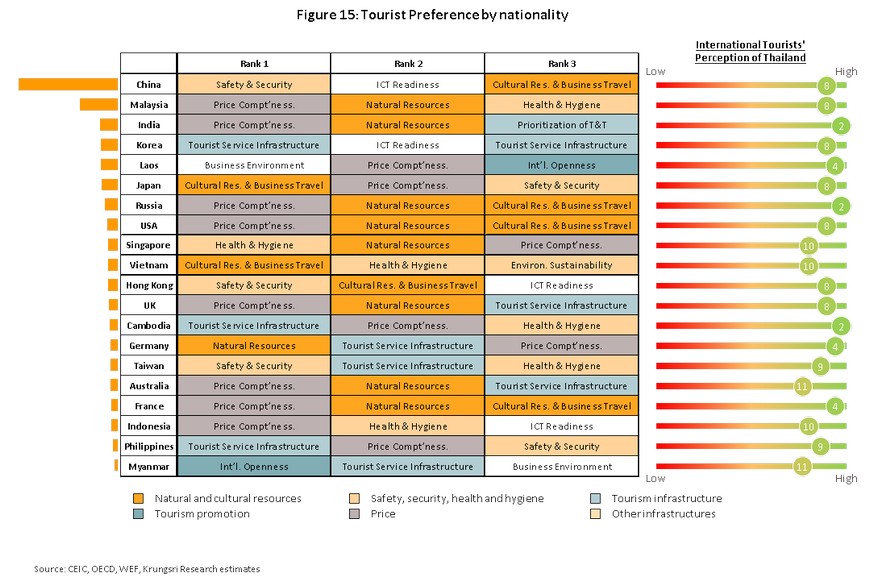

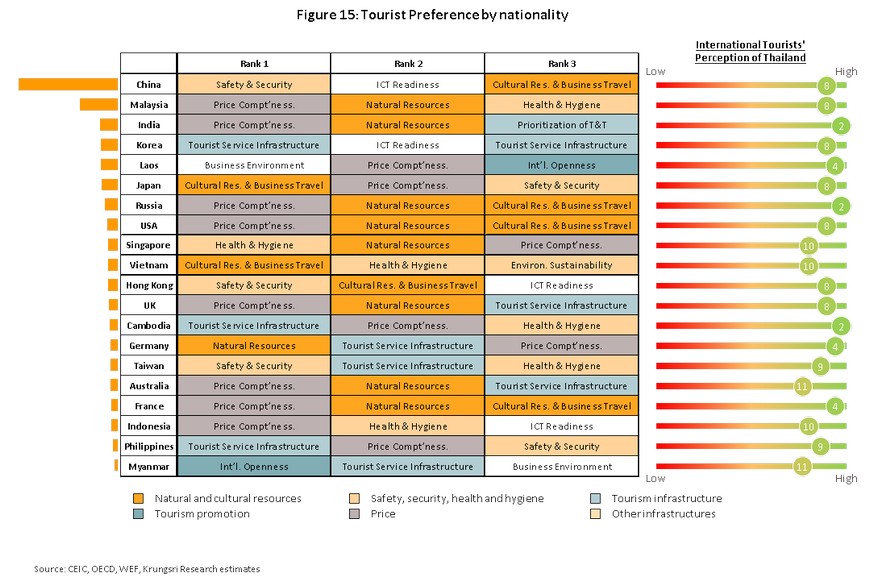

Krungsri Research used a gravity model to analyze the travel preferences of respondents from 48 countries. It shows Thailand is one of the top 10 destinations for residents of most countries (Figure 15). For travelers from India, Russia and Cambodia, Thailand was in 2nd place, while for China and Malaysia, the nation was in 8th place. This shows strong potential for the inbound tourism sector when the COVID-19 crisis is contained.

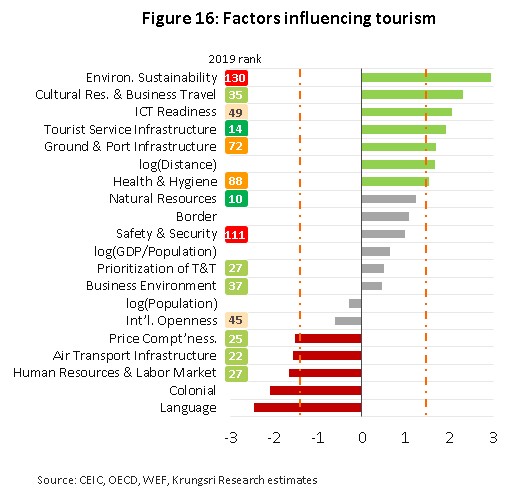

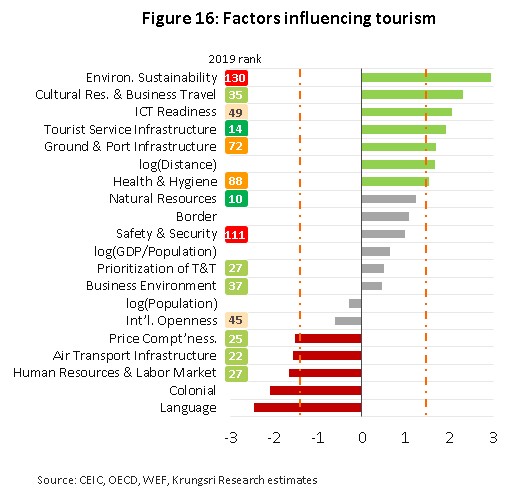

The same model also shows factors related to access to cultural and tourist attractions, the environment, and pricing are the most important determinants of travel decisions. Considerations related to travel infrastructure were the least important.

Looking at the top 20 countries that supply the largest number of visitors to Thailand, the 3 most important factors that influence decisions to holiday in Thailand are price, safety and the presence of natural or cultural tourist attractions. For Chinese travelers, safety is the most important consideration, followed by level of ICT development, and access to cultural tourism sites. For visitors from Malaysia, India, Russia, the US and the UK, price is the most important factor.

Despite these advantages, Thailand is likely to experience greater competition in the coming period because many countries are stimulating economic growth by investing in national infrastructure and promoting and expanding their tourism sectors. This is especially true for countries that are beginning to slowly reopen the door to tourism, and that are relatively new arrivals on the world tourism stage, such as Vietnam which benefits from its novelty, readily available tourist resources, climate and topography that are similar to Thailand’s, and government plans to invest in expanding the national transport network. Some countries are also beneficiaries of foreign investment (especially from China) that is directed to ensure rapid development of infrastructure.

Crowding at tourist sites could be a serious problem for the Thai tourism industry in the future. This has been an issue for some time now, especially during long holidays, when many major tourist areas were packed with Thai and foreign tourists. It can get worse if new attractions are heavily publicized but are not sufficiently developed to accommodate future growth in tourist numbers, or they may simply be badly managed. Over-crowding at tourist attractions is a major problem in the major tourist areas of Pattaya, Phuket, Hua Hin and Chiang Mai; it has reached a level that is reducing their appeal. As a result, foreign tourists are increasingly looking for new travel destinations that offer similar attractions to those found in Thailand, and they are finding these in other parts of ASEAN region, including Vietnam, Myanmar and the Philippines.

Long-distance travel to other regions would decline, while domestic and intra-regional travel will increase in popularity given greater uncertainty over the outlook for the world economy and fears of contracting COVID-19. The switch from long-haul travel to domestic and regional trips is also being driven by tighter budgets and measures by many countries to boost domestic tourism to replace lost international markets, which future remains unclear. These changes are in line with a report by the World Tourism Organization (UNWTO) which suggests slow growth of international tourism in the coming period, especially the long-haul segment.

Issues related to the environment, access to cultural tourist attractions, and the state of ICT infrastructure, are increasingly important factors in determining travel decisions. The important determinants also include the quality of tourism infrastructure, land transport network, and public healthcare services. However, air transport and costs have relatively small influence (Figure 16).

Changing demands in the tourism market can seriously undermine the competitiveness of the Thai tourism sector. Looking ahead, Thailand’s conventional selling points, i.e., human resource, domestic air transport network, and low prices, will be less important to travelers. However, environmental issues, where Thailand scores badly, are becoming more important factors in influencing market direction. Beyond this, many countries also have ambitious plans to develop domestic infrastructure that will also serve their tourism sector, are keen to develop national tourist attractions, and are increasingly opening their borders to foreigners. This is particularly the case for Thailand’s neighbors; and because they are new, relatively unexplored and cheap, they will slowly erode Thailand’s position as a preferred travel destination.

Although Thailand is competitive in international tourism currently, its lead in the region is narrowing. This will change views on these countries, and with that, Thailand’s position in the international market. Thailand will change from welcoming foreign arrivals to both receiving arrivals and moving them on to other destinations in the region. This will not just reduce price competition within countries but will also help to lift the competitiveness of other countries and boost the range of tourism options. Factors that will determine how well countries would be able to co-operate will include visa policies and transport infrastructure that link these countries, including the Bangkok-Phnom Penh-Ho Chi Minh City and Phuket-Phang Nga-Ranong-Andaman Sea highways, and the Had Yai-Kuala Lumpur-Singapore railway.

Box 2: The Role of Technology in a Changing Tourism Sector

- Digital and mobile technology has made accessing news and information massively quicker and easier for consumers. Deloitte estimates that over 80% of the world’s population now has at least 1 smart phone, making this experience almost universal. Indeed, around 33% of consumers in developed economies and 50% in developing ones use their smart phone within 5 minutes of waking. Given this widespread adoption of smart devices into daily life, travelers will be among those now able to access information almost without restriction. Players in the tourism and hotel industries are also now able to benefit from marketing through social media or through a number of different types of application, including those used to book rooms (directly with the hotel or through an OTA), rent vehicles or view digital maps.

- Augmented and virtual reality technologies, which may mix artificial environments or objects with the real world through alterations to what a user sees, feels, hears or even smells, may have a future role to play in the tourism sector, for example, when deciding on a travel destination, making a virtual trip to a museum or acting as a tour guide. A clear example of this is Google street view, which allows users to view locations around the world or to lead tours.

- Data analytics will help increase operators’ abilities to respond to customer needs. By interrogating the huge and growing store of data that is available on tourists and on how and where they have traveled and stayed, players will be able to understand consumer needs more fully and so put themselves in a much better place to respond effectively, especially with regard to their ability to target offerings to narrow market segments. Gathering and successfully using the insights offered by data analytics will also have an important role to play in building brand differentiation and awareness.

Redesigning business strategies amid a changing landscape in the tourism sector

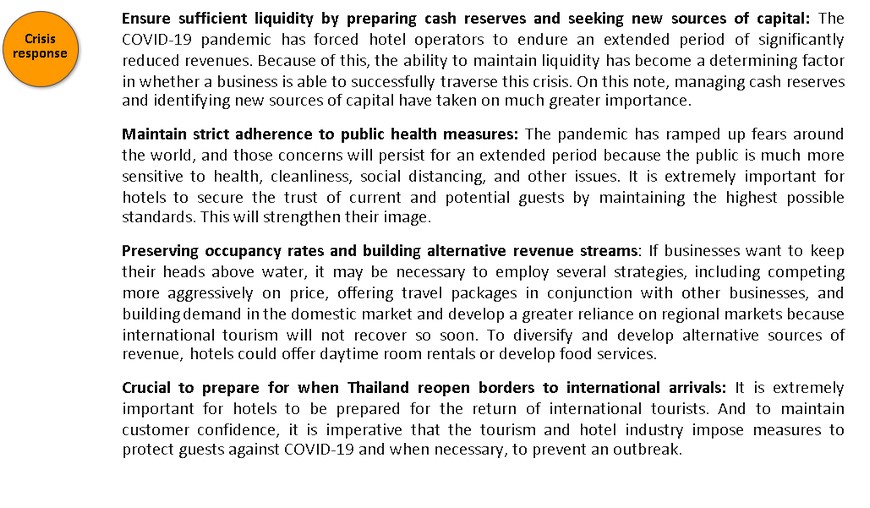

Krungsri Research sees sluggish conditions persisting in the tourism sector for the next 2-3 years, until recovery starts with the emergence of a ‘new normal’ for the industry. However, simply carrying on as before might not be sufficient to meet changing consumer demand. So, hoteliers and other players in the tourism sector need to thoroughly review their business strategies and operations if they want a more sustainable footing. This will include managing liquidity, meeting travelers’ needs more directly, managing risk, and looking for and exploiting new opportunities in related industries. The details are presented below.

Box 3: Policy Recommendations for the Industry

- Develop disease control measures and enforce health standards: Following the COVID-19 pandemic, travelers are more concerned about public health measures. So, getting recognized certification from accredited bodies will help to build confidence in travelers and hotel guests. To this end, marketing and public relations efforts should focus on informing domestic and international travelers about national measures to control the spread of communicable diseases. Operators should also ensure that all staff are aware of such measures and guidelines, practice them at all times.

- Players still need targeted measures to support the tourism industry: The industry will require government measures to support demand as long as borders remain closed to foreign tourists. Hence, Krungsri Research believes that the We Travel Together program (to encourage domestic travel) should be extended at least until the end of 2021. If the government does this, operators will have much better chance of staying afloat until the COVID-19 crisis ends. The government could also consider additional holidays to encourage greater domestic tourism.

- Ramp up competitiveness by reinforcing the industry’s strengths and addressing weaknesses: Given the competitiveness analysis (see Box 1), Krungsri Research suggests operators build on their strengths, especially access to natural resources, the state of ICT infrastructure, and educating local communities to raise the profile of second-tier cities as tourist destinations. They can develop new tourist attractions and help to overcome local problems (e.g., improve safety and public hygiene measures, and manage the environment and natural resources in a more sustainable manner). In the future, hoteliers will also need to offer a wider range of services to meet changing consumer demands; greater utilization of technology will be important in achieving this goal. Beyond this, operators need to cooperate more deeply with businesses in other industries, for example, by adapting hotels to serve as treatment centers, though this could require new funding and expertise. The government also has an important role to play in developing the foundations required for these changes to raise potential in the sector, by improving industrial capabilities, and creating opportunities for those working in the tourism sector to reskill and upskill.

[1] New tourist destinations include Buriram and Saraburi.

[2] Local community tourism (Nawatwithi in Thai) is tourism that helps to promote ‘local wisdom’ by encouraging tourists to develop an understanding of local ways of life and culture by learning about local livelihoods, food preparation techniques, etc. This differs from earlier attempts at community-based development, which focused on selling local produce in other areas.

[3] Fixed cost = employee’s wages, public utility expenses, and hotel management fee