COVID-19 crisis: the impact on businesses and choice of policy tools

- As the number of COVID-19 cases continue to rise, the global economy continues to suffer from social distancing and containment measures. The worst hit are tourism and related sectors. Thailand’s economy is projected to contract sharply in 2020 and would take more than three years to recover to pre-pandemic level. This will hit most industries and businesses through several channels in the near- and longer-term.

- Business Impact Assessments

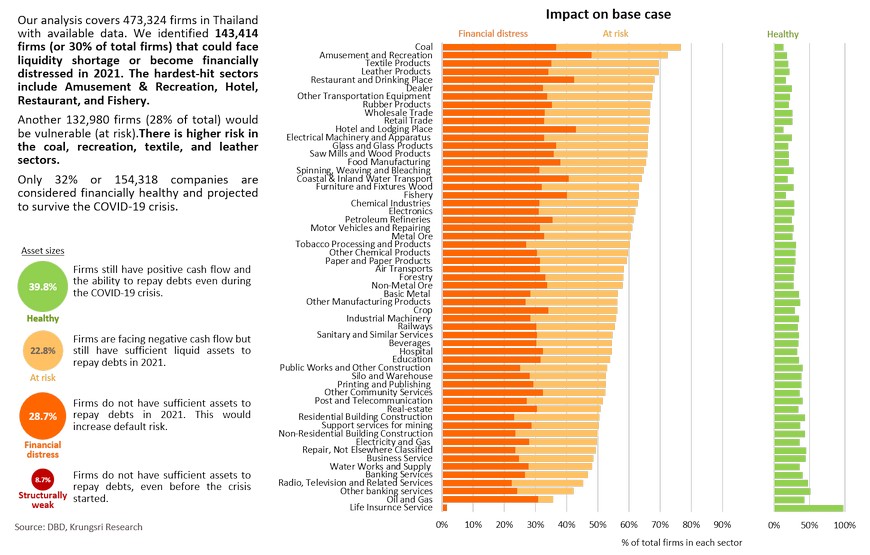

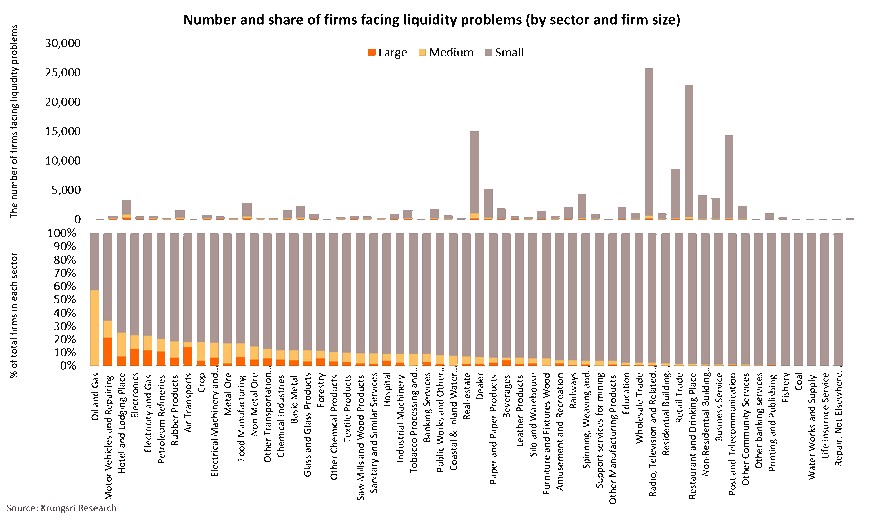

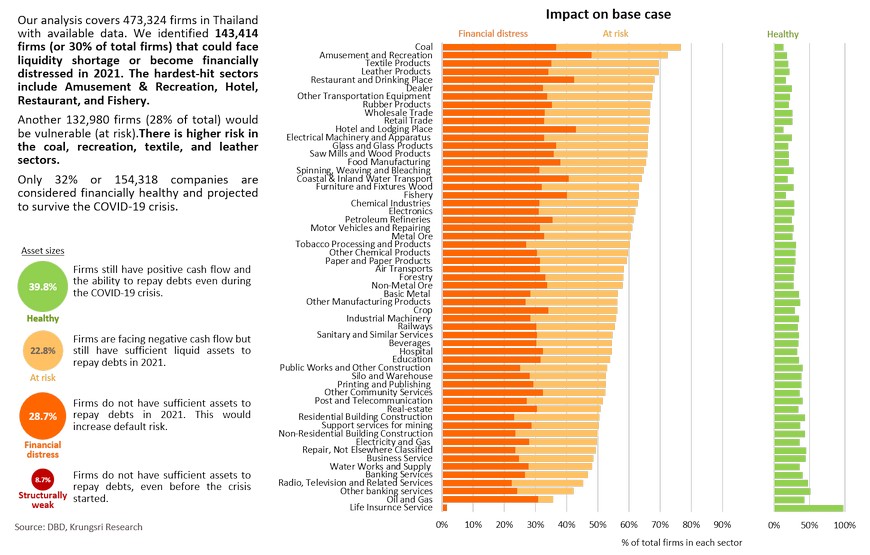

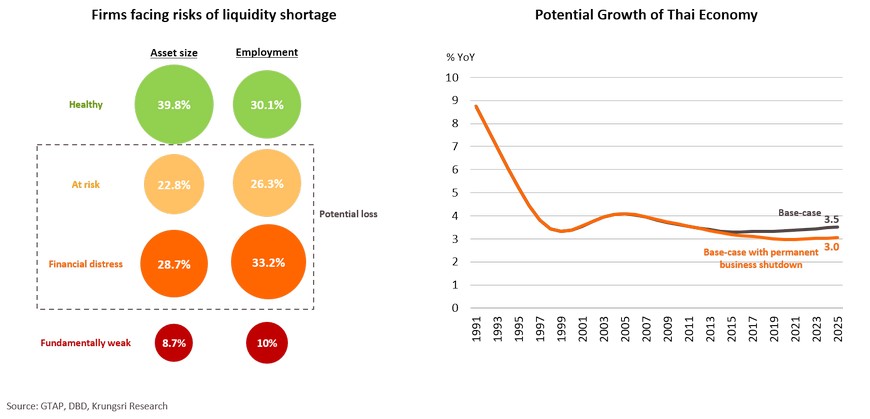

- Company-level data reveal that out of 473,324 companies in Thailand, 30.3% or 143,414 would experience tight liquidity in 2021. Most of the troubled firms would be small in size. Another 132,980 companies (28.1%) would be at risk of facing liquidity shortage. Only 32.6% or 154,318 companies are financially healthy.

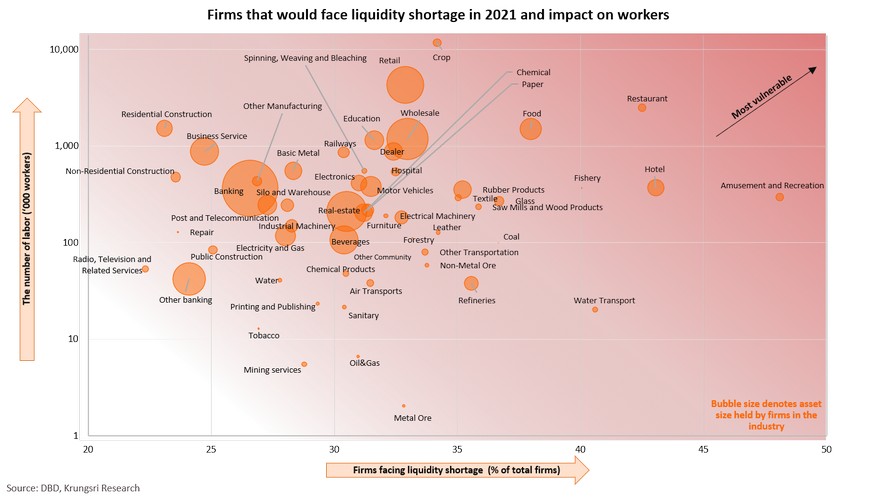

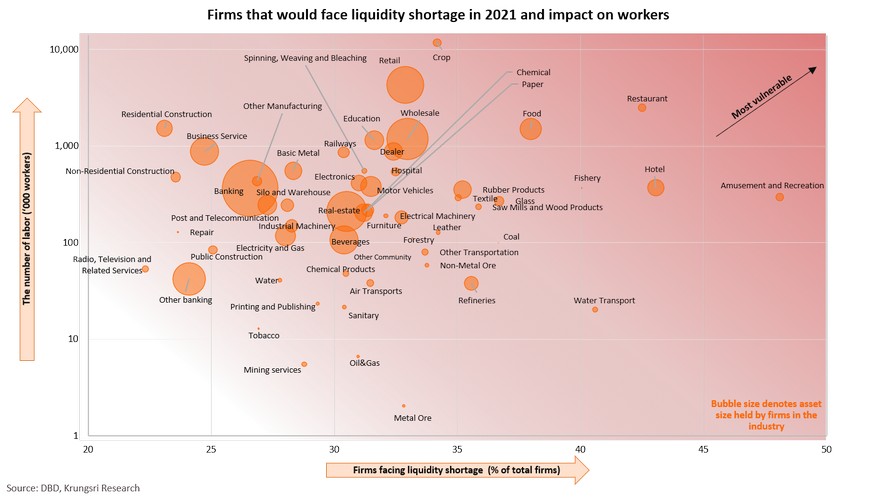

- About 11.8 mil workers, or 33.2% of formal workers, are estimated experience a pay cut or lose their job. The includes 4 mil in the agriculture sector, 1.4 mil in retail trade, and 1 mil in the restaurant industry.

- The most troubled sectors - in terms of both number of companies and employment data – would be amusement & recreation, restaurant, hotel, crop farming and fishery. Krungsri Research estimates at least THB2.3trn would be required to help businesses stay afloat 2021.

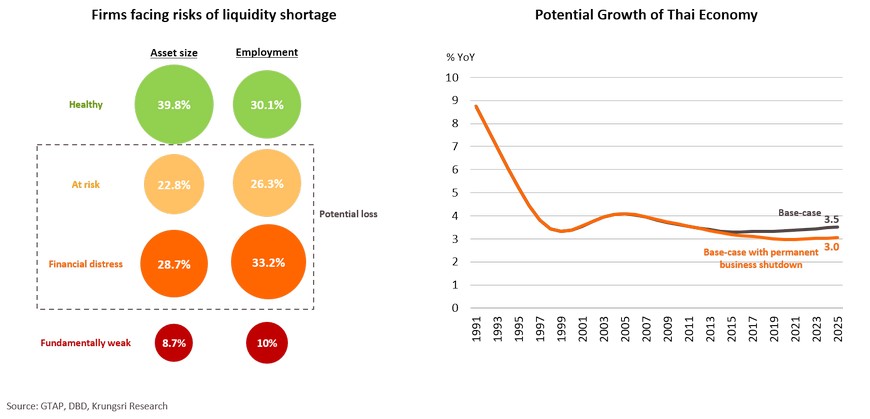

- Thailand’s potential (economic) growth would be wiped out by 0.5 percentage points (ppt) in the coming years triggered by business failures and declining labor productivity. Permanent business shutdowns would cause assets held by these firms to be under-utilized. That would trigger long-term unemployment, leading to lower labor productivity.

- Policy Choices and Recommendations

- Liquidity supports are essential as the hardest-hit firms would face temporary liquidity shortage and could have insufficient assets which can be liquidated quickly. Without further policy responses, liquidity shortfall will turn into a more acute economic slowdown, and inevitably cause banks' balance sheets to deteriorate. Banks must act collectively to avoid a bad equilibrium.

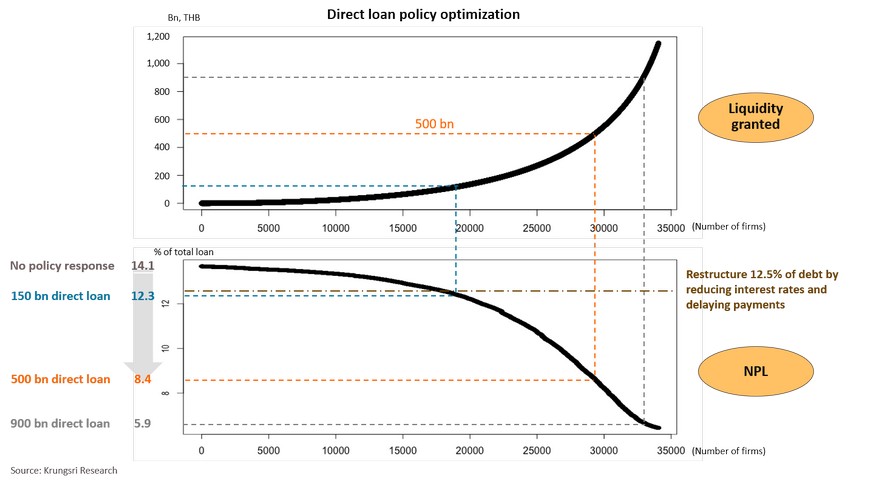

- Policy responses should be channeled to the hardest-hit businesses and customized for their individual financial structure. We propose targeted direct loans and easing credit conditions as main policy instruments. Our simulation shows the optimal size of direct loans could be between 500bn and 1trn baht, which would save between 42,000 and 110,000 firms, respectively. As the economic headwinds might be extended, the lending should cover at least two years. NPLs should drop to 5.6-8.4%, from 14.1% without policy response.

- We also propose adjustments to current soft-loan policies to increase the effectiveness of targeted direct loans. (1) Offer proper compensation for loan loss to incentivize banks to lend. We recommend 80% loan guarantee. Also, we recommend a temporary waiver of guarantee fees as additional incentives. (2) Offload default risk from banks' balance sheets to facilitate risk-sharing.

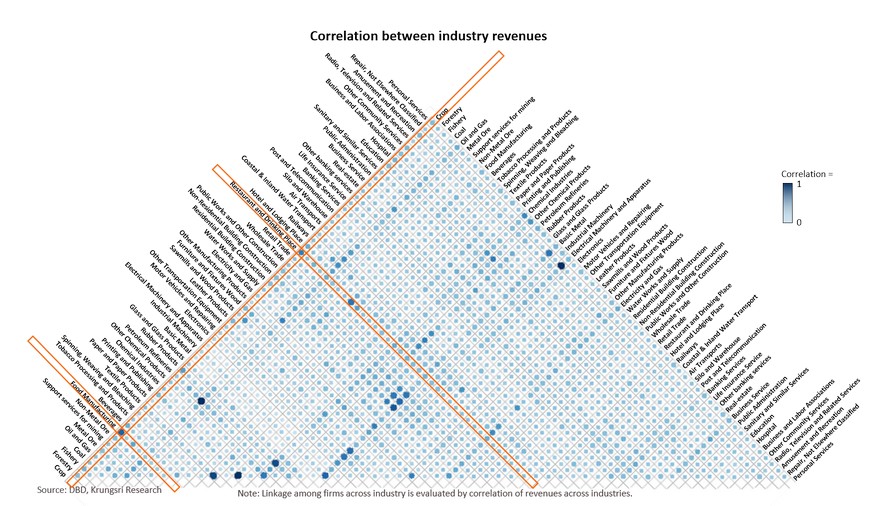

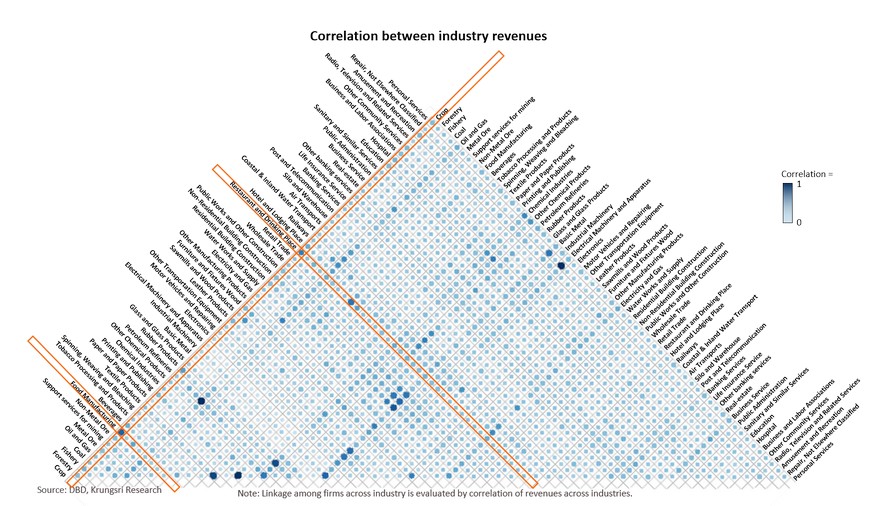

Businesses are linked within the same industry and also across industries

Business performance has been hit by supply and demand shocks; losses and linkage will create a vicious cycle

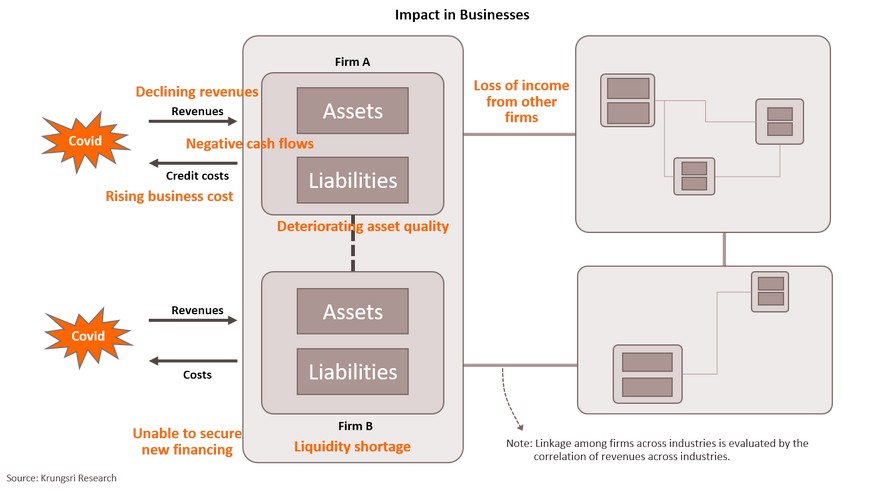

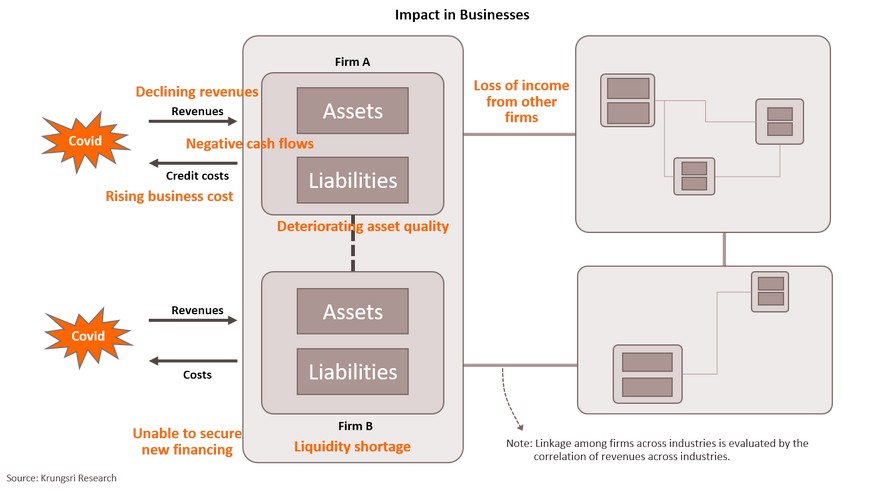

The pandemic has led to a worsening outlook for the overall economy because it is hurting business revenues and profitability. Asset quality has also deteriorated and businesses finding it increasingly difficult to secure new financing. These could lead to liquidity shortage and force businesses to shut down. This will compound the initial impact and create a vicious cycle of closures because of financial linkages among firms. Thus, our analysis and simulation model also captures the link between businesses across industries.

Businesses are linked within the same industry and also across industries

One business closure could hurt another’s revenues, which would in turn, lead to a rising number of businesses with insufficient liquidity to repay debts. For example, the closure of a restaurant would reduce revenues of food suppliers, and ultimately those in the related agriculture sector. This would increase risk of business closures in those industries and business sectors.

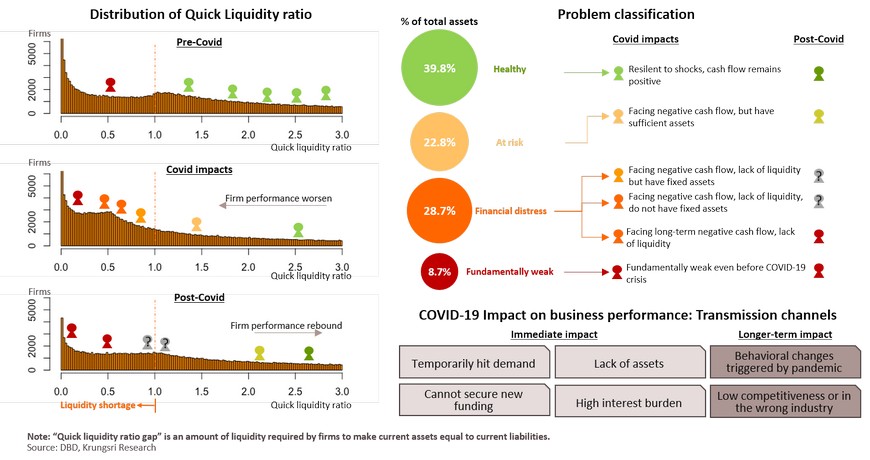

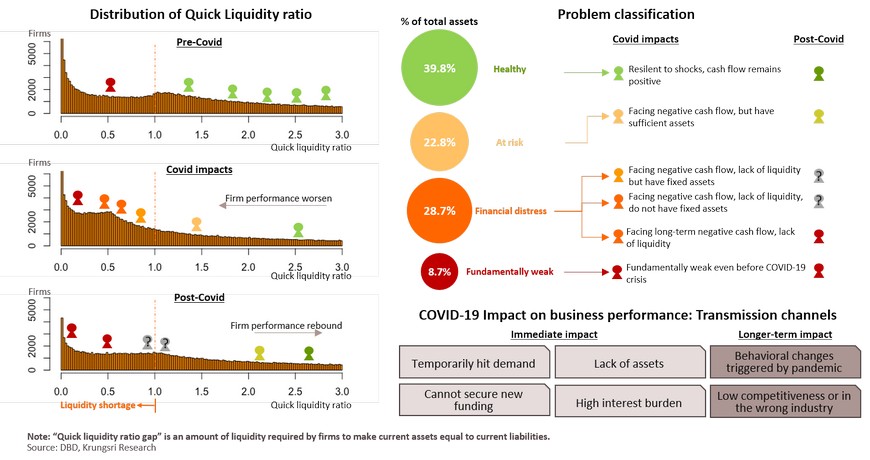

Liquidity problems differ among businesses; impact may be permanent on some but would be temporary on most

The COVID-19 pandemic has hurt business revenues and profits and the majority are experiencing liquidity shortage. Their financial health would only improve when the overall economy recovers. The pace of improvement would differ among businesses, and there would be a group that would shut down permanently. The latest available data suggest most Thai firms do not have sufficient assets to keep their business running, which means their cash flows are vulnerable to shocks. We identified six channels through which COVID-19 might hit businesses in the near future (see chart). Meanwhile, to keep business afloat through this crisis, the OECD has suggested several policy choices, including debt moratorium, offering direct loans to businesses, and easing regulations in the financial market.

Company-level data suggest 143,414 companies (30% of total) would face liquidity shortage

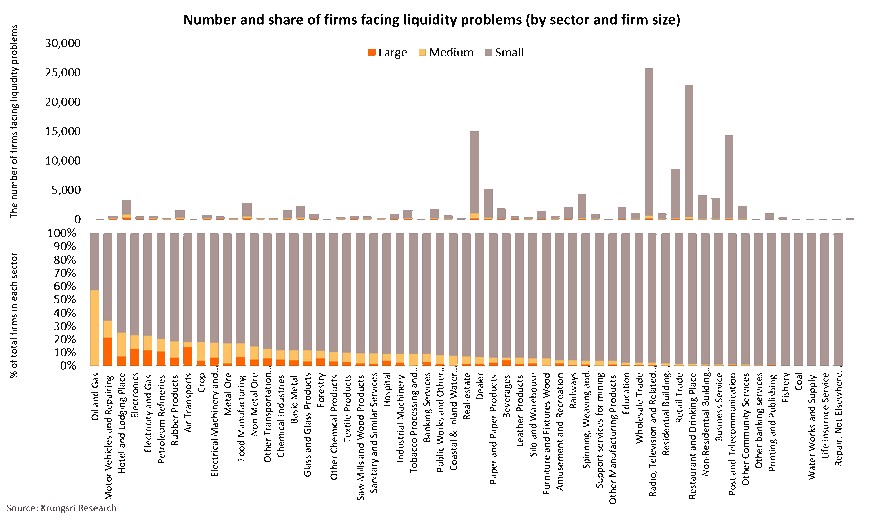

Those facing liquidity issues are relatively small firms

Our analysis suggests 143,403 firms might be unable to repay their debts. Of this, 136,152 (or 95%) are small-size firms. A large number of them are in wholesale and retail, business services, and real estate, in that order. Meanwhile, a large number in the oil & gas, motor vehicle, and hotel sectors are large- and medium-size firms.

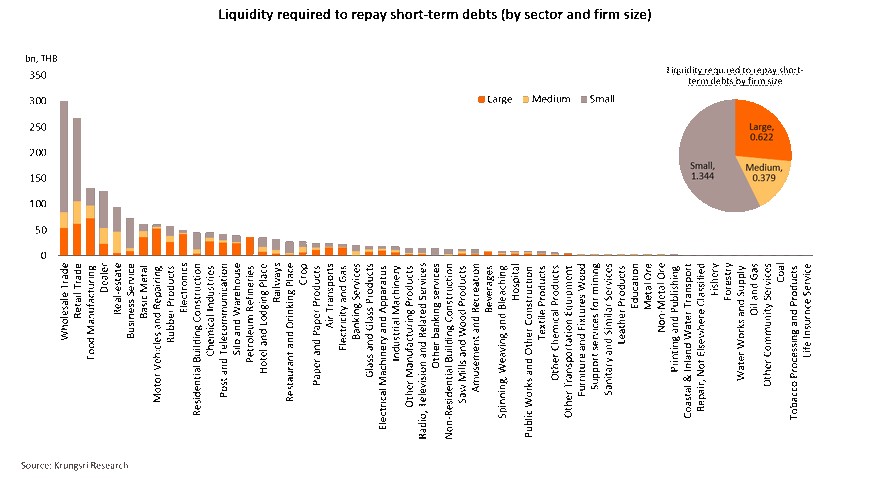

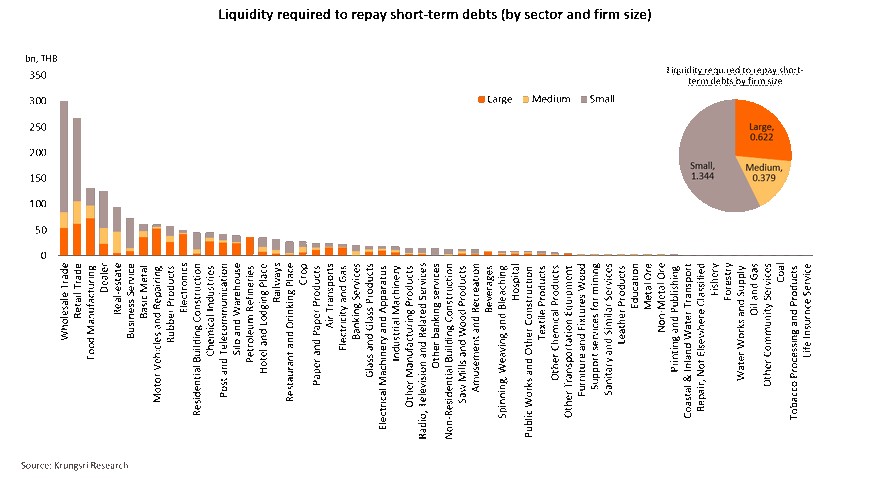

Business would need THB2.3 trillion to stay afloat in 2021

Krungsri Research estimates businesses would need THB2.3 trillion to repay debts. By industry, the wholesale and retail sectors would need a combined THB500 billion. Food manufacturers and dealers would require THB120 billion each. By size, large firms would need THB0.6 trillion and medium-size THB0.38 trillion. Small-size firms would need up to THB1.34 trillion.

11.8 million workers at risk of pay cuts and losing their jobs

Our analysis also suggests 11.8 million workers, or 33.2% of total formal workers, may see pay cuts or lose their jobs. That includes 4 million in agriculture, 1.4 million in retail trade, and 1 million in the restaurant industry. The most vulnerable sectors - in terms of both number of troubled firms and employment - are amusement & recreation, restaurant, hotel, crop farming, and fishery.

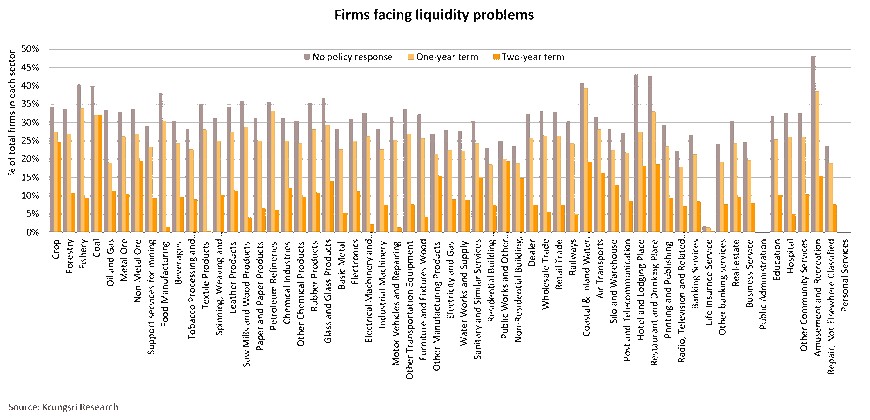

Business closures and lower labor productivity could shave 0.5ppt off Thailand’s potential growth trajectory

The European Commission and Federal Reserve believe the Spanish Influenza had short- and long-term impact on the economy. At that time, income fell by 6-9% and reduced potential economic growth by 0.6ppt. Today, of the 48.3 trillion baht worth of assets held by Thai firms, 28.7% (or 6.9 trillion baht) are held by firms facing financial distress, and another 22.8% is held by those identified as at-risk. These assets could become under-utilized soon if business activity drop. They would lay off employees, which would likely lead to permanent unemployment. This would hurt demand in the near-term and reduce labor productivity in the longer-term. Krungsri Research estimates business closures, under-utilized assets and lower labor productivity would shave 0.5 ppt of Thailand’s potential growth trajectory. There is a need to keep businesses afloat to prevent economic growth from sliding further in the long run. To assess the positive impact of policy responses, we simulated scenarios under five policy tools: interest rate cut, corporate income tax waiver, debt moratorium, easing credit conditions, and targeted direct loans to firms.

Choice of Policy Tools

Further response is absolutely necessary. Failure to act impairs both the real economy and banking sector.

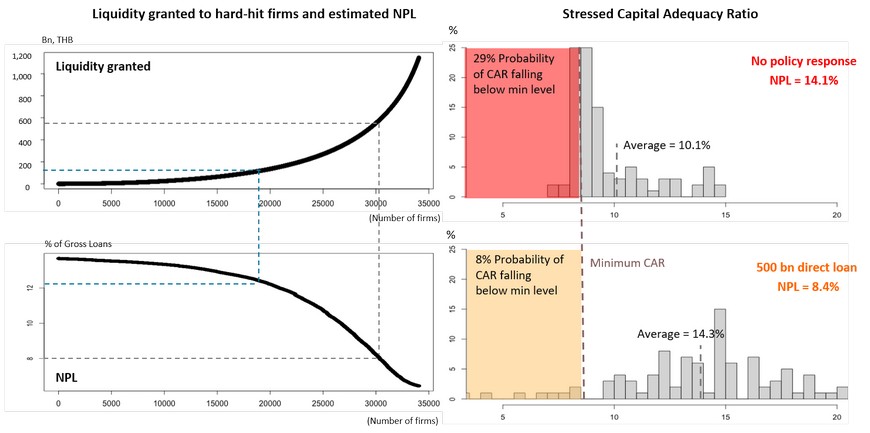

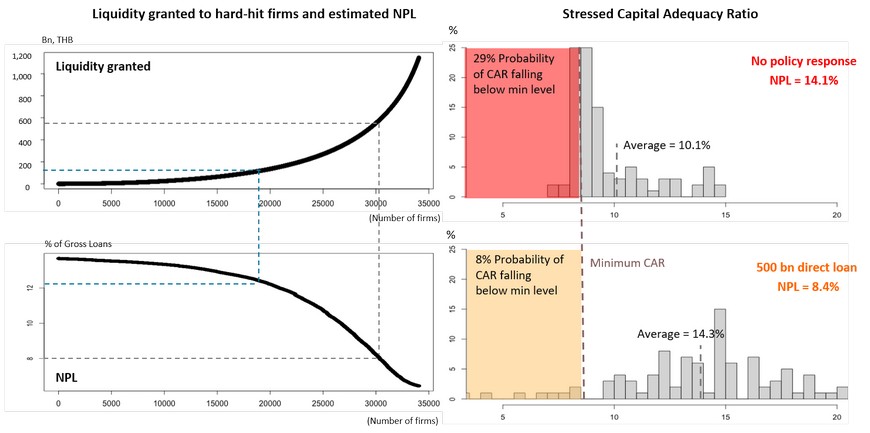

- The health of the banking sector is endogenous to the economic outlook. Liquidity injection with proper design offers firms a chance to revive and return loans. The analysis shows that, with higher liquidity granted, non-performing loans fall significantly and at an increasing rate within two years.

- Further response is essential to prevent severe economic slowdown and higher defaults. Without liquidity injected, the NPL ratio could reach 14.1%. Furthermore, the loan loss would bring the Capital Adequacy Ratio (CAR) down to 10.1% from 19% at the end of 2019, making the banking system very vulnerable. The probability of CAR below the minimum level of 8.5% could be as much as 29%. On the other hand, with 500bn THB direct loan program could reduce the probability of capital shortfall to only 8%.

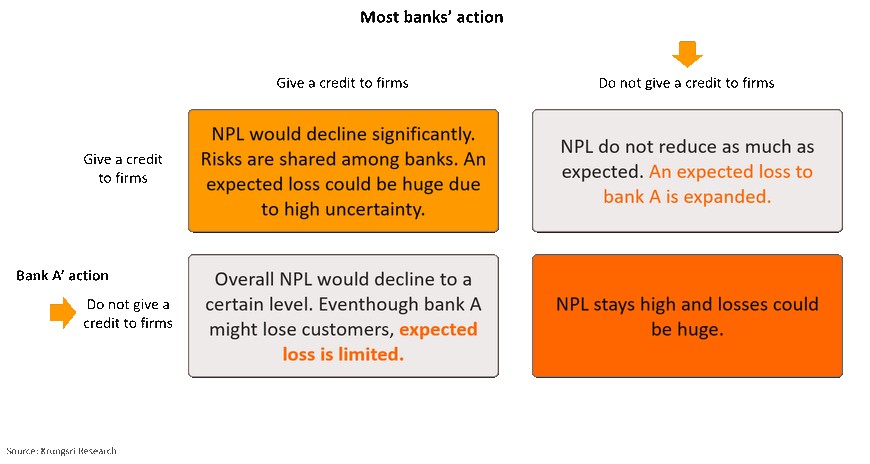

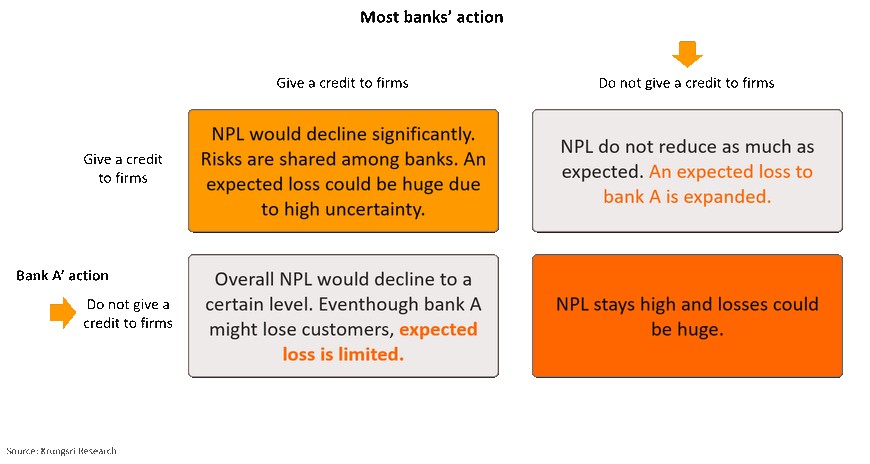

Collective action is needed to avoid bad equilibrium

One bank's actions would not significantly impact NPL, but collective efforts among banks might do. A small amount of liquidity could not save many firms. In turn, it increases expected losses to a bank that gives more credit to its customers while overall risks remain elevated. Thus, banks choose to do nothing to limit expected losses. However, failing to act makes the Thai economy and banking system slide into a bad equilibrium of even worse scenario.

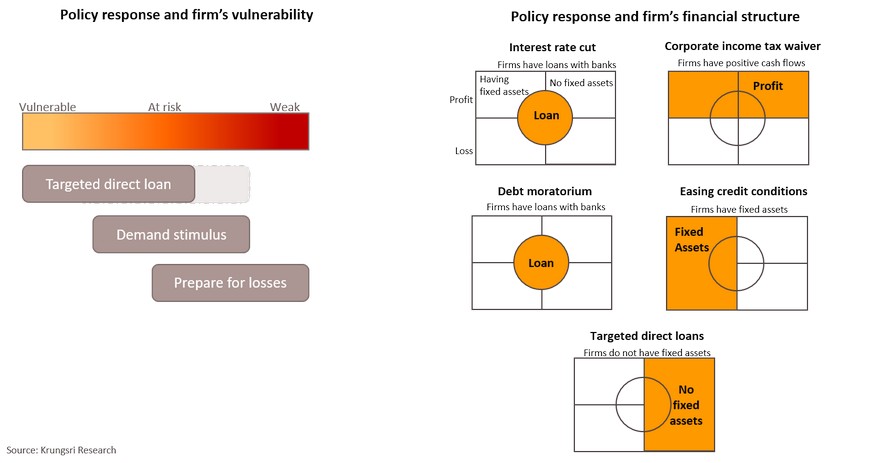

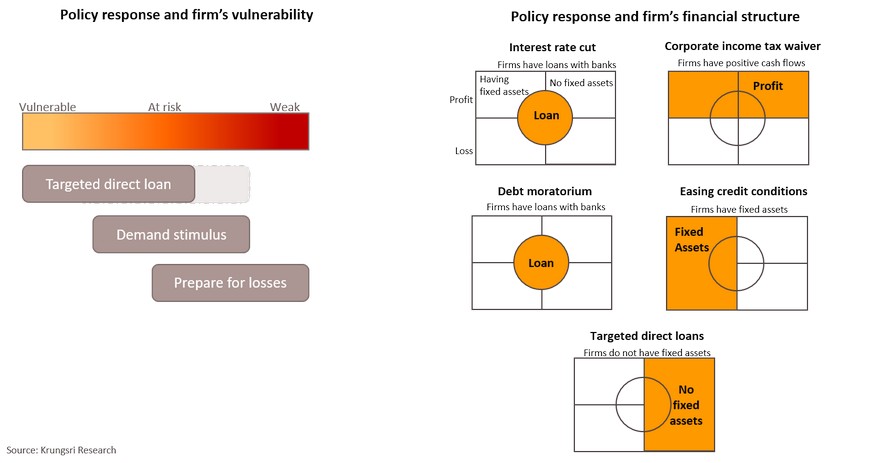

Policy choices should be determined by the problems

Each policy tools would benefit each business differently. Each tool would also have limited resources and there are limitations for each policy instrument. On this note, we opine policy tools should be determined by the nature of the problem and the targeted business's financial structure. For example, if the targeted businesses have sufficient fixed assets, the solution would be easing credit conditions. For firms with little fixed assets and no bank loans, the appropriate tool would be targeted direct loans. Economic policy responses are important especially during a crisis. They would not only prevent business closures in the near-term but could keep the economy on its potential growth trajectory in the long term.

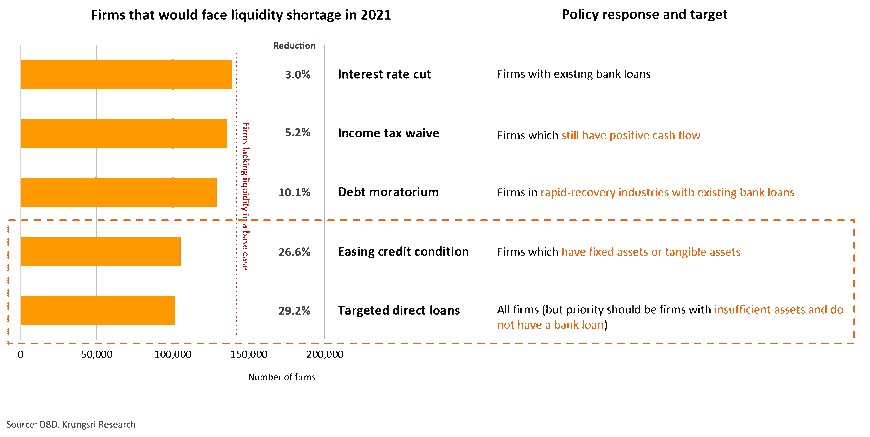

Targeted loans and easing credit conditions would be best to keep businesses afloat

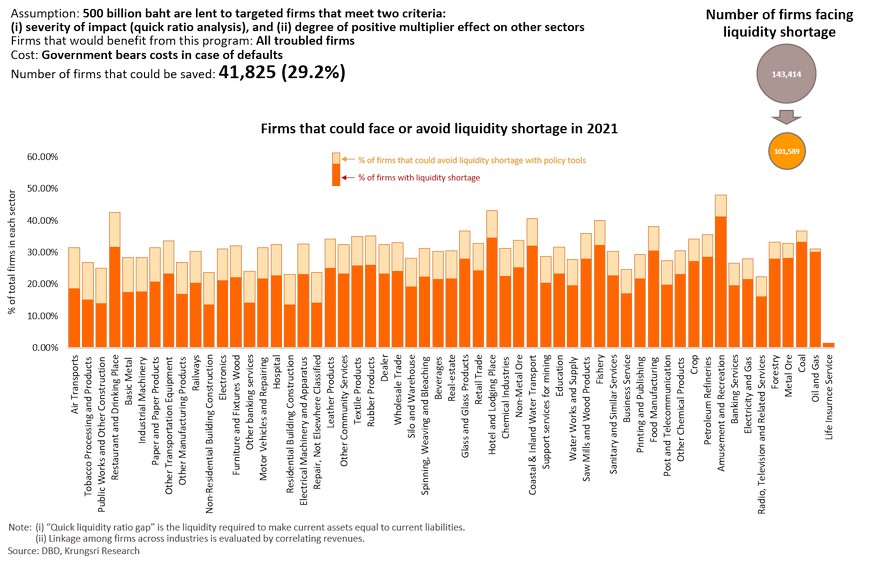

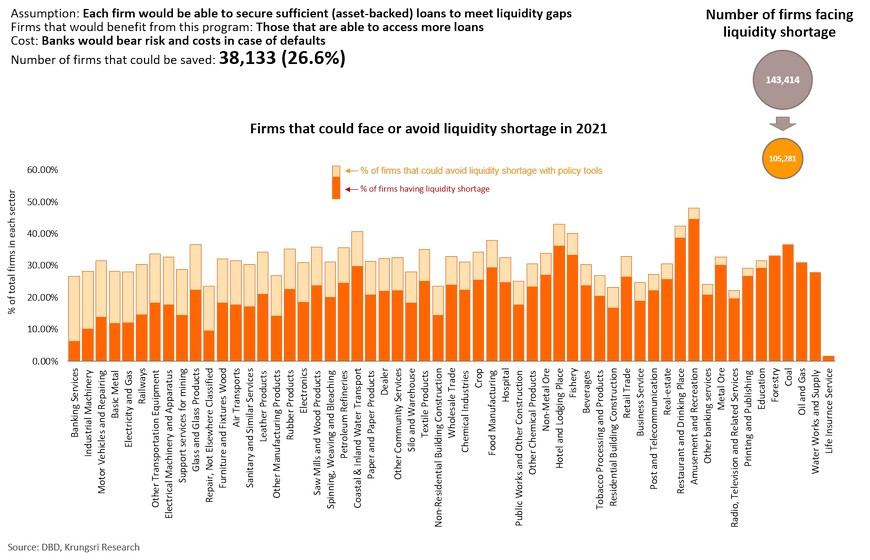

These two tools would help 29.2% and 26.6% of firms to avoid liquidity shortage in the next two years, respectively. Interest rate cuts would help only 3.0% of total firms. More importantly, each policy tool would benefit a different type of business. Debt moratorium and interest rate cuts would help those with existing bank loans. Corporate income tax waiver would only benefit firms with positive cash flow, while easing credit conditions would only help those with sufficient assets. Targeted direct loans would help all severely-troubled firms.

Direct loans targeted at severely-troubled firms would prevent more than 40,000 closures

Easing credit conditions in financial market would support normal market function

Policy Recommendations

1-trn-THB targeted direct loan program with a two-year term could save almost 110,000 firms from a liquidity shortage

- In this simulation, we provide a total of one trillion THB loans with a two-year term to firms. The size of loans for each firm depends on sectoral-level impacts, firm-level impacts, and a quick ratio gap. As a result, firms in the restaurant or hotel sector tend to get bigger loans. Firms are required to start repayment in two years.

- This policy prevents liquidity shortage in 109,329 firms (compared to 29,279 firms in the one-year term program). However, 24,074 firms remain and still need 0.9 trillion baht to survive. Loan repayment could be up to 0.63 trn THB, while 0.37 trn THB might default. If we increase the loan amount to 1.5 trn THB, it could save 123,548 firms. Loan repayment could be up to 0.86 trn THB while 0.65 trn THB might be lost (loss rate increases from 37% to 43%).

We estimate a THB500-900bn direct loan package would allow NPL ratio to stabilize at 5.6-8.4%

- During the pandemic, 34,061 of their businesses with bank loans might face liquidity shortfall. These firms need at least 1.14tn THB to stay afloat.

- With THB150bn liquidity, NPL could drop to 12.3% and about 20,000 firms would be saved. With THB500bn liquidity, NPL ratio could drop to 8.4% and that could rescue 29,350 firms. NPL ratio could be reduced to 5.6% even without the lending to non-bank customers. The optimal size of the direct loan package would be between THB500bn and THB900bn.

Potential policy adjustment:

1. Offer adequate loan loss compensation and waive guarantee fee

Offer adequate compensation for loan loss

- This would be a good incentive for banks to lend. Banks can opt for larger loan guarantee in exchange for lower interest rates. During the economic crisis, the compensation should address higher perceived default risk and more conservative banks’ risk tolerance.

- Under the current scheme, banks who extend soft loans are covered for up to 70% for additional loans to borrowers with a credit line not exceeding 50 mn THB and up to 60% for borrowers with a 50-500 mn THB credit line. However, the compensation is discounted by the ratio of additional loans to total loans per line. As a result, the final coverage could fall to as low as 12%. At this compensation rate, NPL ratio for new loans could exceed 7.42%. Furthermore, the current compensation is low compared to other countries.

- From a back-of-the-envelope calculation, assuming 500bn THB loans are extended, a 50% compensation rate would reduce NPL ratio for new loans to 4.20%. At 80% compensation, the NPL ratio could drop to 1.68%, and total NPL ratio could drop by 18 bps. If 900bn THB loans are extended, a 50% compensation rate would reduce NPL ratio for new loans to below 3%, which is the banks' historical risk tolerance.

- We also support further simplification of account-level loan loss compensation. The current application and claim process is complicated and can induce regulatory uncertainty, which could make the risk-averse banking sector reluctant to lend. (See Gissler, Oldfather, and Ruffino (2016)*) Redesigning the process to require fewer and more objective calculations and set up a team to assist banks with the claim procedure would help the scheme more practical.

Waive guarantee fee

- Guarantee fee is a cost for firms and banks. Temporary fee waiver should have expansionary effects as it would encourage banks to lend. Several countries have waived guarantee cost, including the UK (UK Coronavirus Business Interruption Loan Scheme, CBILS) and Italy (Fondo di Garanzia PMI), while Spain has reduced guarantee fee (Instituto de Credito Oficial, reduced to 20-120bp).

Potential policy adjustment:

2. Offload risky assets from banks

- The government could offload relatively-risky loans from banks’ balance sheets to share risk and create room for further lending.

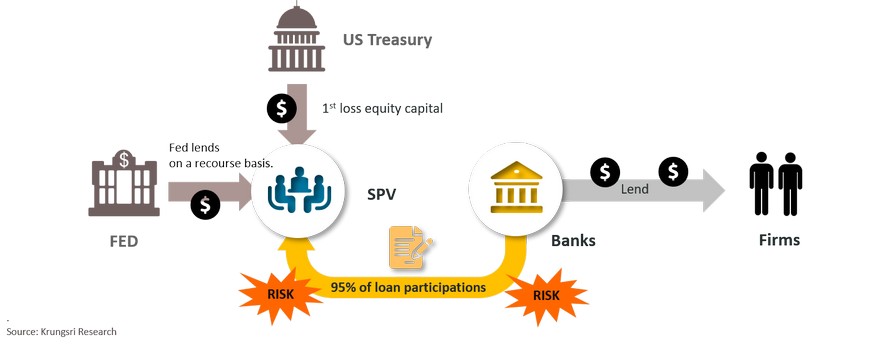

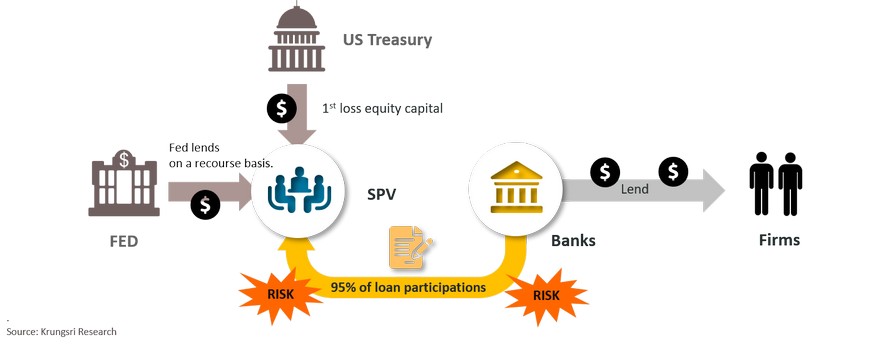

- In the US, the Fed has launched the Main Street Business Lending Program (MSLP) to offload risky assets from banks. The program complements the Paycheck Protection Program (PPP) which is the main policy instrument to provide liquidity.

- Practical mechanism

- The Treasury will make a 75bn USD equity investment in a Fed-established SPV. Funds would come from the Coronavirus Aid, Relief, and Economic Security Act (CARES Act). The Fed lends to the SPV on a recourse basis.

- The SPV will purchase up to 95% of those loans from banks. The 5% gap is meant to discourage irresponsible lending. The leverage is expected to reach USD 600bn in loans.

- We also recommend attached incentives to induce repayments.

- US: Under the PPP and MSLP, businesses must commit to reasonable efforts to maintain employment and retain workers.

- Canada: Under the EDC Loan Guarantee Program, repayment by the end of 2022 will trigger forgiveness of 25% of the loan.