Reassessing Lao PDR’s External Sector Stability in 2022 through the Lens of the Monetary Survey February 2022

Executive Summary: Rapid depreciation of Lao kip recently could indicatea severe shortage of foreign exchange reserves

-

Fundamentally, the kip depreciation is not surprising. Chronic twin deficits and other structural challenges have been pressuring the kip amid a persistent weak foreign exchange reserve position.

-

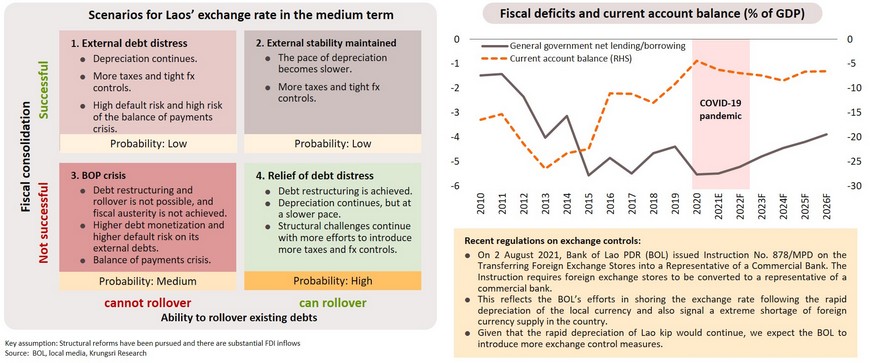

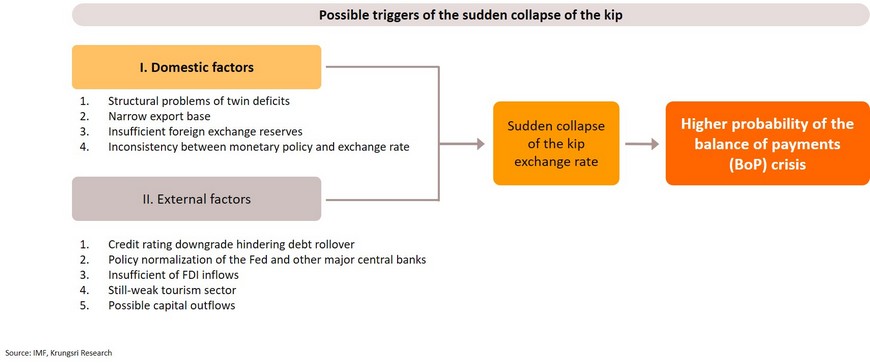

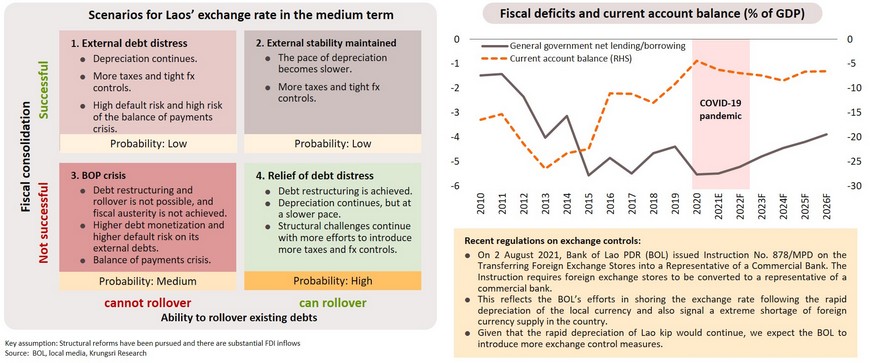

Nevertheless, the recent depreciation might reflect dangerously weak macro fundamentals and exert greater pressure on Lao PDR’s external instability. In addition, if the depreciation is primarily due to low foreign exchange reserves, it could indicate an acute shortage of foreign exchange reserves which could ultimately trigger a balance of payments crisis. Currently, the risk of the crisis however is assessed to be medium with the assumption that the country could rollover the existing external debts.

-

Data from the central bank’s balance sheet and deposit-taking institutions confirm the nation’s weak external position. And there are signs of tighter money market conditions and higher dollarization. Despite a surge in net foreign assets, money in circulation has not risen substantially. This could reflect weak demand for the local currency within the country.

-

The weak kip has also been fueled by the need to service huge external debts in the medium-term against a backdrop of weak foreign exchange reserves. The weak kip would weaken the country’s ability to service foreign currency denominated-debt. Meanwhile, the economy is recovering more slowly from the pandemic, with official growth projection reduced to 4% p.a. from 7% p.a. Ultimately, the kip strength will hinge on fiscal consolidation and the country’s ability to rollover debt.

-

Looking ahead, lingering kip weakness could hurt macroeconomic stability through imported inflation and higher degree of dollarization. The country needs to introduce measures to mitigate exchange rate shocks and default risk in order to attract foreign investors.

Presentation Outline

-

Underlying fundamentals of Lao kip depreciation and recent developments

-

Possible trigger points of the recent episode of currency depreciation

-

Framework of analysis: Linkages of macroeconomic accounts

-

Reviewing Lao PDR’s external stability through the monetary account

-

Structure of public and external debts

-

Outlook for kip exchange rate

-

Implications for investors and businesses

1. Chronic twin deficits and other structural challenges amid low foreign exchange reserves are fundamental factors driving the rapid depreciation of the kip

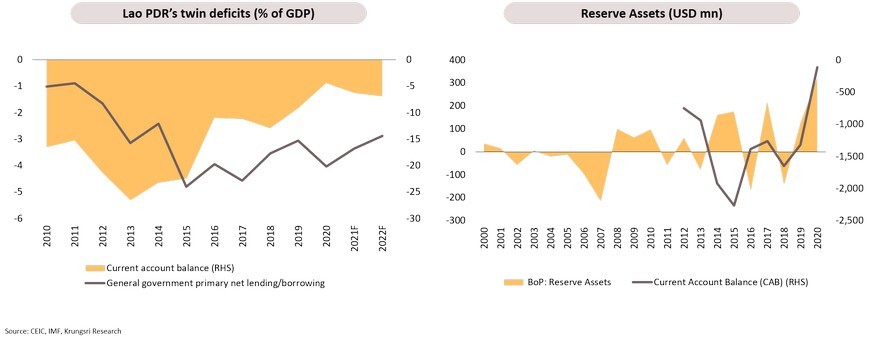

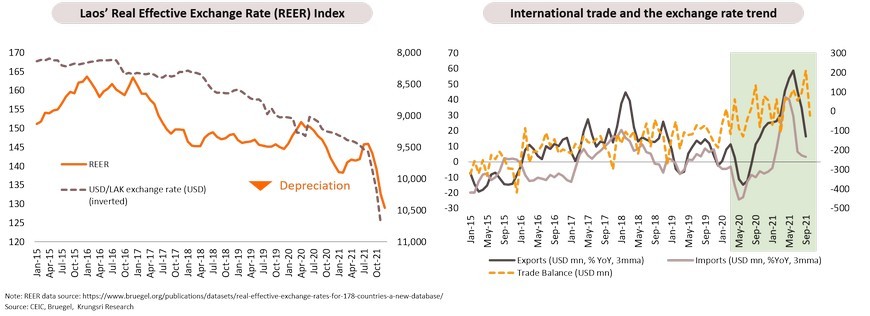

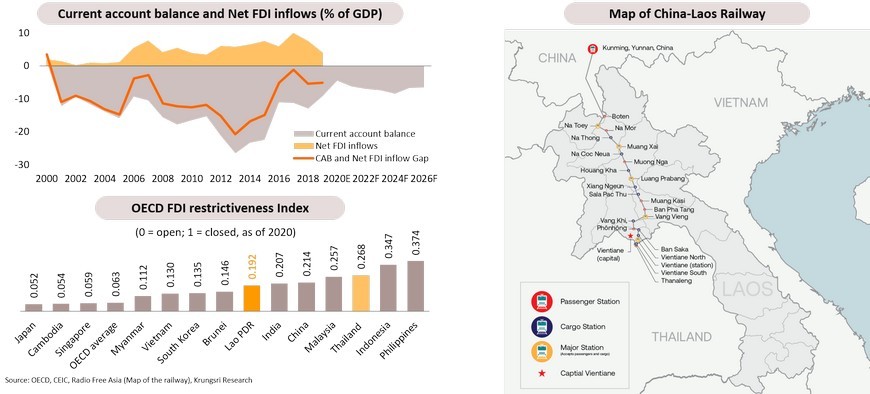

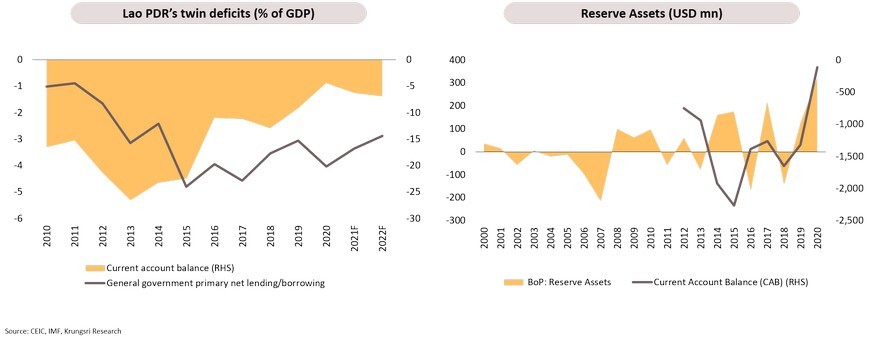

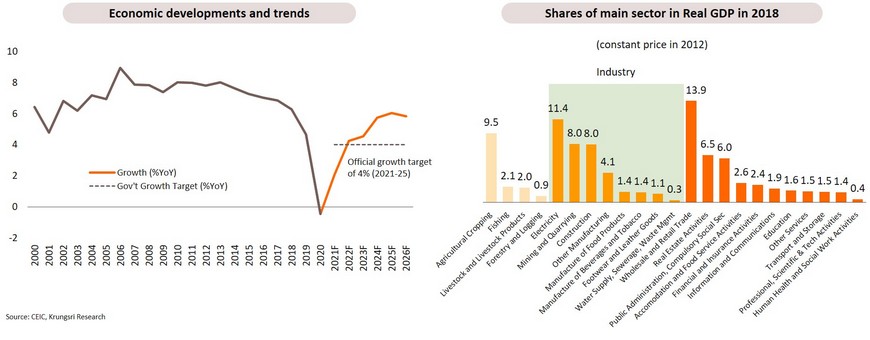

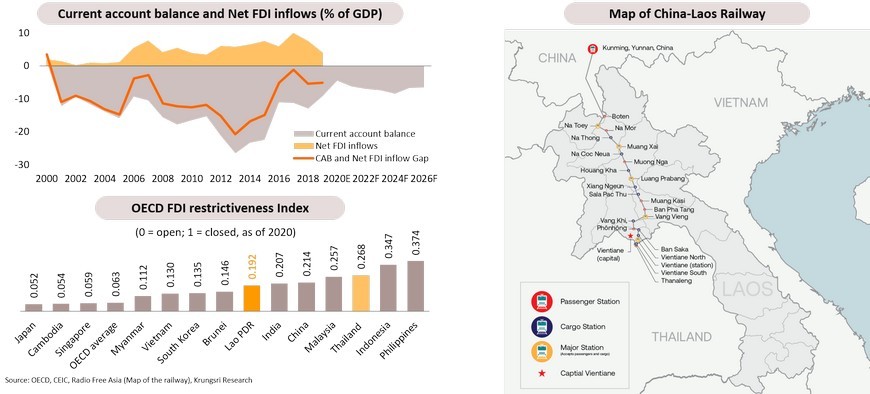

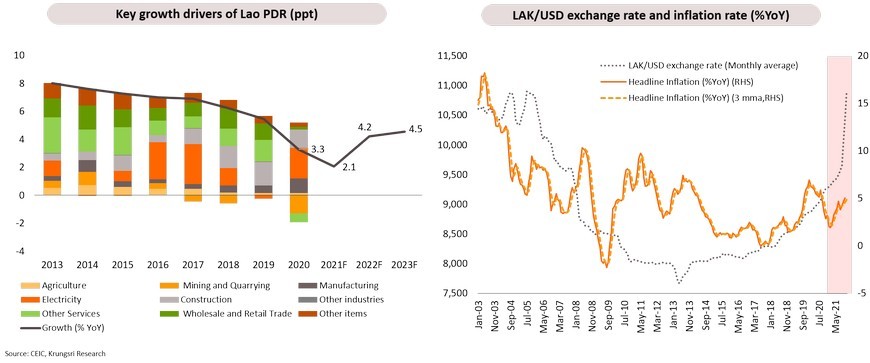

Like several other developing countries, Lao PDR is suffering from twin deficits – fiscal deficit and current account deficit – amid thin foreign exchange reserves. Over the past decade, the government has run fiscal deficits equivalent to 3-4% of GDP annually, which has led to the need for substantial external financing. This is reflected by a persistent current account deficit, averaging more than 10% of GDP. The twin deficits phenomenon is persistent amid thin foreign exchange reserves. Fundamentally, these developments can be explained by the structural characteristics of Lao PDR’s economy, including a narrow export base and being a net importer. As a result, these factors have driven the depreciation of the local currency over the last few years.

A recent episode of rapid exchange rate depreciation however may reflect lamentably weak macro fundamentals adding more pressure on the external instability

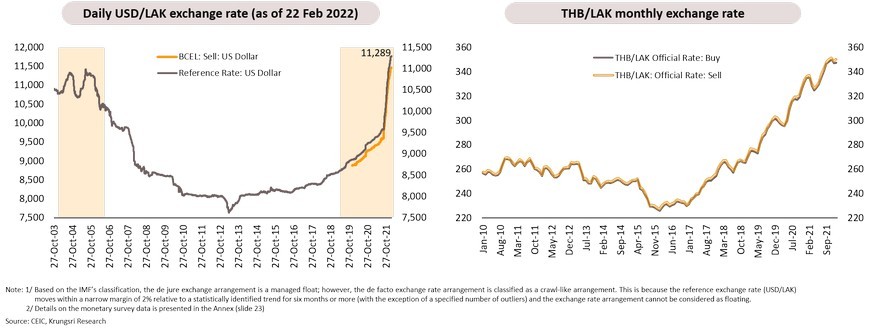

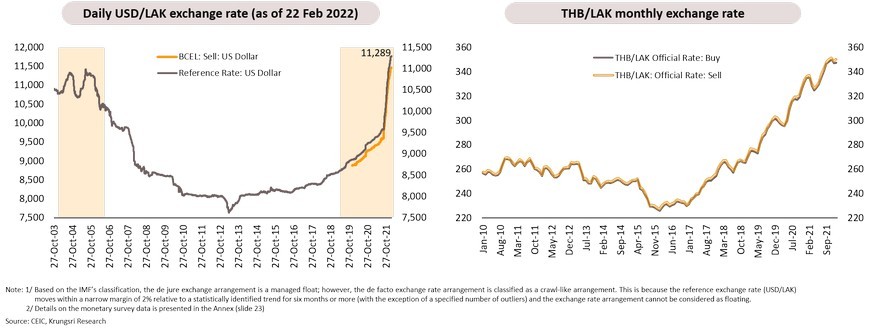

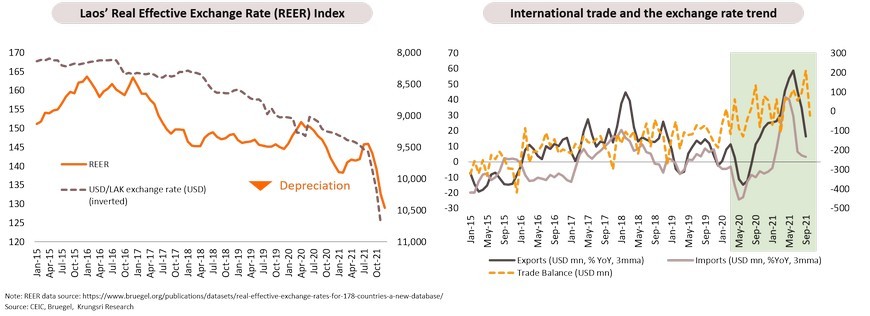

The kip has depreciated rapidly against the USD and THB since 4Q21 to a new low of USD/LAK 11,289 and THB/LAK 355.1 (as of 22 February). Recent developments in the foreign exchange market might not only highlight persistent weak macroeconomic fundamentals amid lingering pandemic impact, but also send a signal to the market that the authorities may not be able to defend the exchange rate due to thin foreign reserves1/. Given this alarming development, we are reviewing the strength of Lao PDR’s external sector. We looked at available economic indicators together with monetary survey data2/ reflected in the balance sheets of the central bank and deposit-taking financial institutions to explore the external position of the country. This is because the monetary sector serves as a clearing-house for all financial flows, so the monetary accounts provide a unique insight into the behavior of these flows, which mirror the flows of real resources among sectors.

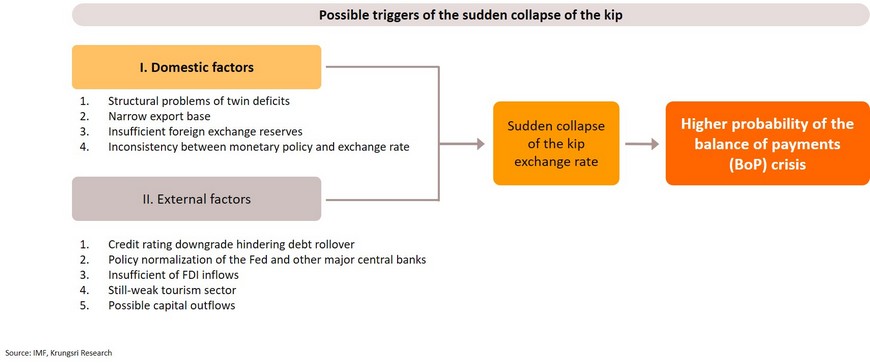

2. Theoretically, rapid depreciation of the currency primarily due to thin foreign exchange reserves could indicate a higher probability of a balance of payments crisis

The sudden collapse of the crawl-like arrangement - which has long been maintained by the central bank- and current exchange rate movements are not aligned with its macroeconomic fundamentals. This could signal irrational behaviors in foreign exchange markets. Based on empirical and academic literature, authorities normally abandoned the peg (similar to the crawl-like arrangement) because of a sudden run-on foreign exchange reserves. This means a country could be facing a balance of payments crisis, a situation where there is insufficient reserves to cover balance of payment.

Sudden weakening of the kip is not surprising, but recent developments are not aligned with its macroeconomic fundamentals

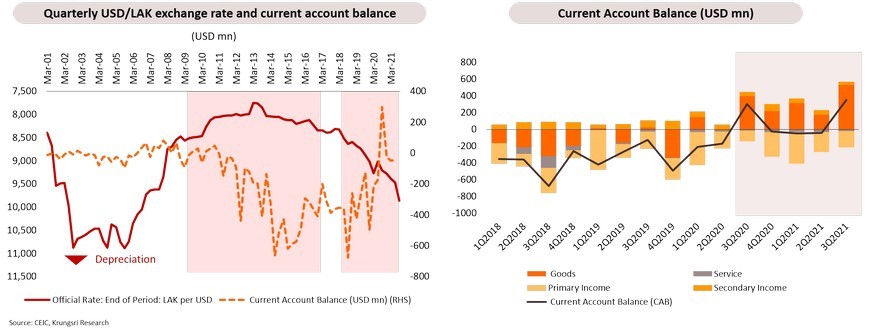

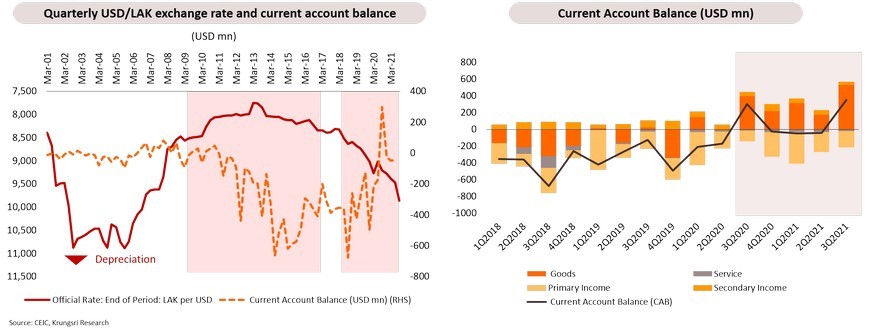

Fundamentally, the kip should weaken against the USD and THB over time because Lao PDR is a net importer country. Its current account has been lingering in negative territory because of insufficient FDI inflows. Recently, despite cyclical improvements in the current account position, the USD/LAK exchange rate has continued its downward trend. This development reflects severe shortage of USD liquidity in the local foreign exchange market. Traditionally, insufficient USD liquidity has been a major challenge in the country as outflows of primary income and deficits in trade in goods and services have continued to weigh on the current account position. It was only in recent quarters that Laos’ current account balance (CAB) has been improving, driven by a surplus in trade in goods as well as sustainable inflows of secondary income.

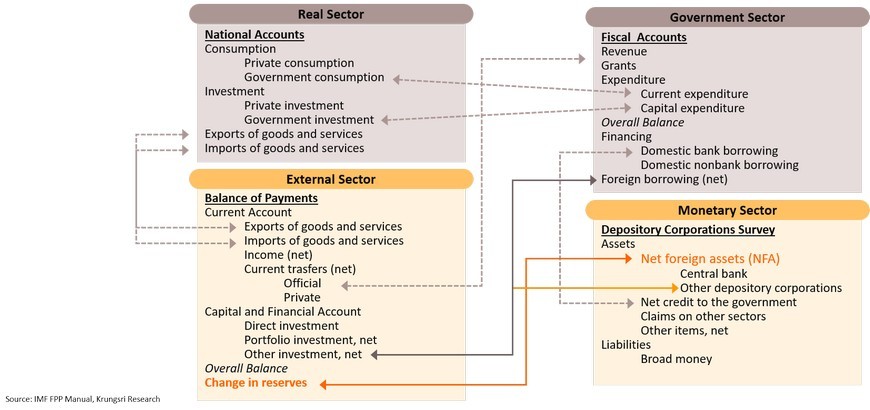

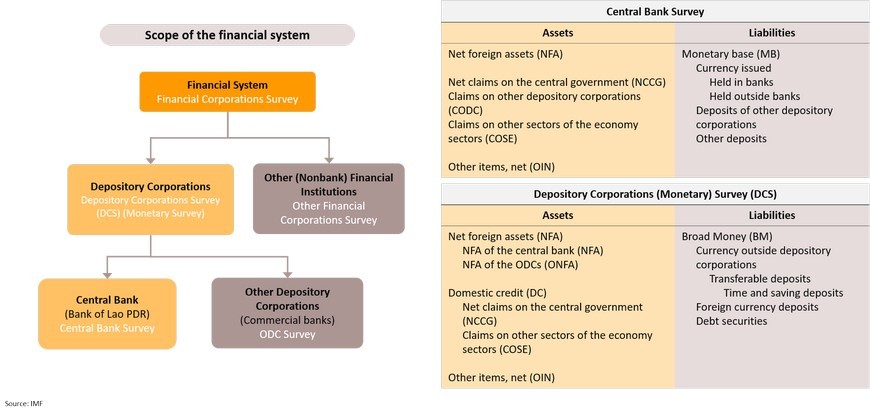

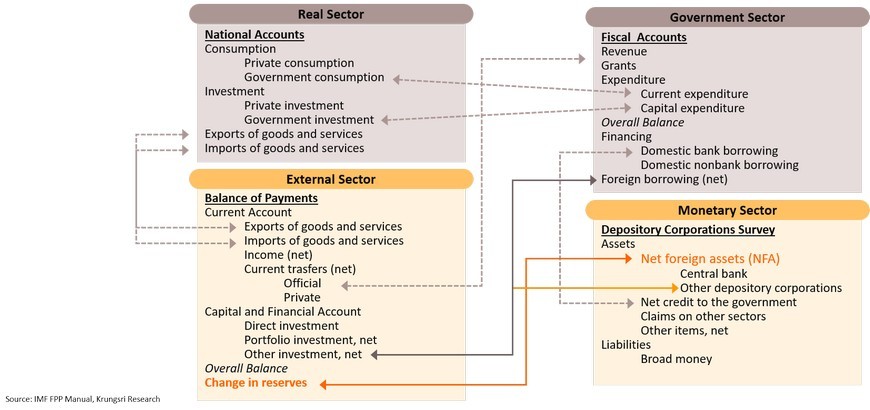

3. Balance sheets of central bank and deposit-taking institutions might offer alternative and broader views of Lao PDR’s external sector strength

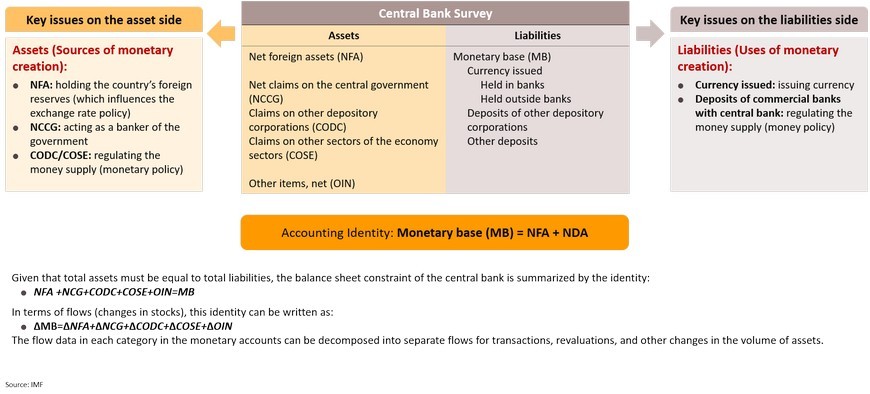

Based on inter-relations between major macroeconomic accounts, the external and monetary sectors, Lao PDR’s external sector stability can be alternatively viewed through the balance sheets of the central bank and financial institutions in the monetary survey statistics. So, net foreign assets (NFA) data in the monetary account reflects the foreign exchange reserves position (balance sheet details are presented in the Appendix).

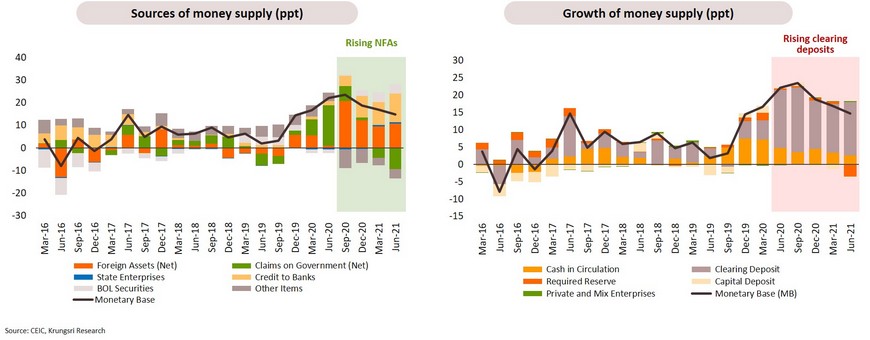

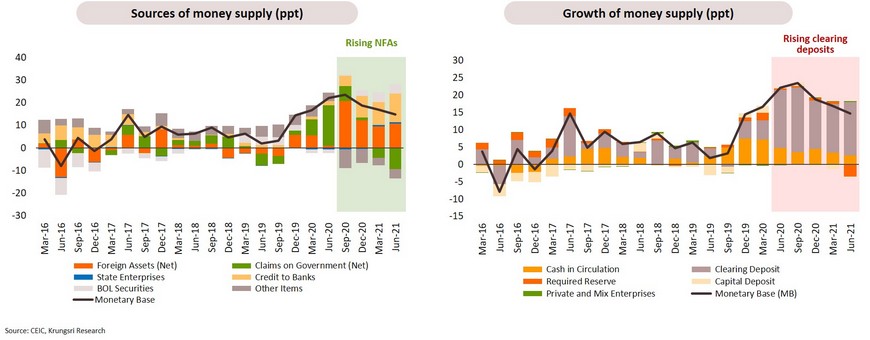

4. Net foreign assets have risen recently; claims on the government played a major role in driving the growth of the monetary base

NFAs in the balance sheet of the central bank have been increasing since 3Q2020 and driven the recent surge in the monetary base. This is in-sync with the improving current account position, reflected by narrower deficit gaps. This means foreign exchange reserves have been accumulated. However, these developments are not reflected in the foreign exchange markets. On the other hand, an increase in NFA has not translated into higher money supply; instead, we saw a rapid jump in clearing deposits at the central bank. Based on historical trends, the surge in clearing deposits reflect irregularities and tighter liquidity conditions in the local interbank and money markets.

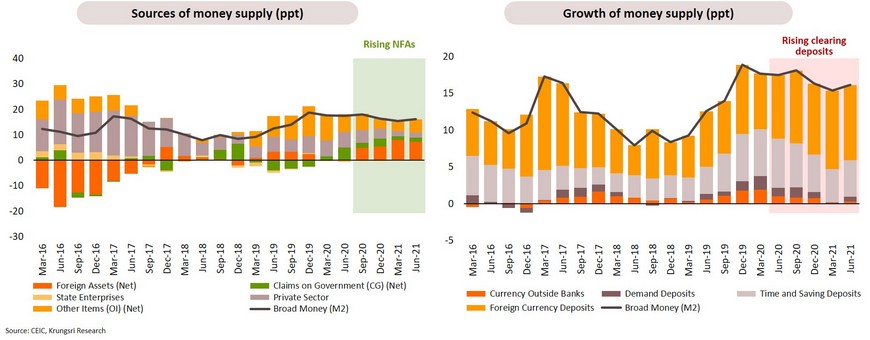

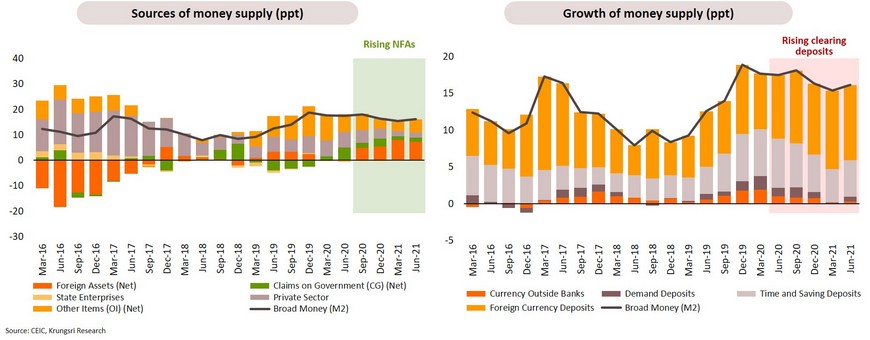

Surge in net foreign assets has led to higher FDCs and time deposits, based on monetary survey data

Based on the monetary survey, a consolidation of the central bank and deposit-taking institutions’ balance sheets, similar to the central bank’s balance sheet, NFAs have increased recently. But surprisingly, the expansion of the monetary base did not translate into more money in circulation but has led to an increase in time deposits and foreign currency deposits (FCD). On one hand, this means that rising money supply is unlikely to trigger inflationary pressure. On the other hand, this suggests local households and businesses prefer not to hold local currency cash and would rather keep their wealth in the form of time deposits and FCDs. This shows a lack of confidence in the local currency, which fuels the lingering dollarization phenomenon in Lao PDR.

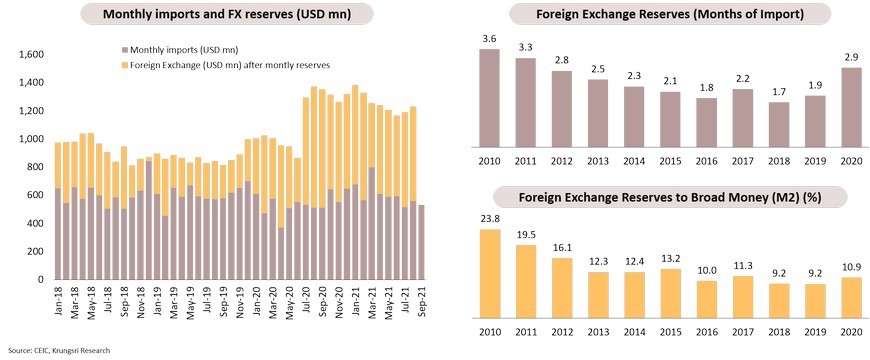

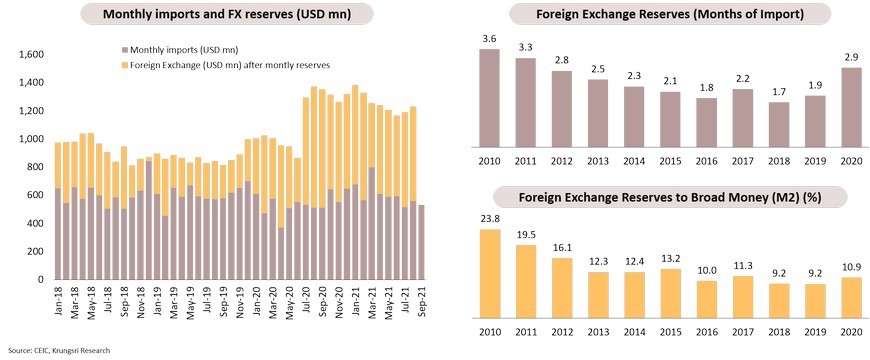

Insufficient reserves is reflected in traditional metrics; external vulnerabilities add pressure on exchange rate

Laos’ foreign exchange reserves is insufficient by international standards. According to the IMF’s reserve adequacy metrics for low-income countries, the optimal level of reserves for Lao PDR should cover 4–6 months of total imports. As at 2020, its reserves covered only 2.9 months of imports and is about 11% of broad money, significantly below the 20% threshold. This has been primarily driven by the persistent current account deficit and trade imbalance. This has created downward pressure on the exchange rate and external stability.

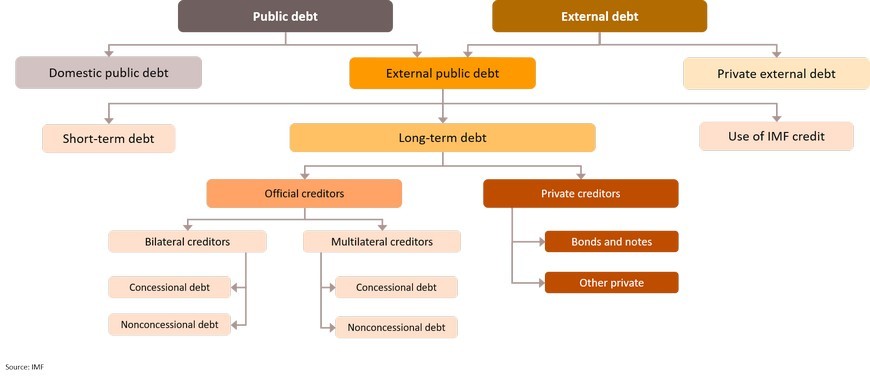

5. Total public debt is beyond sustainable level and could harm the country’s macroeconomic stability

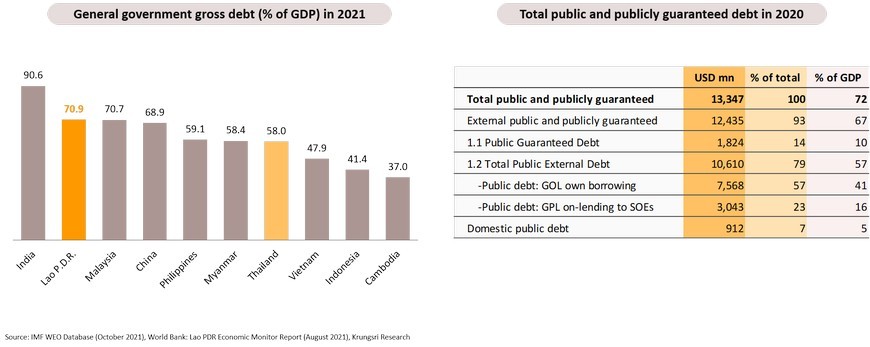

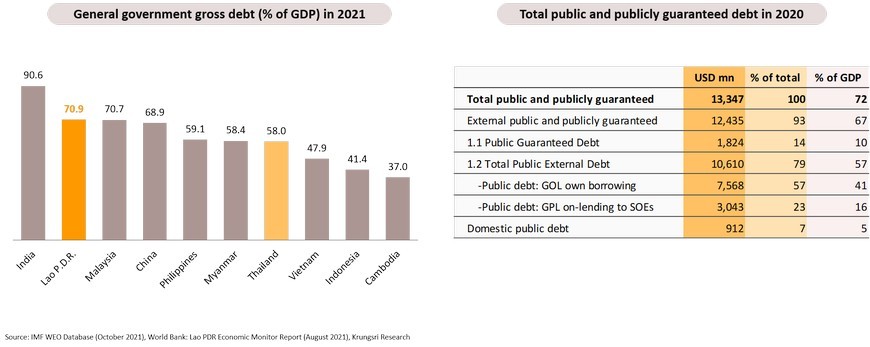

Lao PDR’s government debt is among the highest in the region, at about 71% of GDP in 2021. Based on the assessement of the IMF and the World Bank, the debt has reached critical levels and could harm the country’s macroeconomic stability. According to the World Bank’s 2020 data, total public debt (external and domestic) was USD10.6bn or about 57% of GDP excluding guarantees. About two-thirds of PPG debt relates to direct borrowing to finance expenditure, while one-third originate from on-lending to SOEs, mostly to Électricité du Laos (EDL) which owns and operates the country's electricity generation and supply business.

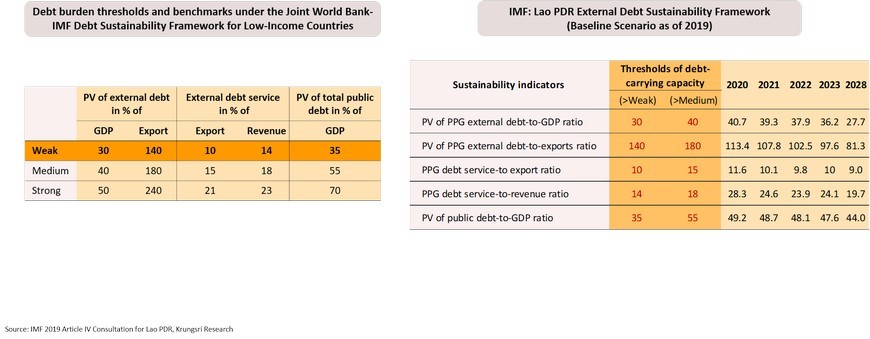

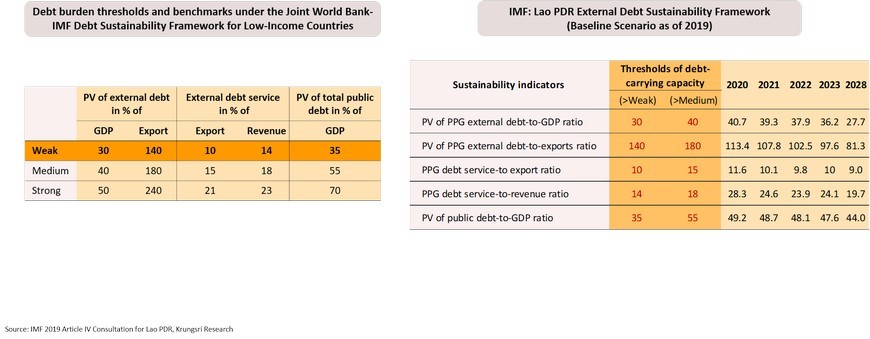

Lao PDR: Risk of external debt distress and overall risk of debt distress have been continuously classified as ”high”

According to the IMF’s latest debt sustainability report on Lao PDR (2019), the country’s external risk and overall risk of debt distress were classified as “high”, the latter due to its deteriorating debt-carrying capacity. This is reflected by most external and total public debt indicators breaching their respective thresholds and benchmarks under the IMF’s baseline scenarios. In addition, external debt indicators are most vulnerable to shocks to exports and depreciation of the currency. Weak reserves also add to these vulnerabilities.

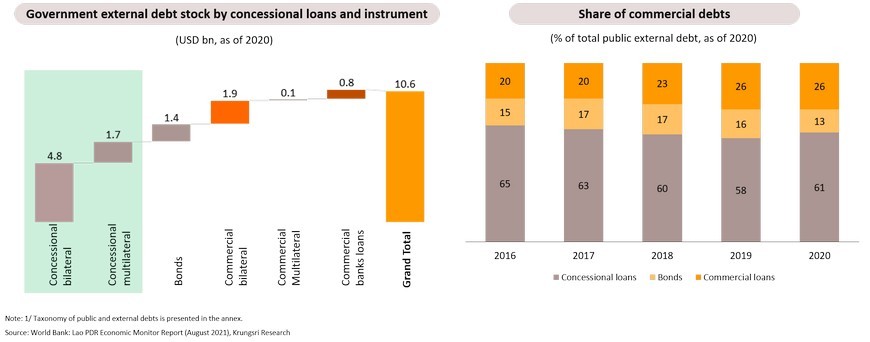

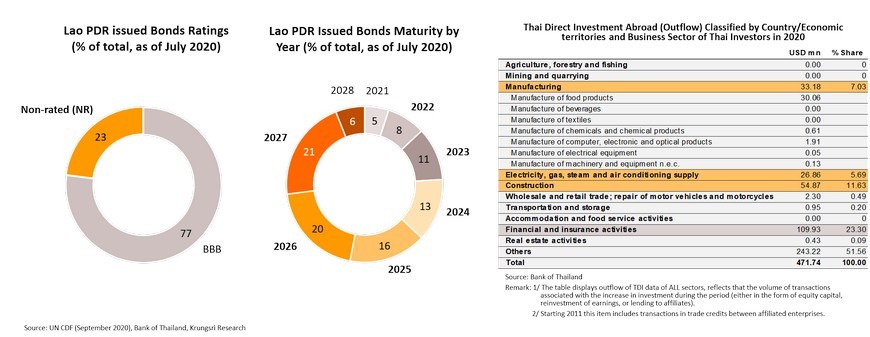

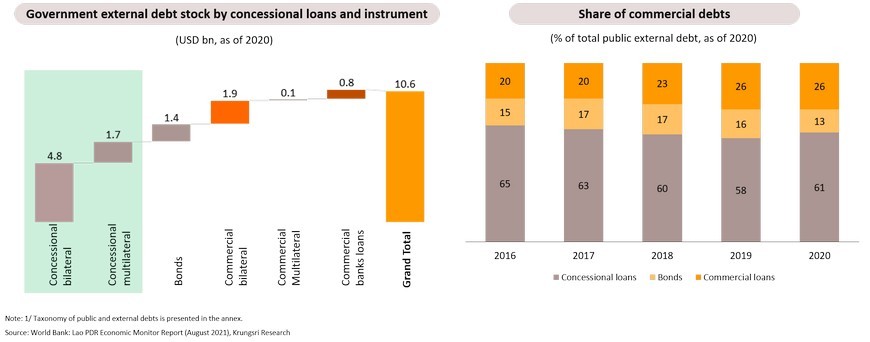

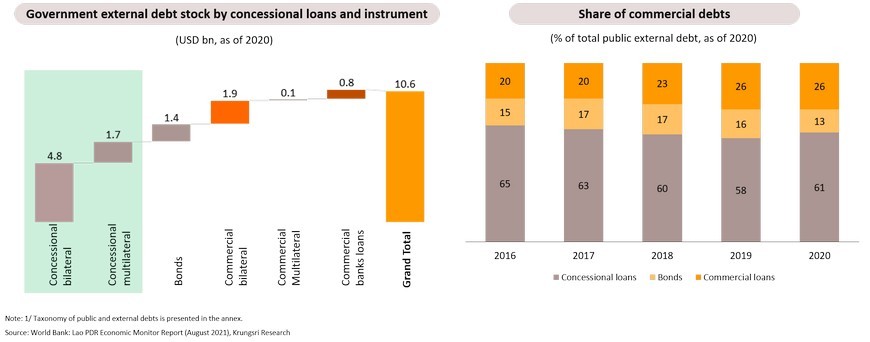

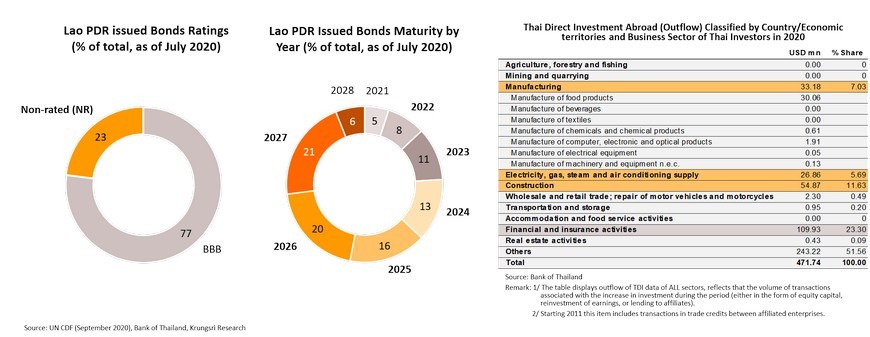

Relatively costly non-concessional and commercial loans have been tapped to finance budget deficits, which will make debt servicing challenging

Non-concessional debt has been a primary source of funds to finance investment projects and to refinance debts. In 2020, total outstanding public external debt reached USD10.6bn, of which concessional debt was USD6.5bn or 61% of the total in 20201/. On the structure of commercial debts which reached USD4.1bn in 2020, bilateral commercial loans and bonds had ballooned from 33% in 2016 to 39% in 2020. This was in line with the sovereign credit ratings from Moody’s and S&P, two of the largest global credit rating agencies. However, after issuing its first sovereign credit rating of B3 (Moody’s) and B-(Fitch) in 1Q 2020,Moody’s and Fitch revised down their ratings to Caa2 and CCC, respectively, in 3Q2020.

Rapid depreciation of the kip could weaken ability to service debt

Against the backdrop of policy normalization by major economies, Lao PDR is facing difficulty servicing its debt obligations because of rising cost of financing and debt levels. According to the World Bank, cost of financing has surged because of high debt level, increase in non-concessional borrowings, and rating downgrades by Fitch and Moody’s. Looking ahead, from 2021 to 2025, Lao PDR has to repay about USD1.3bn of public external debt (excluding guarantees), or about 7% of GDP annually. The annual repayment exceeds it foreign exchange reserves (about USD1.2bn), which is also needed to pay import bills. Therefore, external debt distress and debt sustainability remain a major concern. Not only has the rating downgrade made it challenging for Lao authorities to turn to commercial and market borrowings to rollout and/or service its existing debts, but the rapid depreciation of the local currency is also causing its foreign currency denominated-debts to balloon.

Mounting pressure on ability to service debt as global interest rates rise

As of 2020, China was Lao PDR’s largest creditor at 47% of its total public external debt, while concessional and commercial loans accounted for 35% and 12% of the total, respectively. Other sources of commercial loans include commercial banks and other multilateral lenders. Based on this external debt structure and sooner-than-expected normalization of monetary policy in major economies, the country is exposed to foreign exchange rate and interest rate risks as more than a half its total debt is denominated in USD and about 17.4% is on floating rates against the backdrop of already-high cost of debt driven by the weakening LAK against the USD and THB.

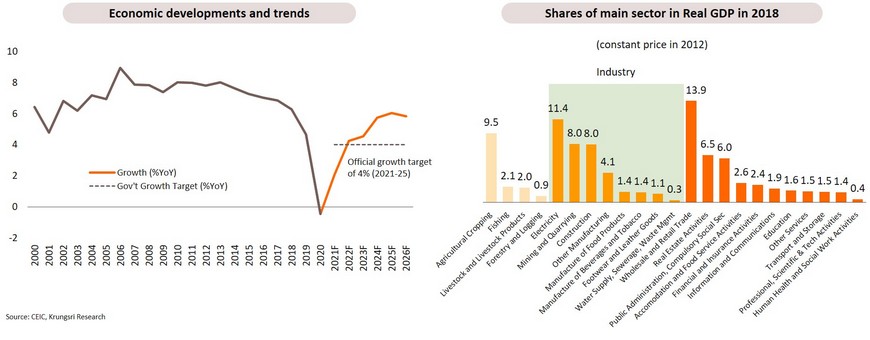

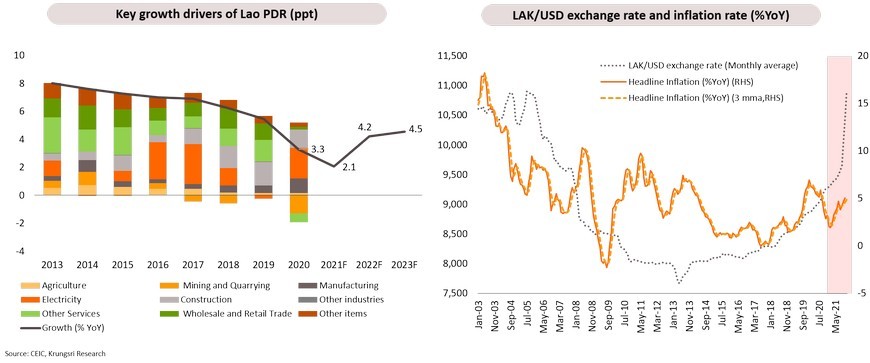

Lower official growth target and weak growth prospects amid the lingering pandemic would undermine Lao PDR’s ability to service mounting external debts

In 2021, the government adopted the 9th 5-year National Socio-Economic Development Plan (NSEDP) for 2021-2025. One of the key targets is to achieve average annual GDP growth of at least 4% by 2025, USD2,880 GDP per capita, and USD2,280 national income per capita. This is significantly below its 7% p.a. growth target in the previous plans, which might mean the government plans to pursue fiscal consolidation and reduce public debts by cutting spending and improving revenue management. In addition, the economy has been disrupted by the pandemic in 2020-2021. As a result, recovery is expected to be slow and supported by exports, a gradual pick-up in the services sector, and infrastructure investment.

LAK depreciation could be a tailwind for exports, but the relatively narrow export structure might cap potential gains

Over the past few years, the real effective exchange rate (REER) has dropped in line with the nominal rate. The currency depreciation – in both real and nominal terms - has improved the country’s export competitiveness and trade balance. However, Lao PDR is unlikely to reap the full benefits of improved export competitiveness due to its narrow export structure - dominated by agricultural products, electricity, commodities, and only a few categories of manufactured products. These products, especially agricultural goods and commodities, tend to have inelastic demand, meaning that lower prices arising from a weaker kip would not lead to significantly higher exports. Looking ahead, there are good prospects for the country’s exports supported by the Regional Comprehensive Economic Partnership (RCEP) and bilateral trade arrangement with China. However, it remains uncertain whether rising exports and trade surplus can sustain the current account surplus in the medium-term amid a sizeable outflow of primary income.

FDI and tailwinds from China-Laos Railway

Foreign Direct Investment (FDI) has played a vital role in supporting industrialization and financing the saving-investment gap in Lao PDR, like other countries in the region. However, against a backdrop of the sizeable, lingering current account deficit, FDI inflows have been insufficient to finance those deficits. Looking ahead, given that it is relatively open to foreign investment, the operation of the China-Laos Railway could be one of the pull factors to attract FDI into the country and further spur domestic industries and international trade by geographically connecting ASEAN and China. However, it remains uncertain if the railway project would secure sufficient foreign investment to ease the country’s external vulnerability.

6. The kip trend will hinge on fiscal consolidation and debt rollover; the external instability remains a concern

There is a lot of uncertainty about the future direction of the kip against the USD and THB, primarily due to lingering and sizeable twin deficits which are expected to last at least in the next few years. Given uncertainties, we performed a scenario analysis based on two factors, fiscal consolidation and ability to rollover existing external debts. We conclude Lao PDR might head for the fourth scenario – failed fiscal consolidation, but being able to rollover existing debts. Therefore, the BOP crisis probability is assessed to be medium. The economic scars created by the pandemic would make it more difficult to manage fiscal consolidation efforts, while China is expected to assist Lao PDR in debt restructuring. As a result, the kip will continue to depreciate but at a slower pace. We also expect more regulations from the central bank to tighten its control over foreign exchange in the country.

Lingering kip weakness could hurt macroeconomic stability

Lao PDR’s economy is expected to recover and expand by 4.2% in 2022, following the pandemic-induced slowdown in 2020 and 2021. The major growth drivers would be normalizing domestic demand boosted by the reopening of the economy and rising exports. However, there is large downside risk to its recovery trajectory, especially because of persistent foreign exchange liquidity constraints. This has led to the lingering kip weakness against the USD and THB. Given rising inflation recently, the rapid depreciation of the currency could harm price stability through imported inflation amid rising oil prices and the resurgence of domestic demand.

7. Implication: Measures to mitigate exchange rate shocks and default risk should be put in place

The government is committed to reduce total public and public-guaranteed debt stock to 64.5% of GDP by the end of 2023 from 71% of GDP in 2021. Despite the possibility of being able to rollover debts, the high amount of debt to service and rising interest rates worldwide could add pressure on Lao PDR’s external debt management strategy. Therefore, we expect the government to pursue austerity measures by improving revenue management and introducing more tax measures, but these efforts might fail as the country needs stimulus measures to nurture the ongoing economic recovery. There are few available policy options, including debt restructuring, debt monetization, and allowing the kip to depreciate further. However, the last two could also fuel dollarization. Against this backdrop, Lao PDR might opt to default on existing debts and request for financial assistance from the IMF to avoid a balance of payment crisis. We recommend investors take measures to mitigate risks arising from external instability.

Appendix

Structure of the monetary accounts

Analytical Aspects of the Balance Sheet of Central Bank

Taxonomy of public and external debts

According to the IMF, public debt and external debt are widely used macroeconomic concepts. Public debt is the debt owed by the public sector to residents (domestic public debt) or non-residents (external public debt). External debt refers to the debt owed by the country as a whole- including the government and the private sector- to nonresident creditors, such as private commercial banks and investors, foreign government, or international financial institutions.