Over the past year, public interest in digital assets has exploded. This includes not only the dizzying number of different cryptocurrencies, for which prices have risen at a breathtaking pace, but also the equally broad spread of different types of digital tokens[1], and among the latter, NFTs in particular stand out for the passion that they have aroused. NFTs are most often found in the form of digital artworks of some kind, but the feverish trading in these has driven up prices and, in the process, these have caught the attention of a broader section of society, who are now wondering just what NFTs actually are.

NFT is an abbreviation of ‘non-fungible token’, a kind of digital asset that carries with it built-in certificates of authenticity that establish proof of ownership or confirm some other kind of right to the NFT. These can take the form of digital content, such as images, photographs, or music, or they may refer to physical assets, such as land. NFTs can thus be thought of as a digital token that confirms ownership or copyright, but unlike digital tokens, each NFT is also unique, which then means that one cannot be swopped for another (i.e., they are non-fungible) and neither can they be divided into smaller parts. NFTs can, however, be traded, and the conditions of the sale can be encoded in a smart contract[2]. NFTs have their individual features recorded on a blockchain, and because this is a kind of distributed ledger technology (DLT)[3], it is possible for everyone else in the same network to inspect this data, which is then unalterable. At present, Ethereum is the preferred blockchain for the creation of NFTs, and in particular, the ERC-721 standard is used because this allows the individual data relevant to that NFT to be recorded and then to be connected with metadata (the metadata links the blockchain token to information that is held off the blockchain, or information relating to the ownership rights of physical objects). This ability then makes the Ethereum ERC-721 standard particularly suitable for use with NFTs.

One ancestor to full-blown NFTs was ‘colored coins’, which have been known among those interested in digital assets since the end of 2012. Colored coins were built on the Bitcoin blockchain but contained additional metadata that allowed the coin to be used to represent the value of another item, which could be a physical or a financial asset, such as stocks, bonds, or a collectible. However, colored coins were withdrawn at the start of 2018.

Slightly predating the extinction of colored coins, NFTs made their first appearance in mid-2017 via the CryptoPunks project[4]. This first generation of NFTs was distributed freely, though in small numbers, and this has helped their value to increase steadily, allowing them to become both valuable and influential. This was followed by the highly popular and rapidly successful CryptoKitties project[5], which then became the first NFT venture to become widely known. The most important aspect of the CryptoKitties project was that it allowed anyone to create NFTs without the need for additional help from an administrator or a programmer, and so following this, a large number of additional NFT projects have been undertaken.

Artists around the world are turning to NFTs to create digital artworks since these are able to encode ownership data and other historical information. NFTs have the added advantage of allowing artists to add automatic royalty payment information related to the use of that artwork, too, and this surge in popularity has given rise to a growing number of platforms where NFTs can be hosted and traded, including SuperRare, Known Origin, MakersPlace, OpenSea, Wax, and Rare Art Labs.

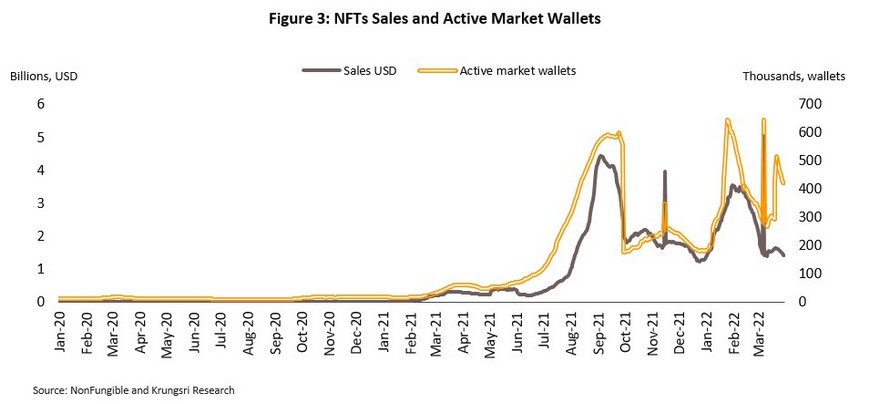

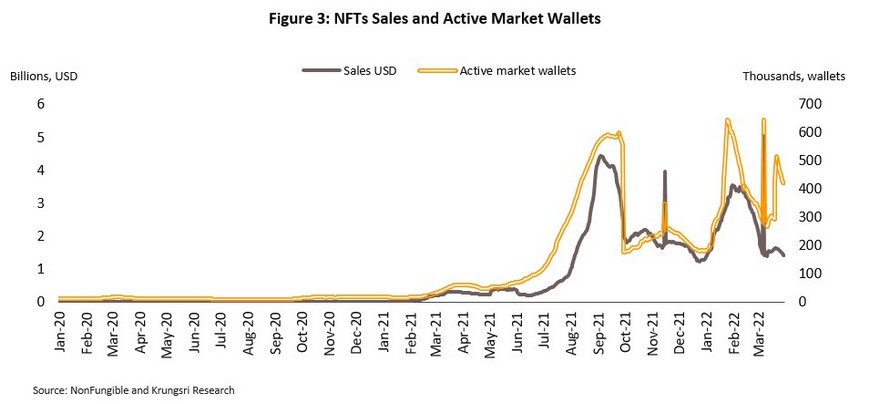

NonFungible.com reports that as of 2021, the market for NFTs was worth over USD 15 billion, up 229-fold (22,851% to be exact) from just USD 67 million a year earlier. This astonishing surge in interest is mirrored in the 20-fold increase in NFT accounts, which went from 86,740 in 2020 to 1,976,256 just a year later.

Creating NFTs is now easier than ever and this is provoking growing interest from artists, investors, and members of the general public who are interested in exploring this new digital territory. Nevertheless, NFTs are still at the first stage of their development and those involved in their creation are still learning about these and trying to find applications for them.

NFT characteristics

Different types of NFT display a wide range of different characteristics, but the most significant of these can be gathered under the following five headings[6].

- Uniqueness: Unlike other tokens or digital assets, NFTs have unique qualities, and when NFTs are issued, it is possible to clearly specify the number that will be created, with identifiable differences between each token.

- Rarity: The limited supply or rarity of NFTs may have several explanations. (i) Artificial rarity occurs through a deliberate decision to restrict the supply or issuance of an NFT. For example, Larva Labs, the creator of the Cryptopunks NFTs, decided that of the 10,000 NFTs that it would issue, just 1.75% would feature a ‘punk’ wearing a mask. (ii) Numerical rarity is similar to artificial rarity but may be more obvious since a numerical limit is set on the number of NFTs to be issued. An example of this would be a musician who issued a new song as an NFT, of which only 100 signed and password-protected copies were created. (iii) Historical rarity can occur when historical circumstances or the history of a token work to underscore that NFT’s rarity. Thus, the Cryptopunks NFTs are valuable and sought after since they are widely recognized as the first NFT. In addition, because the blockchain records the complete ownership data of individual NFTs, those that have been owned by famous individuals may acquire historical rarity and so become more in demand.

- Ownership: NFTs carry their own proof of ownership, as well as encoding their full history. This generally includes data on when the NFT was created, who created it, who the current owner is, and what changes of ownership have occurred since it was first issued. Most NFTs that are created now guarantee only ownership rights, and unless it is otherwise specified, the copyright usually remains with the original creator.

- Immutability: This quality is an extension of properties of the blockchain on which the NFTs are created, i.e., it is impossible to unilaterally alter the data on the blockchain. This then helps to build transparency and trust.

- Programmability: This is a characteristic of NFTs that marks them out from real-world assets. Because NFTs allow for complex agreements to be encoded into smart contracts that are bundled with the NFT, as long as the conditions can be specified and coded, there is no limit to what these can cover, and so changes of ownership of the NFT can involve complex procedures. Thus, an artist might specify that a 10% royalty fee has to be paid every time a particular NFT changes hands. This ability is also allowing NFTs to be trialed as collateral for loans made on DeFi platforms.

What is the source of NFTs’ value?

Although at present, there are no laws that directly regulate or support the market for NFTs and most NFTs only offer ownership rights that do not include copyright, the NFT market has exploded in value and investors are rushing to enter this space. The main determinants of NFT value are thus summarized below.

- Passion for or an appreciation of the value of the artist’s work: Value might derive from the status of a world-famous artist, or for support provided to a particularly admired artist, singer, or sportsperson.

- Benefits that derive from holding an NFT: For example, ownership of an NFT might grant the owner the right to additional goods or services, further benefits or returns as a share of any future income generated by the asset, extra benefits deriving directly from that asset, or other specified rights.

- The social status of NFTs: Owning NFTs may make the owner feel that they are young, progressive. modern, adventurous, entrepreneurial, and that they are a member of the wealthy investor class.

- Community building: Individuals with a shared interest or who belong to the same community will try to support the continuation of that community, and so the value of NFTs has steadily increased with the size of the NFT community and its support for NFTs.

- Speculation and buying for future sale: Because NFTs are unique and limited in supply, they attract the interest of investors looking to sell on for a profit.

Creating and trading NFTs

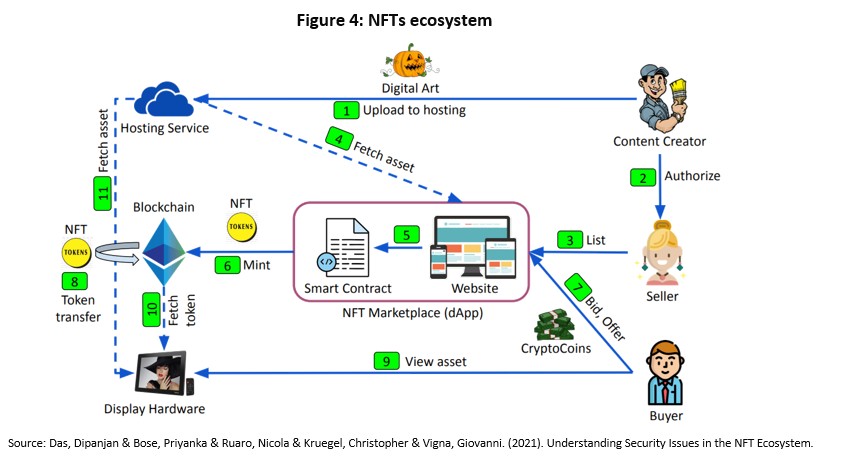

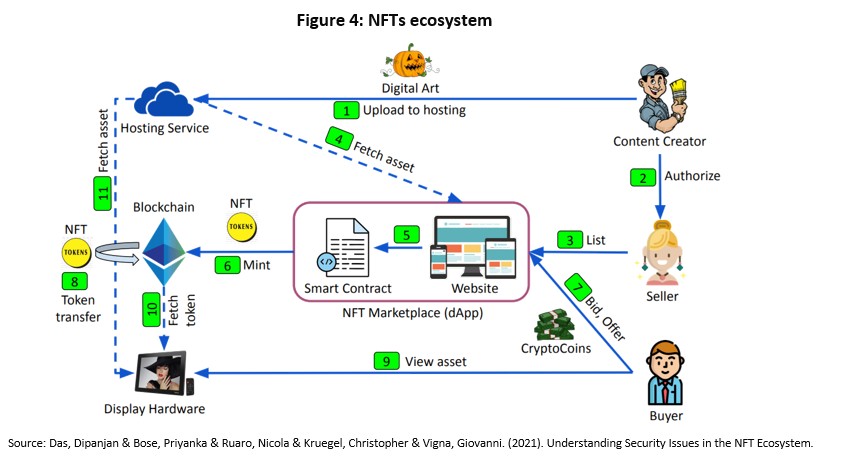

When creating an NFT, it is possible to encode within it a wide range of property rights that relate to that particular asset, but because digital artworks[7] have attracted the most interest in the market for NFTs, the following section will focus on how these are created and traded.

- Minting NFTs: NFTs begin their life when an artist or creator records a graphic or other digital artwork and then uploads this image or artwork together with all relevant accompanying information to a hosting service[8] so that the images and data can be further processed. This could be a centralized storage service, such as the Amazon S3 service, a distributed storage service, such as IPFS (Inter Planetary File System), or possibly an NFT marketplace, which in some cases also offer data storage services. Having been uploaded, the NFT is minted and any accompanying rights or obligations are encoded with it. Artists may create their own NFTs or, if they lack the expertise necessary to convert a digital artwork into a blockchain-hosted NFT, this can be done by an agent or seller, who will then mint the NFT and include it in NFT marketplace catalogues.

- Trading NFTs: When a buyer is interested in an NFT, purchases are relatively straightforward. Prices may be fixed or they may be set by auction, and in NFT marketplaces, these follow one of two models.

- ‘English auctions’ are organized such that prices start from the lowest price that the seller of a particular NFT will accept. The bid prices are then steadily raised by the auctioneer until they reach the highest price that anyone will bid on. NFT marketplaces that use English auctions include OpenSea, Foundation and SuperRare. This style of auction is favored because it is so easy to understand and to follow.

- ‘Dutch auctions’ take the reverse path, beginning with a very high price. The seller will then steadily reduce the sale price until a buyer agrees to the proposed price; the first person to accept a price is then the winning bid. Axie is one NFT marketplace that uses this method.

In either case, when a sale price is confirmed, the seller will transfer ownership of the NFT from the seller’s to the buyer’s account.

In addition to the method used to set sale prices, NFT marketplaces also vary the conditions that they impose on either side of the market, and buyers and sellers will need to consider these carefully before making a decision. For example, some marketplaces may store information about bids on a blockchain or in internal systems, they may have different rules about withdrawing bids, and they may operate differently with regard to how quickly they transfer ownership of NFTs after a sale has been completed.

Using NFTs

NFTs have found a variety of roles in different industries, some examples of which are given below.

Digital art: NFT platforms have helped to create a space within which artists may connect with buyers and so they now do not need to rent their own sales space or rely on galleries organizing exhibitions of their work. This has then had the additional benefit of reducing the cost of marketing to collectors, though these developments have been especially important during the pandemic, when governments severely curtailed travel in countries around the world. NFTs also give artists a way to benefit more fairly from the sale of their works since NFTs can carry and enforce smart contracts that ensure that a proportion of the sale price is returned to them every time the work is resold. Thus, artists are now able to earn royalties in addition to the initial sale price, which had previously been their only source of income from the sale of an artwork. Examples of recent sales of NFTs are ‘Everydays: The First 5000 Days’ by the artist Beeple, which went for a 2021 record of USD 69.35 million, while in Thailand, the current record sale price for an NFT is held by ‘The Invitation’ by Nahathai Naothaworn, or IPUTSA, which sold for 11 ETH, or around THB 1.5 million[9].

In-game assets: The gaming industry has enjoyed high rates of growth that have lifted its market value to beyond USD 100 million, and the emergence of NFTs will help to further add to the appeal of gaming. NFTs allow gamers to generate income from their activities (so-called play-to-earn) by linking gaming assets, which might be objects in the gaming environment or character skills, with NFTs that allow for proof-of-ownership. Gamers are then able to trade these NFTs with others, as is the case with Cryptokitties, Axie Infinity, Aavegotchi, Splinterlands and LiteBringer.

Content ownership: Content creators are able to generate income through NFT versions of songs, or music or other videos, or to use NFTs to make use of their copyright over previously created works. NFTs may be issued that enforce fractional ownership rules regarding that particular artwork, so if that artwork generates additional income, the NFT owner will receive a portion of this as specified. For example, Rocki, a platform for music NFTs built on the Binance Smart Chain, sells songs and accompanying copyright ownership to record labels and collectors, which will be shared with the creator[10]. In Thailand, the well-known singer Tik Shiro has auctioned his song ‘Love Doesn’t Change’ as an NFT.

Fashion: Brands exist as concepts that individuals use to express a particular image, identity, social standing, or other admired feature. The appeal of brands is unlikely to change, and in the future, as the virtual and real worlds become increasingly integrated and hard to distinguish, the desire to express individual identities in the digital space through brands will become ever more important for companies looking to expand their customer base and to take control of this new environment. At present, both mass-market and high-end brands, including Gucci, Louis Vuitton, Burberry, Coach, Dolce & Gabbana, Gap, Balenciaga, Adidas, and Nike, are establishing a presence in NFT markets. Brands are also finding other applications for NFTs in recording and checking the history of goods by using blockchains to track these from raw materials, through retail outlets, and into secondhand markets, and leading brands such as Bulgari, Cartier, Hublot, Louis Vuitton, and Prada are already participating in the Aura Blockchain platform[11].

Ticketing: Tickets for admission to events such as concerts could be issued as NFTs. This would then allow them to be kept as souvenirs or collectibles.

Certificates: Because NFTs are built on blockchains, they are transparent, open and immutable, which makes them suitable for use as a means of recording different types of certification. Hoseo University in South Korea and Dhurakij Bundit University in Thailand have therefore both begun issuing degree certificates as NFTs.

Virtual assets: NFTs are beginning to be used to record ownership of virtual assets, for example, to record ownership of domain names (e.g., via the Ethereum Name Service and Unstoppable Domains) and so permit the owner to trade these. Within the metaverse[12], where activities may straddle the virtual and real worlds, NFTs are widely used to establish ownership of metaverse-based assets, including for example to record ownership of virtual land on the Decentraland, The Sandbox and Cryptovoxels platforms.

Real-world assets: In addition to ownership of virtual assets, NFTs can also be used to establish ownership of real-world assets through the creation of a ‘digital twin’, or a digital representation of a real-world object. NFTs may thus act as the middleman linking property rights in the virtual and the real worlds, and this will then allow for the seamless trading of real-world assets in virtual environments. An example of this is OpenLaw, which has established a platform for trading real estate but which uses NFTs and the ERC-721 standard to encode ownership information. Adidas also offers virtual trainers for sale as NFTs but bundles with these rights that entitle the owner to a pair of real trainers at no extra cost.

Obstacles on the path to widespread adoption of NFTs

Money laundering: At present, most NFT platforms enforce know-your-customer (KYC) rules only cursorily, or even largely ignore these. Thus, on the OpenSea platform, customer identities are checked only to the extent that they have an Ethereum wallet, and when gaining access to the platform to sell NFTs and to be paid in a cryptocurrency, revealing further personal details is not necessary. Moreover, because these transactions take place on the blockchain, buyers and sellers are anonymous to one another, it is not possible to know the origins of the money being used to fund the sale, and it is equally impossible to assess whether or not the price of the asset being sold is a fair reflection of its real value. Beyond this, at present, legal systems do not extend explicitly into NFT markets and regulatory bodies in many countries thus fear that the trade in NFTs is being used for money laundering. It is therefore likely that in the future, buyers and sellers of NFTs will need to perform basic KYC procedures before sales can be completed. This may involve revealing the real names of those on either side of the trade, establishing the source of the funds used to pay for the NFT, and supplying other supporting documentation, even if this runs against the decentralized sprit of the NFT market.

Security concerns: As soon as NFTs began to attract more widespread interest, fears about safety started to mount. These worries extended over problems with confirming actual ownership of the NFT, credit card information being stolen when purchasing an NFT, ownership of NFTs being switched back after the sale had been completed, stealing NFTs, copying NFTs, and using assets without the owner’s permission when minting NFTs (e.g., copyright infringement). Finding ways to reduce fears around all of these issues will thus be an important step on the road to opening the market for NFTs to a broader section of the public. There are several approaches that could help with this. (i) Problems with identity theft could be reduced by enforcing the use of two-factor authentication (as used in commercial banks’ online applications) when accessing accounts or trading an NFT. (ii) Worries about fake NFTs could be reduced by using a middleman to inspect and confirm the authenticity of NFTs when they enter the system or in the period between selling an NFT and completing the transfer of funds and ownership (i.e., enforcing an after-sale cooling-off period during which checks could be made). However, at present, the world of digital assets and especially the area of cryptocurrencies is outside the scope of official regulators, and so operators of NFT marketplaces will need to take it upon themselves to try to enforce these kinds of standards and to ensure that their customers’ data and assets remain secure when they are on their platform.

The difficulty of enforcing real-world linkages: In many ways, NFTs perform the same kind of function as do land title deeds or other types of certificates of ownership, but in the real world, title deeds and ownership certificates are not the asset owned; they are simply accepted as proof that the owner named on them benefits from all the accompanying rights that come with ownership of that asset. However, as described above, although some NFTs are used in this way to assign ownership of real-world assets such as land or other goods to the owner of that NFT, at present, most NFTs have no legal status, and holding ownership through an NFT is not legally sanctioned. Rather, this is simply an agreement between buyer and seller to treat these agreements as though they were legal, without this being the case. It is therefore difficult to enforce NFT-assigned property rights through a court. In addition, international trading of NFTs adds to these difficulties since the law varies from one country to the next, and at present the international agreements that would need to be in place to make the international trade via NFTs secure is still only at the stage of being researched and developed. It is also true that it remains difficult to check ownership of NFTs, even when operating within a single NFT marketplace, and so buyers’ security is at least partially dependent on the safety and stability of these platforms.

Inaccessibility: Most NFT marketplaces insist that users wishing to buy or sell NFTs must have a cryptocurrency wallet, while to make informed choices about what features to include with their NFTs, artists or others looking to create these need to have at least a basic understanding of blockchain technology and to be able to decide questions such as which blockchain to use, which standard to employ, how to write their contract, and what currency they would like to be paid in. Because of this, participants in the market for NFTs tend to be restricted to those with experience and knowledge about cryptocurrencies and the use of DApps (decentralized applications). As such, the market is currently concentrated among ‘early adopters’ and particular groups with shared goals. By contrast, much of the population either does not understand the benefits that come from owning NFTs or does not trust them. To counter this and to attract a greater number of customers, owners of NFT marketplaces are trying to improve the user experience by making their platforms more user-friendly. Nifty Gateway is therefore allowing the purchase of NFTs with credit cards, and OpenSea has extended this to allow payments to be made with debit cards, credit cards, and Apple Pay.

Krungsri Research view: How should the banking sector approach the NFT ecosystem?

Compared to the markets for cryptocurrencies or indeed for other asset classes, the market for NFTs is currently limited in scope, but its rapid expansion and the wide range of potential uses for NFTs indicates that this will not always be the case, and so close attention should be paid to this area. Krungsri Research believes that banks can follow a number of different routes to enter this space.

Brand awareness: Banks could participate in the market for NFTs to improve their branding and to indicate that that bank understands the technology and is a member of the NFT community. At first, this might take the form of supporting the market for digital artists or in-game assets since these are areas where NFTs are finding applications most rapidly. Banks could also buy NFTs directly, fund or participate in activities related to the NFT community, or join with partners to build a network connected to the NFT ecosystem. These types of activity will help to develop brand awareness and build the bank’s image as youthful and tech-forward. However, it should be noted that the biggest gains from this strategy will likely go to the bank that gains first-mover advantage.

Enhancement of operational efficiency: An alternative route would be for banks to increase their own operational efficiency by exploiting the special characteristics of NFTs to encode ownership information in a way that is transparent and trustworthy and to include within themselves smart contracts. For example, NFTs could be used when buying a house or car with a loan, and these could be set up so that ownership would automatically transfer to the buyer from the lender as soon as all payments had been completed. In addition, if a bank customer wished to transfer the loan from one bank to another, this could be done without the need to void the first contract and then create a second. Instead, the NFT-based loan could be traded between the two banks, with the loan conditions being adjusted as necessary. Nevertheless, getting to a point when NFTs can be used in this way will take some time since the requisite infrastructure will need to be built, industry standards need to be agreed, and the regulatory and legal framework needed to support this kind of business will need to be put in place.

Supporting the introduction of new products and services: Banks may also respond to a wide range of consumer needs by designing new products and services that are based on NFTs.

- Establishing an NFT fund: Banks could underwrite NFT investment funds. As well as helping their clients invest in the NFT market without their needing to hold their own NFTs directly, this would also help to stimulate the market for NFTs and related industries.

- Using NFTs as collateral: Once the market for NFTs has matured sufficiently that the price volatility of at least some types of NFT has settled down, or financial tools have emerged to better manage this risk, NFTs may become one option when considering the collateral to be used to secure a loan.

- Provider of financial services: There are many types of financial services associated with the sale of NFTs that could be provided by commercial banks. This could include supplying payment gateways for NFT marketplaces, which because it would allow buyers to pay for their purchases with credit cards, would likely make the whole process much easier. In the future, the trading of high-value NFTs is likely to attract the attention of the authorities, and buyers will need to comply with anti-money laundering/countering the financing of terrorism legislation that requires them to disclose the sources of their income. In this case, banks would be well placed to provide services to facilitate this process. When NFTs are auctioned, banks could also confirm the ability of bidders to finance their purchases in real-time, thus obviating the need to cancel auctions after a winning bid has been made but the funds to pay for this are not forthcoming.

- Providing NFT custodian services for the storage and management of returns arising from clients’ NFTs: Banks could act as custodians for their clients’ NFTs, and for NFTs that represent real-world property rights, banks could offer additional services to look after those assets, too. Banks have an advantage in this area since they are already trusted to look after clients’ other personal assets, such as money on deposit or objects kept in bank safety deposit boxes, and this would pave the way for banks to offer these additional services managing and looking after other assets. Both buyers and sellers of NFTs would likely trust banks not to alter the asset or to allow it to drop in value. Assets that would tend to need these kinds of custodian services would be high-value goods that were more difficult to look after or that the owners did not need to have physical access to. Examples might include precious stones, wine, collectible cards, religious objects, books, or other types of collectible or valuable items.

- Establishing an NFT marketplace: Banks could set up an NFT marketplace, either by themselves or by partnering with another player. This would help them: (i) generate income from the fees charged for carrying out business on the platform; (ii) gain access to customers interested in NFTs, to whom the bank could then try to sell other goods and services; (iii) harvest data on consumer behavior; and (iv) increase the channels through which the bank is able to reach their clients. However, this might be a tricky route to take, and it may be difficult to attract users to the platform and to encourage the development of relationships within it.

Although NFTs remain a new and somewhat exotic asset class that has yet to find a clear role within the banking sector, players in the financial sector should nevertheless pay attention to this corner of the technological world because NFTs may well open another door into the new continent of digital assets. And as long as they are providing financial services in an environment that is undergoing such unprecedented technological change, stepping into this new territory will remain crucially important for players in the financial sector.

References

ชุติภา คลังจตุรเวทย์ และ ดร.พิมพ์นารา หิรัญกสิ. 08 พฤศจิกายน 2564. DeFi กับบทบาทของธนาคารในโลกการเงินโฉมใหม่ที่ไร้คนกลาง. [ออนไลน์]. เข้าถึงได้จาก: https://www.krungsri.com/th/research/research-intelligence/defi-21

พิมพ์พิศา อุดมผลวณิช. 13 ธันวาคม 2564. รวม 5 ผลงานศิลปินไทยในตลาด NFT ที่น่าสนใจและทำรายได้สูงสุด [ออนไลน์]. เข้าถึงได้จาก: https://thestandard.co/5-highest-earn-nft-thai-artworks/

ธงชัย. 11 กุมภาพันธ์ 2565. 7 ประเภทของ NFT ที่นักสะสมควรรู้ [ออนไลน์]. เข้าถึงได้จาก: https://siamblockchain.com/2022/02/11/top-7-nft-use-cases/

พลอยจันทร์ สุขคง. 13 กุมภาพันธ์ 2565. 3 เหตุผลที่ตอบว่าทำไม CryptoPunks ถึงเป็น NFT มูลค่าสูงทั้งที่ไร้สิทธิประโยชน์และโรดแมป [ออนไลน์]. เข้าถึงได้จาก: https://thestandard.co/why-are-cryptopunks-so-expensive/

Non-Fungible Token (NFT) และการกำกับดูแลของ ก.ล.ต. [ออนไลน์]. 6 มกราคม 2565. เข้าถึงได้จาก: https://www.sec.or.th/TH/Template3/Articles/2565/060165.pdf

ZIPMAX. Digital Assets 101. 12 พฤศจิกายน 2564. เมื่อ NFT มาเขย่าวงการแฟชั่น Gucci, Louis Vuitton เริ่มแล้ว! [ออนไลน์]. เข้าถึงได้จาก: https://zipmex.com/th/learn/fashion-in-nft/

Aleksandra Jordanoska. 2021. The exciting world of NFTs: a consideration of regulatory and financial crime risk. Butterworths Journal of International Banking and Financial Law.

Ali, Muddasar & Bagui, Sikha. 2021. Introduction to NFTs: The Future of Digital Collectibles. International Journal of Advanced Computer Science and Applications. 12. 10.14569/IJACSA.2021.0121007. Available: https://thesai.org/Downloads/Volume12No10/Paper_7-Introduction_to_NFTs_The_Future_of_Digital_Collectibles.pdf

DappRadar. 2021. 2021 Dapp Industry Report [On-line]. Available: https://dappradar.com/blog/2021-dapp-industry-report

Das, Dipanjan & Bose, Priyanka & Ruaro, Nicola & Kruegel, Christopher & Vigna, Giovanni. 2021. Understanding Security Issues in the NFT Ecosystem.

Dragos I. Musan. 2020. NFT.finance Leveraging Non-Fungible Tokens [On-line]. Available: https://www.imperial.ac.uk/media/imperial-college/faculty-of-engineering/computing/public/1920-ug-projects/distinguished-projects/NFT.-finance-Leveraging-Non-Fungible-Tokens.pdf

European Network | NFT cross-border perspectives on unprecedented regulatory challenges [On-line]. 2022. Available: https://www.cuatrecasas.com/resources/nft-cross-border-perspectives-on-unprecedented-regulatory-challenges-feb-2022-6203a26e8a836480104329.pdf?v1.1.10.202201191812

INSIDER. 2022. NFTs ballooned to a $41 billion market in 2021 and are catching up to the total size of the global fine art market [On-line]. Natasha Dailey. Available: https://markets.businessinsider.com/news/currencies/nft-market-41-billion-nearing-fine-art-market-size-2022-1

Kendrick Lau. 2020. Non-Fungible Tokens: A brief Introduction and History [On-line]. Available: Crypto.com

Regner, Ferdinand & Schweizer, André & Urbach, Nils. 2019. NFTs in Practice – Non-Fungible Tokens as Core Component of a Blockchain-based Event Ticketing Application [On-line]. Available: https://www.researchgate.net/publication/336057493_NFTs_in_Practice_-_Non-Fungible_Tokens_as_Core_Component_of_a_Blockchain-based_Event_Ticketing_Application

Rehman, Wajiha & Zainab, Hijab & Imran, Jaweria & Bawany, Narmeen. 2021. NFTs: Applications and Challenges. 10.1109/ACIT53391.2021.9677260.

THE EUROPEAN NETWORK. 2022. NFT CROSS-BORDER PERSPECTIVES ON UNPRECEDENTED REGULATORY

The European Union Blockchain Observatory & Forum. 2021. Demystifying Non-Fungible Tokens (NFTs) [On-line]. Available: https://www.eublockchainforum.eu/sites/default/files/reports/DemystifyingNFTs_November%202021_2.pdf

Timo Klein. 2021. Non-fungible. Non-tangible. Still valuable? [On-line]. Available: https://www.oxera.com/wp-content/uploads/2021/07/Non-fungible-Non-tangible-Still-valuable-2.pdf

VISA. 2022. NFTs Engaging Today’s Fans in Crypto and Commerce [On-line]. Available: https://usa.visa.com/content/dam/VCOM/regional/na/us/Solutions/documents/visa-nft-whitepaper.pdf

Warittha Chalanonniwat and Wanwares Boonkong. 2021. NFTs – Simple Guide to the World of NFTs and Its Potential Beyond Art and Gaming Industries [On-line]. Available: https://beaconvc.fund/2021/09/30/nfts-simple-guide-to-the-world-of-nfts-and-its-potential-beyond-art-and-gaming-industries/?utm_source=rss&utm_medium=rss&utm_campaign=nfts-simple-guide-to-the-world-of-nfts-and-its-potential-beyond-art-and-gaming-industries

We would like to thank Khun Bunthep Tacharungreuangkij for granting us an interview and for providing such useful input and Dr. Pimnara Hirankasi for her assistance with preparing this research.

[1] See Box 1 for details.

[2] Smart contracts are programs that are embedded in blockchains and that share many of the features of regular contracts routinely agreed between buyers and sellers. However, smart contracts differ in that they are programmed to execute automatically, while they also retain other notable features of blockchain technology, that is that they are public, transparent, verifiable, distributed, and trustless.

[3] Blockchain refers to a kind of technology that is used to store information. Blockchains are decentralized (i.e., there is no overall owner or administrator of the information) and the stored data is public, with each participant in the blockchain having access to this via a peer-to-peer network that allows blockchain participants to view a shared database. Users are therefore able to inspect this public ledger, and information about who has particular rights or ownership is similarly public. Information is stored in ‘blocks’ that are digitally linked to one another in a chain, and this is the source of the technology’s name.

[4] CryptoPunks is the most influential NFT project to date, and has provided a model for other successful NFT ventures. Cryptopunks was launched by two Canadian artists, Matt Hall and John Watkinson operating under the name Larva Labs, and involved the algorithmic creation of 10,000 unique 24×24-pixel images of men, women, monkey, zombies, and aliens (source: The Standard).

[5] CryptoKitties is a kind of blockchain-based game hosted on the Ethereum blockchain that involves collecting, raising and breeding digital cats. The resulting offspring all have unique characteristics, and these have thus given birth to a new class of objects within the world of cryptocollectibles (source: https://bitblockthai.com/about-cryptokitties/).

[6] EU Blockchain Observatory and Forum

[7] Das, Dipanjan & Bose, Priyanka & Ruaro, Nicola & Kruegel, Christopher & Vigna, Giovanni. (2021). Understanding Security Issues in the NFT Ecosystem

[8] Hosting services provide online data storage capabilities that make the data accessible to others, who can access it, download it, or otherwise interact with it. Generally, users will build a website first and then upload this to the hosting service provider (source: https://blog.phalconhost.com/what-is-hosting/).

[9] https://thestandard.co/5-highest-earn-nft-thai-artworks/

[10] https://siamblockchain.com/2022/02/11/top-7-nft-use-cases/

[11] https://zipmex.com/th/learn/fashion-in-nft

[12] The metaverse is a three-dimensional environment that seamlessly joins the real and the virtual worlds and that is accessed via internet. This provides a setting within which people can live out their lives, spending their time working, resting, consuming media, gaming, socializing with others, and engaging in joint activities much as they would in the real world. The metaverse is entered by wearing a VR headset that is connected to the internet.

[10] https://siamblockchain.com/2022/02/11/top-7-nft-use-cases/

[11] https://zipmex.com/th/learn/fashion-in-nft/

[12] เมตาเวิร์ส (Metaverse) คือโลก 3 มิติที่เชื่อมต่อด้วยอินเตอร์เน็ตและผสมผสานทั้งโลกจริงและโลกเสมือนเข้าไว้แบบ ไร้รอยต่อ จึงทำให้ผู้คนสามารถเข้าไปใช้ชีวิต ทั้งทำงาน พักผ่อน ชมความบันเทิง เล่นเกม พบปะพูดคุยกัน ตลอดจน ทำกิจกรรมร่วมกันได้เหมือนเป็นโลกจริงๆ โดยมีอินเทอร์เน็ตและอุปกรณ์สวมศีรษะเป็นเครื่องมือสำคัญในการเข้าถึง