Update on Myanmar: A Year after the Coup –What Next?

Executive Summary: Myanmar will continue to face challenges ahead

- Myanmar has faced multiple headwinds since the coup in February 2021. Against the backdrop of the COVID-19 pandemic, the military interference has additionally induced a deep economic slump since last year.

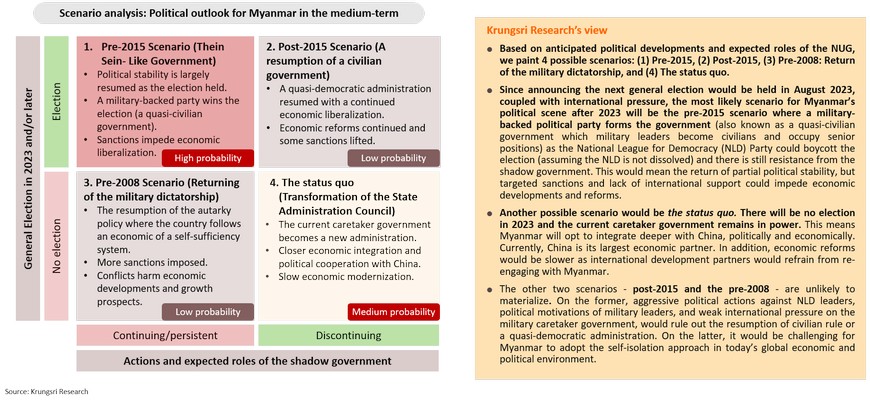

- There are lingering uncertainties but there should be a semblance of political stability following the next general election which is tentatively scheduled to be held in 2H 2023. This is mainly because we expect the military-backed political party to win the election and form the next government – instead of a civilian government - and military leaders would occupy main positions despite persistent opposition to the military dominance.

- Myanmar’s economy is showing signs of stabilizing in 2022; medium-term economic outlook remains gloomy. Targeted sanctions would hinder not only economic liberalization and reforms but also foreign investment and support from international and bilateral development partners. These will hurt Myanmar’s economic growth prospects.

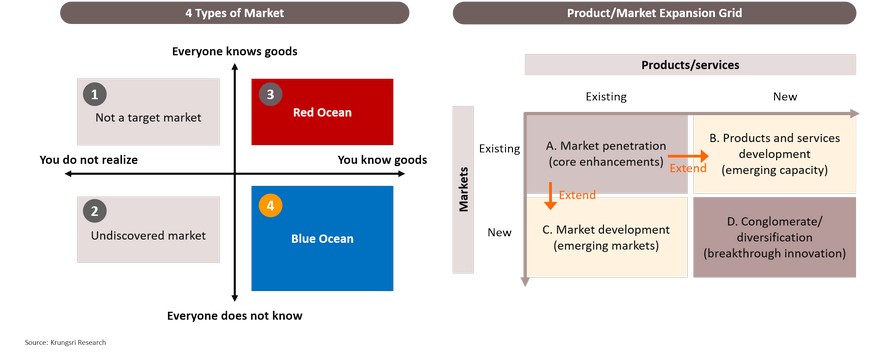

- Businesses with long-term commitments in the country may consider different strategies to weather the challenges and adapt to the new normal. Businesses may also re-examine new opportunities by adopting the Blue Ocean Strategy through creating an uncontested market space and making the competition irrelevant. Initially, this could be done by exploring the product/market expansion grid, where businesses can start to create a new market space by developing either new markets or product & services. However, measures to contain risks, particularly, operational and exchange rate risks, should be in place.

Presentation Outline

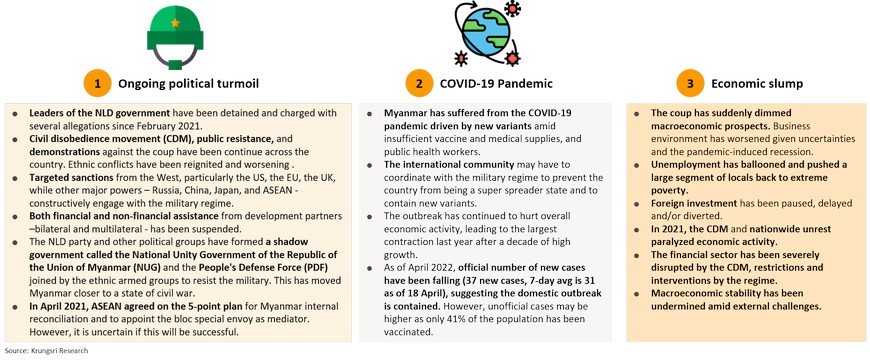

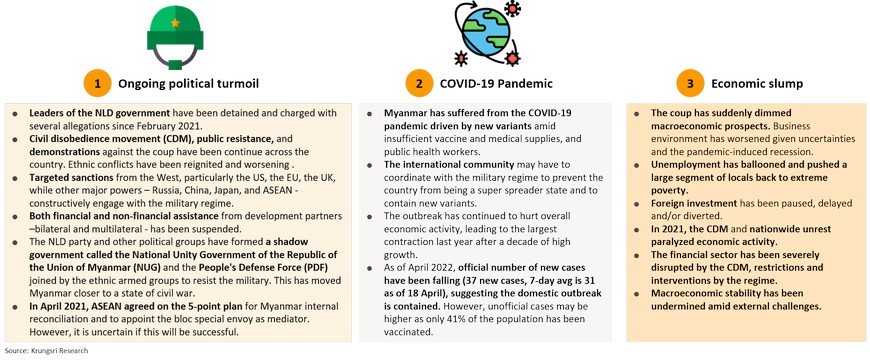

Myanmar remains in a state of political and economic turmoil despite a semblance of stability since the coup on 1 February 2021

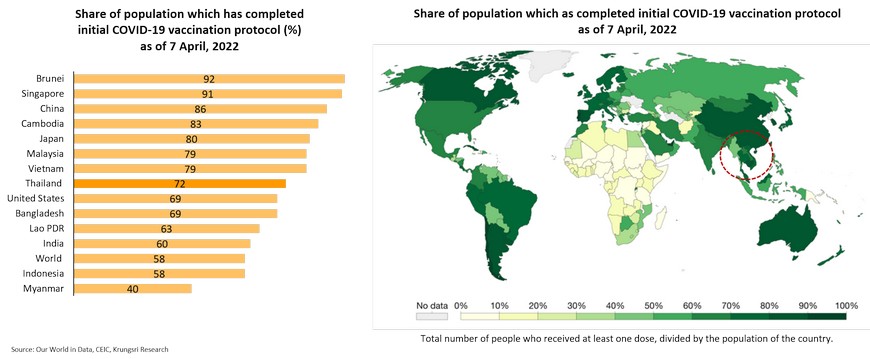

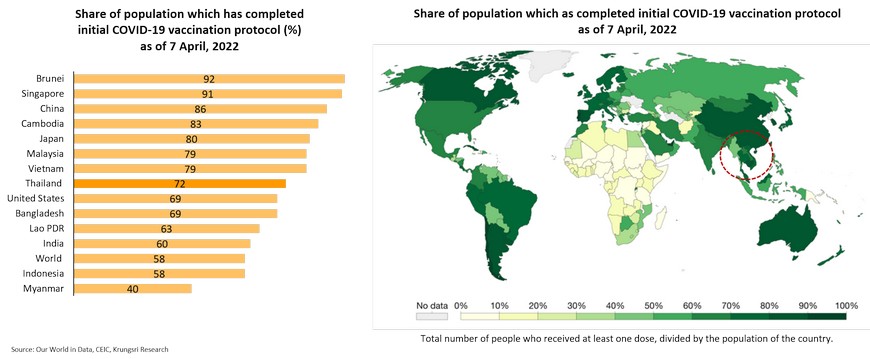

Despite cyclical improvements, the ongoing unrest and political conflicts are likely to persist, and this will continue to weigh on a full normalization of the economy against the backdrop of the lingering outbreak of the COVID-19 pandemic. Although the timeline of the next general election has already been announced, we view that political uncertainties remain as anti-coup forces remain strong and persistent. While the domestic outbreak of the pandemic has not been fully contained due to a relatively low vaccination rate by regional standards, political chaos and the pandemic have continued to weigh on the economy and growth prospects.

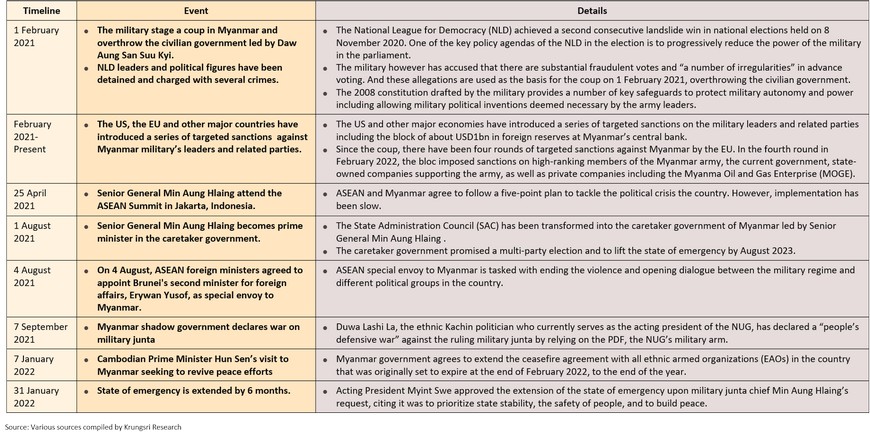

Political timeline: Key events

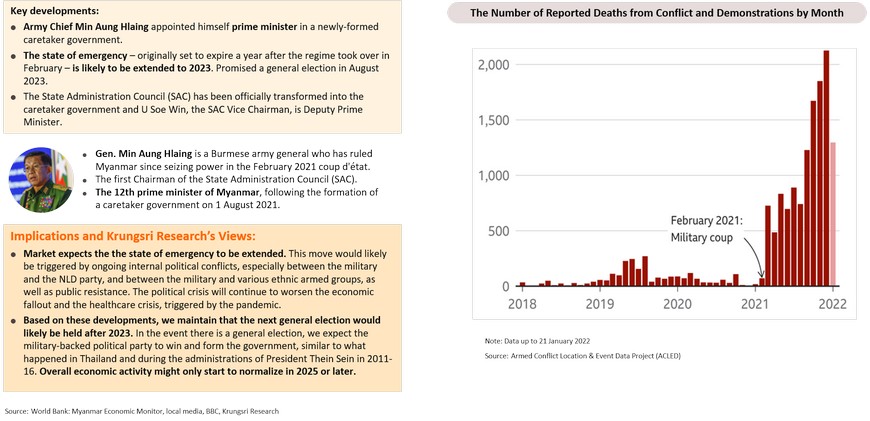

Caretaker government promises next general election in August 2023

Political uncertainties will be lingering, and a military-backed government will return

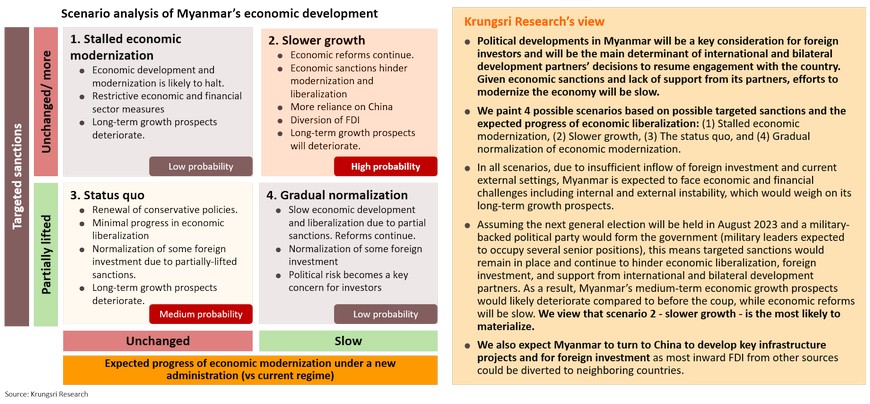

Political stability will be the key to ending the negative growth amid sporadic outbreaks. We expect political unrest to persist at least until the general election in 2023, as announced by the caretaker government in August 2021. In the medium-term, the political scene remains uncertain because of several domestic issues. We paint several possible scenarios based on expected political developments and expected roles of the shadow government.

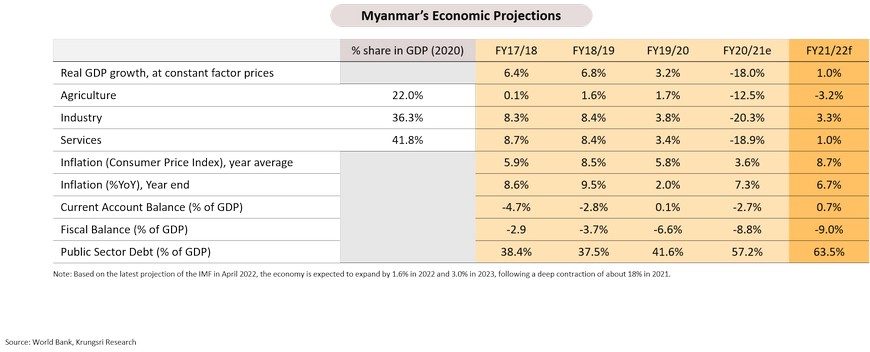

Myanmar’s economy is showing signs of stability in 2022; medium-term economic outlook remains gloomy

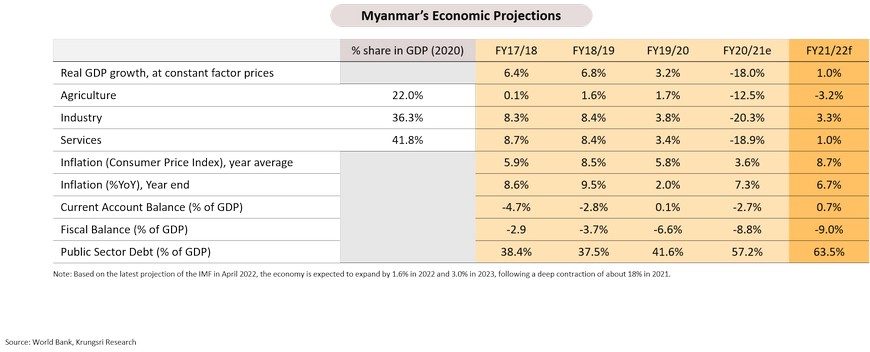

The world Bank projects Myanmar’s economy would expand by 1% in 2022 (FY2021/22) following estimate 18% contraction in FY2021, as overall economic activity has started to normalize and there are signs of stability. However, there are headwinds and lingering uncertainties, particularly on the political front. Over the medium-term, we expect growth to recover gradually. Myanmar’s growth potential has been derailed not only by the pandemic but also the coup in February 2021. Based on World Bank’s latest report January 2022, Myanmar’s economy is estimated to be 30% smaller than it might have been in the absence of the COVID-19 pandemic and the February 2021 coup. Hence, future political developments, including the next general election promised to be held in 2023 and subsequent political transitions, will be the major determinants of Myanmar’s growth prospects and direction of its economy.

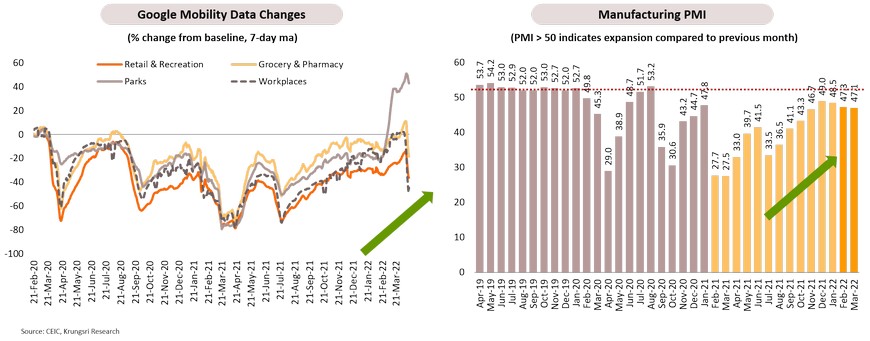

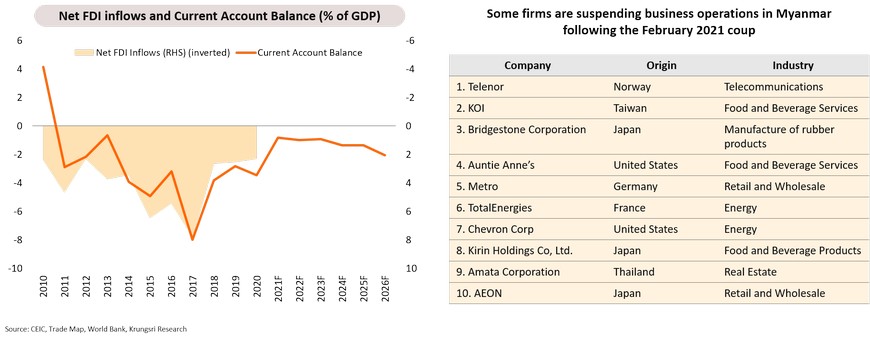

High-frequency data indicates a gradual economic recovery amid the lingering pandemic outbreak and the political conflicts

Latest high-frequency data, including Google Mobility Trends and Purchasing Managers' Index (PMI), confirm the gradual normalization of Myanmar’s economic activity following more than 2 years of economic slump. But despite that, overall economic and business activities are expected to remain anemic due primarily to persistent COVID-19 outbreaks in the country, political conflicts, and ongoing public opposition to the military government. In addition, with the uncertain business environment and targeted sanctions imposed primarily by the US and the EU are discouraging new inflow of foreign investment and have prompted several major MNCs to exit the country.

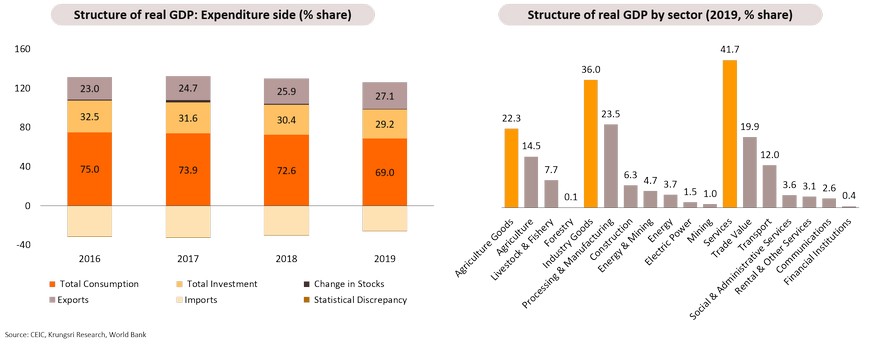

Tentative signs of economic stability in key sectors suggest demand- and supply-side weaknesses have diminished, but recovery remains fragile

Myanmar is structurally a domestic-oriented economy. On the demand side, household consumption which accounts for about 70% of real GDP has played a vital role as a growth driver, along with investment and exports. And on the supply side (2019), the services sector accounted for about 42% of real GDP in 2019, and the industry and agriculture sectors accounted for 36% and 22.3%, respectively. If the impact of the ongoing political unrest on the macroeconomy is contained, the economy would recover gradually in the medium term. However, it remains questionable if recovery would be sustainable because of several internal and external risks.

Slow vaccination rollout could retard economic normalization

The relatively slow rollout of COVID-19 vaccination program and shortage of high-efficacy vaccines are among the major headwinds hindering Myanmar’s economic normalization. As of 7 April, the share of the population which has completed the initial protocol (2 doses) was only 40%, the lowest among ASEAN peers. Despite reporting less than 100 new cases per day, there is speculation the actual number could be much higher given the latest outbreak is dominated by the Omicron variant and the small number of tests conducted per day. This could delay not only the normalization of domestic activity, but also country reopening to cross-border tourism in mid-April.

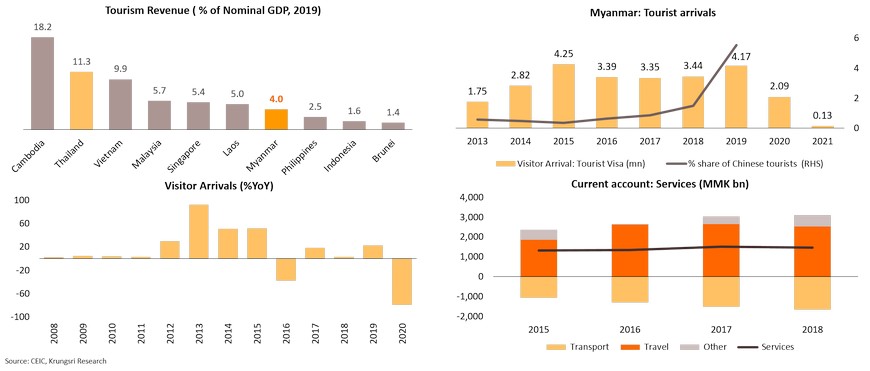

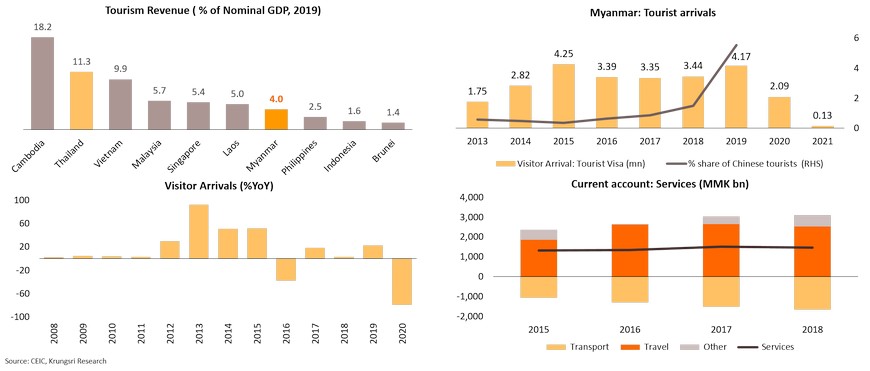

Plans to reopen Tourism sector in mid-April but ongoing unrest and political conflict could deter foreign tourists

In March, the military government reportedly planned to resume international commercial flights and reopen for cross-border tourism starting 17 April. According to the official statement, the objective was to improve the country’s tourism industry and to facilitate cross-border transportation. Prior to the pandemic, Myanmar’s tourism sector was starting to grow with total arrivals reaching 4 million and the tourism receipts reaching 4% of GDP in 2019. In addition, the sector was another major source of foreign exchange revenues for the country. However, reopening will be challenging due to ongoing political conflict, targeted sanctions, limited commercial flights, and a one-week quarantine requirement.

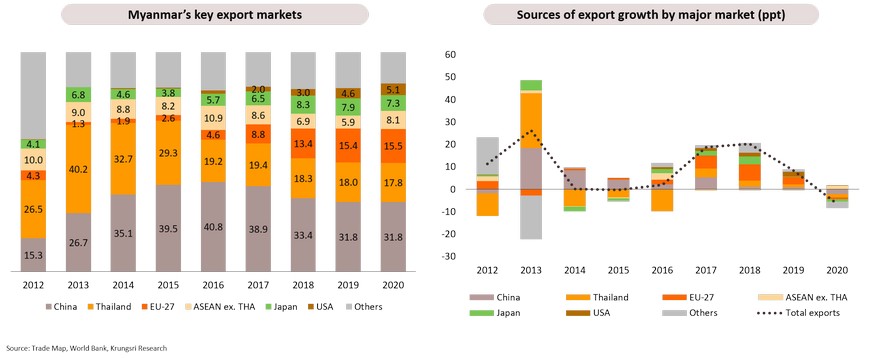

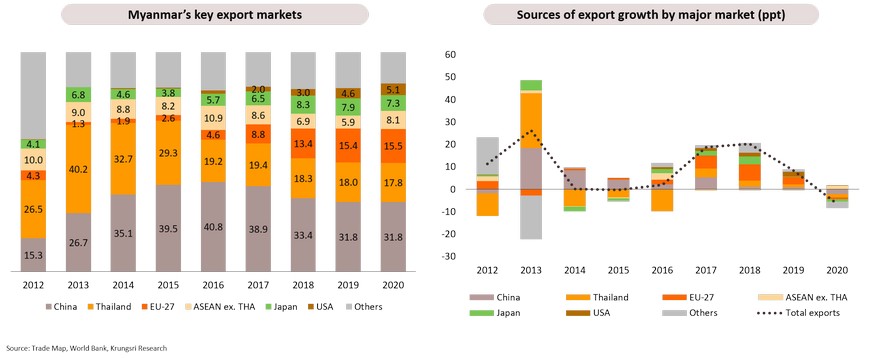

Cross-border trade has been disrupted; multiple headwinds, including sanctions, make it challenging to grow exports

Since the coup, international trade has been disrupted by logistics bottlenecks, border closures and restrictions, particularly at the Chinese border as a result of strict COVID-19 control measures, restrictions on cash transactions introduced by the Central Bank, and political unrest across the country. Despite signs of stabilizing, near-term trade will remain weak because of existing and emerging external challenges, including the Russia-Ukraine conflict. In addition, Myanmar has introduced restrictive measures to limit imports of some consumer goods such as drinking products, soap, soap powder and toothpaste from Thailand. In September 2021, the authorities introduced new restrictions on car imports and other capital goods. These are aimed at stabilizing the local currency and preserving foreign exchange reserves. In the medium-term, Thai businesses would find it more challenging to conduct business with their Myanmar counterparts because of several potential risks, including (i) weaker domestic demand and slow economic recovery in Myanmar, (ii) sanctions and risks of more capital controls, (ii) volatile MMK currently, (iv) macroeconomic and financial instability, and (iv) policy uncertainty.

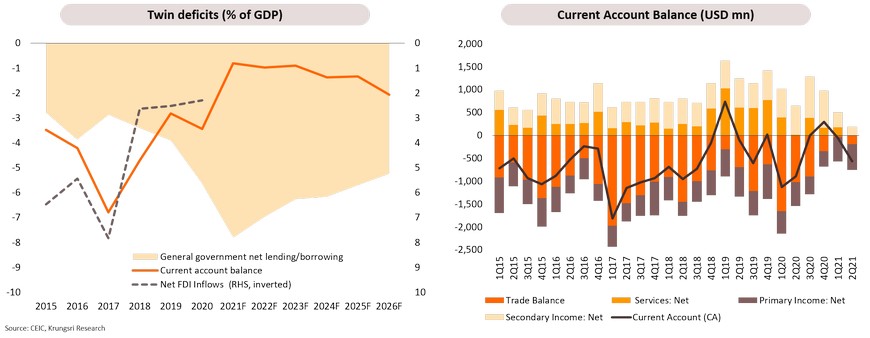

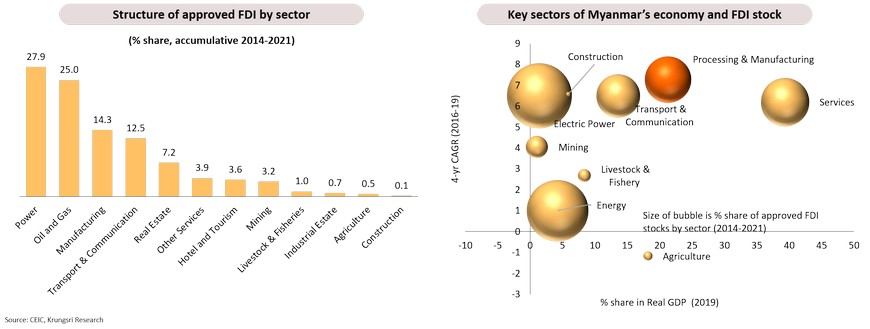

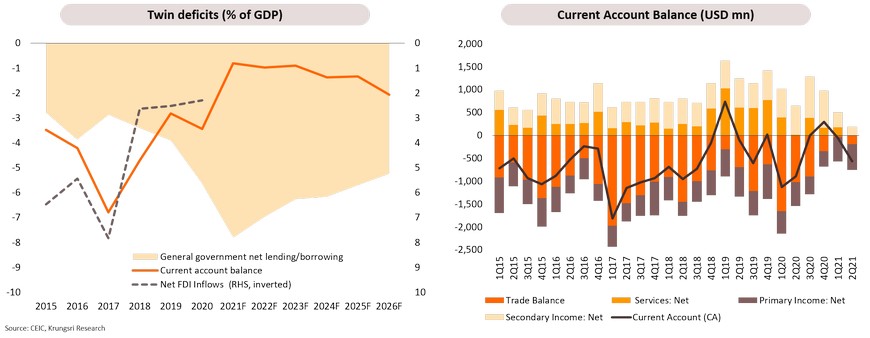

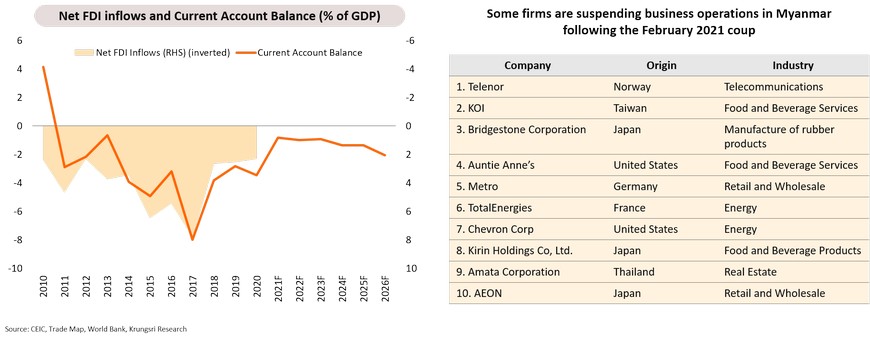

FDI inflows would be weak due to a worsening business environment, which could dampen the country’s external stability

Myanmar, like other developing countries, has been dependent on foreign investment to drive industrialization and to finance its current account deficits. Since reopening to the global economy, the country has run twin deficits – fiscal and current account. Political disruptions leading to a worsening business and investment climate could divert foreign direct investment away from Myanmar. The diversion is expected to happen primarily in the manufacturing sector which is dominated by the export-oriented and labor-intensive garment and footwear industries which currently account for over a third of Myanmar’s total exports. Without sufficient FDI inflows, external stability will be more vulnerable as current account deficits will widen and the USD/MMK exchange rate would continue to depreciate.

FDI commitments will drop; international firms will continue to exit Myanmar as the business environment worsens

The coup has crimped FDI prospects in Myanmar and the business environment has been severely hurt by targeted sanctions by the US, the EU and other major economic partners. Against this backdrop of uncertainties, the country’s long-term growth outlook has dimmed considerably. Multinational firms have continued to announce the suspension or termination of operations in the country. Their departure would reduce employment and new job creation, as well as prevent access to foreign expertise and technology. According to the World Bank’s latest publication dated January 2022, given the uncertain business environment, actual FDI inflows – which amounted to just under half of total FDI commitments between 2014 and 2020 – are expected to drop throughout 2022. This would mean insufficient funds to finance the current account deficit, which could jeopardize the country’s external stability if the situation continues to persist.

Halt in inward FDI could not only hurt growth but also derail industrialization plans and development of the manufacturing sector

Myanmar had enjoyed and benefited from foreign investment, especially since reopening to the global economy in 2011. However, political uncertainties induced by the coup in February 2021 have delayed new inflows and diverted most foreign investment to neighboring destinations. The diversion has been observed in the labor-intensive manufacturing sector, namely the garment and footwear industry. There have also been multiple rounds of divestment by MNCs in key sectors including power, oil & gas, and manufacturing. Without FDI, the development of the manufacturing sector and industrialization plans could be held back. This would mean missing opportunities to generate jobs and income for the sizeable young population. It could also stall basic infrastructure development, including power and electricity supply.

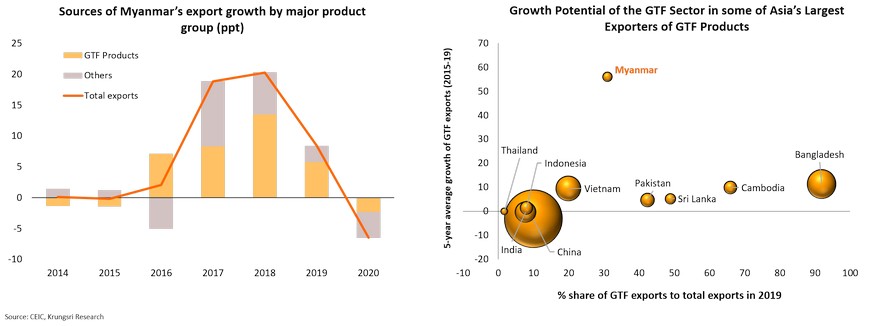

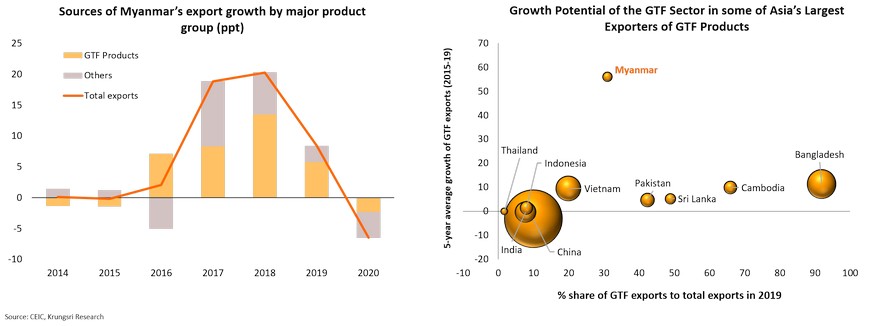

Garment, textile, and footwear (GTF) production which has driven Myanmar’s export growth over the past decade might be relocated to neighboring countries

In line with economic developments in neighboring countries, the textile and clothing industry has supported Myanmar by driving its industrialization efforts, exports, employment, and income, as well as economic growth. In the past decade, the high-growth GTF industries have contributed significantly to the country’s export. However, due to political uncertainties and targeted sanctions, the country’s garment and footwear industry is likely to be hit severely by the diversion of foreign investment. This is already reflected in the series of weak Manufacturing PMI data. Some GTF producers have moved to other parts of the region, like Cambodia and Vietnam.

In addition, targeted sanctions by the EU and the US – Myanmar’s major export markets for GTF products – could dampen the industry’s development prospects

The share of Myanmar’s exports to the EU and the US have surged following the lifting of sanctions on Myanmar, reaching 15.5% and 5.1% of total exports, respectively, in 2020. The two economies are not only the key markets for GTF products but also major sources of direct investment for the garment industry. The targeted sanctions and supply chain bottlenecks, in addition to political unrest, will deter inward FDI and development prospects for the industry.

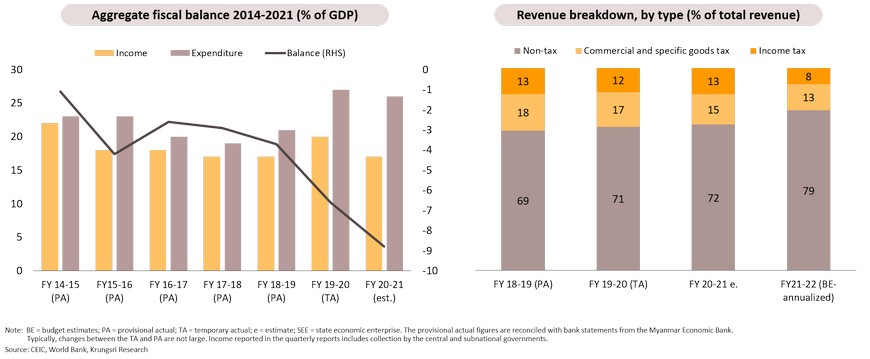

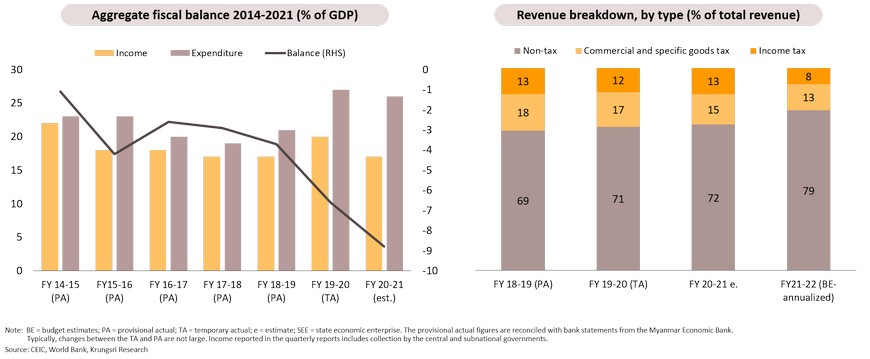

Fiscal deficit will remain sizeable due to dim growth prospects and other challenges

The government budget deficit is expected to be large in the medium term because revenue will drop sharply which expenditures will rise to address the pandemic-induced economic slump. In addition, the political disruption in February 2021 has had ripple effects and led to nationwide unrests, which have hurt domestic economic activity and long-term growth prospects and prompted the exit of several large multinational companies (MNCs). The dual shocks have had marked implications on public finances, leading to a steep drop in revenue, slower spending execution, and greater need for financing. Given the sizeable drop in tax revenues and limited funding options, the government would have to borrow more from the central bank. However, more debt monetization by the central bank would add pressure on the exchange rate and overall macroeconomic stability, as well as encourage dollarization in the country.

Debt monetization by the central bank could fuel inflation and dollarization in the country

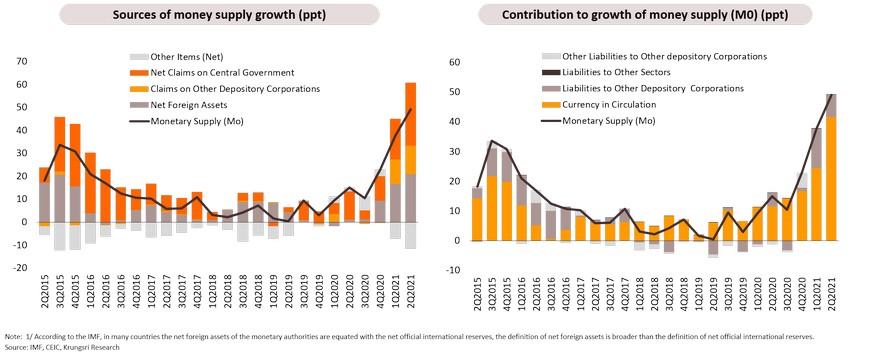

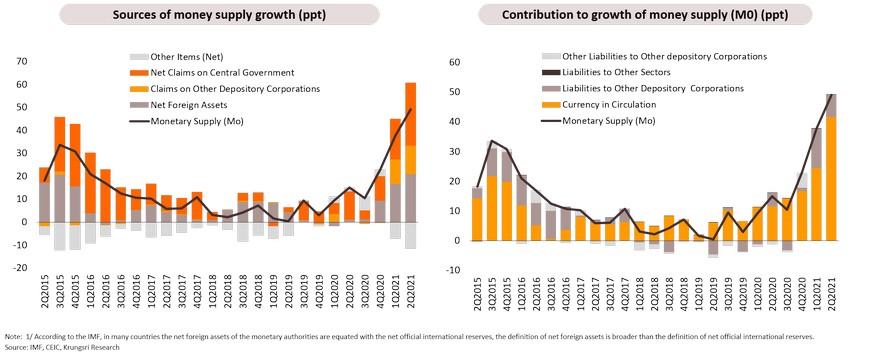

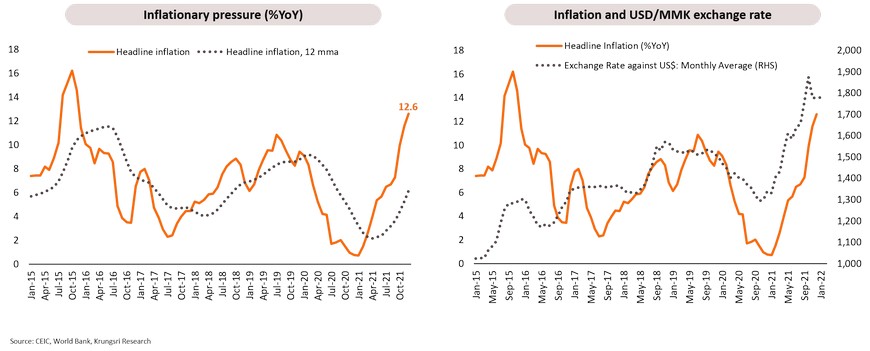

Looking at data on the central bank’s balance sheet, net foreign assets (NFAs)[1] have been rising since 4Q2020 (chart on left) and driven the recent surge in money supply (chart on right). The surge in NFAs is due mainly to the IMF’s financial assistance for Myanmar to address the COVID-19 pandemic, about USD700mn. In case of Myanmar, an increase in any item on the asset side had caused money supply to surge. The recent increase in NFAs has translated into larger money supply on the liabilities side with a rapid rise in currency in circulation. Going forward, the central bank’s weak sterilization intervention in the money market, any increases in net claims on the central government due to debt monetization will add to inflationary pressure in the country.

Currency in circulation has surged and will add to inflationary pressure if debt monetization by the central bank climbs further

Given the small share of tax revenue, exit of multinational companies, domestic economic slump, and financing challenges created by targeted sanctions, the military government is likely to seek financial support from the Central Bank of Myanmar (CBM) to finance its sizeable budget deficit through monetization. This had led to “periods of high inflation” and “domestic dollarization” in the past. Despite restrictions on cash withdrawals imposed by the central bank, there has been a surge in currency in circulation following the coup in February 2021. In addition, the military has appointed a new top management team to the CBM to take control of monetary policy.

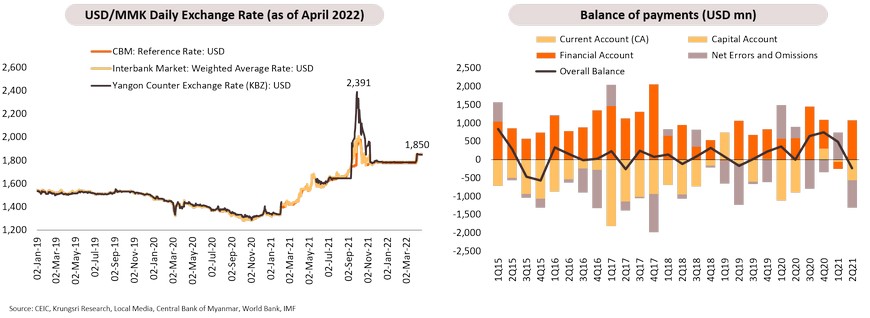

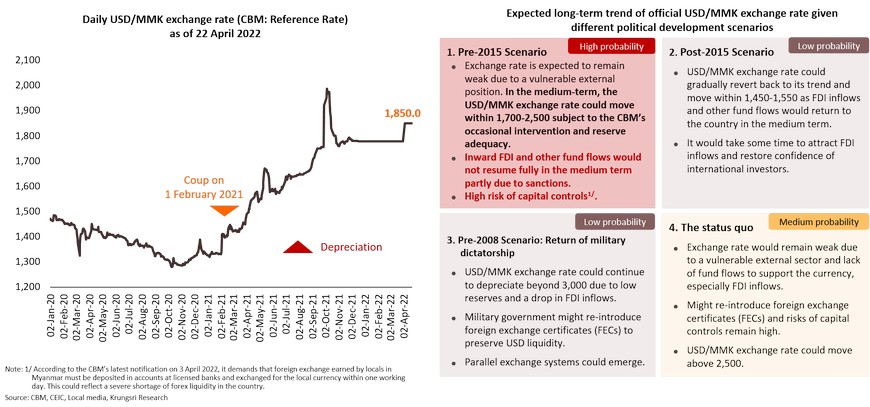

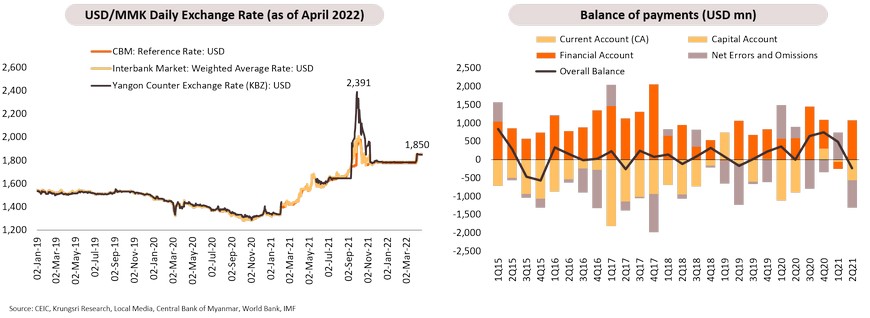

USD/MMK exchange rate will fundamentally depreciate in the medium term; there might be more restrictive measures to counter the weakening kyat

The USD/MMK exchange rate has been stable recently after persistent depreciation since February 2021. Following the coup, the kyat had tumbled in September 2021 and the USD/MMK exchange rate had dropped to a new low of 2,400 kyat since the exchange rate unification in 2012. On 9 November 2021, the CBM issued an instruction demanding all banks and authorized money changers to trade foreign currencies within the reference rate ± 0.5 % set by the CBM to stabilize the currency, in addition to occasional intervention in the foreign exchange market. This helped to reverse the weakening trend. On 3 April 2022, the central bank issued a regulation demanding all foreign currency in bank accounts to be converted into local currency within one day to help to stabilize the exchange rate and ensure adequate USD liquidity in the country. But fundamentally, the kyat will continue to depreciate as the current account deficit would widen as Myanmar is a net importer and the military government has failed to maintain public confidence in the local currency and the banking system. We also see high probability of more restrictions and/or capital control measures to reverse the weakening currency.

Officially allows direct payments in Chinese Yuan and Thai Baht to settle border and cross-border trade to ease USD liquidity shortage

The CBM has recently allowed direct payments in Chinese Yuan and Thai Baht to settle border trade with China and Thailand, respectively. According to the CBM, this would help to facilitate bilateral trade, flow of goods, and payment and settlement system, as well as promote the use of local currencies between Myanmar and its two key trading partners. In addition, designated banks have also been allowed to open Chinese Yuan and Thai Baht accounts for importers and exporters to facilitate settlement of cross-border trade. China and Thailand are among the top trading partners and investors in Myanmar. In our view, this policy is aimed at easing the shortage of USD liquidity in the domestic market. Insufficient USD supply has put downward pressure on the USD/MMK exchange rate since February 2021. Traditionally, the Chinese Yuan and Thai Baht have been used for border trade settlements by local traders. While there are benefits to reducing dependence on USD through the official endorsement of the Chinese Yuan and Thai Baht, allowing those currencies to be used for direct payment could backfire by fueling dollarization in the country.

Kyat will continue to depreciate due to weak macroeconomic fundamentals

Due to uncertainties surrounding political developments and the economic outlook, long-term movements of the official USD/MMK exchange rate could head in several directions depending on different development scenarios. As of 8 April 2022, the USD/MMK reference rate was 1,850 while the unofficial USD/MMK exchange rate was reported to be more than 2,000.

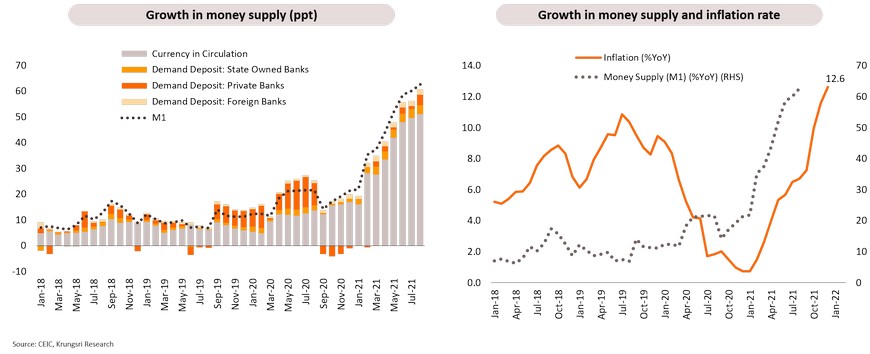

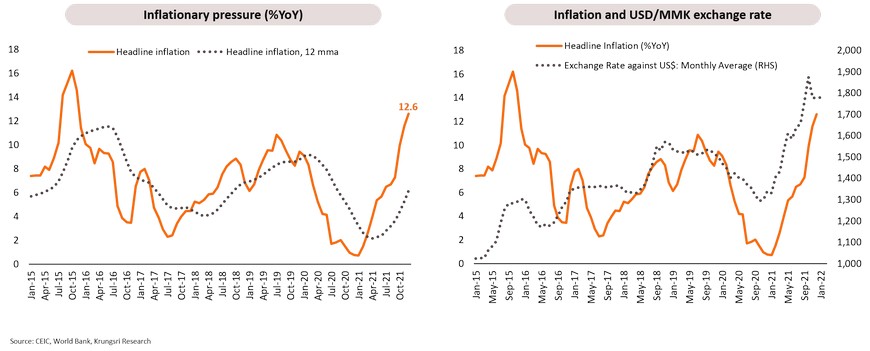

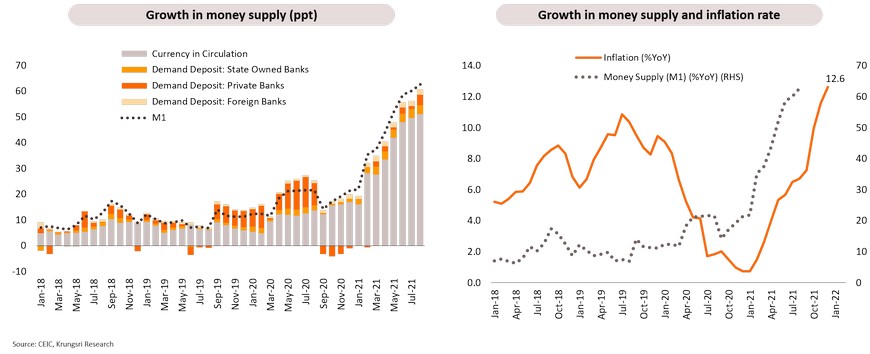

Price stability will be hurt by the weak currency, elevated global oil prices, and supply chain disruptions amid a growing money supply

Myanmar is expected to face surging inflation, driven mainly by supply-side factors. Based on the latest available official data, inflation has surged to 12.6% YoY in December 2021. In addition, inflationary pressure will remain elevated due primarily to strong pass-through effects of the weaker kyat especially the unofficial exchange rate, surging global energy prices, lingering supply chain bottlenecks, conflict-induced food supply shortage, ongoing political unrest, and higher debt monetization by the Central Bank. The elevated price pressure will not only curtail domestic demand but also harm overall macroeconomic stability.

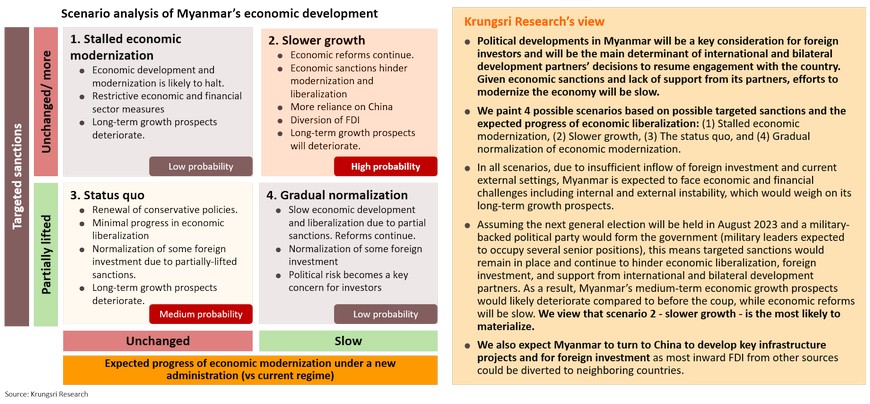

Medium-term economic outlook: Growth prospects will be dim

Going forward, political developments will dominate international investors’ decisions in conducting business in Myanmar as well as significantly shape the country’s medium-term economic outlook. Given several uncertainties surrounding the political trajectory, we illustrate different scenarios for Myanmar’s economic development based on possible targeted economic sanctions and expected progress of economic modernization under a new administration following the general election in August 2023.

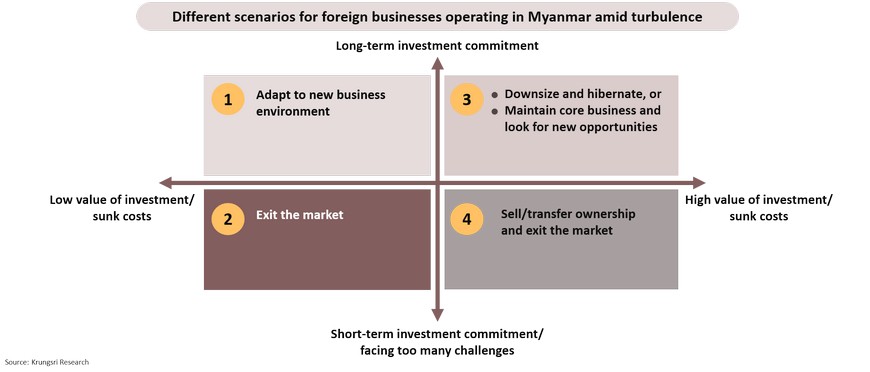

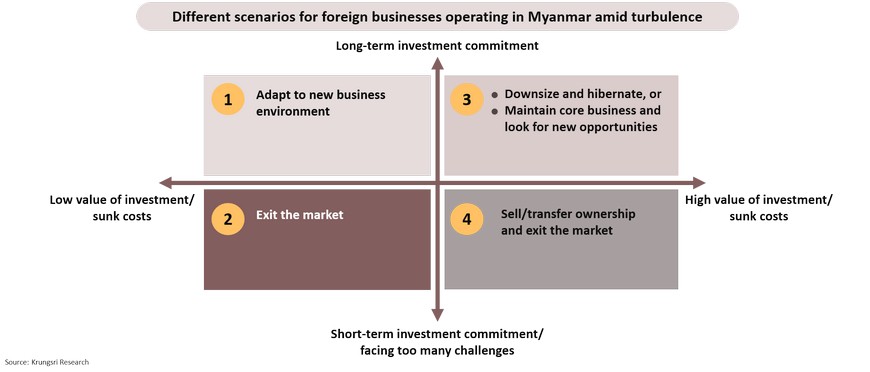

Businesses must consider different strategies to weather the challenges and adapt to the new normal in Myanmar

Myanmar is deeply integrated politically and economically with the international community since reopening in 2011. This would prevent the country from reverting to the autarky model adopted during the military dictatorship in the 1990s. Therefore, economic and political developments will improve sooner or later. Hence, businesses may have to consider different strategies to weather the short-term challenges and to adapt to the new and evolving business environment in Myanmar depending on their investment value and commitment.

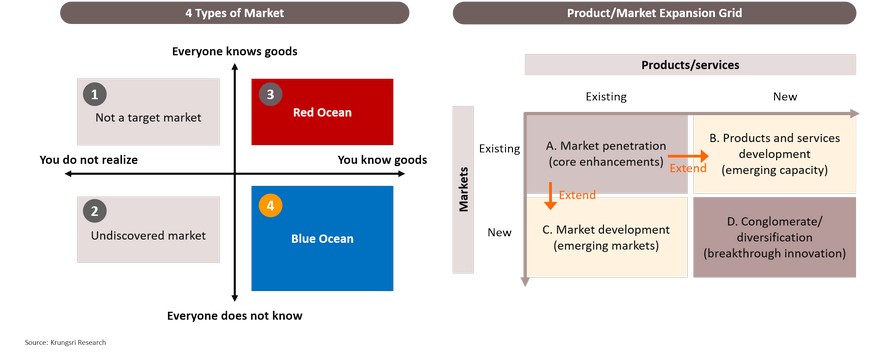

Blue Ocean Strategy should be adopted to guide businesses with long-term commitments to seek emerging opportunities in Myanmar

In a time of crisis, instead of competing in the red ocean, businesses could reconsider business opportunities to create an uncontested market space and make the competition irrelevant. This could be initially explored through the product/market expansion grid where businesses could start to create a new market space by either developing new markets or products and services.

Addressing customers’ pains and seeking new growth engines in emerging trends could offer new business opportunities in a challenging environment

Following a turbulent year, businesses may use the TOWS matrix to help identify and explore new business strategies based on their strengths and emerging opportunities. In addition, to achieve growth targets in the near-term, businesses should focus on addressing customers’ pains in the current or adjacent market space by offering the appropriate solutions to customers. In the longer-term, it is necessary for businesses to adapt to a new normal and explore new opportunities in emerging trends in the country. However, there must have firm measures to reduce risks, particularly, operational and exchange rate risks.