Introduction

It is undeniable that our world is currently facing increasingly severe changes in climate. To the point that the Secretary General of the United Nations has recently stated that “The era of global warming has ended. The era of global boiling has arrived.”1/ Faced with these challenges, countries around the world have joined together to agree on international plans to cut greenhouse gas emissions and to put the world economy on a more sustainable footing. As part of this, Thailand has set the goal of reaching Carbon Neutrality by 2050 and the goal of hitting Net Zero Emissions by 2065. As awareness of the challenges that lie ahead filters through society, stakeholders across the business world are coming to agree on a shared vision for the energy transition and the greening of the economy, and given its role as a key fulcrum around which much economic activity turns, the finance sector plays a crucial role as an intermediary in promoting and supporting environmentally responsible business practices through green financial products and services (Green Finance) aimed at encouraging investment in projects and activities that generate positive environmental impacts while also continuing to support economic development.

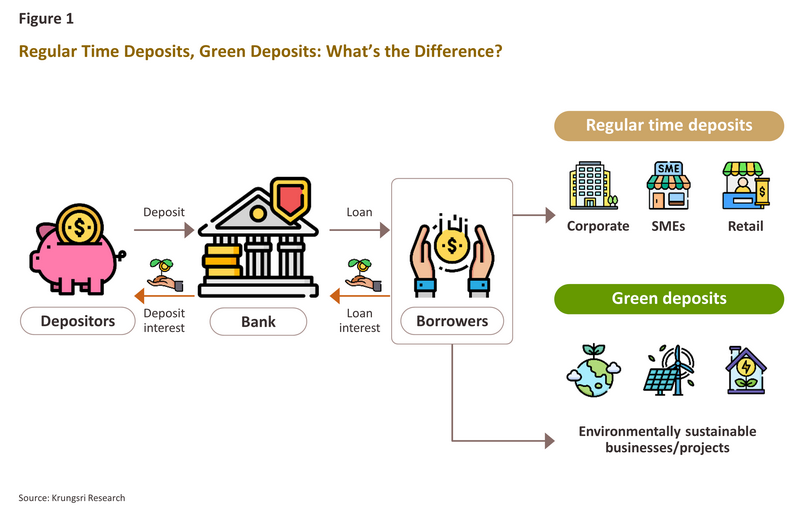

“Green Deposits” have become a trend in the global financial market in recent years. Both corporate and retail customers can deposit funds with banks in the form of time deposits, each with varying durations as determined by individual banks. Money deposited in Green Deposits differ from regular time deposits in that green deposits promise to invest money held by the bank in projects or businesses that are expected to have positive environmental impacts or to accelerate progress towards the adoption of green business practices, and so examples of areas that might receive funding via green deposits include alternative energy, sustainable agriculture, and clean technology. Thus, in addition to savers receiving Interest on their deposits, they also contribute indirectly to supporting environmentally friendly activities.

Green Deposits in Thailand are still a new and relatively unknown product, and so it remains to be seen how these will be received by bank customers and how fast the market will grow amidst challenges related to interest rates, which are trending towards the end of the upward interest rate cycle as inflationary pressures gradually ease, while the savings behavior of the Thai population across different age groups remains a significant consideration in the ongoing development of financial products that are both suitable and attractive.

Regular Time Deposits vs. Green Deposits

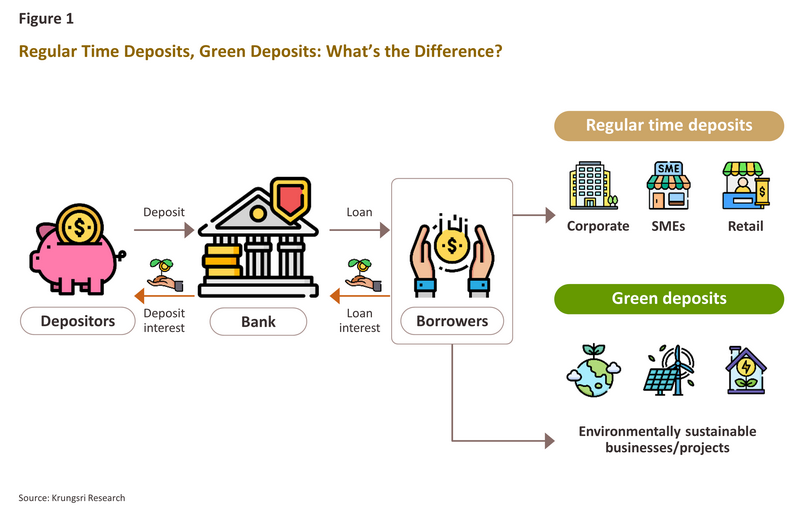

Regular time deposits and green deposits share the same deposit format, which involves depositing money for a fixed period. However, they differ in the objectives of how the bank will use the deposited funds. Typically, banks use the funds from regular time deposits to provide loans, whether to large enterprises, small and medium-sized enterprises (SMEs), or retail customers. These loans may take the form of business loans, car loans, home loans, credit cards, and various other personal loans. It is evident that different customer segments receive different types of loans, without a specific requirement that the funds must be used for environmentally friendly activities. By contrast, green deposits are utilized exclusively for businesses or projects that are environmentally friendly. Each bank will selectively choose exclusively for businesses or projects within the framework of their green deposit programs. In summary, the source of funds for green deposits is not different from other deposits, but the distinction lies in directing these funds toward environmentally friendly initiatives. Therefore, green deposits are a type of financial product that promotes sustainable business practices for commercial banks by encouraging responsible lending with a focus on environmentally friendly projects.

Green deposits around the world

Hong Kong:

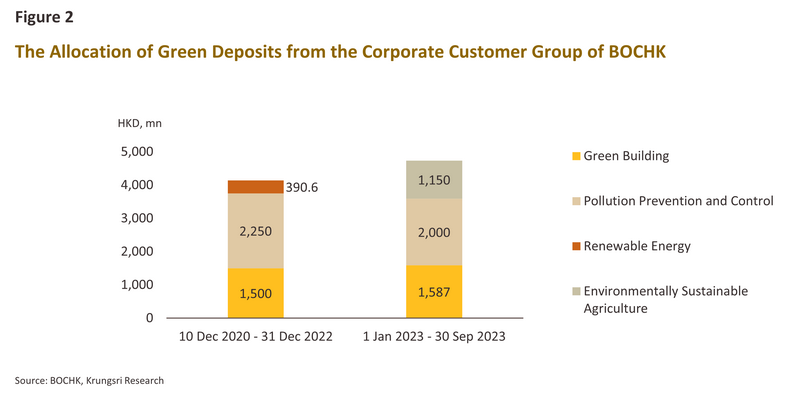

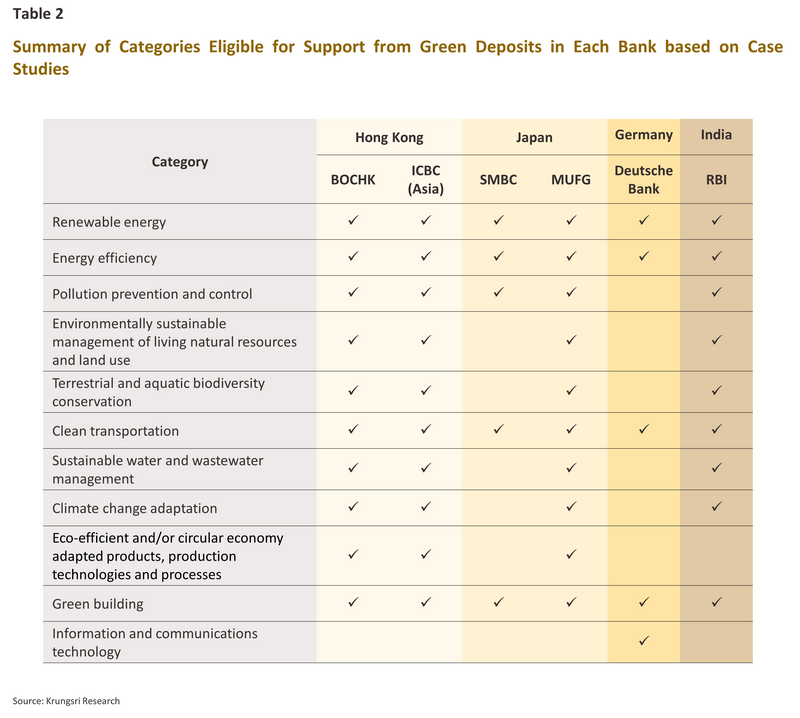

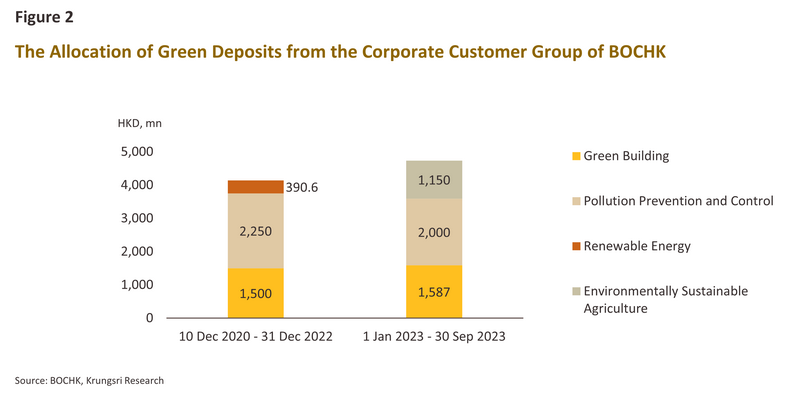

The Bank of China (Hong Kong) Limited, or BOCHK,2/ provides green deposits to both corporate and retail customers, with a focus on corporate customers. Between the end of 2020 and 2023, green deposits were utilized to finance activities in two main categories: pollution prevention and control and green building (Figure 2). Additionally, ICBC (Asia)3/ has also offered green deposits to their customers since 2022. For both banks, funding is available under these schemes for projects covered by the following ten categories.

-

Renewable energy: This encompasses projects to harness energy from renewable sources including solar, wind, biomass, and hydro.

-

Energy efficiency: These include the design, construction, and installation of energy-saving systems in buildings, improvements to illumination systems made through the use of LED lighting, and the construction of low-carbon buildings.

-

Pollution prevention and control: Within this category, qualifying projects include those leading to greenhouse gas control, soil remediation projects, and improvements to waste management systems.

-

Environmentally sustainable management of living natural resources and land use: This area covers the promotion of sustainable and/or agriculture, animal husbandry, fishery and aquaculture, reforestation projects, as well as organic farming.

-

Terrestrial and aquatic biodiversity conservation: This includes projects related to coastal and marine environments, as well as the conservation of natural habitats and endangered species.

-

Clean transportation: These projects entail the transition to clean energy within the transportation sector, such as the use of battery electric vehicles (BEVs) and the provision of the infrastructure needed for EV charging stations.

-

Sustainable water and wastewater management: Examples of these projects include the development of efficient irrigation systems, the installation and improvement of wastewater management infrastructure, water resource conservation, and flood defenses.

-

Climate change adaptation: These projects target the development and improvement of infrastructure with the goal of making this more resilient to the impacts of climate change.

-

Eco-efficient and/or circular economy adapted products, production technologies and processes: These focus in particular on the development and manufacture of products and packaging materials certified by the Roundtable on Sustainable Biomaterials (RSB),4/ as well as the development of technologies and equipment that promote the sustainable use of biomass/biomaterial resources.

-

Green building: This includes the renovation of buildings to meet modern environmental standards and the promotion of sustainable practices in the construction industry.

Japan:

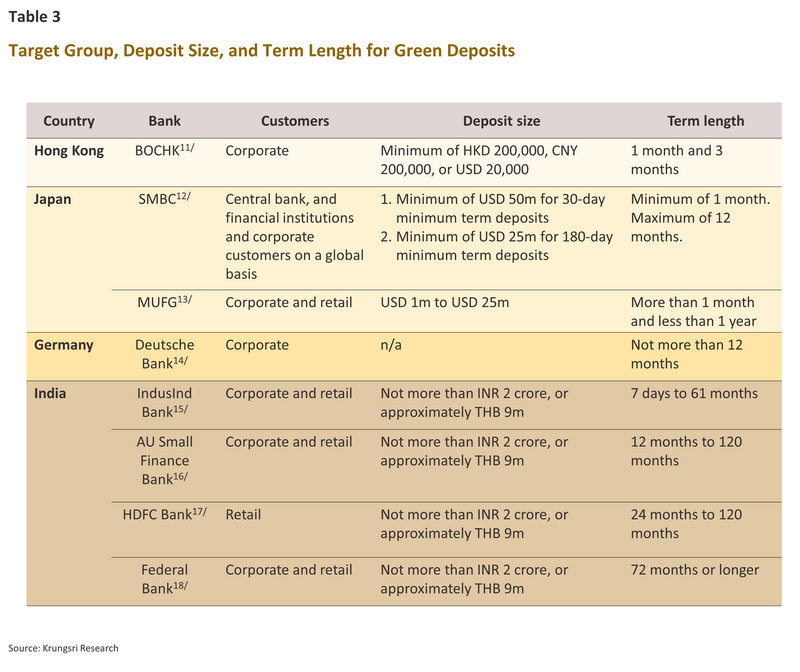

Sumitomo Mitsui Banking Corporation (SMBC), one of Japan’s leading banks, has offered green deposits since April 2021 under the Green Deposit Framework in cooperation with Sustainalytics Japan Co. Ltd., part of the Sustainalytics group, for evaluation. SMBC’s green deposits are available to major clients including central banks, financial institutions, and corporate customers on a global basis. For deposits with a term of at least 30 days, a minimum of USD 50 million is required, with this deposited in US dollars, while for those with a minimum term of 180 days, this requirement is reduced to USD 25 million. Deposits are limited to a maximum term of 1 year.5/

The Japanese banking giant MUFG has been offering green deposits since April 2022, having already successfully piloted similar schemes in the US and Australia a year earlier. These facilities are managed under the bank’s green deposit framework,6/ which MUFG has created in cooperation with Sustainalytics for evaluation. MUFG green deposits are available to Japanese corporate and retail customers,7/ with terms set at more than 1 month and less than 1 year for deposits of between USD 1 million and USD 25 million. Deposits must also be denominated in US dollars.

Projects eligible for support from green deposits in Japan are broadly similar to those in Hong Kong, and so SMBC does not allow green deposits to be utilized for investment purposes in the following projects; fossil fuel-based assets, defense and security, nuclear power generation, coal-fired power generation, all mining and tobacco sectors. Similarly, MUFG prohibits funds raised from green deposits from being channeled to investments in carbon-intensive projects, the production of systems or equipment that create a fossil fuel lock in, projects that have negative impact on Indigenous People Communities, High Conservation Value areas, wetlands designated under the Ramsar Convention, or UNESCO designated World Heritage Sites, and land expropriation leading to involuntary resettlement.

Germany:

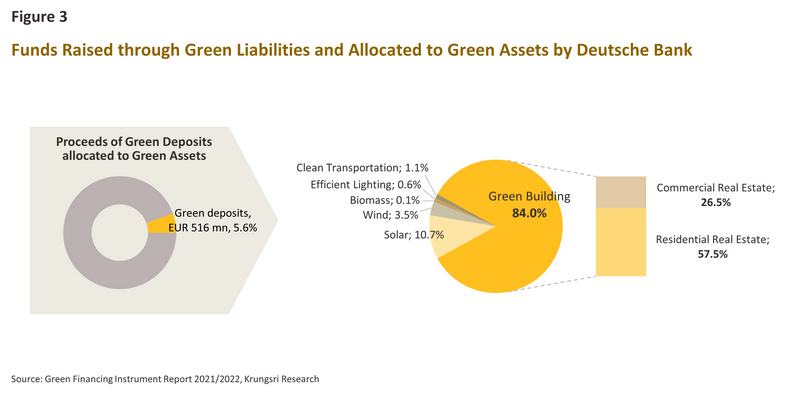

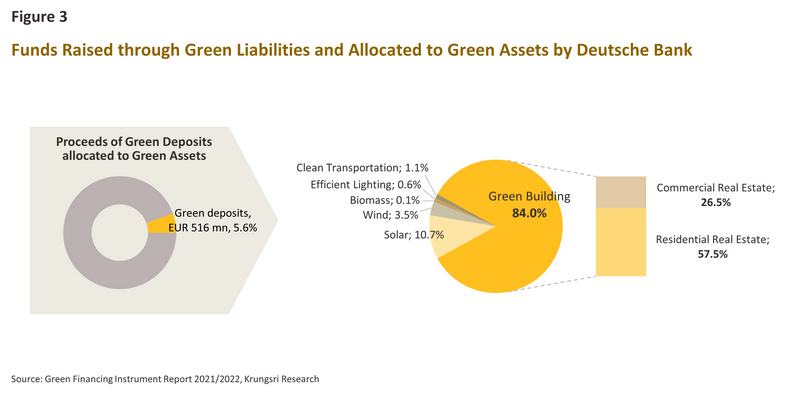

The leading German bank, Deutsche Bank, introduced green deposits with a maximum term of 12 months for its corporate customers in 2021. Funds raised through this are then available for projects in five categories,8/ namely renewable energy, energy efficiency, information and communications technology, clean transportation, and green buildings. Of these, the most important area receiving funding via green financial products has been green buildings, including both residential and commercial developments, and between January 2021 and June 2022, funding allocated to these that came from green deposits totaled EUR 516 million.

Funds deposited in Deutsche Bank’s green financial products are not used for investments in projects connected principally to the exploration or production of fossil fuels, those using nuclear technology, weapons, alcohol, tobacco, gambling, adult entertainment, or activities connected to forest degradation or deforestation. Considering other German banks, including major players such as KfW and DZ Bank, they have not yet brought similar products to market.

India:

Using deposits to fund activities that aim to strengthen sustainability has attracted growing interest in India following the publication in April 2023 of the Reserve Bank of India’s (RBI’s) Framework for Acceptance of Green Deposits, which has been in force since June of the same year.9/ This document lays out a framework for the regulation and operation of ‘regulated entities’, a category that describes scheduled commercial banks and deposit-taking non-banking financial companies wishing to offer green deposits to retail and corporate customers. Regulation of the allocation of funds raised through green deposit facilities to businesses covers everything from the approval of the rules or policies of the company by the Board of Directors for using this money to fund businesses approved as such by the Indian central bank, impact assessments and external auditing, to the reporting of results and data disclosure. In addition to supporting the direction of funds to investments in improved sustainability, the framework also aims to ensure that investors receive adequate returns and that the scheme is not used for greenwashing.10/ Under the RBI framework, the types of projects eligible for funding are similar to those supported by MUFG in Japan, and so these cover a total of nine categories, excluding only products, eco-efficient and/or circular economy adapted products, production technologies and processes.

The RBI framework also details the activities that may not be funded through green deposit schemes, a list that includes projects connected to the extraction, production and distribution of fossil fuels, nuclear power generation, direct waste incineration, alcohol, weapons, tobacco, gaming, or palm oil industries, renewable projects generating energy from biomass using feedstock originating from protected areas, landfill projects, and hydropower plants larger than 25 MW.

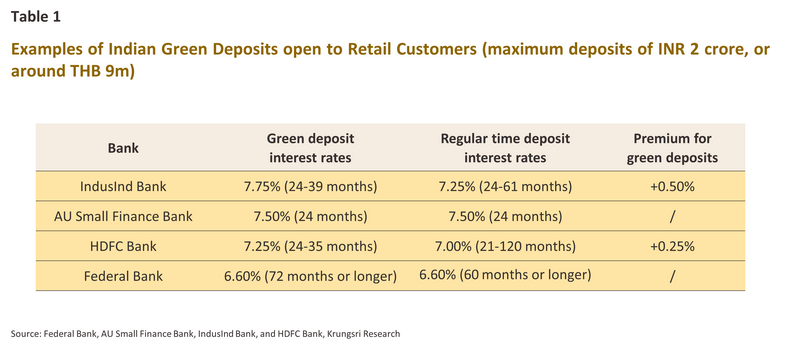

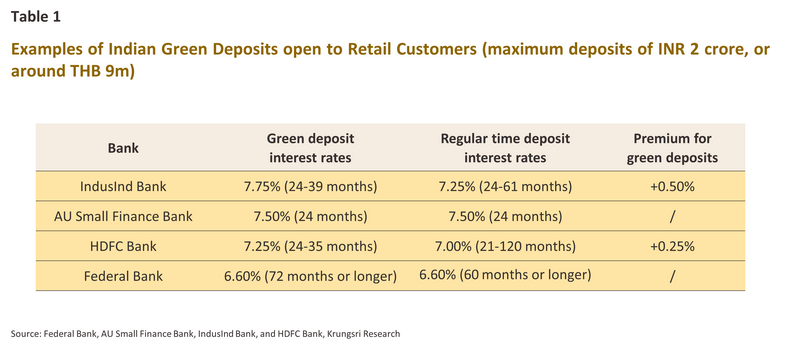

In the case of the Indian banking system, the evidence shows that some banks (e.g., IndusInd Bank and HDFC Bank) attract savers to open green deposit accounts by offering higher interest rates than regular time deposit interest rates. In addition, they typically set shorter maximum deposit periods for green deposits compared to regular time deposits (Table 1) to incentivize depositors seeking higher returns and environmentally conscious depositors to invest more in green deposits, which will then be available for allocation to environmentally friendly business activities.

Overview of green finance in Thailand

In Thailand, no commercial banks have previously offered green deposits. But recently, Bank of Ayudhya Public Company Limited became the first Thai commercial bank to offer green deposits to corporate customers under the name Sustainable Deposits,19/ similar to the green deposit market in other countries.20/ Customers interested in depositing money in this type of account must meet the bank's criteria. (Based on information as of March 8, 2024)21/

Green deposits are considered a new financial product in Thailand's "green finance" market. When considering the overall picture of the green finance market, it is found that it has been emerging in the country for more than 5 years. There are three other types of green financial products frequently mentioned: green bonds,22/ green equity, and green loans.

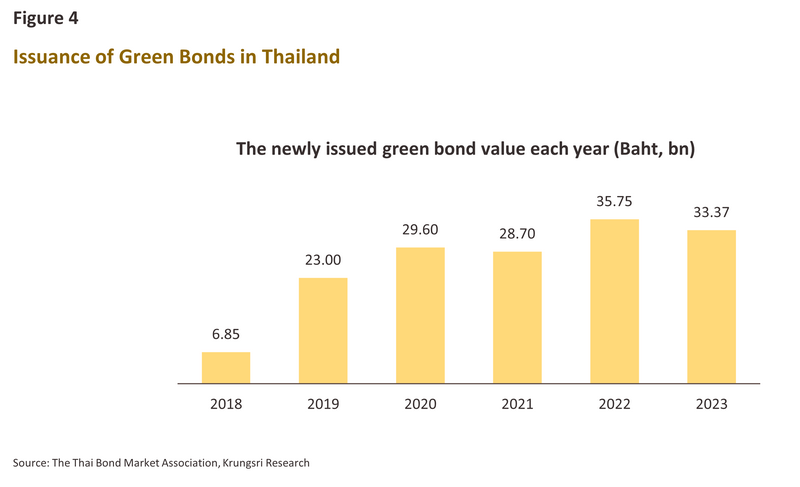

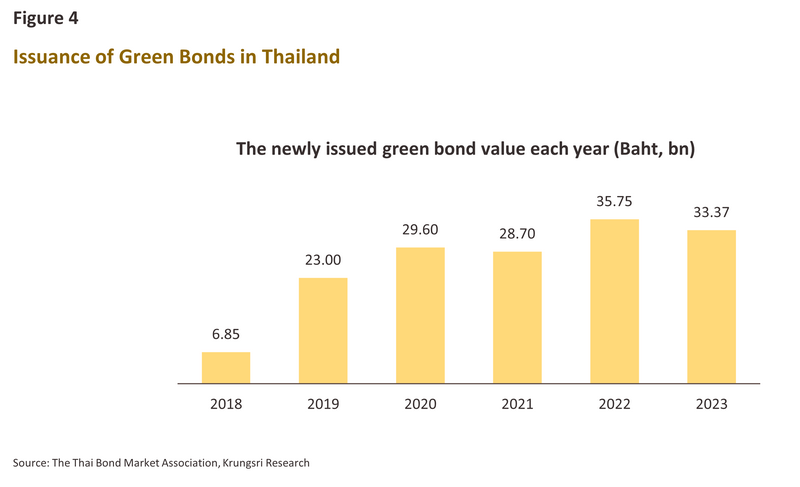

The first green bond was issued in Thailand in 2019, and over the subsequent near-6 years (i.e., from 2018 to 2023), total issuance of green bonds came to THB 157.26 billion, or around 3.3% of all corporate bond issuance in the period.23/ Market interest in these has held steady through this period, and although issuance has come from a range of industries, because they are relatively carbon-intensive and so need to green more thoroughly and intensely than other parts of the economy, this has especially included energy and transport.24/ These industries are also having to shoulder rising fuel costs, which is then another factor motivating players to transition to a greater reliance on alternative energy. Thus, when conservation and sustainability carry a price tag, and businesses are beginning to make the transition to a low-carbon economy, raising funds through green bonds is clearly an attractive proposition for Thai companies.

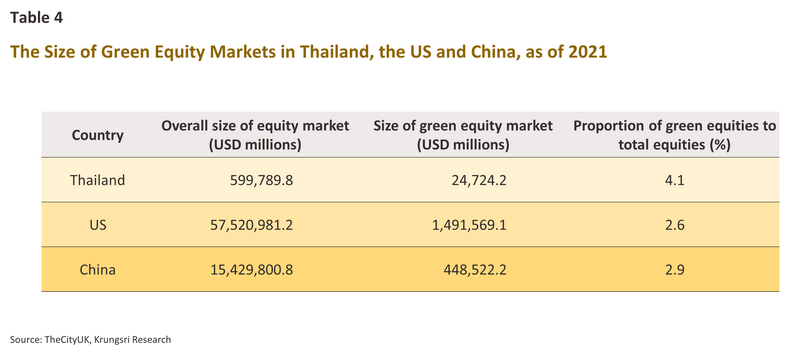

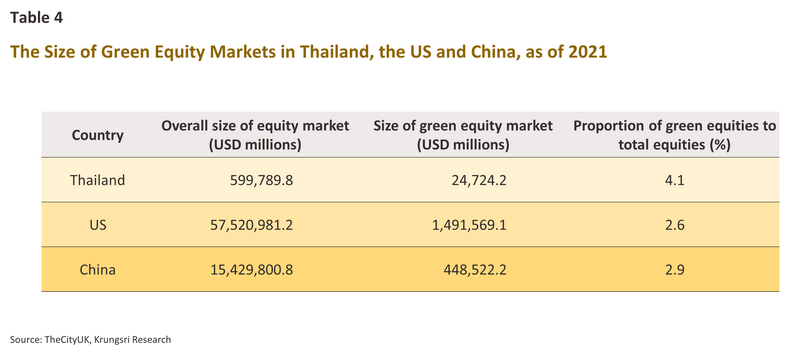

As of 2021, the Thai market for green equity was estimated to be worth USD 24.72 billion25/ or around THB 800 billion,26/ and although the Thai stock market is only a fraction of the size when compared to those in the US and China, the proportion of green equity to total market size (i.e., the green penetration rate) is higher in Thailand than in either of these economic giants. This thus indicates that Thai investors are broadly accepting of the market for green equity.

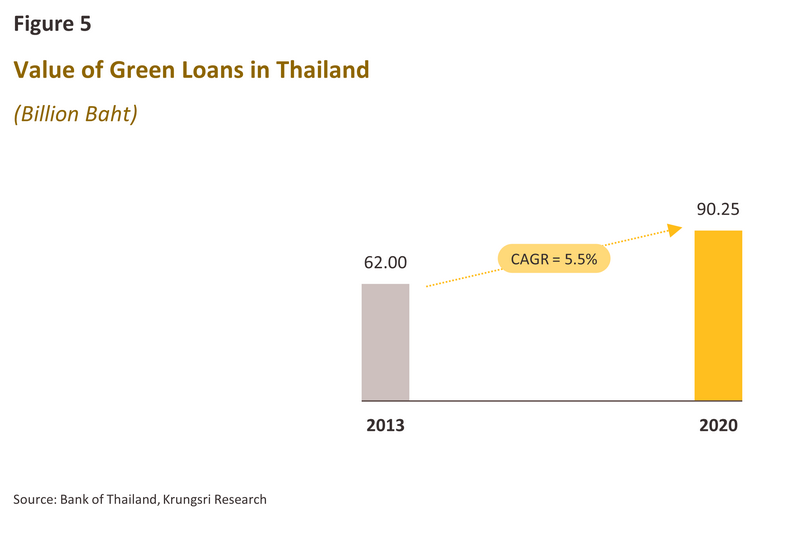

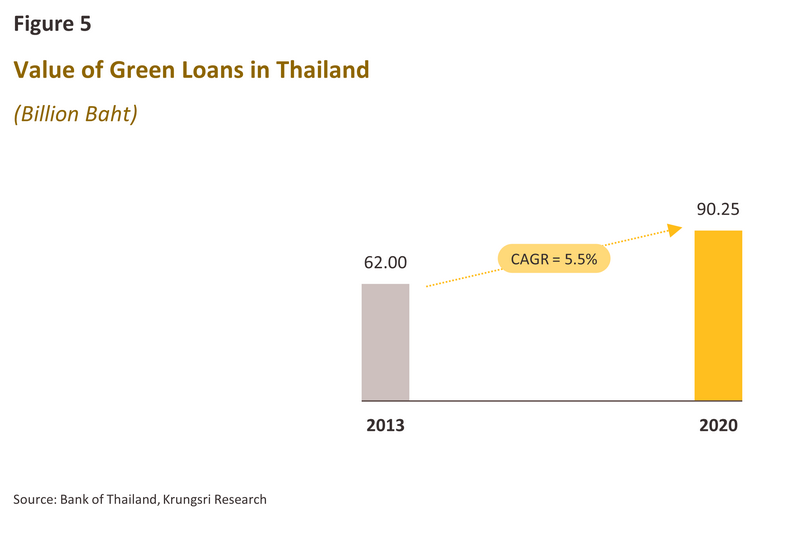

A report by the Bank of Thailand shows that the value of green loans issued domestically (excluding those made to power generating companies) grew from THB 61.97 billion in 2013 to THB 90.25 billion in 2020,27/ or by 5.5% annually over this period. This therefore can be seen as a positive sign, both for Thai businesses showing increased awareness of environmental issues and for the banking sector itself, which has developed financial tools to support businesses in various green initiatives.

Who is the target customer group for green deposits in Thailand?

The examples described above show that banks in a number of countries are beginning to introduce green deposits to the market, though most often, access to these is restricted to corporate clients, and with minimum thresholds set at USD 50 million, these are likely to be companies successfully operating across national boundaries. However, in India, the structure of the local market means that some banks have brought these products into the retail clients due to their large customer base and the popularity of savings in time deposit accounts. Thus, the overall value of the Indian market for savings comes to USD 2.26 trillion,28/ or almost five-times the size of the Thai market.29/ Moreover, Indian savers tend to favor time deposit accounts since these are viewed as a safe haven away from market volatility,30/ and so average Indians save 425,725.54,31/ or around THB 180,000 in time deposits.

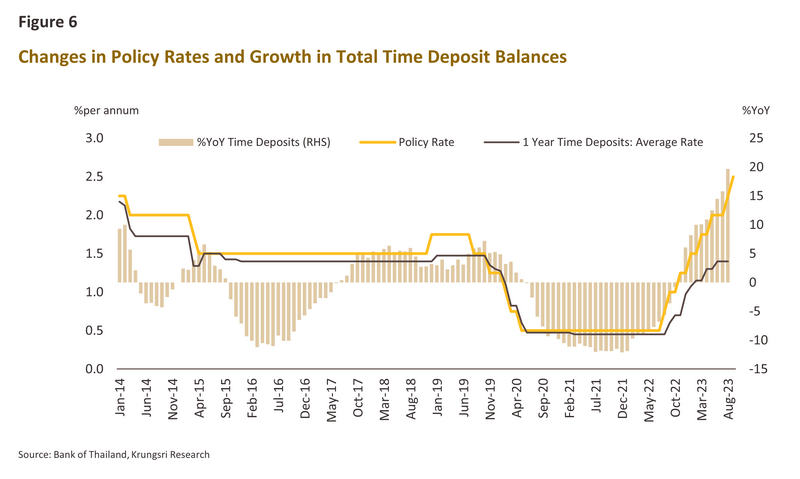

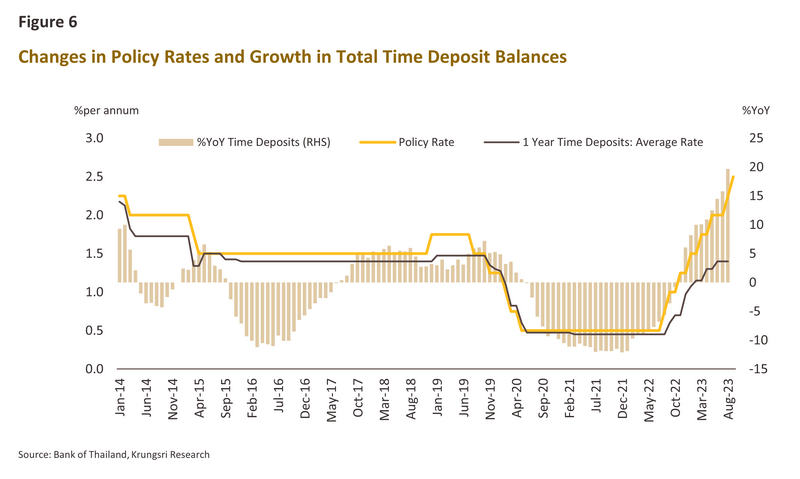

When looking back at Thailand, data collected by the Bank of Thailand on deposits made with commercial banks registered in Thailand show that these totaled THB 15.87 trillion as of August 2023. Of this, 29%, or THB 4.59 trillion, was held in time deposit accounts, split between THB 0.98 trillion from corporate clients and THB 2.88 trillion from retail customers. The total value of time deposits for corporate and retail clients combined contracted from the onset of the Covid-19 pandemic in mid-2020 through to the start of 2022, and then began to rise again from the end of 2022 onwards, when the most recent cycle of rate hikes began (Figure 6). Indeed, the total balance held in time deposit accounts has risen in step with increases in policy rates, which most recently rose to 2.5% on September 27, 2023.

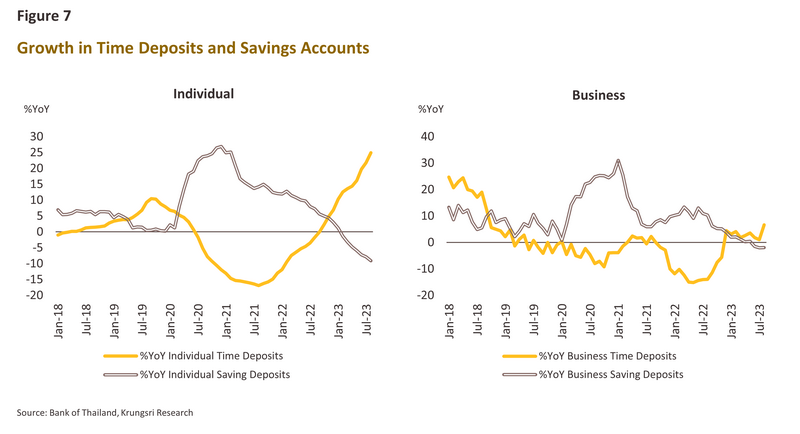

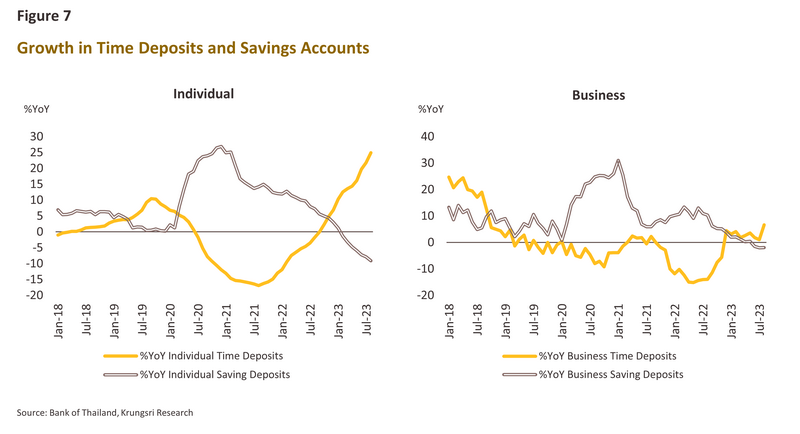

The steady rise in the combined value of time deposits runs counter to the trend in the overall size of savings accounts, which has been falling in value for the past few years. This reflects the changing behavior of savers, especially retail customers, who are tending to move savings from saving accounts to time deposit accounts to take advantage of their higher returns especially during periods when time deposit interest rates continuously increase in accordance with the direction of the policy rates (Figure 7).

In light of this, Krungsri Research believes that the target customers for green deposits in Thailand could be both corporate and retail customers with different perspectives. In the corporate segment, awareness of the importance of issues related to climate change is growing and with markets for carbon credits32/ now expanding and environmental financial products being developed, many companies are beginning to consider seriously their commitments to sustainability and to expand their involvement in environmentally friendly business activities. Furthermore, in the future, green deposits may also assist organizations in reducing indirect greenhouse gas emissions (Scope 3). For the calculation of indirect greenhouse gas emissions, green deposits may be included in Category 15.33/ Considering the retail segment, target markets can be identified through an analysis of savings behavior and awareness of environmental issues among different age cohorts.

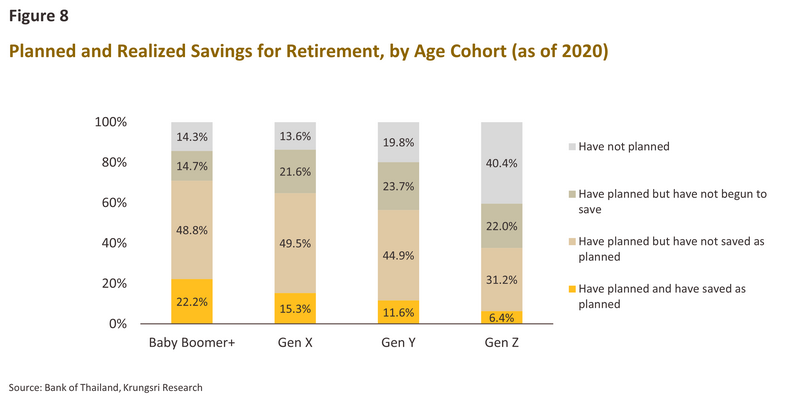

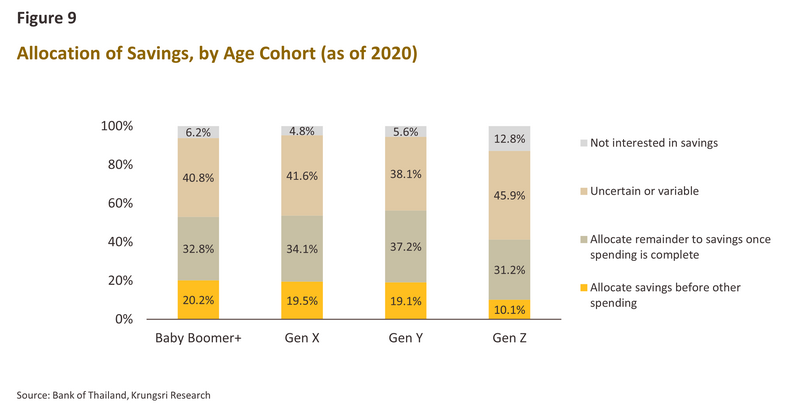

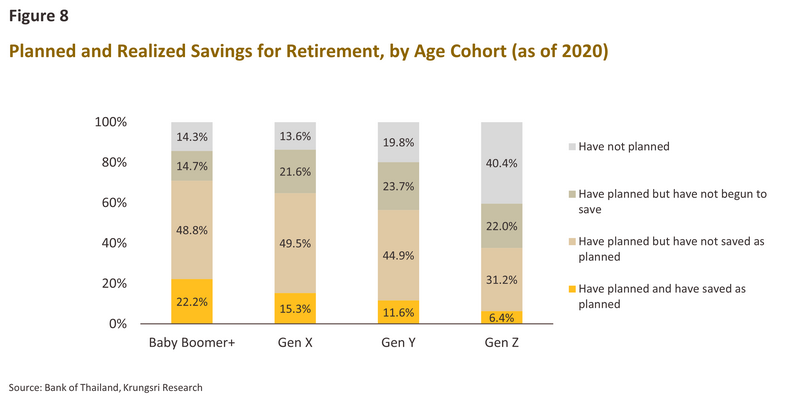

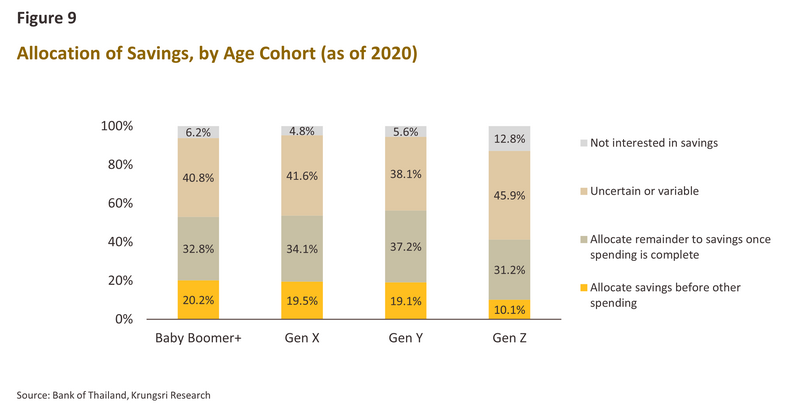

Data on the behavior of Thai savers stratified by age is drawn from a survey on financial literacy carried out and published by the Bank of Thailand in 2020.34/ This shows that savings habits were most developed among baby boomers,35/ 71.0% of whom had made a savings plan for their retirement and had begun to follow this, with 22.2% of the total saying that they had been able to follow their plan successfully. After baby boomers, the extent to which savings habits had been established was strongest in Gen X and then Gen Y (Figure 8). However, younger individuals were less likely to have planned or begun saving, especially for those in Gen Z, though for them, retirement was still some way off and the road there is uncertain. Thus, among Gen Z individuals who were surveyed, 45.9% were unsure about how to proceed with a savings plan, and 12.8% were uninterested in this, the highest share of any age group (Figure 9).

Analysis of environmental awareness and responsiveness by generation is drawn from the report “Voice of Green: For the world, for us”, published by Mahidol University College of Management for a seminar on this topic held on January 9, 2020.36/ This shows that baby boomers are the greenest generation, and perhaps because they are the oldest and the most financially secure, members of this cohort are keenest to address environmental problems by paying more for environmentally friendly goods and services.

In combination, the evidence on savings behavior and awareness of and concern over environmental issues points strongly to baby boomers comprising the main target for green deposits in Thailand, followed in decreasing order of importance by Gen X, Gen Y and Gen Z. Interestingly, the research cited above also demonstrates that women are more actively interested than men in environmental issues.

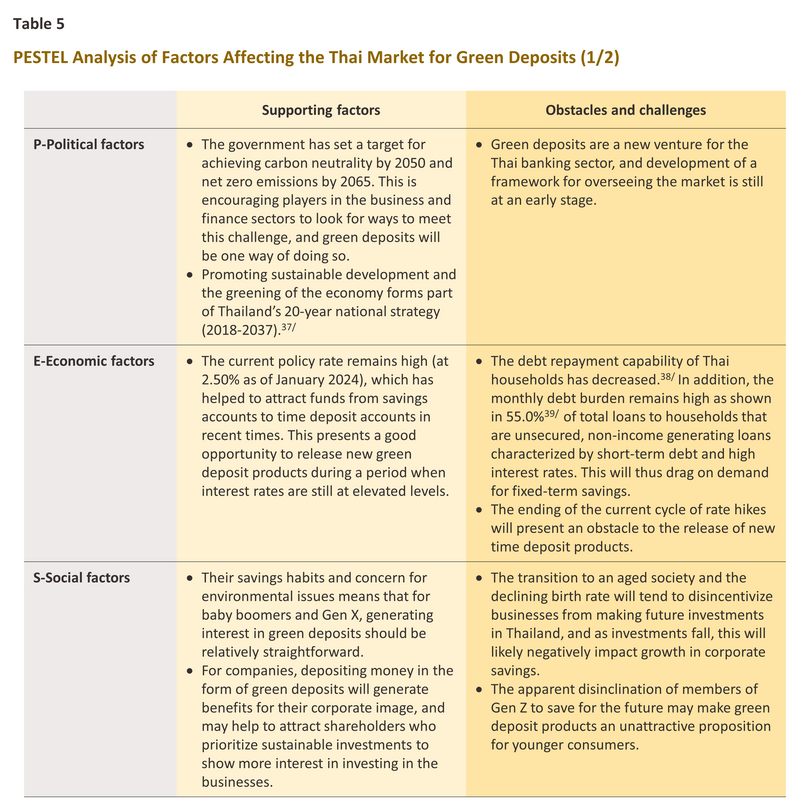

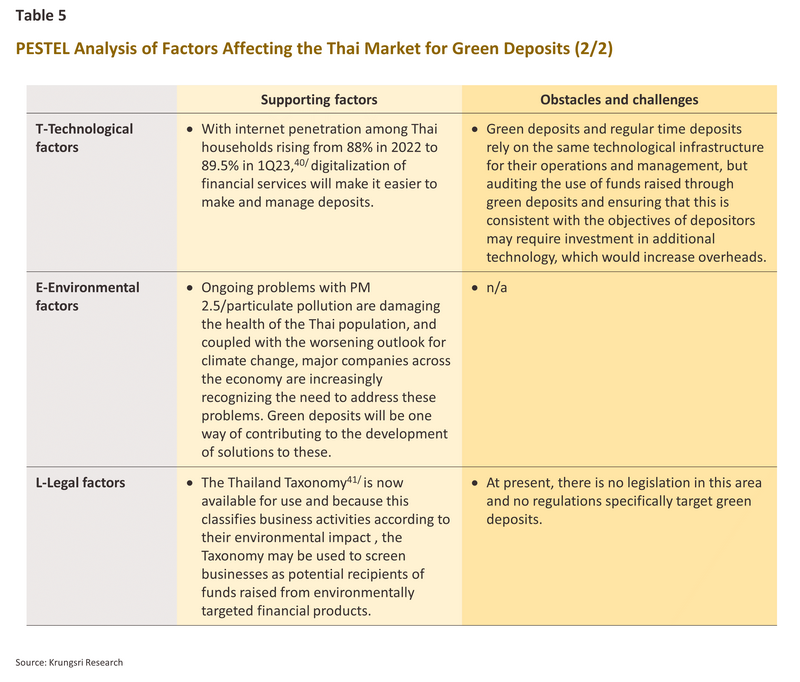

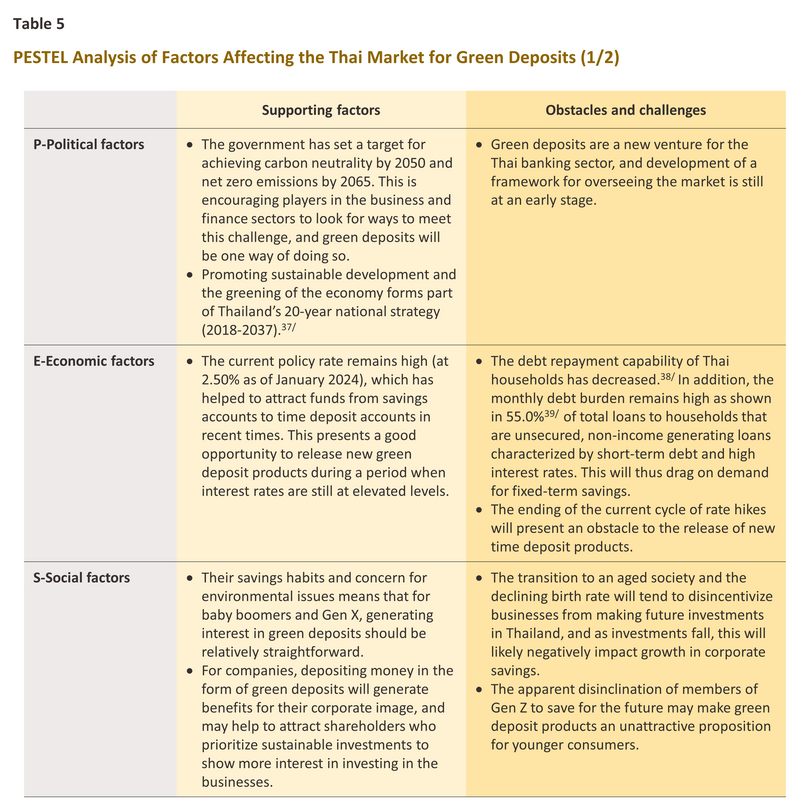

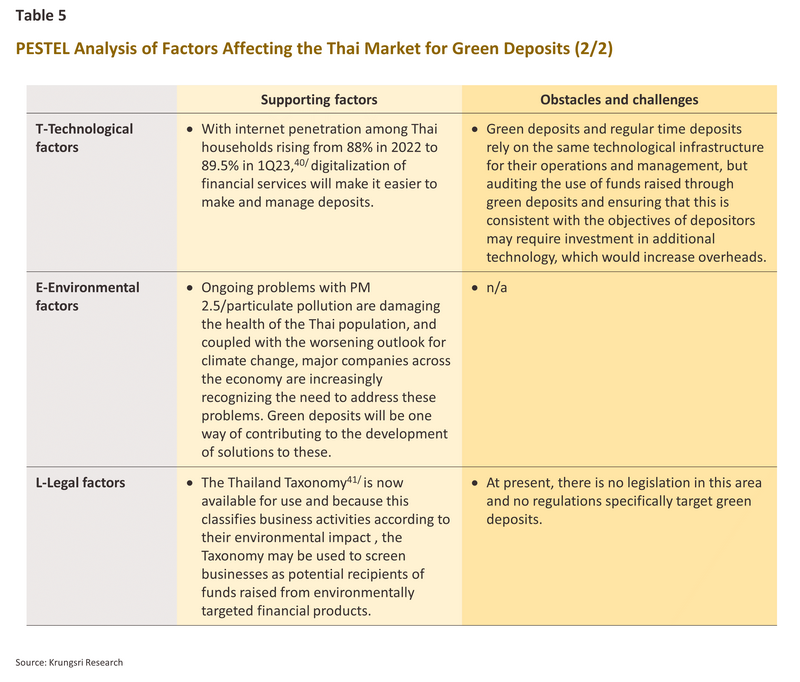

Challenges to developing a domestic market for green deposits

The following analysis of the potential challenges to the successful rollout of green deposits in Thailand uses the PESTEL framework, which entails a consideration of six factors: the political, the economic, the social, the technological, the environmental, and the legal (Table 5). This analysis shows that although the market has potential for growth, uncertainty over interest rates and the likely returns to depositors will remain a challenge.

Krungsri Research view: Opportunities and future directions for green deposits

The acceleration in the pace of modern life, ceaseless competition, and an economic system focused on production for profit-maximization have all contributed to a worsening of the climate crisis, and as such, fears over the outlook for the global environment are taking an increasingly central place in thoughts about the future in Thailand just as much as in other countries. Within this evolving business landscape, the banking industry has the potential to play a major role in facilitating cuts in greenhouse gas emissions thanks to its position as a financial intermediary within an enormous range of markets. Moreover, through the judicious use of green financial products that encourage the adoption of sustainable business practices and activities, the banking industry has the capacity to become an important driver and the move to a greener, more environmentally friendly economy. One tool in this arsenal will be green deposits, though because these will be a new venture for Thai bankers, careful consideration needs to be given to how these can be best designed to combine solutions to environmental problems with the requirement that they meet the needs of banks’ retail and corporate customers.

With regard to the timing of these new products, releasing green deposits to the market at a point when interest rates are already elevated should allow any bank doing so to expand its customer base relatively easily. In addition, intensifying concerns about the environment will also help to encourage savers, and especially in the corporate segment, to look closer at these products. This is because in addition to helping to solve environmental problems, putting funds into green deposits will also improve corporate PR and reinforce public faith in the environmental responsibility of that company. In particular, the uptake of green deposits will become more than just a passing trend if this is led by major companies having an interest in depositing funds, and especially if these are publicly listed since these companies have the resources to undertake and to maintain high-profile social initiatives coupled with long-term plans and policies targeting improved business sustainability.

As shown above, the target market for retail customers is among baby boomers and Gen X. These have significantly more entrenched savings habits than other age cohorts, and because they are also the wealthiest generations, they are the most committed to helping address problems with the environment and climate change through their own actions. These individuals can thus be expected to show greater take up rates for goods and services that have positive environmental impacts, even if these cost more. A bank releasing green deposits to the market could connect directly with these as potential customers through proactive social media marketing on the channels most favored by this age group (e.g., Facebook and Line), as well as through SMSs and even in-branch advertising and promotion. In practice, because they are so much more primed for green deposits than other age cohorts, it should be relatively straightforward to reach this target group and to generate interest among it when these products reach the market.

Nevertheless, Thailand lacks a framework specifically targeting green deposits, and so any banks venturing down this path and releasing their own products to the market and then planning to use the funds raised through this to support credit issued to environmentally conscious activities or businesses will likely need to rely on the Bank of Thailand’s ‘Thailand Taxonomy’42/ since this categorizes business activities by their environmental impacts. Unfortunately, because the market for environmentally friendly investments is still underdeveloped, problems identifying projects that are suitable investment targets may pose a considerable obstacle to the market’s development, at least at the initial stages, and this may then impact the size of the offerings that a deposit provider may make.

Commercial banks will of course be free to set their own conditions for businesses seeking funding via green deposit schemes. This would include determining loan interest rates, as well as possible scaled reductions in these according to the borrower’s sustainability performance as defined by the bank's criteria.

Looking forward, it seems probable that the current round of rate hikes is over in both Thailand and the majority of other countries, and so the positive effect of interest rates on deposit accounts may now weaken. In addition, consumer behavior is variable with regard to savings rates, and this is subject to different influences for different generations. Given this, releasing new green deposits with the expectation that they will remain a popular choice within the market for green financial products over the long run may be unrealistic. However, the future remains uncertain, and it will take time for the popularity and longevity of green deposits to be established, just as was the case with other green financial products released to the market over the past few decades.

References

Ankit Sinha and Rupul Jhanjee. (2023). “Green Deposits: Driving Sustainable Finance and Environmental Impact in India”. Retrieved from https://www.lexology.com/library/detail.aspx?g=00db49fd-aaaf-4f1f-bd9d-8b9b00d66d7d

Bank of China. (2023). “Green Time Deposit”. Retrieved from https://www.bochk.com/en/corporate/ESG/greendeposit.html

Basudha Das. (2023). “New rules for green deposits from June 1: What are green deposits, how do they work; check details here”. Retrieved from https://www.businesstoday.in/personal-finance/investment/story/new-rules-for-green-deposits-from-june-1-what-are-green-deposits-how-do-they-work-check-details-here-383991-2023-06-02

ETBFSI. (2023). “Green deposit push hits a banking wall in India”. Retrieved from https://bfsi.economictimes.indiatimes.com/news/banking/green-deposit-push-hits-a-banking-wall-in-india/102362345

Heinrich Fromsdorf. (2021). “Deutsche Bank launches green deposits for its corporate clients”. Retrieved from https://www.db.com/news/detail/20210331-deutsche-bank-launches-green-deposits-for-its-corporate-clients?language_id=1

KPMG Thailand. (2022). “การเงินสีเขียว: อีกก้าวที่จำเป็นสู่อนาคตที่ยั่งยืน”. Retrieved from https://kpmg.com/th/en/home/media/press-releases/2022/04/green-financing-th.html2/https://kpmg.com/in/en/home/insights/2023/05/first-notes-framework-on-green-deposits-and-its-use-for-green-activities.html

KPMG. (2023). “Framework on green deposits and its use for green activities”. Retrieved from https://kpmg.com/in/en/home/insights/2023/05/first-notes-framework-on-green-deposits-and-its-use-for-green-activities.html

PWC. (2023). “Green bank deposits: A gateway to sustainable financing”. Retrieved from https://www.pwc.in/assets/pdfs/consulting/green-bank-deposits-a-gateway-to-sustainable-financing.pdf

RBI. (2023). “Framework for acceptance of Green Deposits”. Retrieved from https://rbidocs.rbi.org.in/rdocs/notification/PDFs/CIRCULARGREENDEPOSITS55FFC86E3BD94C4A8BFF8946C6C282EA.PDF

Rounaq Neroy. (2021). “All You Need to Know about HDFC Green Deposits”. Retrieved from https://www.personalfn.com/dwl/fixed-income/all-you-need-to-know-about-hdfc-green-deposits

Sanicha Lakhonphol. (2021). “เอชเอสบีซี เปิดตัว ‘บัญชีเงินฝากสีเขียวสกุลเงินบาท’ ประเดิม 2 ลูกค้ารายใหญ่ ‘ซีพี ออลล์ และอินโดรามา”. Retrieved from https://thestandard.co/hsbc-green-deposit/

Supavit Kaewkunok. (2021). “ยุทธศาสตร์ ‘พลังงานไฮโดรเจนสีเขียว’ ของอินเดีย โอกาสการเปลี่ยนผ่านพลังงานของโลก”. Retrieved from https://www.the101.world/green-hydrogen-strategy-india/

Yashita Muthamma. (2023). “Framework For Acceptance Of Green Deposits For Regulated Entities In India”. Retrieved from https://ksandk.com/newsletter/framework-for-acceptance-of-green-deposits-for-regulated-entities-in-india/

1/ https://thaipublica.org/2023/07/un-chief-says-era-of-global-boiling-has-arrived/

2/ https://www.bochk.com/dam/corporatebanking/description_2023_green_dep.pdf

3/ https://v.icbc.com.cn/userfiles/Resources/ICBC/haiwai/Asia/download/TC/2022/GreenDepositFramework202209.pdf

4/ Roundtable on Sustainable Biomaterials (RSB) sets standards for the sustainable use of bio-materials, and in their area, these are regarded as one of the world’s most stringent.

5/ https://www.smbc.co.jp/news_e/pdf/e20210402_01.pdf

6/ MUFG will revise its green deposit framework annually to keep this aligned with changes in the environment, market trends, and ESG (environmental, social, and governance) regulations. The role out of green deposits under this framework reflects MUFG’s Carbon Neutrality Declaration commitment, with the bank aiming to achieve net zero gas emission in its own operations by 2030, and to achieve net zero gas emission in its investment and loan portfolios by 2050.

7/ https://www.bk.mufg.jp/global/newsroom/announcements/pdf/20220401_greendeposits_en.pdf

8/ https://investor-relations.db.com/files/documents/green-financing/Green-Financing-Instruments-Report-2021-2022.pdf

9/ https://www.rbi.org.in/Scripts/NotificationUser.aspx?Id=12487&Mode=0

10/ Greenwashing refers to the practice of establishing a positive corporate image by releasing products or services that claim to be environmentally friendly but that in reality are not.

11/ https://www.bochk.com/dam/corporatebanking/green_dep_info.pdf

12/ https://www.smbc.co.jp/news_e/pdf/e20210402_01.pdf

13/ https://www.bk.mufg.jp/global/newsroom/announcements/pdf/20220401_greendeposits_en.pdf

14/ https://www.db.com/news/detail/20210331-deutsche-bank-launches-green-deposits-for-its-corporate-clients

15/ https://www.bankbazaar.com/fixed-deposit/indusind-bank-green-fixed-deposit.html

16/ https://www.aubank.in/interest-rates/green-fd-interest-rates

17/ https://www.hdfcsec.com/hdfc-limited-green-and-sustainable-deposit

18/ https://www.bankbazaar.com/fixed-deposit/federal-bank-green-deposits.html

19/ Follow for further details at https://www.bangkokbiznews.com/finance/investment/1116781

20/ Foreign banks such as Sumitomo Mitsui Banking Corporation, Deutsche Bank and The Hongkong and Shanghai Banking Corporation Limited offer green deposits through their bank branches located in Thailand.

21/ In Thailand, there was the introduction of a deposit product similar to green deposits in December 2022. At that time, it was the launch of ESG deposits by the Small and Medium Enterprise Development Bank of Thailand (SME D Bank). However, at that point, it was not considered true green deposits because the objectives were different. ESG deposits were introduced to raise funds for ESG projects, covering environmental, social, and governance aspects. Additionally, it aimed to raise a specific amount of funds (1,000 million baht) with a restricted timeframe (1 year). The ultimate intention was to support the bank’s customer base (given its status as a specialized financial institution) through various credit products. https://www.smebank.co.th/en/press-release/sme-d-bank-thailands-first-financial-institution-opens-to-raise-funds-deposits-esg-moving-forward-to-drive-the-national-agenda-supporting-thai-smes-to-grow-to-achieve-sustainable-success/

22/ Green bonds may be issued by the government, corporations, or financial institutions. These aim to raise funds to be used partly or wholly for investment in or refinancing of environmentally friendly projects, such as the production of alternative energy, the use of clean energy in the transport sector, or the treatment of wastewater.

23/ In 2023, Thailand’s corporate bond market had a value of THB 4.75 trillion (source: https://www.thaibma.or.th/doc/press/y2024/Doc012024.pdf)

24/ The Office of Natural Resources and Environmental Policy and Planning (ONEP) reports that in 2016, total greenhouse gas emissions from Thailand came to 354.36 million tonnes of CO2-equivalent. 71.65% of this was attributable to activities within the energy and transport sector, 14.72% from the agricultural sector, 8.90% from industrial processes and consumption of goods, and 4.73% from waste disposal.

25/ https://www.thecityuk.com/media/021n0hno/green-finance-a-quantitative-assessment-of-market-trends.pdf

26/ The average exchange rate for the year 2021 is 31.9807 Thai Baht per US Dollar, according to data from the Bank of Thailand.

27/ https://www.bot.or.th/th/research-and-publications/articles-and-publications/articles/Article_21Jul2021.html

28/ https://www.ceicdata.com/en/indicator/india/total-deposits

29/ https://www.ceicdata.com/en/indicator/thailand/total-deposits

30/ https://www.financialexpress.com/money/why-do-indians-invest-in-fixed-deposit-survey-reveals-top-reasons-2973544/

31/ https://www.business-standard.com/finance/personal-finance/how-much-do-indians-save-in-fds-all-india-average-is-rs-42-573-123070700236_1.html

32/ For more details on “Carbon credits a mechanism for achieving sustainability targets”, please see https://www.krungsri.com/en/research/research-intelligence/carbon-credit-2023

33/ In the current context, Scope 3 Category 15 comprises investments in four types, namely: equity investments, debt investments, project finance, and managed investments and client services. https://ghgprotocol.org/sites/default/files/2022-12/Chapter15.pdf

34/ https://www.bot.or.th/content/dam/bot/image/research-and-publications/2563ThaiFLsurvey.pdf

35/ Gen Z: born 1997-2012. Gen Y: born 1981-1996. Gen X: born 1965-1980. Baby boomers: born 1946-1964

36/ https://www.everydaymarketing.co/trend-insight/voice-of-green-marketing-cmmu-eco-trend-2020/

37/ https://www.nesdc.go.th/download/document/SAC/NS_SumPlanOct2018.pdf

38/ https://ittdashboard.nso.go.th/preview2.php?id_project=76

39/ https://app.bot.or.th/BTWS_STAT/statistics/BOTWEBSTAT.aspx?reportID=984&language=TH

40/ https://tdo.onde.go.th/documents/2023/01-A5-Infographic_TIME-202242_V11.pdf

41/ https://www.bot.or.th/content/dam/bot/financial-innovation/sustainable-finance/green/Thailand_Taxonomy_Phase1_Jun2023_TH.pdf

42/ https://www.bot.or.th/content/dam/bot/financial-innovation/sustainable-finance/green/Thailand_Taxonomy_Phase1_Jun2023_TH.pdf