The Future Food Industry

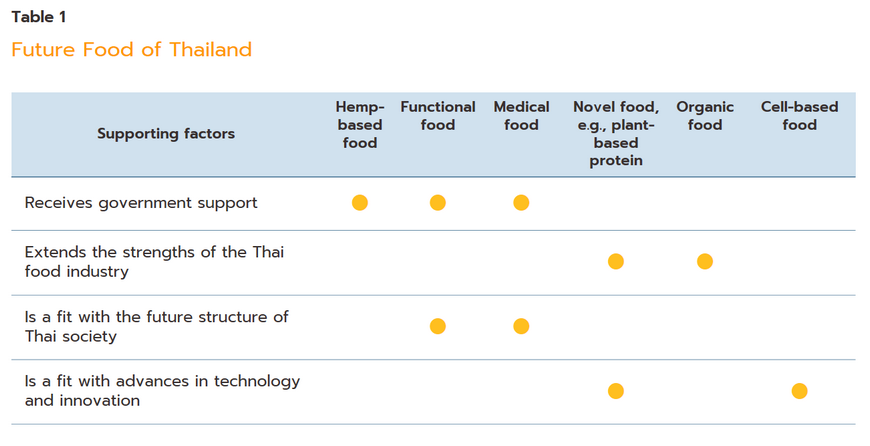

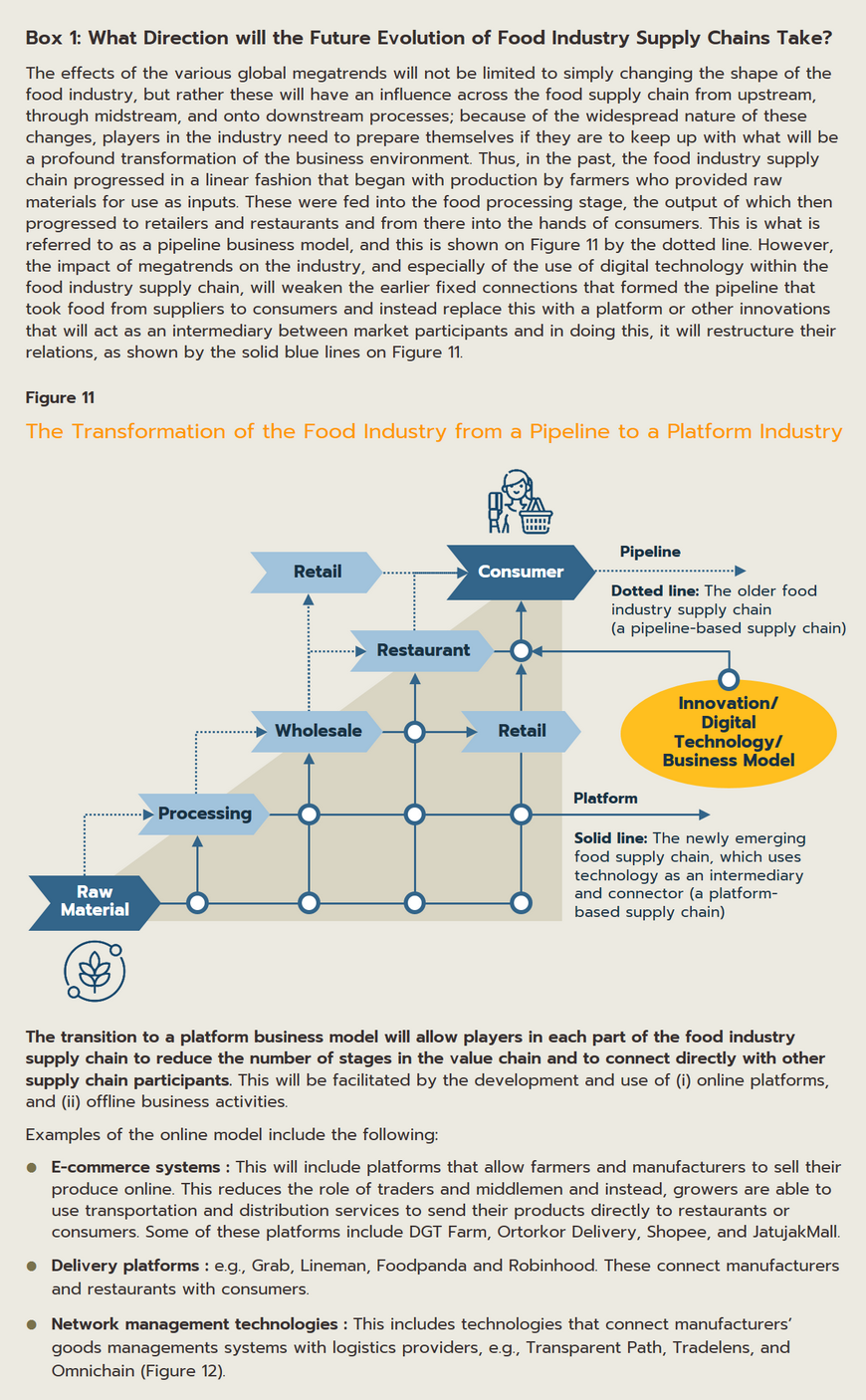

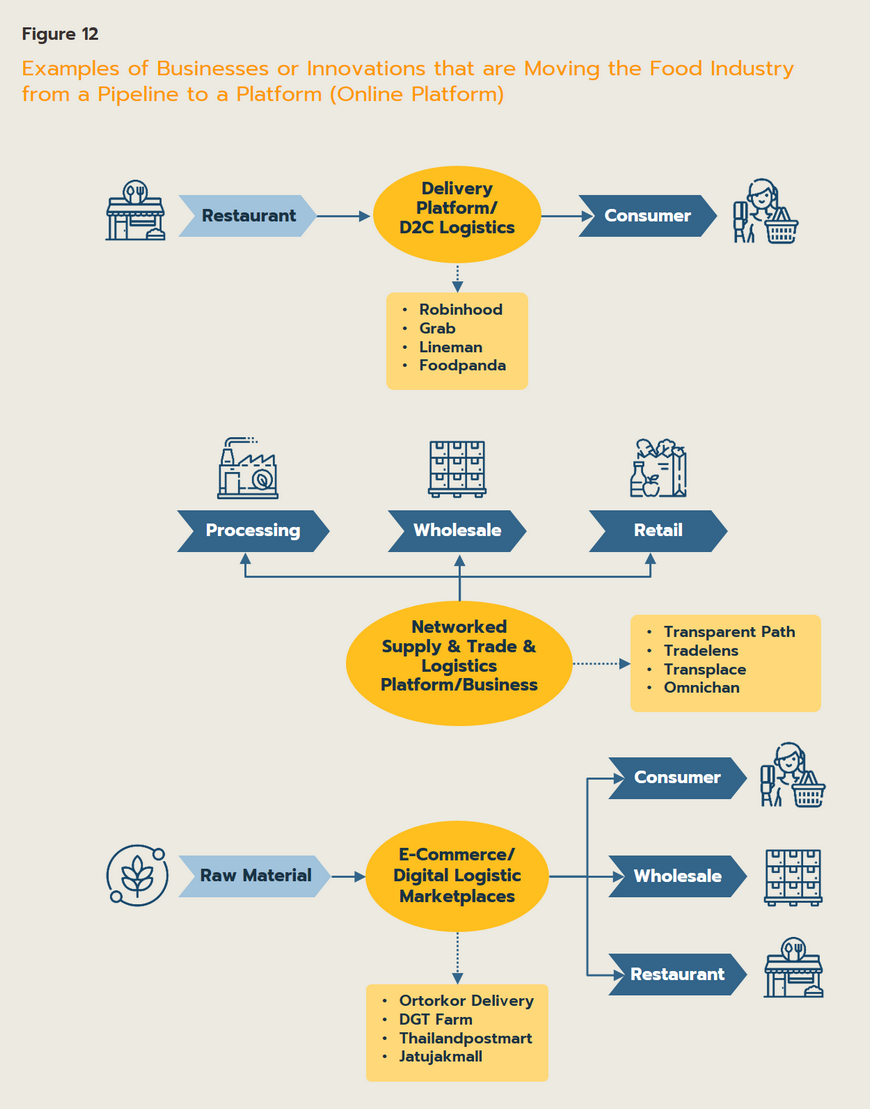

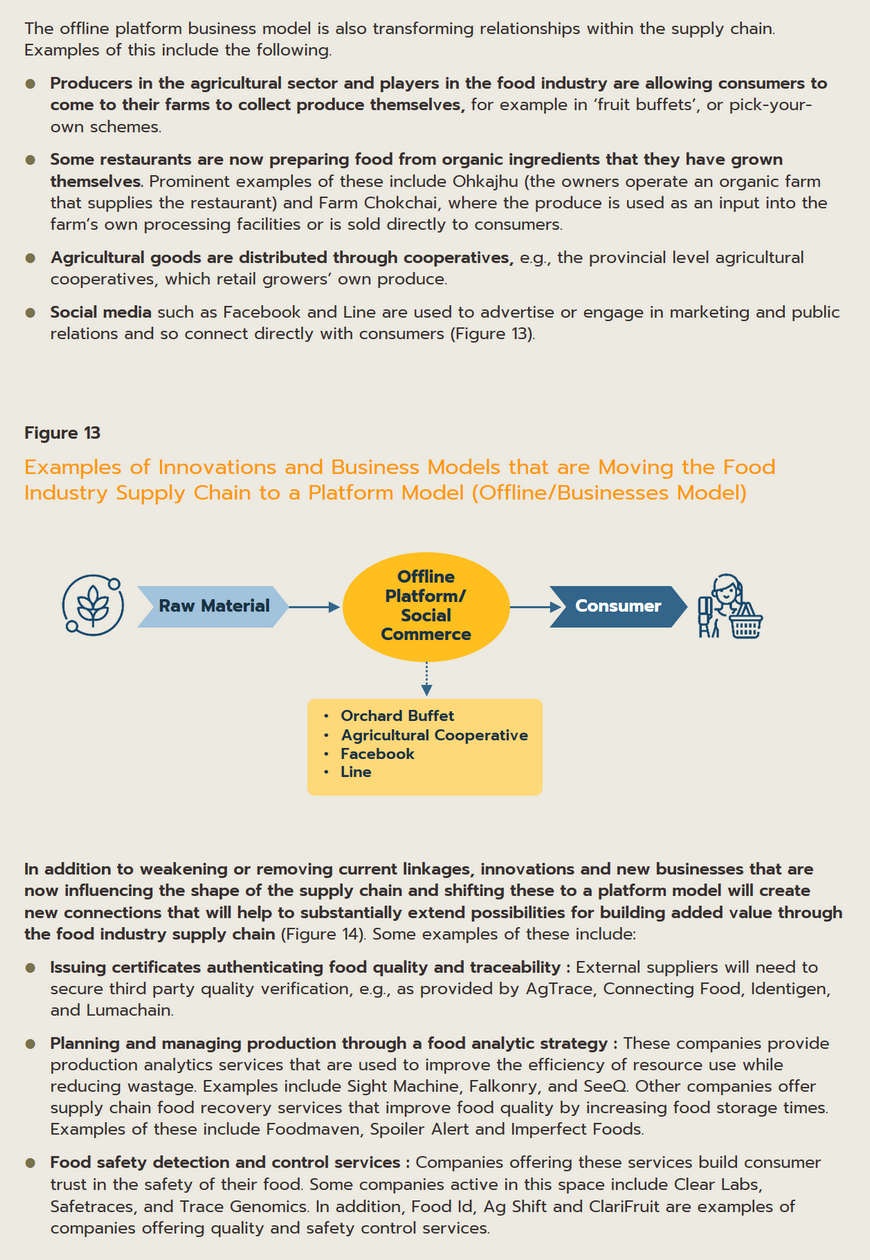

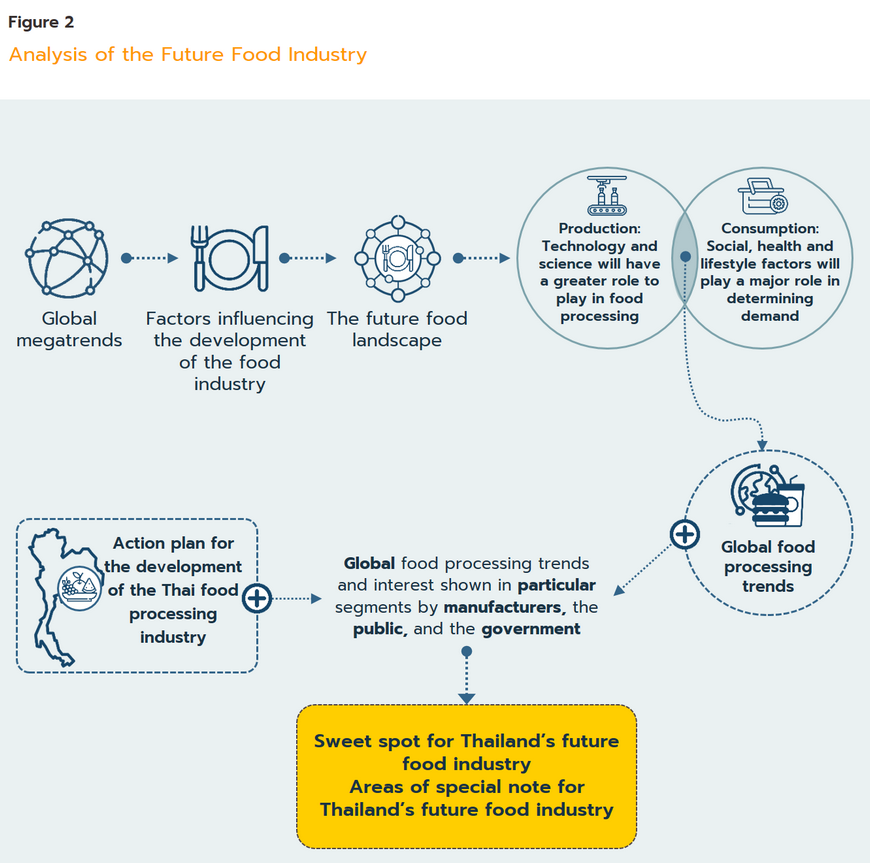

The shape of the future food landscape will be strongly determined by changes in the behavior of consumers and producers that are occurring within the context of five megatrends, namely those affecting health, technology, demographic change, nature and the environment, and the global economy and regulatory environment. The Thai government has therefore set out an action plan for the development of the food processing industry and called for cooperation in developing Thailand’s future food industry in step with these emerging global trends. In light of this, Krungsri Research sees several future food products being particularly relevant to Thailand: (i) organic food, (ii) hemp-based food, (iii) plant-based food, (iv) cell-based food, (v) medical food, and (vi) functional food. However, rapid technological change is not only altering the food on our plates, it is also reorganizing food industry supply chains, and this is leading to profound transformations that are shifting the industrial environment from being centered around a pipeline-type model to a platform-based structure. On the positive side, this will help to add value to the food industry supply chain, but at the same time, some businesses will see their presence in the market diminish. Given this, players in the industry will need to reassess their operations by overhauling their business models, exploiting new opportunities, and above all, by gaining a deep understanding of the technology that is disrupting the sector.

Market Research estimates that as of 2022, the global food and drink industry had a total market value of USD 6.4 trillion, with this expected to rise to USD 8.9 trillion by 2026. Given both the size of the market and its continuing growth, new players are being attracted to the industry, but the challenge facing these companies is to identify products that will meet changing consumer demand and help to seed new markets. Understanding the shape and detail of future market trends is thus a priority and an opportunity for both incumbents and newer challengers.

Global megatrends are revolutionizing the food industry

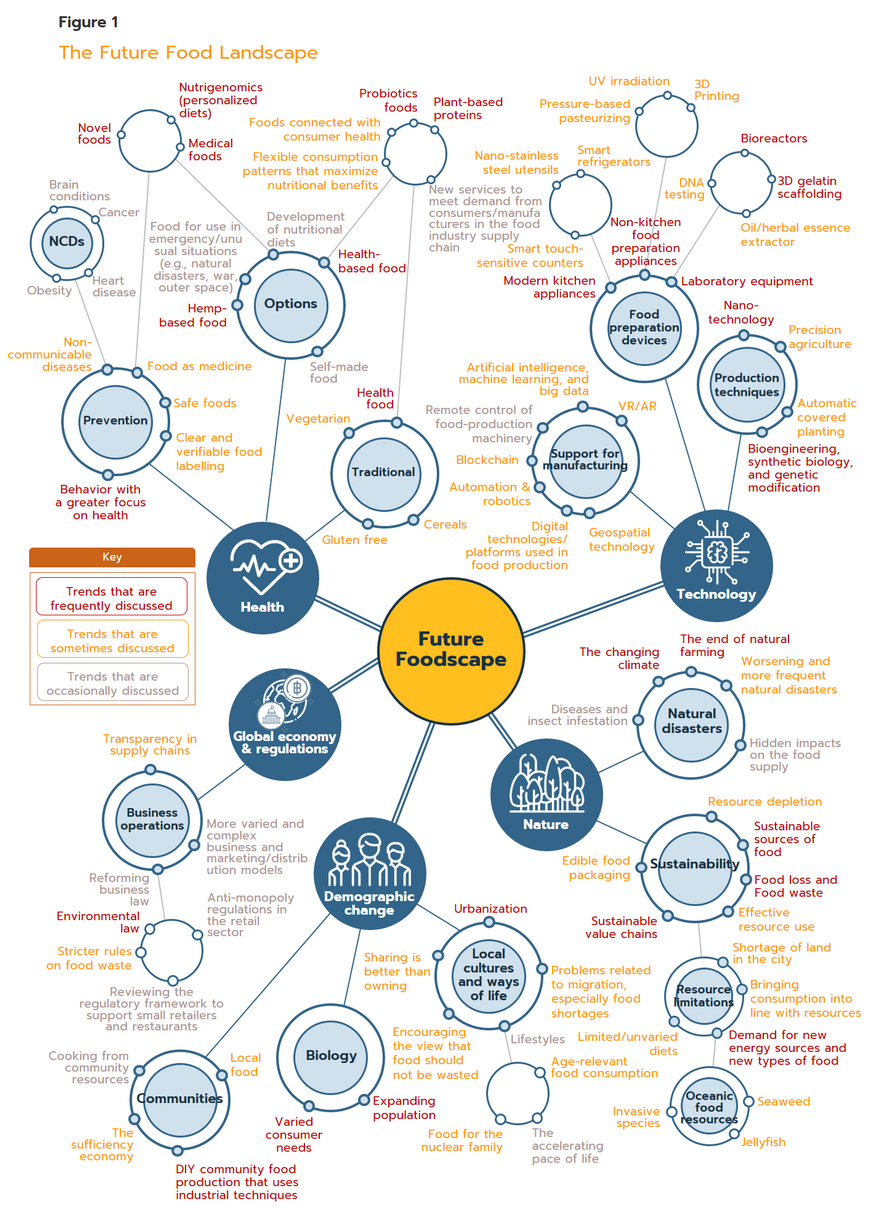

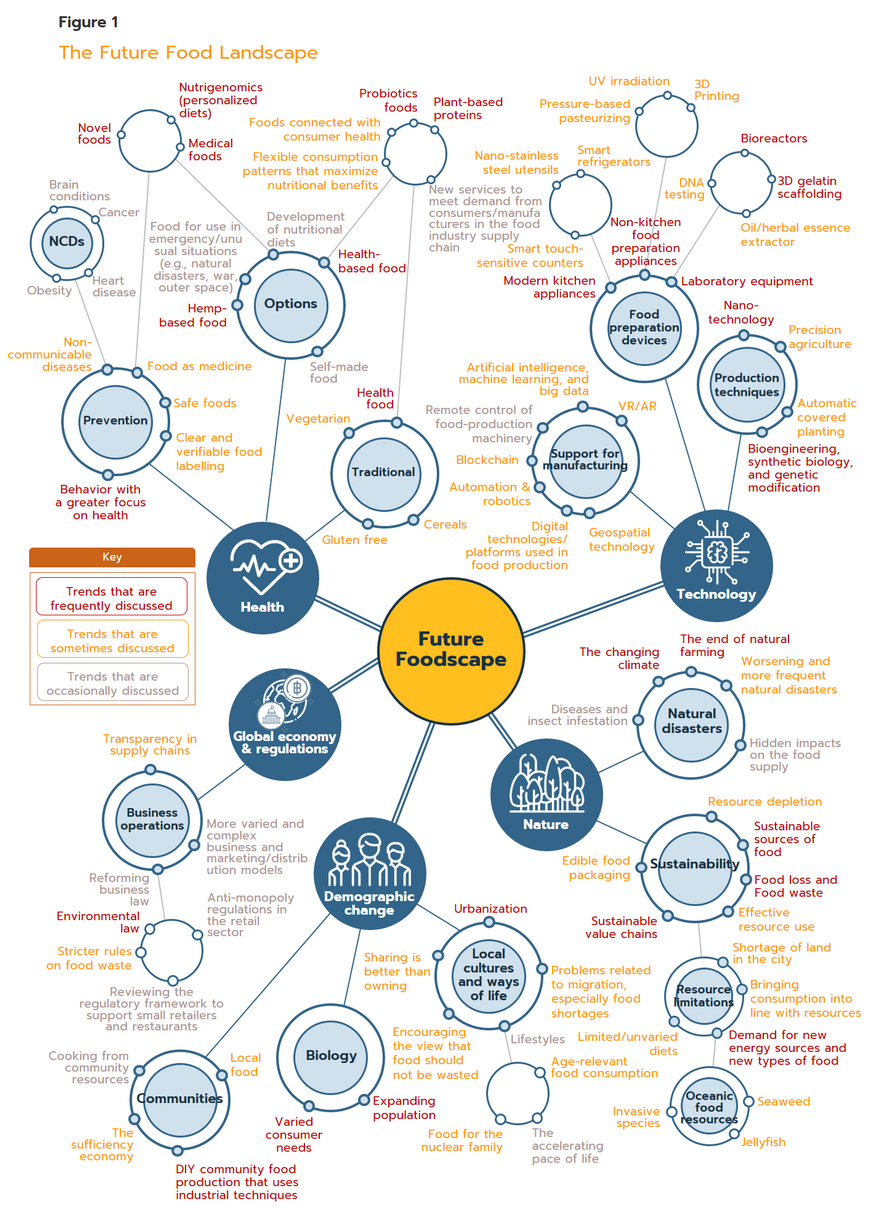

Major global processes, or what are called ‘megatrends’, that are currently unfolding will have a significant impact on the future across a broad front that encompasses manufacturing, the economy, lifestyles, society, and consumer behavior. Understanding how these megatrends will affect the food industry will therefore help to shed light on how the global industry is likely to develop in the future. These megatrends can be clustered under the following five headings.

- Health : This will have a significant impact on the development of the food industry, especially given the stimulus effect of the Covid-19 pandemic on the public’s awareness of and concern for their personal health. The wish to avoid both communicable and non-communicable diseases[1] is translating into increased consumption of more nutritional food, more regular exercise, greater attention to public health and safety, and the development of provenance and supply chain tracking to increase food safety. In addition, changes to lifestyles, preferences, and the age of consumers is also affecting the market.

- Technology : The impacts of new technology are becoming more evident on an almost daily basis, and although some areas of innovation are finding uses across a number of sectors, those that will find particularly clear applications in the food industry will include: (i) biotechnology, including bioengineering, synthetic biology, genetic modification, and nanotechnology; (ii) digital technologies, such as artificial intelligence (AI), big data storage and analytics, and blockchain technology; (iii) engineering technologies, including automation and robotics; and (iv) visualization technologies, namely augmented reality (AR), mixed reality (MR), and virtual reality (VR).

- Demographic Change : Another important megatrend is the significant changes to societies globally that are currently underway, though the nature of these varies from one country to another. Although the overall global population is still on track to increase[2], differing birth rates will lead to significantly different social structures in different parts of the world, and this will then affect demand for food. Both the types of food and the overall quantity will be affected by demographic factors including age, ethnicity, religious and cultural affiliations, urbanization rates, and population movements. As such, demand for food will vary by region.

- Nature and the environment : The need to address mounting environmental problems is becoming more and more evident globally. This is particularly the case for climate change, which is leading to more frequent and more severe natural disasters (e.g., storms, floods, droughts, etc.) that in addition to causing loss of life and assets are also inflicting further damage on already weakened ecosystems. In the near future, both industry and the public will therefore have little choice but to pay much greater attention to building systems that are more heavily focused on sustainability.

- The world economy and the global regulatory framework : Megatrends affecting rules and regulations will allow the food industry to build additional added value, to increase trust[3], and to firm up food security on both the production and consumption sides of the market. Examples of regulatory changes include the introduction of rules that aim to increase trust by requiring foods to specify their origin or production history (these will likely also add value to some products), rules that require the disclosure of provenance and processing at all stages from harvesting to delivery to the consumer, and antitrust laws that prevent the establishment of unjustified monopolies.

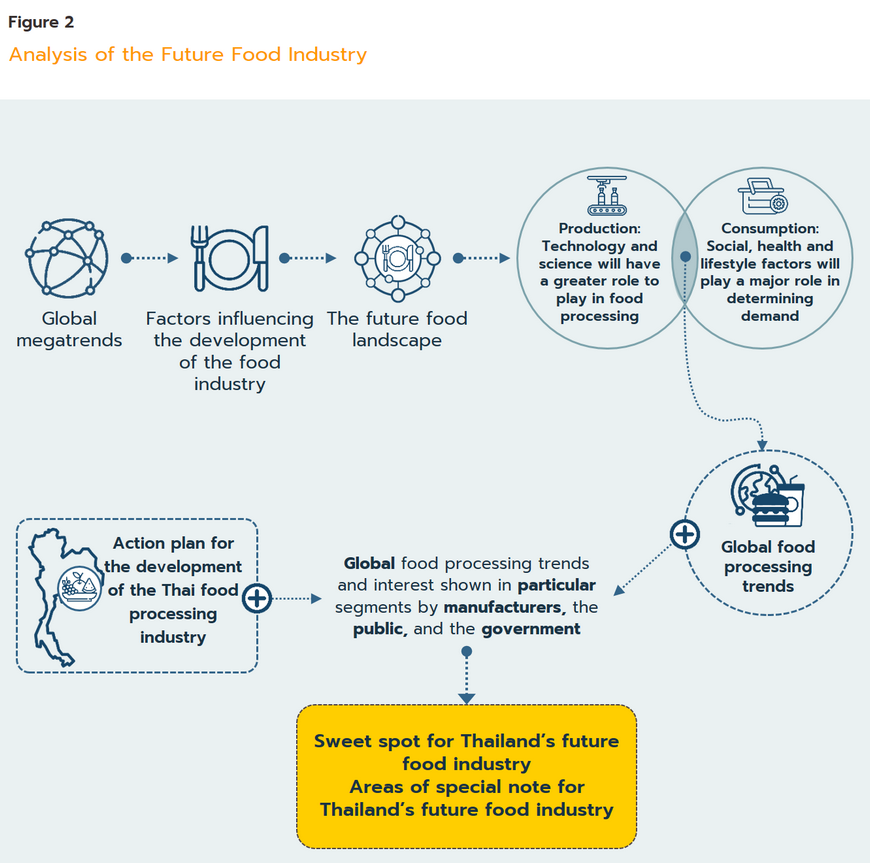

Considering the possible interactions of these megatrends with the food industry helps to illuminate the future direction of the latter, likely changes in taste, and how and what sub-trends may emerge. Taken together, these comprise the ‘future food landscape’ (Figure 1). Armed with insights into the overall shape of the factors that will influence the food industry, it will then be possible to evaluate how the megatrends operating within that landscape will influence the development of new types of food as players look to expand product lines and meet emerging consumer needs. This is what is meant by ‘future food’ and in the following, we discuss Thailand’s future food industry (Figure 2).

Consumer behavior and demand

The period 2020 to 2022 was a challenging time for the world economy, and Thailand was no exception to this. The Covid-19 pandemic brought with it changes across a broad swathe of society, and the shifts that the crisis precipitated in work, accommodation, travel and consumption rapidly coalesced into a set of behavioral changes that have been widely labeled as the ‘new normal’. This period of dramatic upheaval underlined the importance of consumer demand and behavior both as a key driver of social change and as a core catalyst that accelerated the progress of various megatrends. Krungsri Research believes that these megatrends will heavily affect future food-related consumption patterns and consumer demand, as described below.

- Consumer demand is rising for nutritional foods: Fears that surfaced during the Covid-19 pandemic of becoming infected through food helped to build consumer awareness of the importance of one’s diet, and this then added to both general health consciousness and demand for immunity boosting foods. This is reflected in a survey conducted by FMCG Gurus[4] that revealed that globally, 79% of respondents planned to increase their consumption of healthy foods, and 70% wanted to increase the effectiveness of their immune system[5]. Indeed, demand is increasing for food that does more than meet the body’s basic biological need for energy and instead helps to positively develop consumers’ health. Consumer goals with regard to the latter can take various forms, including maintaining their general health, keeping a good figure, rehabilitation, improving their physical abilities, adding muscle mass, and reducing excess levels of cholesterol. Functional foods and probiotics have the most important role to play in this area. In addition to affecting the market for food, increasing consumer concern with personal health and wellness is also being seen in other areas, especially in consumer electronics. The rising influence of health-oriented megatrends is thus reflected in sales of smart electric masks, devices for disinfecting clothing, the health functions included in smart watches, and mobile phone health apps. Functional foods represent a good response to the increasing prominence of health concerns since these are able to provide a range of nutritional benefits simultaneously (e.g., mineral water or sports foods that are fortified with vitamins, ready-to-eat amino acids, or protein and that can be taken to help add muscle or improve recovery after exercise).

- Functional food market value : As of 2021, the global market for functional food and drink had a combined value of USD 180.8 billion. Mordor Intelligence predicts that this will grow at an average rate of 2.7% per year to a value of THB 206.7 billion by 2026. The major players active in this segment include Nestle, Danone, Abbott Lab, PepsiCo and Kellogg’s.

Functional food: This is food that in addition to providing calories for the body also includes ingredients or components that help the body to work better, and that provide additional nutritional benefits such as boosting the immune system, improving physical abilities, slowing degradation of the body, and reducing or negating the impacts of illness or other physical conditions. These foods are generally not taken in the form of capsules or pills, and can be split into two sub-groups.

- Food products that are fortified with additives that help improve health. These can be consumed just like normal food and so they get around some of the problems with taking more pharmaceutical-like supplements. These include:

- Food that is fortified with vitamins, minerals, herbal extracts, or other substances such as antioxidants, probiotics, prebiotics, dietary fiber, and omega-3.

- The use of alternative products, such as adding the sweetener fructo-oligosaccharide in place of regular sugar in products that are consumed by diabetics, or adding the fiber inulin to promote the growth of prebiotics and so improve the gut microbiome.

- Foods that are prepared from natural ingredients that provide significant nutritional benefit. Examples include tea, tomatoes, soy, and garlic, though these are prepared ‘straight’ and the processing neither adds nor removes compounds from these.

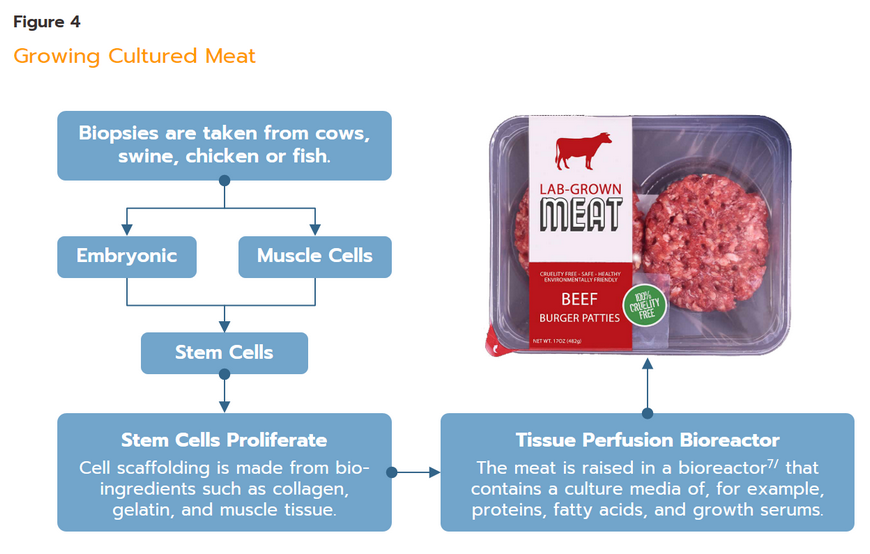

- Consumers are interested in innovative food products : FMCG Gurus reports that globally, 63% of consumers are attracted to interesting or unusual new food and drink products, while 74% report being interested in trying food with new flavors. Applications of modern food production techniques and technology that these consumers may be interested in include lab-grown meat, food produced from CBD extracts, food that is produced using 3D printing, and food manufactured using nanotechnology[6]. Cell-based food is a second type of future food that meets needs generated by global megatrends. This is thanks to its many attractive features, including its ability to reduce the slaughter of animals, the release of greenhouse gases, and the risk of infection with disease or adulterants. On the positive side, it is also possible to improve the food’s nutritional value by adding beneficial ingredients during production. Consumers will also be able to select from a wide range of products (e.g., chicken, pork, lamb, goat or fish), and this broad range of benefits is adding to the appeal of these foods.

- Group Cell-based food/cultured meat market value : Allied Market Research estimates that as of 2021, the global market for cultured meat was worth just USD 1.6 million but compound annual growth of 128.5% through this decade should take the market value to USD 2.79 billion by 2030. Major players active or investing in this area include Aleph Farms, Cubiq Foods, Future Meat Technologies, Meatable, Memphis Meats, Mission Barns, Mosa Meat , Redefine Meat and Vow Group.

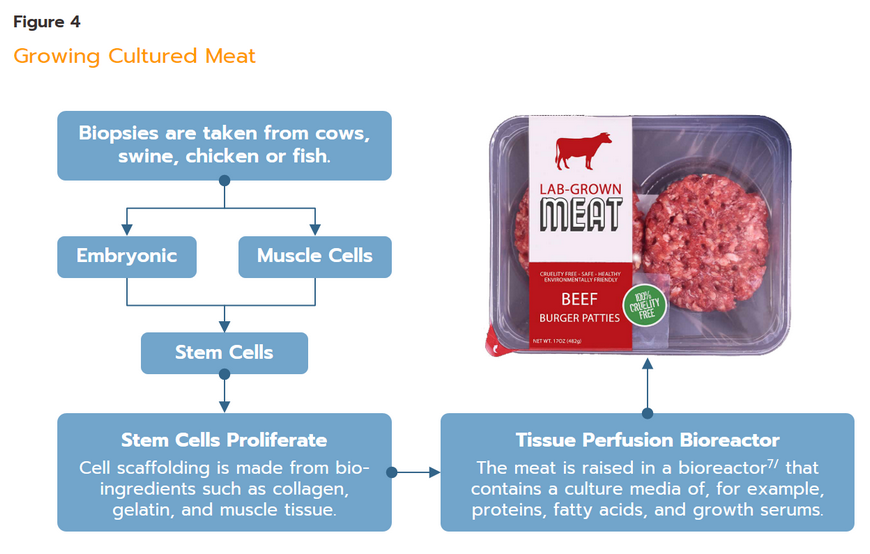

Cell-based food/cultured meat is a form of protein that is produced in laboratories or industrial settings. To make cultured meat, animal tissue is processed to extract stem cells, which are then fed nutrients so that they multiply. The resulting cells will assemble themselves into sheets of muscle fiber, similar to the meat found in living tissue. Once a sufficiently large quantity of tissue has been grown, this can then be cooked like regular meat.

- Consumer demand is becoming more diverse : The increase in the total global population will mean that in the future, demand for food will likewise increase, but in addition, demand will also be driven by rising rates of urbanization, which is linked to greater per capita food consumption[8]. The food industry will thus need to increase its output, but beyond this, societies are becoming more diverse and this too will have effects on the market for food, especially given differences in dietary requirements.However, in the future, the increasing diversity of society will not be limited to just greater differentiation by age (e.g., stratification into infants, working-age adults, and the elderly), but will extend to include greater diversity of social backgrounds, culture, religion, income, blood group, and presence of illness or disability. The differing needs of people in these various groups is thus helping to increase the profile of the personalized nutrition megatrend[9],[10]. This involves the design of nutritional programs or diets that are optimized for particular individuals and that take into account their lifestyle, their health, and the food’s nutritional value. These types of individualized nutrition programs are required because mass-market food production is not able to meet the needs of individual consumers, especially for people who are malnourished[11] or those who have special needs, such as infants, the elderly, the ill, or athletes, who typically have more demanding nutritional needs than do the general public. This has then given rise to the next part of the future food industry to be discussed, medical food.

- Medical food market value : Grand View Research estimates the market for medical food was worth USD 18.5 billion in 2021, with this predicted to grow to USD 23.4 billion by 2025, giving annual growth of 6.0% CAGR. Major players currently active in this segment include Donane, Nestle, Abbott, Targeted Medical Pharma, Victus, Primus Pharmaceuticals, Fresenius Kabi AG, Meiji Holdings and Mead Johnson & Company.

Medical foods are products that are in fact neither medicines nor supplements. Target consumers for these foods are individuals with particular dietary needs or illnesses or conditions that impose special nutritional requirements, such as people with metabolic problems, Alzheimer’s, lactose intolerance or other food allergies, or elderly individuals who have problems with their digestion. These individuals will typically require food that is of a different type, that has a different nutrient profile, or that is prepared in different ways to food that is consumed by the general public.

- Consumers are concerned about the environment : FMCG Gurus states that globally, 74% of the population are trying to reduce food waste, while an ever-greater proportion are worried about the environment. Awareness is thus rising among consumers of the changes underway in the environment and the natural world, and this is reflected in the intensification of interest in nature conservation that has been seen in recent years. As part of these trends, consumer behavior is changing and so what is called the ‘green megatrend’ emphasizes environment sustainable consumption and social responsibility, for example by buying food products that use edible packaging, that are produced without degrading the environment, that do not generate additional waste, and that do not involve animal suffering (e.g., battery hens and foie gras production). Research shows that some types of food will help to address these problems and to reduce damage to the environment, and these include: (i) cultured meat, consumption of which helps to reduce the need to slaughter animals and cuts the release of carbon from livestock operations, as well as yielding edible products more rapidly than traditional animal husbandry; (ii) plant-based alternative protein; and (iii) organic food.

- Value of the market for plant-based alternative protein : BIS Research estimates that this segment was worth USD 53.9 billion in 2021, though the market is expected to increase in value to USD 80.4 billion by 2025 (CAGR of 14.3%). At present, companies with a presence in the segment include Amy’s Kitchen, Before the Butcher, Beyond Meat, Blue Diamond Growers, Boca Foods, Califia Farms, ConAgra Brands, The Meatless Farm and The Vegetarian Butcher.

- Value of the market for organic food : Work by Research on Global Markets shows that as of 2021, the market for organic food was worth USD 194.3 billion but that anticipated CAGR of 16.0% would take this to a total of USD 303.0 billion by 2024. Some of the most visible companies selling in this segment include General Mills, Hain Celestial Group, Danone, Campbell Soup Company, Nestle, Kellogg’s, Tyson Foods and Cargill.

Plant-based alternative proteins are proteins that are produced from plants rather than from animals, and these may have a different nutrient profile to animal-based proteins, for example having more or less fat or vitamins. Plant-based proteins can be split into five groups.

- Cereals: These proteins come from edible grasses such as corn, wheat, rice, millet and barley.

- Legumes: Protein from these sources originates in beans, such as black beans, kidney beans, mung beans, soy beans, chickpeas, black-eyed peas, and lentils.

- Seeds and nuts: This group includes pumpkin seeds, sunflower seeds, sesame seeds, linen seeds, hemp seeds, poppy seeds, almonds, chestnuts, and macadamia nuts.

- Pseudo-cereals: These include buckwheat, chia, quinoa, and amaranth.

- Vegetable protein: This is produced from broccoli, kale, cauliflower, potato, stink bean, star gooseberry, climbing wattle, vegetable hummingbird, Leucaena, Siamese cassia, moringa, and chaya. In addition, alternative sources of protein include seaweed and mycelium.

Organic food involves planting crops and raising livestock in a natural way that does away with the use of chemical inputs. Organic food does not use genetically modified organisms (GMOs), chemical fertilizer, pesticides, hormones, or radiation as a sterilizing agent.

The organic marketplace has now expanded from its original focus on fruit, vegetables, meats and processed food to include all types of consumer goods that come into contact with the body, but when producing this wider group of consumer goods, it is important that only organically grown inputs are used. However, specifying the size of the organic marketplace is difficult because what qualifies as organic depends on the criteria of individual accrediting bodies[12].

Hemp-based food is food that is legally produced from hemp seeds, other parts of the hemp plant, or hemp extracts that are then processed into food or drink products. Hemp contains many beneficial nutrients, though the seeds are particularly rich sources of protein, omega-3 and omega-6, and this can be used as a substitute for meat and animal-based food products.

Hemp extract also has medicinal properties, especially the cannabidiol compounds (CBDs) that it contains. This is therefore used in or added to a wide variety of food and drink products, including protein powders, granola, snacks, milk products, energy drinks, coffee, tea, and fruit juices. Hemp extracts are also used as a supplement in the form of hemp oil or CBD extracted from hemp thanks to its medicinal properties[13].

- Consumers want safe, high-quality food: One result of the Covid-19 pandemic has been that a third of global consumers are now concerned about the origin and quality of the ingredients used in their food[14], and in particular how this affects food safety. As a consequence, future food production will need to focus on higher quality products that remain free of contamination as they move through the supply chain and that maintain consumer faith through supply chain traceability and verifiability (e.g., by specifying where and how a product was grown, raised, harvested and transported). Needless to say, food will also need to meet the requisite legal requirements and to pass the standards set by the Food and Drug Administration.

Players will need to stay current with the evolution of megatrends

Consumer demand is acting as an accelerator of global megatrends and so to remain in a position from which they can best meet consumer needs, food manufacturers and processors will need to stay abreast of these changes by adjusting their operations. Krungsri Research has thus analyzed the future prospects for the food industry through the lens of these megatrends, and details of this analysis is given below.

- Manufacturers will need to place a greater emphasis on using healthy ingredients : To better respond to the trend for ‘food as medicine’[15] or for ‘eating for better mental health’, food processors will need to make greater use of herbs or extracts. Manufacturers will thus need to extend existing lines to include foods with the qualities demanded by the market. These will include, for example, hemp-based foods that have medicinal qualities and probiotics that boost the immune system and improve the functioning of neurotransmitters.

- Value of the hemp-based food market : Allied Market Research believes that the global market for hemp-based food[16] had a value of USD 1.4 billion in 2021, with average annual growth of 22.0% expected to bring this to USD 4.6 billion by 2027. Important companies active in the hemp-based food market include Marijuana Company of America, Hempflax Group, Hempro International, Aurora Cannabis and MH Medical Hemp.

- Using technology to exploit new sources of food : Generally, the food processing industry relies on biotechnology, but progress in developing innovative new technologies is allowing the industry to explore the use of new food extracts derived from vegetable, animal and mineral sources. The expansion of the so-called ‘novel foods’ segment has been made possible by new technologies in the following areas:

- Engineering : e.g., automatic machinery and 3D printing, which helps reduce the time and cost involved in mass producing food products by increasing economies of scale. This also helps to increase the quality of the food and so build consumer trust in these products.

- Bioengineering : e.g., producing protein from non-meat sources, which facilitates the production of antibiotic- and hormone-free products.

- Synthetic biology : This can be used to produce artificial food that tastes similar to traditionally made food but that can be manufactured much quicker, e.g., artificial wine, which can be produced in 15 minutes.

- Gene editing : This can be used to change the qualities of food, for example by improving its taste or by increasing the quantity of a particular compound or mineral.

- Nano-technology : This can also be used to change a product’s flavor, as well as to alter its consistency or increase its ability to absorb other substances.

- Manufacturers need to take more responsibility for their environmental impacts : The Sustainable Development Goals (SDGs) make clear that in the future, players in the food industry will need to reduce damage to the environment caused by food production and instead, move to a sustainable business model. Given this, future food supply chains will need to be much more heavily invested in environmental protection, which can be done through: ensuring that limited resources are used in the most efficient manner, using processes or inputs that are sourced from processes that do not cause environmental degradation, reducing losses and waste in supply chains and consumption and effectively managing food waste, supporting local food production, and reducing animal suffering. Food production techniques that are particularly environmentally friendly are cell-based food[17] and organically grown food.

Novel food is the name given to food or ingredients that are made using innovative new technology. The phrase is also used to describe food that is produced using processes that significantly alter the food’s composition, structure or appearance, or that affect its nutritional value, metabolic interactions in the body, or the level of undesirable substances that it contains. The European Union has defined novel food to include the following.

A. Compounds that are derived from growing cells or animal or plant tissue, e.g., compounds extracted from the herb echinacea, and 3,3'-diindolylmethane (DIM) that is extracted from cruciferous vegetables.

B. Compounds that are derived from microbes or seaweed, e.g., omega-3 that comes from seaweed, and powdered extract of the mushroom Agaricus blazei.

C. Compounds extracted from plants or plant tissue, e.g., noni extract, Salvia hispanica extract, and mung bean proteins.

D. Compounds that are extracted from animals or animal flesh that have not been bred for the purpose, e.g., Antarctic krill oil, which has antioxidants that counter the effects of free radicals, and emu oil.

E. Compounds derived from minerals, e.g., clinoptilolite, a natural zeolite that is used to control the presence of heavy metals in the body.

F. Foods that contain engineered nanomaterials, including vitamins, minerals, and other chemicals, e.g., iron, ammonium phosphate, chromium picolinate, and iodine.

G. Food that has had its molecular structure modified, e.g., low calorie replacements for oil or fat, sweeteners, or amino acid derivatives (N-Methyl-D-aspartate (NAMDA).

H. Food that has undergone a process that significantly changes its structure or composition, e.g., mushrooms that are subjected to ultraviolet light to increase their vitamin D content and fruit, vegetables and meat that is subjected to high-pressure pasteurization.

- Manufacturers will need to respond to consumption that is more varied and flexible : Consumer demand is expanding and diversifying, and in the future, manufacturers will need to meet the needs of a greater number of consumer groups. Food will also need to be easy to access and quick and convenient to prepare and eat. Future foods that best meet these criteria are functional foods, foods made from plant-based alternative protein, and medical foods.

- Food manufacturers and processors will need to operate within a stricter and more complex regulatory environment : In the future, the rules governing the production of food are likely to become tighter and more complicated, especially as these relate to the environment and sustainability. Many countries have thus now signed up to and started enforcing new environmental regulations that include the following.

- Under the zero deforestation commitments, European companies have agreed not to make purchases of any agricultural or forestry goods that have come to the market through processes that involved deforestation. For example, in 2020, the European Union announced that it would not buy latex or rubber trees that was not certified by the Forest Stewardship Council (FSC) or the Program for the Endorsement of Forest Certification (PEFC) (Figure 10). One result of this was that Michelin (the French tire producer) and Ikea (the Swedish furniture giant) will not now buy rubber products that come from deforested areas.

- Within Europe, the zero palm oil movement is gaining pace thanks to moves by the European Union to force member states to cut their use of vegetable-based biofuels (including those made from oil palm) that is planted in areas that function as carbon sinks. The goal is to bring use of the latter to zero by 2030, and the upshot of this is that demand for palm oil is on a downward trend.

- The ‘European green deal’ aims to create a society that does not pollute the air, land or sea by 2050, and so future food production will need to take into account changes in these countries and the proliferation in regulations globally.

The Thai food industry is receiving strong support from the government

Phase 1 of the Ministry of Industry’s action plan for the development of the food industry covers the period from 2019 to 2027. This lays out four principal measures.

- Measures that aim to develop ‘food warriors’ : These are focused on developing a new generation of food entrepreneurs who will operate across the supply chain, from agricultural activities through food production and processing to marketing and distribution, and who will be a driver of added value, job and wealth creation, and through this of growth in the economy generally. The emphasis will be on the production of future foods including health foods, food derived from biotechnology, and novel foods.

- Measures that aim to encourage future food innovation : These will raise the level of food innovation by helping to make new developments commercially viable. This will be achieved by building the infrastructure needed to improve national capabilities in research, development and innovation, and the results will include the establishment of a food industrial transformation center, the building of a future food lab, and the development of intelligent packaging capabilities.

- Measures that aim to build new marketing platforms : These measures will open up business opportunities by creating platforms that will increase the participation of Thai producers in world markets, connect national to international trade, strengthen local grassroot economies through culture and creativity, and link food production with tourism. It is hoped that this will include the future development of food expos, the development of big data resources that will be accessed by SMEs, the opening of the ‘One Portal’ for SMEs, the creation of a digital value chain, and the promotion and development of the food industry and its ability to support and integrate into community tourism, especially as this relates to SMEs.

- Measures that aim to accelerate the industry’s expansion by building on its fundamentals : This group of measures is being put in place to support the development of the food industry by increasing the ease of doing business. These measures will thus create a business environment that will lead more quickly to the emergence of ‘industry 4.0’. This will include promoting the creation of a system for ensuring food traceability, raising the standards of SMEs in the industry, establishing a quality standard (TIS-S), and creating a standards system for identifying new extracts derived Thai food and herbs that will then increase acceptance of these in domestic and international markets. Alongside this, transparency, public responsibility, and private-sector participation will be encouraged and expanded.

Current Thai Food Exports and the Shape of the Country’s Future Food Industry

Having taken into account the trends affecting the food industry on both the consumption and production sides of the market, together with the other factors described above that will help to drive the development of the industry, Krungsri Research believes that the future of the Thai food industry will be centered on the four types of food that will be best placed to respond to the challenges generated by the market.

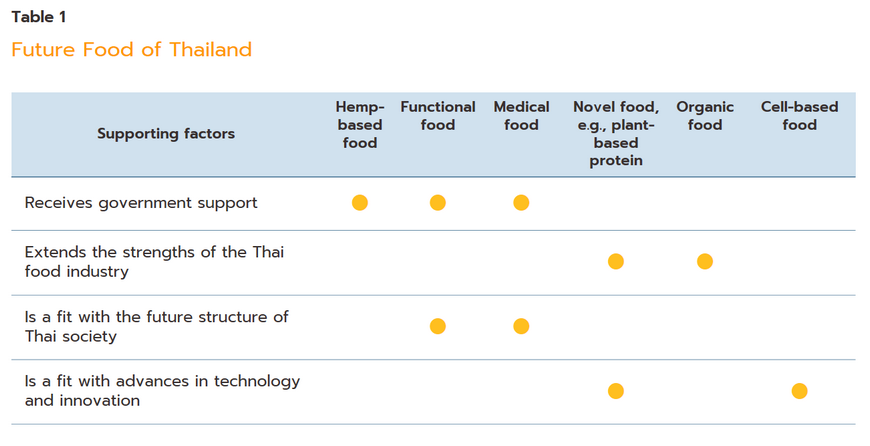

- Food that is benefitting from government support : The latter includes the action plan for the development of the food processing industry, support for the use of Thai herbs, and the recent changes to the laws governing the growth and use of hemp. Food groups that fall into this category include hemp-based food, functional food, and medical food.

- Food that extends the strengths of the Thai food industry : Thailand benefits from particular strengths that arise thanks to its favorable environment, its biodiversity, and the wide range of agricultural inputs that are available domestically. The food groups that are best situated to take advantage of these strengths are plant-based alternative proteins and organic food.

- Foods that are a fit for the future structure of Thai society : In the future, Thai society will become more diverse with regard to consumers’ health, religion, age, and income. This will then support growth of the functional food and medical food segments.

- Food that is a fit for advances in technology and innovation : Thailand is in the process of developing its research and development efforts as a way of building additional added value and of strengthening supply chains. Future technological progress and support from the government will thus help to create new opportunities, especially for food manufacturing processes that entail high levels of innovation, namely cell-based food and novel food.

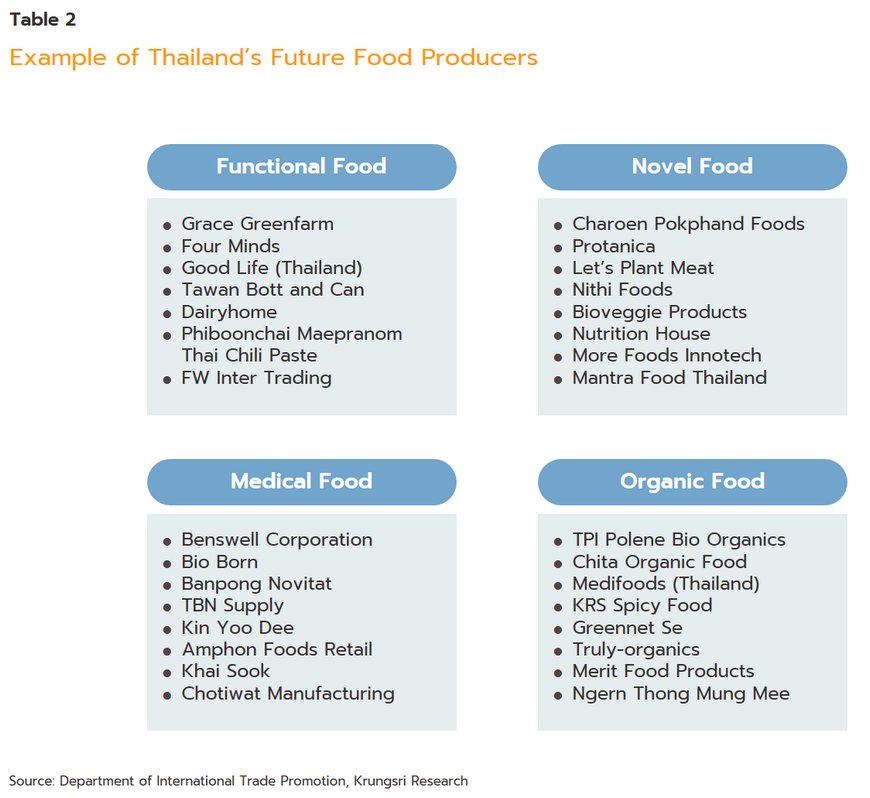

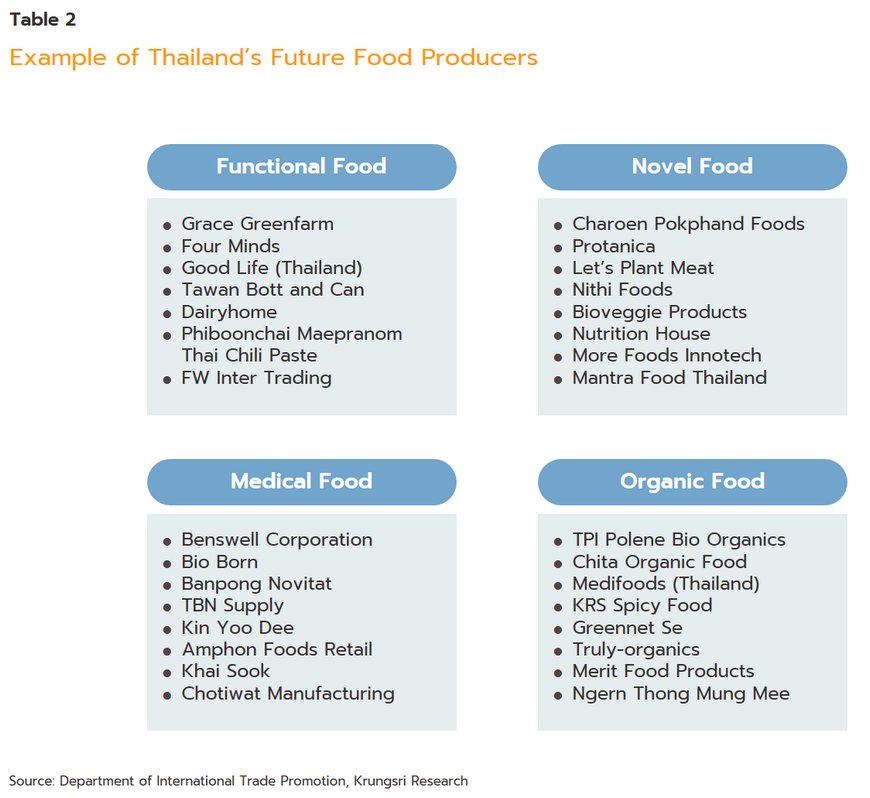

At present, Thailand produces future food products from four groups. These are sold on both domestic and international markets, and in 2021, exports of these generated THB 93.6 billion in receipts, a rise of 4.9% YoY. These four groups are:

1) Functional food : Exports were worth THB 86.2 billion (+5.7% YoY). Exported products include flavorings and sauces that have added vitamins, minerals, and fiber (71% of the value of functional food exports), and fruit juices, vegetable juices, and other drinks (29%).

2) Novel food : Overseas sales of these generated THB 4.7 billion in income (-6.0% YoY). This segment is comprised of plant-based proteins and cereal-based foods (75% of the total value of the group), protein concentrate and milk and cream products (24%), and tinned insects (1%).

3) Medical food : Exports of foods in this group jumped 51.6% to a value of THB 1.6 billion. The main product in this category is food supplements for the seriously ill (95% of the value of the segment), which is followed in importance by other medical foods (4%) and premixed vitamins that are used to add nutritional value (1%).

4) Organic food : Exports slumped -25.2% YoY to a value of THB 1.2 billion. This segment is comprised of organic brown rice (70%) and organic fruit (30%).

Which future food has the highest level of market attractiveness?

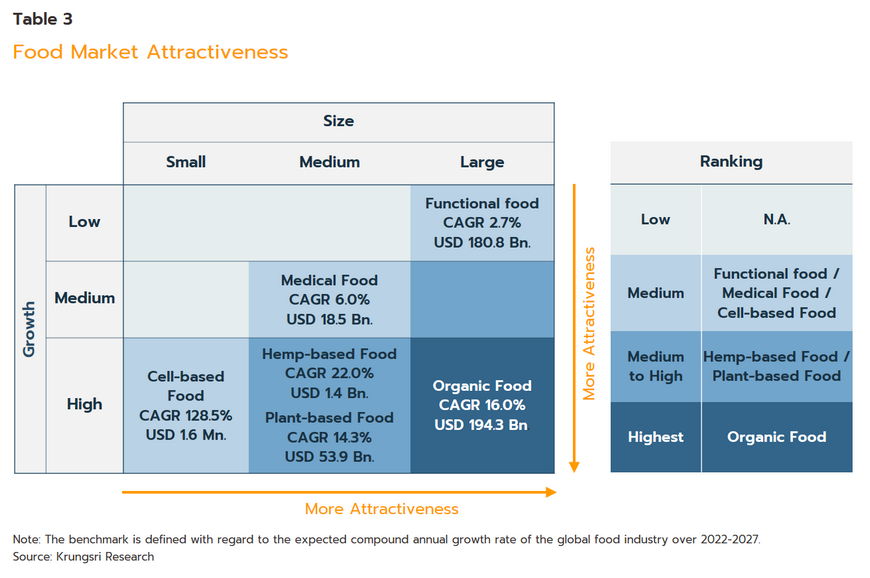

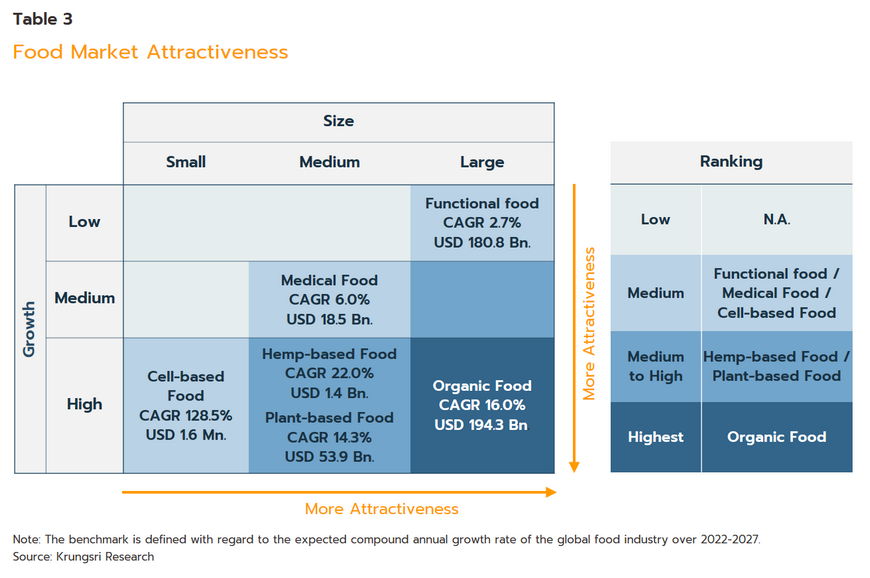

Given differences in their individual characteristics, market size, and growth rates, the various types of food described above exhibit differing levels of attractiveness to investors. The situation can best be understood through a business analysis that compares the current market size (the horizontal axis) with the growth rate (the vertical axis), which will then help to highlight the relative attractiveness of each type of food (Table 3).

- Organic food shows high potential with regard to both the size of the market (the horizontal axis) and expected growth rates (the vertical axis). This is because worldwide, the market is not limited by age or gender, and organic foods are broadly viewed as providing the foundations for good health. This segment thus has a high level of attractiveness.

- Hemp-based food and plant-based alternative protein (novel foods) both benefit from forecasts of high levels of growth but at present, the markets for these are somewhat limited in extent. Manufacturers are able to use hemp or vegetable protein to make a wide range of food and drink products, but consumer demand is somewhat narrow and specific, and as such, this segment is rated as having a high-intermediate level of attractiveness.

- Functional food : This market for these foods is large and the broad selection of products makes it possible to target particular consumer groups, but high levels of competition mean that growth rates are low. Attractiveness is thus rated as intermediate.

- Medical food : The market for medical foods is somewhat restricted in size but it is composed of smaller niche markets that promise high levels of consumption and unlike other segments, this is not subject to significant variation in demand. Given this, the attractiveness of the medical food segment is also rated as intermediate.

- Cell-based food (a novel food) : Despite high levels of growth, the market is constrained by limited consumer demand. In addition, players in this segment need access to advanced technology and high levels of capital, and overall, this segment is also rated as having an intermediate level of interest.

Looking at Table 3, we can see that with regard to market size and growth, the most attractive of the five food groups under consideration is organic food, followed in equal second place by hemp-based food and plant-based food. Sitting behind these in equal third place is functional food, medical food and cell-based food. However, this is not the whole story because any consideration of a segment’s attractiveness will also need to consider a broader range of factors that includes its profitability, the market structure and level of competition, the market density, trends in prices, access to inputs and resources, and current availability of production technology.

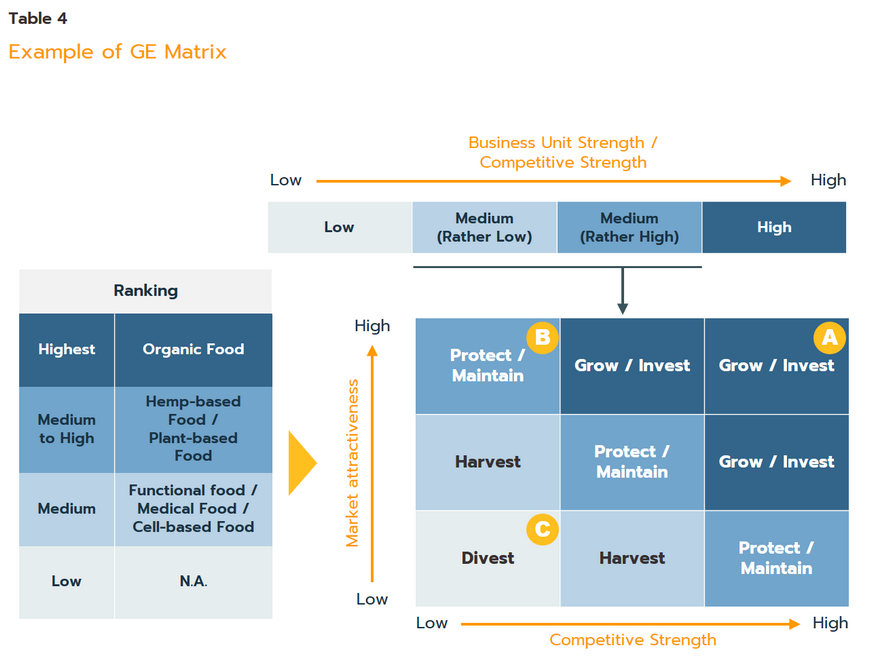

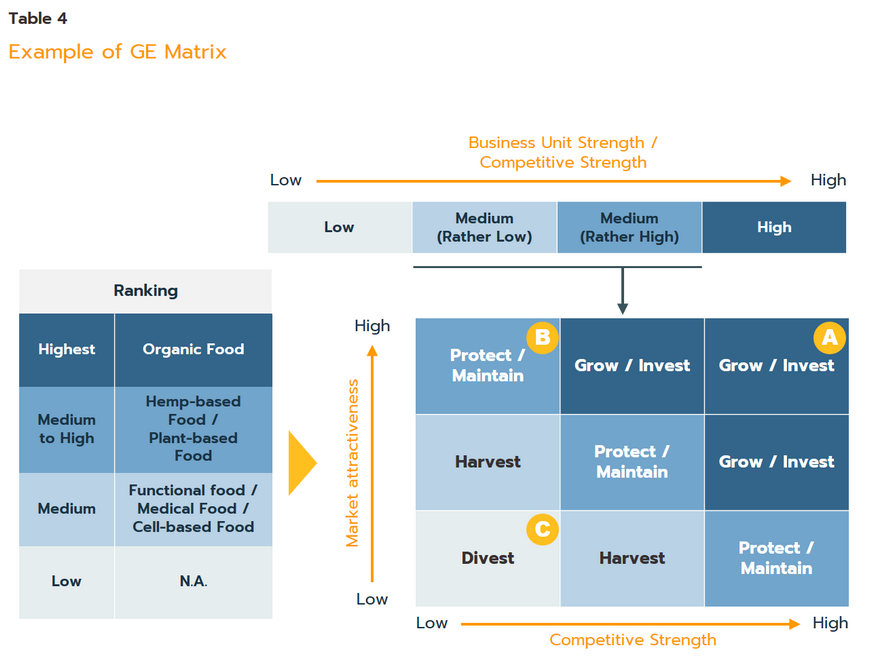

Armed with an analysis of external factors and the understanding of the market attractiveness of each segment that this provides, players need to evaluate the appropriate strategy to adopt. This will be one of grow/invest, protect/maintain, harvest, or divest. Considering the market attractiveness together with individual business unit strengths can best be done using the GE-McKinsey matrix, which is shown in Table 4. This thus presents market attractiveness on the vertical axis and business unit strengths on the horizontal axis, and the resulting comparison helps to throw light on the correct approach to adopt with regard to products and the direction of the market for each.

For example, organic food has a high level of attractiveness (shown on the vertical axis) and if a business has a high level of strength in that area, this will place it in position (A) on Table 3. This then implies that that that company should expand its activities in that area and increase its investments in the organic food industry. If the business is already active in the industry, it should protect its investments and prevent other players from stealing its market share. However, if a player has only low levels of competitive strengths in the production of organic food, this will put it in position (B). In this case, the company should move to a stance of ‘protect/maintain’, which would involve placing a temporary halt on any expansion in investments while the company addressed the internal factors that were limiting its competitiveness.

By contrast, in the hypothetical case that 3D printed food was considered to have a low level of attractiveness and a player lacked capabilities in this industry. This would place them in position (C) and that company would be advised to divest themselves of their investments. Understanding market attractiveness in light of business unit strength will therefore help players that are interested in entering or expanding their presence in the future foods market achieve an optimum level of investment.

The GE-McKinsey matrix helps to select the best corporate strategy by analyzing two factors:

- Market/industry attractiveness : This is the level of appeal the industry or market under consideration has with regard to investment. This is based on an assessment of the size of the market and its anticipated rate of growth, coupled with an analysis of other external factors affecting that market, such as those carried out using the Five Forces Model or the External Factor Analysis Summary (EFAS).

- The business unit strength is judged via an evaluation of where the business’s particular abilities are strongest and what its competitive strengths are relative to other players in the industry. This thus involves an analysis of factors internal to the business and so an evaluation of the business’s strengths with regard to the area under consideration can be made with reference to a model (e.g., of value chains or an Internal Factor Analysis Summary (IFAS)) or to important variables, such as market share, growth in market share compared to the performance of rivals, brand strength, profitability, customer loyalty, level of innovation, strength of the company’s value chain, product differentiation, and production flexibility.

Krungsri Research view: What road should Thai food processors take?

The unfolding of global megatrends will not just affect how and what food is consumed; these processes will also have widespread impacts on supply chains within the food processing industry and on industries that are connected to these. These effects will be both positive and negative, and although these changes will lead to higher quality food and the creation of greater added value throughout food industry supply chains, some businesses will see their participation in the market eroded. It is thus imperative that operators adapt to this changing business landscape and stay abreast of a continually evolving market. One route to doing this will be to use market trends and factors relevant to the business environment to reduce a player’s weaknesses and to add to their strengths.

- Creating new business opportunities or building greater added value for the business : Companies should create or develop new products that generate greater added value relative to their existing offerings. This could be done by harnessing the impetus given by changes to the national business environment, e.g., as a result of the 2019-2027 action plan for the development of Thailand’s food processing industry, measures that aim to accelerate the transition of the industry from producing Thai foods to producing future foods[18], and growth in the use of social media and online platforms. This would then help businesses grow into the evolving global market for food and to stay current with increasing demand, while also adding to their business strengths.

- Re-imaging their businesses and overhauling their business model : This might include the following.

- Bringing their corporate image into line with global trends : Global interest in the BCG economy, or the bio-circular-green economy[19], is increasing and this, combined with continuing technological progress, should push businesses to adopt these principles. This could take the form of: (i) using environmentally friendly technology, inputs and packaging; (ii) providing comprehensive welfare and healthcare to workers and of being diligent about following all relevant labor laws; (iii) using domestically sourced inputs; (iv) placing a greater emphasis on food safety and health; (v) expanding the range of public relations channels that are used to include digital communications, such as mobile apps and online platforms, as well as display advertising; (vi) collaborating with retailers and department stores to form strategic partnerships and then using these to run sales promotions and to engage in joint investments; (vii) using new distribution channels to connect to customers with unusual or unique qualities, for example by organizing food events in restaurants, hotels and sports centers, and by using the services offered by B2C platforms and food influencers[20].

- Revising business models in light of market trends : Businesses should work with partners in other industries, for example by: (i) using food as a driver of gastro or food tourism[21]; (ii) exploiting new technologies to create a meal-sharing platform; (iii) uniting individuals interested in experimenting and practicing with cooking together (i.e., in co-cooking kitchens), which could then be extended into a business renting cooking equipment for commercial use (i.e., creating a ‘cloud kitchen’); (iv) working with ‘bio-diverse’ restaurants that are particularly focused on maintaining bodily health through eating a healthy and balanced diet that includes a wide range of ingredients. These strategies can be extended by creating supply partnerships that allow for the creation of new product lines incorporating a wide and more exotic range of inputs and that provide diners with a comprehensive nutrient profile.

- Using investments in technology and innovation to strengthen business activities : This has the following goals.

- Increasing production efficiency : This might be achieved by applying AI to food production, using big data to provide clearer access to more narrowly defined consumer groups, and cutting production time or managing production logistics through the use of robots or other automated systems.

- Using technology to present novel food experiences : AR, MR and VR could be used for virtual chef or cooking training, or to create a novel and exciting dining experience, for example, when eating a multi-course meal or enjoying aesthetic food. This would allow players to respond to demand from consumers looking for creative and exciting new experiences.

- Establishing food safety protocols and standards : Companies should develop standards that cover safety and hygiene in food production. These could be based on innovations such as blockchain technology, which could be used to check the source and processing of goods across the entire supply chain. This would then help to build consumer confidence in the industry’s products.

- Adding features to food groups by using food of one type to produce food of another : Examples of this would include using organic produce to manufacture functional foods or vegetable proteins, or mixing functional foods with hemp-based foods. By combining the qualities of two future foods, companies will be able to expand existing markets or create entirely new ones, and this will increase interest in these products.

References

ABB. A Taste of the Future Understanding What's Driving Food & Beverage in 2020 and Beyond. Retrieved from https://library.e.abb.com/public/f84a88114afa43868859d0d170785934/Taste_of_the_future_2020.pdf

All Icon come from https://thenounproject.com/

All Picture come from company profile and company website.

Allied Market Research (2021). Cultured Meat Market : Global Opportunity Analysis and Industry Forecast, 2022-2030. Retrieved from EMIS database.

Anne Bardsley, Bridget Coates, Stephen Goldson, Peter Gluckman and Matthias Kaiser, The University of Auckland (2020). The Future of Food & the Primary Sector : the Journey to Sustainability. Retrieved from https://informedfutures.org/wp-content/uploads/The-Future-of-Food-The-Primary-Sector.pdf

Barilla Center, For Food and Nutrition. Eating in 2030 : trends and Perspectives. Retrieved from https://www.barillacfn.com/m/publications/eating-in-2030-trends-and-perspectives.pdf

BCC and BCC Innovation. Future of Food Report for 2050 : Based on the Gastronomy & Multisensory Design London Event. Retrieved from http://projectgastronomia.org/uploads/categories/FUTURE_FOOD_REPORT_2050-Reduced.pdf

BIS Research (2019). Global Plant-Based Food and Beverage Alternatives Market (2019-2024). Retrieved from EMIS database.

David Henkes, Emerson Climate Technologies. Food Industry Forecast : Key Trends Through 2020, Crucial Trends Transforming the Industry. Retrieved from https://climate.emerson.com/documents/dallas-%E2%80%93-food-industry-forecast-key-trends-through-2020-pt-br-3632778.pdf

Deloitte. Future of Protein : Preparing for success in an uncertain environment. Retrieved from https://www2.deloitte.com /content/dam/Deloitte/ch/Documents/consumer-business/deloitte-ch-the-future-of-protein-Jan-2021.pdf

Department of International Trade Promotion. Future Food Fact Sheet. Retrieved from https://ditp.go.th/ditp_web61/article_sub_view.php?filename=contents_attach/754468/754468.pdf&title=754468&cate=2514&d=0

Euromonitor International. The Impact of Coronavirus on Megatrends. Retrieved from Euromonitor database.

European Parliament’s Committee on Agriculture and Rural Development. Impacts of the digital economy on the food chain and the CAP. Retrieved from https://www.europarl.europa.eu

FMCG Gurus. Top Ten Trends 2021 Report. Retrieved from https://fmcggurus.com/top-10-trends-2021-report-sm-download/

Food and Agriculture Organization of the United Nations. Food Loss and Waste Database. Retrieved from FAO website.

Food and Agriculture Organization of the United Nations. OECD-FAO Agricultural Outlook 2019-2028. Retrieved from http://www.agri-outlook.org/Outlook-Summary-ENG.pdf

Food and Agriculture Organization of the United Nations. The future of food and agriculture: Trends and challenges. Retrieved from http://www.fao.org/3/i6583e/i6583e.pdf

Food Intelligence Center. Future Food. Retrieved from Food Intelligence Center website.

Francesco Castellano. Feeding the Future : An Overview of Agrifood Technology., and Feeding the Future : An Overview of Agrifood Industry. Retrieved from https://www.novu.ventures/insights

Fraunhofer Institute for Syatems and Innovations Research. 50 Trends Influencing Europe’s Food Sector by 2035. Retrieved from https://www.isi.fraunhofer.de/content/dam/isi/dokumente/ccv/2019/50-trends-influencing-Europes-food-sector.pdf

Frost and Sullivan. World’s Top Global Mega Trends To 2025 and Implications to Business, Society and Cultures. Retrieved from https://www.thegeniusworks.com/wp-content/uploads/2016/01/Megatrends-2025-Frost-and-Sullivan.pdf

Grand View Research (2018). Medical Foods Market. Retrieved from EMIS database.

Handelsblatt Research Institute, BAYER. The Future of Agriculture and Food. Retrieved from https://www.bayer.com/en/bay-landwirtschaft-ernaehrung-fakten-en-final.pdfx?forced=true

Institute for the Future. Food Web 2020 : Forces Shaping the Future of Food. Retrieved from https://www.iftf.org/uploads/media/SR1255B_FoodWeb2020report_1_.pdf

Institute for the Future. Future Food Experiences : Designing Good Food for the 21st Century. Retrieved from https://www.iftf.org/foodexperiences/

Jones Lang LaSalle IP,Inc. Foodservice Trends 2020. Retrieved from https://www.jll.nz/en/trends-and-insights/research/foodservice-trends-2020

Kurt Salmon. The Future of Food : New Realities for the Industry. Retrieved from https://www.accenture.com/us-en/_acnmedia/pdf-70/accenture-future-of-food-new-realities-for-the-industry.pdf

Market Research. Food & Beverages Global Market Report (2022). Retrieved from https://blog.marketresearch.com/key-insights-into-the-global-food-and-beverage-market.

Marketline. Global Food & Beverages Manufacturing (December 2021). Retrieved from EMIS database.

MICE Intelligence, Thailand Convention & Exhibition Bureau (Public Organization). Global Future Trends. Retrieved from https://www.businesseventsthailand.com/uploads/press_media/file/190903-file-Ac1c8ccxh.pdf

Ministry of Industry. Food Processing Industry Development Action Plan 2019-2027. Retrieved from http://old.industry.go.th/oig/index.php/2016-05-02-07-30-27/item/download/5901_674003293c19cfc88b8965d4c178defb

Mintel. Global Food and Drink Trends 2030. Retrieved from https://www.mintel.com/global-food-and-drink-trends-2030

Mordor Intelligence (2020). Global Functional Food Market (2021-2026). Retrieved from EMIS database.

Naksit Panyoyai. Plant-based Proteins : Nutrition, Structure, Functionality, and Applications in Food Industry.

National Science and Technology Development Agency. Food For Future. Retrieved from https://www.nstda.or.th/home/knowledge_post/food-for-future/

NextGenChef. The State and Future of the Food System. Retrieved from https://static1.squarespace.com/static/5e404b48098d724e00ef3bb6/t/5ef765147097fa758665037d/1603478899811/NextGenChef_The+State+and+Future+of+the+Food+System+Whitepaper.pdf

Office of National Higher Education Science Research and Innovation Policy Council. BCG in Action. Retrieved from https://www.nxpo.or.th/th/bcg-economy/

Oxfam. Global Megatrends : Mapping the Forces that Affect Us All. Retrieved from https://oxfamilibrary.openrepository.com/bitstream/handle/10546/620942/dp-global-megatrends-mapping-forces-affect-us-all-310120-en.pdf?sequence=1&isAllowed=yOxfam

Pobpad. Hemp Benefits. Retrieved from https://www.pobpad.com

Research on Global Markets (2019). Global Organic Food Products Market (2019-2024). Retrieved from EMIS database.

Sainsbury’s. Future of Food Report. Retrieved from https://www.about.sainsburys.co.uk/~/media/Files/S/Sainsburys/pdf-downloads/futureoffood-10c.pdf

Sara Olson and Thomas Hayes, Lux Research. The Food Company of 2050. Retrieved from https://www.luxresearchinc.com

Sarah Boumphrey and Zandi Brehmer, Euromonitor International. Megatrend Analysis Putting the Consumer at the Heart of Business. Retrieved from https://www.askfood.eu/tools/forecast/wp-content/uploads/2019/08/Consumer-Megatrends.pdf

Uber Eats, Deloitte. Future of food : How technology and global trends are transforming the food industry. Retrieved from https://www2.deloitte.com/au/en/pages/economics/articles/future-of-food-uber-eats.html

UBS AG and UBS Switzerland AG. The Food Revolution : The Future of Food and the Challenges We Face. Retrieved from https://www.ubs.com/global/en/wealth-management/chief-investment-office/sustainable-investing/2019/food-revolution.html

Vanessa Matthijssen, Deloitte. The Future of Food : The trends that are shaping the industry. Retrieved from https://www2.deloitte.com/content/dam/Deloitte/au/Documents/consumer-industrial-products/deloitte-au-cip-future-of-food-key-trends-170320.pdf

World Business Council for Sustainable Development. Future of Food : A Lighthouse for Future Living, Today. Retrieved from https://www.iftf.org/uploads/media/SR1255B_FoodWeb2020report_1_.pdf

World Health Organization. Global Action Plan for the Prevention and Control of Noncommunicable Diseases. Retrieved from https://www.ncdcountdown.org/index.html

Xprize, Australian Centre for International Agricultural Research, The Foundation for Food and Agriculture Research, and International Development Research Centre. The Future of Food : Impact Roadmap. Retrieved from https://www.xprize.org/articles/future-of-food-blog-post

[1] Non-communicable diseases (NCDs) include heart disease, stroke, cancer, chronic obstructive pulmonary disease, and diabetes.

[2] 2021 data from the World Population Data Sheet indicates that global population will reach 9.7 billion by 2050, which is 2.4% higher than the 2020 prediction but lower than the 9.9 billion expected a year earlier.

[3] i.e., with regard to the hygienic standards of the food, the quality of the inputs, the production process, its nutritional value, its freshness, the manufacturer’s reputation, and the quality of the packaging, and so on.

[4] FMCG Gurus, Market Research, Top 10 Trends for 2021

[5] The five most commonly consumed health- and immunity-boosting food and drink additives are: omega-3, vitamins, calcium, protein, and probiotics.

[6] Nanotechnology is being used in food production to improve the smell, color, taste, and overall qualities of products at the molecular level. Examples include: (i) changing food taste and quality, for example by making the texture of a food finer (for mayonnaise and ice-cream), by reducing bitterness/increasing sweetness (in carbonated drinks and chocolate products), or by cutting its cholesterol content (in active canola oil); and (ii) using nano particles to carry minerals or vitamins, for example in bread that uses nanotechnology to add omega-3 or in selenium-enriched nano tea.

[7] Bioreactors or fermenters are containers that are used to breed microorganisms. These maintain sterile conditions and contain culture media that is kept at an ideal heat to promote the development of the organisms being grown.

[8] Urbanization has been linked to higher per capita consumption of food and thus to higher overall levels of food consumption. The FAO estimates that by 2050, 68% of the world’s population will be living in cities.

[9] Almost two-thirds of global consumers are interested in personalized food and drink according to the ‘Top 10 Trends for 2021’ report published by FMCG Gurus.

DNA analysis may be used to create optimized diets or individual nutrition programs for particular consumers. [10] These are based on genetic information collected from saliva, blood, or waste products, which is then used to plan the appropriate diet, medicine and exercise.

[11] Malnutrition is said to occur when someone does not receive sufficient food or calorific intake. This can happen when the total food intake is too low or when it provides an insufficient supply of particular nutrients.

[12] Within Thailand, the independent government body Organic Agriculture Certification Thailand is responsible for accreditation. In addition, several international bodies also provide organic certification. These include: the Organic Guarantee System, run by the International Federation of Organic Agriculture Movements (IFOAM); the Japanese Agricultural Standard (JAS), which is managed by Japan’s Ministry of Agriculture, Forestry and Fisheries; USDA Organic, run by the US Department of Agriculture, ECOCERT, a French private-sector accrediting body; the National Association for Sustainable Agriculture Australia (NASAA); and EU Leaf.

[13] Source: ‘Medicinal Cannabis’, Chao Phraya Aphaiphubet Hospital

[14] 36% (source: FMCG Gurus, Top 10 Trends for 2021)

[15] This is a trend in consumer behavior by which individuals make food buying decisions that are influenced by their desire to protect against particular conditions or illnesses or to reduce the impact of conditions that they already have. This thus treats food as a kind of medicine. Individuals most affected by this trend are consumers who are concerned about their health and who have adapted their behavior in light of this, for example, by increasing their consumption of fruit and vegetables and reducing or eliminating their consumption of meat and processed food.

[16] Includes hemp-based food, drink and supplements but excludes clothing, personal care items, pharmaceuticals and other hemp products (i.e., those used in agriculture, auto assembly, and the manufacture of furniture, construction materials, paper, or animal feed).

[17] The research paper ‘Environmental Impacts of Cultured Meat Production’ written by Hanna Tumisto shows that the total environmental consequences of cultured meat are significantly less than those of meat raised in the traditional way. Comparing cultured meat to meat produced using the methods commonly deployed at present in Europe reveals that the production of the former results in a 7-45% drop in energy use, a 99% fall in land use, an 82-96% drop in water use, and a 78-96% reduction in carbon dioxide emissions.

[18] This is a strategy of the Chamber of Commerce and Board of Trade of Thailand. This has four aspects: (i) the promotion of sales of processed food and drinks; (ii) the promotion of future foods; (iii) domestic and international standards and regulation; and (iv) the development of processed and future foods.

[19] The BCG economy, or the bio-circular-green economy, provides a model that will help to shift the economy to a more sustainable footing. This involves using science, technology and innovation to sustainably increase the competitiveness of targeted industries, which is achieved by improving manufacturing efficiencies and supporting the development of higher value-added goods and services. In addition, the BCG economy also supports the development of innovations that are linked to the circular economy, such as products and processes that embody eco-design principles and zero-waste outcomes, that promote the principles of ‘reuse, refurbish, share’, and that allow for recycling and upcycling of used goods.

[20] ‘Food influencers’ does not include only individuals but may also encompass social media activities and reviews in articles, or posts on social media or other platforms.

[21] Gastro tourism or food tourism is tourism that uses food to attract tourists, who then visit an area to sample its local dishes and to experience the local culture.