Digital Assets (Part 2) ‘Digital Asset Trading in Thailand’

Background and significance of the research

As described in the first half of this research, published as “Digital Asset (Part 1) When Thais are drawn towards digital assets”1/, any new rules or guidelines that are put in place to regulate markets for digital assets will not only need to have clearly defined objectives, but also need to consider the specifics of the environment in which they will be implemented, including the uses to which digital assets are put and the characteristics of market participants. Thus, to help public and private sector stakeholders gain insights into the shape of the market and to understand how ‘Thai digital natives’ think and act, Krungsri Research has collected data on trading and investment in and the holding of digital assets by Thais. This was achieved using an online survey that was open to respondents between 16 September and 31 October, 2022. This allowed researchers to collect information on the level of knowledge and understanding displayed by market participants, the types of digital assets that they held and the aims that they hoped to realize through this, their preferences, and their views on the risks involved in investing in digital assets.

It is hoped that this research and the light that it throws on the specifically Thai characteristics of the market for digital assets will be of use to commercial banks and other players active in the finance and banking sector, as well as government and private sector stakeholders involved in related areas. The information and analysis given below should thus help commercial and non-commercial bodies better understand the role that they have to play in developing the domestic market for digital assets.

Respondent profile and behaviors

General information

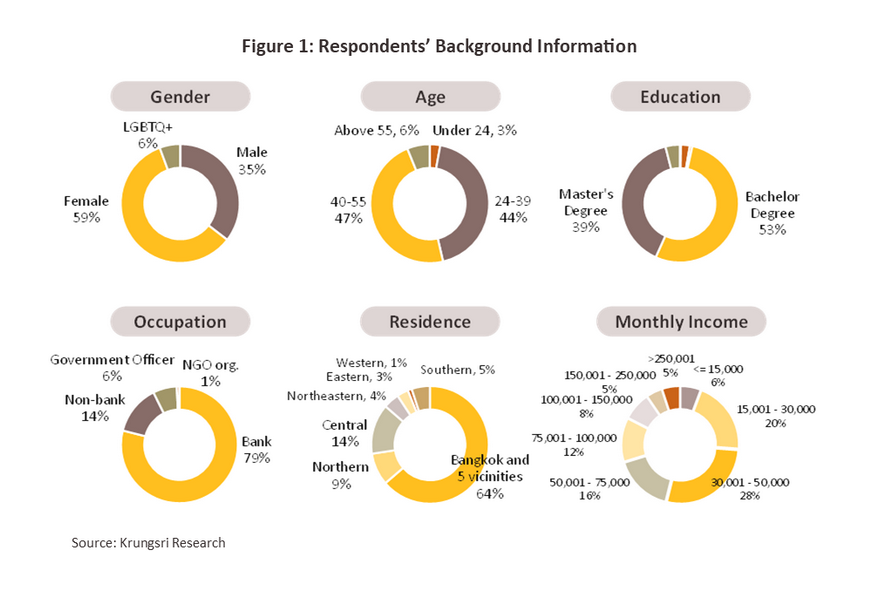

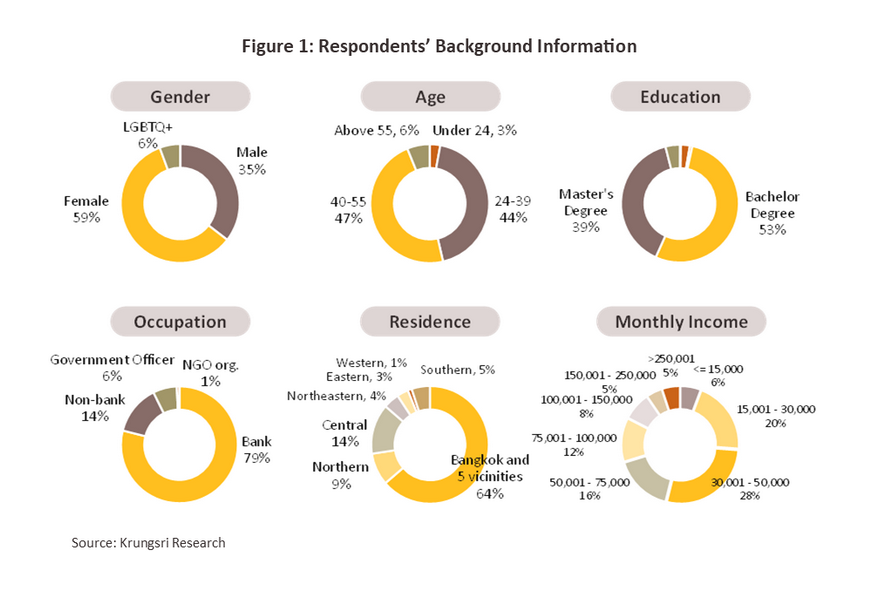

733 voluntary survey responses were gathered online, with respondents spread across all age groups, including baby boomers (over 55 years old), Gen X (40-55), Gen Y (24-39), and Gen Z (under 24). 59% of respondents identified as women, 35% were men, and 6% were LGBTQ+. Over 90% were between 24 and 55 years old (i.e., Gen X or Gen Y). Respondents were educated to degree level and above, and almost two-thirds were resident in the Bangkok Metropolitan Region.

As regards to employment, 79% of respondents worked in the banking and finance sector, while 14% worked elsewhere in the private sector. The remaining 7% were either civil servants or worked in state enterprises or other state organizations, or were employed in non-profits or non-governmental organizations. By income, with 28% of all respondents, the THB 30,001-50,000/month group was the largest, followed by THB 15,001-30,000/month and THB 50,001-75,000/month, with respectively 20% and 16% of the total.

Survey respondents’ Behavior

Financial behavior

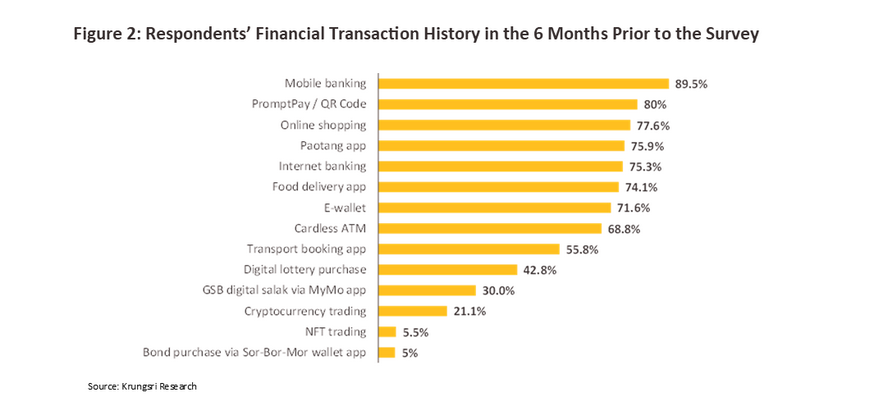

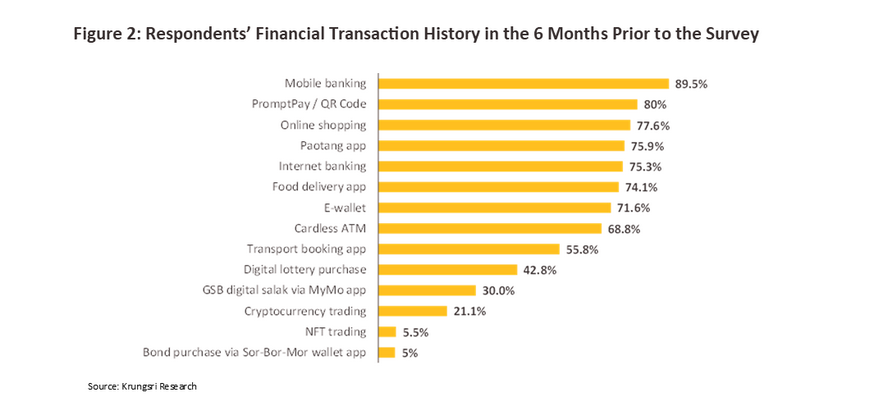

The survey also collected information on respondents’ history of making digital transactions and their risk preferences, and this showed that in the 6 months prior to completing the survey, almost 90% had used a mobile banking app and 80% had made a payment through the ‘PromptPay’ system. Moreover, over 70% had also made another type of electronic financial transaction in the preceding 6 months. These included buying goods through an online platform, using the Paotang app, making use of internet banking services, ordering food through an app, and making payments through an e-wallet. Given these high levels of digital adoption, it seems reasonable to conclude that survey respondents were mostly genuine digital natives.

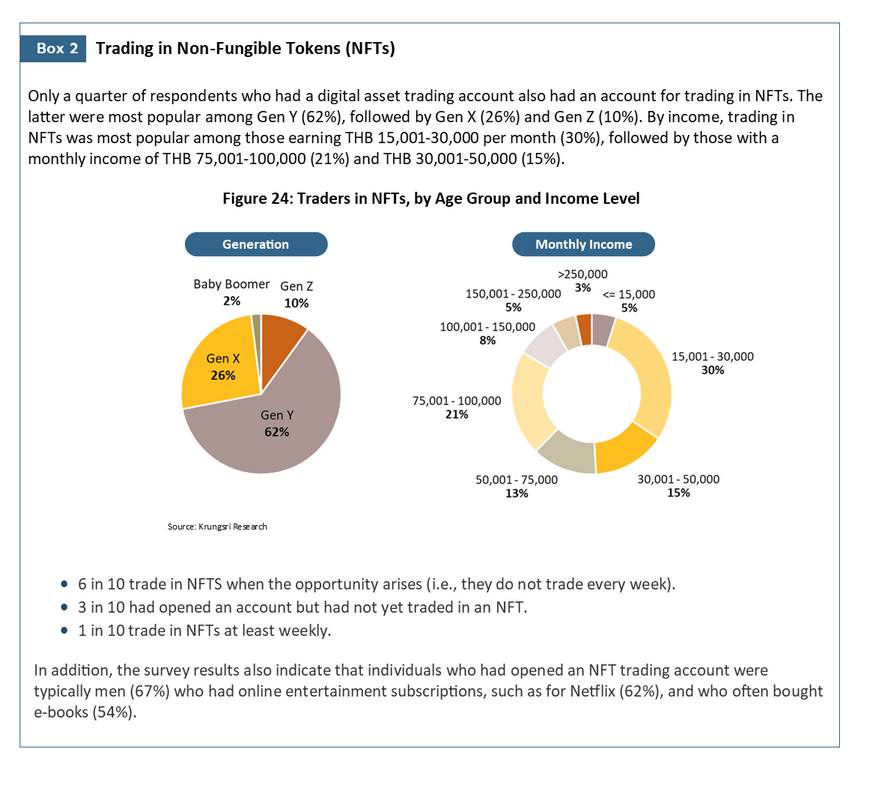

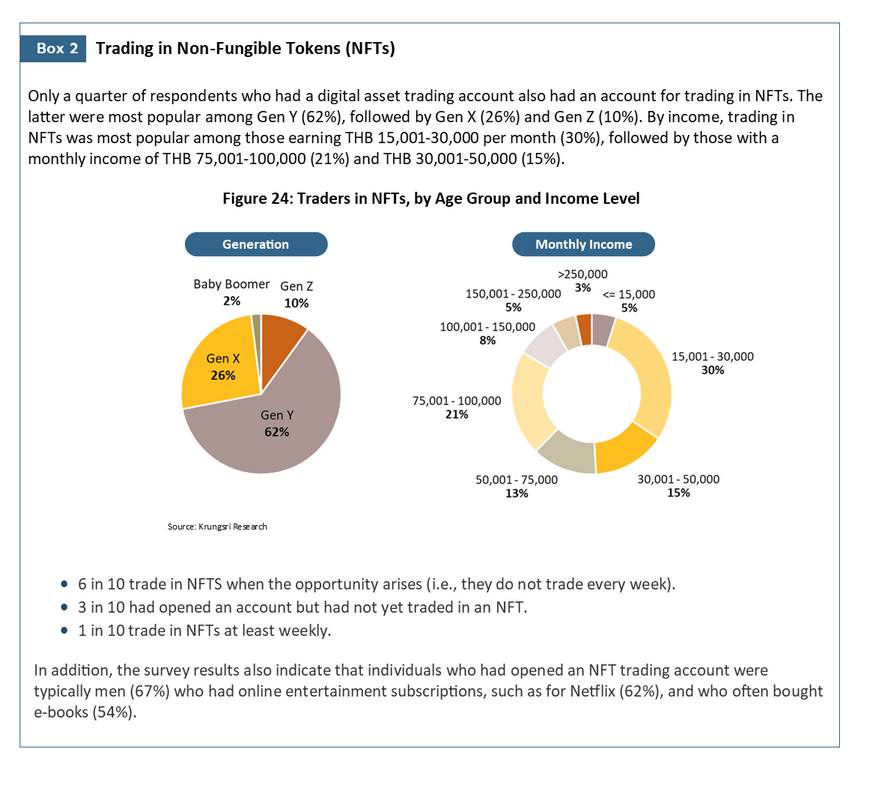

However, although the majority of respondents were presumably comfortable using digital products as part of their normal day-to-day life, this does not imply that they are necessarily also interested or involved in digital assets; and in fact, in the six months prior to completing the survey, only around a fifth of respondents (21.1%) had bought or traded in cryptocurrencies, and just 5.5% had traded in a non-fungible token (NFT). Digital assets should thus perhaps be considered a “new type of products” of which most Thais lack much understanding, and the latter may therefore view trading in these as being risky. The survey therefore next investigated Thai digital natives’ investment risk preferences.

Buying or investing in risky assets

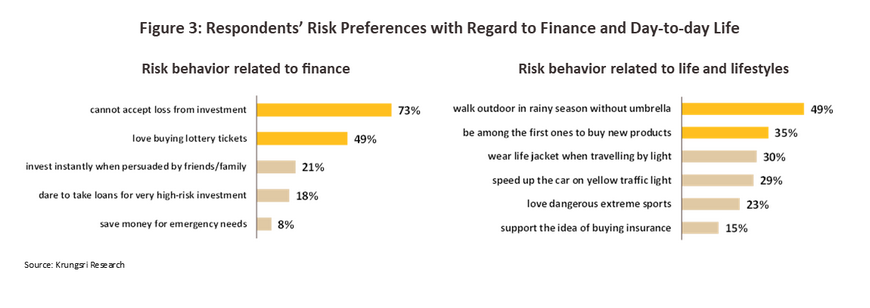

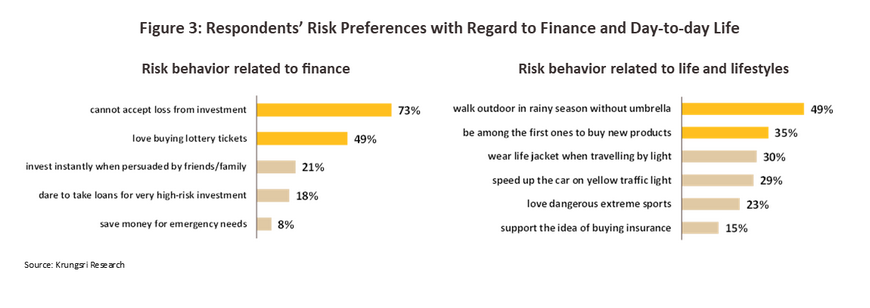

The survey produced the following insights with regard to Thai digital native’s investment risk preferences:

-

1 in 3 saw themselves as being pioneers or early adopters with regard to purchases of new products.

-

1 in 5 did not hesitate to take loans for risky and potentially loss-making investments.

-

1 in 5 were prepared to see their investments make losses and so were not worried by the prospect of this happening.

-

1 in 5 were ready to make snap investment decisions when invited to do so by people they knew well or admired.

Questions that probed the behavior of the survey respondents were in agreement with regard to risk tolerance and propensity to trade in cryptocurrency. Thus, a fifth of individuals questioned displayed a preference for risk when making investments and likewise, a fifth had also traded in a cryptocurrency in the preceding 6 months.

Analysis of the survey responses shows that individuals who enjoy buying new products were 2.1-times more likely to open trading accounts than those who do not, while individuals who are happy to make a snap investment decision on the advice of a friend or trusted advisor were 1.7-times more likely to open a trading account than those not prepared to make such a decision.

On the other hand, respondents who were worried about the potential of losses arising from making an investment or who were not able to accept such losses were 0.37-times as likely to open a trading account as those who were not worried by this. To switch this around, those who were not worried about making losses were 2.7-times more likely to open a trading account than those who were concerned about this.

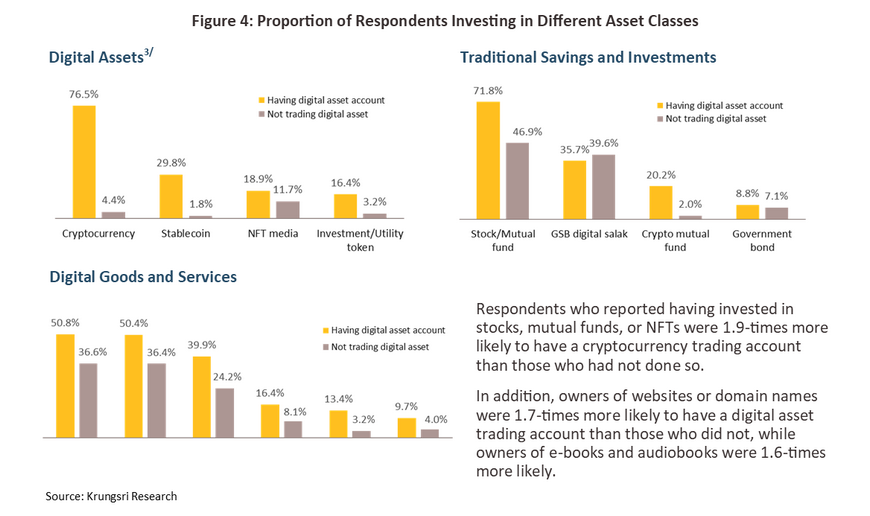

Buying digital assets and digital goods or services

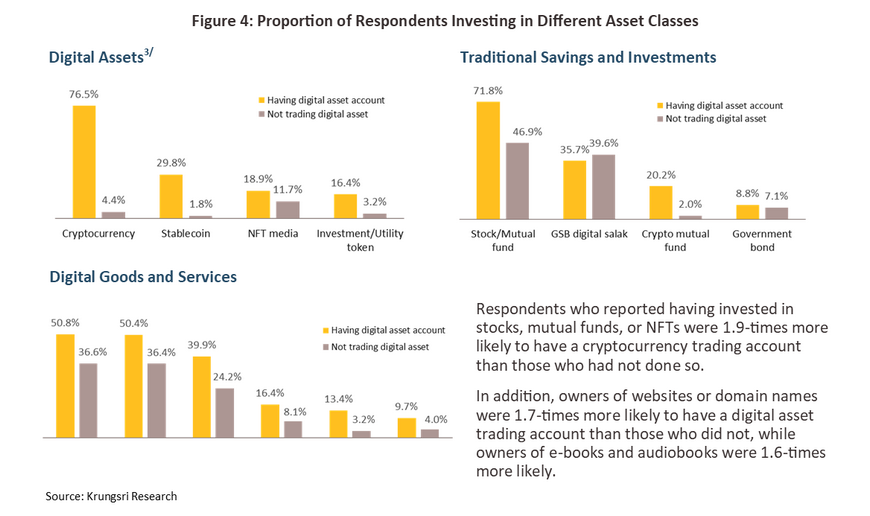

Although Thai digital natives purchase a broad range of goods and assets, and often make investments in a number of different ways, the survey shows clearly that overall, individuals who have a digital asset trading account are more likely to favor investing (in both digital assets and other asset classes) than those who do not have an account. These individuals also typically have a stronger preference for buying digital goods and services. To facilitate analysis, the survey divided products that can be bought or invested in into three groups.

- Digital assets, e.g., cryptocurrencies, stablecoins, NFTs, and investment and other types of digital tokens.

- Traditional investments or savings, e.g., stocks, bonds, mutual funds, and ‘GSB digital salak’.

- Digital goods/services, e.g., software and applications, e-books, online media subscriptions, buying websites or domain names, virtual goods or assets, and digital artworks.

Overall, respondents who had a digital asset trading account were more likely to buy or invest in these digital goods than those who did not have such an account. However, this was with the exception of the GSB digital salak, with 40% of non-trading account holders favoring these compared to 36% of those with a trading account. This difference may be explained by the fact that this is a form of prize-based saving2/, and digital trading account holders prefer riskier speculation to simply leaving money on deposit in a bank.

However, those who had a digital asset trading account were 1.5-times as likely to invest in stocks or in mutual funds than those without an account.

Digital assets literacy

As described in the first part of this research, the general class of digital assets encompasses cryptocurrencies and digital tokens. Cryptocurrencies have been created to function as the smallest possible units of electronic data that can serve as a means of exchange, and these can then be used for the purchase of goods, services or to acquire some other kind of right or benefit, or to serve as a unit of exchange when trading in digital assets. Similarly, digital tokens are units of digital data that are used within a system to encode an individual’s right to or history of investing in a project or activity and to record their resulting rights to goods, services or other returns. As per the 2018 announcement on digital asset businesses, the Thai authorities have divided digital assets into two classes according to their uses and the rights accruing to holders. These are (i) cryptocurrencies and (ii) digital tokens, which includes both investment tokens and utility tokens.

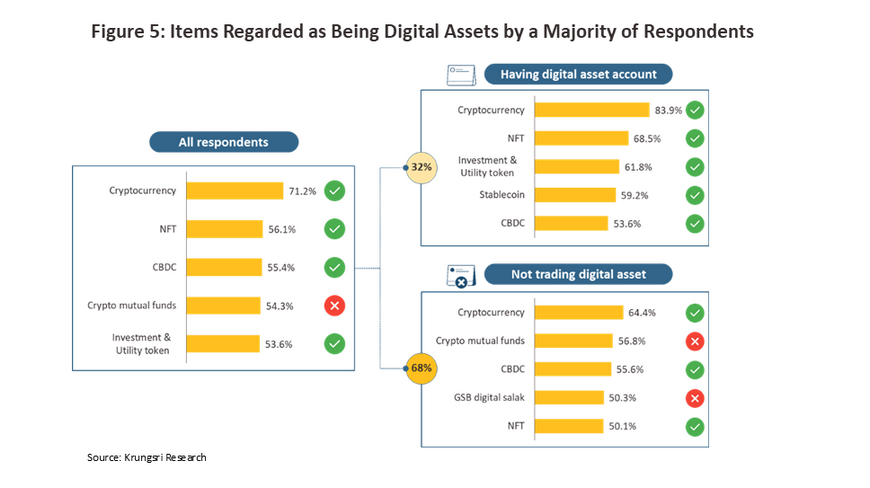

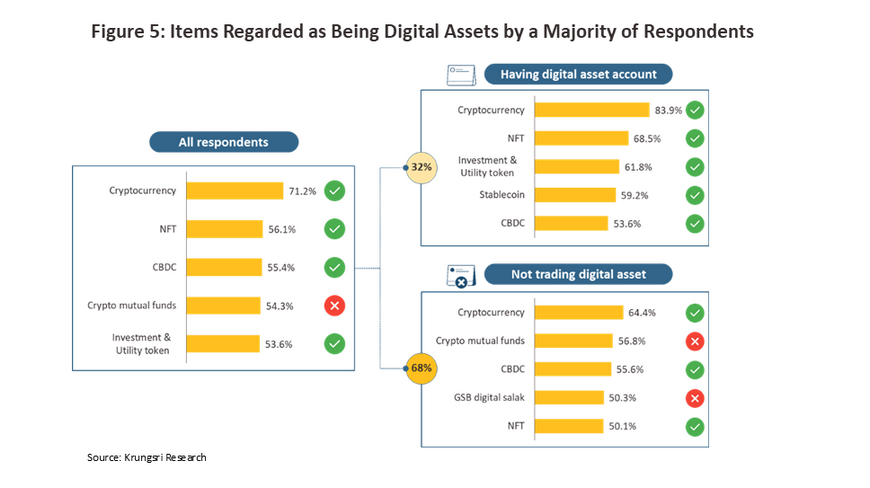

Over half of the respondents to the survey regarded the following items as digital assets.

- Cryptocurrencies (71.2%)

- NFTs (56.1%)

- CBDCs (55.4%)

- Crypto asset– or crypto mutual funds (54.3%)

- Investment or utility tokens (53.6%)

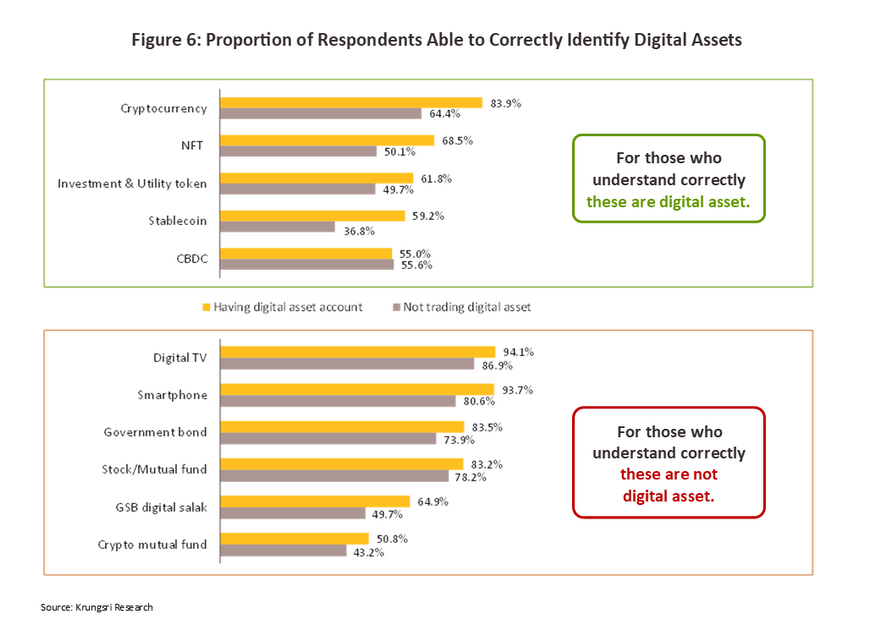

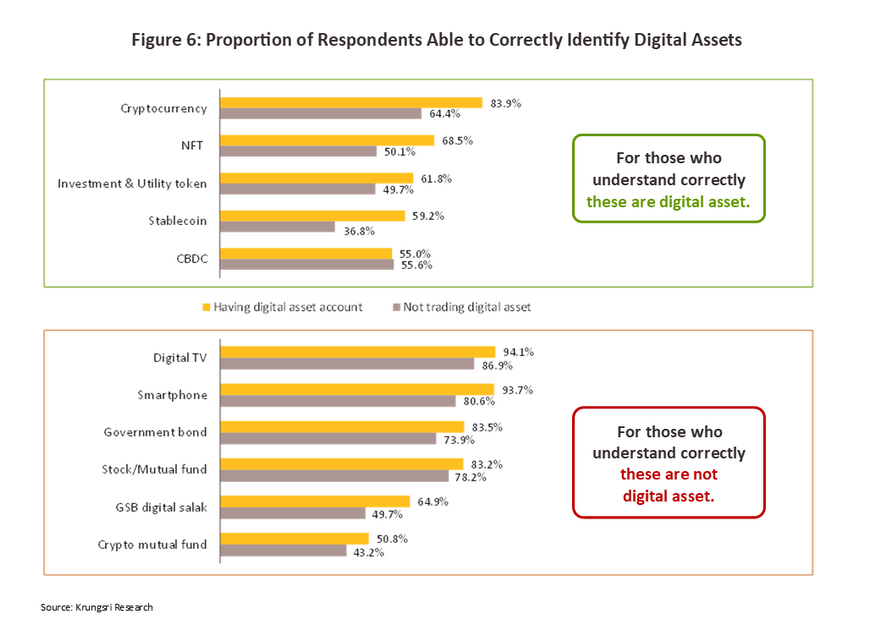

Respondents were clearly able to correctly identify cryptocurrencies, NFTs, CBDCs, and digital tokens as different types of digital assets, but they also misidentified mutual funds as an actual or potential digital asset. Even though some mutual funds do indeed invest in digital assets (e.g., in cryptocurrencies), the mutual fund itself is still not considered to be a digital asset, and a cryptocurrency-based mutual fund is not regarded as being fundamentally different from mutual funds that invest in other assets, such as bonds, equities, gold, oil, or real estate.To further investigate knowledge of digital assets, the survey respondents were split into two groups: those who held an account for trading in digital assets and those without. Among the former, almost two-thirds (64.9%) correctly answered that prize bonds4/ (the GSB digital salak) are not a type of digital asset according to the definitions given in the 2018 declaration on digital businesses. However, among those without a trading account, the proportion giving a correct answer fell to just half.

Apart from that, the survey respondents had a deviated understanding of the official categorization of stablecoins5/ . The majority of those non-trade account holders thought that stablecoins are not digital assets, with only 36.8% answered this question correctly by stating that stablecoins are in fact a kind of digital asset. However, it was noteworthy that even among those with trading accounts, two-fifths still thought that stablecoins were not a kind of digital asset.

Around half of non-trading account holders and a third of trading account holders believed incorrectly that NFTs and digital tokens were not classified as digital assets.

Sources of news and information

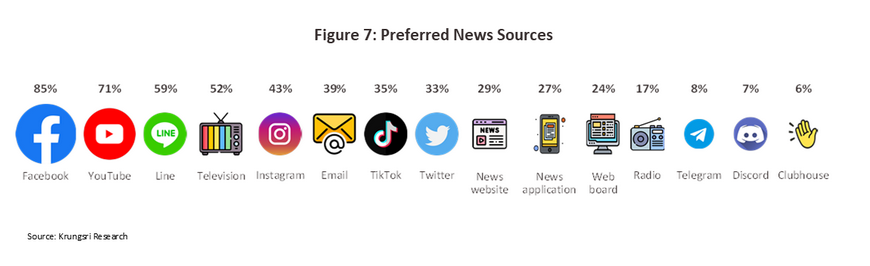

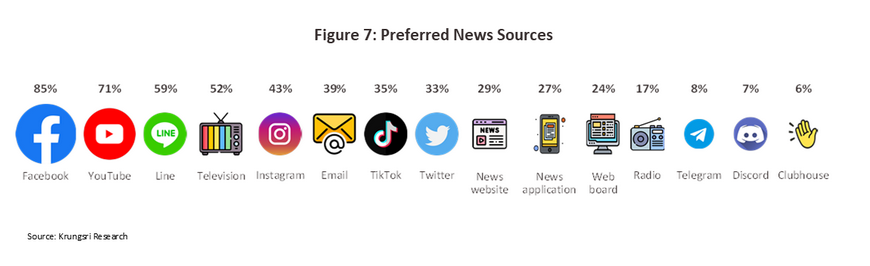

In their normal day-to-day lives, Thai digital natives typically stay up to date with the news, and the three most favored sources for this were the social media outlets of Facebook (used by 85% of respondents), YouTube (71%), and Line (59%). However, traditional media still retained a place in the lives of many respondents, and slightly over half (52%) reported regularly watching television news.

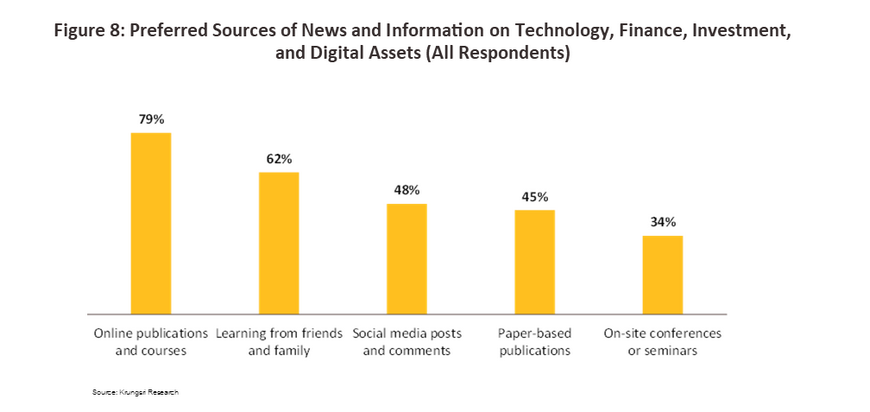

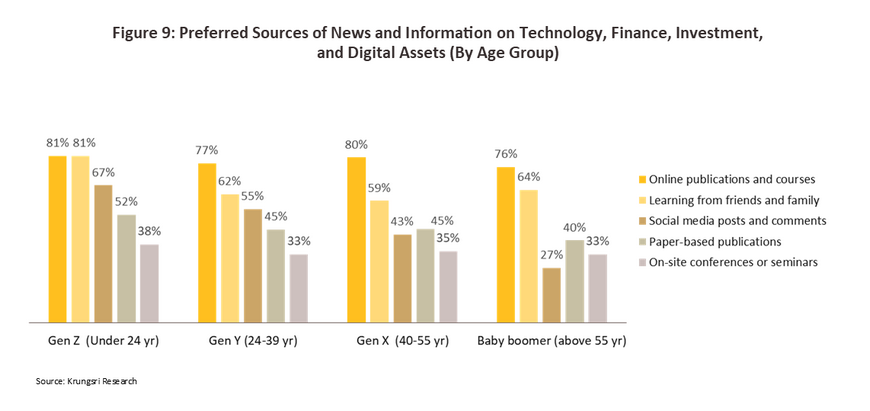

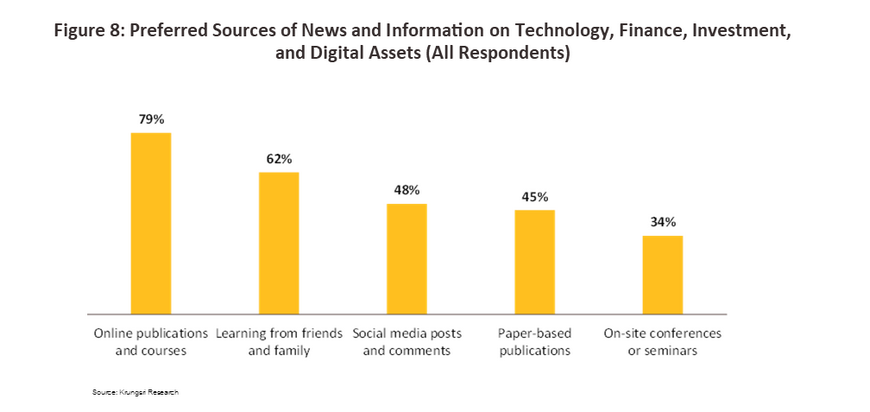

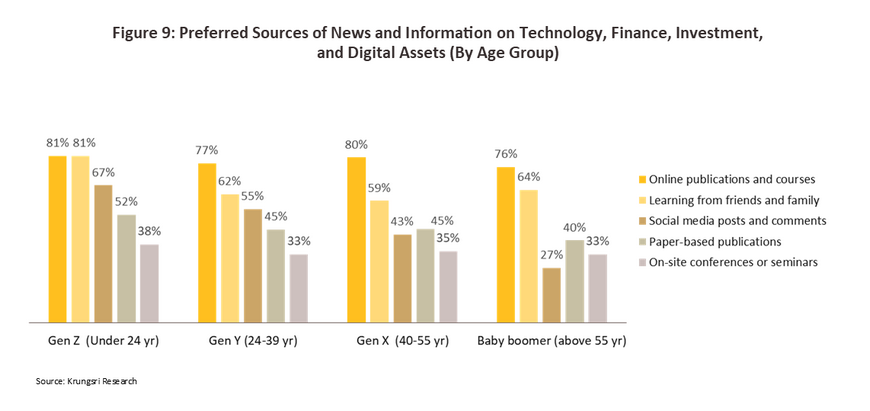

It is perhaps not surprising that in all age groups, respondents favored online news sources. Indeed, 79% of those answering the survey reported that they preferred to find news and information about technology, finance, investment and digital assets on the internet, for example, by reading articles, watching videos, or taking online courses. 62% also turned to family, friends, work colleagues, and associations and clubs for this news. In third place in the rankings, 48% of respondents sought out information from online chat, tweets, and comments as a way of connecting with people. Least favored among the options were researching from physical books and other printed materials (45%) and attending meetings, seminars or in-person courses (34%). However, considering just Gen X and baby boomer respondents, sourcing information from books and other printed materials was more popular than doing so from online chat, tweets and comments on social media.

Respondents who looked to the internet for information on technology, finance, investment, and digital assets were 1.7-times more likely to have a digital trading account than those who used other sources of information, while those who turned to chat, twitter, and comments on social media for information were 1.8-times more likely to also have a trading account.

Factors influencing the decision to trade in digital assets

A considerable number of factors were found to influence an individual’s decision to trade in digital assets. These may be external or environmental and relate to an individual’s circumstances or the people with whom they are in contact, or they may be internal, such as that individual’s particular needs, their normal investment practices and preferences, and their tolerance for exposing themselves to risk in pursuit of profit.

External and environmental factors

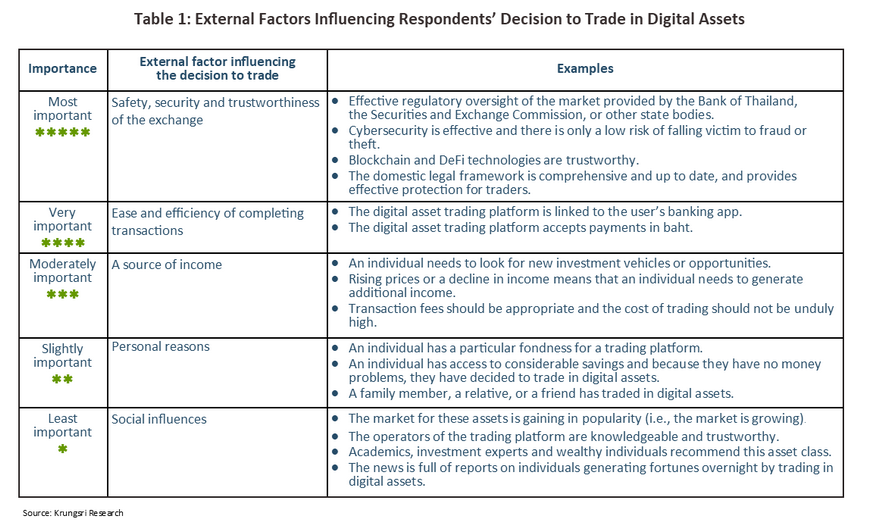

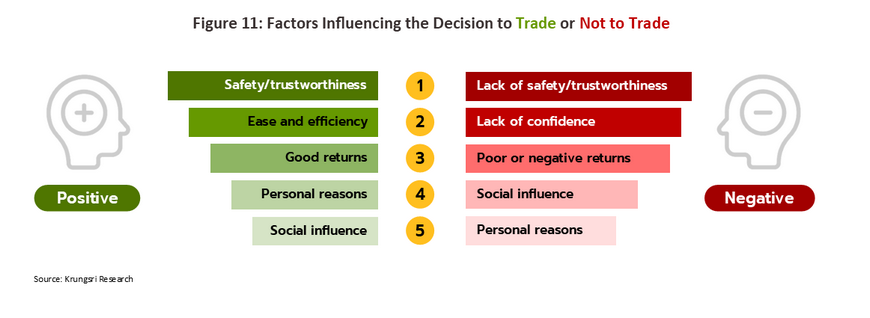

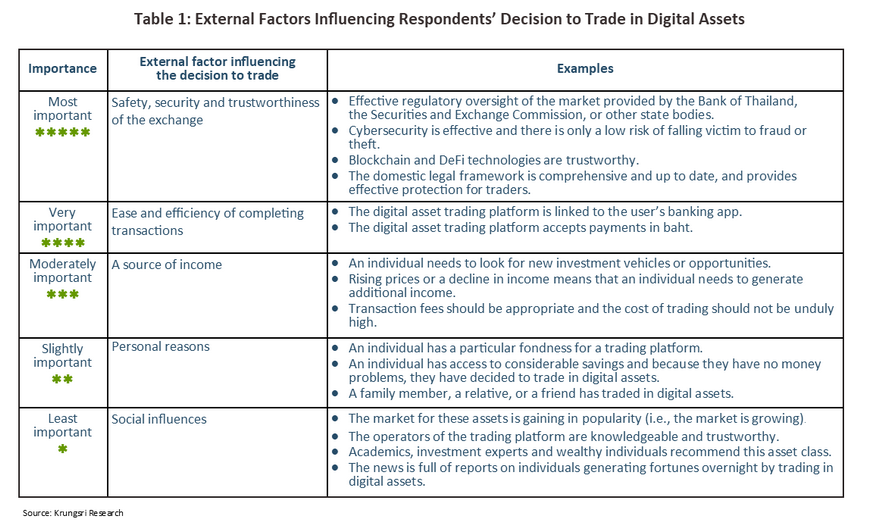

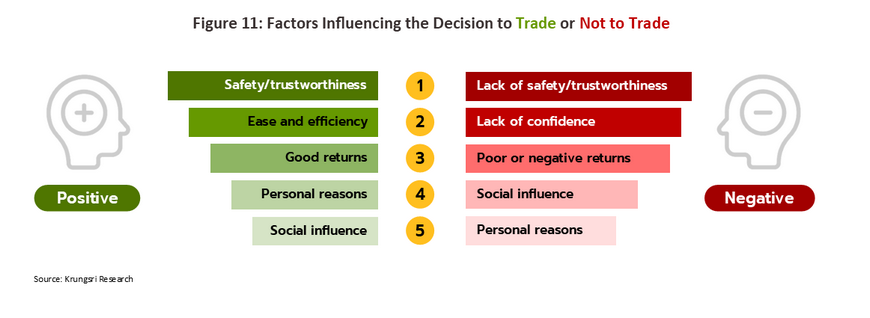

1. Factors influencing the decision to trade Respondents identified five environmental factors that had a positive influence on their decision to trade in digital assets. The most important of these was the safety, security and trustworthiness of the trading platform, which was followed in importance by the ease of completing transactions. The other three factors were, in order of importance, the prospect of trading providing a source of income, personal factors, and social influences.

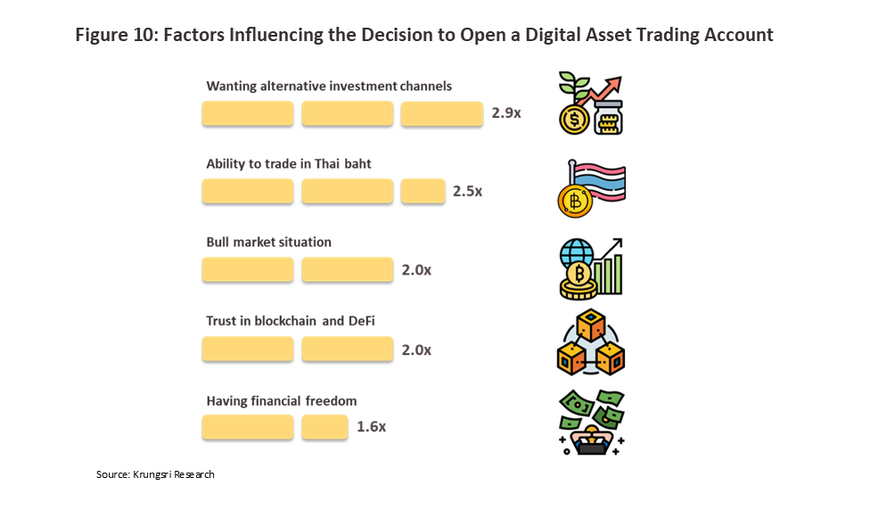

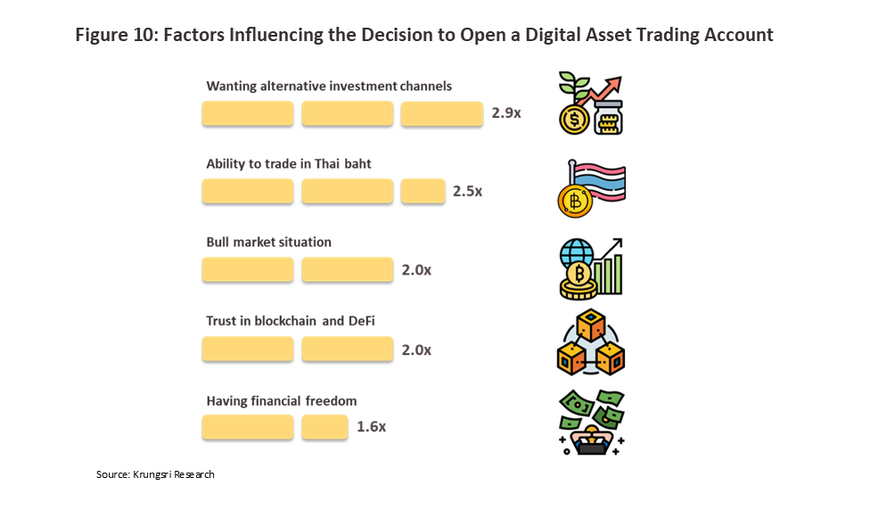

In-depth analysis shows that respondents for whom ‘looking for new investment vehicles or opportunities’ was a ‘very’ or ‘most’ important factor in determining whether or not to trade were 2.9-times more likely to open a digital asset trading account than those for whom this was not true. Similarly, respondents who valued a ‘platform’s ability to take payments in baht’ as very or most important were also 2.5-times more likely to have opened a digital asset trading account.

Other factors that had a significant influence on the decision to open a trading account included ‘the market being bullish’ and a belief in ‘the trustworthiness of blockchain technology and DeFi’ protocols and systems. Respondents who stated that these were very important or the most important factor in motivating then to invest or speculate in digital assets were twice as likely to open a digital asset trading account. For respondents who believed that they were ‘in a strong financial situation and that they had surplus income’, and this was a very important or the most important factor in determining their decision to trade were 1.6-times more likely to open a trading account.

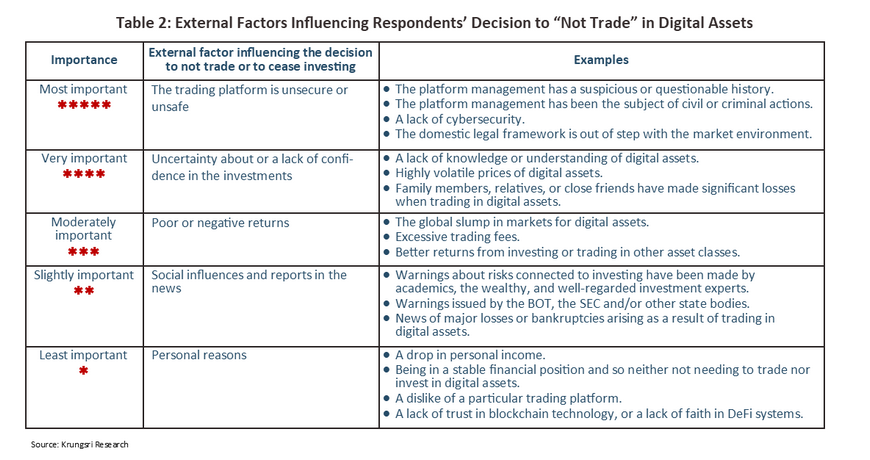

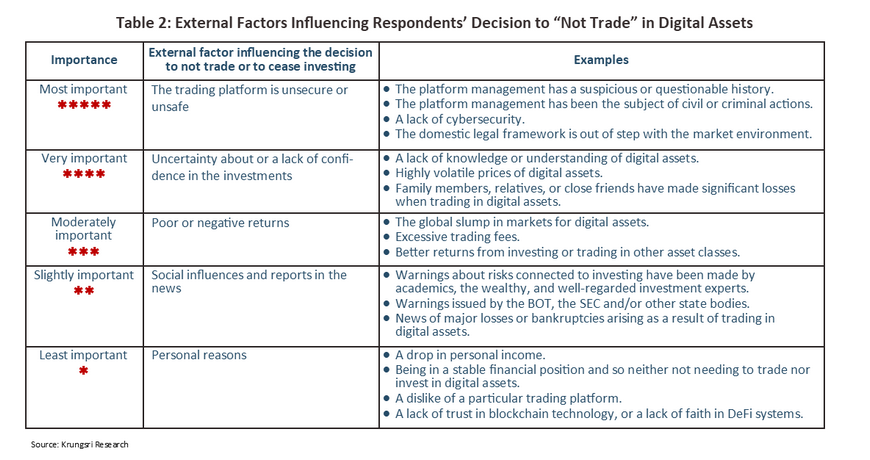

2. Factors negatively influencing the decision to trade or to invest External and environmental factors that persuaded respondents to not trade or to cease investing in digital assets included in order of importance: a lack of trustworthiness or of safety; a lack of confidence when making investments; poor or negative returns; social influences and news reports; and personal reasons (Table 2).

In-depth analysis of the data shows that individuals who ranked warnings from the BOT, SEC or other state bodies as a very important or the most important factor in deciding not to trade or to cease investing in digital assets were only 0.17-times as likely to open a trading account as those who did not make this assessment.

In addition, individuals who, when asked about their decision to cease or abstain from trading and investing in digital assets, likewise ranked as very or most important one of (i) a lack of knowledge or understanding about digital assets, (ii) a lack of trust in blockchain technology and a lack of faith in DeFi systems, or (iii) the extreme volatility of digital asset prices were 0.6-times as likely to open a trading account as those who did not.

Factors relating to individuals or the trading platform

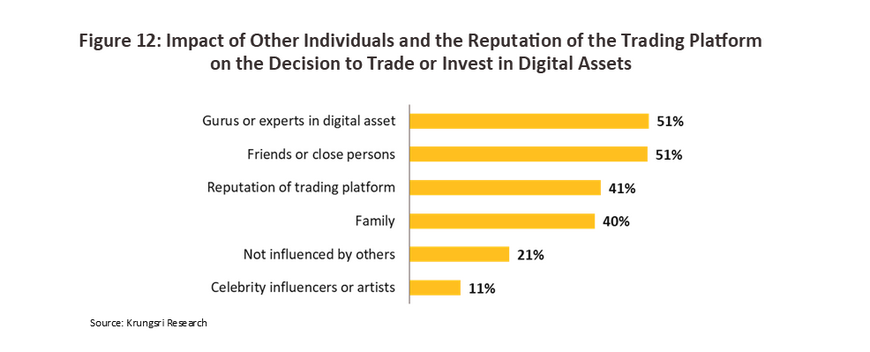

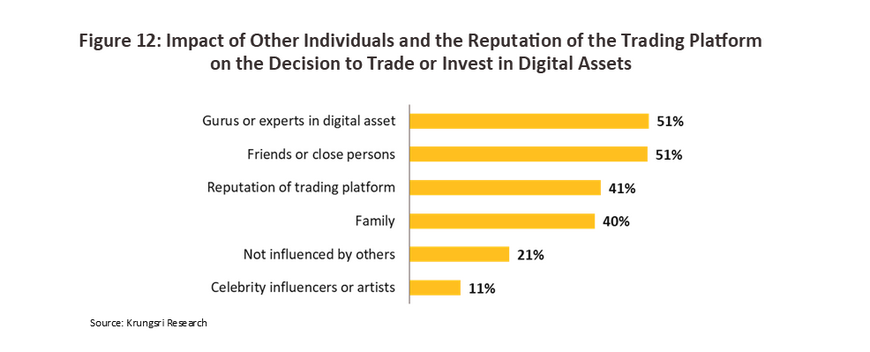

In addition to being influenced by external and environmental factors, the population is also affected by the opinions and actions of other individuals, and all survey respondents reported that friends, close associates and investment gurus all had an impact on their investment decisions. Moreover, a majority (51%) said that this was the most important factor. This was followed in importance by the reputation of the trading platform and influences from the respondent’s family (40-41%).

Considering just respondents who had a trading account, the impact of friends and close associates was the most significant (53%), though that of experts and investment gurus was almost as important (52%). In third place, with an equal share of respondents (45%) reporting these as an influence were the reputation of the platform and the influence of family members.

However, although it appears that most Thai digital natives are influenced by other individuals, looking deeper into the data shows that 2 in 5 of respondents who had a trading account and who traded in digital assets at least weekly were not affected in this way, either by other people or by other factors, and as such these individuals made the decision to trade alone, and were confident in their abilities to do this successfully. If these traders were influenced by other factors, it was only by experts and gurus and by the reputation of the trading platform.

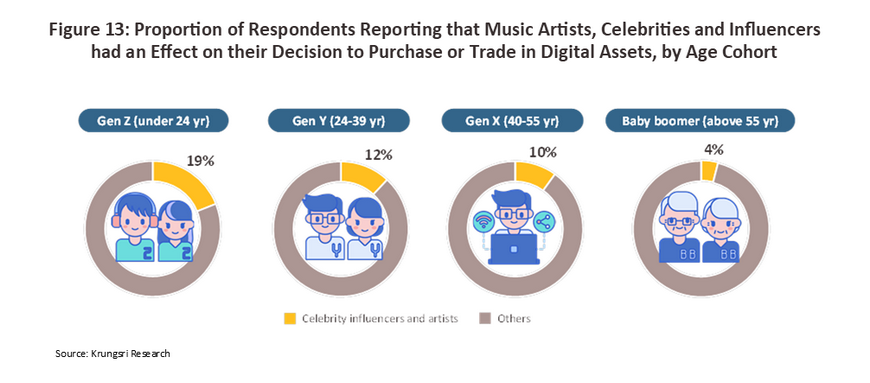

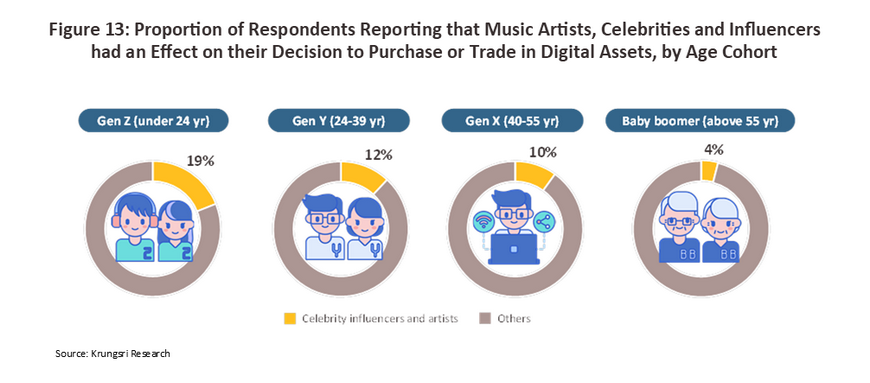

It is also interesting to note that around a tenth of all respondents reported that music artists, celebrities, and influencers had an impact on their decision to purchase, or invest or trade in digital assets. Among Gen Z respondents, this proportion rose to 1 in 5, while the proportion fell back to 1 in 10 for both Gen Y and Gen X. Because only a limited number of baby boomers responded to the survey, it is not possible to be certain how important this factor was for older individuals.

Recently, influencers, celebrities, and musicians have all been having a greater impact on the market by encouraging the trade in digital assets, with these individuals being paid to promote both particular assets and the use of named platforms or exchanges. However, because markets for digital assets have been swamped by a large number of inexperienced investors and are in any case highly risky, the role played by celebrities and influencers in encouraging greater market participation is a double-edged sword. These types of promotion should be carried out only when doing so is both transparent and responsible, and thus in the US, the authorities have recently moved against celebrities and influencers promoting cryptocurrencies. Most recently, on 22 March, 2023, the US Securities and Exchange Commission (SEC) brought proceedings against Justin Sun, a Chinese entrepreneur. Sun is accused of fraud and of illegally profiting from the sale of Tronix (TRX) and BitTorrent (BTT) digital assets by conspiring with eight celebrities, including Hollywood stars and famous singers, to promote these products through social media but to obscure the fact that these individuals had been paid to do this. Because the commercial nature of this relationship was obscured, the public were misled into believing that these individuals had independently developed an interest in TRX and BTT and so, alongside Sun, the SEC is prosecuting these celebrities for hiding their commercial interests and the payments to them from Sun’s company6/.

Although the US authorities have now decided to move against famous individuals for breaches of the law relating to the promotion of financial products, it remains to be seen how far other countries (including Thailand, where the market shows many similarities to the situation in the US) will do likewise by blocking and restricting celebrities and influencers from advertising digital assets.

Reasons for buying or holding digital assets

Looking only at survey respondents who had a digital asset trading account, these typically gave a range of different reasons for buying or holding digital assets. These included the following:

-

8 in 10 traded to make a profit.

-

7 in 10 saw trading as a way to gain more knowledge.

-

3 in 10 traded because it is fashionable, because their friends or close associates traded, because digital assets can be used as a store of value, or because holders use cryptocurrencies as a means of exchange in place of a fiat currency.

-

1 in 10 traded because holding digital assets entitled holders to discounts or other benefits.

In addition to these reasons, 1 in 7 trading account holders also used cryptocurrencies as a way of making cross-border money transfers without incurring a charge.

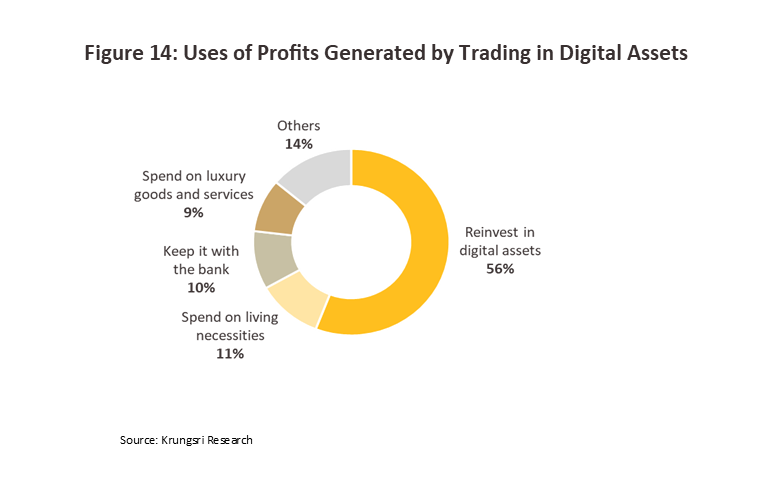

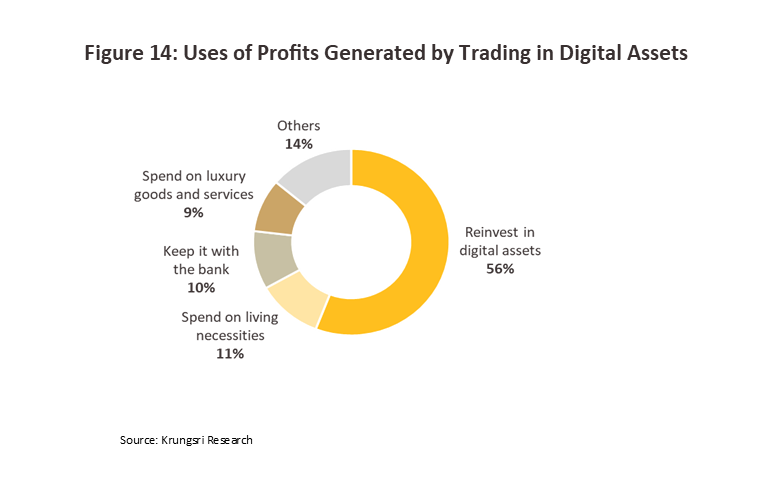

Although many reasons were given for buying or holding digital assets, the survey data shows clearly that for the majority of traders, their primary motivation was generating profits. When asked what they would do with these, more than half of the respondents answered that they would reinvest these back into markets for digital assets. As a rule, this tendency to put profits back into markets helps to sustain strong bullish runs, and this may therefore be one explanation for the boom in cryptocurrency values that was seen between the end of 2020 and the end of 2021.

However, not all traders were so keen to reinvest, and around 1 in 10 of respondents reported realizing their profits and then using these to pay for day-to-day necessities such as consumer goods or medical bills. Another 1 in 10 of respondents took their profits out of the market and instead either kept these on deposit at a bank or bought high-yielding banking products, and around another 1 in 10 hoped to use profits from trading in digital assets to pay for luxury goods or services, such as travel and tourism, high-end cars, or brand-name products.

Popular exchanges and trader behavior

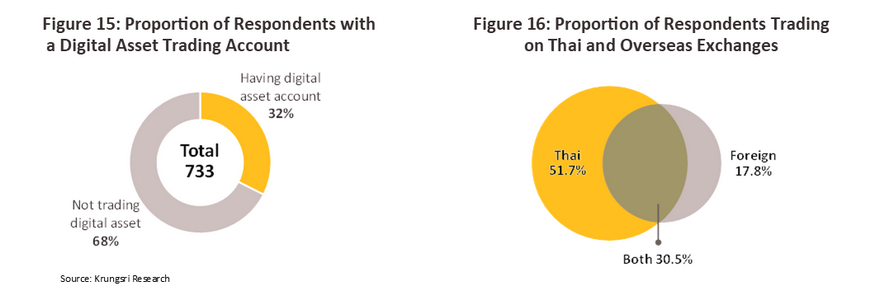

Around half of those respondents who had a trading account (approximately a third of all respondents) reported trading in digital assets only on Thai-based platforms or exchanges7/, while just 17.8% of account holders said that they traded exclusively on foreign-based exchanges.

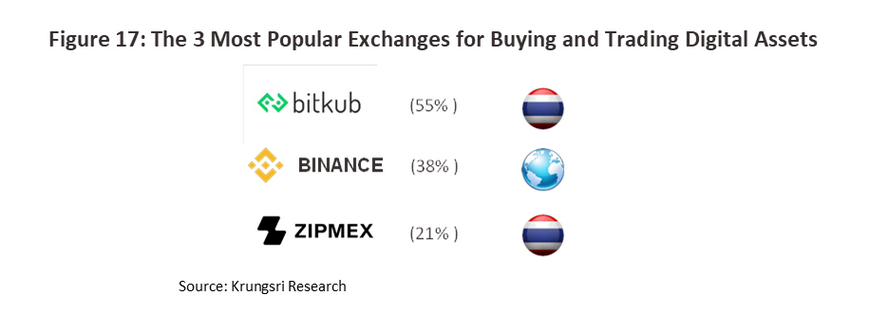

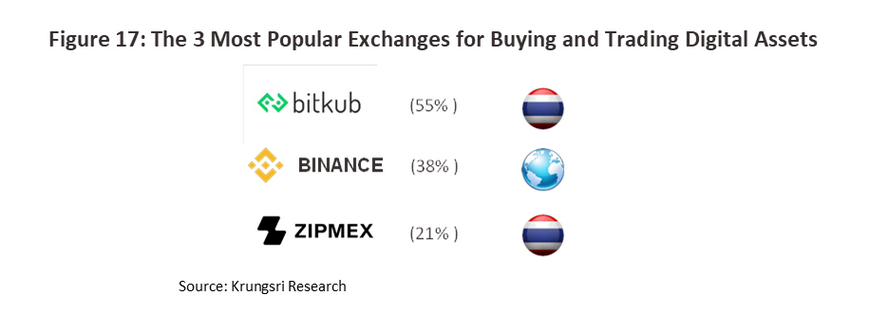

As reported by survey respondents, the three most popular exchanges were Bitkub, Binance and Zipmex. Bitkub, a Thai exchange, was favored by 55% of respondents, making it the most popular in the survey. This was followed by the non-Thai Binance (38%), and Zipmex, another Thai platform, which was preferred by 21% of respondents.

Thai vs foreign exchanges

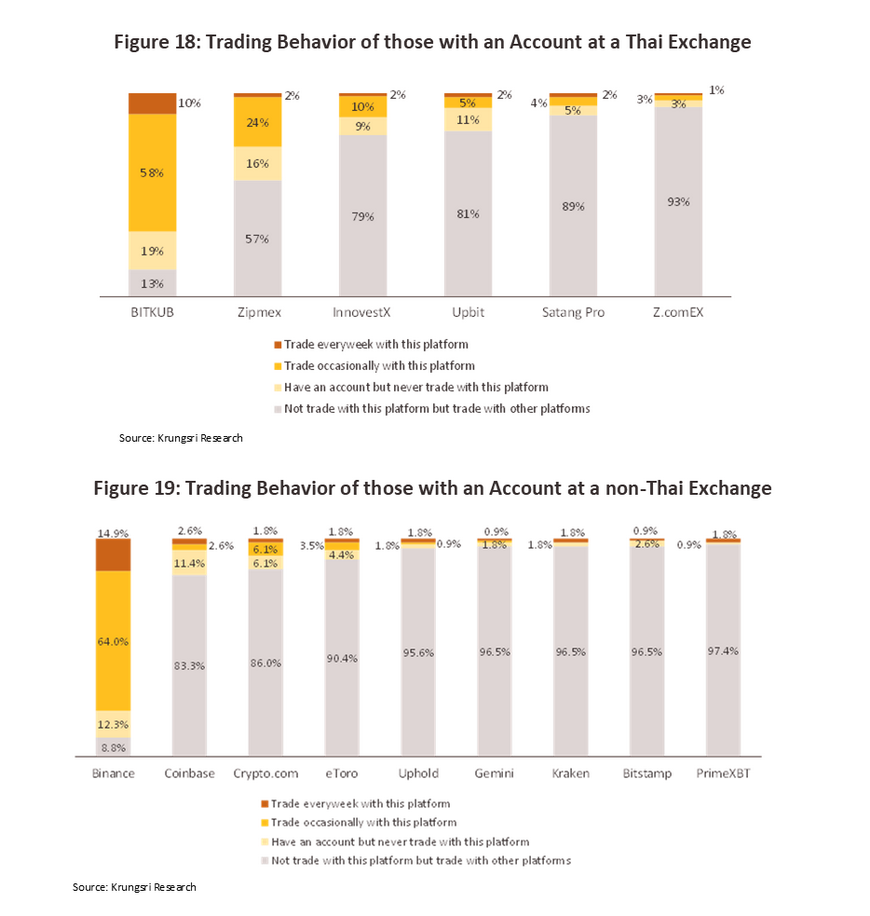

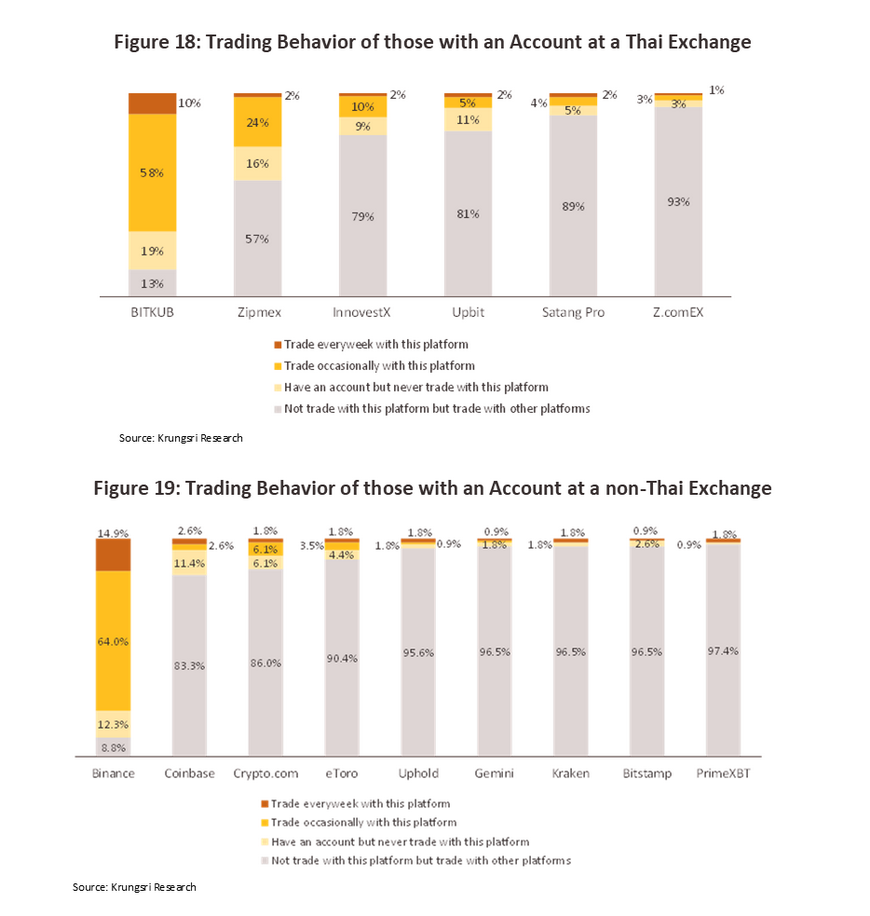

Between March and September 2022, Bitkub was the most popular exchange among those who had a Thai cryptocurrency trading account, and in this group, 86.6% of respondents had a Bitkub account. This was followed in importance by Zipmex, with 42.8% of respondents having an account there, but less than 20% had an account at one of InnovestX, Upbit, Satang Pro, or Z.comEX. It should be noted that one cannot conclude from this that all those with an account were actively involved in trading digital assets, and it is likely that some accounts were permanently inactive.

Nevertheless, 10.3% of those with a Thai trading account reported trading in cryptocurrencies on Bitkub at least weekly, and another 57.7% reported doing so periodically, though less often than once a week. These statistics show that Bitkub was massively outperforming Zipmex and the other Thai exchanges, and so Bitkub can reasonably be described as the Thai crypto trading platform. However, this survey did not gather data on the size of trades that respondents were typically making and so when an individual reports trading weekly on, for example, Bitkub, the amount traded could be anywhere from 10 baht (the minimum) upwards.

When the survey data was being collected at the end of 2022, Binance was by far the most popular overseas exchange among respondents who had an account on a non-Thai trading platform. Thus, 91% of this group had a Binance account, which was followed in second place by Coinbase (17%) and Crypto.com (14%). Fewer than 10% of those with an overseas trading account used one or more of eToro, Uphold, Gemini, Kraken, Bitstamp, or PrimeXBT.

Almost 15% of respondents who reported having an overseas digital asset trading account also said that they traded cryptocurrencies on Binance at least weekly, and a further 64% traded on Binance regularly but less often than once per week. This was far ahead of the number of people trading on Coinbase or other overseas exchanges, and so it appears that among Thais, Binance is in a clear lead as the most favored non-Thai digital trading platform.

Who are the master traders?

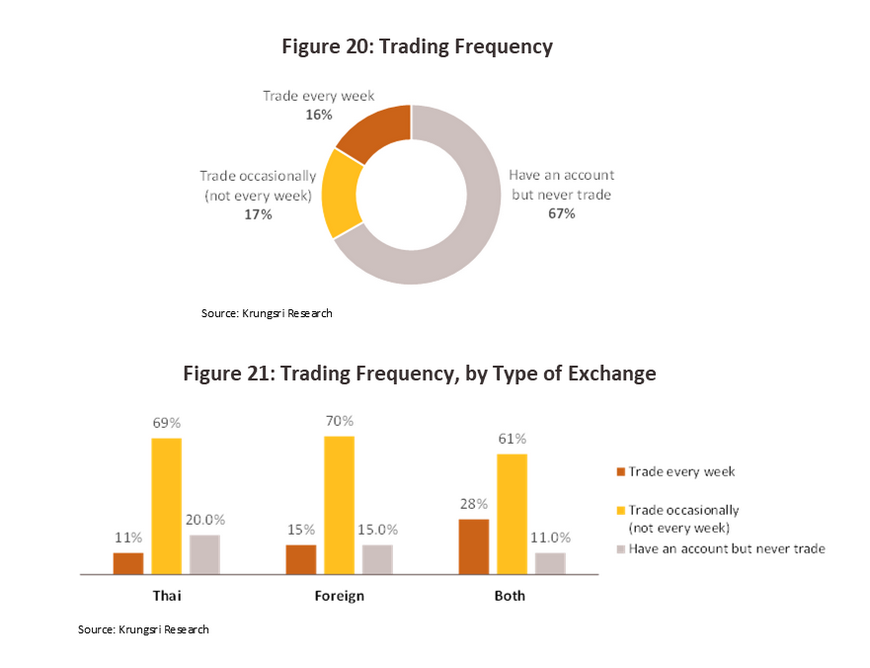

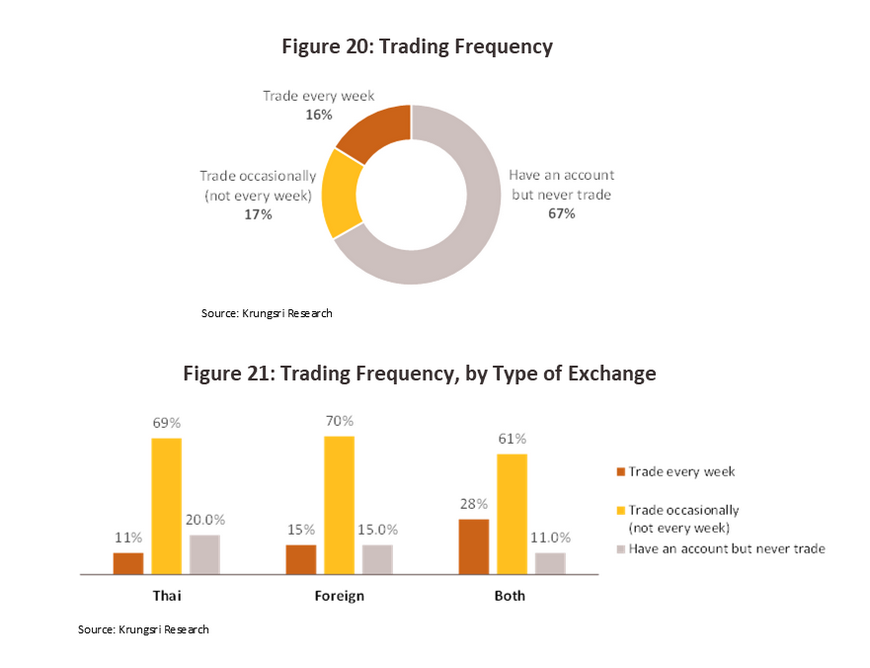

Among those who have any kind of digital asset trading account, 17% trade at least once a week, around two-thirds trade intermittently, though not as often as every week, and the remainder have opened accounts but never trade. Traders can be divided into the three groups of: (i) those who trade only on Thai exchanges, (ii) those who trade only on overseas exchanges; and (iii) those who trade on both Thai and overseas exchanges. Individuals who trade at least once a week comprise a full 28% of traders in the third group but only 15% and 11% of those in groups two and one, respectively. This perhaps should not be unduly surprising since those who are more committed to trading can presumably be expected to be more likely to operate on both Thai and non-Thai exchanges.

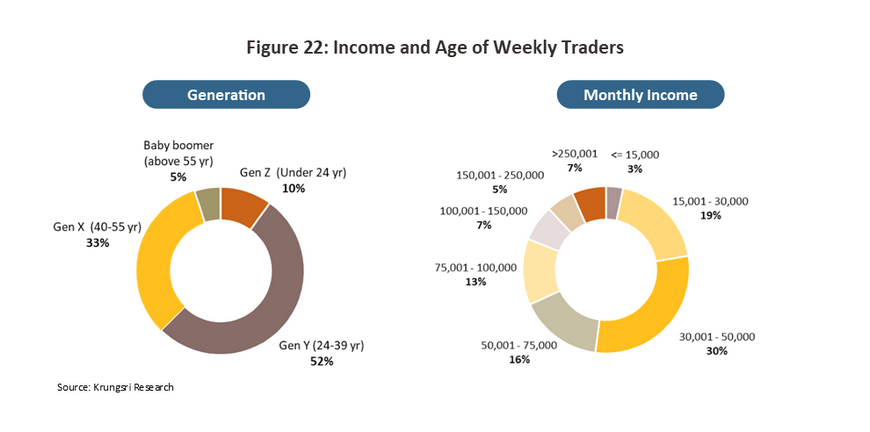

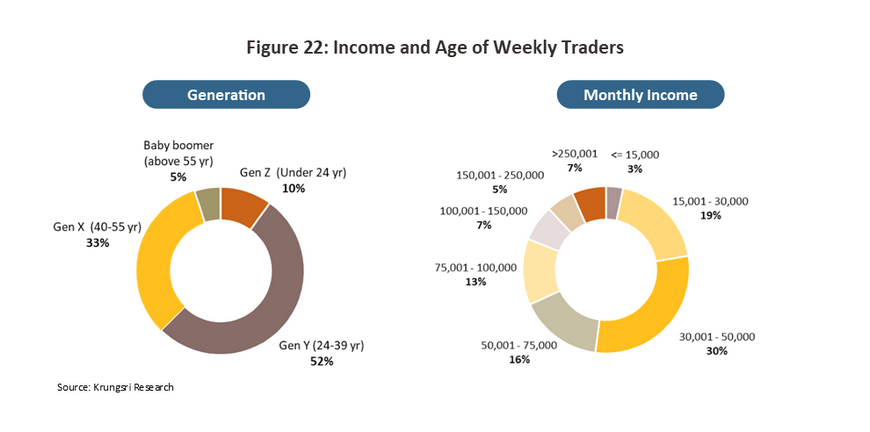

Considered with regard to age and income, regular traders (i.e., those trading at least weekly) are mostly Gen Y (52%) and a plurality have an income of THB 30,001-50,000 per month (30%). This is in line with the overall income for Gen Y, which according to the data gathered in this survey averages THB 49,000 per month.

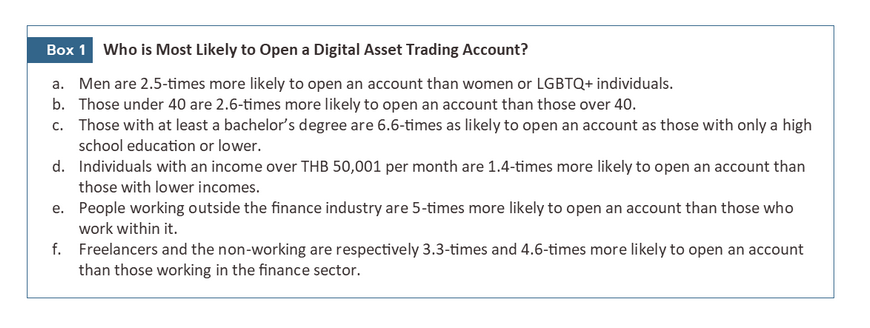

Who is likely to open a digital asset trading account?

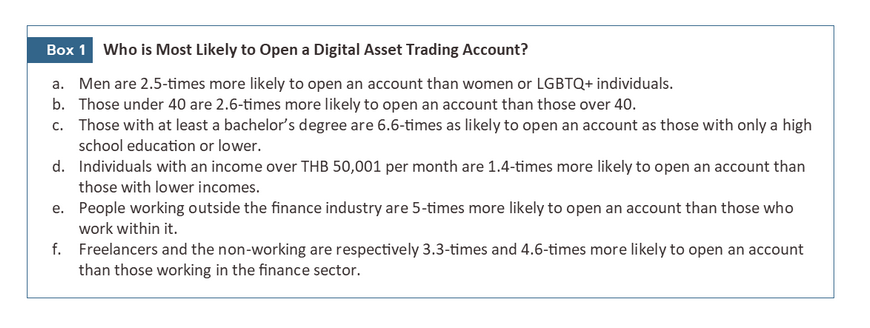

Analysis of the survey data reveals that individuals most likely to open a digital asset trading account are men who are less than 40-years old, have at least a bachelor’s degree, earn over THB 50,001 per month, and do not work in finance. Account holders are also likely to be not working or to be self-employed. The fact that those working in the finance industry are less likely to invest in digital assets than those not in the industry may be explained by the fact that people inside the finance sector are likely to be more exposed to news and information about traditional types of investment and speculation. They may therefore be more confident in the latter than in markets such as those for cryptocurrencies, which are still new and are viewed as being highly risky.

Future development of the market for digital assets

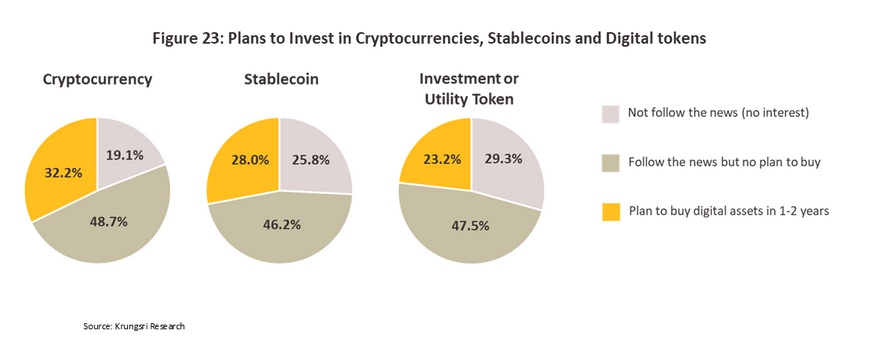

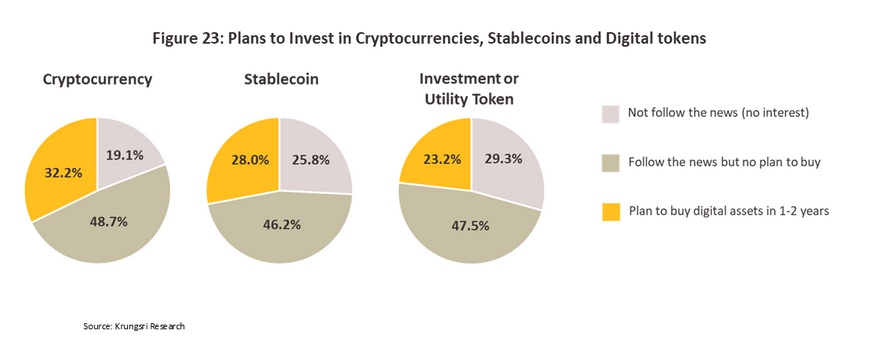

Around two fifths of respondents reported that they planned to purchase some kind of digital asset in the next 1-2 years. 32% planned to buy cryptocurrencies, 28% wanted to buy stablecoins, and 23% wanted to buy NFTs, though this rises to 70% if one considers only those who have already opened a digital asset trading account. Factors that might encourage individuals who have a trading account to cease trading are the reputation and trustworthiness of the trading platform and matters relating to cyber security.

Digital assets and the banking sector

The role played by the commercial banking sector in markets for digital assets varies by country, but in the US, commercial banks are closely involved in the industry. This intimacy is reflected in a survey undertaken by The Bank of New York Mellon in 2022. This sought the opinions of institutional investors in 271 organizations worldwide, and the survey revealed that 70% would expand their involvement in markets for digital assets if trusted and well-known financial institutions (e.g., commercial banks) offered services whereby they held digital assets in custody for their clients together with other related services8/. In addition to institutional investors, retail investors in the US are also interested in such a service, and a survey of 3,898 US consumers carried out in 2020 by Cornerstone Advisors showed that 60% of respondents would be interested in investing in cryptocurrencies if their own bank offered such a service9/. This is also in line with an interview given by a partner in EY Consultants in their San Francisco office, who in February 2022 told Fintech Nexus News that EY had also surveyed cryptocurrency holders and had discovered that 80% would like to be able to deposit their cryptocurrency holdings at a bank, rather than leaving it with an exchange. The EY survey showed that if this was possible within the current regulatory environment, this had the potential to appeal to a significant number of the bank’s customers10/.

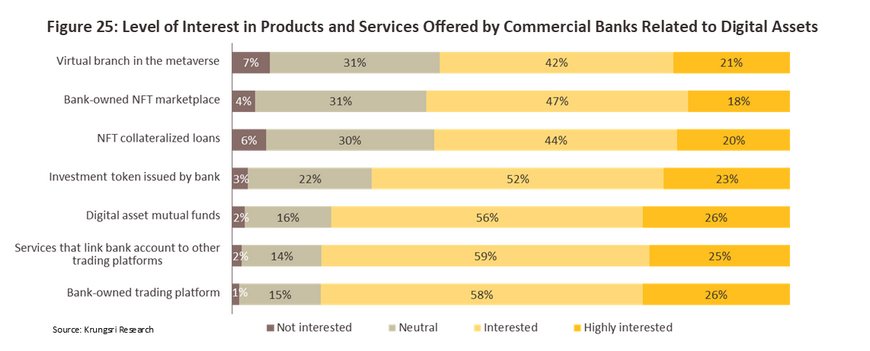

The Krungsri Research survey indicates that the appeal of these types of services is equally high in Thailand, with 8 in 10 of all respondents reporting that they would be interested in financial products related to digital assets if these were sold by commercial banks. Of those who expressed an interest in these products and services, the greatest share (63%) was accounted for by those who had never opened a digital asset trading account. This group was followed in importance by those who traded intermittently or as opportunities arose (25%) and in equal third place on 6% each were those who traded at least weekly and those who had opened a trading account but who had never traded. In addition, the data show that those who worked in the banking and financial sector were twice as likely as those who worked in other industries to express an interest in financial products and services released by commercial banks that were related to digital assets.

The survey also shows that trading account holders hope to see a greater role for commercial banks in markets for digital assets, with 90% of these saying that they would be interested in digital asset-related products and services if these were produced by commercial banks. These individuals were in addition 4-times more likely to express such an interest than those who did not have a trading account.

Given this, it is likely that if commercial banks did indeed expand their involvement in markets for digital assets, both those who already have a trading account and those who have never opened one would become more interested in trading in digital assets. In this context, the Thai market is, in order of importance, most interested in seeing commercial banks: opening their own trading platforms, linking their bank accounts to other trading platforms, and offering mutual funds based on digital assets.

Krungsri Research view: When true value proves itself

New industries such as the market for digital assets are closely tied to the finance and banking sector, and so it is not surprising that surveys conducted in Thailand and overseas reveal widespread interest among both investors and the general public in commercial banks playing a greater role in the industry. This also further illuminates the extent to which fears about cybersecurity and the trustworthiness of trading platforms continue to affect the public, but the flip side of this is that the desire to have traditional financial institutions play a role countering these problems indicates how far trust in the banking system has been maintained.

Beyond issues relating to trust and safety, the survey also reveals that much of the public lacks knowledge and understanding of the market for digital assets as well as of trading in and managing these. It is therefore the case that most individuals are not yet ready to take advantage of new decentralized financial systems (DeFi), although the hope is that banks and other financial institutions that offer traditional financial services (and which most people are already very familiar with) will enter these markets themselves or will operate as middlemen to help facilitate transactions involving digital assets.

In addition to the banking sector, regulatory authorities such as the Securities and Exchange Commission (SEC) also have a role to play in providing material support for the development of the market for digital assets by issuing new regulations and ensuring effective oversight of the industry. Thus, as described above, the survey shows that around 1 in 5 Gen Z respondents and 1 in 10 Gen Y and Gen X respondents had made a decision to invest in digital assets that was informed by the views of celebrities and social media influencers. It is true that as a proportion of the total, these figures are fairly low but it is nevertheless concerning that individuals appear to be making what may be significant investment decisions based on the advice of those who lack any knowledge of the topic and without making a careful consideration of the issues. Fortunately, the SEC is aware of this problem, and in addition to issuing operating licenses to those working in the market for digital assets11 (the body has recently licensed digital asset fund managers and digital asset advisory services), the SEC has also revised the rules on the advertising and promotion of businesses connected to digital assets, and in particular those involving cryptocurrencies. As such, from 1 September, 2022, new and much stricter rules now bring regulation of this area into line with international standards, and it is hoped that this will help to extend protection to retail investors who may lack in-depth knowledge, understanding and experience of investing. By acting in this way, the SEC will help to protect both new and experienced investors from being persuaded to use services or to trade in cryptocurrencies without first researching these and considering the potentially significant risks involved.

Other state bodies also have a role to play in managing misleading advertising relating to digital assets, as well as in fighting the spread of fake news and strengthening cybersecurity. The latter is a potential problem for people of all ages but because they are less familiar with technology than other age groups, this may be a particular problem for baby boomers. In this context, it should be noted that for private and public sector bodies wishing to communicate with the public to ease worries over cybersecurity and to provide additional education relating to digital assets, the most appropriate communication channels to use are Facebook and YouTube since this survey reveals that these were favored by respectively 85% and 71% of respondents.

The novelty and volatility of markets for digital assets may have raised fears among many stakeholders, most notably from the regulatory authorities. However, when these products gain broader acceptance and can prove themselves to be beneficial to a wider cross-section of society, at this point, market mechanisms will ensure that the digital asset industry will thrive and grow alongside traditional financial institutions.

References

Bnymellon (October, 2022) “Migration to digital assets accelerates”. Retrieved March 12,2023 From

https://www.bnymellon.com/content/dam/bnymellon/documents/pdf/insights/migration-digital-assets-survey.pdf

Fintechnexus (February, 2022) “Crypto-curious consumers would prefer to hold with banks: Survey” Retrieved March 21,2023 From

https://news.fintechnexus.com/crypto-curious-consumers-would-prefer-to-hold-with-banks-survey/

Forbes (April, 2021) “The Coming Bank-Bitcoin Boom: Americans Want Cryptocurrency From Their Banks” Retrieved March 16,2023 From

https://www.forbes.com/sites/ronshevlin/2021/04/19/the-coming-bank-bitcoin-boom-americans-want-cryptocurrency-from-their-banks/?sh=6296df394908

U.S. SEC (March, 2023) “SEC Charges Crypto Entrepreneur Justin Sun and his Companies for Fraud and Other Securities Law Violations” Retrieved March 31,2023 From

https://www.sec.gov/news/press-release/2023-59

สำนักงานคณะกรรมการกำกับหลักทรัพย์และตลาดหลักทรัพย์ (กรกฎาคม, 2561) “ผู้ประกอบธุรกิจสินทรัพย์ดิจิทัล” Retrieved March 9,2023 From

https://www.sec.or.th/TH/pages/lawandregulations/digitalassetbusiness.aspx

1/ Digital Asset (Part 1) ‘When Thais are drawn towards digital assets’” is available for download from https://www.krungsri.com/th/research/research-intelligence/digital-asset-part1-2023

2/ Social media advertising campaigns carried out by the Government Savings Bank highlight the fact that prize bonds are suitable for those who wish to leave money on deposit with the chance of winning a monthly prize. Advertising for these savings facilities also focuses on their convenience, since savers can make deposits and withdrawals through the MyMo by GSB app.

3/ Individuals who stated that they did not have a digital asset trading account but who had nevertheless bought digital assets may have done so in the past but have now stopped trading and closed their account. Alternatively, some individuals may have had a third party make a purchase on their behalf.

4/ A prize bond is a kind of saving account that operates much like a lottery, with savers buying ‘tickets’ at a fixed price. Draws are held regularly, and owners of winning tickets are awarded monetary prizes. In Thailand, the Digital Salak is distributed through MyMo by GSB, an app operated by the Government Savings Bank.

5/ Stablecoins are a type of digital asset that is tied to or backed by another asset (e.g., a fiat currency, a commodity, or another cryptocurrency) and this then fixes the value of the stablecoin.

6/ From US SEC 22 March 2023 https://www.sec.gov/news/press-release/2023-59

7/ Here, Thai exchanges are those that are registered with the Thai SEC, namely: BITKUB, Satang Pro, Zipmex, Upbit, Z.comEX and InnovestX. For more details, please see : https://www.sec.or.th/TH/Pages/Shortcut/DigitalAsset.aspx#exchange

8/ https://www.bnymellon.com/content/dam/bnymellon/documents/pdf/insights/migration-digital-assets-survey.pdf

9/ https://www.forbes.com/sites/ronshevlin/2021/04/19/the-coming-bank-bitcoin-boom-americans-want-cryptocurrency-from-their-banks/?sh=24cd08194908

10/ https://news.fintechnexus.com/crypto-curious-consumers-would-prefer-to-hold-with-banks-survey/

11/ Operating licenses for other types of business include those for digital asset exchanges, digital asset brokers, and digital asset dealers. Source: https://www.sec.or.th/TH/pages/lawandregulations/digitalassetbusiness.aspx