Introduction

The waves of technological innovation have ushered in a period of intense digital disruption, and this has then had profound impacts on the livelihoods and lifestyles of individuals around the world. New innovations are created and developed to advance economic activities both in the manufacturing sector and in the financial sector. Interestingly, one development that has attracted attention globally is the emergence of digital assets.

Digital assets are a type of asset that may be used to represent value, but they are built on electronic systems or networks and so they have only a virtual, immaterial form. Although digital assets cannot be physically held, they can be traded; and this often occurs on online platforms that are built on new technologies such as the blockchain. Because blockchain platforms are distributed and disintermediated, digital assets may be traded ceaselessly, 24 hours a day, 7 days a week, unlike traditional financial transactions that require intermediaries like banks. The most widely known of these new digital assets are cryptocurrencies, but in addition to these, the general category of digital assets also includes investment tokens and utility tokens. These will be discussed in more detail below; but in brief, these have the potential to provide considerable value in business settings. As with traditional fiat currencies, digital assets may be used or viewed as a medium of exchange or as a store of value, but their development and use presents considerable opportunities for businesses to cut costs, increase financial transparency (through the use of digital infrastructure such as blockchain technology), and to be easily and rapidly traded.

In addition to the business use of digital assets, interest in these has also been considerable in finance and investment, with this coming from both investors used to dealing in traditional assets and a new generation of investors looking to build their future financial security or to become richer. These two groups are united in seeing digital assets as a new option that exists alongside better-known activities such as investing in stocks or bonds, or even purchasing lotteries and hoping to hit the jackpot one day.

With growing interest in digital assets, at the end of 2022, Krungsri Research conducted

a survey to determine the Thai public’s behaviors relating to purchases and holdings of digital assets with the goal of gaining a better understanding of the Thai market, the opinions and investment behaviors of the people, and the level of digital asset literacy. This research is being published in two parts. This is the first part and is titled “When Thais are drawn towards digital assets”. The second part is titled “The Behaviors of Digital Thais in Digital Assets Trading” and will include survey results and analyses. Insights from this research can be of value to the finance and banking sector, to regulators, to private sector players, and to the public.

Growing Interest in Digital Assets in Thailand

Interest in digital assets has built rapidly in Thailand. Information from the Thai Securities and Exchange Commission shows that through the Covid-19 pandemic period, digital asset investment was intense. As of 2Q2022, some 2.9 million accounts

1/ had been opened on digital asset exchanges; and of these, around 250,000 were active. This compares with some 5.5 million accounts

2/ registered for trading on the Thai stock exchange, and so although the digital revolution is still in its infancy, trading in digital assets has gained a solid and rapidly expanding foothold in the Thai investment space.

However, while public interest has risen and pressures have built in markets for digital assets, most obviously for cryptocurrencies; the authorities, analysts, and market gurus have all issued warnings about the growing risk of untrammeled speculation in these markets. Alongside this, a steady stream of bad news from the digital world has revealed a less attractive side to this bonanza, first with the collapse of Three Arrows Capital

3/, then with the spectacular crash of Samuel Bankman-Fried and FTX

4/, and most recently with the bankruptcy of the crypto broker Genesis

5/. Each of these ran into what turned out to be fatal financial problems, and the subsequent insolvency and collapse of each acted as a domino, the fall of which further added to the waves of fear, uncertainty, and doubt rippling across the digital landscape. With the outlook still clouded, investors have been left wondering whose number will come up next.

The onset of the so-called ‘crypto winter’ has encouraged central banks in the major economies to take a firmer stance on these issues, with the Bank of England indicating that in its view, it is possible that volatility in the market may drive the value of Bitcoin close to zero, which would then potentially have significant consequences for Britain’s financial stability

6/. In addition, the Bank of America, as an example of regular commercial banks, recently confirmed that the company will not be offering crypto-related services in the near time to come

7/.

Crypto Speculation Among New-Generation Thais

A report by The Office of the National Economic and Social Development Council (NESDC) issued August 2022 on ‘The State of Thai Society’ indicates that the global cryptocurrency market was worth USD 2.2 trillion (approximately THB 74.8 trillion)

9/, having exploded 12.4-fold in the two years between January 2020 and December 2021, a period that coincides fairly tightly with the global Covid-19 pandemic. Likewise, the number of individuals worldwide owning some cryptocurrency increased almost 3-fold over 2021, jumping from 106 million at the start of the year to 295 million by its end

10/.

The domestic market has seen, if anything, even more vigorous growth. A report published by the Thai Securities and Exchange Commission (SEC) in the second quarter of 2022 reveals that as of the end of 2021, the Thai trade in cryptocurrencies averaged THB 140 billion per month. Remarkably, the number of domestic cryptocurrency trading accounts surged almost 15-fold in just over a year, with the number exploding from 0.17 million in 2020 to 2.5 million only 14 months later. This shows that Thais, and in particular new-generation Thais, are deeply attracted to the trade in cryptocurrencies.

The NESDC ‘State of Thai Society’ report also references the thesis ‘Clustering of Thai Investors by Investment Behavior in Bitcoin’ (Srikanchanason, 2019)

11/, which shows that over 25% of those investing in cryptocurrencies had carried out little or no research prior to their investment. This is in agreement with a survey by the SEC into interest in digital assets that showed that 25% of those playing the markets made decisions based on instinct. Moreover, the NESDC report reveals that with regard to those less than 30-years old, 25.6% of investors invested for ‘fun’, ‘entertainment’, or ‘social reasons’. The report also refers to a paper published by Mahidol University on ‘Marketing to Risk Lover’, which indicates that new-generation speculators in crypto are most often motivated by the promise of attractive short-term returns

12/.

The overall impact of these reports has been to raise worries across a broad range of issues, though particularly concerning is the tendency for young, inexperienced investors to rush headlong into speculating in the highly risky market for cryptocurrencies. Some of these issues are described below.

The regulatory environment is weak. Although it is true that the Securities and Exchange Commission is tasked with oversight of companies registered as traders of cryptocurrencies, the scope of this power is limited and the SEC is able to regulate only those companies that are registered in Thailand. Thus, companies registered overseas are excluded from oversight, which means that the Thai regulations also do not cover transactions made by individuals on platforms registered outside Thailand.

Investors may be easily misled, and it can be difficult to prevent ‘pump and dump’ schemes. These involve one party releasing favorable but fake news or otherwise dishonestly talking up the price of an asset. This then pulls in smaller, more inexperienced investors who wish to ride the rising price; but after the price has risen to a suitable level, the original coin holder will dump their holdings on the market, realizing a profit for them but leaving the other investors holding overvalued assets.

Many different types of outright frauds or scams are found in crypto markets. For example, phishing attacks may be used to encourage an individual to click on a link or download an app that then fools the user into logging into a fake version of a trading platform. Alternatively, a user may receive an email claiming to be from the trading platform’s technical support and asking the user to reset or confirm their password. Once the fraudster has acquired the user’s login information, they will then generally also have complete access to their digital assets.

Asset impairment may erode the value of investments. Because investors in cryptocurrency markets generally do not post collateral against their coin holdings, any decline in asset value may result in the loss of some or all of the value of investments.

On the surface, it may be natural to think that digital assets are the concern exclusively of the new generations. This thought is perhaps reinforced by the habit exhibited in much research of referring to the young as ‘digital natives’, particularly in the West, where generational labels and classification is also extremely widespread when considering individual behaviors and beliefs. However, the research paper ‘Understanding the future traits, behaviors, and attitudes of Thai digital natives’ (Thianthai, 2020) shows that being a ‘Thai digital native’ does not necessarily entail any special consideration of age or generation, and the characteristics that are stereotypically associated with particular generations are as likely to be found in the same individual as in separate age cohorts

13/. Given this, it should not be surprising that investors and speculators in cryptocurrency are found across Thai society at all ages, and that these activities are not restricted solely to those in Gen Z.

Understanding digital assets

During their initial period when digital assets were first making an appearance in Thailand, some individuals began to use cryptocurrencies as a medium of exchange and to trade in these on exchanges; but at the time, the market was not formally covered by any regulations and no official body had yet been given the task of oversight of this. This situation clearly posed a risk to the stability of the financial system, to the economy overall, and to the general public. To make up for the shortfalls in the Securities and Exchange Act B.E. 2535 (1992)

15/, the Royal Decree on the Digital Asset Businesses B.E. 2561 (2018)

16/ was promulgated, and this was enforced with effect from 14 May, 2018.

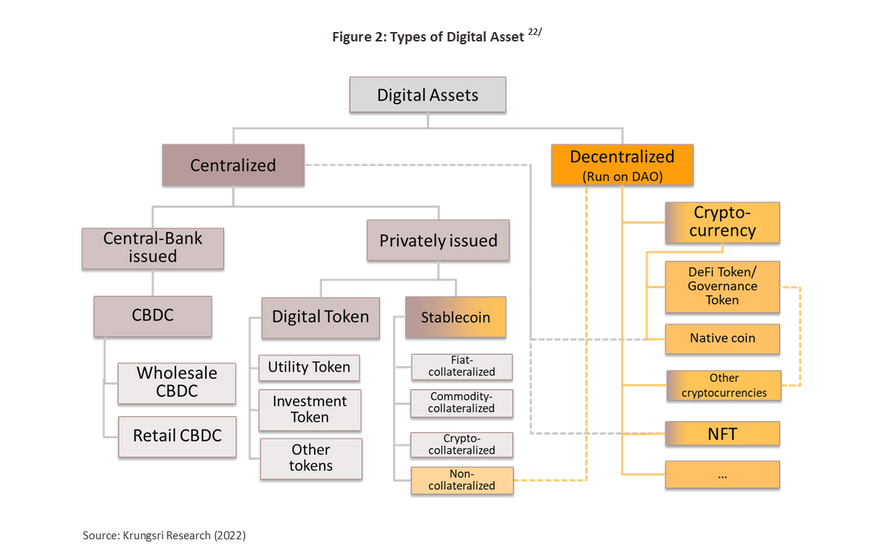

This decree was made with the goal of regulating the market for digital assets and of encouraging the use of related technology for the sustainable development of the economy and society. The decree separates digital assets into the two categories, i.e., cryptocurrency and digital token, based on their uses and the benefits that accrue to their holders.

Category 1: Cryptocurrency

Cryptocurrencies are units of electronic data stored on computer systems or networks that have been created for use as a medium for facilitating the exchange of goods, services, other digital assets, or other benefits. These use advanced cryptography to ensure data security, and hence their name. Because the value of cryptocurrencies is determined on the open market without the intervention of any regulatory

- Bitcoin (BTC) is the world’s oldest and most heavily traded cryptocurrency. BTC was created in 2009 by the pseudonymous Satoshi Nakamoto (the individual’s real identity has never been revealed), who wished to create a currency that operated independently of any controlling authority. BTC is built on the blockchain, a secure and trustworthy technology that is used to record transactions in a decentralized fashion. Records are made and verified by all users on the blockchain, which makes it very difficult for any individual actor to make unauthorized changes to the data.

- Ether (ETH) is another extremely popular and heavily traded cryptocurrency. This is the native coin17/ for the Ethereum blockchain, which may be used to build decentralized applications (DApps). ETH was created in 2015 by Vitalik Bullettin; and at present, it has the second largest market cap after Bitcoin. This technology has been favored for use in decentralized finance (DeFi)18/ applications because Ethereum is open and supports the use of DApps, in particular for the implementation of smart contracts that can self-execute when predetermined conditions are met.

Category 2: Digital token

Like cryptocurrencies, digital tokens are units of electronic data stored on computer systems or networks; but these are created to record an individual’s income or current or future rights to goods, services, or other benefits as agreed by the token issuer. These types of tokens may be sold via an initial coin offering (ICO), which operate similarly to an initial public offering (IPO) (i.e., the initial sale of company securities to regular investors for companies being listed on a stock exchange). Digital tokens may be split into two sub-categories.

- Investment tokens: These are created on digital networks and give the holder the right to invest in a project or activity run by the token issuer and then to benefit from this. This is thus similar to holding a digital security or debt instrument.

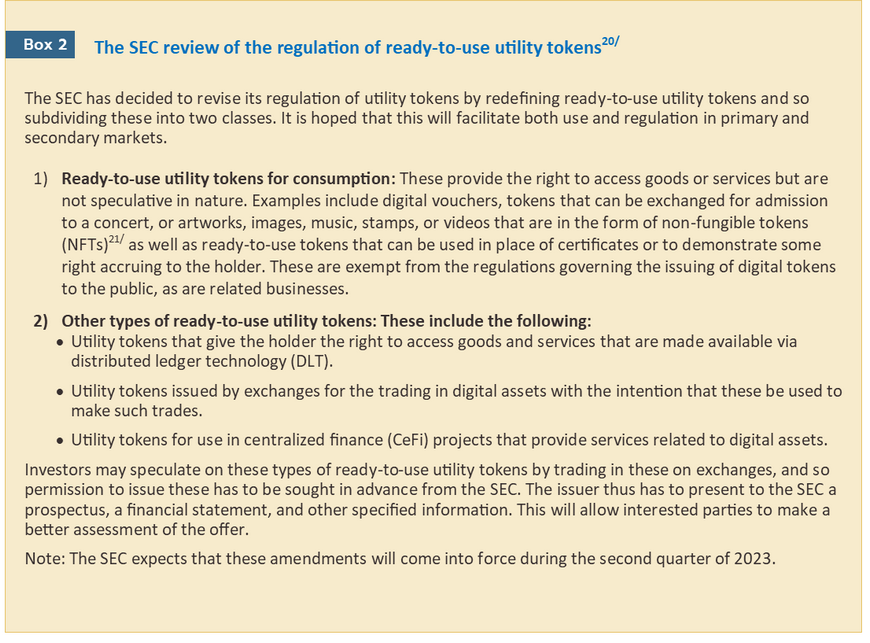

- Utility tokens: These are units of digitally networked data that grant the holder the right to goods, services, or other specific benefits, such as access to a platform or a project, or to allow the exchange of goods on a platform or project. Utility tokens can be split into two subtypes: (i) ready-to-use tokens that are not used to raise funds but rather to embody the right to access goods or services that have already been made available; and (ii) not-ready-to-use tokens that are used to represent future rights to goods and services, which are not yet available but for which funding is currently being raised for development of such goods and services.

Note that under the Royal Decree on the Digital Asset Businesses B.E. 2561 (2018), “assets” that are defined as per the stipulations of the Securities and Exchange Act B.E. 2535 (1992) are not considered to be digital assets, i.e., these are regarded as distinct from cryptocurrencies and digital tokens. This is to avoid duplication of the law

19/.

Digital Assets Classification

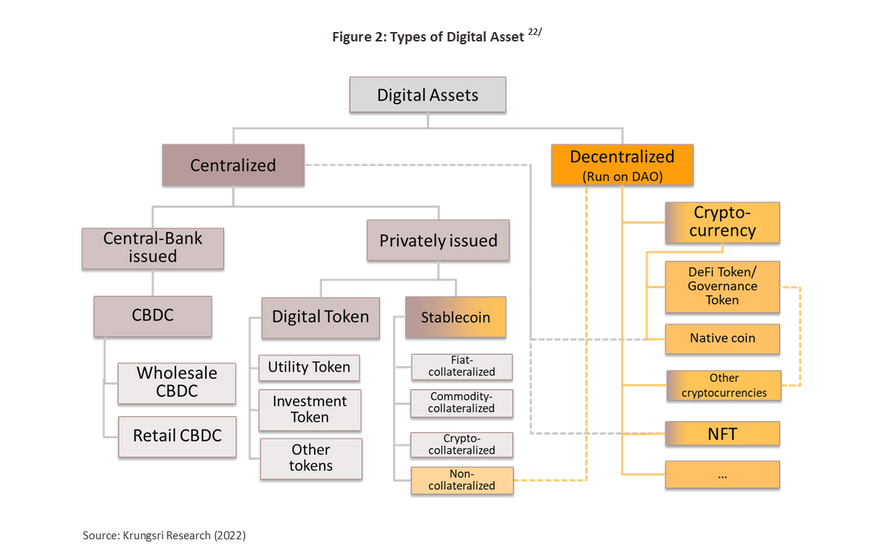

There are various ways in which digital assets can be classified beyond the scheme used in the royal decree on digital assets. Indeed, in Krungsri Research’s own paper ‘The role of banks in the new world of NFTs’ published in April 2022, digital assets are classified according to their governance structure, with the primary division beingbetween those that are centralized and those that are decentralized.

Centralized digital assets are defined as those for which a central authority controls the issuing or value of that asset. These may then be further subdivided according to the type of the issuing authority. Thus, privately-issued digital assets include digital tokens and stablecoins23/, while central bank-issued assets are currently limited to central bank digital currencies, or CBDCs24/. By contrast, decentralized digital assets are issued without the volume or value of the asset being controlled by the issuer. These are generally structured as decentralized autonomous organizations (DAOs); and these can then be divided into several major categories, such as cryptocurrencies, NFTs, and other types of digital assets.

Regulation of digital assets: a new challenge to face!

Nevertheless, whatever kind of governance structure may be in place for particular digital assets, the market for these is global and borderless, and so the extreme volatility that digital assets can experience has the potential to affect investors in every corner of the world. Given this, fears have grown over the breakneck pace of growth that has inflated the market massively over the past few years. Many organizations have voiced concerns over the rapidly expanding threat that this poses to financial stability. This has come from national and international banking regulators, and suggestions for better management and oversight of digital assets have been made at, among others, meetings of the Basel Committee of Banking Supervision (BCBS), the Financial Security Board (FSB), and the International Organization of Securities Commissions (IOSCO)

25/.

The regular reporting of market volatility and the resulting risk of enormous losses to investors has encouraged the authorities to recognize the importance of putting in place firewalls to prevent contagion from digital asset markets affecting other parts of the financial sector. It is therefore essential that regulatory oversight catches up with and then keeps pace with the dynamic of rapid development that has marked out the digital asset space. That said, regulators will also have to balance the requirement for ensuring the security of the financial system with the need to maintain room within which the sector can continue to flourish and to innovate.

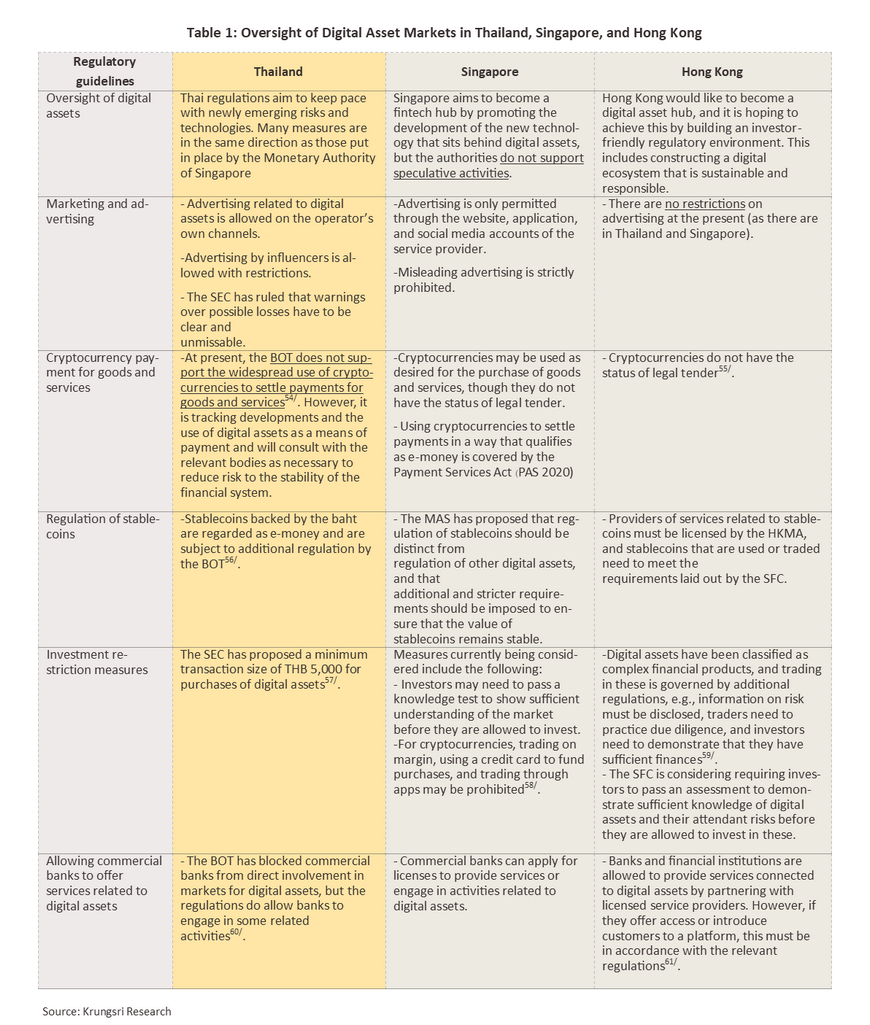

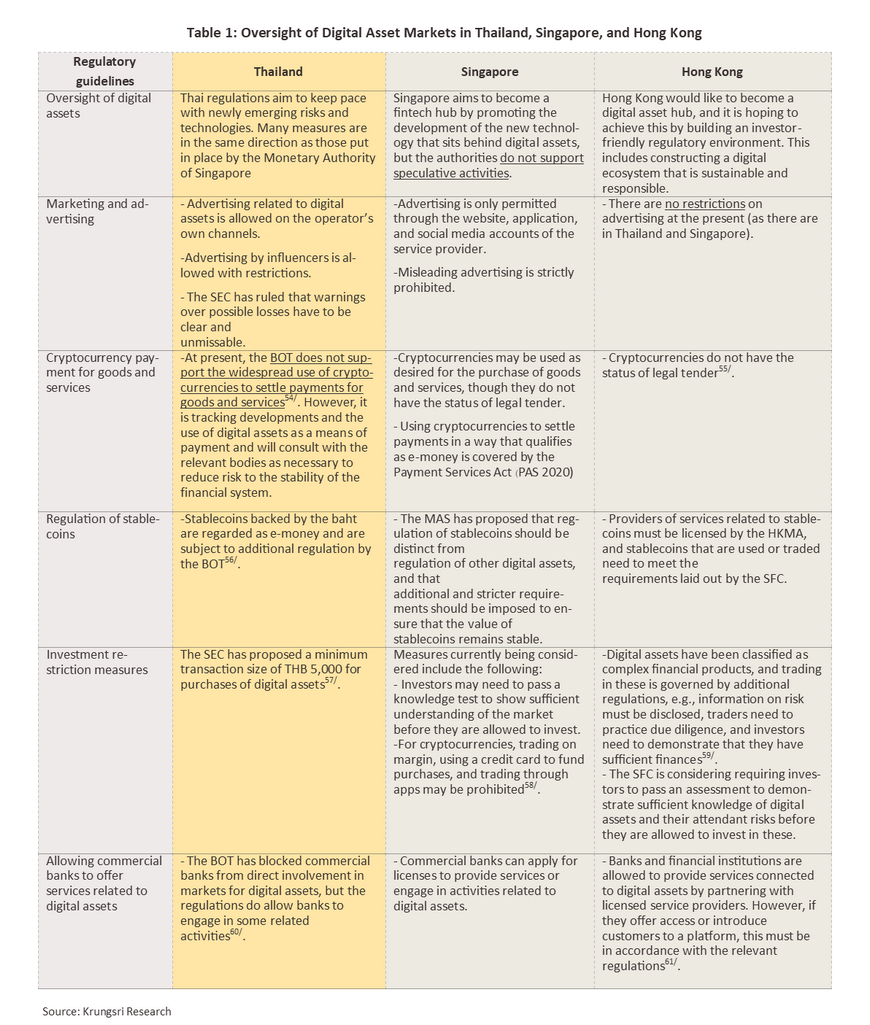

As far as the regulation of digital asset markets is concerned,

Singapore and Hong Kong SAR provide interesting discussion. Both have plotted a route to becoming hubs for the trading of digital assets and so the authorities in these areas have endeavored to design and to construct regulatory environments that not only support and benefit private sector businesses active in this area, but that also protect investors and ensure that financial markets are secure from any potential problems relating to digital assets.

Singapore emerges as Asia’s leading financial center

According to the Global Financial Centres Index, in 2022

26/, Singapore overtook Hong Kong to become Asia’s leading financial center. The city-state now sits in third place in the global rankings, behind only New York and London.By contrast, Hong Kong dropped to 4

th place, falling as a consequence of China’s insistence on maintaining its zero-Covid policy long after most of the rest of the world began to reopen.

Singapore strengthens its market regulation for digital assets to protect investors and the financial sector

Singapore provides an interesting case study in regulation and oversight of digital asset markets, because

while the government has a declared goal of establishing the country as a crypto asset hub, the authorities have also put considerable effort into protecting consumers and retail investors. The Monetary Authority of Singapore (MAS) has been given primary responsibility for regulation of digital asset markets; and to this end, the MAS has set out a policy of promoting innovation in the digital asset ecosystem. The MAS has therefore issued operating licenses for a wide range of activities related to digital assets, which attracts leading companies from many different countries to set up offices in Singapore. In 2020, over 180 players active in crypto payment services expressed an interest in applying for licenses to operate in the country

27/.

Singapore’s regulation of the digital asset market has become clearer since 2020 with the enforcement of the Payment Service Act (PSA). This established the MAS as the regulator responsible for oversight of the industry and for issuing operating licenses for providers of digital payment token services

28/. Under the new regulations, the use of digital tokens is permitted for the exchange of goods and services, but these have not been granted the status of legal tender and are not treated as financial products when traded in capital markets. In 2021, the scope of the MAS’s authority was extended to cover custodian wallet services

29; and henceforth, as laid out in the Financial Services and Market Bill (FSM)

30/, virtual asset service providers were also required to apply for an operating license from the MAS, which is now tasked with their oversight.

Although the MAS has been supportive of the digital asset ecosystem, the authority holds the view that now is not the time for cryptocurrencies to be used as a full medium of exchange. In addition, MAS does not support speculation in these since given the extreme volatility in crypto markets and the fact that these are not backed by other assets, retail investing may easily lead to significant losses for members of the public. This view has only been reinforced by the collapse of LUNA and Terra (UST), which were in fact registered in Singapore; and then by the

failure of FTX, for which Singaporeans were the second largest user group

31/. These events accelerated moves by the MAS to tighten regulation of the industry, which it pushed through in 2022. As part of this, the authority issued a consultation paper in October 2022, with opinions given in December

32/, and this resulted in a stiffening of protections for retail investors and a strengthening of measures that aim to underpin the stability of financial markets, in particular with regard to stablecoins.

Singapore’s regulatory framework includes the following:

- Imposing rules and measures to reduce risks for retail investors. For example, offering gifts or tokens as incentives to new retail investors is prohibited; and from January 2022, advertising has been banned in ATM booths; social media influencers are not allowed to promote digital asset services to the public33/. In addition, there are proposals to put a condition that investors are required to pass a knowledge test on digital asset risks before they are allowed to play in the markets for real34/. In light of the MAS’s recent consultation process, it also seems likely that regulations on retail participation in the market will be tightened further. This may include restrictions on leverage ratios or buying on margin when trading crypto assets, as well as a ban on the use of credit cards to make purchases of cryptocurrencies.

- Overseeing and supervising the operations of service providers related to digital assets. The MAS’s regulation includes requiring all operators to adhere strictly to the requirements for digital payment token service providers on anti-money laundering (AML) and countering the financing of terrorism (CFT); and even if companies are focused primarily on serving overseas markets, their licensing requirements still ensure that they are required to have a policy and/or procedures to effectively handle customer complaints.

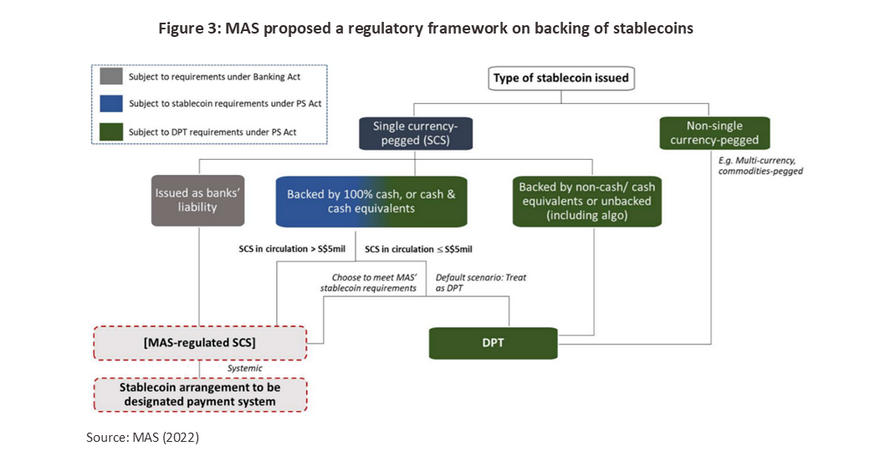

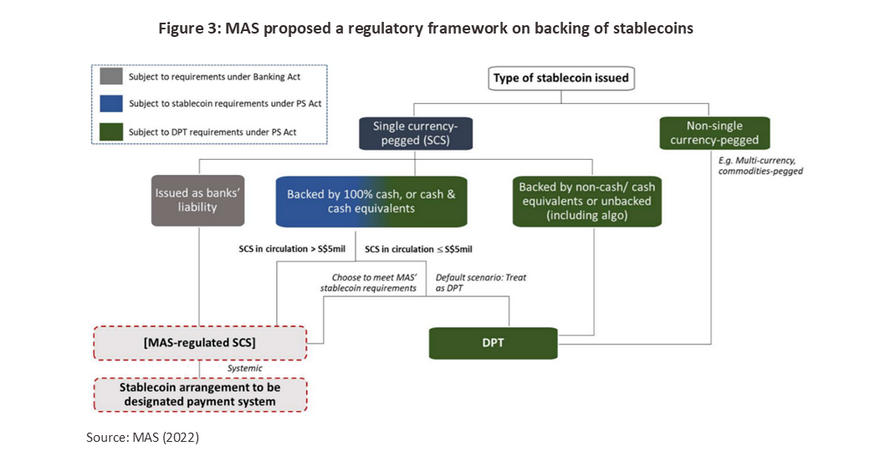

- Stablecoin oversight. In light of their potential to act as a medium of exchange, at the end of 2022, the MAS invited the submission of opinions on how best to tighten the regulation of stablecoins. This led to a series of new regulations being issued that specify that single-currency stablecoins (SCSs) now need to be backed by reserve assets in the form of cash or short-term government bonds to a value of at least 100% of the currency in circulation (i.e., backed at par value at a minimum)35/. The regulations also cover the exact type of assets that may be used to back a stablecoin. While for stablecoins issued by non-banks, additional prudential requirements establish stricter capital requirements and enforce the need to maintain liquid assets36/.

However, Singaporean banks can still apply for a license to offer services related to digital assets, and this is proving to be popular. For example, DBS, Singapore’s largest bank, has been running the DBS Digital Exchange since 2020; and in 2022, senior executives from the bank laid out a roadmap for how they planned to expand the service provision related to trading in digital assets

37/.

Hong Kong aims to reclaim its title as Asia's financial hub

Hong Kong’s decision to impose extremely strict measures to combat the Covid-19 pandemic had the unfortunate effect of restricting inflows of capital and encouraging investors to pull their funds out of the region, and this then helped to undermine Hong Kong’s status as one of the world’s centers for the trade in digital assets. In addition, the ban on trading in these on the mainland has further weakened Hong Kong’s position and added to fears among operators of cryptocurrency platforms. This was thus one reason behind the decision by Crypto.com to decamp to Singapore.

Nevertheless, the Hong Kong authorities have not sat idly by as these changes have washed over the city, and Hong Kong Financial Secretary Paul Chan has confirmed that “The digital transformation of our financial services sector is a central priority.”

38/ In pursuit of this, the authorities have announced a range of new policies and pilot projects, including programs related to NFTs and the tokenization of green bonds

39/, as well as working on the issuance of a Hong Kong CBDC. These moves have the goal of evaluating the technical utility of digital assets and their application and use in financial markets, with the intention that this will help to pave the way towards Hong Kong becoming a digital asset hub.

The Hong Kong regulatory environment: Overhauling retail investor oversight and establishing a digital asset hub

In 2022, Hong Kong attempted to amend its regulation for digital/virtual assets

40/ with the goal of pushing through legislation that would comprehensively cover trading in these by retail investors. This is in contrast to the legal situation in mainland China, where this is banned. Thus, the Securities and Futures Commission (SFC) worked together with the Hong Kong Monetary Authority (HKMA) and other relevant bodies to draft regulations covering the operations of virtual asset service providers (VASPs), which should come into force in June 2023

41/.

The Hong Kong authorities hope that these revisions to the legal framework governing markets for digital assets will help to protect investors, and that creating a more investor-friendly environment will then pave the way for Hong Kong to become a center for digital assets on a par with Singapore. These moves have helped to steal some of Singapore’s limelight; but although players have reacted positively

42/, some in the industry have warned that excessively tight regulation will add to operating costs and this may then undercut the competitive appeal of

Hong Kong

43/.

In 2018, the SFC issued new regulations governing the licensing of operators of digital asset trading platforms and of portfolio managers that (i) intended to invest in digital assets, or (ii) had a mixed portfolio but intended to invest at least 10% of its gross asset value (GAV) in digital assets. Portfolio managers were henceforth required to abide by rules including regulations on issuing warnings over the management of digital assets. At the same time, trading platforms were licensed only to offer their services to professional investors44/ since in the view of the SFC, these were better placed than retail investors to weather market volatility and would be less affected by losses. In 2019, the SFC then established a virtual asset regulatory sandbox for testing of these, while also implementing a voluntary licensing regime for providers of digital asset services. However, at present only 2 companies have been granted licenses by the SFC to operate as digital asset exchanges45/. This is because typically, Hong Kong retail investors prefer to “sidestep” local regulations by trading in NFTs and other digital assets on platforms that are

registered overseas46/, though the result of this is that these sidestepping retail investors may not receive legal protection on their digital asset investment.

Hong Kong has plans to strengthen its regulatory regime through the following:

- Oversight of businesses related to digital assets: Operators of online exchanges will need to meet stated capital reserve requirements, have in place measures to prevent price manipulation, carry out due diligence on all financial products that are traded on their platform, and abide strictly by the laws on anti-money laundering and combating the financing of terrorism that apply to traditional financial institutions. Once they are licensed, operators will be given a grace period of 9 months47/.

- Reducing investors’ risk exposure: Platform operators will be required to warn investors that they may face significant losses, and to have insurance to protect against damage arising from cyberattacks, although it should be noted that these insurance policies do not cover the case of the operator going out of business. Investors are also required to pass an assessment test that they have sufficient knowledge regarding digital assets and that they acknowledge the risks involved in speculating on the latter before they can access platform services48. At present, though, the Hong Kong authorities have yet to announce details on how regulation of the activities of retail investors will be tightened, as has happened in Thailand and Singapore, for example by banning advertising49/ for digital exchanges or prohibiting trading on margin.

- Registration of digital assets: The SFC is currently engaged in a process of consultation to consider potential registration guidelines to allow retail investors to buy and sell only eligible large-cap virtual assets50/ when executing trades on licensed platforms. Bitcoin (BTC) and Ether (ETH) have the highest market capitalization of all traded cryptocurrencies, and so it is expected that these will be registered, meaning that as of 1 June, 202351/, retail investors will likely be able to trade in these on Hong Kong exchanges. In addition, the SFC also intends to ensure that digital assets that are made available to retail investors meet criteria for liquidity and market capitalization52/.

- Regulation of stablecoins: Providers of services related to stablecoins will first need to seek authorization from the HKMA, and all stablecoins that are traded or used will need to meet the requirements set out by the SFC53/.

It is clear that tightening and clarifying the overall regulatory environment will not only help to better protect investors but will also assist in ensuring the stability and security of financial markets and of the broader economy. However, abiding by these new rules comes at the cost of more onerous requirements on providers of services related to digital assets; and it remains to be seen whether Singapore’s desire to insulate retail investors from excessive risk will help to make the country more attractive, or whether Hong Kong will be able to transform itself into a hub for the trade in digital assets. As for Thailand, the future will show how far the country is able to learn from the experiences of others and then to use this for the benefit of the public.

Krungsri Research view: Designing a regulatory framework to match market conditions

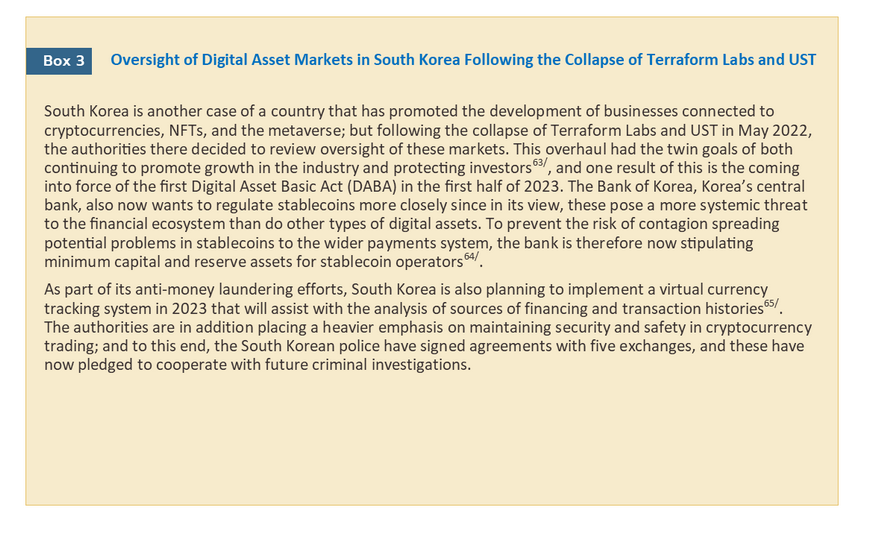

The explosive growth in interest in digital assets has shaken regulators around the world, and at both national and international levels, organizations are now cooperating as they look for ways to protect investors and financial systems as a whole from the potential problems that this new class of assets may generate. Nevertheless, although many countries support the enforcement of global regulatory standards for the industry, it remains the case that many others are still strongly opposed to digital assets and speculation on these.

Moreover, markets for digital assets exist within countries, where each has its own (and in many cases vastly different) economy, social system, and population. Within each of these countries, banking and financial systems vary further, as do government policies and objectives; and so Krungsri Research expects that certainly over the short term, improving the regulatory environment will have to begin at the national level, though over the longer term, it is possible that national regulators will be able to work with international bodies to develop and implement an international framework to guide the development of markets for digital assets. Before that day arrives, digital markets will need to move beyond the sharp volatility that they have demonstrated over the past few years, with investors sometimes doing little more than calling “heads or tails” on a weekly basis; and to make real progress, markets will need to achieve a level of security and stability that they currently lack.

Undoubtedly, any new rules or guidelines that are put in place to regulate markets for digital assets will not only need to have clearly defined objectives, but also need to consider the specifics of the environment in which they will be implemented, including the uses to which digital assets are put and the characteristics of market participants. In the particular case of Thailand, Krungsri Research is well aware that the Thai population differs from that in other countries with regard to their digital asset literacy, their investment or speculative behavior, their views and attitudes, and their adoption of modern lifestyles and the use of digital technologies. To help both government and private sector bodies better understand this emerging market, Krungsri Research has carried out an internet-based survey into the Thai population’s purchases, investments, and holdings of digital assets. This survey and its analysis is a continuation of this paper and will be published next month as ‘Part 2’ under the title “The Behaviors of Digital Thais in Digital Assets Trading”.

Reference

Alan H. Linning and Wei Na Sim (November, 15) “Worldwide: Regulatory Approach To Digital Assets In Hong Kong And Singapore”. Retrieved February 23,2023 from

https://www.mondaq.com/unitedstates/fin-tech/1250424/regulatory-approach-to-digital-assets-in-hong-kong-and-singapore

Bangkokbiznews (Jan, 2023) “ก.ล.ต.ปรับเกณฑ์ Utility Token พร้อมใช้ หวังคุ้มครองผู้ลงทุน” Retrieved February 24, 2023 from

https://www.bangkokbiznews.com/finance/cryptocurrency/1049825

Capital.com (Dec, 2022) “Terra price prediction: What is terra (LUNA)?” Retrieved February 2,2023 From

https://capital.com/terra-luna-price-prediction

CNBC (August, 2022) “Singapore considers tightening cryptocurrency trading by retail investors”. Retrieved February 10,2023 from

https://www.cnbc.com/2022/08/29/singapore-considers-tightening-cryptocurrency-trading-by-retail-investors.html

Global Legal Insight (January,2023) “Blockchain Laws and Regulations 2023: Hong Kong” Retrieved February 7,2023 from

https://www.globallegalinsights.com/practice-areas/blockchain-laws-and-regulations/hong-kong

Hong Kong Monetary Authority (January, 2023), “Conclusion of Discussion Paper on Crypto-assets and Stablecoins”. Retrieved February 21,2023 from

https://www.hkma.gov.hk/media/eng/doc/key-information/press-release/2023/20230131e9a1.pdf

Investing.com (April, 2022) “สิงคโปร์ผ่านร่างกฎหมายคุมเข้มธุรกิจคริปโต”. Retrieved February 13,2023 from

https://th.investing.com/news/cryptocurrency-news/article-71746

Kenneth George Pereire and Lin Yingxin (September, 2022) “The Virtual Currency Regulation Review: Singapore”. Retrieved February 12,2023 from

https://thelawreviews.co.uk/title/the-virtual-currency-regulation-review/singapore

Monetary Authority of Singapore (January, 2022) “MAS Issues Guidelines to Discourage Cryptocurrency Trading by General Public”. Retrieved February 15,2023 from

https://www.mas.gov.sg/news/media-releases/2022/mas-issues-guidelines-to-discourage-cryptocurrency-trading-by-general-public

Monetary Authority of Singapore (October, 2022) “MAS proposes measures to reduce risks to consumers from cryptocurrency trading and enhance standards of stablecoin-related activities” Retrieved February 15,2023 from

https://www.mas.gov.sg/news/media-releases/2022/mas-proposes-measures-to-reduce-risks-to-consumers-from-cryptocurrency-trading-and-enhance-standards-of-stablecoin-related-activities

Narisara Suepaisal (November, 2021) “Digital Asset คืออะไร?” Retrieved February 3,2023 from

https://thematter.co/futureverse/futureword-digital-asset/160461

Polymesh (September, 2022) “A Spotlight on Digital Asset Regulation in Singapore”. Retrieved February 5,2023 from

https://polymesh.network/blog/a-spotlight-on-digital-asset-regulation-in-singapore

Puey Ungphakorn Institute for Economic Research (June, 2022) “ คนไทยถือครองคริปโทมากที่สุดในโลก?” Retrieved February 8,2023 from

https://www.pier.or.th/en/blog/2022/0601/

Securities and Futures Commission (November, 2018) “Regulatory standards for licensed corporations managing virtual asset portfolios”. Retrieved February 27,2023 from

https://www.sfc.hk/-/media/EN/files/ER/PDF/App-1---Reg-standards-for-VA-portfolio-mgrs_eng.pdf

The opportunities (October, 2022) “ฮ่องกงตั้งเป้าศูนย์กลางคริปโทฯ เตรียมอนุญาตนักลงทุนรายย่อยซื้อขาย สวนทางจุดยืนจีน ที่คริปโทฯ ยังผิดกฎหมาย”

Retrieved February 7,2023 from

https://www.finnomena.com/the-opportunity/news-update-28-10-2022-2/

TRM Insight (January, 2023) “2022: A Roaring Year for Digital Assets in Singapore”. Retrieved February 8,2023 from

https://www.trmlabs.com/post/2022-a-roaring-year-for-digital-assets-in-singapore

Zipmex.com (June, 2022) “13 ตลาด NFT ที่น่าจับตามอง แหล่งซื้อขาย NFT ยอดนิยม” Web Retrieved February 2,2023 From

https://zipmex.com/th/learn/nft-marketplace/

กรุงเทพธุรกิจ (สิงหาคม, 2565) “‘สิงคโปร์’ จาก Crypto hub สู่ 'เกณฑ์คุมเข้ม“. Retrieved February 1,2023 from

https://www.bangkokbiznews.com/columnist/1018485

จุฬาลงกรณ์มหาวิทยาลัย (มิถุนายน, 2565) “หยั่งอนาคตชาติ เข้าใจ “อัตลักษณ์ชาวดิจิทัลไทย” จุฬาฯ คว้ารางวัลผลงานวิจัยดีมาก จาก วช. ปี 2565” Web Retrieved February 1,2023 From

https://www.chula.ac.th/highlight/74984/

ฐานเศรษฐกิจดิจิทัล (สิงหาคม, 2565) “สศช. ผวา เด็กไทยแห่เล่นคริปโต สุดเสี่ยง หวังรวยเร็ว แต่ความรู้น้อยมาก” Retrieved February 6,2023 From

https://www.thansettakij.com/economy/538134

ตลาดหลักทรัพย์แห่งประเทศไทย (Feb, 2023) “ ข้อมูลสถิติทางธุรกิจหลักทรัพย์” Retrieved February 2,2023 from

https://www.set.or.th/th/market/statistics/market-statistics/trading-statistics

สำนักงานคณะกรรมการกำกับหลักทรัพย์และตลาดหลักทรัพย์ (กรกฎาคม, 2561) “ผู้ประกอบธุรกิจสินทรัพย์ดิจิทัล” Retrieved February 9,2023 From

https://www.sec.or.th/TH/pages/lawandregulations/digitalassetbusiness.aspx

สำนักงานคณะกรรมการกำกับหลักทรัพย์และตลาดหลักทรัพย์ (กุมภาพันธ์, 2566) “รายงานสรุปภาวะตลาดสินทรัพย์ดิจิทัล รายสัปดาห์” Retrieved February 23,2023 From

https://www.sec.or.th/TH/Pages/WEEKLYREPORT.aspx

สำนักงานคณะกรรมการกำกับหลักทรัพย์และตลาดหลักทรัพย์ (ธันวาคม, 2565) “ก.ล.ต. กับ ทิศทางการกำกับดูแลสินทรัพย์ดิจิทัล” . Retrieved January 21,2023 from

https://www.sec.or.th/TH/Template3/Articles/2565/081265.pdf

สำนักงานคณะกรรมการกำกับหลักทรัพย์และตลาดหลักทรัพย์ (มกราคม, 2562) “ผลิตภัณฑ์เพื่อการลงทุน: สินทรัพย์ดิจิทัล” Retrieved February 9,2023 From

https://www.sec.or.th/th/pages/investors/digitalassetproduct.aspx

สำนักงานส่งเสริมเศรษฐกิจเศรษฐกิจดิจิทัล (ดีป้า) (พฤษภาคม, 2562) “Getting to know Cryptocurrency”. Retrieved February 7,2023 from

https://www.depa.or.th/th/article-view/article-getting-know-cryptocurrency

Appendix

Appendix: Glossary of terms

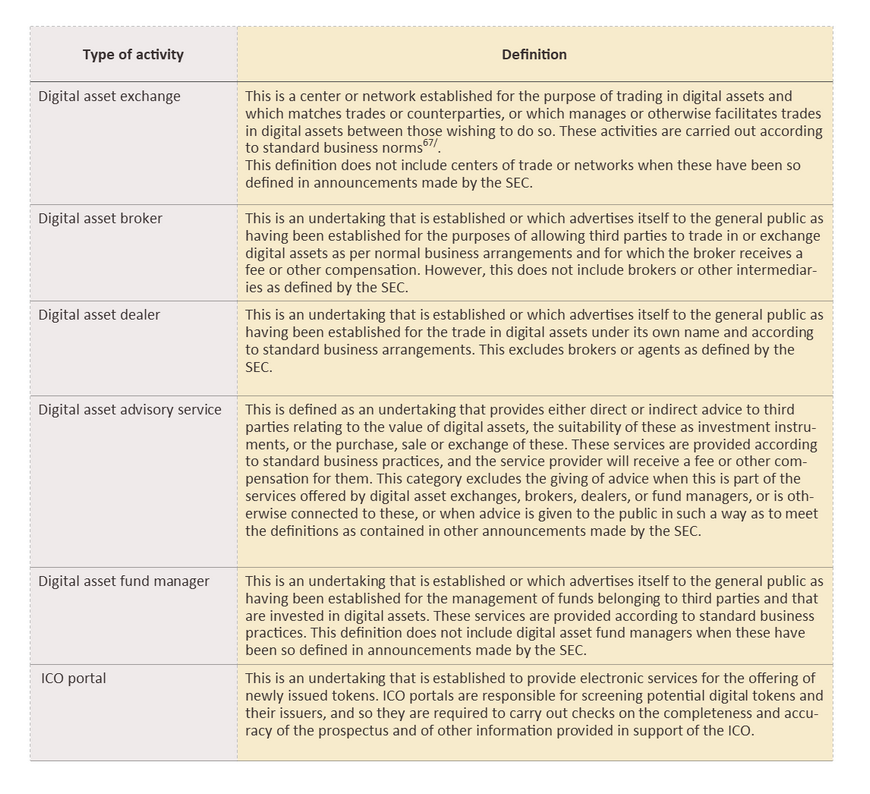

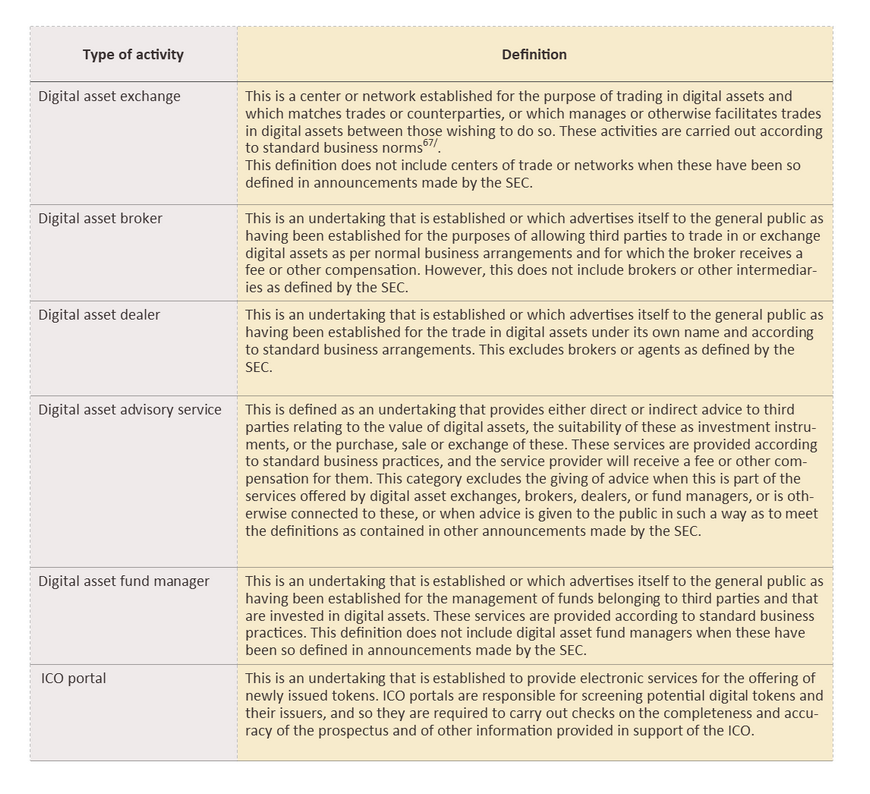

The Securities and Exchange Commission (SEC) has defined a “digital asset business operator” as a licensed operator of a digital asset business. This definition excludes operators who are defined as commercial banks under the law on financial institution, insurance companies identified as such under insurance law, or securities companies as defined in the securities and exchange law

66/.

1/ Data on the number of accounts is from the SEC’s weekly report on digital asset activity, published 8 July 2022. For more information, please see https://www.sec.or.th/TH/PublishingImages/Pages/WeeklyReport/DAWeeklyReport20220708.jpg

2/ Data on the number of accounts comes from the table ‘Trading Statistics 2022’ published on the website of the Stock Exchange of Thailand. For more details, please see https://www.set.or.th/th/market/statistics/market-statistics/trading-statistics

3/ https://www.bloomberg.com/news/articles/2022-07-01/crypto-hedge-fund-three-arrows-files-for-chapter-15-bankruptcy

4/ https://www.forbes.com/sites/forbesstaff/article/the-fall-of-ftx/?sh=7248de297d0c

5/ https://www.bbc.com/news/technology-64343377

6/ https://www.bbc.com/news/business-59636958

7/ https://cryptopotato.com/bank-of-america-has-no-plans-to-offer-crypto-services/

8/ https://forexsuggest.com/crypto-acceptance-report/

9/ Assuming an exchange rate of 34 THB to 1 USD.

10/ https://www.nesdc.go.th/ewt_dl_link.php?nid=13504&filename=social_outlook

11/ https://repository.nida.ac.th/bitstream/handle/662723737/5133/b210812.pdf?sequence=1&isAllowed=y

12/ https://km.cm.mahidol.ac.th/archives/10626

13/ https://khonthai4-0.net/system/resource/file/yjohq_content_attach_41.pdf?date=2022-05-25%2014:00:51.1

14/ https://khonthai4-0.net/system/resource/file/yjohq_content_attach_41.pdf?date=2022-05-25%2014:00:51.1

15/ https://www.sec.or.th/TH/Documents/ActandRoyalEnactment/RoyalEnactment/enactment-digitalasset2561.pdf

16/ https://www.sec.or.th/TH/Documents/ActandRoyalEnactment/Act/act-sea2535-codified.pdf

17/ Native coins are coins that are used on that particular blockchain. Thus, Bitcoin (the oldest cryptocurrency) is the native coin of the Bitcoin blockchain, while Ether (ETH) is Ethereum’s native coin.

18/ DeFi refers to a newly emerging understanding of how decentralized financial services might be structured, with users themselves jointly responsible for maintaining the system and for managing and settling transactions. For more information, please see “Traditional Banking and DeFi: What Role will be Left for Banks if the Financial System is Disintermediated? ”

19/ https://www.sec.or.th/TH/Documents/DigitalAsset/digitalasset_summary.pdf

20/ https://www.sec.or.th/Documents/PHS/Main/867/hearing042566.pdf

21/ An NFT that does not specify a right to a product, service, or another benefit is not classified as a utility token and is not subject to regulation under the Royal Decree on the Digital Asset Businesses B.E. 2561 (2018).

22/ For more information and analysis, please see “The role of banks in the new world of NFTs”

23/ Stablecoins are a type of digital asset that has a fixed value because it is backed by a secondary asset, such as a fiat currency, a commodity, or another cryptocurrency.

24/ For more information, please see “Central Bank Digital Currencies: A Challenge for Commercial Banks”

25/ https://www.ft.com/content/0e0dc602-af91-4253-a230-c1598781b3b4

26/ For more information, please see https://www.longfinance.net/media/documents/GFCI_32_Report_2022.09.22_v1.0_.pdf

27/ https://www.cnbc.com/2022/08/29/singapore-considers-tightening-cryptocurrency-trading-by-retail-investors.html

28/ MAS has defined a digital token as “Digital representations of value that do not have a physical form, and are typically maintained using blockchain

technology”. For more information, please see: https://www.mas.gov.sg/-/media/MAS-Media-Library/who-we-are/mas-gallery/MAS-Gallery/Digital-Payment-Tokens.pdf

29/ https://www.mas.gov.sg/news/speeches/2021/payment-services-amendment-bill

30/ For more information, please see https://www.mas.gov.sg/news/speeches/2022/explanatory-brief-for-financial-services-and-markets-bill-2022

31/ https://www.straitstimes.com/business/singapore-was-second-biggest-user-of-ftx-pre-collapse-averaging-240000-unique-visitors-a-month

32/ The consultation process focused on “Payment services based on digital tokens”, with 3 areas in particular highlighted: (i) consumer access, (ii) business operations, and (iii) technology. The process also included discussion of “Regulation of stablecoins”. For more details, please see https://www.mas.gov.sg/publications/...

33/ With effect from January 2022. For more details, please see https://www.mas.gov.sg/-/media/...

34/ This was proposed by the MAS and is included in the consultation document under ‘Risk awareness assessment’.

35/ Singaporean banks are allowed to issue single-currency stablecoins and these are exempt from the regulations governing capital requirements and liquidity in the case that: (i) the stablecoin remains on the bank’s balance sheet as a liability and is issued only as a coin or in a tokenized form; and (ii) the bank abides strictly by the MAS’s other requirements for reserves and liquidity.

36/ Additional requirements include the need to maintain: (i) capital of at least SGD 1 million (approximately THB 25 million) or at least 50% of annual operating expenses, and (ii) liquid assets worth at least 50% of annual operating expenses or of the expenses likely to result from the issuer ceasing trading.

37/ https://bitcoinaddict.org/2022/02/15/singaporean-megabank-dbs-works-on-expanding-bitcoin-trading-to-retail/

38/ https://fintechnews.hk/19799/blockchain/hong-kong-intends-to-win-back-role-as-digital-asset-hub/

39/ The ‘green bond’ is a bond issued to raise funds for environmental projects or to promote conservation.

40/ A virtual asset is defined as ‘a cryptographically secured digital representation of value’.

41/ This has been postponed from 1 March, 2023 https://www.hkma.gov.hk/media/eng/doc/key-information/guidelines-and-circular/2022/20221207e1.pdf

42/ https://finance.yahoo.com/news/hong-kong-unveils-policies-develop-093000078.html

43/ https://www.coindesk.com/policy/2022/11/02/hong-kong-wants-to-be-a-crypto-hub-again/

44/ A professional investor is defined as an investor holding a portfolio worth more than HKD 8 million, or around USD 1 million.

45/ These are OSL and HashKey Pro, which were licensed in 2020 and 2022 respectively. Source: https://www.sfc.hk/en/Welcome-to-the-Fintech-Contact-Point/List-of-licensed-virtual-asset-trading-platforms

46/ https://www.coindesk.com/consensus-magazine/2023/01/25/asia-crypto-regulation/

47/ https://www.legco.gov.hk/yr2022/english/bc/bc05/papers/bc05cb1-629-1-e.pdf

48/ As of 21 February, 2023, this was still in the process of consultation, with this due to run until 31 March, 2023. For more details, https://apps.sfc.hk/edistributionWeb/api/consultation/openFile?lang=EN&refNo=23CP1

49/ The SFC consultation document dated 20 February, 2023, mentions controls on advertising: (i) advertising should not contain misleading or deceptive information, and (ii) platform operators should not advertise specific types of digital assets.

50/ From the SFC consultation document. “Eligible large-cap virtual assets” refers to assets that appear in at least two accepted cryptocurrency indices created by organizations that are independent of one another. The consultation document indicates that these indices should be investible and should have sufficient levels of liquidity.

51/ As of 21 February, 2023. Source: https://www.businesstimes.com.sg/international/hong-kong-plans-let-retail-sector-trade-larger-crypto-tokens-bitcoin

52/ PwC Global Crypto Regulation Report 2023, accessible at: https://www.pwc.com/gx/en/new-ventures/cryptocurrency-assets/pwc-global-crypto-regulation-report-2023.pdf

53/ For further details, please see https://www.hkma.gov.hk/media/eng/doc/key-information/press-release/2023/20230131e9a1.pdf

54/ https://www.bot.or.th/landscape/paper/resilient/new-risks/

55/ https://www.globallegalinsights.com/practice-areas/blockchain-laws-and-regulations/hong-kong However, although cryptocurrencies are not yet legal tender, a survey by Visa carried out in 2021 shows that 18% of Hong Kong respondents use cryptocurrencies as a means of payment for the sale or purchase of goods and services. For more details, please see: https://www.visa.com.hk/en_HK/about-visa/newsroom/press- releases/visa-study-consumers-in-hong-kong-see-crypto-as-the-financial-way-of-future-and-investment-diversification.html

56/ https://www.bot.or.th/Thai/PressandSpeeches/Press/2021/Pages/n1664.aspx

57/ https://www.infoquest.co.th/2022/234585

58/ The SEC is considering applying this to Thailand. Source: https://mgronline.com/stockmarket/detail/9650000103751

59/ https://apps.sfc.hk/edistributionWeb/api/circular/openAppendix?lang=EN&refNo=19EC42&appendix=0

60/ https://www.bot.or.th/Thai/FIPCS/Documents/FPG/2565/ThaiPDF/25650188.pdf

61/ https://gia.info.gov.hk/general/202210/31/P2022103000454_404805_1_1667173469522.pdf

62/ https://www.coindesk.com/consensus-magazine/2023/01/26/south-korea-national-assembly-crypto-debate-regula

63/ https://forkast.news/south-korea-crypto-law-what-we-know-so-far/

64/ https://www.coindesk.com/policy/2022/12/07/south-koreas-central-bank-wants-to-oversee-stablecoins-report/

65/ https://cointelegraph.com/news/south-korea-to-deploy-cryptocurrency-tracking-system-in-2023

66/ https://www.sec.or.th/TH/pages/lawandregulations/digitalassetbusiness.aspx

67/ Investors can buy and sell digital assets through the exchange as usual.