Introduction

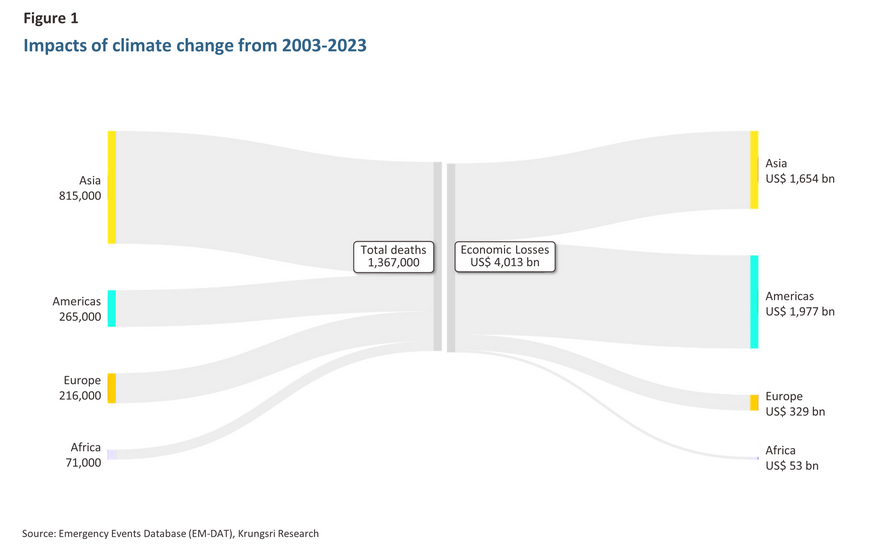

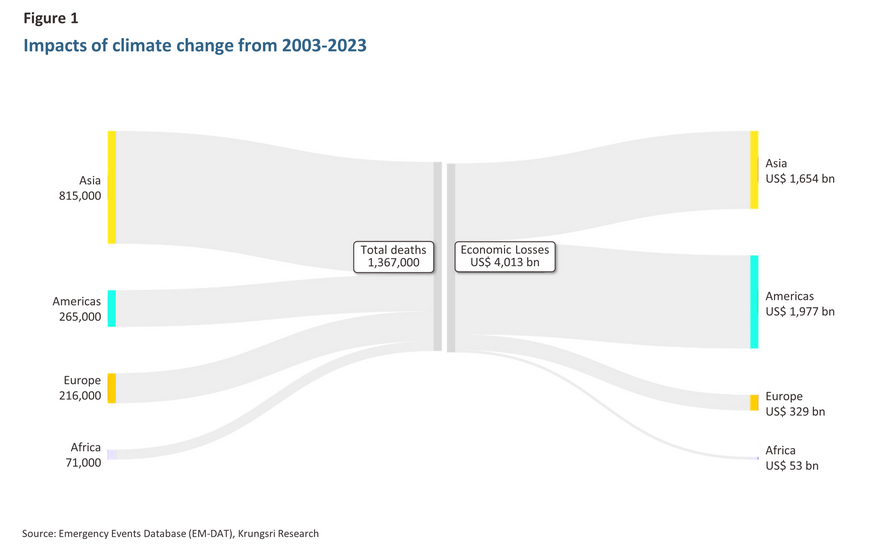

Asia is one of the regions most severely impacted by climate change, experiencing extreme effects both in terms of mortality and economic damage. Addressing climate change requires international collaboration, as the issue has evolved from global warming to the era of global boiling. In response, countries around the world, including ASEAN1/ member states, have demonstrated collaboration by signing the Paris Agreement on Climate Change2/ at COP263/. They have pledged to limit the global temperature rise to below 2 degrees Celsius and have committed to achieving this goal through Net Zero Emissions and Carbon Neutrality Targeting.

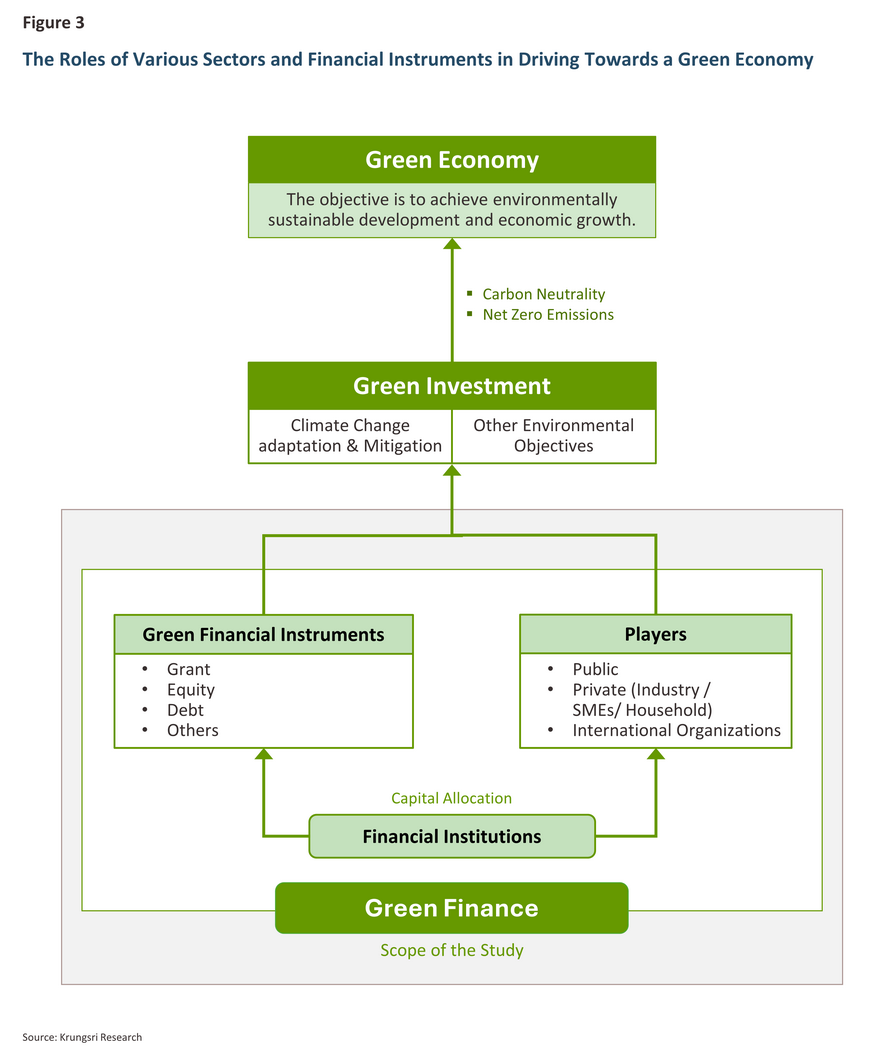

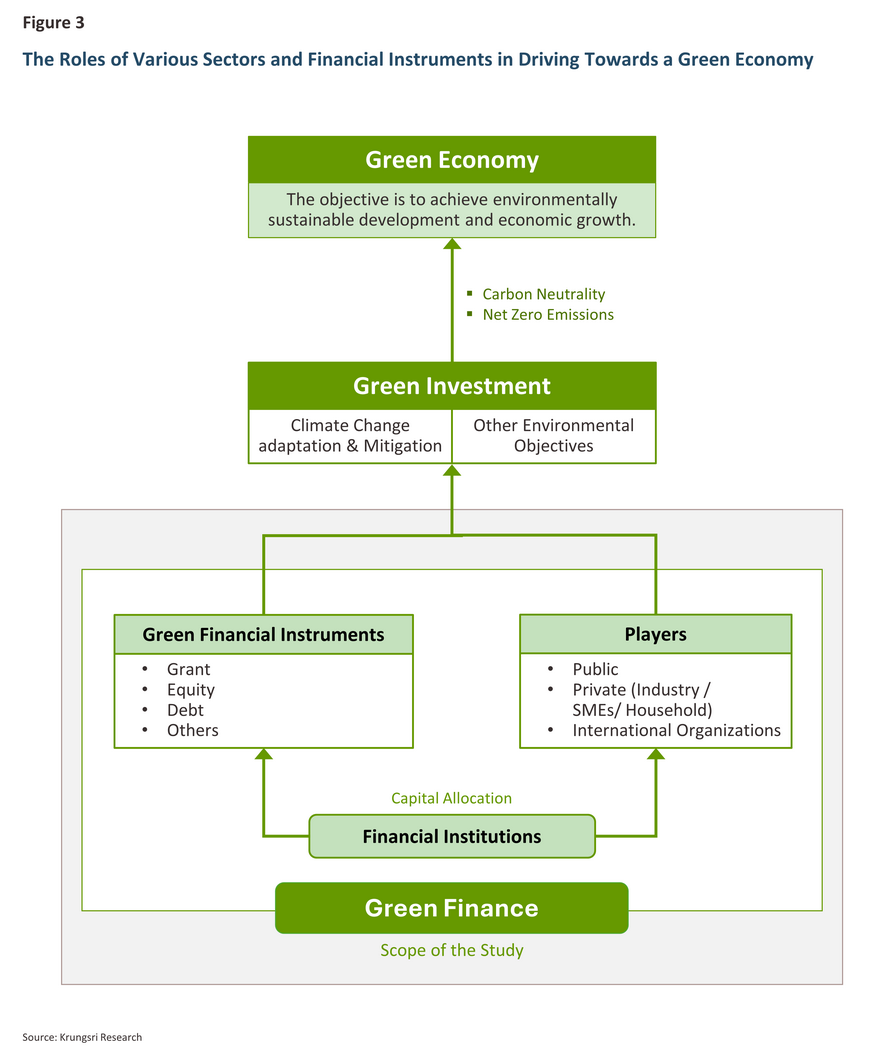

This global effort has amplified the importance of the "Green Economy" concept. According to the United Nations Environment Programme (UNEP), green economy is “one that results in improved human well-being and social equity, while significantly reducing environmental risks and ecological scarcities.” The World Bank further elaborates that a green economy aims to balance economic development and environmental protection. Accelerating the transition to a green economy requires capital to stimulate Green Investment and this is where "Green Finance"4/ plays a crucial role.

This article analyzes various aspects of green finance, including: (1) the roles of various sectors and financial instruments in driving towards a green economy, (2) the development of green finance in ASEAN, (3) opportunities for the banking sector in the green finance market, and (4) the challenges of the green finance market. The article will focus on six ASEAN member countries: Indonesia, Malaysia, the Philippines, Singapore, Thailand, and Vietnam.

The Roles of Various Sectors and Financial Instruments in Driving Towards a Green Economy

Economic players can facilitate the transition to a green economy through behavioral changes to reduce greenhouse gas emissions, as well as through green investments that generate financial returns and positive environmental impacts. Investment in environmental projects includes renewable energy, energy efficiency, clean technologies, sustainable agriculture, waste management, water conservation, etc.

The Roles of Various Sectors

-

Public Sector can support environmental investments through domestic policy-making and by laying the groundwork for both physical and regulatory infrastructure. These actions help other sectors engage in green investments and initiate green economic activities. Moreover, the government should play a leadership role in environmental investments, acting as a catalyst to encourage private sector investment.

-

Private Sector can integrate environmental considerations into their decision-making processes, particularly when it comes to investments aimed at developing technologies or processes that reduce, limit, capture, or eliminate greenhouse gas emissions. While the initial costs may be significant, these investments are expected to decrease over time.

-

Small and Medium-sized Enterprises (SMEs) and Households can contribute by altering their production and consumption patterns towards more environmentally friendly practices, as well as adopting renewable energy sources.

-

For International Cooperation, most economies globally have signed the Paris Agreement on Climate Change, establishing their own Nationally Determined Contributions (NDCs) as targets for reducing greenhouse gas emissions. This international commitment fosters collaboration on data sharing and financial support through established international funds, in addition to driving change through community efforts.

Given that environmental investments require substantial capital, the Financial Sector—including financial institutions, capital markets, and other funding sources—plays a critical role as an intermediary in green financing, as well as developing and offering green financial products and services tailored to consumers. This not only encourages businesses and households to alter their behavior in the short to medium term but also supports balancing between the risks posed by climate change and long-term financial stability.

Financial Instruments for Green Investments: ASEAN Context

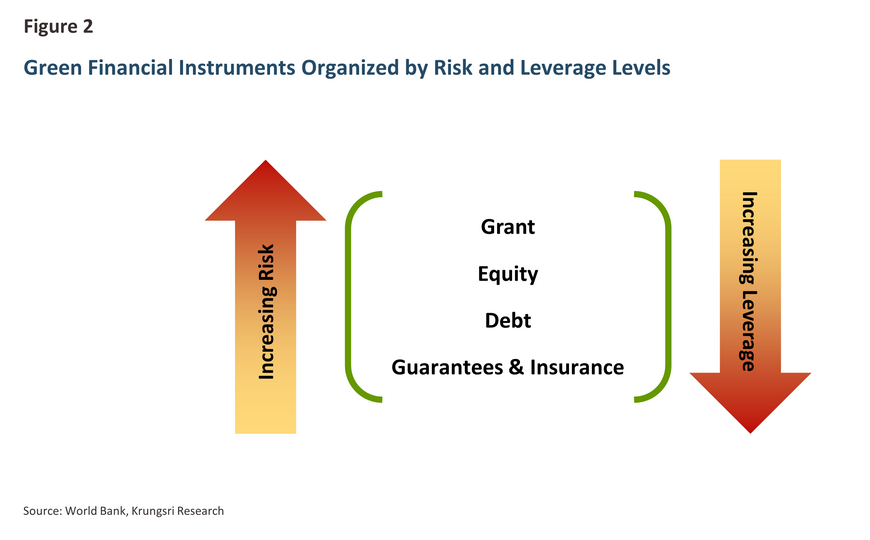

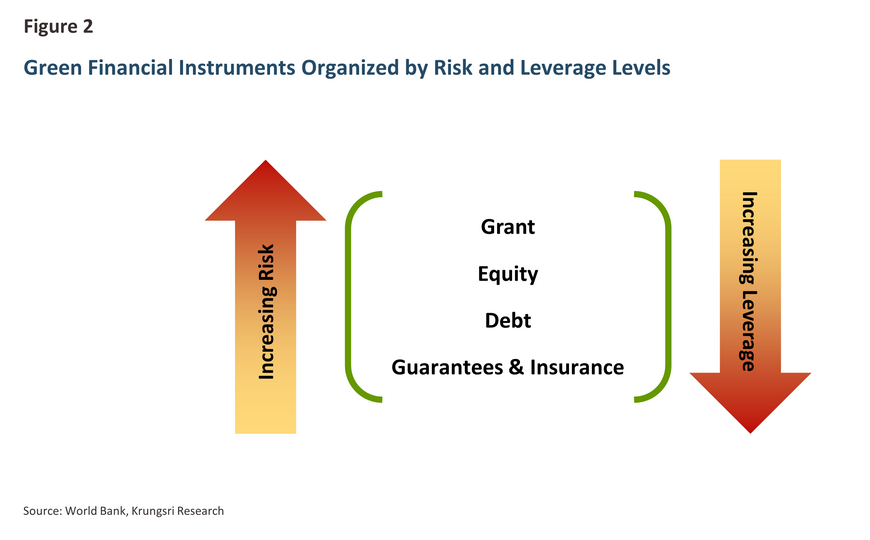

The diverse funding needs across sectors have led to the development of green financial instruments tailored for different types of green investments. The World Bank and the Climate Bonds Initiative (CBI)5/ distinguish these green financial instruments as follows:

1) Grant, typically provided by governments or environmental agencies, are used to incentivize or leverage private sector investments in green projects. In some cases, these grants act as subsidies to cover a set amount of first loss. For grants, there is no obligation to repay the funds, thereby resulting in a lack of incentives for the project developer to deliver a viable project.

2) Equity instruments are forms of capital investing in exchange for an ownership interest. They are frequently used in early-stage or high-risk projects. Investors in equity instruments typically expect high financial returns upon the project's success. Examples of such instruments include Stocks, Public-Private Partnerships (PPP), and Private Equity6/.

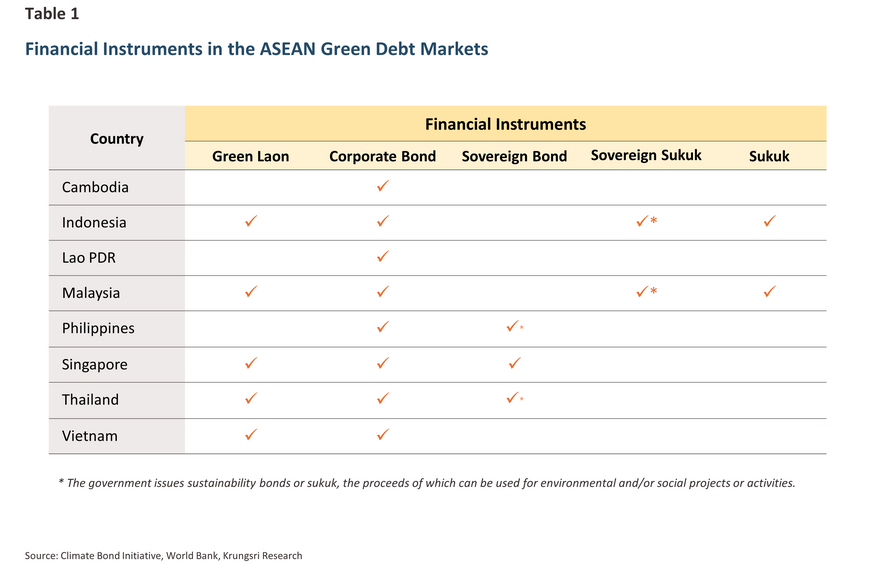

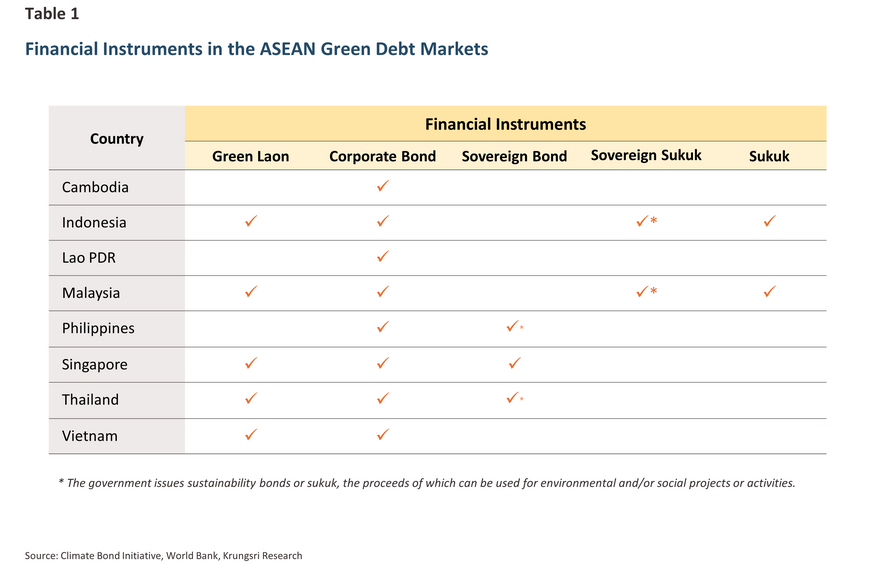

3) Debt instruments are forms of borrowing financing, typically suitable for low-risk projects or those that are assessed to be able to meet their obligations to repay due principal and interest to creditors. The instruments comprise Green Loans, Green Bonds—including Green Corporate Bonds and Green Sovereign Bonds—and Islamic financial instruments like Green Sukuk7/.

In addition to the aforementioned green financial instruments, other sustainable financial instruments have been developed to raise funds for projects or initiatives with broader objectives, encompassing multiple sustainability goals, including Environmental, Social, and Governance (ESG) through a single fundraising round. These include Sustainability Bonds, which enable borrowers to finance projects related to environmental conservation and/or social development, and Sustainability-linked Loans and Bonds, which feature conditions for adjusting returns based on the borrowing company’s sustainability achievements or performance8/.

4) Other Financial Instruments serve as risk-sharing mechanisms or for enhancing project credibility, which in turn helps increase their borrowing capacity in green projects. Examples include Credit Guarantees, Risk-sharing Facilities, and Default Swaps.

In addition to these financial instruments, environmental agencies and related regulatory bodies in various countries, as well as international fora, have established Taxonomies for sustainable finance, a classification system that defines criteria for environmentally friendly economic activities, to serve as a reference tool to provide clarity and confidence in environmental projects. In ASEAN, collaboration under the ASEAN Finance Ministers’ and Central Bank Governors’ Meeting has led to the development of the ASEAN Taxonomy for Sustainable Finance (ASEAN Taxonomy). To date, three versions of ASEAN Taxonomy have been published9/, covering guiding principles and frameworks, as well as detailed guidelines for assessing economic activity of focused sectors, namely Electricity, gas, steam, and air conditioning supply; Transportation and storage; Construction and real estate activities; Agriculture, forestry and fishing; Manufacturing; and Water supply, sewerage, waste management and remediation activities.

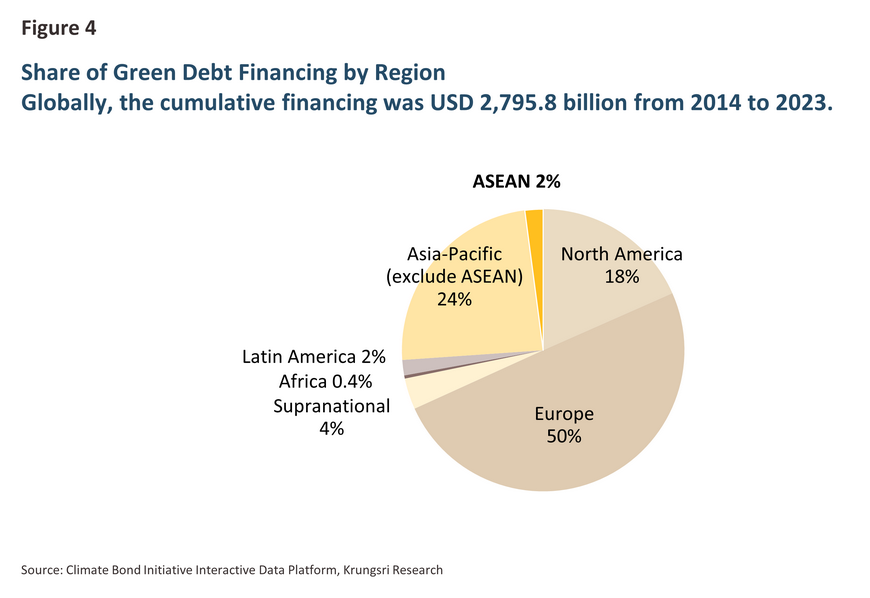

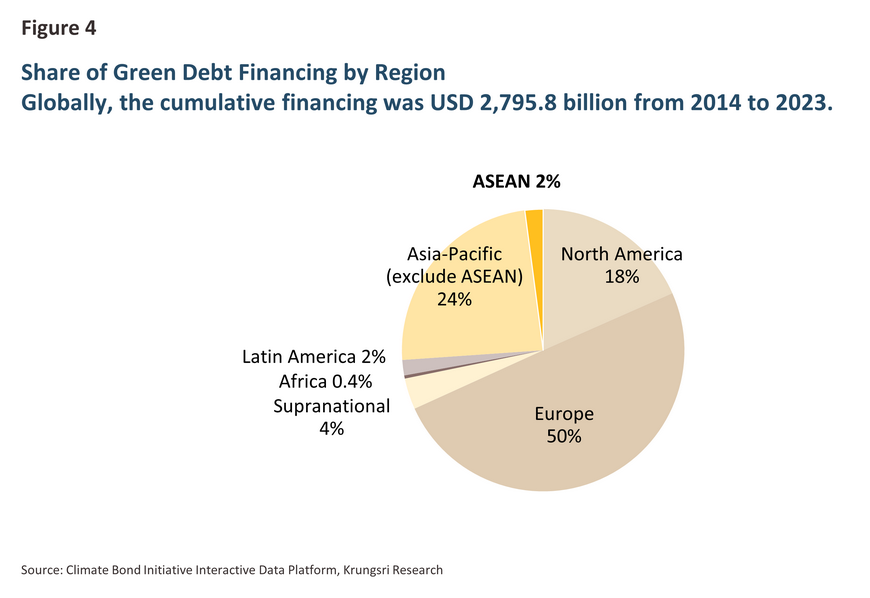

Among green financial instruments, debt instruments have gained the most popularity in ASEAN and are more suited to the region's environmental investment context compared to equity instruments. Several reasons contribute to this preference. First, the regulatory framework for debt instruments is the most developed among green financial instruments and various ASEAN countries are actively focusing on enhancing their regulations for green bonds. This creates a supportive regulatory landscape for debt-based financing. Second, investors find it easier to track environmental performance from debt issuers compared to equity-based financing. Equity investments, especially when the business’s primary focus is not environmental operations, often require more complex processes for disclosing and verifying the utilization of funds. Third, equity instruments are frequently used to raise capital for projects involving specialized environmental technologies and are in the early development stage or for high-risk green projects. Such projects are less widespread in ASEAN compared to developed countries. Fourth, government support, including subsidies and tax incentives for investment in green debt instruments, is a crucial factor drawing economic players towards these instruments. As a result, financial instruments for green investment in ASEAN have mainly focused on the development of debt instrument markets.

The Development of Green Investment and Green Finance in ASEAN

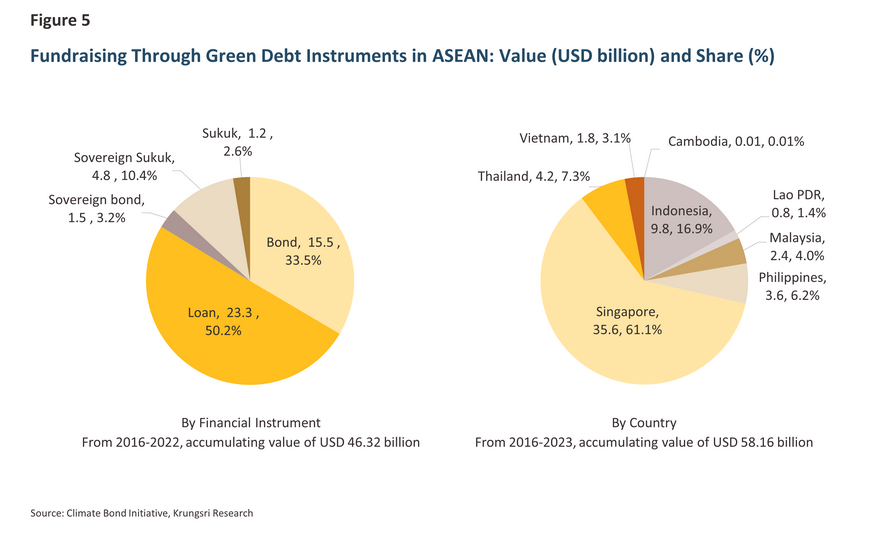

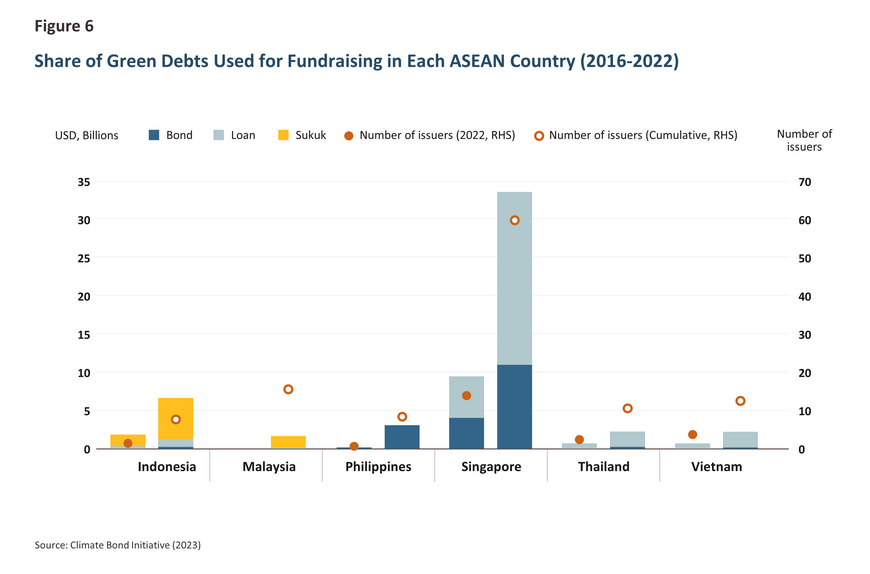

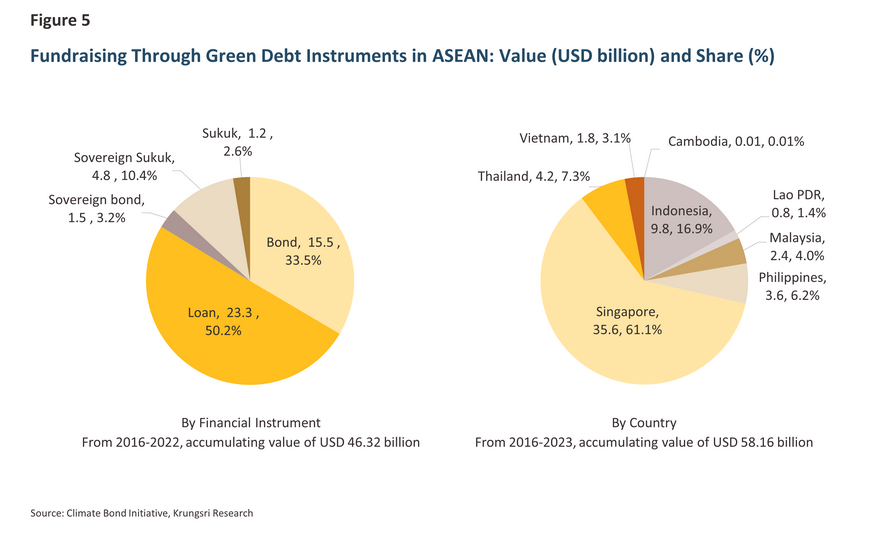

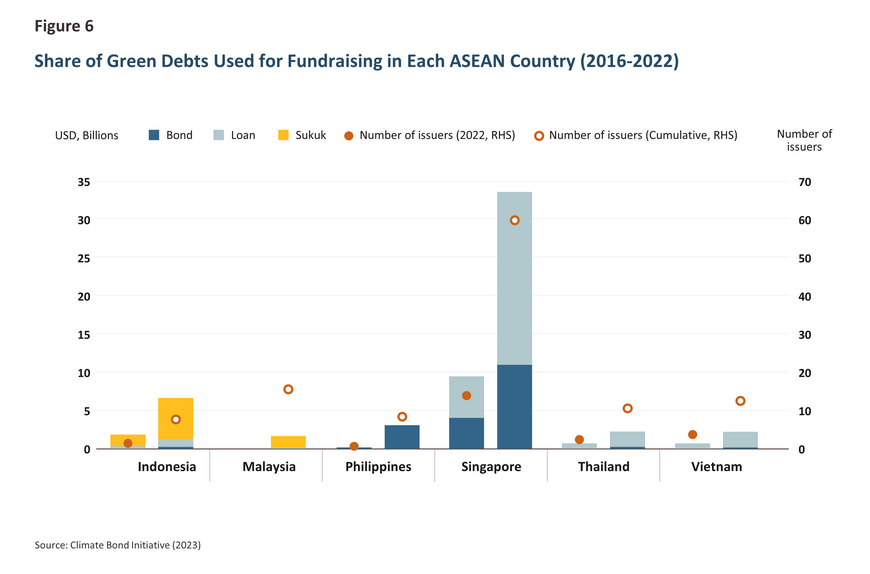

From 2016 to 2023, ASEAN member countries have issued approximately USD 58.16 billion in green debt instruments, accounted for only 2% of total green debt financing globally10/. Six key countries—Indonesia, Malaysia, the Philippines, Singapore, Thailand, and Vietnam—have consistently issued green financial products since 2016. During this period, we have observed significant growth in market size and the diversification of financial instruments, including green loans, green corporate bonds, green sovereign bonds, and green sukuks. Additionally, a broader range of players has entered the market, financing a wider variety of green projects across different sectors.

The Development of Green Debt Instrument Market by Types of Financial Instruments

-

Green Loans have accounted for the highest share of green financing in ASEAN, with more than 80% of funds raised by non-financial corporations. The remainder was raised by private financial corporations and state-owned enterprises. However, green loans have limited disclosure, resulting in a lack of information regarding the transaction and the utilization of funds.

-

Green Bonds, comprising green corporate bonds issued by the private sector and green sovereign bonds issued by governments or state-owned enterprises. In ASEAN, green bonds are the second preferred financial instrument after green loans. However, their issuers are more diversified—including private financial institutions, non-financial corporations, national and local governments, state-owned enterprises, and multinational development banks which has enabled green financing for a wide range of environmental projects. Approximately half of the green bonds have been issued by non-financial corporations. Furthermore, financial institutions and governments have taken on a more significant role in utilizing this instrument compared to green loans. For example, the Singaporean government issued its first green sovereign bond in 2022, and both the Thai and Philippine governments have issued sustainability bonds, which channel funds toward green and/or social projects.

-

Green Sukuk also plays a significant role, accounting for about 13% of the green debt in ASEAN’s green finance market. Green sukuks are particularly popular in Indonesia and Malaysia, where both the public and private sectors widely use them for fundraising. Going forward, the green sukuk is likely to remain the most preferred green financial instrument in these two countries.

The Development of Green Debt Instrument Markets by Country

-

Singapore has issued the highest value of green debts, accounting for approximately 61% of the total value in ASEAN. With the government's goal of making Singapore the green finance hub of ASEAN11/, Singapore’s green debt market has grown exponentially since 2019. Another key factor is its long-standing status as one of the world’s leading financial hubs, which means that a large number of large financial institutions stand ready to offer green investment products and services. This has led to rapid growth in the market, particularly in green loans across various currencies for investments, especially in green building projects12/.

-

Indonesia ranked second in terms of green debt issuance value in ASEAN. Indonesia's primary player has been its government, which has continuously issued green sukuks from 2018 to 2023. These green sovereign sukuks make up over three-quarters of the country's green debt financing, with investments spanning various sectors such as energy, green building construction, eco-friendly transportation, and waste management. As such, Indonesia's green finance market is largely driven by the public sector.

-

Thailand has private corporations dominate the green finance market. More than half of the funds raised are being allocated to the energy sector. Whereas the Thai government issued its first sustainability bond in 2020, which financed the MRT mass transit orange line (environmental project) and the Covid-19 relief package for those affected (social project). Between 2018 and 2023, green bonds and sustainability bonds accounted for approximately 23% and 65% of total sustainable bond market issuances, respectively13/.

-

The Philippines was the first country in the region to pioneer green corporate bond issuance in 2016, the market has grown slowly though, trailing behind Singapore, Indonesia, and Thailand. The Philippines' green finance market is less diversified, consisting solely of green corporate bonds. However, the Philippine government has begun to take a more active role in promoting green project financing, evidenced by the issuance of its first sustainability bond in 2022.

-

Malaysia is a global leader in Islamic green finance, being the first country to pioneer the issuance of green sukuks in 2017 and maintaining the largest green sukuk issuance globally until 2020. Though the majority of green sukuks in Malaysia, over 87% of the green debt market, were issued by the private sector, the Malaysian government entered the market in 2021 with the issuance of a sustainability sukuk aimed at financing environmental and/or social projects.

-

Vietnam green debt market represents approximately 4% of ASEAN’s total. Green loans were the sole green financing tool from 2016 until the first issuance of green bonds in 2021. The increasing diversity in financial instruments reflects the evolving development of Vietnam’s green finance market. Additionally, the government has started prioritizing sustainable development goals and is working to strengthen its green financing framework, particularly for infrastructure and renewable energy projects.

-

Lao PDR and Cambodia issued their first green bonds in 2023. Despite contributing only 1% of ASEAN's total value, it marks a significant milestone for both countries and a great development of ASEAN's green finance market.

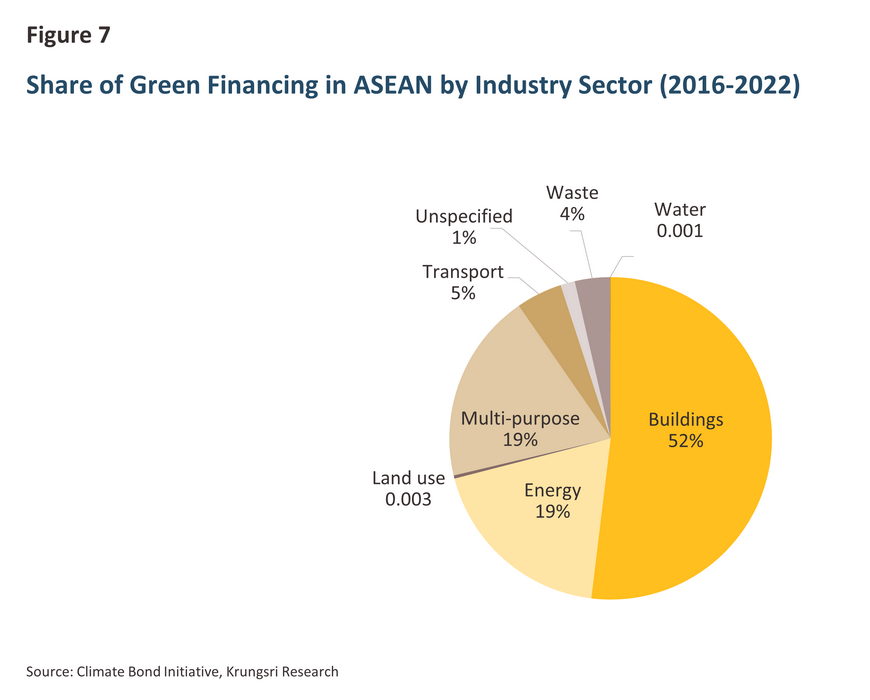

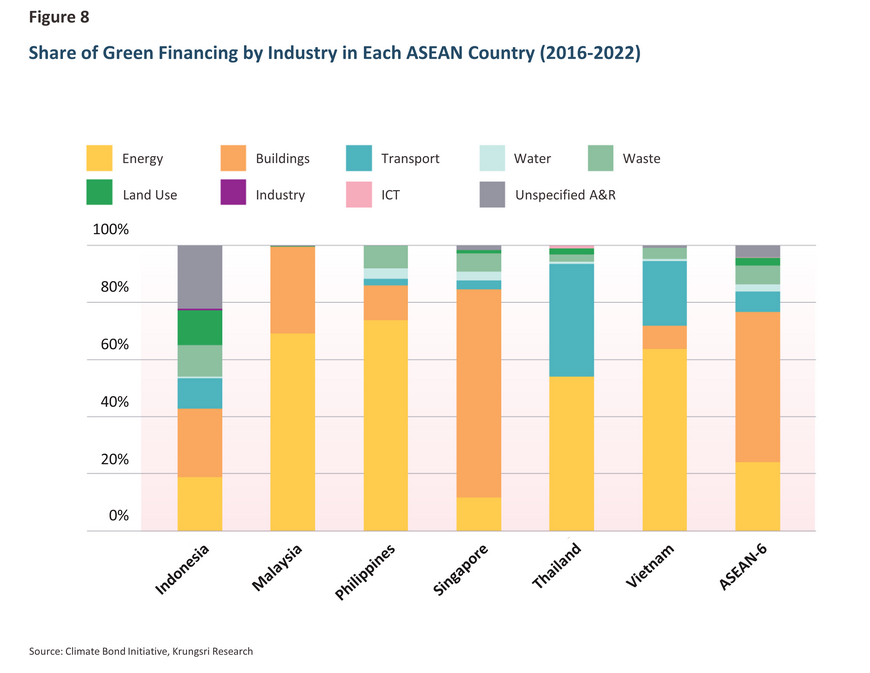

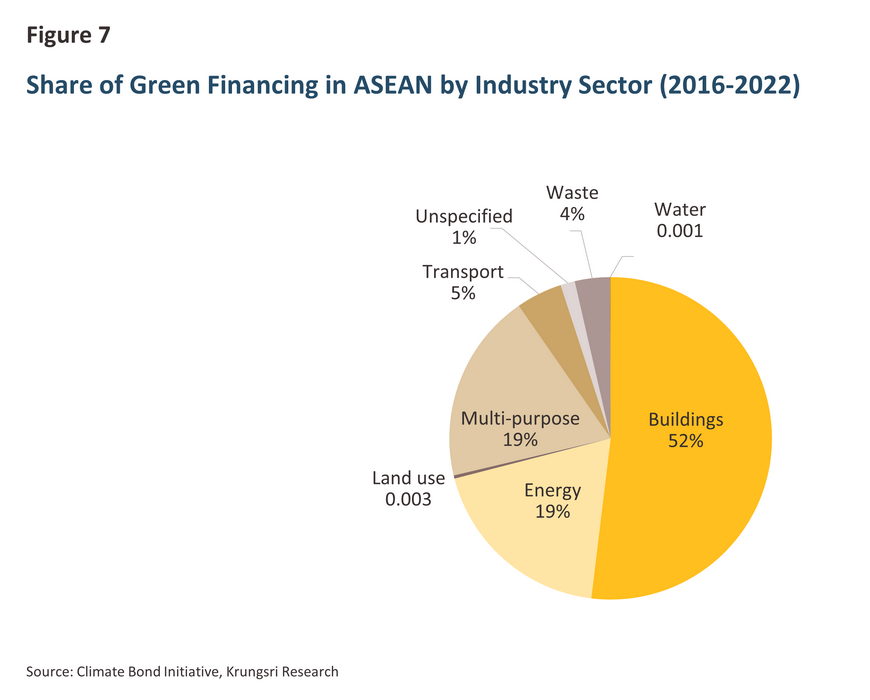

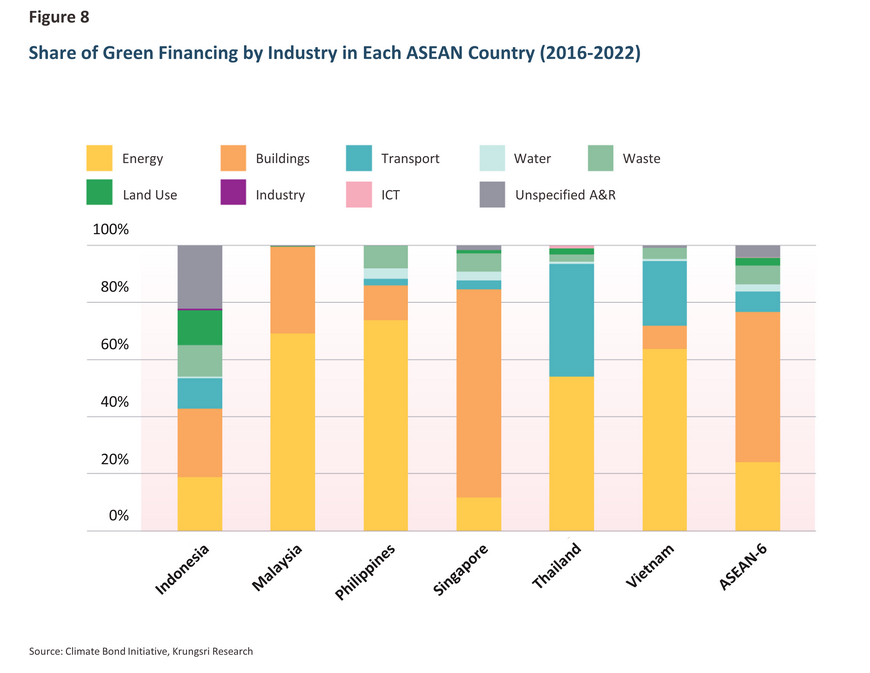

The Development of Green Financing in ASEAN's Industries (2016-2022)

The allocation of green financing across various industries in ASEAN has become increasingly diversified, spanning sectors such as renewable energy, green building, transportation, water resource management, manufacturing, waste management, and land use, etc. However, most projects still focus on established technologies rather than developing new ones.

Green building projects have received the largest share of green financing in ASEAN, followed by the energy sector. Together, these two sectors account for more than 80% of the green financing in the region. However, when considered by country, over 80% of the financing for green building projects came solely from Singapore, which has the largest green finance market in ASEAN. In addition, the financing of green building projects is mainly funded from green loans; therefore, it cannot reflect the development of green debt financing for industries in the region. In contrast, countries, namely Malaysia, Thailand, Vietnam, and the Philippines, tend to allocate most of their green financing to energy projects, with more than 50% of green financing in each country directed toward energy. This trend mirrors global patterns in green financing, where the energy sector attracts the most funding, followed by green building projects and transportation.

Green financing to other industries varies based on the specific context of each country. In Indonesia, where the government plays a leading role, the objective of green financing is more equitably allocated across diverse sectors compared to its peers. Although financing for energy and green buildings has the largest share, the size of green financing for transportation, waste management, and land use is relatively similar. This is a result of the Indonesian government’s attempt to diversify funds to many industrial sectors via green sukuk, reflecting a maturing market where financing meets the various needs of industries.

Despite these developments, the endeavor to create a green economy in ASEAN still requires massive green investment, particularly from the private sector across all industries. Therefore, accelerating the mobilization of green finance in various industries presents both an opportunity and a responsibility for organizations with fundraising potential, with the banking sector playing a key leadership role.

Potential Growth of Green Finance and Opportunities for the Banking Sector in ASEAN

The green finance sector in ASEAN holds significant growth potential. The United Nations estimates the market size for green finance in ASEAN between 2016 and 2030 at approximately USD 2.3 to 3 trillion14/. However, by the end of 2023, the actual figure reveals a large gap, with the green financing gap estimated to be around USD 2.25 to 2.95 trillion15/. This gap presents both an opportunity and a necessity for financial institutions, particularly banks, to play a pivotal role as financial intermediaries, fundraising and financing to support the transition of ASEAN toward a green economy.

During this transitional period, industries across the board will increase green investment substantially. This provides an opportunity for the banking sector to offer innovative green financial instruments that comply with international standards, are recognized by investors, and are tailored to meet the unique needs of different customer segments. Tailored financing solutions can be offered to industries, SMEs, and even households. The key lies in providing the appropriate financial tools for each industry, considering differences in fundraising requirements, the scale of investment, investment horizon, and the target investors, etc.

In addition to traditional lending, banks can (1) integrate multiple financial instruments to suit the financed green projects, such as Blended Finance, which combines capital from multiple sources, or Syndicated Loans, which arrange financing with other financial institutions; (2) offer risk-sharing mechanisms or credibility-enhancing mechanisms, such as Credit Guarantees, Risk-sharing Facilities, and Default Swaps, to render green investments more appealing; and (3) offer financial products focused on addressing specific environmental challenges, for example, Catastrophe Bonds—financial instruments for natural disaster risk management; Blue Bonds—ocean financing instruments for marine environment and resource conservation; and Sustainable Supply Chain Finance16/—a financial instrument for sustainable supply chain management. These products offer banks ample opportunities for further innovation in the green finance sector.

Opportunities for the banking sector in providing green financial products for industrial sector investment and the allocation of funds to SMEs and households are as follows:

1) Opportunities for Green Investment in the Industrial Sector

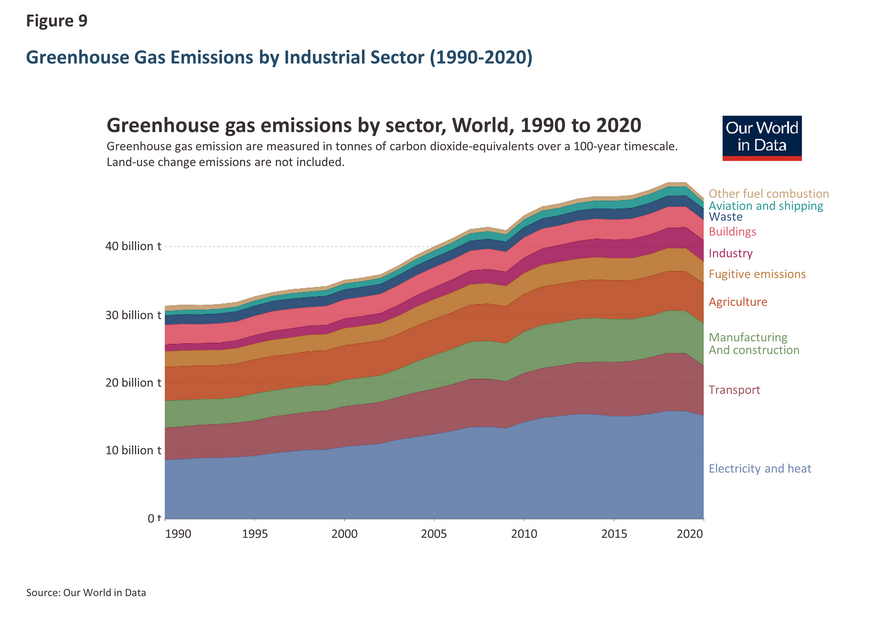

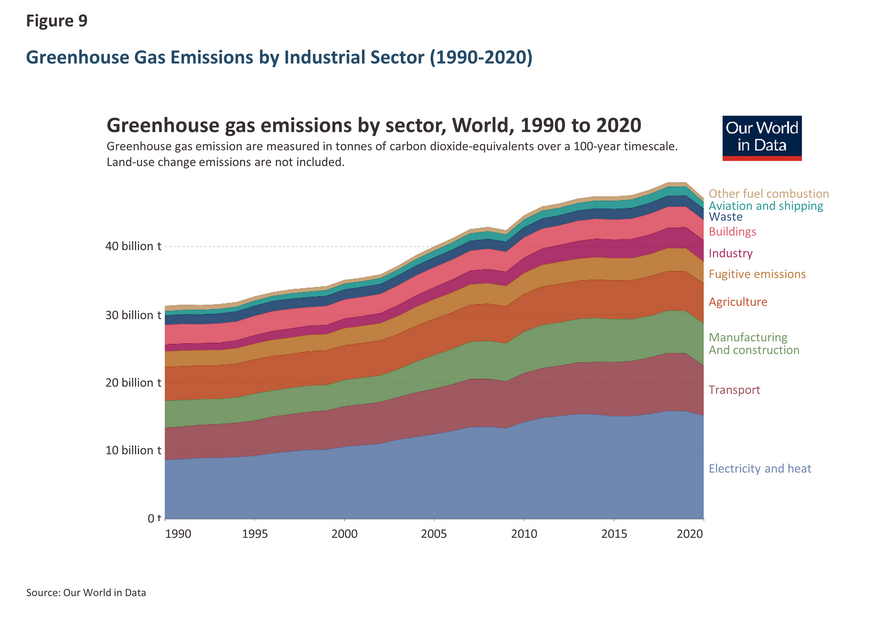

Nearly every industrial sector has opportunities for green investment, particularly those with high greenhouse gas emissions. These industries can invest in reducing emissions, which will mitigate the impacts of climate change. A crucial first step toward achieving Net Zero emissions is reducing carbon dioxide (CO2) emissions, which account for more than 75% of greenhouse gases. Besides, around 90% of CO2 emissions come from the burning of fossil fuels (coal, oil, and gas).

According to data from Our World in Data, the economic sectors that emitted the most greenhouse gases in 2020 were electricity and heat (38%), followed by transportation (15%), manufacturing and construction (12.8%), and agriculture (12.1%).

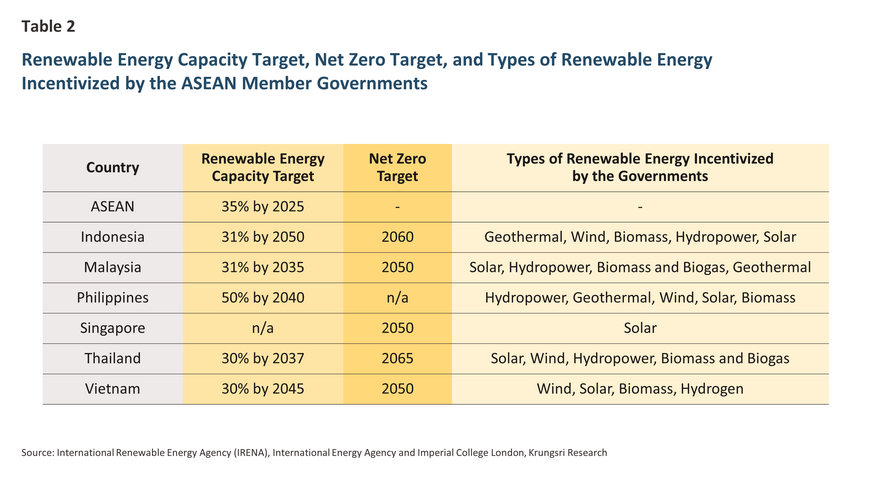

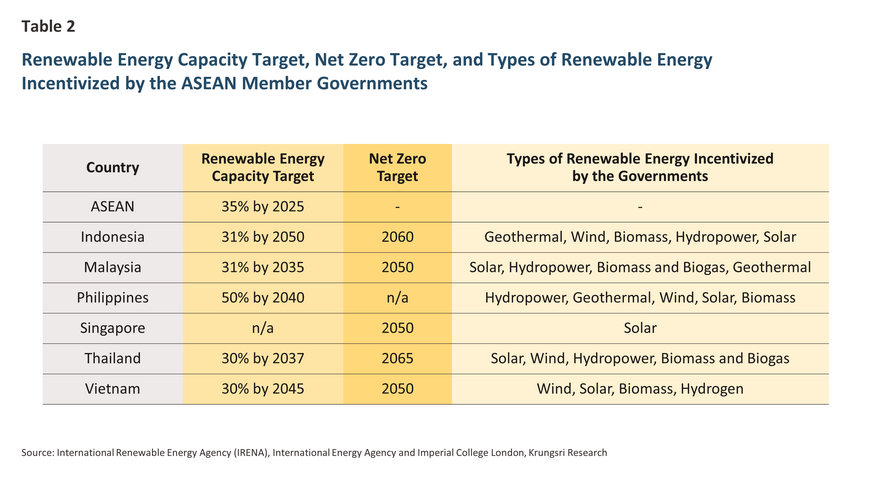

Consequently, the renewable energy sector exhibits considerable investment potential across all regions, including ASEAN. Globally, more than 83% of electricity generation relies on fossil fuels, thus many regions are transitioning toward a low-carbon economy by increasing the share of renewable energy while decreasing fossil fuels dependency. ASEAN countries have committed to increasing renewable energy, prompting accelerated investments in this sector. Governments across ASEAN have set renewable energy targets based on their available resources and have offered incentives to support investors in this sector. This creates a promising opportunity for banks in ASEAN to serve as financial intermediaries for this emerging industry.

In addition to renewable energy investments, there are further environmental investment opportunities. These investments include improving energy efficiency and shifting production materials or processes; for example, investing in energy-efficient machinery in the manufacturing sector, promoting electric vehicles and enhancing public transportation systems, utilizing materials that reduce energy consumption in air conditioning or employing recycled materials in the construction sector, improving agricultural and livestock efficiency, deploying Carbon Capture, Utilization, and Storage (CCUS) technologies in heavy industries such as petrochemicals17/, as well as addressing waste management in agriculture which is an important sector in ASEAN, etc.

Furthermore, banks can play a role in guiding capital and investment towards other industries, such as “Hard-to-abate Sectors”18/, which face challenges in reducing carbon emissions. These sectors, despite requiring significant capital and complex financial instruments, should not be left behind. Banks may ease financial constraints and facilitate the shift towards more environmentally friendly practices. The Rocky Mountain Institute19/ suggests that banks must closely collaborate with clients in these sectors to understand their decarbonization processes and co-develop transition strategies tailored to their specific challenges. Additionally, banks need to develop expertise in emerging technologies, such as green hydrogen and Sustainable Aviation Fuel (SAF)20/, to precisely assess investments in these new technologies.

2) Opportunities for Green Financing to SMEs and Households

When considering green financing, it is essential to prioritize the inclusion of SMEs and households, as these entities are significant economic drivers. These units play a significant role in both production and consumption, which impacts the environment. Focusing on these grassroots economic units is key to driving sustainable and inclusive change. Therefore, opportunities for the banking sector to offer suitable products for SMEs and households include:

-

Green Microfinance includes financial products provided for SMEs to support environmentally friendly operations. Banks can design green microfinance with small loan sizes and conditions tailored to customer needs, specifying loan purposes such as production process change, engaging in sustainable farming, or waste management. Additionally, households, as major consumers of industrial sectors, can play a key role in driving towards a green economy. Financial support in the form of green mortgages for solar panel installations or green auto loans for electric vehicles can encourage environmentally friendly consumption. Green microfinance for households not only creates economic opportunities but also enhances quality of life and promotes environmental sustainability.

-

Green Insurance is another product that financial institutions can develop to mitigate environmental risks affecting SMEs and households. For instance, crop insurance for climate-related disasters, insurance covering financial risks from environmental threats, and insurance for disruptions in renewable energy generation. Moreover, banks can play a role in sharing knowledge and information with retail clients to accelerate green transitions.

In addition, the banking sector's opportunities can extend internationally through the ASEAN Taxonomy, which classifies economic activities and green financial instruments within the ASEAN investment context. This enhances financial product standards, increases investor confidence, and fosters sustainable investments in capital markets, the banking sector, and insurance, driving ASEAN's shift towards a green economy. Despite current implementation and disclosure are voluntary, it serves as a solid foundation to advance future transparency. The ASEAN Taxonomy shares similarities with the EU Taxonomy and aligns with other international standards like the Climate Bonds Initiative Taxonomy and the Green Bond Principles. This cooperation benefits green financial product issuers in ASEAN by enabling them to classify products and green investments corresponding to the regional context while simultaneously attracting global investment through adherence to international standards.

Banks that recognize the importance of green investment and engage in green financing utilizing established standards will have the potential to generate new revenue streams through green financial products and services offered to clients, ranging from corporations to SMEs and households. Simultaneously, they will contribute to environmental sustainability and long-term economic development.

Nevertheless, the green finance market remains relatively nascent for all stakeholders, including banks, investors, and consumers. Banks, as intermediaries, are inevitably encountering the challenge of nurturing a robust and resilient green finance market.

Challenges in the Green Finance Market

Despite a significant increase in global awareness regarding financing for green projects, green investment remains relatively new for both banks and investors in ASEAN. The green finance market in ASEAN has underperformed its potential implying a lot of opportunities ahead. Meanwhile, there are several challenges arising from the unique characteristics of green investments and challenges specific to developing countries:

1) Mismatch between Cost Structure and Risk-Adjusted Returns: Returns and risks are the most important factors in the investment world. However, green projects often generate lower profits than high-emission projects (Brown Projects) while incurring higher costs, with high up-front expenses and longer payback periods. For example, renewable energy projects require significant initial investment. Therefore, government policies promoting investment, such as tax incentives and loan guarantee programs, are crucial in developing the renewable energy market21/. While investors often perceive green investments as high-risk, particularly those involving new or developing technologies, which may not yet be commercially viable. This contrasts with most investors' goals of achieving high returns in the short term. As a result, market mechanisms may lead investors to favor higher-return investments over green projects.

2) Data Limitations often make it difficult for investors to assess the risks and returns associated with green investments, particularly in developing countries where data quantity and quality are often constrained.

3) Regulatory Ambiguity in Green Finance Notwithstanding collaboration on the ASEAN Taxonomy, each ASEAN state remains dedicated to developing its own regulatory frameworks for green investments to correspond with its investment and environmental contexts. Most ASEAN countries are in the process of developing their national green investment frameworks, which might require future amendments to cover additional issues. This uncertainty could make investors reluctant due to the possibility of changing regulations, thereby amplifying the risks associated with long-term investment plans.

4) Lack of Awareness of the Benefits of Green Investment is another challenge in the green finance market in terms of fundraising. Some investors still lack understanding of the negative impacts of climate change and may not recognize the necessity to accelerate the capital financing to green investment projects.

Given these challenges, the governments can play a role to reduce risks and promote green finance market growth directly through grants or investment incentives to support green projects with potential losses in the initial stages. Moreover, green investments often have characteristics of public goods—projects with broad societal and environmental benefits. Hence, the government, which typically allocates resources for the public good, may need to take a more proactive role in initiating green investments to attract further private sector investment (Crowding-in Effect). Additionally, developing a clear legal framework for green finance, along with transparent practices and disclosures, will help boost investors' and stakeholders' long-term confidence and set standards for the green finance market in the region, ultimately raising awareness of the importance and benefits of green investments.

At the same time, banks can collaborate with governments, international organizations, or multinational development banks to develop financial innovations that reduce the risks of green investments and attract investor participation, such as (1) Risk-sharing Mechanism: Public-Private Partnerships (PPPs) and government-backed green loan guarantees, particularly for large-scale environmental projects; (2) Blended Finance: Combining capital from multiple sources, such as using public or multinational development bank funds as seed capital for high-risk green projects to attract private sector involvement, while delivering financial returns to investors; and (3) Syndicated Loans: Multiple financial institutions pool resources to finance large green projects, sharing risk across institutions and strengthening investment credibility.

These collaborations will enhance the efficient use of public and private capital, allowing for extensive development of the maturing green finance market in the future.

Krungsri Research View

Green finance plays a crucial role in driving the green economy, which seeks to balance long-term economic development with environmental conservation. However, the endeavor to create a green economy requires the collaboration of all stakeholders in transforming production and consumption patterns, which both need funding for green investments. Therefore, sectors aiming toward achieving environmental change have to gain the ability to employ green financial instruments appropriate to their context.

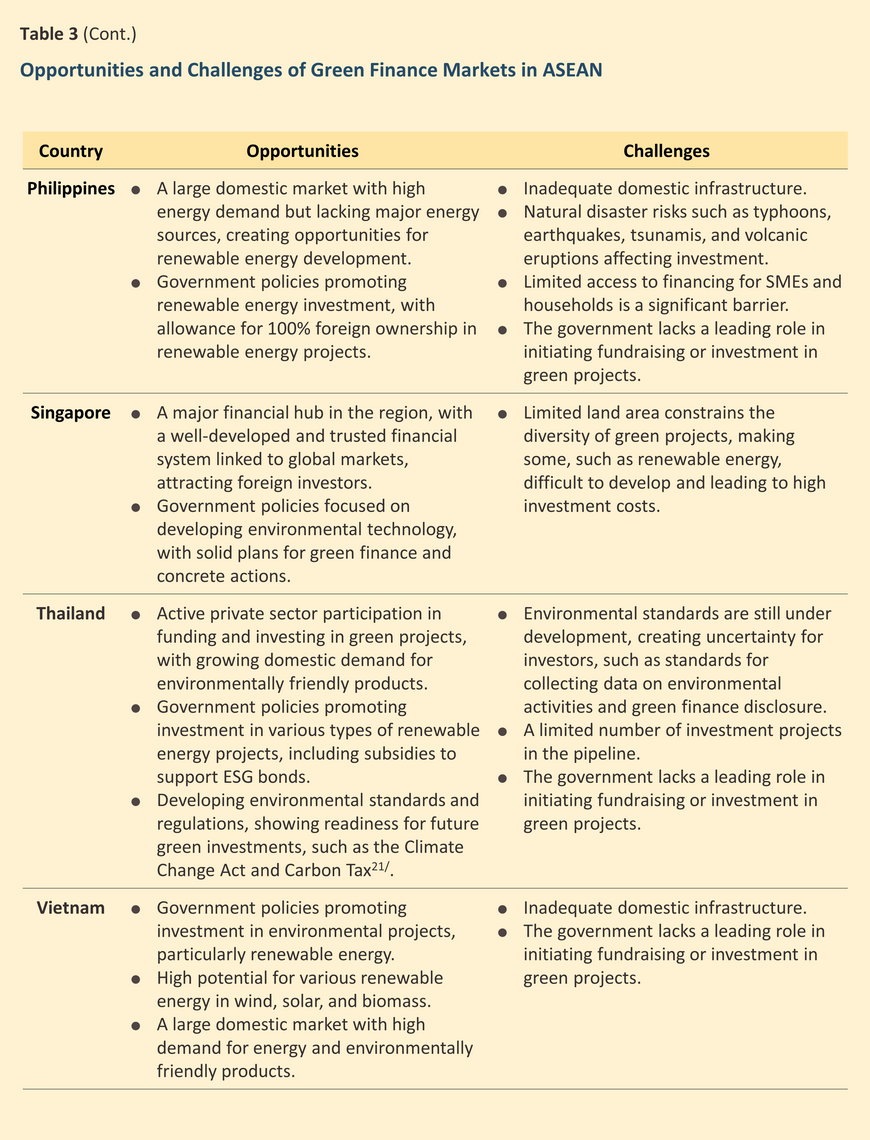

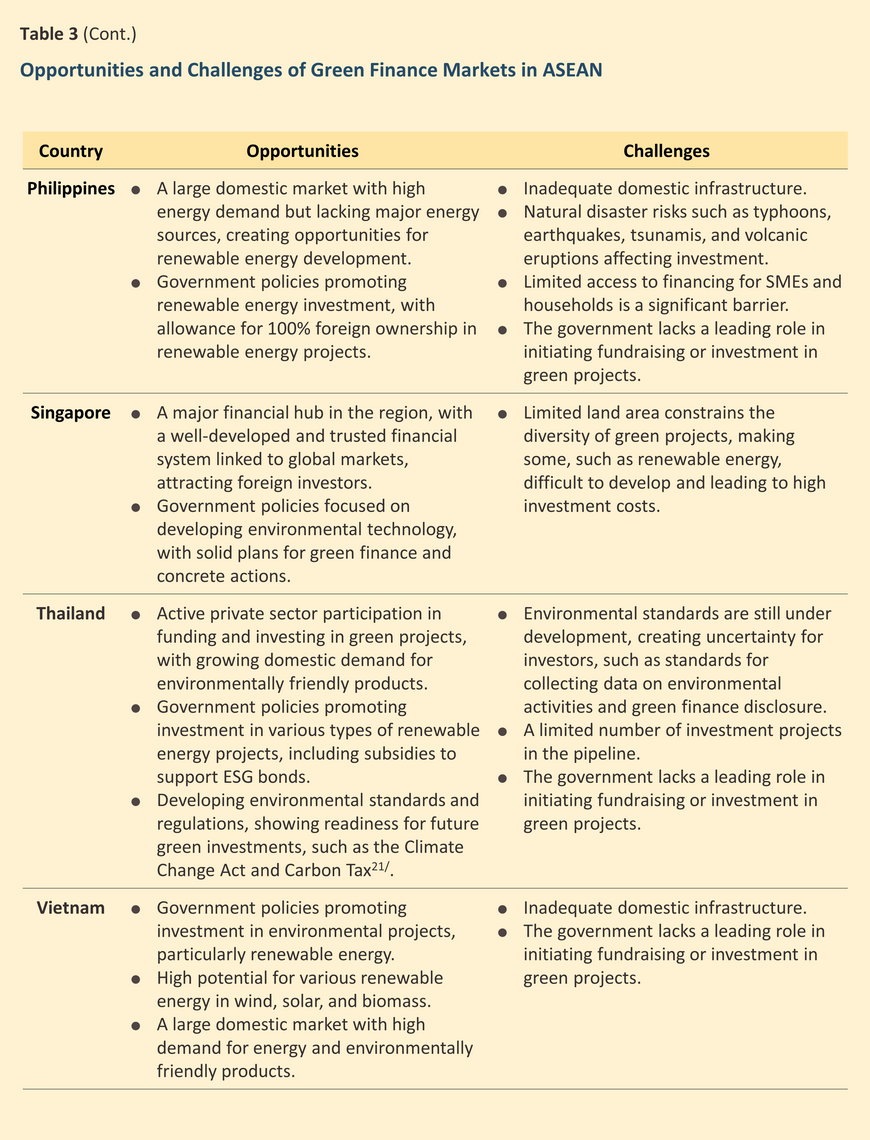

ASEAN is a region where governments, the private sector, and international organizations are actively engaged in developing green finance and green investments through capital mobilization and the allocation of funds to various green projects across industries. Despite progress in the number of market players, financial tools, and green investment in various industrial sectors, Krungsri Research sees significant opportunities and challenges in ASEAN’s green finance market, as shown in Table 3.

ASEAN is a region that has insufficient green debt financing compared to its own potential and compared to other regions of the world. Meanwhile, the demand for renewable energy and environmentally friendly products is growing, driven by factors such as population growth and ASEAN's status as a key global manufacturing hub. Developing green infrastructure, therefore, will help attract investment from leading global companies committed to nature conservation and clean energy, providing long-term opportunities for ASEAN’s development.

In terms of government roles in this region, ASEAN countries have introduced policies to promote green investments through investment incentives. When combined with ASEAN’s abundant natural resources and biodiversity, along with regional collaboration on the ASEAN Taxonomy, these positive factors will support the region's transition towards a green economy. However, environmental-related laws and policies in most ASEAN countries remain uncertain, and governments often lack a proactive role in initiating green projects. On top of that, there are a limited number of investment projects in the pipeline, and, crucially, there is a shortage of experts and essential data in green finance and green investment. These factors could increase the risks of green investments in the region.

In fact, ASEAN countries are not required to depend solely on regional investment. They could encourage investors from other regions to invest in green projects, particularly those from regions where the green finance market has matured. This will not only generate capital but also enable the transfer of green technologies.

Therefore, the banking sector, as a key driver of the financial sector, plays a critical role as an intermediary supporting the mobilization and allocation of green finance to various economic players in need of financing to transition toward a green economy. Focusing on environmental transition and offering green financial products that meet customer needs will create new revenue opportunities for banks, while promoting environmental and economic sustainability. Despite the challenges facing the green finance market, collaboration among banks, governments, and international organizations can help mitigate risks through appropriate financial instruments. This will consequently lead to the development of a robust green finance market in the future.

References

ASEAN Taxonomy Board. (2021, November). ASEAN TAXONOMY FOR SUSTAINABLE FINANCE. Retrieved from https://asean.org/wp-content/uploads/2022/06/ASEAN_Taxonomy_V1_final_310522.pdf

Alliance for Transformative Action on Climate and Health. (n.d.). Commitment tracker. Retrieved from https://www.atachcommunity.com/our-impact/commitment-tracker/

ASEAN+3 Macroeconomic Research Office. (2023). Chapter 2. On the Road to Net Zero. Retrieved from https://amro-asia.org/wp-content/uploads/2023/04/Chapter-2-Full_1.pdf

Asian Development Bank (ADB) and the Global Green Growth Institute. (2022, November). SURVEY ON GREEN BONDS AND SUSTAINABLE FINANCE IN ASEAN. Retrieved from https://www.adb.org/publications/survey-green-bonds-sustainable-finance-asean

Asian Development Bank (ADB). (n.d.). คู่มือการออกและเสนอขายตราสารหนี้เพื่ออนุรักษ์สิ่งแวดล้อม. Retrieved from https://www.thaibma.or.th/Doc/esg/green-bonds-factsheet-th.pdf

Centre for Research on the Epidemiology of Disasters (CRED). (2024, April 5). 2023 Disasters in numbers. Retrieved from https://reliefweb.int/attachments/305f0dbc-ee04-4631-a518-0238240c41aa/2023_EMDAT_report.pdf

Climate Bonds Initiative . (2023). Interactive Data Platform. Retrieved from https://www.climatebonds.net/market/data/

Climate Bonds Initiative. (2019, January 22). ASEAN Green Finance State of the market 2018. Retrieved from https://

www.climatebonds.net/files/files/ASEAN_SotM_18_Final_03_web.pdf

Climate Bonds Initiative. (2019, January 22). ASEAN Green Financial Instruments Guide. Retrieved from https://www.

climatebonds.net/files/reports/asean_green_fin_istruments_cbi_012019_0.pdf

Climate Bonds Initiative. (2020, April 14). ASEAN Green Finance State of the market 2019. Retrieved from https://www.

climatebonds.net/files/reports/cbi_asean_sotm_2019_final.pdf

Climate Bonds Initiative. (2021, April 29). ASEAN Sustainable Finance State of the Market 2020. Retrieved from https:

//www.climatebonds.net/files/reports/asean-sotm-2020.pdf

Climate Bonds Initiative. (2022, June 15). ASEAN Sustainable Finance State of the Market 2021. Retrieved from https://www.climatebonds.net/files/reports/cbi_asean_sotm2022_final.pdf

Climate Bonds Initiative. (2023, May 2). ASEAN Sustainable Finance State of the Market 2022. Retrieved from https:

//www.climatebonds.net/files/reports/cbi_asean_sotm_2022_02f.pdf

Climate Bonds Initiative. (2024, May 2). Sustainable Debt Global State of the Market Report 2023. Retrieved from https://www.climatebonds.net/files/reports/cbi_sotm23_02h.pdf

Duggal, H. (2021, November 14). Infographic: What has your country pledged at COP26? Retrieved from https://

www.aljazeera.com/news/2021/11/14/infographic-what-has-your-country-pledged-at-cop26

Furness, V. (2022, November 11). Explainer: Decoding COP27: the many shades of green bonds. Retrieved from World Economic Forum: https://www.weforum.org/agenda/2022/11/decoding-cop27-the-many-shades-green-bonds/

Green Network. (2018, March 2). อาคารเขียวไทยที่ใช่ ตามเกณฑ์มาตรฐาน TREES. Retrieved from https://www.greennet

workthailand.com/trees-building-standard/

Hardcastle, D., Tsukamoto, Y., Tan, K., Harris, T., Park, K.-A., & Lee, B. (2024 , April 15). Southeast Asia's Green Economy 2024 Report. Retrieved from https://www.bain.com/globalassets/noindex/2024/bain_report_

southeast_asias_green_economy_2024.pdf

Harnett, T. H. (2024, January 19). How Global Banks See Transition Finance in 2024. Retrieved from Rocky Mountain Institute: https://rmi.org/how-global-banks-see-transition-finance-in-2024/

Hussain, M. (2013, April 3). Financing renewable energy options for developing financing instruments using public funds (English). Retrieved from World Bank Group: http://documents.worldbank.org/curated/en/196071468331818432/Financing-renewable-energy-options-for-developing-financing-instruments-using-public-funds

International Energy Agency. (2024, January). Renewables 2023 Analysis and forecasts to 2028. Retrieved from https://www.iea.org/reports/renewables-2023#overview

International Renewable Energy Agency (IRENA). (2022, September). Renewable Energy Outlook for ASEAN Towards a Regional Energy Transition. Retrieved from https://www.irena.org/-/media/Files/IRENA/Agency/Publication/2022/Sep/IRENA_Renewable_energy_outlook_ASEAN_2022.pdf

Joint Research Centre (JRC), the European Commission’s science and knowledge service. (2024). GHG EMISSIONS OF ALL WORLD COUNTRIES. Luxembourg: Publications Office of the European Union.

Krushelnytska, O. (2017, January). Introduction to Green Finance. Retrieved from Global Environment Facility: https://www.thegef.org/sites/default/files/publications/Introduction%20to%20Green%20Finance%20ENG.pdf

Larsen, M. (2019, November 22). A growing toolbox of sustainable finance instruments. Retrieved from https://greenfdc.org/a-growing-toolbox-of-sustainable-finance-instruments/?cookie-state-change=1726678446791

Lu, M. (2023, November 8). Visualizing All the World’s Carbon Emissions by Country. Retrieved from https://www.

visualcapitalist.com/carbon-emissions-by-country-2022/

Maizland, L. (2021, November 15). COP26: Here’s What Countries Pledged. Retrieved from Council on Foreign Relations: https://www.cfr.org/in-brief/cop26-heres-what-countries-have-pledged

Mingsakul, P. (2024, April 11). Green Financing: Accelerating the Green Transition. Retrieved from Krungsri Research: https://www.krungsri.com/en/research/research-intelligence/green-Financing

NGThai. (2023, August 19). รู้จัก TAXONOMY กติกาด้านการเงินและภาษี เพื่อการเปลี่ยนผ่านภาคธุรกิจสู่สังคมคาร์บอนต่ำ. Retrieved from National Geographic: https://ngthai.com/sustainability/50727/thailand-taxonomy/

Public Debt Management Office. (2020, July 24). สบน. จับมือ ADB และรัฐวิสาหกิจออกพันธบัตรเพื่ออนุรักษ์สิ่งแวดล้อม. Retrieved from https://www.pdmo.go.th/pdmomedia/documents/2020/Jul/แถลงข่าวออกพันธบัตรเพื่อความยั่งยืน%20v11.pdf

Ritchie, H., Rosado, P., & Roser, M. (2020). Breakdown of carbon dioxide, methane and nitrous oxide emissions by sector. Retrieved from https://ourworldindata.org/emissions-by-sector

Ritchie, H., Rosado, P., & Roser, M. (2020). CO₂ emissions by fuel. Retrieved from

https://ourworldindata.org/emissions-by-fuel

Satafang, N. (2024, March 8). Green Deposits for Greater Sustainability. Retrieved from Krungsri Research: https://www.krungsri.com/en/research/research-intelligence/green-deposits-2024

Thailand Greenhouse Gas Management Organization. (n.d.). NDC (Nationally Determined Contribution). Retrieved from https://www.tgo.or.th/2023/index.php/th/page/ndc-nationally-determined-contribution-198

The Securities and Exchange Commission, Thailand. (2024, July 8). ก.ล.ต. เข้าร่วมเป็นสมาชิก ASEAN Taxonomy Board จัดทำมาตรฐานและเกณฑ์การจัดหมวดหมู่ด้านการเงินเพื่อความยั่งยืนอาเซียน. Retrieved from https://www.sec.or.

th/TH/Pages/News_Detail.aspx?SECID=10913

The Securities and Exchange Commission, Thailand. (n.d.). Sustainable Finance Ecosystem of Thailand Capital Market. Retrieved from https://www.sec.or.th/TH/Pages/SustainableFinance.aspx

The Stock Exchange of Thailand. (n.d.). Sustainable Investment. Retrieved from https://setsustainability.com/page/sustainable-investment

The Stock Exchange of Thailand. (n.d.). Sustainable Supply Chain. Retrieved from https://setsustainability.com//page/sustainable-supply-chain

United Nations Environment Programme (UNEP) and DBS,. (2017, November). Green Finance Opportunities in ASEAN. Retrieved from https://www.dbs.com/iwov-resources/images/sustainability/img/Green_Finance_Opportunities_in_ASEAN.pdf

Wood, J. (2021, November 9). What does net-zero emissions mean and how can we get there? Retrieved from https://www.weforum.org/agenda/2021/11/net-zero-emissions-cop26-climate-change/

World Bank. (2021, August 5). Sustainable Finance. Retrieved from https://www.worldbank.org/en/topic/financialsector/brief/sustainable-finance

World Bank and Institute of Finance and Sustainability. (2022, November). Unleashing Sustainable Finance in Southeast Asia. Retrieved from World Bank: https://openknowledge.worldbank.org/handle/10986/38341?_gl

=1*1hpr20x*_gcl_au*MTc5OTkyMDkzMy4xNzI2Njc2NDcw

World Meteorological Organization. (2024 , April 23). WMO report: Asia hit hardest by climate change and extreme weather. Retrieved from https://news.un.org/en/story/2024/04/1148886

แจงสี่เบี้ย. (2021, July 21). SMEs ไทยจะพลิกฟื้นโตยั่งยืนอย่างไรภายใต้ภูมิทัศน์โลกใหม่การเงินสีเขียว (ตอนที่ 2). กรุงเทพธุรกิจ.

1/ The Association of Southeast Asian Nations (ASEAN) comprises 10 member states: Indonesia, Malaysia, the Philippines, Singapore, Thailand, Brunei, Laos, Myanmar, Cambodia, and Vietnam.

2/ An international accord under the United Nations Framework Convention on Climate Change (UNFCCC), aimed at reducing carbon dioxide emissions since 2015. As of today, 197 countries have signed the Paris Agreement. Each participating country is required to establish mechanisms to achieve the goals of the agreement, known as the "Nationally Determined Contributions (NDCs)." Every five years, countries must submit NDCs to represent a progression compared to the previous NDC and reflect its highest possible ambition.

3/ The 26th session of the United Nations Framework Convention on Climate Change Conference of the Parties (UNFCCC COP), held from 31 October to 12 November 2021, in Glasgow, United Kingdom.

4/ Instruments for fundraising and financing green projects, initiatives, or environmental policies to support the transition towards a Green Economy. More information on “Green Financing: Accelerating the Green Transition”

5/ International organization working to mobilize global capital for climate action.

6/ Private Equity (PE) serves as an alternative funding channel for emerging businesses, SMEs, businesses seeking restructuring, and those relying on innovations in science and technology. This funding approach offers businesses the opportunity to receive financial support from interested investors. Fundraising may occur either through public markets by trading shares on stock exchanges or through private placements, targeting institutional investors or high-net-worth individuals (The Securities and Exchange Commission, Thailand, 2014).

7/ Sukuk, or Islamic bonds, derive their investment returns from participation in business transactions and shared risk, in accordance with Islamic finance principles. (Climate Bonds Initiative)

8/ https://sustainablefinance.sec.or.th/Bond

9/ The first ASEAN Taxonomy was published in November 2021.

10/ Data according to CBI Interactive Data Platform as of the end of 2023.

11/ The initiative under Singapore's Green Finance Action Plan 2030, launched in November 2019.

12/ Construction or renovation projects with an environmentally sustainable concept. It emphasizes on increasing the efficiency of the building in using natural resources efficiently, responsible for the environment and society throughout the life cycle of the building, covers the processes of selecting the location, designing, constructing, operating, maintaining, renovating, including destroying the building. The main goal is to reduce the impact of the building or the built environment that will affect human health and the natural environment (Green Network, 2018). However, the criteria for green building projects may differ depending on the agency that sets the criteria in each country.

13/ Data from the Thai Bond Market Association (ThaiBMA).

14/ Green finance opportunities by industry sector as follows: 1) infrastructure, USD 1.8 trillion; 2) energy efficiency, USD 0.4 trillion; 3) renewable energy, USD 0.4 trillion; and 4) food, agriculture and land use,

USD 0.4 trillion. (United Nations Environment Programme and DBS, 2017)

15/ The authors' calculations are based on a total value of USD50.6 billion of green debts issued in ASEAN between 2016 and 2022, excluding financing via other green financial instruments and sustainability financial instruments with a broader green investment objective.

16/ The Stock Exchange of Thailand and ThaiBMA

17/ More information on “Net Zero Pathways for Petrochemical Industry”

18/ Industries that require advanced technology and high transition costs, such as aviation, oil and gas, mining, and heavy industries such as steel and cement, etc. Due to technological limitations, transition costs remain very high, coupled with complex transition processes, such as investments in carbon capture and storage and investments in entirely new processes to make them more energy efficient, which require more capital to enable the transition.

19/ A nonprofit organization aiming to radically improve America’s energy practices.

20/ More information on “CORSIA Paving the Way for Flying Net Zero”

21/ Global Environment Facility (World Bank, 2005)

22/ thaibma.or.th/EN/Training/cmdf.aspx