Introduction

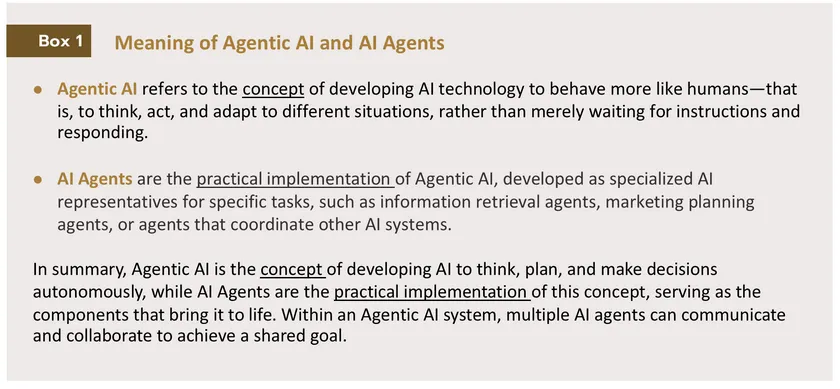

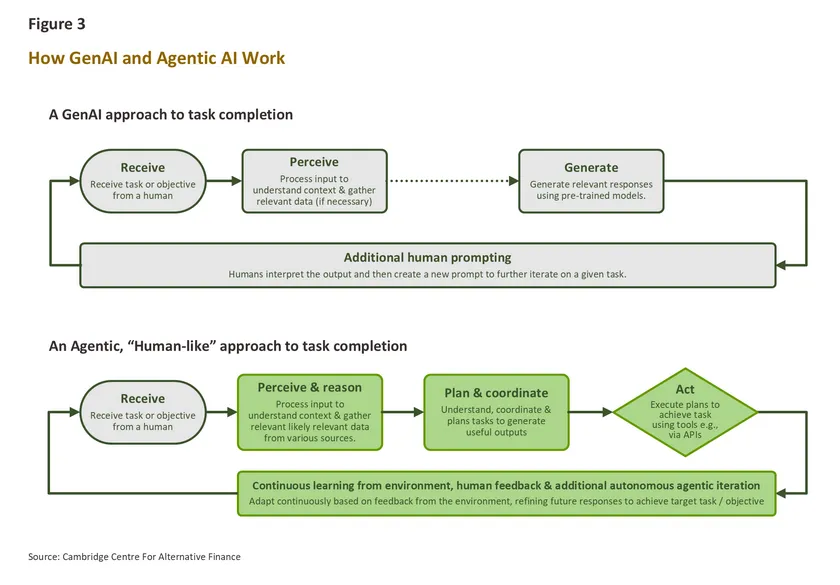

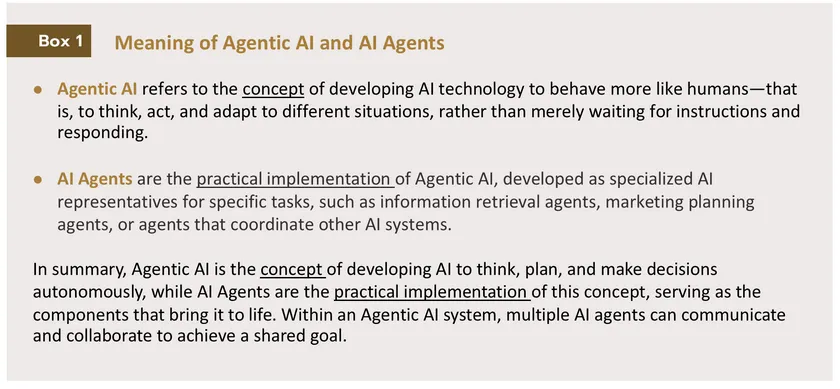

In recent years, artificial intelligence (AI) has evolved at an extraordinary pace. The world was captivated by Generative AI — systems capable of creating new content based on human prompts. Today, the spotlight has shifted toward a new generation of AI known as “Agentic AI” — artificial agents that can not only analyze data but also plan and take actions on their own.

Agentic AI has been ranked among the most strategic technologies of 2025,1/ with the potential to transform operations across many industries. For the banking sector, this technology could act as an intelligent assistant capable of assessing situations, making decisions, and executing tasks automatically. This marks a significant shift in how banks operate and serve their customers. However, with greater autonomy comes greater risk. As Agentic AI gains more decision-making power, the potential impacts on financial systems, customer trust, and regulatory compliance also grow. Banks must therefore prepare carefully — not only to harness the efficiency and innovation that Agentic AI promises, but also to manage the new layers of risk that accompany this rising intelligence.

What Is Agentic AI — and How Is It Different?

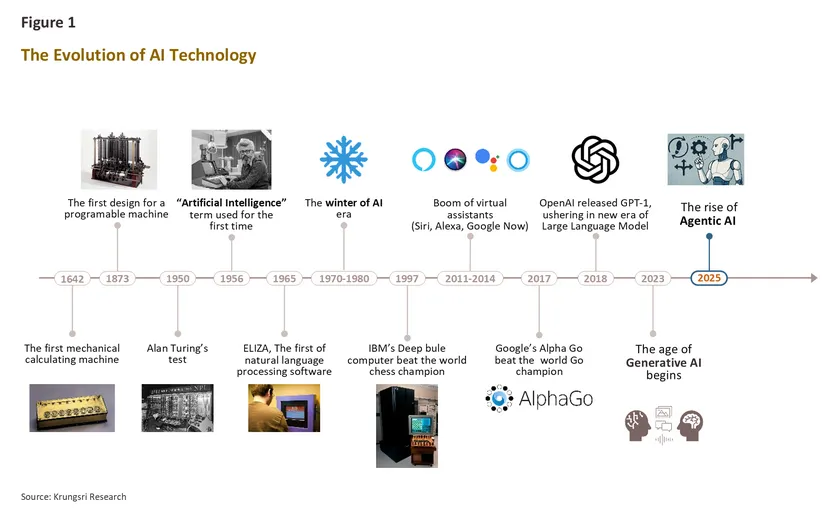

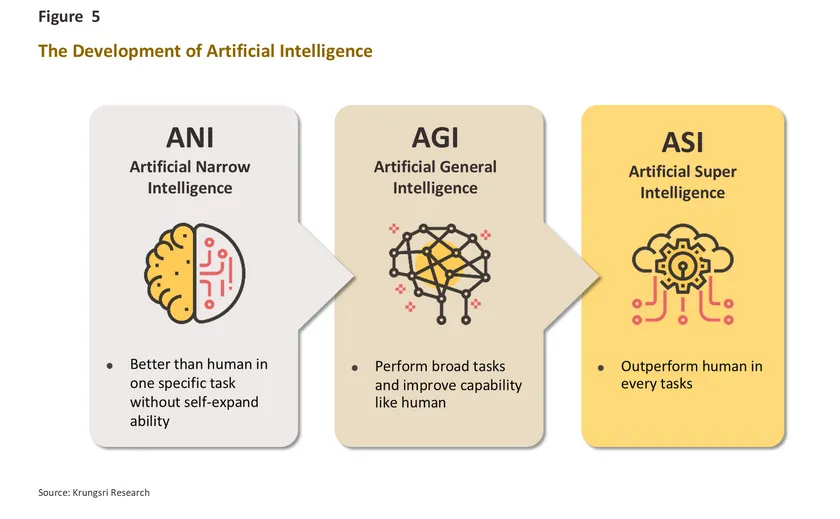

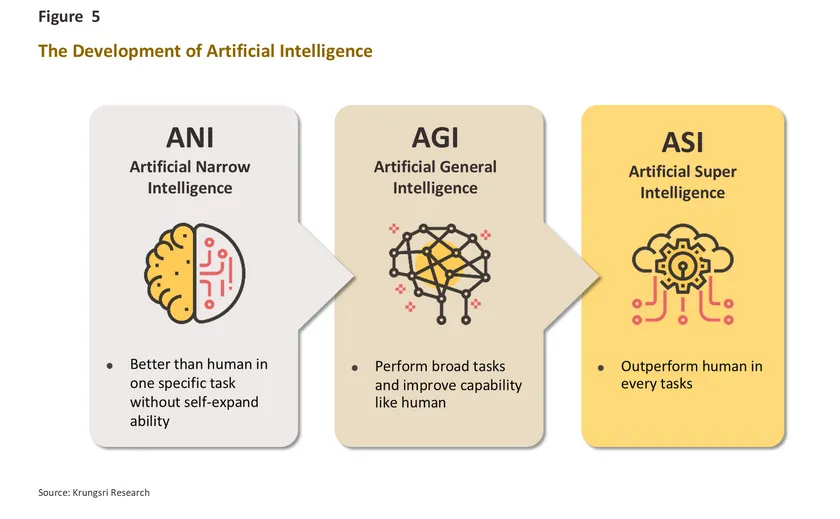

Artificial Intelligence, or AI, was first coined in 1956 to describe technologies that enable machines or computer systems to think like humans. Since then, AI has evolved continuously—becoming part of everyday life and growing ever closer to human-level intelligence.

2/

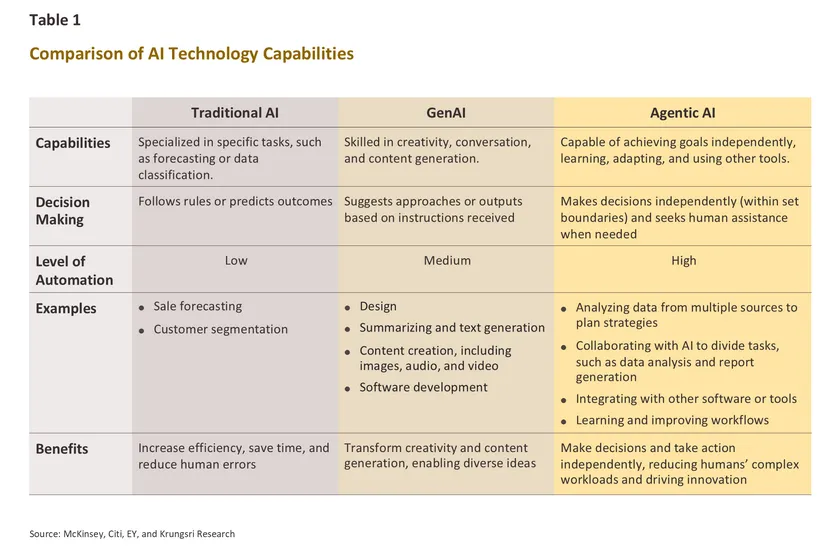

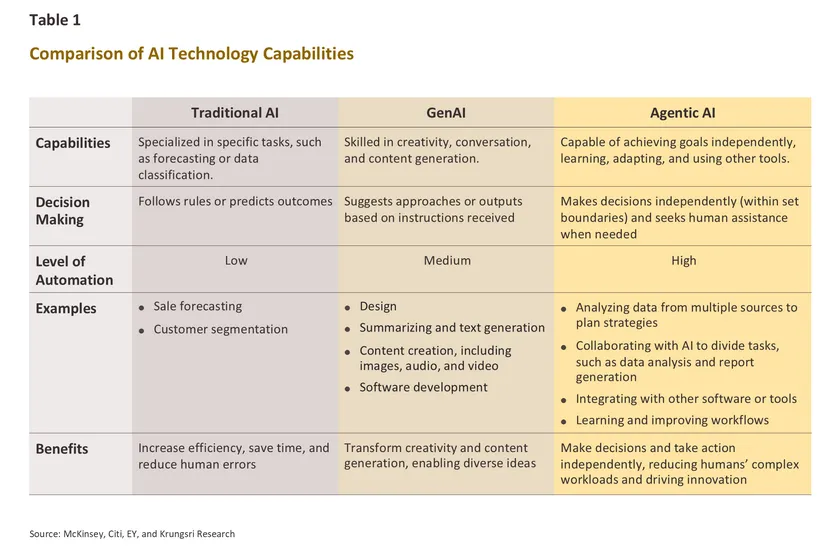

Early forms of AI, often referred to as

Traditional AI, could only follow predefined rules or perform step-by-step tasks within a fixed scope. These

rule-based systems were effective for specific problems but lacked flexibility. Whenever situations fell outside their programmed logic, human intervention was still required. Examples include chatbots that could only answer scripted questions or credit approval systems that strictly followed preset criteria without adapting to new information.

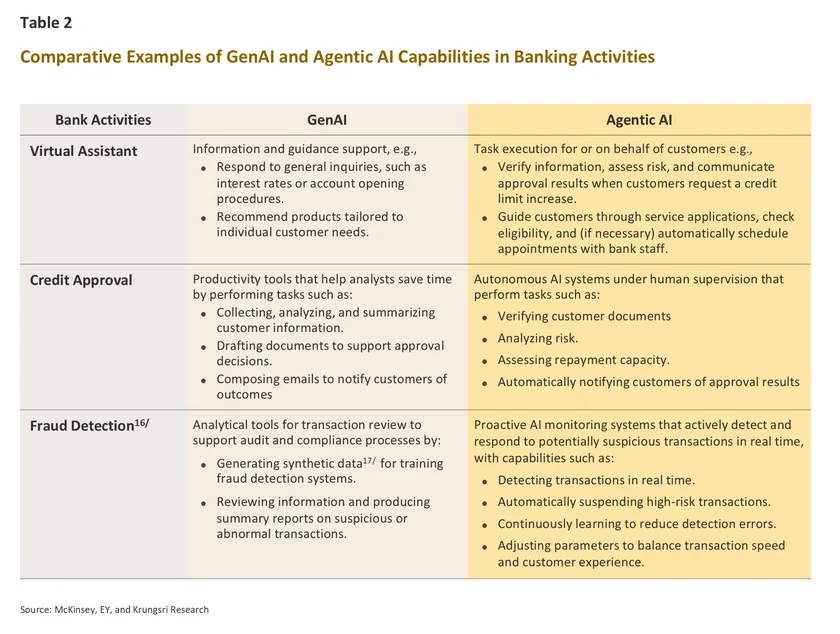

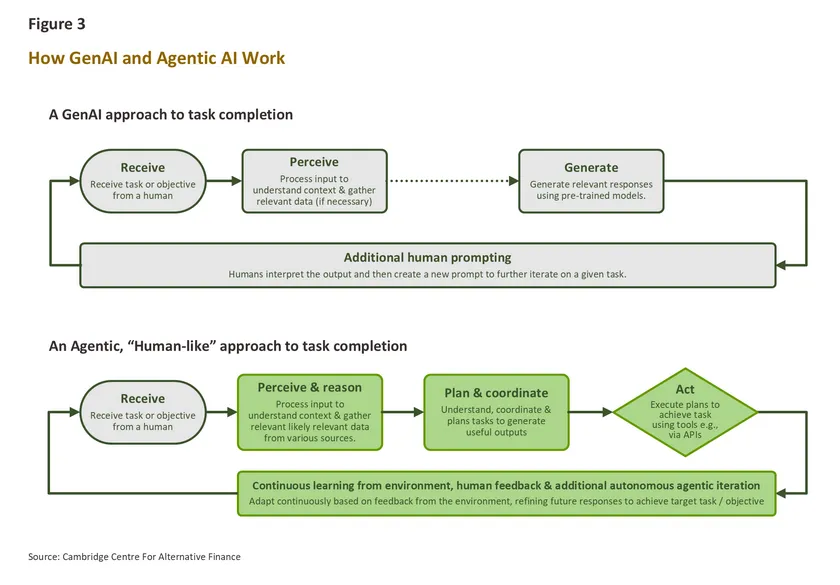

Generative AI (Gen AI) marks a major milestone in AI development. It can produce entirely new outputs from existing data with creativity, generating text, images, audio, or video. Since around 2022, the world has entered the era of GenAI. Despite its versatility and creative abilities, GenAI still operates step by step under human instructions.

By 2025, AI technology has reached a new level with

Agentic AI, whose systems can think, decide, act, and adapt automatically to changing situations. They can also collaborate with digital tools and applications to achieve human-assigned goals without requiring step-by-step instructions.

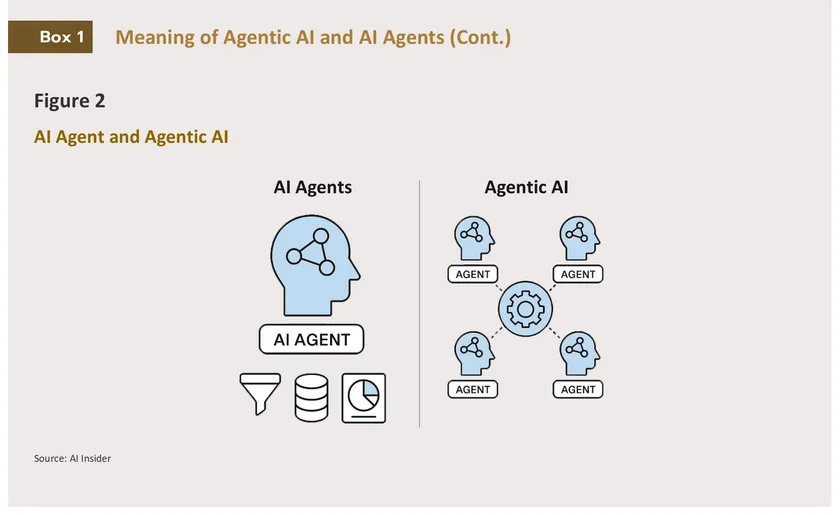

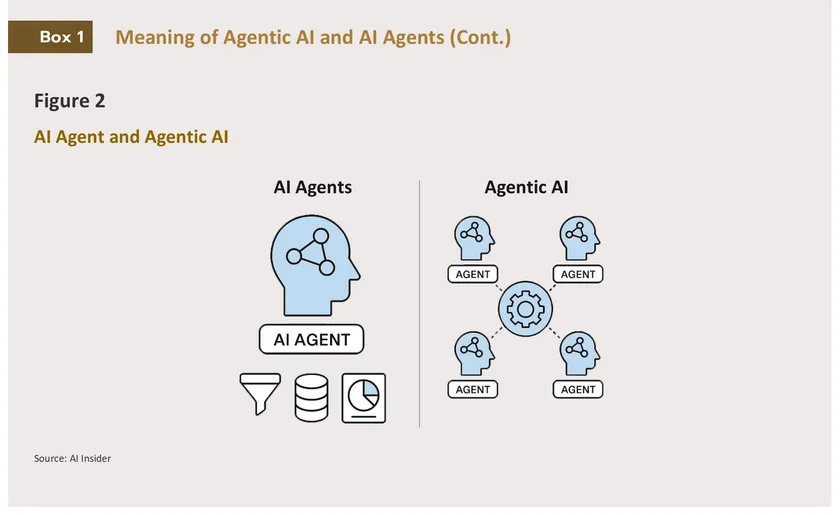

Agentic AI relies on the collaboration of multiple AI agents, each with specialized expertise. These agents can operate independently or work together. Key types of AI supporting Agentic AI include:

1. Large Language Models (LLM) and GenAI

LLMs can respond to situations or data that were not pre-defined. They act as intermediaries, receiving instructions from humans and coordinating with specialized AI agents. Generative AI helps create content such as documents, reports, or messages to support Agentic AI’s tasks.

2. Traditional AI

Traditional AI excels at logical, rule-based decision-making, making it suitable for tasks that require high accuracy under fixed conditions. An example is Predictive AI (PreAI), which specializes in forecasting probabilities or outcomes to support decision-making.3/

3. Reasoning Models4/

Reasoning models handle tasks requiring step-by-step thinking or analytical reasoning, such as complex data analysis or prioritization. They help plan and organize the workflow for Agentic AI.

Agentic AI can also interact with digital tools much like humans do. It can access databases, use web browsers, click on options, or fill in information independently. By connecting through application programming interfaces (APIs) and AI communication protocols (Model Context Protocol, MCP),5/ Agentic AI can communicate with other AI systems and collaborate seamlessly with various tools and workflows.

Key features of Agentic AI:

-

Goal-oriented Decision-making: Agentic AI can set goals based on human instructions, gather and process data from multiple sources to assess situations, and choose the appropriate tools or other AI systems to solve problems, enabling end-to-end task execution.

-

Autonomy: Agentic AI can plan and carry out multi-step tasks independently, without waiting for step-by-step human instructions or control

-

Coordination: Agentic AI can collaborate with other AI agents with different expertise and use external applications (if granted permission or access rights by humans).

-

Adaptability: Agentic AI can continuously improve its performance by learning from results and feedback, enhancing efficiency and effectiveness over time.

Agentic AI Initiatives by Leading Tech Companies

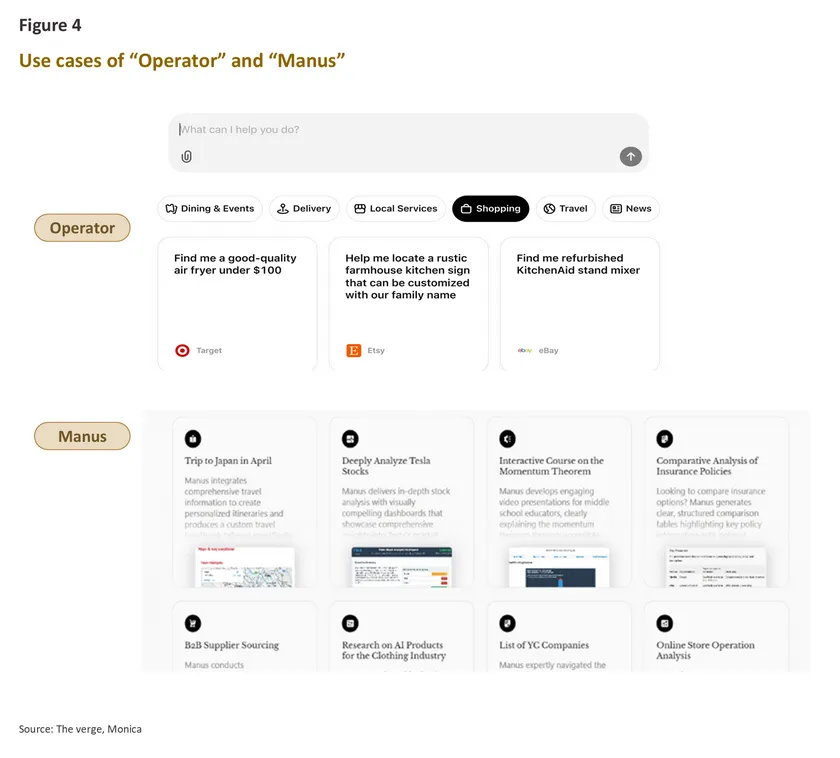

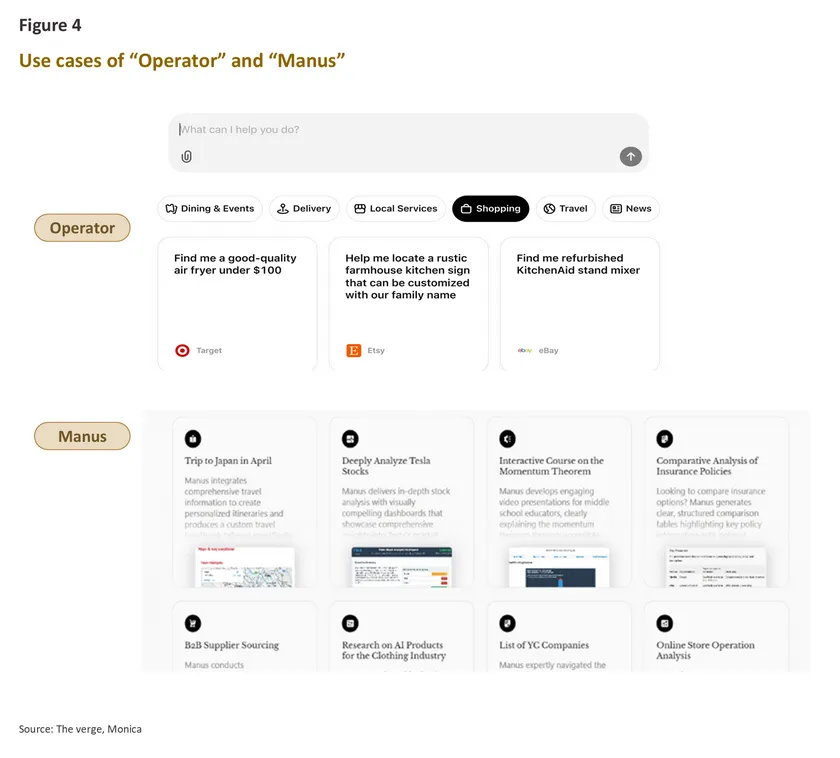

Leading AI companies are racing to develop technologies for the Agentic AI era. For example, OpenAI, the developer of ChatGPT, has launched “Operator”, an AI agent capable of understanding website content, scrolling pages, clicking, and filling in information automatically. Operator acts as a user-friendly assistant, performing tasks such as booking accommodations, reserving restaurants, and conducting online transactions.6/ OpenAI also plans to develop AI agents capable of conducting PhD-level research.7/ Meanwhile, Google is advancing various AI agents, including marketing-focused agents that can handle end-to-end campaigns, from creating ad visuals and designing marketing strategies to suggesting optimal pricing.8/ Across the globe, the AI scene in China is also progressing rapidly. For instance, Monica, a Chinese startup, has developed an AI agent named “Manus”, capable of performing complex tasks such as analyzing financial transactions and building websites independently.9/

Agentic AI is poised to become the future of work, acting as a “team member” that can help think, plan, and execute tasks. According to Gartner, by 2028, Agentic AI is expected to handle about 15% of decision-making in the workplace. Beyond this, Agentic AI is also paving the way toward Artificial General Intelligence (AGI)—the next evolution of AI, capable of analyzing, reasoning, and solving problems autonomously in a human-like manner.10/

How Agentic AI Could Transform Banking Operations

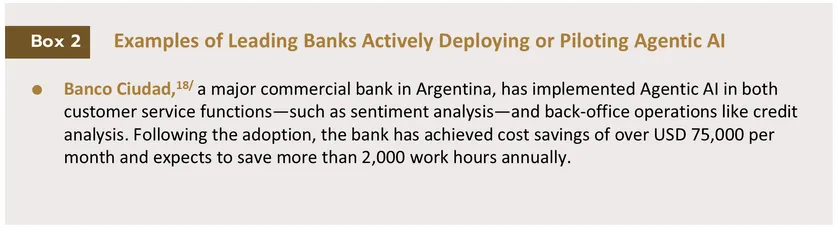

Although nearly all banks today have adopted AI technologies, their use is often fragmented and not systematically integrated. Many banking operations involve repetitive tasks and require strict compliance with regulations. According to Citi, about 54% of tasks in the banking sector have high potential for automation,11/ making them well-suited for Agentic AI. This technology is poised to bring major transformations across both internal processes and customer-facing services.

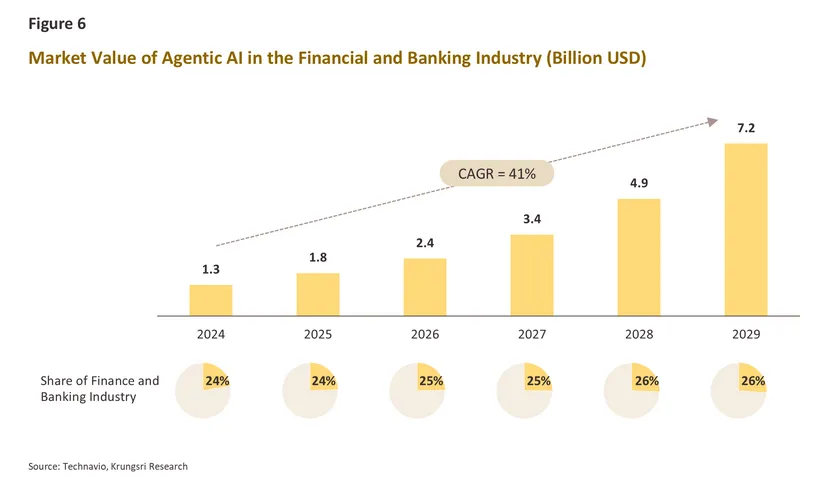

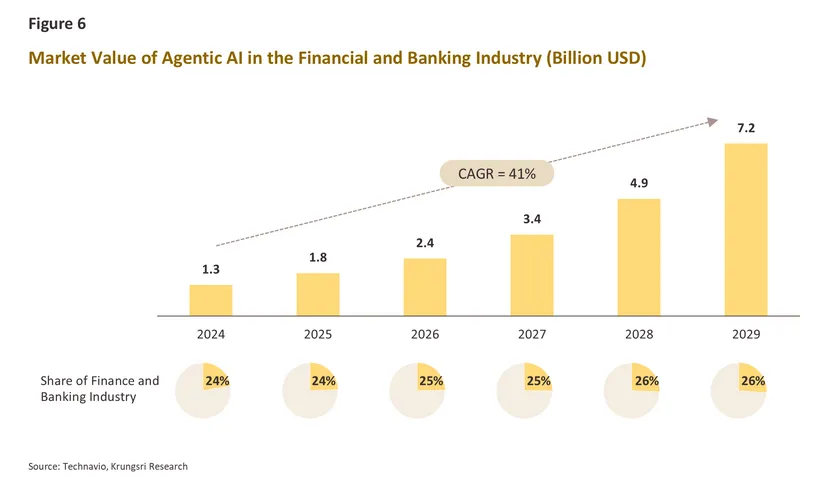

Over the next five years, the global market for Agentic AI in the financial and banking industry is expected to grow sharply—from USD 1.3 billion in 2024 to USD 7.2 billion by 2029, representing a compound annual growth rate (CAGR) of 41%. The financial and banking sector is projected to account for about one-quarter of the total Agentic AI market across all industries, indicating a high readiness to adopt this technology.

Use Cases of Agentic AI in the Banking Sector

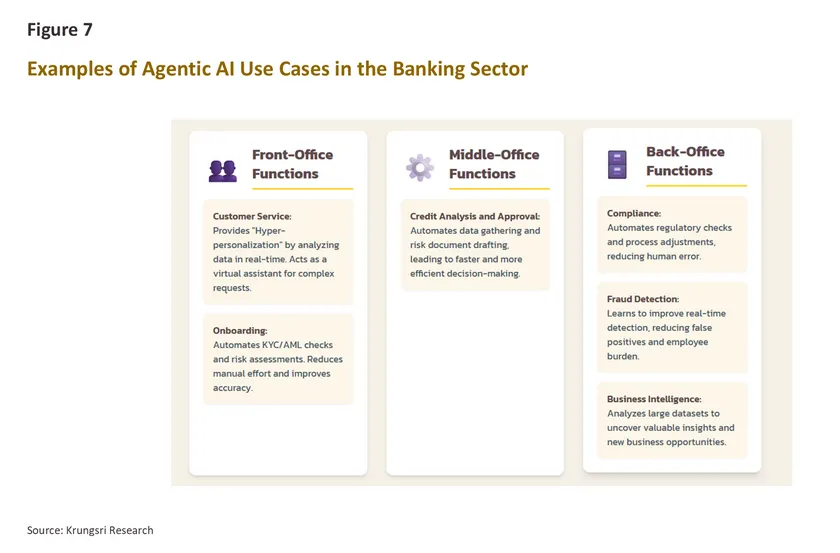

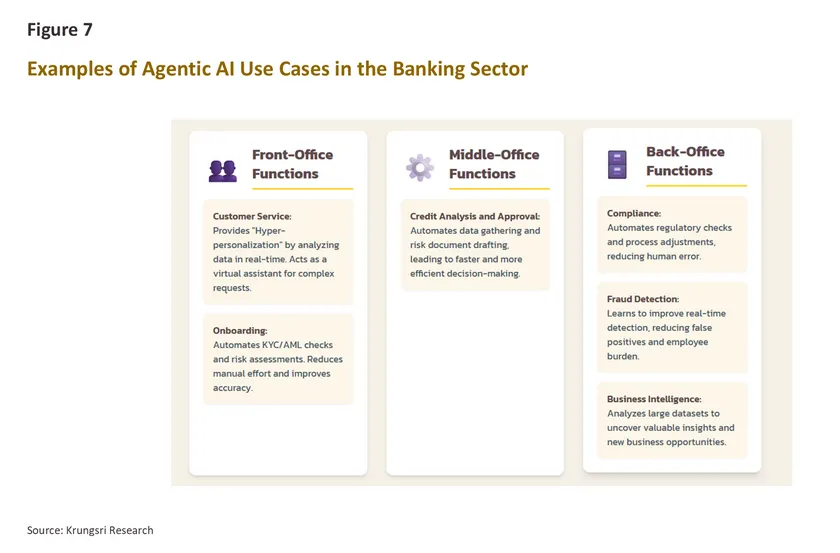

Front-office functions

The onboarding process for both individual and business customers remain highly labor-intensive, requiring a large number of human employees to perform repetitive tasks. According to McKinsey, banks may need to allocate around 10–15% of their total full-time workforce to handle Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures from start to finish.12/

Agentic AI can play a role throughout the entire process — from data collection, document and customer information verification, and risk assessment, to automatically contacting customers for additional documents when needed. This technology helps reduce workload, accelerate processing times, and minimize human error. According to McKinsey, Agentic AI could enhance productivity in KYC-related tasks by as much as twenty-fold.12/

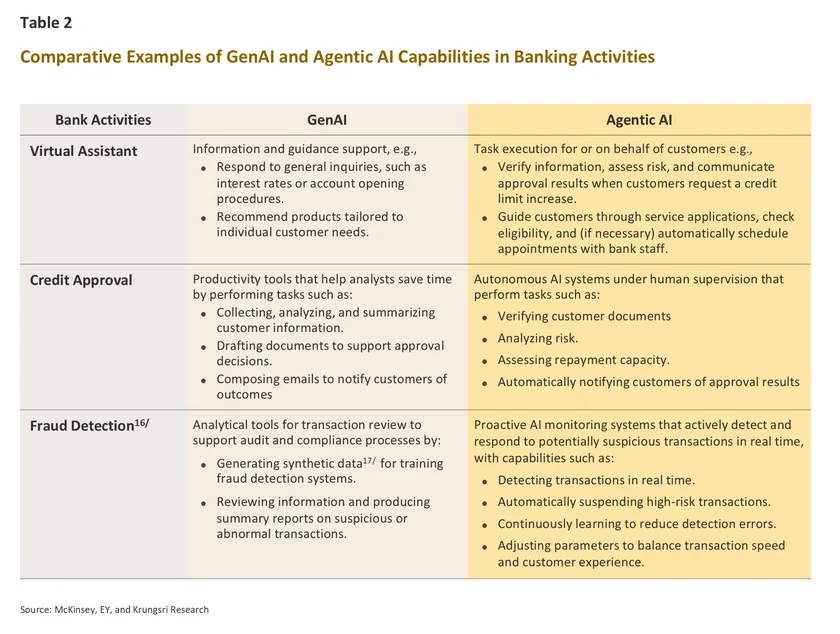

Banks can leverage Agentic AI to enhance customer service—shifting from a reactive approach that merely responds to customer requests toward proactive, hyper-personalized13/ financial offerings tailored to each individual’s needs. Agentic AI can analyze vast amounts of data in real time to deliver personalized financial advice or product recommendations, automatically adapting to each customer’s changing behaviors, preferences, and needs. For example, it can propose a savings plan that aligns with a customer’s spending habits.

In addition, banks can develop virtual assistants that go beyond answering routine inquiries to performing more complex tasks and learning from customer behavior. For instance, when a customer requests a credit limit increase, Agentic AI can review financial history, assess repayment capacity, and automatically notify the customer of the result.

In this way, Agentic AI functions as a truly human-like “virtual assistant,” capable of taking action and directly assisting customers—unlike traditional GenAI, which primarily provides information or recommendations without executing tasks.

Middle-office functions

In traditional credit analysis, analysts may spend several weeks preparing a credit risk memorandum to support loan approval decisions and ensure compliance with the bank’s internal regulations. This process requires gathering information from multiple sources—such as income statements, cash flow records, and collateral details—and involves extensive analytical reasoning.

Agentic AI can automate this entire workflow, from data collection and document drafting to credit assessment. By doing so, it can improve productivity by up to 60% and accelerate decision-making by approximately 30%.14/

Back-office functions

Compliance work has traditionally required a large number of human employees to interpret regulations and draft documents. Agentic AI, however, can perform end-to-end tasks—from accessing data and verifying regulatory compliance to automatically adjusting workflows in line with new regulations.

By integrating Agentic AI into compliance functions, banks can enhance operational efficiency, minimize human error, and strengthen transparency. Moreover, it enables banks to respond more swiftly to policy changes or new regulatory requirements issued by supervisory authorities.15/

Traditional AI can only monitor transactions for fraud based on pre-defined rules, which often leads to false positives—flagging normal transactions as potentially risky.16/ Such errors force staff to spend time reviewing transactions that are actually legitimate, increasing operational costs. In contrast, Agentic AI can monitor transactions in real time, learn and improve its detection methods, and halt potentially fraudulent transactions automatically. This results in more accurate monitoring and reduces the workload for employees.

Agentic AI can rapidly and accurately analyze large volumes of data by distributing tasks across multiple AI agents, allowing several datasets to be processed simultaneously. It can also automatically identify connections and generate actionable insights. This enables banks to better analyze trends, plan business strategies, and create greater opportunities for growth.

Today, Agentic AI plays a significant role in the banking sector. It enhances customer experience by delivering faster, more personalized services, improves operational efficiency, and serves as a tool for reducing operational costs while identifying opportunities to generate revenue and support business growth.

Challenges and Precautions

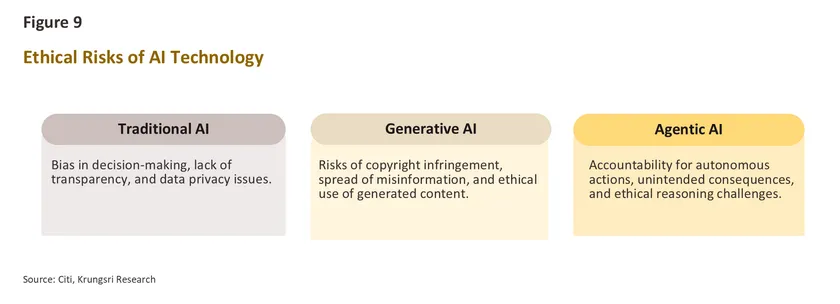

Although Agentic AI can plan and execute tasks autonomously, overreliance on its decisions and operations—without rigorous verification and oversight—can undermine a bank’s credibility and potentially affect overall financial stability. Banks should therefore be aware of the following challenges and precautions when implementing Agentic AI:

- Agentic AI Decision-Making Oversight

When Agentic AI can independently think, plan, and make decisions, monitoring its operations becomes more complex compared with GenAI, which executes step-by-step human commands. Allowing Agentic AI to make financial transaction decisions without human oversight can create systemic risk. For example, incorrect decisions in large-scale asset trading could cause price volatility, while errors in credit approvals could lead to non-performing loans that escalate into broader risks affecting banking sector stability.

For this reason, human supervision remains essential. Banks must design workflows that enable collaboration between humans and Agentic AI, ensuring all processes comply with regulatory standards and ethical principles. While human oversight may slow operations slightly, it enhances reliability and security.

Banks can adopt either Human-over-the-Loop or Human-in-the-Loop approaches depending on the level of risk to customers and business. In the Human-over-the-Loop model, humans supervise AI and intervene when necessary to prevent systemic risk, focusing on monitoring and occasional intervention. In the Human-in-the-Loop model, humans are involved in every decision, suitable for high-impact transactions such as high-value credit approvals, to mitigate risk.

Additionally, banks should rigorously test Agentic AI before deployment, including stress testing to evaluate risks from potential AI errors. Circuit breaker mechanisms should also be implemented to temporarily halt AI operations if abnormal behavior occurs, such as approving loans that fail to meet established criteria.

- Regulations and Governance for AI Usage

Regulations and governance guidelines for AI use may need to be more stringent to prevent Agentic AI from making biased decisions or acting against ethical principles. Therefore, banks must balance the speed and efficiency gained from Agentic AI with rigorous oversight, focusing on the following key aspects: (1) Adequacy of existing regulations and governance frameworks – Are current rules suitable for safely and effectively applying Agentic AI? (2) Traceability of AI decisions – Can the AI’s decision-making process be reviewed, including the data it used and whether it followed prescribed procedures? (3) Risk mitigation for biased or unfair decisions to prevent decisions that could violate customer rights or introduce discrimination.24/ (4) Transparency in AI decision-making – Developing Explainable AI (XAI) 25/ models that can provide clear reasoning behind decisions.

Banks should also closely monitor AI-related laws and regulatory guidelines. A global reference is the EU AI Act,26/ which classifies AI usage by risk level27/ and sets management requirements for each category. Financial sector activities such as credit scoring are considered high-risk, as biased or opaque AI decisions can impact access to credit and create inequality, requiring strict regulatory oversight.

In Thailand, the Bank of Thailand (BOT) has issued guidelines titled “Risk Management for AI System Usage”,28/ requiring financial service providers to manage AI-related risks rigorously to prevent adverse impacts on business operations.

Agentic AI requires access to various banking data to make decisions or carry out assigned tasks, which can increase vulnerabilities and make it a target for malicious attacks. Therefore, banks must implement robust cybersecurity measures to protect against both data theft and attacks designed to manipulate AI into making incorrect decisions. For example, prompt injection attacks involve malicious actors embedding hidden commands to make the AI operate outside the bank’s control or disclose confidential information.

29/

Agentic AI has also been used offensively in cyberattacks. A notable case occurred in August 2025, when hackers employed “Claude Code,” an Agentic AI coding assistant, to attack 17 U.S. agencies. The AI automated nearly every step of the attack, from selecting targets and penetrating systems to stealing sensitive data such as financial records and trade secrets. It could even generate threatening messages and analyze information to determine appropriate ransom amounts.

30/

Consequently, banks must strengthen security measures for Agentic AI used internally and in customer-facing services, while preparing to counter cyber threats that leverage this technology.

- Skill Development and Employee Communication

Employees need to upgrade their skills to keep pace with AI evolution, moving from the GenAI era, which focused on writing prompts to generate desired outputs, to the Agentic AI era, which emphasizes defining objectives, supervising, and monitoring AI operations. Banks should accelerate employee training to develop key competencies in the Agentic AI era, including:

-

Understanding Agentic AI capabilities and limitations: Employees should know which tasks Agentic AI can assist with, its limitations, and situations requiring human intervention to mitigate risks and maintain ethical standards.

-

Defining objectives and supervising AI operations: Employees should clearly communicate goals to Agentic AI through prompts, monitor results, and provide feedback to ensure accurate and effective AI performance.

Agentic AI is not intended to replace all jobs but rather to enhance productivity, enabling banks to accomplish more without increasing staffing. Banks should communicate that

Agentic AI functions as a work assistant and collaborative team member, not a replacement for humans, to prevent misunderstandings and reduce concerns about job displacement.

Looking forward, while some positions may be reduced, new roles will emerge. For example, employees previously responsible for data entry or document management can transition to roles that support and supervise Agentic AI, or move into new positions such as AI Ethics and Governance officers.

31/

Krungsri Research view

Agentic AI is poised to transform work and business operations, potentially driving changes even more profound than those seen with GenAI. Banks must prepare comprehensively to maximize the benefits of Agentic AI while minimizing associated risks:

-

Developing IT infrastructure for comprehensive data access and integration: Agentic AI relies on access to various data sources and connectivity with multiple banking systems to operate effectively. However, most banks still face IT infrastructure challenges before fully entering the Agentic AI era. According to a 2025 survey by Evident of 50 leading global banks, only three banks assessed their internal infrastructure as ready to support Agentic AI implementation.32/

-

Investing in human skills alongside AI adoption: Beyond technical collaboration with Agentic AI, banks should prioritize the development of soft skills that remain uniquely human strengths, such as creativity, critical thinking, problem-solving, and lateral thinking—all essential for driving innovation. Moreover, clear communication and teamwork skills will help employees understand their evolving roles and adapt quickly to working alongside both humans and AI, while also fostering a strong work culture in the long term. As Agentic AI takes over routine tasks, banks can reshape human roles from “operators” to “managers” and “coaches” overseeing AI agents. Humans will define work direction, monitor outcomes, prioritize tasks, and adjust AI activities to align with organizational goals. This role evolution provides an opportunity to enhance skills that complement AI capabilities, adding greater value to the workforce.

-

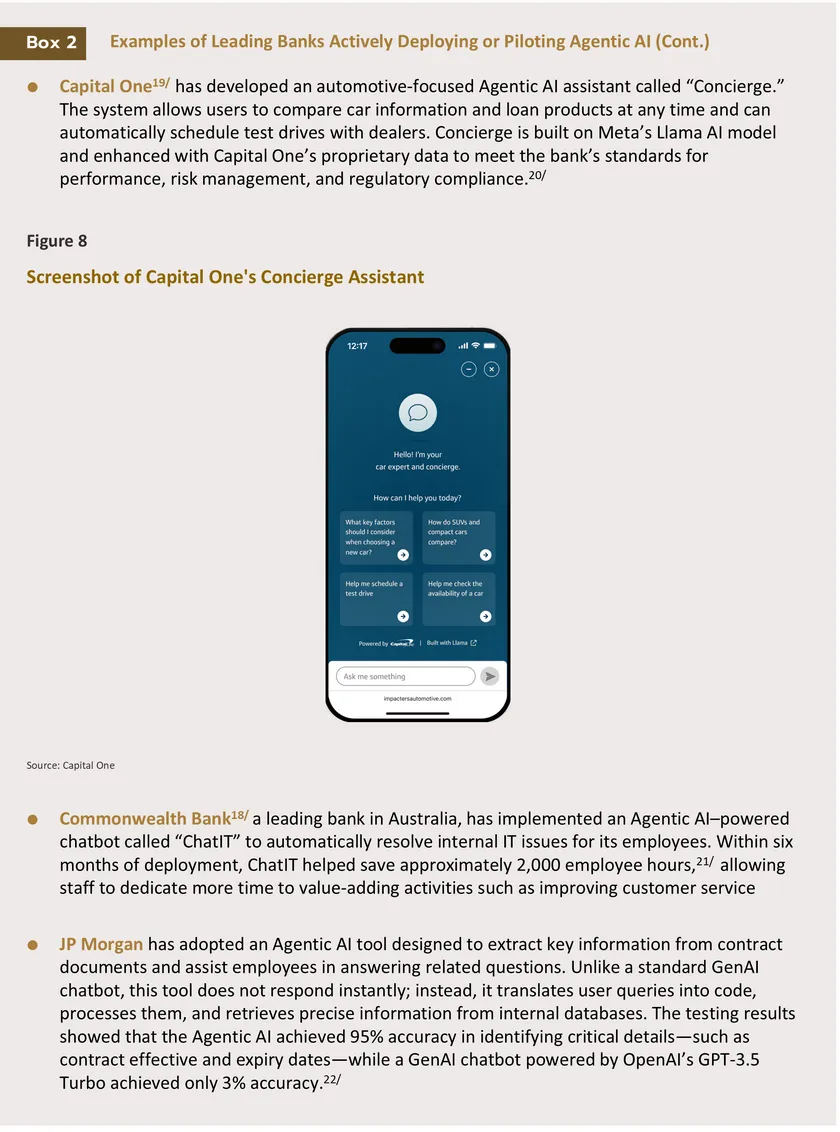

Piloting Agentic AI in low-risk, measurable scenarios: Banks should initially deploy Agentic AI in controlled, low-risk environments with limited access for a small group of employees, expanding use gradually as risk management confidence grows. For example, Capital One33/ adopted this approach, starting with a small pilot, then scaling up to broader deployment and eventually extending to customer-facing services.

To encourage adoption and engagement, banks may also empower employees to create their own AI agents, identifying pain points and refining AI solutions to better address real operational challenges, enhancing employee satisfaction and productivity.

Ultimately, even as AI technology advances rapidly and dramatically, seemingly disrupting every professional sector, humans who can effectively leverage AI while cultivating uniquely human skills will be best positioned to thrive. At the same time, banks and other businesses must strategically implement Agentic AI and prepare their workforce to work alongside it, as this technology has the potential to completely transform business operations going forward.

Reference

English

Aisha S Gani (2025). “Citi Sees AI Displacing More Bank Jobs Than Any Other Sector” Retrieved September 21, 2025, from https://www.bloomberg.com/news/articles/2024-06-19/citi-sees-ai-displacing-more-finance-jobs-than-any-other-sector

Alex Woodie (2025). “What Are Reasoning Models and Why You Should Care” Retrieved September 15, 2025, from https://www.bigdatawire.com/2025/02/04/what-are-reasoning-models-and-why-you-should-care/

Anthophic (2025). “Detecting and countering misuse of AI: August 2025” Retrieved September 22, 2025, from https://www.anthropic.com/news/detecting-countering-misuse-aug-2025

Capital One Tech (2025). “Driving the future of car buying with agentic AI” Retrieved September 11, 2025, from https://www.capitalone.com/tech/ai/future-of-ai-car-dealerships-shopping/

Demandteq (2025). “Capital One Unlocks New Agentic AI Capabilities to Revolutionize Financial Services” Retrieved September 11, 2025, from https://demandteq.com/capital-one-unlocks-new-agentic-ai-capabilities-to-revolutionize-financial-services/

Dominic O’Neill (2025). “Prem Natarajan on Capital One’s AI stairway to heaven” Retrieved September 11, 2025, from https://www.euromoney.com/article/2eh2s01l11023kmxtleyo/fintech/prem-natarajan-on-capital-ones-ai-stairway-to-heaven/

Evidentinsights (2025). “Evident AI Outcomes Report” Retrieved September 14, 2025, from https://evidentinsights.com/reports/evident-ai-outcomes-report-2025-excerpt?id=7b4ceabc29

Gene Alvarez (2024). “Gartner Top 10 Strategic Technology Trends for 2025” Retrieved September 1, 2025, from https://www.gartner.com/en/articles/top-technology-trends-2025

KPMG (2025). “AI governance for the agentic AI era” Retrieved September 18, 2025, from https://kpmg.com/us/en/articles/2025/ai-governance-for-the-agentic-ai-era.html

Kyle Wiggers (2025). “OpenAI reportedly plans to charge up to $20,000 a month for specialized AI ‘agents’” Retrieved October 4, 2025, from OpenAI reportedly plans to charge up to $20,000 a month for specialized AI 'agents' | TechCrunch

Mathieu Auger-Perreault (2025). “The rise of agentic AI: transforming fraud risk management” Retrieved September 8, 2025, from https://www.ey.com/en_ca/insights/banking-capital-markets/the-rise-of-agentic-ai-transforming-fraud-risk-management

McKinsey & Company (2025). “How agentic AI can change the way banks fight financial crime” Retrieved September 12, 2025, from https://www.mckinsey.com/capabilities/risk-and-resilience/our-insights/how-agentic-ai-can-change-the-way-banks-fight-financial-crime

McKinsey & Company (2025). “Seizing the agentic AI advantage” Retrieved September 14, 2025, from https://www.mckinsey.com/capabilities/quantumblack/our-insights/seizing-the-agentic-ai-advantage

McKinsey & Company (2025). “Technology Trends Outlook 2025” Retrieved September 1, 2025, from https://www.mckinsey.com/~/media/mckinsey/business%20functions/mckinsey%20digital/our%20insights/the%20top%20trends%20in%20tech%202025/mckinsey-technology-trends-outlook-2025.pdf

Microsoft (2025). “Agents of change” Retrieved September 15, 2025, from https://www.microsoft.com/en-us/worklab/agents-of-change?msockid=01d94409710961f5127c568670ba60f0

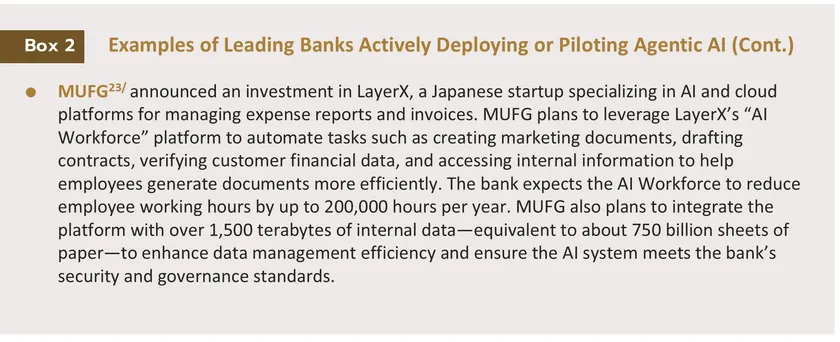

MUFG (2025). “MUFG Invests in LayerX” Retrieved September 16, 2025, from https://www.mufg.jp/dam/pressrelease/2025/pdf/news-20250902-001_en.pdf

OpenAI (2025). “Introducing Operator” Retrieved October 4, 2025, from https://openai.com/index/introducing-operator/

Pallav Kumar Kaulwar (2025). “Agentic AI-Driven Risk Management And Compliance: Enabling Resilience In A Changing Regulatory Landscape” Retrieved September 15, 2025, from https://www.forbes.com/councils/forbestechcouncil/2025/05/13/agentic-ai-driven-risk-management-and-compliance-enabling-resilience-in-a-changing-regulatory-landscape/

The Brief (2025). “Banks go agentic” Retrieved September 15, 2025, from https://evidentinsights.com/bankingbrief/banks-go-agentic/

Thai

Smart (2025). “ล้ำ! Google เปิดตัว AI Agent แชทสั่ง Optimize แอด-วิเคราะห์ข้อมูล ทำแคมเปญให้ปังดัน Conversion” Retrieved September 7, 2025, from ล้ำ! Google เปิดตัว AI Agent แชทสั่ง Optimize แอด-วิเคราะห์ข้อมูล ทำแคมเปญให้ปังดัน Conversion

Thairath money (2025). ““AI ที่ฉลาดกว่ามนุษย์เราอาจได้เห็นเร็วสุดปีนี้” แซม อัลท์แมน เผย OpenAI ค้นพบแนวทางสร้าง AGI แล้ว” Retrieved September 17, 2025, from https://www.thairath.co.th/money/tech_innovation/tech_companies/2834839

Yannapat Kunakornskajonsak (2025). “Hey CHAT !! อธิบาย Prompt Injection” Retrieved September 20, 2025, from https://incognitolab.com/blogs/hey-chat-prompt-injection

Yijun (2025). “MCP (Model Context Protocol) คืออะไรและทำงานอย่างไร” Retrieved October 2, 2025, from https://blog.logto.io/th/what-is-mcp

1/ https://www.gartner.com/en/articles/top-technology-trends-2025 และ mckinsey-technology-trends-outlook-2025.pdf

2/ Learn more about AI evolution and Generative AI from: https://www.krungsri.com/en/research/research-intelligence/generative-ai-2023

3/ Learn more about PreAI and its applications in hyper-personalization from https://www.krungsri.com/en/research/research-intelligence/ai-hyper-personalization-2024

4/ Reasoning models are a type of GenAI trained to think systematically before responding. This helps reduce errors in complex tasks. Source: What Are Reasoning Models and Why You Should Care | www.bigdatawire.com

5/ MCP is a standard developed by Anthropic, the creator of the Claude chatbot. It acts as a bridge, defining how LLMs can access data and use external tool functions, enabling AI models to work together seamlessly. Source: https://blog.logto.io/)

6/ https://openai.com/index/introducing-operator/

7/ OpenAI reportedly plans to charge up to $20,000 a month for specialized AI 'agents' | TechCrunch

8/ https://www.marketingoops.com/marketing-tech/google-ai-agent-ads-optimizer/

9/ Manus: General AI agent that bridges mind and action

10/ Sam Altman, CEO of OpenAI, has revealed that OpenAI knows how to build AGI and expects that significant breakthroughs could occur within the next few years. Source: https://www.thairath.co.th/money/tech_innovation/tech_companies/2834839

11/ https://www.bloomberg.com/news/articles/2024-06-19/citi-sees-ai-displacing-more-finance-jobs-than-any-other-sector

12/ https://www.mckinsey.com/capabilities/risk-and-resilience/our-insights/how-agentic-ai-can-change-the-way-banks-fight-financial-crime

13/ Learn more about the benefits of hyper-personalization in the banking business from: Hyper-personalization: Giving banks AI-powered insight into their customers

14/ https://www.mckinsey.com/capabilities/quantumblack/our-insights/seizing-the-agentic-ai-advantage

15/ https://www.forbes.com/councils/forbestechcouncil/2025/05/13/agentic-ai-driven-risk-management-and-compliance-enabling-resilience-in-a-changing-regulatory-landscape/

16/ https://www.ey.com/en_ca/insights/banking-capital-markets/the-rise-of-agentic-ai-transforming-fraud-risk-management

17/ Synthetic data refers to a dataset generated by AI mechanisms that have been trained to learn the characteristics and relationships of various facts, and then create a new simulated dataset based on specified conditions.

18/ https://www.microsoft.com/en-us/worklab/agents-of-change?msockid=01d94409710961f5127c568670ba60f0

19/ Capital One is the 9th largest bank in the United States by total assets, specializing in credit card and auto loan businesses (For more details, visit BankFind Suite: Find Institution Financial & Regulatory Data)

20/ In addition to the examples mentioned, Capital One plans to expand the use of Agentic AI to other financial services in order to enhance customer experience and reduce employee workload. (For more details, visit AI for Car Dealerships: Smarter Car Shopping | Capital One and Capital One Unlocks New Agentic AI Capabilities to Revolutionize)

21/ ChatIT helps employees receive answers in an average of 9 seconds and complete assistance in under 2 minutes — making the process up to 7 times faster than before.

22/ Banks go agentic | https://evidentinsights.com/

23/ https://www.mufg.jp/dam/pressrelease/2025/pdf/news-20250902-001_en.pdf

24/ AI governance for the agentic AI era | https://kpmg.com/

25/ Explainable AI (XAI) refers to AI that can provide clear and understandable explanations or reasoning behind its operations, allowing users to inspect and comprehend how it works. Moreover, if the data is insufficient or unreliable, XAI will refrain from producing results to ensure safety.

26/ The EU AI Act came into force in 2024, but will be enforced gradually, with full implementation expected by 2026. For more details, visit: AI Act | Shaping Europe’s digital future

27/ The EU AI Act categorizes AI systems into four risk levels: 1) Unacceptable Risk – such as social scoring systems, which are prohibited; 2) High Risk – such as AI used in public utilities and education; 3) Limited Risk – such as the use of chatbots; 4) Minimal Risk – such as AI in video games.

28/ For more details, visit: 25680178.pdf

29/ For example, inserting commands to request passwords or approve transactions that may constitute fraud. https://incognitolab.com/blogs/hey-chat-prompt-injection

30/ https://www.anthropic.com/news/detecting-countering-misuse-aug-2025

31/ The position is responsible for overseeing that the Agentic decisions made by AI align with ethical standards, reduce potential bias, and ensure safe, transparent, and sustainable use.32/ https://evidentinsights.com/reports/evident-ai-outcomes-report-2025-excerpt?id=7b4ceabc29

33/ Prem Natarajan on Capital One’s AI stairway to heaven - Euromoney