Introduction

Savings help to form the bedrock on which society’s long-term financial security and stability rests, though this is especially so given the volatility inherent in the modern economy and the potential of this to impact lives and livelihoods. At the individual level, navigating this uncertain economic environment is made easier by strong financial literacy and the support that this provides to those attempting to manage their finances effectively. One example of the importance of this was seen in the Covid-19 pandemic, when widespread layoffs and enormous disruptions to the economy forced individuals to fall back on their personal savings as they tried to sustain their livelihoods and keep their businesses afloat.

To gain insight into these matters, the Bank of Thailand (BOT) joined with the National Statistical Office (NSO) in 2022 to survey 12,402 Thai households on their savings behavior. The survey made use of a framework developed by the Organization for Economic Co-operation and Development (OECD)1/ and this revealed that 87.5% of households saved some portion of their income, mostly in secure forms such as cash or dedicated savings accounts.

A wide range of savings vehicles are now available to the public, some of which are connected to or overlap with “low-risk investments” that offer more attractive returns than are available through traditional savings accounts, but as the range of options proliferates, savers’ behavior is evolving. Krungsri Research has thus surveyed the behavior of domestic consumers with regard to their savings (and investments), with the results broken out according to income, age and occupation. This has then allowed for a deeper understanding of each consumer groups’ attitudes, and provided insight into their hopes and expectations with regard to their savings and the financial infrastructure that makes this possible.

Saving behavior in the ASEAN zone

Consumer financial behavior in the major ASEAN markets

Milieu Insight, a market research agency that specializes in producing digitally mediated insights into Southeast Asian consumers, has carried out research into the public’s financial behavior in the six most important markets in the ASEAN zone, namely Singapore, Malaysia, Indonesia, Vietnam, the Philippines and Thailand.2/ This shows that 43% of respondents saved only 10% of their income, and only 46% invested their savings. Singapore stands out among these countries thanks to investment rates that rise to a regional high of 59% of the population, with equities being the most favored vehicle among Singaporeans (Milieu, 2024).3/ Meanwhile, Vietnam leads with regard to the savings rate thanks to the reported 61% of the Vietnamese population prefer saving over investing (Nielsen IQ, 2024).4/

In the case of Thailand, the financial authorities recommend that individuals save around a quarter of their income, though the exact amount will depend on their wages or salary and the exact nature of their financial plans.5/ A survey undertaken by the BOT and the NSO shows that as of 2022, 75.4% of Thai households had savings in the form of cash and 53.3% had a dedicated savings account at a financial institution, which generally provide low returns but which also do not put the savings at risk. By contrast, only 2.6% of households had swapped security for higher returns by investing in financial instruments such as bonds, equities or mutual funds. This survey also reveals that 61.1% of the Thai population had a financial plan for their retirement and had begun building savings towards this, though only 15.7% had been able to stick completely to their plan.

Savings vehicles

Individuals save for a wide range of reasons, including financial security, wealth generation, retirement, a better lifestyle, and so on. Nevertheless, whatever the motivation, saving helps reduce financial risks in the future and can be seen as a willingness to forego current consumption for future consumption, in line with the theory of intertemporal consumption.

This survey focuses in particular on three types of saving.

-

General saving: This refers to saving money from current income for use in the future, i.e., for the deferred purchase of goods or services. This may also include saving for future investment, should the opportunity arise.

-

Emergency saving: This refers to savings that are accumulated to cover unexpected expenses or use in the case of some unforeseen crisis, for example to cover the costs of an accident, medical care, home repairs or a period of unemployment. It is often recommended that individuals maintain an emergency fund sufficient to cover 6 to 12 months of regular expenses.

-

Retirement saving: This entails making long-term financial plans in the hope of ensuring that an individual has sufficient funds to cover his or her retirement. In addition to standard savings vehicles, this category also includes savings that are directed into provident funds, annuities, and specially designed retirement mutual funds (RMF).

Survey results

Scope of the study

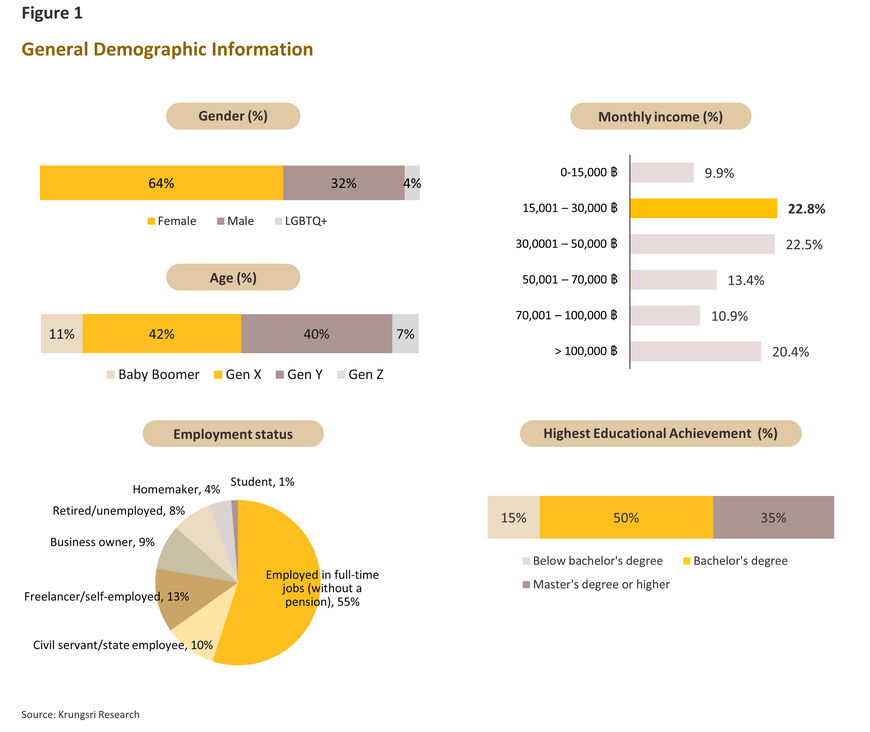

Through November and December 2024, Krungsri Research conducted a survey of savings behavior among Thai consumers. This survey was carried out online, and 1,138 responses were collected covering individuals from a wide range of age groups,6/ occupations, educational achievements, and income.

General demographic information

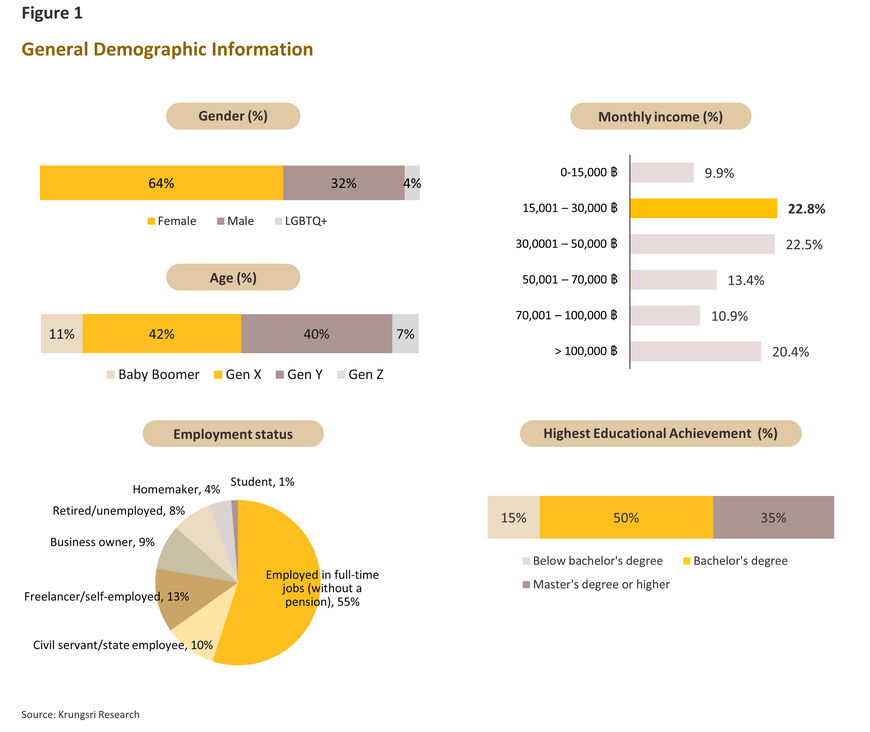

42% of respondents qualified as Gen X (45-59 years old) and another 40% were Gen Y (29-44 years old). Almost two-thirds were women, and over 45% had a monthly income of between THB 15,000 and THB 50,000. 65% were employed in full-time jobs (in either the private or public sector) and around half had a bachelor’s degree or equivalent.

Thai people and saving discipline

Thais pay debts first.. invest later

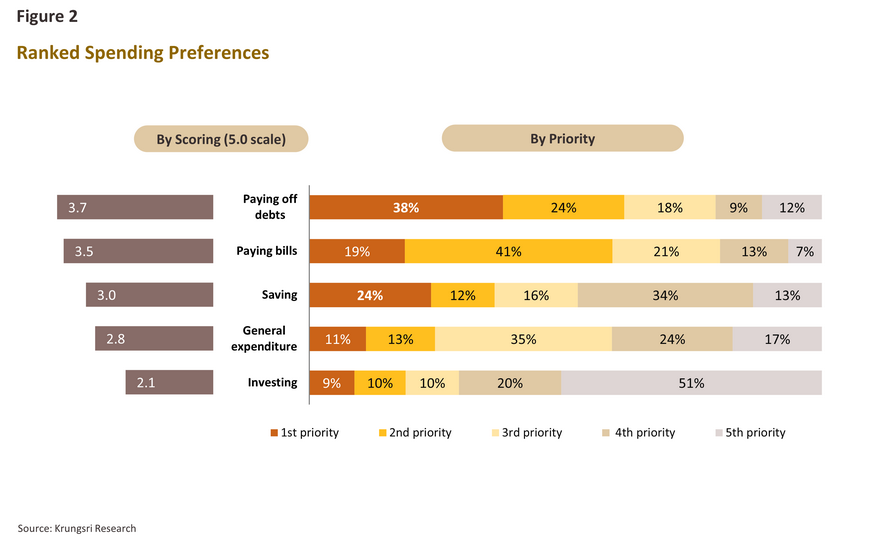

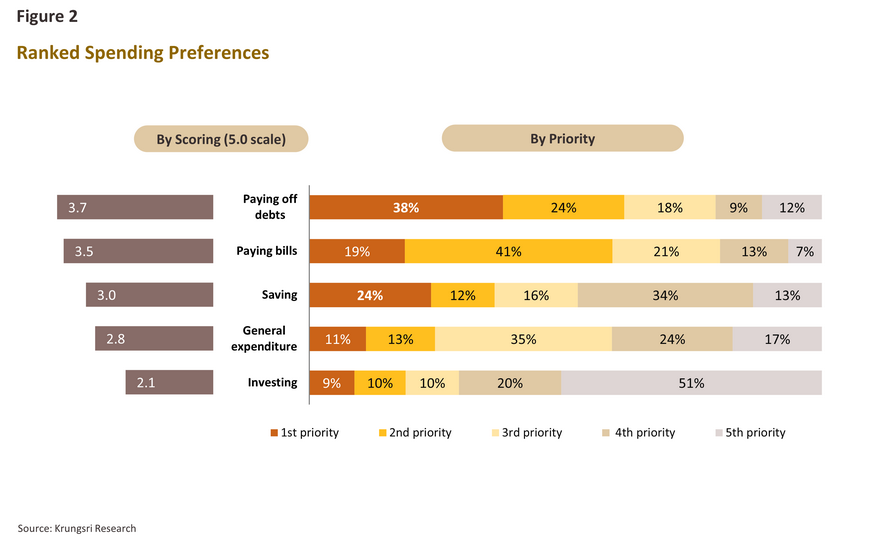

Despite Thailand’s continuing high levels of household indebtedness,7/ the survey shows that within all groups (considered by age, gender, education and income), respondents prioritize debt repayments. As such, when receiving income, 38% of individuals surveyed reported prioritizing paying off their debts, compared to 24% who preferred to save and just 9% who set aside a portion of their income for investing.

Analyzing the weightings given to different options through ranked preferences8/ (Figure 2) demonstrates that survey respondents did indeed prioritize paying off their debts. This was followed in importance by paying bills, adding to savings, and general spending. Interest in investing was ranked lowest in importance. This ranking was repeated across all age groups with the exception of Baby Boomers, who prioritized paying their bills, with savings and investment ranked least important.

Savings behavior and financial discipline

With regard to savings and investments, the survey revealed that 60% of respondents showed strict financial discipline, saving and/or investing regularly each month. 31% saved or invested periodically when receiving a lump sum, while a further 9% did not save. These behaviors were positively correlated with education and income, and as one or both of these increased so did the likelihood of regularly saving or investing.

Looking more closely at the data shows that generally, respondents who are able to save or invest regularly put aside 20-30% of their monthly paycheck, which matches the recommendations of the BOT described above. Moreover, those earning more than THB 70,000 per month are more likely to save or invest more than 30% of their income, with this proportion rising in step with higher income, better education, and age. It is interesting to note that men are slightly better at saving than other genders.

Conversely, some respondents and in particular those earning less than THB 30,000 per month and those with less than a bachelor’s degree are much more likely not to save or invest regularly. This may be for a number of reasons, including uncertain income, income that is insufficient to cover outgoings, high levels of debt, and a lack of knowledge about financial planning.

Reasons for saving

Regular saving

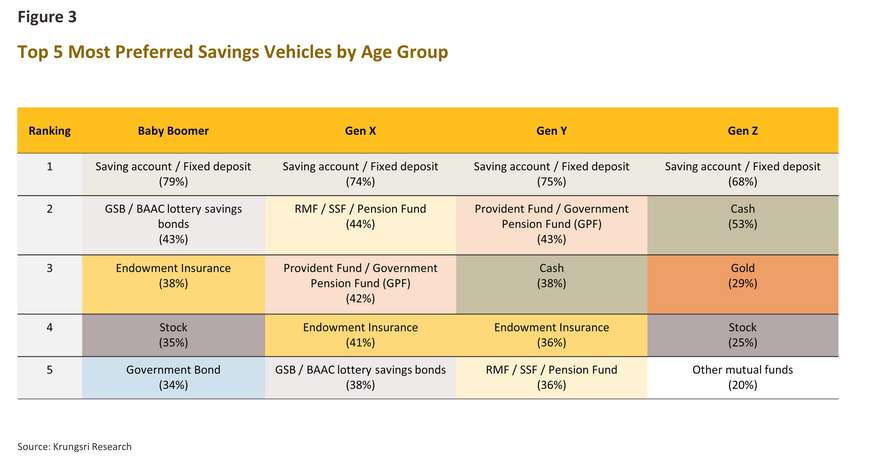

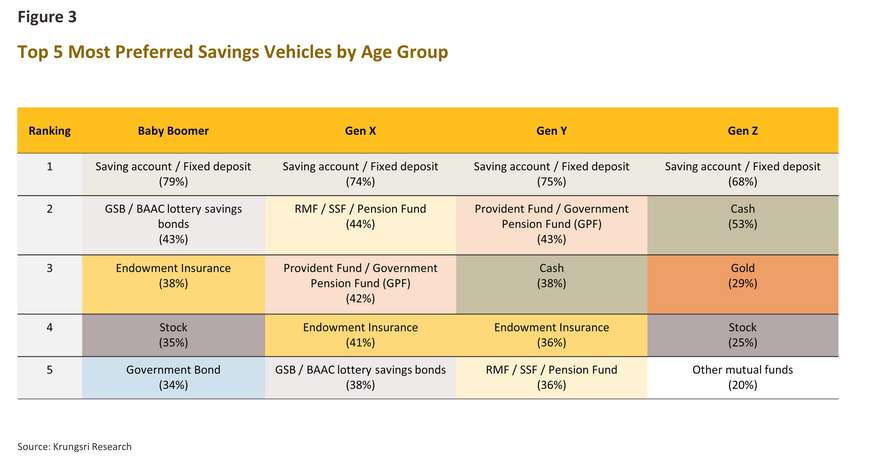

Across all income groups and ages, respondents favored using regular savings and fixed deposit accounts. The exception to this was those earning more than THB 100,000 per month, for whom tax concerns are more salient and so these individuals are correspondingly more likely to divert their savings into tax-saving funds or retirement mutual funds. The survey also shows that although paying money into savings and deposit accounts was broadly regarded as the best way to save, there are nevertheless differences across age groups. For Baby Boomers, savings bonds, the Government Savings Bank or BAAC lottery and bonds are significantly more popular than for other groups. By contrast, Gen Y and Gen Z respondents are more likely to save cash, while those in Gen Z prefer to store their savings and investing in gold. However, risky assets like stocks are only in the top 5 for the Baby Boomer and Gen Z groups. Meanwhile, middle-aged working groups like Gen X and Gen Y do not favor them as much. It is noteworthy that risky assets such as stocks and gold do not rank in the top 5 for Gen X and Gen Y, but they are clearly popular among Baby Boomers (stocks) and Gen Z (both stocks and gold).

It can thus be seen that significant differences emerge across age groups with regard to preferred savings vehicles.

Emergency saving

The Covid-19 pandemic has raised awareness of the importance of stepping up individual savings rates, and the Bank of Thailand thus recommends that households maintain savings covering at least 3-6 months of normal expenditure.9/ Given this, Krungsri Research has analyzed the survey data to look at how well individuals would be able to cope with a scenario in which one year in the future, a new pandemic breaks out resulting in another shutdown that causes a total loss of income for 6 months. In particular, this analysis looks at which groups of regularly-saving salaried individuals10/ would be able to save enough in the year-long run-up to the pandemic to carry them through the following 6 months of lost income.11/ This analysis was also undertaken under the assumption that: (i) respondents' ongoing expenses are estimated as the remaining portion after their savings are deducted from their income; and (ii) respondents did not access currently existing savings or assets since the survey did not include data on these. This analysis reveals the following.

26% of respondents would be able to save enough to meet these spending targets, with the average savings rate across this group coming to 47% of income. These respondents were concentrated in the Gen X and Baby Boomer groups, with around 80% receiving a regular salary and 33-42% earning in excess of THB 70,000 per month.

By contrast, 74% of respondents would be unable to amass sufficient savings over this timeframe. Within the group of unsuccessful savers, the savings rate averaged 18% of income. It was found that Gen Z had the highest proportion of individuals who were unable to save enough, reaching 84%. In addition, around 80% of those earning less than THB 70,000 per month would also fail to save sufficient funds. In this scenario, unsuccessful savers would thus need to increase their savings rate if they were to be financially prepared for a new crisis, and this would require their raising their average savings rate to 41% of total income (i.e., they would have to save an additional 23% of their income). Failure to do this would then mean that in this hypothetical crisis, those without sufficient pre-existing savings or liquid assets that could easily be converted into cash would either have to borrow or rely on another form of external assistance.

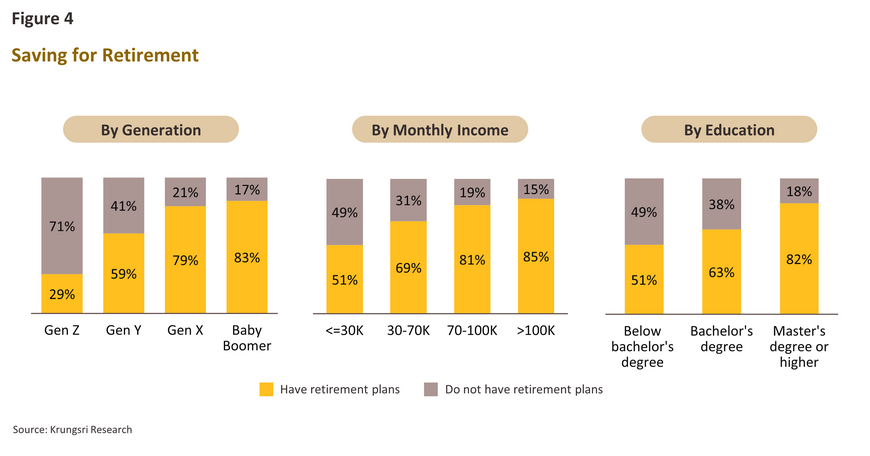

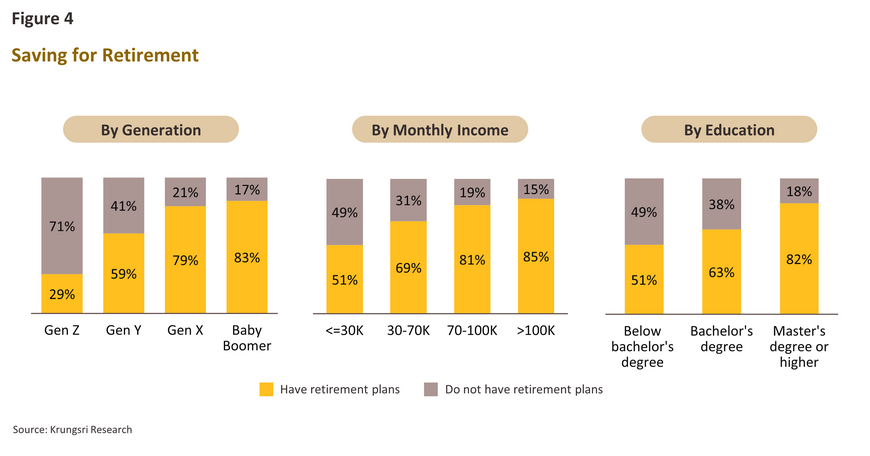

Retirement saving

About 7 in 10 survey respondents had made financial plans for their retirement. By raw numbers, Gen X and Gen Y individuals were most strongly represented in this group but overall, the likelihood that any individual had planned for retirement was correlated with age, income and education. 83% of Baby Boomers had put in place financial plans for retirement, largely because most are over 60 and so for them, this is a pressing issue. The proportion then dropped across Gen X (79%), Gen Y (59%) and Gen Z (29%). Those earning in excess of THB 70,000 per month and those with at least a master’s degree were also more likely to have retirement plans, with over 80% of these individuals having done so. Thus, those with a master’s degree or above were 1.78-times more likely than those with a bachelor’s degree to have made financial plans for their retirement. Although personal finance is not a formal part of the curriculum, there are several factors that may explain this relationship. Most obviously, those with better education are likely to earn more, thus making it easier to lay out comprehensive financial plans, though these individuals may also be better placed to access sources of financial information and then to analyze this. Education may also help to make the necessity of long-term financial planning clearer.

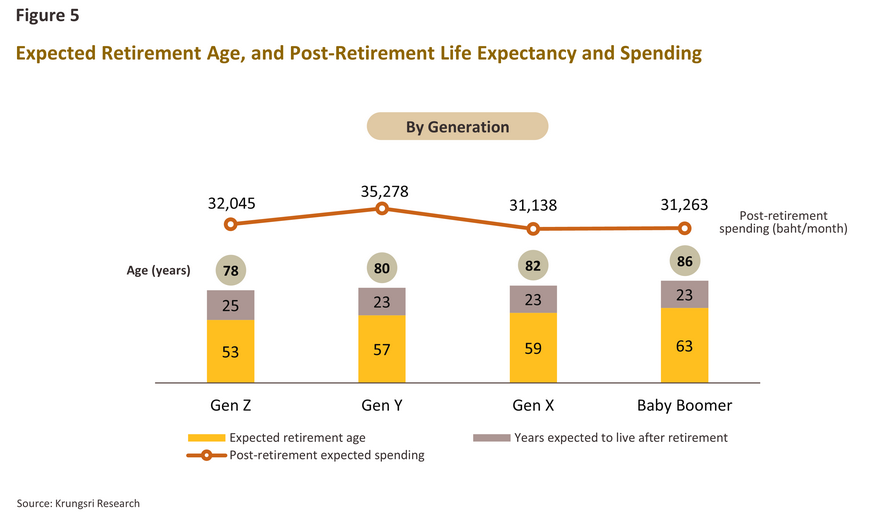

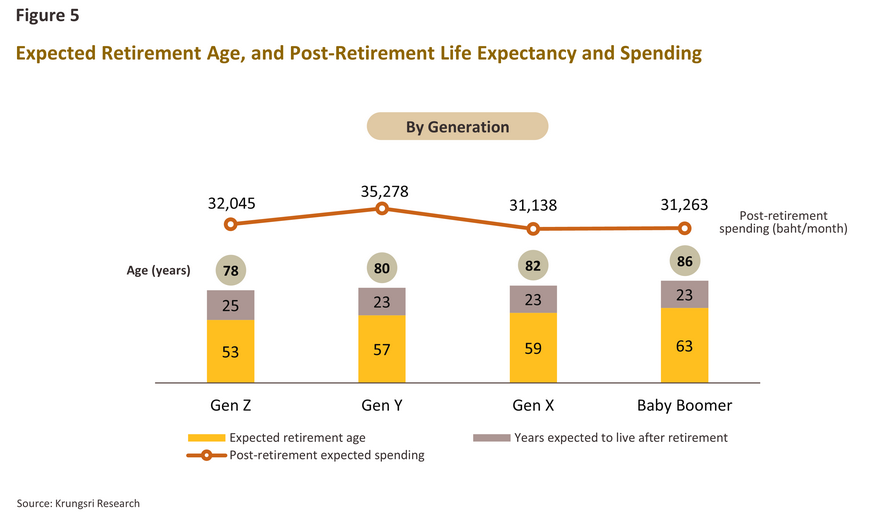

Expectations around retirement also show clear differences across age groups, both with regard to retirement age and expected post-retirement lifespan. On average, Gen Z respondents expected to retire at 53 (the lowest of any group) but these expect to live for another 25 years after retirement. Baby Boomers expect to retire at 63 (though 30% would like to retire at 65) and then to live for another 23 years, while Gen X and Gen Y would like to retire at respectively 59 and 57.

LGBTQ+ respondents wanted to retire the latest of all groups, expecting to do so at 60, compared to 58 for men and women, though this was compensated for by the fact that they are also expected to have a slightly shorter post-retirement lifespan compared to other genders at 21 years (compared to 22 for women and 24 for men). LGBTQ+ respondents thus anticipated that on average, they would live to 80. This was the same as women respondents but behind men. Men expect to live slightly longer than other genders (82 years) and anticipate higher monthly post-retirement spending than others, at 38,372 Baht. This compared to THB 29,472 for women and THB 34,286 for LGBTQ+ respondents.

Income was not correlated with expected retirement age, and so across all levels of income, individuals expected to retire at 58-59 years old. However, those earning in excess of THB 100,000 per month anticipated living for 25 years after retirement, compared to the 22 years expected by those with a monthly income of less than THB 30,000.

Attitudes and planning for retirement

Post-retirement spending

Expected post-retirement spending averaged THB 32,431 per month, peaking at THB 35,278 per month for Gen Y respondents. However, the effects of lifestyle inflation showed up in the survey data, with those currently on a higher income expecting to spend more in retirement than those with less. Thus, low-income earners (i.e., those with a monthly income of less than THB 30,000) anticipated needing THB 21,316 per month after retirement, compared to THB 35,150 for those earning more than THB 70,000 per month.

Planning for retirement

It has become much more normal to hear about the importance of beginning planning for retirement at an early age, and the possible effects of this have shown up in the survey data, which show that the average age of those who have laid out a serious plan for their retirement (38% of respondents) is just 36. However, this average obscures the existence of two modes, indicating that planning and the implementation of these plans in fact tends to happen at two points in the life trajectory. These are at around 30, when individuals become fully adult and start to enjoy the benefits of financial stability, and again at around 39, when middle age begins to loom and the reality of retirement becomes a more pressing consideration.

The data thus show that younger generations tend to start planning for retirement earlier, with Baby Boomers leaving this latest (starting at an average age of 41 years old), followed by Gen X (38), Gen Y (32) and Gen Z (beginning at just 26 years old). This shift may be explained by the increasing share of the Thai public who qualify as financially literate, which research by the Bank of Thailand shows stood at 71.4% of all adults as of 2022. This is up from 67.4% in 2020 and above the 2020 OECD average of 60.5%. Beyond this, those earning more than THB 70,000 per month were 2.5-times more likely than other respondents to put in place firm plans for their retirement. Men were also 1.6-times more likely than women to do so.

With regard to savings that are accumulated specifically for retirement, Gen X are most active. Thus, in this group, 41% of all savings are earmarked for retirement, though this may be simply because these individuals are closest to the end of their working life. By contrast, among the younger Gen Z, this proportion falls to 25%. Income is also correlated with engagement with the need to save for retirement and so those earning in excess of THB 100,000 per month apportion an average of 49% of all savings to their retirement fund, a proportion that is higher than for any other income level. The type of occupation also affects saving behavior, with individuals receiving a salary (payroll group) allocating 42% of all savings to retirement funds, whereas for those not on a salary (e.g., freelancers and business owners), this falls to 34%.

Retirement savings vehicles

Respondents were most interested in low-risk savings vehicles and across all age groups, the most favored ways of saving for retirement were: (i) fixed deposit/savings accounts, (ii) saving insurance, and (iii) provident funds, or for civil servants, the Government Pension Fund. Individuals thus appear to be more concerned with the safety of their savings than with their returns, though this is especially true for Gen X, with 40% preferring to save for retirement through Provident Funds, Retirement Mutual Funds (RMFs), and general savings insurance — a higher proportion than any other age group.

Perhaps unsurprisingly, those earning more than THB 100,000 per month were more interested than other groups in tax-efficient savings vehicles (e.g., RMFs, provident funds and endowment policies). Men were also more likely to favor RMFs and Thai ESG funds, while women favored insurance/endowment policies and LGBTQ+ individuals preferred general purpose mutual funds.

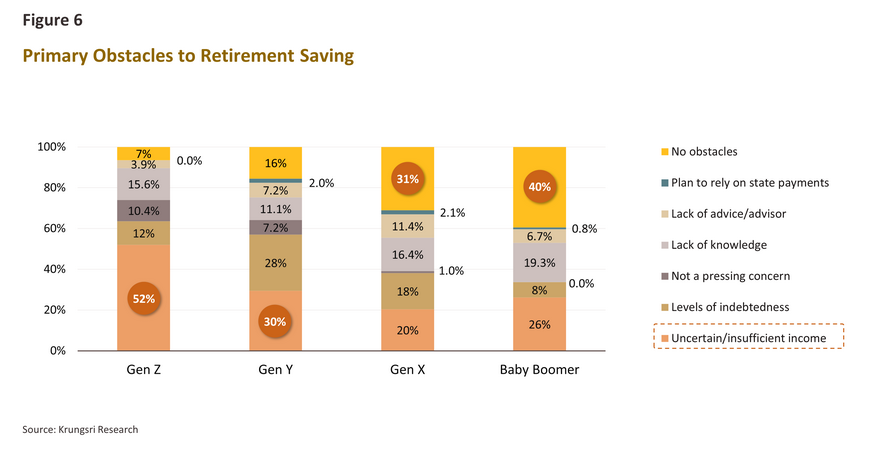

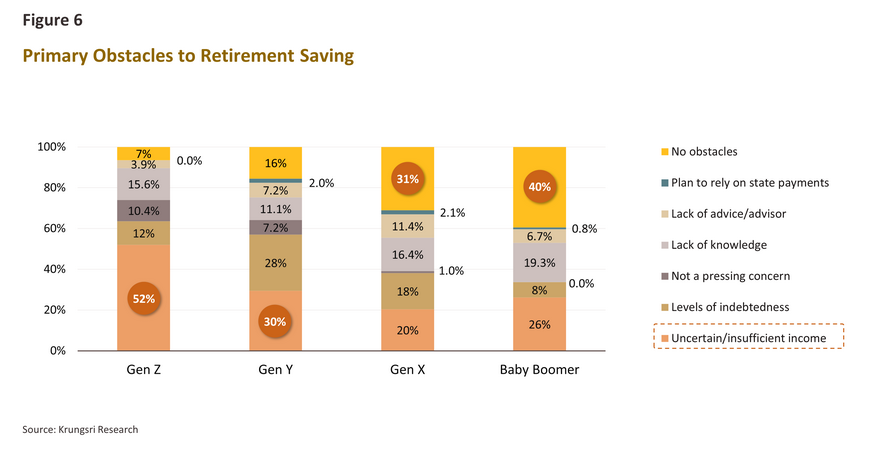

Obstacles to saving for retirement

Uncertainty over income or an outright lack of sufficient funds were cited as the most important reasons for failing to save for retirement. This was especially pronounced among Gen Z (52%) and Gen Y (30%) respondents, who said that unstable income was the greatest problem faced when trying to build up their savings. 28% of Gen Y respondents also stated that high levels of personal debt stood in the way of their effectively implementing their retirement plans.

However, a significant share of Baby Boomer (40%) and Gen X (30%) respondents reported facing no obstacles when implementing their saving plans. This was sharply ahead of Gen Y and Gen Z respondents, for whom the proportion fell to just 16% and 7% respectively. Across all income groups, some 14-20% of respondents also stated that a lack of knowledge about how to plan for their retirement was a major hinderance, this thus indicating that better knowledge is an important factor to consider when looking to improve the savings rate for all groups.

Case Study: Who is likely to save enough for retirement?

This analysis now considers potential shortfalls in savings, in particular among non-civil servants receiving a salary who have planned for their retirement.12/ This involves analyzing survey information on individual income, the proportion of this income allocated to a retirement fund, the age at which savings began, the individual’s retirement age, and his or her expected post-retirement spendings. This analysis also assumes that: (i) income increases at a fixed rate of 3% annually; (ii) individuals receive a 3-month annual bonus; (iii) savings are held in a deposit account paying 0.5% interest annually; and (iv) inflation comes to 2% per year. Given this, retirement savings will be insufficient to meet the expected post-retirement needs of a forecast 81% of individuals, and of this total, 93% will face a shortfall in excess of THB 1 million.

Who will have a big enough retirement fund?

Salaried individuals who regularly save or invest at least 40% of their monthly income, or who save at least 26% of their monthly income for retirement, were most likely to be on track to save enough for retirement. Income is an important determiner of how likely it is that an individual will be in this group, with 64% of these earning more than THB 100,000 per month and a further 17% earning THB 70,000-100,000. The proportion then falls as one moves down the income scale. Age is also a factor in this, and so 67% of those with sufficiently ambitious retirement plans are in Gen X, while 25% are in Gen Y. Among these individuals, the most favored investment vehicles are: (i) retirement mutual funds or RMFs (69%), (ii) provident funds (67%), and (iii) deposit accounts (61%).

A further important observation is that those with sufficient savings tend to have lower post-retirement spending expectations, as reflected by the average desired monthly spending after retirement, which is only 30,851 Baht. This is substantially below the THB 37,223 expected by those failing to meet their targets.

The role of the banking sector

Respondents’ views on the commercial banking sector

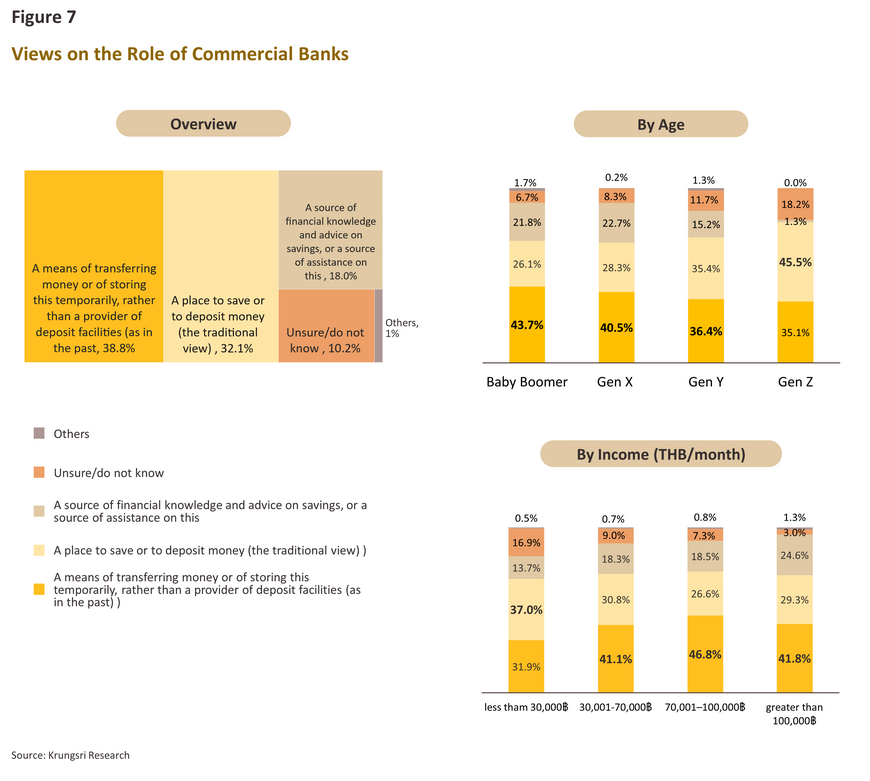

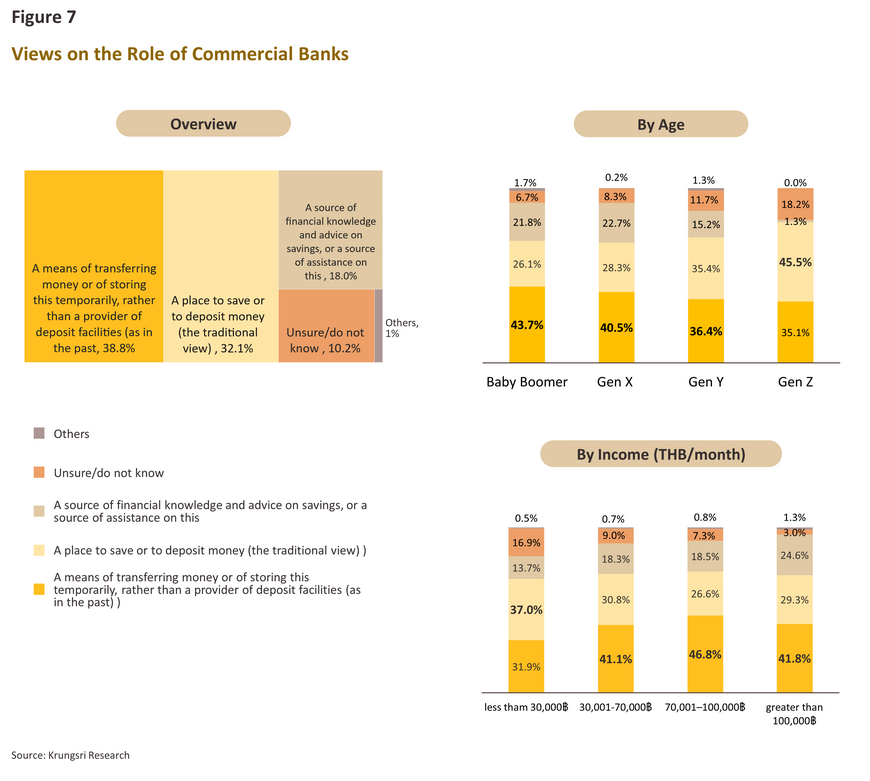

The digital transformation of the sector and the rollout of frictionless and seamlessly integrated banking services is contributing to a fundamental shift in how the public views commercial banks. The survey thus shows that a large number of respondents (38.8%) now see banks primarily as a conduit through which money can be funneled (i.e., via payments or transfers) or as a place where this can temporarily be warehoused. This contrasts with the 32.1% who hold to a more traditional view of banks as institutions that provide access to savings and deposit facilities. Nonetheless, 18.0% of respondents view banks as being primarily repositories of knowledge relating to finance or sources of advice on this.

Analysis by age shows that Gen Z, the group most at ease with technology and most likely to use social media as a source of financial information,13/ differ markedly in their views on the banking sector relative to other groups, with 45.5% maintaining a traditional view of banks as providers of deposit and saving facilities. This aligns with the views of those with monthly incomes lower than THB 30,000 per month (37% of this group hold to this view), but as incomes rise and respondents age, there is an increase in the proportion of individuals who see banks as simply a way to channel money from one account to another or as a temporary holding place for this.

However, those with higher incomes are also more likely to believe that banks have a role to play in providing knowledge and advice related to financial planning. This is most pronounced in the highest income group (i.e., those with an income over THB 100,000 per month), of whom around a quarter reported having this belief. Those with a monthly income in excess of THB 100,000 were thus 1.7-times more likely than those earning less than THB 30,000 to see banks as a source of financial knowledge.

Commercial banks remain key providers of saving and investment services

A full three-quarters of survey respondents use banks as their primary means of making savings and/or investments, and this proportion remains steady across most income groups. However, half of those in the highest income band (i.e., those earning more than THB 100,000 per month) use commercial banks as their primary means of both saving and investing, which is a greater portion than among those in either the middle- or lower-income bands. Indeed, statistical analysis shows that upper-income earners are 1.7-times more likely than lower-income earners (i.e., those earning less than THB 30,000 per month) to both save and invest via a commercial bank. Similarly, lower-income earners are twice as likely as upper-income earners to take advantage only of banks’ savings facilities.

In addition, around a tenth of individuals in the Baby Boomer and Gen X groups use commercial banks as their primary means of investing, despite not taking advantage of their savings facilities. This is roughly twice as high as among Gen Y and Gen Z respondents. 30% of those only investing via banks are also classified as high-income earners (earning more than 100,000 baht per month), while 29% of women use banks only to save, slightly ahead of LGBTQ+ individuals (28%) and men (25%).

Among those who did not use commercial banks as their primary means of saving or investing, 41% preferred to save/invest via equities and mutual funds, 27% favored savings cooperatives, and 14% turned to insurance and real estate. A further 9% speculated in high-risk assets such as gold and cryptocurrencies.

Krungsri Research view: Personal success as a saver

Savings clearly play a major role in building wealth and financial security, but among a range of factors, reaching one’s financial goals depends on carrying out effective planning and then maintaining the discipline required to consistently implement this plan. Factors that will help to underpin success in this and in building wealth over the long term include the ability to earn, the ability to save, the ability to invest, and the ability to start early.

An individual’s potential to earn clearly undergirds their success in building savings, and if income rises while outgoings remain stable, a greater surplus will be available to save. Indeed, as John Maynard Keynes described in his savings function, the level of potential savings is directly related to disposable income, and so receiving a higher income enables individuals to better construct and implement long-term savings plans.

For any individual, income flows may be broadened through a number of ways, including pay raises, generating additional income through side-jobs, or improving one’s work-related skills and experience. However, this alone will not guarantee financial success.

Implementing a savings plan requires considerable financial discipline and commitment, but the flip side of this is that beginning with even small but regular deposits can lead to long-term financial stability. This principle has long been recognized, as is reflected in for example Sunthorn Phu’s ‘Proverbs for Women’ and its injunction to ‘save a baht if you have a saleung’ (a saleung is a quarter of a baht). This same thought is expressed in the contemporary expression ‘pay yourself first’, which emphasizes the need to prioritize savings over consumption by allocating money to the former before thinking about the latter.

Improving one’s ability to save can begin with implementing a regular and systematic savings plan, for example by setting aside a fixed portion of income for savings and keeping this separate from money that is to be used to cover outgoings and investments.

Investment provides a route for accelerating savings plans since if successful, this can use long-term returns to grow the total pool of savings. However, it is necessary to exercise care when doing this and to be sure to balance potential returns with the risk inherent in the investment.

Acquiring greater knowledge about investment and risk management can improve one’s overall ability to invest successfully. Nevertheless, a good investment strategy should be in line with an individual’s risk tolerance and this should therefore not focus on opportunities that present the highest possible returns. Rather, investment plans should take advantage of strategies to diversify and thus reduce exposure to risk.

Incidentally, as discussed in Part 4, “Case Study: Who is Likely to Save Enough for Retirement?”, Krungsri Research conducted a case study based on several important assumptions — namely, that savings are placed in vehicles yielding only 0.5% interest per year and that individuals make no additional investments beyond these savings. As a result, it was found that only 2 in 10 survey respondents were able to save enough to meet their desired post-retirement spending, but changing these initial assumptions also changes these outcomes. Thus, if individuals are assumed to be well informed and able to make sound investments and that retirement savings are instead actively though carefully invested, the resulting improvement in returns will increase the number of respondents able to meet their post-retirement needs. For example, a different analysis might assume that instead of saving in a deposit account, retirement funds were placed in a low-risk fund such as the Vayupak Fund 1 (Class A), which provides returns of 3-9% annually.14/ If returns were on the lowest bound of this range (i.e., at 3% pa), the proportion of respondents who would then be able to successfully meet their savings plans would rise to 3 in 10 respondents, or increase by about 10%.

- The Ability to Start Early

The mechanics of compound interest mean that the benefits of starting to save early are very considerable and the earlier this process begins, the greater the space within which savings can accumulate and grow. In addition, starting to save early in life also helps to develop good financial habits, which will then pay further dividends as the decades go by.

For those who have not yet begun saving, the best time to start is immediately, or as soon as funds become available. This could begin with small steps that grow over time as the savings habit and financial discipline strengthen and deepen. This will provide solid foundations for future savings and investment, though the earlier that one starts saving, the easier it will be to meet one’s financial goals

It is clear that saving is not merely a matter of depositing money in a bank account. Rather, saving involves a mix of planning and discipline, together with the ongoing development of skills connected to identifying sources of income, sustaining the practice of beneficial savings habits, and building the knowledge, abilities and strategies needed to invest successfully. Moreover, because this will provide the time needed for capital to grow safely and securely, individuals should also begin their savings and investment journey at the earliest possible opportunity. Nevertheless, all of this is possible for any motivated individual and by getting to work without delay, savers of all types will be able to reach their financial goals.

References

Bank of Thailand. (n.d.). การออม. Bank of Thailand. Retrieved from https://www.bot.or.th/th/satang-story/money-plan/saving.html

Bank of Thailand. (2022). รายงานผลการสำรวจทักษะการเงินของไทย ปี 2565. Bank of Thailand. Retrieved from https://www.bot.or.th/content/dam/bot/image/research-and-publications/2565ThaiFLsurvey.pdf

Financial Wisdom. (n.d.). ลดเสี่ยง เพิ่มสุข ด้วยเงินออมเผื่อฉุกเฉิน. Bank of Thailand. Retrieved from https://www.bot.or.th/th/research-and-publications/articles-and-publications/bot-magazine/Phrasiam-63-2/FinancialWisdom-SustainableShopping.html

Milieu Team. (2024). 43% of Southeast Asians Save Just 10% of Their Income, Says Study. Milieu. Retrieved from https://www.mili.eu/sg/insights/43-of-southeast-asians-save-just-10-of-their-income-says-study

The Standard Wealth. (2024). ‘เงินฉุกเฉิน-ลงทุน-เกษียณ’ ปมกังวลการเงินคนไทย เผยแห่หาคำตอบบน TikTok พบ 79% ดูมากกว่าวันละครั้ง. The Standard. Retrieved from https://thestandard.co/financial-concerns-thai-people-tiktok-trends-2025/

Vien Thong. (2024). More Vietnamese choose saving over spending. VnExpress International. Retrieved from https://e.vnexpress.net/news/business/data-speaks/more-vietnamese-choose-saving-over-spending-4820061.html

งานข้อมูลสถิติการเงิน. (n.d.). เงินให้กู้ยืมแก่ภาคครัวเรือนจำแนกตามวัตถุประสงค์ 1/. Bank of Thailand. Retrieved from https://app.bot.or.th/BTWS_STAT/statistics/BOTWEBSTAT.aspx?reportID=891&language=TH

1/ https://www.bot.or.th/content/dam/bot/image/research-and-publications/2565ThaiFLsurvey.pdf

2/ The survey was carried out over January and February 2024, with 3,000 responses collected from the region.

3/ https://www.mili.eu/sg/insights/43-of-southeast-asians-save-just-10-of-their-income-says-study

4/ https://e.vnexpress.net/news/business/data-speaks/more-vietnamese-choose-saving-over-spending-4820061.html

5/ https://www.bot.or.th/th/satang-story/money-plan/saving.html

6/ These were Baby Boomers (60 years old and up), Gen X (45-59 years old), Gen Y (29-44 years old) and Gen Z (18-28 years old).

7/ https://www.krungsri.com/th/research/research-intelligence/household-debt , https://app.bot.or.th/BTWS_STAT/statistics/BOTWEBSTAT.aspx?reportID=891&language=TH

8/ This was calculated on a points system, with 5 points awarded for the top priority, 4 for the second priority, 3 for the third, 2 for the fourth and 1 for the least important.

9/ https://www.bot.or.th/th/research-and-publications/articles-and-publications/bot-magazine/Phrasiam-63-2/FinancialWisdom-SustainableShopping.html

10/ ‘Salaried individuals’ describes those who are in receipt of a regular salary or wage. This includes civil servants and employees of state enterprises as well as private-sector employees (without a pension). Non-salaried individuals includes the self-employed, freelancers, business owners, the retired, the unemployed, homemakers, and students.

11/ For example, if a pandemic occurred resulting in 6-months of lost income from January to June 2027, would those individuals receiving a salary and saving regularly be able to cover this period through savings made between January and December 2026.

12/ 186 respondents fall into this group.

13/ A survey by TikTok Thailand reveals that Gen Z are the age cohort most likely to use TikTok to learn about finances, with 73% of this group reporting carrying out additional research after watching a video. For more details, please see: https://thestandard.co/financial-concerns-thai-people-tiktok-trends-2025/

14/ The Vayupak Fund (Type A) is a mutual fund established in response to government policy. The fund is open to state institutions as well as to retail and institutional investors. Dividends are paid at least twice annually and are calculated according to actual returns, though with a guaranteed minimum set at 3%. For more details, please see: https://www.set.or.th/th/market/product/stock/quote/vayu1/company-profile/information