EXECUTIVE SUMMARY

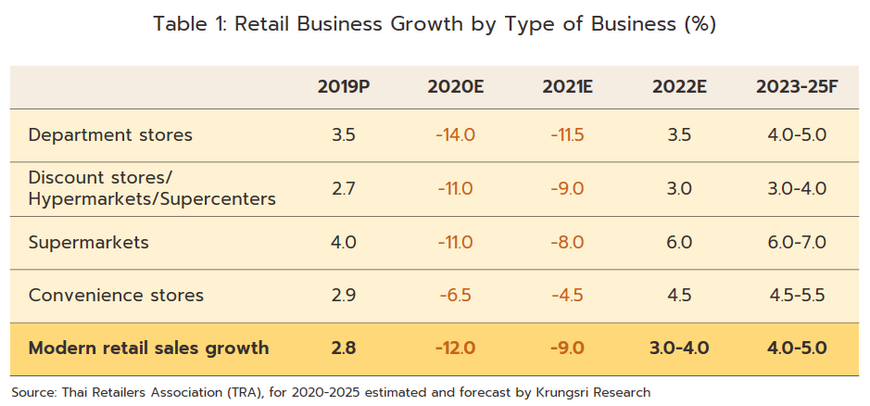

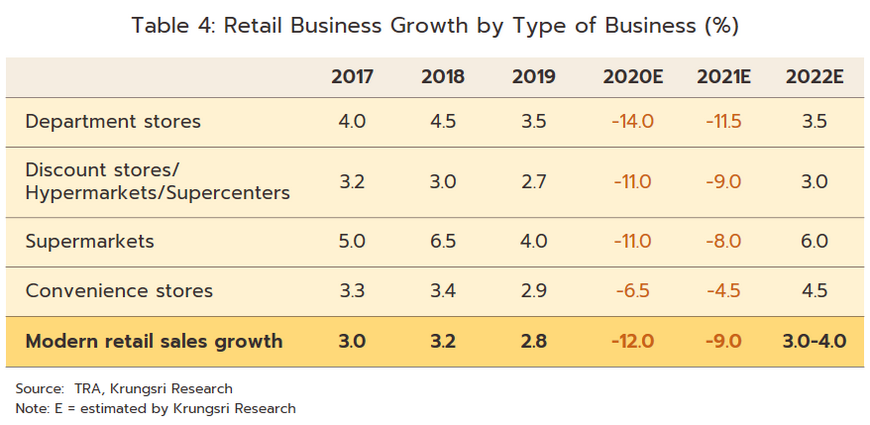

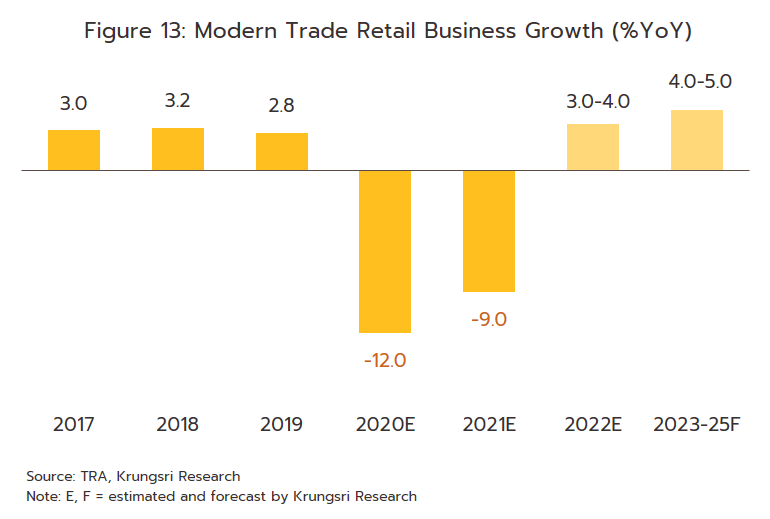

Business conditions gradually improved for modern trade outlets through 2022 with the turnaround in the Thai economy, though the industry has been boosted in particular by: (i) government stimulus packages on consumer spending; (ii) the reopening of the country and the rebound in tourist arrivals; and (iii) the resilience of consumer spending power among mid- to upper-income earners. In addition, the continuing expansion in online distribution has also helped to lift sales, but unfortunately for most consumers, the rising cost of living is weighing on purchasing power, and as such, 2022 sales growth will be limited to 3.0-4.0%. The situation will improve in 2023-2025, and over the next three years, average annual growth should run in the range 4.0-5.0%. This outlook will be supported by: (i) forecast GDP growth of 3.0-4.0% per annum that will feed into a strengthening of consumer spending power; (ii) the rebound in the tourist sector and the return of tourist arrivals to their pre-Covid level by 2025; (iii) the positive effects on employment and spending of government investment in megaprojects; and (iv) economic growth across the broader region, which will open up new opportunities for players to develop additional income streams.

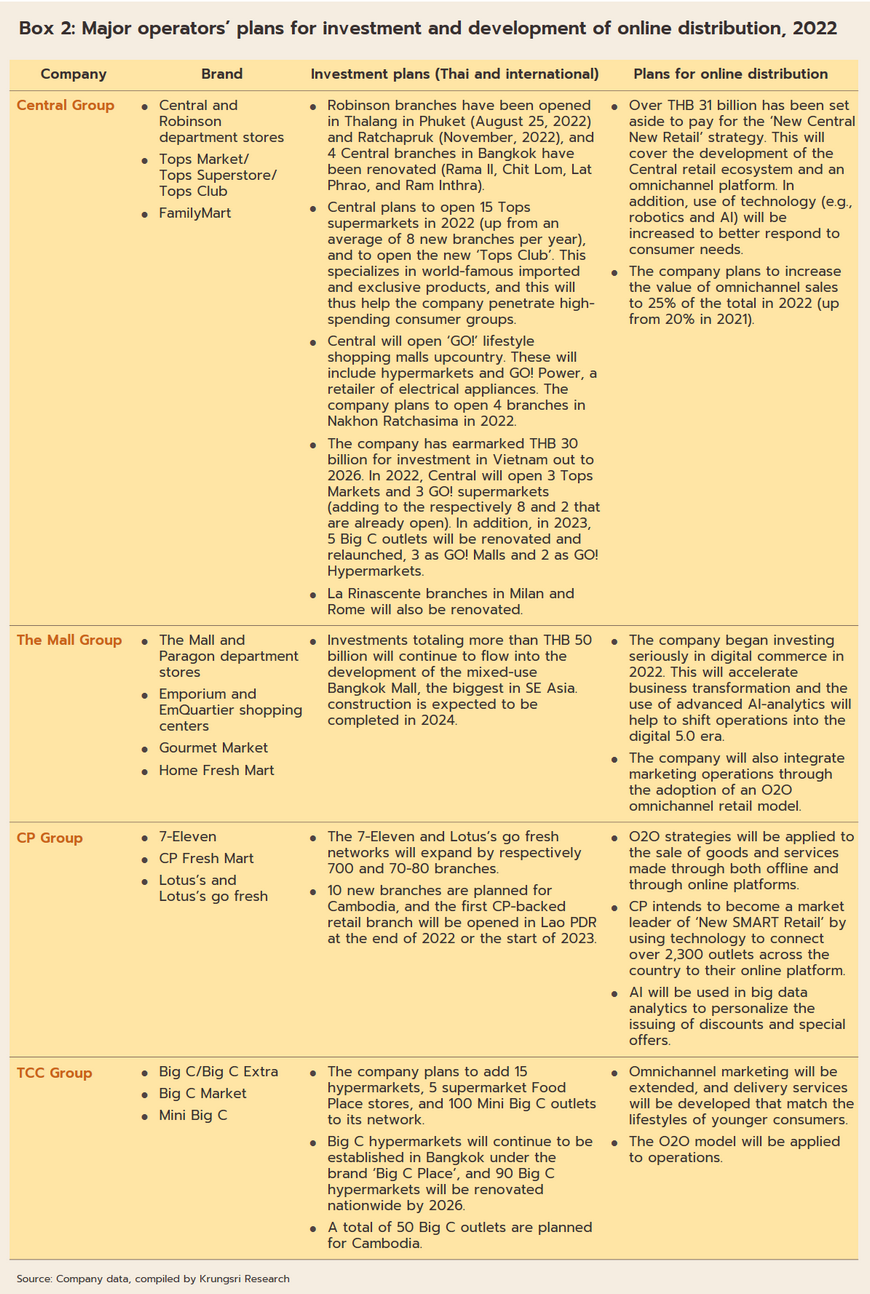

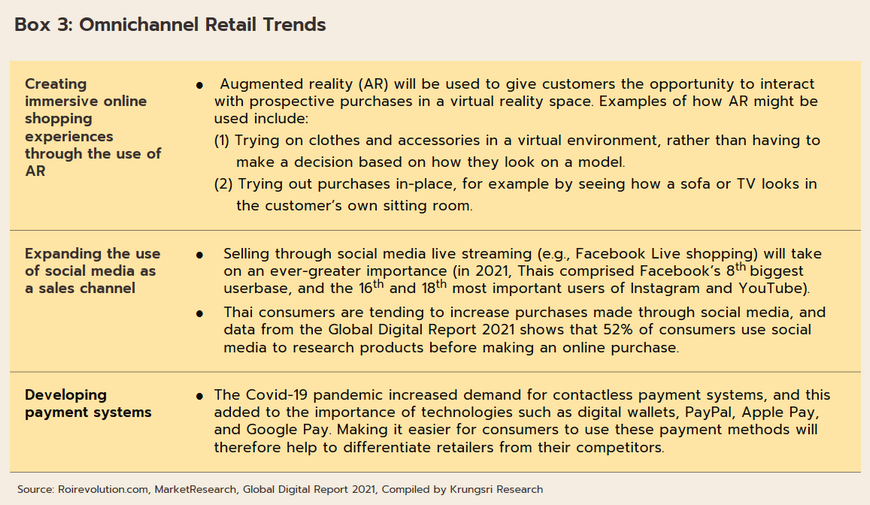

Modern trade retailers will develop their businesses along a twin-track of expansion in their online presence and the reach of their brick-and-mortar outlets. This will be supported by the development of new business models that take advantage of new technology, and this will help to both differentiate players and to increase their competitiveness. This will, though, take place against a backdrop of intensifying competition as players look to secure sources of long-term growth by broadening and deepening their market penetration.

Krungsri Research view

Over 2023-2025, the modern trade sector will enjoy growth that will move along with an improving outlook for consumer spending. Sales will benefit in particular from the accelerating rebound in foreign tourist arrivals and progress on government infrastructure projects, which will then support an expansion in branch numbers. Nevertheless, competition will intensify and problems with persistently high levels of household debt will drag on sales. This will have different effects for each segment of the market. The details are listed below..

-

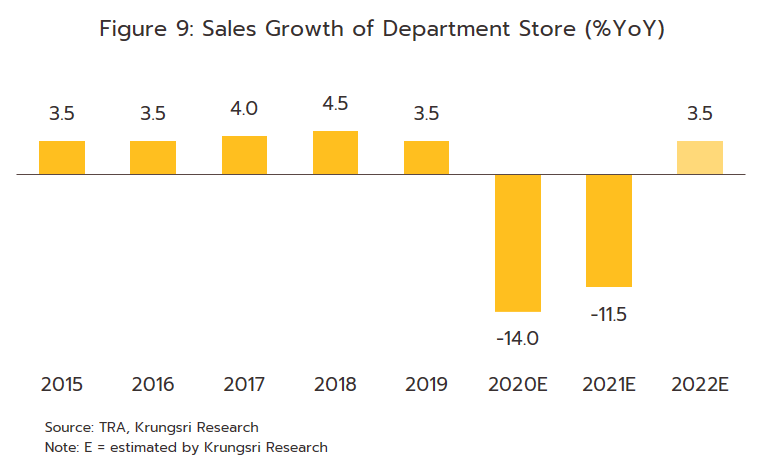

Department stores: Sales will strengthen from 2021’s 3.5% expansion to growth of 4.0-5.0% annually. This will be a result of the abating of the Covid-19 pandemic andthe shift in business strategy to developing omnichannel platforms and using 5G and AR technology to offer new and enticing consumer experiences. Players will also step up their investments in high-potential markets in the broader region, and this will help them to develop additional sources of income.

-

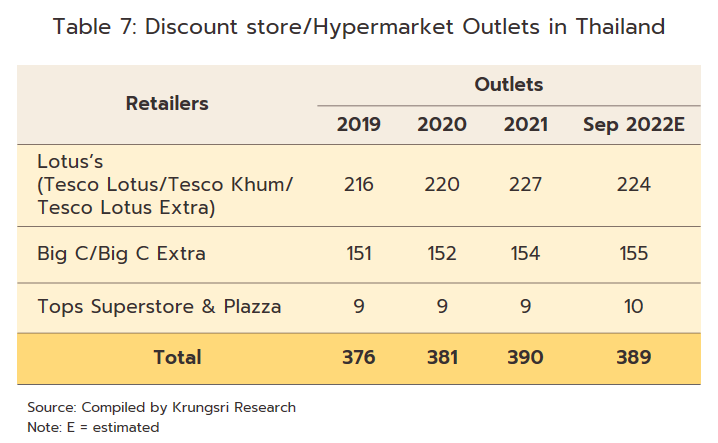

Discount stores/hypermarkets/supercenters: 2022’s growth of 3.0% will inch up to 3.0-4.0% over the next three years as operators increasingly adapt and diversify their store formats according to the demands of individual locations. Players will also expand into local communities across the country, which will help them connect with a wider range of customers. Alongside this, they will continue to put their efforts into the development of digital platforms, all the while selling goods at prices that undercut those of other types of retailers. However, operators will face stiffer competition as a result of the lack of strong product differentiation marking their product lines off from those on sale in other segments of the retail market.

-

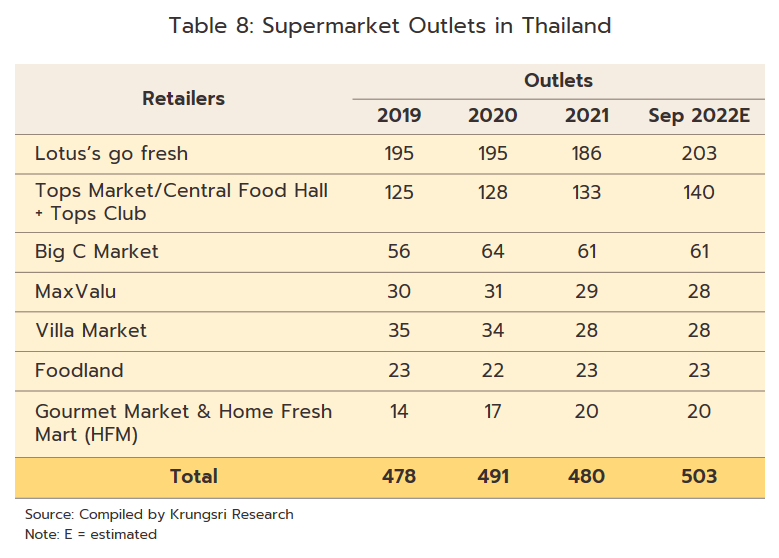

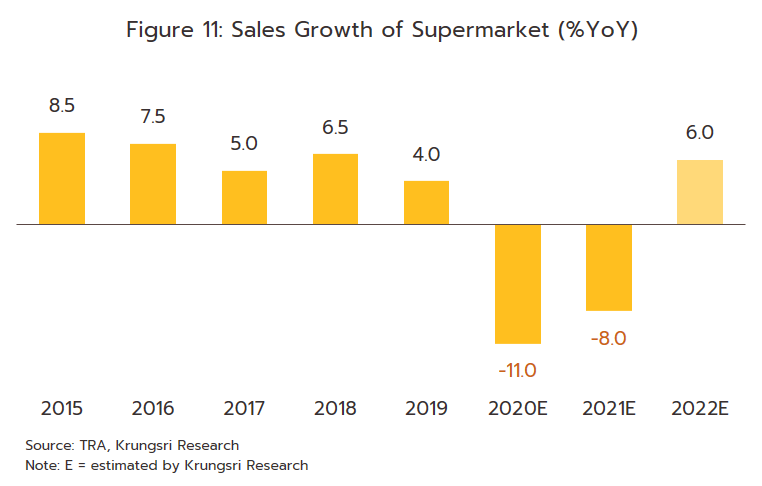

Supermarkets: Annual sales growth may move up slightly from the 6.0% achieved in 2022 to 6.0-7.0% in the coming period. This segment will enjoy the highest growth within the retail sector thanks to players’ ability to match their marketing strategies to the needs of their shoppers, most of whom are mid- to upper-income consumers with significant purchasing power. Supermarkets gain from the high-quality of their produce, and from strategies that include: (i) rebranding outlets as premium lifestyle supermarkets that offer higher-priced imported goods; (ii) expanding their presence into higher-income provinces; (iii) developing their online offerings to make consumers’ online experience as smooth as possible. In light of this and the benefits that they gain from their size, supermarkets will likely be able to sustain healthy turnover.

-

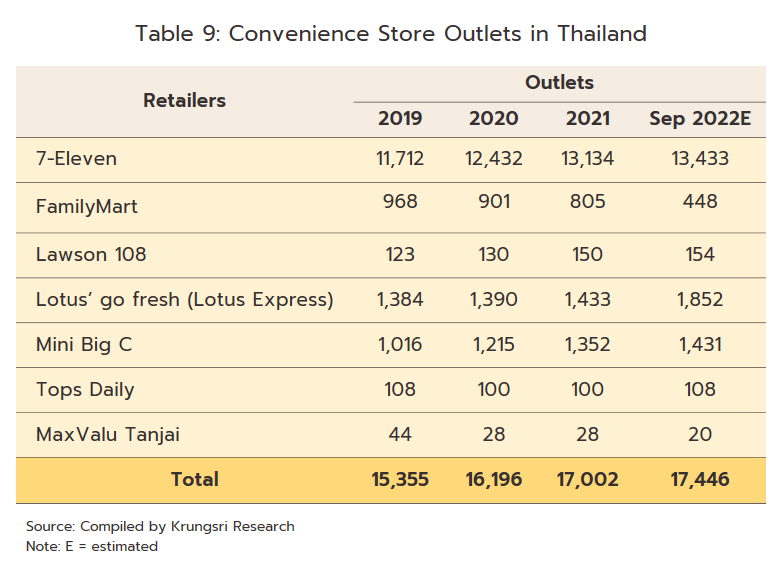

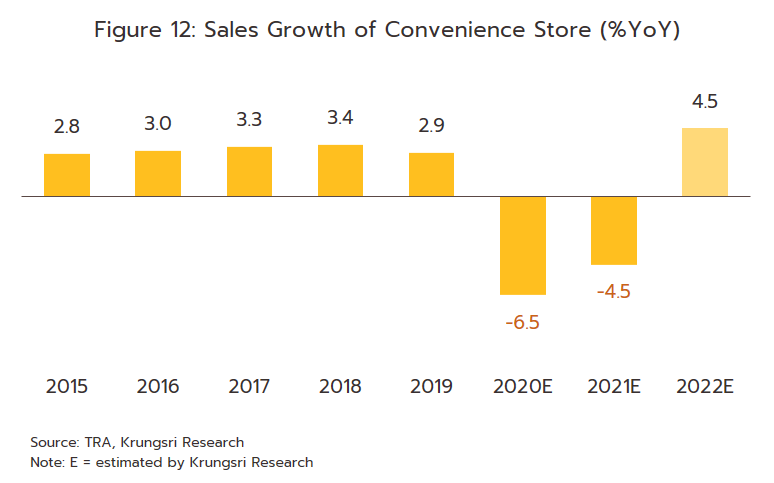

Convenience stores/minimarts: Income rose by 4.5% in 2022, and annual growth will continue in the range of 4.5-5.5% over the next 3 years. The continuing expansion in the coverage of branch networks, the extension of services to include sales of ready-to-eat food, and an increase in the use of online channels will all help to build additional income. This will, though, be balanced by an intensification of market pressure as direct competitors open branches to challenge convenience stores, and indirect competitors (e.g., hypermarkets) increasingly adapt their retail formats as they look to steal market share. Thus, the move by major players to partner with traditional retailers is helping these establish a presence on the high street, and this is then affecting convenience store takings. As such, average branch incomes are likely to fall from earlier highs. Nevertheless, while franchisees will face an increased threat to their operations, franchisors will continue to generate profits

OVERVIEW

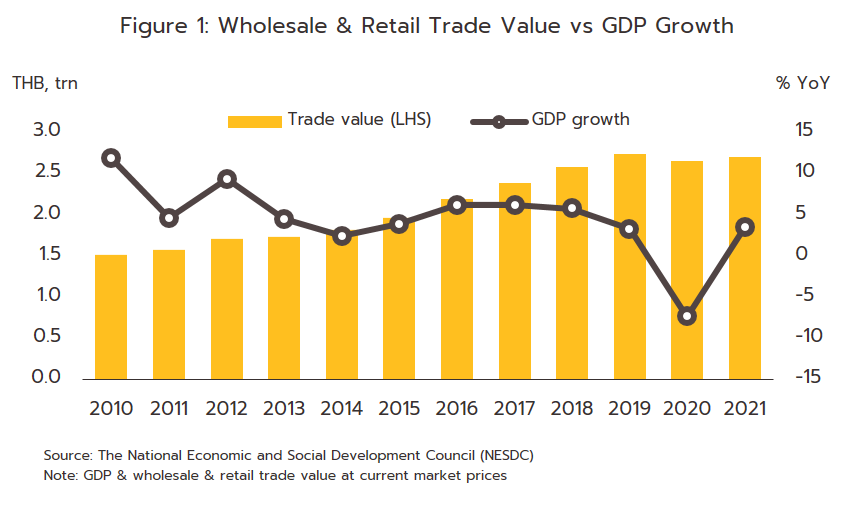

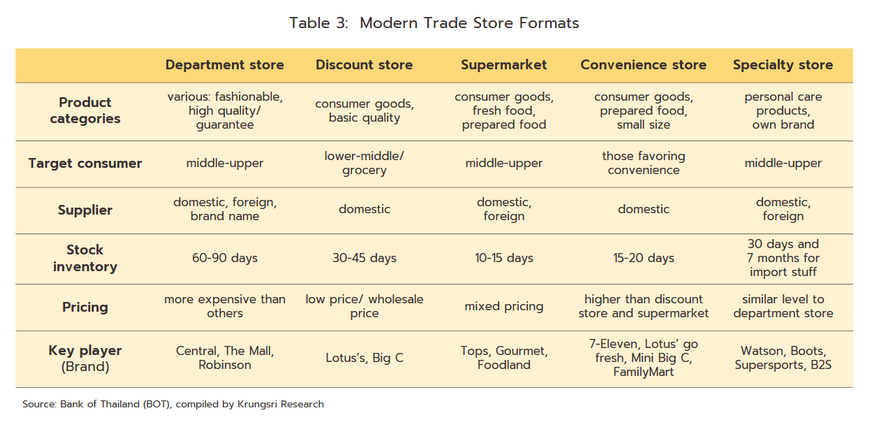

The modern trade industry falls within the broader retail sector, which as of 2021, had a total value of THB 2.7 trillion (up 1.9% from 2020), and the sector thus accounts for 16.7% of Thailand’s total GDP. This was sufficient to put the retail sector second in terms of its importance to the Thai economy, coming after only manufacturing, which has a 27.0% share of GDP. Modern trade players are generally major corporations that operate extended commercial networks, and because they buy in such large quantities, their market strength and negotiating position outweighs that of manufacturers and distributors[1]. Stores are managed using modern logistics and distribution techniques, and players are in the process of leveraging a greater use of modern technology and an expanded online presence for the advantages that this provides to their marketing.

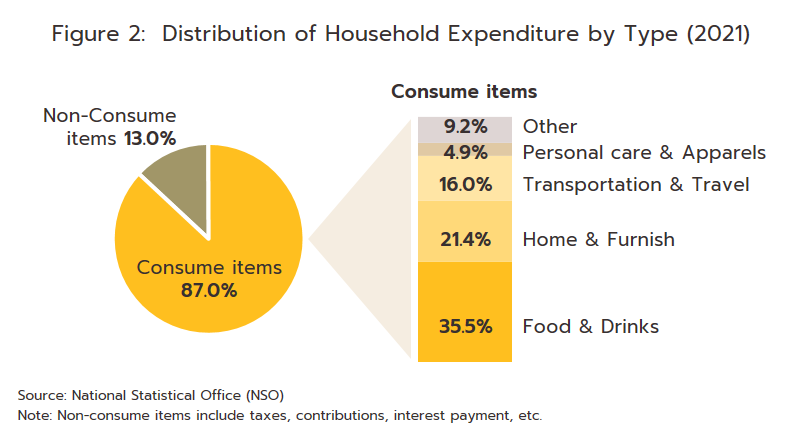

Modern trade outlets have enjoyed rapid growth in Thailand, especially in and around Bangkok and in other more urbanized parts of the country. Sectoral success has been built on: (i) government policy to allow foreign players that have access to modern management and operational technology to invest in the retail sector;[2] (ii) consumer preferences that favor retailers offering a unified shopping experience under a single roof that extends over food, personal care items, and household goods (Figure 2) that are generally cheaper than equivalent goods sold in traditional outlets; and (iii) ongoing investment in the opening of new branches and the expansion of operators’ markets.

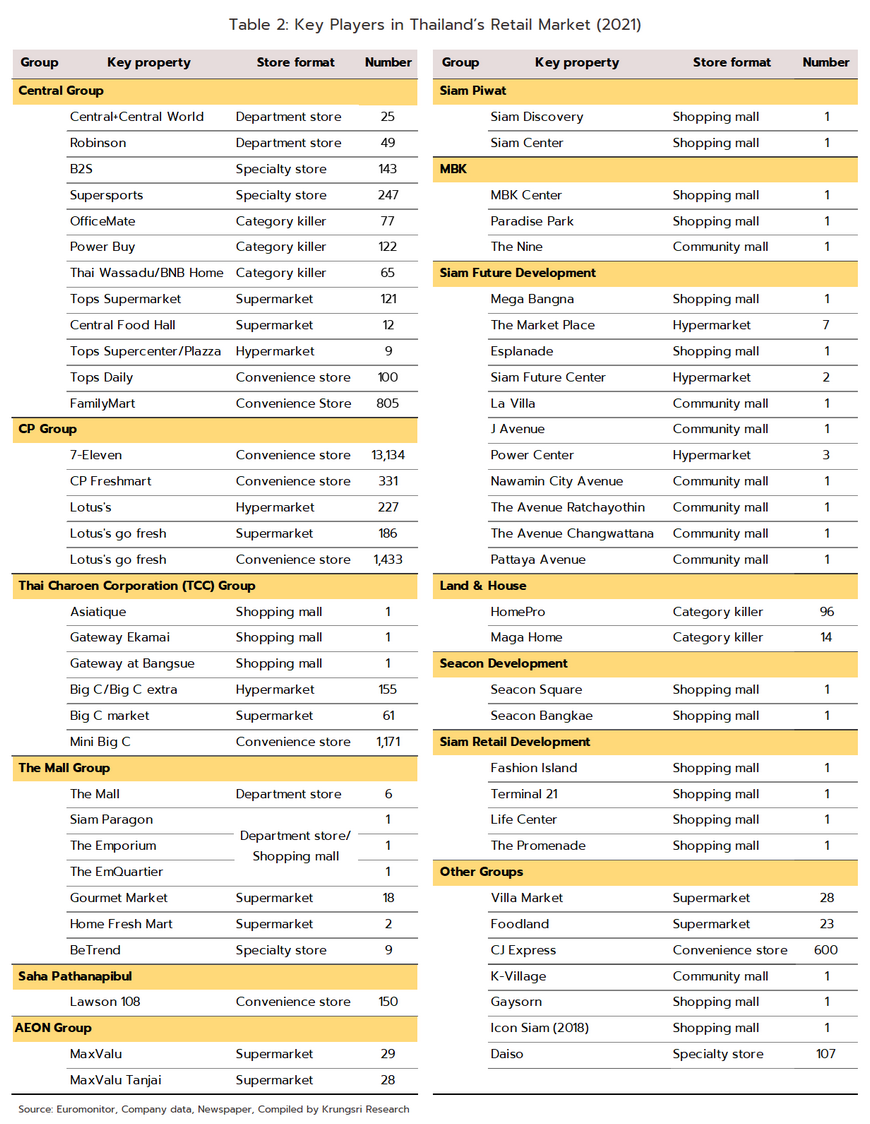

The majority of the players active in the modern trade segment are major, well-established Thai corporations that are well-versed in revenue generation. These companies benefit from their economies of scale, their access to sources of funding, their extensive commercial and retail networks, and their ability to develop new businesses across a broad front. Examples of these include Central Group, Charoen Pokphand (CP) Group, Thai Charoen Corporation (TCC) Group, The Mall Group, and Saha Pathanapibul Group (Table 2).

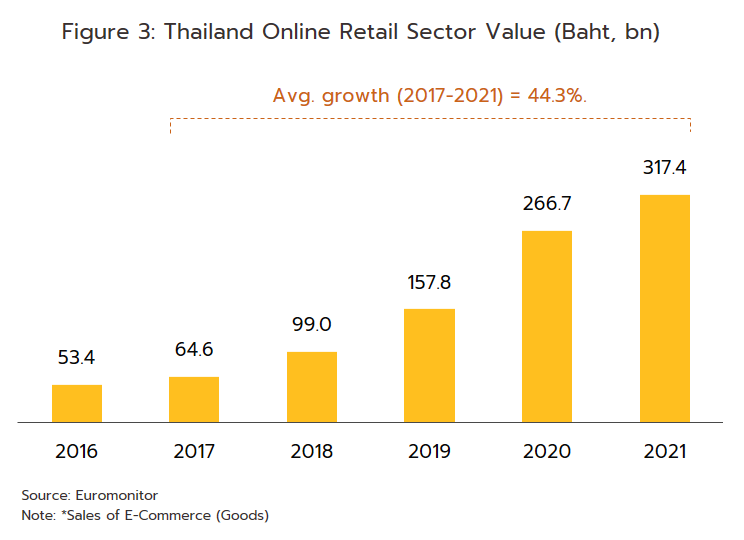

Competition is somewhat intense given the similarity of the goods sold, the number of modern trade branches in the country, and the rising threat from online distribution. The latter has grown with the spread of internet access and mobile phone ownership, though this process was turbocharged by the Covid-19 pandemic; 2021 online sales were double their level in 2019 (Figure 3). Nevertheless, despite these impressive growth rates, the volume of goods sold online is still relatively small compared to the size of the overall retail market, and customers generally still prefer to shop offline. (source: Electronic Transactions Development Agency). This situation presents an opening to players to increase their online sales and to connect with a wider customer base.

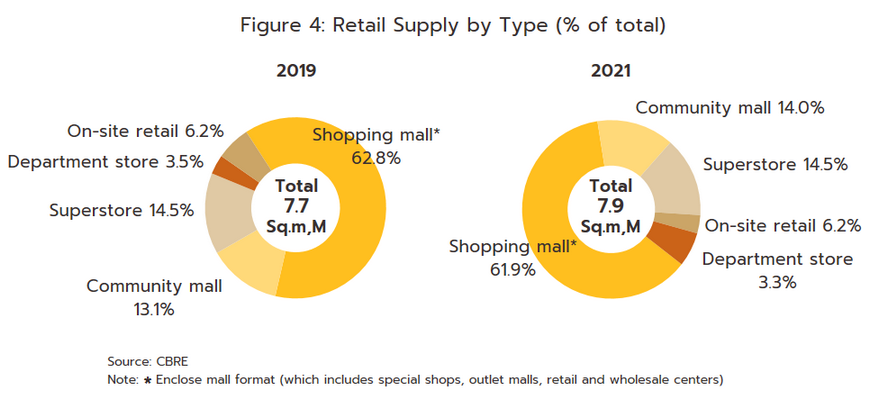

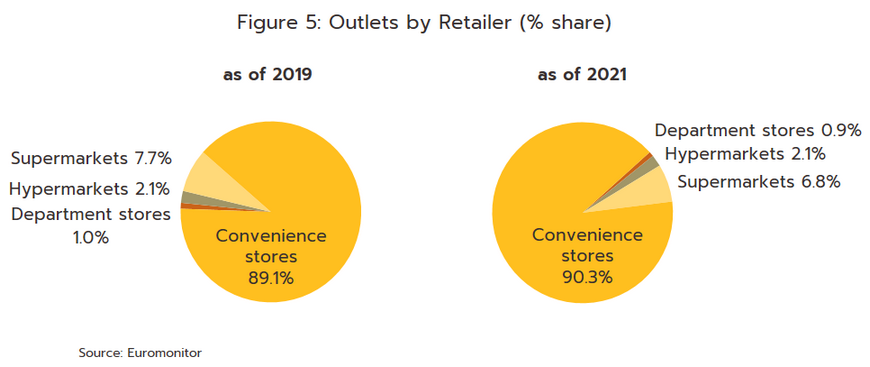

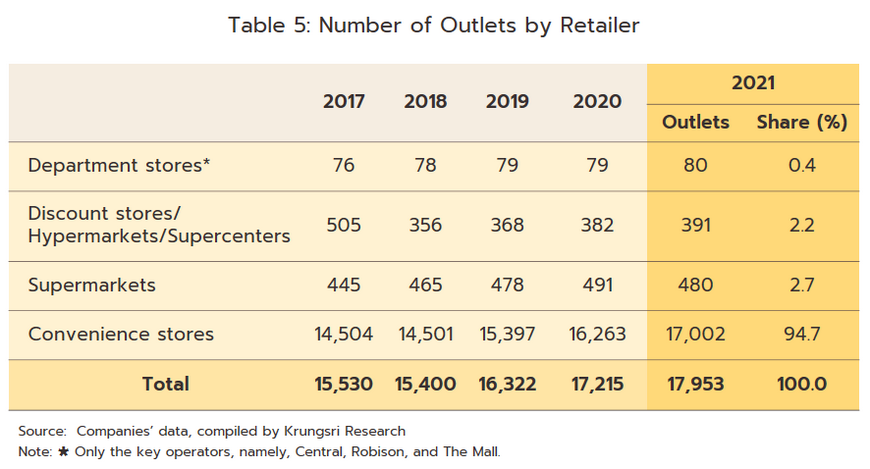

Operators of modern trade outlets moved forward somewhat carefully with expansion plans while the pandemic raged, and so in 2021, cumulative total retail space in the Bangkok Metropolitan Region (BMR)[6] increased by just 1.3% to 7.93 million sq.m. (Figure 4). For shopping malls and department stores (respectively, 61.9% and 3.3% of BMR retail space), the totals remained relatively unchanged from 2020. However, space on community malls (14.0% of BMR retail space) expanded 8.3% (compared to growth of 1.1% in 2020), superstore space (14.5% of the total) increased 1.6%, and supporting retail space (6.2%) edged up 0.3%. Outside the BMR, the big players (7-Eleven, Lotus’s, and Big C) pressed on with their plans, and deepening partnerships with traditional retailers have pushed new retail outlets across all parts of the country. By number of outlets, as of the end of 2021, convenience stores accounted for a full 90.3% of the modern trade industry, up from 89.1% in 2020. These were followed in importance by supermarkets, hypermarkets, and department stores (Figure 5).

SITUATION

Modern trade operations suffered under the impact of the multiple waves of Covid-19 that washed over the country between the start of 2020 and the end of 2021, when the government began to relax pandemic controls by limiting and then lifting the curfew, extending the hours during which shops were able to open, and beginning the easing of restrictions on foreign arrivals. This then began the process by which the economy returned to more normal conditions.

Modern trade sales strengthened through 2022, and following a -9.0% contraction in 2021, these are forecast to have grown by 3.0-4.0% in 2022. The market has benefited from the following:

-

Social and economic life has returned almost to normal following the designation of Covid-19 as an endemic disease from 1 October.

-

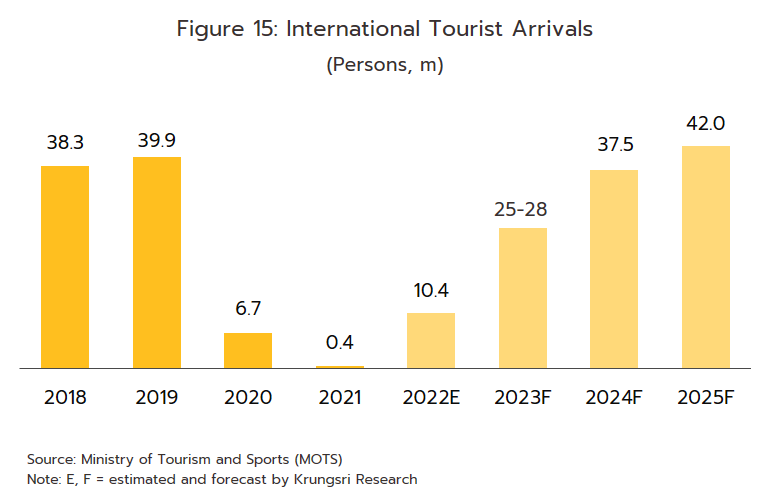

Since the start of the year, the authorities have gradually relaxed restrictions on foreign arrivals. This has included withdrawing the Test & Go system, reopening to fully vaccinated tourists from May 1, and from July 1, no longer requiring arrivals to register for the Thailand Pass. As a result, 5.7 million arrivals were recorded between January and October, and for the year, a total of 10.4 million foreign tourists are expected to come to Thailand, which would mark a sharp increase on 2021’s 0.43 million arrivals. This will then help to lift sales for shops in tourist areas and outlets that target the overseas market.

-

Farm incomes have strengthened (up 14.4% YoY during 9M2022) and this will now support an increase in spending.

-

Consumption has been boosted by government stimulus packages, including phases 4 and 5 of the Half Each program (covering March-April and September-October respectively), the Shop and Refund scheme (from 1 January to 15 February), and phase 4 of the We Travel Together program (July-October).

-

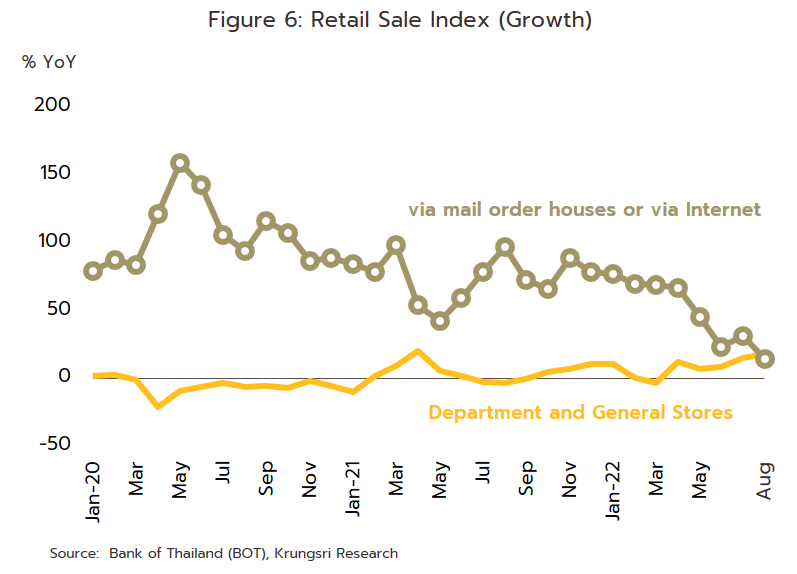

Continuing growth in the e-commerce sector is reflected in the rise in the index of goods ordered by post, television, radio, telephone and internet, which jumped 45.9% YoY over 8M22 (Figure 6). Likewise, modern trade outlets’ online sales are also up sharply, with Lotus’s reporting growth in excess of 400% YoY in this area. This is in line with the Global Digital Stat 2021 report by We Are Social and Hootsuit, which indicates that Thailand has the 3rd highest rate of internet shopping in the world. Goods that are particularly favored by Thai consumers when making online purchases include health products, fashion items, electronic products, goods for babies and children, and pet supplies. Priceza thus estimates that the Thai e-commerce market will expand by another 30% YoY in 2022.

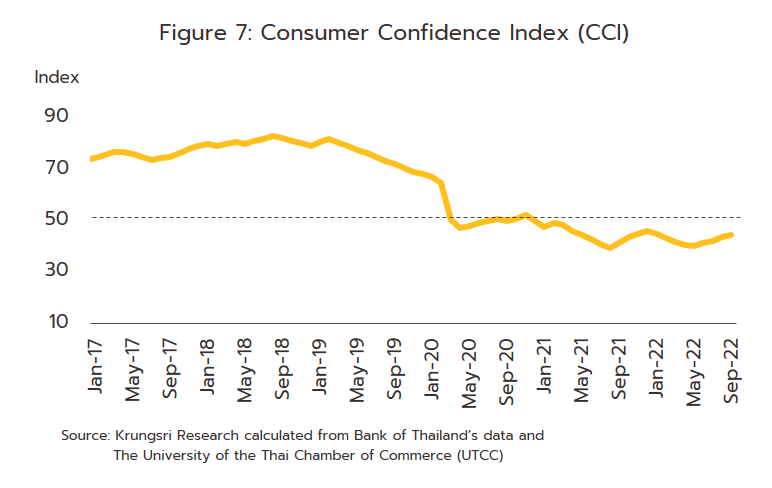

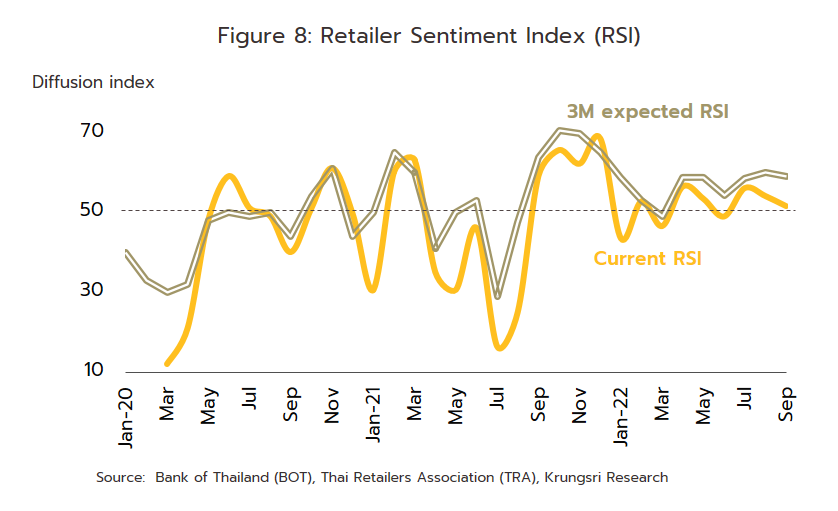

Although the retail sector has been showing signs of recovery, businesses continue to struggle against the deadweight of inflation and the effects of this on consumer spending power. The latter is showing up most clearly among mid- to low-income earners, who were already affected by the only slow transmission of the recovery to those receiving smaller pay packets. The market is also battling against rising interest rates (that put higher pressure on household dept); a survey by the University of the Thai Chamber of Commerce shows ‘household debt’ by the end of 2022 this will hit a 16-year high of 89.3% of GDP from 88.2% as of the 2nd quarter. Even among mid- to upper-income earners, spending is softening, and the difficulties troubling the consumer market are reflected in the fall in the Consumer Confidence Index to a 10-month low in May (Figure 7), the worsening of the Retailer Sentiment Index (Figure 8), and the inflation-driven increase in average spending per bill. Moreover, consumers have increased the frequency of their shopping only slightly, and the average shopping basket is now filled with a greater proportion of household necessities, rather than discretionary purchases (source: the Bank of Thailand, and the Thai Retailers Association).

Operators have been steadily expanding their branch networks. This has been most evident among convenience stores, which have been relentlessly extending their reach into communities, but shopping centers, community malls, and superstores have also been opening new branches and extending existing sites (in Q2 2022, the total retail space of community malls and superstores increased by respectively 2.0% YoY and 3.0% YoY). In addition, retailers have been revising their stock lines, for example by adjusting how goods are packaged to take into account increased concerns about public health, and reconfiguring their operations to better respond to the rising consumer preference for shopping on digital platforms. This has involved: (i) using omnichannel digital platforms[7], for example by opening webstores, building mobile applications, developing ‘quick commerce’ operations (i.e., dispatching goods almost as soon as they are ordered), and working with online marketplaces such as Lazada, Shopee and JD Central; (ii) extending online to offline[8] (O2O) operations by offering personal shopper, call and shop, and chat and shop services that are delivered through social commerce channels such as Facebook, LINE and e-ordering; and (iii) increasing the use of digital payment services such as Alipay (online banking), WeChat Pay and Dolfin, as well as the online payment gateways used by domestic Thai banks. By developing along these lines and taking greater advantage of the opportunities provided by the online world, modern trade outlets have been able to increase the efficiency of their distribution networks and connect with new consumer groups.

The situation for individual segments of the modern trade industry is given below.

OUTLOOK

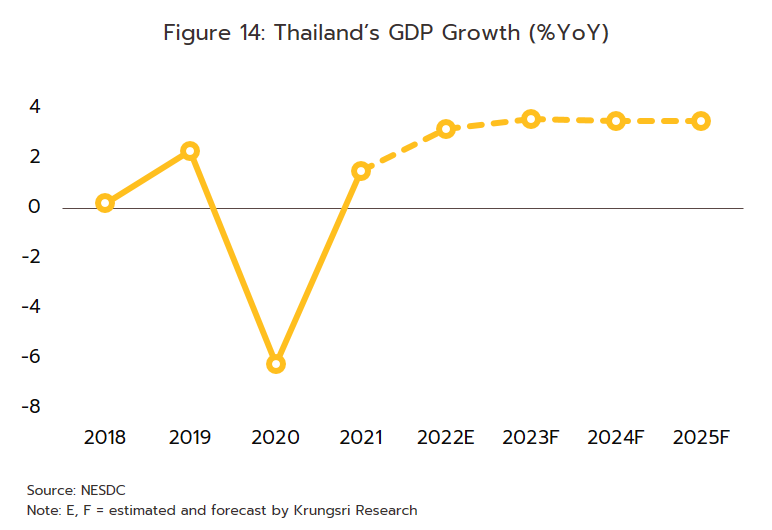

The modern trade sector should enjoy average annual growth of 4.0-5.0% over 2023-2025 (Figure 13), with the sector benefiting from a range of factors. (i) The economy is expected to expand by 3.0-4.0% per year (Figure 14) and this will then lift consumer spending power. (ii) Both the domestic and international tourist markets will return to close to their 2019 pre-pandemic levels over the period (Thai tourists are expected to make 185 million trips in 2024, and total foreign arrivals should hit 42 million by 2025) (Figure 15), which will then add to income for outlets or branches in tourist areas.

(iii) The government will move forward with spending on megaprojects, and this will inject additional funds into the economy, add to employment, boost incomes, and support an expansion of modern retail chains. (iv) Online sales are forecast to rise by 13.6% per year (source: e-Conomy SEA 2021). (v) Government efforts to stimulate spending and consumption will likely bear fruit. These include raising the minimum wage (from October 1, 2022) and issuing long-term visas to four classes of high-potential visitors[9]. (vi) The IMF sees annual GDP growth averaging 3.5-6.5% in the CLMV countries, which will open up new business opportunities for retailers in major regional centers and in border provinces.

Outlook for individual segments

-

Department stores: Sales will strengthen from 2021’s 3.5% expansion to growth of 4.0-5.0% annually. This will be a result of the abating of the Covid-19 pandemic and the shift in business strategy to developing omnichannel platforms and using 5G and AR technology to offer new and enticing consumer experiences. Players will also step up their investments in high-potential markets in the broader region, and this will help them to develop additional sources of income.

-

Discount stores/hypermarkets/supercenters: 2022’s growth of 3.0% will inch up to 3.0-4.0% over the next three years as operators increasingly adapt and diversify their store formats according to the demands of individual locations. Players will also expand into local communities across the country, which will help them connect with a wider range of customers. Alongside this, they will continue to put their efforts into the development of digital platforms, all the while selling goods at prices that undercut those of other types of retailers. However, operators will face stiffer competition as a result of the lack of strong product differentiation marking their product lines off from those on sale in other segments of the retail market.

-

Supermarkets: Annual sales growth may move up slightly from the 6.0% achieved in 2022 to 6.0-7.0% in the coming period. This segment will enjoy the highest growth within the retail sector thanks to players’ ability to match their marketing strategies to the needs of their shoppers, most of whom are mid- to upper-income consumers with significant purchasing power. Supermarkets gain from the high-quality of their produce, and from strategies that include: (i) rebranding outlets as premium lifestyle supermarkets that offer higher-priced imported goods; (ii) expanding their presence into higher-income provinces; (iii) developing their online offerings to make consumers’ online experience as smooth as possible. In light of this and the benefits that they gain from their size, supermarkets will likely be able to sustain healthy turnover.

-

Convenience stores/minimarts: Income rose by 4.5% in 2022, and annual growth will continue in the range of 4.5-5.5% over the next 3 years. The continuing expansion in the coverage of branch networks, the extension of services to include sales of ready-to-eat food, and an increase in the use of online channels will all help to build additional income. This will, though, be balanced by an intensification of market pressure as direct competitors open branches to challenge convenience stores, and indirect competitors (e.g., hypermarkets) increasingly adapt their retail formats as they look to steal market share. Thus, the move by major players to partner with traditional retailers is helping these establish a presence on the high street, and this is then affecting convenience store takings. As such, average branch incomes are likely to fall from earlier highs. Nevertheless, while franchisees will face an increased threat to their operations, franchisors will continue to generate profits.

Modern trade operations will continue with their strategy of building out new branches, developing online distribution channels, and investing in new business models that exploit recent technological innovations as they look to make up for delays to expansion plans and ground lost during the pandemic. However, against a backdrop of changing consumer spending patterns, players will need to build greater consumer awareness of their apps if they wish to more fully develop the potential offered by online distribution. With regard to business expansion, several possibilities are in play.

-

Branches may be either shrunk or expanded to allow for a nimbler approach to siting new outlets and thus of entering new markets, building new customer relationships, and expanding total branch coverage.

-

Branches may be opened in new formats, such as smaller lifestyle shopping malls that are being set up in less prominent provinces and larger districts. Alternatively, reduced-size retail outlets may be opened in locations where players will be able to benefit from changes to consumer behavior that are seeing shoppers make fewer trips to large outlets and instead to increasingly shop near home.

-

Players will expand their use of social media platforms and other direct to consumer (D2C)[10] online channels as they try to bring their operations more into line with changing consumer lifestyles. In addition, quick commerce will also become more popular as consumers shift to a preference for on demand shopping, buying small selections of items that are dispatched within half an hour.

-

Operators of discount stores, hypermarkets, and supercenters will tend to expand via sales of their own-brand products distributed through traditional retailers serving local markets in Bangkok and upcountry. This will allow players to develop a new source of long-term growth, as well as strengthening their negotiating position relative to suppliers.

-

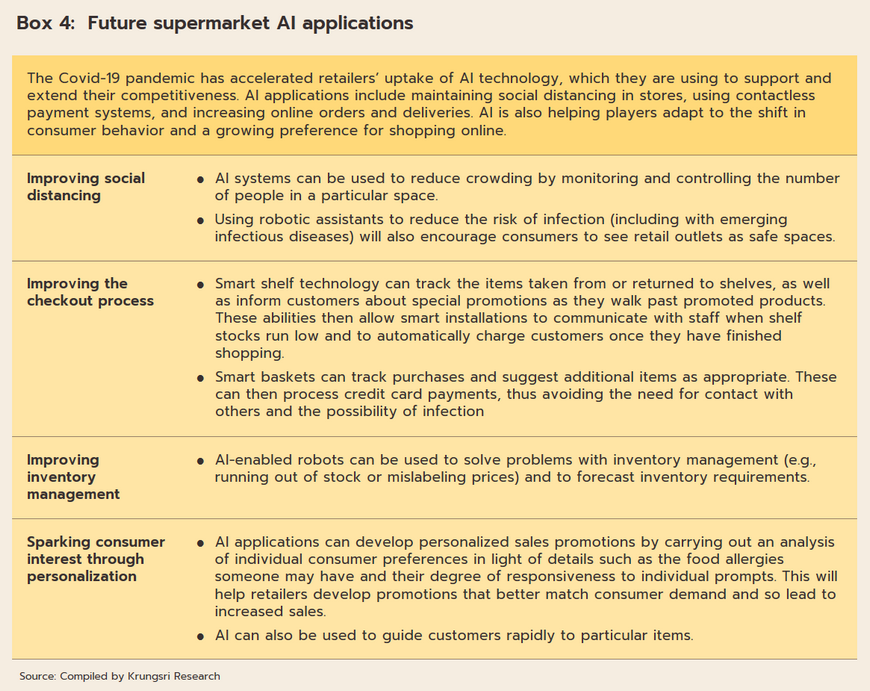

Wider exploitation of the possibilities offered by new technology will help operators better penetrate niche markets. For example, advances in AI will help retailers design discounts and sales promotions that more precisely match consumer needs and behaviors, and to do so in an increasingly personalized way.

-

Expansion into markets in neighboring countries that have both the wealth and size to make this viable will support growth in long-term income. Thus, by 2026, Central plans to have invested THB 30 billion in new retail operations in Vietnam.

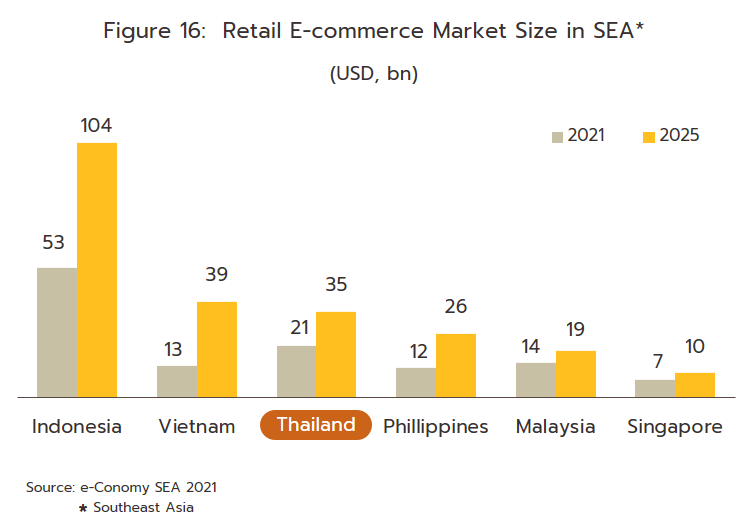

Despite this broadly positive outlook, headwinds will blow against the sector, and these will include the following. (i) Competition will tend to intensify as a result of the constantly increasing number of outlets. Competition will come from within the same segment, from other parts of the market, and from major Thai and overseas corporations that see the growth potential of the Thai market and are acting accordingly. (ii) The number of online competitors is also rising, and this includes both Thai and non-Thai players in the consumer to consumer (C2C)[11] market and those operating on e-marketplaces (e.g., Lazada, Alibaba, Shopee, JD.com, eBay and Amazon). Indeed, the e-Conomy SEA 2021 report indicates that the value of the Thai e-commerce market will reach THB 35 billion by 2025, up 66.7% from 2021 (Figure 16). As such, players will need to be diligent in managing their e-commerce supply chains, which will need to be flexible, responsive and efficient, and to ensure that their online distribution meets the standards expected by consumers, players may need to partner with companies that have expertise in transport and logistics. (iii) To maintain and to sharpen their competitiveness, operators will also need to adapt and exploit modern technology by: (a) developing omnichannel operations that take advantage of 5G technology; (b) using AI to evaluate consumer demand and expenditure, and to maintain optimal stock levels; and (c) building augmented reality (AR) and virtual reality (VR) systems that offer consumers the possibility of experiencing a convincing simulation of the products they are considering buying.

[1] One reason that large modern trade operations are able to offer goods at price points below those of traditional retailers is that they are in a position to set up condition to collect fees from manufacturers and distributors that wish to sell through their shops. Sources of income include: (i) initial fees for stocking new lines; (ii) charges for marketing and other services for, e.g., hosting display stands, access to shelf space, signage, bonuses in the case that sales exceed monthly targets, and the transport and logistics fees incurred in shipping goods from distribution centers to stores; (iii) the fees for producing leaflets and flyers, as well as the provision of free or additionally discounted goods on special occasions (e.g., New Year, the opening of new branches, store renovations and re-openings, and during festivals); (iv) credit terms that extend to 90-120 days; and (v) contracts that allow players to terminate business relations unilaterally.

[2] The 1999 Foreign Business Act allows non-Thais to operate in the retail and wholesale industries (reserved occupations as per Appendix 3 of the Act) if they invest at least THB 100 million in Thailand. Potential investors must also apply for a license from the Foreign Business Committee.

[3] The Standing Committee on Commerce, Industry and Labour has designated large self-service wholesale cash & carry operations such as Makro as a particular type of distributor, but this paper considers only retail operations..

[4] Shopping centers/shopping malls are single structures within which many goods and services are retailed, though the exact products that are available will depend on decisions made by renters/occupiers of retail space; these sign contracts with the landlord operating the shopping center to pay rent for this space for a specified period.

[5] In 2021, the Charoen Pokphand Group bought Tesco Lotus, which was rebranded across the board as Lotus’s. This was with the exception of Tesco Lotus Express, which became Lotus’s go fresh.

[6] Colliers International Thailand

[7] Omnichannel is a form of distribution that mixes online (e.g., websites, social media, or e-commerce) and offline (e.g., in store) marketing and sales. Information gathered on customers from these diverse sources is gathered and analyzed to give retailers an overview of the market and to provide a better understanding of consumer needs and intentions, and this puts them in a better position to offer more comprehensive assistance to potential and actual buyers.

[8] O2O, or online to offline, marketing combines the advantages of both the on- and offline worlds, and this allows companies to raise the quality of their services, expand sales, and engage with a broader consumer base.

[9] These are: (i) high net worth individuals; (ii) wealthy pensioners; (iii) professionals and expats working in Thailand; and (iv) highly skilled professionals.

[10] D2C or direct to consumer marketing describes the use of online channels to sell directly to shoppers. This may be through websites and apps, but sales do not pass through an intermediary.

[11] C2C or consumer to consumer selling is an e-commerce model that allows consumers to buy and sell directly to and from one another

.webp.aspx)