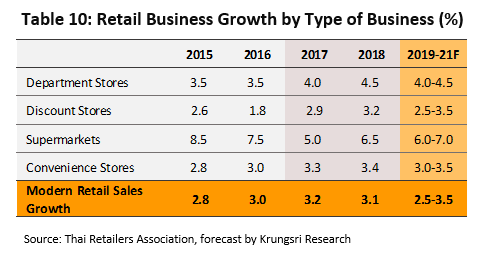

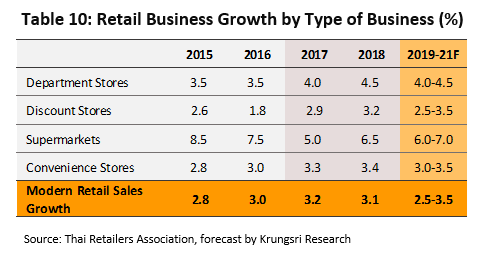

Krungsri Research forecasts that for the period 2019 to 2021, the modern trade sector will see annual growth of 2.5-3.5%, and although consumer spending power will tend to soften in 2019, modern trade operators will benefit from the continuing growth of the tourism sector and from a number of government spending plans which will tend to support the expansion of urban regions. This will then encourage Thai and foreign players to increase the number of branches that they operate in Bangkok and up country and so extend their ability to connect with new customers, while beyond this, large players are also expanding into growing markets in neighboring countries. However, over the next few years, competition within the modern retail sector is also expected to intensify, with this coming from both major Thai and non-Thai players that see Thailand as a route to business expansion, and from the rapidly expanding e-commerce sector; together these challenges will tend to put downward pressure on profits for operators.

Overview

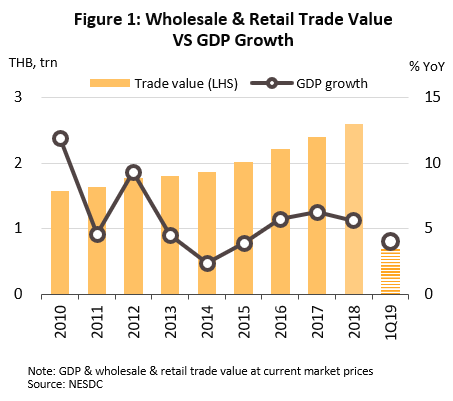

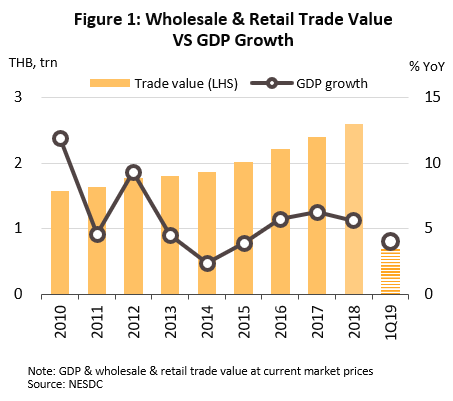

In 2018, the modern trade sector had a combined value of THB2.6 trillion, up 8.5% from 2017 and accounts for 15.9% of GDP, which puts it in second place after the manufacturing sector, which accounts for 26.8% of GDP.

In the past, the Thai retail sector was dominated by small, family-run grocers which obtained stock from middlemen and distributors. However, the situation has changed considerably and large-scale operators which are less dependent on wholesalers as they now own extensive branch networks and are able to occupy favorable bargaining positions when negotiating with producers and wholesalers[1]. In addition, they have managed to adopt a range of innovations, including shop & stock and distribution management systems, distribution centers, and the widespread use of technology deployed to help in a range of tasks, which allow them to gain various marketing advantages.

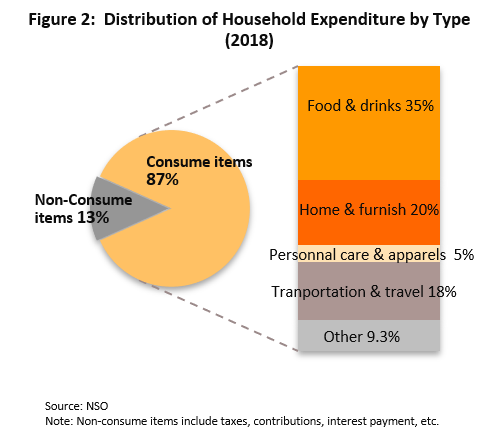

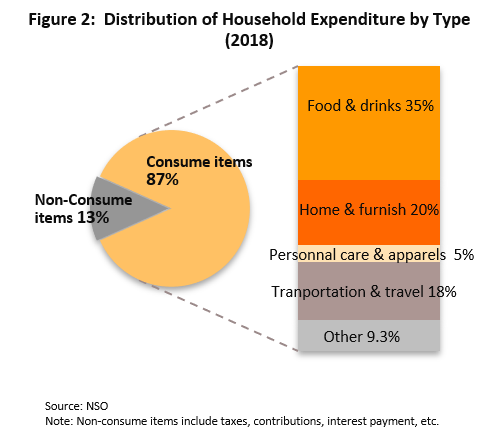

The modern trade sector has seen rapid expansion, in particular in Bangkok and in those regional centers where the level of urbanization has been high. This is a result of 1) government opening the domestic market to foreign investors with advanced technology to invest in retail business[2]. 2) Modern trade outlets meet the demands of consumers for greater levels of convenience when shopping, for example by allowing shoppers to buy a wide range of goods in a single shop (e.g. food, and personal and household goods) (Figure 2), and they may also sell items at lower prices than do traditional retailers; and (iii) ongoing investment in new branches in order to expand the customer base that operators have access to. This ability to meet consumer demand effectively is one factor in explaining how modern traders have been able to rapidly usurp the position of traditional grocers, a triumph underlined by the fact that in 2014, modern traders control 61% of the market, compared with only 25% in 2001[3].

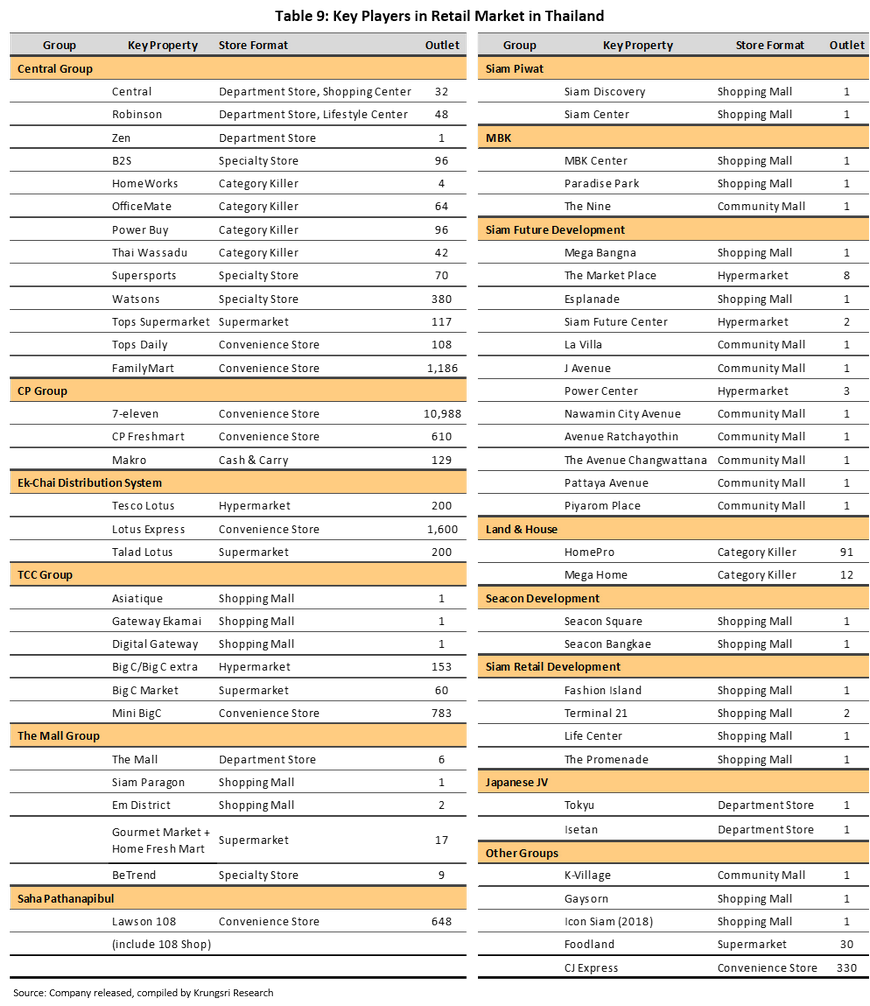

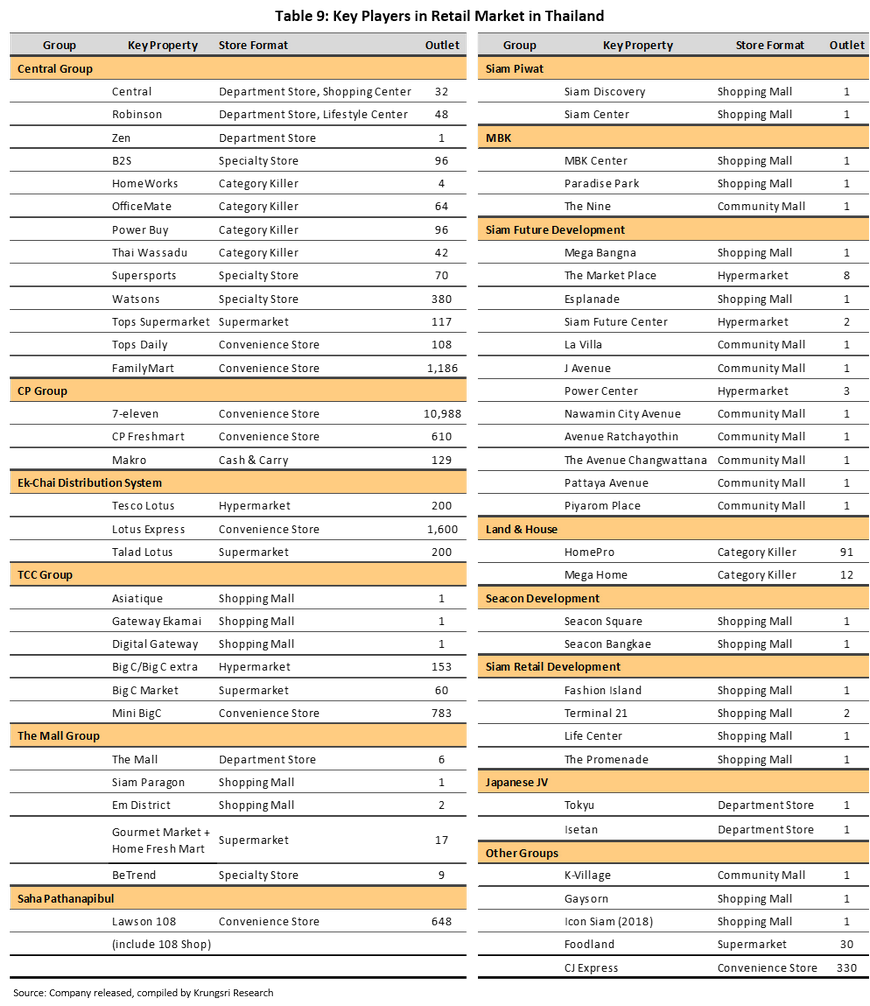

Presently, large-scale modern traders in Thailand include 2-3 multinational companies and 3-5 local operators; they have solid performance from strong revenue generation potential thanks to economies of scale owing to extensive branch coverage, financial strength, and diverse business formats that can respond to the needs of consumers.

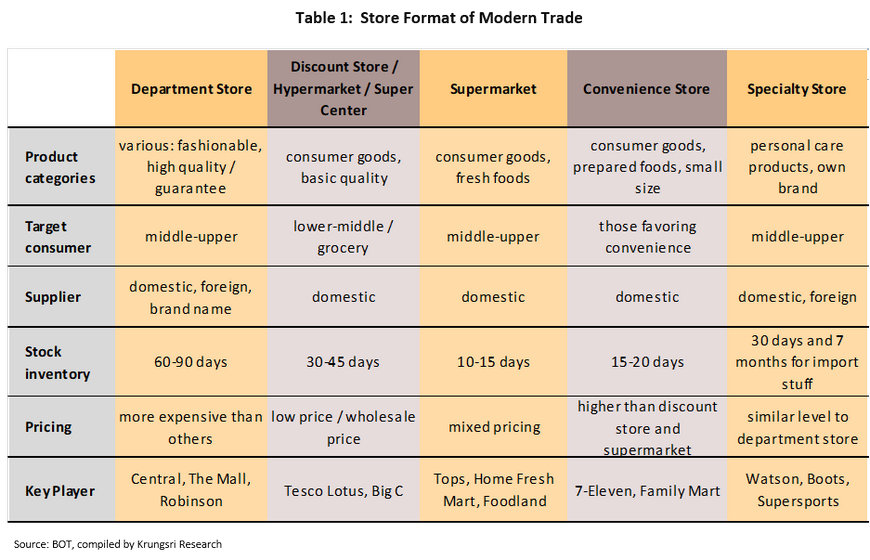

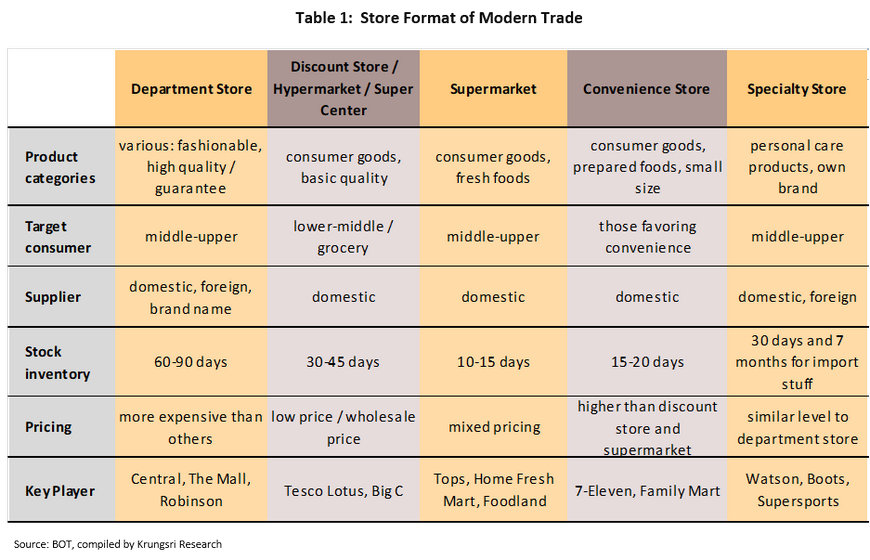

The outlets can be categorized into five types[4], each of which has distinct features.

- Department stores are large-scale retailers with a store floor space of over 1,000 sq.m. and sell products to medium- and high-level consumers. These sell a wide range of products which are modern and have high quality both domestically produced and imported and sell at the same as market prices or higher. Central, Robinson and The Mall are major operators in this mold.

- Discount stores/hypermarkets/supercenters are retail store with a store floor space of more than 1,000 sq.m. which primarily focus on lower- and mid-level consumers. These stores mainly sell consumer products which are normally used in everyday lives. These typically emphasize low price which is key strategy of this type. In this group, Big C, and Tesco Lotus are the main players.

- Supermarkets cover a retail floor space of more than 400 sq.m. and focus on medium- and high-level consumers. In addition, they distribute household consumer goods, especially various fresh foods; and imported products. Key players include Tops Supermarket, Gourmet Market and Foodland.

- Convenience stores/ Express/ Mini Mart are small retail units with a retail store space of more than 40 sq.m. and sell a range of daily life products which are based on the market price. This type is conveniently located in or near communities. 7-Eleven and FamilyMart are notable examples of this type of store.

- Specialty stores emphasize specific product categories with high quality. Boots, Watsons, and Supersports are examples here.

In addition, modern trade has developed new formats such as category killer (such as HomeWorks, PowerBuy and HomePro) and single-price stores (such as Daiso, Tokutokuya). Also, they expand their branches to other provinces and penetrate into communities. Retail outlets have become a center of communities.

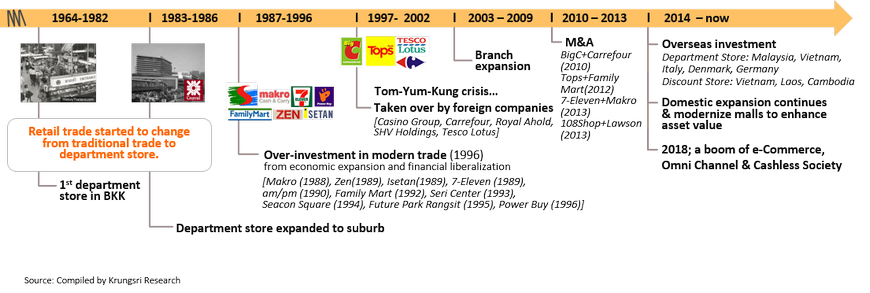

Development of retail business in Thailand

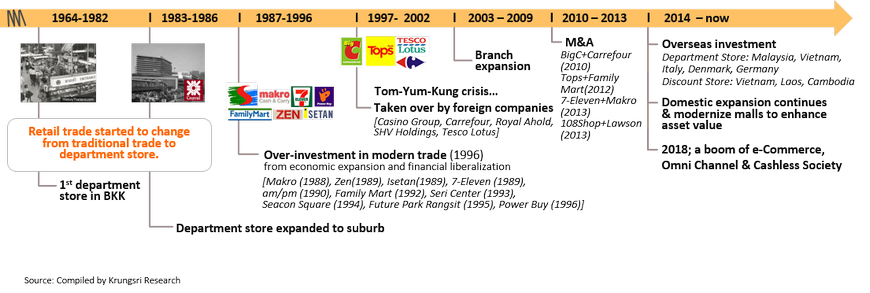

The first modern trade in Thailand is department store that was developed from a family store. The retail formats have been developed following the economic and social changes with a rapid increase in demand for products. Consequently, the retail business has gradually expanded. The first two department stores are Central (in 1956) and Daimaru (in 1964) that capture high-end customers or medium-to high-income earners in Bangkok. They start to embark a supermarket, which is large retail store, in the department stores. Later, retail business has been developed to shopping malls such as Indra square, Ploenchit Akhet and Siam Center; and small department stores such as PATA, The Cathay and Merry King. In addition, department stores have expanded their branches to suburb and the upcountry.

In 1988-1994, the Thai economy grew robustly at an average of 10%. This is one of factors which induces both Thai and foreign investors to invest in modern trade business continually such as wholesale stores (Makro in 1989), convenience stores (FamilyMart in 1987, 7-Eleven in 1989, and AM-PM in 1990), hypermarkets (Big C in 1993), and supermarkets and large shopping malls around outskirts of Bangkok (Future Park Bangkae in 1993, Future Park Rangsit and Seacon Square in 1994). Moreover, large-scale operators have set up joint ventures to save costs; for example, Central Group partnering with Robinson.

However, during the 1997 economic crisis, many Thai retailers face foreign-dominated debt and liquidity squeeze. The government changed regulations by amending law on foreign ownership of land, and allowed foreigners to hold more than 50% shares in some Thai businesses. Consequently, foreign investors could acquire or become major shareholders in several retail businesses. The structure of domestic retail business has thus been changed and several retail businesses were owned by foreigners, especially discount stores such as Tesco Lotus (98% British), Big C Supercenter (63% French) and Makro (90% Dutch). After the Thai economy recovered, some Thai operators bought other retail stores or shares from other foreign investors (e.g. CP Group acquired Makro), or merge with other retail businesses to reduce costs (e.g. Big C acquired Carrefour). In addition, Thai operators seek more opportunity from overseas investment, sell franchises to expand branches to overseas, acquire or merge with foreign businesses in other countries. Therefore, the retail business have grown rapidly .

Situation

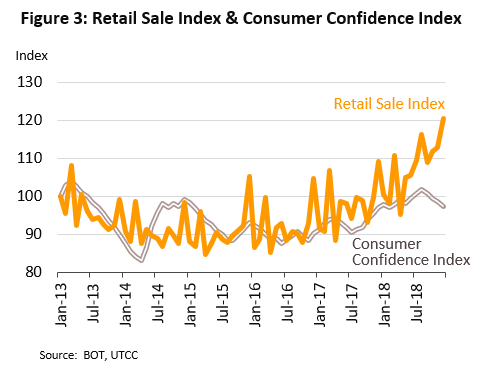

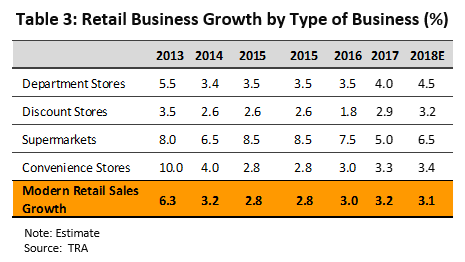

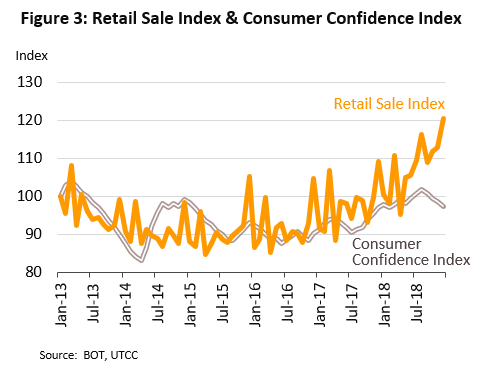

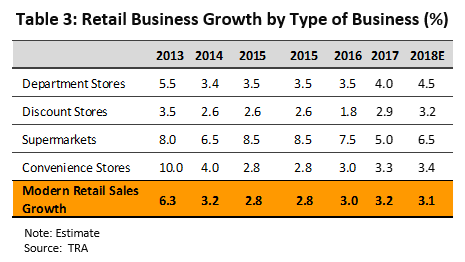

During 2013-2017, growth in the modern trade sector slowed to an average annual rate of 3.6%, which was a significant decline from the 10.6% recorded in the previous five years. This worsening of business conditions was attributed to a softening of domestic consumer purchasing power that was itself caused by a range of economic problems that arose simultaneously, including a declining export sector that was dragged down by a weakening of the world economy, the impact on the economy of continuing political conflict, low prices for agricultural goods, and high levels of household debt. However, from the second half of 2017 onwards, the Thai economy showed clear signs of recovery and this then fed in to improving conditions for modern trade in 2018, which strengthened in step with rising consumer confidence (Figure 3). Several factors contributed to this turn around. (i) Government spending plans for a wide range of projects began to be put into action and this increased the flow of funds through the economy, while earnings from exports and tourism also continued to grow, and the outcome of this was then that consumer spending power rose and the Thai economy grew at an annual rate of 4.1%, the strongest growth for 6 years. (ii) Measures by the government to encourage spending directly, such as through its welfare card scheme, also helped to stimulate grassroots consumption.

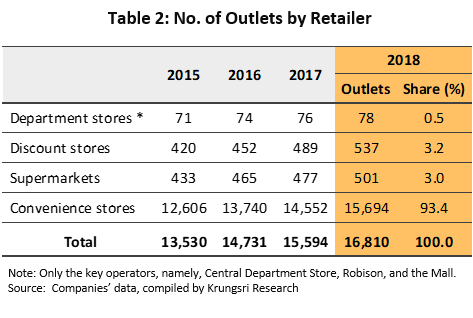

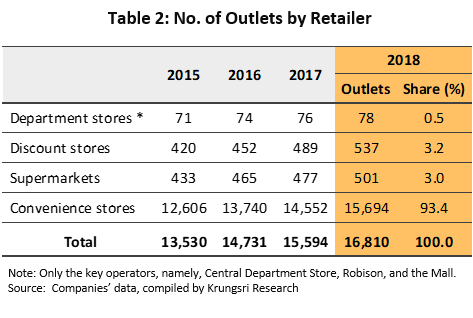

In terms of the number of modern trade outlets, operators have been expanding their investments in new branches so the total number has increased in both Bangkok and upcountry (Table 2). Existing branches are also being renovated and expanded in order to increase the total floor space available and so maximize operators’ ability to meet anticipated future rises in consumer spending power. Thus, the Thai Retailers Association states that between 2016 and 2018, modern chain stores invested an annual average of THB 43.40 bn. In 2018, the total footprint of modern trade outlets in the Bangkok Metropolitan Region (BMR)[5] increased by around 230,000 sq. m. (or 3.1%) from the 2017 figure and this brought the total area of modern trade branches in the BMR to 8.5 million sq. m. By shop type, this area is split between: 61% shopping malls, 16% community malls, 10% discount stores, 6% specialty stores, 5% entertainment complexes and supporting retail space, and 4% department stores Outside the BMR, the major national modern trade players (e.g. Robinson, Tesco Lotus and Big C) are pushing to open new branches in a range of different forms in regional centers, important tourist areas and second-tier provinces, and at the same time, small modern trade outlets are in addition being opened in every province. Operators are also introducing new technology into their operations and are trialing this in new test stores as well as expanding into online shopping that is integrated with their in-store sales (so-called omni-channel sales)[6]. The outcome of this has then been to help support sales growth through 2018 for almost all types of modern trade segment and for the year, growth across the sector came to 3.1% YoY, close to the 2017 figure of 3.2% (Table 3).

The situation for individual types of modern trader

Department Stores

- Flows of new investment in department stores has been consistent for many years, especially in 2012-2013, in which property market in upcountry was boom. This led to increased activity in land purchases and house building, which in turn opened opportunities for investors in large modern trade businesses and prompted a number of department stores to expand operations in regional centers and in tourism provinces.

- Competition among department stores emphasizes the unique points of each together with expansion to various formats to expand customer base.

- Central Group has the largest number of branches and the greatest floor space. To help segment the market, Central Group has invested in building a range of different brands which from lower- to higher-end are Robinson, Central, Zen and Central Embassy. Branch or store expansion is taking different forms according to their location. Robinson branches up country tend to take the form of a ‘lifestyle center’ that has a smaller overall area and that emphasizes rental space, whereas Central is investing in high-potential provinces. In addition, to better connect to a wider customer base, operators are also rushing to develop omni-channel businesses.

- The Mall Group has concentrated its efforts at the more exclusive end of the market, with investments in large, distinctive operations in central locations in Bangkok, such as Emporium, EmQuartier and Siam Paragon. Its recent opening of The Mall upcountry shows a move into tourist areas and signals an attempt to capture the foreign market such as BluPort (Hua Hin) and BluPearl (Phuket-not yet opened).

- Other groups. Many other players exist in this area, with a significant number of Thai investors who operate in other sectors making investments in department stores. These investments typically take the form of developments in prime areas in Bangkok which are directed at middle- to upper-level consumers. Examples of these investors include Siam Piwat (Siam Discovery and Siam Center), Seacon Development (Seacon Square and Seacon Bangkae), Siam Retail Development (Fashion Island and Terminal 21), MBK Group (MBK Center and Paradise Park), Japanese JV (Tokyu and Isetan), Gaysorn Property (Gaysorn Plaza), Siam Future (Mega Bangna and Esplanade), TCC Group (Asiatique and Gateway Ekamai) and currently under construction Icon Siam, which is part of the joint ventures between the CP Group and Siam Piwat

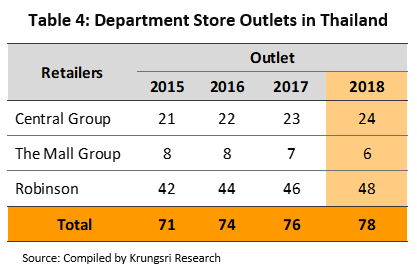

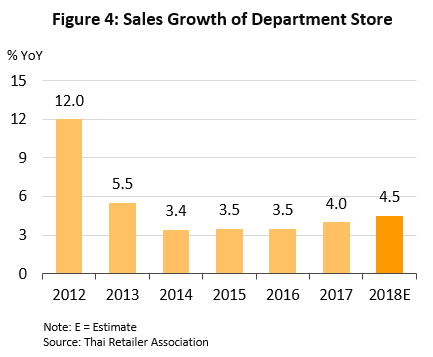

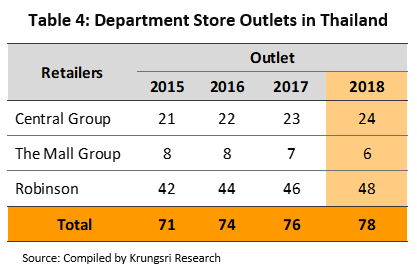

- In 2018, the 3 biggest department store groups (Central, Robinson and The Mall) had a combined total of 79 outlets across the country, up from 74 in 2017 (Table 4). These operators have been investing continuously in expanding their business in Bangkok and up country, as well as looking to overseas markets as a further route to expansion and as a way of securing long-term returns from current investment, and this includes markets with high potential in neighboring countries, for example Central’s new Central i-City department store in Malaysia. In response to changing consumer behavior and rising demand for an easier and more convenient shopping experience, operators have also adjusted their business strategies and have increasingly shifted their focus away from an exclusive concern with in-shop sales to online shopping. This then helped to lift 2018 sales for department stores by 4.5% YoY (Figure 4), up from the 2017 rise of 4.0% YoY.

Discount stores/hypermarkets/supercenters

- Operators have also adjusted their investment plans to maximize long-term returns by increasing the number of discount stores that they run, these being easier to operate than department stores thanks to their lower investment costs, although on the down-side they usually occupy a large area and at present it is becoming harder to find suitable sites, while those that are available tend to be expensive, especially those in city centers. Investments are also hampered by town planning regulations7/ that permit large retail and wholesale properties to be built only in restricted areas.

- Investments in BMR will focus on branches with a smaller footprint and will expand the outlets in alternative store formats. For example, Tesco Lotus is increasingly investing in its Lotus Express while Big C is opening Mini Big C stores and Big C Food offering 24-hour service.

- Operators have thus reviewed their investments in new branches, both large and small in major and second-tier provinces, where urbanization rates are continuing to rise, and expanding the total extent of retail space by opening new branches in second-tier districts. However, Big C, a major player in the sector, has shown more flexibility and responsiveness by expanding into smaller provinces and districts while reducing the footprint of new stores to an average of just 3,000-4,000 sq. m., compared to a more normal store size of 7,000-8,000 sq. m.

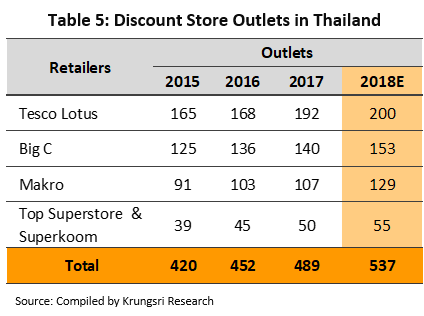

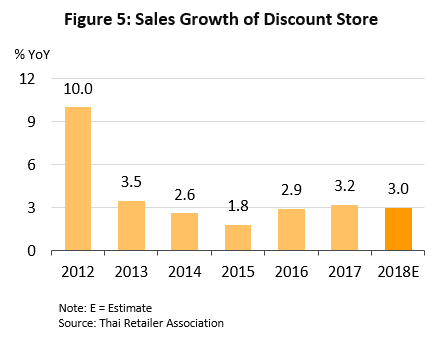

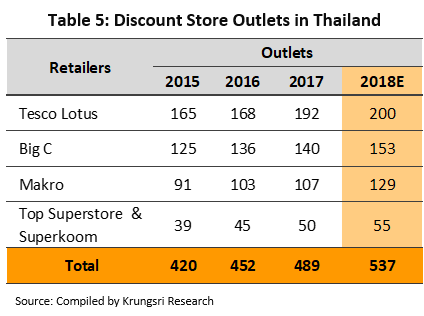

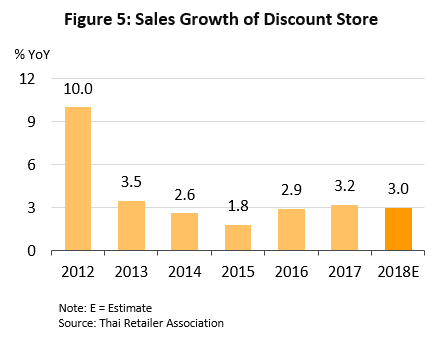

- Competition in these businesses were rather stiff. There were market pressures as a result of weak purchasing power of the mid- to low-level customers, especially in upcountry as well as increasing competition from other store formats namely convenience stores, supermarkets, and specialty stores. Therefore, operators put their efforts to maintain and to increase market share, with marketing strategies revolving around discounting and price cutting as well as minimize size of branches to spread out in other communities. Some operators cut expenses; for example, Tesco Lotus reduces service hours. Beyond this, operators are also working hard to differentiate their offerings from those of their competitors, and this is being achieved through the range of products and services offered, the introduction of smaller, 24-hour branches to service areas covered by large outlets, and extending coverage into communities over a wider area by opening small stores. In addition, future income streams are being developed through investments made across the wider region and thus Big C has invested in new operations in Vietnam and Laos PDR and is preparing to move into Cambodia, too. The effect of these moves has been to support income growth for discount stores of 3.0% YoY in 2018, a rate close to that of 2017 (Figure 5).

Supermarkets

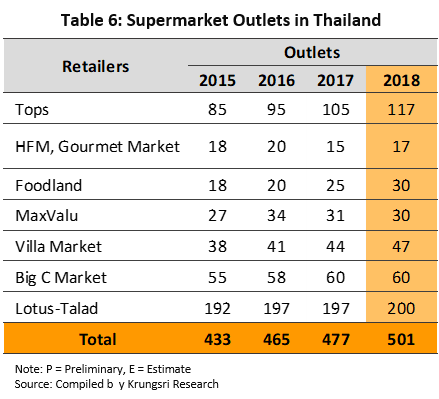

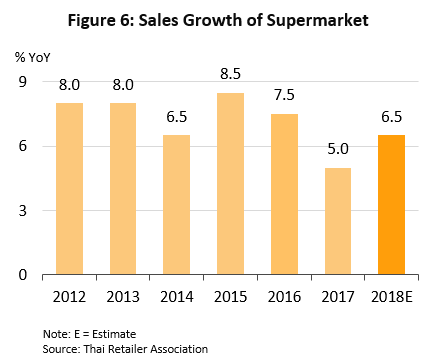

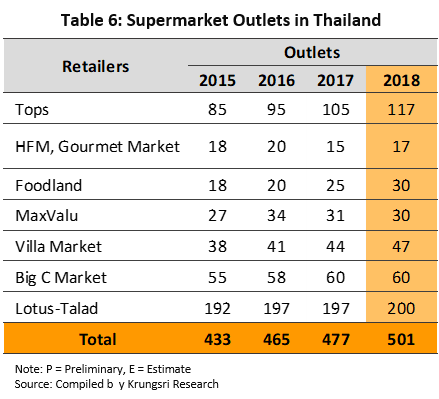

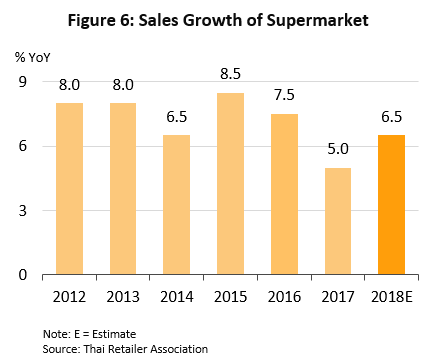

- In 2018, there were 501 supermarkets in the country, up from 477 in 2017. (table 6). In the recent years, supermarkets posted the highest sales growth compared to other store type, as they concentrate on necessity goods used in daily life and attracted middle- and upper- level customers with higher purchasing power. In addition, operators adjust their marketing strategies to serve consumer behavior with the need for convenience suchas Eat-in Service; and provide online food ordering services which are delivered to customers’ doorstep. Furthermore, a variety form of new branches has been developed to support purchasing power in community; for example, Top Supermarket has opened larger stores known as ‘Top Superstore’ and Gourmet market has created a new branded named ‘Gourmet Go’. In 2018, supermarkets were approximated to have expanded at a rate of 6.5%, YoY (figure 6).

- Investment in supermarkets has been continuous and ongoing both by the larger players, i.e. Tops (Central), Gourmet Market (The Mall), Talad Lotus and Big C Market. The mid-range operators -- Foodland, MaxValu and Villa Market -- has been opening new branches in more potential areas, after previously focusing only on Bangkok and vicinities as main market. Meanwhile, Talad Lotus has pursued an extensive policy of investment in second-tier provinces where the competition has yet to be intense.

Convenience Store

- Convenience stores have shown the highest rates of growth in investment of all modern trade store formats and have also taken the greatest market share from traditional retailers as investment capital of convenience store business is less than other retail modern trade outlets’. They have continuously investment and expansion of branches in communities, sub-lanes and petrol stations to achieve complete national coverage. In addition to other existing businesses, new entrants have also appeared in the market:

- Thai operators from other retail businesses (such as Lotus Express, Mini Big C and Tops Daily) who engage in stand-alone shops and outlets in petrol stations in order to support demand from travelers and people in communities such as Lotus Express with Esso and Mini Big C with Bangchak;

- New players from non-retail businesses such as “Jiffy” operated by PTT; and “SPAR” run by Bangchak Petroleum.

- Foreign businesses including Lawson, from Japan, which is engaging in joint ventures with Sahapat, a major Thai manufacturer of consumer goods and in 2012, Sahapat’s some branches of 108shop were renovated to become Lawson108s; and Aeon, another Japanese venture, has joined with MaxValu Tanjai, to distribute ready-made meals and distinguishes itself from the competition by offering imported Japanese items, which comprise around a fifth of its total range.

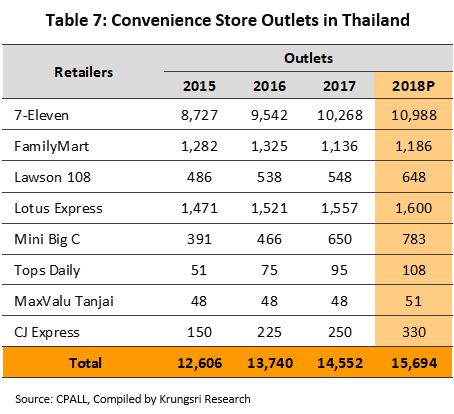

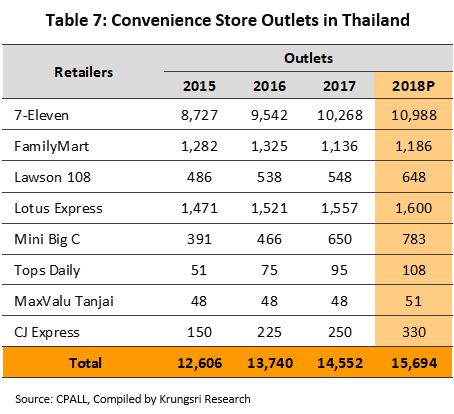

- Investment in new branch expansion leapfrog. In 2018, Thailand was home to 15,694 convenience stores nationwide (table 7) , up from 14,552 in 2017 or 7.8% YoY. The latest expansion include all brands, led by 7-Eleven opened 720 branches (7.0%), Family Mart 50 (4.4%). In addition, large retail stores speed up expansion of small-sized branches which have been similar to a form of convenience store (or known as ‘super convenience store’) such as Lotus Express and Mini Big C Therefore, competition in the convenience store market is reasonably high (such as location, services, price and marketing strategy). In addition, operators have partnered with logistics service providers and E-commerce service providers) to increase more lines of products and services. Nonetheless, 7-Eleven, a market leader, runs more than 10,000 outlets across the country (the world’s second largest number of branches behind Japan) and take a variety of marketing strategies including competition on discounts and price. Operator also developed the new style of two-storey outlets; expanded large-sized branches with parking area; opened new branches in shopping malls; and increased the range of products (including coffee, bakery goods, ready-to-eat food and medicines) and the services that they offer (e.g. making payments for utilities and credit cards, offering agent services for commercial banks, and acting as a collection and distribution point for a range of online businesses). Some 7-Eleven branches are also stocking more supermarket-type goods (e.g. fruit and vegetables). Other convenience store operators provide more services with ready-made meals and coffee shops, offer health and beauty zone, parcel delivery center and delivery services.

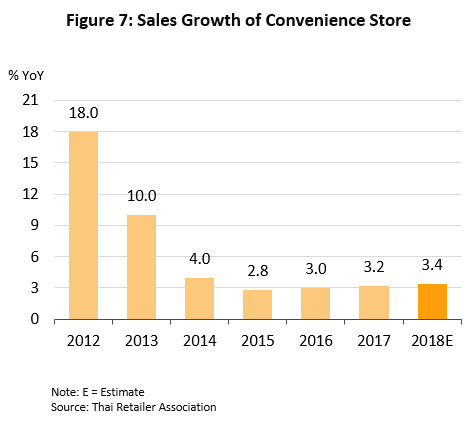

- Revenue growth rates have slowed since 2013 as purchasing power of low- and medium-level customers (major customers) was hurt by the Thai economic slowdown and dwindled agricultural prices. However, in 2018, revenue growth of business increased to 3.4%, slightly up from 3.2% in 2017 due to i) broad-based recovery of domestic purchasing power; and ii) investment expansion to neighboring countries (such as Mini Big C in Laos) (figure 7) .

Industry Outlook

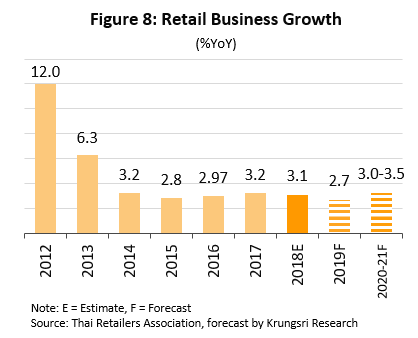

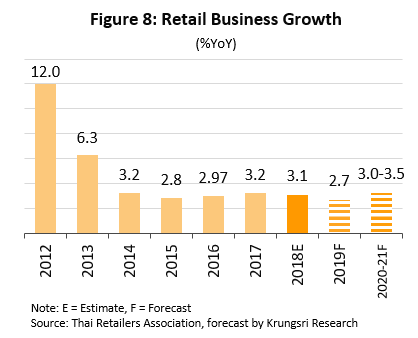

The modern trade sector is expected to grow by 2.5-2.9% in 2019, which would be a slight decline on 2018’s growth of 3.1%, and the forecast is for growth to then accelerate slightly to 3.0-3.5% during 2020 and 2021 (Figure 8). The outlook for 2019 is based on the expectation that the sector will be negatively affected by the slowing of the Thai economy, although more positively, domestic consumption will continue to grow steadily, helped by government measures to increase spending at the start of the year, for example through the ang pao chuay chat (‘Red envelopes for the nation’) promotion and the travel-related tax incentives that have been put in place for 2019, and the national election that was held earlier in the year and that helped to encourage increased circulation of money in the economy. In 2020 and 2021, modern trade will be supported by several factors.

(i) Government and private sector spending plans will have a stimulus effect on the economy, increasing the quantity of money flowing through the system and boosting domestic consumer purchasing power. Moreover, the build out of government-backed infrastructure in the provinces will also tend to encourage the opening of modern trade outlets nearby.

(ii) Growth in the tourism sector (foreign arrivals are forecast to rise to 40 million from the 38 million in 2018) will increase business opportunities for players in the modern trade sector, especially in tourist centers.

(iii) Government measures to increase consumer spending e.g. the reduction in tax for tourism expenses in second-tier provinces, and the government’s measure for helping low-income earners via Welfare Card project.

(iv) Other positive factors will include the impacts of rising incomes and the continuing expansion of the Thai middle class, on-going urbanization, which the United Nations estimates in the case of Thailand will rise from 49.2% in 2017 to 51.4% in 2020, and the strengthening of regional economies, which will open opportunities for modern trade operators to profit from new outlets in border regions and in neighboring countries.

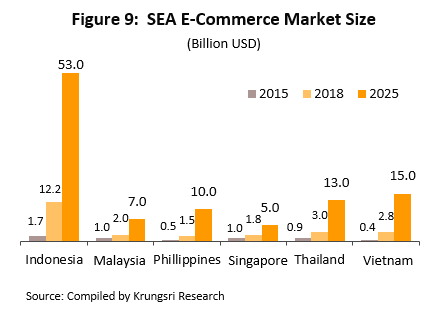

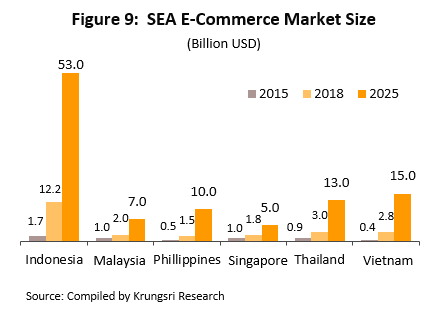

However, in addition to these positive factors, the modern retail trade sector will also face a separate set of restraints. (i) consumer spending power may recover slowly due to uncertain prices for agricultural goods and continuing high levels of household debt, especially at the mid- and lower-levels and these comprise the largest sectors of the Thai market. (ii) Competition will tend to stiffen across the board. Thus, increasing competition will come from other modern retail outlets in the same commercial group, from modern trade outlets that are part of a different commercial group but which are attempting to attract the same customers, and from new operators, both domestic and international, that have entered the market to take advantage of Thailand’s growing modern retail sector. Beyond this, competition will also come from e-commerce, and as a result of this, modern retail operators will need to adjust their operations. This will involve increasing sales and competitiveness by moving from selling primarily off-line to establishing an on-line presence and exploiting these on-line distribution channels more fully. Temasek e-Conomy SEA 2018 puts a value of USD 3 bn on the Thai e-commerce market, placing the country in the top three Southeast Asian e-commerce markets. The value of the market is then forecast to grow to USD 13 bn by 2025 (Figure 9). Indeed, the Thai Retailers Association estimates that over the next five years, online sales will grow to a 5% share of all retail sales in the country, a large jump from the 1% that went to online sales in 2017.

Players in the modern trade sector will tend to speed up their efforts to revise business operations and to raise their levels of competitiveness, including developing their off-line and on-line sales and entering into partnerships with businesses active in other parts of the economy, for example with mobile-based ride-sharing services. They will also continue to invest in new branches in the Bangkok region and in the provinces, although these new outlets may be smaller and the types of goods and services that they offer will vary according to the location; this will be to increase the ease and extent to which players are able to penetrate communities and gain access to a broader customer base. Investments overseas will likewise increase.

- Domestic investments: Players will tend to expand their investments in Bangkok, provinces that are home to tourist centers, second-tier provinces, areas where there has been extensive spending on improvements to communications networks, areas near special economic zones, areas in the Eastern Economic Corridor (EEC), border regions and all other areas across the country that have high potential. Operators intend to achieve national coverage down to the district level by switching to a greater emphasis on smaller branches, and within the convenience store segment, companies such as 7-Eleven plan to invest in opening 700 new outlets per year, with the target of having 13,000 branches across the country by 2021.

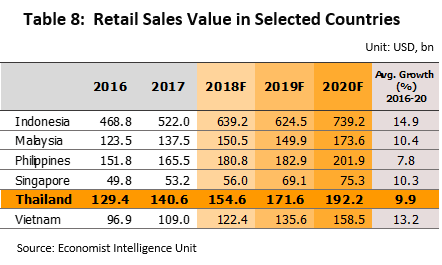

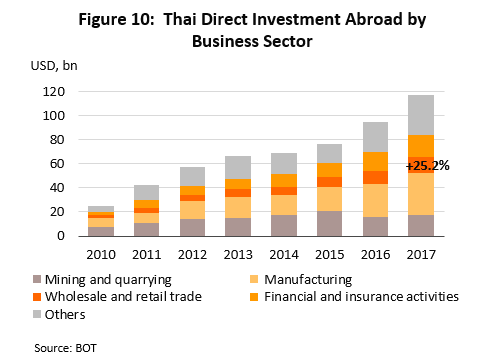

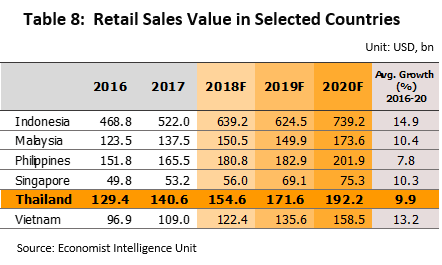

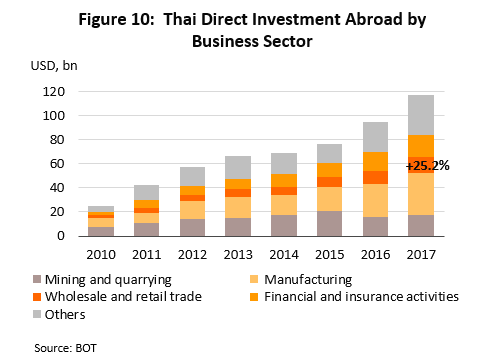

- Overseas investment: Large Thai players in the modern trade sector are also expected to increase the scale of their investments in neighboring ASEAN nations. This is a market that has potential for growth in terms of the size of the economy, of the population and of the middle classes, and it is forecast that by 2020 the value of the total retail sector of the six ASEAN countries will come to USD 1.6 trn, up from USD 1 trn in 2017 (Table 8). Thus, in 2017, the value of overseas investments made by Thai modern trade operators rose 25.2% relative to the 2016 figures (Figure 10). Investments that have already been made in the region include the TCC Group’s purchases of retail outlets and convenience stores, including Vietnam’s MM Mega Market and B’s Mart (a convenience store chain) and Laos’s M-point Mart, and in addition to this, the group has future plans for investment in retail outlets in Cambodia and Malaysia. In addition, Central Group has opened Supersports, Powerbuy and Big C (with its name changed to GO and its format changed to a shopping mall) outlets and a ‘Robins’ department store in Vietnam, a Central department store in Indonesia, and Central i-City shopping center in Malaysia in 2018.

In the coming period, challenges facing the modern trade sector will include stricter official regulations that aim to make trade between retailers and producers or distributers fairer and more equitable. In addition, the changing trend of business moving towards customization approach, from the traditional strategy of mass marketing approach. The outcome of this will then be to push operators to adjust business plans and to use technological solutions, such as big data techniques, to analyze customer information in depth. Players that take advantage of these opening will likely gain competitive advantages and will therefore be able to maintain profitability over the long-term.

Krungsri Research’s view:

In 2019-2021, modern trade business is likely to grow further at 2.5-3.5% per year (Table 10). The intense competition may lower business’s margin. Outlook and opportunity for each store format are detailed below:

- Department stores are expected to see sales growth at 3-4% per year from 4.5% in 2018. Expansion or opening or renovation of department store will accelerate due to 1) a recovery of purchasing power in line with the Thai economy; 2) an increase in the number of foreign tourists; and 3) expansion of second-tier cities and in border zones which are well linked to neighboring countries. Nevertheless, this business will face challenges from penetration of online shopping. To maintain customer base, the operators have to adopt their market strategies including investment in e-commerce platform. This move may put pressure on the margin. Local operators will be more difficult to operate their business.

- Discount stores/ supercenters/ hypermarkets are expected to see rising income by 2.5-3.5% per year from 3.2% in 2018. Competition is stiff and often occurs on price. In addition, they also compete with other retail outlets and new foreign players who plan to penetrate in this market. However, this business is expected to brighten due to a monopoly that has few retailers and diverse customer base.

- Supermarkets are anticipated to see continuous growth of 6.0-7.0% per year from 6.5% in 2018 as a consequence of strong purchasing power in low-to mid-end markets, the supermarket format and their strengths in product quality, as well as the advantages which come from their size and the presence of branches in large communities. Therefore, supermarkets have the potential to respond to the needs of particular consumer groups well and would be able to keep their profitability.

- Convenience stores and minimarts: overall sales are expected to grow moderately by 3.0-3.5% per year from 3.4% in 2018. They will expand by opening new branches covering wide areas in community, residential accommodation which are adjacent to mass transit routes, new opening of department stores and the ease customers experience in shopping at these outlets and the close proximity of branches. In addition, competition will intensify particularly when competing businesses open in close proximity to one another and other competitors such as supermarket is opened in the form of mini supermarket. This will narrow the geographical scope of the areas reached by marketing for each branch with the result that income per branch will fall below previous levels. Stand-alone stores will be particularly vulnerable.

[1] Modern traders have significant bargaining powers and can undercut traditional grocers and retailers since they are able to specify terms of trade to their advantage and to collect a variety of charges from suppliers and agents who wish to be stocked by an operator. These include: charges for first orders or for providing a product code; fees to support services or activities such as rent for store space and charges for signage, meeting sales targets, and transportation from distribution centers to branches; charges for promotions and marketing such as those for printing leaflets, and subsidizing giveaways, and discounts, particularly for occasions such as anniversaries, new store openings, renovations and festivals; providing favorable credit terms to retailers, typically 90-120 days; and contracts which allow for unilateral termination of business.

[2] Working in retail and wholesale is a restricted activity, according to the Foreign Business Act B.E. 2542 and as such, non-Thai nationals who wish to make investments of less than THB100 million are required to seek authorization from the Foreign Business Committee. However, those investing more than this limit need only notify the authorities and they will automatically be granted authorization to engage in retail and wholesale trade in Thailand and thus the law provides an opening for non-Thais to enter the sector.

[3] The Standing Committee on Commerce, Industry and Labor, the National Legislative Assembly.

[4] Cash and Carry stores are regarded as wholesalers and were not discussed here.

[5] Colliers International Thailand

[6] Omni-channel: Development of marketing channel as cross-channel by integrating both online and in-store channel to create complete cohesion (It removes all barriers between a customer’s online and off-line journey)

[7] Regulations on the establishment of commercial buildings (retail and wholesale) are, for instance, 1) those with a store floor space of less than 300 sq.m. may be located in the area which is permitted and specified in the comprehensive city plan; 2) those with a store floor space of between 300-1,000 sq.m. should face a public road with at least four lanes or over 20 meters wide, and with a front road setback of at least 50 meters from public roads; 3) those with a store floor space over 1,000 sq.m must be located outside the area specified in the urban comprehensive plan, face public road or over 40 meters wide, and a front road setback of over 75 meters from public roads.

.webp.aspx)