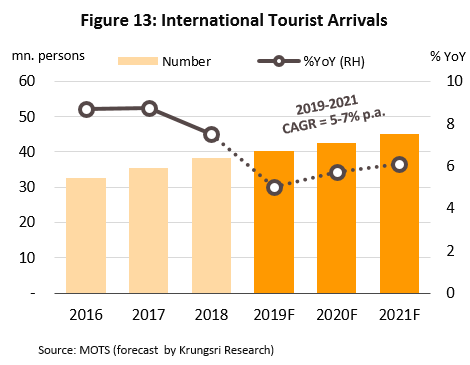

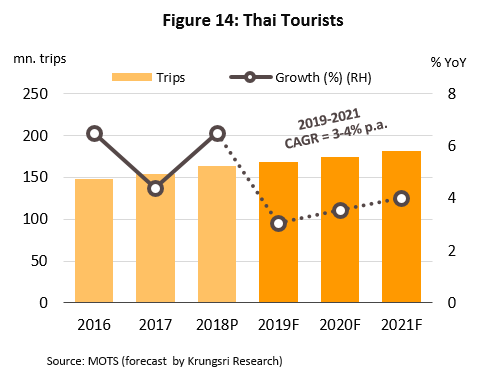

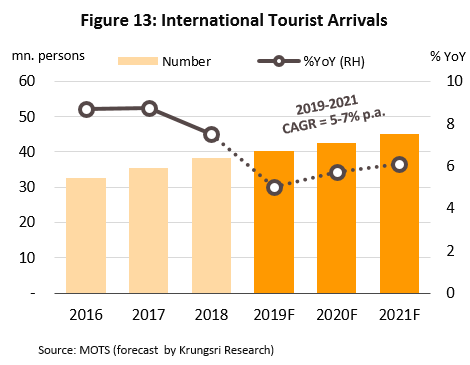

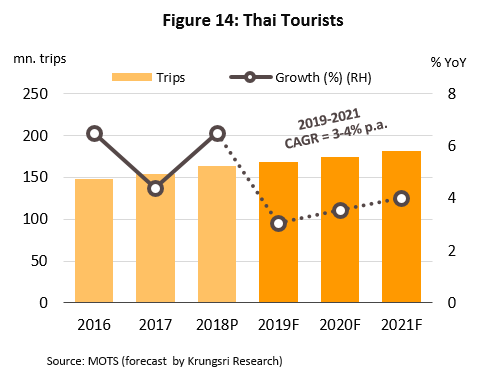

Between 2019 and 2021, the hotel industry is expected to grow steadily along with the tourism sector. Foreign tourist arrivals are forecast to rise by 5-7% per year during the period, while the number of domestic tourists is expected to increase at a slightly slower annual rate of 3-4%. These should lift average hotel occupancy rates to 71.5-72.5% from 71.4% in 2018.

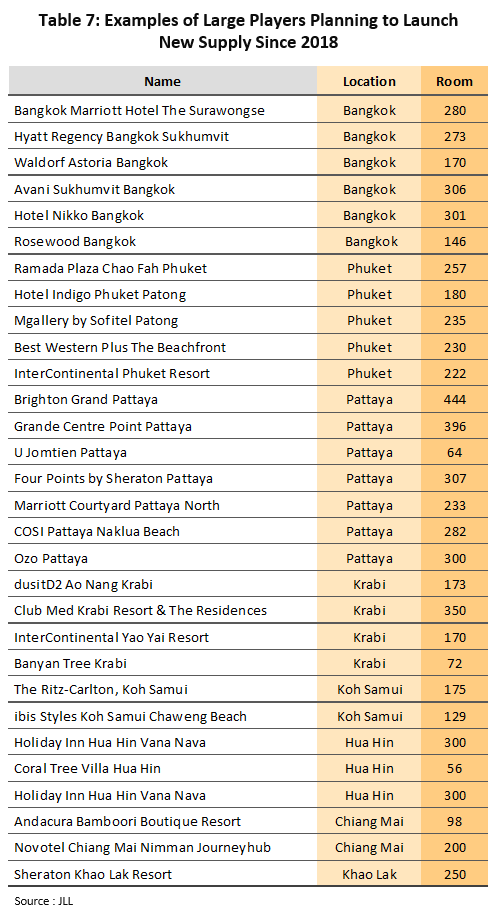

In the same period, hotel operators will continue to invest in more hotel properties. These will be predominately (i) in Thailand’s major tourist destinations (Bangkok, Pattaya and Phuket), with the bulk of investment by large-scale Thai and foreign investors, and (ii) in provinces that are regional development hubs and in secondary tourism destinations and provinces that are benefitting from rising levels of economic activity (including trade, investment, and tourism) in the region. However, the expanding supply of hotel accommodation coupled with the increasing prevalence of day-rates offered by apartments and condominiums, and the rising popularity of online booking platforms (e.g. Airbnb) will lead to stiffer competition in the sector.

Overview

The hotel industry (which here includes hotels, resorts and guesthouses) is directly connected to the tourism sector. In 2018, hotels and restaurants combined accounted for 5.6% of Thai GDP, bringing in THB920bn.

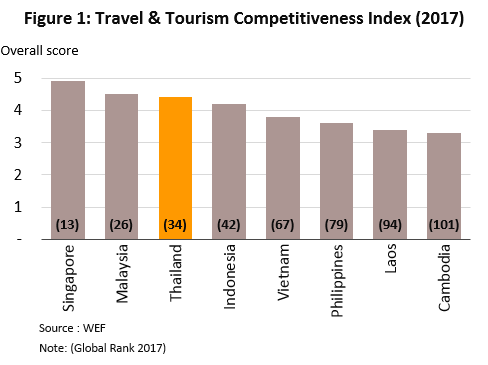

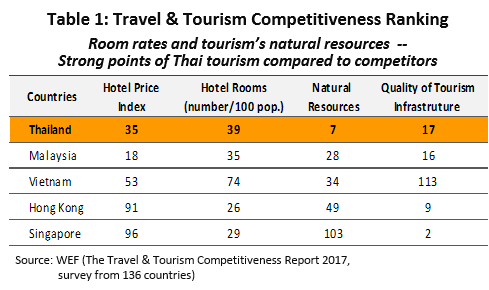

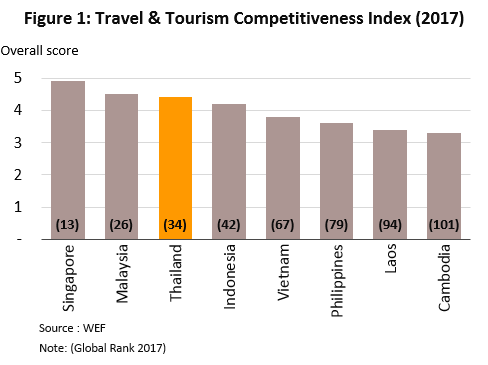

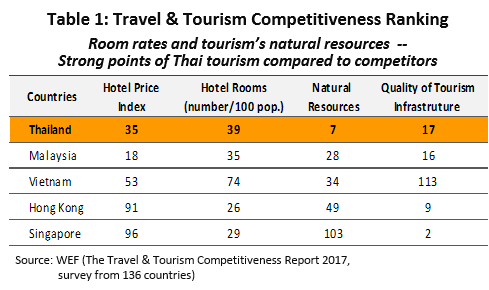

Thailand is a top tourist destination partly because of the world-class tourism attractions spread throughout the country. Bangkok is a major and perennially popular tourist attraction, with the city consistently winning tourism awards. There are popular beach destinations in the south and east, and in the north, a range of eco-tourism travel options. In addition, the country benefits from competitively-priced accommodation and low cost of living which, when compared to other countries, is considered good value for money. Beyond this, the country’s extensive communications network makes travel convenient. National infrastructure is also constantly being upgraded. These factors give Thailand an advantage over its competitors. Indeed, the 2017 Travel and Tourism Competitiveness Index compiled by the World Economic Forum places Thailand 34th out of 136 countries surveyed and 3rd in Southeast Asia after Singapore and Malaysia (Figure 1). Relative to other countries in the region, Thailand benefits particularly from having the highest quality of natural resources in the Asia-Pacific region (Table 1)

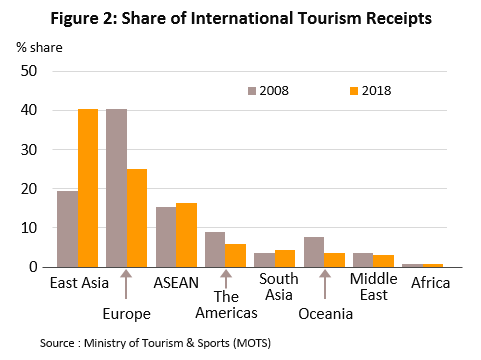

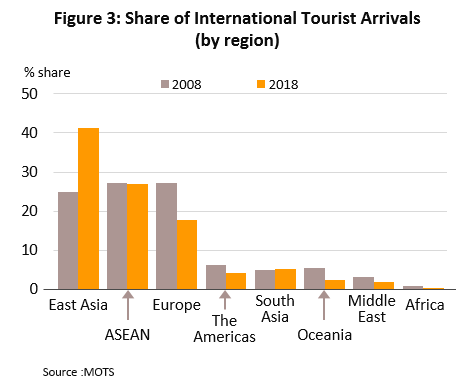

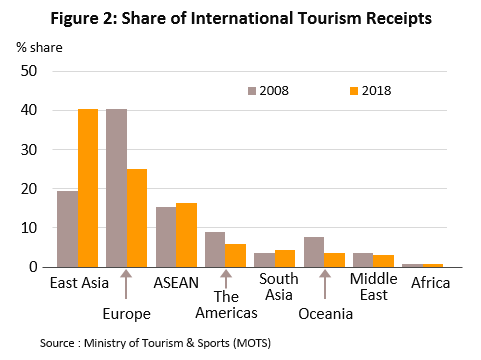

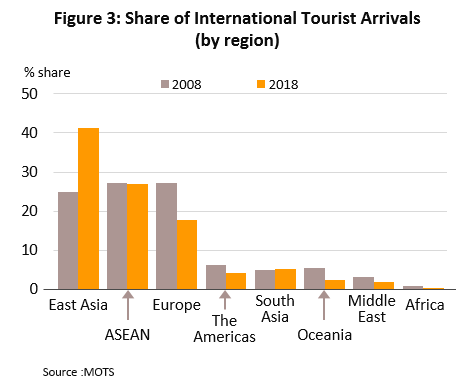

On the demand side, foreign tourists comprise the most important group and contributes around 65% of the sector’s receipts. They spend more per head and stay longer in tourist accommodation than domestic tourists. Within the general category of foreign tourists, those from East Asia (China, Japan, South Korea, Hong Kong and Taiwan) are the most important in terms of receipts and numbers, contributing 40% of all receipts from overseas arrivals (Figure 2) and accounting for 41% of total foreign tourists (Figure 3). Europe is the second largest receipts contributor at 25% of all receipts from foreign arrivals, but the ASEAN zone is second in the number of foreign arrivals (27%).

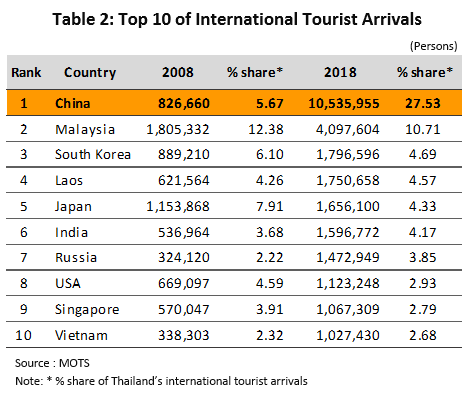

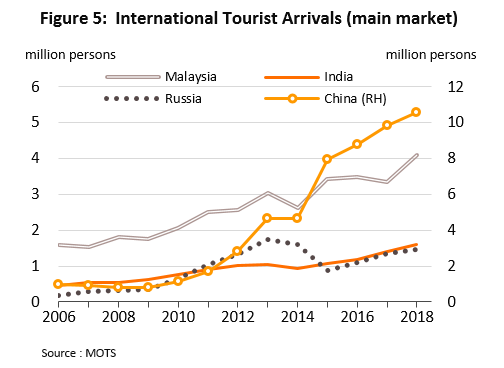

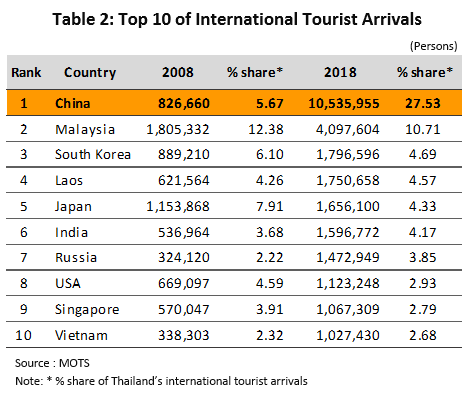

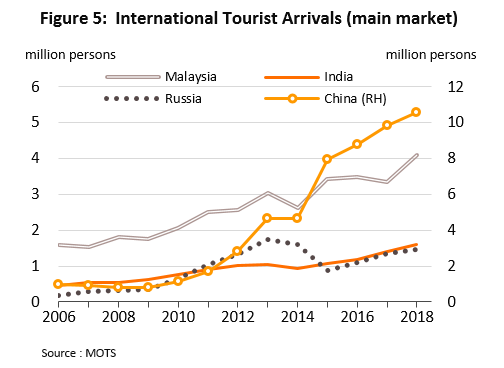

The most important tourist markets for Thailand are China, Malaysia, India and Russia.

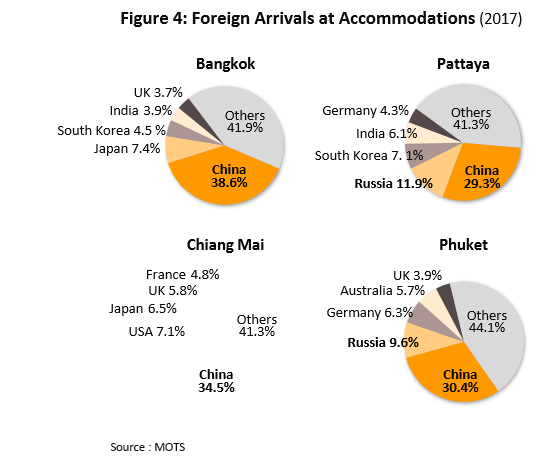

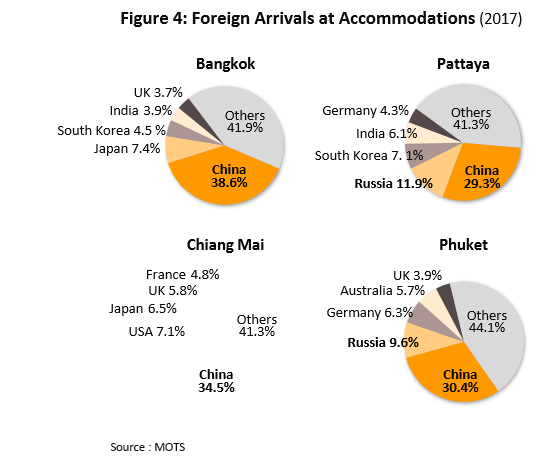

China: With 10.5 million Chinese tourists coming to Thailand last year (27.5% of all foreign arrivals), China is Thailand’s most important tourist market (data for 2018, Table 2). Although the Chinese market is large, it recently experienced explosive growth, increasing more than ten-fold in size since 2007, with Chinese visitors now visiting all of Thailand’s major tourist destinations in approximately equal proportions (Figure 4). A combination of several ‘push’ factors are encouraging more Chinese visitors. These include the following: (i) China has eased restrictions on international travel by Chinese citizens, who can now visit 140 countries[1]. (ii) The rapid growth of the Chinese economy has caused an equally-rapid expansion of the middle-class population. McKinsey estimates that in urban regions, the middle-class population made up 76% of the population in 2015 from only 22% in 2005, and they naturally have greater ability to travel abroad. (iii) The number of low-cost carriers has increased, as has the number of direct flights linking Thailand and China. In addition, land links between the two countries, especially the R3A (Thai-Laos-South China) connection, have also improved. (iv) Relations between China and Japan and South Korea have not been entirely smooth over the past 3-4 years and because of this, some Chinese travelers have changed their travel plans and visited Thailand instead. (v) The popularity of the Chinese film ‘Lost in Thailand’ (originally screened in December 2012, the first Chinese film to gross over CNY 1,000 m) was a powerful advertisement for Thailand, and especially Chiang Mai where it was filmed. The film fueled a sharp rise in Chinese tourists during 2013-2016.

In addition, there are also several ‘pull’ factors originating from Thailand, including (i) government policies to promote tourism to Thailand such as waiving fees for visas issued on arrival (VOAs) for Chinese citizens, and (ii) ongoing marketing efforts by official organizations to attract more Chinese tourists, including road shows in Chinese cities and setting up Tourism Authority of Thailand (TAT) offices in cities including Beijing, Shanghai, Guangdong, Chengdu and Kunming.

Looking at behavior of tourist markets, those from East Asia, especially China, tend to be more responsive to emergencies such as those terrorist acts, disease outbreaks, or natural disasters. In contrast, European and North American tourists are more sensitive to changes in economic conditions, partly explained by the fact that Europeans and North Americans travel from considerably further and so it is more difficult for visitors from these countries to change plans at short notice.

Malaysia: Within Asia, Malaysia is as a major market for Thai tourism. There has been substantial growth in tourist arrivals that has been sustained over the past few years. Compared to CLMV, Malaysia is also a major source of tourist income; in 2017, it reached THB95bn compared to THB130bn from CLMV tourists. This is being driven by the growth of cross-border Thai-Malaysian trade. Malaysian tourists typically enter the country through the Sadao crossing (main entry point) or those in Batong and Sungaikolok. In addition, introduction of a Malaysia-Chiang Mai air route has increased the number of Malaysian tourists traveling to Chiang Mai (in 2017, the number staying in hotels in Chiang Mai rose by 19.4% YoY).

India: Between 2015 and 2018, the Indian market registered double-digit growth annually supported by steady growth of the domestic economy and a rapidly-growing middle class. The Indian National Council of Applied Economic Research (NCAER) estimates that in 2016, 267 million Indians were categorized as middle class. More immediately, growth in the segment, and particularly tourists arriving from smaller Indian cities, has been helped by the rising number of low-cost airlines flying between Thailand and second-tier Indian cities such as Ahmedabad, Kochi and Dehradun. The more wealthy Indian tourists also have a preference for holding marriage ceremonies in Thailand because of accommodation and overall costs are lower than in India. In addition, flight time from cities such as New Delhi, Mumbai, Chennai and Bangalore, traveling to Thailand is relatively short at only 4-5 hours .

Russia: Russia is the most important market in Europe for Thai tourism, and has potential to grow further. The Russian segment has been boosted by several factors. (i) The Russian economy is improving. (ii) Tensions in the Middle East (especially between 2010 and 2013) had encouraged Russian tourists to switch from previously-popular travel destinations such as Turkey and Egypt, to Thailand instead. (iii) There has been an increase in the number of flights, especially charter flights, between Thailand and Russia (around 60% of Russian tourists travel on charter flights). The other pull factors are road shows in Russia by the TAT and an agreement between the Russian and Thai governments to allow visa-free travel for tourism for up to 30 days, effective since April 2007.

In domestic tourism, between 2007 and 2017, growth has averaged 7% per year in terms of trips made. Growth had been supported by (i) ongoing efforts to encourage tourism, including tax deduction measures and the private sector cutting prices of accommodation; (ii) the expansion of low-cost airline services and the upgrade and development of provincial airports; and (iii) easier access to tourist sites for independent travelers, thanks to improvements in the communications network, especially the road system.

Domestic tourism accounts for only around 35% of total tourism receipts because domestic tourists spend less per head and their stays are shorter than foreign tourists. However, Thai tourists remain important to hotel operators and the tourism industry in major tourist areas such as Rayong, Chiang Mai, and Kanchanaburi, and in regional centers such as Nakhon Ratchasima, Phitsanulok and Khon Kaen, where income from Thai tourists is more important than from foreigners.

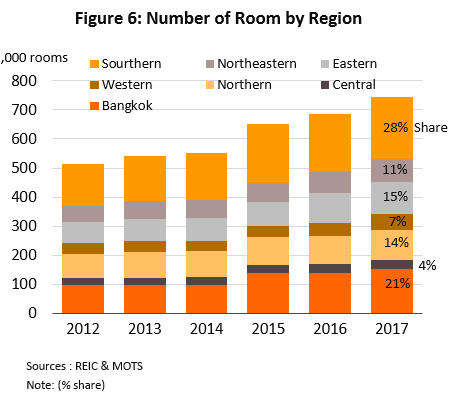

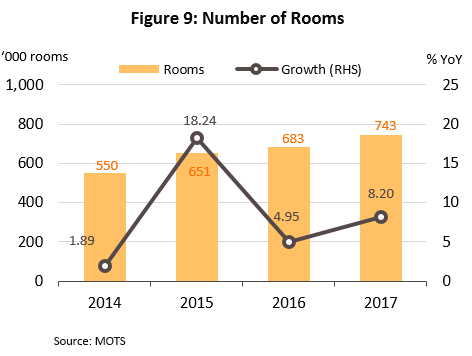

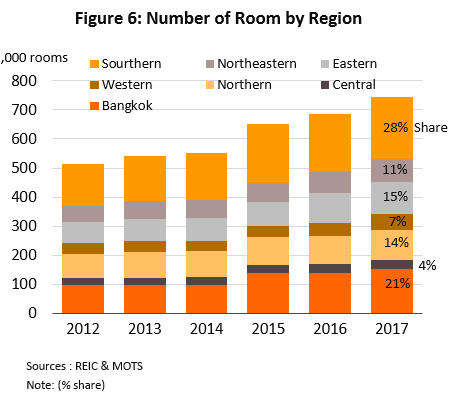

On the supply side, the expansion of the tourism sector has continued to fuel the growth in the hotel business in terms of both the number of hotels and the number of rooms within those hotels. In the past, investment typically went into the development of operations in Bangkok as this is both a central tourist destination and the national travel hub, and into developments in the world famous seaside resorts of Phuket and Pattaya (in Chonburi province). But over the past five years there has been an official policy to develop tourism across the country and improve the standards of the national communications network and regional airports. This has pulled in private sector investment in hotels in regional centers and in tourist areas such as Pattaya, Phuket, Chiang Mai, Krabi and Koh Samui (in Surat Thani province). The net effect is an increase in the national supply of hotel rooms from 515,087 in 2012 to 743,107 in 2017 (Figure 6). This represents 7.6% growth per year and both Thai and international hotel chains have participated in this build out of new supply (Figure 7).

Hotel operators main revenue source is room charges which account for 65-70% of total hotel income. Another 25% is generated from the sale of food and drinks, with four- and five-star hotels typically deriving a greater portion than smaller hotels. Income from other sources, such as washing and ironing services and collecting rents from shops operating in hotel premises usually contribute the remaining 5-10% of revenue.

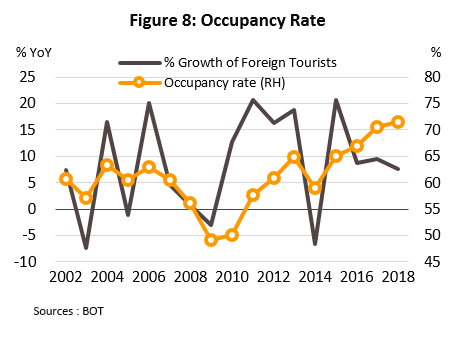

Situation

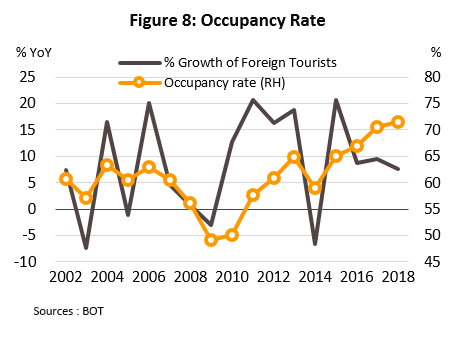

Overall, the Thai hotel business is improving but in some parts of the country, there is persistent excess supply of accommodation. Between 2001 and 2007, domestic and the international tourists grew by 6.2% and 7.4% p.a., respectively, but continued investment in hotels and the resulting large supply of rooms kept occupancy rate at an average of 60.7% (Figure 8). Following this, from 2008 to 2014, average growth of the domestic and international tourism segments ran to 7.5% and 8.5% per year but despite this, occupancy rate slipped significantly to an average of 56.8% as supply continued to grow, both in terms of hotel rooms (by 8% per year between 2008 and 2014) and rising number of condominiums and apartments that are offering daily rental. This stoked competition in the sector.

Between 2015 and 2017, the number of Thai and international tourists continued to rise and lifted occupancy rate to 67.6%. Hotel operators find this satisfactory[2] (occupancy rates of 65-70% are considered acceptable), though occupancy varied according to the area and was highest (over 75%) in the major tourist areas of Bangkok, Chonburi and Phuket, followed by secondary destinations such as Phetchaburi, Chiang Mai and Surat Thani where they were 65-75%.

In 2018, conditions continued to improve for the hotel business amid a steadily rising number of foreign and Thai tourists, which in turn pushed up the average occupancy rate. The positive situation for foreign arrivals was boosted by several factors, including: (i) the continued recovery of the global economy ; (ii) more charter and direct flights to Thailand coupled with a rising number of low-cost airlines, especially in China (e.g. Xiamen Airlines, China Eastern Airlines, Juneyao Airlines and Spring Airlines); and (iii) government measures to stimulate the tourism sector, such as waiving of fees for visas on arrival for tourists from 21 countries[3]. Domestic tourism was also a beneficiary of government efforts to stimulate the sector, as well as the strengthening economy.

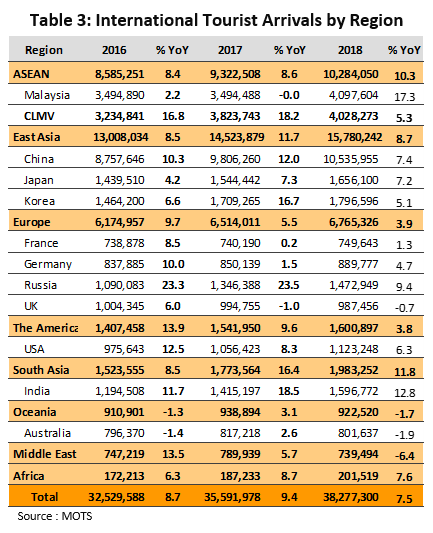

The state of the tourism sector in 2018 and indicators of the health of the hotel trade

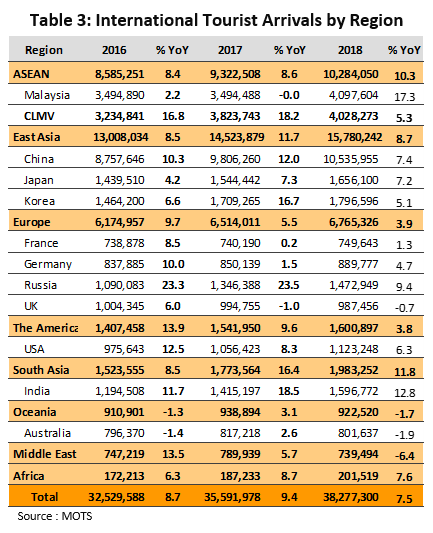

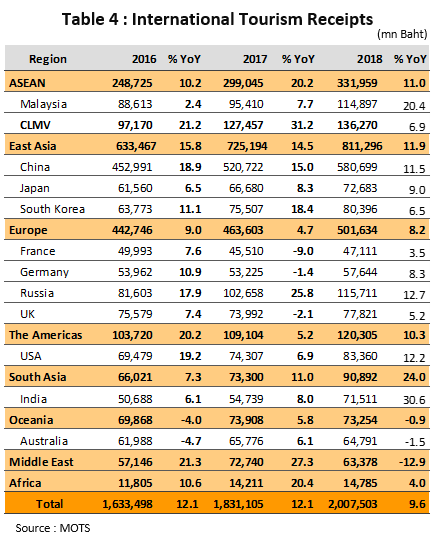

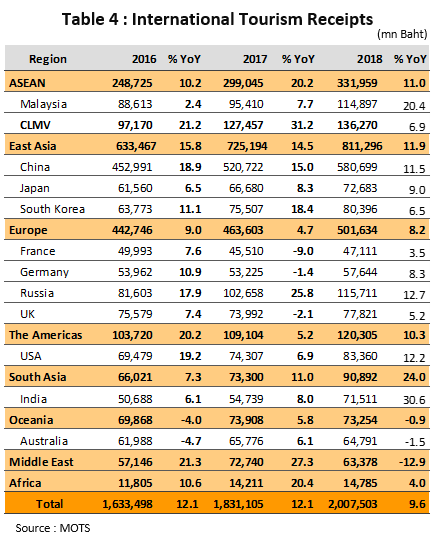

- Total international tourist arrivals rose 7.5% YoY to 38.3 million in 2018, with growth recorded in almost all segments. In the largest market, East Asia (China, Japan, South Korea, Hong Kong and Taiwan), growth hit 8.7% YoY (Table 4) led by tourists from China (+7.4% YoY). In the first half of the year, Chinese tourist arrivals jumped 25.9% but in the second half of 2018, following the tragic sinking in July of a ferry carrying Chinese tourists in Phuket, arrivals shrank by 9.6% YoY. The European market saw 3.9% YoY growth, driven especially by the rise of the Russian segment (up 9.4% YoY) (Table 4) which benefitted from an improving economy and more flights between Russia and Thailand. However, the European and Russian markets are seeing slower growth as travelers gradually returned to destinations that were previously popular, such as Egypt and Turkey. The South Asian market recorded the highest growth rate (up 11.8% YoY) due to a rising number of Indian tourists coming to Thailand, while the Middle Eastern market shrank by 6.4% YoY on weaker consumer spending power following the introduction from January 1, 2018 of 5% value added tax in Saudi Arabia and the United Arab Emirates.

In 2018, income from overseas arrivals rose by 9.6% YoY to THB2.0trn (Table 5). Of this, the East Asian market was the largest contributor at THB 810 bn (40% of all income from foreign tourists). This was a rise of 11.9% YoY, led by Chinese visitors who brought in THB 581 bn receipts (up 11.5% YoY). The European market generated THB 500 bn (up 8.2% YoY) with Russians the biggest spenders at THB 120 bn (up 12.7% YoY).

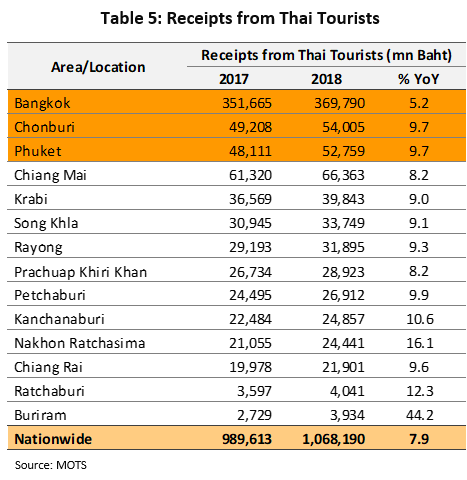

- On domestic tourism, Thais made 164 million trips in the year, an increase of 3.6% YoY. This was encouraged by a combination of economic growth and expansion of tourism in secondary cities which were supported by the 1.1% YoY increase in the number of domestic flights (data from the Airports Authority of Thailand). There was also help from government policies aimed at stimulating domestic tourism. Particularly noteworthy were the measures to encourage tourism in secondary cities in 55 provinces[4] (from January 1 to December 31, 2018) that allowed tourists to deduct payments made for accommodation, travel guides and package holidays in these cities against their personal taxes, up to a value of THB 15,000 per year.

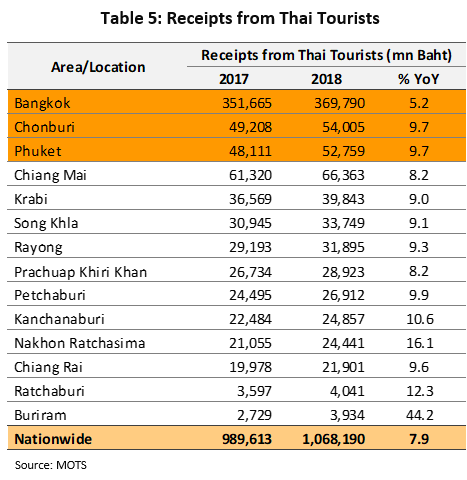

Receipts from domestic tourism reached THB1.07trn, up 7.9% YoY (Table 6). The three major tourist sites of Bangkok, Chonburi and Phuket alone generated THB476.55bn receipts, or 44.6% of total domestic tourism receipts. In 2018, tourism receipts were still concentrated in the major tourist destinations, although there were sharp increases for other provinces, including Buriram where receipts rose 44.2% YoY. This was the result of a successful campaign to promote sports tourism, in particular the development of the nationally popular football team and stadium, as well as organizing world-class sporting events such as the Thailand Moto GP.

- The latest available data (2017) indicates Thailand is home to a total of 743,000 hotel rooms, a rise of 8.2% from the end of 2016 (Figure 9). With 210,000 rooms (28% of the total), the south is the region best supplied with hotel accommodation.

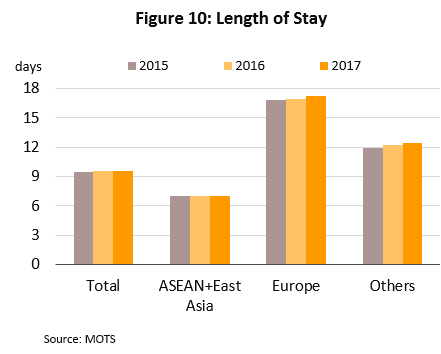

- Foreign visitors’ length of stays were stable at 9.52 days (2017 data), which was a slight drop from 9.56 days in 2016 (Figure 10). European visitors stayed the longest because they traveled from further away and like to escape the cold in their home countries.

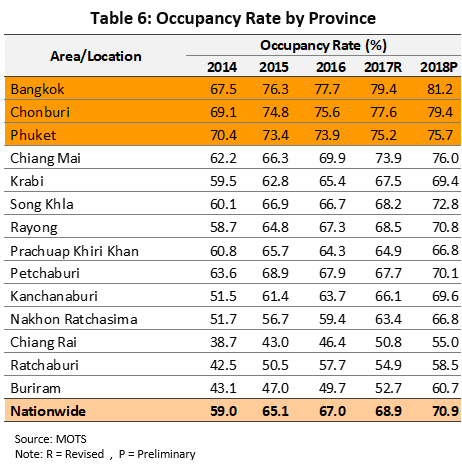

- For 2018, occupancy rate rose to 71.4% from 70.6% in 2017 (Figure 8). Data from the Ministry of Tourism and Sports show increments in all parts of the country (Table 7). In Bangkok, occupancy rate hit 81.2% (up from 79.4% in 2017), while in Chonburi it rose to 79.4% (from 77.6% a year earlier). The increase in Phuket was smaller, inching up to 75.7% from 75.2% in 2017, because of the negative impact on Chinese arrivals in 2H18 after the tragic ferry accident in July of that year. Operators in important provincial centers and secondary provinces also reported rising occupancy rates driven by government measures to stimulate regional tourism.

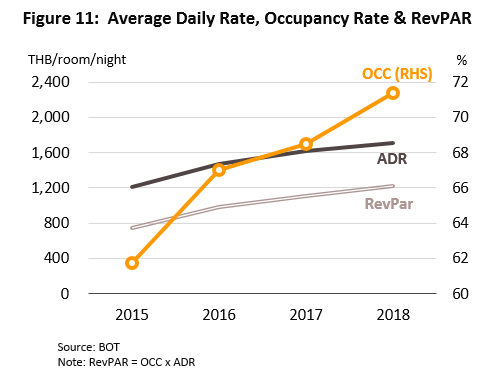

- Room rates surged in 2018, by 10.9% YoY to THB 1,710 per room per night from THB 1,613 in 2017 (Figure 11). This lifted revenue per available room (RevPAR) to THB 1,221 per room per night (up 10.2% YoY).

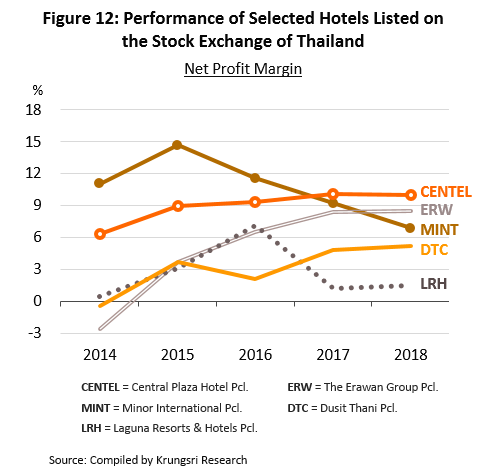

- For the majority of hotel operators (based on returns of companies listed on the stock exchange), business conditions supported continued growth in 2018 through higher occupancy rates (Figure 12). Large players expanded their income streams by ongoing investment in operations in Thailand and abroad, as well as managing hotels overseas.

In the first quarter of 2019, the sector continued to enjoy growth supported by strengthening domestic tourism and an increasing number of foreign arrivals, especially from the ASEAN region and South Asia, despite weaker China arrivals for the third quarter.

- Foreign tourist arrivals increased by 1.8% to 10.8 million. By region, the greatest number of arrivals came from East Asia but growth was slow at +1.3% YoY because of a drop in Chinese tourists (-1.7% YoY for the year, compared to a jump of 30% YoY the year before). However, arrivals from other East Asian countries continued to rise and so the segment still registered growth. South Asia saw a sharp rise in arrivals (up 20.7% YoY) driven by a 25.0% YoY increase in Indian tourists, and tourists from the ASEAN region also increased, albeit at a slower lower rate of 5.7% YoY. However, the European market contracted by 2.3% YoY as tourists from France, Germany and Russia switched back to tourist destinations that had been popular before, including Turkey and Egypt. In addition, the Russian economy struggled under the increase in value-added tax from 18% to 20% (from January 1, 2019) while the number of UK tourist arrivals slid 1.2% YoY as the weaker pound made travel abroad more expensive. For the Middle East, arrivals contracted 14.6% YoY from 2018 figure.

Receipts from international tourism rose slightly in the year (up 0.4% YoY) to THB 570 bn, but receipts from Indian, Japanese and Malaysian tourists bucked the trend and increased by 27.0% YoY, 12.3% YoY, and 10.3% YoY, respectively. However, receipts from Chinese tourists (around 30% of total receipts from international tourism) and Russians declined by 1.8% YoY and 1.6% YoY.

- In the first two months of 2019, Thai tourists made a total of 23.96 million trips (up 2.6% YoY) and receipts rose 4.5% YoY to THB 190 bn.

- For the year, national occupancy rate rose from 77.7% in 2017 to 78.6%. In Bangkok, it reached 89.0% (up 0.2ppt from 88.8%), in Chonburi 85.0% (+2.2ppt), and Phuket 87.1% (+1.1ppt). For other tourist areas and important regional centers, occupancy rates also rose. In Songkhla, it increased by 4.2ppt to 78.2% and in Khon Kaen by 2.8ppt to 60.4%. However, the situation in the north was less favorable due to the air pollution issue, and in Chiang Mai and Chiang Rai, rates fell by 4.6ppt to 80.8% and by 0.3ppt to 67.4%, respectively. The majority of secondary tourist areas also saw their occupancy rates rise, including Buriram where it rose by 3.0ppt to 64.5%, in Chanthaburi by 2.8ppt to 68.8% and in Nakhon Sawan by 2.2ppt to 61.2%.

Outlook

A report by the World Travel & Tourism Council (WTTC) forecasts that for the decade starting 2016, foreign tourist arrivals in Thailand will grow by 6.7% p.a., slightly higher than the average for the ASEAN region of 6.2%. Krungsri Research estimates that over 2019-2021, hotel business will see growth in step with the wider tourism sector, and foreign arrivals will rise by 5-7% and internal tourism by 3-4% per year (Figures 13 and 14). This would lift average occupancy rate from 71.4% in 2018 to 71.5-72.5%. Overall, the positive forecast for the sector will be supported by: (i) continued growth in the services offered by low-cost carriers; (ii) the development of national infrastructure, especially the upgrade and expansion of regional airports and improvements to the national communications network, in particular motorways and rail links; (iii) government policies to stimulate tourism; and (iv) competitive advantages that the Thai tourism sector has relative to regional alternatives. The outlook for the different segments of the tourism market are given below.

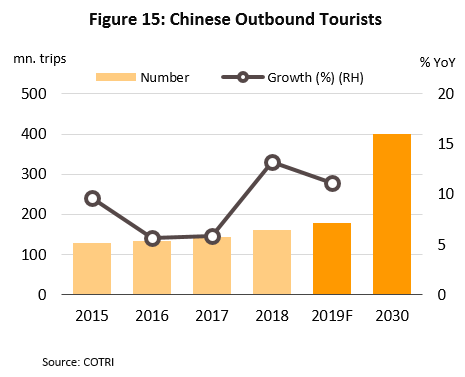

- Foreign tourists remain the principal driver of tourism sector in Thailand, both in terms of raw numbers and receipts, especially, Chinese tourists play an important role. McKinsey estimates that by 2025, 90% of the urban population of China would qualify as middle class (up from 76% in 2015) and these individuals have a strong tendency to spend on travel abroad. This would fuel the ongoing increase in outbound tourism by the Chinese; research by the China Outbound Tourism Research Institute (COTRI) indicates the number of Chinese outbound tourists will rise from 180 million in 2019 to 400 million in 2030. At the same time, the Thai government is trying to promote Thailand as a tourist destination to Chinese tourists. For example, the Ministry of Tourism and Sports is issuing free VOAs and conducting promotional roadshows in several major Chinese cities. In 2019, the government is targeting to attract 11-12 million tourists from China.

However, growth of

European arrivals might rise at a slower rate due to some sluggish European economies, and tourists from countries such as

Russia, Germany and France are expected to switch back to traveling to destinations that are closer to home than Thailand. This will have knock-on effects on hotels, especially those in Pattaya and Phuket, the favored destinations for Russian travelers. As for tourists from the

ASEAN zone, this should continue to grow in step with the expanding economies and improving land and air connections that make travel within the region easier and more convenient.

- In terms of domestic tourism, this will benefit from: (i) low oil (fuel) prices; (ii) continuous government efforts to stimulate the sector, especially by allowing expenses related to travel within the country to be tax deductible; (iii) improvements to infrastructure related to tourism, such as the upgrade and expansion of airport facilities, including those in secondary tourist sites in the mid-South, the Northeast and the lower North. In addition, improvements to rail links and the construction of motorways would help to attract travel to secondary destinations, and (iv) the expansion of services offered by low-cost airlines

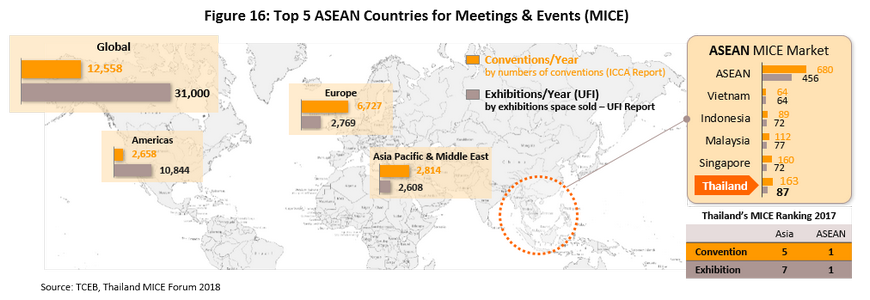

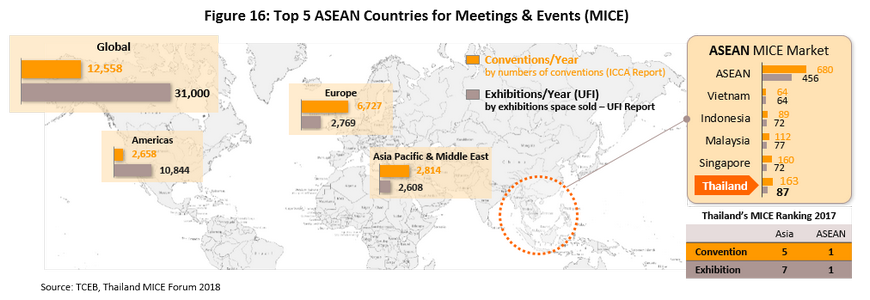

- MICE travelers[5] (meetings, incentives, conventions and exhibitions) is increasingly more important to hoteliers. Business from MICE events is continuing to grow steadily; in the first quarter of 2019, a total of 8.1 million MICE travelers were recorded in Thailand (+2.9% YoY), comprising 7.8 million Thais and 350,000 foreigners, whose activities were worth a combined THB 55 bn (up 6.3% YoY). Thailand is now the leading ASEAN MICE destination for conventions and exhibitions (Figure 16), and hotels servicing this market will, in addition to generating income from accommodation charges, also generate additional revenue from food and drinks as MICE travelers typically spend more on this than general tourists. Because of the higher spending by MICE visitors and their demand for better services, especially by foreign MICE travelers, for some hotels, and especially 4-5 star operations, this segment is an increasingly important source of income. In the 2019 financial year, receipts from MICE travel (Thai and foreign) is expected to increase 4.0% YoY to THB 220 bn.

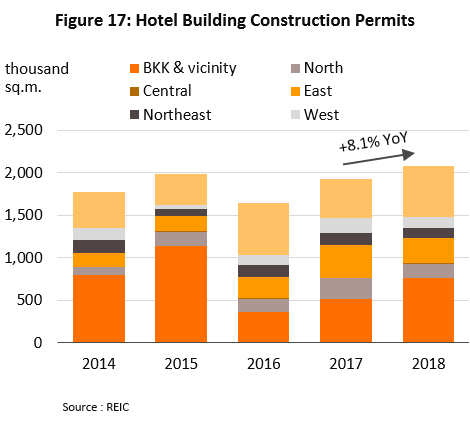

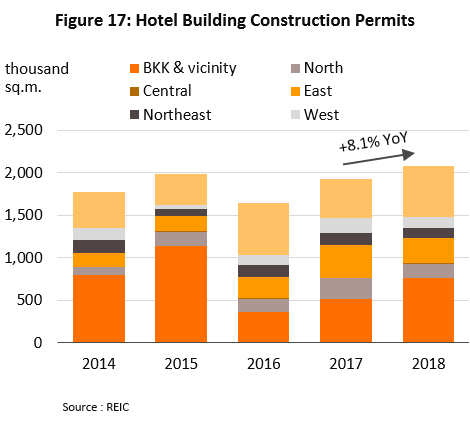

Alongside rising demand, supply is also forecast to expand and 2018 applications for construction permits for hotels (a reliable indicator of increases in supply 1-2 years out) rose by 8.1% YoY to a total of 2.0 million square meters (Figure 17). The Bangkok Metropolitan Region received the greatest number of applications at 37% of the footprint; these rose by 46.0% YoY, reflecting the sustainable potential of the city as a tourism hotspot. In second place, with 29% of the total, was the Southern region, where applications increased by 33% YoY with 77% of these concentrated in Phuket. Investors clearly believe tourism in Phuket still has room for growth and operators there are looking to develop new overseas markets to reduce dependence on Chinese visitors. In the Eastern region (14% of the total), this was led by Chonburi (65% of construction permit applications in the eastern region), where Pattaya, a world-class tourism destination, naturally attracts a considerable number of new hotel construction. However, 2018 applications for construction permits for hotels in Chonburi had a footprint of 190,000 square meters, which represented a slide of 40% YoY. This was partly caused by the large number of applications in 2017 (total 320,000 square meters) and partly due to the high land prices and scarcity of sites suitable for development. This had encouraged investors of new hotels to look at nearby areas such as Rayong, where applications have ballooned by more than 200%, though in addition to meeting demand from tourism, the increasing interest in Rayong is also driven by the need to service an expected rise in demand from the expansion of industrial activity in the EEC once this project is completed.

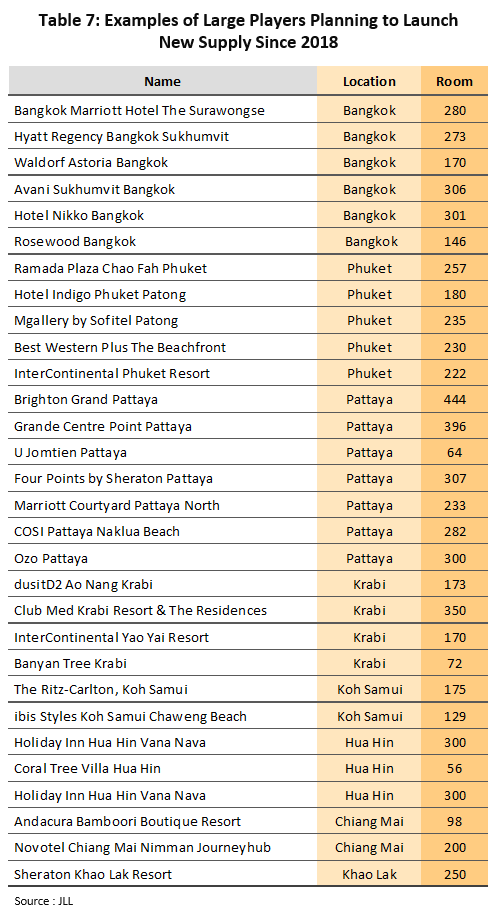

The bulk of investment has been in building new mid-range (i.e. 3-4 star) and budget hotels, and were made by large players in regional centers, tourist areas and border regions that are benefitting from deeper economic linkages with neighboring countries. Examples include Hop Inn (part of Erawan Group), Fortune D (part of C.P. Land) and Cosi (part of Central Plaza Hotel). Thai and foreign operators have also continued to invest in 5-star hotels in major tourist destinations (Figure 7).

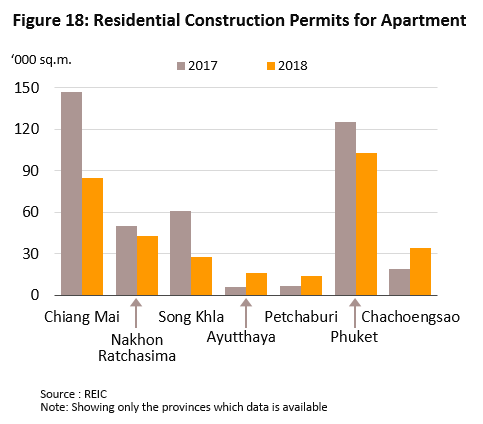

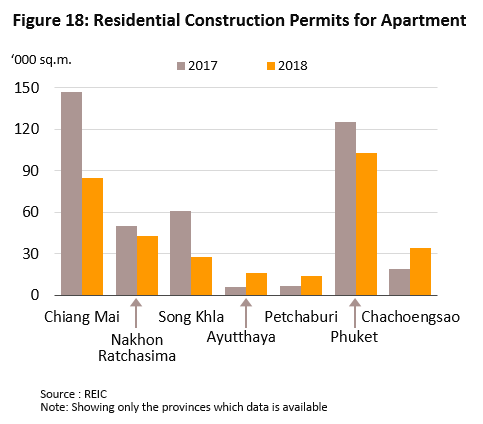

Competition is also expected to intensify. (i) Competition will come from other hotels, which have been investing to expand their operations in the main tourist areas and important provincial centers. This investment is made directly and also by administering hotels on behalf of others (the majority of this is by operators within larger commercial groups or hotel chains). (ii) Competition from alternatives to hotels will also stiffen, including daily rentals offered by apartment blocks, serviced apartments and condominiums. This has been seeing an increasing presence in the market (Figure 18). The government has tried to address this problem by easing requirements for operators of these alternatives, and require unlicensed hotels to register to operate legally. But there are still a considerable number of operations that are offering accommodation illegally and their existence could hurt hotels’ ability to generate income, especially for SMEs which have to employ pricing strategies to attract customers.

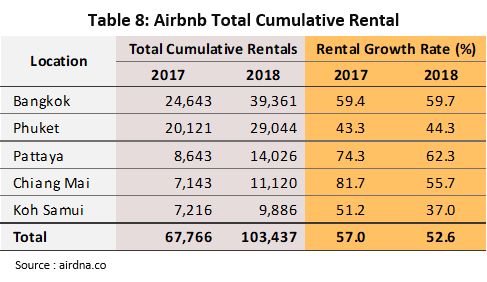

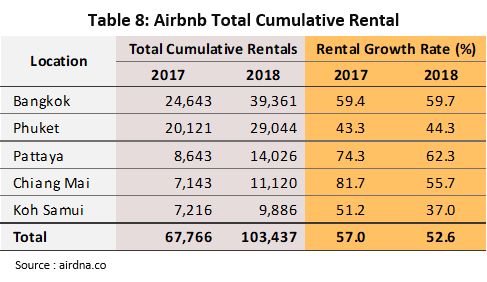

In addition, the spread of the sharing economy will also add to the problems experienced by traditional operators. Booking platforms such as Airbnb, which acts as a middleman linking those offering and those looking for accommodation, present consumers with a huge range of accommodation options from individual rooms to entire condominiums or houses, often at prices below those offered by hotels. Within Thailand, the booking platforms have seen steep growth rates for accommodation offered in the main tourist areas (Table 8). And although currently these platforms account for a relatively small share of the market (according to information from the Department of Tourism, Colliers International and Airdna, September 2016, they represent around 10% of the supply of accommodation in the top five destinations - Bangkok, Pattaya, Phuket, Koh Samui and Chiang Mai) and have not yet had a major impact on hotel business, in the future, they might hurt income and profits of hotels that are targeting the same consumer groups.

Krungsri Research view:

In 2019-2021, hotels in the most important tourist areas are forecast to continue to register growth, supported by increasing levels of domestic and international tourism. Large operators will be able to maintain their current levels of income, while SMEs will have to contend with rising competition.

- Hotels in the major tourist areas of Bangkok, Pattaya and Phuket: Within this group, businesses should be able to maintain healthy profits as occupancy rates are expected to stay high at 75-80%. Both large operators (Thai and foreign) and smaller ones are likely to continue to invest in hotel accommodation at all segments of the market to meet growing consumer demand.

- Hotels in regional centers and other important tourist provinces (Chiang Mai, Chiang Rai, Phitsanulok, Kanchanaburi, Chonburi, Rayong, Chachoengsao, Nakhon Ratchasima, Khon Kaen, Udon Thani, Ubon Ratchathani, Phetchaburi, Prachuap Kirikhan, Songkhla, Krabi, Phang-gna and Surat Thani (Koh Samui), most of which focus on the domestic market: For players in this group, it should be possible to maintain profits at a similar level to last year. This is because these areas will benefit from: (i) a greater level of economic activity which will increase regional inter-connection; (ii) the expansion of existing sites/development of new sites, which will encourage business tourism and promote investment in hotels in these areas; and (iii) the development of infrastructure (for example, building new motorways and expanding regional airports) that will make travel in the region more convenient and help to spread tourism-related travel to other tourist sites and to regional centers. These moves will tend to be more relevant to domestic tourists than to international arrivals and should help to keep hotel occupancy rates at 67-70%.

- Hotels in other provinces: Turnover for these players are expected to soften amid excess supply of accommodation, the bulk from SMEs, while customers for these hotels generally only traveling for business or are en route to another province. As such, visitors generally only stay for a short period of time and use hotel services to only a limited extent, and thus on average, they spend only fairly small amounts of money. Occupancy rates are also low for these hotels.

- However, hotels in all areas will have to contend with rising competition because of the steadily rising supply of both traditional hotels and alternative accommodation. This would make it challenging to raise room rates, although operators in major tourist destinations such as Bangkok, Pattaya and Phuket, as well as those in regional centers and other tourist areas, will have an advantage in terms of greater potential for growth and greater demand for accommodation, relative to hotels in less noteworthy provinces. Because of this, the former group will also enjoy higher occupancy rates than the latter.

[1] In November 1983, the Chinese government first allowed Chinese citizens to travel to Hong Kong and Macau in order to visit family members and subsequent to this, the number of countries that citizens were allowed to visit steadily increased until it reached the current total of 140. This process was accelerated by China’s entry to the WTO in 2001, and the requirement for China to operate under WTO regulations regarding tourism. The result of this has then been to increase the number of Chinese tourists traveling abroad (Bank of Thailand, June 2014).

[2] Interviews with operators of hotels and an evaluation of data by the Bank of Thailand indicates that an occupancy rate of 65-70% is considered satisfactory by operators.

[3] The waiving of fees for visas on arrival ran from 15 November 2018 to 31 October 2019 and applied to tourists from the following countries: Andorra, Bulgaria, Bhutan, China, Cyprus, Ethiopia, Fiji, India, Kazakhstan, Latvia, Lithuania, Malta, Mauritius, Papua New Guinea, Romania, San Marino, Saudi Arabia, Taiwan, Ukraine and Uzbekistan.

[4] The secondary provinces are:

16 provinces in northern Thailand: Kamphaeng Phet, Chiang Rai, Tak, Nakhon Sawan, Nan, Phayao, Phichit, Phitsanulok, Phetchaburi, Phrae, Mae Hong Son, Lampang, Lamphun, Sukhothai, Uttaradit and Uthai Thani.

18 provinces in northeastern Thailand: Kalasin, Chaiyaphum, Nakhon Phanom, Bueng Kan, Buriram, Mahasarakham, Mukdahan, Yasothon, Roi Et, Loei, Sri Saket, Sakon Nakhon, Surin, NongKhai, Nong Bua Lamphu, Amnat Charoen, Udon Thani and Ubon Ratchathani.

5 provinces in eastern Thailand: Chanthaburi, Trat, Nakhon Nayok, Prachinburi and Sa Kaeo.

7 provinces in central Thailand: Chainat, Ratchaburi, Lopburi, Samut Songkhram, Singburi, Suphanburi and Ang Thong.

9 provinces in southern Thailand: Chumphon, Trang, Nakhon Sri Thammarat, Narathiwat, Pattani, Phatthalung, Yala, Ranong and Satun.

[5] Foreign MICE visitors represent about 3% of all foreign arrivals but their spending contributes 7% of all receipts from foreign visitors.

.webp.aspx)