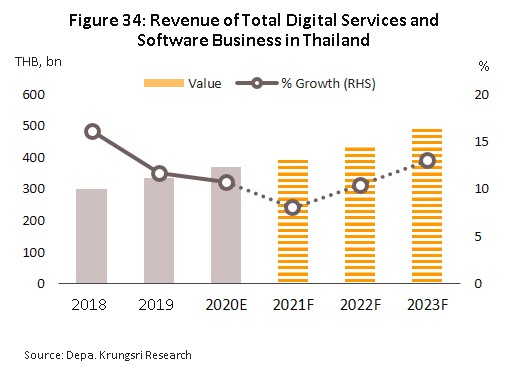

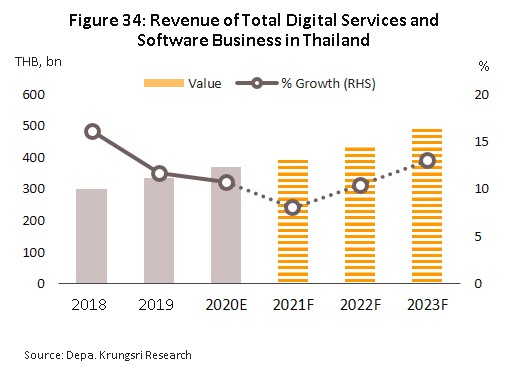

During 2021-2023, overall revenue of digital services and software industry is forecast to rise at an annual average of 10.5%. The industry will be buoyed by the widespread embrace of private sector’s strategies centered on digital transformation[1] by companies looking to meet consumer’s specific demand. In addition, the emergence of a post-pandemic ‘new normal’ is also likely to result in a greater share of business online transactions. However, new players will be increasingly attracted into the market to develop a range of new platforms, competition will stiffen. The outlook for major segments is explained as follows:

1) Digital services: Revenue will grow steadily on the development of new platforms and a steady expansion in the volume of business transactions carried out online supported by comprehensive coverage of 5G networks. E-transaction, e-retail and

e-content services will likely see impressive growth where these services are tied to sales of products and services used in day-to-day life. The FinTech segment will also benefit from the steady replacement of cash with e-wallets, but players will have to contend with high levels of competition from a high number of players.

2) Software and software services: Revenue will strengthen with growth in investment by businesses that are overhauling and rebuilding their corporate infrastructure. Especially notable beneficiaries of this will be providers of customized software and of cloud-delivered software as a service (SaaS) products.

3) Digital content: The ever-rising popularity of online games means that much of the growth in this segment will come from game developers, and as such, mobile cloud gaming will have an increasingly important role to play in this space. However, the likely weak state of the economy in 2022 and 2023 means that growth is expected to be only anemic for animators and character developers.

Overview

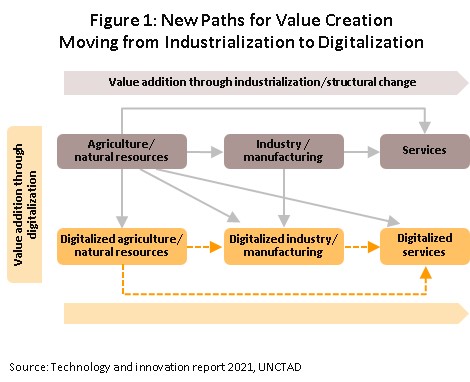

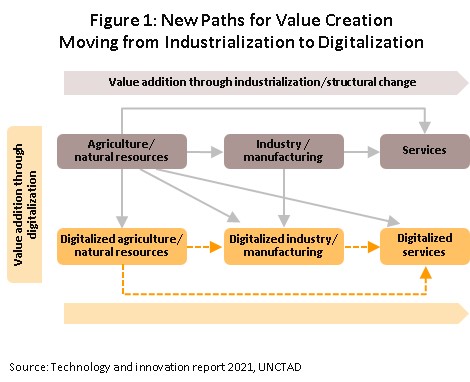

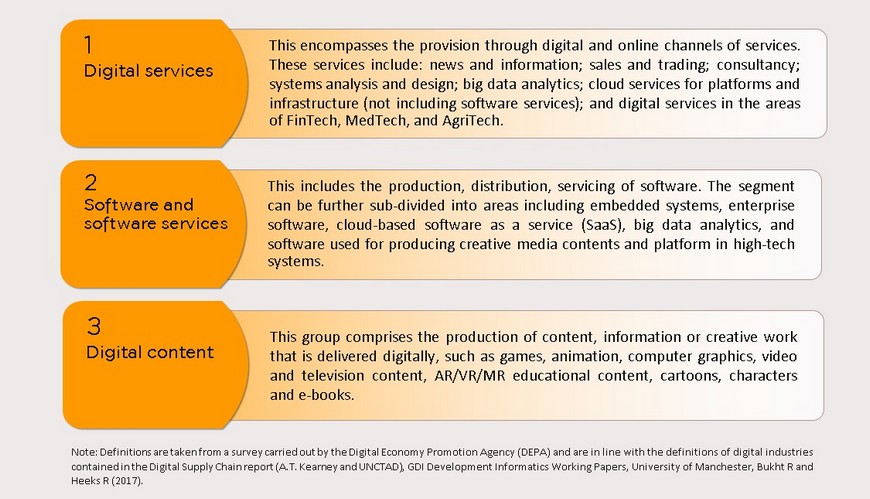

The digital services and software industry encompasses the production of products and the offering of services that are based on digital technology. This includes the development of digital platforms and the use of these to deliver contents and transactions to users, as well as more general software development and the provision of software services. This broad group of digital products and services, taken together with the innovation and creativity that the digital economy engenders, has now become a crucially important part of the value creation process towards digital economy. Indeed, the global industrial transformation that the digital revolution has ushered in is now allowing businesses to develop new sources of value for their customers. For providers of services, digitalization is thus tending to find an increasingly broad range of roles in the value-adding process (UNCTAD 2021, Figure 1).

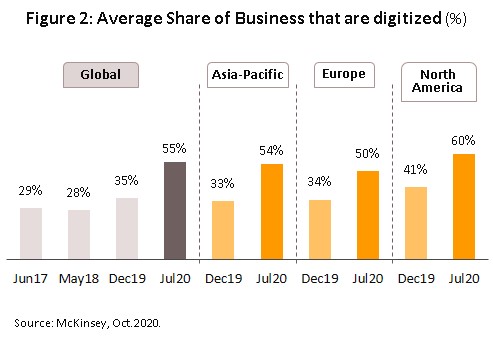

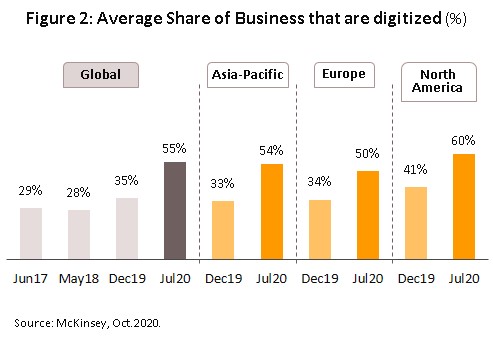

The global COVID-19 pandemic has vastly accelerated both these processes and the parallel development of the digital services industries. Thus, a global survey carried out by McKinsey into the adjustments to company practices made by 900 companies shows that the proportion digitizing their activities rose from 35% at the end of 2019 to 55% in July 2020. Clearly, the global need to adopt the ‘new normal’ of social distancing in personal and business life has meant that much activity has moved online (Figure 2). McKinsey believes that global investment in the digitalization of businesses will increase all the way through the period from 2021 to 2027.

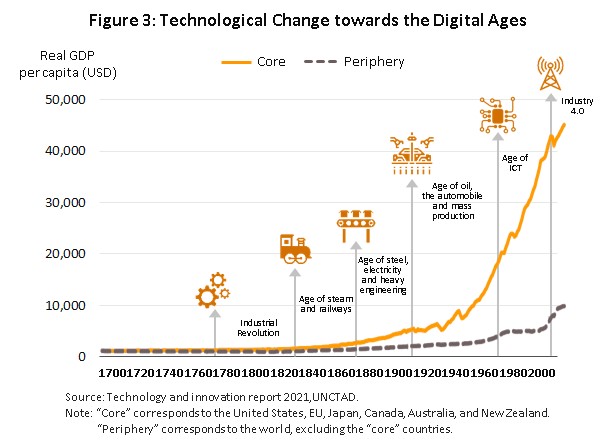

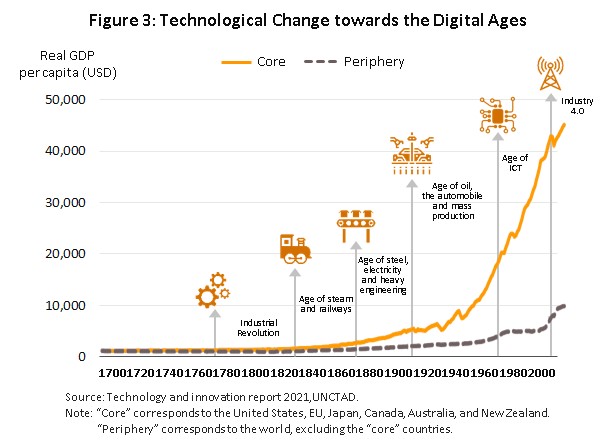

For global digital industry, after steady progress in the development of information technology over the preceding 30 years, the digital industries have seen very rapid rates of growth to sharply accelerate its productivity since the start of the new millennium (the so-called Fourth Industrial Revolution, or Industry 4.0), but these developments remain concentrated in the advanced economies, which are the US, Europe and Japan, with the result that in these areas, real per capita GDP has continued to race ahead (Figure 3).

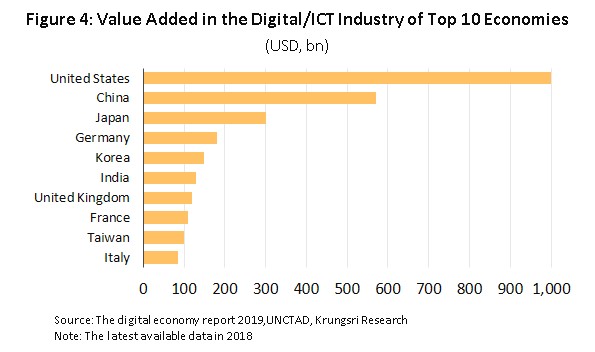

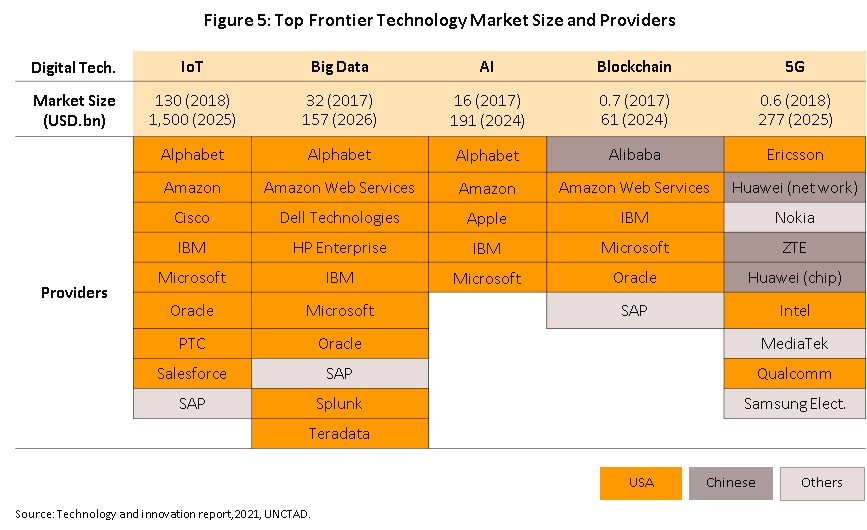

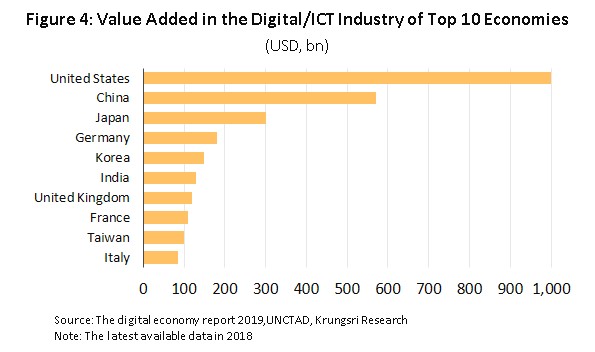

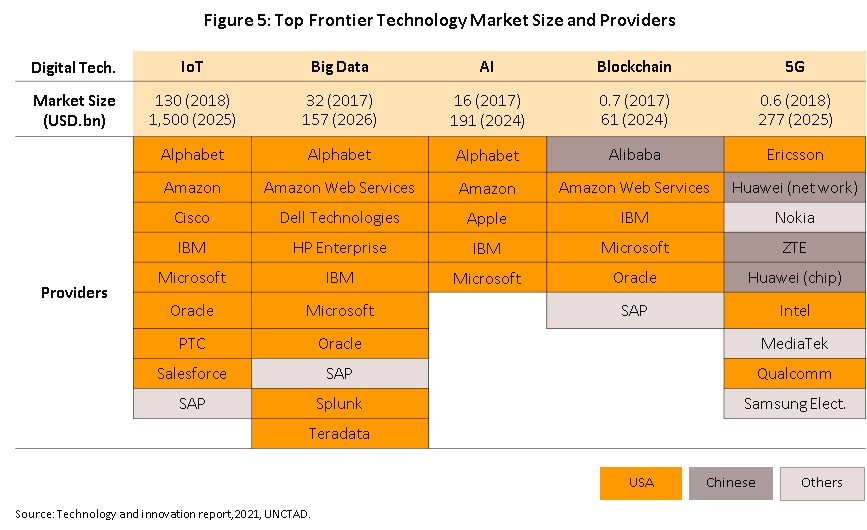

The US and China are the world leaders in the provision of digital services, and UNCTAD’s 2019 Digital Economy Report (the most recent that is available) shows that in terms of value-added of global digital industry2/, in 2018, a full USD 1,000 billion originated in the US, with a further USD 570 billion generated in China (Figure 4). This preeminence is due to rapid progress in frontier technology development, though the US is especially prominent in this, being home to Silicon Valley and a huge concentration of world-leading developers of digital platforms that are used to provide digital services. The market for the latter is in fact dominated by tech giants that in the US includes Microsoft, Apple, Amazon and Alphabet, and Alibaba and Huawei in China. The enormous valuation of the global market for digital services largely comes from the value of their digital platforms, comprising IoT, big data, AI, blockchain and 5G, that is expected to steadily increase in the coming period (UNCTAD, Figure 5).

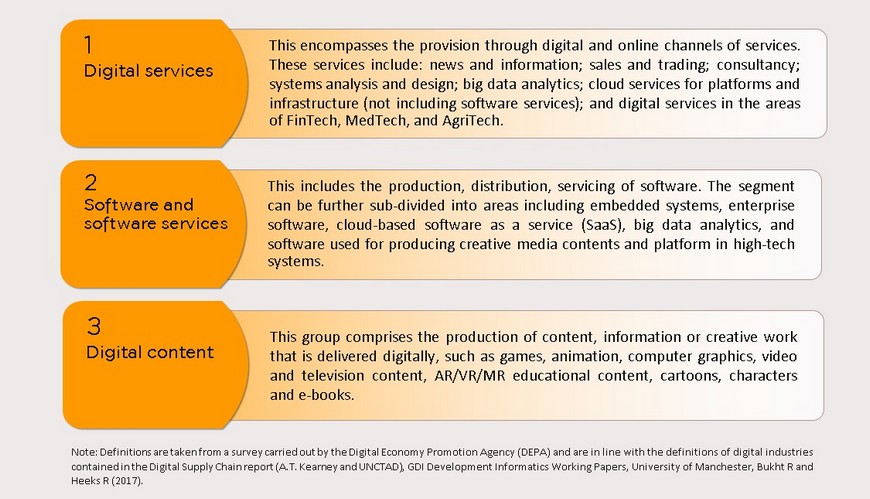

The Thai software and digital services sector may be divided into three main segments.

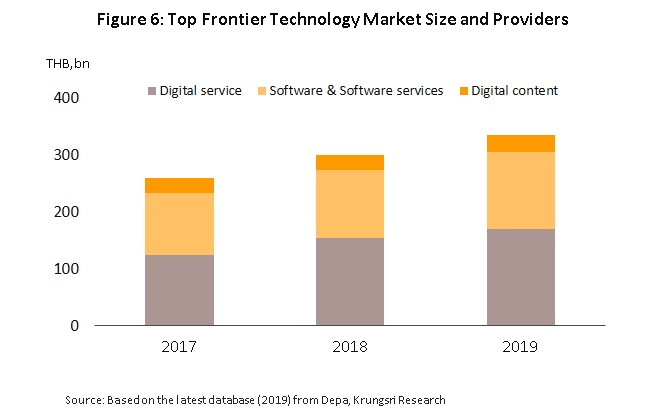

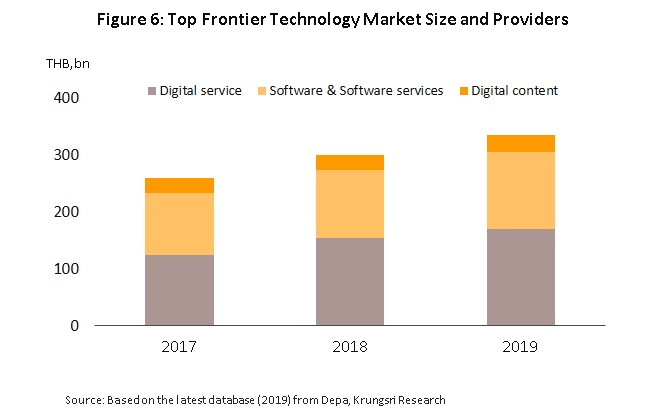

The domestic market for digital services and software had an average value of around THB 300 billion between 2017 and 2019 (Figure 6), though within this, digital services alone counted for almost half of the market (an average of 49.8%), followed by software and software services (40.8%), leaving digital content with just 9.4% of the value of the industry. On the supply side, at 95%, almost all players in the software and digital services industry are Thai, though the most competitive companies are also large ones, and these are often overseas companies that are able to develop and exploit the latest technology. These players are also the most innovative and are able to adjust their business operations as digital technology mutates and evolves, though they are not present in the Thai market in huge numbers. Overall, the industry is very heavily oriented towards the domestic market and over 90% of revenue comes from this. That said, there is some potential for exports of digital content, though this is generally for design work produced on contract (source: Trade Policy and Strategy Office, Ministry of Commerce, TPSO, MOC and DEPA).

The digital services can be subdivided into the following:

1) E-content: delivers information through online channels, which can include online news, e-books, and e-information. Examples of Thai high-traffic e-content providers include Ookbee, Wongnai and Pantip.com.

2) E-transaction: provides facilities that make it possible to carry out business transactions online. Revenue typically comes from fees, for example for booking hotel rooms or using logistics services. Some of the larger Thai e-transaction sites include Agoda (hotel bookings) and Kerry Express (delivery services).

3) E-retail: operates online stores or platforms that intermediate between buyers and sellers and that therefore facilitate online sales. Examples include Lazada, Shopee, and Central JD Commerce.

4) E-entertain: provides online entertainment that includes television, music and movies. The majority of these players are major international operations, such as Netflix, Iflix (both movie platforms) and Joox (music).

5) FinTech: provides online financial services or otherwise use digital technology to make financial services available to their customers. These include InsurTech startups, e-wallets and payment gateways, cryptocurrency apps, and e-payment services such as 2C2P and True Money.

6) E-advertise: covers not only online advertising but also brand development carried out by digital marketing agencies such as ThaiFranchise Agency (TFCA), MACO, TBWA (Thailand) and Primal.

These businesses all use digital channels as their principal means of delivering goods or services, for which they then charge a fee. Setting up in this sector may involve significant initial investments, but sectoral growth has been supported in recent years by: (i) the passing of the 2017 Payment Systems Act, which cut the registered capital required for e-money players from THB 200 million to THB 100 million and so increased supply to the market; (ii) the introduction of new regulations in 2019 governing the operation of peer-to-peer lending platforms, which then helped strengthen the market for P2P lending, funding platforms, and FinTech; (iii) the continuing development of digital technology and the emergence of social platforms that are then supporting online content services through a proliferating range of new channels; (iv) the spread of 3G, 4G and now (in some areas) 5G networks, which together with the use of new technology such as AI, chatbots, blockchain, cryptocurrencies and ever-more powerful smartphones is helping to feed growing uptake of digital services; (v) the 2018 waiving of fees for online payments supporting growth in demand for mobile money services; and (vi) changes in consumer behavior that increasingly expect that day-to-day activities should be completed as rapidly and easily as possible, and that because of this have made smartphones a ubiquitous feature of modern life.

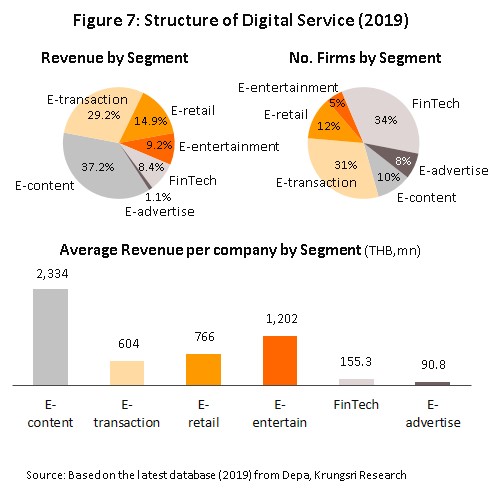

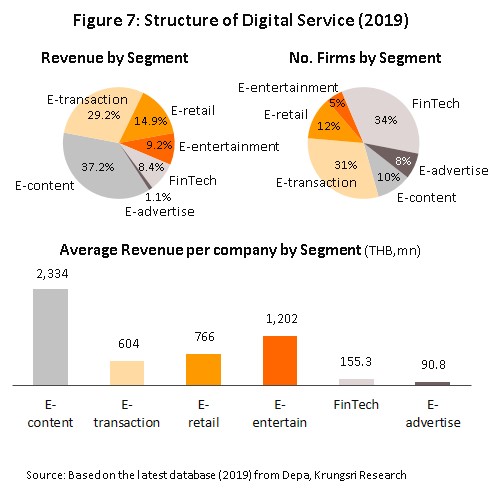

66.4% of the market value of the digital services segment comes from e-content and e-transaction businesses, while the most congested supply is found in FinTech and e-transaction (65% of players in digital services are active in these markets, information correct as of 2019). E-content provides the highest average level of per company revenue since this involves the creation of content through social media and this generates the highest value added, though in addition, there is also only a limited number of players active in the market. By contrast, although the Fintech market is growing, supply is crowded and as such, competition is stiff and average company revenue is relatively low (Figure 7).

The software and software services may be subdivided into 6 smaller sub-categories.

1) Software system integration (SI): involves developing or integrating software or related systems.

2) Software as a Service (SaaS)): delivers traditional software packages via the cloud, thus allowing users to access a wide range of programs through the internet. Popular examples of these include Microsoft Office365 and Google Drive. Revenue may be generated by a monthly or annual subscription fee.

3) Software license: generates revenue from the selling or leasing of software licenses.

4) Software maintenance: provides services of typically sourcing, installing, maintaining and upgrading software for their clients.

5) Customized software: involves the design and development of specific software. Clients will hire a company to produce a program that achieves a particular, specialized goal and they will generally then own the copyright to this once the work has been completed.

6) Software consult/training: provides advice on which software best meets their client’s needs and then arrange training on the use of this.

Revenue for players in the software and software services segment comes from the design, development, distribution, servicing and leasing of software products together with the provision of ancillary services. Overall, the market has been growing with the trend for digital transformation as companies adopt more advanced tools to assist with complex tasks such as data analytics. Consumption of these products is also changing, with the dominant business model moving from one where end users buy licenses to one where users rent or pay subscription fees. This is then allowing smaller operations to gain access to a wider range of services, though it is also in accord with the move by software companies to transform their businesses and to broaden their revenue streams, for example by offering software as a service (SaaS) or software enabled services that exploit these companies’ intellectual property.

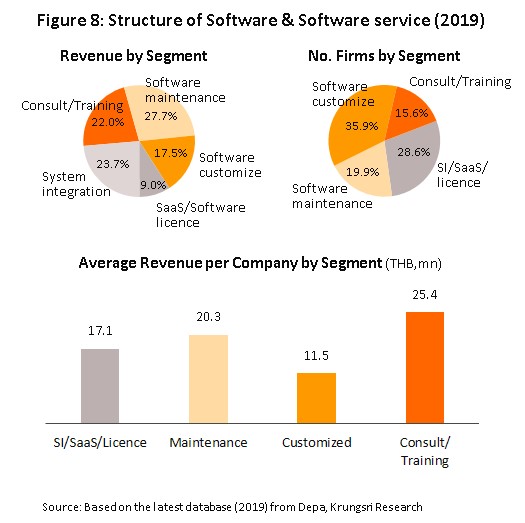

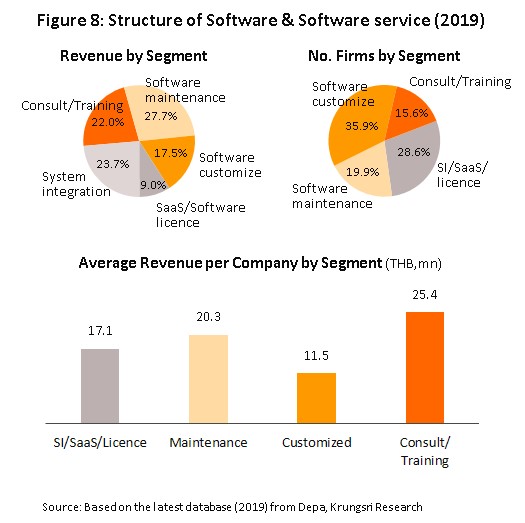

Among the general market for software and software services, the software maintenance, SaaS and SI groups generate the greatest revenue, and combined these three accounts for 73.4% of the value of the Thai software market (correct as of 2019). Considered in terms of the number of players, customized software, SI/SaaS/and license are the most densely packed markets, and 64.5% of companies are active in these areas. However, the highest average company revenue was reported by players in consulting and training. A significant share of consultancy work involves providing advice on the design and development of embedded software that uses the consultancy’s own intellectual property, thus allowing these players to generate higher levels of revenue. In addition, this segment is relatively uncontested, further helping players who are active in the market. Software maintenance (including both maintenance and upgrading) had the second highest level of revenue after consultancy and training (Figure 8).

Digital content covers the production of digital content, though this excludes process of servicing e-contents through digital channels, as described in the digital services section above. Within this category, there are three subgroups.

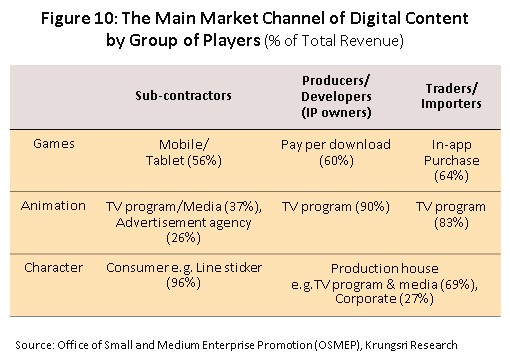

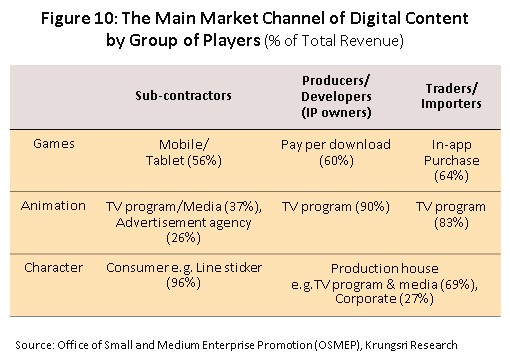

1) Games: Suppliers to the markets for games include all types of business, from large through small to individual freelancers. 96% of these are importers and distributors of games. The number of games developers that hold the copyright to products and game designers on contract is limited because developing new products requires significant investment in both software development and marketing[3]. Online games imported into Thailand are mostly from copyright holders in South Korea, China and Taiwan (around 80% of the total), and over 50% of sales in Thailand are made through smartphones and tablets.

2) Animation: This covers all types of animation, including animated feature films, TV series, mobile content, visual effects, etc. Most of this work is carried out on contract (54% of revenue), though work may be ongoing (e.g., for a series) or for one-off specialist or technical contracts. Independent contractors, holders of intellectual property rights and importers all tend to depend on distribution via television or advertising.

3) Character: This describes the market for illustrators and designers who develop characters for distribution as digital products through online channels. Supply is dominated by independent designers, but by value these account for only 8% of the market, with the remaining 92% taken by distributors and importers (source: TPSO, MOC). Sales channels (e.g., Line Sticker) are open to small customers, and independent operators, who may also work on contract for other businesses.

This business group expands according to increasing use of social media, which transferred to digital technology. There are a small number of players who have copy right products of their own, thus they mostly generate revenue by providing services as mentioned above.

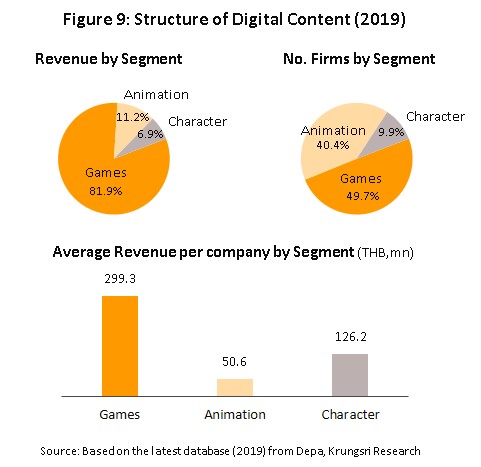

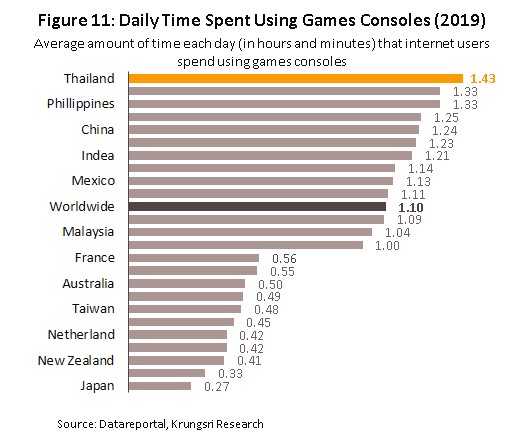

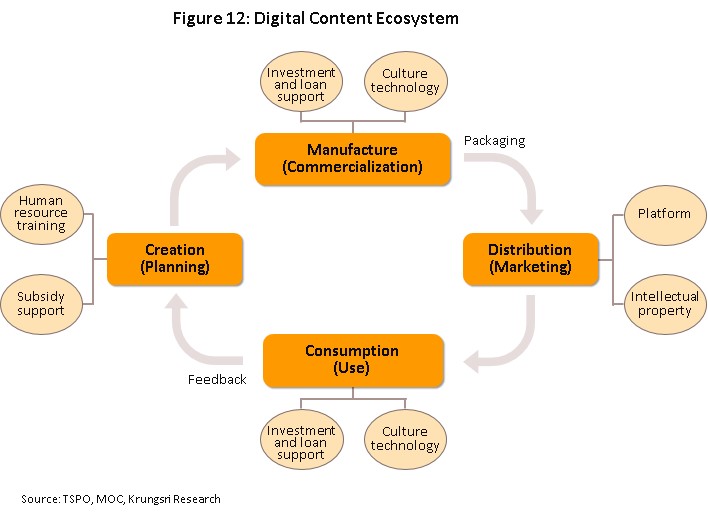

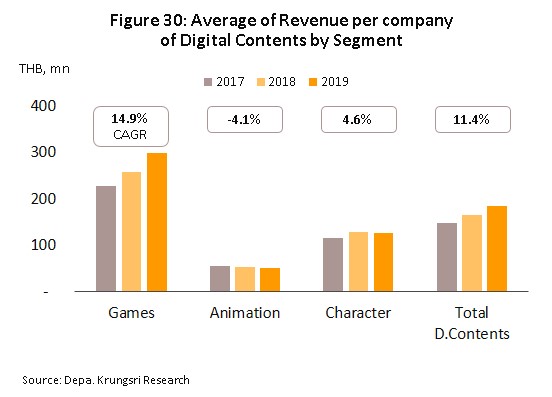

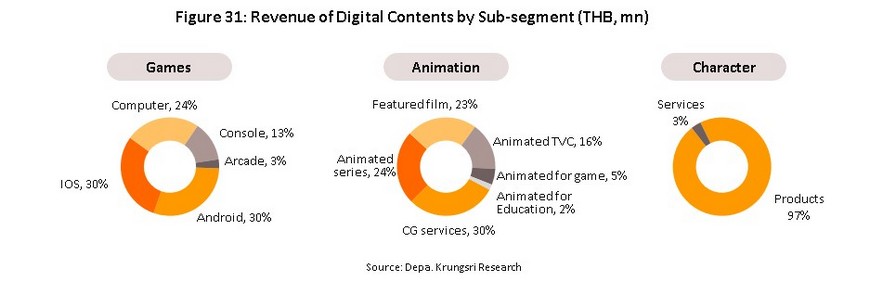

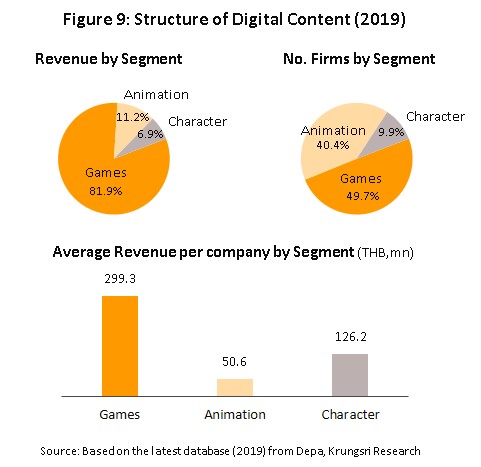

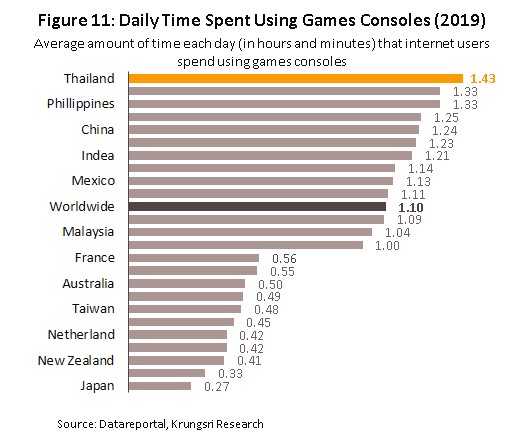

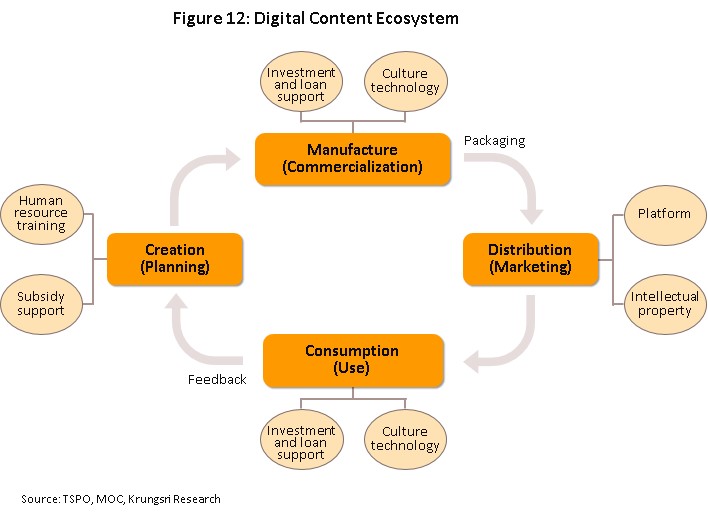

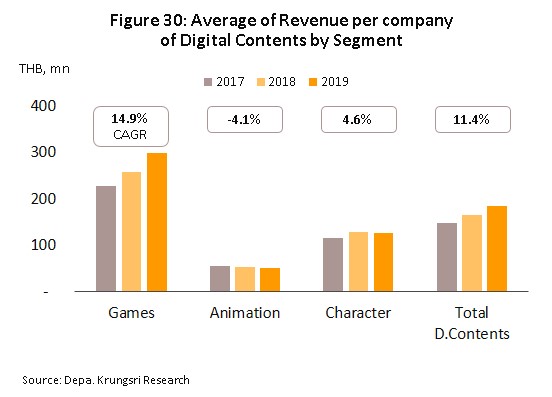

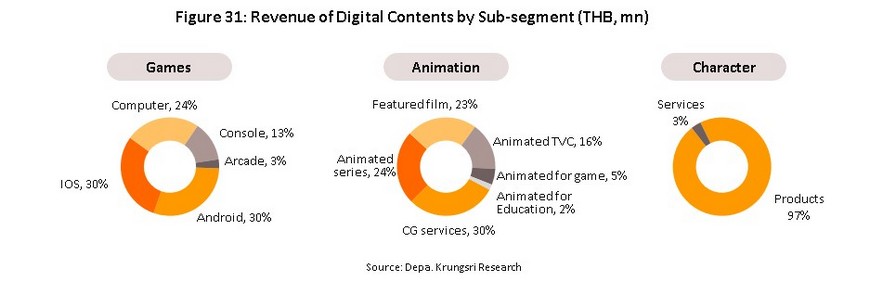

Players in the Thai digital content market tend to be small companies and so they typically lack the skills required to sell into overseas markets. Their products are therefore generally relatively unknown at the global level and instead, they mainly focus on the domestic market (source: TPSO, MOC). However, some larger players produce products for international clients (generally in the US, Japan and China). Digital content is likely to grow in the future, given the trend for businesses in the developed economies to increasingly outsource creative work. Domestically, the market is benefitting from the growth in the number of people playing games online, the official recognition of mobile and e-sports, and the ever-larger uptake of streaming services delivered to mobiles and tablets, but thanks to the large amount of time Thais devote to online games relative to other countries (Figure 11), 80.0% of the value of the market for digital content comes from the games segment. The games segment reports the highest levels of revenue per company, although it is also the most crowded segment. Games are followed by ‘character’ businesses, a high-value creative industry, with average company revenue lowest for animation. This segment is marked by the large number of SMEs or contractors (figures 9-12).

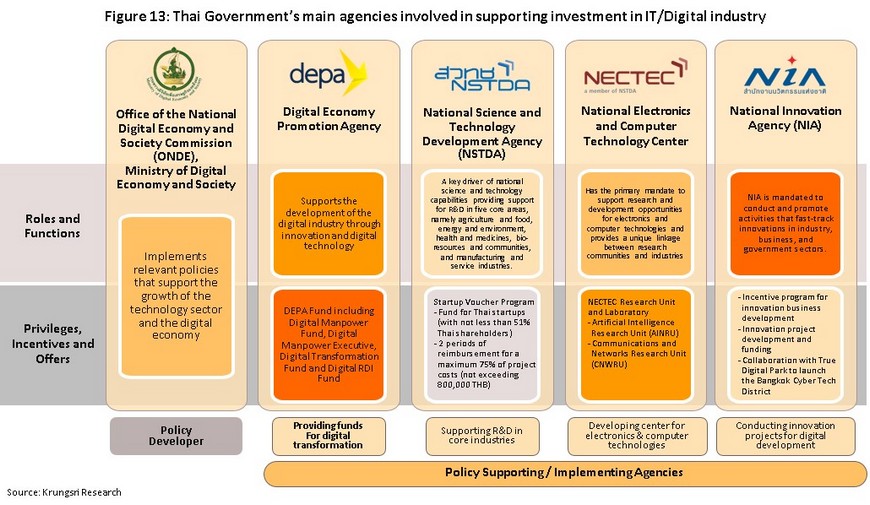

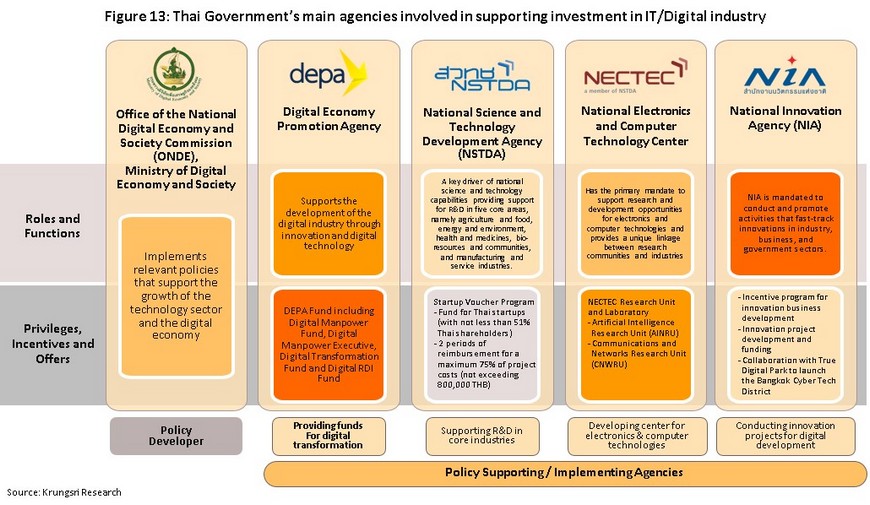

Key state agencies has a significant role to play in driving the rapid growth in digital technology into the era of Industry 4.0. However, if domestic digital industries are to grow and Thailand is to compete effectively on the world stage, many obstacles need to be overcome, and to this end, the authorities have developed a number of policies that will help to propel the country fully into the digital era. These have been gathered together under the Digital Thailand’ master plan and include the Digital Development for Economy and Society Act B.E 2560 and the establishment of the Office of the National Digital Economy and Society Commission. It is hoped that these moves will accelerate the development of a supportive ecosystem that will then facilitate the digital transformation of the public and private sectors. The individual government agencies responsible for digital development and integration are described below (Figure 13).

1) The Office of the National Digital Economy and Society Commission (ONDE) operates under the Ministry of Digital Economy and Society and is the main state body responsible for policy development in this area. The ONDE is charged with managing the national master plan for the digital economy, both in its general and particular aspects, and to this end, the Commission emphasizes the need to upgrade national infrastructure, create a supportive digital ecosystem, and apply digital technology to economic development (e.g., through the creation of e-commerce platforms, the development of smart cities, and the provision of support for R&D in the digital industries).

2) Agencies for supporting or implementing policy include the following.

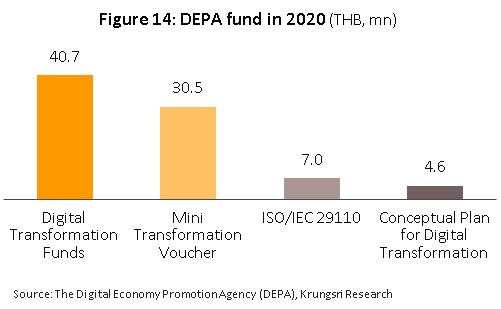

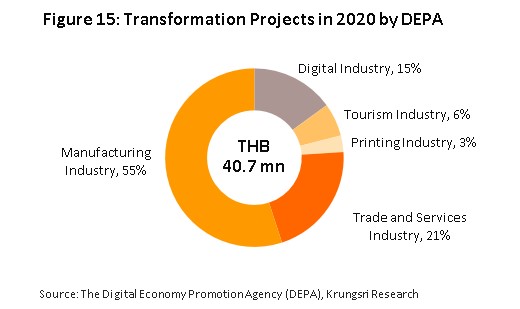

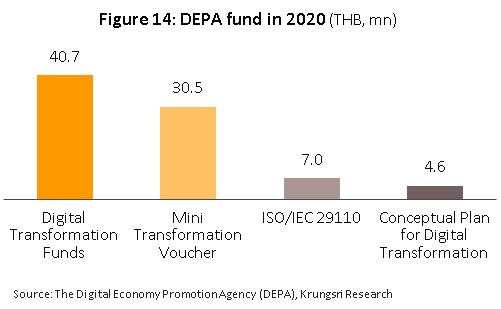

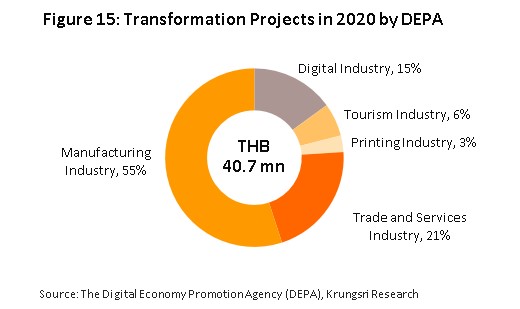

- The Digital Economy Promotion Agency (DEPA) is also under the control of the Ministry of Digital Economy and Society. DEPA is the main support agency responsible for implementing government policy with regard to the digital industries, and to this end, the agency is focused on the development of digital skills among the workforce and the provision of support for the transition to a digital economy. The latter is being achieved through funding of worthwhile projects and the cultivation of startups from the beginning of their journey through the process of scaling-up to full commercial profitability. To date, grants that have been made have emphasized digital transformation, most notably in manufacturing (55%) and in trade and services (21%) (Figure 14 and Figure 15).

- There are three support agencies that operate under the aegis of the Ministry of Science and Technology, these being the National Science and Technology Development Agency (NSTDA), the National Electronics and Computer Technology Center (NECTEC) and the National Innovation Agency (NIA). These generally provide research and development in target industries. Thus, the NSTDA is focused on the five areas of agriculture and food, energy and the environment, health and medicines, bio-resources and communities, and manufacturing and the service industries, while NECTEC concentrates on electronics and computing.

- Other agencies that have an influence over the sector include the Board of Investment (BOI). By offering 5-8-year exemptions for corporate tax and waivers for duties on the import of machinery and parts, the BOI promotes investment in digital businesses (including the development of digital technology, software, digital services and digital infrastructure) that are part of the ‘new S-curve’ industries and that use advanced technology or that are based on new breakthroughs or innovations (the A1-A3 industries).

Digital industry’s supporting factors in Thailand: Thailand’s digital industries is being driven by the digital transformation of both the consumer and business environments, where these technologies are increasingly used as a background feature that seamlessly facilitates their businesses and daily activities. This is then feeding demand for high-volume data streams and the complex services that are required to manage these. As outlined below, the penetration and uptake rates of internet services bear out this picture.

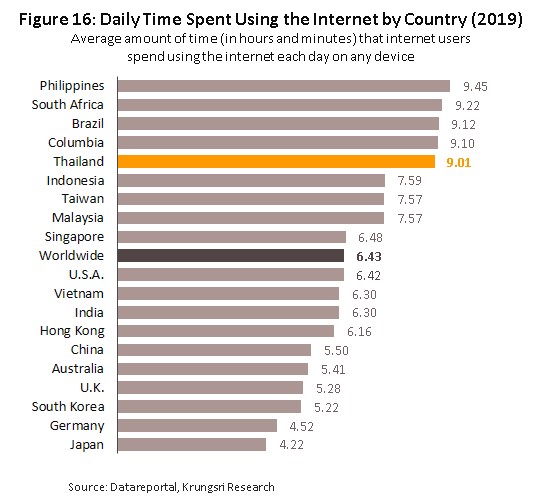

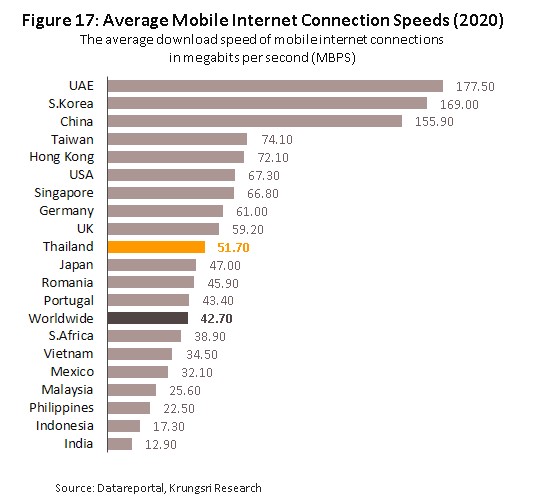

1) Daily consumption of internet services in Thailand rose from an average of 5.5 hours in 2015 to 9.01 hours in 2019 (significantly above the global average of 6.5 hours per day). Average connection speeds for mobile devices also rose from 2.8 Mbps in 2015 to 51.7 Mbps in 2020 (against a global average of 42.7 Mbps) (Figure 16 and Figure 17).

2) Thai users average 10.1 social media accounts per person compared to a global average of 8.6 (as of 2019).

3) As of 2019, for a population of 69.6 million, there were 93.3 million mobile internet connections in Thailand. This thus represents 134.0% of the national headcount, indicating that as much as 34% of the population have more than 1 mobile internet connection (source: DataReportal).

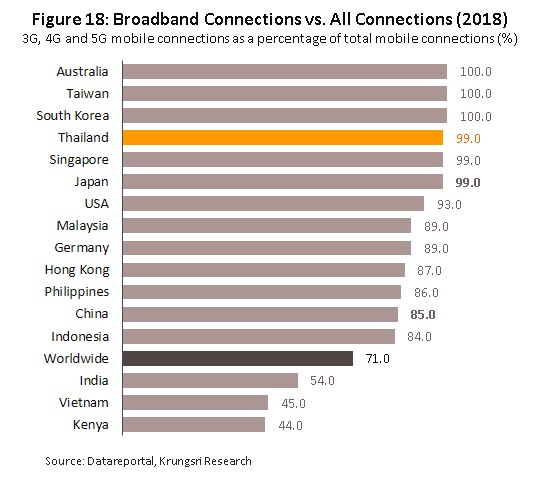

At the same time, support for the supply side of the sector comes from the advanced state of the nation’s digital infrastructure, in particular the country’s high smart-connection density and the broad coverage of high-speed networks. Indeed, as of 2018, about 99% of mobile internet connections in Thailand were made through 3G-5G networks, compared to a world average of 71% (Figure 18). This is then helping to extend access to cloud technologies, which in turn increases available computing power, a major determinant of how effectively businesses are able to develop their digital and software services.

Thanks to the positive factors outlined above, revenue for Thai players in the digital services, software and digital content markets rose by an average of 14.0% per year over 2017-2019 (DEPA).

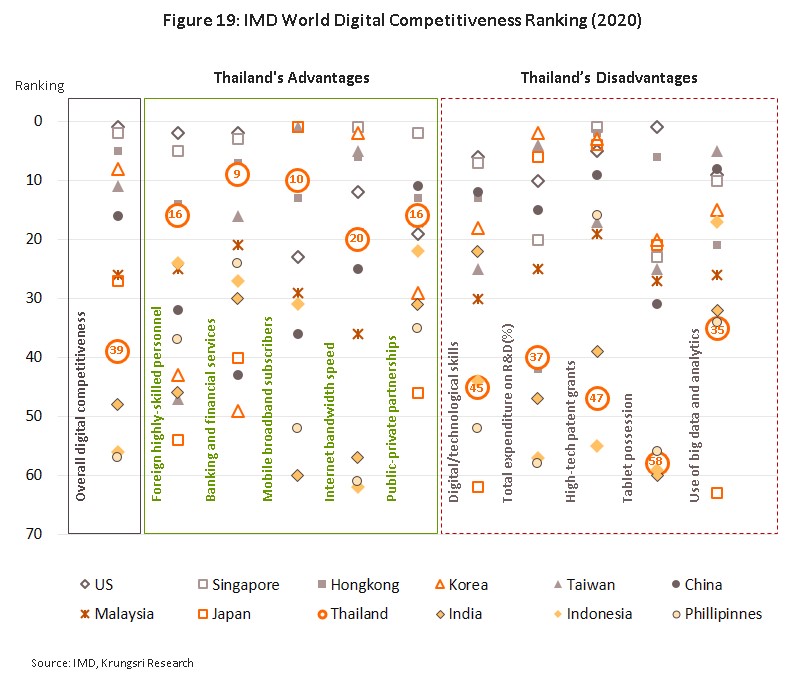

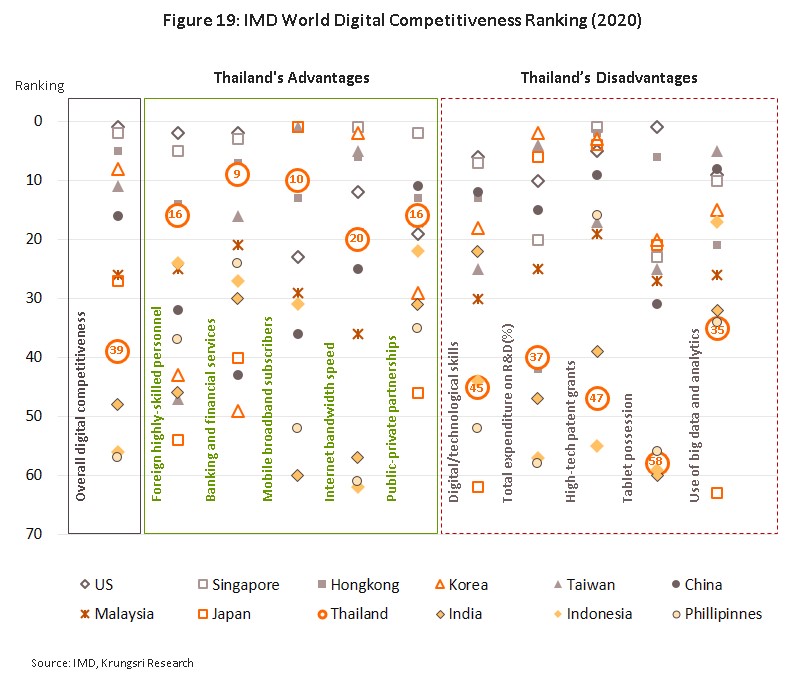

In terms of Thailand’s competitiveness on the global market for digital services industry, a report by the International Institute for Management Development (IMD) published in 2020 ranked Thailand 39th out of the 63 countries considered, which were analyzed with regard to national potential and the possibility of sectoral development. Thailand was ahead of some ASEAN countries, including Indonesia (56th) and the Philippines (57th), but lagged behind others, such as Malaysia (26th). On the positive side, Thailand benefits from the broad coverage of its high-speed internet networks and the advantages that come from joint public-private investment in related infrastructure. However, the domestic industry is hampered by the widespread lack of digital skills in the workforce and the shortage of highly-skilled experts, while spending on research and development also remains low. Indeed, in the past, access to highly-skilled personnel in the domestic industry has tended to be restricted to foreign experts who have invested in Thailand (Figure 19).

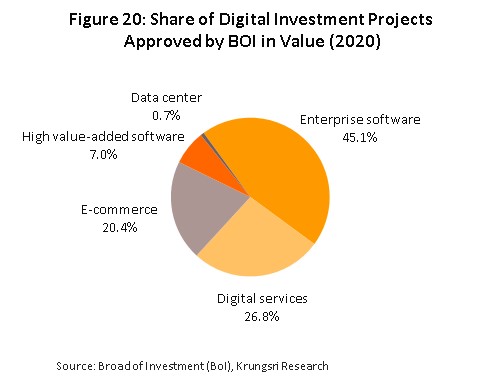

The weakness in digital skills and unsatisfactory levels of spending on R&D have translated into only limited investment in the development of high-value software and platforms, and in 2020, these accounted for just 7.0% of the value of all investments in digital services approved by the BOI. Instead, investment flows much more strongly into the development of enterprise software (45.1%), despite this having much lower levels of added value (Figure 20).

Situation

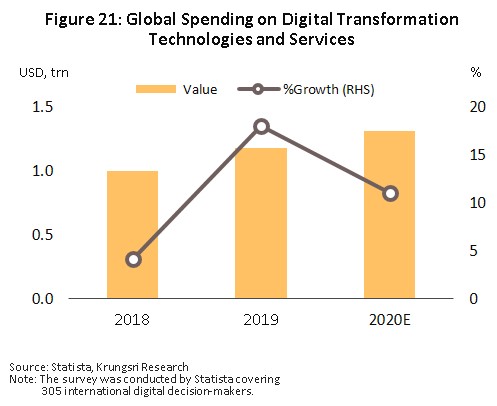

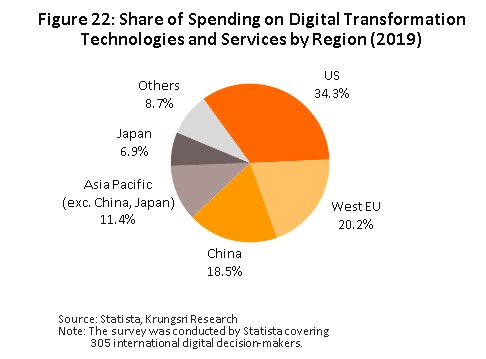

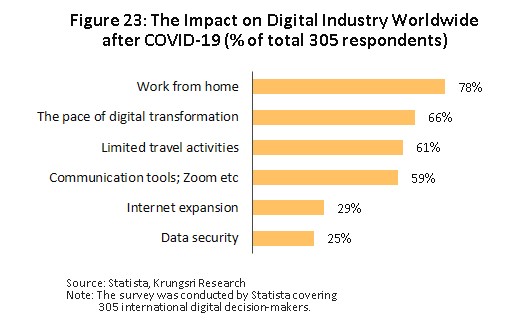

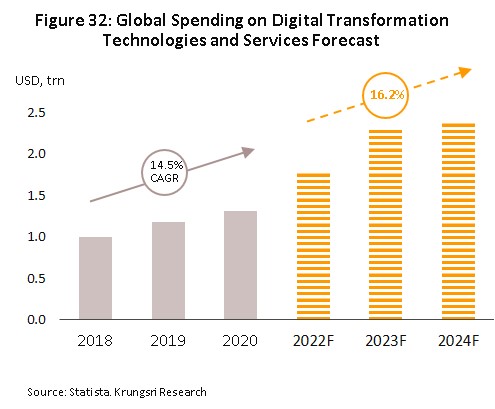

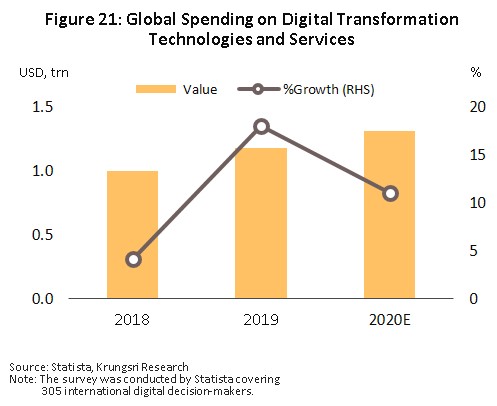

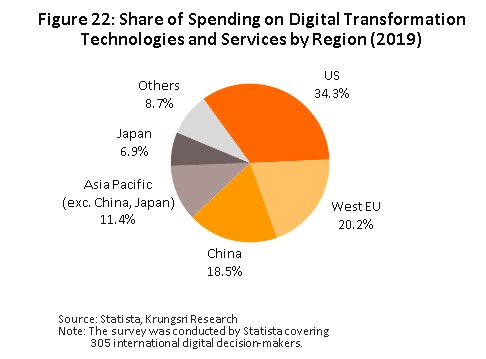

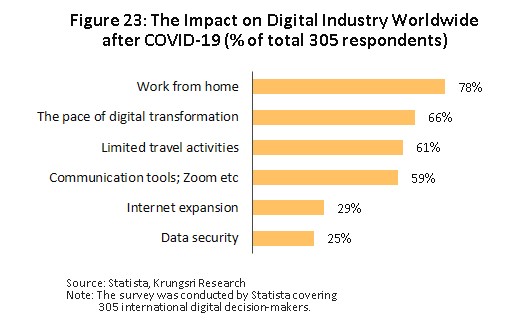

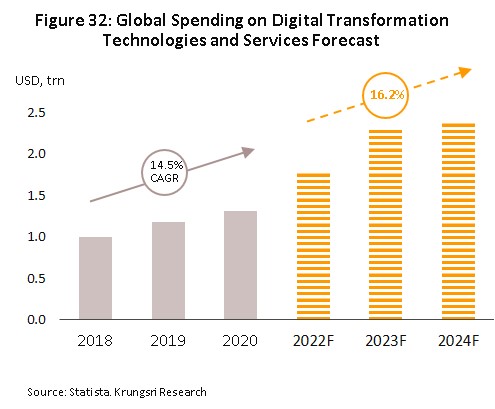

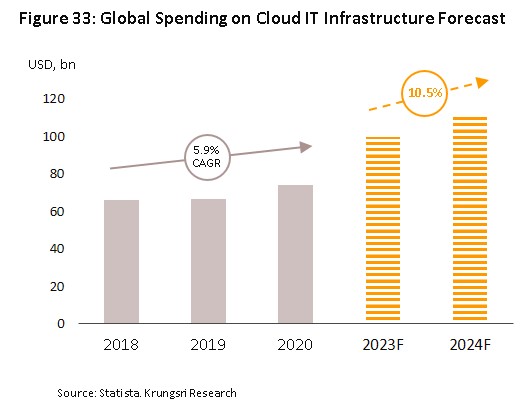

Global market: Over the 3 years from 2018 to 2020, spending on digital transformation technologies and services grew at an average annual rate of 11.1%, ending the period at a total of around USD 1.3 trillion. This spending is, however, overwhelmingly concentrated in the major economies, and especially in the US, Europe and China, which in 2020 accounted for respectively 34.3%, 20.2% and 18.5% of the global total (Figure 21 and Figure 22). Spending is being driven by competition between world-leading businesses that are looking to use digital technologies to add value to their products and services and to gain an edge in the market. A significant fraction of this spending on digital technologies is now going on cloud computing[4], which is an increasingly important part of the infrastructure to support the development and use of SaaS products and online platforms. Worldwide, spending on cloud computing thus reached USD 74.1 billion in 2020, up from USD 47.4 billion in 2017 (growth of 16.1% per annum). In addition, a global survey of 305 businesses carried out by Statista in 2020 also shows that the rise in working from home that the Covid-19 pandemic precipitated has provided a further stimulus to the market for digital services (Figure 23).

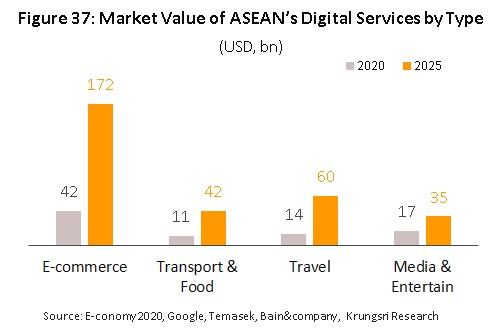

The acceleration in investment in digital transformation that is occurring across the ASEAN region is also becoming an important factor in setting growth rates for the global market for digital services. To this end, the annual e-Conomy SEA report from Google, Temasek and Bain & Company for 2020 reveals that across the region, the number of individuals with internet access rose from 360 million in 2019 to 400 million a year later, thus indicating that around 70% of the population of the ASEAN region is now online. The e-Conomy report also estimates that as of 2020, the ASEAN digital economy was worth USD 105 billion, having grown by 26.8% (CAGR) over the preceding 5 years.

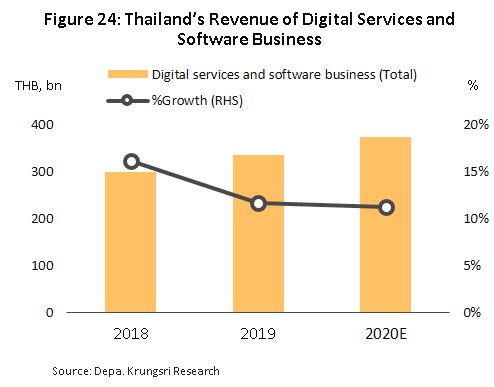

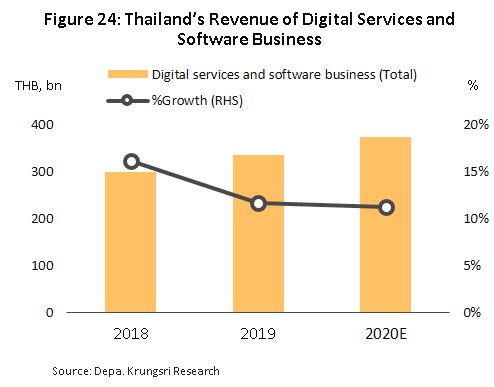

The Thai market: Between 2018 and 2020, revenue for Thai digital services and software industry climbed by an average of 13.0% per year. Demand has been boosted by the strong desire among business owners to effect a digital transformation of their activities and, in line with steadily unfolding global megatrends, to move a greater share of their operations online. This process has then been accelerated by the government’s so-called ‘Thailand 4.0’ policy, which has encouraged businesses to exploit the ability of analytics software to sift through the big data collected by cloud and IoT-enabled online platforms and then to use this for commercial advantage. At the same time, consumers are now able to more easily access the internet thanks to the extensive coverage of 4G networks, and this has helped to increase use rates of the digital communication services that have recently become a feature of day-to-day life. Beyond this, the outbreak of Covid-19 has been another important factor adding to demand for platform-driven software and digital services (Figure 24). Details of individual market segments are given below.

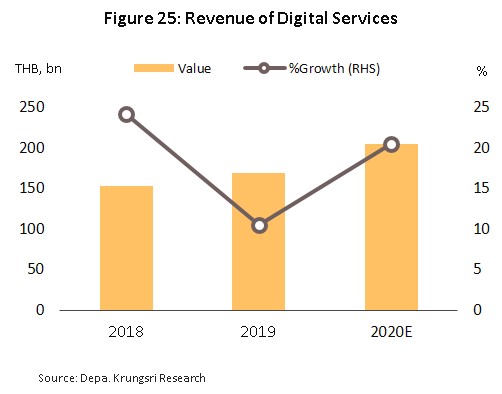

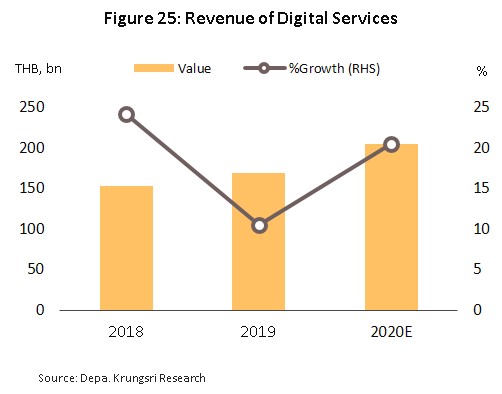

Digital services: Annual revenue growth stayed above 10% through 2018-2020.

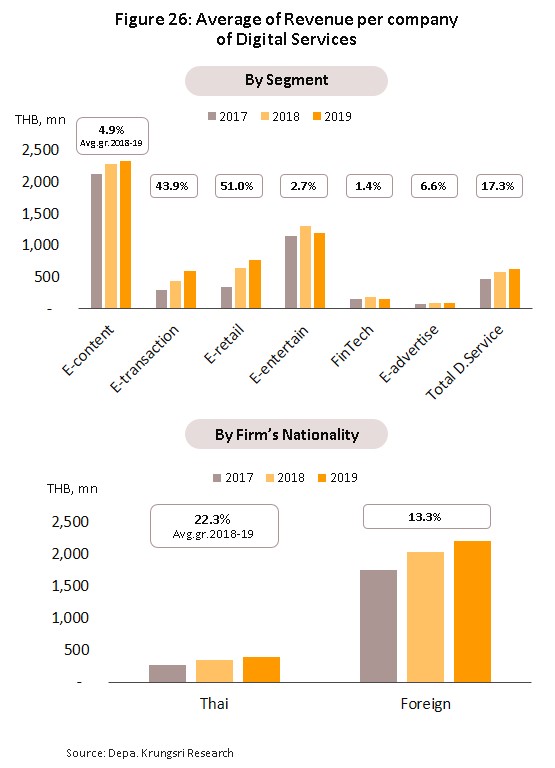

In 2018 and 2019, revenue for providers of digital services jumped by respectively 24.2% and 10.4% (Figure 25). A substantial portion of this growth is attributable to expansion in the market for e-content, which provided an average of 40.7% of the total revenue to the digital services segment. E-content was followed in importance by the e-transaction and e-retail markets, which supplied a further 24.4% and 13.0% of revenue. Changes in consumer behavior have also had important consequences for digital services, especially now that broadband access via mobile devices is close to universal. Most important among these changes has been the sharp increase in the number of people sourcing information online and, now that many platforms make access to online marketplaces, which also support digital businesses that are co-located in the same supply chains, including e-entertainment and e-advertising operations, and these are now seeing growth as a result.

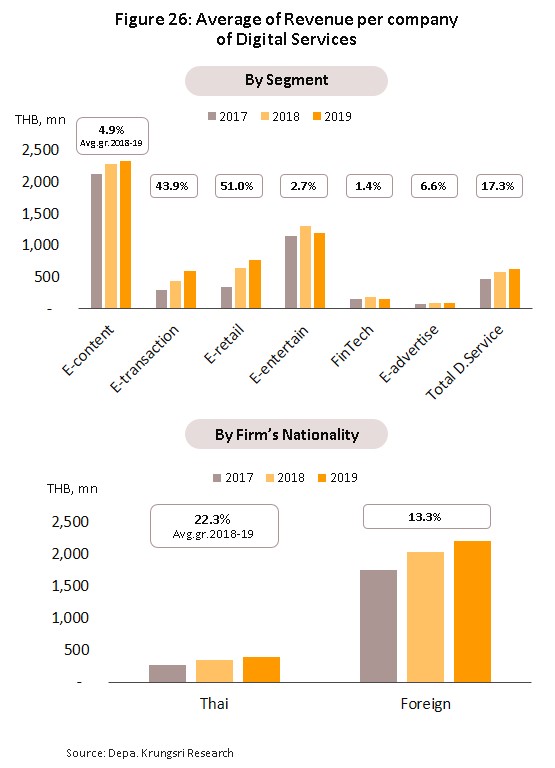

Comparing average company revenue in each of the six sub-markets for digital services, it becomes clear that in 2018 and 2019, the most profitable segments were e-content and e-entertainment (Figure 26). These services benefit from providing news and entertainment online, areas for which consumer demand is escalating rapidly, while at present, supply to the market is relatively uncongested. However, in terms of the fastest growth in company revenue, e-retail and e-transaction win out thanks to the rapid expansion in online shopping that has occurred over the past few years. At the other end of the data, average company revenue remains somewhat limited for FinTech players since competition is so intense in this space. This is due to recent changes to laws on peer-to-peer lending and e-finance that led to a flood of new entrants coming into the market, especially startups, and as such, the Thai FinTech space is now contested by 92 companies, compared to an average of around 35 for the other sub-markets within the digital services segment.

In terms of nationality, foreign-owned companies have average revenues that are 6-7 times as high as those of their Thai counterparts, though this is somewhat offset by the fact that average rates of growth in revenue are higher for Thai than non-Thai companies. This is mostly being driven by expansion in the e-retail market, itself a result of growth in the number and scale of platforms.

Total revenue for the digital services segment rose by a further 20.5% in 2020 thanks to the emergence of the Covid-19 pandemic and the subsequent government-backed measures to control the spread of the disease, the most important of which were those related to social distancing and lock-down measures. This then fed into a rapid surge in demand for online services, helped by the coincidental spread of high-speed internet networks across the country. The 2020 e-Conomy SEA report thus indicates that the proportion of Thai internet users upcountry rose to 43% of the total in 2020 (up from 36% a year earlier), and this has been another important factor in broadening uptake of digital services outside the Greater Bangkok region. (This includes consumption of online information, online shopping, online ordering of food for home delivery and making payments and transfers online).

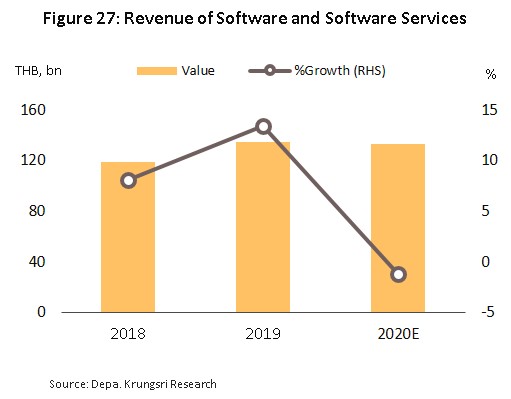

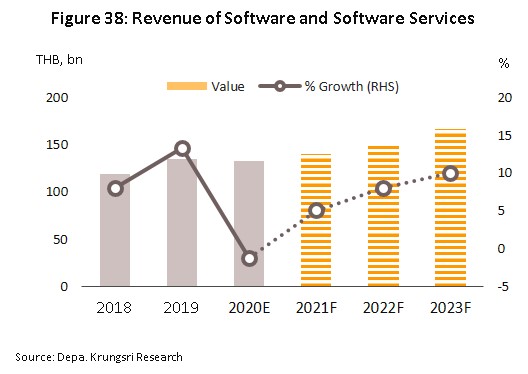

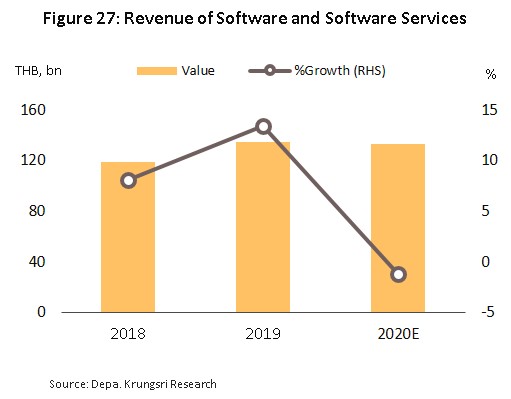

Software and software services: Revenue growth accelerated in 2018 and 2019 before falling back slightly in 2020.

In 2018 and 2019, revenue for software and software services segment rose by respectively 8.1% and 13.4% (Figure 27). The largest sources of revenue were systems integration, SaaS and software licensing (25.3% of revenue) and consultancy and training (20.3%). Many players in the software and software services segment are in the process of adding value to their business by expanding the range of services that they offer, and by taking advantage of the opportunities afforded by cloud technology, providers are now able to develop new business models that are based on fee-collection from public- and private-sector clients for the use of SaaS products. Across the segment, the finance sector was the most important source of revenue, followed by the public sector and tourism (from a survey carried out by DEPA in 2020).

Despite seeing solid growth over the previous two years, revenue in the software and software services segment slid 1.2% in 2020 on the generally unfavorable economic environment and the effects of this on corporate spending on software and other IT overheads. This was, however, somewhat compensated for by the additional demand that Covid-19 created for some types of software, including communications packages (e.g., for managing online meetings) but overall, corporations tightened spending in the year and businesses tended to cut costs by making do with whatever software they were already using.

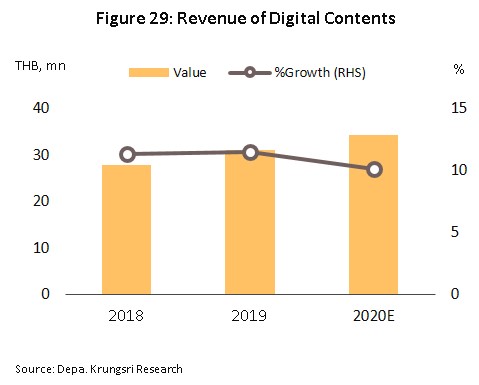

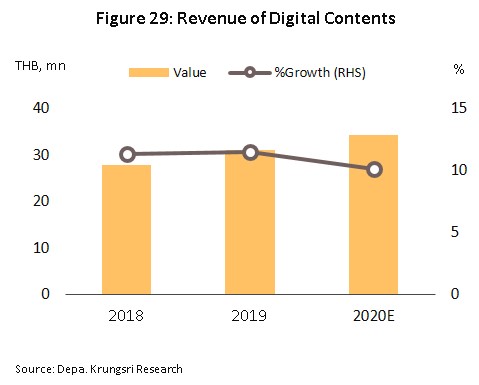

Digital content: Revenue grew at an average rate of 10-12% per year over 2018-2020.

As elsewhere in the digital industries, revenue for digital content providers grew at 11.3% and 11.5% solidly in 2018 and 2019, respectively (Figure 29). The lion’s share of revenue to the segment came from games, which accounted for 79.4% of the total market for digital content. This healthy performance was helped by: (i) outsourcing by games companies based in developed countries that are trying to meet rising global demand for games, which Newzoo estimates grew by 10.3% and 9.6% in 2018 and 2019 (by value, around 45-50% of the market is for mobile-based games); (ii) the acknowledgment of games as e-sports by the Thailand e-Sports Federation (TESF), which most recently has resulted in these being accepted as demonstration sports at the 2018 ASEAN Games; and (iii) the development of new business models, with revenue being generated by a mix of subscription fees for mobile games and in-app purchases.

Unfortunately, the markets for animations and characters still generate only limited revenue and growth prospects are somewhat underwhelming. This is because: (i) the majority of Thai contractors run small operations and have to make do with only limited orders; (ii) many Thai consumers make purchases online from overseas creators, rather than from Thailand-based distributors (source: IMC Institute); (iii) the majority of characters preferred by Thai consumers belong to copyright holders based overseas (e.g., Disney and Doraemon), whereas the development of Thai characters has been somewhat restricted; and (iv) many of the preferred Thai sales channels (e.g., Line Sticker) are now reaching saturation (source: DEPA).

This general outlook is reflected in the figures for revenue in 2018 and 2019. Among digital content providers, average company revenue was highest for players in the games market, for whom mobile games (Android and iOS) proved to be the most important product group, followed by computer-based games and then consoles. However, in the same period, producers of animations and characters had to make do with average company revenue that remained flat and somewhat low (Figure 30 and Figure 31).

In 2020, overall revenue to digital content providers expanded by 10.1%, largely thanks to growth in the market for games. The latter benefited from a number of different factors. (i) The emergence and continuation of the ‘new normal’ of social distancing forced consumers increasingly to work at home, and DEPA estimates that as a result, game playing increased through the year by 20%, which then supported growth in the domestic market for games of 14.0%. This is in accord with AIS E-Sports, which estimates that the Thai games market expanded by 15.8% in 2020, split between mobiles/tablets, PCs and game consoles 71%, 22%, and 7%. (ii) Thai developers released a batch of new games in the year. Many of 2020’s most successful games incorporating indie-based visuals, sound, systems or plot that first gained acceptance in niche markets before achieving more mainstream success. Examples of this include Home Sweet Home (a horror-themed game) and Timeline. (iii) Entry level smartphones have reached a level of development that now allows them to run games with an acceptable level of detail. However, the market for animation and characters continued to slow through 2020. Consumers are increasingly switching from watching television to consuming streaming services, and whereas the former was the main distribution channel for domestically produced animation and characters, the latter shows animations for international markets, in which Thailand lacks a significant presence.

Industry Outlook

Global market: Spending on digital services will continue to rise globally through the period 2021-2023, with Statista Research seeing growth averaging 16.2% over 2022-2024 (Figure 32). Factors underpinning growth in the coming period include the following.

1) Many companies are upgrading their organizational infrastructure to ensure that all their outlets or branches will be able to use advanced technology to provide more personalized services to consumers.

2) Continuing technological progress means that new digital platforms are in a constant state of development. This will support growth opportunities for digital services..

3) Major providers of digital services are forming alliances with companies from other parts of the economy, and this is providing new ways for the former to develop software or provide services for new projects. For example, both Apple and Huawei have partnered with EV manufacturers to develop intelligent driving systems.

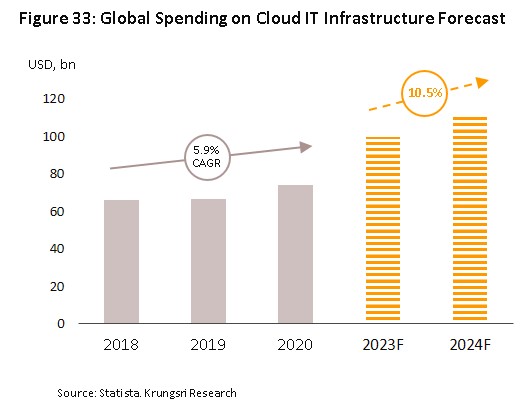

4) Companies will speed up their investment in cloud computing infrastructure as they try to benefit from real-time data analytics, and this will coincide with the increasing dominance of the software-as-a-service model. Statista Research therefore sees global spending on cloud computing doubling from its 2018-2020 level through the period 2021-2024 (Figure 33).

5) A new normal of work and life during the Covid-19 pandemic as communications and transactions moved online are likely to persist over the coming period, and a reliance by consumers and business on digital channels can be expected to extend into the future.

This growth in the global market for digital services is reflected in the rise in turnover reported by the operators of the major online platforms, such as Amazon, Apple store and Facebook, which saw 40-50% jumps in revenue during the first quarter of 2021 (Prachachat Turakij, 6-9 May, 2021). This revenue is generated by markets for digital services that circle the globe, but considered by region, the Asia-Pacific area and especially the ASEAN zone is growing more rapidly than global averages. Thus, the e-Conomy SEA 2020 survey reports that over 2021-2025, the market for digital services in the ASEAN region is forecast to expand at the breakneck pace of 24% per year (against the global annual average of 16-17%), with much of this growth coming from digital services that will be delivered through apps. These have shown strong growth potential since 2020 and include businesses such as ride-hailing apps (85.7% of the population of ASEAN report having used these services during 2020) and online payment and transaction systems, such as ShopeePay, which experienced a four-fold increase in size during 2020 (ShopeePay (Thailand), Prachachat Turakij, 3-6 June, 2021). More generally, the force of global megatrends and competition between businesses to push through with digital transformation have been accelerated by the Covid-19 pandemic, and this has then increased the chance of mergers and acquisitions occurring among leading global providers of digital services5/. If these mergers do indeed happen, the market value of players in the digital services space may then rise faster than would otherwise be expected (Global M&A industry trends report, PwC US 2021).

The domestic market: Over 2021-2023, revenue for the software and digital services sector is forecast to rise by an average of 10.5% per annum (Figure 34). Players will benefit from a rebound in consumer spending power and stronger demand from businesses looking to overhaul their organizational structures and to add greater value through the application of digital technology.

The outlook for individual segments is given below.

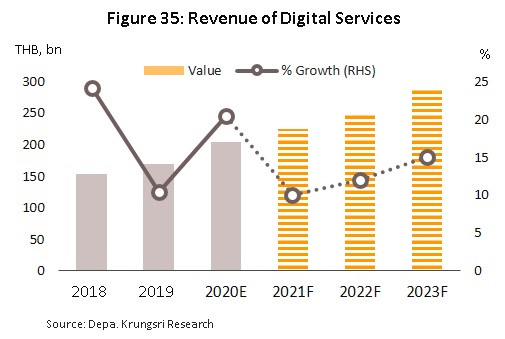

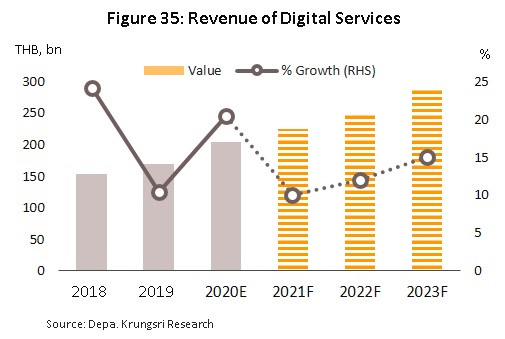

Digital services: Revenue is expected to strengthen by some 12.0-13.0% per year over 2021-2023 (Figure 35), helped by the following:

- The rollout of 5G networks will mean that these will cover an ever-broader area. The Office of the National Digital Economy and Society Commission agreed on 24 March, 2021 to support the 5G strategic plan with a budget of THB 500 million. This is to be used to help connect networks and to accelerate private-sector investment (by AIS, True and Dtac) in 5G technology with the result that access should be universal by the end of 2022.

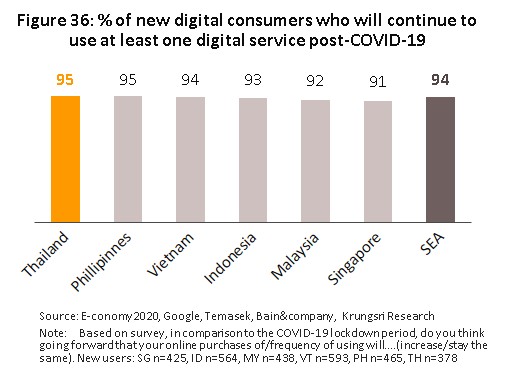

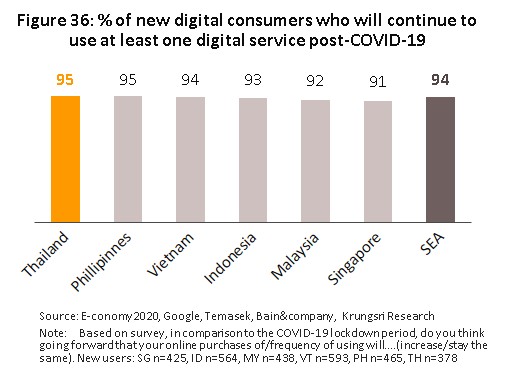

- The use of digital platforms for work and daily life that has occurred as part of the pandemic-driven ‘new normal’ is likely to persist. The 2020 e-Conomy report reveals that a full 95% of Thai consumers who have used these services during the pandemic expect to continue to do so even after the crisis has receded and life has returned to more normal conditions (Figure 36).

In addition, the government has recently changed the regulations governing the digital service tax (DST), and foreign-owned companies with an annual turnover in excess of THB 1.8 million are now required to register with the authorities and to pay VAT at a rate of 7% (with effect from 1 September 2021). This brings them into line with Thai operators of digital platforms that provide services such as digital news and information, entertainment or downloads (e.g., Ookbee, Wongnai and Pantip), and the effect of these changes should be to make Thai players more competitive.

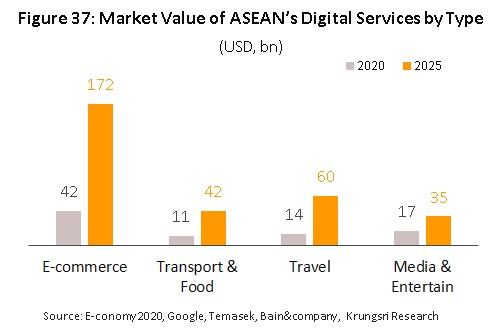

Within the digital services sector, the majority of growth will come from the three business areas of e-transactions, e-retail and e-content. In the coming period, online shopping will develop from its current focus on food, travel and entertainment to increasingly encompass a much broader range of goods in daily life. Next in importance will be FinTech, which will be boosted by the growing popularity of e-wallets and the trend for these to replace cash, but the FinTech market is crowded and many players are developing their own finance platforms, for example, in March 2021, ShopeePay extended its range of payment options by connecting an e-wallet to its e-commerce operations. In addition, players from outside the sector are increasingly attracted to it, as was the case with the property company Sansiri, which bought a 15% stake in XSpring Capital (finance and securities businesses) in May 2021 with the goal of expanding into the area of digital financial services by creating a digital token backed by the asset for investors. Growth trends in the domestic market for digital services are in line with broader expansion in these markets across the ASEAN region, and indeed the e-Conomy report predicts that in the latter, all the major digital products and services will enjoy continuous expansion through to 2025 (Figure 37).

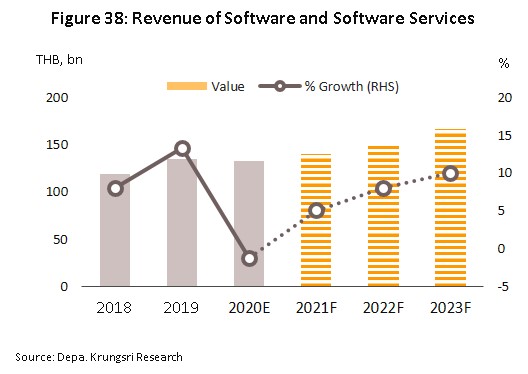

Software and software services: Revenue to this segment should grow by 7.0-8.0% per year through the period 2021-2023 (Figure 38) on an improving business condition in 2022 and 2023. Many businesses are in the process of transforming their organizations as they try to improve their ability to process data and provide more focused responses to customer needs, and a more favorable business environment will then support stronger spending on the software and cloud computing capabilities needed to achieve these ends. State organizations are also keen on delivering more of their services through online and applications platforms. Beyond this, to speed up the process of digital transformation and to increase overall levels of competitiveness, the government has changed the rules to allow SMEs to use software and/or software services-related expenses as a deductible on corporate revenue tax at two-times rate (up to a total of THB 100,000) in 2021-2022.

The most important driver of growth in the software segment will be developers of customized or bespoke software, who develop products that are designed to solve particular problems or to meet specific needs (for example for the embedded software that is used in a wide range of modern goods). Also important for growth will be SaaS products. The use of these will help companies adopt new organizational structures and will make businesses more competitive by cutting IT costs related to the installation and maintenance of software. Gartner therefore estimates that spending on SaaS will increase steadily in Thailand over the next three years as expenditure on software licenses declines in importance, because while the latter involves making significant upfront purchases, SaaS products can generally be accessed on a pay per use basis.

Digital content: For this segment, revenue is expected to strengthen by an average of 9.0-10.0% per year through 2021-2023 (Figure 39). As elsewhere, the persistence of habits adopted under the ‘new normal’ will likely encourage consumers to continue spending a significant portion of their leisure time relaxing with digital content and smart technology, helped by the ubiquity of high-speed internet connections. The market for games will play an outsized role and growth in sales in the Thai market can be expected to match what happens at the global level. SuperData, a games researcher and part of the Nielsen network, reports that global market value of game industry and online media rose 12% to USD 139.9 billion in 2020, with 59% of receipts coming from Asia. The company predicts that even once the vaccine rollout is complete and the Covid-19 crisis has begun to fade, sales of games will continue on this growth track, with Thailand one of the Asian markets potentially showing a strong performance.

This view is echoed in the Global Entertainment & Media Outlook, 2020-2024 (published by PwC Thailand), which sees spending on video games and e-sports in Thailand rising 7.2% per year over 2020-2024. The market will be supported by the official recognition by the Ministry of Tourism and Sports of e-sports and the interest in sponsorship deals that this will help to generate in other industries, while the industry will also be able to develop platforms and then use these to sell advertising. Alongside this, rising investment in digital infrastructure, most notably in cloud computing, will allow Thai developers to shift to a greater emphasis on cloud gaming delivered to mobile devices via the internet rather than console-based games (e.g., for PlayStations and Xboxes). This will then help increase online games downloads.

The markets for animation and characters is expected to grow marginally in line with the recovery of trading partners in 2022 and 2023. Overseas major market tend to be Japan where Thai animations and characters are beginning to gain a wider audience. The industry will gain a further fillip from the government’s Thai Cartoon Project, which is showing Thai cartoon characters and animation online for Japanese viewers between February and September 2021 (courtesy of the Department of International Trade Promotion, Ministry of Commerce, 2021).

Krungsri Research’s View

Through the next 3 years (2021-2023) overall revenue to the Thai digital services and software industry is expected to continue to rise steadily. The market will be strengthened by (i) widespread investment in digital transformation as companies try to build greater value by meeting more specific consumer needs, and (ii) the continuation of the Covid-19-driven switch to the digital mediation of business activities and social lives.

The outlook for individual segments follows.

- Digital services: Revenue is likely to rise steadily with the development and rollout of new platforms that will meet demand from both businesses and consumers wishing to move their activities online, though this process will be further boosted by the spread of 5G networks. Within the segment, the strengthening of revenues will largely come from businesses involved in e-transactions, e-retail and e-content since these facilitate online services that extend over almost all product and service groups used in daily life. Following these in importance will be FinTech. This will find an expanding role to play in the marketplace as e-wallets continue to replace cash, amid intense competition from many players that are trying to develop their own e-payment systems.

- Software and software services: Revenues would rise on a better business environment, which will then encourage higher levels of investment in software and cloud computing. Many companies are going through a process of transformation that is being spurred on by the desire to take advantage of the power of big data analytics and through this, add greater value to business operations. Sectoral growth will tend to be driven by software houses producing bespoke or custom programs and by those developing and offering SaaS products.

- Digital content: Revenue growth will come from stronger performance by online gaming operations, especially those built on cloud gaming platforms and delivered to mobile devices. The greater acceptance of online gaming as an e-sport, and game industry in Thailand will likely feed into the development of online gaming platforms that will then be used to develop new revenue streams, for example by developing new e-commerce possibilities and selling other products. Revenue for animation and character businesses also tend to increase, but will be limited in line with a gradual recovery of customers’ business conditions in 2022 and 2023.

[1]This includes using technology and digital strategies as a foundation for business activities, for setting goals, business activities, work procedures and organizational culture (Demeter ICT, a consultancy offering business transformation services in the Asia-Pacific region since 2015).

[2]The digital industry covers a wide range of digital products and services, including software and software services, the provision of digital services and content, the creation of smart devices, and the development of digital platforms (UNCTAD, 2019).

[3]Thai games developers will invest an average of around THB 100-200 million in development and a further THB 50-100 million in marketing per game. By comparison, leading global developers will often invest at least THB 1 billion in each game that they produce (source: Thai Game Software Industry Association).

[4]Growth in spending on cloud systems is an important indicator of the extent of digitalization in organizations.

[5]For example: (i) the merger in Indonesia between Gojek (a ride-hailing and payments app) and Tokopedia (an e-commerce company) in May 2021 that was undertaken with the intention of increasing these companies’ ability to compete with Singaporean operators including Grab (another ride-hailing and delivery app) and Sea (a Shopee platform), and (ii) the merger in the US between AT&T (a telecommunications company) and Discovery (a TV and digital media operation) to develop a new streaming platform. The latter is expected to be completed during 2022, when the resulting operation will be positioned to compete against Netflix and Walt Disney.

.webp.aspx)