In 2021, housing sales in the 6 major provinces[1] will likely remain flat or drop slightly from 2020 levels as COVID-19 continues to hurt the economy. In response to the prevailing weak business conditions, developers have been trying to run down existing stocks of unsold properties. Looking at 2022 and 2023, conditions should improve along with stronger economic growth, while government stimulus measures will help to lift consumer purchasing power. But there are still several headwinds weighing on the property market. Household debt would continue to trend up, which would reduce affordability and simultaneously lead to tighter credit conditions. In addition, demand for housing has been mostly absorbed in 2020, when developers had cut prices to run down inventories, reflected in the mild drop in house ownership transfers. Also, demand from foreigners will continue to be capped by restrictions on international travel.

Overview

The real estate sector contributed 8% of Thailand’s GDP, which is significant to the national economy. A large amount of capital circulates within the economic system and supports rising employment and income. The sector also has a large influence on the direction of related businesses such as construction, construction materials, finance, electrical appliances, furnishings and decoration.

The real estate sector generally consists of three principal segments: residential, commercial and industrial. In Thailand, residential sector is the largest with two-thirds of the total value of the property market (source: World Bank). Developers of residential properties normally focus on Thai customers because Thai law stipulates that non-Thais can only buy condominiums subject to a maximum of 49% of total saleable area in any project. For detached housing and townhouses (also called rowhouses or shophouses), the ownership regulations for non-Thais are more onerous.

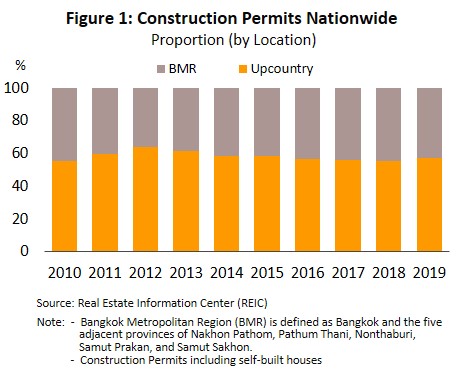

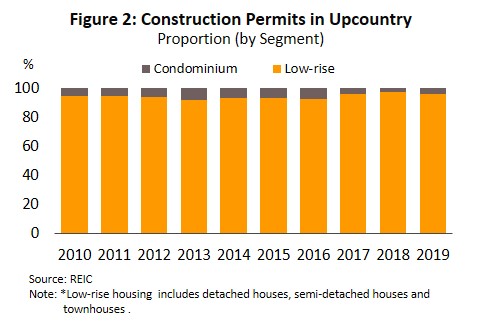

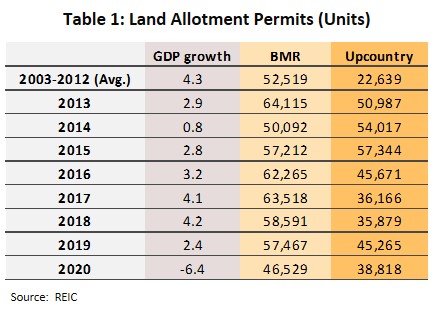

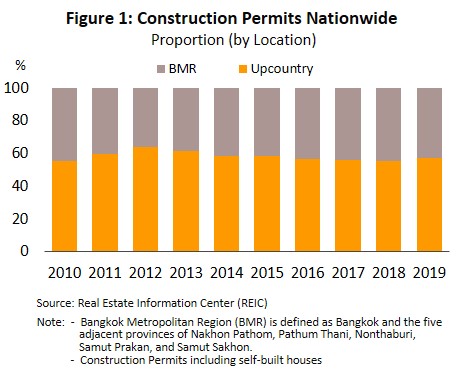

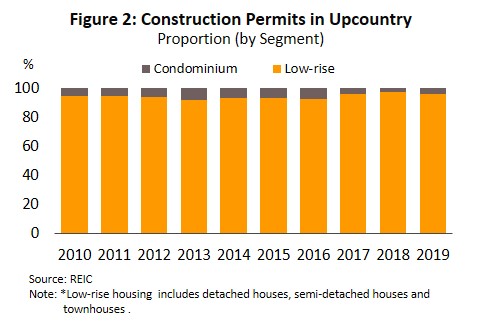

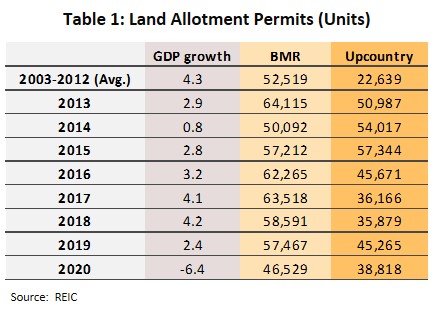

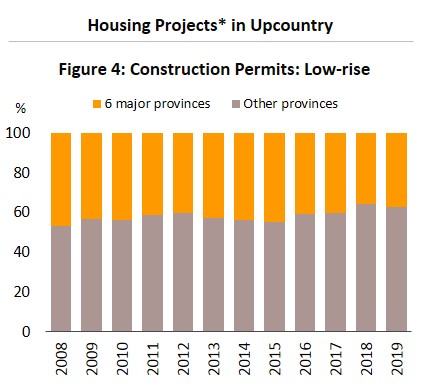

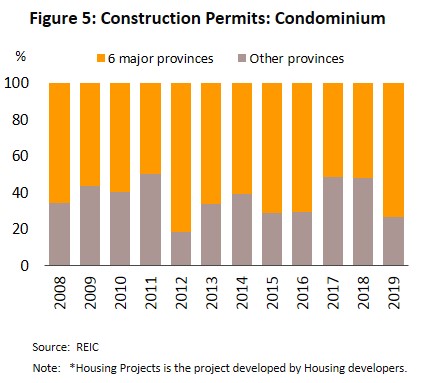

Housing developments upcountry account for around 60% of nationwide construction permits (Figure 1). Unlike in Bangkok, the majority of developments are low-rise housing[2], rather than condominiums (Figure 2). This is because of far fewer constraints on access to land for development upcountry, land there is relatively cheaper, and construction cost per square meter of low-rise buildings is significantly lower than for condominiums. Hence, housing developers upcountry tend to focus more on low-rise projects than condominiums. However, revenue growth has been limited due to volatile consumer purchasing power, which has translated into different impact on the market (Table 1).

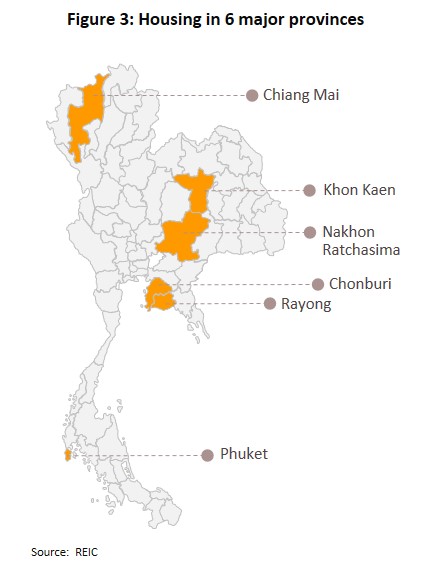

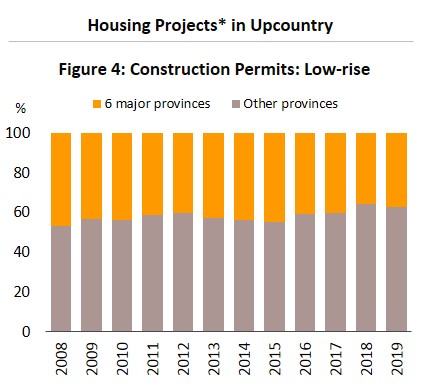

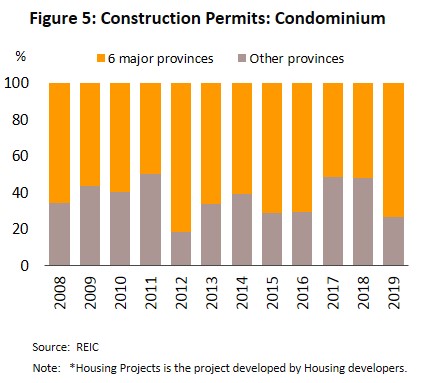

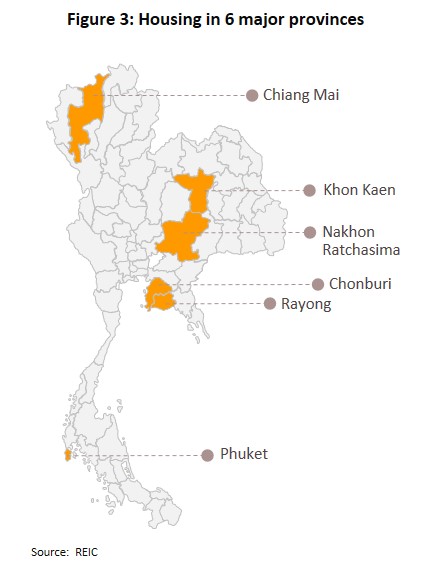

Growth of the upcountry housing market has been concentrated in 6 major provinces: Chiang Mai, Chonburi, Khon Kaen, Nakhon Ratchasima, Phuket and Rayong. In 2019, these provinces accounted for 23% of nationwide construction permits (low-rise 24% of nationwide permits for this segment; high-rise 13% of nationwide permits for this segment). And, they accounted for 39% of all construction permits upcountry (low-rise 37% of all construction permits for low-rise upcountry; high-rise 73% of all construction permits for high-rise upcountry) (Figures 4 and 5).

This is because these provinces have strong potential, as regional centers for economy, industry, trade, investment, tourism and education. It is also driven by government policy that has sought to broaden the geographical spread of economic growth, for example, through the implementation of the infrastructure development plan, entry to the ASEAN Economic Community, and the development of the Eastern Economic Corridor (EEC). These have helped to increase employment, encourage the internal relocation of the population, and boost the growth of urban centers. This has increased population density in some areas (from internal migration for education and work, and external immigration for employment purpose). This has, in turn, led to more intense development of commercial and residential properties, and thanks to relatively cheaper land in the provinces, low-rise housing are popular.

There is stronger demand for high-rise housing (i.e., condominium) in provinces that are heavily dependent on tourism – Chonburi, Chiang Mai and Phuket – where foreigners would buy investment properties or a holiday- or second-homes. In 2019, 31% of foreign arrivals visited one or more of these three provinces, and receipts from foreign tourists in these areas accounted for 40% of revenue from overseas tourists. There is also rising demand from Thais triggered by the widespread and severe flooding in Bangkok and the central region in late 2011. Upcountry markets have also been buoyed by the saturated housing market in the Bangkok Metropolitan Region, strong competition there, and rising prices for development land. In response, large developers based in the regions have been increasingly developing projects that include condominiums in the major provinces, especially in Chiang Mai, Chonburi, Rayong and Khon Kaen. This caused a spike in the number of such developments in 2012 with a new record for the number of construction permits for condominiums, and into 2013.

The housing markets in the 6 major provinces have not been heavily developed, suggesting ample room for growth. But, sources of demand vary among the provinces. (i) Chiang Mai: Buyers are generally Thai nationals, while the foreign market is dominated by Chinese investors who tend to buy condominiums to offer tourist accommodation to other Chinese travelers. (ii) Phuket: Buyers from China and Hong Kong dominate here, often purchasing entire floors of new developments or whole buildings in multi-building projects. Investors from Singapore and Russia are also active in the area. (iii) Chonburi: The main buyers here are Chinese and European investors. (iv) Rayong: the market is tilted towards Thai buyers, most of whom work in local industries. Detached-houses are generally owned by high-income earners, whereas townhouses and condominiums are more often owned by operation-level staff. Housing markets in both Chonburi and Rayong are benefiting from the EEC and government investment in transportation infrastructure in the area, for example, the high-speed rail link and upgrades to U-Taphao Airport. This is encouraging property developers to step up investments in these locations. (v) Nakhon Ratchasima: Buyers of low-rise housing projects are concentrated in the municipal districts and most buyers are generally locals. However, they may buy condominiums for own use (long-term residency for education or for employment) or for investment (as rental properties). In Pak Chong District, the market is skewed towards high-end buyers who are seeking a holiday or retirement home. (vi) Khon Kaen: Buyers are typically salaried locals, mostly civil servants, and the self-employed or business owners.

Situation

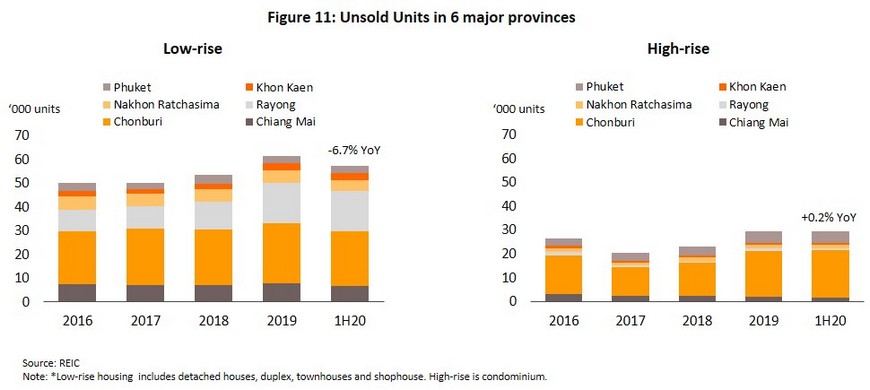

In 2016-2017, housing markets in the 6 major provinces were sluggish as a weaker economy had eroded consumer purchasing power. Low prices for agricultural products had hurt local economies and ate into the spending power of low- to middle-income earners. As a result, the number of unsold units (especially condominiums) had surged. The exception was Phuket, where the condominium market continued to be supported by investors from China, Hong Kong, Singapore, and Russia. This was especially noticeable in the high-end market, with prices climbing steadily due to limited supply. At end-2017, in the 6 major provinces, there was a total of 50,039 unsold low-rise properties and 20,517 unsold condominium units.

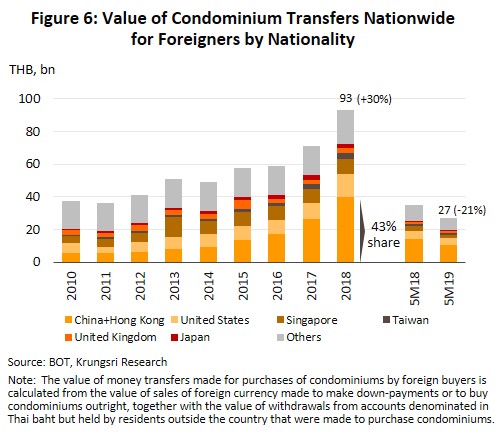

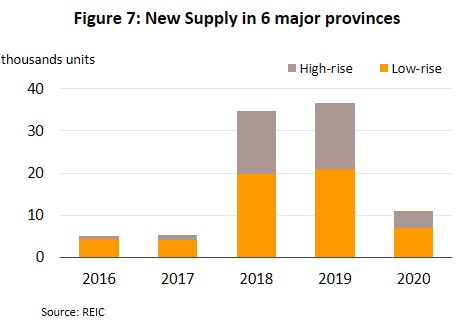

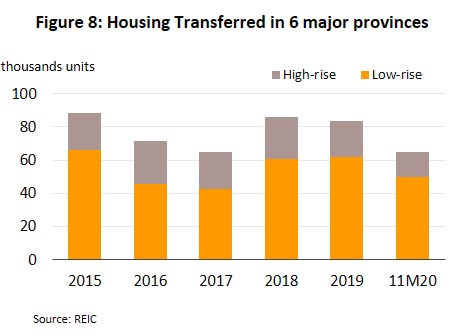

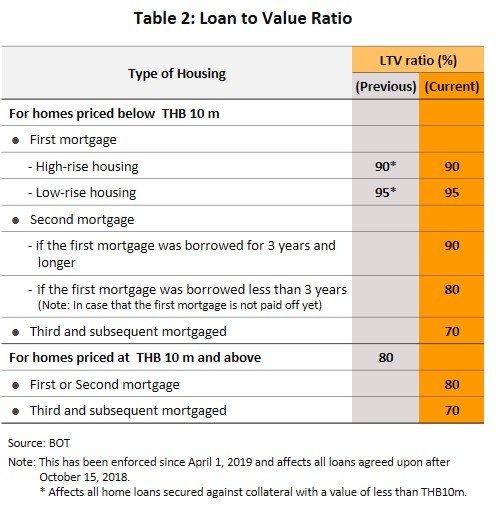

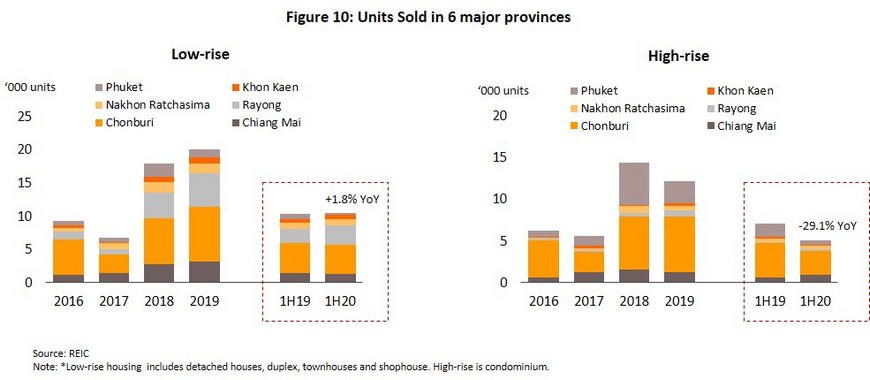

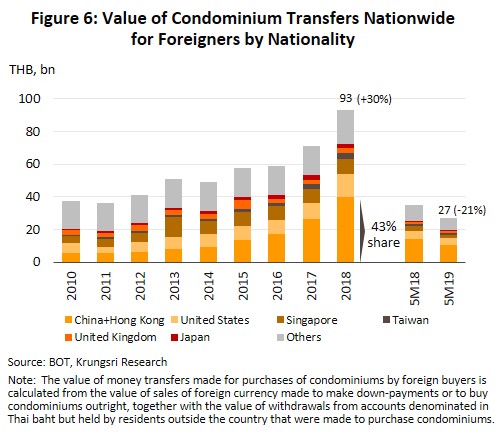

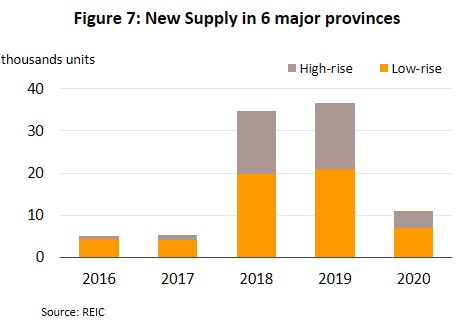

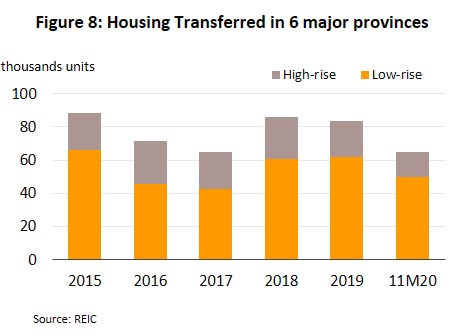

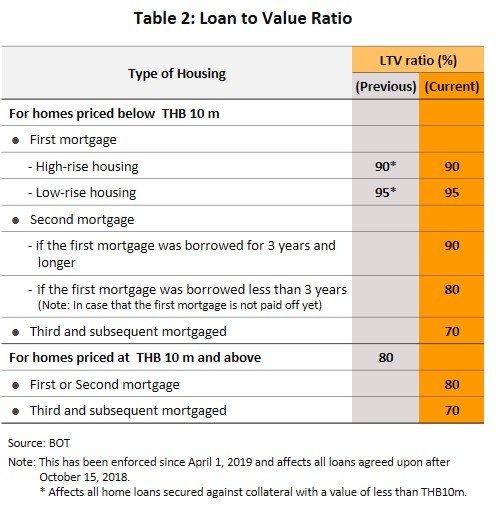

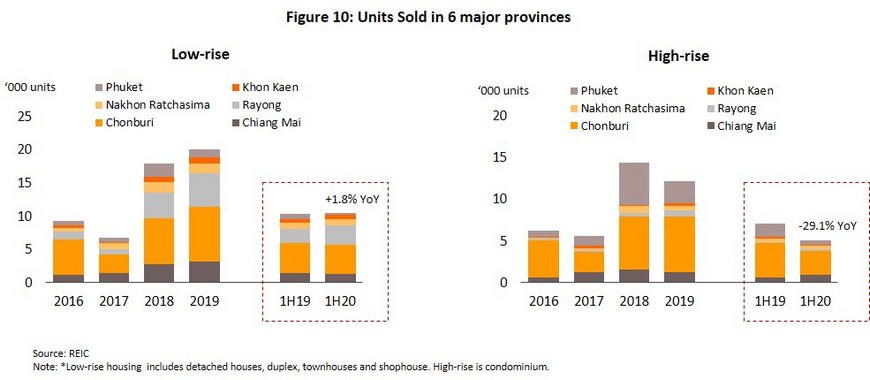

In 2018, the housing market benefited from a 4.1% expansion in the domestic economy, and an improvement in the Consumer Confidence Index to 67.1 from 64.6 a year earlier. In addition, the global economy was strong and this helped to drive stronger demand from overseas purchasers, especially Chinese buyers whose share of foreign purchases of Thai properties surged from 28% in 2017 to 43% in 2018 (Figure 6). The escalating demand pushed developers to quickly launch more projects. And in 2018, new supply of low-rise housing rocketed 365%, while new supply of condominium units exploded by 1,247% from a year ago (Figure 7). This surge in new supply was especially visible in tourist provinces (i.e., Chonburi and Phuket) and industrial areas (i.e., Rayong). Looking at demand-side variables, the market was also boosted by the rush to complete transfers of housing units (Figure 8) before the enforcement of new loan-to-value (LTV) ratios in 2019, introduced by the Bank of Thailand (BOT) to reduce speculation in the housing market. (Table 2). As such, housing sales jumped 160% from a year earlier (Figure 10).

In 2019, the market was hit by a slowdown in the economy. Meanwhile, enforcement of the BOT’s new LTV rules had forced some people to defer decisions to buy a second home, because of higher down-payment requirement, and prevented some buyers from securing credit from financial institutions. In addition, the baht had appreciated by 8.8%, making the Thai market less attractive to overseas buyers, a situation that was compounded by a weaker Yuan and tighter regulations on capital outflows by Chinese authorities that made it much more difficult to transfer funds to buy property in Thailand. This had hurt demand from Chinese investors, who had become the most important group among non-Thai buyers. However, the government responded by stimulating demand from genuine owner-occupiers, which pared down the excess housing stock. They achieved this by cutting tax for first-time buyers for properties priced at less than THB5m[3], reducing transfer and mortgage registration fees to 0.01% of property value[4], and introducing the Baan Dee Mee Down program[5]. Beyond this, the government also passed the 2018 Eastern Economic Corridor Act which liberalized property ownership rules in the EEC for non-Thais[6]. This pushed up sales of new residential projects, especially low-rise housing, in Chonburi and Rayong.

Overall in 2019, new housing units in the 6 major provinces rose 5.6% YoY to 36,706 units, sales edged down 0.1% to 32,264 units, and unsold stock jumped 18.7% to 90,895 properties.

In 2020, like elsewhere in the economy, the COVID-19 pandemic also hurt the property market, both low-rise and high-rise segments. The pandemic had caused economic activity to slow precipitously, especially in the tourism sector. To make matters worse, a severe drought had extended into the first half of the year, suppressing incomes upcountry. The combined effect was to pull down consumer confidence to its lowest level in a decade. Against this gloomy economic outlook, developers slowed work on new projects. Both domestic and international buyers also pulled back from the market, deferring or cancelling purchases as incomes fell and confidence in the future evaporated. The situation for the first half of 2020 is reflected below.

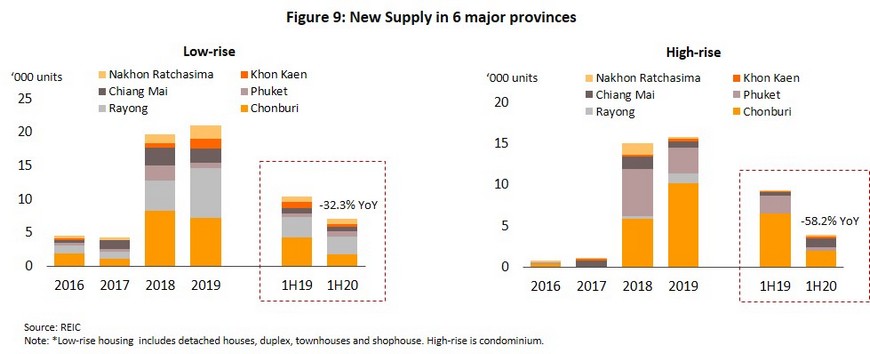

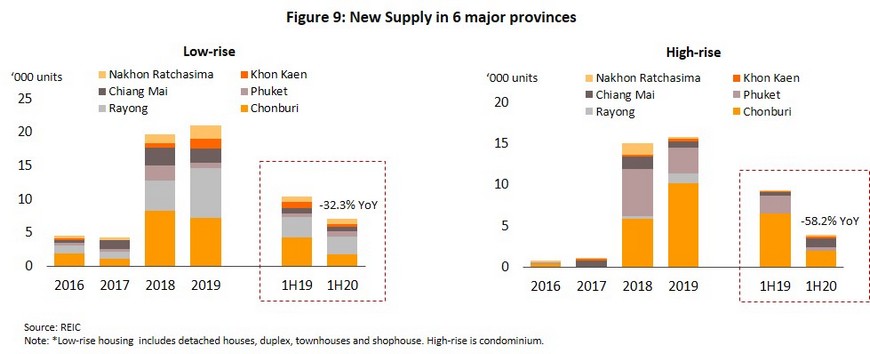

- New housing units coming into the market crashed at an unprecedented rate, tumbling 44.5% YoY to just 10,914 units. In 1H20, new supply of low-rise housing fell 32.3% YoY (to 7,027 units), while high-rise segment contracted by 58.2% YoY to 3,887 units (Figure 9).

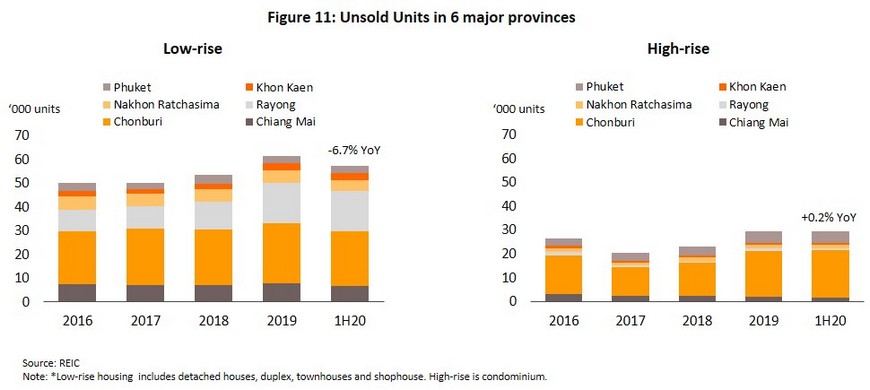

- In 1H20, sales contracted 10.8% YoY to 15,539 units as rising household debts (which reached 83.8% of GDP in 2Q20) and the move by lenders to tighten release of new credit took their toll. However, demand for low-rise housing continued to strengthen in the EEC (in Chonburi and Rayong), Nakhon Ratchasima and Khon Kaen. For condominiums, sales dropped 29.1% YoY, especially in Chonburi and Phuket where sales fell by 31.5% and 71.7% YoY, respectively. Overall, the ratio of low-rise to high-rise sales in the 6 major provinces in 1H20 was 68% to 32%. Sales of the former grew 1.8% YoY to 10,501 units, while the latter fell 29.1% YoY to 5,038 (Figure 10). Because new supply of housing had shrunk sharply, the cumulative number of unsold stock also fell in this period, sliding 4.5% YoY to 86,850 properties, comprising 57,365 low-rise units (-6.7% YoY) and 29,486 condominiums (+0.2% YoY) (Figure 11).

The housing market continued to see depressed conditions in the second half of 2020, amid persistent uncertainty over COVID-19. Indeed, as the year came to a close, a new cluster of domestic infections had emerged in Thailand, prompting authorities to reintroduce restrictions on economic activity. These events dragged the economy and again, developers slowed work on new projects and consumer purchasing power remained weak. Hence, Krungsri Research expects that in 2020, the number of newly launched units would tumble 70.3%, while sales would drop by 21.1%.

In 2020, transfers of house ownership fell 13.0% relative to 2019 (Figure 12) as worries about future income pushed Thais to postpone or cancel purchases, while restrictions on international travel meant that foreign buyers were unable to travel to Thailand to complete transfers.

For the low-rise segment, transfers fell 10.9% to 54,892 units. Declines were especially significant in Phuket and Chonburi, where demand is strongly influenced by revenue from the tourism sector. In Chiang Mai and Khon Kaen, sales of detached and semi-detached housing continued to rise because demand is largely non-speculative and driven by local Thai buyers, many of whom are government employees or work in education. There was a sharper drop in the condominium segment, where transfers slipped 18.7% to 17,597 units. The market was weaker across the 6 major provinces with the sole exception of Nakhon Ratchasima, where transfers jumped 21.3% on stronger purchases from salaried civil servants.

Industry Outlook

Over 2022 and 2023, housing markets in the 6 major provinces should return to growth mode thanks to developers’ plans to invest more in areas that attract large numbers of tourists and in industrial zones. Growth will also be supported by rising competition in Bangkok and nearby areas that had pushed up average land prices by 8.0% in 2020. However, markets are expected to remain slow in 2021.

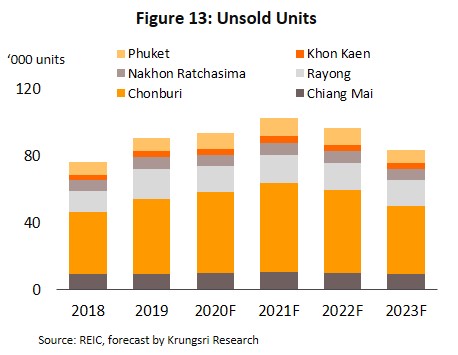

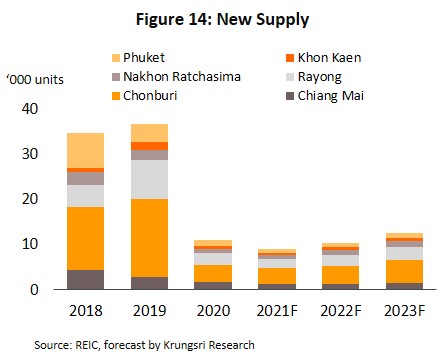

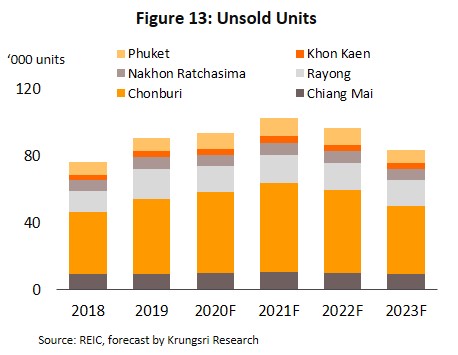

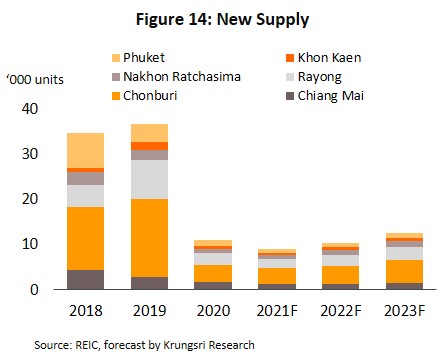

Krungsri Research expects the pandemic to continue to hurt the economy and lead to flat sales of upcountry property or possibly a small drop. At the same time, developers will try to run down the estimated 100,000 unsold units (Figure 13) while consumers continue to postpone purchases. This means the number of new projects coming into the market this year would be almost similar to that in 2020 (Figure 14).

However, the housing markets should improve in 2022 and 2023, thanks to the following factors.

- Following contracting by 6.1% in 2020, Thailand’s GDP is forecast to grow at an average annual rate of 3.0-4.0% over 2021-2023. More specifically, government spending on infrastructure development should pick up, especially in the EEC where progress in government-backed projects will stimulate stronger demand for housing. Because of this, the housing markets in Chonburi and Rayong will recover ahead of other provinces. Tourist numbers will rebound slowly following the rollout of vaccination programs overseas and in Thailand. Initially, Thailand would restrict arrivals to specific categories, such asbusiness travelers, those arriving for medical treatment, or tourists from countries with low domestic transmission of COVID-19. Given this, it would be at least 2024 before the tourist industry returns to 2019 level of around 40 million foreign arrivals.

- Other factors supporting the market include ongoing government efforts to boost sales. These include, for example, reducing fees for registering transfers and mortgages[7] and maintaining low interest rates, which would reduce costs for borrowers. In addition, the government has put in place the Thailand Elite Card scheme[8]. This encourages non-Thais to buy properties (including second homes) in the country by emphasizing the success of the Thai healthcare system in suppressing the domestic transmission of COVID-19. Developers will try to raise sales through a range of strategies including slashing prices on their stocks of unsold properties and having greater emphasis on low-rise projects. The latter would help to address changing customer needs that now include the possibility of working from home, and will also help to meet real demand within the market. With the steep decline in demand from overseas buyers, developers are relying more on the Thai market. The outlook for the various markets segments is summarized below.

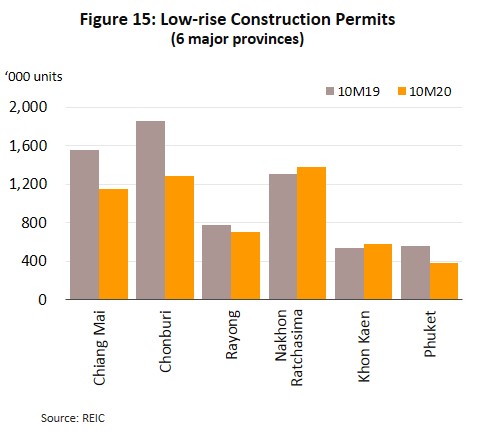

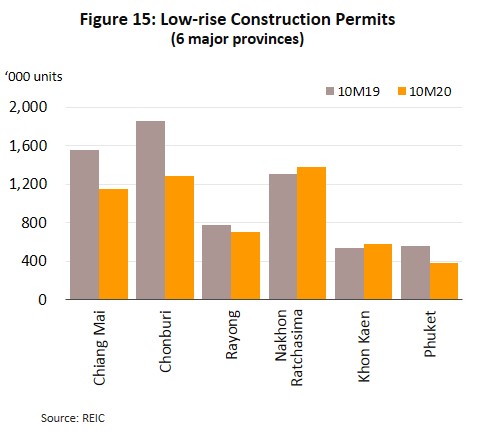

- Low-rise housing: Given the 16.7% YoY drop in construction permits in 10M20, Krungsri Research forecasts new supply of low-rise properties will slide 7.5% in 2021 before surging by an average of 23.5% in each of 2022 and 2023. Demand for low-rise housing will improve, supported by those buying for residential use (i.e., non-speculative) and from buyers who have ready access to funds, i.e., middle-income earners, and those with strong purchasing power. The market will benefit from still-reasonable pricing, although demand patterns might change post-COVID, for example, increasing work-from-home activity could take demand away from condominiums and towards town- and detached-houses (Figure 15).

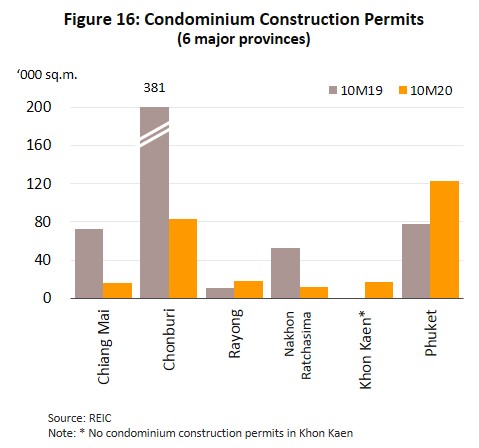

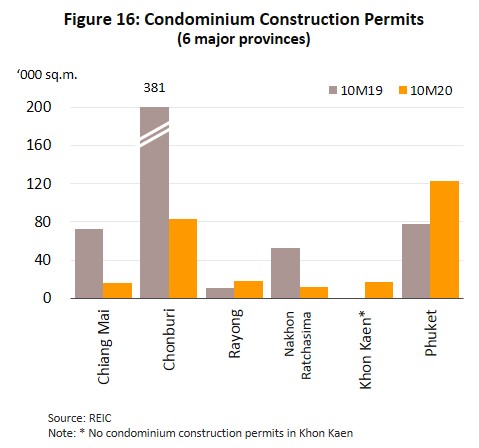

- High-rise housing (condominiums): Recovery will be slower than for low-rise housing. Following a 54.7% YoY drop in construction permits in 10M20, new supply coming into the market in 2021 is forecast to drop by 35.7% (Figure 16). Recovery will start in 2022 and 2023, with expectations of 2.0% average annual growth. However, note that in Rayong and Phuket, recovery will run ahead of other provinces as developers seek to capture rebounding demand driven by recovery in the industrial and tourism sectors.

Property developers will also tend to widen the range of offerings made to the market as they react to diversifying consumer needs. This will include increasing the amount of workspace offered in developments, now that working from home has become so much more important, designing living spaces that respond to growing consumer interest in health and wellness, and meeting the needs of an increasingly aged society, where considerations of safety and access become much more important.

Through 2021-2023, headwinds will continue to cap growth in the market, with these originating from: (i) the steady rise in household debt, which will have a direct impact on the ability of buyers to make house purchases; (ii) lenders’ continuing wariness over the release of new credit; and (iii) the supply glut that is weighing on the market, which will likely remain at high levels. Beyond this, demand for housing has mostly been absorbed in 2020, when developers used price-cutting strategies to run down inventories, reflecting from a slight correction in housing transfer transactions. At the same time, the overseas market remains depressed by the restrictions on foreign arrivals to Thailand. Given this combination of factors, operators’ earning will come under significant pressure.

Krungsri Research’s view

Between 2021 and 2023, housing markets in the 6 major provinces will gradually recover with a steady rebound in consumer purchasing power and a mixed-bag of government stimulus measures. However, persistent COVID-19 fears will prevent markets from quickly returning to normal in provinces that are dependent on tourism. Within these markets, sale of condominiums will be badly affected. Given this, sales will remain weak but developers will also need to spend on marketing to stimulate sales, which would add to their overheads.

In terms of flexibility, development of gated communities win over high-rise projects. This is because the former can be developed in phases according to the wider business and economic environment, while the latter must be completed in one go, regardless of any changes in the market between breaking ground for a new project and completion. In addition, the market for low-rise housing/gated communities is also primarily driven by Thai buyers who are making purchases driven by need, rather than for speculation.

- Low-rise housing developers (in major cities): The large number of players active in the market will increase competitive pressure. Small- and mid-size operators are often local to the area and normally have ready access to land banks, but they also face stronger threats from large corporations that are listed on the stock exchange and which are increasingly looking to expand into upcountry markets. These large players also have an advantage over smaller developers, because of stronger brand recognition which has some influence on customer purchasing decisions. Meanwhile, there would be stronger pressure on SMEs, from higher marketing, finance and operating costs.

- High-rise housing developers (in major cities): Like the low-rise segment, SME developers and investors are generally local operators that already own development land. Major corporations that are listed on the stock exchange are increasingly focusing on condominium projects of up to 8 floors. This means supply would be congested and competition will rise, while demand remains limited. The upshot is that developers have to accept the slim profits, a situation that poses a greater danger to SMEs than to large players.

[1] Residential property in the 6 major provinces of Chiang Mai, Chonburi, Khon Kaen, Nakhon Ratchasima, Phuket and Rayong.

[2] Low-rise housing, i.e., detached houses, semi-detached houses, and townhouses.

[3] The cuts in tax for first-time home buyers provided for reductions in personal income tax (calculated according to the cost of purchases) up to a value of THB 200,000 for those buying houses and land together or apartments with a value of not more than THB 5m. These measures ran from 30 April to 31 December 2019.

[4] Charges for the housing transfer and for registering mortgages have been cut from respectively 2% and 1% of the estimated value of the property to only 0.01% of its value. This reduction applies to (i) purchases of property with a value of not more than THB 1m made between 24 June 2019 and 31 May 2020 and (ii) those with a value of not more than THB3m made between 1 November 2019 and 24 December 2020.

[5] The ‘baan dee mee down’ program was run by the Ministry of Finance, and under this, a contribution of THB 50,000 was made by the government to the down-payments of those purchasing new properties. The program was limited to 100,000 applicants, who had to have an annual income of not more than THB 1.2m. The scheme ran from 11 December 2019 to 31 March 2020.

[6] The 2018 Eastern Economic Corridor Act specified that non-Thai nationals and companies registered overseas were eligible for special rights with regard to owning land and property within the 3 provinces of the EEC (Chonburi, Rayong and Chachoengsao). 1. Foreign businesses and individuals (as defined in the relevant land law) with businesses in the special economic zone are allowed to own land in that area for the purpose of carrying out approved business activities without the need for the additional permission specified in the land code. 2. Foreign businesses and individuals (as defined in the relevant buildings law) with businesses in the special economic zone are allowed to own condominiums in that area, and are exempt from the additional requirements imposed by the relevant building code.

[7] The reduction in charges for the transfer of ownership and for registering mortgages from respectively 2% and 1% of the estimated value of the property to just 0.01% for purchases of property with a value of not more than THB 3 million has been extended for 1 year to 31 December 2021.

[8] The Thailand Elite Card is intended to encourage purchases of real estate by holders of the ‘Elite Flexible One’ card. Members of this scheme need to invest at least THB 10 million in the purchase of one or more condominiums built in Thailand. These purchases need not be for an individual condominium of that value but if a member buys condominiums that are individually worth less than THB 10 million, their combined value needs to be greater than this. In addition, the condominiums need to be constructed by the same developer or company, although they can be in different locations. The scheme will run for two years from 1 January 2021 to 31 December 2022. Members of the scheme must meet the following requirements. - Buyers must be at least 20 years old. - When applying for an Elite Flexible One card, members must provide evidence that they have transferred money from abroad to invest in Thai real estate and that they have used this to purchase properties to a value of at least THB 10 million. - Members must also meet other criteria to show that they are not part of transnational criminal networks and/or involved in money- laundering in Thailand.

(Source: www.ddproperty.com)

.webp.aspx)