Executive Summary

The housing markets in the 6 major provinces1/ will continue to strengthen over 2023-2025, helped by: (i) the gradual recovery of the Thai economy; (ii) progress on the public infrastructure investment, which will then encourage an uptick in economic activity; (iii) recovery in the tourism sector, with foreign arrivals now expected to return to their pre-Covid-19 level by 2025; and (iv) government efforts to stimulate property sales by cutting fees for registering mortgages and transferring ownership (from January 1, 2023) and promoting Thailand as ‘a second home’ for high-potential foreigners. However, headwinds will also blow against the market as a result of: (i) the tightening of lending conditions in the face of persistently high household debt; (ii) the average 5-10% annual increase in the cost of new developments, a result of more expensive energy and construction materials and of higher wages (a consequence of labor shortages); and (iii) rising interest rates that are causing consumers to be more careful about taking on large long-term debts.

Krungsri Research view

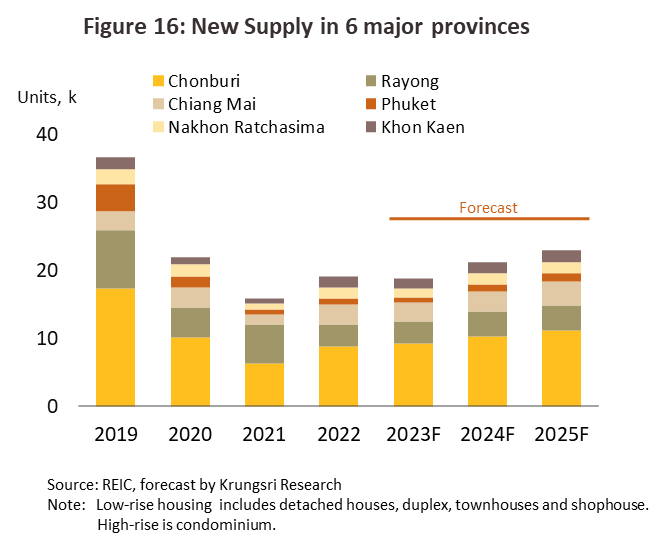

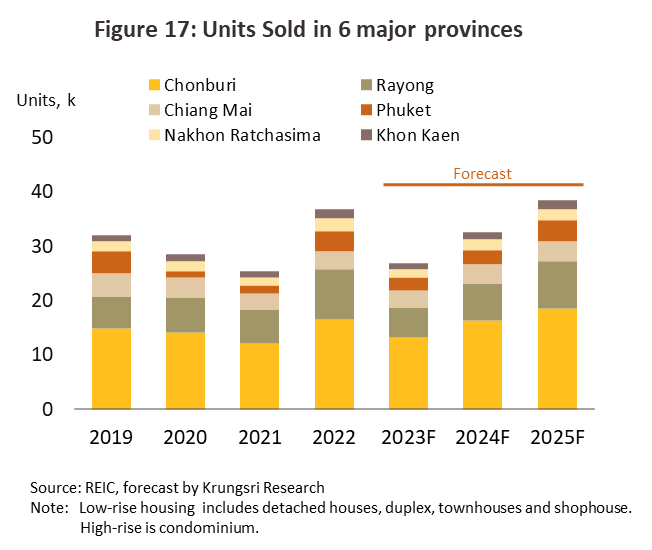

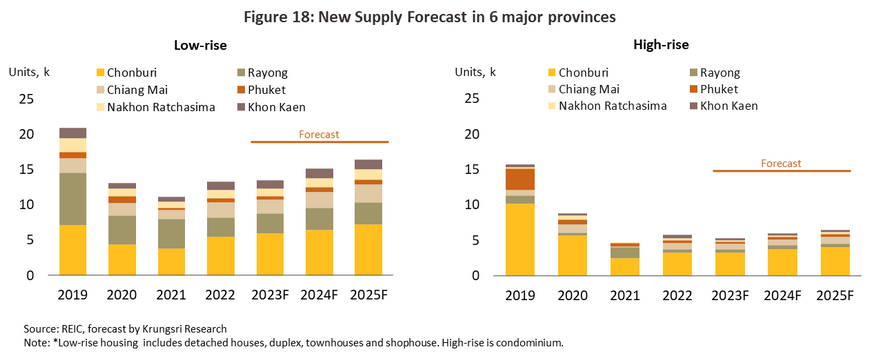

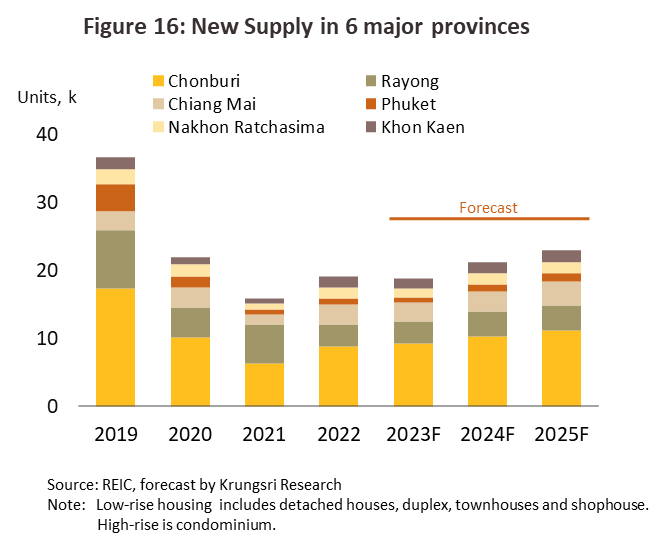

Krungsri Research believes that over 2023-2025, the new housing supply in the 6 major provinces, including both low- and high-rise housing, will expand by an average of 6.5% annually, or by 19,000-23,000 units per year. Despite this, supply growth would still run below the 36,000 new units averaged annually in 2018-2019. Sales are also expected to rise by an average of 4.0% annually to 33,000 units/year. The outlook for individual segments is described below.

-

Low-rise housing developers (in major cities): The large number of players active in the market will add to competitive pressures. Small and mid-sized operations are often local to the area and may have ready access to land banks but may face stronger threats from large listed corporations that are increasingly looking to expand into upcountry markets. These large players also have advantages relative to smaller developers due to their greater brand recognition that has some influence over buyers’ purchasing decisions. Meanwhile, there will be stronger pressure on SME from higher marketing, finance and operating costs.

-

High-rise housing developers (in major cities): SME developers are generally investors and local landowners who occupy accumulated land. These typically focus on buildings with a maximum height of 8 floors. However, this segment is now becoming congested, and competition is rising as local developers increasingly have to fight for market share with projects developed by major stock exchange-listed corporations. Moreover, demand is being affected by the global slowdown and because demand from foreign investors and tourists has not fully recovered, the number of transfer ownership made by overseas buyers remains somewhat depressed. Developers will thus need to compete more vigorously for market share, and the upshot of this is that these will need to make do with narrower profits, a situation that poses a greater danger to SMEs than it does to large players.

OVERVIEW

The real estate sector has a big role in driving the Thai economy. When combined with other related sectors and industries in its value chain, the extended real estate sector contributed around 10%2/ of Thailand’s GDP in 2022, which is significant to the national economy. A large amount of capital circulates within the economy and supports employment and income. The sector also has a large influence on the direction of related businesses such as construction, construction materials, finance, electrical appliances, furnishings and decoration.

The real estate sector generally consists of three principal segments: residential, commercial, and industrial. In Thailand, residential sector is the largest with two-thirds of the total value of the property market (source: World Bank). Developers of residential properties mainly focus on Thai customers because Thai law stipulates that non-Thais can only buy condominiums subject to a maximum of 49% of the total saleable area in any project. For detached housing and townhouses (also called rowhouses or shophouses), the ownership regulations for non-Thais are more onerous.

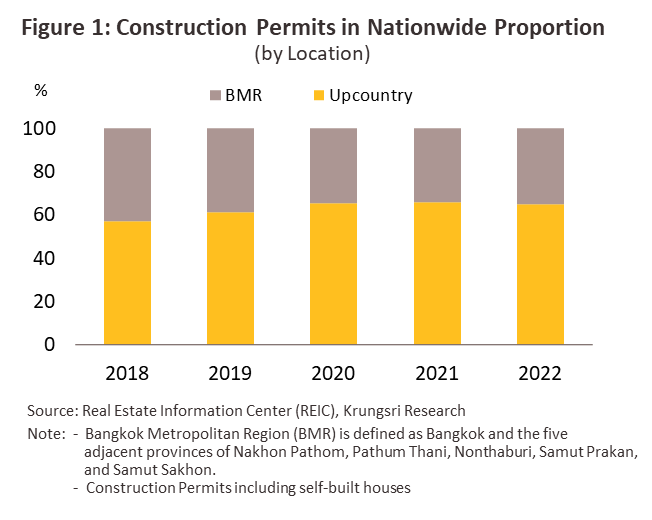

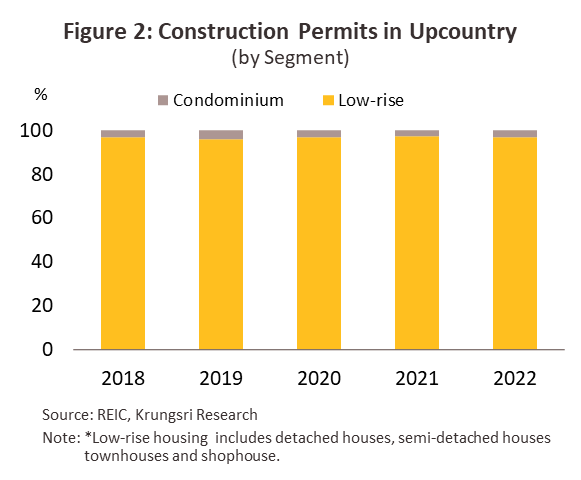

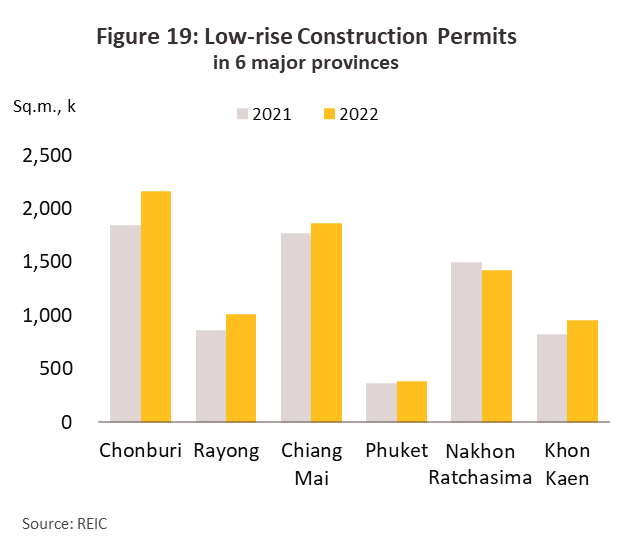

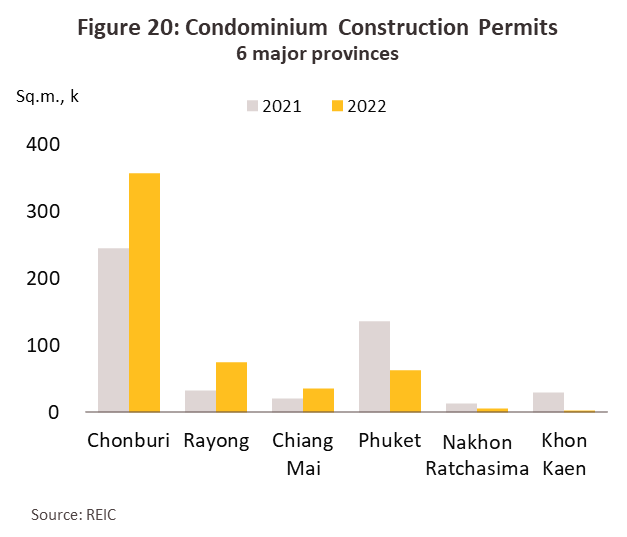

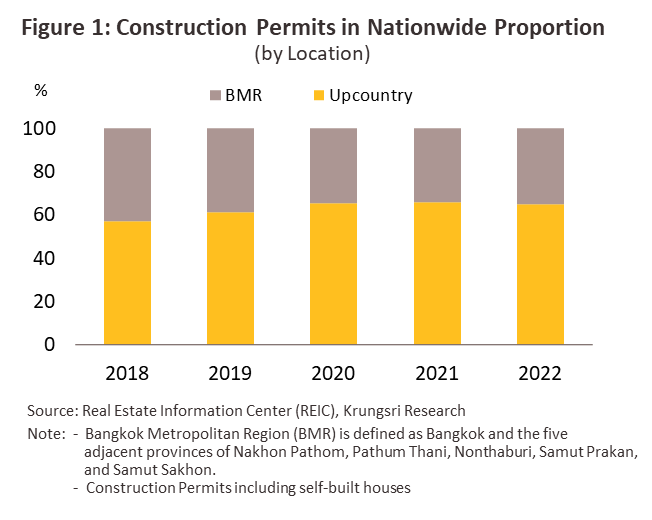

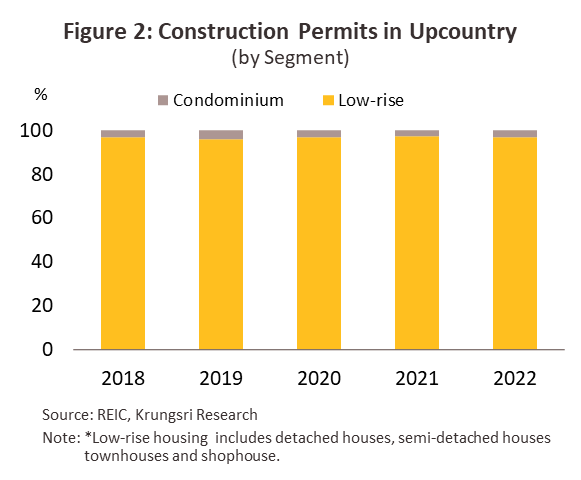

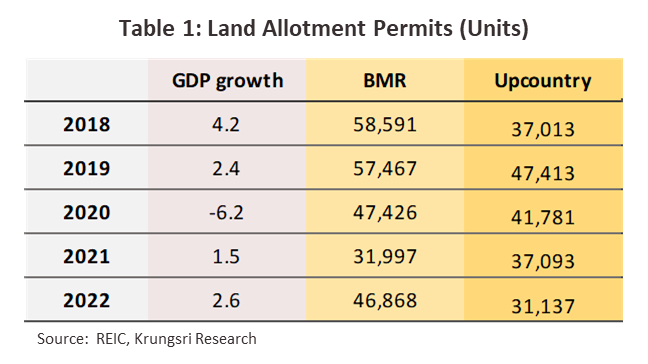

Residential project developments in the upcountry have risen from 57% of the total construction permits in 2018 to 65% in 2022. (Figure 1). Unlike in Bangkok, the majority of developments are low-rise housing3/, rather than condominiums (Figure 2). This is because of far fewer constraints on access to land for development upcountry, land there is relatively cheaper, and construction cost per square meter of low-rise buildings is significantly lower than for condominiums. Hence, housing developers upcountry tend to focus more on low-rise projects than condominiums. However, revenue growth has been limited due to volatile consumer purchasing power, which has translated into different impact on the market (Table 1).

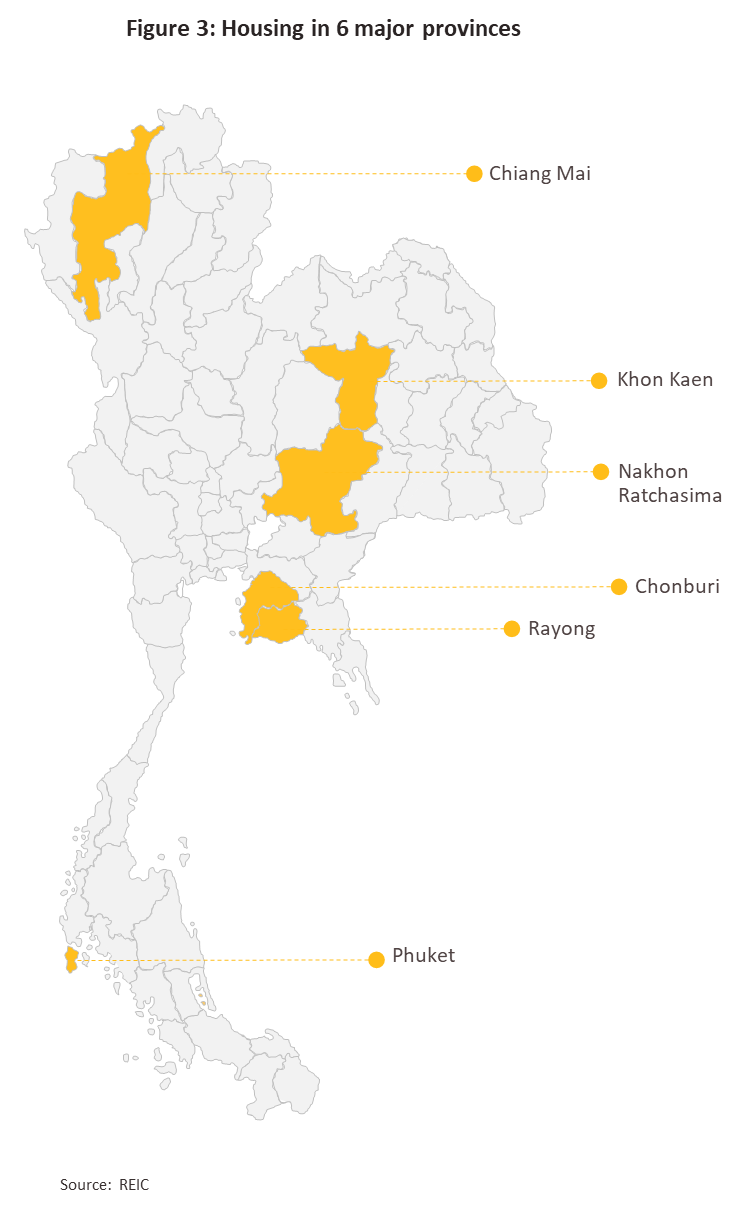

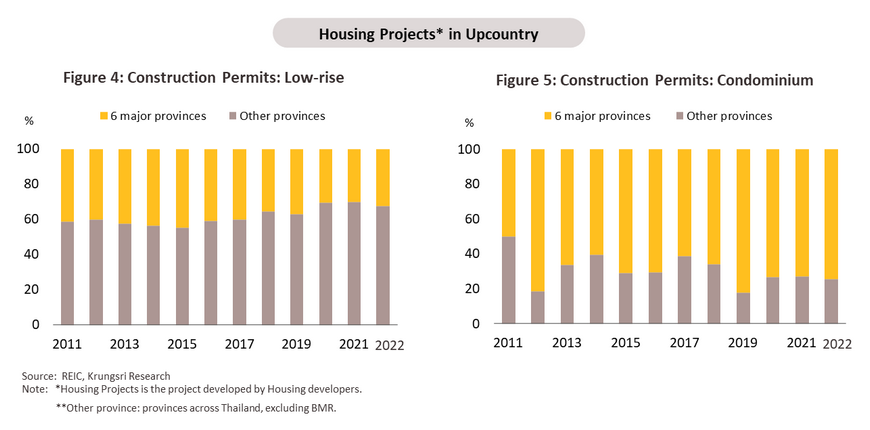

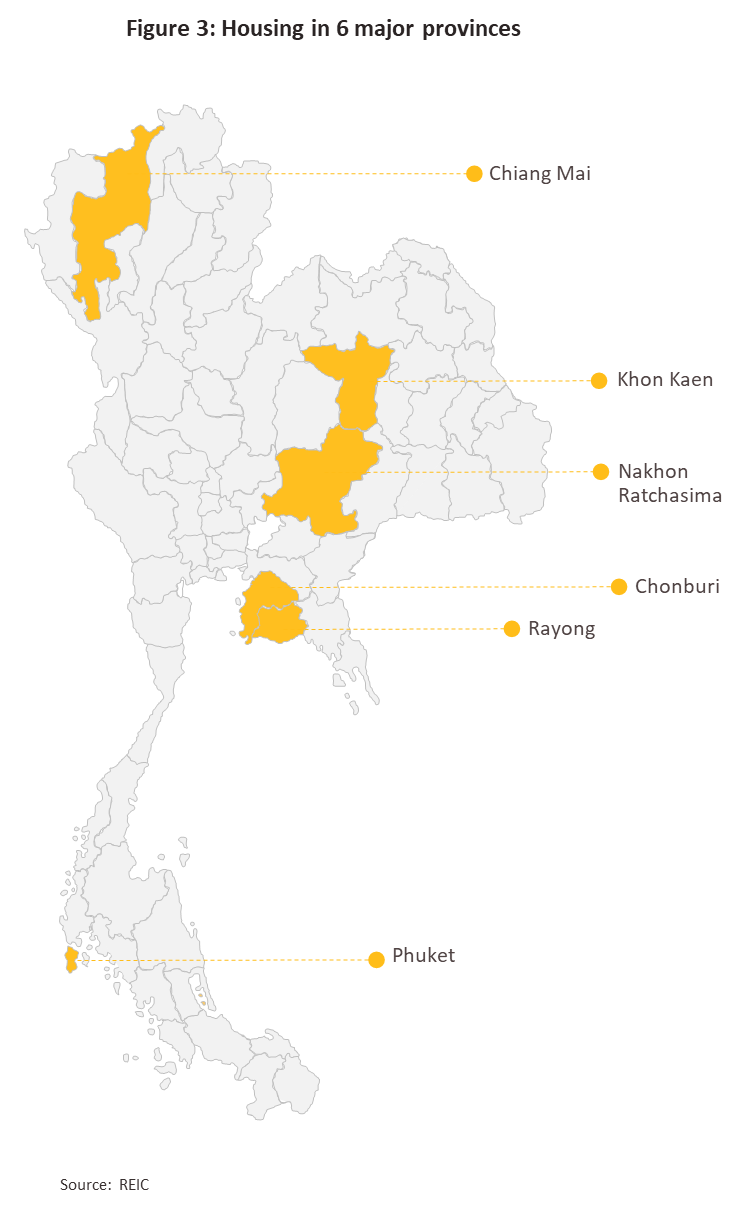

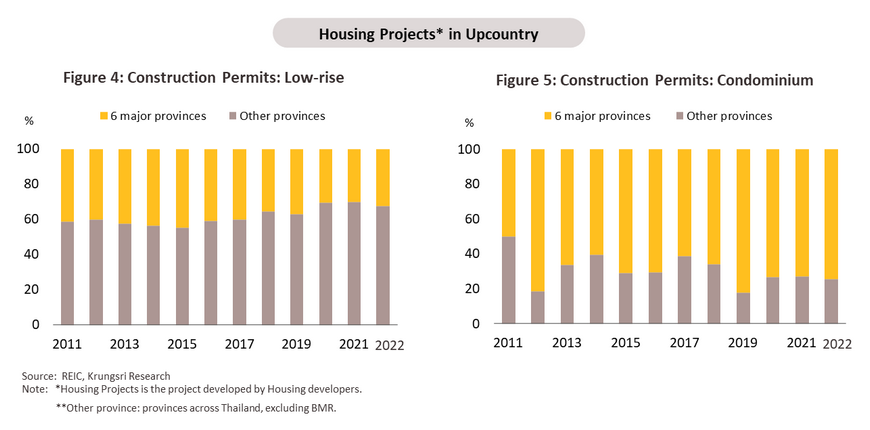

Within the upcountry segment, housing markets in the 6 major provinces of Chiang Mai, Chonburi, Rayong, Nakhon Ratchasima, Khon Kaen, and Phuket have increased in importance, and as of 2022, projects in these provinces accounted for 22% of nationwide construction permits and 34% of upcountry construction permits (low-rise 32% of upcountry permits for this segment; high-rise 75% of upcountry permits for this segment). (Figures 4 and 5). This is because these provinces have strong potential as the regional centers for economy, industry, trade, investment, tourism, and education. It is also driven by government policy that has sought to broaden the geographical spread of economic growth, for example, through the implementation of the infrastructure development plan, entry to the ASEAN Economic Community, and the development of the Eastern Economic Corridor (EEC). These have helped to increase employment, encourage the internal relocation of the population, and boost the growth of urban centers. This has increased population density in some areas (from internal migration for education and work, and external immigration for employment purpose). Therefore, income per capita in such areas, especially Rayong and Chonburi is relatively high. This has, in turn, led to more intense development of commercial and residential properties, and thanks to relatively cheaper land in the provinces, low-rise housing is popular.

There is stronger demand for high-rise housing (i.e., condominium) in provinces that are heavily dependent on tourism – Chonburi, Chiang Mai, and Phuket – where foreigners would buy investment properties or a holiday- or second-homes. In 2022, 29% of foreign arrivals visited one or more of these three provinces, and receipts from foreign tourists in these areas accounted for 48% of revenue from overseas tourists. There is also rising demand from Thais triggered by the widespread and severe flooding in Bangkok and the central region in late 2011. Upcountry markets have also been buoyed by the saturated and competitive housing market in the Bangkok Metropolitan Region and rising prices for development land. In response, large developers based in the regions have been increasingly developing projects that include condominiums in the major provinces, especially in Chiang Mai, Chonburi, Rayong, and Khon Kaen. This caused a spike in the developments in 2012-2013 with a new record for the number of construction permits for condominiums.

The housing markets in the 6 major provinces have not been heavily developed, suggesting ample room for growth. But sources of demand vary among the provinces. (i) Chiang Mai: Buyers are generally Thai nationals, while the foreign market is dominated by Chinese investors who tend to buy condominiums to offer tourist accommodation to other Chinese travelers. (ii) Phuket: Buyers from China and Hong Kong dominate here, often purchasing entire floors of new developments or whole buildings in multi-building projects. Investors from Singapore and Russia are also active in the area. (iii) Chonburi: The main buyers here are Chinese and European investors. (iv) Rayong: the market is tilted towards Thai buyers, most of whom work in nearby industrial estates. Detached-houses are generally owned by high-income earners, whereas townhouses and condominiums are more often owned by operation-level staff. Housing markets in both Chonburi and Rayong are benefiting from the EEC and government investment in transportation infrastructure in the area, for example, the high-speed rail link and upgrades to U-Taphao Airport. This is encouraging property developers to step up investments in these locations. (v) Nakhon Ratchasima: Buyers of low-rise housing projects are concentrated in the municipal districts and most buyers are generally locals. However, they may buy condominiums for their own use (long-term residency for education or for employment) or for investment (as rental properties). In Pak Chong District, the market is skewed towards high-end buyers who are seeking a holiday or retirement home. (vi) Khon Kaen: Buyers are typically salaried locals, mostly civil servants, and the self-employed or business owners.

SITUATION

Housing markets in the 6 major provinces were severely depressed during the peak of the pandemic (2020-2021). The sharp economic slowdown especially the collapse in the tourism industry had profound impacts on income and employment. Faced with a combination of extreme uncertainty over the future and difficulties traveling to complete business transactions, Thai and overseas buyers tended to delay purchasing decisions, or to put off or cancel transfers of ownership. Developers also slowed work on new projects and cut prices to help increase sales in a sluggish market. However, buyers in the mid- to upper-income segments were less affected by the economic slowdown, so the market for low-rise developments managed to maintain growth through this period.

Housing markets began to rebound in 2022 with the economic recovery helped by the widespread rollout of COVID-19 vaccines, which supported economic activity to return to normal, as well as by high farmgate prices. As the economy returned to growth, consumer purchasing power strengthened, though the extent of this was somewhat limited. The reopening of the country also helped to pull in additional buying power from overseas investors and from foreigners coming to work in Thailand (in 2022, foreign arrivals totaled 11.15 million, a leap of 2,507% from their level in 2021). The market was further helped by ongoing government stimulus packages that have included: cuts to the fees reduction for transferring ownership and registering mortgages for properties valued at less than THB 3 million (January 18-December 31, 2022), the deferral of the new land value appraisals (2021-2024)4/ and leaving charges made under the land and building tax unchanged over 2020 and 2021, as well as temporarily relaxing the rules on loan-to-value ratios5/ (October 20, 2021- December 31, 2022). Thanks to the combined impact of these measures, demand revived among both investors and the real demand group, though this was restrained by the sharp run-up in energy prices (global crude prices surged 42% from their 2021 level), which then fed into much stronger inflation and weaker purchasing power. Prices for goods and services thus rapidly rose across a broad front, and because the costs of construction materials and transport also increased, house prices climbed by 5-10% from a year earlier. Alongside this, commercial banks raised their interest rates, adding to the cost of financing.

Property developers, and in particular larger players, have adapted to a changing business environment by increasingly shifting their attention to upcountry markets and to areas such as the EEC. Developers are also responding to greater demand for “hybrid workplaces”, which have become more popular post-COVID. This has thus added to demand for low-rise units or vacation homes that can be used for combined residency and work.

Overall, the situation of housing markets in the 6 major provinces in 2022 was as follows:

-

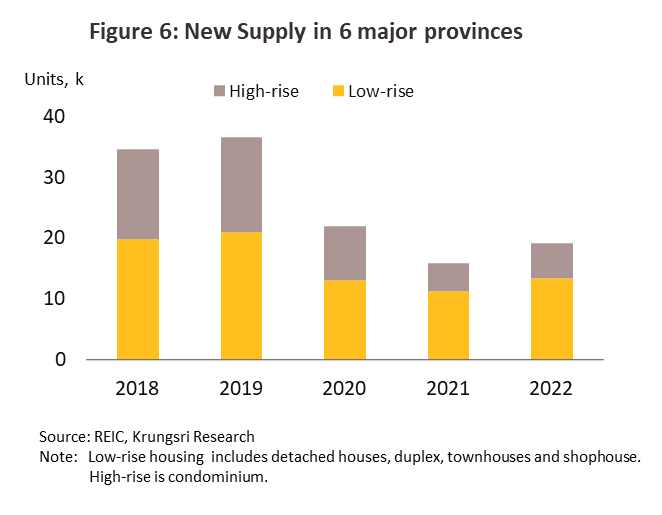

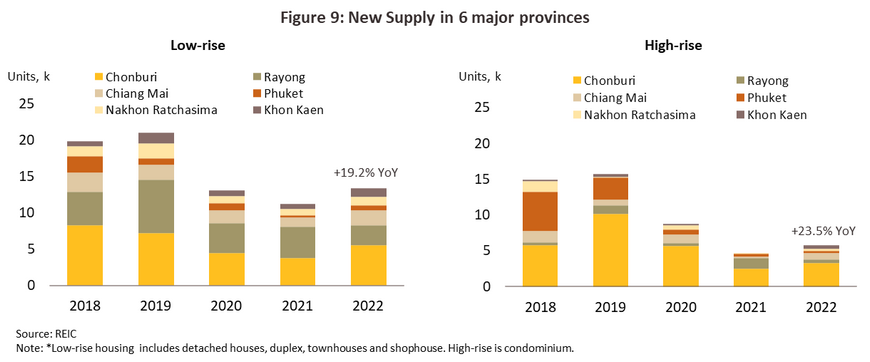

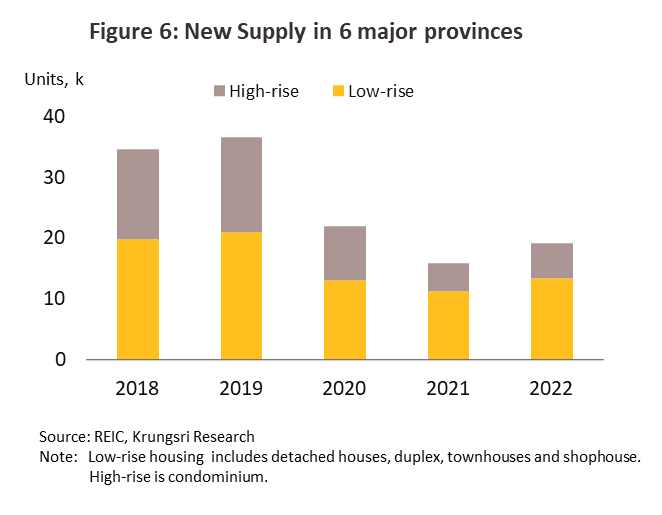

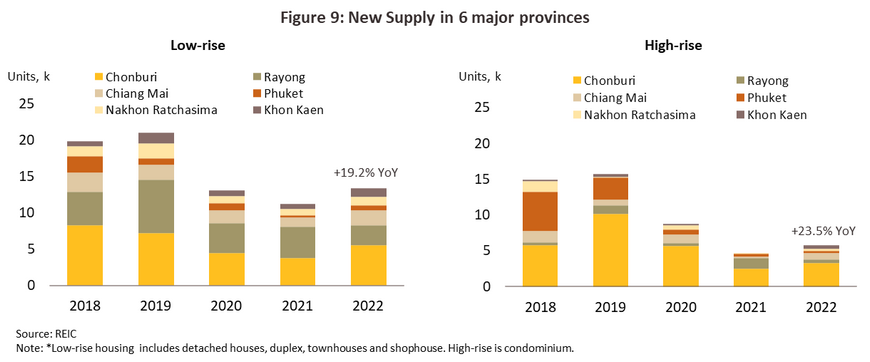

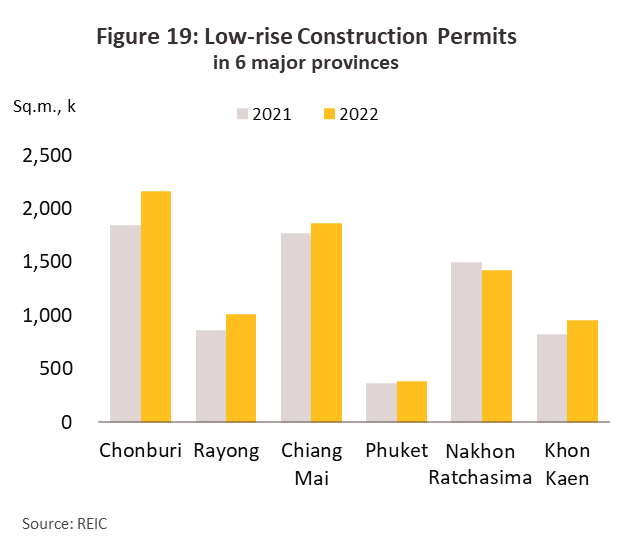

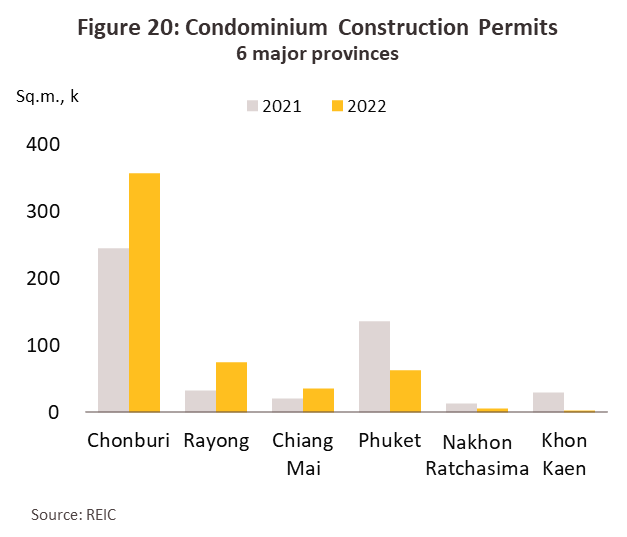

The supply of new housing units jumped 20.5% YoY to 19,106 units (Figure 6). Developers looked to generate income and worked through their backlog of projects following the slowdown in the past 2 years. Almost 70% of units (13,334 units) were in low-rise housing, for which supply increased 19.2% YoY, and the majority of this was in Chonburi, Rayong, and Chiang Mai. The remaining 30% (5,772 units) was condominiums, whose supply rose 23.5% YoY (Figure 9), most of which were in Chonburi and Chiang Mai.

-

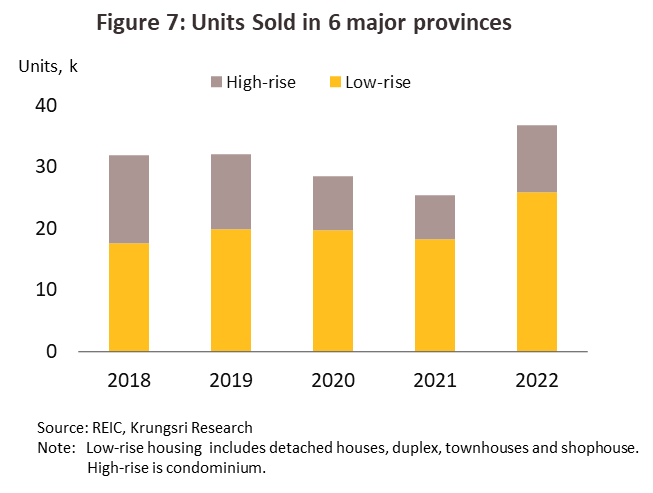

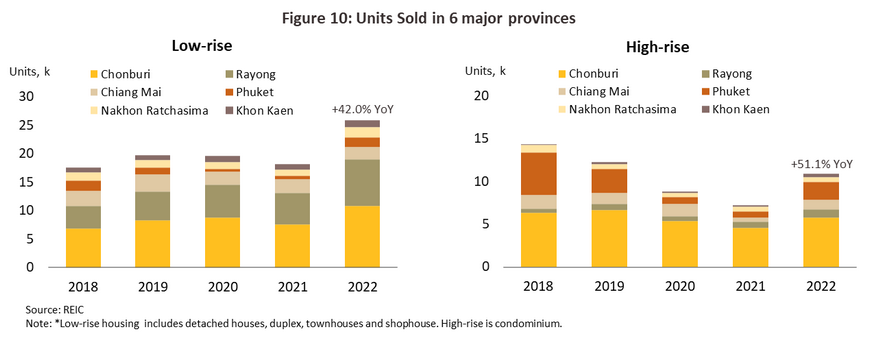

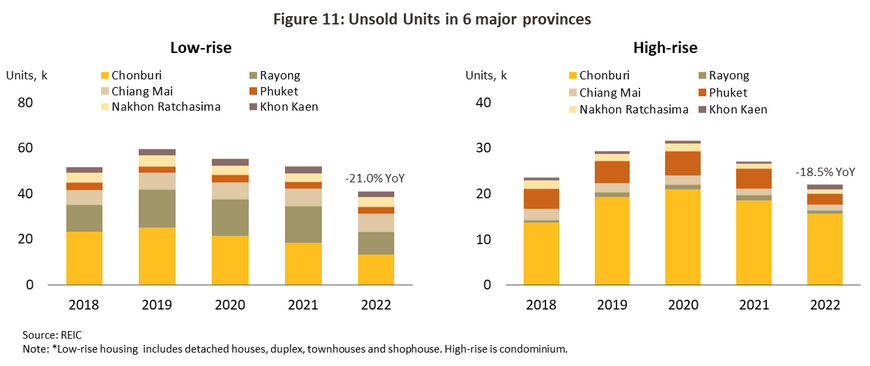

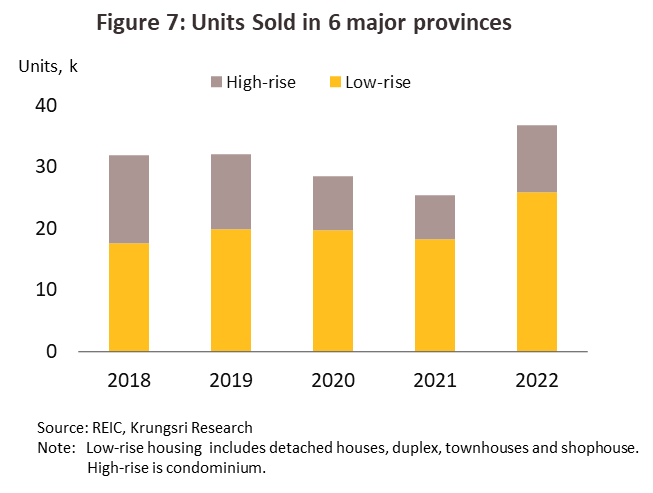

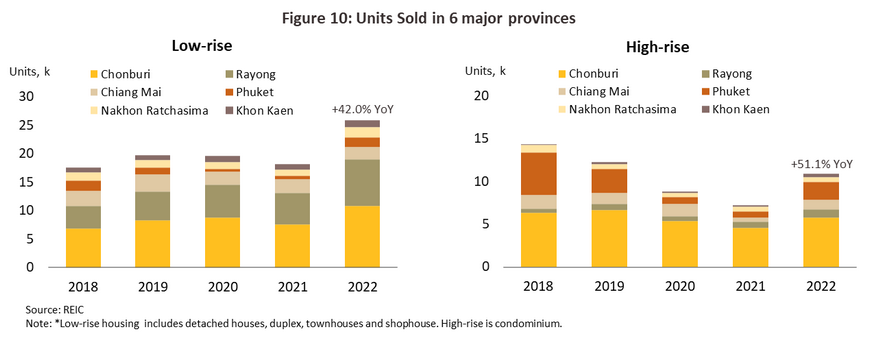

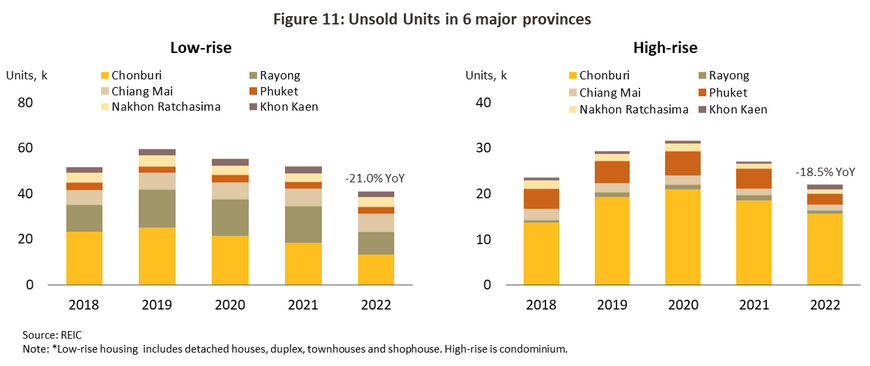

Total property sales substantially increased by 44.6% YoY to 36,776 units (Figure 7), with purchases of low-rise housing increasing 42.0% YoY to 25,887 units (Figure 10), surpassing their pre-COVID-19 level. Sales of low-rise units were concentrated in Chonburi, Rayong, and Chiang Mai, and buyers typically placed a greater emphasis on interior usable space that would allow them to work from home. Sales of condominiums increased even more rapidly, jumping 51.1% YoY to a 3-year high of 10,889 units. Sales were strongest in Chonburi, Phuket, and Chiang Mai, partly as a result of government efforts to stimulate demand from overseas buyers. These measures included the introduction of the Thailand Elite Card6/, which allows non-Thais to buy condominiums valued at least THB 10 million, and the issuing of long-term residency visas7/ to high-potential visitors, both of which have benefited from the positive publicity generated by Thailand’s handling of the COVID-19 pandemic. Nevertheless, sales of condominiums remained lower than their pre-COVID (2018-2019) average of 13,000 units/year, though purchases outpaced new supply. As such, the cumulative total of unsold units at yearend 2022 dropped -20.1% YoY to 63,072 units. Of this total, 41,012 were low-rise properties (-21.0% YoY). These were concentrated in Chonburi (32.3% of all unsold low-rise units in the 6 major provinces), Rayong (24.8% of the total), and Chiang Mai (18.9%). 22,060 condominiums remained unsold (down -18.5% YoY), with these overwhelmingly located in Chonburi (70.9% of all unsold condominiums in the 6 major provinces), which was followed in importance by Phuket (11.4%) (Figure 11).

-

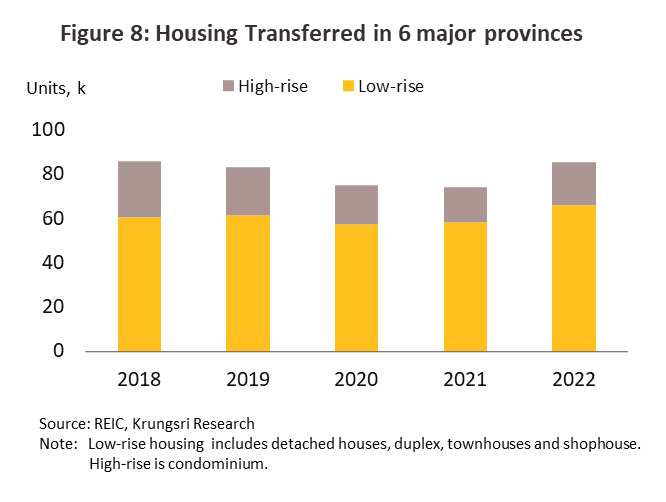

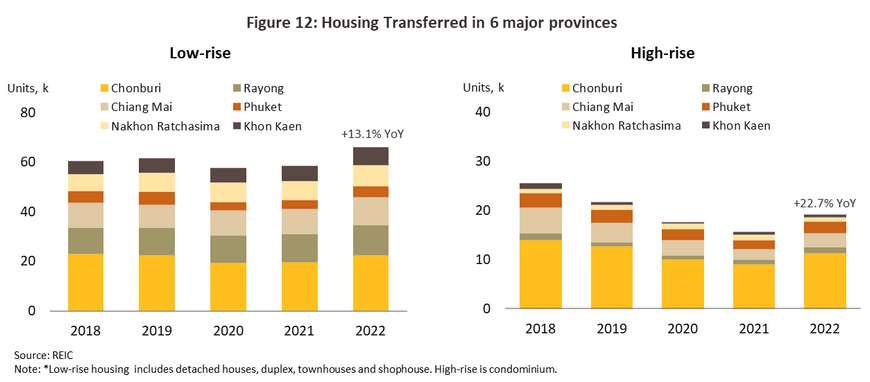

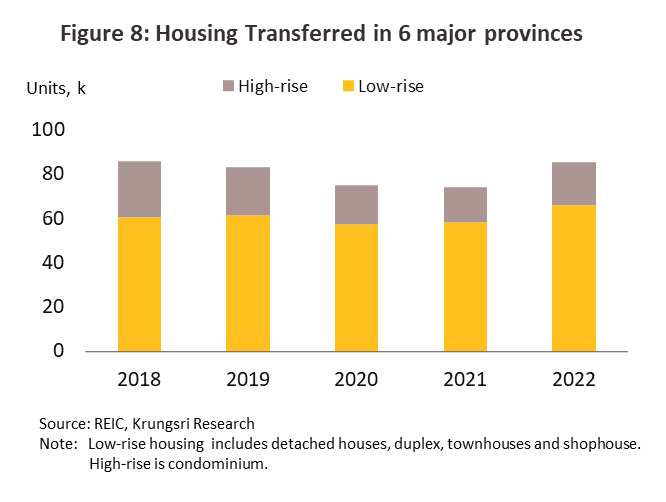

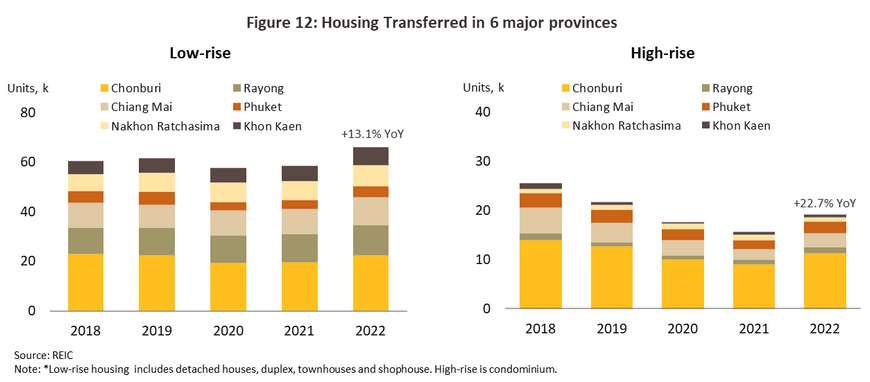

In 2022, transfers of house ownership rose 15.1% YoY to 85,268 units (Figure 12). For low-rise segment, transfers increased 13.1% YoY to 66,130 units (80% of all transfers, split between 42% detached houses, 22% townhouses, 8% semi-detached houses, and 8% other properties), and demand was generally domestic and generated from ‘real demand’, that is, it originated from owner-occupiers. Transfers of condominiums also rose 22.7% YoY to 19,138 units (20% of the total), and in Chonburi and Rayong, this was enough to bring the number of transfers back to close to the pre-COVID total. However, in Nakhon Ratchasima, the number of ownership transfers slumped -23.0% YoY due to the high number of transfers made in 2020 and 2021.

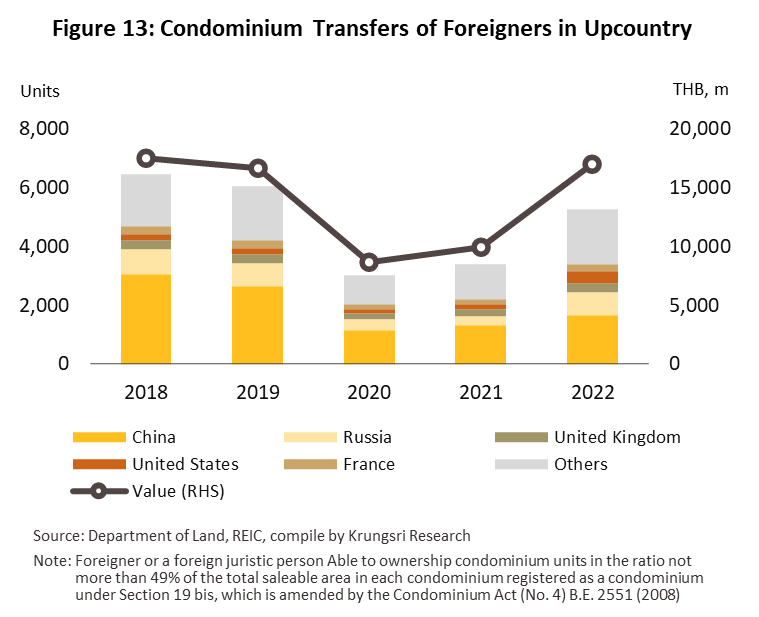

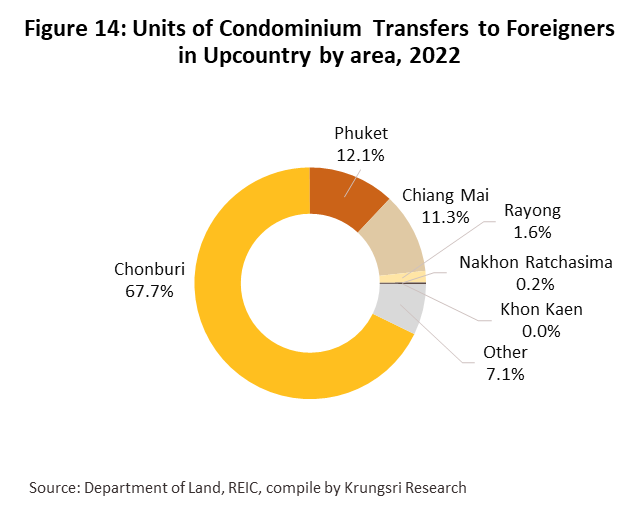

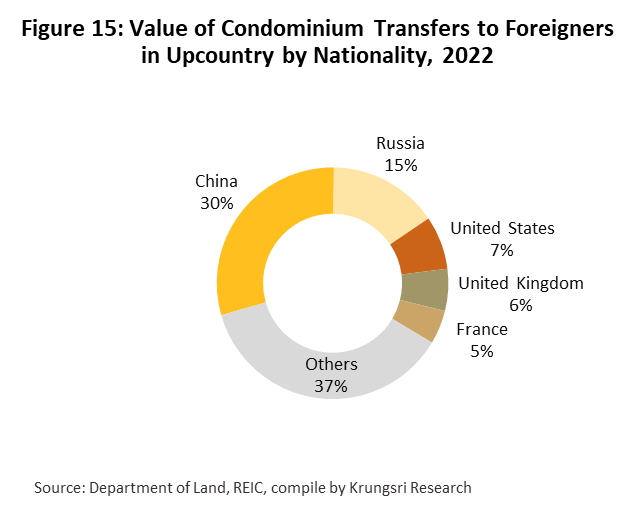

- Transfers of ownership of condominiums in the 6 major provinces by overseas owners climbed 55.6% YoY to 4,897 units, which represented 93% of all the 5,270 units such transfers made upcountry (Figure 13). These were most common in the major tourist areas of Chonburi (67.7% of the total), Phuket (12.1%), and Chiang Mai (11.3%) (Figure 14). Thanks to the high average value of the units, the total value of these transfers came to THB 15 billion, up 74.2% from 2021, and this then brought the total back to close to the THB 16 billion annual average maintained in 2018 and 2019 (Figure 15). Accounting for almost a third of the total, Chinese buyers were by far the largest single group. These were followed in importance by Russians (15.2%) and Americans (7.4%).

OUTLOOK

Housing markets in the 6 major provinces will strengthen steadily over 2023-2025, and thanks to their status as tourism, industrial, and regional centers, markets in the 6 major provinces should develop faster than those in other parts of the country. Markets will also strengthen on rising consumer purchasing power, which will build in the coming period thanks to the following factors.

1) The Thai economy is forecast to grow by around 3.0-4.0% annually, and growth will be helped further by government plans for continuing investment in infrastructure (e.g., in the high-speed rail link connecting Bangkok’s three airports). Thailand is also a favored site for international businesses looking to expand overseas production facilities, and these factors will all help to maintain demand for new residential accommodation, especially in the EEC (i.e., Chonburi and Rayong).

2) Foreign arrivals are expected to return to their pre-COVID-19 level by 2025 (in 2019, Thailand welcomed 40 million visitors) and this will help to add to demand for properties in the major tourist centers of Chonburi, Phuket, and Chiang Mai as domestic and foreign investors look for stronger returns from Thai real estate. (Anjuke, a large Chinese real estate website, reports that investing in property in Thailand generates returns of 5-10%, c ompared to just 2% for investments made in China).

3) Among wealthier Thais and overseas buyers, demand will stay strong for second homes that are able to function as hybrid workplaces.

4) Competition for sites in markets in Bangkok and the surrounding areas is intense, and land prices there continue to rise.

5) Government policy is helping to stimulate demand through, e.g., cutting fees for transferring title deeds and registering mortgages (from January 1, 2023) and encouraging high-potential overseas buyers (especially retirees) to acquire second homes in Thailand, either through freehold or leasehold purchases, or to invest in properties in the country.

Nevertheless, growth in the market will be constrained by: (i) persistently high levels of household debt, which is encouraging financial institutions to tighten lending conditions; (ii) an increase in new house prices of 5-10% annually that is being driven by the higher cost of energy and of construction materials, as well as by labor shortages that have then pushed up wages; (iii) the reintroduction of the Bank of Thailand’s LTV rules8/, which had been relaxed during the COVID-19 pandemic and which are now acting as a brake on the market, especially for investors in condominiums; and (iv) the current cycle of interest rate hikes, amplifying the debt service burden for borrowers.

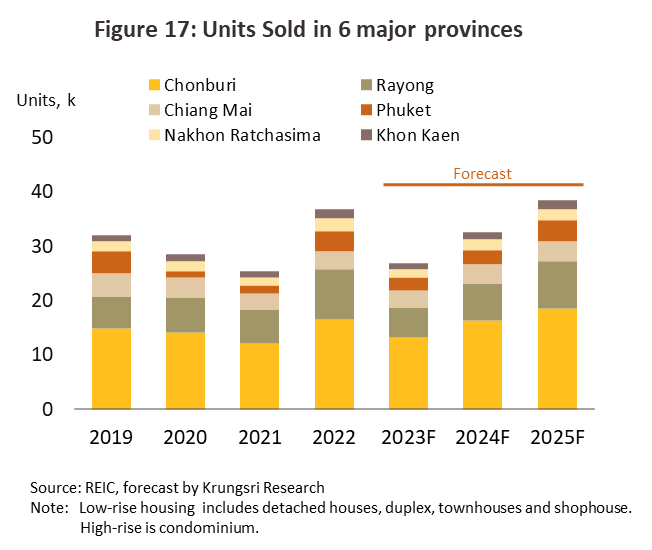

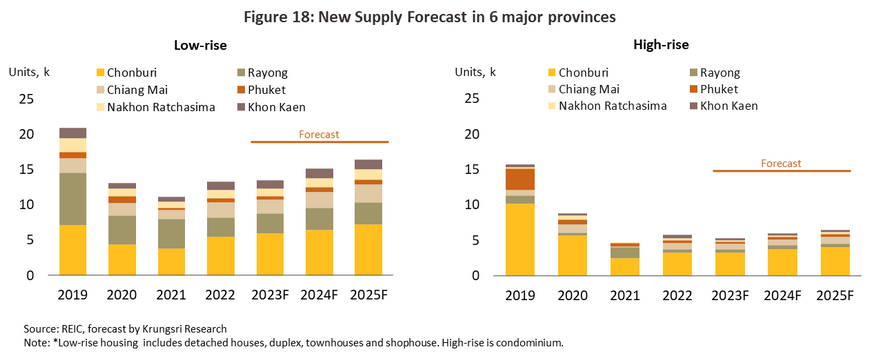

Krungsri Research believes that over 2023-2025 and including both low- and high-rise housing, the new housing supply in the 6 major provinces will expand by an average of 6.5% annually, or by 19,000-23,000 units per year (Figure 16), though despite this, supply growth would still run below the 36,000 new units averaged annually in 2018-2019. Sales are also expected to rise by an average of 4.0% annually to 33,000 units/year (Figure 17). The outlook for individual segments is described below.

-

Low-rise housing: The supply of new units is forecast to expand at an average rate of 7.3% annually (Figure 18). Demand will be driven by owner-occupiers (i.e., by real demand) and buyers looking to purchase a second home. Those working from home and also using their property for long-term residency will be interested in the total usable space and its functional uses. Most buyers will be at the mid to upper end of the market, and with sales of detached and semi-detached houses sustained by these wealthier individuals, this segment will support stronger rates of growth than other parts of the market.

-

High-rise housing (condominiums): Given the significant supply glut and the anticipated only-slow recovery in consumer purchasing power, the market will take some time to recover. Nevertheless, condominiums remain in demand from investors and overseas buyers, who still see investing in these 6 major provinces as providing both good returns and value for money. This is especially so for the branded residences that are bought by wealthy Thais and foreigners (e.g., from Singapore and Hong Kong) looking to acquire properties for long-term investment or occupation, and this will underpin increasing demand. The number of new projects should therefore expand by an average of 4.5% annually (Figure 18), with growth particularly strong in major tourist centers (e.g., Phuket) and the EEC, where demand will come from investors moving to the area.

The situation for the 6 major provinces is given below.

-

Chonburi: The housing market has potential for strong growth since the province is part of the EEC, one of Thailand’s most important industrial areas, and it continues to benefit from ongoing government investment in the region’s infrastructure. This includes the Pattaya-Map Ta Phut motorway, the Bangkok-Rayong highspeed railway, the highspeed rail link connecting the area’s three airports (U-Tapao, Suvarnabhumi and Don Muang) and phase 3 of the development of the Laem Chabang deep seaport. Chonburi is in addition one of Thailand’s premier tourist destinations. Domestic and international property developers are therefore looking to work on projects that will meet demand from wealthier buyers who are looking for properties to live in, who have moved into the area for work (e.g., foreign experts, especially those from Japan) or who are buying second homes, or from investors in the buy-to-let market. New supply is expected to grow by an average of 8.4% per year, with annual sales of new units expanding at the lower rate of 5.6%.

-

Rayong: The housing market will continue to strengthen due to the province’s status as home to a major concentration of industry hence a source of employment, and an important center of tourist activity. The local economy has expanded strongly in recent decades, maintaining an average Gross Provincial Product (GPP) growth of 7.7% during 2004-2019, the second fastest growth in the country (Chonburi was in the top spot). Moreover, the province is in first place nationally in terms of GPP per capita. With such a strong local economic base, developers are confident that their projects will be well placed to meet demand from wealthier Thai and foreign buyers who are moving to the area in greater numbers. To better meet demand from owner-occupiers and because land prices have not risen as fast as in Chonburi, new projects will tend to take the form of low-rise developments. The overall increase in supply is predicted to run to an average of 5.1% per year, against growth of 4.2% in sales of new properties.

-

Chiang Mai: Both low-rise and high-rise segments will continue to grow thanks to Chiang Mai’s position as an important tourist destination for both Thais and non-Thais. The former will tend to buy properties in Chiang Mai as investments, while both Thais and foreigners (predominately from Europe and Asia, including China, South Korea, and Japan) will also buy second homes there. The supply of new properties is predicted to grow by an annual average of 6.1%, with sales expanding by 2.9% per year.

-

Phuket: The housing markets can look forward to healthy rates of growth in Phuket. The province benefits from being an important travel destination and from ongoing government spending on local infrastructure. The latter has included phase 3 of the expansion of Phuket Airport, which will allow the site to handle 25 million travelers annually, the LRT light railway connecting the airport and the city, the development of ‘Phuket Smart City, which would make it Thailand’s first smart city, and the establishment of the area as a center of health tourism. As a result, developers, including mainstays of the industry such as Sansiri and Origin Property, are increasingly investing in the area as they try to meet rising demand for properties, especially from overseas (e.g., Russian and Chinese) buyers looking for second homes. Going forward, supply should therefore expand at an average rate of 8.2% per year, while sales growth should run to 5.8%.

-

Nakhon Ratchasima: The local property market is supported by the province’s status as a regional center that has also been the beneficiary of infrastructure development, including the construction of the local motorway and the highspeed rail link. Demand for property is mostly local (80%), with 20% of the market coming from Bangkok buyers (source: Real Estate Association, Nakhon Ratchasima Province). Demand has been boosted by the trend to “work from anywhere” and by increased sales of holiday homes, especially around Khao Yai, a favorite of buyers from Bangkok looking for a second home. In addition, the area is host to several industrial estates (the Suranaree Industrial Zone and Navanakorn Korat Industrial Zone) that provide jobs for many local people and that add to demand for properties to buy and to rent. Through the coming period, the number of new properties coming to market is expected to grow by 4.7%, while sales of new units should increase by an average of 2.7% per year.

-

Khon Kaen: Demand for property in Khon Kaen is lifted by the presence of the International Convention and Exhibition Center and the Khon Kaen University Hospital, the development of local transport systems (the highspeed Thai-China railway and the Bangkok-Nong Khai twin-track railway (phase 2 from Khon Kaen to Nong Khai)), and the large number of well-regarded schools and universities in the area. In terms of the number of housing developments, Khon Kaen is thus in second place in the Northeast of the country, after Nakhon Ratchasima. To meet real demand from wealthier owner-occupiers, especially medical professionals and business owners, most developments are of low-rise properties, while condominiums tend to be embedded in communities where demand is strongest from nearby universities and hospitals, as well as from nonlocal workers. New supply should grow by an average of 2.3% annually in the coming period, with sales growth close behind at 2.0%.

Bangkok-based developers, especially larger players, will tend to expand their investments in the main provincial centers, tourist provinces, and industrial areas as competition intensifies in the Greater Bangkok region (the latter is reflected in the 40% increase in land prices between 2019 and 2022). Low-rise developments are expected to increase in number as companies react to rising demand, including that coming from non-Thais working in or retiring to Thailand. The types of properties on offer will also multiply and so developers will work on projects that respond to global megatrends related to ‘well-living’, while luxury properties will increasingly feature in the marketing mix as supply echoes the rising importance given to quality-of-life issues in the purchasing decisions of upper-end Thai and foreign buyers. Alongside this, developers will partner with businesses such as hospitals or well-known hotel chains to offer ‘branded residences’. These are becoming popular in the Phuket market, partly because buyers typically view these as grade-A assets whose value will appreciate. Other new segments will include mixed product developments, which include detached homes and townhouses in the same development, and smart homes that come equipped with modern smart appliances. These are linked and controlled through smartphones and may be used to manage home utilities or safety features (e.g., water, electricity, and internet connections).

Challenges facing developers in the near future will include (i) the slow recovery in the economy and the only patchy rebound in purchasing power, which may drag on demand, especially at the mid to lower end of the market; and (ii) as a result of the global slowdown and the continuation of the war in Ukraine, marketing to overseas buyers is problematic and so the strength of demand remains uncertain.

1/ Residential property in the 6 major provinces of Chiang Mai, Chonburi, Khon Kaen, Nakhon Ratchasima, Phuket and Rayong.

2/ From Ministry of Finance

3/ Low-rise housing, i.e., detached houses, semi-detached houses, and townhouses.

4/ The Treasury Department announced that it would be postponing the use of new land value appraisals for 1 year, and so for 2022, it continued to use the values set for 2016-2019. The new appraisal values have been in use from 1 January 2023 onwards.

5/ This specified that home loans could be for a maximum of 100% (the LTV ratio) of the value of the collateral against which they were secured (i.e., buyers could borrow the full value of their purchase). This was extended to include other types of loan when these were secured against residential property, or so-called top-up loans, and applied when: (i) the collateral was valued at less than THB 10 million when this was for a second home, and (ii) the collateral was worth THB 10 million or more when this was for a first home. The relaxation of the LTV rules applied to loans agreed between 20 October 2021, and 31 December 2022.

6/ The Thailand Elite Card was intended to encourage purchases of real estate by holders of the ‘Elite Flexible One’ card. Members of this scheme needed to invest at least THB 10 million in the purchase of one or more condominiums built in Thailand. These purchases did not need to have been for an individual condominium of that value but if a member bought condominiums that were individually worth less than THB 10 million, their combined value needed to be greater than this. In addition, the condominiums needed to be constructed by the same developer or company, although they could have been in different locations. The scheme ran for two years from January 1, 2021, to December 31, 2022.

7/ As of 1 September 2022, a new 10-year long-term residency (LTR) visa has been created to attract four classes of high-potential foreign residents to Thailand: high-net worth individuals, retirees, expat employees, and experts.

.webp.aspx)