EXECUTIVE SUMMARY

The market for office rentals will strengthen over 2023 to 2025 on the ending of the Covid-19 pandemic and recovery in the economy, encouraging businesses to take on new hires. This in turn feeding stronger demand for office for at least 0.85 million sq.m., of which is expected to come to market over the next three years. However, because growth in hybrid working patterns[1] is pulling against demand, the occupancy rate is expected to slip to a 16-year low. Despite this, the continuing strength of demand for new office building space in the CBD and for Grade-A office building in non-CBD will mean that average rental rates for these will remain flat or edge up slightly and expected to remain unchanged or fall for office building elsewhere.

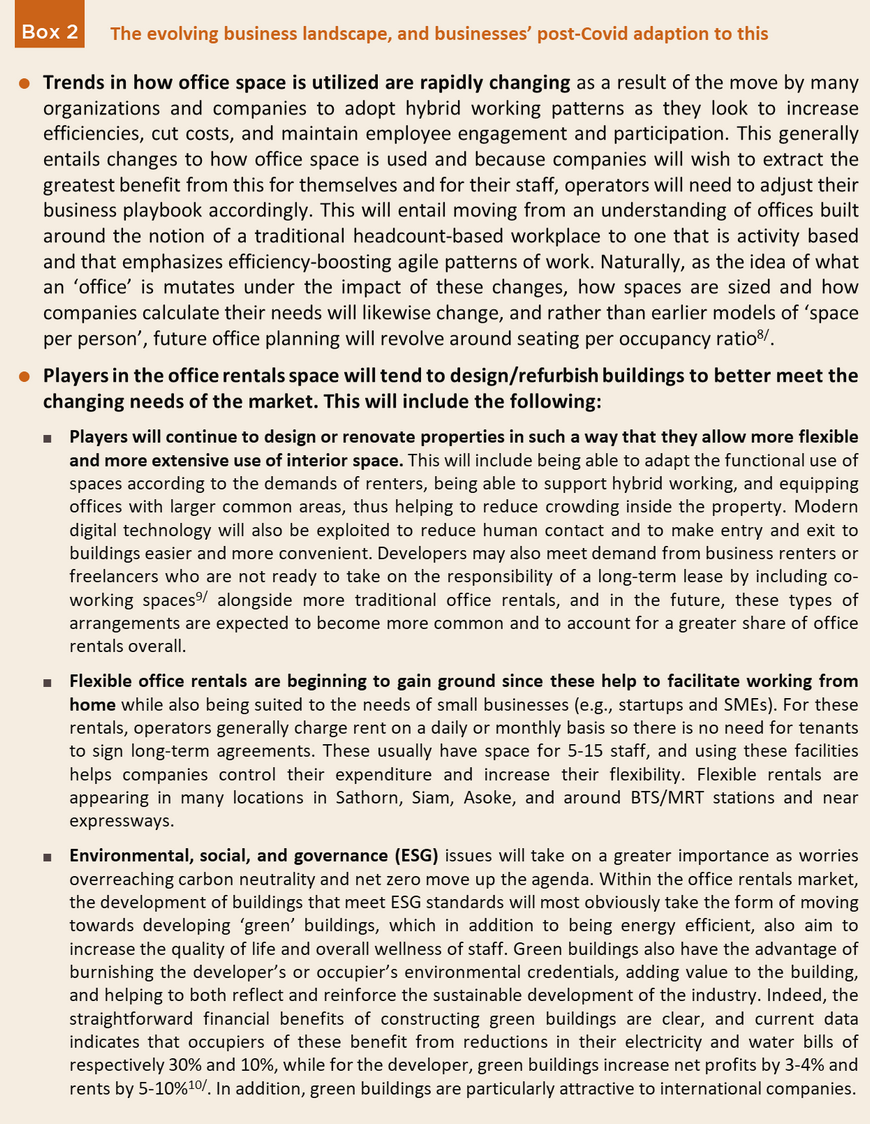

Challenges that will have to be surmounted in the coming period will include the following. (i) As they transition to a post-Covid work environment, many companies are switching to hybrid working arrangements, but this can impose more difficult requirements on how properties are managed since usage patterns may change over the course of a single day. (ii) Competition will tend to intensify on developers’ plans to increase investment in new office projects by 130% over 2023-2025, while on the demand side of the market, growth will be only gradual, and this will place a cap on how far rents can be raised. (iii) Demand for certified green (or eco-friendly) buildings will rise from renters looking to strengthen their environmental credentials, though this is likely to be especially the case for foreign companies.

Krungsri Research view

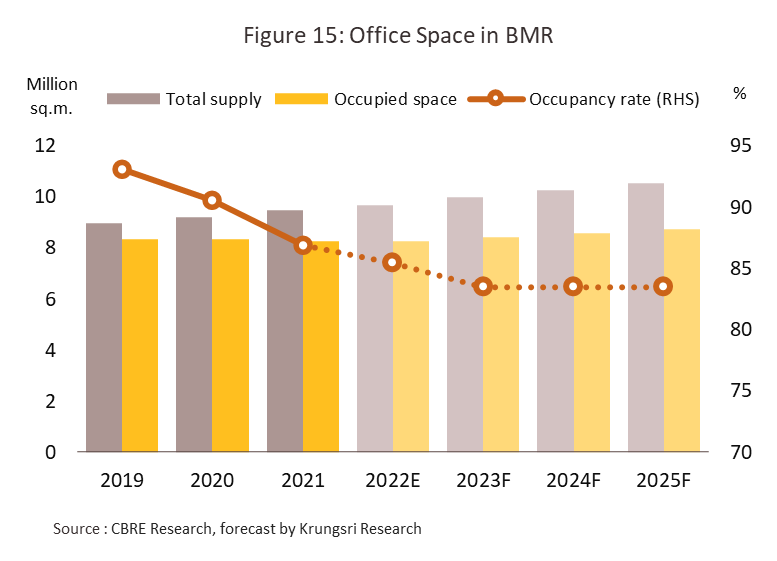

Demand for office rentals will strengthen steadily over 2023 to 2025 with recovery in the economy, and as companies take on more staff, their need for office space will rise accordingly. However, partly thanks to the persistence of hybrid working patterns, demand will fail to keep pace with supply, which is expected to expand by at least 0.85 million sq.m. over the period. This will then weigh on the occupancy rate, and as such, this is forecast to slip to a 16-year low of 84%. For newly built office building in the CBD and Grade-A office building in non-CBD locations, rents may increase slightly but will at worst remain flat, while for office space in other locations, the best outcome is for rents to remain unchanged, though they may well decline.

-

Developers of rented office space in prime areas[2]ill continue to grow. Compe: For these players, income wtition in this segment is restricted by the high capital costs and lack of land for development, which therefore commands a high price, and this restricts the entry of new players to the market. Instead, the market is dominated by established developers that draw advantages from their financial position and their having access to land with high potential. Nevertheless, developers’ have extensive plans for new projects and so demand is likely to fall behind supply, with negative consequences for the occupancy rate and the space within which developers will be able to raise rental rates. Despite this, though, rents will remain higher than in other areas.

- Developers outside the CBD and in the wider BMR region: For developers of older office buildings or Grade-B office building, income will remain flat or contract slightly. Properties in these areas suffer from the fact that land suitable for new projects is attractively priced and easy to find and develop, attracting a steady supply of new players to the market and adding to competition. In addition, most renters of these units are SMEs that are in a more exposed financial position, and so recovery will generally be slower in this segment, and it will remain difficult to raise rents.Overview

Overview

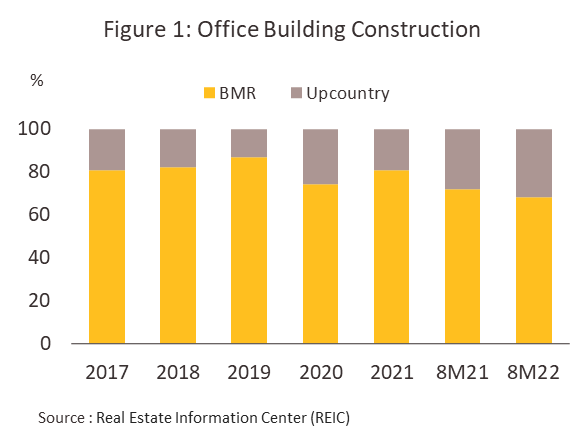

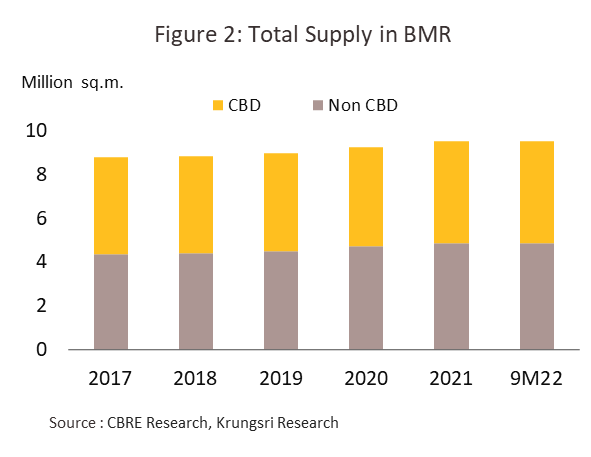

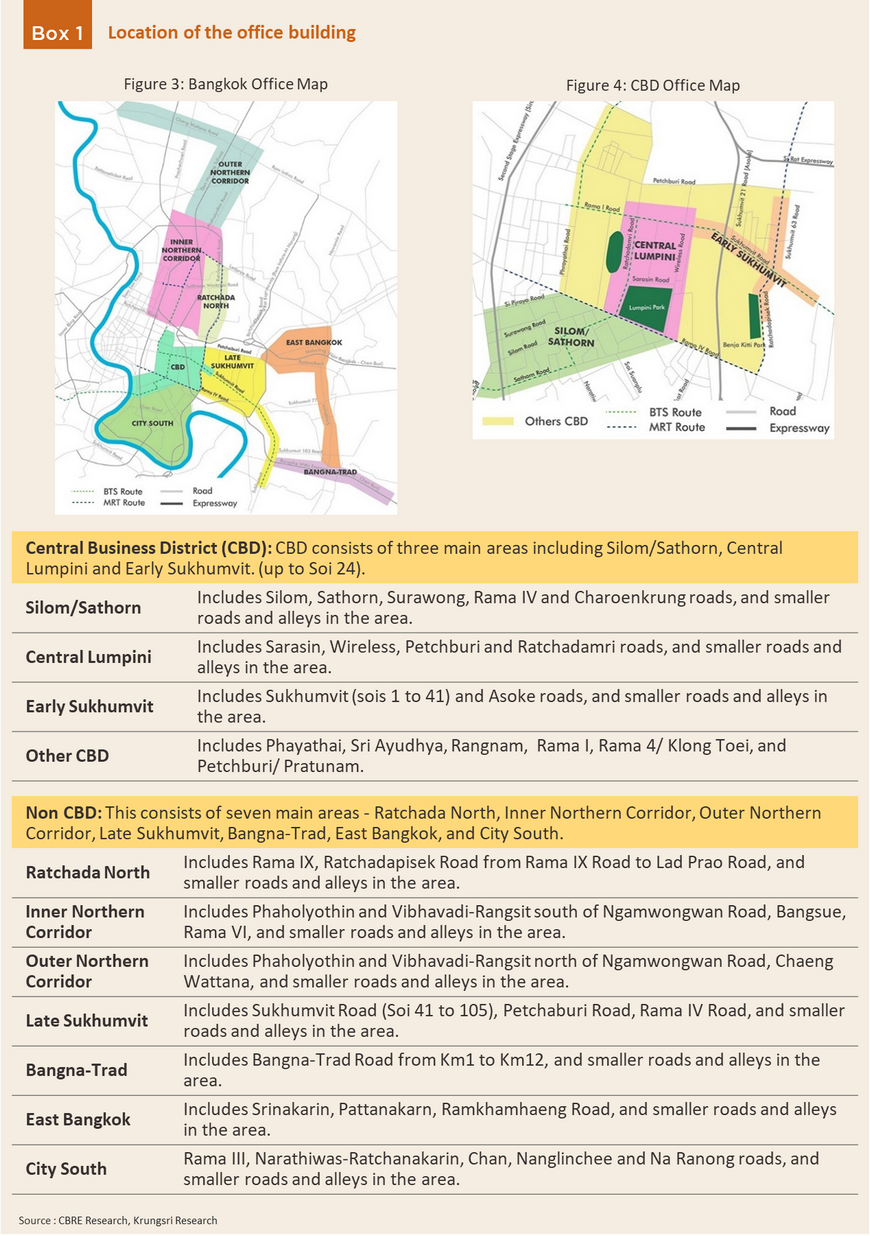

The Bangkok Metropolitan Region (BMR) is home to some 70% of total rentable office space in Thailand (Figure. 1). In Bangkok, office properties building have tended to cluster in the central business district (CBD), where office developments sit alongside flagship shopping complexes and high-end hotels and residential units. The CBD encompasses the central districts of Silom, Sathorn, Ploenchit, Wireless Road, Asoke, and the top end of Sukhumvit (up to Soi 24) (Box 1). This area is well served by communication links, including the BTS, MRT and expressways that link it to outer areas of Bangkok. Success comes at a price, though, and further development in the CBD is limited by a shortage of suitable land and the high price of what remains. This tightening of supply has then encouraged developers to move further afield and thanks to the development of new transportation systems (including a significant extension to the Bangkok metro), most new office developments are now found further out from the CBD in areas such as Ratchadaphisek, Phahonyothin, Vibhavadi Rangsit, Chaengwattana, and Bangna (Figure 2).

Typically, new office space take one of two forms: high-rise development[3] or a large building[4]. These would be either rented out en bloc or sub-divided into smaller units for rent to several independent tenants. The latter would result in more than one company operating on the same floor. The building owners are responsible for supplying and maintaining facilities and utilities including electricity, air-conditioning, lifts, and car parks.

Developing office space in the CBD is capital-intensive and because of this, the market is dominated by large developers with the requisite financial strength and abundant landbank. This has led to restricted new supply of office space, a situation exacerbated by The Bangkok Comprehensive Plan (B.E. 2556) 2013, which limits the construction of new office buildings to commercial areas only. As a result, the land available for development is too small for large office buildings (at least 10,000 sq. m.). In contrast to the CBD, investors of office space in districts surrounding the CBD and in further zones are usually mid- to large-size companies which have different investment patterns. These companies invest in projects ranging from small buildings to house own operations - and perhaps rent out idle space - to commercial properties specifically for rental.

The management of office buildings in the BMR can be split into two types.

-

Single ownership: This accounts for 80% of total office building supply. These are typically high-rise buildings that are owned by a single business, and which are managed by the building owner or by a specialist management company contracted in for the purpose. Most of these buildings will be rented out.

-

Multiple ownership: This accounts for 20% of total office building supply. These operate more like condominium buildings, with units within the development sold separately. Within a single building there will therefore be a number of different owners, and these will have access to shared areas, forming a committee to jointly manage the property.

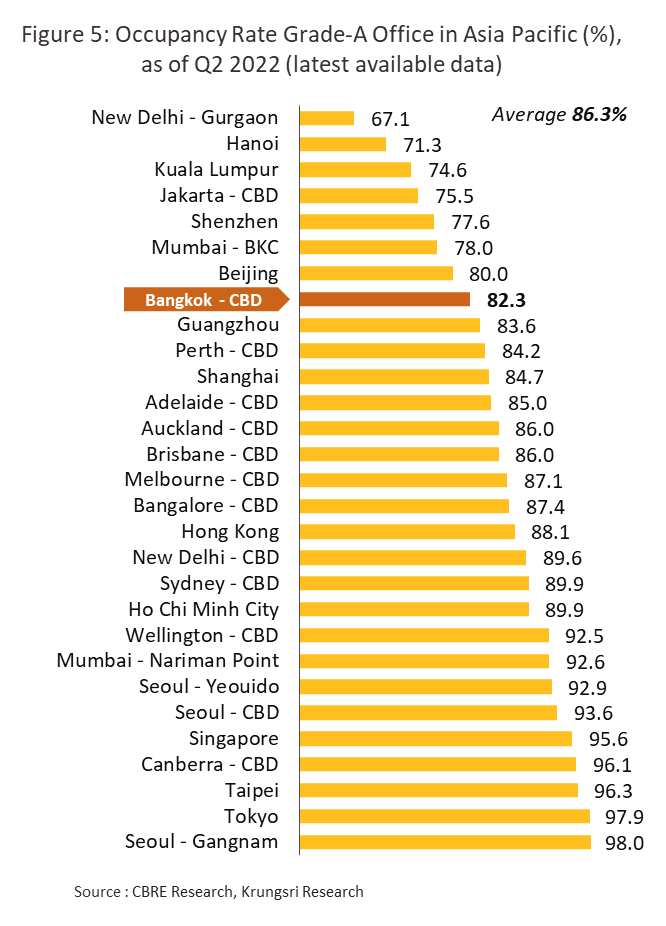

Demand for office space in Bangkok comes from both Thai companies and international operators that have set up offices in Thailand, including players in both the services and manufacturing sectors[5]. Domestic demand is strongly supported by SMEs, who are mostly restricted in their ability to fund building purchases or construction and so they are forced to rent instead. Historically, these rentals have been concentrated in Bangkok’s CBD, where new supply is limited. As a result, the occupancy rate in CBD (as of 2/2022) averaged 82.3% but was still lower than that of 86.3% in Asia Pacific (Figure 5).

Generally, most office rental agreements will include the following topic.

-

Lease agreement: This covers two classes of costs, ground rent (approximately 40% of the total) and service fees (the remaining 60%). The rental contract will be based on a fee for ground rent, set at a fixed price and quoted per square meter per month, while the contract for services will include all the non-rental fees, which will be payable at a variable rate according to usage (e.g., for electricity, air-conditioning, telephony charges, parking fees, management services and so on).

-

Lease terms: Most leases run for 3 years. This benefits both landlords, since it assures them of continued revenue streams, and tenants, because moving to new premises incurs renovation, alteration and decoration costs. On the other hand, when lease terms are longer than 3 years, these need to be registered at the land office and in this case, a registration fee and stamp duty (of 1.1% of the total rental value) must be paid, which tends to make long-term lease agreements somewhat unpopular.

At the same time, competition in the market for office space is relatively high, and this encourages landlords to engage in a constant process of overhauling and renovating their properties. Because grade A office properties that are easily accessible by mass-transit systems, are well managed, and which enforce strict security are in high demand, renovations often involve upgrading and modernizing the technology installed in older buildings and improving their security and safety features.

Determinant of decision-making on renting office space will depend on environmental elements. CBRE Research reports that before 2015, demand was principally driven by the need to expand office sizes, and budgetary considerations were the main influence over this. However, between 2015 and 2019, companies shifted to being more concerned with maximizing their value for money, and 53% of those surveyed reported that if their business expanded and they took on more staff, they would prefer to adapt their current premises, rather than moving to a larger site. In 2020, these preferences changed again, and the most important factors in considering a site have now become the need to control expenses and to ensure staff safety. The ability to use office space in the most efficient manner possible is also now important.

Situation

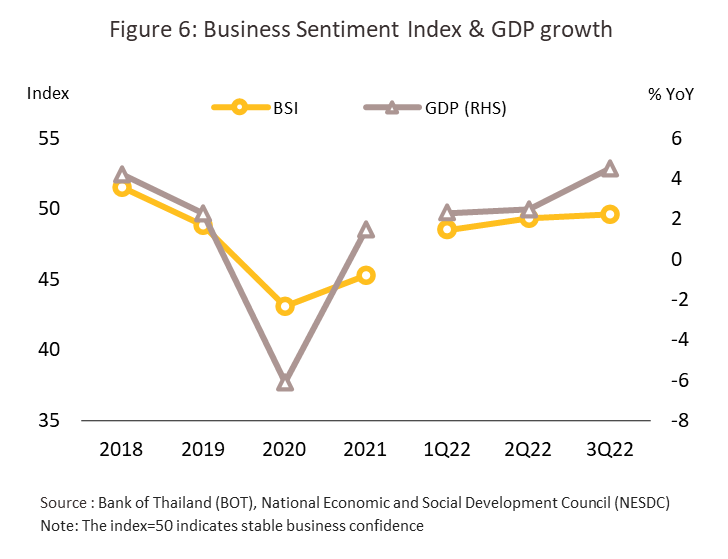

Demand for rented office space slowed significantly with the outbreak of Covid-19 in 2020, which triggered a slump in the Business Sentiment Index (BSI) that pulled this down to a 12-year low (Figure 6). The economic slowdown that the pandemic ushered in put considerable pressure on the incomes of companies renting office space, and so these responded by downsizing, laying off staff, encouraging greater working from home or working offsite, which in addition to cutting costs also helped to maintain social distancing rules, and placing a greater reliance on online technology. As a result of these moves, demand for space shrank, and so many companies either cut back on the size of their offices or gave up leases entirely.

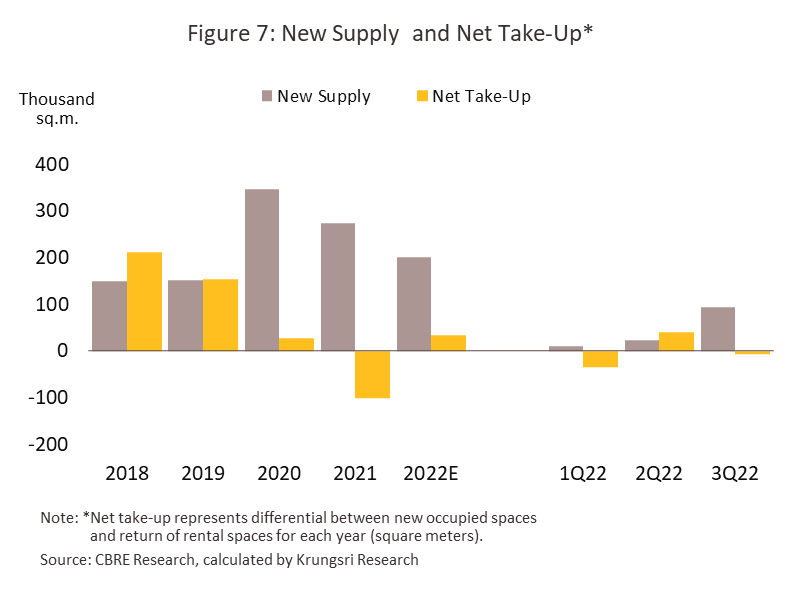

The success of the national vaccine rollout has meant that through 9M22, worries over infection with Covid-19 gradually dissipated, and as businesses began to look at expanding their premises or moving to new locations, 2Q22 demand for office rentals returned to growth for the first time since 2020 (Figure 7). This included some foreign operations and tech companies that moved into new office buildings (these had a larger footprint, but overall rental rates were similar to those charged at their old site), together with some businesses that moved into cheaper units. Alongside this, some companies extended previous rental agreements but to rein back costs, negotiated a rent reduction or a cut in the total area rented. In light of this, operators have had to change their stance and become more flexible over rental rates, and this has included offering discounts to keep existing renters in place and to attract new tenants. The situation has improved with the gradual easing of pandemic restrictions and the full reopening of the country to foreign arrivals on 1 July, which has then helped economic and social activity return to normal. With the outlook brightening, the BSI has bounced back to its 2019 pre-Covid level, and many companies are now bringing staff back to the office to work. Nevertheless, some companies continue to operate hybrid work schemes that mix on- and offsite working. The overall situation for the office rentals industry through 9M22 is given below.

-

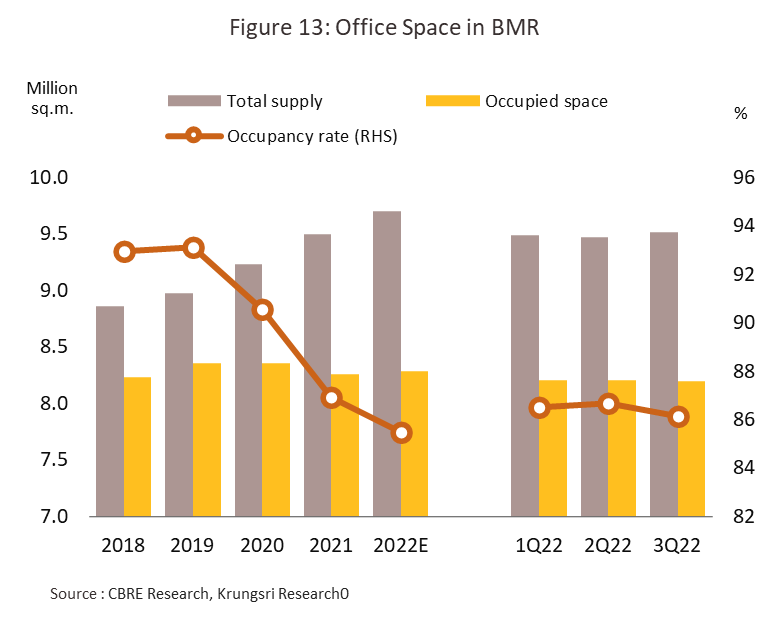

The net take-up[6] decreased by 1,547 sq.m. (Figure 7) through the period. As of the end of 3Q22, the total occupied rented office space slipped -0.8% YoY to 8.2 million sq.m. (Figure 13).

-

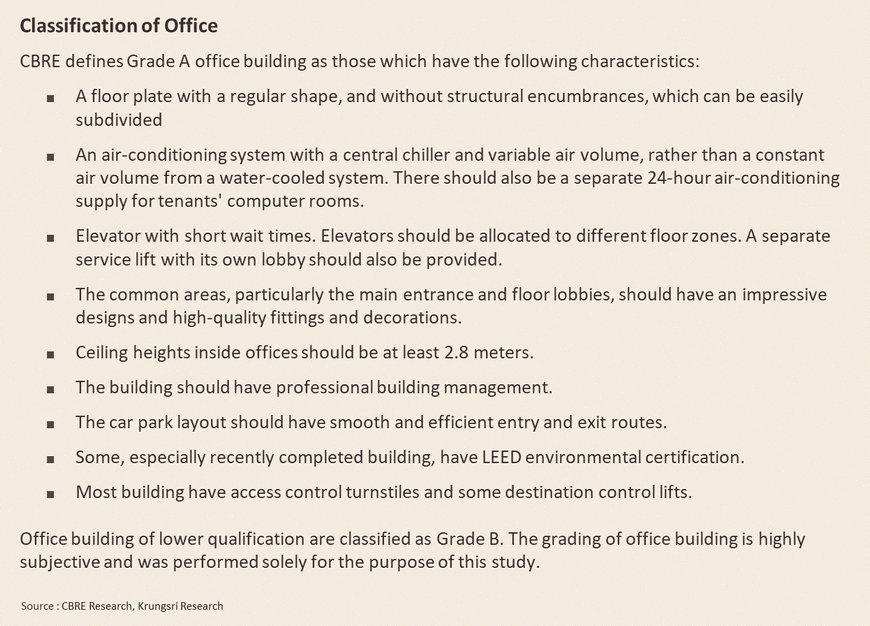

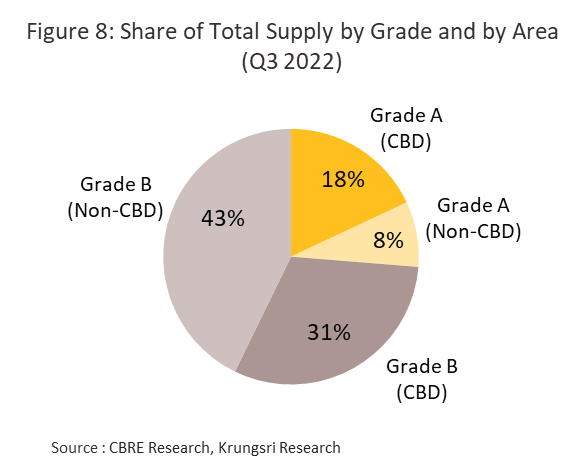

The supply of new office space contracted -27.8% YoY to 125,600 sq.m., during which the new projects that were completed included the UOB Headquarters and Silom Edge, which are in the CBD, and the non-CBD Summer LaSalle (Campus B), S-Oasis and True Digital Park Phase 2. As of the end of Q3, total supply of office space had thus risen 1.3% YoY to 9.5 million sq.m. (Figure 13). Almost three-quarters (74%) of this total was of Grade-B office building, the remainder (26%) being Grade-A office building (Figure 8).

-

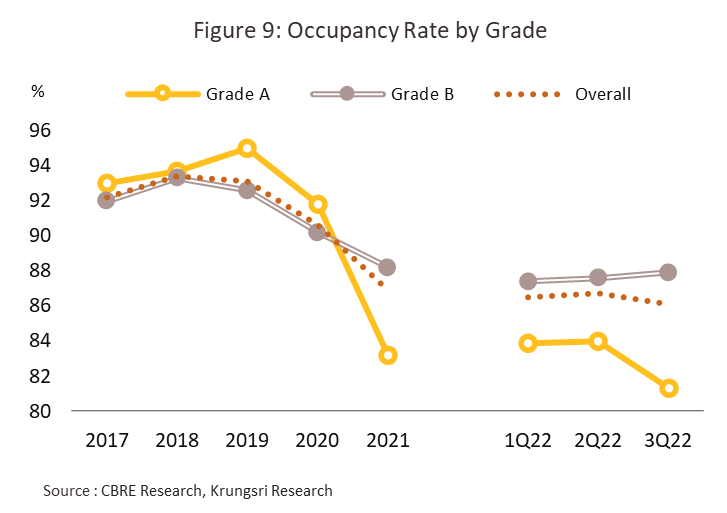

As of the end of Q3, average occupancy rates had dropped to a 10-year low of 86.1%. By type, the occupancy rate of Grade-A offices was just 81.3%, compared to 87.9% for Grade-B offices, these two down from respectively 86.2% and 88.7% for the same period a year earlier (Figure 9). The difference between these two segments is partly explained by the fact that faced with the need to cut costs, some renters have downshifted from Grade A to Grade B office buildings, while the market has also been affected by the preponderance of Grade-A offices in new developments. In fact, these accounted for 80% of all new office builds completed over 9M22, and this helps to explain why for the past two years, occupancy rates for Grade-A offices have managed to underperform those for Grade B offices (Figure 9). Within the CBD, the highest occupancy rates are currently seen in Sukhumvit, while outside the CBD, these are highest on the west of the city (source: Colliers Thailand)

-

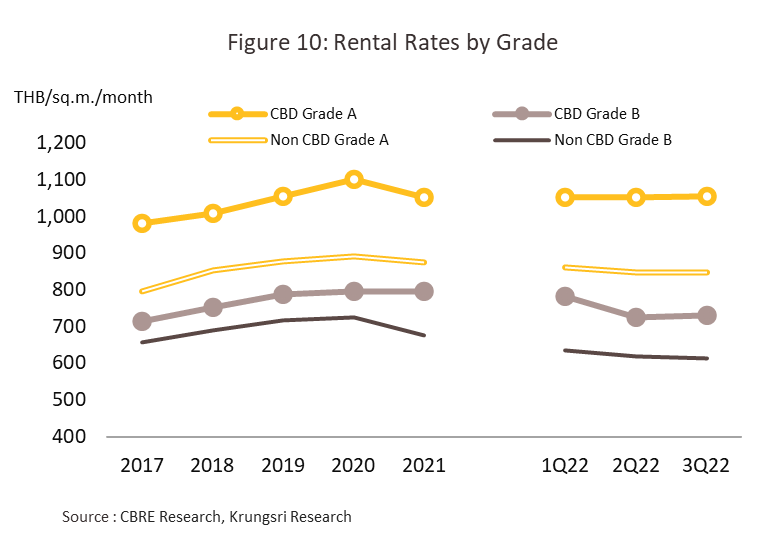

Average rents have slipped for both Grade A and Grade B offices. In the period, these edged down -2.6% to THB 951/sq.m for Grade A offices, but for grade B offices, rents plunged -8.8% YoY to hit a 5-year low of THB 672/sq.m. (Figure 10). Rents were affected by the need to use more attractive pricing strategies to keep current tenants in place and attract new ones, particularly when working with tenants facing uncertain economic conditions and who might delay a moving decision or move to a newer and cheaper location. Some operators thus worked with these tenants by cutting rents for a specified period of time or by leaving rents unchanged but extending lease lengths.

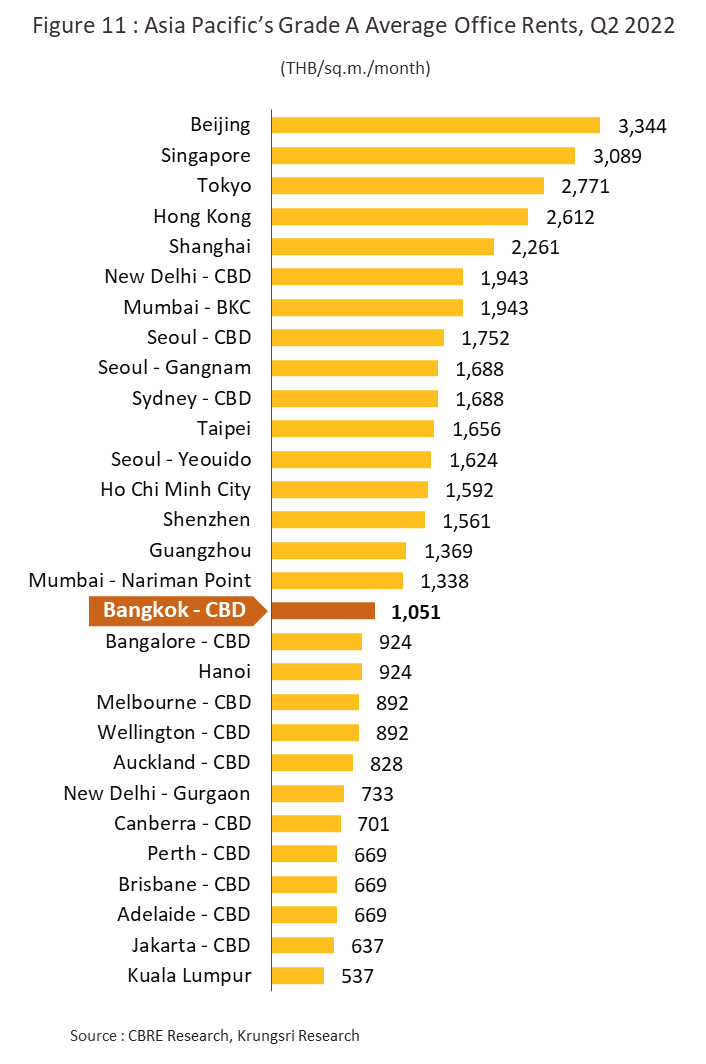

Data from Knight Frank shows that in 2021, around 44% of all rental income came from newly built or refurbished units. This was the highest proportion in a decade, and this helps to demonstrate that renters place a premium on the quality of their premises. However, making cost savings is still an important factor in doing business, and Thai office rental rates are still below those of many countries in the Asia-Pacific region, including Hong Kong, Singapore, and Ho Chi Minh City (Figure 11), and this is certainly one factor attracting foreign companies to Thailand.

Through the remainder of 2022, the supply of office space should have risen with the broader uptick in economic activity and the steady return of staff to their offices. However, rising energy prices and higher inflation, which has pushed up the cost of construction materials, will combine with labor shortages to drag on the construction sector, and it is likely that work on some new office projects will be postponed (Colliers estimates that 58% of the footprint of current construction sites is within the CBD in areas such as Rama IV, Sukhumvit, Silom and Sathon, with 82% of these developments being for Grade A offices). For all of 2022, the supply of new office space will expand by 2.1%, or by around 200,000 sq.m. (Figure 12) but alongside this, demand for office space will be impacted by the continuing popularity of hybrid working, and so demand will inch up just 0.4%, or by an additional 33,000 sq.m. The discrepancy between the two sides of the market will then pull average occupancy rates down from the 87% recorded at the end of 2021 to around 85% (Figure 13). With regard to rents, those for Grade A offices may edge up slightly since these properties remain in high demand, especially among companies that have enjoyed strong rates of growth in recent years (e.g., tech players and platform operators, e-commerce companies, and providers of financial services). On the contrary, for operators of Grade B offices, the news is less good, and rents may fall slightly as tenants look for better quality offices that are only slightly more expensive. In addition, renters of Grade B offices tend to be SMEs, and many of these still find themselves in a fragile economic situation.

Industry Outlook

Over the three years from 2023 to 2025, the market for rented office space will strengthen on a better outlook for the economy, and as a result of the ending of the Covid-19 pandemic, the return of staff to office-based working. One survey of over 150 Asia-Pacific companies found that around 40% expect staff to work fully from the office, up from 26% in 2021 (source: CBRE), and this indicates that having access to rented office buildings remains an important factor in carrying out business. However, hybrid working, which allows staff to mix on- and off-site work or to reduce the number of days that they come to the office, are more popular in parts of the economy, for example in some service industries, and this may impact overall levels of demand for office space with regard to both the size and type of the space and the uses to which it can be put. The market is also being affected by the popularity of co-working spaces, which are spreading rapidly, and which give individuals a considerable degree of freedom in how they utilize their workspace. The CBRE survey also shows that many Thai companies are overhauling their offices to better meet the needs of hybrid work, for example by resizing and changing how different spaces are used, installing new equipment and smart technology, and providing hot desking facilities changing the size and function of office portfolios to implementing new in-office features like hot desking and smart workplace technology. The overall outlook for the industry over the next three years is outlined below.

-

Demand for office space will rise at an average annual rate of 1.5-2.0% (down from an average of 2.5% over 2015-2019). Growth will be supported by recovery in the economy, and as businesses grow, they will take on more staff and allowances will then need to be made for these. In addition, demand from overseas companies will continue to support the market, especially for Grade A offices in the CBD. Nevertheless, growth may be held back by constraints imposed in contracts on how space may be used and by a property’s flexibility. For example, a renter may rent a core unit for business and then expand into a co-working space, instead of renting an entire floor. In addition, one survey has shown that over half of all rentals of office properties in the CBD in the previous year (the data was correct as of mid-2022) were for a space rental in a building certified as ‘green buildings’; it is now easier for renters to gain environmental certification and so move towards what may be long-term corporate goals of putting their business on a more sustainable and environmentally friendly footing (source: Future of work survey by Jones Lang LaSalle (JLL)).

-

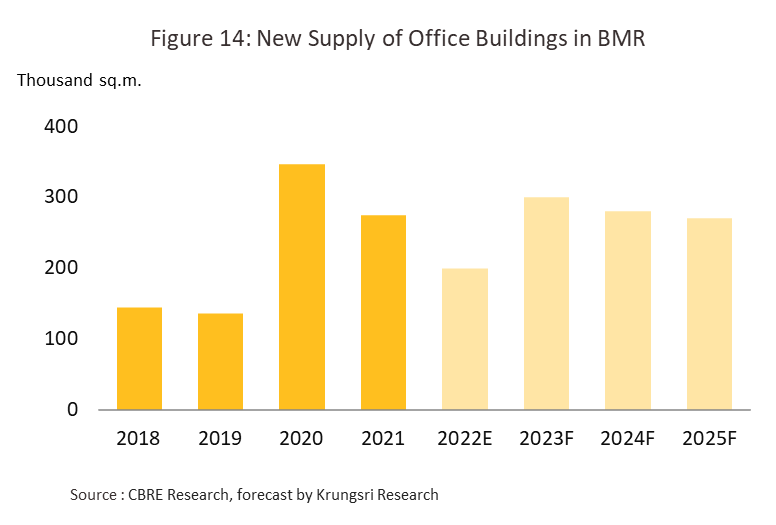

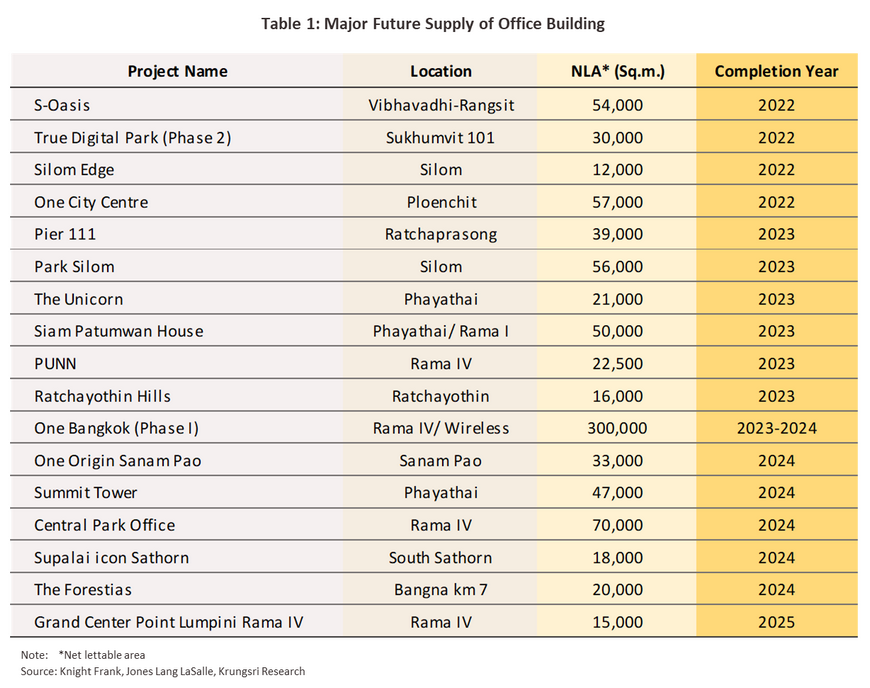

The supply of new office buildings will rise on greater investment by developers, though the Covid-19 pandemic has resulted in delays to some projects. 70% of new supply will be in the CBD, which will contain a particularly high share of large mixed-use projects, including The Unicorn, Park Silom, EmSphere, and One Bangkok, all of which qualify as super-premium developments. The total footprint of new space that will be completed over the next 3 years is expected to come to 850,000 sq.m., bringing supply up by an average of 2.8% per year (Figure 14). Growth in supply will therefore outpace that of demand, and the relative oversupply to the market will shift bargaining power to renters, who should then be able to extract advantages from this situation.

-

Occupancy rates are forecast to drop to a 16-year low of 84% (Figure15) thanks to the steady supply of new space becoming available from some 20 major projects currently underway (as per developers’ own plans). On the other side of the market, demand will come mostly from renters currently in older buildings that are more than 12 years old, which combined account for around half of all supply. In addition, an increasing proportion of renters who have been in the same building for more than 15 years will move into newly built offices (source: JLL), and this will put pressure on the owners of older office buildings to refurbish these, whether they are inside or outside the CBD. Falling occupancy rates in older buildings will also push some operators to use more aggressive pricing strategies, for example by holding rents flat or even cutting these, especially as they look to extend leases and maintain occupancy levels by keeping existing tenants in place.

-

Rents for all office space in the CBD and for non-CBD Grade A offices will either remain unchanged or increase slightly as demand strengthens, especially from renters in fast growing industries in the service sector, trade, and technology. In addition, development costs (including labor) are also rising, especially for new developments that are sold on the quality of their architectural design, in terms of both appearance and the building’s sustainability and ESG standards. These structures often rely on complex technological systems to make them more user friendly and come with first class management systems that support post-Covid office usage patterns, while owners of older buildings will likely renovate, refurbish, and modernize these. Rents for non-CBD Grade B buildings will tend to slip, partly due to renters decamping for higher quality premises, though for buildings over 20 years old, rents will fall even faster relative to the market average. Nevertheless, if older buildings are modernized and improved, they may still be well placed to meet the needs of renters and to find a place within the property market as a value proposition.

Problems that will likely affect players in the industry over the next three years will include the following. (i) Some organizations will continue with hybrid working, and this may generate some difficulties with managing workspaces since these may have to support different uses as these change over the course of a single day. (ii) Competition will tend to intensify, and although developers plan to increase investment 1.5-fold over 2023-2025 relative to the average for the past five years, demand will strengthen only gradually, and this will limit the space for increases in rent. (iii) Demand will rise for certified green buildings among businesses that have set environmental targets, especially for overseas companies (a survey by Jones Lang LaSalle (JLL) found that 30-50% of businesses were looking for space in green buildings, up from 10-20% only 3 years ago).

Thai office space is also relatively appealing when compared to alternatives in the ASEAN region thanks to: (i) Thailand’s geographical position in the center of the region, which helps to facilitate the building of trade and investment connections with neighboring countries; (ii) rental rates that are still low compared to those of some competitors, e.g., Singapore and Ho Chi Minh city; and (iii) government schemes to encourage companies to move to Thailand, for example by offering tax breaks for corporations setting up international business centers (IBCs)7/ in the country (in place of measures targeting ROHs). These factors should then help to sustain ongoing growth in the office rentals business in the coming period.

Clearly, the office rentals business will continue to occupy an important role in business considerations and in the economy more generally. Working in an office has the advantage of allowing staff to coordinate their work and to communicate with one another directly and easily, while also providing them with easy access to all the equipment that they need to complete their work. By contrast, working from home may be significantly less convenient, especially for those living in smaller houses or apartments where workspace may be limited. Given this, better management of office space may not entail simply a reduction in the total area rented because business tenants will still need access to modern offices that are fully equipped with digital technology that ensures that staff are able to quickly and efficiently complete their work. Companies will also continue to need space that can be managed for a variety of uses, that is flexible, and that can be quickly adapted to serve functions that have not been specified in advance.

[1] Hybrid working refers to the practice of mixing traditional on-site or in-office working with remote off-site working.

[2] Prime areas’ are those that developers view as having investment potential, having considered the accessibility of the site through communications and mass-transit networks, together with the infrastructure that is already in place. In Bangkok, prime areas include Silom, Sathorn, Wireless Road, Ratchadamri, and Ploenchit.

[3] High rise building’ means a building in which people may enter to reside or utilize, and which shall be at least twenty-three meters high.

[4] Large buildings’ means a building which has total floor area or area of any floor within the same building more than 2,000 square meters or a building which is 15.00 meters high or more and has an area in the same building more than 1,000 and not more than 2,000 square meters.

[5] From ‘Real Estate Market Outlook 2019’ (CBRE).

[6] The net take-up measures the area occupied by tenants, which may rise or fall in that year.

[7] Revenue Department announced tax incentives for the establishment of International Business Center (IBC) in Thailand to replace tax measures for International Headquarters (IHQ), International Trading Centers (ITC), the Regional Operating Headquarters (ROH). IHQ, ITC, and ROH which are required to change to become IBC have been allowed since 25 December 2018.

[8] Data from Knight Frank

[9] Co-working spaces are commercial areas available for use by people from any profession, who may rent space that is provided together with access to standard office infrastructure and equipment (e.g., desks, high-speed wi-fi internet access, meeting rooms, printers, etc.). Customers are able to choose rental arrangements to suit their needs, which may include using a private working area, discussing business in a small meeting room with a few others or using a more substantial conference room to meet larger groups of people. Likewise, rental arrangements may be made by the hour, the day or the month.

[10] SCG Green Building Solution

.webp.aspx)