Through the period 2019-2021, the outlook for retail space in BMR will be generally positive due to demand for consumption which is forecast to grow; progress on the government’s infrastructure projects and the subsequent stimulus that this will give to private sector investment. However, the supply of new retail space has been steadily expanding and this may cause the occupancy rate to dip slightly, although it is still expected to remain above 90%. As for average rental rates, these will continue to rise, especially for retail space in downtown.

Overview

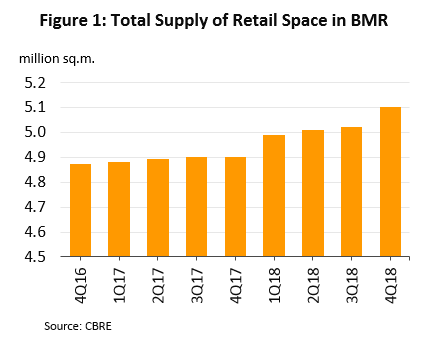

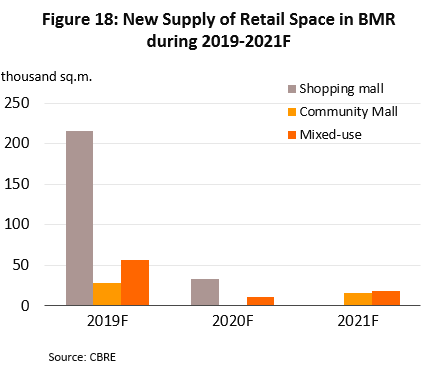

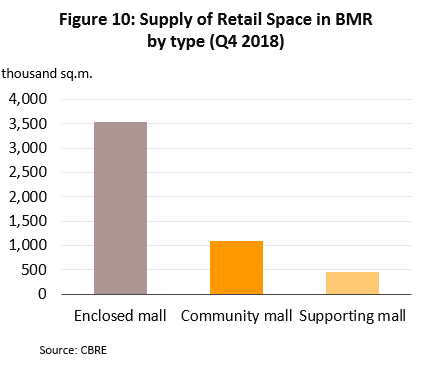

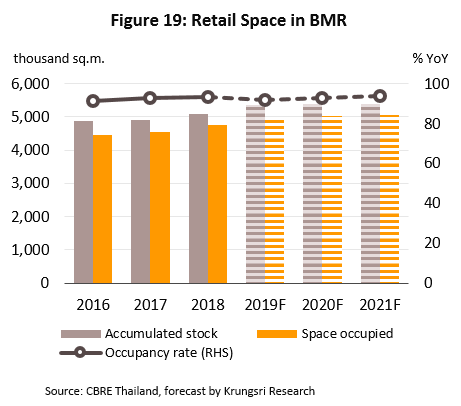

The greater part of Thailand’s retail space is located in the Bangkok Metropolitan Region (BMR) and major regional centers[1]. Currently, the total supply of retail space in the BMR comes to around 5 million sq. m. (Figure 1), the majority of which is in shopping malls. This category includes only retail space for which the operator receives rental income (excluding department stores, since operators of these also receive income from sales.) Shopping malls are sub-divided into enclosed malls, community malls and supporting malls (see page 3 for a description of these terms). Businesses operate primarily by developing the built infrastructure of a site and by providing amenities to renters and their main income then comes from the rental of this space.

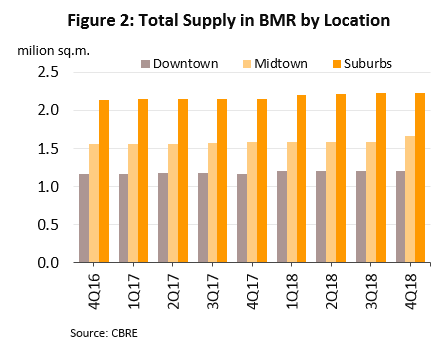

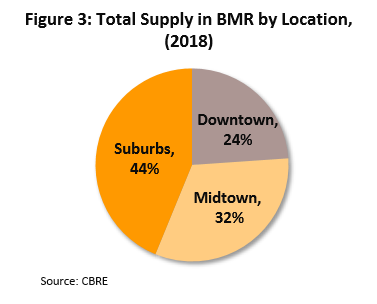

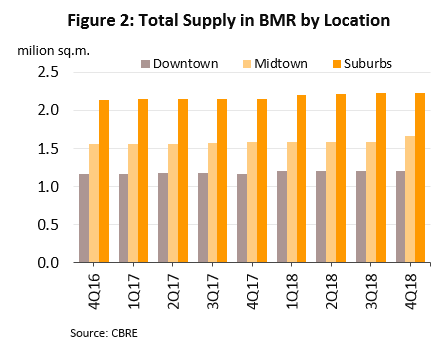

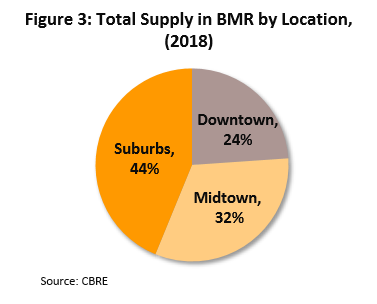

Almost 44% of the rental retail space in the BMR is in the suburbs (figures 2 and 3). Since over the past decade, many large shopping and community malls have been opened to serve the rapidly growing suburban housing developments due to access to land that is less expensive than that in central Bangkok and the steady investment in and expansion of mass transit systems, which have made travelling to and from central Bangkok more convenient. In addition, regulations of comprehensive plan have restricted the ability of developers to invest in large Shopping malls in some central parts of Bangkok and so those malls which are already in operation in downtown areas such as Silom, Sathorn, Ratchadamri, and upper Sukhumvit have are renovated to become more modern and more luxury to serve demand from high-income groups, and especially from foreign tourists, while malls in midtown areas have looked to mid-income groups.

From a historical perspective, the Thai retail rental sector began life with the development of department stores. The impetus for the growth of department stores lay in rising consumer demand for access to a wider range of goods and services. To generate boarder customer base and more income, this expansion led in turn to the development of shopping malls, which mixed internal floorspace given over to department stores with additional space that was made available to a range of other retail outlets, including restaurants, pharmacies, specialist shops, banks, music and art schools, cinemas, food courts, and so on. These helped to establish the popularity of shopping malls among customers.

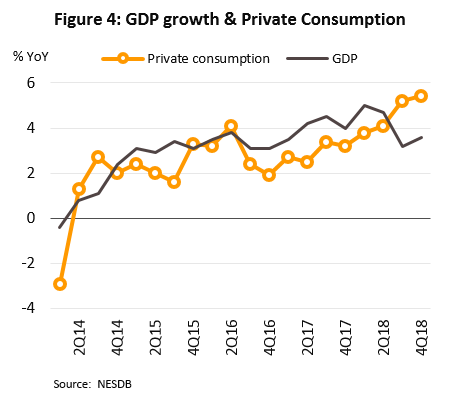

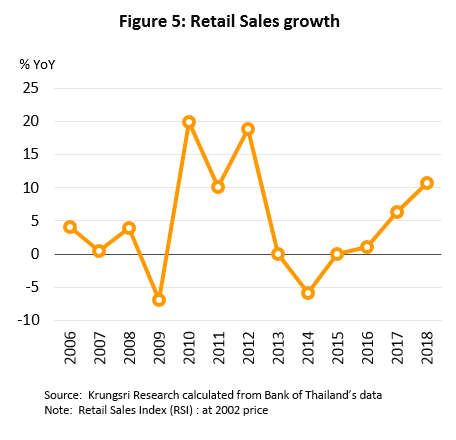

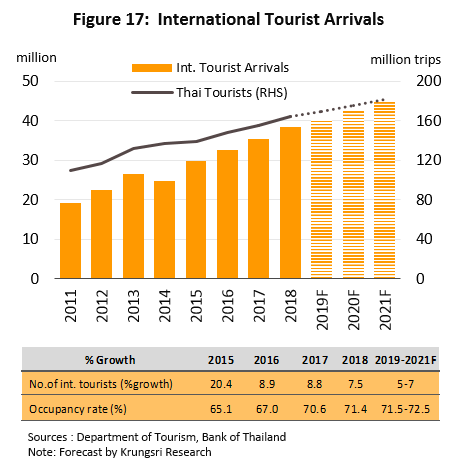

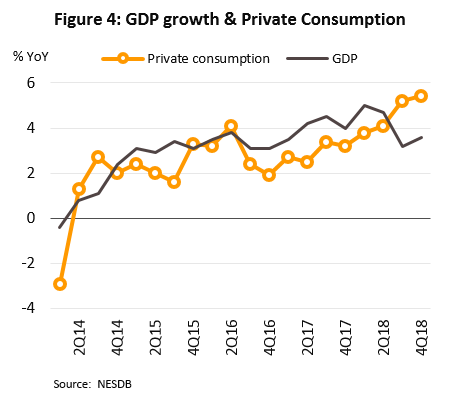

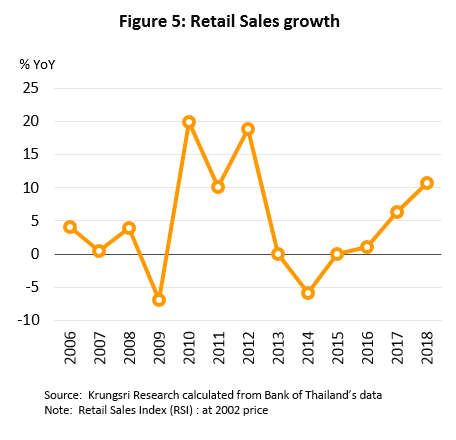

During 2017-2018, the overall retail sector improved on a strengthening economy and recovering private sector consumption (Figure 4). This improvement is reflected in an increase in the retail sales index, which rose to 5-year highs (Figure 5). The sector has benefited from i) a change in operators’ marketing strategies; ii) from the renovations that have been made to a number of malls in order to make them more attractive to prospective customers, especially malls in CBD that serve businesspeople with higher spending power; and iii) rising tourist arrivals, since many tourists enjoy shopping in malls, particularly in larger sites in CBD.

Key components of the sector are the three different categories of renters, rental contracts or agreements, and developers or owners of the retail space.

- Renters: These may be divided into two groups:

- Major renters (or anchors) are those renters which occupy a significant fraction of the floorspace in a retail operation or mall. This will include supermarkets, cinemas, and areas for special activities. Members of this group are very important for the overall operations of malls since their presence will help to attract small renters to the project and to pull in consumers.

- Minor renters are smaller retail operators that rent space in a mall. These may either be independent retailers or branches of chains and within a mall these will include restaurants, pharmacies, specialist shops, banks, etc.

- Types of rental agreement: In Thailand, contracts for retail space are both for the short-term (3 years) and the long-term (10-30 years), although when renters or operators wish to sign a contract that lasts for longer than 3 years, this needs to be registered at the land office.

Typically, rental contracts are split into two separate agreements. The first covers the actual ground rent, and will usually run to around 40% of the total fees, while the second (the remaining 60%) will be for various additional charges, such as those for repairs, insurance, service fees, etc. Splitting the contract in two in this way is done because it helps to reduce the building owner’s property taxes, which are calculated only on the rental portion of the agreement.

- The rental contract will specify the rent in terms of an amount per square meter per month and this will normally be paid one month in advance. Rent provides a stream of net income for owners of the rental rates which will vary according to the size of the space rented, its floor location. Normally, rents will be reviewed every three years and on average, they will rise by around 10%.

- The service contract will specify any and all fees due for other services beyond merely the provision of rented space. This might include insurance premiums, charges for utilities (electricity, water, telephone, gas, etc.), management fees, VAT and so on. These service charges will vary depending on use. As regards increases in fees, these will largely be determined by the level of increases in the costs of utilities periodically.

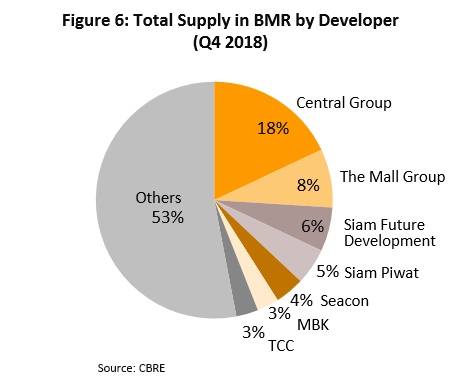

- Operators: The major players invested primarily in developments in the BMR and have also been expanding their operations into major provincial centers for several years. Key players can be separated into two main groups according to the nature of their business operations.

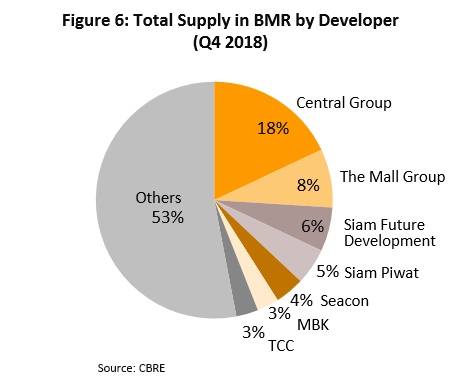

- Operators that focus their efforts on large-scale malls includes Central Pattana, The Mall Group, Siam Future Development, and Siam Piwat, which tends to invest in joint ventures with large retailers. The latest development by this group is the Icon Siam project, a large new mall in Bangkok, and the successful launch of this has lifted the company’s market share from 4% to 5%.

- Other operators focus on developing smaller community malls, and these include Siam Future Development, although since 2012, this company has expanded into large-scale developments with the Mega Bangna shopping center.

As regards other players (around 53% of the market), these include investors in the local area or investors who have assembled significant land banks. The majority of projects undertaken by these operators will involve smaller retail sites, especially community malls.

Types of retail space

Retail Space: refers to areas in shopping malls which the operator receives income from rents and services. This rent originates in rental of space under a single roof or in areas that are next to one another outside. Shopping malls’ operators will invite renters to lease this space, signing a contract with tenants and collecting rents as determined in advance. Malls may be large and comprehensive, supplying a wide range of goods and services, including restaurants, pharmacies, specialist shops, banks, music and art schools, cinemas, and food courts. Major malls currently include Future Park Rangsit, Terminal 21, Central Plaza Grand Rama 9, and Central Embassy (source: Wikipedia, TerraBKK). Malls can be classified into three types.

- Enclosed mall: The enclosed mall format comprises individual outlets leased by a number of tenants. It mainly derives income from renting out space, which can either be a fixed amount or a percentage of the tenant’ sale revenues. The format includes the retail space in shopping mall complex, wholesale shopping center and specialty store complex (source: CBRE).

- Community mall: Similar to a plaza in format, the community mall format comprises individual outlets leased. However, a community mall is usually smaller in size compared to the plaza format, and they usually offer more open-air space. The community mall usually aim to serve the neighborhood area (source: CBRE).

- On-Site Retail: Retail area in a mixed-use project which supports people in the building. On-site retailers are usually location in office/residential/hotel building (source: CBRE).

Department stores are large retailers that carry a wide-range of stock, clearly separated according to the type or category of goods. Department stores source goods for sale from manufacturers or middlemen themselves. Examples include Central Chidlom, Robinson Bangrak and The Mall (source: terrabkk.com).

Locations

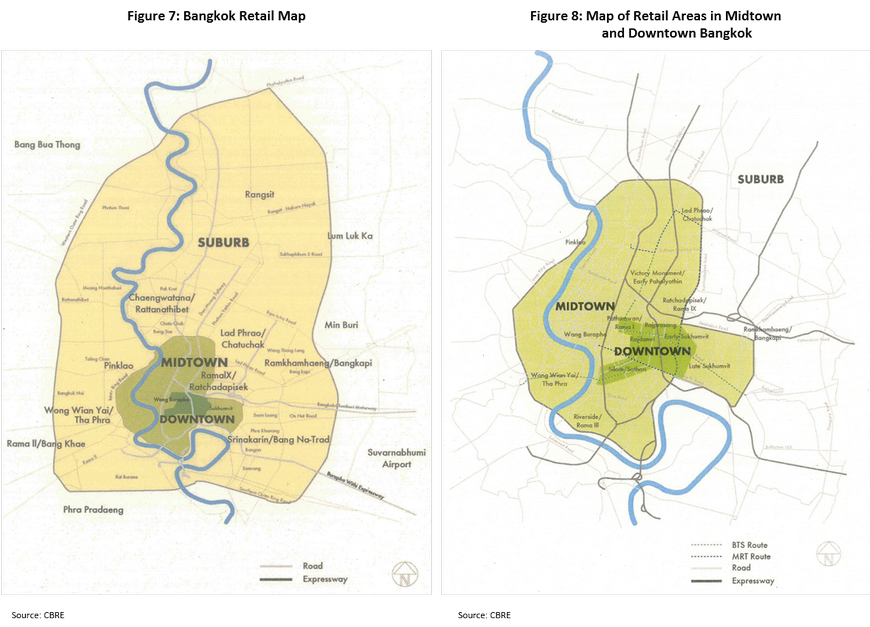

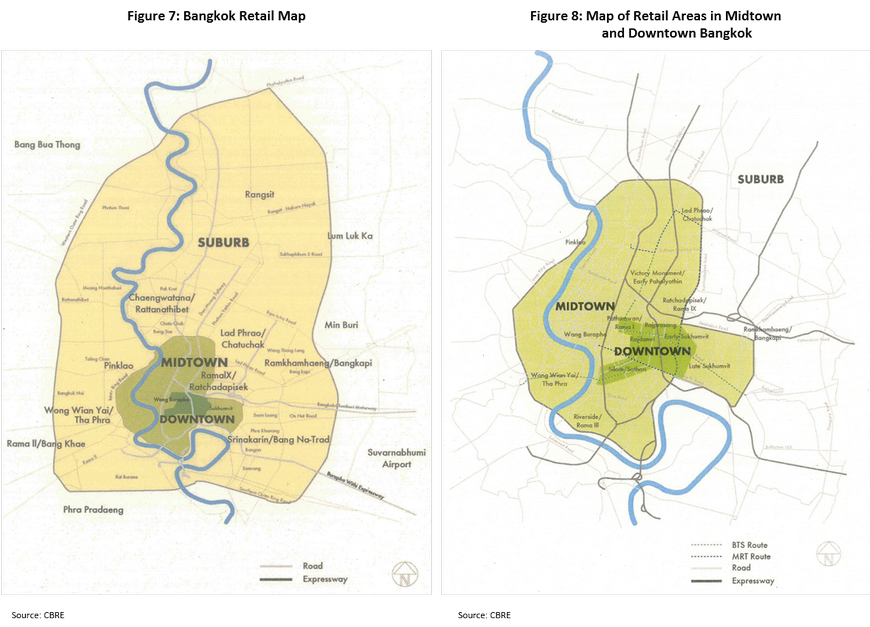

Downtown is the important location for business and retail projects, including Silom, Sathorn, Rama I, Pathumwan, Ratchadamri and upper Sukhumvit (up to Soi 24) which are generally accessible by BTS.

Midtown Secondary location in Bangkok bounded by the inner Ring Road, including major residential areas and secondary business centres. The target shoppers are middle-to high-income earners in the area, which covers Lad Phrao, late Sukhumvit (from Soi 24 to 63), Ramkhamhaeng, Bang Kapi, Chatuchak, Phaholyothin, Ratchadapisek, Rama IX Road, Victory Monument, Pinklao, Riverside, Rama III, Wong Wien Yai, Wangburapa.

Suburbs The outlying areas of Bangkok with easy access to the city center; they form the gateway to the five neighbouring provinces. These locations include Lak si, Don Muang, Rangsit, Ramindra, Sukhapibal 1-3, Srinakarin, Bangna-Trad, Samrong, Thepharak, Rama II, Bang Khae, Bang Bua Thong, Bang Yai, Rattanathibet and Chaengwattana.

Situation

Between 2008 and 2017, there was a significant expansion in the supply of retail space in the BMR, in particular in enclosed and community malls. These rapidly spread through suburban areas in the BMR in response to the growth in the number of housing developments, especially along new suburban mass transit routes.

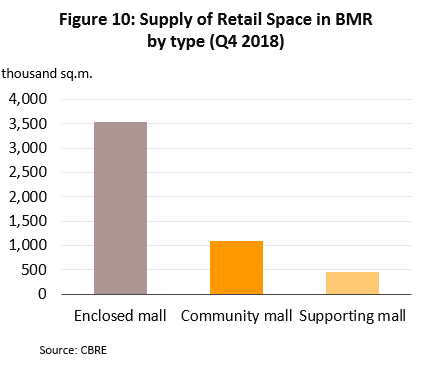

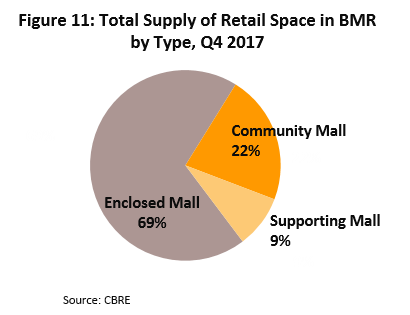

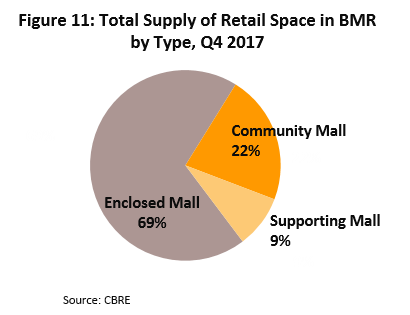

Enclosed malls comprise 70% of all retail space in the BMR, and the majority of these are in the outer parts of the city, where new residential developments are still being constructed. These typically have a size in the range 70,000-200,000 sq. m or over and tend to be somewhat dispersed because city planning regulations and the size of plots available in Bangkok have tended to push developments to the outskirts of the city, close to residential housing areas or business zones that will support trade within the mall. Examples of these include Mega Bangna, Central Plaza Chaengwattana, Central Plaza Salaya, Central Plaza WestGate, and Central Festival EastVille.

Community malls help to meet increasing demand driven by changing consumer behavior and a desire for a more convenient and more easily and rapidly accessible shopping experience. Consumers therefore prefer to purchase the goods and services needed in daily life either near to their home or their place of work. Expansion in the number of community malls has also been driven by the restrictions imposed on the development of large commercial shopping malls in central Bangkok contained in the 2005 Bangkok regulation code and the 2013 law on Bangkok comprehensive plan, and so instead of investing in downtown areas, developers have turned to community malls, which increased in number by an average of 18% per year between 2012 and 2014 (source: Collier International). Community malls have also been an attractive proposition continuing to expand supported by relatively-low investment cost. The upshot of this has, however, been increasing competition, both between community malls and with other types of mall located in nearby areas. As such, occupancy rates are not high, and some projects have even failed and had to be abandoned.

With reference to the study about community mall segment in 2014[2], 103 community malls showed that of these, only 12 were reporting high levels of turnover, a further 31 were seeing moderate turnover, and the remaining 60 were either having difficulties in continuing operations or were in crisis. Indeed, the majority of the investors in these projects came from the real estate sector, were owners of the sites. Following this period, in 2015 and 2016, expansion of community malls slowed at an average of 11% per year (source: Collier International) as the purchasing power of mid- to low-level income groups, the primary customer base of community malls, remained weak. These led to sharply increased competition. In addition, in search of more stable returns, investment funds from large retail operators have subsequently tended to swing away from community malls and back to more traditional shopping malls due to more sustainability in return on investment.

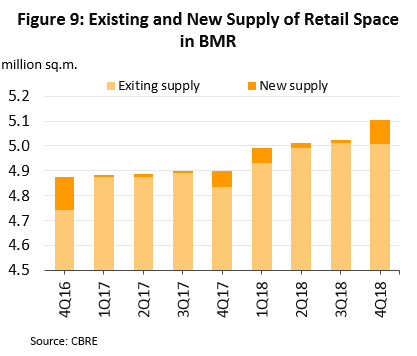

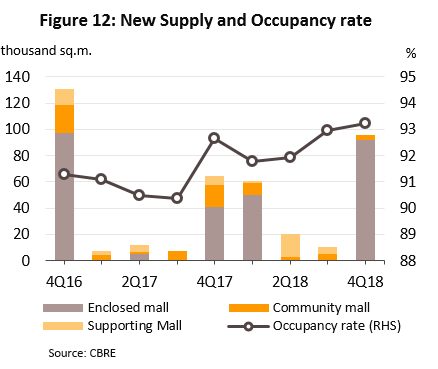

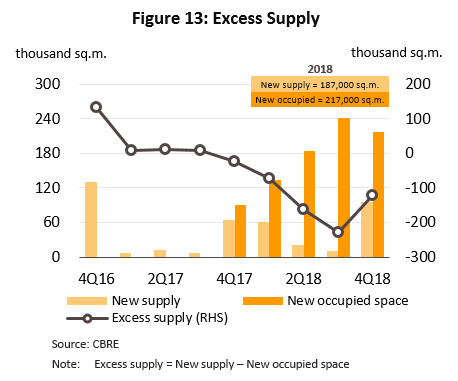

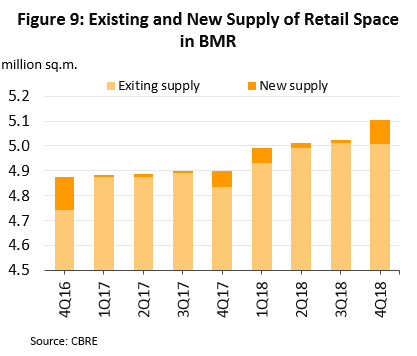

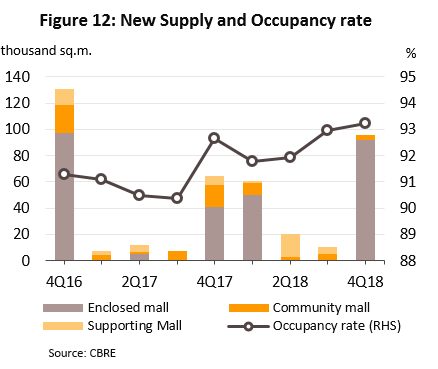

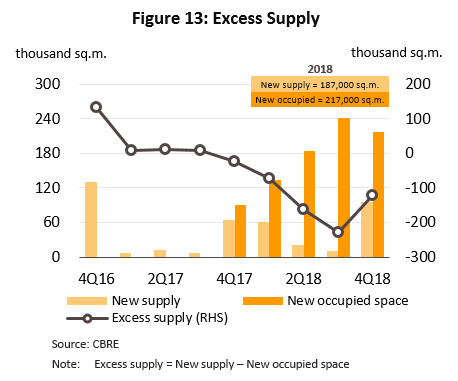

In 2018, a total of 187,000 sq.m. of new supply came on to the market (Figure 12), with the majority of this space being in enclosed malls, including Icon Siam and Gateway Bangsue. Following this in terms of area was space in supporting malls (the supply of which increased sharply in the second and third quarters of 2018) and in community malls. The net effect of this was to lift the total supply of rental retail space in the BMR to 5.1 million square meters, an increase of 4.1% YoY.

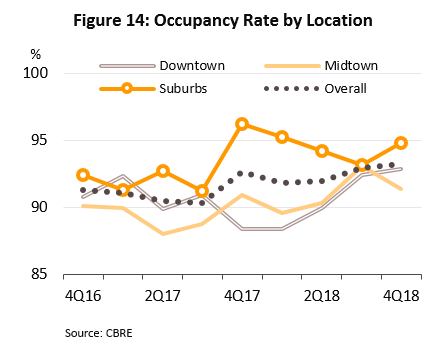

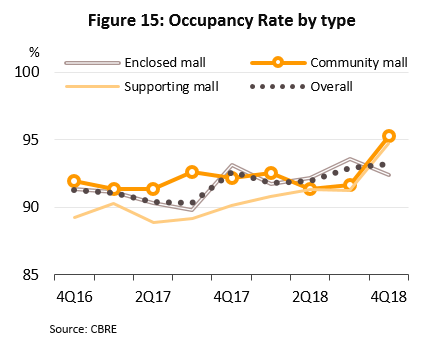

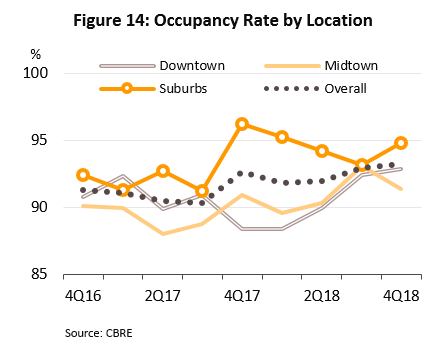

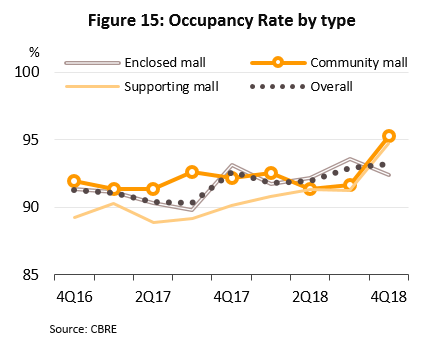

At the same time, demand for rented retail space strengthened in step with the recovery of the economy, and as such, a total of 217,000 sq. m. of rental space was newly occupied. This was greater than the increase in supply of new space and so the total quantity of excess supply headed downwards (Figure 13). This movement was also in line with changes in the occupancy rate, which rose slightly from the previous year’s average of 91.1% to 92.5% (figures 14 and 15).

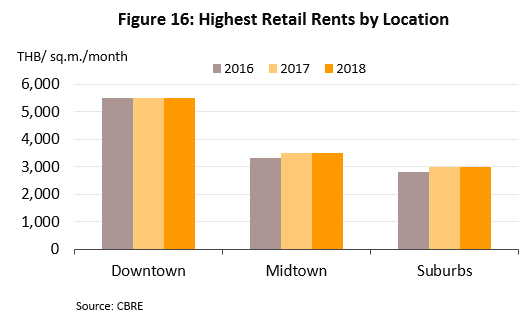

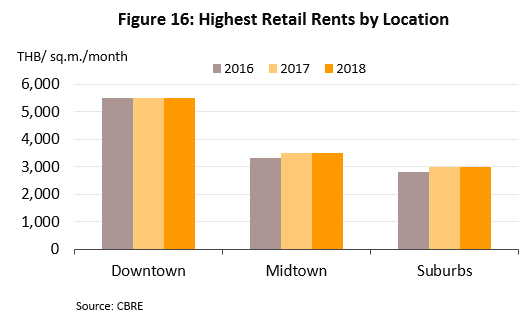

Across the BMR, average rents stayed steady from those of the year before at around THB 4,000/sq.m./month. By area, the downtown region was naturally the most expensive, with average rents remaining at the high level of THB 5,500/sq.m./month due to operators’ renovation and modernization and the limited supply of space that is available in the center of the city. The midtown region was cheaper at THB 3,500/sq.m./month, and cheaper still were the suburbs, at THB 3,000/sq.m./month (Figure 16).

Outlook

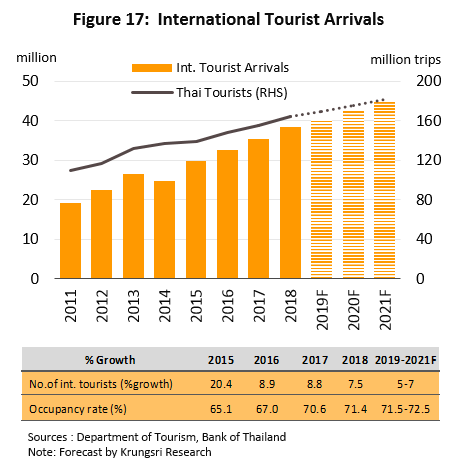

For the three years of 2019-2021, business conditions involved in the rental of retail space will be positive and operators should benefit from growth, with this supported by an anticipated strengthening in consumption. In addition, progress on the build out of government infrastructure will help to stimulate investment in connected areas, including in rented retail space. Also, growth in the tourism sector will also support increased retail spending, a positive sign for this business, amid a challenge of growing competition from the e-commerce sector.

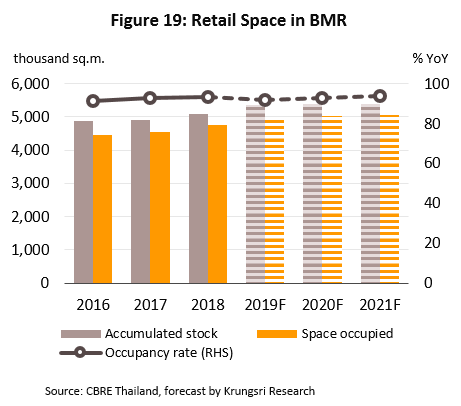

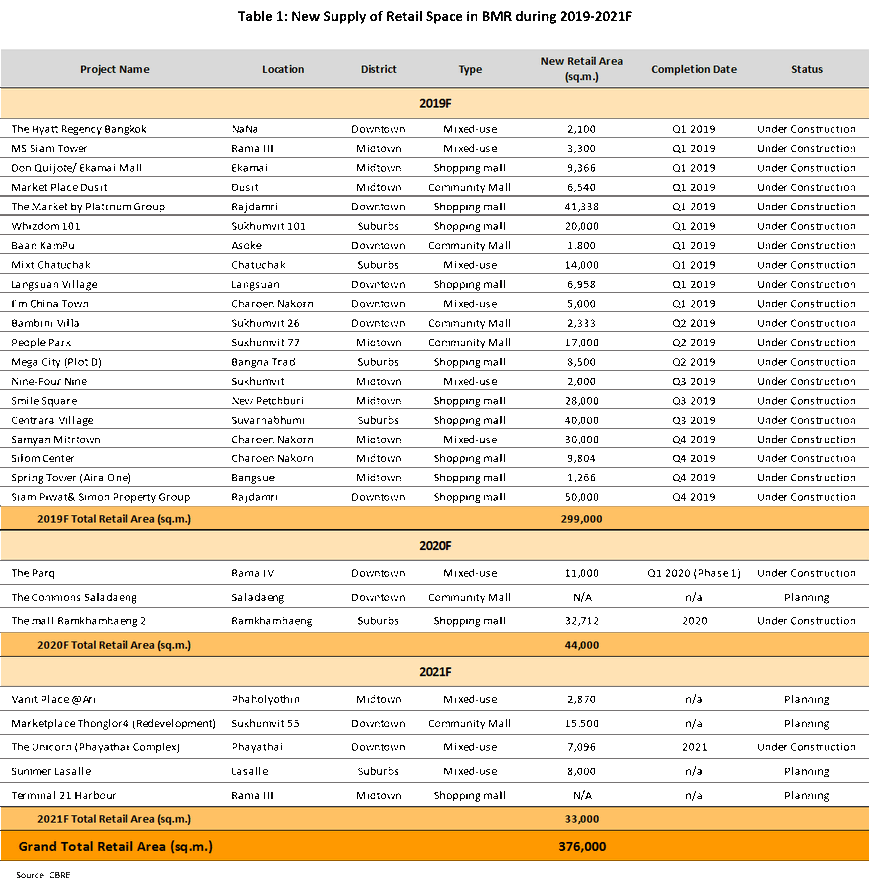

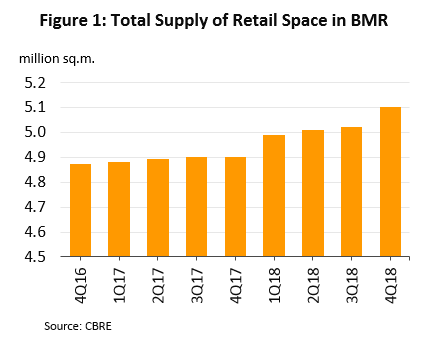

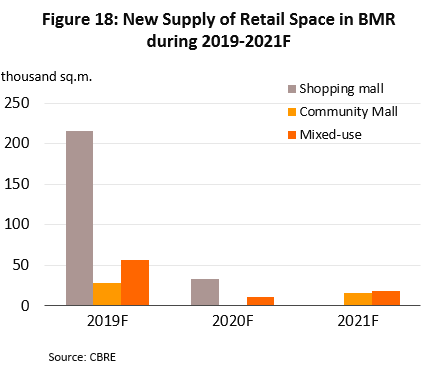

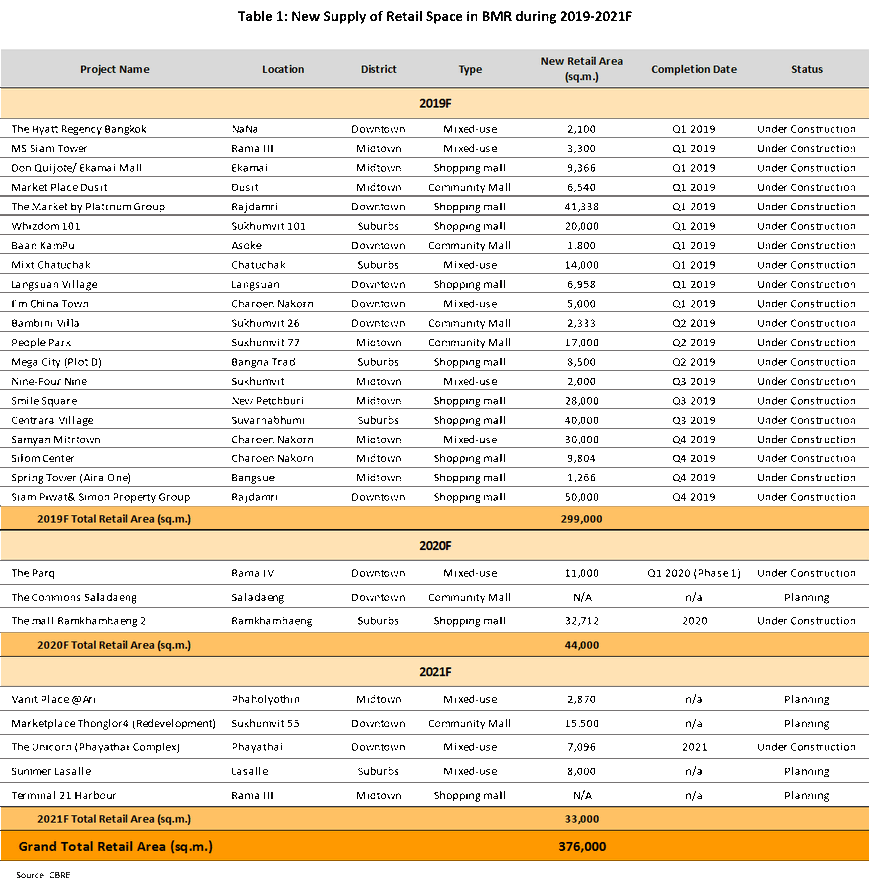

It is expected that in 2019-2021, a total of 376,000 square meters of new rental space will be released to the market (or an average of some 125,000 sq.m. per year) in developments such as The Market by Platinum, Wisdom 101, Smile Square, Central Village and Samyan Mitrtown. However, the vast bulk of this (299,000 sq.m.) will be finished in 2019, leaving an average of just 39,000 sq.m. to be released in each of 2020 and 2021 (Figure 18) and compared to an average annual new supply of 140,000 sq.m. in the previous three years, this is not a dramatic increase in supply. As regards demand, this is still growing steadily, with growth coming from both retailers and from distributors of overseas brands. These players are continuing to open stores in malls in Bangkok, especially in the central business district and in malls that are served by comprehensive communications links and that have heavy footfall (areas that are able to generate higher incomes for operators) and as a result, occupancy rates remain above 90% (Figure 19). However, the supply of property is also continuing to grow and this is driving greater competition between players. As such, in order to meet demands from their customers to purchase a complete range of goods and services in the same space and to justify keeping rents at high levels, operators are being pushed to modernize their premises.

Over the long-term, competition in the sector is likely to stiffen, driven by trends in real estate development that are emphasizing a move to mixed-use projects.[3] A large number of these developments are now in the pipeline and CBRE estimates that the combined floorspace of large mixed-use projects incorporating offices, hotels, serviced apartments, condominiums and retail units that will come to the market by 2025 will exceed 1 million sq.m. reflecting supply of new retail space that will expand considerably.

Krungsri Research view:

In 2019-2021, players in the retail space sector should see steady growth in their businesses, supported by rising demand for and the continuing development of retail projects by operators as they seek to meet customer demand that can be completed in a single space. However, the level of competition in the sector will tend to rise and this might put a limit on profitability, and so the forecast is for business performance to be at moderate levels.

- Operators with retail space: The forecast for this group is for solid growth in income. Players with a presence in the market benefit from the obstacles (including high investment costs) which are in the way of new entrants. Therefore, such existing players dominate the market, enjoying advantages in terms of their financial strength and cumulative landbanks in potential areas. Because it is difficult to expand to new sites downtown, operators in central Bangkok will put their efforts into modernizing these retail spaces in order to better meet the needs arising from the wide variety of lifestyles of their customer base. This will then tend to increase rental rates.

- Operators of community malls: Income is forecast to rise steadily on anticipated growth in consumption. New supply will tend to expand at a slowing rate following high cumulative supply in the preceding seven years. This situation was caused by the relatively low barriers to entry to the market, itself a result of the typically small size of community malls and accompanying relatively low investment costs and the fact that it was fairly easy to find sites suitable for development, especially in cheaper areas on the outskirts of Bangkok or in surrounding areas. As a result, occupancy rates are tending to improve, especially in sites in CBD that have greater potential. However, the number of new players continuing to rise and this is stoking greater levels of competition.

[1] Major regional centers’ refers to important tourist destinations and centers of economic development in the regions of the country, excluding the five provinces surrounding Bangkok. Examples include Chiang Mai, Nakhon Sawan, Phitsanulok, Khon Kaen, Nakhon Ratchasima, Chonburi, Rayong, Phetchaburi, Prachuap Khiri Khan, Songkhla, Surat Thani, Krabi, Phang Nga and Phuket.

[2] Dr.Chartchai Tuongratanaphan’s view referred from the result of study about community mall operated by large retailers.

[3] Mixed-use real estate projects combine residential and commercial uses in the same development, which may include retail, office and residential spaces.

.webp.aspx)