Depressed conditions have extended from 2020 into 2021 for the office rentals business, and the industry is continuing to battle against the stiff headwinds generated by this year’s severe outbreak of Covid-19 and the impacts of this on the economy. The pressure on costs that this has generated has then forced businesses to trim back on expenses, lay off staff and reduce their office sizes, but in 2022 and 2023, demand is forecast to make its way slowly out of this trough as the effects of the vaccine rollout begin to be felt, the economy rebounds, and the government moves forward with infrastructure projects, especially those connected with communications. The net effect of this will be to spur developers to step up their investments in new office space and/or in renovations of older buildings both within the CBD and in less central parts of the BMR. However, major developers’ investment plans indicate that over the period 2021-2023, growth in supply is likely to outpace what will be only somewhat weak recovery in demand, and so over the next 3 years, the occupancy rate will trend downwards.

The industry will also have to face a number of challenges in the near future, though two in particular stand out. (i) Although the Covid-19 crisis is beginning to abate, there is a possibility that over the next 1-2 years, some office staff will continue to work from home, and this will eat into demand for office space. (ii) Investment in new offices is predicted to double over 2021-2023, but recovery in demand will lag behind this. As a result, competition will stiffen and it will be difficult for landlords to raise rents.

Overview

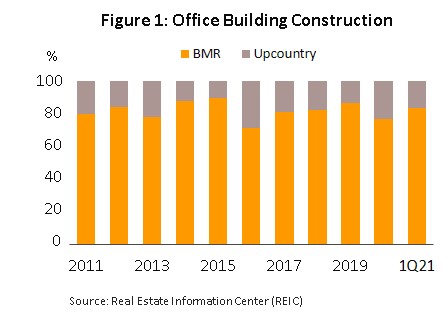

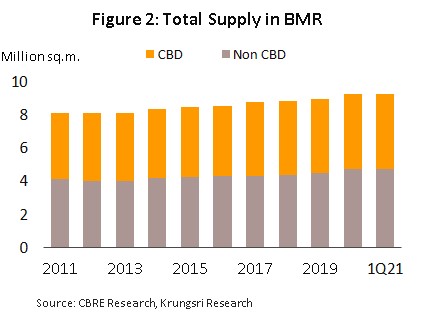

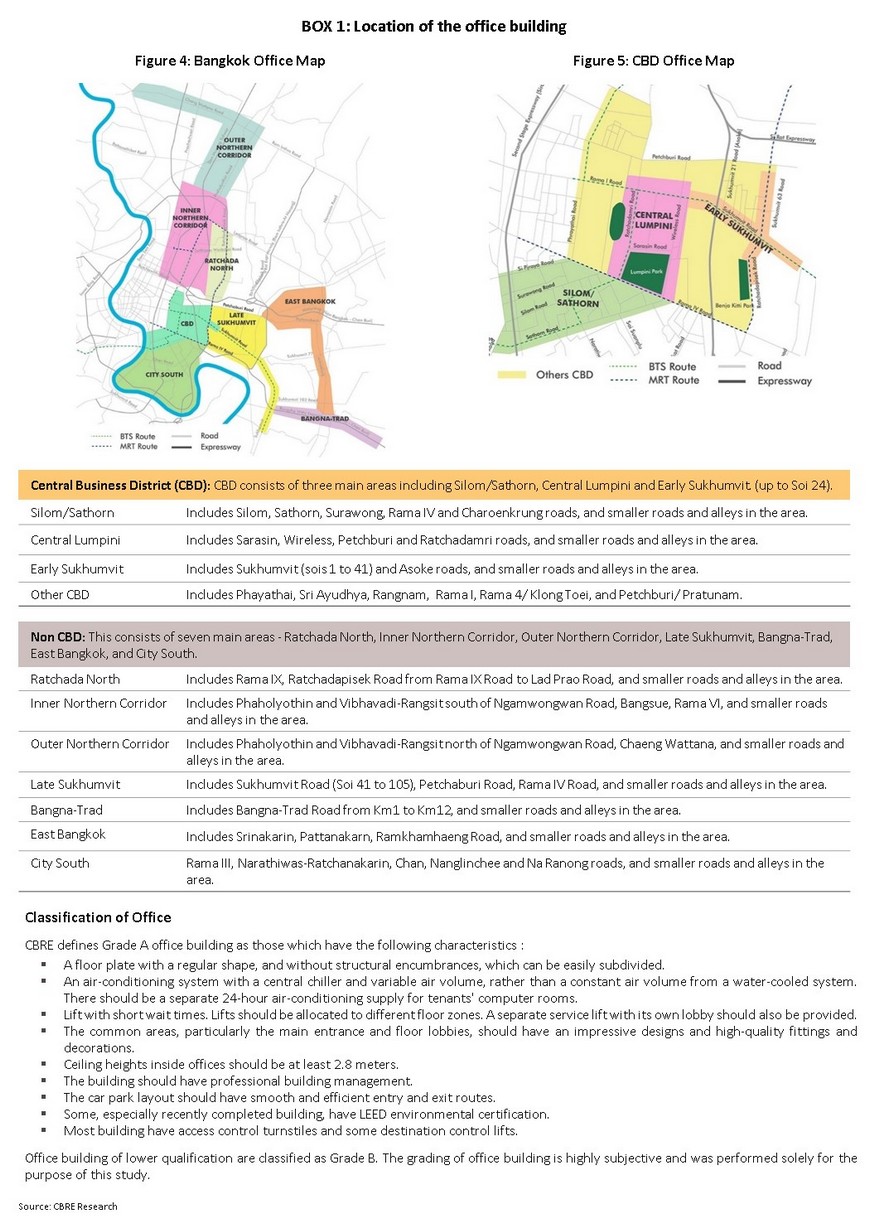

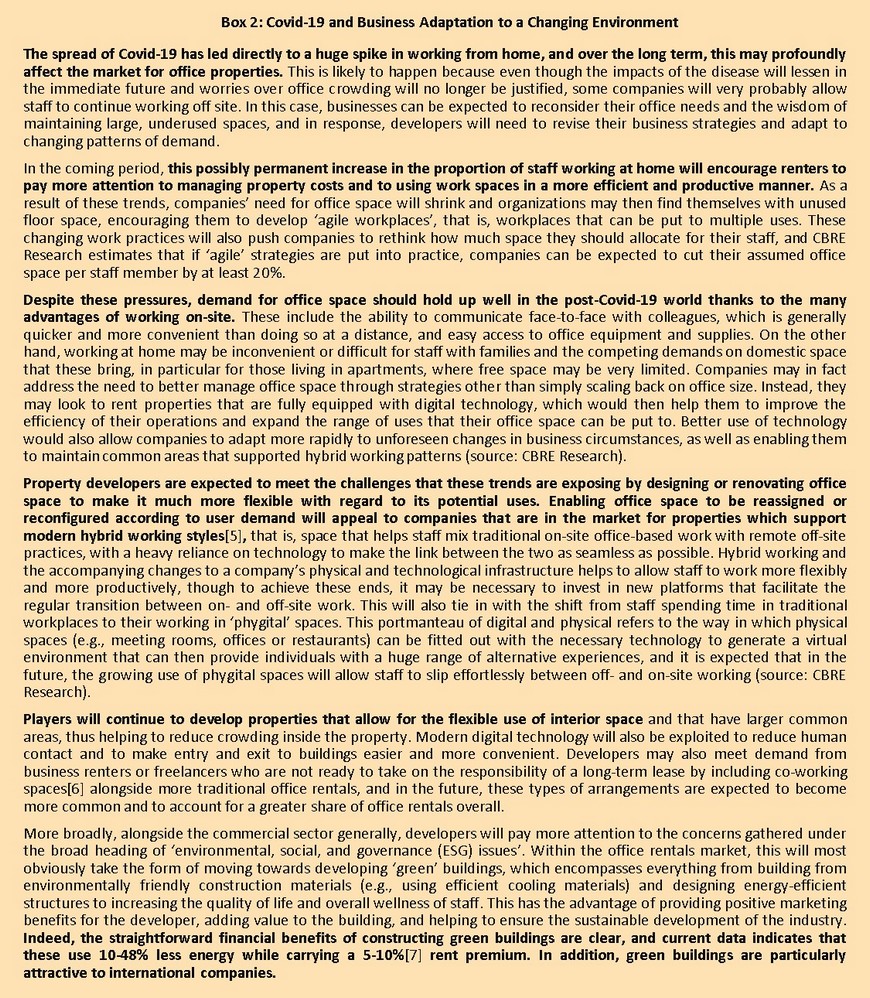

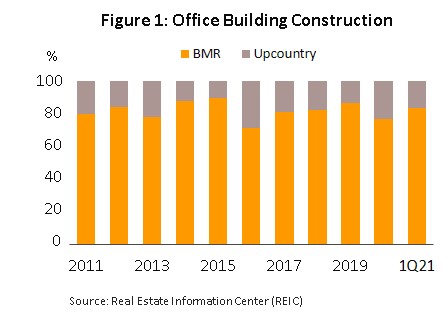

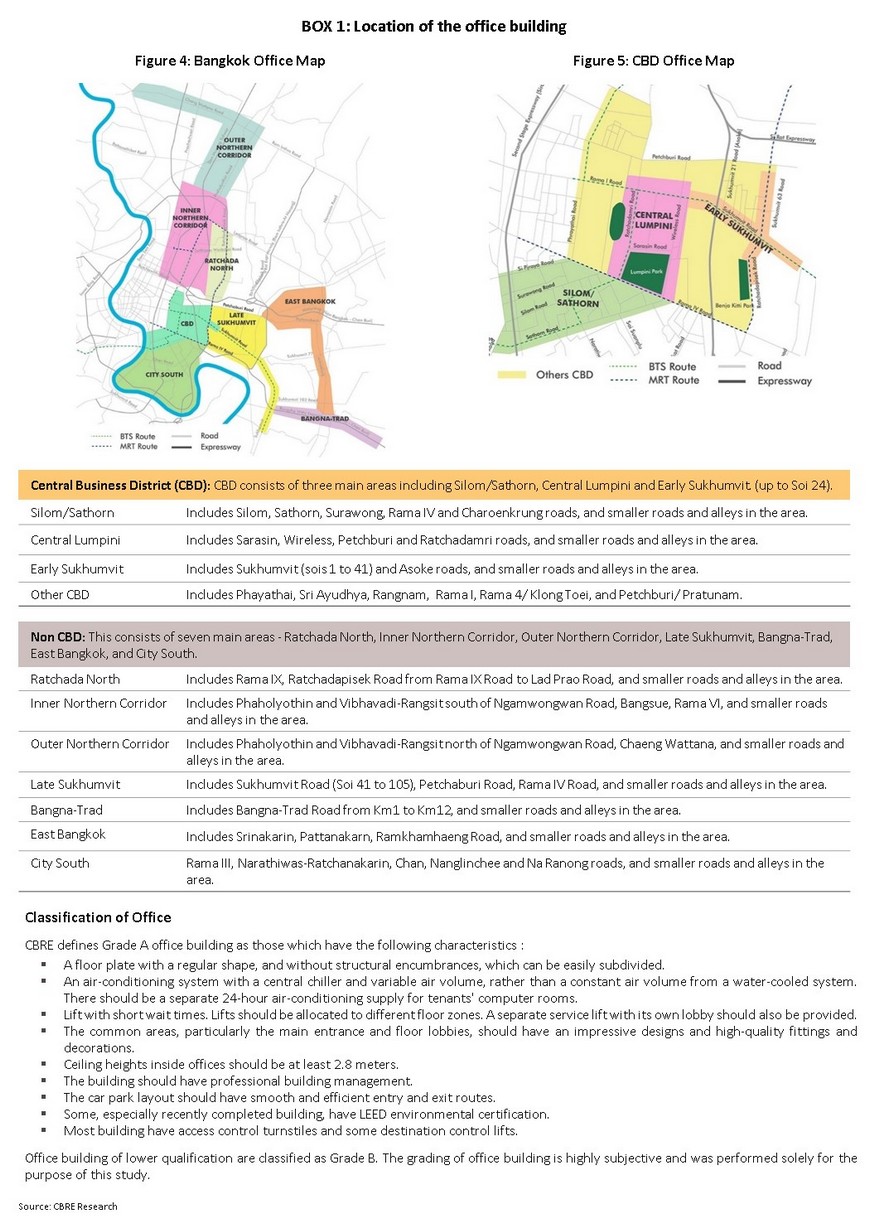

The Bangkok Metropolitan Region (BMR) is home to 80% of total rentable office space in Thailand (Figure. 1). These are mostly clustered in the central business district (CBD) and are part of (or linked to) mixed-use developments that typically include shopping malls and high-end hotels and residential units. Developers and consumers are attracted to the CBD because it is well-served by public transport links (BTS, MRT), and expressways that offer direct links from central districts of Silom, Sathorn, Ploenchit, Wireless Road, Asoke, and Sukhumvit (up to Soi 24) to outer area of Bangkok. But this comes at a price as the rapidly shrinking volume of land available for development in the CBD has pushed up land and property prices. The development of rapid mass transit systems since 2006 has seen new office buildings mushrooming outside the CBD and in suburbs such as Ratchadaphisek, Phahonyothin, Vibhavadi Rangsit, Chaengwattana and Bangna (Figure. 2).

Typically, new office space take one of two forms: high-rise development[1] or a large building[2]. These would be either rented out en bloc or sub-divided into smaller units for rent to several independent tenants. The latter would result in more than one company operating on the same floor. The building owners are responsible for supplying and maintaining facilities and utilities including electricity, air-conditioning, lifts, and car parks.

Developing office space in the CBD is capital-intensive and because of this, the market is dominated by large developers with the requisite financial strength and abundant landbank. This has led to restricted new supply of office space, a situation exacerbated by The Bangkok Comprehensive Plan (B.E. 2556) 2013, which limits the construction of new office buildings to commercial areas only. As a result, the land available for development is too small for large office buildings (at least 10,000 sq. m.). In contrast to the CBD, investors of office space in districts surrounding the CBD and in further zones are usually mid- to large-size companies which have different investment patterns. These companies invest in projects ranging from small buildings to house own operations - and perhaps rent out idle space - to commercial properties specifically for rental.

The management of office buildings in the BMR can be split into two types.

- Single ownership: These are typically high-rise buildings that are owned by a single business and which are managed by the building owner or by a specialist management company contracted in for the purpose. Most of these buildings will be rented out.

- Multiple ownership: These operate more like condominium buildings, with units within the development sold separately. Within a single building there will therefore be a number of different owners and these will have access to shared areas, forming a committee to jointly manage the property.

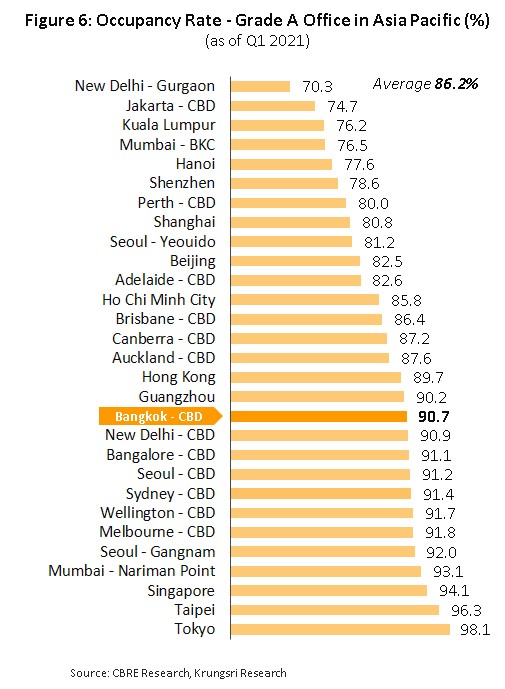

Demand for office space in Bangkok comes from both Thai companies and international operators that have set up offices in Thailand, including players in both the services and manufacturing sectors[3]. Domestic demand is strongly supported by SMEs. This is because these feature prominently within the Thai economy but these companies are restricted in their ability to fund building purchases or construction and so they are forced to rent instead. Historically, these rentals have been concentrated in Bangkok’s CBD, where new supply is limited and so occupancy rates within this area have averaged 90.7%, the 12th highest in the Asia-Pacific region (Figure 6). This in turn has enabled property developers to use their more advantageous negotiating position to extract higher rents, which have steadily risen as a result.

Generally, most office rental agreements will include the following topic.

- Lease agreement: This covers two classes of costs, ground rent (approximately 40% of the total) and service fees (the remaining 60%). The rental contract will be based on a fee for ground rent, set at a fixed price and quoted per square meter per month, while the contract for services will include all the non-rental fees, which will be payable at a variable rate according to usage (e.g., for electricity, air-conditioning, telephony charges, parking fees, management services and so on).

- Lease terms: Most leases run for 3 years. This benefits both landlords, since it assures them of continued revenue streams, and tenants, because moving to new premises incurs renovation, alteration and decoration costs. When leases are agreed for periods of time that are longer than 3 years, these need to be registered at the land office and in this case, a registration fee and stamp duty (of 1.1% of the total rental value) must be paid, which tends to make long-term lease agreements somewhat unpopular.

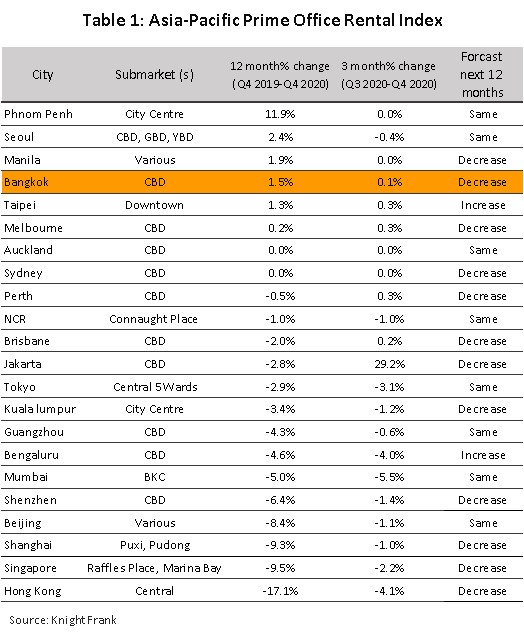

Rental values are determined by a building’s location, its grade or standard, the safety systems that are installed within it, and the facilities and amenities that are provided to occupants. The Asia-Pacific Prime Office Rental Index, which is compiled by Knight Frank and which covers a total of 22 cities, indicates that during 2020, Bangkok saw the 4th highest rate of increase in rents of the whole Asia-Pacific region (up 1.5% YoY). Rent rises in Bangkok were in fact only outpaced by those in Phnom Penh (Cambodia), Seoul (South Korea) and Manilla (the Philippines), comparing to other 14 cities that have reduction in rent.

At the same time, competition in the market for office space is relatively high, and this encourages landlords to engage in a constant process of overhauling and renovating their properties. Because grade A office properties that are easily accessible by mass-transit systems, are well managed, and which enforce strict security are in high demand, renovations often involve upgrading and modernizing the technology installed in older buildings, and improving their security and safety features.

Over the 5 years from 2015-2019, the criteria used by companies to assess potential office sites have also undergone change. CBRE Research reports that before 2015, demand was principally driven by the need to expand office sizes, and budgetary considerations were the main influence over this. However, between 2015 and 2019, companies shifted to being more concerned with maximizing their value for money, and 53% of those surveyed reported that if their business expanded and they took on more staff, they would prefer to adapt their current premises, rather than moving to a larger site.

In 2020, these preferences changed again, and the most important factors in considering a site have now become the need to control expenses and to ensure staff safety. The ability to use office space in the most efficient manner possible is also now important.

Situation

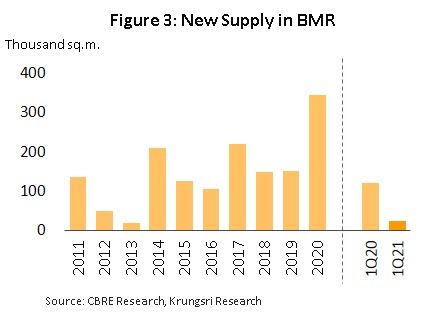

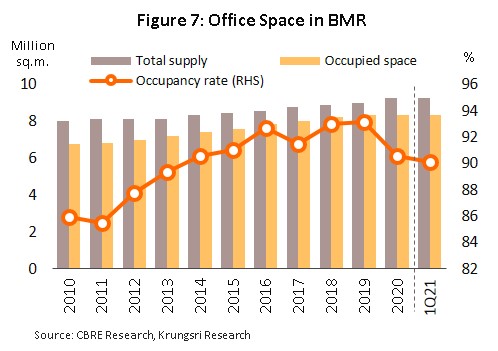

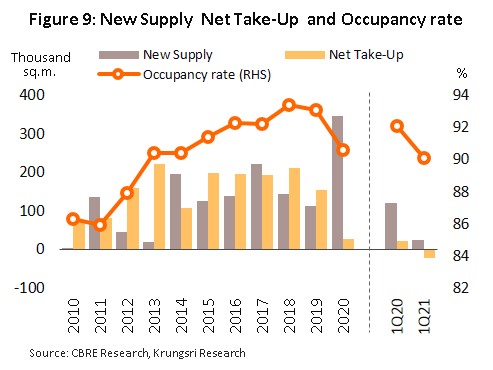

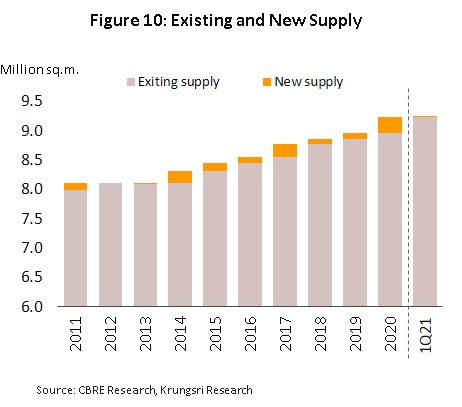

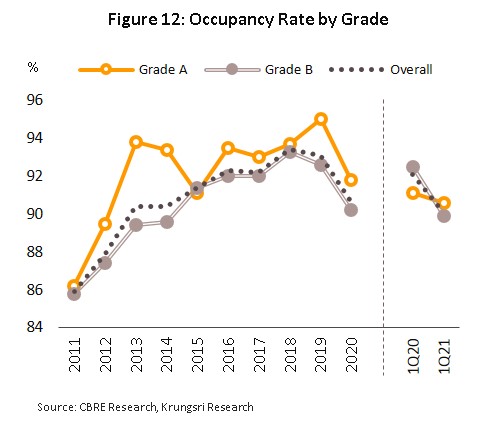

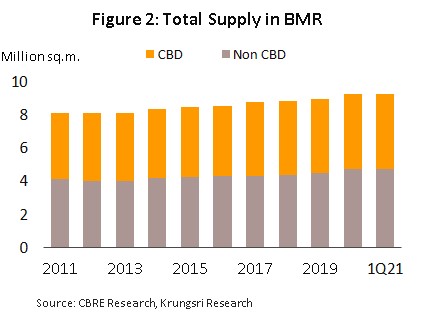

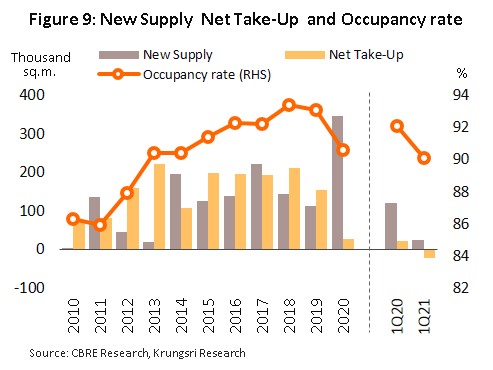

Demand for office space in the BMR rose steadily through the decade from 2010 to 2019, rising in step with economic growth and stronger business confidence. Over this period, demand expanded by an average of around 160,000 sq. m. per year, and naturally this prompted investors to renovate, expand and develop properties as they tried to profit from this situation. As such, supply rose by some 110,000 sq. m. per year through the decade, but the shortfall in supply steadily built and this translated into a gradual rise in the occupancy rate, which having started the period at 85.9%, finished it at 93.1%. Thus, for the decade overall, the total occupied space within the office rentals segment expanded 2.3% annually to a total of 8.36 million sq. m., while supply rose 1.2% per year to finish at 8.97 million sq. m. (Figure 7).

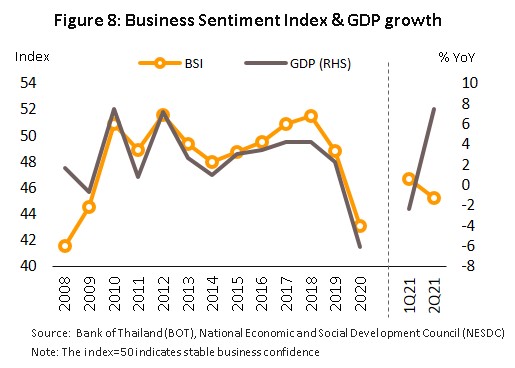

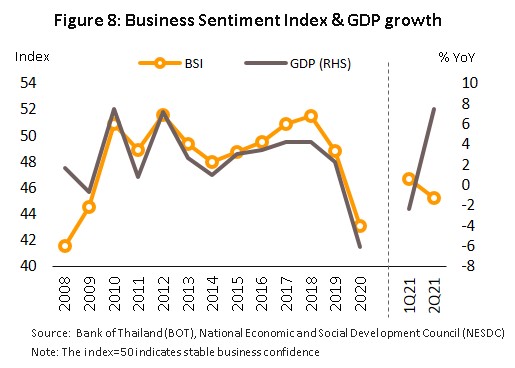

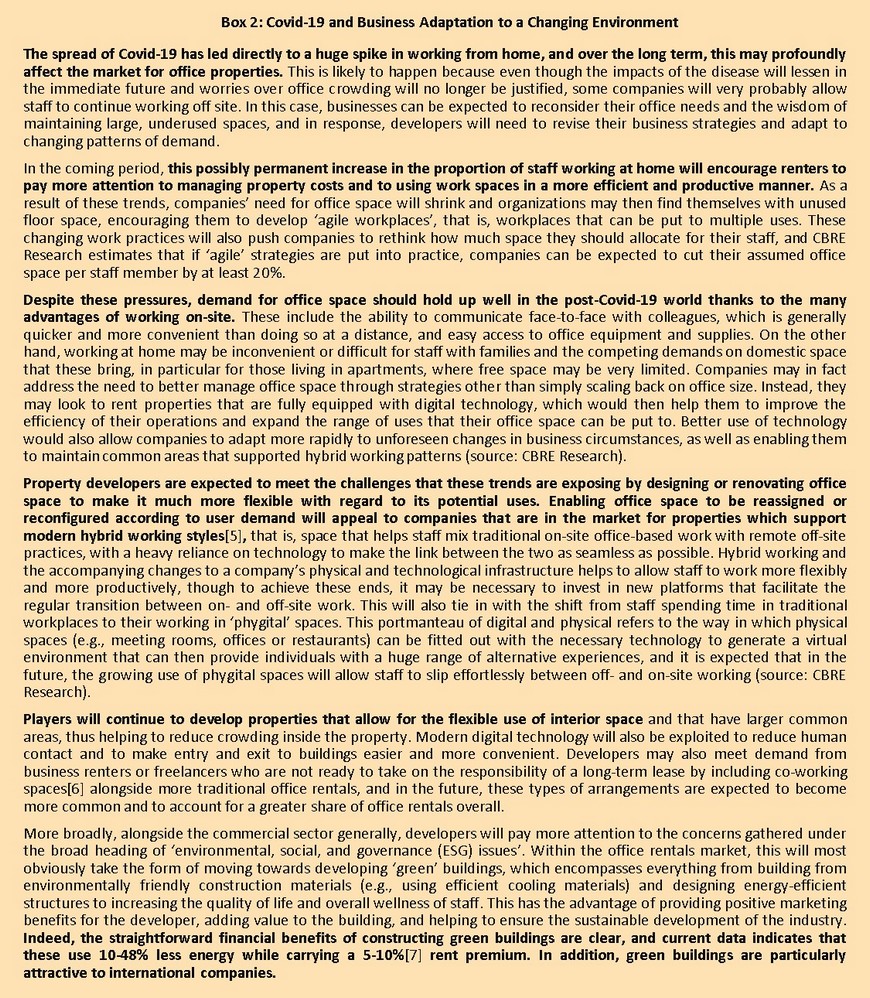

As was seen in industries across the economy, the outbreak of Covid-19 badly affected office rentals, and demand for office space slumped with the sharp slowdown in business activity seen in the first half of the year, the -6.1% contraction in Thai GDP (the first such recession since 1999) and the fall in business sentiment to a 12-year low (Figure 8). This challenging business environment undercut renters’ cash flows, and as a consequence, a total of 20,920 businesses became insolvent (5% contraction from 2019) and were forced to cease operating, while new business registrations fell at the even steeper rate of -11.4% YoY, significantly softening demand for office space. This general weakening of the market has been amplified by the need to protect against infection with Covid-19 by working from home scheme, which has prompted corporate and other renters to reassess their overall need for office space, and because of this, many are postponing or delaying decisions over whether to extend current leases or to agree to new ones.

As a consequence, in 2020, net take-up slipped to a 22-year low of just 27,325 sq. m., compared to 153,000 sq. m. a year earlier (Figure 9). However, one bright spot for the industry was 2020’s 100% jump in demand for office space from startups, and e-commerce and logistics operations, and the 200% surge in demand from for technology companies. This then helped to offset losses to the market from other businesses (e.g., in advertising, healthcare, automotive engineering and law) that rationalized, reduced or abandoned their leases, and as such, total occupied office space remained largely unmoved from 2019 and ended 2020 at 8.4 million sq. m. (source: CBRE Research).

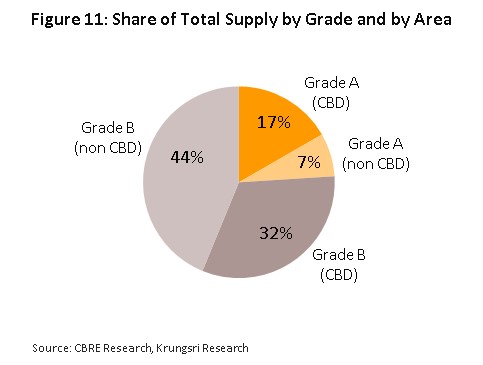

Despite this weakening of demand, developers have moved forward with aggressive investment plans, hoping to be in a position to meet recovering demand in the near future. The total supply of new space that came to market in 2020[4] therefore totaled 346,000 sq. m., over twice the average annual increase in supply recorded through the previous decade. This brought the total supply of office space at the end of 2020 to 9.2 million sq. m. (+2.9% YoY) (Figure 10), comprising grade B properties (76%) and grade A (24%) (Figure 11). The combination of slowing demand and a large extension in supply had the predictable effect of lowering the overall occupancy rate, and in 2020, this fell to a 6-year low of 90.6%, split between 91.8% for grade A properties and 90.2% for grade B space (Figure 12).

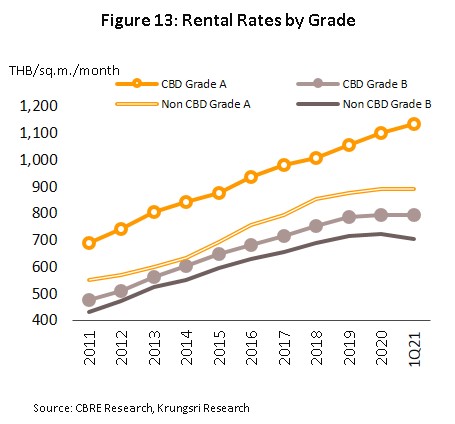

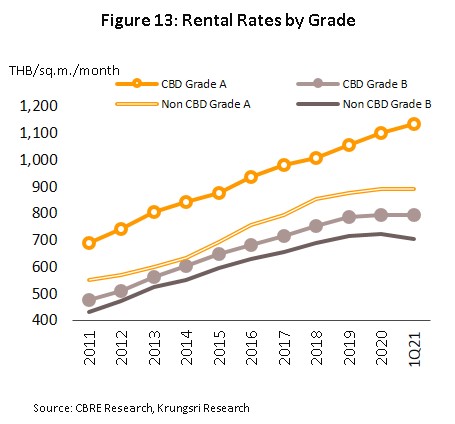

In 2020, rents also rose at their lowest rate in 9 years. For grade A properties, these were up by 3.2%, while for grade B office space, the average increase was limited to just 1.3% YoY. Details of this are given below.

- Grade A office space: Average rents for grade A properties in the CBD were the highest of all, and in 2020 these rose 4.2% to THB 1,100/sq. m./month (Figure 13), whereas outside the CBD, these were up 1.9% to THB 892/sq. m./month. These increases compare to averages of respectively 4.7% and 6.7% over the period 2015-2019, but rents held up relatively well in the circumstances thanks to continuing demand for grade A units, especially from businesses that enjoyed growth through 2020 and the Covid-19 pandemic (e.g., for technology platform companies and e-commerce players) and foreign companies that wish to present a more upscale image. In addition, the figures may be somewhat inflated by the fact that many contracts date from the start of the year, before rent reductions were agreed between tenants and landlords.

- Grade B office space: 2020 rents for properties inside and outside the CBD averaged respectively THB 797/sq..m./month and THB 728/sq. m./month. These figures represent YoY increases of 1.1% and 1.5%, significantly down from the average for 2015-2019 of 5.5% and 5.4%. Rents were bolstered somewhat by some renters (e.g., travel and tour companies, and advertising agencies) cutting their overheads and downgrading from grade A to grade B properties, but at the same time, landlords wished to keep current tenants in place and to attract new ones, and so this tended to restrict rent hikes. Landlords also tried to reduce renters’ costs by offering rent reductions for a specified period of time or by leaving rents unchanged when extending leases.

Data from Knight Frank show that in 2020, around 33% of all rental receipts came from properties that were newly constructed or that had been recently renovated. This was up from 21% in 2019 and

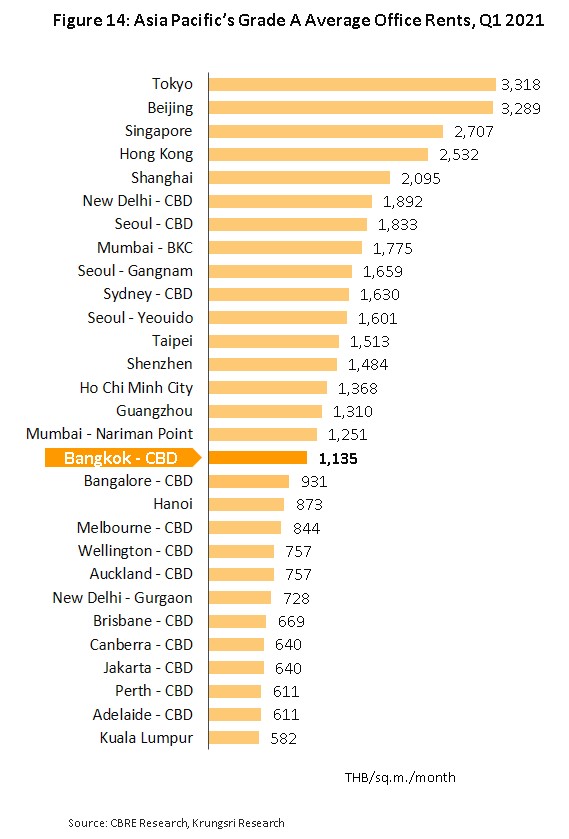

indicates that there is demand from some renters for new or modernized office space, and this is one ingredient helping to underpin overall rent rises. Nevertheless, office rental rates in Bangkok remain fairly low compared to some other cities in the Asia-Pacific region, such as Tokyo, Beijing, and Singapore (Figure 14), and these low prices are one reason why foreign companies are attracted to setting up operations in Bangkok.

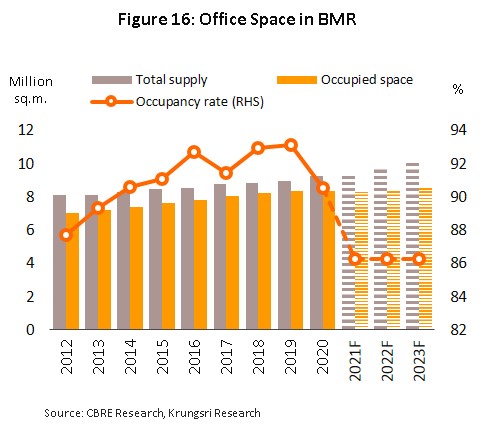

In the first quarter of 2021, depressed conditions continued to weigh on demand for office space. The upsurge in Covid-19 cases recorded at the close of 2020 extended and worsened into 2021 and this kept the economy in a weak and fragile state. In this unfavorable environment, businesses have tended to put off expansion plans, reduce the size of their office or even close altogether, but despite this, most landlords have been able to keep their tenants in place and even attract new renters, principally by keeping rents low (especially for less attractive grade B units outside the CBD). Players were broadly successful in this, and in 1Q21, total demand for office space therefore slipped just -0.5% YoY to 8.3 million sq. m., while supply expanded 1.8% YoY to 9.3 million sq. m., and this difference then pulled the occupancy rate down to 90.1% from 92.1% in 1Q20.

Industry Outlook

The commercial environment will remain depressed for owners of office space through 2021 results from the ongoing effect of Covid-19 on the economy. The weak economy is encouraging many companies to restructure and to slash overheads by laying off staff and looking for smaller premises, especially outside the CBD. However, the acceleration in the vaccination program and its rollout across the country will help to bring the pandemic under control, and in 2022 and 2023, this will feed into an improvement in the outlook for both the economy generally and the office rentals space in particular.

Krungsri Research therefore sees demand for office space remaining flat or possibly shrinking by up to -0.5% in 2021, but in 2022 and 2023, demand should return to average annual growth of 1.8% (this compares to an average over 2015 to 2019 of 2.5%). In addition to the boost to demand given by the rebound in economies at home and abroad, increased government disbursements for infrastructure projects, especially for transport and communications, will also encourage investors to step up spending on the construction and renovation of office buildings across the BMR, with demand from players in the service sector, retail and technology expected to be particularly strong.

Developers are likely to move forward with ambitious investment plans that include a significant number of mixed-use developments (e.g., Siamscape, The Unicorn, Park Silom, Emsphere and One Bangkok (phase 1)), though labor shortages will mean that the completion dates of some projects will probably be postponed.

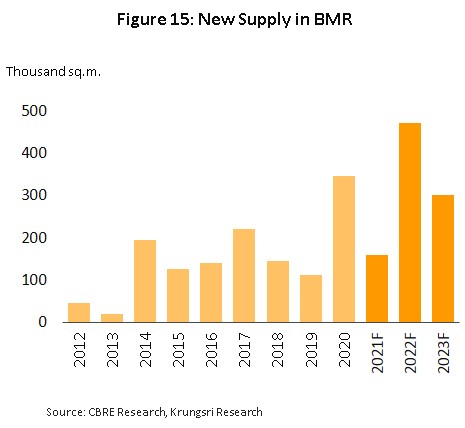

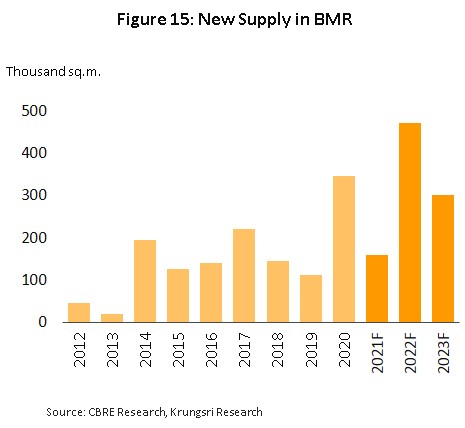

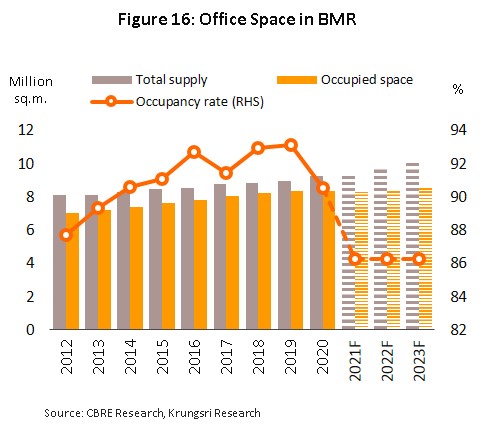

Krungsri Research’s assessment of the market is that over 2021 to 2023, supply will expand by 1 million sq. m., an increase of 3.3% per year (Figure 15), but demand growth is likely to lag behind this, and so the occupancy rate will weaken to an estimated 86% (Figure 16).

Overall, rents will likely trend upwards. For all properties in the CBD and grade A units outside it, rental rates will lift slowly with recovery in demand, especially from fast growing segments of the services, retail and technology sectors. Costs will also rise for developers, most notably for the renovation and modernization of existing sites and for new projects, which increasingly require heavy investment in modern design, advanced technological infrastructure, and high-quality building management. For grade B sites outside the CBD, rents may decline in 2021 but they should return to growth in 2022 and 2023; most renters of these units are SMEs that have been badly buffeted by the Covid-19 pandemic, but from 2022 onwards, businesses should return to a more normal state as the crisis abates.

Despite an expected improvement in the business landscape, major challenges will remain for developers in the near future. (i) Even as the Covid-19 pandemic abates and the need to work from home lessens, some staff are likely to continue to do so over the next few years, and this will tend to erode demand for office space. (ii) Developers’ current investment plans indicate that over 2021-2023, new supply will grow at approximately double the average of the preceding 5 years, but recovery in demand is unlikely to match this aggressive pace and as such, competition will stiffen and it will be difficult for operators to raise rental rates.

Internationally, the market for office property in Thailand enjoys several advantages relative to competitors elsewhere in the ASEAN region. (i) Thailand is situated at the geographical heart of Southeast Asia and the country is well served by communication links with neighboring countries, making it an attractive launch pad for trade and investment across the region. (ii) Office rents are still low compared to some competitors (e.g., Singapore). (iii) The government provides incentives to companies establishing operations in Thailand (e.g., those setting up regional operating headquarters). These factors will thus support ongoing growth in demand in the coming period.

Krungsri Research’s view

Depressed conditions have continued from 2020 into 2021, but the market for rented office space will pick up again in 2022 and 2023 as the economic outlook strengthens and government spending on infrastructure rises. However, supply growth is expected to outpace recovery in demand, and over the next two years, this will pull down the occupancy rate and restrict the extent to which landlords are able to raise rents. Indeed, although average rents will tend to rise, this will be largely thanks to continuing demand for all types of office space within the CBD and for grade A units outside it.

- Developers of rented office space in prime areas[8]: For these players, income will continue to grow. Competition in this segment is restricted by the high capital costs and lack of land for development, which therefore commands a high price, and this restricts the entry of new players to the market. Instead, the market is dominated by established developers that draw advantages from their financial position and their having access to land with high potential. Nevertheless, demand will return only slowly to this segment, while supply is forecast to expand on ambitious investment plans, and this discrepancy will tend to reduce occupancy rates and make it difficult for operators to put up rents, although these will still remain higher than in other areas.

- Developers outside the CBD and in the wider BMR region: For developers based outside the CBD, income growth will remain flat on expanding supply. The latter will be boosted by urban expansion along new and extended metro lines and into more suburban areas, where because land prices are still relatively low, new investors are entering the market. The increase in supply that this will bring is likely to run ahead of any strengthening of demand, and so competition will increase and developers will find it difficult to raise rents.

[1‘High rise building’ means a building in which people may enter to reside or utilize, and which shall be at least twenty-three meters high.

[2Large buildings’ means a building which has total floor area or area of any floor within the same building more than 2,000 square meters or a building which is 15.00 meters high or more and has an area in the same building more than 1,000 and not more than 2,000 square meters.

[3]From ‘Real Estate Market Outlook 2019’ (CBRE).

[4]E.g., The Park, Spring Tower, Tipco Tower 2, Major Tower Ramkhamheng, TRR Building, CP Tower North Park, Sathorn Prime, Summer Point, and Lumpini Tower Vibhavadi-Chatuchak.

[5]Hybrid working refers to the practice of mixing traditional on-site or in-office working with remote off-site working.

[6]Co-working spaces are commercial areas available for use by people from any profession, who may rent space that is provided together with access to standard office infrastructure and equipment (e.g., desks, high-speed wi-fi internet access, meeting rooms, printers, etc.). Customers are able to choose rental arrangements to suit their needs, which may include using a private working area, discussing business in a small meeting room with a few others, or using a more substantial conference room to meet larger groups of people. Likewise, rental arrangements may be made by the hour, the day or the month (source: www.estopolis.com and www.bisnescafe.com).

[7]SCG Green Building Solution

[8]‘Prime areas’ are those that developers view as having investment potential, having considered the accessibility of the site through communications and mass-transit networks, together with the infrastructure that is already in place. In Bangkok, prime areas include Silom, Sathorn, Wireless Road, Ratchadamri, and Ploenchit.

.webp.aspx)