Office rents in Thailand will continue to rise between 2019 and 2021, supported by the improving domestic economy and deeper trade and investment links within the ASEAN region. At the same time, anticipated limited supply of new office space would keep occupancy rates above 90%, which would offer an opportunity for developers to improve profitability and earnings.

Overview

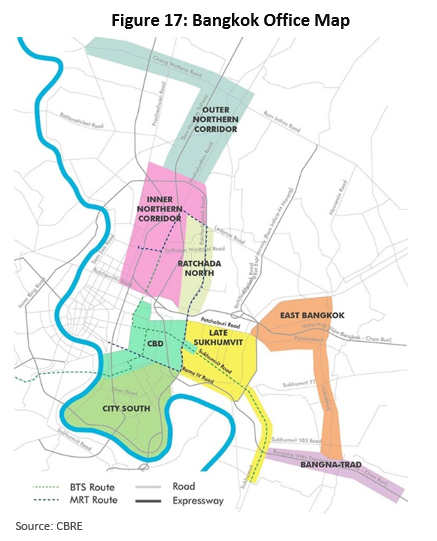

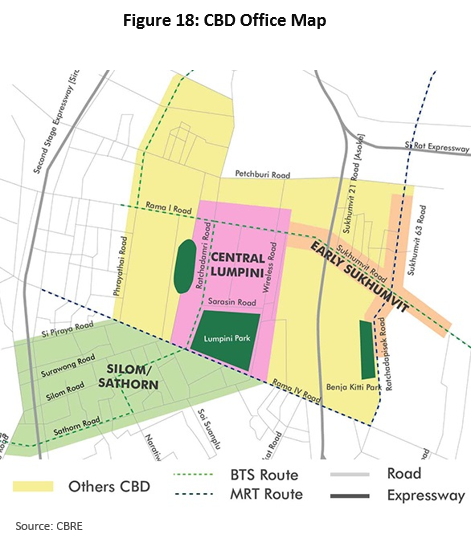

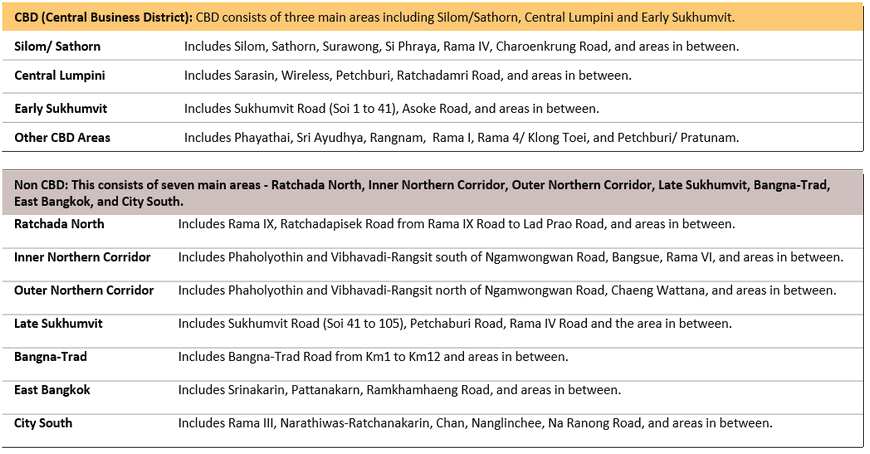

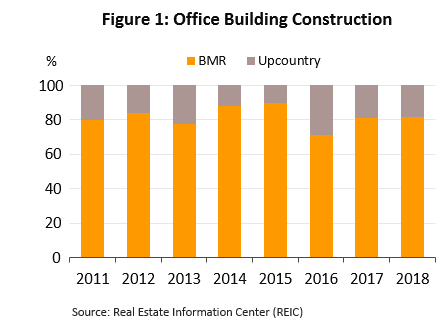

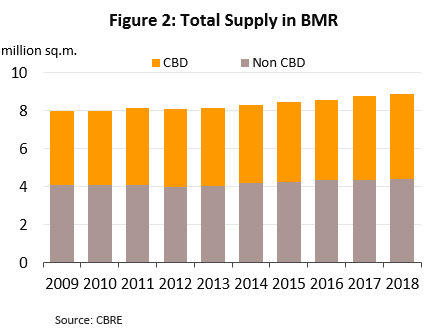

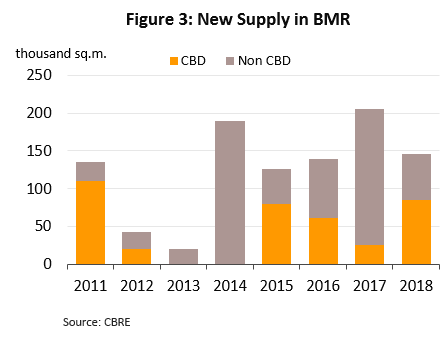

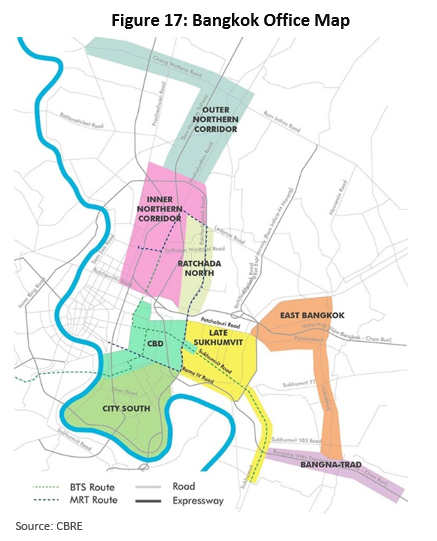

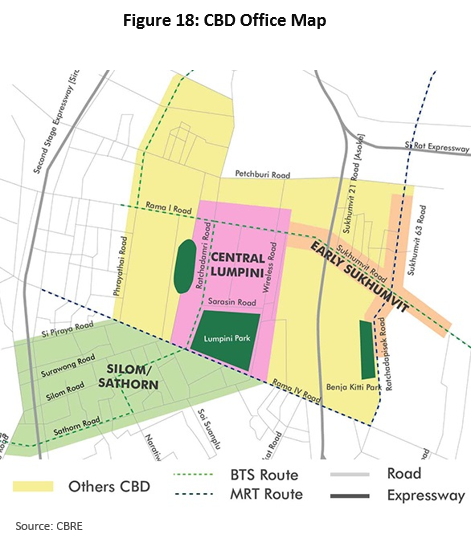

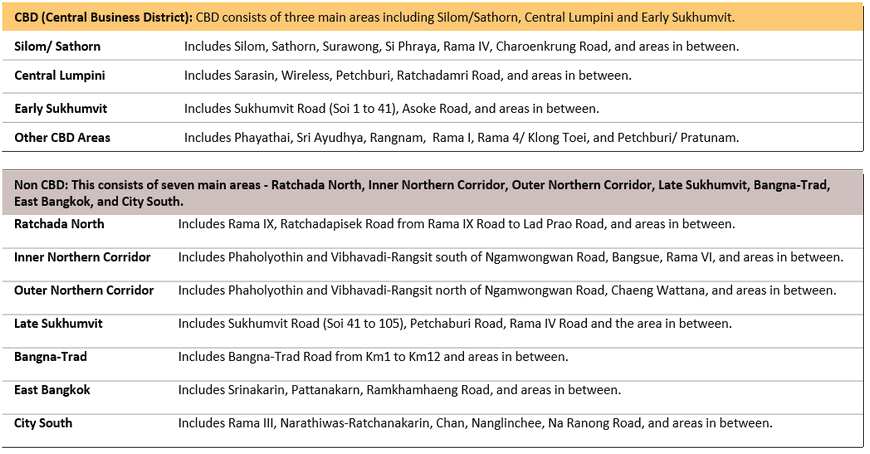

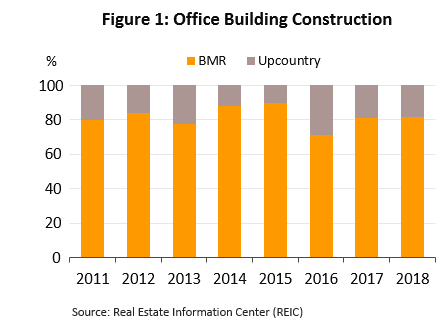

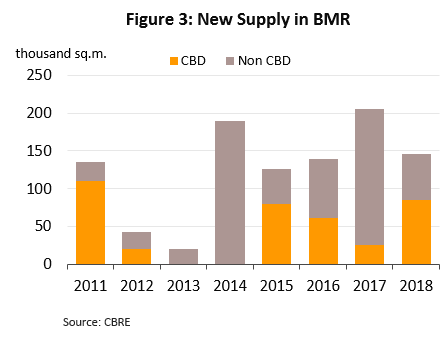

The Bangkok Metropolitan Region (BMR) is home to 80% of total rentable office space in Thailand (Figure. 1). These are mostly clustered in the central business district (CBD) and are part of (or linked to) mixed-use developments that typically include shopping malls and high-end hotels and residential units. Developers and consumers are attracted to the CBD because it is well-served by public transport links (BTS, MRT), and expressways that offer direct links from central districts of Silom, Sathorn, Ploenchit, Wireless Road, Asoke, and Sukhumvit (up to Soi 24) to outer area of Bangkok. But this comes at a price as the rapidly shrinking volume of land available for development in the CBD has pushed up land and property prices. The development of rapid mass transit systems since 2006 has seen new office buildings mushrooming outside the CBD and in suburbs such as Ratchadaphisek, Phahonyothin, Vibhavadi Rangsit, Chaengwattana and Bangna (Figure. 3).

Typically, new office space take one of two forms: high-rise development[1] or a large building[2]. These would be either rented out en bloc or sub-divided into smaller units for rent to several independent tenants. The latter would result in more than one company operating on the same floor. The building owners are responsible for supplying and maintaining facilities and utilities including electricity, air-conditioning, lifts, and car parks.

Developing office space in the CBD is capital-intensive and because of this, the market is dominated by large developers with the requisite financial strength and abundant landbank. This has led to restricted new supply of office space, a situation exacerbated by The Bangkok Comprehensive Plan (B.E. 2556) 2013, which limits the construction of new office buildings to commercial areas only. As a result, the land available for development is too small for large office buildings (at least 10,000 sq. m.). In contrast to the CBD, investors of office space in districts surrounding the CBD and in further zones are usually mid- to large-size companies which have different investment patterns. These companies invest in projects ranging from small buildings to house own operations - and perhaps rent out idle space - to commercial properties specifically for rental.

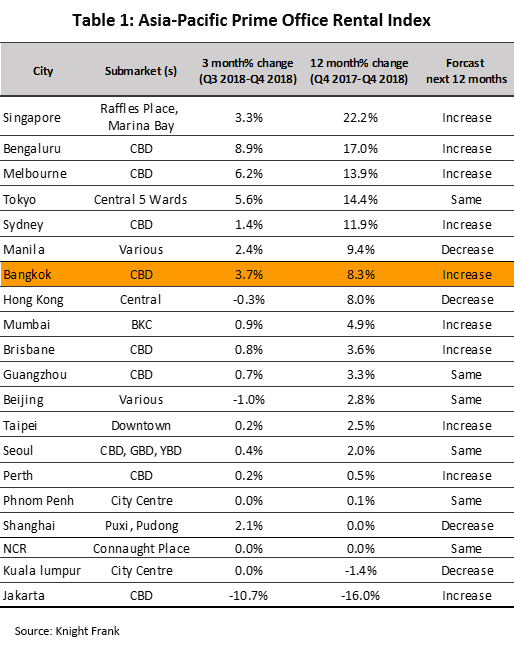

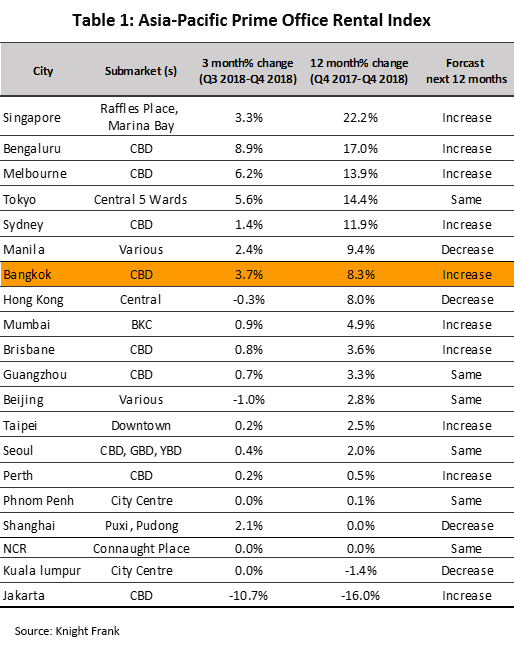

Office rents are determined by the building’s location, grade or standard, installed safety systems, and facilities and amenities provided to occupants. The rapidly growing services sector in Thailand continues to raise demand for office space and consequently, push up rents. The 2018 Knight Frank Asia-Pacific Prime Office Rental Index, which compares rents for office space in 20 cities in the Asia-Pacific region, reveals rents in Bangkok had risen at the 7th fastest pace. The 4Q18 index shows Bangkok rents had risen by 8.3% YoY and 3.7% QoQ (Table 1),. And, rents will continue to rise for at least the next two years driven by strong demand and restricted new supply.

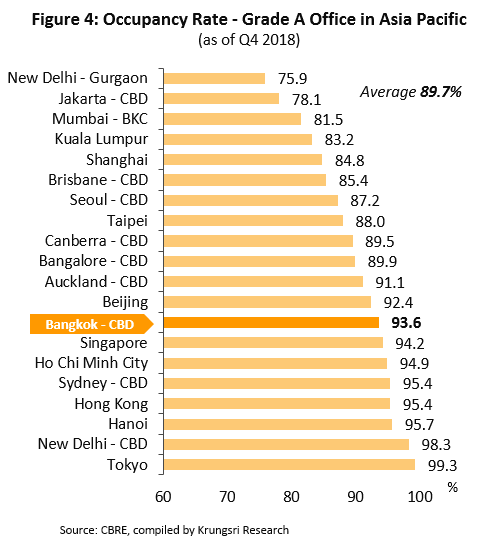

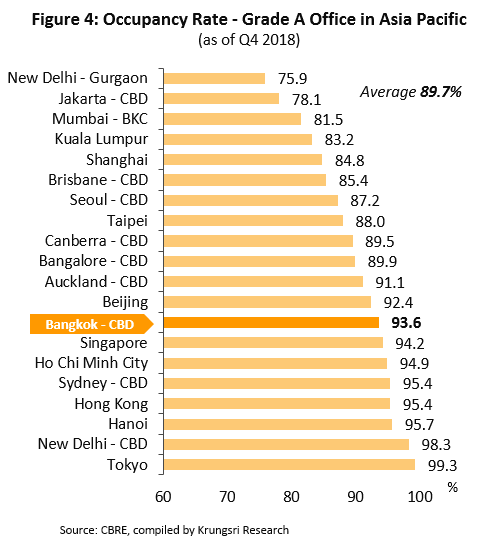

Demand for office space in Bangkok from both Thai and multinational companies (MNC). More recently, a rising number of MNCs which have chosen to set up base in Thailand are tech companies (including those in the telecommunications and online retailers of goods and services)[3]. Meanwhile, most domestic demand for office space come from SMEs, which normally have limited financial capacity to buy or construct their own space, and hence, are forced to rent. Historically, these rentals have been concentrated in Bangkok CBD, where new supply is limited and occupancy rates are averaging 93.6%. This is considered high compared to other cities in the Asia-Pacific region (Figure. 4), and that has enabled property developers to use stronger negotiating power to extract higher and higher rents.

However, there is also strong competition in the office space market as potential tenants also consider the quality of building services and management, technology employed, security and safety features, and increasingly, public transportation links. There is strong demand for Grade A office buildings that are easily accessible by mass transit systems, and that are well-managed and enforce strict security measures (see Page 9 for grading system).

Office buildings in the BMR are one of two types (Source: CBRE Thailand).

- Single ownership: These are high-rise buildings that are owned by a single business and which are managed by the building owner or by a specialist management company contracted for this task.

- Multiple ownership: These operate more like condominium buildings, with units within the development are sold to separate buyers. The multiple owners will have access to shared areas and facilities, and form a committee to jointly manage the property.

Most rental agreements are for 3 years. This benefits both landlords and tenants. Landlords are assured of recurring rental income while tenants would be assured their investment in renovation, alterations and interior decoration would not be wasted. Rental agreements longer than 3 years need to be registered at the land office and a registration fee and stamp duty (of 1.1% of the total rental value) must be paid.

Typically, the total rent payable will comprise about 40% ground rent and 60% fees for services such as electricity, air-conditioning, telephone charges, parking fees, management services. However, since building tax is payable on only the ground rent, contracts will generally be split into smaller agreements, one for actual rent and one for additional services. The rental contract will usually specify the fee for ground rent, set at a fixed price per square meter per month, while the contract for services will include all the non-rental fees, which are mostly payable at a variable rate according to usage.

The majority of companies which offer office space for rent in the BMR are large property developers. TCC Group is the most prominent; they own 0.5 million sq. m of office space or 6% of the total BMR market. Their projects include FYI Center, Cyberworld, Park Venture, Goldenland, Athenee Tower, 208 Wireless Road, Sathorn Square, Empire Tower, and Nation Tower. In addition, operators such as CP Land, Q House, and Central Pattana also invest in leasehold property funds.

Current Situation

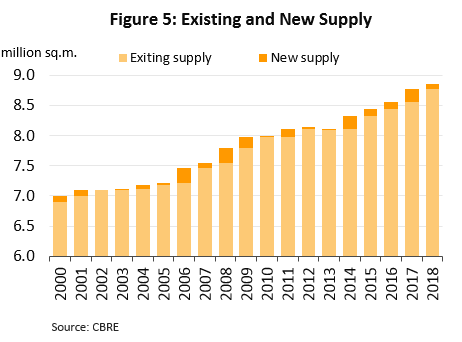

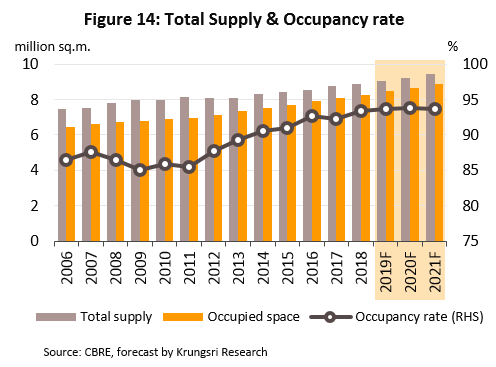

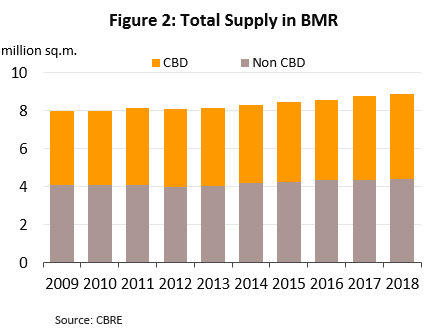

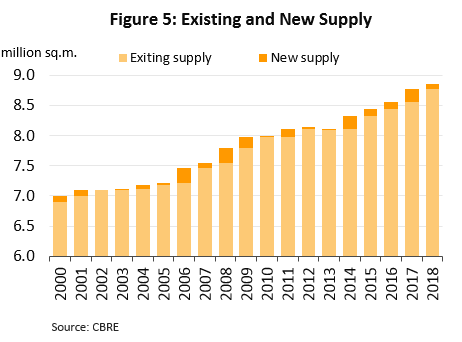

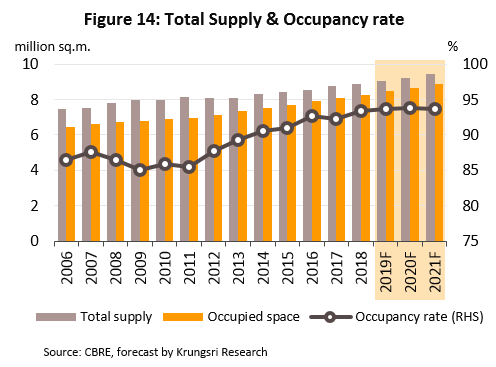

Prior to the 1997 Asian Financial Crisis, the Thai economy had been growing rapidly. Riding on that, the office property sector also experienced strong growth and when the crisis started, there was 6 million sq. m. of office space in the BMR. Following the crash, between 2000 and 2005, new supply of office space slowed to an average of only 50,000 sq. m. per year, with no new supply in some years. In 2006, the sector started to pick up again partly driven by the extension of the MRT and BTS networks which helped to stimulate investment in new developments both in and around Bangkok CBD. Overall, between 2006 and 2017, an average of 140,000 sq. m. of new office space was released into the market annually, resulting in a total cumulative supply of 8.78 million sq. m. of rental space by the end of 2018 (Figure. 5).

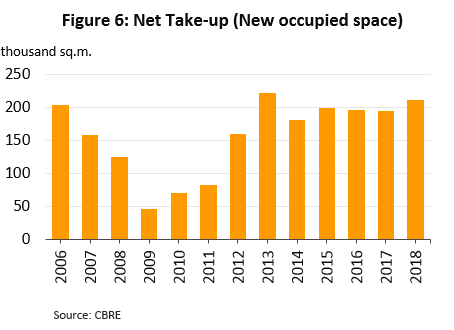

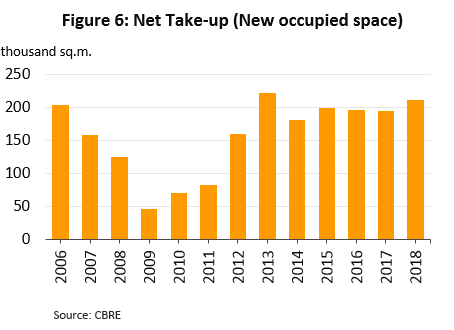

The office rental sector continued to grow throughout 2018 amid steadily rising demand and limited new supply. There was strong demand from both current occupants who were expanding operations as well as new businesses seeking premises in the area (Source: CBRE). This supported a net take-up rate of 211,414 sq. m. (Figure. 6), close to the average for the last five years. As such, in 2018, total occupied rental office space in the BMR reached 8.28 million sq. m. (up 2.2% YoY).

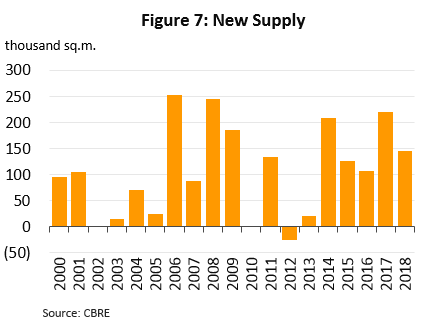

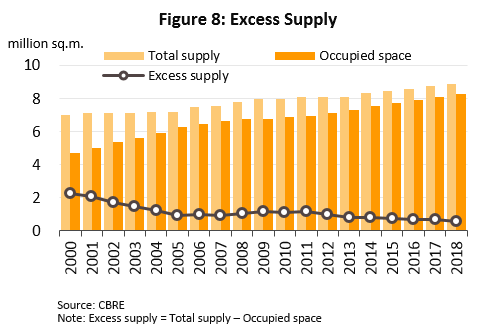

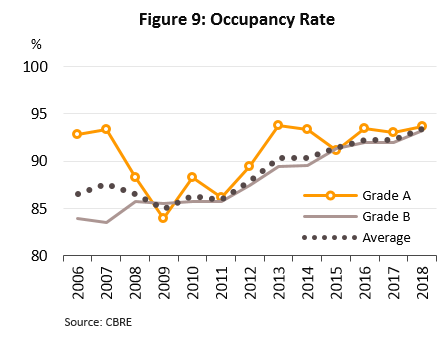

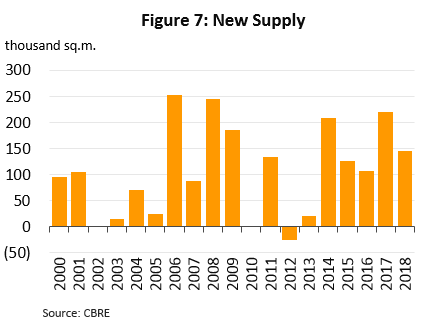

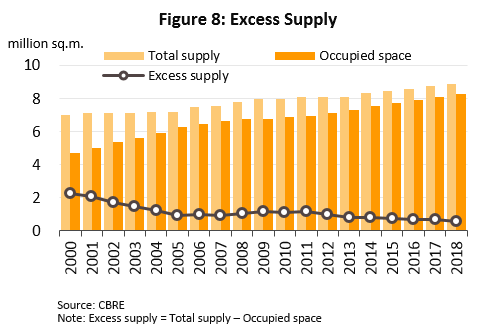

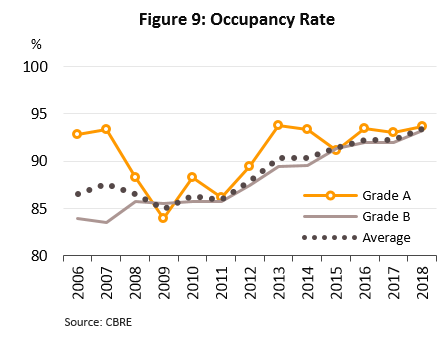

A total of 146,319 sq. m. of new office space came into the market in 2018 (Figure. 7). This represented a 33.8% drop compared to the previous year which included the opening of Singha Complex, Ari Hills, and T-One office building. If we remove 62,970 sq. m. of space that was taken off the market from the 2018 slide for new rentals, the supply of rental office space would have been insufficient to meet demand for the year. This suggests some excess supply from earlier years were absorbed (Figure. 8) to keep occupancy rate high at 93.4% (Figure. 9). This implies there is still strong demand for office space.

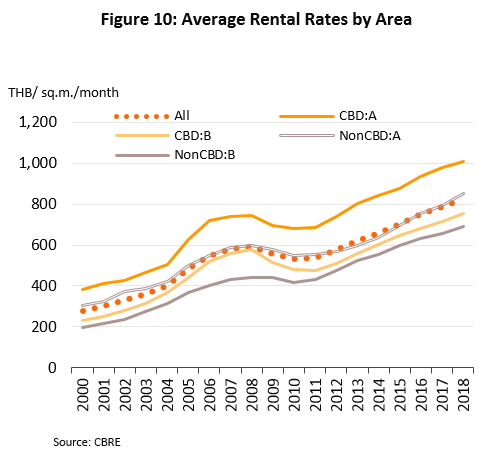

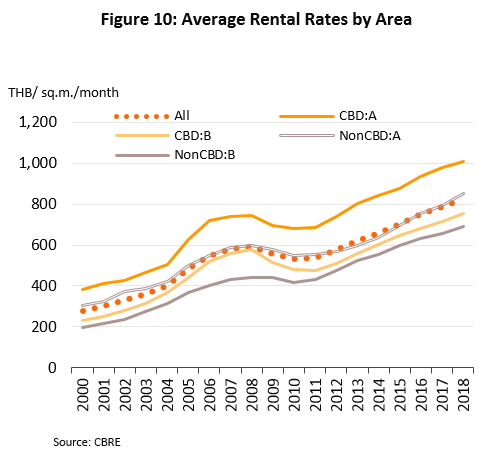

In 2018, rents rose for all grades of rental properties in all areas. The average increment was 5.0% YoY driven by a combination of continued strong demand and limited new supply. Rents for Grade A properties in the CBD rose by 3.0% YoY to THB1,009/sq. m., while rents for similar properties outside the CBD rose 7.3% YoY to THB853/sq. m. (Figure. 10). The stronger growth for the latter is explained by the fact that there is still strong demand for Grade A buildings but these only comprise 23% of office rental properties, so renters are increasingly seeking sites outside the CBD. Within the CBD, the limited space and relatively expensive land cost have been encouraging developments for other uses, such as condominiums.

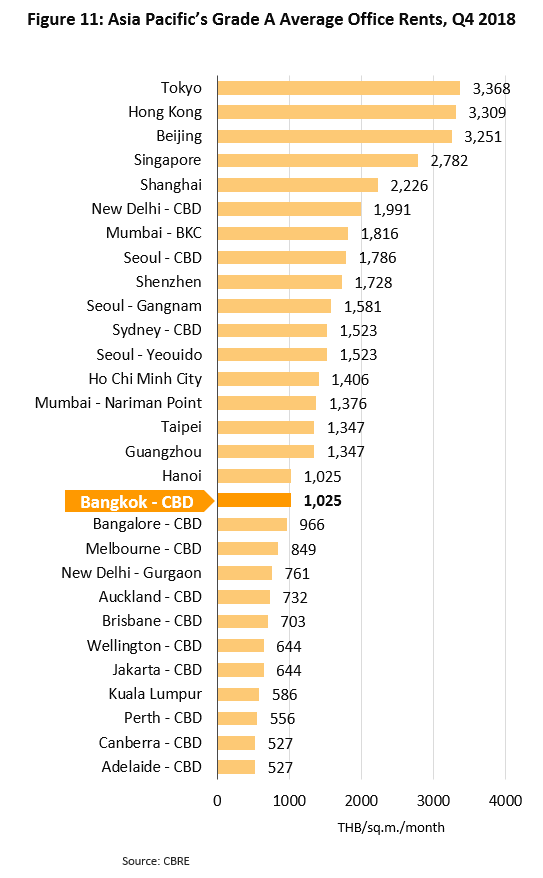

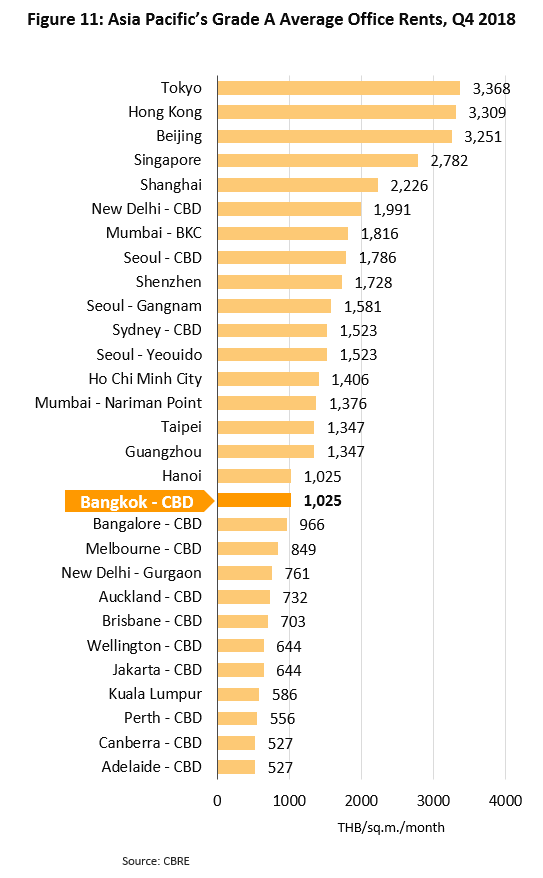

Although office rents are still rising in Bangkok, they remain low compared to several other cities in the Asia-Pacific region. For example, office rents in Tokyo, Hong Kong and Beijing are three times most expensive at THB3,368, THB3,309 and THB3,251 per square meter per month (Figure. 11). In Bangkok, the average rent in the CBD is THB1,025/sq. m./month.

Industry Outlook

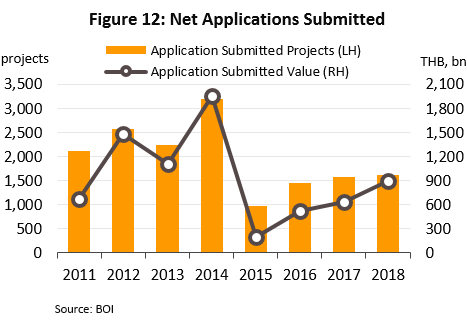

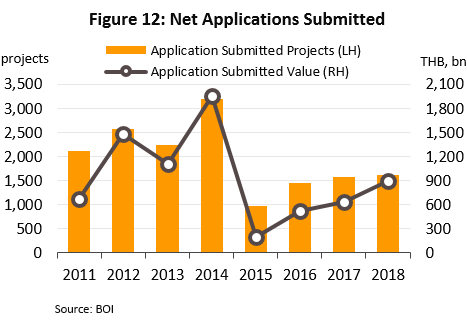

Krungsri Research’s analysis shows that between 2019 and 2021, demand for rental office space in the BMR will remain stable at around 200,000 sq. m. per year. Demand will be underpinned by progress in the government’s infrastructure development plans, which will attract additional investment from the private sector. Indeed, the number of foreign applications submitted in 2018 had jumped 42.9% YoY. These had a combined value of THB902bn[4], which points to increasing demand for rental office space in the next period. Research by Jones Lang La Salle Incorporated (JLL) also indicates 70-75% of MNCs that plan to open offices in Thailand will require an average space of over 1,000 sq. m. each.

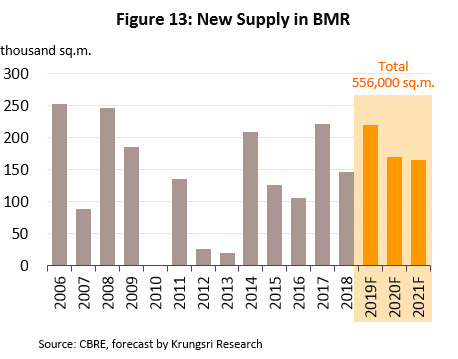

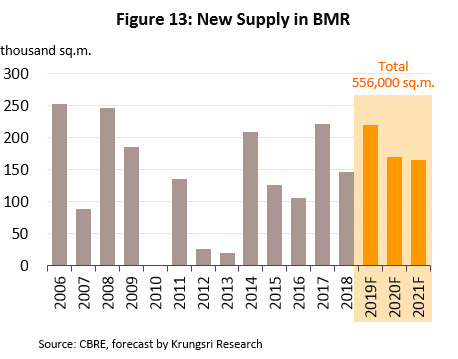

However, the scarcity of land suitable for development, especially within the CBD, means that new supply will be limited. We estimate new supply in the CBD will average 185,000 sq. m. annually up to 2021 (Figure. 13), including MS Siam Tower, True Digital Park, Samyan Mitrtown, and Spring Tower. And because demand will exceed new supply, occupancy rate is expected to stay high at 94% (Figure. 14).

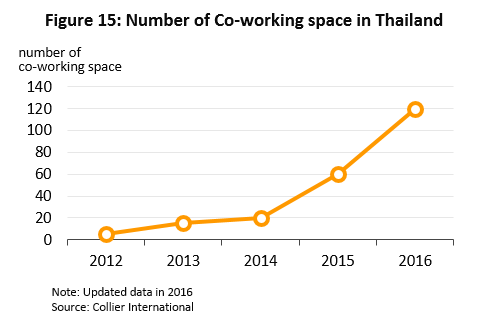

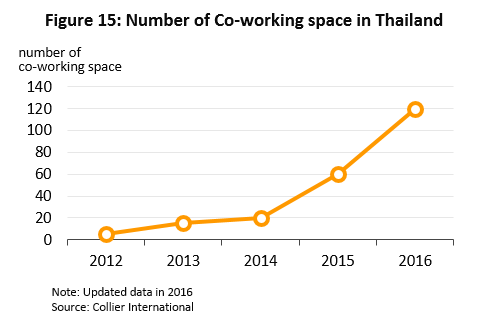

Rents are also driven by competition within the market. In addition to the conventional competitors offering similar services, there has recently been an increase in the number of companies that offer co-working space[5]. The standard business model is to provide shared office facilities to individuals for work, meetings or other uses. The rental plans can be casual (by the hour, daily, weekly) or monthly, and/or for a fixed desk or private room. Co-working spaces first appeared in the BMR in 2012, when fewer than 10 sites had opened. By 2016, 120 co-working spaces were in operation (Figure. 15). They had grown to meet demand from freelancers and businesses that need office space but do not require or are unable to commit to long-term contracts. Although co-working spaces have not had a significant impact on the office space market, they are gaining popularity and could influence owners and managers of existing office space to revise their business models. Colliers International, Thailand forecasts the number of co-working spaces will increase and office rental operations will likely develop into a mix of conventional office rentals and co-working spaces. In addition, companies are increasingly considering ‘agile workplace’ principles, which will reduce demand for office space, and consequently, rents will drop over the long-term.

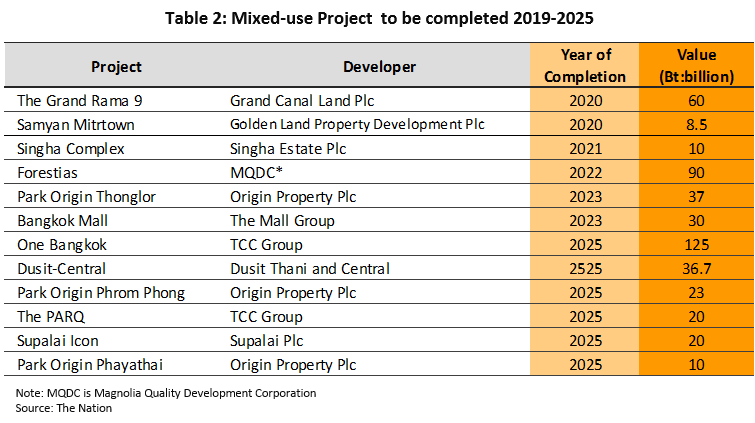

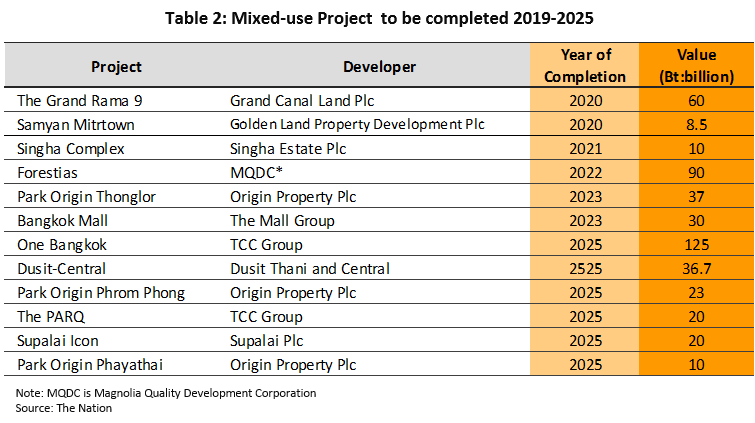

Beyond this, several mixed-use real estate developments[6] will be completed in the coming years, and by 2025, these will have a total footprint of 1 million sq. m. Of this, 710,000 sq. m. will be office space[7].

As a result, the office rental market will face rising competition over the next 6 years.

Office rents are expected to rise in line with both demand and rising development costs as new supply are likely to emphasize spending on design to make buildings more attractive and equipped with the best services. Hence, they will carry higher price tags. Older buildings will also be be renovated and modernized. But, rising competition and the anticipated 556,000 sq. m. in new supply over 2019-2021 suggests office rents would soften.

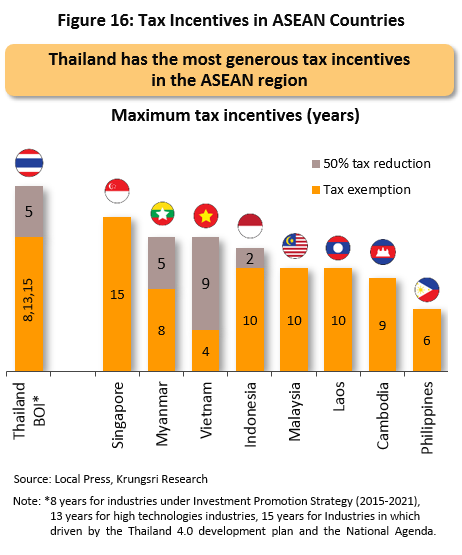

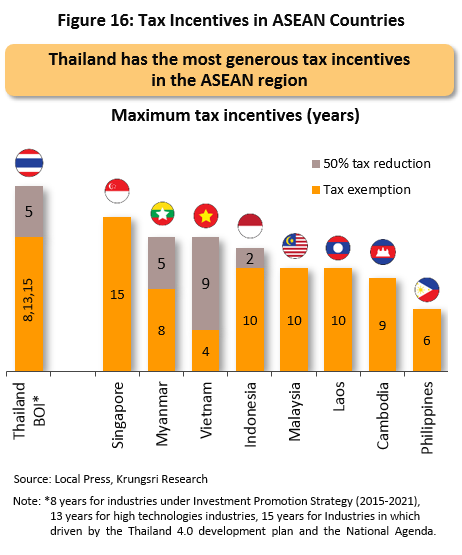

Over the long-term, the office rental market in Thailand will remain attractive to investors relative to other countries in the ASEAN zone, for several reasons. (i) Thailand enjoys a natural advantage, being geographical located in the center of the region. This makes it easy to connect to and coordinate trade and investment in surrounding areas; (ii) office rents remain low relative to other countries that might be considered competitors; (iii) the government has continued to implement measures to stimulate the sector, for example by offering tax breaks to companies that establish regional operating headquarters (ROHs) in the country; and (iv) corporate tax exemption measure is extended to up to 8 and 13 years following amendments to the Investment Promotion Act, and to 15 years under the Competitiveness Enhancement Act for 10 targeted industries (Figure. 16). These are all important factors in making Thailand a more attractive proposition for investors than other countries in the ASEAN region, and will help to support rising demand for office space in the future.

.

.

Krungsri Research’s view

The office building sector will continue to grow between 2019 and 2021. During this period, new supply of office space, especially within the CBD, will be limited. This would help to keep occupancy rates above 90%. Rents will rise, but at a slower pace due to increasing competition.

- Developers of rental office space in prime areas[8] will remain profitable. New entrants to the sector are restricted by high capital costs and scarcity of land for development in prime areas, which also command high prices. Because of this, the market is dominated by established developers who draw advantages from their financial position and having access to land with high potential. Given rising demand and restricted new supply, these players will benefit from relatively higher occupancy rates and rents.

- For developers in outer Bangkok and the wider BMR zone, earnings would be similar to current levels. These developers would invest in a range of commercial properties that differ in scale/size, by development type including small office units, purpose-built to use for own operations and rent out idle space to other businesses, and commercial office space specifically for rent. Demand for rental office space will expand along with the mass transit networks but the entry of new operators to the office rental market will also increase competition.

Locations:

Classification of Office (Source: CBRE)

CB Richard Ellis defines Grade A office building as those which have the following characteristics :

- A floor plate with a regular shape, and without structural encumbrances, which can be easily subdivided.

- An air-conditioning system with a central chiller and variable air volume, rather than a constant air volume from a water-cooled system.There should be a separate 24-hour air-conditioning supply for tenants' computer rooms.

- Lift with short wait times. Lifts should be allocated to different floor zones. A separate service lift with its own lobby should also be provided.

- The common areas, particularly the main entrance and floor lobbies, should have an impressive designs and high-quality fittings and decorations.

- Ceiling heights inside offices should be at least 2.7 meters.

- The building should have professional building management.

- The car park layout should have smooth and efficient entry and exit routes.

Non-Grade A office buildings are classified as Grade B. This grading is highly subjective and adopted solely for this report.

[1] ‘High rise building’ means a building in which people may enter to reside or utilize, and which shall be at least twenty-three meters high.

[2] ‘Large buildings’ means a building which has total floor area or area of any floor within the same building more than 2,000 square meters or a building which is 15.00 meters high or more and has an area in the same building more than 1,000 and not more than 2,000 square meters.

[3] Source: Real Estate Market Outlook 2019: (CBRE)

[4] The majority of this investment is related to software development in the digital, petrochemical and chemicals sectors and these projects should provide employment for at least 100,000 people (BOI).

[5] Co-working spaces are commercial areas available for use by people from any profession. Space is provided together with all the basic office infrastructure and equipment required for general office work, such as work desks, meeting rooms, access to high-speed internet and printers, and other such items. Customers are able to choose rental arrangements to suit their needs, which may include using a private working area, chatting in a small meeting room with a few others, or using a more substantial conference room to meet larger groups of people. Likewise, rental arrangements may normally be made by the hour, the day or the month (source: www.estopolis.com and www.bisnescafe.com).

[6] Mixed-use real estate projects are developments that combine residential accommodation with commercial or office uses in the same space. Retail, office and residential units may therefore be included in the same development.

[7] Source: PHOENIX Property Development and Consultancy Co., Ltd.

[8] ‘Prime areas’ are those that developers view as having investment potential, having considered the accessibility of the site through communications and mass-transit networks together with the infrastructure that is already in place. In Bangkok, prime areas include Silom, Sathorn, Wireless Road, Ratchadamri, and Ploenchit.

.webp.aspx)

.

.