The total value of the domestic medical devices market is forecast to grow more slowly in 2020, projected at 3% compared to 5.5% in 2019, although sales of single-use devices will be supported by new demand triggered by the Covid-19 pandemic. However, in 2021 and 2022, annual growth is expected to accelerate to 6.5% driven by the following: (i) rising domestic incidences of heart disease, stroke, cancers and diabetes, and an aging population, will raise demand for modern, hi-tech diagnostic equipment; (ii) ongoing investment by private hospitals to expand existing operations and open new sites, which will require outfitting with medical equipment; and (iii) government policy to support the development of the industry by offering tax breaks to investors.

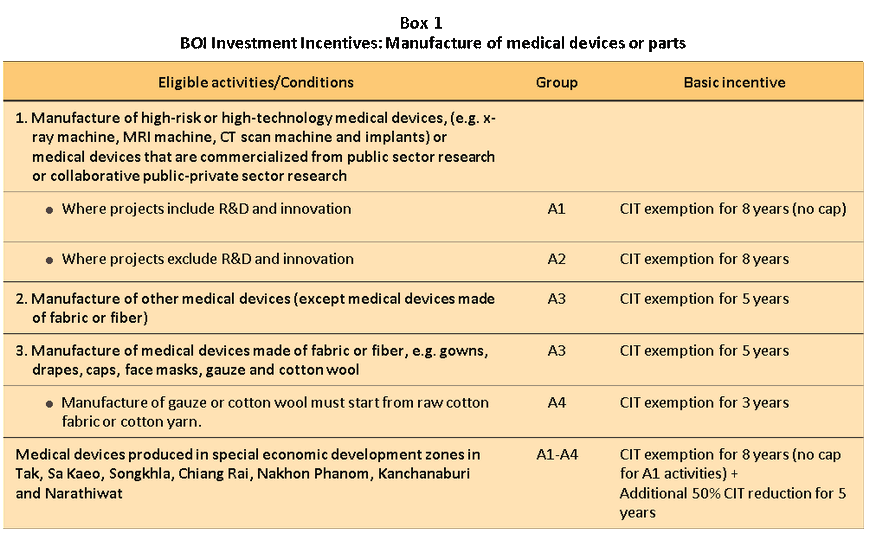

The investment incentives offered by the Board of Investment (including waiving import duties on inputs and parts used in research & development) have helped to stimulate continuing investment in the industry by overseas operators. However, this has also increased competition within the industry that has mostly affected SMEs, which comprise the majority of players in the sector.

Overview

The medical devices sector includes both medical devices and medical equipment[1]. Considered a high-value industry, accounting for 1.0% of GDP[2] in 2018. The sector has continued to grow in tandem with the rising number of patients and and aging population. Because the products are considered life essentials, the sector is also resilient to changes in economic conditions.

Medical devices and medical equipment can be divided into three categories according to use.

(1) Single-use devices are used in general medical treatments and normally not high-tech. The items are meant to be disposed after use. Examples include syringes, hypodermic needles, tubes, catheters, cannulas, disposable gloves and some items used in dentistry or ophthalmology.

(2) Durable medical devices normally have a life-span of at least one year. Examples include first aid kits, wheelchairs, medical beds, technical equipment used in medicine, surgery and dentistry, electrical diagnostic tools, and x-ray machines.

(3) Reagents and test kits include equipment used to diagnose illnesses and conditions and chemical kits used to test samples drawn from patients. For example, to test for blood type before dialysis, pregnancy tests, and to detect HIV infection.

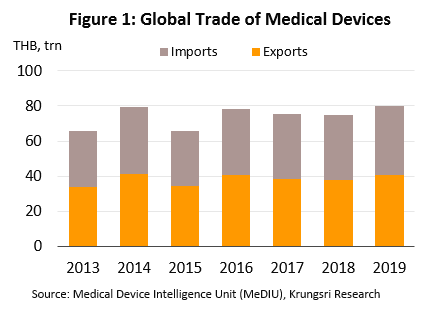

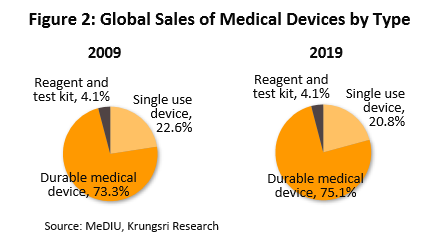

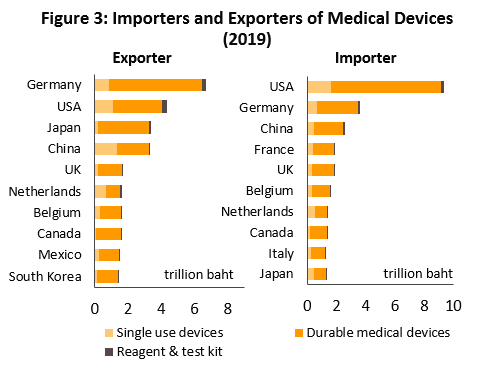

In 2019, the value of medical devices traded on the global market (combined imports and exports) reached THB80.0trn (Figure 1). The majority of these products were durable items which comprised 75.1% of total value (Figure 2). This was followed by single-use items (20.8% of total value), and reagents & test kits (4.1%). By export value, the most important countries are Germany with 16.6% share of world exports of medical devices (Figure 3), followed by the United States (10.8%), Japan (8.3%) and China (8.2%). Looking at imports by value, the United States absorbed 23.6% of global imports, followed by Germany (9.1%), China (6.5%) and France (4.8%). Thailand is 17th for exports (1.3%) and 29th for imports (0.6%).

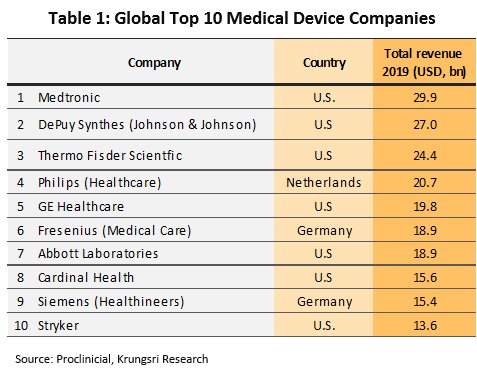

The United States is the biggest manufacturers of medical devices and record the largest sales revenue from such products (Table 1). The powerhouse has production bases scattered around the world and most of them produce high-value products such as electro-diagnostic devices, orthopedic and fracture devices, x-ray equipment, and dentistry devices. Within Europe, the most important manufacturers and distributors are Germany and the Netherlands. Germany is known for producing high-quality goods and an innovator of new products.

In the Asia-Pacific region, Japan is a leading producer of high-tech and innovative medical devices. Their devices are increasingly gaining recognition worldwide. China and ASEAN nations focus mostly on single-use medical devices. As such, these countries normally need to import high-tech medical devices from countries such as United States, Germany and Japan.

Thailand’s medical devices sector operates under the legal provisions of the Medical Devices Act (2008)[3]. The Medical Device Control Division under the Food & Drug Administration is the agency responsible for regulating the sector and issuing permits to produce, distribute and import medical devices, subject to specifications and standards laid out by the Thai Industrial Standards Institute. This is aimed at assuring consumers that all medical devices in Thailand meet the same standards, and to build up the competitiveness of the sector and acceptance of Thai products in the domestic and export markets.

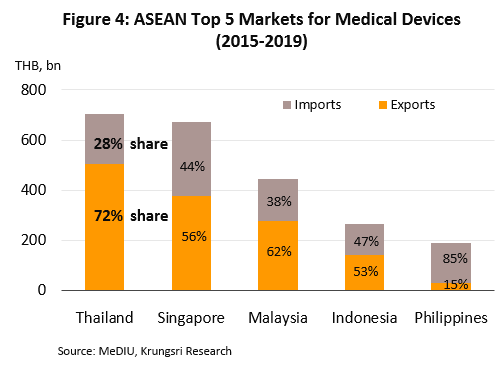

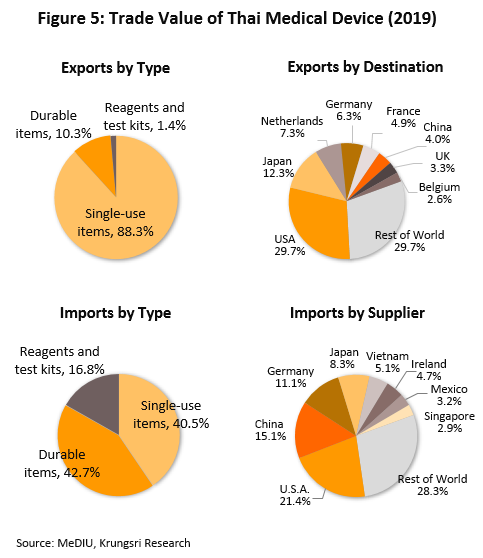

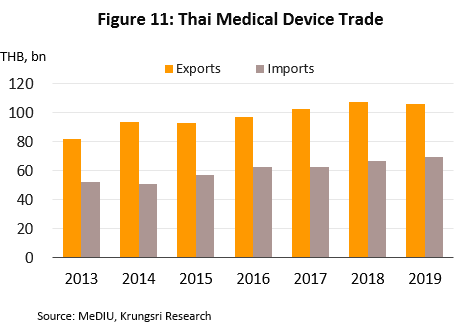

Within ASEAN, Thailand is the largest importer and exporter of medical devices (by value). In 2015-2019, the value of Thai exports and imports were split in the ratio of 72:28 (Figure 4). In 2019, Thailand exported mostly single-use devices which accounted for 88.3% of export value (vs 83.4% in 2018). These included medical rubber gloves, catheters and medical tubing, syringes and hypodermic needles, and bandages and dressings. Thailand’s key export markets are the United States, followed by Japan, the Netherlands, and Germany. Most of the manufacturers and exporters in Thailand are foreign-owned companies that export the items back to their home countries, e.g. Japan, the United States and France. Looking at imports, these were mostly durable medical items (42.7% of value) and single-use devices (40.5%), e.g. ultrasound equipment, x-ray machines, electrocardiogram (ECG) and electroencephalogram (EEG) monitors, and ophthalmological equipment. The major sources of imports were the United States, China, Germany, and Japan (Figure 5).

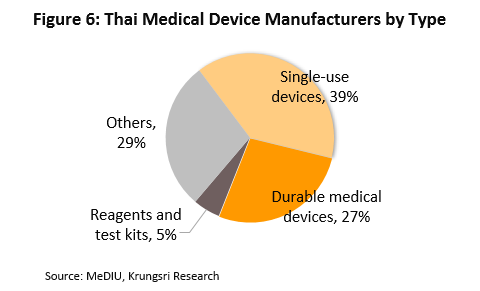

Most medical devices produced in Thailand do not require complex technology, and are targeted for export. An estimate 70% of the sector’s total sales value is derived from exports and the rest from the domestic market. The primary output is basic goods that use raw materials and inputs such as rubber and plastic that are available in the domestic market. The producers may be classified according to the use of the finished product:

(1) Single-use devices: The number of producers in this segment represent about 39% of the total number of medical device producers (Figure 6). The high-potential and globally–competitive products include medical gloves because these do not require sophisticated technology. Thailand is also an important world producer of rubber, the major input for medical gloves. Over 90% of the medical gloves produced in Thailand is exported and there has been rising demand for the same. Syringes and hypodermic needles are the second most important products, and the producers benefit because the main input - plastic – is relatively cheap, and these are widely-used products

(2) Durable medical devices: About 27% of total medical device producers falls into this category. The more important products are hospital beds, examination tables and wheelchairs, because producers do not require advanced manufacturing technology.

(3) Reagents and test kits: Only 5% of manufacturers in the industry produce these, and they are mostly joint ventures with multinationals that want to enter the Thai market. The products include test kits for diabetes, kidney disease, and hepatitis. Between 2015 and 2019, Thailand’s exports of reagents and test kits have surged more than 10-fold [4]

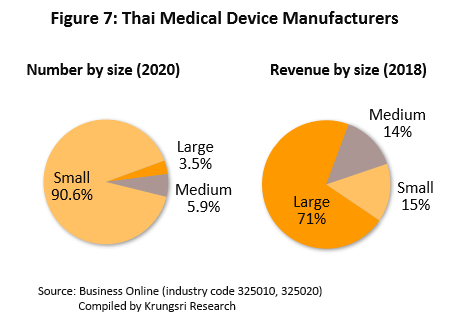

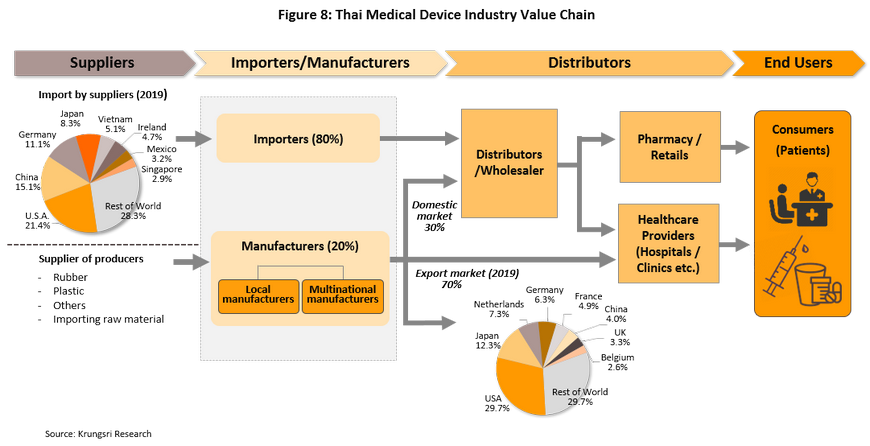

595 producers of medical devices are registered with the Department of Business Development[5] (as of May 2020). Of this, 96.5% are SMEs which recorded a combined 29% share of total revenue. Another 3.5% are large manufacturers which command 71% of total revenue (2018; Figure 7). They include Nipro (Thailand), Hoya Optics (Thailand), and Kawasumi Laboratories (Thailand) (Table 2). Meanwhile, there are over 2,000 registered importers of medical devices, according to data from the Food & Drug Administration. The distribution channels of manufacturers and importers are shown in Figure 8.

(1) Direct distribution to healthcare providers: This includes distribution to public- and private-sector hospitals and clinics. Sales of medical devices to public-sector hospitals is carried out according to government procurement procedures. The Ministry of Finance has changed the purchasing system for public hospitals to the e-bidding process. Under the previous system, purchases up to THB 0.1 million can be conducted under an ‘agreed price’, purchases between THB 0.1 million and THB 2 million is subject to the ‘price-checking’ mechanism, and purchase over THB 2 million has to be conducted through competitive bidding. Private-sector hospitals purchasing procedures are not regulated.

(2) Distribution to intermediary companies, representatives, or to shops: This includes distribution to companies which are part of the same commercial network as the producer or importer, or to general shops in attempts to reach target customers throughout the country. Players in this group typically have some knowledge of healthcare and are able to exploit a range of distribution channels.

(3) Distribution to export markets: The majority of goods distributed are single-use devices, notably medical rubber gloves. The main markets are the United States, Japan, and Germany. A major player in this group is the Thai Rubber Latex Corporation.

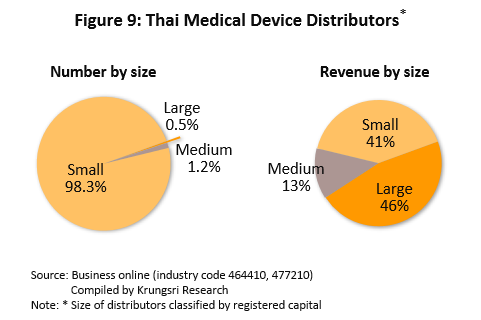

In Thailand, there are over 8,000 wholesale distributors, agents and retailers of medical devices[6]. Again, most (99.5%) of these are SMEs and that command a combined 55% of revenues (Figure 9). Within this group, there is strong competition because of low entry barriers and products are mostly generic, making it easy for consumers to switch to competitor’s products. The major distributors include Zuellig Pharma, Proctor and Gamble Trading (Thailand), Pharmahof, B. Braun (Thailand), Biogenetech, Bionet-Asia, and Technomedical.

Limited growth potential for producers and importers of medical devices. (i) Distributors normally focus on selling to government-funded hospitals, which involves competitive bidding and exposes operators to price competition. (ii) The bulk of imported medical equipment has a long lifecycle, which means replacements are infrequent. (iii) Producers and importers of raw materials, parts, and equipment are exposed to higher costs because they may need to employ currency hedging tools and the cost of imports can fluctuate with changes in technology and innovation. This could hurt profitability.

Growth of the sector would be influenced by expansion of public health services and government support. Currently, the. latter is the major driver. The Board of Investment is offering tax incentives to manufacturers of medical devices. The medical devices sector is also one of the new S-curve industries and would benefit from government incentives for investments in the Eastern Economic Corridor (EEC). The government also plans to turn Thailand into a medical hub and a center for the export of medical devices to the CLMV countries which are seeing rising demand for medical devices. Beyond this, the 12th National Economic and Social Development Plan (2017-2021) lays out a framework to develop and grow the medical devices sector in line with the 20-Year National Strategy. The framework emphasizes the development of capabilities in areas where there is strong domestic demand and that do not require the mastery of complex technology. This has attracted rising investment in the sector, although this has also led to competition as the number of operators increase.

Situation

The Thai medical devices industry has grown steadily. From 2015 to 2018, the value of goods distributed to the domestic and export markets (split 30-70% by value) had risen by 7.1% and 5.7% annually. This was driven by: (i) high standard and quality of medical care in Thailand (Table 3); (ii) government policy (since 2003) to turn Thailand into a medical hub has grown the medical tourism industry; and (iii) a new policy to make Thailand a center for the export of medical devices to the wider region.

Manufacture and distribution of medical devices, 2019

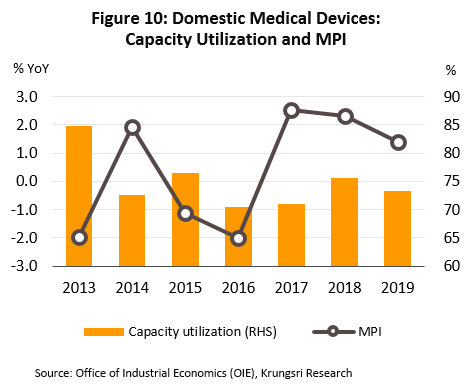

- Production continued to expand in 2019. This is reflected in the 1.4% rise in the industry’s manufacturing production index, and relatively high capacity utilization which averaged 73.4% (Figure 10).

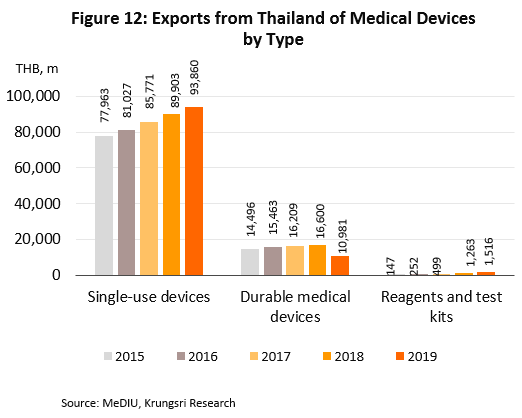

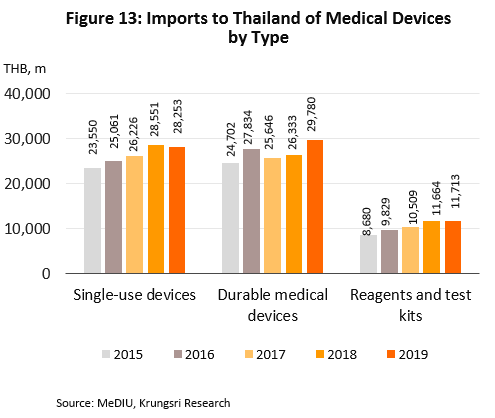

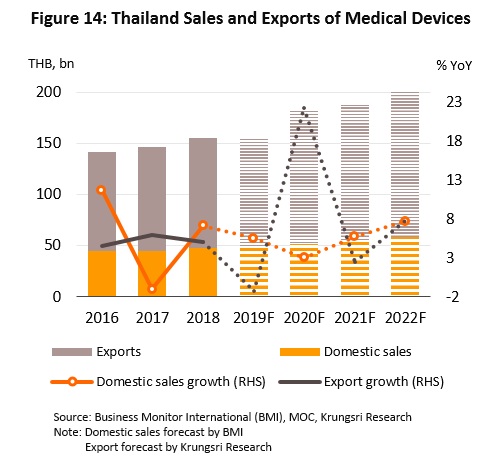

- Sales to the domestic market reached THB50bn in 2019, up 5.5% from 2018 figure (source: Fitch Solutions), but exports[7] slipped 1.3% to THB106bn due to depressed conditions in the main markets - United States, Germany, Japan and the Netherlands. Combined, these account for 55.5% of total export value of medical devices. In 2019, sales to these markets fell by 0.7%. By product group, exports were as follows: (i) single-use devices (88.3% of total export value of medical devices) rose by 4.4% to THB94bn; (ii) durable medical devices (10.3% of exports) tumbled by 33.9% to THB11bn; and (iii) reagents & test kits (1.4% of exports) jumped 20.0% to THB2bn. The major export markets for the latter product group are (i) Japan, where receipts rose by 5.6% (to 46.3% of export value of reagents & test kits) and which imports mostly test kits for conditions that affect the elderly (e.g. to check blood pressure and test for diabetes), and (ii) China (13.3% of exports), where exports rose almost nine-fold led by strong increase in sales of pregnancy test kits.

Imports also rose in 2019, by 4.8% to THB70bn. The major sources of imports were the United States, China and Germany (47.6% of total import value), which combined import value rose by 14.0%. However, imports from Japan (8.3% of the total) dropped by 1.6%. By product group, imports of single-use devices (40.5% of import value) contracted by 1.0% to THB28bn after rising the previous year, while imports of durables (42.7% of value) increased by 13.1% to THB30bn and reagents & test kits (16.8%) by 0.4% to THB12bn (Figures 12-13).

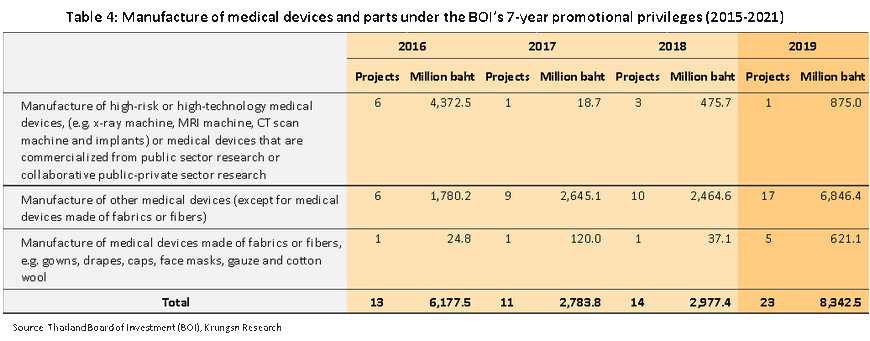

- Investment in the industry surged in 2019. The government approved investment incentives for 23 projects with a combined value of THB8.3bn (+180%) under a 7-year government program that runs from 2015 to 2021 (Box 1). Of these, 17 projects with a total value of THB6.8bn (up 178%) were approved under the ‘other’ category, followed by 1 project in the ‘high risk/hi-tech’ category valued at THB875.0m (up 84%), and 5 in the ‘textiles’ category with a combined value of THB621.1m (+1,574%) (Table 4).

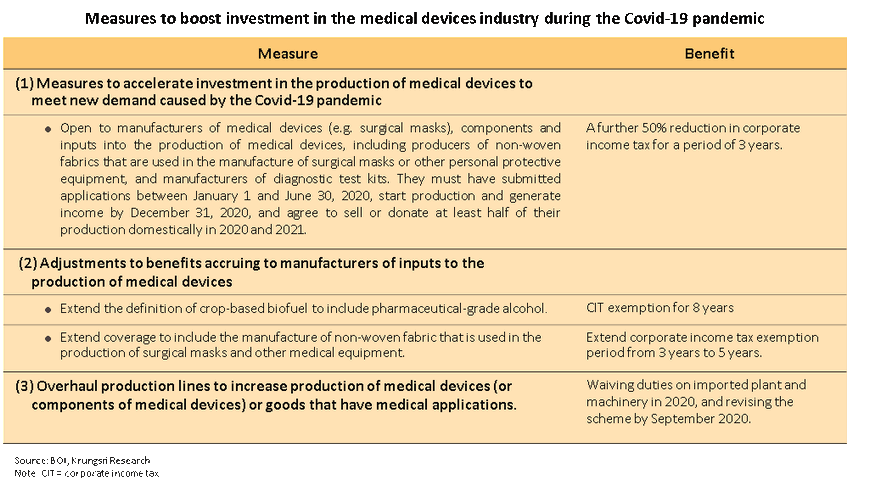

In the first half of 2020, the Covid-19 pandemic boosted demand for medical devices and equipment worldwide, especially single-use items such as latex gloves, surgical masks, syringes, and Covid-19 test kits. Between 2019 and 2020, contribution from single-use devices and reagents & test kits had risen from 20.6% to 22.3% of total sales value from 4.1% to 4.4%, respectively. The United States is the largest importer of surgical masks, absorbing 25.0% of global production, followed by Japan (12.0%), France (11.0%) and Germany (7.2%). The largest exporters of surgical masks is China which has 87.9% global market share, followed by the United States (1.1%) and Germany (1.0%). However, the sudden surge in global demand for medical devices triggered by the Covid-19 pandemic has prompted many countries to restrict exports of medical devices – especially of surgical masks – to meet rising domestic demand. Thailand is one of those countries and has restricted the export of masks up to December 2020. At the time of publication, over 24 million Covid-19 cases have been reported worldwide.

Output by the domestic medical devices industry slowed in the first half of 2020 because of the lockdown in April-May. For 1H20, the index of industrial output for medical and dental devices fell by 23.2% YoY. However, capacity utilization for disposable goods (e.g. masks and latex gloves) and diagnostic kits rose as manufacturers rushed to meet heavier demand in domestic and export markets. The industry was also boosted by special efforts by the government to encourage investment in the sector to address the Covid-19 pandemic. And, exports surged 37.1% YoY in 1H20 to THB73bn led by stronger demand from Japan and China. Exports of single-use devices (88.8% of total export value), durables (9.4% of exports) and reagents & test kits (1.7%) increased by 37.2%, 28.5% and 97.6% YoY, respectively. At the same time, imports rose 29.2% YoY to THB44bn with increases seen across the board: durables (41.7% of imports) grew 29.2% YoY, single-use devices (37.8% of imports) rose 16.0% YoY, and reagents & test kits (20.4% of imports) jumped 63.6% YoY.

The Covid-19 outbreak has pushed Thai manufacturers to rapidly develop easily manufactured products that are perceived to protect against infection by the novel coronavirus (e.g. plastic face shields, cloth face masks and alcohol disinfectant gel). However, more complex and advanced equipment has also been utilized to treat Covid-19 patients, including robots, so that medical staff can maintain a safe physical contact from infected patients. Such robots are being used at Bamrasnaradura Hospital, Rajavithi Hospital and the Central Chest Institute of Thailand. Manufacturers are producing fully-enclosed, fan-equipped laboratory-style personal protective equipment (PPE). As the world awaits the production of a successful vaccine, the pandemic has created an opportunity for players to accelerate the manufacture and export of new products.

Outlook

For all of 2020, the value of medical devices distributed to the domestic market is forecast to rise by 3.0%, the weakest growth in the past 4 years. The combination of the Covid-19 pandemic, and government policies and incentives for the industry have helped to boost demand for single-use medical devices, these are mostly low-value products. On the negative side, higher-value items such as durable medical devices are typically used for in-hospital treatment, and demand for that has been adversely affected by fears of being infected Covid-19, especially in the second quarter of the year. However, this will be offset by the anticipated 20-24% jump in export value led greater demand for single-use devices and reagents & test kits.

In 2021 and 2022, we project the domestic market will grow by an annual average rate of 6.5%, while the export markets will expand at a slower rate of 5.0% p.a. (Figure 14). This outlook is supported by the following:

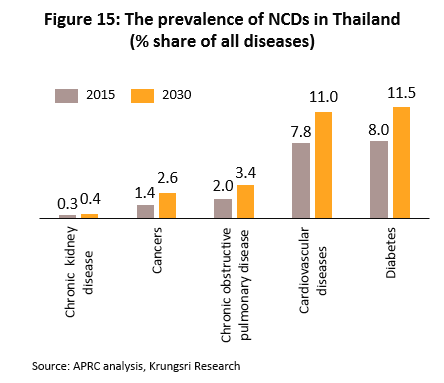

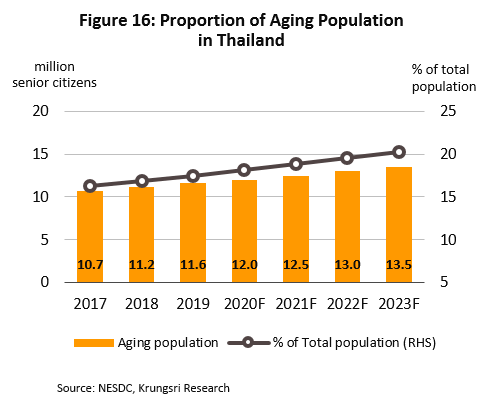

(1) Rising incidences of cases of communicable and non-communicable diseases (NCDs)[8]. The most common in the the former category are diarrhea, pneumonia and dengue fever. For the latter, they are hypertension, diabetes, chronic obstructive pulmonary disorder, and coronary heart disease (Figure 15). In addition, Thailand has an aging population and a large percentage of the elderly have been diagnosed with at least one NCD with almost half diagnosed hypertension[9], followed by diabetes, heart disease, stroke and cancer. These would increase demand for modern, hi-tech medical equipment, especially for diagnostic purposes. The Office of the National Economic and Social Development Council forecasts the population over 60 years old in Thailand will increase from 11.2 million in 2018 to 13.5 million by 2023 (Figure 16), and spending on healthcare for the elderly will rise to THB230bn (2.8% of GDP) in 2022 from THB63bn in 2010 (2.1% of GDP). (Source: 12th National Health Development Plan, 2017-2021).

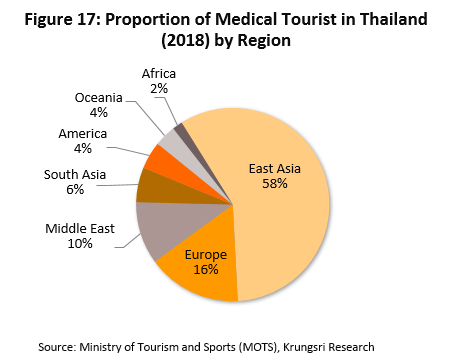

(2) In 2021 and 2022, the number of foreign patients seeking treatment in Thai hospitals is projected to rebound. This would be supported Thailand’s ability to offer high quality care and services at its hospitals, which are also increasingly equipped with high-tech equipment and specialist treatment centers, especially those targeted at serious NCDs such as heart disease, skeletal conditions and cancers. In addition, domestic care facilities for the elderly are also competitively-priced relative to its neighbors (e.g. Singapore and Malaysia). The combination of these factors make Thailand one of the world’s leading destinations for medical tourism. General and medical tourists account for 80% of foreign patients in Thai hospitals. Most of them are from East Asia, Europe and the Middle East (Figure 17), and come for health checks, cosmetic surgery, dental work, and orthopedic and heart surgery. Naturally, the higher number of foreign patients seeking treatment in Thailand will feed into greater demand for medical equipment and supplies.

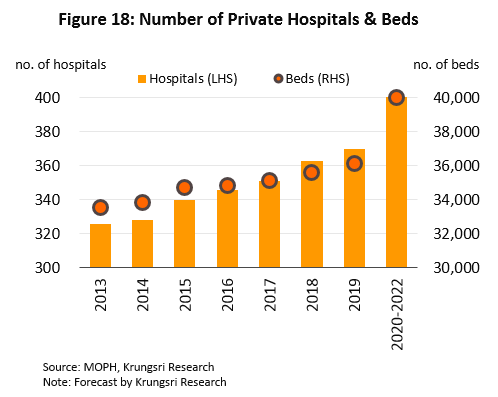

(3) To meet increased demand from Thai and overseas patients, many private hospitals plan to increase investment in new buildings and fitting these out new equipment, especially to treat complicated conditions. Many of the larger hospitals are currently expanding their existing premises and/or opening new branches. For example, Bangkok Hospital plans to increase its network from 49 sites to 50 by 2023 and expand its capacity by 172 beds, with a focus on specialist treatment for conditions such as neurological disorders, and bone & joint conditions. Bamrungrad Hospital also plans to open a 202-bed Phetchburi campus, while Kasemrad Hospital is opening a new branch in Aranyaprathet in 2020. Overall, supply is projected to increase by at least 2,000 beds by 2022 (Figure 18), which will increase demand for modern, innovative, high quality medical equipment.

(4) Rising demand for preventive treatment in Thailand. This has increased since the Covid-19 outbreak, and created an opportunity for players to develop new healthcare and hygiene products.

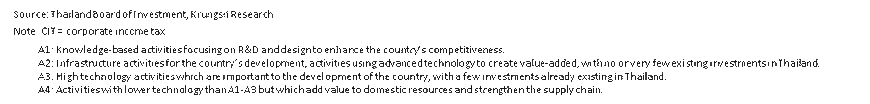

(5) The industry has received direct support in the form of government policies that encourage the manufacture of medical devices. From 2017 to 2026, the government will pursue its long-term plan to establishing Thailand as a medical hub, particularly by designating the production of medical devices as one of the ‘new S-curve industries’ and offering special tax breaks to (i) those investing in the manufacture of high-risk or hi-tech medical equipment such as x-ray, MRI or CT machines, or in implants, or (ii) manufacturers that can develop commercial use of, or that work with the government to commercially exploit, state-funded research. In either case, investors will be eligible for an 8-year exemption on corporate income tax, while manufacturers of medical devices and equipment in the special economic zones in Tak, Sa Kaeo, Chiang Rai or Nakhon Phanom or in the Eastern Economic Corridor (EEC) will also be eligible for tax breaks (Box 1). These policies would help to develop industrial capabilities in the sector, which would lead to the research & development of new, lower-cost products and improve the ability to compete on world markets.

Krungsri Research’s evaluation of opportunities for developing markets for each product group is laid out below.

- Demand for single-use products will grow steadily, driven by the following: (i) rising interest in personal health and hygiene and the effects of government measures to combat the spread of Covid-19, for example by requiring health professionals to wear PPE; (ii) expansion of public health services; and (iii) the fact that these are general goods that are used widely in daily life and Thailand benefits from ready-access to upstream inputs, as the world’s leading source of rubber (used in the production of disposable medical gloves), a domestic petrochemical industry (which supplies inputs to produce syringes and catheters), and a textile industry (to produce surgical masks). However, competition is rife in this segment, from both Thai producers and producers in China (surgical masks) and Malaysia (surgical gloves).

- Markets for durables and reagents & test kits will also grow. Demand for durables will grow with government support for community-level health checks, use of mobile testing centers, as well as expansion of existing/construction of new hospitals, which will raise demand for technology-based medical equipment. For diagnostic kits, those used to check for coronary heart disease should see the strongest growth. In the future, medical robots and automated systems will play a greater role in healthcare; they will be used to diagnose and treat patients, as well as in artificial limbs and applications that include AI systems which can help to analyze x-rays, robotic cameras and sensors, and robotic operating systems that can be used to perform remote surgery. But unfortunately, Thailand lacks both the investment funds and knowledge to develop these systems indigenously. Hence, the country is largely dependent on imports or foreign operators (e.g. from Japan and France) to set up production facilities in Thailand.

Competition will rise due to increasing involvement of foreign investors in the production of medical devices, encouraged by BOI investment incentives and waiver of duties on imported parts or materials used in research & development. In 1H20, Thailand received 18 applications for investment support worth a total of THB1,453m in medicine, and 2 applications for robotics and automation projects valued at THB111m. Japanese players have been especially interested in setting up production facilities in Thailand, and this will increase competition in the industry. High-potential products will include those used in elderly care, innovative consumables, implants, and parts for electronic and radiation-based diagnostic machinery. However, most manufacturers have to import the machinery used in their production processes, which exposes them to risks of fluctuations in exchange rates and import costs, which may increase along with rapidly-changing technology.

Future challenges faced by manufacturers of medical supplies and equipment will be innovation and application of technology. In the case of single-use medical products, although this can offer a high degree of protection against the transmission of disease, its use can create significant environmental problems because although used equipment may be sterilized, the materials from which they are made are almost never biodegradable. And so, in developed economies (e.g. Britain and the United States), there are reports of increasing problems with medical waste, while in China and India, governments are implementing policies to reduce the environmental impact of medical wastes and supporting research into new materials. In attempts to addressing these problems, the use of biodegradable materials will play a major role and industry players need to meet this challenge. Beyond this, developing domestically-produced medical robotics systems[10] will also help to reduce imports of hi-tech products over the long-term. These might include robots that provide care for the elderly and stroke victims, and that are used in other specialized settings, robots that assist with micro-surgery, and automated systems to manufacture and manage pharmaceuticals. Government support for the research & development of commercially viable products in these areas would help to increase the value of exports, reduce dependency on imports, and ensure the sustainable, long-term development of the Thai medical devices industry.

Krungsri Research’s view:

In 2020, the domestic market for medical devices will grow at a slower rate but stronger demand from overseas will lift exports. Looking at 2021-2022, the projected economic recovery will drive healthy earning growth across the sector.

Manufacturers of medical devices: After 2020, earning are projected to grow satisfactorily and operators will enjoy steady profits, even as competition strengthens. Manufacturers that distribute medical devices and equipment through healthcare facilities will continue to register higher revenues, especially those that sell to private hospitals that are expanding operations. Consumers are also taking a greater interest in their health, and this presents an opportunity for players to develop new products and equipment to meet this burgeoning demand. Operators will also be able to develop export markets in neighboring countries by taking advantage of the government’s efforts to promote investment in the EEC, to complement plans to turn Thailand into a medical hub and a regional center for the export of medical supplies and equipment. Nevertheless, despite this generally upbeat assessment, competition is rising within the industry as more international companies invest in production facilities in Thailand to export the products back to their home countries (such as Japan, the United States and France), and operators that need to import parts could face higher costs because they may need to employ currency hedging tools.

Distributors of medical devices (including retailers, wholesalers and importers): revenue will grow in the next few years, albeit slowly. The majority of goods distributed are disposable items that are used regularly in healthcare facilities and by the unwell, but competition is worsening due to the large number of SME distributors in the market. They are fighting for space with agents and retailers that are part of a manufacturer’s commercial network and have access to wider and more comprehensive distribution channels. This would cap growth in this segment. However, importers of medical equipment are generally large, efficient operations that are skilled in marketing and cost-management. These players are now increasingly importing medical robots for use in private hospitals, for example to assist with micro-surgery and in the production and management of pharmaceuticals. This will support earning growth in the coming period.

[1] Medical devices include items which are used in the medical, nursing and midwifery professions to provide treatments for bodily conditions such as X-Ray equipment, ultrasound machines, reagent and test kits, and dental devices. Medical equipment refers to surgical and medical equipment e.g. scalpels, thermometers, blood-pressure monitors, and items such as disposable gloves and masks.

[2] Calculated from domestic sales and export value

[3] The Medical Device Act, Amendment (No.2), B.E. 2562

[4] Detailed Figure 12

[5] Including dental devices and equipment

[6] This refers to the wholesale and retail of medical products including instruments, tools, equipment treated bandages, first-aid kits, birth control products, and pharmaceutical products.

[7] Export data collected from Medical Device Intelligence Unit, the Plastics Institute of Thailand

[8] Source: Ministry of Public Health, Fiscal Year 2020 (October 2019 – March 2020)

[9] The Ministry of Public Health states that of 9 million elderly, over 4 million have hypertension and over 2 million have diabetes.

[10] Thailand Center of Excellence for Life Sciences (TCELS) estimates that the global medical robotics market will earn revenue of US$ 46.24 billion in 2022, or average growth of 20% annually from US$ 6.62 billion in 2012