Executive Summary

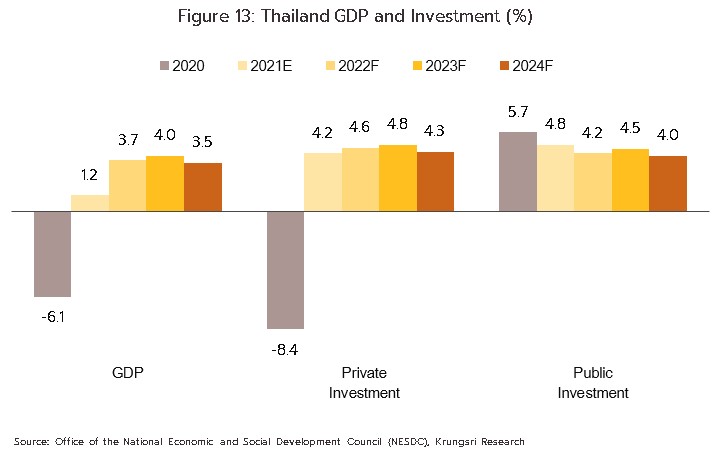

Over 2022 to 2024, the warehousing industry will improve with recovery in manufacturing and exports, expansion in the online retail and logistics sectors, development of new projects in industrial estates, special economic zones, and the EEC, and investment by the government in infrastructure and transportations networks that will increase regional connectivity. Thanks to the influence of these factors, demand for warehouse space to be used in collection and distribution centers will strengthen, and this will help to incentivize major developers to broaden the scope of their investments. However, growth in individual segments of the market will vary, and will be determined by the prevailing business conditions within each niche.

On the downside, competition will tend to stiffen on: (i) ongoing investment by major operators that is increasing the supply of rented warehouse space; and (ii) rising investment by new players, including both Thai companies that are moving into the market from other industries (especially from the real estate sector) and foreign operations. In addition, growth in supply in some areas has created excess vacant space of a glut, and this is limiting the room within which rents can be raised.

Krungsri Research view

Over the 3 years from 2022 to 2024, operators of rented warehouse space will see business conditions improve in line with gradual economic recovery, though this will be driven in particular by the state of the export sector and of domestic retail. As a result, investment in new supply will tend to increase, though large players will be especially responsible for this, with the consequence that local markets in some areas will be oversupplied, triggering an increase in competition on price and limiting the extent to which operators are able to raise rents.

- General-purpose warehouses: Income growth in the general-purpose segment will likely outpace that of other parts of the industry, with warehousing in high potential locations or areas that serve as distribution hubs doing especially well, such as the BMR and the EEC (Chonburi, Rayong, and Chachoengsao). However, investment by large and/or new players will increase supply, most of which will be of modern warehousing. This will then take market share from traditional warehouses and SME operators, and place a cap on rent rises in many areas. Some players will react to this by forming business partnerships or joint ventures with large Thai or international players since this will help them revamp their business model by investing in modern warehousing, thus building their competitiveness and laying the path to long-term growth in business income.

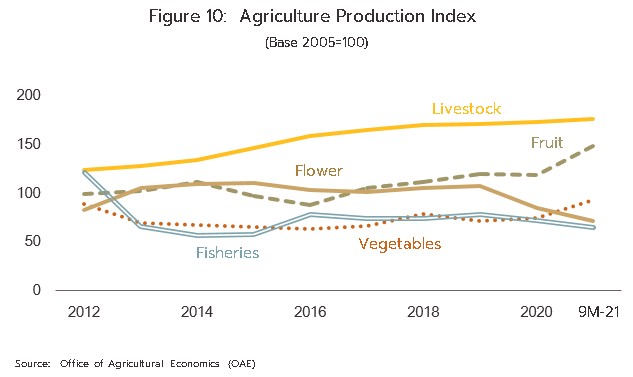

- Cold storage warehouses: Income will tend to remain flat or possibly fall slightly. Demand will persist for the storage of fresh fruit and vegetables, cut flowers, and fisheries products, but the oversupply of cold storage space means that operators will be in a weak bargaining position relative to their customers. Nevertheless, exports of processed, chilled and frozen food should improve with a better economic outlook, and this will help to boost demand.

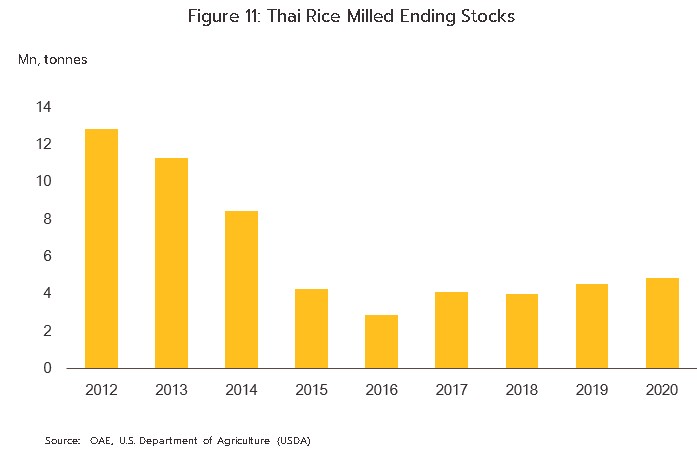

- Silos: Income will tend to be fluctuate since this is dependent on crop yields that move with changes in the weather. At the same time, a supply glut continues to weigh on the market, and this will force players to use pricing strategies to attract and keep customers, though this will put profits at risk.

OVERVIEW

Warehouses are spaces used for the short- or long-term storage of goods, in the former case usually as part of the distribution process, and these thus support the operation of supply chains connected to manufacturing (for the storage of raw materials, parts, and components) and distribution (for the storage of finished goods). Rented warehouse space therefore forms a part of the logistics sector, and the industry has an important role to play in facilitating business operations in a wide range of industries across the manufacturing, trade and transport sectors.

The Thai warehousing industry can be split into two main segments. (i) Traditional warehouses account for 95% of the national supply of warehousing and these typically emphasize the provision of a barebones service, with renters getting access to their warehouse space and basic utilities and amenities such as roads, electricity, water, telecommunications, and on-site security. (ii) Modern warehouses offer a much more comprehensive set of services, with operators providing access to full logistics operations, technology to improve warehousing efficiency (e.g., systems for collecting, counting and checking stored goods), and systems that make managing incoming and outgoing stock considerably easier. These factors, combined with the added advantage of being less labor intensive, give modern warehouses a considerable edge in meeting the needs of renters (Figure 1). At present, some operations are upgrading their facilities to offer modern warehousing services, which then enables them to broaden their customer base and to generate income from additional services. Players are also upgrading facilities in other ways, for example by bringing their warehouse buildings up to recognized industry standards (e.g., the Leadership in Energy and Environmental Design (LEED) scheme) by investing in energy saving and environmental protection systems, and by installing facilities that increase protection against natural disasters, including floods and earthquakes. Warehouses have in addition been expanded by raising their floors and ceilings, which has the added benefit of making the throughput of goods quicker and more convenient.

The warehousing industry in Thailand operates under the supervision of the Committee for the Management of Warehouses, Silos and Cold Storage Units, a part of the Ministry of Commerce. Organizations offering warehouses for rent in Thailand include state industries, such as the Public Warehouse Organization[1], private organizations operating under the management of and supported by the state (e.g., agricultural cooperatives), and fully independent, commercial organizations with corporate status.

The Department of Business Development (operating under the Ministry of Commerce) specifies three categories of rented warehouse operations. (i) General-purpose warehouses are buildings used for the storage of industrial and commercial goods (e.g., general consumer goods, raw materials, and parts and components). (ii) Cold storage warehouses are temperature-controlled units that are run for the purposes of preserving and so extending the shelf-life of perishable food, including seafood, dairy products, flowers, meat, fruit and vegetables, and medicines and vaccines. (iii) Silos are large temperature- and humidity-controlled cylindrical structures used for the bulk storage of cereals and similar crops, including rice, cassava, maize, flour, and rice bran.

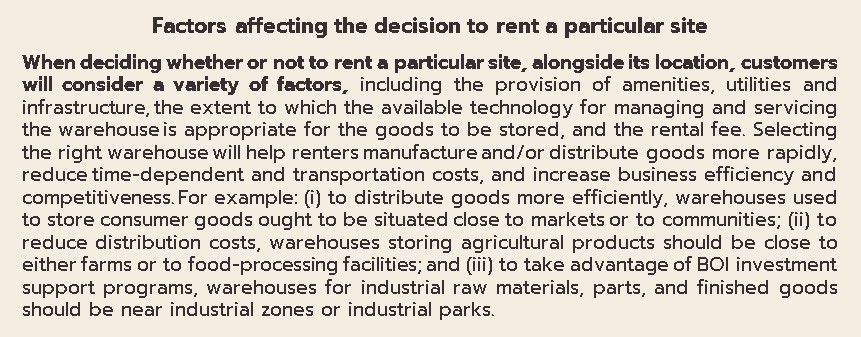

The outlook for the warehouse industry is dependent on the general business conditions prevailing in manufacturing and commerce, together with overall levels of investment and household spending. The industry displays two important characteristics that help to determine its overall features: (i) Returns on investment typically occur over 8-13 years. On the one hand, upfront costs, especially those for land and construction (on average, putting up new warehouses takes 6-18 months, though this depends on the footprint of the building) tend to be high, while on the other, income comes overwhelmingly from rent, which accumulates only gradually over the long term. Generally, rental rates will vary depending on the size of the space, the type of warehouse, its location, and the degree of competition in the area. (ii) The location of any particular warehouse plays a major role in determining its commercial success. Given this, evaluating the potential of different sites and the types of warehouses that ought to be constructed plays an important role in determining long-term growth in income for operators.

Two types of rental agreement are used when renting or leasing warehouse space.

- Short-term contracts (not exceeding three years) are generally for traditional warehouse space and are usually made with SMEs and/or businesses that experience uncertain or fluctuating business conditions, for example seasonal businesses such as traders in agricultural produce or players in the fashion trade. Given the somewhat rapid expiry of these leases, operators in this segment may experience higher levels of risk as a result of uncertainty over income.

- Long-term contracts (longer than three years) are typically made with renters that are managing steadier and more predictable levels of stock and these are generally for modern-style warehouse operations, though these may be either ready-built or built-to-suit spaces. The majority of players in this segment are large operators that are active principally in the real estate and industrial estates industries, including WHA Corporation, JWD InfoLogistics, Wyncoast Industrial Park, and Frasers Property Thailand. Sites operated by these companies tend to be located close to industrial parks, distribution centers, and industrial and manufacturing zones. For landlords, agreeing long-term contracts offers them the advantage of being able to manage their sites more efficiently and to minimize fluctuations in income.

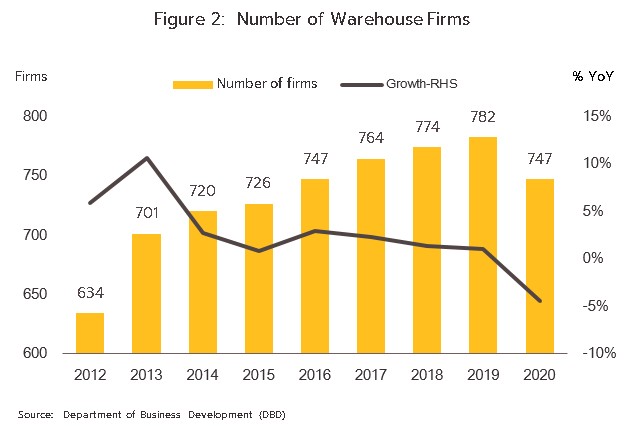

As of 2020, there were 747 companies offering warehouse space for rent (Figure 2). These fall into the following 2 groups.

- Large players: 33 companies that were registered as active in the industry (4.4% of the total) qualify as large. This group comprises: companies that provide logistics services (e.g., JWD InfoLogistics, Berli Jucker Logistics, and Mon Logistics Services); companies that are active in food production and processing (e.g., Intersia, and Pacific Cold Storage); distributors of household and office goods (e.g., Officemate Logistics); real estate developers (e.g., WHA Corporation, and Prospect Development); and joint ventures with overseas players (e.g., Suzuyo Distribution Center (Japanese), and Kerry Logistics (Chinese/Singaporean)).

- SMEs: There are 714 SMEs in the industry (95.6% of the total), and within this group, important players include the companies Bangkok Cold Storage Services and companies in the JWD InfoLogistics, CRC Property and Development, MBK, K Line (Japanese) groups, and BFS Cargo DMK (part of Bangkok Airways).

SITUATION

Over 2015-2019, warehouse operators enjoyed growth that moved in line with the overall expansion in the economy, but in 2020, the outbreak of COVID-19 and the ensuing sharp recession caused a drop off in demand for warehouse space and as a result, some players closed their operations. Nevertheless, demand bounced back in the latter half of 2020, helped by the rapid acceleration in the uptake of e-commerce services, and in response, large players stepped up their investments in new warehouse space. The conditions for particular market segments are given below:

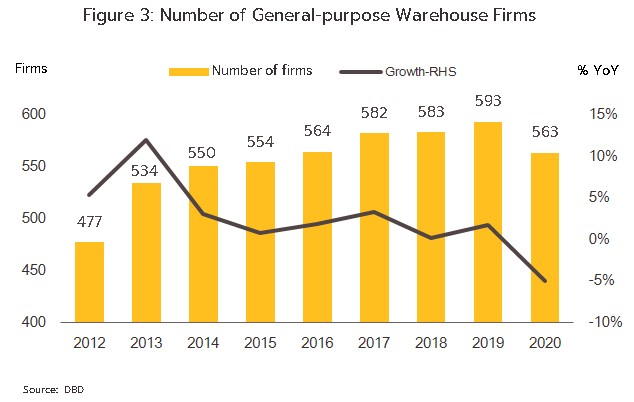

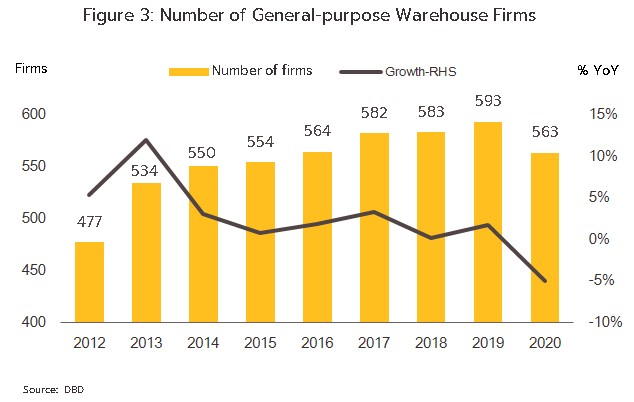

General-purpose warehouses: This segment represents over 75% of the country’s total supply of warehouse space, and because general warehousing can be used to store a wide range of goods, many different industries and businesses make use of these services. In many areas, extending these warehouses is also fairly straightforward. Over 70% of income to the industry comes from the rental of general-purpose warehousing (data as of 2020).

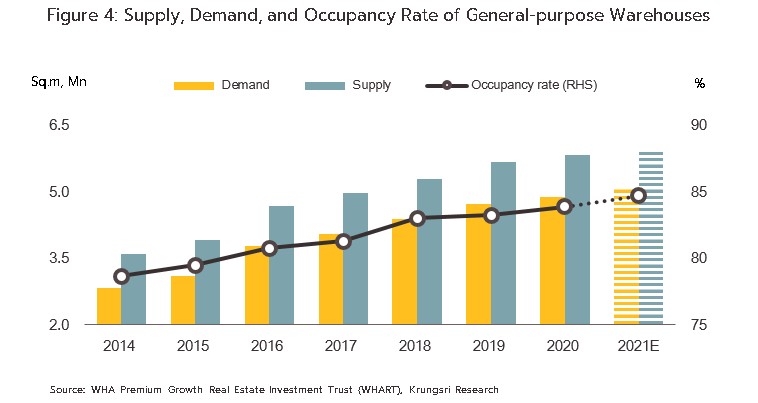

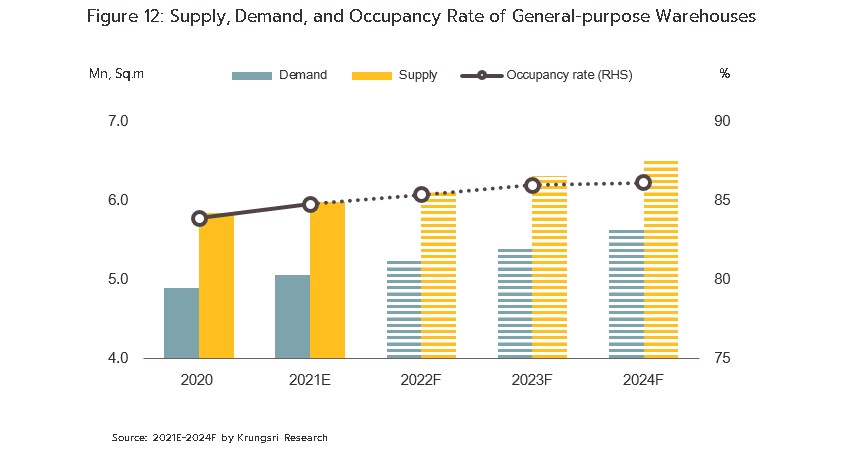

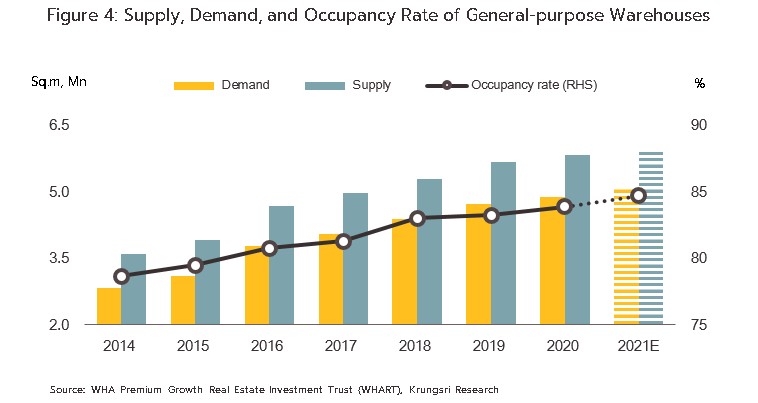

- Rapid growth in the e-commerce sector through 2020 helped to lift total demand for warehouse space by 3.5% YoY to 4.9 million sq.m. This was despite the outbreak of COVID-19 and the disruption to manufacturing supply chains that this brought, in particular in the second quarter of the year, which then undercut demand for warehousing from players in manufacturing and the import-export industries. Against this, rapidly changing consumer behavior and the switch to online shopping fed into 24% YoY growth in B2C e-commerce (source: Electronic Transactions Development Agency) that extended across online sales of agricultural product, consumer goods, and ready-to-eat and take-away food. In addition, the manufacturing sector began to recover in the second half of the year, and this then revived demand for warehouse space. Combined, these two trends encouraged operators (in particular large corporations) to meet this revival in demand by continuing to invest in new warehouse space for rent. Players engaging in this include WHA, which has developed the WHA E-Commerce Park (located at Km. 37 on the Bang Na-Trat road and covering over 200,000 sq.m.) and Frazers Property and Mitsui Fudosan Asia, which have formed a joint venture to develop Bangpakong Logistic Park Phase 1 (located at Km. 46 on the Bang Na-Trat road and covering 220,000 sq.m.) As a result of these developments, total supply grew by 2.7% YoY in 2020 to 5.8 million sq.m., but despite this increase, growth in demand moved ahead of supply and as such, the overall warehouse occupancy rate rose from 83.2% in 2019 to 83.9% in 2020 (Figure 4)[2].

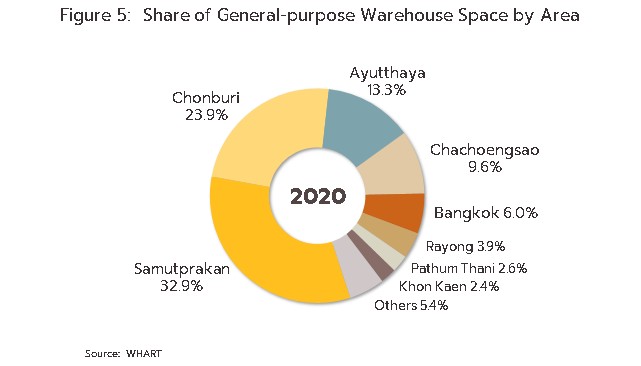

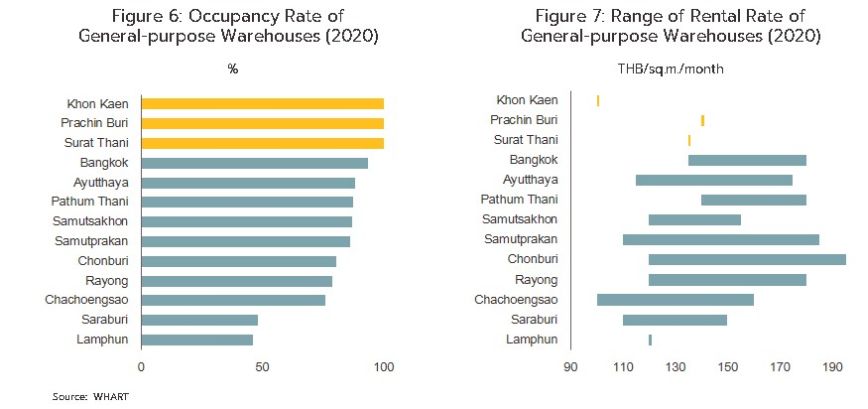

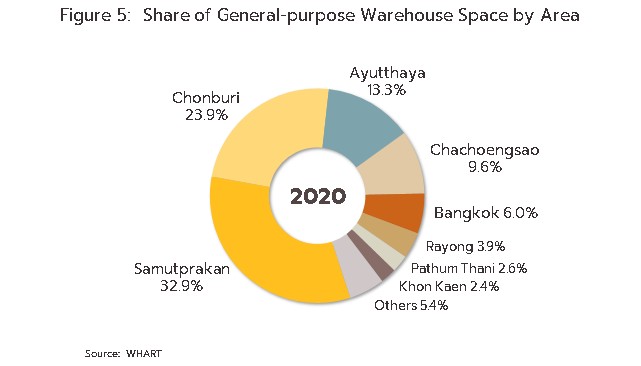

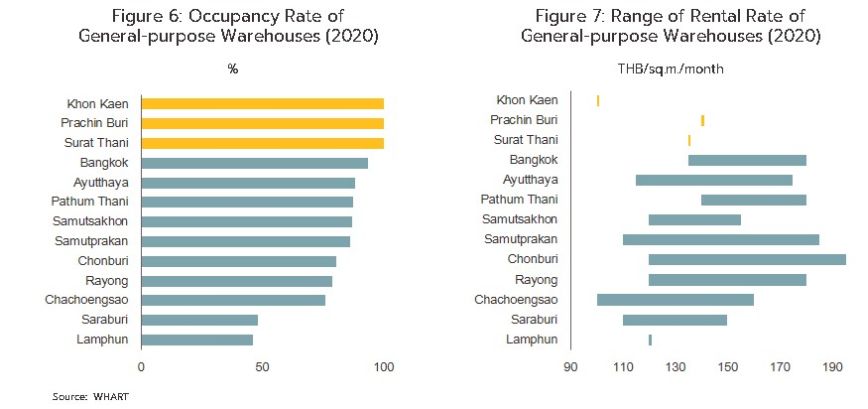

- General-purpose warehouses for rent is clustered in Samutprakan (32.9% of all warehousing for rent by area), Chonburi (23.9%), and Ayutthaya (13.3%) (Figure 5), but rental and occupancy rates differ according to the potential of particular sites, the number and condition of warehouses for rent, the level of competition, and access to transport links (Figures 6 and 7). The highest rents are found in Chonburi, where these average THB 200/sq.m./month, followed by Samutprakan (THB 185/sq.m./month), which benefits from its access to centers of production and distribution, and Rayong and Chachoengsao (THB 180/sq.m./month), which are part of the EEC.

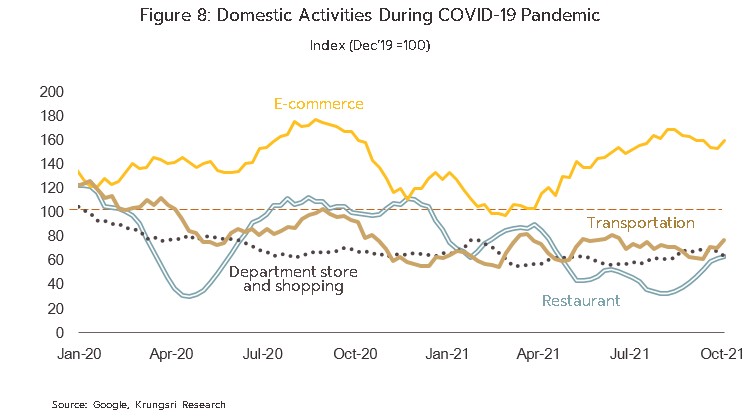

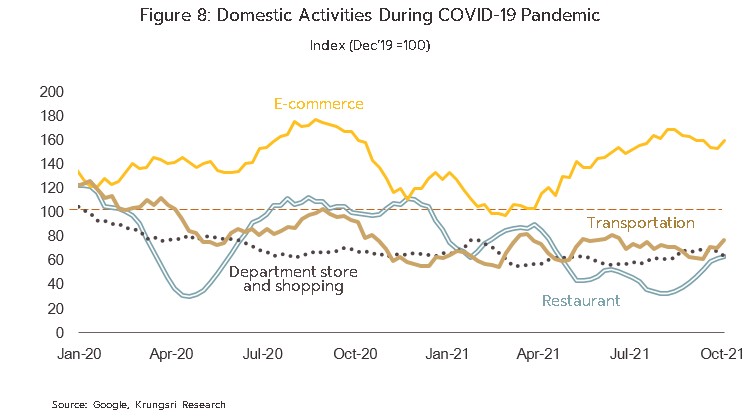

- Demand for warehouse space to rent is forecast to have risen by 3.3%, or 0.16 million sq.m., in 2021. The market has been boosted by growth in both the export sector overall and in many individual industries, including food processing, the production of medical equipment, devices and supplies, and the design and manufacture of packaging. Moreover, the severity of the COVID-19 pandemic and the subsequent reintroduction of control measures by the government, which included partial lockdowns, controls on travel, and the switch to online study and working from home (Figure 8), fed into a 25-30% surge in the value of online commerce. This in turn then translated into stronger demand for warehouse space to store goods before being distributed to consumers, with this coming in particular from the large players in the e-commerce world (e.g., Shopee, Lazada, and JD.com).

- Through 2021, increases in supply lagged behind strengthening demand, rising 2.3% from the 2020 total, or by around 0.13 million sq.m., this then taking the total supply of warehouse space to 6.0 million sq.m. The majority of this new supply came from new built-to-suit projects carried out by the major players (e.g., WHA, JWD, and Frasers) as extensions to existing sites. Operators have also tended to keep rents unchanged or, in some cases, to offer rent reductions as they try to lift the financial burdens placed on renters and so ensure that their customer base remains intact. Because supply growth has lagged behind that of demand, the overall occupancy rate improved across 2021, rising from 83.9% in 2020 to 84.7%.

- In 2021, new general-purpose warehouse space for rent was largely located in areas that are strategically important from the hub of logistics. This includes areas in the Bangkok Metropolitan Region (BMR), especially around Suvarnabhumi and Bangpakong, from where distribution to end users is rapid and convenient, industrial estates in Samutprakan and Ayutthaya provinces, and areas near the EEC that are well connected to transportation networks and close to central distribution centers or to Suvarnabhumi Airport, ports and the Lat Krabang inland container depot (ICD). Average rents in the area remained at THB 158/sq.m./month (source: Knight Frank). In the BMR and the EEC, these averaged THB 160-161/sq.m./month, though they will tend to rise in the coming period thanks to the area’s economic importance, while across the rest of the central region (excluding the BMR), they averaged THB 146/sq.m./month.

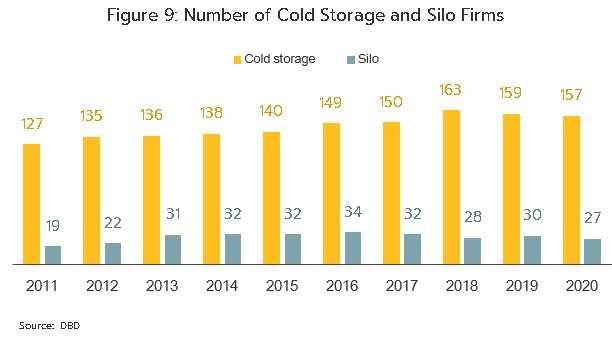

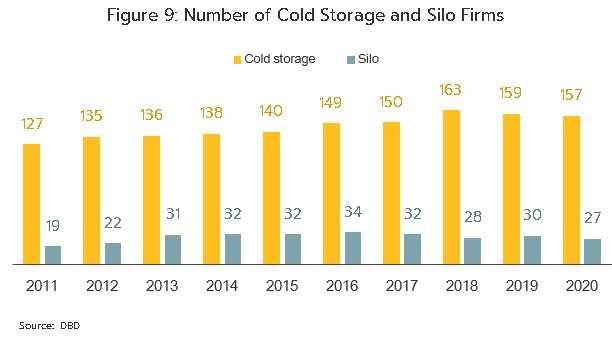

Cold storage warehouses: The increasing popularity of chilled and frozen food at home and abroad has encouraged some players in the food processing industry (e.g., seafood processors) to invest in their own cold storage units, thus ensuring that their products meet the stiff quality standards imposed by importers, but with the consequence that existing operators have had to watch their customer base shrink. The most recent data that is available is from 2020, and this shows that at that point, there were 157 providers of cold storage facilities registered in Thailand (Figure 9). 8 of these (5% of the total) were large players, most of which were part of larger commercial networks involved in the production and processing of vegetables, fruit, dairy products, meat, and seafood. The remaining 95%, or 149 companies, were SMEs.

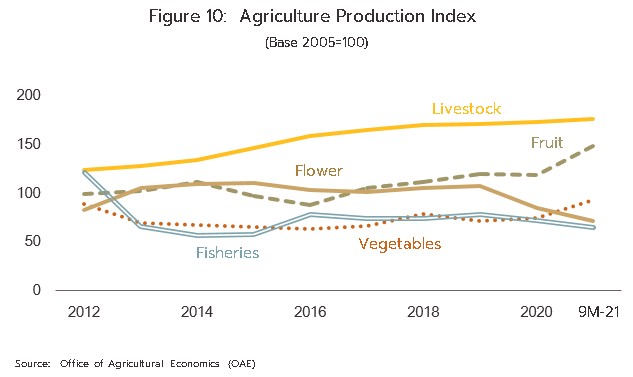

- In 2020, the cold storage segment was affected by the control measures put in place to limit the spread of COVID-19, in particular by the lockdown, and by the 6.5% YoY slump in exports from Thailand, which then naturally fed into weaker demand for refrigerated and freezer storage space. The segment was, though, boosted by higher yields for vegetables and livestock (Figure 10) and by growth in the food industry, which then stoked stronger demand for space to store fruit, vegetables and meat. However, the return of migrant workers to their home countries negatively affected seafood processors, and so demand from this market remained weak and turnover suffered accordingly. For 2021, demand is expected to have improved on the twin impacts of a 14.5% YoY jump in exports of agricultural produce (e.g., fruit, vegetables, and chilled and frozen chicken) over 9M21 (yields of seasonal fruits rose 9.6% YoY while stocks of frozen fruit and vegetables were up 7.0% YoY) and strong growth in online sales of chilled and frozen food and agricultural products. On the downside, demand for the storage of fisheries products remains weak due to continuing problems with labor shortages in the domestic industry and a slowing of imports into some overseas markets following the discovery of COVID-19 in a major Thai fish market (yields of fisheries products were down 7.8% YoY in the period, while stocks of fresh, chilled and frozen seafood dropped 11.1% YoY)

Silos: As a result of the government’s 2011-2013 comprehensive rice pledging scheme, this segment saw explosive growth over 2012-2014, with demand for space for the storage of rice rising 5-fold to around 5-6 million tonnes (Figure 11). However, the ending of the scheme and from 2014, the gradual running down of accumulated rice stocks undercut demand for silo space, forcing many players to leave the market in subsequent years. The majority of those that now remain are SMEs and, because these areas are the country’s main rice growing regions, 74% of operators can be found in the northern and central regions of the country (the remainder are in the East and Northeast).

- For silo operators, conditions began to improve in 2020, helped by higher yields for the major cereal crops (for paddy and maize, these rose by respectively 5% YoY and 6% YoY). Improvements continued into 2021, and the more favorable climate and better access to irrigation water supported a further increase in yields of 11.3% for paddy and of 10.9% for maize, which then boosted demand for silo space.

OUTLOOK

Over 2022 to 2024, suppliers of rented warehouse space will see conditions improve in line with the general economic recovery. Details for particular segments are given below:

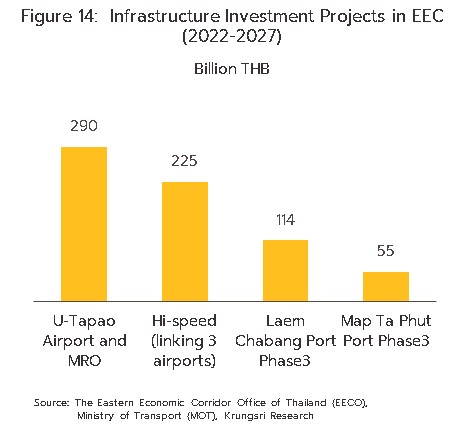

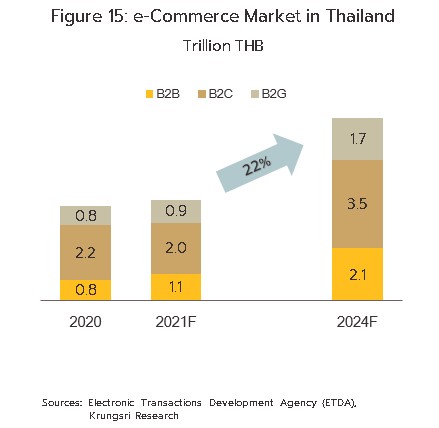

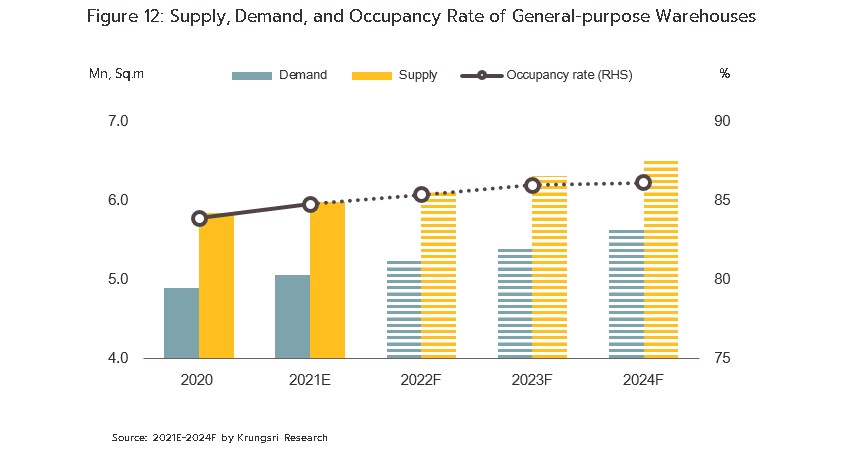

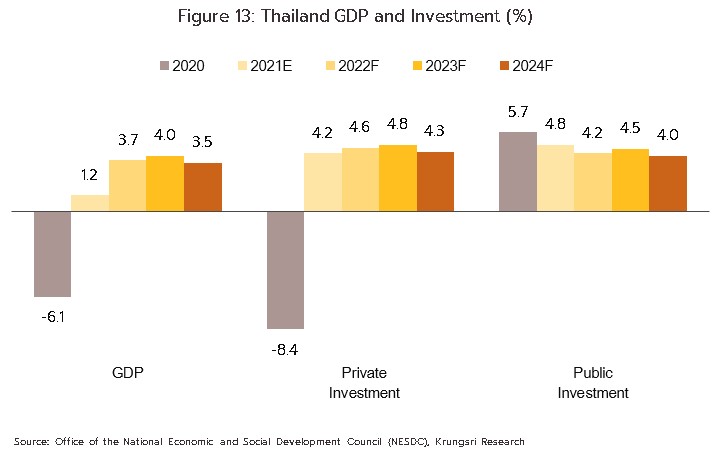

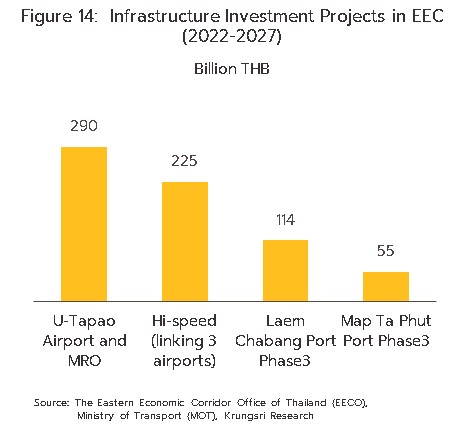

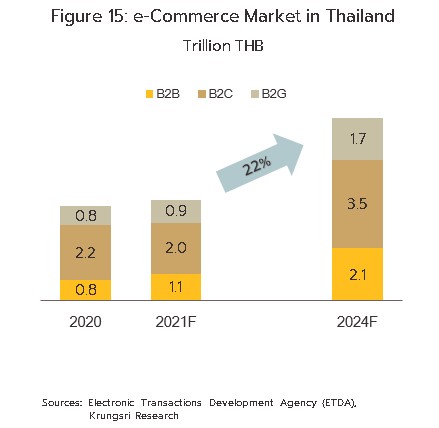

General-purpose warehouses: Overall demand for general-purpose warehousing space is forecast to strengthen by 3.5% annually (Figure 12) on: (i) economic recovery (Figure 13) that the IMF forecasts will run to 3.0-4.0% per year over 2022-2024 for the world economy, while Krungsri Research sees the Thai economy growing by 3.5-4.0% annually over the same period, this thus supporting growth in manufacturing and international trade; (ii) the development of new projects on industrial estates, especially in the Eastern Economic Corridor, where investment in infrastructure and transportations networks that connect the area to the wider region (e.g., phase 3 of the Laem Chabang and Map Ta Phut port developments and the high-speed 3-airport rail-link (Figure 14)) is helping to attract stronger investment inflows into Thailand-based manufacturing facilities; and (iii) continuing rapid growth in the e-commerce and logistics industries, and with growth in the former running at around 20-25% annually (Figure 15), demand for space for the storage and distribution of goods is rising. Operators are therefore expected to expand the supply of general-purpose warehousing at an average rate of 3.0% annually, and because this supply growth will lag behind rising demand, the occupancy rate will climb to around 85-86%. Players will tend to compete for customers by investing in modern warehousing facilities in the form of built-to-suit and ready-built warehouses that are fitted out with more comprehensive supporting technology (e.g., automated stock management systems), which will then make it easier for them to agree long-term contracts and to raise their rents than is the case when providing traditional warehouse space.

Cold storage warehouses: Demand for temperature-controlled storage space to rent is expected to remain relatively unchanged from its 2021 level. The segment will benefit from the food industry for the storage of goods including fruit, vegetables, dairy products, fish, and meat, as well as for the storage of vaccines and medicine, but this will be balanced by the significant oversupply of capacity that is troubling the market. The latter has been caused by players in various industries separately adding to supply, these including: (i) operators of chilled and frozen facilities that store fruit on behalf of other organizations, or that hold or process agricultural produce in different locations before this is distributed to buyers or exported, e.g., the facilities run by 25 agricultural cooperatives in 5 provinces[3]; (ii) cold storage facilities in the Smart Park industrial estate in Rayong that forms part of the so-called ‘Eastern Fruit Corridor’ (EFC); (iii) privately-run chilled and frozen storage space owned and run by large players in the seafood sector that provide the supply chain provenance assurances that are required in some export markets; and (iv) ‘super-frozen’ storage facilities, a new type of temperature-controlled warehousing that is receiving increasing interest in response to consumer demand for food that is healthier and fresher than traditional processed and prepared meals.

Silos/storage space for cereal crops: Demand will tend to fluctuate with yields of the major crops, which will in turn be determined by the climate, but overall, operators will tend to cut back on investments in additional supply due to: (i) the considerable pre-existing oversupply of storage space; (ii) the fact that although higher yields are forecast to support stronger demand in 2022, over 2023 and 2024, possibly worse climatic conditions will mean that this will fall back again[4]; and (iii) intensifying competition to purchase stock for storage, this coming from operators buying stock to store themselves, middlemen, and traders setting up their own storage space.

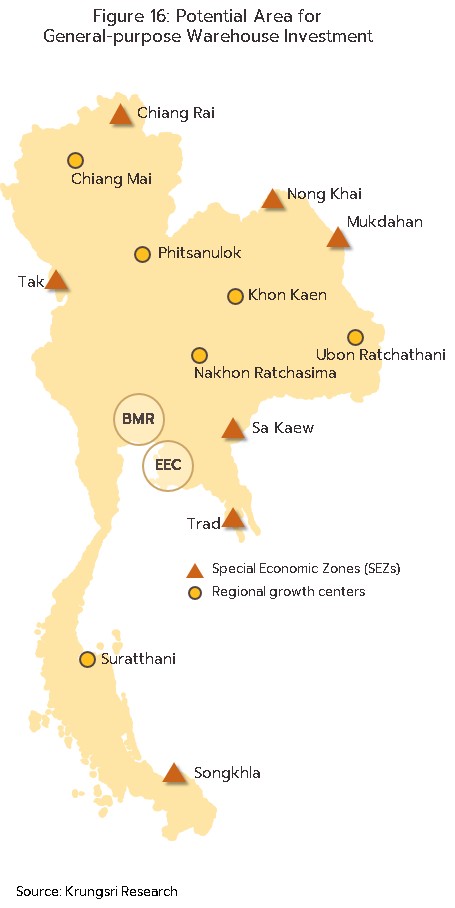

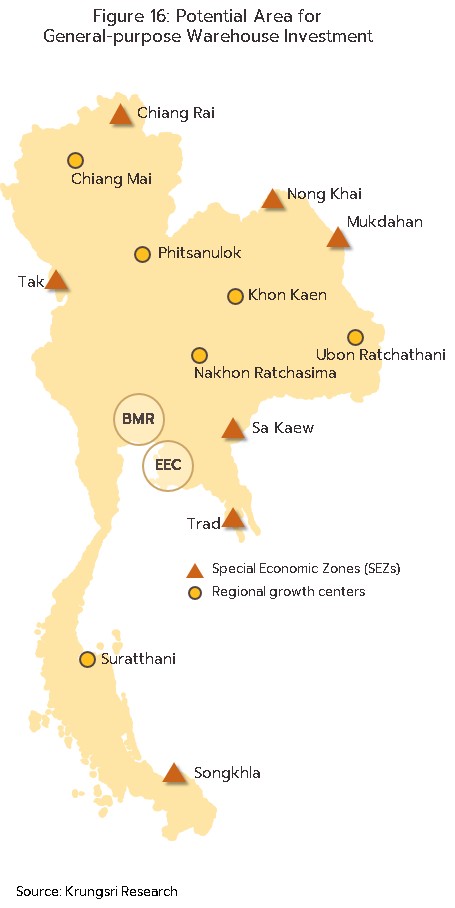

Locations that are likely to see growth in the coming period will include the following (Figure 16):

- Warehouse space located close to centers of production: This includes the Bangkok Metropolitan Region, industrial estates, areas that are recipients of government support for targeted industries (e.g., Ayutthaya province, and the EEC and nearby areas), and regional centers in the provinces.

- Warehouse space located close to consumer markets: Following growth in e-commerce in the Bangkok Metropolitan Region and important regional centers of growth (e.g., Chonburi, Phitsanulok, Nakhon Ratchasima, Khon Kaen, Ubon Ratchathani, and Surat Thani), micro-fulfilment centers may be set up in easy-to-access urban areas.

- Warehouse space in border regions: Demand will tend to grow in these areas with progress on road, rail, air and sea transportation infrastructure. This will help to connect Thailand more tightly to neighboring countries, increasing the impact of Thailand’s favorable position at the center of Southeast Asia and feeding demand for space in areas such as Tak, Mukdahan, Sa Kaew, Trat, Songkhla, Chiang Rai, and Nong Khai. This will particularly help SEZs and border regions that are being opened up by new transport connections (e.g., warehouses in container-yard areas with access to the Laos-China rail-link).

Beyond this, investing in warehouse space overseas will present an additional opportunity for Thai investors to increase their offerings and expand their customer base. This process is being eased by the high growth potential of many countries in the region and by increasingly liberalized markets that are allowing foreign investors to hold shares in warehouse operations. Thus, in Vietnam, investors from ASEAN nations may now hold 100% of the shares in warehouse operations, while in Indonesia, Cambodia, and the Philippines, the level of permitted shareholding is currently set at 49-51%, 49%, and 40% of the total, respectively.

Overall, competition is likely to strengthen in the coming period. This will be due to: (i) rising investment in new rented warehouse space by large players (e.g., WHA Corporation, Wyncoast Industrial Park, Frasers Property Thailand, and WICE Logistics), especially in the general-purpose warehousing segment, though this will result in an oversupply of space in some areas that will then limit players’ ability to raise rents; and (ii) increasing investment from new entrants to the market, the latter including Thai real estate companies, foreign players, and joint ventures that are being undertaken to extend the provision of logistics services into warehousing (e.g., the Alpha Industrial Solution company which is a partnership between Origin Property and JWD InfoLogistics, to develop warehouse and factory spaces for more than 1 million sq.m. during 2022-2026. And the BFTZ Bangpakong which is a partnership between Sansiri and Prospect Development, to develop 110,000 sq.m. of warehouse and factory spaces in Wang Noi in 2023 as the first phase). Restrictions placed on the siting of warehouses by planning regulations will also affect the industry, for example by specifying that in ‘green zones’ (farming and agricultural areas), sites for the collection and cold-storage of goods cannot have a footprint in excess of 2,000 sq.m., and this will naturally place limits on business expansion in some areas. In response, companies will need to raise their operating efficiency, for example by increasing their uptake of technology, from stocking goods to transferring and transporting them. This might also include deploying other management technologies or switching to the use of automated warehouses, which make more efficient use of available floorspace while reducing labor costs. By moving in this direction, companies will become more competitive and they will likely be much better placed to secure their long-term growth.

[1] The Public Warehouse Organization (PWO) is a state enterprise tasked with maintaining stable prices for agricultural products. To fulfil this remit, the PWO offers services for the storage and gradual distribution of agricultural produce to domestic and international markets, as determined by government policy. The PWO also offers services to state and private organizations for the depositing of agricultural goods and their use in ‘pledging schemes’, as well as operating a wharf for the loading and unloading of goods in transit in and out of the country.

[2] From the report ‘An Overview of Investment Returns in Real Estate’ produced by the Real Estate Investment Trust and WHA Premium Growth Freehold and Leasehold Real Estate (WHART). This was based on a survey of warehousing businesses in Bangkok and provinces that are home to industries that have benefited from significant investment inflows.

[3] Chonburi, Chachoengsao, Rayong, Chanthaburi, and Trat.

[4] Data from the National Oceanic and Atmospheric Administration (NOAA) shows that over the last 60 years, severe La Niñas and El Niños have occurred roughly every 12-15 years, within Thailand, the last of these having been recorded in respectively 2010-2011 and 2015-2016. However, as climate change takes hold, extreme weather is occurring more often and one aspect of this is that the timeframe over which El Niños and La Niñas happen has shortened, these now swapping every 2-3 years. Krungsri Research thus believes that there is a possibility that a La Niña will occur in 2021-2022 and an El Niño will follow in 2023-2024.

.webp.aspx)