EXECUTIVE SUMMARY

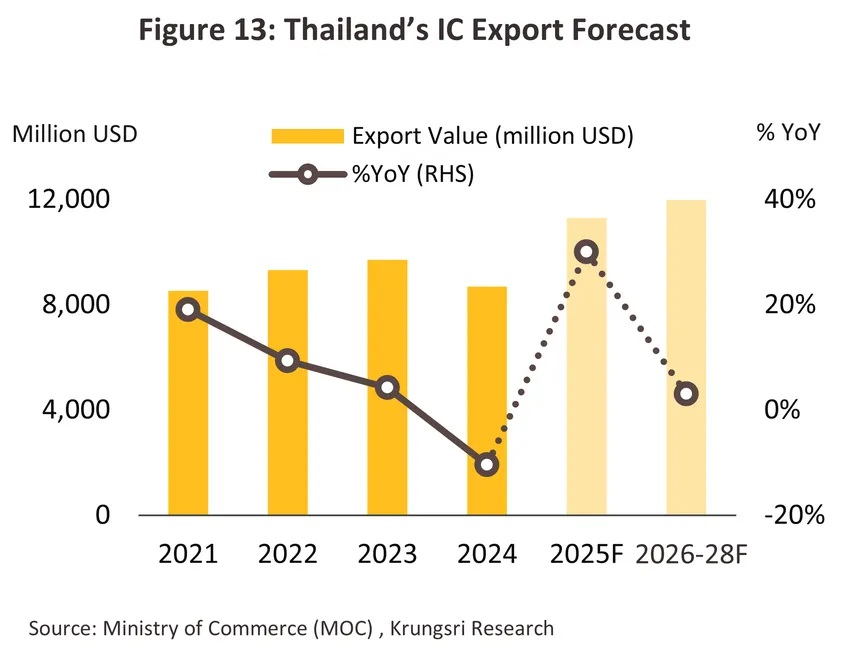

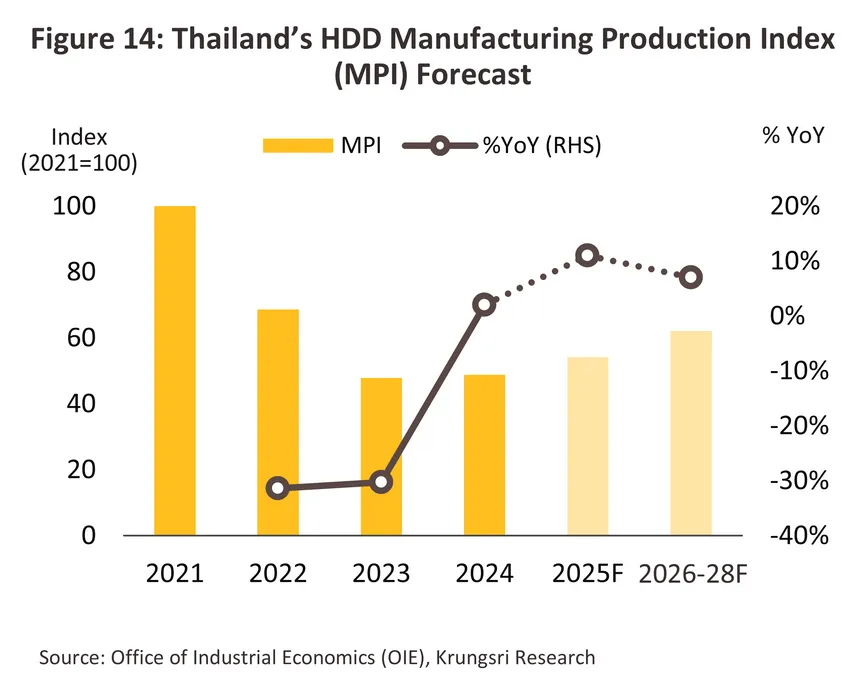

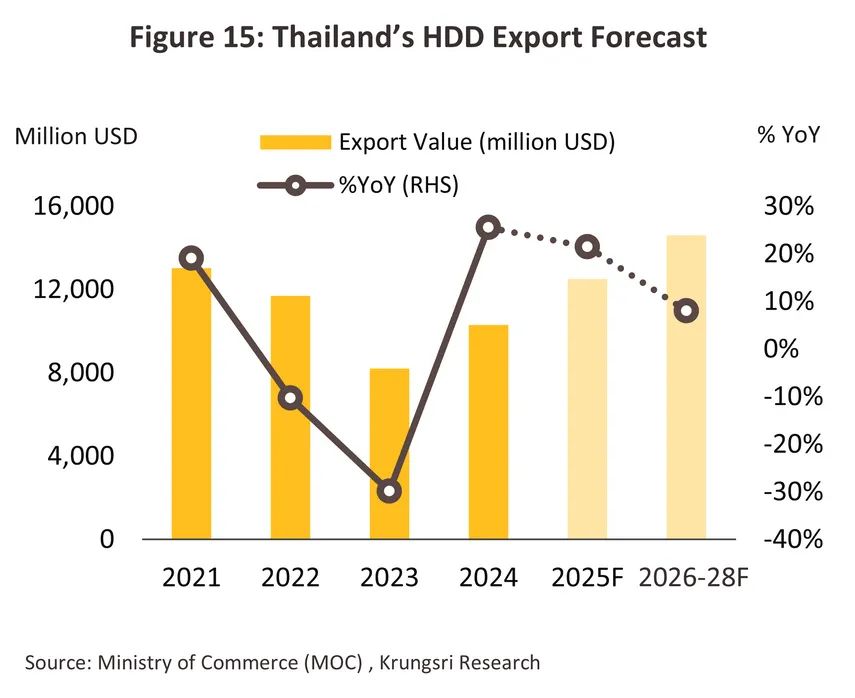

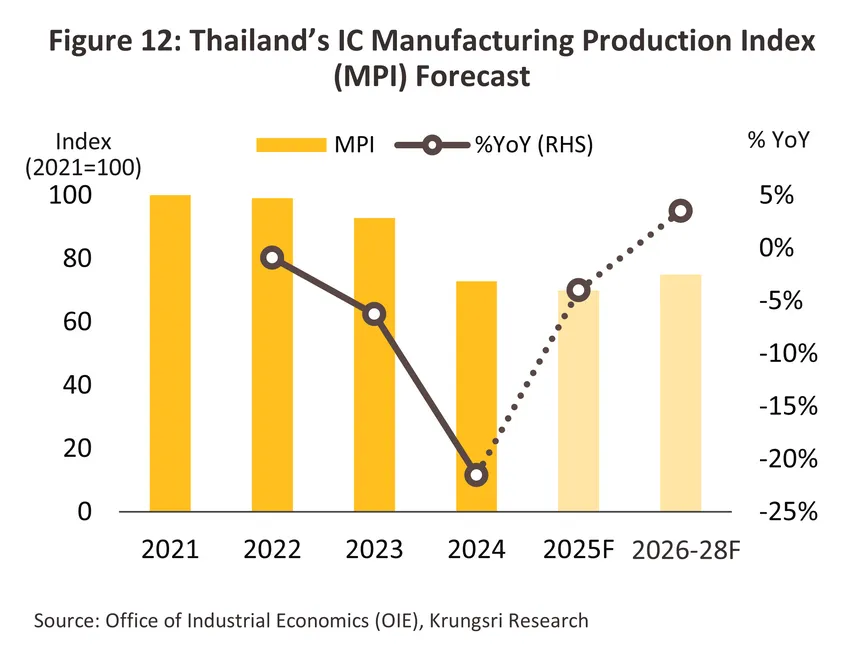

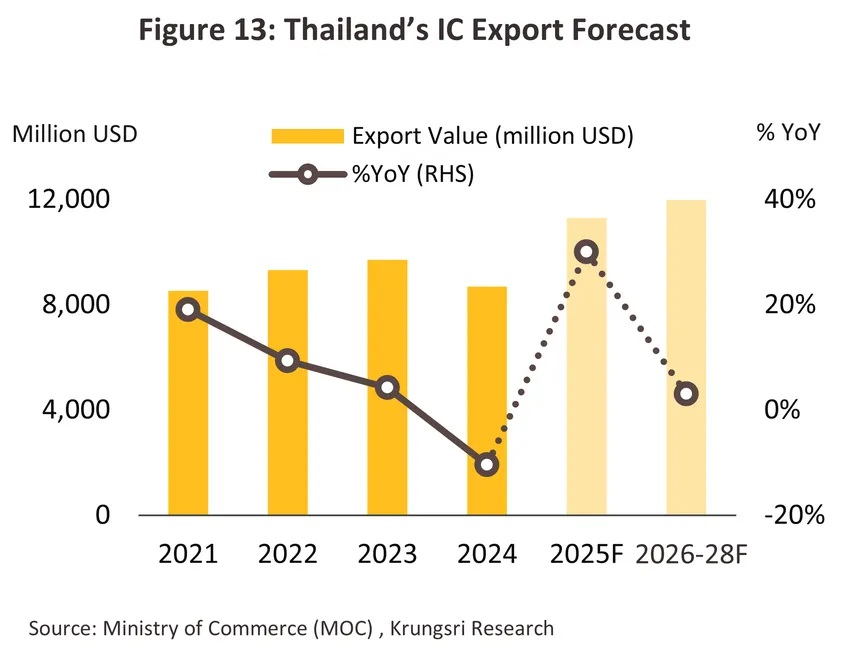

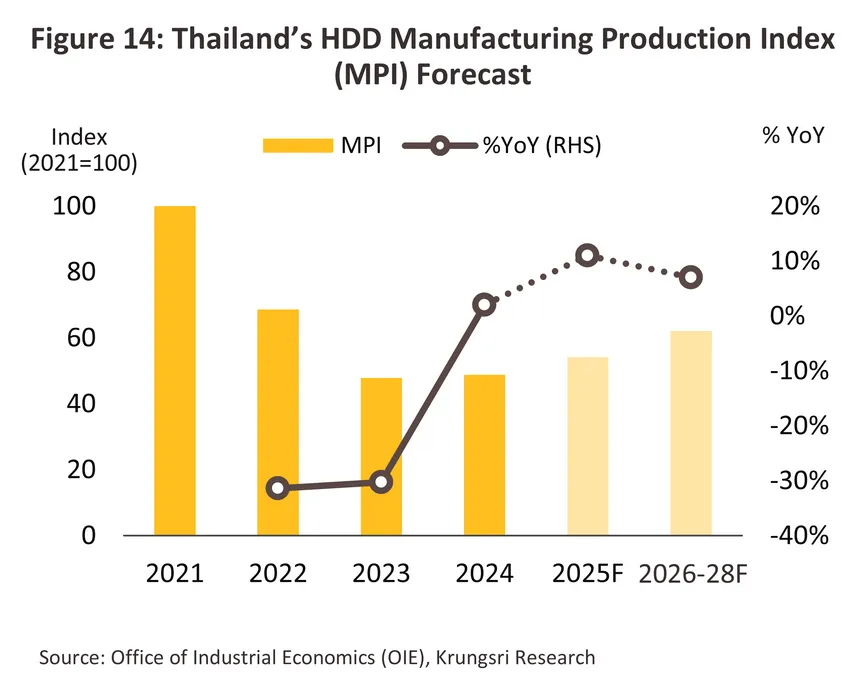

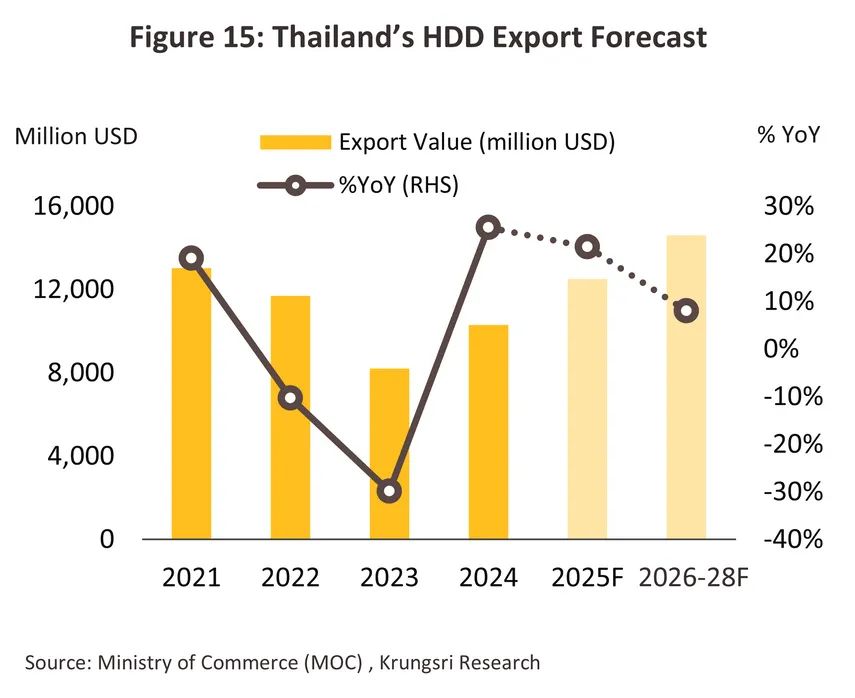

During 2026–2028, Thailand’s electronic components production and exports are expected to continue expanding. The Integrated Circuit (IC) industry is projected to post average annual growth of 3.0–4.0% in production and 2.5–3.5% in export value, while the Hard Disk Drive (HDD) industry is expected to record stronger gains of 6.5–7.5% and 7.5–8.5%, respectively. Key growth drivers include: (i) growing global demand from technology-driven downstream industries, such as AI services, information technology and telecommunications, data centers, home appliances, and next-generation automotive; (ii) capacity expansion and technological upgrades by Thai electronic component manufacturer; and (iii) stronger domestic demand supported by recent investments from downstream producers, including data centers, smart appliance manufacturers, PCB producers, and electric vehicle industries. Nevertheless, Thai electronic component manufacturers may face downside risks, including potential supply chain disruptions stemming from China’s tighter rare-earth export controls, possible U.S. tariff hikes if products are deemed to originate from China, and intensifying global competition, particularly from emerging ASEAN rivals.

Krungsri Research view

The electronics industry is expected to strengthen, supported by both growing demand from related industries and increased supply through recent investments in capacity expansion and technological development.

-

Manufacturers of ICs are expected to benefit from: (i) global growth in computing driven by rising AI investments; (ii) continued expansion in the global telecommunications sector, supported by the smartphone replacement cycle and the launch of new AI-enabled smartphones; (iii) ongoing growth in global Electric Vehicle (EV) production; and (iv) increased domestic investment in downstream industries, such as PCBs, home appliances, and EVs, which will further boost demand.

-

Manufacturers of HDDs are expected to benefit from: (i) continued global expansion of data centers and cloud services, driven by AI development; (ii) the global PC replacement cycle; and (iii) recent investments in HDD production to expand capacity and improve technology, in order to increase unit storage, enhance data transfer speeds, and lower unit costs. Despite the ongoing challenge of SSD substitution, HDD demand is expected to remain strong over the next three years, supported by advantages in cost and capacity.

Overview

The electronics industry in Thailand has continuously developed since 1972, when the government began promoting investment through various fiscal and non-fiscal incentives under the Board of Investment (BOI) to attract foreign investors. Between 1972 and 1992, the government focused on encouraging export-oriented manufacturing, leading foreign investors to establish electronics production bases in Thailand, including Integrated Circuits (ICs), Printed Circuit Boards (PCBs), Hard Disk Drives (HDDs), floppy disks, electric motors, as well as wires and cables. Thailand’s relatively low labor costs at the time provided a competitive advantage. The 1987 Plaza Accord, which strengthened the yen, further prompted Japanese companies to relocate production abroad, with Thailand emerging as a high-potential manufacturing base due to its strategic position in ASEAN. This advantage was reinforced after the establishment of the ASEAN Free Trade Area (AFTA) in 2004, attracting additional multinational companies from Japan, Taiwan, and the United States to set up electronics production facilities in Thailand.

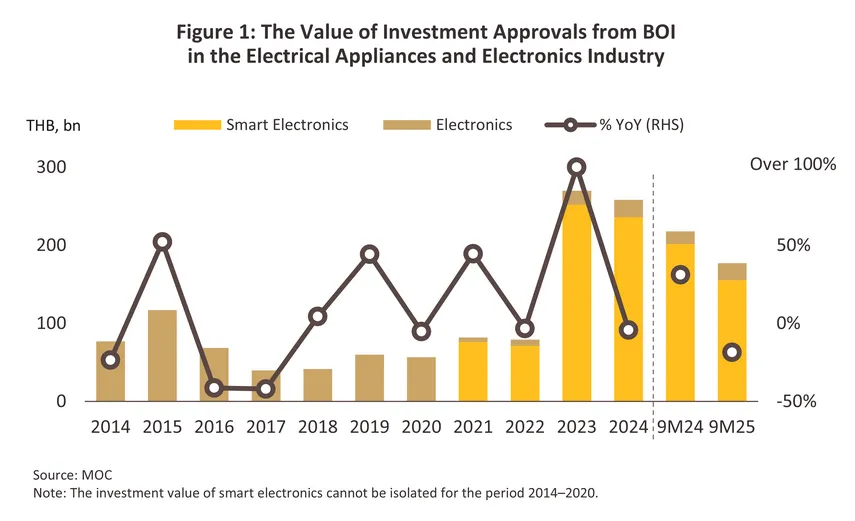

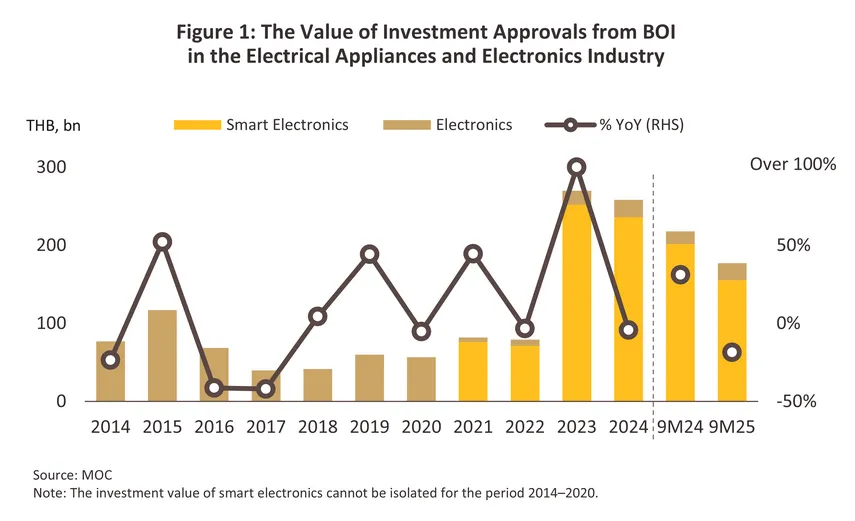

The Thai government has consistently supported investment in the electronics industry (Figure 1) and designated it as one of the S-curve target industries under the Thailand 4.0 policy since 2016. The industry was elevated to a “strategic industry” by BOI, offering tax incentives to attract investment in advanced electronics using cutting-edge technologies from 2021 onward. In 2023, BOI approved the highest level of investment promotion in the electrical and electronics sector, with a total value of THB 270 billion, up 240.6% YoY, accounting for 36.0% of all approved investment promotions. This sustained prioritization was further supported by geopolitical tensions prompting investors to relocate production bases to ASEAN, particularly Thailand, to diversify risks. In the first nine months of 2025, approved investment totaled THB 180 billion, down -18.7% YoY in line with the global economic and investment slowdown, but still representing 15.9% of total approved investment. Most of this investment targeted smart electronics (e.g., semiconductors, ICs, HDDs, and air conditioners), totaling THB 160 billion or 92.6% of all electronics industry investment in Thailand. This ongoing transitional period marks a crucial phase in strengthening Thailand’s electronics supply chain toward upstream capabilities, supporting other modern target industries reliant on electronics as a key upstream sector, including electric vehicles, data centers, and comprehensive healthcare services.

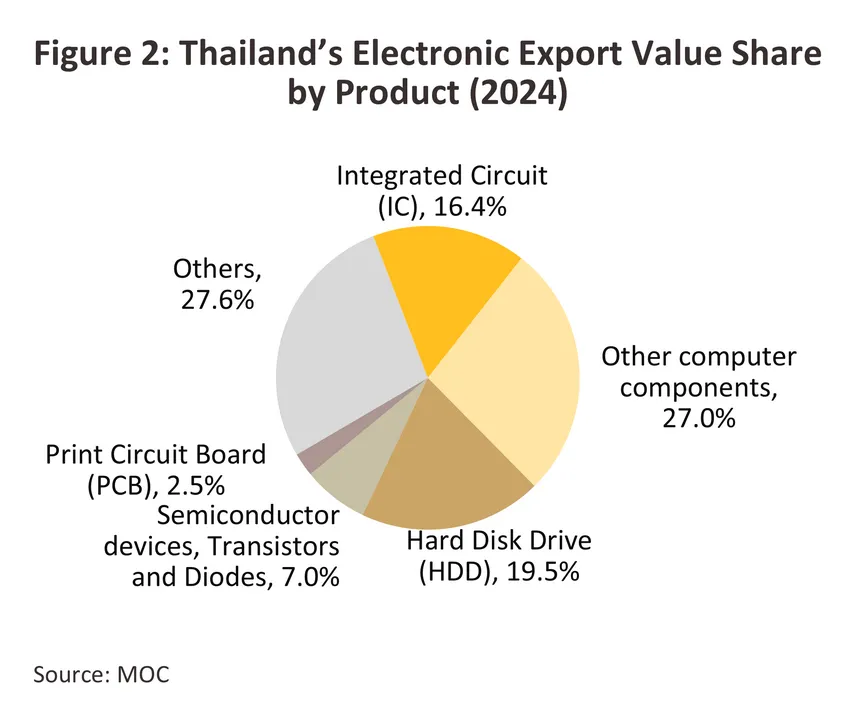

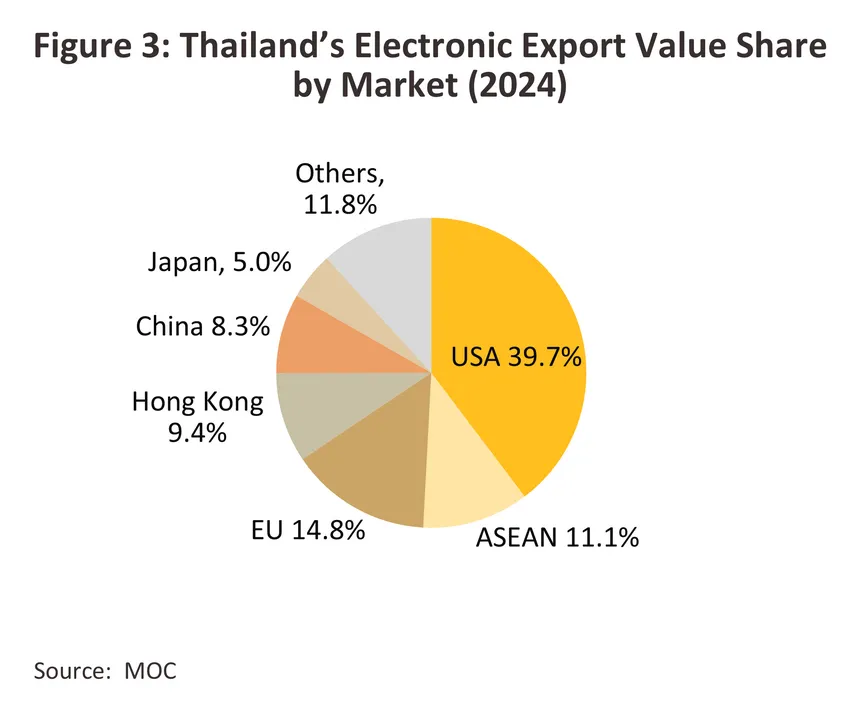

Thailand’s electronics industry is predominantly export-oriented, with 90–95% of total production destined for overseas markets. Electronics exports rank first among all Thai products, accounting for 27.4% of total export value in 2024. Between 2019 and 2024, electronics exports grew at an average CAGR of 9.3%. The largest export segment is computers, peripherals, and other components, representing 27.0% of total electronics exports, followed by HDDs (19.5%), ICs (16.4%), semiconductors including transistors and diodes (7.0%), PCBs (2.5%), and other electronics (27.6%) (Figure 2). Key export markets for Thailand include the U.S. (39.7% of electronics exports), Europe (14.8%), ASEAN (11.1%), Hong Kong (9.4%), China (8.3%), and Japan (5.0%) (Figure 3). Domestic sales account for only 5–10% of production, mostly used as components in final products such as communication devices, automotive parts, home and office appliances, medical instruments, and various industrial equipment.

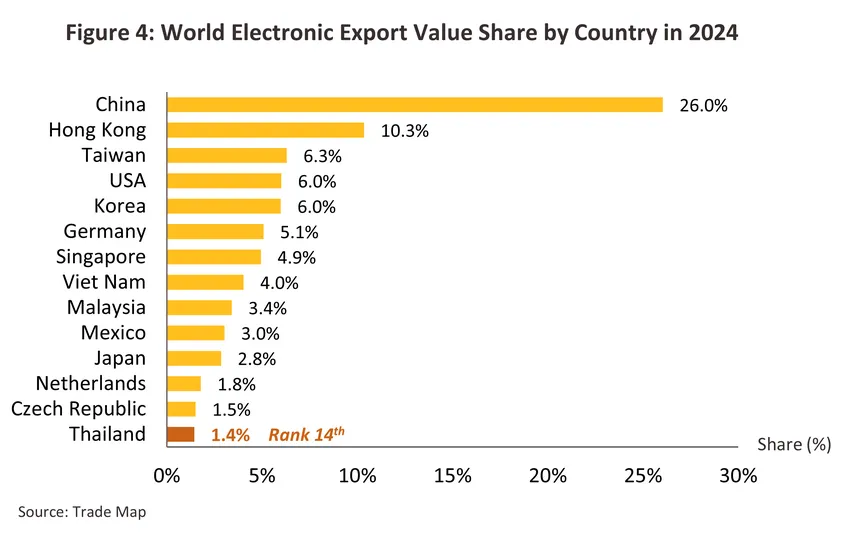

In 2024, Thailand ranked as the 14th largest electronics manufacturing base globally, yet it accounted for only 1.4% of total global electronics exports. The top exporters in the global electronics market are China (26.0%) and Hong Kong (10.3%), followed by Taiwan (6.3%), the United States (6.0%), and Germany (5.1%) (Figure 4).

The export structure of Thailand’s electronics industry, classified by major products and key markets, is as follows:

Integrated Circuit (IC) Industry

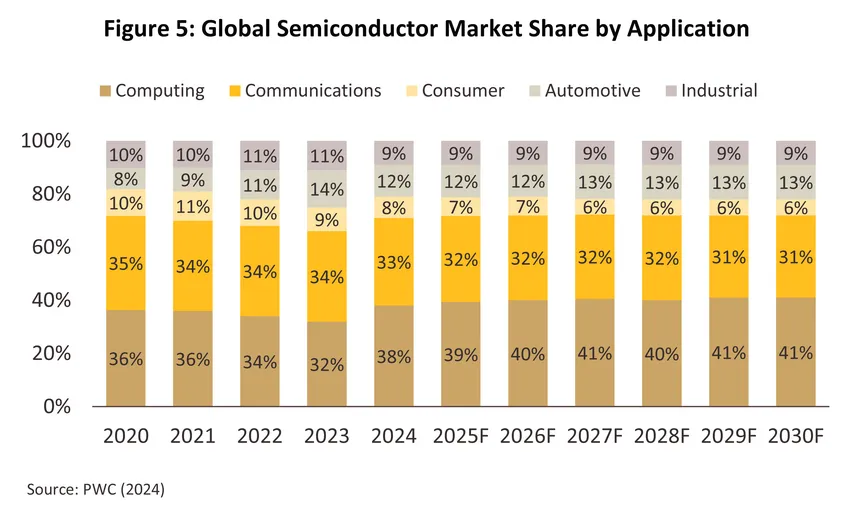

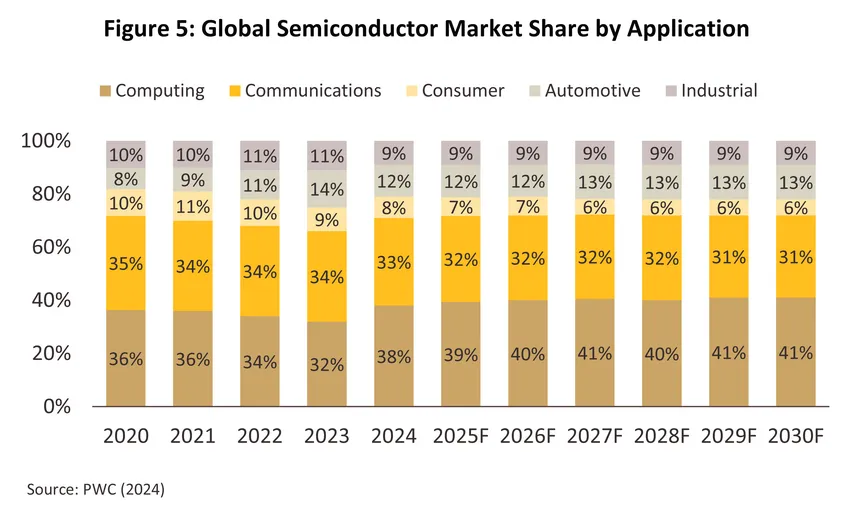

The IC industry is closely linked to the semiconductor sector, a key source of essential materials, and its growth is influenced by global economic trends as well as related downstream industries. In 2024, the top three sectors with the highest semiconductor usage were Computing (38% of global semiconductor sales), Telecommunications (33%), and Automotive (12%) (Figure 5). The three most widely used types of semiconductors were Logic (34% of global semiconductor sales), Memory (17%), and Microcomponents (17%)1/. Key growth drivers include:

-

The growth of computing and communication businesses, driven by advances in AI, Machine Learning, Neural Networks, and Data Analytics in recent years, has strengthened demand for advanced semiconductors, particularly high-density, high-capacity, high-speed, and high-bandwidth memory chips.

-

The growth of the EV industry, which requires far more semiconductor components in production than Internal Combustion Engine (ICE) cars, is also driving demand. An EV contains semiconductor components worth roughly six times more than an ICE vehicle, with most semiconductors installed in the motor drive system and battery management systems, such as the inverter, DC-DC converter, on-board charger, and Battery Management System (BMS).

The semiconductor industry is a proactive target sector for attracting foreign investment, reflected in the rising value of approved investment promotions in the smart electronics industry in recent years. Beyond incentives, the industry also holds growth potential to meet rising demand from other target sectors, particularly modern industries relying on advanced technologies, such as automated manufacturing, healthcare, and next-generation automotive. However, production in Thailand still faces shortages of key mineral raw materials and requires significant R&D for upstream technology, leading the country to focus on midstream and downstream production in the global supply chain. Consequently, government investment-supportive policies remain essential for advancing Thailand’s high-end semiconductor capabilities.

Thailand ranks 12th globally in IC exports, with a total value of USD 13 billion in 2024, representing 1.3% of global IC exports2/. Major Thai producers include Hana Microelectronics Public Company Limited, Stars Microelectronics Public Company Limited, Maxim Integrated Products (Thailand) Co., Ltd., Microchip Technology (Thailand) Co., Ltd., and Rome Integrated Systems (Thailand) Co., Ltd.

Hard Disk Drive (HDD) Industry

-

The HDD industry aligns with the growth trends of the electronics and computing sectors. Currently, HDDs are increasingly utilized in data centers, driven by advancements in AI technology, which requires massive data storage capacity3/. Moreover, modern electronic devices have become more intelligent, capable of processing, storing data, and connecting online. This trend is fueling higher demand for storage devices4/.

-

Key global players include Seagate, Western Digital, and Toshiba, with manufacturers currently prioritizing improvements in HDD performance, such as Heat-Assisted Magnetic Recording, which allows storage devices to be made smaller. Major Thai manufacturers include Western Digital Storage Technologies (Thailand) Co., Ltd. and Seagate Technology (Thailand) Co., Ltd.

-

Impact of Solid-State Drives (SSD): In recent years, the global HDD market has been affected by replacement with SSDs, which offer advantages in durability, faster data transfer speeds, and lower energy consumption. Continuous development has also increased SSD capacity per unit while reducing the cost per unit5/.

-

Domestic investment is on an upward trend to support the growing demand for HDDs in the future, following a prolonged market downturn. Major HDD manufacturers, such as Seagate Technology (Thailand) Co., Ltd. and Western Digital Storage Technologies (Thailand) Co., Ltd., are driving this expansion. In 2023, total investment reached THB 16 billion, and in 2024, it rose to THB 23 billion. These investments aim to expand production capacity in Thailand and develop advanced HDD technology with higher storage capacity and smaller sizes to remain competitive against SSDs, which are still more expensive. The focus is primarily on meeting the needs of the rapidly growing Data Center business6/, reflecting Thailand’s strong potential for this product segment to regain growth.

-

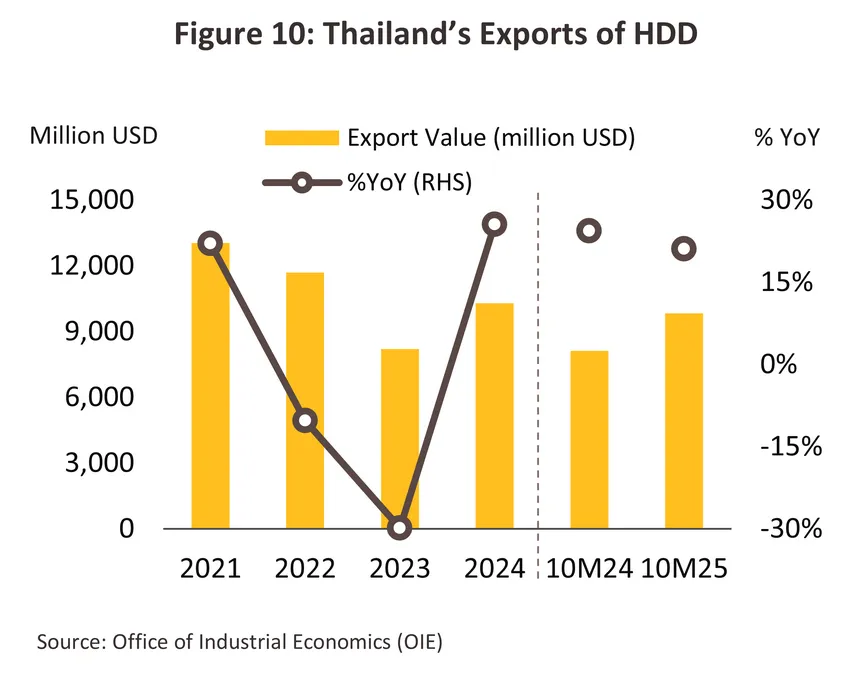

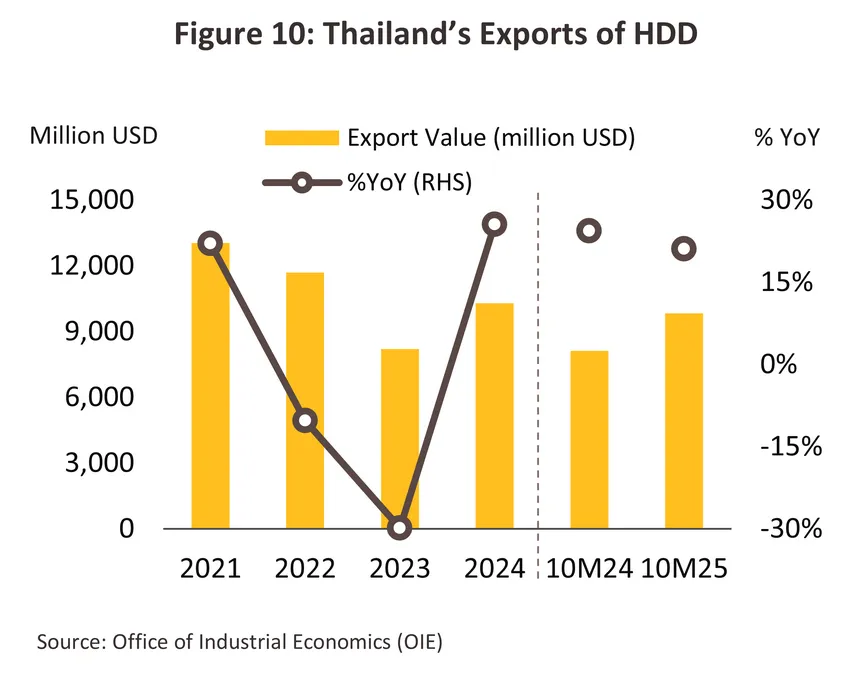

Thailand remains one of the world’s key HDD manufacturing bases, with export value in 2024 reaching USD 10 billion, accounting for 17.5% of global HDD exports and ranking second after China2/.

Situation

Integrated Circuit (IC) Industry

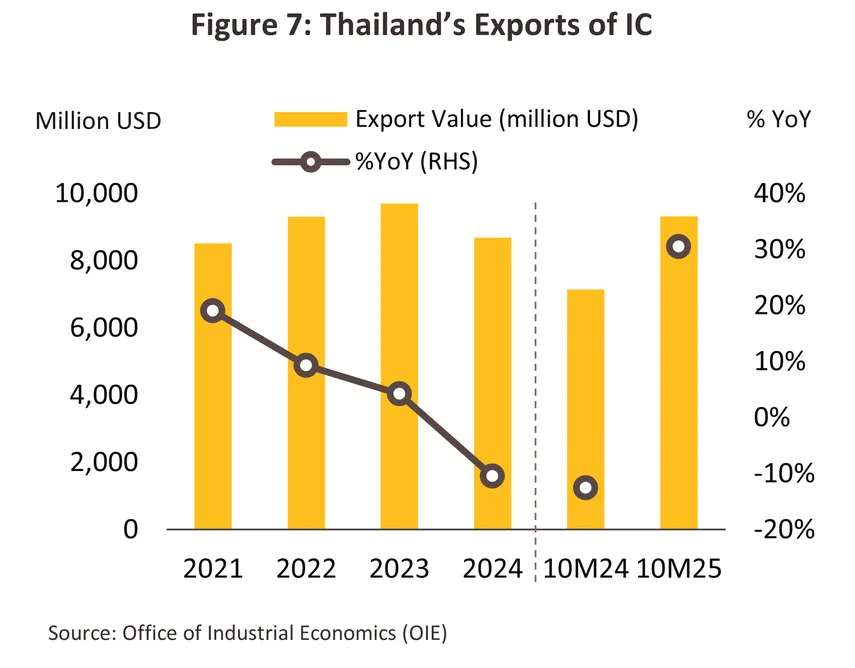

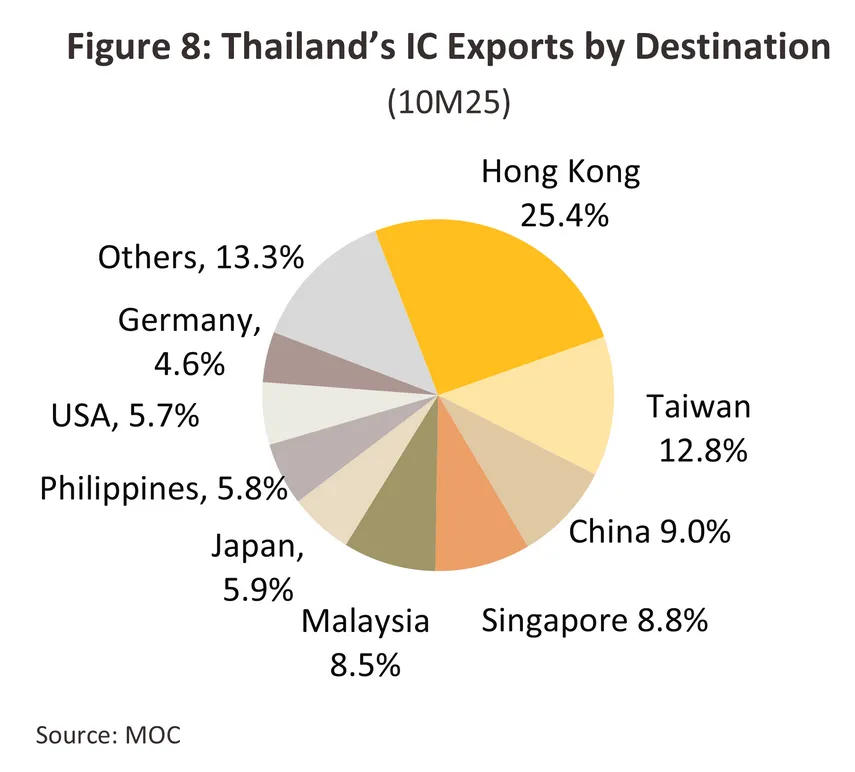

During the first 10 months of 2025, Thailand’s IC export value surged 30.5% YoY to USD 9.3 billion (Figure 7). The top three export destinations for Thai IC products were Hong Kong, Taiwan, and China, respectively (Figure 8). The increase in IC export value was driven by several supporting factors, including:

-

Growth in global sales of electrical appliances and IT devices has been supported by a new replacement cycle for home appliances, mobile phones, and PCs, after peaking during the COVID-19 period; additionally, the launch of new IT devices designed to accommodate AI technology has further driven demand. Gartner projects global spending on IT devices in 2025 to increase 8.4% to USD 780 billion; meanwhile, spending on communication services, which rely on chips for signal processing and management, is expected to rise 3.8% to USD 1.3 trillion7/.

-

The increase in investment in AI technology has been driven by rising capital expenditures from both existing U.S. firms and new Chinese entrants, focusing on the development of Generative AI (GenAI) that delivers more accurate and efficient processing. This trend has fueled demand for Logic and Memory chips, which are essential for executing AI algorithms and storing massive datasets for AI training. Gartner projects that investment in AI infrastructure, hardware, and Graphics Processing Units (GPUs) will surge 49.7% in 2025 to USD 1.5 trillion8/.

-

The continued increase in global EV production has driven higher semiconductor usage compared to ICE vehicles, particularly for silicon carbide and gallium nitride semiconductors. These materials offer superior energy efficiency and power capacity and can operate under higher temperatures than conventional semiconductors. Global EV production in Q1 2025 has grown in line with EV sales, surging 35% YoY to 4 million units9/, supported by policies promoting EV adoption to achieve global carbon emission reduction targets in the transportation sector.

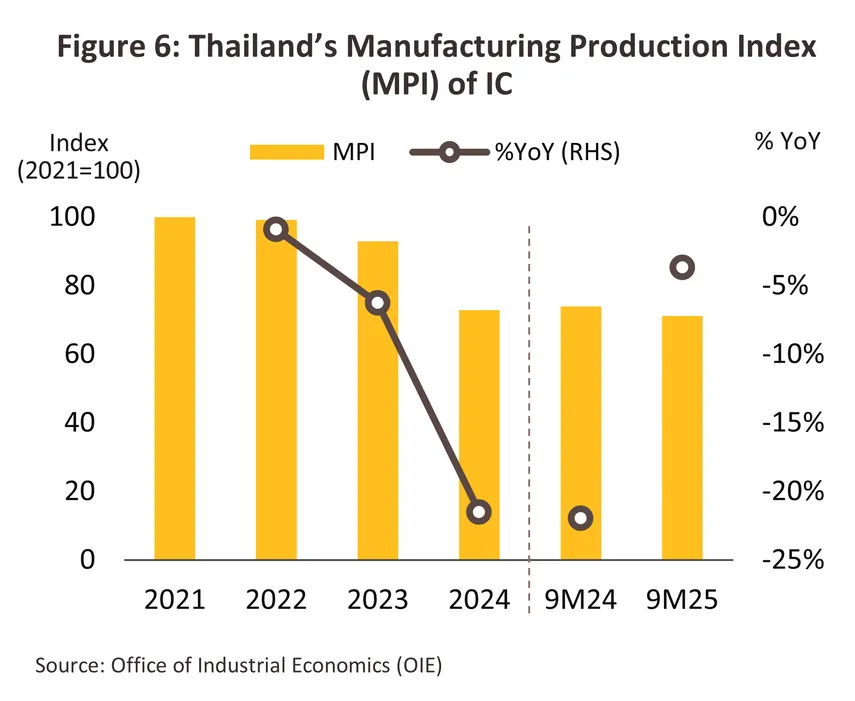

However, Thailand’s IC production index dropped -3.7% YoY during the first nine months of 2025 (Figure 6), mainly due to destocking as inventory levels surged 19.9% YoY10/. Despite this, Thailand continued to increase IC imports, particularly from China, with the import value of IC products from China soaring 51.7% YoY over the same period. Most of these imports were IC wafers and upstream IC components requiring specialized chemicals that Thailand is unable to produce on an industrial scale due to technological and raw material constraints. This reflects Thailand’s continued reliance on upstream IC imports, limiting the country’s ability to create added value in semiconductor manufacturing.

Hard Disk Drive (HDD) Industry

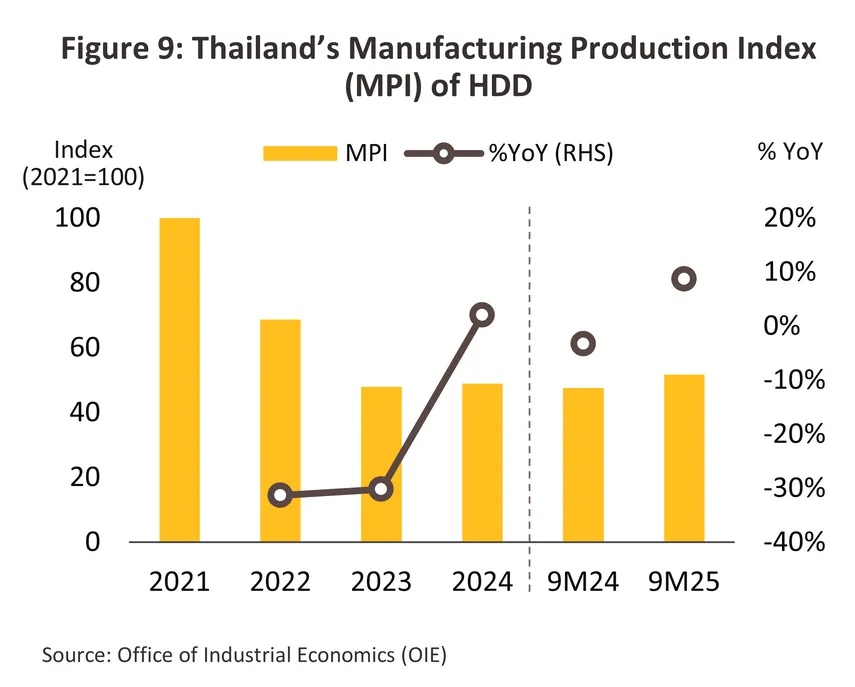

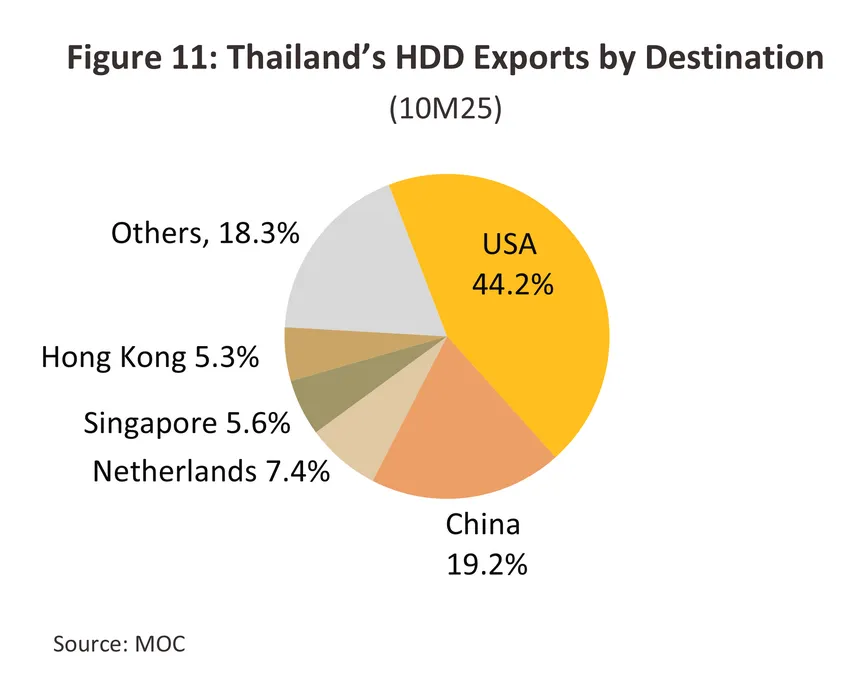

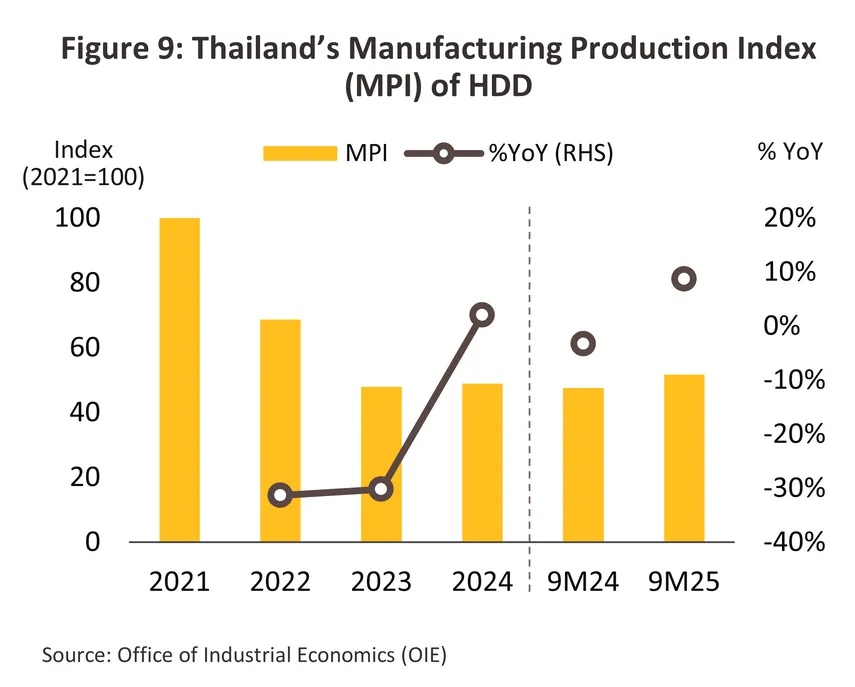

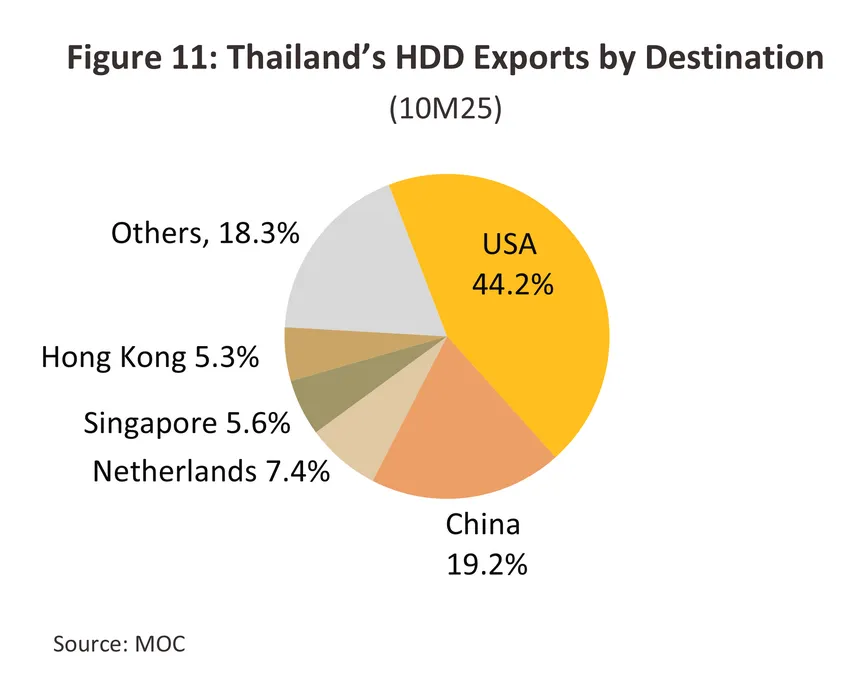

The HDD production index rose 8.7% YoY during the first nine months of 2025 (Figure 9), in line with export value, which also surged 21.1% YoY to USD 9.8 billion in the first ten months of 2025 (Figure 10). Thailand’s top three HDD export destinations were the United States, China, and the Netherlands, respectively (Figure 11). The key factors driving the recovery in HDD production during this period include:

-

The continued growth of data center and cloud businesses has driven the first global HDD shortage in years11/. This results from rapid AI development, which requires massive memory to store huge data volumes, coupled with businesses increasingly shifting to cloud-based IT infrastructure. Consequently, global data centers saw HDD demand surge over 40% in 2024, pushing prices up 10–30%, with some manufacturers facing backlogs of up to 24 months11/. In 2025, Gartner projects global data center revenue to rise 46.8% to USD 490 billion7/, while Infrastructure as a Service (IaaS) revenue is expected to grow 20.6% to USD 210 billion12/.

-

The global PC market continued to recover, with worldwide PC sales rising 5.9% YoY to 192.1 million units13/ in the first nine months of 2025. Key drivers include: (i) a new PC replacement cycle since the COVID-19 pandemic, which has boosted global PC sales from Q4 2024 onward; (ii) the end of Windows 10 updates, prompting upgrades to modern PCs; and (iii) the industry’s shift toward AI PCs, equipped with more advanced AI processing capabilities.

-

HDDs currently offer advantages in storage capacity and cost per unit, with a cost per terabyte about six times lower than SSDs14/. Manufacturers continue to invest in technology to develop new HDD models with higher storage capacity and faster data writing speeds, keeping HDDs highly popular in global data center businesses. TechRadar and TrendForce11/ estimate that global HDD demand will increase by as much as 40% in 2025.

However, Thailand’s HDD industry still faces challenges from global industry structural changes that pressure production and export growth, particularly due to increasing adoption of SSDs. This is especially evident in AI PCs, which primarily use SSD memory because of its advantages in faster data writing, lower energy consumption, and greater durability compared with HDDs. Currently, SSDs continue to gain popularity, accounting for about 31% of all new PC sales, while data center businesses are increasingly adopting QLC SSDs (Quad-Level Cell Solid State Drives)15/ to replace HDDs that are currently in short supply.

Looking ahead to the rest of the year, Thailand’s electronics industry is expected to continue benefiting from the replacement cycle of consumer electronics and IT devices, as well as ongoing global investment in data center businesses. This is likely to support growth in Thailand’s electronics exports at a rate similar to previous periods. IC export value is projected to rise 29.5–30.5% in 2025, despite a contraction in production volume of -3.5% to -4.5%, while overall HDD production and export value are expected to increase 8.0–9.0% and 21.0–22.0%, respectively.

Outlook

Integrated Circuit (IC) Industry

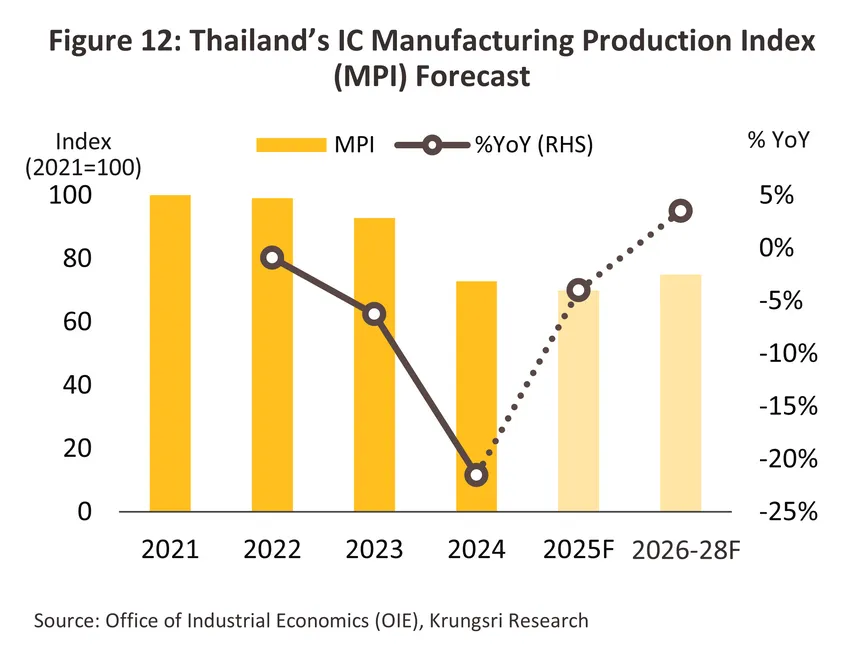

From 2026 to 2028, IC production is expected to grow 3.0–4.0% per year (Figure 12), in line with export value projected to rise 2.5–3.5% per year (Figure 13), supported by the following factors:

-

The growth of global computing businesses, which account for the largest share of semiconductor usage at around 40% of global semiconductor sales1/, will be a key driver. This is supported by continued expansion in global AI spending, projected to rise 36.8% in 2026 to USD 2.0 trillion8/. AI PCs requiring numerous processing chips are expected to see sales surge 84.0% to 143.1 million units, or 55.0% of total PC sales16/. Domestic demand will also benefit from rapid digital sector growth, driven by soaring investment. Indicators show investment promotion value jumped at a 1,158.3% CAGR from 2023 to September 2025, mostly in AI and data centers, supporting local sales of processing and memory chips.

-

The continued growth of global communications businesses, which account for the second-largest share at around 32% of global semiconductor sales1/, is being driven by rising AI smartphone sales. Key factors include growing popularity of smartphones that enable direct interaction with AI and the increasing trend of using AI as a proactive digital assistant. Global AI smartphone sales are projected to surge 51.3% in 2026 to 559 million units, and by 2029, nearly all premium smartphones worldwide are expected to feature Generative AI capabilities17/.

-

The continuous growth of global EV production, which accounts for the third-largest share at approximately 12% of global semiconductor sales1/, is expected to drive demand. According to the IEA, global EV demand is projected to grow at an average CAGR of 15% during 2024–203018/. Meanwhile, EV production in Thailand is anticipated to accelerate, particularly for passenger BEVs, as automakers will need to ramp up local production by 2–3 times to offset previous imports. This trend is expected to drive passenger BEV output during 2026–2028 to surge at a 41.4% CAGR, reaching around 120,000 units annually19/.

-

The expansion of related domestic supply chains, driven by increased investment promotion in recent years, includes: (i) the midstream supply chain, particularly PCB manufacturing, which is a key component for integrating with semiconductors to assemble complete electronic circuits. Investment promotion applications from 2022 to June 2025 totaled around THB 200 billion20/, accounting for 28.6% of all semiconductor and advanced electronics manufacturing incentives; and (ii) the downstream supply chain, such as appliance manufacturing, with investment promotion from 2022 to August 2025 exceeding THB 200 billion21/. Smart home appliances, in particular, are expected to continue expanding, supporting demand for processing chips used in enhanced functions for automation, energy efficiency, and safety22/.

However, Thailand’s IC production and exports could encounter several risks that may weigh on its growth prospects, including: (i) supply chain disruption risks due to China’s tightening of critical mineral exports, particularly gallium and germanium, where China holds the largest global production share. These elements are key raw materials for semiconductor wafers used in integrated circuits, high-power chips, high-frequency chips, and sensor chips; (ii) the risk of facing U.S. tariff hikes if products are deemed to be transshipments of Chinese origin, as Thailand’s electronics industry focuses on midstream and downstream production, relying heavily on imported components, making it vulnerable to stricter rules of origin. In the first ten months of 2025, Thailand imported USD 1.1 billion worth of semiconductor devices from China, accounting for 35.4% of total semiconductor imports; and (iii) intensifying global market competition, driven by investment and trade collaboration among ASEAN competitors. Such competitors include Vietnam and Malaysia, which continue to invest in the semiconductor industry. For example, in 2025, Vietnam announced additional commitments exceeding THB 17 billion23/. Moreover, Malaysia established the Johor–Singapore special economic zone, which could potentially affect Thailand’s future competitiveness in attracting electronics industry investment24/

Hard Disk Drive (HDD) Industry

During 2026–2028, HDD production is expected to grow at an average of 6.5–7.5% annually, in line with projected export value growth of 7.5–8.5% annually, supported by factors including:

-

The continued expansion of global data center and cloud businesses is driven by enterprises adopting AI in their operations, which increases demand for storage space or leased storage services to train and improve AI models. This is expected to sustain growth in global demand for data storage devices. According to Gartner, in 2026, global investment in data center IT equipment is projected to rise 19.0% to USD 580 billion7/, while spending on Infrastructure as a Service (IaaS) worldwide is expected to grow at a 23.8% CAGR from 2024 to 2029, reaching USD 500 billion by 202912/.

-

The continued growth of global PC sales is supported by the ongoing PC replacement cycle following the last buying wave during the COVID-19 pandemic, as well as pent-up demand from some consumers who delayed purchasing new PCs in Q2 2025 due to the global economic slowdown7/. According to Gartner, in 2026, global PC sales are expected to continue rising in line with IT equipment spending, projected to increase 6.8% to USD 840 billion7/.

-

The expansion of related domestic production chains, particularly downstream segments, has benefited from data center and digital businesses that continue to expand investment in Thailand. Between 2023 and September 2025, the BOI approved investment promotion in digital technology-related businesses, rising at a 316.7% CAGR to a total value of THB 460 billion, supporting HDD sales growth in the domestic market. Meanwhile, in upstream and midstream segments, HDD manufacturers will benefit from increased investment in electronic components such as semiconductors and PCBs, which offer higher added value and enable production of high-performance HDDs with greater storage capacity and faster data transfer in the future.

-

The recent expansion of HDD manufacturing investment, including capacity upgrades and technology development to boost storage per unit, improve data transfer speed, and lower unit costs, has strengthened Thailand’s capability to produce large volumes of high-performance HDDs to meet rising global demand. Between 2015 and June 2024, Thailand received continuous investment promotion applications in the HDD industry, totaling 42 projects worth over THB 82.6 billion11/.

1/ Source: PWC (2024)

2/ Source: Trademap

3/ Source: McKinsey (2024)

4/ Source: Mordor Intelligence (2024)

5/ Source: E&E Intelligence (2024)

6/ Source: Prachachat Business (August 26, 2024)และ E&E Intelligence (2024)

7/ Source: Gartner (October 22, 2025)

8/ Source: Gartner (September 17, 2025)

9/ Source: IEA (2025)

10/ Demand increased from 11.1 million units per month in the first nine months of 2024 to 13.2 million units per month in the first nine months of 2025(Source: OIE, 2025)

11/ Source: Thansettakij (November 11, 2025)

12/ Source: Gartner (August 6, 2025) and Gartner (October 15, 2025)

13/ Source: Gartner (April 14, 2025), Gartner (July 14, 2025) and Gartner (October 16, 2025)

14/ Source: The Standard (October 20, 2025)

15/ Rising demand for QLC SSDs has resulted in some manufacturers having backlogged orders extending into 2026 (Source: Thansettakij (November 11, 2025))

16/ Source: Gartner (August 28, 2025)

17/ Source: Gartner (September 9, 2025)

18/ Source: IEA (2025)

19/ Source: IEA (2025)

20/ Source: Krungthep Turakij (October 25, 2025)

21/ Source: Thansettakij (October 6, 2025)

22/ Source: Thansettakij (August 13, 2025)

23/ Source: Krungthep Turakij (March 3, 2025)

24/ Singapore holds an advantage over Thailand in managing economic zones and has strong capabilities in attracting investment in the electronics industry (Source: Krungthep Turakij (August 3, 2025))

.webp.aspx)